- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

Family Business Succession Planning—Tips for Success

Planning needs to start early

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Every company that wants to pass on its business to the next generation needs a business succession plan.

Sooner or later, everyone wants to retire. However, determining what happens to the business can be as important as ensuring that you have enough money to retire on. Who's going to manage the business? How will ownership be transferred?

With family businesses , succession planning can be especially complicated because of the relationships and emotions involved and because many people are not comfortable discussing topics such as aging, death, and financial affairs.

Business Structure, Ownership, and Taxes

The assets of a sole proprietorship or partnership are indistinguishable from the personal assets of the owner. Separate the business from yourself by forming a corporation that can continue to operate after it is sold or after the owner has died.

If transferring the business, it's important to realize that management and ownership are not the same. You may decide, for instance, to transfer management of your business to just one of your children but transfer equal shares of ownership to all your children, whether they're actively involved in operating the business or not.

However management and ownership are defined, accountants and lawyers who specialize in business succession planning can provide advice about strategies to minimize taxes when the transfer takes place.

By reorganizing your corporation to exchange your common shares in the business for preferred shares with a fixed value equal to the common-share value, you can pass all future capital appreciation and income tax liability on that future appreciation to your children while you retain control, and access to the current value of the business, in effect freezing the corporation .

Succession Planning Tips

Family is the primary emphasis of succession planning for many businesses. Whether you're thinking about the future management of your business, how ownership is going to be passed along, or taxes, you won't be able to help thinking about how your decisions will affect your family. Consider six key tips to have the best chance at a successful transition.

- Start planning early: Five years in advance is good, but 10 years in advance is better. Many business advisers tell budding entrepreneurs to build an exit strategy right into their business plan. The longer you get to spend on succession planning, the smoother the transition process is likely to be.

- Involve family members in discussions: Making your own succession plan and then announcing it is the surest way to sow family discord. Discussing the plan helps to identify who in the family wants to be involved directly and who is focused elsewhere. It also might help some family members find interest in the business they didn't know they had.

- Be realistic: You may want your first-born son to run the business, but does he have the business skills or even the interest to do it? Perhaps there's another family member who is more capable. It may even be that there are no family members capable of or interested in continuing the business and that it would be best to sell it . Examine the strengths of all possible successors as objectively as possible.

- Do what's best for the business: Making sure everyone has equal shares seems nice, but it may not be in the best interests of your business. It may be fairer for the successor(s) you have chosen to run the business to have a larger share of business ownership than family members not active in the business. Another alternative is to use voting and nonvoting shares so that only some of the family shareholders can make decisions on company policy. It may be best to transfer both management and ownership to your chosen successor and make other financial arrangements to benefit your other children.

- Train your successor(s): How can you expect your successor to take over and run your business successfully if you haven't spent any time training him? Your succession planning will have a much better chance of success if you work with your successor(s) for a year or two before you hand over the reins. For solo entrepreneurs, sharing decision making and teaching business skills to someone else can be difficult, but it's definitely an effort that will pay big dividends for the business.

- Get outside help: Lawyers, accountants, financial advisers, and others can help you put together a successful succession plan. There even are companies that specialize in family business succession planning that will facilitate the process of working through issues.

Family Business Succession Planning: The Definitive Guide & FAQs

Family business succession planning can be tiring and exhausting. Our definitive guide provides answers to all the questions about succession planning, including when to start, who to involve, and the dangers of getting it wrong.

