Have We Seen the Peak of Just-in-Time Inventory Management?

Logistics issues have taken on unexpected and possibly unwanted “glamour” among those who study business and economics, thanks to the COVID-19 pandemic and its global aftermath.

It’s a throwback to the days when railroad management was all the rage in the original Harvard Business School curriculum among those interested in studying business in 1908. I should know. I was invited to join the HBS faculty not to teach marketing, service management, or general management, among my later teaching assignments, but to help breathe life into efforts to teach logistics.

In those days, there was fascination with air freight and the trade-off of inventory and transportation costs—as in spending more for air transport in order to spend less on owning inventory, thereby optimizing what we called the “total cost curve.” (I can still draw those curves in my sleep.) A plentiful supply of “safety stock” was the order of the day for those using slower forms of transportation.

"The result, of course, was what came to be known as 'just-in-time' inventory management, as championed by firms such as Toyota."

One of my interests: The value of improved inventory information in a distribution channel on overall inventory levels and costs. One thing that may have helped generate the HBS offer was an experiment I performed using my own crude version of what would become known as the “beer game.”

In my approach, my Ohio State students managed inventory at various levels in a distribution channel. Fluctuating demand at the retail level would generate exaggerated fluctuations—a “whipsaw” effect—in expected demand and inventory planning at the back end, or manufacturing level, in an effort to meet possible future demand. In one simulation, students had little knowledge of inventory levels other than those for the company they were managing. In another, they had full information about inventory quantities at every level in the channel. I found significant value—expressed in lower inventories and fewer out-of-stock situations—in channel-wide inventory knowledge.

Over the years, information technology contributed to more complete knowledge about inventory status as well as more dependable transport. Both made a strategy with less safety stock more viable. The result, of course, was what came to be known as “just-in-time” inventory management, as championed by firms such as Toyota.

The approach worked. The amount of inventory needed to support a given sales level shrank. Logistics as a component of the total cost (transport plus inventory) of doing business came down. Customer service, as measured by stockouts, improved.

"What we had come to take for granted then exploded in our collective faces."

US auto manufacturers, following Toyota’s lead, were at times maintaining just half a day of inventory of some parts supplied domestically—until the pandemic. What we had come to take for granted then exploded in our collective faces.

When the smoke has finally cleared and flows of goods have become more plentiful and dependable, how will industry respond? Surely inventor-to-sales ratios will come back down, but to what extent?

Will we return to the halcyon days of pre-pandemic inventory management? Or will larger safety stocks, with determinants programmed into inventory management formulae, be the order of the day?

Have we seen the peak use of “just in time” inventory management? What do you think?

Share your thoughts in the comments below.

Editor's note: Heskett explores the leader's role in his book, Win From Within: Build Organizational Culture for Competitive Advantage .

Your feedback to last month’s column

Is Stakeholder Management Facing New Headwinds?

Thoughtful comments raise added questions. That was the case in the several responses to last month’s column. The general sense that they left in my mind was that stakeholder management is facing new challenges posed by the rise of what John referred to as the “tribal spectrum” and the polarization that accompanies it.

Perhaps the most significant question raised by respondents was that of balance. To what extent should a leader attempt to balance the interests and values of various stakeholders in making an important decision?

Meena Raghunathan said, “My concern is more for the stakeholders who have interest but no power or voice! … They are given the least attention and support, though they may need it most.”

On the other hand, Mark K., the CEO of a “publicly traded financial institution,” commented that, “it is my experience that a critical component of the leader’s job is to ensure that proper, meaningful consideration is given to the unique balance of the needs of each of the corporate stakeholders … Balance leads to performance whereas imbalance leads to M&A and becoming a statistic.”

The challenge of balancing interests is that a wide variety of interests may describe any one stakeholder. As John points out: “Sometimes you have to decide which employee values does the business need to foster in order to align to your customer demand.”

Clearly, stakeholder management is not getting any simpler or easier.

- 24 Jan 2024

Why Boeing’s Problems with the 737 MAX Began More Than 25 Years Ago

- 02 Apr 2024

- What Do You Think?

What's Enough to Make Us Happy?

