- Purchase History

Wedding Venue Financial Plan Template [2024 Guide]

by I.J. Karam | Jan 1, 2024 | Business Plans , Financial Plan Guide

Starting a wedding venue business is a unique opportunity to create something special, but success doesn’t come without a solid financial plan in place. Your wedding venue financial plan is your roadmap to success, guiding your decisions and helping ensure the long-term viability of your project.

In this article, we’ll delve into the crucial components of a comprehensive financial plan for a wedding venue business, including cost forecasts, capital expenditures, startup costs, revenue projections, break-even analysis, profit and loss forecasting, cash flow statement and balance sheet. We’ll provide you with the tools you need to understand the financial landscape of your business, making informed decisions that support growth and success.

Just as a great builder starts with a solid foundation, a great wedding venue business starts with a solid financial plan. This article will serve as your foundation, providing all the information and guidance you need to create a plan that supports your project for the long term. So whether you’re just starting out or looking to take your wedding venue to the next level, read on!

Wedding Venue Financial Plan Template in Excel

Before we start, we recommend you check our automatic Wedding Venue financial plan in Excel included in our Ready-Made Wedding Venue Business Plan package. This is an off the shelf and cost-effective solution in case you don’t have the time to create a financial model from scratch. We have already done all the hard work on your behalf. All you need to do is change a few assumption in our wedding venue financial spreadsheet in Excel and the model will automatically generates an P&L, Cash flows and Balance sheet forecast for your project in addition to several beautiful charts and tables that you can easily paste in our pre-written business plan in Word (Yes, it also comes with an off the shelf business plan document that you can easily customize as well). For more information, check out our Wedding Venue Business Plan Template with Financials.

Without further delay, let’s crack on.

Wedding Venue Financial Plan: Cost Forecast

The first crucial step is to understand the cost structure in a wedding venue business. This includes the cost of goods sold (COGS) and the operating expenses (Opex).

COGS includes the direct costs associated with running the wedding venue, such as food, beverages and supplies needed for each event. These expenses should be accurately forecasted and regularly tracked to ensure they are in line with the budget. For instance, supplies will vary depending on the type and quantity of consumables required for each celebration. It’s important to factor in the cost of both one-time and recurring supplies, such as candles, flowers and decorations.

Understanding Your Wedding Venue’s Monthly Expenses

Opex refers to the ongoing expenses necessary to keep the business running and these “overhead” costs can vary greatly depending on the size and location of the venue and the level of service offered.

It is important to consider the following costs in the Opex forecast:

- Rent (or mortgage interest payments in case of ownership): This is likely the largest expense for a wedding venue business and should be based on market rates for similar properties in the area. This cost may increase over time due to inflation (or interest rate hikes in the case of a mortgage), so it’s important to factor in annual increases in the forecast.

- Utilities: This cost will vary depending on the size of the venue, the number of events held and the time of the year. It’s always a good idea to research utility rates in the area and budget for both regular and peak usage.

- Salaries: The cost of staffing will depend on the number of employees needed to run the wedding venue, their hourly wages and any benefits offered. It’s also important to also include the cost of hiring and training new employees, as well as the cost of uniforms and personnel equipment.

- Marketing & advertising: This may include print or online advertising, email marketing, commissions on referrals from agents and social media campaigns. Make sure to allocate a budget for ongoing marketing efforts to maintain visibility and attract new customers.

- Maintenance: This cost will vary based on the frequency and type of maintenance needed. Think for example about the funds needed to fix some old sound system or to maintain your HVAC system. As a side note, investing in the equipment themselves (e.g. a new sound system) does not fall under Opex but rather under CapEx; more on that in the following section.

- Legal and Insurance costs: These services (and related expenses) are important for this type of business so make sure to find the best deal for your wedding venue project.

By carefully estimating and tracking both COGS and Opex, a wedding venue business can create a realistic financial plan that will ensure its long-term success.

Wedding Venue Capital Expenditures

Capital expenditures (CapEx) refer to the funds you invest in long-term assets or improvements that will benefit your business over several years. In the context of a wedding venue business, CapEx typically includes:

- Building or venue purchase: You may decide to purchase a property rather than renting one. In that case, the venue itself will be considered as a Capital Expenditure rather than an expense.

- Major renovations or improvements: This could include remodeling or upgrading the venue space, installing new lighting or flooring or adding amenities like a bridal suite or outdoor patio. These expenditures can improve the guest experience and increase the value of the wedding venue over time.

- Equipment purchases: This includes buying or upgrading kitchen equipment, sound systems, security systems or other event-related technology.

- Vehicles: If the business operates a fleet of vehicles for transportation or delivery purposes, these can also be considered capital expenditures.

- Technology upgrades: Upgrading software or hardware to improve operational efficiency and enhance the guest experience can help the wedding venue remain competitive and relevant in an ever-changing market.

When planning for capital expenditures, it’s important to consider the following:

- Cost estimates: Establishing a budget for each project, based on vendor quotes or industry standards, will help the business determine how much it needs to invest and when. This information can inform funding decisions and help the business prioritize Capital expenditures.

- Funding sources: Businesses may use a combination of debt financing, equity financing or internal funds to finance capital expenditures. The best funding option will depend on the size and timing of the expenditures and the business’s overall financial situation.

- Project prioritization: Businesses should prioritize expenditures based on the potential return on investment, impact on the guest experience and the long-term impact on the venue’s competitiveness.

- Timing: CapEx investments should be timed to align with the business’s growth plans ensuring that they are made when they are most needed.

Wedding Venue Financial Plan: Startup Capital

Startup capital refers to the funds a wedding venue requires to get up and running, covering costs such as venue rental (or purchase), equipment purchases, marketing and staffing. The amount of startup capital required will depend on the size and scope of the venue, as well as the local market conditions.

Some of the key figures you need to cover include rent (or initial deposit if you plan to buy the venue and get a mortgage), equipment and supplies, marketing and ad budget (for the initial launch phase), up to 6-12 months salaries and working capital (this is a reserve of funds used to cover the venue’s operating expenses until it begins to generate positive cash flow).

It’s important to note that the amount of startup capital required will vary depending on the specific circumstances of your wedding venue business. A business plan should be developed to estimate the capital required and inform funding decisions. This can help ensure that your venue has the resources it needs to launch and succeed.

Revenue Forecast for a Wedding Venue

The next step is to model your wedding venue’s revenue. This process involves estimating the amount of sales you can expect to generate in the future based on various assumptions, such as the number of events held, the average price per event and the occupancy rate.