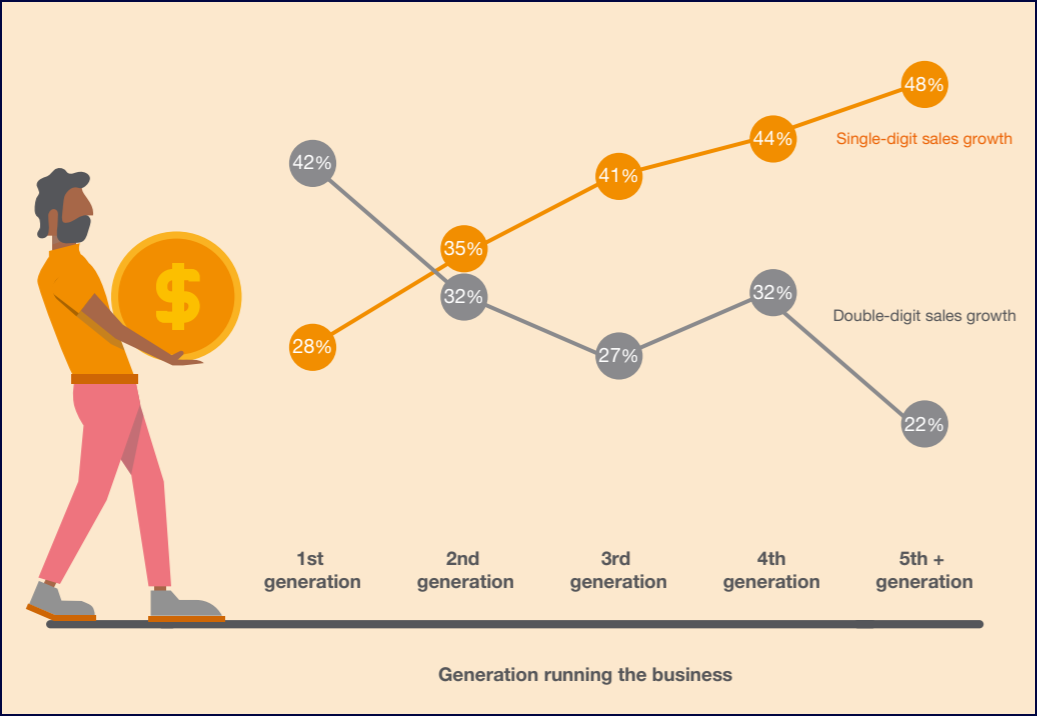

Succession is an emotional and exhausting time for many family businesses. If handled incorrectly, it can have dire consequences for the reputation and stability of a firm. Statistics bear this out. According to research, roughly 75 percent of all businesses fail to survive past the first generation – and more than 85 percent fail by the third generation.

When succession events take place, the result can go one of two ways: the growth of your family’s business or its slow terminal decline. An ill-prepared plan, or even worse, a non-existent plan, could lead to the decline in value of your family business – and possibly even its collapse.

Our services

There is a huge amount at stake. So, it is important to create a robust plan that can see your business sail smoothly into its next chapter, where it can grow in the careful hands of your successors.

This guide provides an overview of all the key questions that families may ask as they start to think about the succession process – as well as a backgrounder on all the fundamental concepts that underlie a successful succession process.

What is succession planning?

Does a succession event happen all at once, does management and ownership have to be transitioned at the same time, how is succession in a family business different to other businesses, are next generation members part of succession discussions, what is leadership succession planning, do i only need to start thinking about succession planning when i’m ready to retire, are other business families taking succession planning seriously, why is succession planning important, what advisors are usually involved in the succession process, is there any excuse for not preparing for succession amongst business families, why don’t more families start planning early, how can you engage the next generation in the succession process, what should next-generation family members do to ensure smooth transition during succession events, in practical terms, what activities should the next-generation family members be involved in during succession, when should the current generation start to introduce younger members of the family, how early should you start to think about succession planning, how can you ensure that the succession process is staying on track, how can business families avoid the pitfalls of getting succession wrong, how do i ensure we have a strong internal family candidate to take over leadership of the company, how do i pick the right individual to take the business forwards, how do you resolve tensions between next-generation members, after you have decided on the next-generation leader, what needs to be done, how do you ensure you have made the right choice, who is responsible for developing a succession plan who should be involved, how can succession planning help you better articulate your values, what is a family charter, and how can it help with succession, what is the most common mistake when it comes to succession planning, what should you get to paper as part of succession planning, does succession planning only happen at the ceo level, how do succession events impact reputation, how do you control reputation risks during succession, how can you raise the profile of the next generation, is it best to just not say anything to stakeholders at all, what stakeholders should we think about during succession events, can succession events also improve a business’ reputation, can you give me an example of a succession event gone wrong, can you give an example of a smooth succession event, frequently asked questions (faqs).

Succession is the process of handing a business – or a large amount of wealth – down to the next generation. This means not only thinking about the future of business operations but considering the future of management and ownership.

The process can be a daunting and overwhelming task for founders who may find it difficult to hand over control of the day-to-day management of the family business.

No. ‘Succession’ is not simply the moment when the business changes hands – it is the long-term process of slow transition from one generation to the next. There is not a single moment when it happens. It is a gradual process.