- 25 Jan 2022

- Research & Ideas

More Proof That Money Can Buy Happiness (or a Life with Less Stress)

- 01 Apr 2024

- In Practice

Navigating the Mood of Customers Weary of Price Hikes

- 25 Feb 2019

How Gender Stereotypes Kill a Woman’s Self-Confidence

- Transportation Networks

- Manufacturing

- Transportation

Sign up for our weekly newsletter

- Business Essentials

- Leadership & Management

Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Online Business Certificate Courses

Business Strategy

- Digital Transformation

- Leadership, Ethics, and Corporate Accountability

- Business Strategy →

Key Concepts

Who will benefit, mid-career professionals, general managers, consultants and investors.

What You Earn

Certificate of Completion

Boost your resume with a Certificate of Completion from HBS Online

Earn by: completing this course

Certificate of Specialization

Prove your mastery of strategy

Earn by: completing any three courses within this subject area to earn a Certificate of Specialization

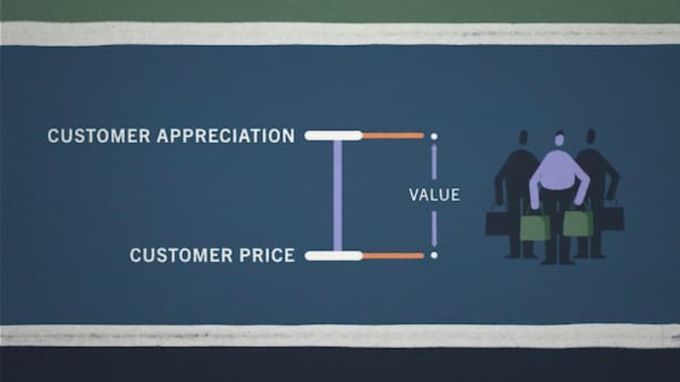

Creating Value for Customers

- An Introduction to Value-Based Strategy

- Sales Success and Willingness to Pay

- Near-Customers

Featured Exercises

Adding value through complements.

- Understanding Complements

- Shifting Value

- Navigating the Frenemy Relationship

- Discerning Complements from Substitutes

Competing with Network Effects

- Understanding Network Effects

- Which Markets Will Tip

- Strategies for Underdogs

- Digital Platforms and Innovation

Creating Value for Talent

- Linking Productivity and Customer Delight

- Competing on Flexibility

- Compensation Policy

Mastering Productivity

- Measuring Productivity

- Economies of Scale

- Teaching and Learning

- Good Management

Implementing Strategy

- Evolving Your Value Proposition

- Connecting Strategy, Activities, and KPIs

- Execution Challenges

How to Formulate a Successful Business Strategy

Our difference, about the professor.

Felix Oberholzer-Gee Business Strategy

Dates & eligibility.

No current course offerings for this selection.

All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the course.

Learn about bringing this course to your organization .

Learner Stories

Business Strategy FAQs

What are the learning requirements in order to successfully complete the course, and how are grades assigned.

Participants in Business Strategy are eligible for a Certificate of Completion from Harvard Business School Online.

Participants are expected to fully complete all coursework in a thoughtful and timely manner. This will mean meeting each week’s course module deadlines and fully answering questions posed therein. This helps ensure your cohort proceeds through the course at a similar pace and can take full advantage of social learning opportunities. In addition to module and assignment completion, we expect participation in the social learning elements of the course by offering feedback on others’ reflections and contributing to conversations on the platform. Participants who fail to complete the course requirements will not receive a certificate and will not be eligible to retake the course.

More detailed information on course requirements will be communicated at the start of the course. No grades are assigned for Business Strategy. Participants will either be evaluated as complete or not complete.

What materials will I have access to after completing Business Strategy?

You will have access to the materials in every prior module as you progress through the program. Access to course materials and the course platform ends 60 days after the final deadline in the program.

How should I list my certificate on my resume?