The number of events held at your wedding venue will depend on multiple factors such as the venue’s capacity, local market demand and your marketing efforts. It’s also important to take into account the type of events that you will host, such as weddings, corporate events, and other events, as this will impact the overall revenue.

The average price per event is another crucial factor in forecasting your revenue. This is the average revenue generated from each event, taking into account the type of event (private or corporate), the services provided and the pricing structure. Factors such as the catering cost and the décor and entertainment expenses will surely impact your venue’s overall profitability. Additionally, make sure not to forget any discounts or promotions that your may offer, as these will impact the average price per event.

Now let’s talk about the occupancy rate. This is the percentage of the venue’s capacity that is used for events. A higher occupancy rate will result in higher revenue, while a lower occupancy rate will result in lower revenue (especially if you price per guest). Always consider the venue’s capacity utilization when forecasting revenue, as this determines the number of events that can be held simultaneously as well as the average price per event.

Next, let’s discuss seasonality which is another major factor to consider when forecasting the revenue of a wedding venue. The demand for wedding and events experience fluctuations throughout the year, with some seasons being busier than others. For instance, summertime may be the peak season for weddings especially in regions with a nice weather in the summer. Conversely, wintertime is probably not the best season for weddings. Of course, this varies depending on geographical location of your venue but in all case make sure to take the seasonality into account when forecasting your revenue.

Here are additional factors you should also take into account when estimating your revenue:

- Event Types: For example, weddings typically generate higher revenue than corporate events. It’s important to consider the mix of events held at the venue and how this will impact your revenue.

- Packages: Your venue may offer different event packages with varying prices and services. This should be taken into account when forecasting your revenue, as it will impact the average price per event.

- Marketing Efforts: Your marketing efforts will impact the number of events held at the venue, and therefore, the revenue generated. Marketing efforts should be factored into the revenue forecast, taking into account the cost of marketing and the expected return on investment.

- Economic Factors: The local economy and the overall state of the wedding industry will impact the venue’s revenue. For instance, a recession may reduce demand for weddings while an economic boom may result in increased demand.

- Competition: Competition from other wedding venues in the local market will impact the venue’s revenue. It’s important to keep an eye on the competition, and how their pricing strategies, marketing efforts, and event packages may impact your own business and revenue.

To conclude this section, remember that a comprehensive revenue forecast should be based on realistic assumptions and informed by market research, competitive analysis and other relevant data.

Break Even Analysis for a Wedding Venue Business

The break-even analysis is a key tool for a wedding venue business to determine when its revenue will cover its expenses, marking the point at which the business begins to generate a profit. By understanding the break-even point, you can better plan your finances and make informed decisions about growth and expansion.

Let’s take an example to illustrate the components of a break-even analysis for a wedding venue:

- Total Fixed Costs: For example your total fixed costs could be $15,000 per month, including rent, utilities, insurance, and other recurring expenses.

- Variable Costs: Variable costs such as food and beverage costs, staffing and marketing costs would change based on the type and size of the event held at the venue. But let’s assume an average of $5,000 in variable costs per event based on your historical data.

- Average Revenue per Event: Let’s also assume an average revenue of $10,000 generated from each event held at your venue.

- Break-Even Point: By dividing the total fixed costs of $15,000 by the difference between the average revenue per event of $10,000 and the average variable cost per event of $5,000, we can calculate the break-even point as three events. This means the venue must hold at least three events per month to cover its costs and generate a profit.

- Impact of Changes: By understanding the break-even point, you can assess the impact of changes to the financials, such as a change in prices, costs or event mix. For example, if you increase the average revenue per event to $12,000, the break-even point would decrease to about two events per month.

Wedding Venue Income Statement Forecast

A Profit & Loss (P&L) forecast is an essential tool for a wedding venue business to estimate its expected revenue, expenses and profits over a specified period of time. Here are the key components of a P&L forecast for a wedding venue business:

- Revenue: As discussed above, this includes all income generated through venue rentals, food and beverage sales and any other sources.

- Cost of Goods Sold (COGS): As already seen, COGS refers to the direct costs associated with producing the goods or services the venue offers, such as food and beverage expenses and supplies.

- Operating Expenses: These include indirect costs such as salaries, marketing, utilities and other overhead expenses. Staffing costs should include the cost of hiring, training and maintaining a competent and professional team, while marketing expenses should cover the cost of promoting the venue to potential customers. Other overhead expenses should include the cost of utilities, insurance, and other recurring costs associated with running the venue.

- Gross Profit: Gross profit is calculated by subtracting the COGS from revenue. Gross profit provides a useful indicator of the venue’s profitability and helps in making informed business decisions.

- Net Profit: Net profit is calculated by subtracting the operating expenses from the gross profit. Net profit is the final indicator of the venue’s financial performance and provides an estimate of the profit that will be available to reinvest in the business or distribute as dividends. The Net Margin (Net Profit divided by Revenue) is an important financial ratio you should compute and track on a regular basis. A high net margin is an indicator of a strong business performance.

By creating and regularly updating a P&L forecast, you can monitor the financial performance of your wedding venue, identify areas for improvement and make informed decisions that drive growth and success.

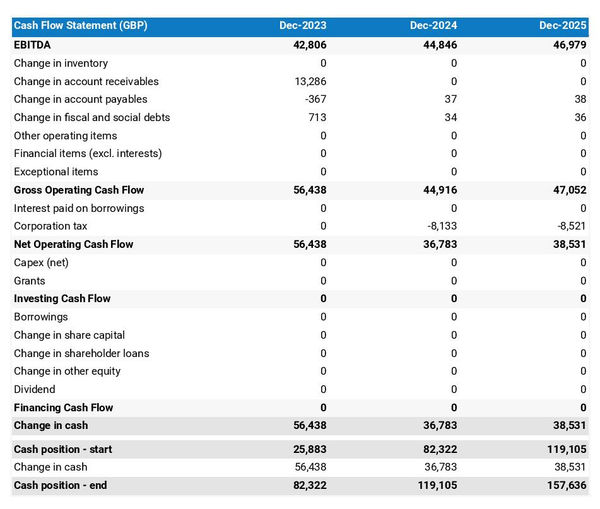

Wedding Venue Cash Flow Forecast

Here are the key components of a cash flow statement for a wedding venue business:

- Cash Inflows: This includes all sources of cash entering the business from your sales. It is important to accurately estimate the amount of cash that will be generated from each event and the timing of these inflows.

- Cash Outflows: This includes all payments made by the business, such as staff salaries, advertising expenses and the cost of goods and supplies.

- Operating Activities: Operating activities represent the cash inflows and outflows associated with the day-to-day operations of the wedding venue. This section should provide a clear picture of the net effect of the venue’s operating activities on its cash balance over a specified period of time.