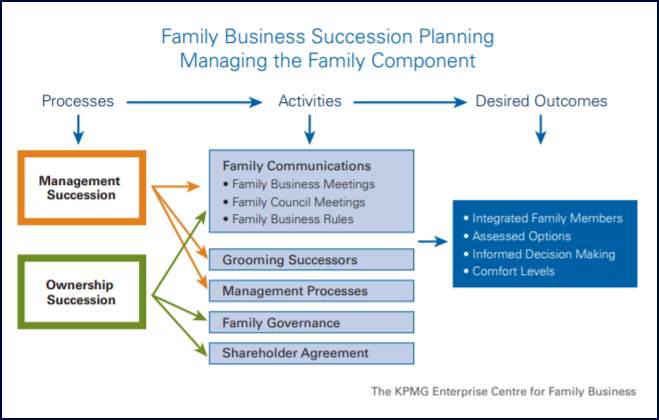

No. The handing over of control and management of the business does not necessarily mean the handing over of ownership – both transfers do not have to happen at the same time, and many advisors will recommend separating out those processes. In fact, these two different parts of the succession process could take place years apart.

In most cases, one generation will handover management of the business to the next generation first. Transitioning ownership might not take place until the last member of the current generation passes away.

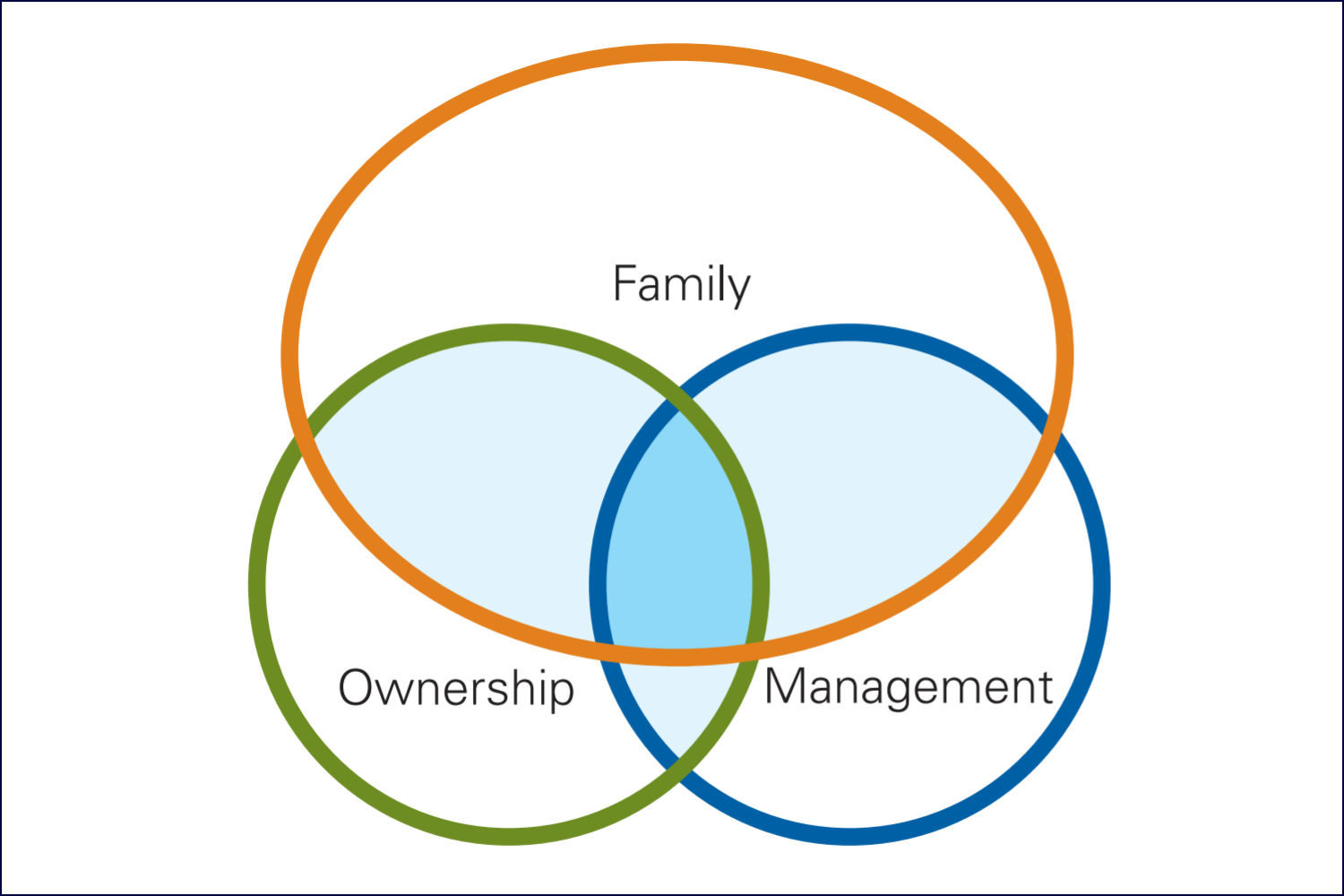

Venn diagram showing the overlap between family, business, and management. Source: KMPG Family Business Succession

