Financial Tips, Guides & Know-Hows

Home > Finance > What Is Business Financial Planning

What Is Business Financial Planning

Published: November 2, 2023

Discover the importance of business financial planning and how it can optimize your finances. Gain insights into finance strategies and maximize profitability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Table of Contents

Introduction, definition of business financial planning, importance of business financial planning, steps in business financial planning, components of business financial planning, benefits of business financial planning, challenges in business financial planning, considerations in business financial planning.

Welcome to our comprehensive guide on business financial planning. In today’s fast-paced and competitive business landscape, having a solid financial plan is crucial for the success and sustainability of any organization. Whether you are a small start-up or a large corporation, effectively managing your finances is a key factor in achieving profitability, growth, and long-term stability.

Financial planning for businesses involves analyzing the company’s current financial situation, setting realistic financial goals, and developing strategies to achieve those goals. It encompasses various aspects such as budgeting, forecasting, cash flow management, investment planning, risk management, and tax planning.

In this article, we will explore the definition, importance, steps, components, benefits, challenges, and considerations involved in business financial planning. By gaining a deeper understanding of these critical elements, you will be equipped with the necessary knowledge and insights to create a strong financial foundation for your organization.

Financial planning is not just for companies seeking external funding or facing financial difficulties. It is a fundamental process that applies to all businesses, regardless of their size or industry. It allows you to make informed decisions, optimize resource allocation, and seize opportunities as they arise.

Effective financial planning provides you with a roadmap to success, setting a clear direction for your business and helping you stay on track. It enables you to anticipate potential obstacles and devise strategies to overcome them, ensuring smooth operations and sustained profitability.

As we delve deeper into the world of business financial planning, it’s important to remember that every organization’s needs and circumstances are unique. While there are standard principles and best practices, it is essential to tailor your financial plan to align with your specific objectives, challenges, and resources.

Are you ready to embark on this journey of optimizing your business’s financial health? Let’s dive in and explore the exciting world of business financial planning together!

Business financial planning is the process of assessing, organizing, and managing a company’s financial resources to achieve its goals and objectives. It involves analyzing the company’s financial status, setting financial targets, and developing strategies to achieve those targets.

Financial planning also includes creating budgets, forecasting future financial performance, and monitoring cash flow, investments, and expenses. It helps businesses make informed decisions about resource allocation, capital investments, and risk management.

At its core, business financial planning aims to ensure the organization’s financial stability, growth, and long-term success. It provides a roadmap for allocating financial resources effectively, maximizing profitability, and mitigating financial risks.

Business financial planning covers various areas, including:

- Income and expense management: Monitoring and controlling the company’s revenue streams and expenses to achieve financial sustainability.

- Cash flow management: Managing the inflow and outflow of cash to ensure sufficient liquidity for day-to-day operations and future growth.

- Investment planning: Identifying investment opportunities that align with the company’s financial goals and risk tolerance.

- Debt management: Evaluating and managing the company’s debt levels to optimize financial leverage and maintain healthy financial ratios.

- Risk management: Identifying potential risks, such as market volatility or regulatory changes, and implementing strategies to mitigate their impact on the organization’s finances.

- Tax planning: Developing strategies to minimize tax liabilities and ensure compliance with applicable tax laws and regulations.

Business financial planning is an ongoing process that requires regular review and adjustment. As market conditions, financial goals, and business circumstances change, it is crucial to update and adapt the financial plan accordingly to maintain its effectiveness.

The ultimate goal of business financial planning is to optimize the company’s financial performance, enhance shareholder value, and provide a solid foundation for sustainable growth. By proactively managing the company’s finances and making informed decisions, businesses can navigate challenges, seize opportunities, and achieve their desired financial outcomes.

Business financial planning is of utmost importance for organizations of all sizes and industries. It provides a roadmap for success by guiding key financial decisions and ensuring the long-term stability and growth of the business. Here are several reasons why business financial planning is essential:

- Goal Setting and Strategic Alignment: Financial planning helps businesses set clear financial goals and align them with the overall strategic objectives of the organization. By defining specific targets, such as revenue growth or profitability ratios, businesses can track their progress and make informed decisions that drive them closer to accomplishing their goals.

- Resource Optimization: Financial planning allows businesses to plan and allocate their resources effectively. By carefully analyzing income and expenses, businesses can identify areas of inefficiency, eliminate unnecessary costs, and focus resources on initiatives that generate the highest returns. This optimization of resources leads to increased profitability and the preservation of valuable capital.

- Risk Management: One of the key benefits of financial planning is the ability to assess and mitigate risks that may impact the financial health of the business. By performing risk analysis and implementing risk management strategies, businesses can prepare for unforeseen events, such as economic downturns or industry disruptions, and minimize their potential negative impact.

- Cash Flow Management: Effective financial planning enables businesses to manage their cash flow efficiently. By forecasting future cash inflows and outflows, businesses can ensure that they have sufficient liquidity to meet their financial obligations, such as paying suppliers or employees, while also planning for future investments or expansion.

- Financial Decision-Making: Financial planning provides businesses with the necessary information and analysis to make informed financial decisions. Whether it is evaluating investment opportunities, determining pricing strategies, or deciding on financing options, a solid financial plan acts as a guiding framework, ensuring decisions are based on sound financial principles and long-term objectives.

- Stakeholder Confidence: Having a robust financial plan instills confidence in stakeholders, including investors, lenders, and shareholders. It demonstrates that the business is well-managed, financially stable, and capable of delivering on its promises. This, in turn, enhances credibility and attracts potential investors or financing opportunities.

Overall, business financial planning plays a crucial role in setting the direction, optimizing resources, and managing risks for an organization. It provides the foundation for effective financial management and decision-making, enabling businesses to navigate challenges, seize opportunities, and achieve sustainable growth in a competitive market environment.

