Your Guide to What Social Security Numbers Mean

If you’ve ever applied for a job, loan, or credit card, you’ve probably been asked for your Social Security number. In many ways, your Social Security number is as much a part of you as your date of birth—it follows you from birth to death and can serve as a key to your sensitive information.

It’s clear that having one is vital because it’s used in various ways. You probably even know the number by heart. But have you ever wondered what Social Security numbers mean?

In this guide, discover what a Social Security number is, how to decode the numbers, if they’re reused, and what your number says about you.

What is a Social Security number?

It seems everyone asks for your Social Security number (SSN) these days. So, what is it? An SSN is a unique identifier issued by the Social Security Administration (SSA).

The number was originally a way for the government to keep track of your earnings and the money you paid into the Social Security program. But now, you can use it in a variety of ways:

- Tax reporting

- Help assure a person’s identity

- Open a bank account

- Apply for federal or private student loans

- Open a line of credit, home loan, or auto loan

- Apply for a job

- Qualify for government benefits

- Get a passport

- Get a driver’s license

Most people receive an SSN when they’re born. If you don’t have one, you can ask the SSA to issue one to you. The SSA can also give you a replacement card if yours was lost or damaged.

What do the numbers in your Social Security number mean?

The digits in your SSN have a unique configuration. What Social Security numbers mean isn’t a secret—but it isn’t very well known.

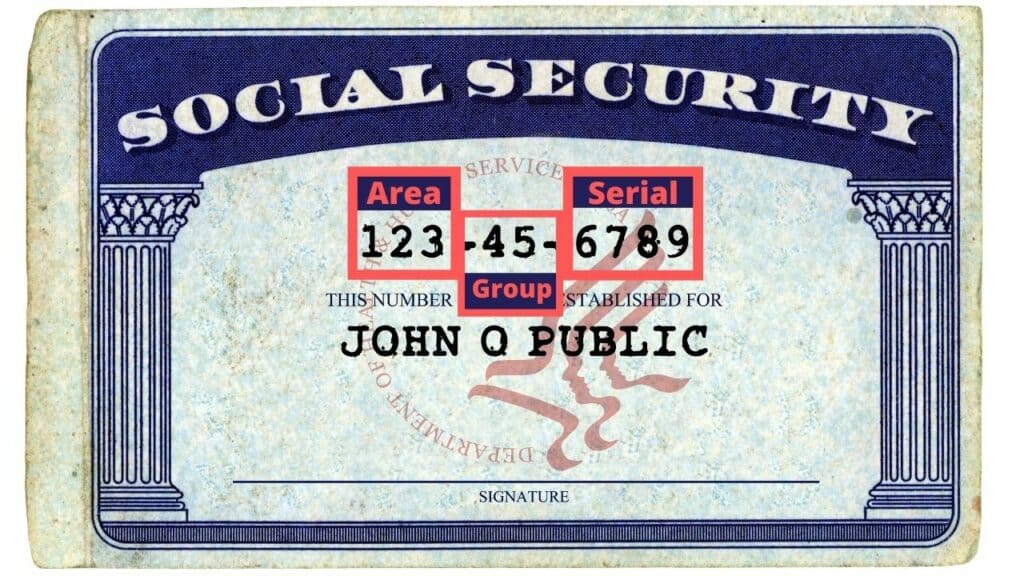

According to the SSA, your nine-digit SSN is divided into three parts:

- The area number is the first set of three digits.

- The group number is the second set of two digits.

- The serial number is the third set of four digits.

The original intent was to limit the range of numbers based on specific criteria. For instance, the area number was assigned according to the state in which the SSN was issued.

But several changes have been made since the passage of the Social Security Act in 1935.

Area number

The area number is the first three digits of your SSN. When first issuing numbers, the area number indicated the location of the SSA office that assigned the number. In 1973, the SSA’s Baltimore office began supplying SSNs and used the applicant’s ZIP code to determine the area number.

The system changed again in 2011. What do the first 3 digits of your Social Security mean now? Nothing. SSNs are assigned using “randomization,” and the numbers are not tied to a specific location.

Group number

Group numbers are the two digits in the middle of your SSN. Your group number can range from 01 to 99. So, what do the middle numbers in Social Security mean?

In the early days, the group number was used to identify records. Because the SSA issued SSNs before the era of computers, program administrators used the middle two numbers to organize the records into sub-groups.

Each group number pointed to a specific area of filing cabinets, making the records easier to manage.

Serial number

The last piece of the SSN puzzle is the serial number. The serial number is the last four digits of your SSN.

They can range from 0001 through 9999 and help to ensure your number is unique.

How are Social Security numbers assigned?

How SSNs are assigned has changed throughout the years. Initially, the SSA used a system to issue numbers. For example, area numbers told the location where the card was given, and group numbers identified the filing cabinet where the record could be found.

The SSA transitioned to a new system of “randomization” on June 25, 2011. The change was “to help protect the integrity of the SSN,” according to the SSA .

Are Social Security numbers reused?

The SSA has issued over 453 million SSNs and supplies about 5.5 million new numbers per year. At that rate, you may think the SSA would run out of unique numbers to assign.

However, the SSA does not reuse SSNs—not even after a person dies. Because of the switch to a randomized numbering system, the SSA reports having enough new numbers available for many future generations.

What does your Social Security number say about you?

Now that you know what Social Security numbers mean, what does your number say about you? Fortunately, not much.

Your area number may indicate the state from which your SSN was issued or the ZIP code you used to apply if the SSA issued your number before 2011. However, since the change to a randomized system in 2011, there’s no Social Security number decoder or way to decipher what the numbers mean.

[…] Area number. The area number is the first three digits of your SSN. When first issuing numbers, the … […]

[…] Your Guide to What Social Security Numbers Mean […]

How can we get a new social security card for my 19 year old daughter who has her adopted name on her card and it’s never been changed. We don’t feel comfortable to send adoption papers in the mail. Thank you Eileen

Social Security

Social security number and card, see what card services you can do online.