Family businesses are noticeably different to other types of businesses. During succession events, complicated internal family dynamics are often at play – and these can lead to difficult, emotional, and challenging discussions amongst the family.

In many cases, the future of the business is not only a commercial decision but, instead, a deeper discussion about the family’s future itself: will they continue to lead the business? Will the family hire in new professional management? Will they sell the business? These are difficult, sometimes painful, questions that families need to ask when starting to think about succession.

Absolutely. Next-generation engagement is crucial to the success of any business’s succession planning programme. The next-generation members of the family – whether the immediate next generation or the generation below that – are the future of the company, and it’s important that their views about the direction of the business are properly represented in the process.

Younger family members may want to take the business in a different direction, prefer hiring professional management, or simply not feel up to taking the business forward. It’s important that the current generation know this because they start making decisions about the future.

‘Succession planning’ can also mean the process of identifying talent to lead a business in the future – this process applies to all businesses, and not just family businesses. For example, a publicly listed company will often undergo a process of identifying a list of candidates to takeover from an CEO when they step down or retire.

When researching succession planning, it is important for families and family businesses to distinguish between these two types of succession planning – it can be easy to confuse the two, which may lead to misunderstandings when talking about succession planning with partners, advisors, and peers.

Absolutely not. Succession events can take place completely unexpectedly, and it’s important that a family knows what to do in these unfortunate (and last-minute) circumstances. It may be that the current head of the family dies suddenly or, alternatively, that they are otherwise unable to run the business. This will be an exceptionally stressful time for the family, even without the added pressure of having to take difficult decisions around succession immediately.

Additionally, the succession process can take up to 20 years to complete successfully, so the earlier families start planning, the better.