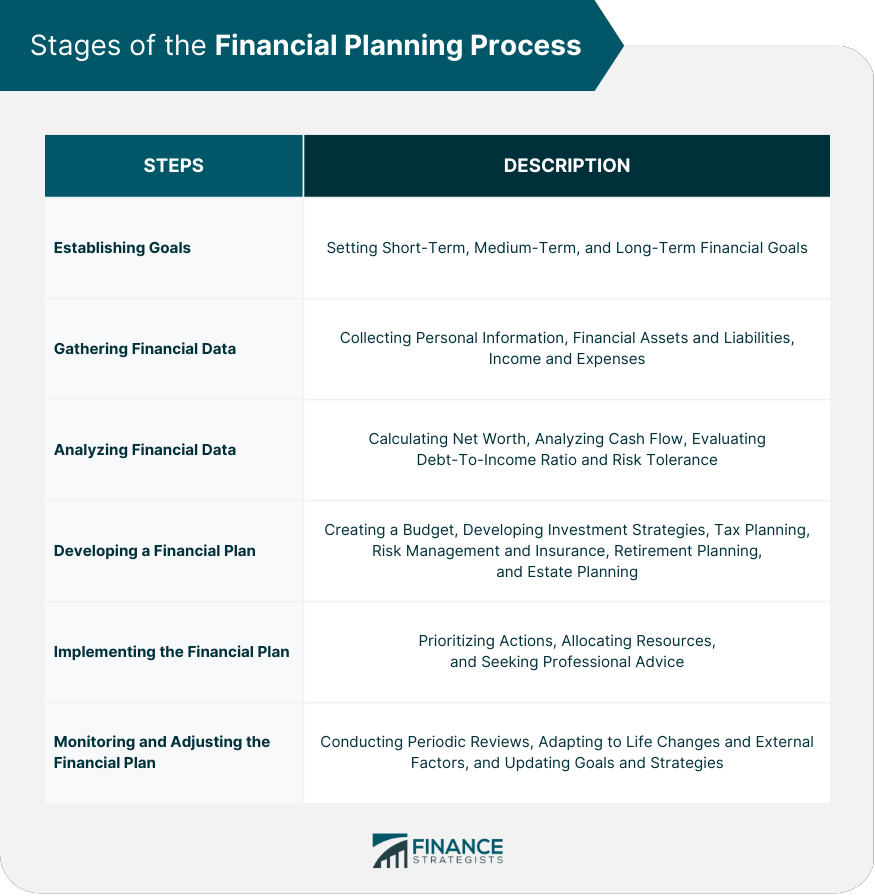

Effective business financial planning involves a series of steps that help organizations analyze their current financial position, set financial goals, and develop strategies to achieve those goals. While each business’s financial planning process may vary based on their specific needs, here are the general steps to follow:

- Assess Current Financial Position: The first step in financial planning is to assess the company’s current financial position. This involves gathering and analyzing financial statements, such as income statements, balance sheets, and cash flow statements, to understand the company’s revenue, expenses, assets, liabilities, and cash flow. It also involves identifying any financial strengths, weaknesses, or areas for improvement.

- Set Financial Goals: Once the current financial position is evaluated, the next step is to set specific financial goals. These goals can include increasing revenue, improving profit margins, reducing costs, increasing cash flow, or achieving a specific return on investment. It is important to ensure that these goals are realistic, measurable, and aligned with the overall strategic objectives of the business.

- Develop a Budget: A budget is a crucial tool in financial planning as it helps to allocate resources and track financial performance. Based on the identified financial goals, businesses create a budget that outlines projected income, expenses, and cash flow for a specific period, typically on an annual basis. The budget should be detailed and comprehensive, accounting for all aspects of the business’s operations.

- Perform Financial Analysis: Financial analysis involves examining historical financial data and using financial ratios to assess the company’s financial health and performance. This analysis helps to identify trends, patterns, and areas of improvement. Key financial ratios to consider include liquidity ratios, profitability ratios, and solvency ratios.

- Create Financial Strategies: With a clear understanding of the current financial position, goals, and budget, businesses can develop strategies to achieve their financial objectives. These strategies may include steps to increase revenue, reduce costs, manage cash flow, optimize investments, and mitigate financial risks. The strategies should be realistic, actionable, and aligned with the overall business strategy.

- Implement and Monitor: Once the financial strategies are defined, it is important to implement them and closely monitor their progress. Regularly reviewing and comparing actual financial performance against the budget and goals helps to identify any deviations or areas requiring adjustments. This monitoring allows for timely decision-making and course correction to stay on track.

- Periodic Review and Adjustments: Financial planning is an ongoing process, and it is essential to periodically review and adjust the financial plan as business conditions change. This includes revisiting financial goals, updating the budget, and adapting strategies to reflect new opportunities or challenges. Regular reviews help businesses stay agile and responsive to the evolving market dynamics.

Following these steps in business financial planning ensures that organizations have a clear understanding of their financial position, set realistic goals, and implement strategies to achieve those goals. It provides a structured approach to financial management and enables businesses to make informed decisions for long-term success and profitability.

Business financial planning encompasses several key components that work together to create a comprehensive and effective financial strategy. These components provide the necessary framework for managing and optimizing the company’s finances. Here are the primary components of business financial planning:

- Financial Goals: Defining clear and specific financial goals is an essential component of business financial planning. Financial goals can include revenue targets, profit margins, cash flow objectives, and return on investment. These goals provide direction and purpose to the financial planning process, guiding decision-making and resource allocation.

- Budgeting: Budgeting is a critical component of financial planning that involves creating a detailed plan for income and expenses. A well-structured budget lays out projected revenue, costs, and investments over a specific period, typically on an annual basis. It helps businesses track their financial performance, allocate resources effectively, and make informed financial decisions.

- Cash Flow Management: Managing cash flow is crucial for the financial health of any business. It involves monitoring and controlling the inflow and outflow of cash to ensure there is enough liquidity to meet ongoing expenses and fund future growth. An effective cash flow management component of financial planning includes forecasting cash flow, optimizing working capital, and implementing strategies to improve cash flow efficiency.

- Financial Analysis: Financial analysis plays a pivotal role in business financial planning. It involves analyzing financial statements, ratios, and other financial data to assess the company’s financial health and performance. Key financial analysis components include liquidity ratios, profitability ratios, and solvency ratios. This analysis helps identify trends, evaluate the company’s financial strengths and weaknesses, and make data-driven financial decisions.

- Investment Planning: Investment planning focuses on identifying investment opportunities that align with the company’s financial goals and risk tolerance. This component involves evaluating potential investments, such as new projects, technology upgrades, or acquisitions, and assessing their potential returns and risks. Effective investment planning allows businesses to allocate resources wisely to maximize profitability and long-term growth.

- Risk Management: Risk management is an integral part of financial planning that involves identifying and mitigating financial risks that can impact the company’s finances. This component includes assessing market risks, legal and regulatory risks, credit risks, and operational risks. Implementing risk management strategies, such as insurance coverage or hedging techniques, helps businesses protect their financial stability and minimize potential losses.

- Tax Planning: Tax planning is an essential component of financial planning that involves developing strategies to minimize tax liabilities while maintaining compliance with tax laws and regulations. This includes understanding tax incentives, deductions, and credits, as well as effectively managing tax reporting and documentation. Effective tax planning ensures businesses optimize their tax positions and maximize after-tax profitability.