If you lost your card, you may not need a replacement. In most cases, simply knowing your Social Security number is enough. But if you do need a replacement, we make it easy. Once you complete your application (online or in-person), you will receive your Social Security card in the mail.

Answer a few questions to find the best way to get what you need. You can:

- Request a copy of a lost, stolen, or damaged card

- Update or correct your personal information (e.g. name, citizenship, sex identification, date of birth)

- Request a Social Security number for the first time

Learn what documents you will need to get a Social Security Card

Citizenship

Mailing address, who the request is for, request type, proof of identity, change your name.

We are unable to provide online options that meet your needs. Visit your local SSA office for personalized assistance with your Social Security number and card.

You can request your card online today!

Sign in or create an account to submit your request

You can replace your card online and receive it in 14 days. You can also use your account to check the status of your request and manage other benefits you receive from us.

Sign in Create account

Trouble signing in?

Start the application online and visit your local SSA office for additional guidance for completing your application.

Prefer to talk to someone?

Contact your local SSA office .

You can start your Social Security number (SSN) card application online. Once you've submitted your request, visit your local SSA office for additional guidance for completing your application. You will need to give us some of the information you provided again.

- Getting Pregnant

- Registry Builder

- Baby Products

- Birth Clubs

- See all in Community

- Ovulation Calculator

- How To Get Pregnant

- How To Get Pregnant Fast

- Ovulation Discharge

- Implantation Bleeding

- Ovulation Symptoms

- Pregnancy Symptoms

- Am I Pregnant?

- Pregnancy Tests

- See all in Getting Pregnant

- Due Date Calculator

- Pregnancy Week by Week

- Pregnant Sex

- Weight Gain Tracker

- Signs of Labor

- Morning Sickness

- COVID Vaccine and Pregnancy

- Fetal Weight Chart

- Fetal Development

- Pregnancy Discharge

- Find Out Baby Gender

- Chinese Gender Predictor

- See all in Pregnancy

- Baby Name Generator

- Top Baby Names 2023

- Top Baby Names 2024

- How to Pick a Baby Name

- Most Popular Baby Names

- Baby Names by Letter

- Gender Neutral Names

- Unique Boy Names

- Unique Girl Names

- Top baby names by year

- See all in Baby Names

- Baby Development

- Baby Feeding Guide

- Newborn Sleep

- When Babies Roll Over

- First-Year Baby Costs Calculator

- Postpartum Health

- Baby Poop Chart

- See all in Baby

- Average Weight & Height

- Autism Signs

- Child Growth Chart

- Night Terrors

- Moving from Crib to Bed

- Toddler Feeding Guide

- Potty Training

- Bathing and Grooming

- See all in Toddler

- Height Predictor

- Potty Training: Boys

- Potty training: Girls

- How Much Sleep? (Ages 3+)

- Ready for Preschool?

- Thumb-Sucking

- Gross Motor Skills

- Napping (Ages 2 to 3)

- See all in Child

- Photos: Rashes & Skin Conditions

- Symptom Checker

- Vaccine Scheduler

- Reducing a Fever

- Acetaminophen Dosage Chart

- Constipation in Babies

- Ear Infection Symptoms

- Head Lice 101

- See all in Health

- Second Pregnancy

- Daycare Costs

- Family Finance

- Stay-At-Home Parents

- Breastfeeding Positions

- See all in Family

- Baby Sleep Training

- Preparing For Baby

- My Custom Checklist

- My Registries

- Take the Quiz

- Best Baby Products

- Best Breast Pump

- Best Convertible Car Seat

- Best Infant Car Seat

- Best Baby Bottle

- Best Baby Monitor

- Best Stroller

- Best Diapers

- Best Baby Carrier

- Best Diaper Bag

- Best Highchair

- See all in Baby Products

- Why Pregnant Belly Feels Tight

- Early Signs of Twins

- Teas During Pregnancy

- Baby Head Circumference Chart

- How Many Months Pregnant Am I

- What is a Rainbow Baby

- Braxton Hicks Contractions

- HCG Levels By Week

- When to Take a Pregnancy Test

- Am I Pregnant

- Why is Poop Green

- Can Pregnant Women Eat Shrimp

- Insemination

- UTI During Pregnancy

- Vitamin D Drops

- Best Baby Forumla

- Postpartum Depression

- Low Progesterone During Pregnancy

- Baby Shower

- Baby Shower Games

Social Security numbers and why your baby needs one

Getting a Social Security number for your newborn has many benefits. It allows you to claim your child on your taxes, enroll your baby in health insurance, and set up a college savings plan and/or bank account for your little one. The easiest way to get an SSN for your baby is to apply using birth registration forms at the hospital. If you don't give birth at a hospital, or if your child is older or adopted, you can fill out Social Security forms online and apply in person at your local Social Security office.

How to get a Social Security card for a newborn

How do i look up my child's social security number, what if i haven't received my child's social security card, getting a social security number for an adopted child.

A Social Security number (SSN) is the U.S. federal government's way of identifying you and your child. In the United States, registering your child for a Social Security number is voluntary, but it's necessary to obtain important services. You'll use your child's SSN to claim child-related tax breaks (such as the dependent exemption and the child tax credit ), add your child to your health insurance plan, set up a college savings plan or bank account, and perhaps apply for government benefits for them.

The easiest way to apply for a Social Security card and number for a newborn is by completing a birth registration form at the hospital. You'll need to check the "yes" box where the form asks if you want to apply for a Social Security number for your baby.

You'll eventually need to provide both parents' Social Security numbers, but if you don't know both parents' SSNs, you can still fill out the form.

If you didn't deliver in a hospital, you weren't given the birth registration form, or you choose to wait to get an SSN for your child, your other option is to visit your local Social Security Administration Office (you can use the SSA's Office Locator Opens a new window ) and request a number in person. This process requires you to do three things:

- Complete Form SS-5 (Application for Social Security Number Opens a new window ) and provide both parents' Social Security numbers on the form. To save time, you can download, print, and complete the form before you go.