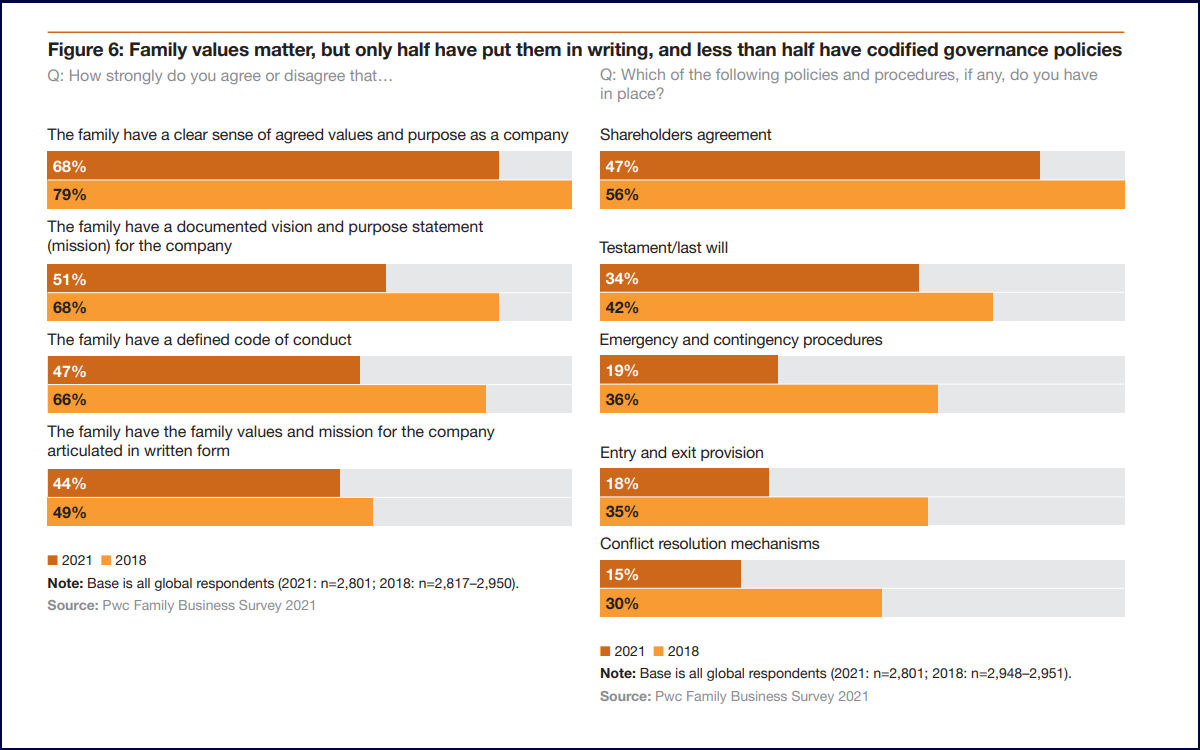

Yes. Succession planning is a central focus of energy and anxiety amongst business families – because getting the process wrong can have long-term damaging impacts on the wealth of the family and the performance of their businesses. Research shows that nearly three in five families (57%) have started to draft a succession plan. On top of that, 67% say that succession planning and inheritance is their biggest business concern.

If the succession process isn’t handled well, it can have a hugely damaging impact on the financial affairs of the family and their businesses. A few of the potential implications:

- Next-generation family members not having the right skills to run the business effectively

- Banks and financial partners losing faith in the future of the business

- Employees not respecting the skills and capacity of the next generation to lead the business

- Lack of clarity amongst the family members about who will lead the business, resulting in interfamily disputes and conflict

- Weaker relationships between next-generation members and important partners, suppliers, and others

Ultimately, if the succession process is not handled in a professional and smooth way, it can result in a very poor outcome for the business. According to results, 70% of families report failure in intergenerational wealth transfers.

A family business could risk collapse without a strong succession plan. Source: PwC.

Business families may want to engage outside experts to help them prepare for the transition of the business to the next generation. These outside experts include:

- Lawyers to put in place structures to transition wealth effectively

- Financial advisors to help mitigate financial risk

- Family business consultants to help the family understand and navigate the risks of succession

- Reputation and public relations experts to help with communicating the succession event effectively

- Wealth managers

- Accountants

Not at all. Firstly, there is countless research to demonstrate the negative impact that a succession event can have on a family, their businesses, and its collective finances. Secondly, it is already known well ahead of time that the current generation will one day step aside and pass down the business – and the family’s collective wealth – to the next generation.

Maybe families are so ‘trapped’ in the day-to-day business that they forget to find the time to devote to succession. For many families, succession is always a topic that dropped to the bottom of the list – many families do not feel a sense of urgency, so it is always left until tomorrow.

On the other hand, many families know that discussions about succession could lead to difficult discussions about the future of the business and, potentially, even conflict. As a result, they would rather avoid these difficult discussions rather than confront – and resolve – them directly.

The family can encourage next-generation engagement through the following activities:

- Conducting family-wide meetings to discuss and decide the future of the business

- Including next-generation members in company Board meetings where succession and the future direction of the business is discussed as an agenda point

- Starting informal discussions about the future of the business around the dining room table

- Ensuring the presence of next-generational members in discussions with non-family members of staff about their own thoughts about the future of the business

The next-generation should build a hands-on, practical, and thorough understanding of all parts of the family business – and meet as many important partners as possible.

This will help tackle two potential risks of the succession process: firstly, the next generation not properly understanding all aspects of the business and how it operates, secondly, not having the strong and important relationships with partners and stakeholders that the current generation does.

In order to build a thorough understanding of the business as well as build strong relationships with partners, next-generational members might want to get involved in the following activities:

- Attend internal business meetings

- Work for short stints (3-6 months) in different departments of the business

- Participate in the preparation of financial documents and Annual Reports

- Attend meetings with important external stakeholders, such as banks, business partners, suppliers, regulators, and others

- Take a leadership position within a particular division

- Work for a short stint in partner business or supplier

- Build experience in another company in the same industry as the family business

- Take a course or degree that aligns with the family business’ industry

The components of successful family business succession planning. Source: KPMG Family Business Succession Planning.

As soon as possible. Founders can sometimes hold back on introducing younger generations to the business for fear they are not ‘old enough’, yet it is truly never too early to introduce them. Familiarity takes a long time to build, so the earlier that this process starts the earlier stakeholders will build confidence and respect for the next generation.

Within family business, it is important to start thinking about your succession plan up to 20 years in advance – this allows for the correct structures to be put in place. This might include taking steps to introduce the next generation of leaders to customers, shareholders, suppliers, and so on.