By integrating these components into their financial planning process, businesses can create a comprehensive and dynamic strategy that addresses their financial goals, manages cash flow, analyzes performance, minimizes risks, and optimizes investments. Each component contributes to the overall financial health and success of the organization, helping businesses navigate challenges, seize opportunities, and achieve sustainable growth.

Business financial planning offers several significant benefits to organizations of all sizes and industries. It serves as a fundamental tool for managing and optimizing financial resources, making informed decisions, and achieving long-term success. Here are some key benefits of business financial planning:

- Goal Clarity and Focus: Financial planning helps businesses set clear financial goals and objectives. By defining specific targets, businesses can align their efforts and resources towards achieving those goals. It brings clarity and focus to the organization, providing a sense of direction and purpose.

- Resource Optimization: A well-developed financial plan enables businesses to allocate their resources effectively. It helps identify areas of inefficiency, wasteful spending, or underutilization of resources. Through financial planning, organizations can optimize their resource allocation, reduce costs, and maximize profitability.

- Risk Management: Financial planning incorporates risk management strategies that help businesses identify and mitigate potential risks. It enables companies to anticipate and prepare for unforeseen events, such as economic downturns, regulatory changes, or supply chain disruptions. By mitigating risks, businesses can protect their financial stability and minimize potential losses.

- Sustainable Growth: Financial planning is crucial for sustained business growth. It allows organizations to assess their financial position, identify growth opportunities, and develop strategies to capitalize on them. By setting achievable financial goals, businesses can expand their market share, enter new markets, invest in research and development, and drive long-term growth.

- Better Decision-making: Financial planning provides businesses with a solid foundation for making informed decisions. By analyzing financial data, evaluating risk factors, and considering various scenarios, businesses can make strategic decisions that align with their financial goals. This leads to better investment choices, pricing strategies, and capital allocation.

- Improved Cash Flow: Effective financial planning helps businesses manage their cash flow efficiently. It involves forecasting cash inflows and outflows, optimizing working capital, and ensuring sufficient liquidity for day-to-day operations and growth initiatives. Improved cash flow management enables businesses to meet financial obligations, seize opportunities, and maintain financial stability.

- Enhanced Credibility: Financial planning enhances a business’s credibility and reputation with stakeholders, including investors, lenders, and customers. It demonstrates that the organization is well-managed, financially stable, and has a clear vision for the future. This credibility attracts potential investors, lenders, and partners, opening doors to new growth opportunities.

Overall, business financial planning plays a vital role in guiding organizations towards financial success and sustainability. It provides a framework for goal setting, resource optimization, risk management, and decision-making. By implementing effective financial planning strategies, businesses can navigate challenges, seize opportunities, and achieve their desired financial outcomes.

While business financial planning is crucial for success, it is not without its challenges. Organizations must navigate various obstacles to develop and implement effective financial plans. Here are some common challenges in business financial planning:

- Data Accuracy and Availability: Financial planning heavily relies on accurate and up-to-date financial data. However, obtaining reliable and comprehensive data can be a challenge, especially for small businesses or those with inadequate financial reporting systems. Without accurate data, it becomes difficult to perform accurate financial analysis and make informed decisions.

- Uncertain Economic Climate: The ever-changing economic landscape poses a challenge in financial planning. Businesses need to adapt their financial plans to account for economic fluctuations, changes in market trends, and shifts in consumer behavior. Uncertainty, such as recessions, inflation, or global crises, can impact revenue streams, cash flow, and profitability, making financial planning more complex.

- Complexity of Financial Regulations: Compliance with financial regulations is a significant challenge in financial planning. Businesses must stay abreast of constantly evolving regulations, tax laws, and reporting requirements. Failure to comply can result in penalties, legal issues, and reputational damage. Ensuring accuracy and compliance while navigating a complex regulatory environment adds complexity to the financial planning process.

- Difficulty in Forecasting: Forecasting future financial performance is integral to financial planning. However, accurately predicting future events, such as sales growth, market demand, or industry trends, can be challenging. External factors like changing customer preferences or new competitors can impact revenue projections, making it difficult to create realistic financial forecasts.

- Limited Resources: Limited financial and human resources can pose challenges in financial planning. Small businesses often face constraints in hiring dedicated financial professionals or investing in sophisticated financial planning tools. Lack of expertise and resources can hinder the ability to develop and execute robust financial plans.

- Inadequate Communication and Collaboration: Financial planning requires collaboration across different departments and stakeholders within an organization. Ineffective communication and collaboration can lead to misalignment between financial goals, operations, and strategic objectives. It is essential to foster effective communication channels and ensure all stakeholders are involved in the financial planning process.

- External Factors: External factors beyond a business’s control, such as political instability, natural disasters, or shifts in the global economy, can impact financial planning. These unforeseen events can disrupt supply chains, affect customer demand, or create financial instability. Adapting financial plans to mitigate the impact of external factors is a challenge that businesses must navigate.

Despite the challenges, businesses can overcome them by adopting proactive measures. Implementing robust financial systems, investing in accurate data collection and reporting tools, staying informed about regulatory changes, and fostering effective communication can help organizations navigate these challenges and develop resilient financial plans.

When embarking on business financial planning, there are several important considerations to keep in mind. These considerations help ensure that the financial plan is comprehensive, realistic, and tailored to the specific needs of the organization. Here are key factors to consider in business financial planning:

- Business Objectives: Align financial planning with the overall strategic objectives of the business. The financial plan should support and contribute to the achievement of the organization’s goals, whether it is revenue growth, market expansion, profitability, or sustainability.

- Risk Tolerance: Understand the risk tolerance of the business and factor it into the financial plan. Different businesses have varying levels of risk appetite, and the financial plan should account for this. It should include risk management strategies that align with the organization’s risk tolerance and protect against potential financial setbacks.

- Industry and Market Conditions: Consider the specific industry and market conditions in which the business operates. Market trends, customer preferences, competitive landscape, and regulatory environment all impact financial planning. Keeping abreast of industry dynamics helps in making informed financial decisions and formulating realistic financial projections.

- Customer and Supplier Relationships: Analyze the relationships with customers and suppliers to understand their impact on the financial health of the business. Ensure financial planning accounts for any dependencies, credit terms, payment schedules, and potential risks associated with these relationships.

- Technology and Systems: Assess the technology infrastructure and financial systems in place to support financial planning. Evaluate whether the existing systems are capable of providing accurate and timely financial data for analysis. Consider whether any upgrades or investments in technology are needed to enhance financial planning capabilities.