- Investing Activities: These represent cash inflows and outflows linked to the investments made by the business, such as the purchase of property or equipment.

- Financing Activities: Activities associated with the business’s financing arrangements, such as loans, equity investments or payment of dividends make up this category of cash flows.

- Net Cash Flow: Net cash flow is calculated by subtracting the total cash outflows from the total cash inflows. Net cash flow provides an estimate of the change in the venue’s cash balance over a specified period of time.

It is important to regularly update the cash flow statement to ensure it remains accurate and relevant. By monitoring cash inflows and outflows, the venue can ensure it has sufficient cash to meet its financial obligations.

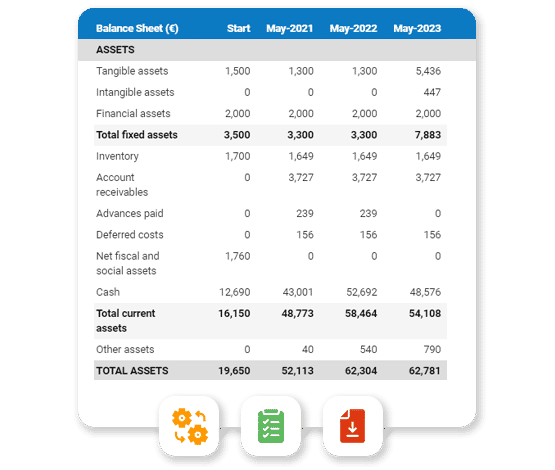

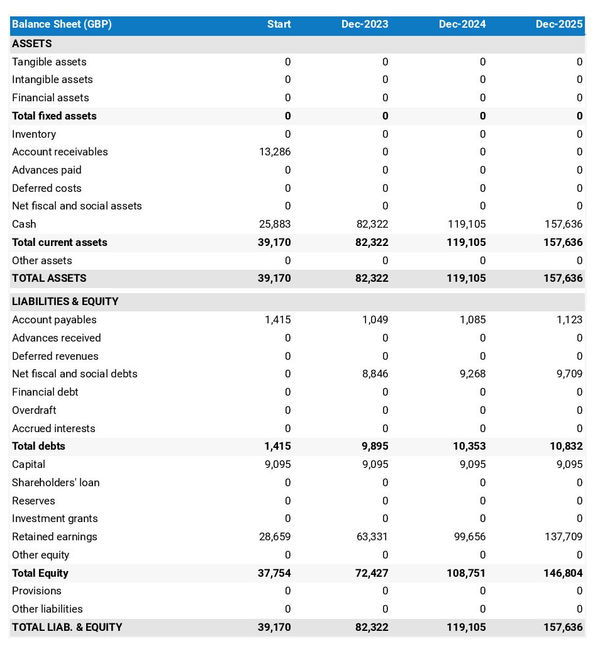

Wedding Venue Balance Sheet

A balance sheet is a snapshot of your wedding venue’s financial position at a specific point in time. It provides a clear picture of the business’ assets, liabilities and equity and is an essential tool for monitoring the general financial health.

Here are the key components of a balance sheet for a wedding venue business:

- Assets: Assets are resources that the business owns and has the potential to generate future economic benefits. This includes items such as cash, investments, property and equipment.

- Liabilities: Liabilities are obligations owed by the business, such as loans, accounts payable, and taxes owed. It is important to accurately estimate the amount of these obligations and their expected repayment date.

- Equity: Equity represents the net worth of the business after deducting liabilities from assets. This includes items such as owners’ capital, retained earnings and any other equity contributions.

Regular updates to the balance sheet ensure it remains accurate and relevant, providing valuable insights into the business’s financial performance and position.

Wedding Venue Financial Plan: Final Thoughts

We have reached the end of our guide. Remember, a financial plan is a critical component of any successful wedding venue business. From cost forecasts to balance sheets, each element of your financial plan provides valuable insight into the financial health and future of your business.

By taking the time to create a comprehensive financial plan, you’ll have the tools you need to succeed, and as we mentioned above, you can even purchase our automatic financial plan included in our ready-made wedding venue business plan template – This option is guaranteed to save you a lot of time, effort and money.

Whether you’re just starting out or looking to take your business to the next level, a well-structured financial plan can help you achieve your goals. So don’t wait, start putting together your financial plan today, and see the difference it can make for your wedding venue business. With this in place, you’ll be well on your way to creating a successful, thriving wedding venue that makes your dreams a reality.

Download a Ready-Made Business Plan, Choose Your Industry:

- F&B Business Plans

- Services Business Plans

- Retail Business Plans

- Tourism Business Plans

- Tech Business Plans

Recent Posts

- Restaurant Business Model Canvas

- How to Create a Bar Business Plan

- Gym Financial Plan Template [2024 Guide]

- Laundry Financial Plan Template [2024 Guide]

- Juice Bar Financial Plan Template [2024 Guide]

Wedding Planning Business Plan Template

Written by Dave Lavinsky

Wedding Planning Business Plan

You’ve come to the right place to create your Wedding Planning business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Wedding Planning businesses.

Below is a template to help you create each section of your Wedding Planning business plan.

Executive Summary

Business overview.

Elegant Weddings is a wedding planning company founded by Carrie Goode in 2023. It is located in Milford, Massachusetts and the company primarily plans weddings for couples who want a luxurious wedding. Carrie has been a wedding planner since 1999 and uses her decades of experience to offer the most prestigious, elegant surroundings and wedding services available within Massachusetts. Carrie is highly-skilled at communicating extensively with wedding couples, assisting in making selections based on those communications, and recommending the best of every vendor for select weddings.

When Carrie opened her business, she recruited from her former colleague, an assistant wedding planner, Danielle Woods, to support the efforts of the company in meeting the needs of Gen Z couples and those who are looking for “less than traditional” ceremonies and settings. Danielle has ten years of experience and enjoys providing wedding plans that cover every item wedding couples want.

Product Offering

The following are the services that Elegant Weddings will provide:

- Introduction luncheon with wedding planner and couple

- Pre-wedding scheduling and calendar-setting

- Pre-wedding vendor event with selections and tastings

- Pre-wedding honeymoon planning

- Wedding Day and Reception management, coverage and 24/7 attendance

- Post-wedding consultation and luncheon with couple

- Day-to-day management of the wedding and reception processes

Customer Focus

Elegant Weddings will target clients who are considering a wedding or are already planning a wedding. Elegant Weddings will also target couples who are engaged, but have not yet confirmed a season or date for marriage. Secondary targets will include couples who aren’t engaged, but who are considering possibly becoming engaged and marrying. Also, the parents and friends of engaged couples within the Massachusetts region will be targeted.