- Provide at least two documents proving your baby's age, identity, and citizenship status. One document should ideally be your child's birth certificate, and the other can be their hospital birth record or another medical record.

- Provide proof of your own identity and proof of your relationship to the child. Your driver's license and passport are both acceptable.

If you'd prefer not to make the trip, you can send a completed Form SS-5 along with your identification documents to your local SSA office by mail. However, you'll have to send originals or certified copies of all identification documents, which is why most people opt to apply in person.

Once you've submitted your application, you should receive your child's Social Security card in the mail in six to 12 weeks, but keep in mind that each state has slightly different processing times. Note as well that it could take longer than this to receive the card if your child is older than 1, because the SSA will contact your state's department of vital statistics to confirm that the birth certificate you've provided is valid.

You won't be able to find your child's SSN online due to the sensitivity of this information. You'll need to contact the Social Security Administration at ssa.gov Opens a new window and eventually visit your local SSA office in person with the proper identification to find out your child's SSN.

(Note: You can look up your baby's SSN on your tax return documents if you've declared your child as a dependent.)

Once your baby's SSN card arrives in the mail, keep it in a safe space at home with other important government-issued documents such as birth certificates and passports . This way, the card is less likely to be misplaced or stolen, and it's readily available when you need to reference your child's Social Security number (the digits are written clearly on the front of the card).

Figure out your state's approximate processing time for SSN applications for newborns, since it varies based on where you live. If you still haven't received your baby's card in the mail after the indicated length of time (and you're sure you submitted the application properly), you have two options:

- Visit your local SSA Office.

- Call the national SSA hotline at 1.800.772.1213. This phone number has automated services 24/7, or you can speak to a live person during business hours Monday through Friday.

Depending on your application status, someone at your local SSA office or an official on the hotline could ask you to refile your application; you can do so at ssa.gov. Keep in mind that you can't apply via phone or mail, so if you're asked to do this, report this immediately and consider it fraud.

Also, applying for a SSN and a Social Security card is free, so don't be tricked by scammers who may be trying to charge you a fee for your application.

If the child you're adopting is a United States citizen, the child's birth mother most likely filled out an application for an SSN for the baby at the hospital. However, you have the option to register them for a new SSN that bears the child's new legal name, no matter how old the child is at the time of the adoption.

You'll have to apply in person at your local Social Security Office. You must fill out the SS-5 application Opens a new window and provide proof of the child's citizenship and identity – you can present your Adoption Order, a certified copy of the child's birth certificate, or a hospital record – as well as your own identity and your relationship to them. This new number will override the child's old one.

If you're adopting a child from another country, you'll have to wait until the adoption is final and your child has entered the United States to obtain a Social Security number. To apply, fill out the application and bring the required paperwork described above, as well as other adoption paperwork such as immigration documents from the Department of Homeland Security, to your local Social Security Office. Then, follow the rest of the process described above to obtain your child's Social Security number and card.

If you want to file your child as a dependent on your tax return while the adoption is pending – before you receive the child's SSN card in the mail – you can obtain an Adoption Taxpayer Identification Number (ATIN). To apply for one, complete IRS Form W-7A Opens a new window .

Was this article helpful?

5 ways to save money on groceries when you have kids

Do babies need passports?

Costco just slashed prices on memory foam pillows so you can have your best pregnancy sleep yet

How to tell your child you're getting divorced (ages 5 to 8)

BabyCenter's editorial team is committed to providing the most helpful and trustworthy pregnancy and parenting information in the world. When creating and updating content, we rely on credible sources: respected health organizations, professional groups of doctors and other experts, and published studies in peer-reviewed journals. We believe you should always know the source of the information you're seeing. Learn more about our editorial and medical review policies .

Social Security Administration. Social security numbers for children. https://www.ssa.gov/pubs/EN-05-10023.pdf Opens a new window [Accessed June 2022]

Social Security Administration. 2022. How long does it take to get my baby's Social Security card that I applied for in the hospital? https://faq.ssa.gov/en-US/Topic/article/KA-01969 Opens a new window [Accessed June 2022]

Social Security Administration. Identity theft and your Social Security number. https://www.ssa.gov/pubs/EN-05-10064.pdf Opens a new window [Accessed June 2022]

Social Security Administration. Social Security numbers for children. https://www.ssa.gov/pubs/EN-05-10023.pdf Opens a new window [Accessed June 2022]

Social Security Administration. How to get a Social Security card and prove U.S. citizenship for a foreign-born adopted child. https://www.ssa.gov/people/immigrants/children.html Opens a new window [Accessed June 2022]

US Birth Certificates. How to get your newborn's Social Security number and card. https://www.usbirthcertificates.com/articles/newborn-social-security-card-number#how-to-apply-for-a-newborn-s-social-security-number [Accessed June 2022]

Alliance for Children's Rights. 2015. Adoptive parent FAQs. https://allianceforchildrensrights.org/wp-content/uploads/2016/08/FAQs-for-Adoptive-Parents_2015Update.pdf Opens a new window [Accessed June 2022]

Where to go next

- Police 10 Codes

- Police Reports

- Police Body Cameras

- Police Training

- Duties & Responsibilities

- Background Checks and Searches

- Open Source Intelligence (OSINT)

- Financial Investigations

- Corporate InvestigationResources

- Crime Scene Investigations

- Insurance Investigations

- TV Crime & Detective Shows

- Frauds & Scams

- Celebrity Investigations

- Software (All)

- Case Management Software Solutions for Investigation Agencies

- Computer Forensics

- Mobile Tracking Software

- P.I. Research Tools

- Genealogy Research

- Government Research

- Legal Research

- Lists of Lists

- Military Locates

- Maps & Geography

- Glossary of Terms

- Hire a Private Investigator

- Get a PI License

- Investigator Associations

- Industry Conferences

- Jobs and Careers

- Spy Gear (All)

- Audio Amplifiers

- Binoculars & Night Vision

- Camera & Bug Detectors

- Security Systems

- Legal Forms

- Personal Safety

Search Billions of Online Public Records .