Once you've earned your Certificate of Completion, list it on your resume along with the date of completion:

Harvard Business School Online Certificate in Business Strategy [Cohort Start Month and Year]

List your certificate on your LinkedIn profile under "Education" with the language from the Credential Verification page:

School: Harvard Business School Online Dates Attended: [The year you participated in the program] Degree: Other; Certificate in Business Strategy Field of Study: Leave blank Grade: "Complete" Activities and Societies: Leave blank

Description: Business Strategy is a 6-week, 30-35 hour online certificate program from Harvard Business School. Business Strategy equips professionals with a simplified framework they can immediately apply to create value for customers, employees, and suppliers while maximizing returns and an organization’s competitive edge. Participants learn to evaluate trade-offs and align, prioritize, and formulate strategic initiatives for the greatest business impact.

Related Program

CLIMB enables new and experienced leaders to ignite their careers with a combination of vital and forward-looking business skills, self-reflection, and an immersive cohort-based learning experience with a diverse global network.

- Write For Us

- Ask Dr. Jain

- Conferences

- IBF Podcast

- Log in / Join

The 4 Cornerstones Of An Effective Demand Review

Misty has over 20 years' experience in Demand and Supply Planning including roles as Demand Planning Manager at Berry Global and Supply Planning Manager at Escalade Sports. She is currently Senior Manager, Planning and Fulfillment Systems, at GE Appliances where she is responsible for their planning and fulfillment systems.

S&OP processes always include a demand review step. There are plenty of articles, webinars, and blogs about how to set up and optimize a Demand Review, covering such topics as the best metrics to use, which departments to include, and whether to use a unconstrained or constrained demand forecast.

These details are important, but there is something often overlooked in our attempts to build a robust Demand Review. We often struggle to speak a “language” that is understood by those outside Demand Planning. By failing to speak a universal language we our peers can undervalue our efforts and fail to see how what we do relates to their work. As a result, we struggle to keep Sales and Marketing partners engaged and, subsequently, we don’t get the necessary insights.

Details are important, but the priority for our Demand Review meetings is cover four key areas. Let’s look at the cornerstones of a healthy Demand Reviews and identify what value should be captured from each of them, including the one even experienced Demand Planners miss that is key to tying our demand plans to revenue.

1 – Understand The Assumptions Behind Past Performance

To start, we need to understand the value of our past assumptions. These assumptions include understanding our demand history, quality of the data, the models we use to create statistical forecasts, and the adjustments we made to accommodate business changes. We can’t possibly build trust in the forecast we are using if we don’t take the time to measure and track past performance. It’s why we have so many discussions around which metric is best, which level to measure, and how to apply formulas.

“Too much time is spent reporting performance as if this is the purpose of the meeting”

Understanding past performance is necessary, but frequently too much time is spent reporting performance as if this is the purpose of the meeting. Capture it, measure it, discuss it but don’t spend all your time on it. It is equally important to take the time to choose the right metrics. While a single metric can certainly tell you something valuable about the forecast, a singular metric limits understanding and often generates misconceptions about the forecast. Using multiple (compatible) metrics improves daily decisions when using the forecast.

This article isn’t to debate which measure is best, which formula to use or how to apply them; it’s a reminder to consider metrics beyond just looking at accuracy and bias. There are plenty of great metrics that you should add like FVA , Forecastability, tracking signals and waterfalls, forecast hit/miss, and even simple absolute error in dollars. Whatever combination you choose, explain the metric in terms of what they measure and what they tell you about the data. Advanced planners will take the time to link results to actionable behaviors in other areas.

“Discuss past assumptions and which ones were most value-added”

For example, forecast performance can explain poor service levels, tendency to build excess inventory (bias), or even why operational efficiency is low (poor product mix measured by accuracy calculated at lower levels). Measurements like FVA can tell us which assumptions, forecast or whatever we want to measure provided a better predictor of actual demand. Discuss past assumptions and which ones were most value-added.

2 – Assess The Current Demand Factors

Secondly, we need to understand our current demand situation. The Demand Review should also highlight our current immediate forecast and help us to understand how we are trending in actual performance. While this isn’t the ultimate focus of our meeting, it is something we should discuss. Are we waiting on orders or are orders ahead of plan? Is there a risk of creating future shortages?