Management Team

Carrie Goode holds a master’s degree in business development and has been employed as a wedding consultant for over 20 years. Her experience as a wedding planner has earned her hundreds of clients and, as a result, hundreds of recommendations by former clients to engaged couples who are beginning to plan weddings.

Carrie Goode, president of Elegant Weddings, left her former place of employment in 2022 to begin building her idea for her own company, which is scheduled to open in 2023. She recruited a former associate, Danielle Woods, also a wedding planner, to join her in the new company. Danielle will support Carrie in her business while she grows her own clientele base with her new title of Senior Wedding Planner.

In addition to the above, Janice Parker has joined the company as the Office Manager, assisting with onboarding wedding coordinators and vendors who partner with the company. She will handle phone calls, social media, website updates and other administrative tasks.

Success Factors

Elegant Weddings will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of Elegant Weddings.

- A minimum of two private luncheons: initially with engaged couples to determine needs and wants and, second, to analyze at a post-wedding luncheon

- Thorough and extensive attention offered to details determined by wedding couples.

- Wedding software for exclusive use of the wedding party, parents and planner.

- Guaranteed vendor experiences for clients (or refunds are issued).

- Elegant Weddings offers the best pricing in the “luxury” category of weddings. Their pricing structure is the most cost-effective when compared to the competition.

Financial Highlights

Elegant Weddings is seeking $200,000 in debt financing to launch its company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

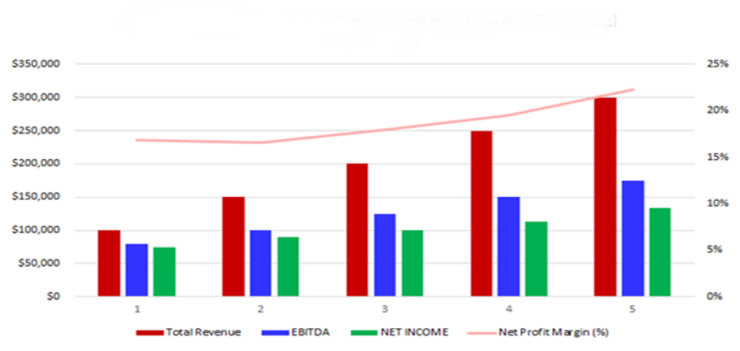

The following graph outlines the financial projections for Elegant Weddings.

Company Overview

Who is “elegant weddings”.

Elegant Weddings is a newly established, full-service wedding planning business based in Milford, Massachusetts. Elegant Weddings will be the most prestigious, communicative and luxury-oriented wedding planner choice for engaged couples in Massachusetts. Elegant Weddings will provide a comprehensive menu of wedding planning services for any engaged couple to utilize. Their full-service approach includes a pre-wedding, private luncheon with the wedding planner and a post-wedding wrap-up luncheon with their wedding planner.

Elegant Weddings will be able to plan and prepare for luxurious and elegant weddings to suit all couples. The team of professionals are highly qualified and experienced in luxury weddings and in the most capable and efficient vendors. Elegant Weddings removes all headaches and issues of the wedding and reception and ensures all issues are taken care of expeditiously while delivering the best client service. In addition, if a guaranteed and vetted vendor fails to perform to expectations, refunds are given to the wedding couple.

Elegant Weddings History

Elegant Weddings is owned by Carrie Goode, who is the president of the new company. She has been a wedding planner since 1999 and, while employed formerly in the industry, consulted with hundreds of engaged couples who thought so highly of her services that they recommended her to several hundred additional engaged couples. Carrie is known throughout the east coast as an exemplary wedding planner who brings true “luxury” to the “luxury wedding sector of the industry.” Carrie has recruited former associates, Danielle Woods, to the be Senior Wedding Planner and Janice Parker to be the Office Manager.

Elegant Weddings is founded on the concept that all weddings should include at least a touch of elegance to mark the symbolism of a wedding. This may mean the wedding planner includes a few touches of distinctive beauty to a wedding, or if the engaged couple chooses, the planner can include something whimsical or of special note to the engaged couple, as long as the items add to the “elegance” of the ceremony itself. This practice has built successfully over the years into the development of the concept for Elegant Weddings.

Since incorporation, Elegant Weddings has achieved the following milestones:

- Registered Elegant Weddings, LLC to transact business in the state of Massachusetts.

- Has a contract in place for a 10,000 square foot office at one of the midtown buildings

- Reached out to numerous contacts to include Elegant Weddings in their portfolios.

- Began recruiting a staff of three and two office personnel to work at Elegant Weddings

Elegant Weddings Services

The following will be the services Elegant Weddings will provide:

- Day to day management of the wedding and reception processes

Industry Analysis

The wedding planning industry is expected to grow over the next five years to over $1.6 billion. This growth and increase in the market is based on the east coast region of the U.S., where wedding planners are traditionally employed for all weddings, versus the west coast, where more weddings are viewed as casual affairs to be conducted informally and without a typical reception. The growth has more heavily been in the “luxurious” or “elegant” wedding categories, as those who opt for weddings choose to have memorable and large wedding experiences overall.

Costs will likely be reduced as innovation continues to create more convenience and comfort for the engaged couples, including reservations for honeymoon adventures, software that tracks wedding gift receipts, 3D printing that assists in creating unique invitations, and other inventive touches.

Customer Analysis

Demographic profile of target market, customer segmentation.

Elegant Weddings will primarily target the following customer profiles:

- Engaged couples with a wedding date

- Engaged couples who do not yet have a season or date

- Couples who are not engaged, but are considering marriage

- Parents of engaged couples who are seeking professional counsel

Competitive Analysis

Direct and indirect competitors.

Elegant Weddings will face competition from other companies with similar business profiles. A description of each competitor company is below.

Cherished Moments

Cherished Moments is an established wedding planning company founded in 2010 by Bridgette Inqvist and Lars Solene. Bridgette and Lars were wedding consultants with a national chain bridal store for over ten years when they formed Cherished Moments as a wedding planning company focused on “partial wedding planning.” A partial wedding planner assists with certain elements of the wedding that are especially crucial to the clients, such as the venue selection, vendor coordination, or design and decor. These areas are visible to guests and make or break the wedding overall and, as such, many engaged couples want help in these areas only while they handle the remaining wedding details.