- Competencies and Resources: Evaluate the financial competencies and resources within the organization. Determine if the current finance team has the necessary expertise to develop and execute the financial plan effectively. Identify any gaps and consider training or hiring new talent to strengthen financial planning capabilities.

- Long-term Sustainability: Consider long-term sustainability when creating the financial plan. Beyond short-term goals, it is crucial to analyze the impact of financial decisions on the overall financial health and viability of the business in the long run. Balancing short-term objectives with long-term sustainability is essential for sustained growth and profitability.

- Regulatory Compliance: Stay informed about relevant financial regulations, tax laws, and reporting requirements. Ensure the financial plan complies with all applicable regulations. Consult with legal and financial experts, if necessary, to ensure compliance and mitigate any potential legal or financial risks.

By considering these factors in business financial planning, organizations can develop a comprehensive and tailored financial strategy that addresses their unique circumstances. Regularly reviewing and updating the financial plan in response to changes in these considerations ensures that the plan remains relevant and effective in driving the organization towards its financial goals.

Business financial planning is a crucial process that organizations must undertake to navigate the complex world of finance and achieve their goals. From setting clear financial objectives to creating budgets, managing cash flow, and analyzing financial performance, financial planning forms the foundation for informed decision-making and long-term success.

Throughout this comprehensive guide, we have explored the definition, importance, steps, components, benefits, challenges, and considerations of business financial planning. We have seen how financial planning helps businesses clarify their goals, optimize resources, mitigate risks, and make strategic financial decisions.

By engaging in financial planning, businesses can set the stage for sustainable growth, enhanced profitability, and improved financial stability. It empowers organizations to allocate resources effectively, manage cash flow efficiently, and respond to changes in the economic, market, and regulatory environment.

However, financial planning is not without its challenges. Obtaining accurate data, forecasting future performance, complying with regulations, and managing limited resources are some of the obstacles businesses may face. Despite these challenges, businesses can overcome them through proactive measures such as investing in technology, fostering effective communication, and staying informed about industry trends.

As you embark on your own financial planning journey, remember that flexibility and adaptability are key. Regularly review and update your financial plan, considering factors such as market conditions, customer relationships, and long-term sustainability. By doing so, you can ensure that your financial plan remains relevant and responsive to the evolving needs of your organization.

In conclusion, business financial planning is a dynamic and essential process that enables organizations to effectively manage their financial resources and achieve their strategic objectives. By integrating financial planning into your business strategy, you lay the groundwork for sustainable growth, profitability, and long-term success in today’s competitive business landscape.

How To Start A Financial Planning Business

Our Review on The Credit One Credit Card

20 Quick Tips To Saving Your Way To A Million Dollars

Who Owns The Medico Insurance Company?

What Can I Get With A 683 Credit Score

Latest articles.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Written By:

Financial Literacy Matters: Here’s How to Boost Yours

Unlocking Potential: How In-Person Tutoring Can Help Your Child Thrive

Understanding XRP’s Role in the Future of Money Transfers

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Related post.

By: • Finance

By: Chelsea • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/what-is-business-financial-planning/

How to Write a Small Business Financial Plan

Noah Parsons

4 min. read

Updated April 22, 2024

Creating a financial plan is often the most intimidating part of writing a business plan.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

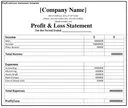

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

6 Min. Read

How to Write Your Business Plan Cover Page + Template

3 Min. Read

What to Include in Your Business Plan Appendix

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

6 Elements of a Successful Financial Plan for a Small Business

Table of Contents

Many small businesses lack a full financial plan, even though evidence shows that it is essential to the long-term success and growth of any business.

For example, a study in the New England Journal of Entrepreneurship found that entrepreneurs with a business plan are more successful than those without one. If you’re not sure how to get started, read on to learn the six key elements of a successful small business financial plan.

What is a business financial plan, and why is it important?

A business financial plan is an overview of a business’s financial situation and a forward-looking projection for growth. A business financial plan typically has six parts: sales forecasting, expense outlay, a statement of financial position, a cash flow projection, a break-even analysis and an operations plan.

A good financial plan helps you manage cash flow and accounts for months when revenue might be lower than expected. It also helps you budget for daily and monthly expenses and plan for taxes each year.

Importantly, a financial plan helps you focus on the long-term growth of your business. That way, you don’t get so caught up in the day-to-day activities that you lose sight of your goals. Focusing on the long-term vision helps you prioritize your financial resources.

The 6 components of a successful financial plan for business

1. sales forecasting.

You should have an estimate of your sales revenue for every month, quarter and year. Identifying any patterns in your sales cycles helps you better understand your business, and this knowledge is invaluable as you plan marketing initiatives and growth strategies .

For instance, a seasonal business can aim to improve sales in the off-season to eventually become a year-round venture. Another business might become better prepared by understanding how upticks and downturns in business relate to factors such as the weather or the economy.

Sales forecasting is also the foundation for setting company growth goals. For instance, you could aim to improve your sales by 10 percent over each previous period.

2. Expense outlay

A full expense plan includes regular expenses, expected future expenses and associated expenses. Regular expenses are the current ongoing costs of your business, including operational costs such as rent, utilities and payroll.

Regular expenses relate to standard business activities that occur each year, such as conference attendance, advertising and marketing, and the office holiday party. It’s a good idea to distinguish essential expenses from expenses that can be reduced or eliminated if needed.

Expected future expenses are known future costs, such as tax rate increases, minimum wage increases or maintenance needs. Generally, a part of the budget should also be allocated to unexpected future expenses, such as damage to your business caused by fire, flood or other unexpected disasters. Planning for future expenses ensures your business is financially prepared via budget reduction, increases in sales or financial assistance.

Associated expenses are the estimated costs of various initiatives, such as acquiring and training new hires, opening a new store or expanding delivery to a new territory. An accurate estimate of associated expenses helps you properly manage growth and prevents your business from exceeding your cost capabilities.

As with expected future expenses, understanding how much capital is required to accomplish various growth goals helps you make the right decision about financing options.

3. Statement of financial position (assets and liabilities)

Assets and liabilities are the foundation of your business’s balance sheet and the primary determinants of your business’s net worth. Tracking both allows you to maximize your business’s potential value.

Small businesses frequently undervalue their assets (such as machinery, property or inventory) and fail to properly account for outstanding bills. Your balance sheet offers a more complete view of your business’s health than a profit-and-loss statement or a cash flow report.