How Social Security Numbers are Assigned

How Are Social Security Numbers Assigned?

This article aims to help you understand how Social Security Numbers are assigned. In 2011, the Social Security Administration (SSA) changed how they assign Social Security Numbers (SSNs). The new method uses a process called “randomization” to assign SSNs.

The Administration developed a new method to help protect the SSN’s integrity and extend the nine-digit SSN’s longevity (instead of adding additional digits).

SSN Randomization changes the assignment process in several ways. First, it eliminates the geographical importance of the first three digits. Also, the new randomization process eliminates the significance of the highest group number.

As a result, the High Group List is frozen in time and can only be used to see the area and group numbers SSA issued before the randomization implementation date.

Overview of Social Security Numbers

A Social Security number is issued to U.S. citizens, permanent residents, and temporary workers in the United States. The number is issued to an individual by the SSA, an agency of the federal government .

Its primary purpose is to track working individuals for taxation purposes and Social Security benefits. Since it was initially introduced, the SSN has become the primary national identification number, even though it was not originally intended to be used as a form of identification.

Since 1972, numbers have been issued by the central office. The first three (3) digits of a person’s social security number are determined by the ZIP Code of the mailing address shown on the application for a social security number.

Previously, before 1972, social security numbers were assigned by SSA field offices. The number merely established that his/her card was issued by one of the SSA offices in that State.

Randomization

In 2011, the SSA changed the assignment process to a process known as SSN randomization. This process eliminates the geographical significance of the number’s first three digits. Below is an explanation of how the numbers were assigned under the old system that was in effect before 2011 .

Social Security Number – Area Group Serial

The Social Security number consists of nine (9) digits, usually written in the format – 1 2 3 – 4 5 – 6 7 8 9. The first three digits of a social security number denote the area (or State) where the original Social Security number application was filed.

Each area’s group number (middle two (2) digits) ranges from 01 to 99 but is not assigned in consecutive order. For administrative reasons, group numbers issued first consist of the ODD numbers from 01 through 09 and then EVEN numbers from 10 through 98, within each area number allocated to a State.

After all numbers in group 98 of a particular area have been issued, the EVEN Groups 02 through 08 are used, followed by ODD Groups 11 through 99.

Within each group, the serial numbers (last four (4) digits) run consecutively from 0001 through 9999.

The chart below shows how Group numbers are assigned:

- ODD – 01, 03, 05, 07, 09——EVEN – 10 to 98

- EVEN – 02, 04, 06, 08——ODD – 11 to 99

List of Social Security Number Prefixes for Each State

Following is a list of social security number prefixes for each state. The listing is organized in ascending order based on the SSN prefix, with the corresponding issuing state listed. Remember, these apply only to numbers issued before 2011 under the old system.

SSN Prefix = Issuing State

001-003 = New Hampshire 004-007 = Maine 008-009 = Vermont 010-034 = Massachusetts 035-039 = Rhode Island 040-049 = Connecticut 050-134 = New York 135-158 = New Jersey 159-211 = Pennsylvania 212-220 = Maryland 211-222 = Delaware 223-231 = Virginia 232 = North Carolina 232 = West Virginia 233-236 = West Virginia 237-246 = North Carolina 247-251 = South Carolina 252-260 = Georgia 261-267 = Florida (Also 589-595) 268-302 = Ohio 303-317 = Indiana 318-361 = Illinois 362-386 = Michigan 387-399 = Wisconsin 400-407 = Kentucky 408-415 = Tennessee 416-424 = Alabama 425-428 = Mississippi 429-432 = Arkansas 433-439 = Louisiana 440-448 =Oklahoma 449-467 = Texas 468-477 = Minnesota

478 – 485 = Iowa 486 – 500 = Missouri 501 – 502 = North Dakota 503 – 504 = South Dakota 505 – 508 = Nebraska 509 – 515 = Kansas 516 – 517 = Montana 518 – 519 = Idaho 520 = Wyoming 521 – 524 = Colorado 525 = New Mexico 526 = Arizona 526 = New Mexico 527 = Arizona 528 – 529 = Utah 530 = Nevada 531 – 539 = Washington 540 – 544 = Oregon 545-573 = California 574 = Alaska 575-576 = Hawaii 577-579 = District of Columbia 580 = Virgin Islands 580-584 = Puerto Rico 585 = New Mexico 586 = Guam & American Samoa 586 = All Other Pacific Territories 587-588 = Mississippi 589-595 = Florida (also 261-267) 600-601 = Arizona (designated) 602-626 = California (designated) 700-728 = Railroad Retirement 729-999 = Not used until randomization was introduced.

Note: The number 666 has never been used and will not be used in the future.

Please post a comment below if you are aware of any new number ranges.

SSN Requirements

No law directly requires a natural-born United States citizen to apply for a Social Security number to live or work in the United States. However, some people still live without a number because they view it as a voluntary government program. Those who don’t get a number find it difficult to engage in ordinary acts of commerce or banking activities because they can’t provide an SSN.

Additional Resources

If you want to learn more about the process, visit the Social Security Administration website. On the website, you can:

- Get more information on how numbers are assigned and the randomization process

- Find the offices near you and get directions using the office locator. Just enter your zip code.

- Learn how to get cards and how to request replacement cards

Questions and Comments

If you have any questions, please post a comment below.

38 COMMENTS

What does a Social Security beginning with 200-75-XXXX indicate? I really didn’t understand the middle number, but I believe the first 3 numbers indicate under the old system that the number was applied for in PA.