Reviewing and discussing the current short term demand picture can also help us identify unplanned and previously uncommunicated events. Finding these events while they are happening — while less than ideal — can help us mitigate risks and drive better customer service in the future than if we were to find them when reviewing our past assumption performance.

Of course, it would be better to be told of these events in advance so they can be properly planned, but let’s face it — for every event or planned promotion there is at least as many and usually more that happen on the fly without any advance notification.

3 – Understand Future Demand Factors

Our Demand Review should help us understand the future. Most of our time should be spent on understanding the assumptions, events, new products, or sunsetting items loaded into the demand plan in the mid to long range period, as well as any risks or opportunities in that plan. Rather than thinking about the forecast for next week, next month or maybe two months out, we should be looking out to the next quarter or the next year in our forecasts. At a minimum, we should be looking at our max lead-time plus one period.

“The Demand Review creates a road map that all other departments in the organization will use to make decisions”

I’ve been in many Demand Reviews and have been guilty of leading reviews where most of our time was spent on looking at past performance. Sure, it helps us to understand something about our process, we must give at least equal attention to the future. The whole reason we’re building the demand plan is to have some understanding of what we can expect in the future and to share that knowledge with the rest of the organization. It’s to set a road map that all other departments in the organization will use to make decisions.

Understanding the assumptions and any risks or opportunities that exist provides context, credibility and builds trust in the forecast, which is critical if other functions are to use it. Thus, when using the demand plan, we can plan contingency strategies for things not in the plan instead of letting fate happen.

4 – Understand The Gap Between The Demand Plan & Financial Plans

One last part often missing from demand reviews is a gap analysis between the demand plan and the operating budgets or financial plans. We work as a team towards a single plan, but those forecasts may look different depending on how they are translated such as the difference between the demand plan, financial plans, and the replenishment plan. As the demand plan rolls through the S&OP process into the supply review, disconnects between what we sell and what we can supply are identified and addressed. Unfortunately, we often overlook the need to compare the demand plan to the latest operating budget or financial plan.

It’s not just about comparing to the original plan from the beginning of the year — that will no doubt change — but instead understanding the gaps between the current financial plan and the demand plan. Are we planning for revenue above what’s in the demand plan? If so, what is being done to ensure the right product (or any product) will be available to sell to meet the revenue expectations? If revenue expectations are below the demand plan, do we understand why, and the potential excess inventory we are building? Communicating and understanding gaps improves opportunities to meet corporate initiatives.

Demand review are a critical step in any S&OP process. As Demand Planners, we often get buried in a lot of details with large charts and files, talking about metrics that many of our sales and marketing partners may not understand or find valuable. Taking the time to communicate the right metrics and refocus efforts on the parts that matter most will result in a more productive demand review meeting. It’s not about who is the most accurate, but rather identifying the data that provides the most value and capturing the insights needed to better run our business.

Privacy Overview

Solving your most complex planning challenges

Explore Industry Research

What do Gartner, Forrester, and IDC have in common? They all named Anaplan a planning leader.

Your success is the heart of our success

Hear from our customers at Anaplan Connect 2024

Join us for a day of connected inspiration from your industry-leading peers who have found the answer in agile, connected enterprise planning.

Transform how you see, plan and lead your business

Get started today.

Explore on-demand demos to discover how our modeling and planning capabilities are designed to meet the specific and unique needs of your business.

Transform how you see, plan, and lead your business

We’d love to find out how we can help you

Events, training, and content for your planning journey

Visit our blog and newsroom

Your hub for Anaplan updates, insights, perspectives, and innovations.

Powerful partnerships to drive your digital transformation and deliver game-changing strategies.

Solutions for your business, your industry, from the world’s leading alliances.

Harvard Business Review: 3 steps towards finance-led integrated business planning

- Share on Twitter

- Share on Facebook

- Share on LinkedIn

Richard Barrett

Content Creator

In 1963 when the economy was booming, Stanley Harding, the financial director of Shell, said that one of the three hats that finance managers should wear was to be “an active member of the management team” (the other two were to be a financial expert and people manager). Fifty years later, markets are increasingly volatile, competition is much fiercer, and businesses are anxious for any kind of revenue growth—and many finance teams still have a ways to go to becoming strategic business partners.