A profit-and-loss statement shows how the business performed over a specific time period, while a balance sheet shows the financial position of the business on any given day.

4. Cash flow projection

You should be able to predict your cash flow on a monthly, quarterly and annual basis. Projecting cash flow for the full year allows you to get ahead of any financial struggles or challenges.

It can also help you identify a cash flow problem before it hurts your business. You can set the most appropriate payment terms, such as how much you charge upfront or how many days after invoicing you expect payment .

A cash flow projection gives you a clear look at how much money is expected to be left at the end of each month so you can plan a possible expansion or other investments. It also helps you budget, such as by spending less one month for the anticipated cash needs of another month.

5. Break-even analysis

A break-even analysis evaluates fixed costs relative to the profit earned by each additional unit you produce and sell. This analysis is essential to understanding your business’s revenue and potential costs versus profits of expansion or growth of your output.

Having your expenses fully fleshed out, as described above, makes your break-even analysis more accurate and useful. A break-even analysis is also the best way to determine your pricing.

In addition, a break-even analysis can tell you how many units you need to sell at various prices to cover your costs. You should aim to set a price that gives you a comfortable margin over your expenses while allowing your business to remain competitive.

6. Operations plan

To run your business as efficiently as possible, craft a detailed overview of your operational needs. Understanding what roles are required for you to operate your business at various volumes of output, how much output or work each employee can handle, and the costs of each stage of your supply chain will aid you in making informed decisions for your business’s growth and efficiency.

It’s important to tightly control expenses, such as payroll or supply chain costs, relative to growth. An operations plan can also make it easier to determine if there is room to optimize your operations or supply chain via automation, new technology or superior supply chain vendors.

For this reason, it is imperative for a business owner to conduct due diligence and become knowledgeable about merchant services before acquiring an account. Once the owner signs a contract, it cannot be changed, unless the business owner breaks the contract and acquires a new account with a new merchant services provider.

Tips on writing a business financial plan

Business owners should create a financial plan annually to ensure they have a clear and accurate picture of their business’s finances and a realistic view for future growth or expansion. A financial plan helps the business’s leaders make informed decisions about purchases, debt, hiring, expense control and overall operations for the year ahead.

A business financial plan is essential if a business owner is looking to sell their business, attract investors or enter a partnership with another business. Here are some tips for writing a business financial plan.

Review the previous year’s plan.

It’s a good idea to compare the previous year’s plan against actual performance and finances to see how accurate the previous plan and forecast were. That way, you can address any discrepancies or overlooked elements in next year’s plan.

Collaborate with other departments.

A business owner or other individual charged with creating the business financial plan should collaborate with the finance department, human resources department, sales team , operations leader, and those in charge of machinery, vehicles or other significant business tools.

Each division should provide the necessary data about projections, value and expenses. All of these elements come together to create a comprehensive financial picture of the business.

Use available resources.

The Small Business Administration (SBA) and SCORE, the SBA’s nonprofit partner, are two excellent resources for learning about financial plans. Both can teach you the elements of a comprehensive plan and how best to work with the different departments in your business to collect the necessary information. Many websites, including business.com , and service providers, such as Intuit, offer advice on this matter.

If you have questions or encounter challenges while creating your business financial plan, seek advice from your accountant or other small business owners in your network. Your city or state has a small business office that you can contact for help.

Business financial plan templates

Many business organizations offer free information that small business owners can use to create their financial plan. For example, the SBA’s Learning Platform offers a course on how to create a business plan. It also offers worksheets and templates to help you get started. You can seek additional help and more personalized service from your local office.

SCORE is the largest volunteer network of business mentors. It began as a group of retired executives (SCORE stands for “Service Corps of Retired Executives”) but has expanded to include business owners and executives from many industries. Advice is free and available online, and there are SBA district offices in every U.S. state. In addition to participating in group or at-home learning, you can be paired with a mentor for individualized help.

SCORE offers templates and tips for creating a small business financial plan. SCORE is an excellent resource because it addresses different levels of experience and offers individualized help.

Other templates can be found in Microsoft Office’s template library, QuickBooks’ online resources, Shopify’s blog and other places. You can also ask your accountant for guidance, since many accountants provide financial planning services in addition to their usual tax services.

Diana Wertz contributed to the writing and research in this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

What is financial planning in business?

Table of Contents

What is financial planning?

Difference between a personal and business financial plan, how to create a financial plan for your business, develop a solid strategy, create a balance sheet, make cash flow projections, prepare a projected income statement, allocate your budget, monitor your results, plan your finances easily with countingup.

Planning and organising your finances is one of the most crucial parts of running your own business. Financial planning helps you prepare for what the future may involve and uncover ways to grow your company.

But a financial plan involves much more than simply tracking income and expenses. To help you understand what financial planning is, this guide covers:

- The difference between a personal and business financial plan

Read on to learn how Countingup can help you manage your financial planning with ease.

A financial plan serves as a roadmap for your economic growth, showing where you’re at right now, where you want to go, and how you will get there.

You can create a financial plan for personal and business purposes, but these processes are slightly different. We’ll explain more about personal vs business financial planning later in this article.

Financial plans are essential because they force you to consider if you’re on the right track to achieve your business goals. Businesses don’t usually grow accidentally but as a result of hard work and careful planning.

Working with specific goals in mind and a plan for reaching them increases your chances of taking your business where you want it to go. Otherwise, you risk stumbling around in the dark, focusing on things that won’t help your business grow.

Most financial plans include much of the same information. However, there are some key differences between a personal financial plan and a business one. The reason is that an individual’s financial goals are likely different from those of a growing company.

For example, your personal financial plan may include a retirement plan, a strategy for investments, and a plan for buying a new house. You’ll also likely focus on making more money while paying yourself as tax-efficiently as possible.

On the flip side, your company’s financial plan is more likely to focus on goals like hiring more staff, buying new equipment, expanding your product or service offering, and purchasing additional inventory.

These goals are entirely different from the hypothetical individual goals we just mentioned. Therefore, you need a different strategy for your business and personal financial planning.

What is important to include in a financial plan? Below we’ve listed some of the main documents and other aspects you need to create a robust plan:

Effective financial planning usually includes a strategic plan. Think about what you want to accomplish in the next year and ask yourself questions like:

- Do I need to expand or hire more staff?

- Do I need more equipment or new resources?

- How will my plan affect my cash flow?

- Will I need financing? If yes, how much?

Once you know where you want your business to go in the next 12 months, think about how much it might cost you.