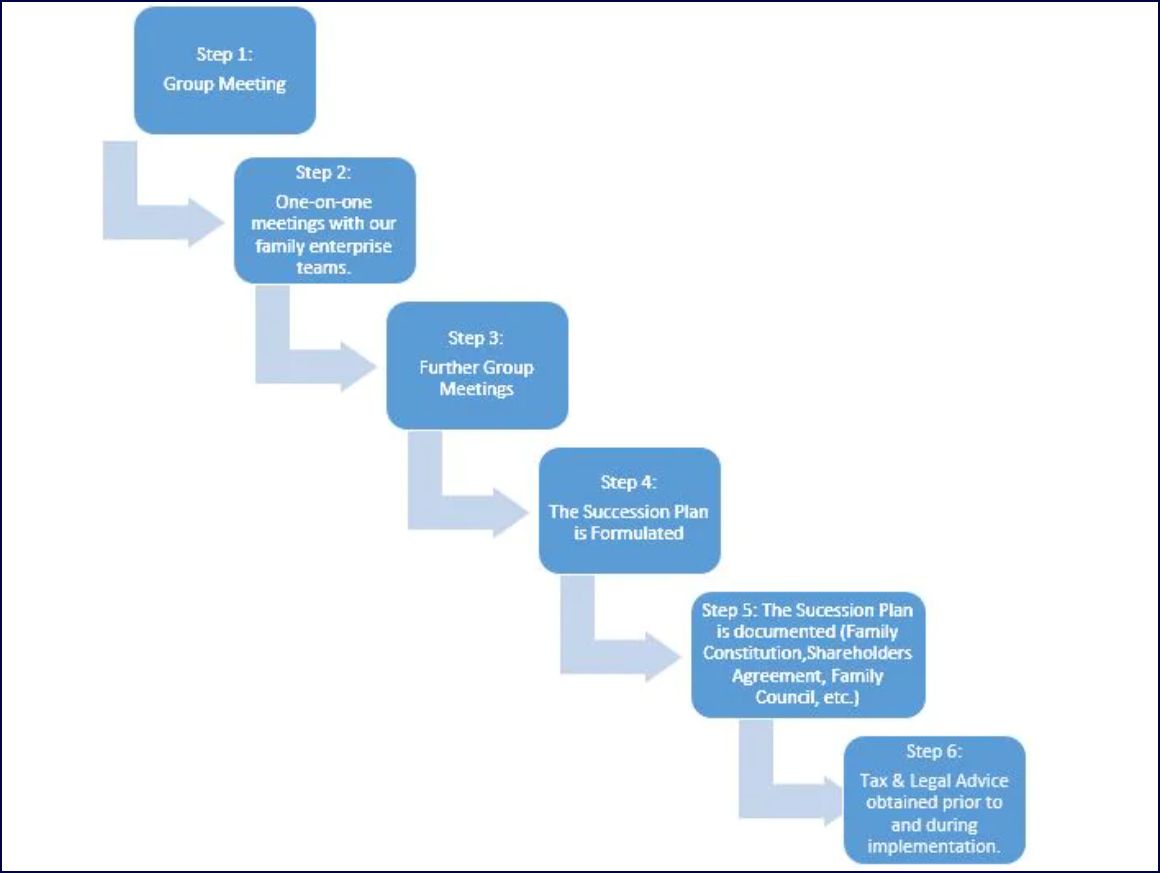

Regular meetings and ongoing communication are essential. It is sensible to have a quarterly meeting specifically about succession planning. These meetings might have to become more frequent the closer you get to the actual transition.

At each meeting, it is important to put to paper the next steps that need to be taken to further prepare the family for succession, whether that is getting the next-generation more involved, taking on further professional advice, or otherwise.

The family can also review the steps that were agreed in the last meeting to see if progress is being made – and the business and the family are moving in the right direction.

One of the best ways to avoid mistakes is to talk to other business families who have navigated the succession process effectively. On one hand, this might mean taking the time to talk to people in your existing network who have managed this process successfully. On the other hand, it might mean tapping into pre-existing networks for business families – like the IFB or Family Business United – where people share best practice.

Follow a step-by-step process when carrying out your succession plan. Source: Deloitte.

Firstly, it is important to understand exactly what makes the current leader of the business successful – this will usually be as a result of the skills, experience, commanding presence, and relationships that the current management bring to the business.

Now, sit down and thoughtfully answer the following questions about the current leadership:

- In precise terms, what are the current leader’s responsibilities?