What is integrated business planning ?

Growth today means more than introducing new products or extending into new markets. Companies frequently need to refresh their strategies and reinvent business models to keep up with changing consumer preferences and stay ahead of competition. To be successful, companies need to move away from the traditional approaches to planning and budgeting, and adopt a more holistic approach that provides the agility needed to create and sustain a competitive advantage. This new way of doing things— integrated business planning (IBP)—is the focus of a new Harvard Business Review Analytical Services Report, “Driving Business Growth With Finance-Led, Integrated Business Planning.”

The IBP approach depends on Finance partnering with the business since implementation involves taking three steps to unify the planning process across the company:

- 1. Focus on metrics that drive growth , such as revenue per unit, expense per headcount, customer retention, and customer satisfaction that give a deeper understanding of current performance and better visibility into the future. 2. Increase business-user collaboration for continuous forecasting , with everyone contributing to the planning process using a technology that enables collaboration and connects plans in real time—i.e., not standalone spreadsheets. 3. Treat IBP as an enterprise-wide initiative with a planning platform that brings people and data together into a streamlined process in one central place. This does not mean implementing IBP necessitates an all-in, expensive, big-bang, IT-driven investment. Companies can work at it incrementally by first integrating aspects of sales that directly impact revenue, along with operational departments with highly variable costs, and then extending the process to back-office functions where costs are largely fixed.

With a flexible and adaptable planning platform , implementing IBP can be turned into a series of agile sprints that focuses first on specific business functions where there are quick wins that improve the accuracy of financial forecasts, allowing business managers to more successfully pursue growth.

One suspects that the forward-thinking Stanley Harding would recognize the need to evolve planning and budgeting software for today’s topsy-turvy world and be wowed by the business planning software available to achieve the transformation.

Read the report to learn more about how you can prepare your business for growth by making the planning process a collaborative enterprise-wide initiative.

- Harvard Business School →

- Faculty & Research →

Publications

- Global Research Centers

- Case Development

- Initiatives & Projects

- Research Services

- Seminars & Conferences

- Publications →

Show Results For

- All HBS Web (115,428)

- Faculty Publications (58,142)

StrategicPlanning →

No results found in faculty publications.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Uber-backed e-bike startup Lime planning fleet expansion

Lime, the operator of a shared electric bike and scooter network backed by Uber Technologies Inc., is planning to invest more than $55 million this year to expand its global fleet.

The San Francisco-based company will add more than 30,000 net-new bikes across North America, Europe and Australia while also replacing aging ones, CEO Wayne Ting said in an interview. It’s also looking to return to Greece and Mexico - markets that it had exited during the pandemic, he said, and is exploring new business lines such as advertising deals and a new vehicle type for its shared fleet.

The company separately reported a 32% increase in gross bookings in 2023 from a year earlier, totaling a record $616 million. Its adjusted earnings before interest, taxes, depreciation and amortization gained by more than 500%, surpassing $90 million.

Lime, which has a fleet of some 200,000 bikes and scooters, is expanding even as its rivals in the US have struggled to stay afloat. Many are looking to offload operations now that the era of low interest rates and easily accessible venture-capital funding is over. Stronger regulations of two-wheelers and shifting commuting trends have also been headwinds for the industry.

Late last year, scooter company Bird Global Inc. went bankrupt. Another peer, Superpedestrian, is shutting US operations and weighing the sale of its European business, according to TechCrunch. Lyft Inc., which bought Citi Bike in 2018, was looking for a strategic partner, or to sell its bike-share business.

Lime is, meanwhile, “at that inflection point where we can scale up the business without having to make a ton more R&D investment,” Ting said. “Our software is already made, our hardware is already developed. We’re not increasing the fixed costs, so profitability grows at a much faster pace. And I think we’re going to continue see that play out for a couple of years.”

Uber threw Lime a lifeline in 2020 when it was struggling through pandemic-induced lockdowns. Uber, which held a roughly 29% stake as of late last year, led a $170 million investment round for Lime back then, selling its Jump bike-sharing business operations to Lime as part of the deal. Lime was valued at about $510 million at the time, people familiar with the terms said, asking not to be identified because the terms were private.