Cherished Moments provides partial wedding planning with event venue selections and design and decor elements of any wedding, including outdoor and themed weddings. Bridgette and Lars do not conduct pre-wedding consultations, preferring to communicate via online conversations and they have engaged couples complete thorough instruction lists for their services that list everything needed or wanted on paper.

Backyard Wedding Planners

Billie Seevers and Jonnie Taylor formed their company, Backyard Wedding Planners, after each had an informal backyard wedding in 2020 and 2021. Their experiences led to conversations and a partnership that focuses strictly on fun, informal backyard weddings. This may mean the wedding couple serves a barbecue meal from the grill or the meal is served by a fast food delivery truck. Events usually include outdoor games for the guests, group singing (with guitar) and informal dancing on the lawn.

The premise of Backyard Wedding Planners is that formal weddings are too difficult and expensive; weddings should be reminiscent of a backyard gathering that is fun. Couples choose from a variety of decor options and settings and vendors are offered for the elements of the wedding that couples choose. The company currently has two employees, Billie and Jonnie.

Destination Dream Weddings

Pat Roberson and Clint Dory formed Destination Dream Weddings while employed as travel agents in 2009. Together they created a format for wedding planning that includes everything destination weddings might require. This means health insurance for the bride and groom are included (in the event of food poisoning, etc), hotels are fully vetted by Destination Dream Weddings, fees are prepaid and costs are set and guaranteed. Destination Dream Weddings often include the wedding parents, grandparents, siblings and friends of the wedding couple, which leads to large-scale planning of multiple people traveling from various points to the destination. Planning is key for Destination Dream Weddings. Pat and Clint have hired one office manager to oversee communication; however, most of their planning services are conducted online and via email communication. They do not travel to the wedding destinations as a rule.

Competitive Advantage

Elegant Weddings will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

Elegant Weddings will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled employees who offer personal, detailed planning with wedding couples from pre-wedding parties through to the end of the reception.

- Private luncheons before and after the wedding with the wedding planner.

- Guaranteed results from preferred vendors or money is refunded by Elegant Weddings.

- Wedding software for exclusive use of the engaged couple, parents and planner.

- Unbeatable pricing for their clients in the “luxury wedding” category.

Promotions Strategy

The promotions strategy for Elegant Weddings is as follows:

Word of Mouth/Referrals

Elegant Weddings has built up an extensive list of contacts over the years by providing exceptional service and expertise to their previous clients. Their contacts and clients will follow them to their new company and help spread the word of Elegant Weddings.

Professional Associations and Networking

Networking will take place at industry events, bridal fairs, personal meetings, and professionally-associated organizations. Private events for parents and selected referrals will be hosted by Elegant Weddings.

Print Advertising

Direct mail pieces will be sent to attendees of bridal fairs and other industry events. Special offers will be given in the direct mail pieces when engaged couples meet with Elegant Wedding planners.

Website/SEO Marketing

Elegant Weddings will fully utilize their website. The website will be well organized, informative, and list all the services that Elegant Weddings provides. The website will also list their contact information and offer sample photos of elegant weddings and wedding couples. The website will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “wedding planning company” or “luxury weddings near me,” Elegant Weddings will be listed at the top of the search results.

The pricing of Elegant Weddings will be on the high end of the wedding planning industry; however, it will be on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for Elegant Weddings. Operation Functions:

- Carrie Goode will be the owner and President of the company. She will oversee all business development and manage client relations. Carrie has spent the past year recruiting the following staff:

- Danielle Woods will become the Senior Wedding Planner and oversee staff, handle phone calls and social media.

- Janice Parker will also join the staff as the Office Manager, overseeing all scheduling, calendar events and tracking engaged couples through the process of planning. She will onboard new employees, as well.

Milestones:

Elegant Weddings will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for the Elegant Weddings

- 6/1/202X – Finalize contracts for Elegant Weddings clients

- 6/15/202X – Begin networking at industry events

- 6/22/202X – Begin moving into Elegant Weddings office

- 7/1/202X – Elegant Weddings opens its doors for business

Financial Plan

Key revenue & costs.

The revenue drivers for Elegant Weddings are the fees they will charge to clients for their services.

The cost drivers will be the overhead costs required in order to staff Elegant Weddings. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of clients per Month: 20

- Average revenue per Month: $27,500.

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, wedding planning business plan faqs, what is a wedding planning business plan.

A wedding planning business plan is a plan to start and/or grow your wedding planning business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Wedding Planning business plan using our Wedding Planning Business Plan Template here .

What are the Main Types of Wedding Planning Businesses?

There are a number of different kinds of wedding planning businesses , some examples include: Traditional, Extreme wedding planning, Destination, Luxury, and Budget-saving wedding planning.

How Do You Get Funding for Your Wedding Planning Business Plan?

Wedding Planning businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Wedding Planning Business?

Starting a wedding planning business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

- Develop A Wedding Planning Business Plan - The first step in starting a business is to create a detailed wedding planning business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

- Choose Your Legal Structure - It's important to select an appropriate legal entity for your wedding planning business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your wedding planning business is in compliance with local laws.

- Register Your Wedding Planning Business - Once you have chosen a legal structure, the next step is to register your wedding planning business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

- Identify Financing Options - It’s likely that you’ll need some capital to start your wedding planning business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

- Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

- Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

- Acquire Necessary Wedding Planning Equipment & Supplies - In order to start your wedding planning business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

- Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your wedding planning business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful wedding planning business:

- How to Start a Wedding Planning Business

How to create a financial forecast for a wedding planning company?

Creating a financial forecast for your wedding planning company, and ensuring it stays up to date, is the only way to maintain visibility on future cash flows.

This might sound complex, but with the right guidance and tools, creating an accurate financial forecast for your wedding planning company is not that hard.

In this guide, we'll cover everything from the main goal of a financial projection, the data you need as input, to the tables that compose it, and the tools that can help you build a forecast efficiently.

Without further ado, let us begin!

In this guide:

Why create and maintain a financial forecast for a wedding planning company?

- What information is used as input to build a wedding planning company financial forecast?

The sales forecast for a wedding planning company

The operating expenses for a wedding planning company.

- What investments are needed for a wedding planning company?

The financing plan of your wedding planning company

What tables compose the financial plan for a wedding planning company.

- Which tool should you use to create and maintain your wedding planning company's financial projections?

- Financial forecast template for a wedding planning company

In order to prosper, your business needs to have visibility on what lies ahead and the right financial resources to grow. This is where having a financial forecast for your wedding planning company becomes handy.

Creating a wedding planning company financial forecast forces you to take stock of where your business stands and where you want it to go.

Once you have clarity on the destination, you will need to draw up a plan to get there and assess what it means in terms of future profitability and cash flows for your wedding planning company.