I didn’t know the numbers were randomized rather than regionalized which makes a lot of sense. I’m a 370 from Michigan. Odd question… why is the prefix 666 unavailable? It’s just a number. I understand it’s Christian significance but it is only a series of digits and this is not a “Christian” domain. I am actually, but my faith is mine not someone else’s concern. The relevance of that number is from The New Testament (St. John’s Revelation)… and that is not fully explained or understood.

i need my grandfathers ssn because he has passed recently and ppl are still calling to collect nothing but they dont believe me they want his number how can i get it

If you are a family member, then you need to look at the DEATH CERTIFICATE. The social security number will be on it. Contact the funeral home, they will have a copy in their files. If you dont; know who handled the service, contact the cemetary, their records should show who the funeral director was. WARNING, if you are not a DIRECT family member no one will give you a copy or any information.

Is a SSN that has the first 5 digits all matching valid? I came across one on a client’s paperwork that had all the same number in the first 5 places. Only the last 4 were different.

I can’t say whether or not the numbers in your particular case are valid, but it would have been possible under the “old” system of issuing numbers. The first three numbers are based don’t the geographic area. The next two numbers are the group numbers, and those numbers are allocated to particular areas within a state.

You say that 729-999 are not in use, but my wife has a SSN that starts with 881. She is from France and got a green card in 2012, and that was the prefix assigned.

Then she got her SSN after June 25, 2011 when they started using random numbers.

Can a person’s prefix be different from the state the were born in? My prefix suggests I was born in Washington, but I was not.

Can group numbers be used to narrow down a location within a state (prior to randomization)?

It is difficult to find official information on the specific manner in which the numbers were issued. However, the group numbers weren’t based on a geographical area. The group numbers were determined by the sequential order in which they were assigned.

With the advent of some financial institutions wishing to make you give them the last six or your social security number, it seems as though they do not understand nor does the government understand the sanctity that should be afforded Social Security identification numbers. With crooks having access to screaming fast computers today, it really is not much of a problem with a nine-digit password to eventually obtain it by searching. And it makes it much easier with the last four that the majority of institutions require for identification. However, with the last six, you might as well just give them the entire number and see your personal security go down the tube. This should be a top priority of our government to band the use of any more numbers being given out to anybody for identification.

Are there duplicates of the last four digits?

Yes. There are social security numbers that have the last four digits that match.

Are SSN’s for noncitizens coded to shos they are not citjzens?

I believe the SSA assigns the numbers using the randomization process that was put in place in 2011. So, they shouldn’t be coded to identify that an individual is a non-citizen. Check the SSA.gov website for more information.

I’m wondering the same thing,

Please remember: the SSN is assigned based on the address provided on the application submitted to the Social Security Administration. This address is supposed to be the applicant’s permanent address. If you have a question, you should contact the Social Security Administration. >>> ASSIGNMENT METHODOLOGY USED STARTING JUNE 26, 2011 <<< The U.S. SSN (Social Security Number) is assigned RANDOMLY. However, the methodology is not public knowledge.

Concerning? I was noting my son’s ssn this year while gathering tax information, and it starts with 881. My concern is that it won’t be valid when he goes to work- as it says numbers starting with 729-999 = Currently not in use???? What could have happened?

It was randomized near the year 1972 because some areas ran out of numbers.

I am a Veteran living in the Houston, Texas area and am enrolled in VA Healthcare. I have recently discovered, when checking in at the DeBakey VA Hospital in Houston, that their VA computer shows that there are 3 Veterans in their system, including myself, that have the same exact last name and the same exact last 4 numbers of their SSN. Should I be concerned?

We’re not in a position to interpret whether it is something that should be of concern. However, it may be something that you should inquire about with VA Healthcare. It is possible that you may have multiple accounts within their system. The records that you see with the same last name and same last four numbers of the SSN may all be referring to you. You may want to give them a call to get more information.

Here it said that the 800 are not in use . 800 are good numbers or bugs number please advice

The SSA changed the way they issue social security numbers, so numbers beginning with 800 are certainly possible.

Both my kids born 2004 & 2009 are 766 and it’s now required to file for them at birth to which they were born in FL but it says the 766 aren’t in use yet when they have been in use for at least 15years now. Strange.

I was born in S.C. but the first 3 digits show it came from Arkansas

I live in NE. Everyone in my family and my first born all start with the 505, 508. This past year I had a baby. His SSN starts with 358. Why is this?

your would indicate you and your family was born in Nebraska, But your sons would indicate he was born in Illinois, so if he wasn’t that is strange, better check into so he don’t have problems later in life with his number

its not where you were born that determines the number, it is the state where the application for an original Social Security number was filed. In my case, I didn’t file till I was 13 and had moved multiple times.

The numbers are now picked at random & are not picked by state. The first three numbers of your baby’s ssn have nothing to do with his state of birth or the state in which his ssn was applied for. Since 2011, the Social Security Administration has been assigning SSNs by randomization. This process eliminates the geographical significance of the first 3 numbers.

I was born in 1980 so my social security number should be from the state I was born in since the change was not started till 2011 where your social security number is pick random

My daughter was born in Connecticut it was issued a social security number while living in Connecticut but she has a New York social security number

I was born in Georgia and I have a New York number. My cousin was born the same month and in the same hospital as me and she has a Georgia number. What could be the reason?

I have an FL ssn and i wasnt born in FL accoding to my birth certificate.

I was born in Alabama, but my SSN was issued at about age 8 (this was many years ago) while living in North Dakota. Therefore, I have a North Dakota SSN.

i have a question it says the 1st 3 numbers say where one was born i have 149 the list says that is the number for new Jersey and i was born in Oklahoma. why?

The first three numbers actually represent the geographic area where the social security number was issued, rather than where a person was born.

In 2011 the first 3 of 808 was used. Every where I have seen says it isn’t, but it was given to my child.

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

eInvestigator.com is a resource website for Police Officers, Private Investigators, Law Enforcement officials, Security Guards, Bodyguards, Legal Professionals and anyone interested in using the internet to search for people and information. Leverage our extensive collection of investigative research tools, reference materials, educational articles, software programs, detective books, spy gear, and more. If you're an aspiring private eye, learn how to become a private investigator in your state, get information on schools, training, continuing education and find a job to start your career.