- Who does the current leader depend on within the business?

- What previous experiences makes the current leader successful?

- What technical skills are essential to the current leader’s success, i.e., accountancy, pricing, supply-chain, marketing, etc?

- What softer skills are essential to the current leader’s success, i.e., management capacity, communications, etc?

- What specific relationships are essential to the current leader’s success, i.e., banks, partners, advisers, suppliers, etc?

Secondly, put to paper a ‘plan of action’ to ensure that the appropriate next-generation family member who will be taking over the business can develop those same skills, experiences, and networks that made the current leader successful. This plan of action might be a five-year pathway of technical education, experience, and exposure.

For a family business with multiple next-generation family members, this is a very difficult question, but it’s important to go through a fair and balanced process – and communicate the answer clearly across the family as early as possible.

It is not beneficial to any of the next-generation family members or the business itself for there to be an aggressive, hostile battle for the position. This could lead to a toxic work environment, one-upmanship, and other destructive behaviour.

Families should go through an objective and balanced decision-making process – and work hard to ensure that the process is not clouded by emotion. Families should answer the following questions:

- Which family members are genuinely interested in leading the business in the future?

- Which family members have existing technical skills?

- Which family members have naturally strong soft skills, and enjoy leadership itself?

- Which family member already commands respect, trust, and confidence of staff members and external partners?

Ask yourself which family members have the genuine interest and skills required to succeed you. Source: Insperity.

When choosing the next-generation leader of the business, there may be a degree of healthy competition between next-generation members. However, it is very easy for this healthy competition to descend into toxic, hostile in-fighting. Resolving these disputes will require emotional sensitivity and effective communication.

Usually, the best way to resolve these disputes is to emphasise that all next-generation members of the family that they each bring their own unique, compelling skillsets to the business – and, ultimately, everyone is pulling in the same direction: to create a growing, sustainable, and successful business that benefits everyone financially.

It is also important to clearly communicate to the next generation why different choices have been made – and show objective criteria for making these decisions.

Communicate the decision sensitively to all next-generation members. At this point, it is also important to stress that there are no guarantees, and the situation may change.

Investment in the professional development of those people who you have selected to lead the company into the future should now be stepped up. This is a good opportunity for your next-generation family members to gain additional knowledge and experience – you may consider connecting them with mentors within (and outside) the business who can boost their skills.

Use any opportunity you might have to ‘trial run’ your plan and reconfirm your choices. This might be having a next-generation member assume some responsibilities of a more senior member who is on leave or taking control of a certain division of the business. The opportunity enables the individual to gain fresh knowledge and experience and, importantly, enables you to assess if that person might need some additional training and support.

The owners and top management of a family business are responsible for developing and implementing a succession plan. It’s essential that the leadership of the business is involved at all stages. The task cannot be outsourced solely to outside advisors or HR – instead, there needs to be buy-in at the very highest levels of the company. Without this commitment, succession will not work effectively.

While strategic decisions will be made at Board level, HR will typically be responsible for carrying out, monitoring, and implementing the process. This will be done with the full involvement of the CEO, other senior leaders, and the Board.

Succession planning also provides families with an important opportunity to articulate the values of the founder (or current generation of leadership), the family, and help to cultivate agreement on these values. These are the values that have enabled the business’ success over recent decades – and the values that the next generation will take forward into the future.

A family charter is a single, collectively agreed document that puts to paper a common understanding of key issues between a family. A family charter may codify the purpose of the family, the family’s values and aims, as well as articulate a very clear plan for the future of the business, including who is expected to take the business forward.

This can be very helpful during succession events because it spells out in crystal clear detail what the future looks like and expectations about the next generation. Getting collective buy-in for the document also mitigates against the risk of dispute, misunderstandings, and strategic drift.

Ultimately, the biggest mistake is the complete absence of a succession plan in the first place. A rushed approach to the succession planning process also has very damaging results. It is like going into a storm without a map, plan, or strategy. You run the serious risk of failure.

Be aware of the common mistakes when creating your family succession plan. Source: TRG Talent.

It’s important not to approach the succession planning process informally. It’s better to have a proper formal plan to paper, which will enable you to see problems, challenges, and opportunities.