Today, about 60% of Lime’s business comes from outside of the US, in cities where the infrastructure is less car-centric and more bike-friendly. The company’s major bike markets include Sydney, Rome, Seattle, London, Milan and Paris - the latter of which banned e-scooters but expanded an e-bike fleet cap by 5,000 ahead of the summer Olympics this year.

Lime is more broadly positioning itself for an initial public offering. It first floated IPO plans in 2021 before US public equity markets dried up. Late last year, it hired Ann Gugino, former chief financial officer of the US pizza chain Papa John’s International Inc., as CFO to build the necessary internal controls before going public.

“We’re doing everything we can to ensure that we are ready internally, and then we’re just going to wait to see when is the right macro environment to consider an IPO,” Ting said. “Much of this is outside of our control.”

Traveling the "The Road to 10G" in the Pacific Northwest

I was a young guy fresh out of the Marine Corps when I took a job in my wife’s hometown of Atlanta as an installer with a cable company.

Brought to you by:

Behind the Growth in Materials Requirement Planning

By: Jeffrey G. Miller, Linda G. Sprague

Materials requirements planning (MRP) is a computer-based system of coordinating materials supply, demand, inventory, and production scheduling for manufacturing operations. In addition to the master…

- Length: 7 page(s)

- Publication Date: Sep 1, 1975

- Discipline: Operations Management

- Product #: 75510-PDF-ENG

What's included:

- Educator Copy

$4.50 per student

degree granting course

$7.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

Materials requirements planning (MRP) is a computer-based system of coordinating materials supply, demand, inventory, and production scheduling for manufacturing operations. In addition to the master production schedule 'drive file,' files are created for bill of materials, inventory status and the materials requirements planning package. The value of MRP depends on an operation's size and the efficiency of its current materials system. Its adaptability, however, promises new applications in other areas.

Sep 1, 1975

Discipline:

Operations Management

Harvard Business Review

75510-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Onboarding New Employees — Without Overwhelming Them

- Julia Phelan

Give people the space and time they need to thrive in their new job.

A great onboarding experience can keep new hires engaged and committed, and increase their learning and preparedness for their new role. In trying to ensure new employees feel supported and properly prepared, some organizations flood new hires with far too much information. Even if managers have the best intentions, bombarding new hires with tasks — such as asking them to read every single page of the employee manual or requiring them to get set-up on Slack, email, Box, and all the other platforms all at once — will backfire. Three strategies can help organizations mitigate this overload and ensure employees have the space, time, and mental resources available to learn and thrive in their new job.

We know that effectively onboarding new employees has huge value. A good onboarding process — with clear information on job requirements, organizational norms, and performance expectations — not only enhances employee productivity but helps increase loyalty and engagement, and decrease s turnover .

- JP Julia Phelan , Ph.D. is a learning design consultant and expert in applying learning science principles to create effective learning experiences. She works with organizations to help build a strong workplace learning culture by improving training design, implementation, and outcomes. She is the co-founder of To Eleven , and a former UCLA education research scientist. Connect with her on LinkedIn .

Partner Center

IMAGES

VIDEO

COMMENTS

Predicting consumer demand for goods and services during the Covid-19 pandemic is more complicated than ever. To improve prediction, managers must abandon their biases and seek out new data sets ...

by John Deighton. The platforms SHEIN and Temu match consumer demand and factory output, bringing Chinese production to the rest of the world. The companies have remade fast fashion, but their pioneering approach has the potential to go far beyond retail, says John Deighton. 21 Apr 2023. Research & Ideas.

Please contact [email protected] or 800 988 0886 for additional copies. The management theorist Henry Mintzberg famously defined strategy as 5 Ps: plan, ploy, pattern, position, and perspective. We have adapted his framework to propose our own 5 Ps: position, plan, perspective, projects, and preparedness.