The articles on our website are general in nature and do not constitute legal advice. eInvestigator.com makes no warranties as to the accuracy or completeness of the information, does not endorse any companies, products, or services described here, and takes no liability for your use of this information. Also, we are an information provider only and do not distribute the products we review on our website. Please note: This post may contain affiliate links. We may receive compensation from the brands we promote. As an Amazon Associate, we earn from qualifying purchases.

Copyright 2024 Brandy Lane Publishing, LLC | All Rights Reserved | Privacy Policy | Powered by Kinsta Web Hosting

Social Security

Frequently asked questions, can i change my social security number.

We can assign a different number only if:

- Sequential numbers assigned to members of the same family are causing problems.

- More than one person is assigned or using the same number.

- A victim of identity theft, who has attempted to fix problems resulting from the misuse but continues to be disadvantaged by using the original number.

- There is a situation of harassment, abuse or life endangerment.

- An individual has religious or cultural objections to certain numbers or digits in the original number. (We require written documentation in support of the objection from a religious group with which the number holder has an established relationship.)

To request a different Social Security number, contact your local Social Security office for an in-person appointment.

Additional Resources:

New Numbers For Domestic Violence Victims

Identity Theft And Your Social Security Number

Give us Feedback.

Introducing AARP Members Edition: Your source for tips to live well, members-only games, exclusive interviews, recipes and more.

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

AARP MEMBERSHIP

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products, hundreds of discounts, a free second membership, and a subscription to AARP the Magazine. Find how much you can save in a year with a membership. Learn more.

- right_container

Work & Jobs

Social Security

AARP en Español

- Membership & Benefits

- Members Edition

- AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

AARP Hearing Center

Advice on Tinnitus and Hearing Loss

Get Happier

Creating Social Connections

Brain Health Resources

Tools and Explainers on Brain Health

Your Health

8 Major Health Risks for People 50+

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Outdoor Vacation Ideas

Camping Vacations

Plan Ahead for Summer Travel

AARP National Park Guide

Discover Canyonlands National Park

History & Culture

8 Amazing American Pilgrimages

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

Movies for Grownups

Summer Movie Preview

Jon Bon Jovi’s Long Journey Back

Looking Back

50 World Changers Turning 50

Sex & Dating

Spice Up Your Love Life

Friends & Family

How to Host a Fabulous Dessert Party

Home Technology

Caregiver’s Guide to Smart Home Tech

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

AARP Solves 25 of Your Problems

Driver Safety

Maintenance & Safety

Trends & Technology

AARP Smart Guide

How to Clean Your Car

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Go to Series Main Page

How to get a Social Security number

Andy Markowitz

If you have a child in the United States, he or she can get a Social Security number (SSN) virtually at birth. At the hospital, while giving information for the birth certificate, you can simultaneously apply for the baby’s Social Security number. You'll be asked for both parents’ Social Security numbers, but if you don't have them you can still apply.

If you decide to wait until later, you'll need to fill out an SS-5 , the application form for a Social Security card, and bring it to your local Social Security office along with:

- At least two documents proving your child’s U.S. citizenship, age and identity. A birth certificate and passport will fully satisfy the requirements. For a list of other acceptable documents, see the Social Security pamphlet “Social Security Numbers for Children.”

- Proof of your identity, such as a driver's license, passport or state-issued ID card.

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine. Find out how much you could save in a year with a membership. Learn more.

All documents must be originals or copies certified by the issuing agency. Photocopies or notarized copies will not be accepted.

If the child is 12 or older, he or she must appear at a Social Security office for an interview. The Social Security Administration recommends calling in advance (800-772-1213) and scheduling an appointment to avoid long waits.

Non-U.S. citizens can get a Social Security number provided they are in the country legally. If you have permanent residency, you’ll be issued the same type of Social Security card that citizens get. You will need to show proof of identity and your authorization from the Department of Homeland Security (DHS) to live and work in the country.

Two types of limited Social Security numbers are available to noncitizens who do not have permanent residency:

- If you have temporary permission to live and work in the United States, you can get a Social Security card stamped “valid for work only with DHS authorization."

- If you do not plan to work but need a Social Security number for another reason — for example, to apply for government benefits or services — your card will be stamped "not valid for employment."

Incoming immigrants can apply for a Social Security number from their home country as part of the visa application process. If you are already in the United States, you will need to visit a Social Security office. The pamphlet “Social Security Numbers for Noncitizens” has more information on how, when and where to apply.

Keep in mind

You can ask Social Security to assign you a new number under limited circumstances, for example if you are a victim of domestic violence or identify theft . You can only apply for a new number in person at a Social Security office. Contact your local office to schedule an appointment or learn more.

Andy Markowitz covers Social Security and retirement for AARP. He is a former editor of the Prague Post and Baltimore City Paper .

Unlock Access to AARP Members Edition

Already a Member? Login

AARP NEWSLETTERS

%{ newsLetterPromoText }%

%{ description }%

Privacy Policy

More Social Security FAQs

More Social Security Answers

How to get a replacement Social Security card

How do I change the name on my Social Security card?

How are Social Security numbers assigned?

ARTICLE CONTINUES AFTER ADVERTISEMENT

AARP Value & Member Benefits

Member Benefits Text Alerts

Unlock more value: Get updates and be the first to know about new benefits

Trust & Will Estate Planning

20% off trusts and wills

LensCrafters

50% off prescription lenses with the purchase of a frame and more

AARP® Staying Sharp®

Activities, recipes, challenges and more with full access to AARP Staying Sharp®

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

Retire Gen Z

When Did Social Security Numbers Start Being Issued At Birth?

Key Takeaway:

- Social Security numbers (SSNs) were first issued in 1936, as part of the Social Security Act signed by President Franklin D. Roosevelt.