Your succession plan should align with the strategic goals of your business and should include:

- A plan to ‘skill up’ the next generation of the family

- A plan to introduce the next generation to important stakeholders

- Explicit agreement of what specific roles and responsibilities next-generation family members will take on at the point of succession

- List of actions that will be undertaken in the case of a sudden transition

- A list of professional, non-family members and advisers with the knowledge, capacity and know-how to support the next generation when they take on the business

Absolutely not. A successful succession plan will span across all levels of your company. The current generation of the family may hold leadership and technical roles across the whole business, including marketing, HR, and accounting. There must be a clear plan to replace these people, either with next-generation members of the family – or newly recruited professional individuals.

A bumpy handover of a senior leader to a next-generation family member can severely impact the reputation of your organisation. The current leader of the business – especially if they are a first-generation entrepreneur who founded the company – are often the most recognised representative of the firm by employees, suppliers, banks, and other important stakeholders.

In fact, many important stakeholders might associate the business solely with that individual and believe the success of the company depends on them.

If stakeholders believe the business cannot stand on its own two feet once the first-generation member has stepped aside, you might start to see banks pulling in credit, long-standing loyal employees leaving, and suppliers ending their dealings with the company. This could lead to a collective crisis of confidence in the company – and the start of a vicious downwards cycle.

There are many ways to mitigate against the risk of a succession event leading to a crisis of confidence in the family business. These include:

- Prepare early . It is better to start planning earlier rather than later – sometimes this means beginning the planning process up to 20 years in advance.

- Prepare a crisis plan . In the event of an unexpected death or another crisis, the future and stability of the company can be thrown up in the air without a plan for how this event will be handled. Putting a plan together that includes prepared statements for all stakeholders is one way to get on the front foot.

- Raising the profile of the next generation. Start raising the profile of the next-generation and start lowering the profile of the current generation. As early as possible, start to build familiarity around the next generation of leaders of the firm.

The best way to raise the profile of your next-generation members is to proactively include them in more of your communications, public relations, and stakeholder engagement activity. Some examples that have worked for other families include:

- Including next-generation members in internal employee-focussed newsletters

- Adding a cover letter from a next-gen member to your Annual Report

- Allowing next-gen members to address staff in townhall meetings

- Letting next-gen member deliver investor briefings

- Including next-gen members as spokespeople in press releases

- Ensuring next-gen members are interviewed and seen in relevant trade publication

- Giving next-generation members visibility on the company website

How many families have codified their values. Source: PwC Family Business Survey 2021

Absolutely not. Instinctively, some businesses might assume it is best not to say anything at all when it comes to a succession event. This is the wrong approach.

When companies ‘go silent’, they hope that important stakeholders will just not notice the transition – but they always do. Employees will start asking questions. So, will banks, suppliers, and others. It is best to answer those questions before they arise.

You should take the time to proactively list all the groups of people and individuals who you rely on to make your business a success. These will likely include:

- Banking partners

- Business partners and co-investors

- Local communities

- Policymakers

Absolutely. Succession isn’t all bad news. In fact, succession events are also opportune times to improve the brand and image of the company. Next-generation members of the family will often bring new skills and approaches to a business. For example, they might bring greater understanding of IT, digital, and social media marketing.

During the succession event, there is an opportunity to showcase to important stakeholders that the business is onboarding these important new skills that will help the business continue to grow into the future.

In 2021, the co-founder of cosmetics company Natura Siberica passed away unexpectedly without a clear plan for who was going to takeover the business. Following his death, a hostile, toxic battle broke out between various potential successors, including children from previous marriages and his widow. This led to several significant, high-profile lawsuits between different members of the family.

In August 2021, the media reported that 57 staff members quit and 101 left for a holiday in just 48 hours. This could potentially lead to a wider, broader crisis in confidence in the company – and a downwards vicious cycle that could damage its long-term value.

Usually if a succession event has been handled smoothly, we will not know about it. Instead, the business will have been handled over without attracting any untoward and unnecessary negative attention. Many of the oldest family businesses in the UK have been handed over in such a quiet and smooth way, including Hoare’s Bank, Folkes Holding, Shepherd Neame, Berry Bros & Rudd, Aspall Cyder, and many others.

Further reading

- Deloitte: Family business succession planning

- KPMG: Family Business Succession

- The Family Business Consulting Group: Family Business Succession

- Forbes: How To Make Family Business Succession Successful

- Davis Wright Tremaine: Succession Planning in a Family Business

- HBR: The Key to Successful Succession Planning for Family Businesses

Transmission Private publishes a monthly newsletter that tracks the future of reputation management for private clients.

Agree with our user data policy

- Evidence led

- Family focussed

- Digital first

IMAGES

VIDEO