Having this clear plan in place will give you the confidence needed to move forward with your business’s development.

Having an up-to-date financial forecast for a wedding planning company is also useful if your trading environment worsens, as the forecast enables you to adjust to your new market conditions and anticipate any potential cash shortfall.

Finally, your wedding planning company's financial projections will also help you secure financing, as banks and investors alike will want to see accurate projections before agreeing to finance your business.

Need a solid financial forecast?

The Business Plan Shop does the maths for you. Simply enter your revenues, costs and investments. Click save and our online tool builds a three-way forecast for you instantly.

What information is needed to build a wedding planning company financial forecast?

The quality of your inputs is key when it comes to financial modelling: no matter how good the model is, if your inputs are off, so will the forecast.

If you are building a financial plan to start a wedding planning company, you will need to have done your market research and have a clear picture of your sales and marketing strategies so that you can project revenues with confidence.

You will also need to have a clear idea of what resources will be required to operate the wedding planning company on a daily basis, and to have done your research with regard to the equipment needed to launch your venture (see further down this guide).

If you are creating a financial forecast of an existing wedding planning company, things are usually simpler as you will be able to use your historical accounting data as a budgeting base, and complement that with your team’s view on what lies ahead for the years to come.

Let's now zoom in on what will go in your wedding planning company's financial forecast.

From experience, it is usually best to start creating your wedding planning company financial forecast by your sales forecast.

To create an accurate sales forecast for your wedding planning company, you will have to rely on the data collected in your market research, or if you're running an existing wedding planning company, the historical data of the business, to estimate two key variables:

- The average price

- The number of monthly transactions

To get there, you will need to consider the following factors:

- Wedding season: The time of year greatly affects the demand for wedding planning services. During peak wedding season, typically in the summer and early fall, you may see an increase in average price as couples are willing to pay more for their dream wedding. This can also lead to an increase in the number of monthly transactions as more couples are getting married during this time.

- Economic conditions: In a strong economy, couples may be more willing to spend more on their wedding, resulting in a higher average price for your services. However, in a weak economy, couples may be more budget-conscious and opt for a more affordable wedding, leading to a decrease in your average price and potentially a decrease in the number of monthly transactions.

- Trends and styles: Wedding trends and styles can greatly impact the average price of your services. For example, if there is a popular wedding theme or concept that requires more elaborate planning and decorations, you may be able to charge a higher price for your services. On the other hand, if more couples are opting for simple and minimalistic weddings, your average price may decrease.

- Competition: The level of competition in your market can also affect your average price and number of monthly transactions. If there are many other wedding planning companies in your area offering similar services, you may need to adjust your pricing to stay competitive and attract clients. Alternatively, if you are the only wedding planning company in your area or offer unique services, you may be able to charge a higher price.

- Client demographics: The demographics of your target clients can also play a role in your sales forecast. For example, if your target market is primarily upper-class couples, you may be able to charge a higher average price for your services. However, if your target market is more budget-conscious couples, your average price may need to be lower in order to attract clients and increase your number of monthly transactions.

Once you have an idea of what your future sales will look like, it will be time to work on your overhead budget. Let’s see what this entails.

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

The next step is to estimate the costs you’ll have to incur to operate your wedding planning company.

These will vary based on where your business is located, and its overall size (level of sales, personnel, etc.).

But your wedding planning company's operating expenses should normally include the following items:

- Staff wages: As a wedding planning company, your biggest expense will likely be your staff wages. This includes salaries for your event coordinators, administrative staff, and any other employees you may have.

- Accountancy fees: You will need to hire an accountant to manage your company's financial records, file taxes, and provide financial advice. This is an important expense to ensure the financial health of your business.

- Insurance costs: Insurance is essential for any company, but especially for a wedding planning business. You will need to invest in liability insurance, property insurance, and possibly even event cancellation insurance.

- Software licenses: To effectively manage and plan weddings, you will need to invest in software licenses for project management, accounting, CRM, and other necessary tools.

- Banking fees: Your business will have various banking fees for transactions, wire transfers, and other financial services. Make sure to budget for these fees to avoid any unexpected costs.

- Marketing and advertising: In order to attract clients and grow your business, you will need to invest in marketing and advertising efforts. This could include website development, social media advertising, and print materials.

- Office rent and utilities: You will need a physical office space to meet with clients and plan weddings. This expense includes rent, utilities, and office supplies.

- Professional development: As a wedding planning company, it's important to stay up-to-date with industry trends and skills. Budget for attending conferences, workshops, and other professional development opportunities.

- Travel expenses: Depending on the location of your weddings, you may need to budget for travel expenses including flights, accommodations, and transportation.

- Client entertainment: You may need to take clients out for meals or drinks to discuss wedding plans. Budget for these expenses to maintain good relationships with your clients.

- Office equipment: You will need basic office equipment such as computers, printers, and office furniture. Make sure to budget for these upfront costs and any future maintenance or replacements.

- Legal fees: It's important to have a lawyer on retainer to handle any legal matters that may arise. This could include contract reviews, trademark applications, or any other legal needs for your business.

- Event supplies: As a wedding planning company, you will need to purchase event supplies such as linens, decor, and other materials. Budget for these expenses to ensure you can provide high-quality services to your clients.

- Telephone and internet: Communication is key for a wedding planning business, so budget for monthly expenses for telephone and internet services.

- Professional memberships: You may want to join professional organizations or associations to network and gain industry knowledge. Budget for membership fees and any associated costs.

This list is not exhaustive by any means, and will need to be tailored to your wedding planning company's specific circumstances.

What investments are needed to start or grow a wedding planning company?

Once you have an idea of how much sales you could achieve and what it will cost to run your wedding planning company, it is time to look into the equipment required to launch or expand the activity.

For a wedding planning company, capital expenditures and initial working capital items could include:

- Office Space: As a wedding planning company, you will need a dedicated office space to meet with clients and store important documents. This could include rent, utilities, and furniture.

- Technology: In today's digital age, having the right technology is crucial for a successful wedding planning company. This could include computers, printers, software, and other necessary equipment.

- Transportation: As a wedding planner, you will likely have to travel for meetings, venue visits, and other wedding-related tasks. This could include purchasing a company vehicle or renting transportation services.

- Inventory: Depending on your business model, you may need to purchase inventory such as wedding decorations, linens, and other supplies. This could also include storage space for these items.

- Website Development: In order to attract clients and showcase your services, you will need to invest in a professional website. This could include hiring a web designer, purchasing a domain name, and hosting fees.