- Initially, SSNs were only issued to workers aged 18 and older and were intended to track their earnings for Social Security benefits.

- SSN issuance expanded over the years, with the 1961 birth registration requirement making it common for individuals to receive an SSN at birth.

Wondering when your Social Security Number, a key identifier of your personal information, was first issued? You’re not alone. Protecting your identity is more important now than ever – let’s uncover the start of this system.

History of Social Security Numbers

Social Security Numbers (SSN) are used to track the earnings of an individual and are essential for the administration of government benefits in the United States. Since their inception, SSN has undergone several changes. Initially, they were issued only to adults, but with the passage of time, they started being issued at birth in the 1980s to help in identifying children for various government services. The issuance of SSN at birth has played a significant role in protecting children from identity theft. SSN has become a crucial identifier for all Americans, and it is essential to keep it confidential and secure.

Interestingly, in the early days of SSN, people were advised not to carry their cards with them as it was considered risky. However, with time, the importance of SSN has increased and it has become essential to carry, as it is required by various facilities. Overall, SSN has evolved over the years, and it has become an integral part of the American identity.

It is worth noting that the first Social Security Number was issued to John David Sweeney Jr, who was born in New Rochelle, New York, on November 24, 1936.

Image credits: retiregenz.com by Harry Duncun

Issuance of Social Security Numbers

The history of Social Security Number (SSN) issuance dates back to 1936, when the government began to assign unique identifiers to individuals for the purpose of tracking their employment records and eventually their social security benefits. These numbers were originally given out only to those who were already employed, but later on, starting in 1986, newborns were included as well. Currently, every child born in the United States is given an SSN at birth.

The reason for issuing SSNs at birth was to create a more seamless process for tracking benefits and to prevent identity fraud. By assigning SSNs at birth, the government can ensure that every American has a unique identifier to use for employment and benefit purposes.

It is important to note that while SSNs have become a ubiquitous part of American life, they should be protected and not shared casually. Due to the prevalence of identity theft, it is recommended that individuals safeguard their SSN and only share it when necessary. To further protect against identity theft, it may be wise to monitor credit reports regularly and to notify authorities immediately if any suspicious activity is detected.

Image credits: retiregenz.com by James Washington

Birth Registration Requirements

The Requirements for Registering Birth in the United States

Birth registration is the process of recording a child’s birth information with the government. It is a crucial task because it provides the child with an identity and various legal rights. In the United States, the birth registration process is mandatory and varies from state to state. Parents or guardians are responsible for registering their child’s birth and providing accurate information.

The registration process involves obtaining a birth certificate, which is proof of a child’s identity. The birth certificate contains crucial details such as the child’s full name, gender, date and time of birth, place of birth, parents’ names, and other necessary demographic information. The birth certificate is required for various purposes like obtaining a passport, enrolling in school, and accessing government benefits.

One unique aspect of birth registration requirements in the US is the issuance of Social Security numbers . Social Security numbers are unique identification numbers assigned to individuals by the government. The system was started in 1936, but it was not until 1986 that Social Security numbers started being issued at birth to all US citizens. This was done to combat fraud and improve the accuracy of Social Security records.

Therefore, it is essential to register a child’s birth promptly to prevent any complications in the future. Failure to register within the required time frame may result in the inability to obtain a birth certificate or Social Security number. The fear of missing out on crucial legal rights and benefits should be a compelling motivation for parents to prioritize timely birth registration.

SSN Issuance at Birth

In recent times, the Social Security Administration has been issuing Social Security Numbers (SSN) to newborns, defining it as the SSN Issuance at Birth . It is a way to ensure that every child has an SSN from birth, thus making the process of obtaining it easier as they grow up. SSN Issuance at Birth was not the practice in the past , and children had to wait until they were of a certain age to apply for an SSN.

Since 1986, the Social Security Administration has been issuing SSNs to newborns as soon as they are born , a process that has proven to be very effective. Before then, parents had to apply for the SSN on behalf of their children, and the process could take weeks. With SSN Issuance at Birth, parents are provided with the SSN right after their child’s birth, making it easier to obtain other government services that require an SSN.

It’s worth noting that before 1986, the SSN was primarily intended for workers to track their income; however, the need to expand its usage arose. In the years that followed, the SSN became a required legal identification number, and it was essential to obtain it as early as possible.

Interestingly, a few states, such as New Hampshire, decided to issue SSNs to newborns in the 1970s, a decision that was then implemented nationally in 1986. This historical information gives context to the implementation of SSN Issuance at Birth and helps us understand the significance of this relatively new process within the wider context of the history of the SSN.

Image credits: retiregenz.com by James Arnold

Five Facts About When Social Security Numbers Started Being Issued at Birth:

- ✅ Social Security numbers started being issued at birth in 1986 as a response to increasing concerns about identity theft. (Source: The New York Times)

- ✅ Some parents object to the practice of issuing social security numbers at birth, citing privacy concerns and government overreach. (Source: NPR)

- ✅ The Social Security Administration initially issued social security numbers only to workers, but now they’re issued to children as well. (Source: Social Security Administration)

- ✅ Social Security numbers are used not only for retirement benefits but also for a wide range of financial transactions, including obtaining credit and opening bank accounts. (Source: AARP)

- ✅ Social Security numbers are also used for government services such as applying for a passport or obtaining a driver’s license. (Source: USA.gov)

FAQs about When Did Social Security Numbers Start Being Issued At Birth?

When did social security numbers start being issued at birth.

Social security numbers started being issued at birth in 1986 for babies born in the United States.

Why did social security numbers start being issued at birth?

Social security numbers started being issued at birth to simplify the process of obtaining a number. It also helps to prevent identity theft later in life, as social security numbers are tied to a person’s identity.

Did all babies born in the United States receive a social security number at birth in 1986?

No, not all babies born in the United States received a social security number at birth in 1986. The law was phased in over several years, starting in 1986 and ending in 1990.