It’s also good to think about what you would do if your finances suddenly deteriorated, perhaps from not getting enough jobs or selling enough products. Maybe you could put money aside when the business goes well to have funds available if money ever gets tight.

Your balance sheet is a snapshot of your business’s financial position, meaning how much money you have, how much you’ll receive, and how much money you owe. It’s called a ‘balance sheet’ because it calculates what you need to balance out.

A balance sheet should list your:

- Assets: Such as unpaid invoices, money in the bank, and inventory.

- Liabilities : Money you owe, credit card balances, loan repayments, and so on.

- Equity: For small businesses, this is usually the owner’s equity, but it could include investors’ shares, retained earnings, and stock proceeds.

Financial planning also involves predicting how much money you’ll make and spend in the coming month, quarter or year. Record how much you expect to make from sales and what you think you’ll spend on expenses like bills, supplies, loan repayments, and so on.

You can use a simple spreadsheet to calculate your cash flow projections. We have a separate guide that tells you all about what cash flow is and how it works.

Next, you’ll want to prepare a projected income (or profit and loss) statement to predict how successful you think your company will be. It can be helpful to include different scenarios, good and bad, to help you prepare for each one.

Income statements typically include:

- Revenue: Money from sales.

- Expenses: Money you’ll spend.

- Total income: Calculated as your revenue minus expenses before income taxes.

- Income taxes: Such as Income Tax, National Insurance, and Corporation Tax for limited companies.

- Net income: Your total income after deducting expenses and taxes.

Once you’ve created your strategy and filled in your balance sheet, cash flow, and income projections, you need to figure out where you’ll spend the money you make.

Take your company’s overall budget (read more about how to budget money for your growing business ) and divide it into specific budgets. For example, one for hiring new staff, one for buying new equipment, and one for expanding your product or service offering.

Once you’re done with your financial planning, monitor your real-life results and compare them to your predictions. Monitoring helps you spot any problems so you can fix them before they get out of hand.

It may be a good idea to hire a financial expert to help you put together and monitor your financial plan. Accounting software like Countingup can also help you keep track of your finances almost effortlessly.

Countingup offers sole traders and small business owners the chance to save time and money.

With Countingup, your business current account and accounting software are available in one app. Coupled with our handy expense reminders, automated invoicing, and tax estimates, you can have complete confidence in keeping on top of your finances as you trade.

The app’s realtime profit and loss dashboard gives an insight into your business’ performance and can give you the edge you need to make it a success.

Find out more about Countingup here and sign up for free today.

- Counting Up on Facebook

- Counting Up on Twitter

- Counting Up on LinkedIn

Related Resources

Business insurance from superscript.

We’re partnered with insurance experts, Superscript to provide you with small business insurance.

How to register a company in the UK

There are over five million companies registered in the UK and 500,000 new

How to set up a TikTok shop (2024)

TikTok can be an excellent platform for growing a business, big or small.

Best Side Hustle Ideas To Make Extra Money In 2024 (UK Edition)

Looking to start a new career? Or maybe you’re looking to embrace your

How to throw a launch party for a new business

So your business is all set up, what next? A launch party can

10 key tips to starting a business in the UK

10 things you need to know before starting a business in the UK

How to set up your business: Sole trader or limited company

If you’ve just started a business, you’ll likely be faced with the early

How to register as a sole trader

Running a small business and considering whether to register as a sole trader?

How to open a Barclays business account

When starting a new business, one of the first things you need to

6 examples of objectives for a small business plan

Your new company’s business plan is a crucial part of your success, as

How to start a successful business during a recession

Starting a business during a recession may sound like madness, but some big

What is a mission statement (and how to write one)

When starting a small business, you’ll need a plan to get things up

Explore Solution Hub - our brand new library of pre-built solutions and interactive tours

Financial Planning

Financial planning definition.

Financial planning enables a business to determine how it will afford to achieve its objectives and strategic goals. A business typically sets a vision and objectives, and then immediately creates a financial plan to support those goals. The financial plan describes all of the resources and activities that the company will require—and the expected timeframes—for achieving these objectives.

Financial planning is crucial to organizational success because it compliments the business plan as a whole, confirming that set objectives are financially achievable.

The financial planning process includes multiple tasks, including:

- Confirming the vision and objectives of the business

- Assessing the business environment and company priorities

- Identifying which resources the business needs to achieve its objectives

- Assigning costs business costs centers included in the plan

- Quantifying the amount of equipment, labor, materials, and other resources needed

- Creating and setting a budget

- Identifying any issues and risks with the budget

- Establishing the time period of the plan or planning horizon, either short-term (typically 12 months) or long-term (2 to 5 years)

- Preparing a full financial plan summarizing all key investments, budgets and departmental costs

Generally, the financial partner role includes three areas:

- Strategic financial management;

- Determining financial management objectives; and

- Managing the planning cycle itself.

- Connecting business partners and teams to financial plan

What Is Financial Planning?

Financial planning is the process of assessing the current financial situation of a business to identify future financial goals and how to achieve them. The financial plan itself is a document that serves as a roadmap for a company’s financial growth. It reflects the current status of the business, what progress they intend to make, and how they intend to make it.

Financial plans include budgets, but the terms are not interchangeable. Budgets are just one piece of a financial business plan, which should also include other important information that contribute to a complete picture of a business’ financial health, such as detailed, itemized breakdowns of company assets; typical expenditures; and forecasts of income, cash flow, and revenue.

Typically, business financial plans also focus on specific growth goals and other long-term objectives, as well as potential obstacles to achieving those objectives. A detailed financial planning checklist can identify overlooked opportunities and highlight possible risks that will affect the growth plan.

The comprehensive financial planning process in business is designed to determine how to most effectively use the company’s financial resources to support the objectives of the organization, both short- and long-range, by accurately forecasting future financial results. Financial planning processes are both analytical and informative, balancing the use of data and metrics to predict the future as well as institutional knowledge in departments and teams.

What is Financial Planning and Analysis (FP&A)?

Financial planning and analysis (FP&A) is a group within a company’s finance organization that supports the health of the organization by engaging in several types of activities: budgeting, integrated financial planning, modeling, and forecasting; decision support via reporting on management and performance; and various special projects. FP&A solutions link corporate strategy and execution, enhancing the ability of the finance department to manage performance.

FP&A professionals provide senior management with forecasts of the company’s operating performance and profit and loss for each upcoming quarter and year. These forecasts allow leadership to assess investments and strategic plans for effectiveness and progress. They also enable improved communication between external stakeholders and management.