Again, this list will need to be adjusted according to the specificities of your wedding planning company.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The next step in the creation of your financial forecast for your wedding planning company is to think about how you might finance your business.

You will have to assess how much capital will come from shareholders (equity) and how much can be secured through banks.

Bank loans will have to be modelled so that you can separate the interest expenses from the repayments of principal, and include all this data in your forecast.

Issuing share capital and obtaining a bank loan are two of the most common ways that entrepreneurs finance their businesses.

Now let's have a look at the main output tables of your wedding planning company's financial forecast.

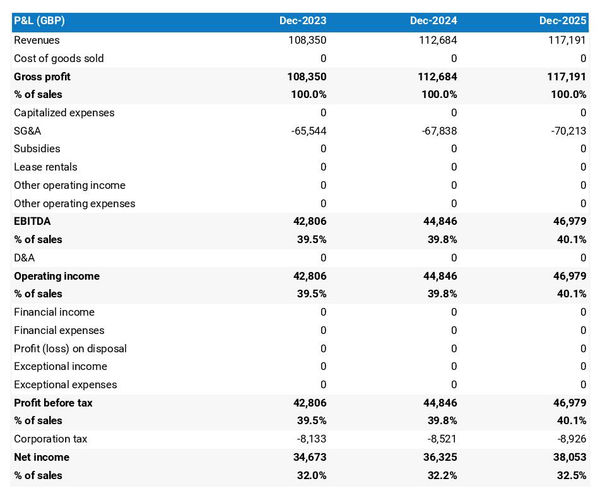

The forecasted profit & loss statement

The profit & loss forecast gives you a clear picture of your business’ expected growth over the first three to five years, and whether it’s likely to be profitable or not.

A healthy wedding planning company's P&L statement should show:

- Sales growing at (minimum) or above (better) inflation

- Stable (minimum) or expanding (better) profit margins

- A healthy level of net profitability

This will of course depend on the stage of your business: numbers for an established wedding planning company will look different than for a startup.

The projected balance sheet

Your wedding planning company's forecasted balance sheet enables you to assess your financial structure and working capital requirements.

It is composed of three types of elements: assets, liabilities and equity:

- Assets: represent what the business owns and uses to produce cash flows. It includes resources such as cash, equipment, and accounts receivable (money owed by clients).

- Liabilities: represent funds advanced to the business by lenders and other creditors. It includes items such as accounts payable (money owed to suppliers), taxes due and loans.

- Equity: is the combination of what has been invested by the business owners and the cumulative profits and losses generated by the business to date (which are called retained earnings). Equity is a proxy for the value of the owner's stake in the business.

The projected cash flow statement

A projected cash flow statement for a wedding planning company is used to show how much cash the business is generating or consuming.

The cash flow forecast is usually organised by nature to show three key metrics:

- The operating cash flow: do the core business activities generate or consume cash?

- The investing cash flow: how much is the business investing in long-term assets (this is usually compared to the level of fixed assets on the balance sheet to assess whether the business is regularly maintaining and renewing its equipment)?

- The financing cash flow: is the business raising new financing or repaying financiers (debt repayment, dividends)?

Cash is king and keeping an eye on future cash flows is imperative for running a successful business. Therefore, you should pay close attention to your wedding planning company's cash flow forecast.

If you are trying to secure financing, note that it is customary to provide both yearly and monthly cash flow forecasts in a financial plan - so that the reader can analyze seasonal variation and ensure the wedding planning company is appropriately capitalised.

Which tool should you use to create your wedding planning company's financial projections?

Building a wedding planning company financial forecast is not difficult provided that you use the right tool for the job. Let’s see what options are available below.

Using online financial forecasting software to build your wedding planning company's projections

The modern and easiest way is to use professional online financial forecasting software such as the one we offer at The Business Plan Shop.

There are several advantages to using specialised software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You have access to complete financial forecast templates

- You get a complete financial forecast ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast, and recalibrate your forecast as the year goes by

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

- It’s cost-efficient and much cheaper than using an accountant or consultant (see below)

If you are interested in this type of solution, you can try our forecasting software for free by signing up here .

Hiring a financial consultant or chartered accountant

Hiring a consultant or chartered accountant is also an efficient way to get a professional wedding planning company financial projection.

As you can imagine, this solution is much more expensive than using software. From experience, the creation of a simple financial forecast over three years (including a balance sheet, income statement, and cash flow statement) is likely to start around £700 or $1,000 excluding taxes.

The indicative estimate above, is for a small business, and a forecast done as a one-off. Using a financial consultant or accountant to track your actuals vs. forecast and to keep your financial forecast up to date on a monthly or quarterly basis will naturally cost a lot more.

If you choose this solution, make sure your service provider has first-hand experience in your industry, so that they may challenge your assumptions and offer insights (as opposed to just taking your figures at face value to create the forecast’s financial statements).

Why not use a spreadsheet such as Excel or Google Sheets to build your wedding planning company's financial forecast?

You and your financial partners need numbers you can trust. Unless you have studied finance or accounting, creating a trustworthy and error-free wedding planning company financial forecast on a spreadsheet is likely to prove challenging.

Financial modelling is very technical by nature and requires a solid grasp of accounting principles to be done without errors. This means that using spreadsheet software like Excel or Google Sheets to create accurate financial forecasts is out of reach for most business owners.

Creating forecasts in Excel is also inefficient nowadays:

- Software has advanced to the point where forecasting can be done much faster and more accurately than manually on a spreadsheet.

- With artificial intelligence, the software is capable of detecting mistakes and helping decision-making.

Spreadsheets are versatile tools but they are not tailor-made for reporting. Importing your wedding planning company's accounting data in Excel to track actual vs. forecast is incredibly manual and tedious (and so is keeping forecasts up to date). It is much faster to use dedicated financial planning tools like The Business Plan Shop which are built specially for this.

Use our financial forecast templates for inspiration

The Business Plan Shop has dozens of financial forecast examples available.

Our templates contain both a financial forecast and a written business plan which presents, in detail, the company, the team, the strategy, and the medium-term objectives.

Our templates are a great source of inspiration, whether you just want to see what a complete business plan looks like, or are looking for concrete examples of how you should model financial elements in your own forecast.

- A financial forecast shows expected growth, profitability, and cash generation metrics for your wedding planning company.

- Tracking actuals vs. forecast and having an up-to-date financial forecast is key to maintaining visibility on your future cash flows.

- Using financial forecasting software is the modern way of creating and maintaining financial projections.

We hope that this guide helped you gain a clearer perspective on the steps needed to create the financial forecast for a wedding planning company. Don't hesitate to contact us if you have any questions!