Disruptions in the global supply chain bring companies to a standstill. Supply and demand shocks. Labor shortages. International trade wars. As businesses and customers struggle to get the products they need from across the globe, manufacturers must reassess how they operate, from rethinking offshore options to exploring new technologies. "Supply Chain: The Insights You Need from Harvard ...

Conventional wisdom says it takes three to five years and tens of millions of dollars to digitize a corporation's supply chain. However, a few companies have reaped major benefits--including higher revenue and customer retention--with a faster, cheaper approach. It involves assembling available data; using analytics to understand and predict customers' and suppliers' behavior and optimize ...

In 2019, Harvard Business School's Project on Managing the Future of Work and Boston Consulting Group's Henderson Institute designed a survey to understand how companies are experiencing the changing nature of work, and how they are using digital platforms to acquire talent. A third-party survey firm administered this survey between ...

Harvard Business Review Digital Article (19,174) Harvard Business School (14,750 ... A rise in collaborative workplaces and dynamic teams over recent years has heightened the demand… Read more. Product Details. Publication Date: Oct 2013 ; Product ... Planning and Organizing Business Reports: Written, Oral, and Research-Based is a three ...

The result, of course, was what came to be known as "just-in-time" inventory management, as championed by firms such as Toyota. The approach worked. The amount of inventory needed to support a given sales level shrank. Logistics as a component of the total cost (transport plus inventory) of doing business came down.

CLIMB enables new and experienced leaders to ignite their careers with a combination of vital and forward-looking business skills, self-reflection, and an immersive cohort-based learning experience with a diverse global network. 1 year, 5-9 hrs/week. Apply by August 21st & 28th $15,000 (four installments of $3,750) Credential.

2 - Assess The Current Demand Factors. Secondly, we need to understand our current demand situation. The Demand Review should also highlight our current immediate forecast and help us to understand how we are trending in actual performance. While this isn't the ultimate focus of our meeting, it is something we should discuss.

pre-digital-era talent models toward on-demand workforce models. To understand the transformational potential of the on-demand workforce on the future of organiza-tions—and how they will work—Harvard Business School's Project on Managing the Future of Work and Boston Consulting Group surveyed nearly 700 senior business leaders at U.S. firms.

Nearly all global organizations are undergoing some kind of digital transformation, with related global spending expected to reach $3.4 trillion by 2026.1. 1.1 billion jobs could be transformed by technology over the next decade.2. In 2022, the average cost of a ransomware attack was more than $4.5 million.3.

The IBP approach depends on Finance partnering with the business since implementation involves taking three steps to unify the planning process across the company: 1. Focus on metrics that drive growth, such as revenue per unit, expense per headcount, customer retention, and customer satisfaction that give a deeper understanding of current ...

By: Peter N. Hadar, Susanna Gallani and Lidia Moura. Physician burnout, which is prevalent in neurology, has accelerated in recent years. While multifactorial, a major contributing factor to burnout is a payment model that rewards volume over quality, leaving physicians overburdened and unfulfilled. The aim of this...

Skip to Main Content. catalog. Disciplines

By: Suraj Srinivasan and Li-Kuan Ni. Teaching Note for HBS Case No. 122-044. The case discusses the ESG strategy of Dollar Tree Inc., a U.S. Fortune 500 company in the deep discount retail industry and the shareholder pressure faced by the company. In 2022, the company faced a shareholder resolution from...

News; Business; Uber-backed e-bike startup Lime planning fleet expansion April 8, 2024 Updated Mon., April 8, 2024 at 12:20 p.m. Electric hire bikes, operated by Lime Technologies AB, outside the ...

A Post-Pandemic Strategy for U.S. Higher Ed. Summary. Amid the Covid-19 pandemic, three external forces have come together to create a perfect storm for American colleges: The cost of higher ...

Materials requirements planning (MRP) is a computer-based system of coordinating materials supply, demand, inventory, and production scheduling for manufacturing operations. In addition to the master…. Length: 7 page (s) Publication Date: Sep 1, 1975. Discipline: Operations Management. Product #: 75510-PDF-ENG.

A great onboarding experience can keep new hires engaged and committed, and increase their learning and preparedness for their new role. In trying to ensure new employees feel supported and ...