To map out future goals and plans and evaluate the company’s progress toward achieving its goals, corporate FP&A professionals analyze the company’s operational aspects both quantitatively and qualitatively. FP&A analysts review past company performance, consider business and economic trends, and identify risks and possible obstacles, all to more effectively forecast future financial results for a company.

In contrast to accountants, who are tasked with accurate recordkeeping, consolidations and reporting, financial analysts must analyze and evaluate the totality of a company’s financial activities and map out the financial future of the business. FP&A professionals manage a broad range of financial scenarios and plans, including capital expenditures, expenses, financial statements, income, investments, and taxes.

Budgeting, planning, modeling, and forecasting

The primary responsibility of FP&A is to anchor the company, unite the business and translate plans to actionable & informed results. . So, what is financial planning and analysis, and how does it look in practice?

Senior management creates and drives the strategic plan in a top-down way, setting net income and revenue goals, core strategic initiatives, and other high-level business targets for the company’s next 2 to 10 years. FP&A’s corporate performance management aim is to develop the financial plan needed to achieve the strategic plan created by management.

In the past, financial planning and analysis teams developed annual budgets that remained mostly static and updated annually. However, whether in tandem with a traditional budget or as a replacement altogether, modern FP&A teams are increasingly developing rolling forecasts to cope with stale static budgets. Other important tasks of FP&A teams that are related to the budgeting, planning, and forecasting process include:

- Creating, maintaining, and updating detailed forecasts and financial models of future business operations

- Comparing budgets and forecasts to historical results, and conducting variance analysis to illustrate to management how actual performance and the rolling forecast or budget compare, suggesting ways to improve future performance

- Assessing expansion and growth opportunities based on forecasts and other projections

- Mapping out capital expenditures and investments, and other growth plans

- Generating long-term financial forecasts in the three- to five-year range

Decision support and reporting

FP&A reports variances and forecasts, naturally. However, the team also advises management using that data, offering support on decisions concerning performance improvement, risk minimization, or risk benefit analysis of new opportunities from outside and within the company.

One primary piece of this the FP&A team typically generates is the monthly budget versus actual variance comparison. This report explanations of variances; analysis of historical financials; an updated version of the forecast with opportunities and risks related to the current stage of plan; and Key Performance Indicators (KPIs). Ideally, this report or analysis offers leadership information sufficient to identify ways to meet specific goals or optimize performance, and answer imminent questions of stakeholders. However, the true goal of the budget vs. actual report should be to inform the business around gaps or opportunities that inform the future.

Other ongoing pieces of the FP&A team’s reporting and decision support role include:

- Using key financial ratios such as the current ratio, debt to equity ratio, and interest coverage ratio to gauge the overall financial health of the business

- Identifying which company products, product lines, or services generate the most net profit

- Determining which products, product lines, or services have the highest and lowest profit margins—separate from total profit

- Assessing and evaluating each department’s cost-efficiency in light of the percentage of total company financial resources it consumes

- Collaborating with departments to prepare and consolidate budgets into a single corporate budget

- Preparing other internal reports in support of decision making for executive leadership

Special projects

Inevitably, the FP&A team works on special projects, depending on the size and needs of the business. For example:

Capital allocation. How much of the organization’s capital should be spent, and on what? Based on factors such as return on investment (ROI) and comparisons with increased stock dividends, different possible investments, and other ways the business could utilize its cash flow, are the company’s current investments and assets the best use of excess working capital?

Market research. What are the sizes and contours of a given market in which the organization may have a competitive advantage? Who are its laggards and leaders, and what potential opportunities does it hold for the company?

M&A. Which potential buy-side support, acquisition targets, integration, and divestiture opportunities exist for the company?

Process optimization. How can the company improve problems of process and workflow inefficiency? How can tools and technology in use by the business speak to and work with each other more effectively?

Ultimately, the FP&A team provides upper management with advice and analysis concerning how to best deploy the organization’s financial resources for optimal growth and increased profitability, while avoiding serious financial risk.

What is Corporate Financial Planning and Analysis?

Corporate financial planning is the process of determining what a company’s financial needs and goals for the future are, and how best to achieve them. Corporate financial planning considers the individual circumstances of the company as well as its broader economic context to determine which activities and investments would be most advantageous and appropriate. Generally, because short-term market trends are more predictable, short-term corporate financial planning involves less uncertainty and more readily adaptable financial plans.

Balanced corporate financial planning should elucidate how the company can achieve its goals and priorities while upholding its values. A financial plan for a corporation achieves at least two aims.

First, it forces management to think about the company’s prospects for business success objectively by basing their analysis on company finances. It also gives lenders and investors a good reason to invest into the business performance, by showing the growth and profit projections. Unrealistic or unbalanced financial plans or plans that understate profits tell investors to reconsider their investment or evaluation.

As a basic matter, three financial statements form the core of a corporate financial plan: income statement, statement of cash flow, and balance sheet. These statements clarify how much profit the business earns, and how much cash actually comes in, compared to the income reflected in accounts receivables. They also detail the relationships between corporate liabilities, corporate assets, and owner equity.

What is the Financial Planning Process?

The financial planning process results in the development of a financial plan, a financial forecast, or both. There are several well-understood steps in this process, and they often come out of sequence, depending on the deliverable or project at hand. However, it’s often simplest to think about these as steps in financial planning as financial planning tips, all of which are parts of a larger, flexible financial planning process.

With that in mind, these key components of financial planning for businesses are, in a sense, a set of best practices for your financial planning checklist.

Forecast revenue

Project revenue or sales for the next three years in a spreadsheet, or even better, in Planful. You’ll track numbers at least monthly in year one, and quarterly in years two and three.

Ideally you want to include sections that track unit sales, pricing, units times price to calculate sales, unit costs, and units times unit cost to calculate COGS or cost of goods sold, also called direct costs. Calculate gross margin, which is sales less cost of sales, and it’s a useful number for considering a new line of business or a new product expansion.

Budget expenses

Here you want to determine the actual cost of making the revenue you have forecasted. Differentiate between fixed costs such as payroll and rent and variable costs such as most promotional and advertising expenses. Lower fixed costs mean less risk; higher fixed costs may signal a need for reduced risk tolerance.

Remember, this is not accountancy, but a forecast, so you will have to estimate things such as taxes and interest. Use run rates or average assumptions whenever possible, and estimate taxes by multiplying estimated profits by estimated tax percentage rate. Then estimate interest by multiplying estimated debts balance by estimated interest rate.

Project cash flow

Project cash flow, or dollars moving in and out of the business, in this statement is based partly on balance sheet items, sales forecasts, and reasonable assumptions.