Also on The Business Plan Shop

- Financial forecast example

Know someone who runs a wedding planning company? Share our business guide with them!

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

How To Write a Successful Wedding Planner Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for wedding planner businesses that want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every wedding planner business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is a Wedding Planner Business Plan?

A wedding planner business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Wedding Planner Business Plan?

A wedding planner business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Wedding Planner Business Plan

The following are the key components of a successful wedding planner business plan:

Executive Summary

The executive summary of a wedding planner business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your wedding planner company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your wedding planner business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your wedding planner firm, mention this.

You will also include information about your chosen wedding planner business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of a wedding planner business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the wedding planner industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of a wedding planner business may include:

- Bridal party members

- Family of wedding couple

- Wedding vendors (e.g., caterers, florists, photographers)

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or wedding planner services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your wedding planner business may have:

- Extensive industry knowledge and experience

- Personalized service

- Comprehensive planning and organization

- Creativity and attention to detail

- Value-driven perspective

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your wedding planner business via word-of-mouth marketing.

Operations Plan

This part of your wedding planner business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a wedding planner business include reaching $X in sales. Other examples include adding new products or services, expanding to new markets, or hiring new personnel.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific wedding planner industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Wedding Planner Business

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Wedding Planner Business

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup wedding planner business.

Sample Cash Flow Statement for a Startup Wedding Planner Business

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your wedding planner company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

A well-written business plan is an essential tool for any wedding planner company. If you are seeking funding from investors or lenders, it’s important to have a polished and professional business plan. Use the template above as a guide as you write your own wedding planner business plan.

Finish Your Wedding Planner Business Plan in 1 Day!

Navigating Year-End Financial Review for Your Wedding Planning Business Budget

As the year draws to a close, wedding planners have a golden opportunity to embark on a financial review that sets the stage for a prosperous new year. In this blog post, we explore the art of managing your wedding planning business budget through a comprehensive year-end financial review, ensuring a solid foundation for continued success.

Reflecting on Revenue and Expenses

Begin your year-end financial review by reflecting on the revenue and expenses of the past year. Analyze income streams, considering sources such as service fees, consultation charges, and any additional revenue avenues. Simultaneously, scrutinize expenses, including operational costs, marketing investments, and professional development expenditures.

Comparing Budget Projections to Actuals

Assess the accuracy of your budget projections by comparing them to the actual financial outcomes. Identify areas where your projections were spot-on and areas that may have deviated. This insight allows you to refine your budgeting skills for the upcoming year, ensuring more precise financial planning.

Evaluating Return on Investments (ROI)

Dive into the effectiveness of your investments throughout the year. Evaluate the return on investments from marketing campaigns, professional development courses, and any other expenditures aimed at enhancing your business. This assessment aids in identifying which investments yielded the highest returns, guiding future financial strategies.

Assessing Client Acquisition and Retention Costs

Calculate the costs associated with acquiring and retaining clients. Understand the marketing and operational expenses tied to client acquisition, as well as the efforts and resources invested in retaining existing clients. This analysis provides insights into the efficiency of your client management strategies.

Adjusting for Seasonal Variances

Consider the seasonal variations that may impact your wedding planning business. Analyze whether there are particular months or seasons where revenue tends to peak or dip. Understanding these patterns enables you to make informed decisions, such as adjusting marketing efforts during slower periods or capitalizing on peak seasons.

Reviewing Vendor Relationships

Evaluate your relationships with vendors and suppliers. Assess the costs, terms, and efficiency of these partnerships. Consider renegotiating contracts, exploring new collaborations, or optimizing existing relationships to enhance your business’s financial health.

Updating Pricing Strategies

Use your year-end financial review to reassess your pricing strategies. Consider the value you provide, market trends, and competitor pricing. Adjusting your pricing model, if necessary, ensures that your services remain competitive while maintaining profitability.

Setting Financial Goals for the New Year

Conclude your year-end financial review by setting clear financial goals for the upcoming year. Establish revenue targets, expense benchmarks, and investment objectives. Outline actionable steps to achieve these goals, providing a roadmap for financial success in the next chapter of your wedding planning business.

A meticulous year-end financial review is the compass that guides your wedding planning business toward financial prosperity. By reflecting on revenue and expenses, comparing budget projections to actuals, evaluating ROI, and addressing various financial aspects, you lay the groundwork for informed decisions and strategic planning. As you bid farewell to the current year, embrace the opportunity to enroll in our courses and cultivate a resilient and flourishing financial future for your wedding planning business.

Our Friends

Sign up for our latest updates

- Memberships

- partner with us

- Affiliate Program

SMS +61 488 858 686 WhatsApp: +61 418313779

- 2023 The Wedding Academy Pty Ltd | ABN 11 663 413 705 | PO Box 523, Cooroy QLD 4563 Australia

- [email protected]

- Our Courses

- Our Programs

- Online Store

- Latest News

David Tutera

Leading Wedding & Entertaining Expert, David Tutera is hailed as an artistic visionary whose ability, uniquely creative talents and outstanding reputation have made him a tremendous success in the lifestyle arena. Tutera has created a name for himself by taking his passion for designing spectacular events and transforming it into a lifestyle.

He continuously exceeds the expected with an unmatched level of inspiration, imagination and innovation to create the latest trends in entertaining. Tutera’s grandfather, a successful florist, first noticed his grandson’s artistic ability at an early age and encouraged David to pursue his destiny. At age 19, with the sound advice of his grandfather and only one client, David opened his own event planning business.

Today, David Tutera presides over an award winning company built from experience, dedication and Tutera’s natural talent for transforming the ordinary into the extraordinary. His name has become synonymous with style, elegance, creativity and vision. David Tutera has a natural talent for transforming the ordinary into the extraordinary. His name has become synonymous with style, elegance, creativity and vision.

Honored by Life & Style Magazine as “Best Celebrity Wedding Planner,” David’s impressive client list includes Jewel, Star Jones’ wedding, Real Housewife Taylor Armstrong’s wedding, Los Angeles Clippers’ Chris Paul’s wedding, NY Giants Antonio Pierce’s wedding, Shannen Doherty’s wedding and events for Jennifer Lopez, Matthew McConaughey, Brandy and Ray J, Jenni “JWoww” Farley, Lil’ Kim, the Official Post Grammy Parties in New York City, Elton John, Barbara Walters, the Rolling Stones, Nancy Reagan, Prince Charles, The White House, private events for the Vice President, Kenneth Cole, Tommy Hilfiger, Susan Lucci, The John F. Kennedy Center, as well as countless film premieres and celebrity parties for royalty, politicians and socialites.