An existing company should have historical documents to base these forecasts on, such as balance sheets and profit and loss statements from years past. A new business which lacks these historical financial statements can project a cash-flow statement broken down month by month.

Remember to choose a realistic ratio for how many of your invoices will be paid in cash, 30 days, 60 days, 90 days and so on when compiling a cash-flow projection so you are not reliant on collecting 100 percent to pay your expenses. Some financial planning platforms build these formulas to make these projections simpler.

Project income

The income projection is the company’s pro forma profit and loss statement or P&L, which offers detailed business forecasts for the coming three years. To project income, use expense projections, sales forecasts, and cash flow statement numbers. Sales minus cost of sales equals gross margin. Gross margin minus expenses, interest, and taxes equals net profit.

Compile assets and liabilities

To deal with assets and liabilities that project the net worth of your business at the end of the fiscal year but are not in the profit and loss statement you need a projected balance sheet. Some of these, such as startup assets, are obvious and affect just one part of the process. However, others are less apparent.

For example, although the profit and loss reflects interest, it does not reflect repayment of principle. This means that loans and inventory register only as assets, but only up until you pay for them.

Cope with this by compiling a complete list of assets, equipment, real estate, and an estimate month by month of inventory if the business has it, accounts receivable (money owed to the company), and cash the business will have on hand. Then compile a complete list of liabilities and debts, including outstanding loans.

Conduct breakeven analysis

The breakeven point is when the expenses of the business match volumes or revenue. Undertake this analysis using the three-year income projection. Overall revenue will exceed overall expenses, including interest, within this period of time if the business is viable. Potential investors must engage in this critical analysis to ensure they are investing in a healthy business that is fast-growing and maintains reasonable profit.

Put the plan to work

Many companies work hard to create a financial plan for small business, only to ignore it as soon as it has been created. Placing all of the focus on creating the plan is a major error, because it is a powerful management tool. It is a better practice to compare actual numbers in the profit and loss statement with projections in the financial plan once a month, and use that data to revise future projections.

Compare statements over time

Undertake a financial statement analysis to compare specific items and entire financial statements over time—even the statements of the business to those of other companies. Conduct a ratio analysis to determine the prevailing industry ratios for profitability analysis, liquidity analysis, and debt. Measure the business both against its past performance and other similar businesses by comparing these standard ratios. You can also use the business plans from similar companies as financial plan examples.

Pitch with past plans

Include past financial plans as supplementary documentation of the business’s financial history as the organization applies for a loan or works to attract investment.

Use financial planning software

Obviously, this is a tremendous amount of dynamic information and calculation, making financial planning software a good option for many teams assembling a business plan’s financial section. These digital financial planning tools also enable visual financial projections such as bar graphs and pie charts.

What Should Financial Planning Include?

All business financial plans should include: a profit and loss statement; a cash flow statement; a balance sheet; a sales forecast; a personnel plan; business ratios; and a break-even analysis.

Profit and loss statement

The profit and loss statement is a financial statement that goes by several names, including P&L, income statement, and pro forma income statement. By any name, the profit and loss statement is essentially an explanation of how the business either made a profit or incurred a loss over a specific time period—typically three-months. The table lists all revenue streams and expenses, along with the total net profit or loss.

Depending on the type and structure of the business, there are different formats for profit and loss statements. However, in general, include in the profit and loss statement:

- Revenue or sales

- Cost of sale or cost of goods sold (COGS), although services companies may not have COGS

- Gross margin, which is revenue less COGS

Revenue, COGS, and gross margin are at the heart of how most businesses make money.

The P&L should also include operating expenses, those expenses that are not directly associated with making a sale but that are associated with running the business. These are the fixed costs that fluctuations in business really don’t affect, such as utilities, rent, and insurance.

The P&L statement should also include operating income:

- Gross Margin – Operating Expenses = Operating Income

Typically, operating income is equivalent to EBITDA: earnings before interest, taxes, depreciation, and amortization—although this depends on how the organization classifies expenses. Another way to think about operating income is the amount in profit before tax and interest but after operational costs.

The net income is the bottom line of the business, found at the end of the profit and loss statement. It represents going back to EBITDA and going a few steps further, subtracting expenses for interest, taxes, depreciation, and amortization to find net income:

- Operating Income – Interest, Taxes, Depreciation, and Amortization Expenses = Net Income

Cash flow statement

Just as critical as the P&L, the cash flow statement is typically a per-month explanation of how much cash the business brings in, pays out, and the ending cash balance. This detailed map of how much cash is in play, where it originates and goes to, and the cash flow schedule itself, is essential to any healthy, functional business.

The cash flow statement assists management in understanding the difference between the company’s actual cash position and the reported income on the profit and loss statement. It is just as important to clearly lay this information out for investors and lenders in the cash flow statement to raise funds.

Some businesses might be profitable but still lack the cash to pay expenses and continue to operate. Others might have the cash on hand to stay open even if they are unprofitable—cash flow break-even is vital to future company scale.. Therefore, the cash flow statement is important to understand.

There are two methods of accounting in the cash flow statement—the indirect method and the direct method. Which you select can affect how the cash flow statement and profit and loss statement compare, and accrual accounting might better reflect actual cash flow than cash accounting for many businesses.

Balance sheet

The balance sheet is a picture of the financial position of the business at a specific point in time. It reflects how much cash and equity is on hand, how much is in receivables, and how the business owes vendors and other debtors.

A balance sheet should include:

- Assets: Cash, inventory, accounts receivable, etc.

- Liabilities: Debt, loan repayments, accounts payable, etc.

- Equity: Owners’ equity, investors’ shares, stock proceeds, retained earnings, etc.

Ideally, as the name suggests, the balance sheet items should balance out. Total assets on one side should always equal total liabilities plus total equity.

- Assets = Liabilities + Equity

Sales forecast

The sales forecast is the FP&A team’s forecast or projections for a set period of what they think will generate revenue. Particularly if a business is seeking investment from investors or lenders, the sales forecast is among the fundamentals of financial planning, and should be part of a dynamic, ongoing process.

The sales or revenue number in the profit and loss statement and the sales forecast should be consistent. In fact, many types of financial planning software automatically connect these projects. Develop, organize, and segment an individualized sales forecast to meet the needs of a specific business.

Personnel plan

The personnel plan identifies the resourced structure and positions needed to run the company operations. How important the personnel plan is depends in large part on the company.

A sole proprietor doesn’t need much of a personnel plan. A large company with high labor costs requires a detailed personnel plan and should invest the necessary time in determining how personnel impacts the business.