How do I apply for a social security number for my newborn?

To apply for a social security number for your newborn, you must provide the hospital with your baby’s full name, date and place of birth, and both parents’ social security numbers. The hospital will then forward this information to the Social Security Administration, and your baby will receive a social security number in the mail.

Are social security numbers issued at birth still in use today?

Yes, social security numbers issued at birth are still in use today. They continue to be an important part of a person’s identity and are needed for various government and financial transactions.

What happens if I never received a social security number at birth?

If you never received a social security number at birth, you can apply for one at any time. You will need to provide proof of identity and citizenship, as well as documentation of any name changes. You can apply for a social security number online or in person at a Social Security Administration office.

Similar Posts

Why Are Social Security Workers So Rude?

Key Takeaway: Social security workers may exhibit rudeness due to high stress levels, understaffing, repetitive and monotonous work, dealing with difficult cases, strict regulations and rules, and lack of training and support. Understanding the underlying reasons can help mitigate the negative impact on customer experience and employee satisfaction. Rudeness from social security workers can lead…

How Much Will My Social Security Be In 2023?

Key takeaway: The amount of Social Security benefits you receive in 2023 will depend on various factors, including your earnings history, age, and whether you are retired, disabled, or a survivor. Changes in 2023 to Social Security benefits include cost-of-living adjustments (COLA), increases in the full retirement age, and changes to income limits for benefits….

How To Live On Social Security Disability Alone?

Key Takeaway: Know the eligibility criteria: Understanding the eligibility criteria for Social Security Disability is crucial in determining whether you can apply for the program as well as the kind of benefits you’re eligible for. Budget wisely: When living on Social Security Disability alone, it is important to prioritize essential expenses such as housing, food,…

How To Pass A Social Security Disability Review?

Key Takeaways: A Social Security Disability Review is a periodic evaluation of a beneficiary’s disability status to determine if they still qualify for benefits. It is essential to maintain accurate medical records and to be prepared to answer questions about your condition. Maintaining good communication with your treating doctors and providing additional information, such as…

What Time The Social Security Office Open?

Key Takeaway: Social Security office hours vary by location, but most offices are open Monday-Friday from 9am to 4pm. Some offices may offer extended hours or weekend hours, so it’s important to check with your local office for their specific schedule. When visiting a Social Security office, it’s important to bring all necessary documents, such…

What Changes Have Been Made To Social Security?

Key Takeaway: Retirement age has increased: Social Security retirement age has increased to 67 years. This means that workers need to work for a longer period to receive full benefits. Calculation of Benefits: The calculation method for Social Security benefits has changed, particularly for high-earning beneficiaries. This means that these beneficiaries may receive lower payments….

ORDER YOUR BIRTH CERTIFICATE ONLINE

How to get your newborn's Social Security Number and Card

What is the purpose of the Social Security number?

How long does it take to get a social security number for your child, why should i get my child’s social security number.

Welcoming a newborn is often an exciting and happy occasion. There are plenty of things to get ready, and parents might feel that there is not enough time. However, once the child is born, parents do need to take care of a few legal matters as soon as possible . On the one hand, it’s essential that parents obtain their child’s birth certificate. Registering a birth and getting your baby’s birth certificate is a fairly easy process.

You will need your newborn’s birth certificate to apply for your child’s Social Security number and card. Keep in mind that a person’s security number must be protected as it is directly linked to their lifetime earnings, taxes, and more.

The Social Security number (SSN) is a nine-digit number which the U.S. government issues to all U.S. citizens . Eligible U.S. residents are able to apply for one as well. This number allows the government to keep track of your lifetime earnings as well as the number of years worked.

U.S. citizens need a SSN to be able to work . An employer will always ask for the social security number, and they will report your income to the Internal Revenue Service, IRS.

Instances when a person is asked to provide their Social Security card or number also include:

- Opening an account with any U.S. financial institution

- Applying for a federal loan

- Applying for certain types of public assistance

- Enrolling in Medicare

- Applying for a passport

- Filing your tax return

- Getting a driver’s license

Without a Social Security number, financial institutions will not be able to run a credit check, and therefore, making it more difficult to get a credit card or a loan.

How to apply for a newborn’s social security number?

To apply for your child’s Social Security number you must complete a birth registration form. When completing this form, you must check a box to request a number for your child . It is also necessary to provide the parent’s Social Security numbers.

You may be wondering where do you get the birth registration form. Most hospitals will distribute the birth registration form after a child has born and while the mother is still a patient. If the birth did not occur at a hospital or for some reason the birth registration form was not completed, new parents can visit a local Social Security Administration (SSA) office and request the number in person. If this were the case, you need to do the following:

- Fill out the Form SS-5 and provide the parent’s Social Security numbers

- Provide at least two documents that prove your child’s age, identity, and citizenship status. One of these documents should be your child’s birth certificate, and the second document can be a medical record or the hospital’s birth record.

- Present proof of your own identity, you may present your driver’s license or passport.

After you have submitted the application at the SSA office, your child’s Social Security card should be delivered between 6 to 12 weeks . If your child is older than one-year, it can take a lot longer to process your application. This is because the SSA will contact your state’s department of vital statistics to verify the validity of the birth certificate provided on the application.

If your child is born at the hospital, it will be much easier to complete the birth registration form instead of going to the SSA office. However, new parents always have the option to apply for their child’s SSN in person.

Generally, it takes between four to five weeks to receive the Social Security number and card if you had submitted the application at the hospital. However, this might vary depending on the state where you live. If your child’s Social Security card has not arrived within six weeks you can head to your nearest Social Security office. You will need to take proof of your child’s citizenship, age and identity as well as documents to identify yourself.

A child’s Social Security number cannot be give out over the phone, therefore it is necessary for you to go in person, in the case that it has not arrived.

One of the main reasons to get your child’s Social Security number after they are born is so that you can claim your child as a dependent on your income tax return . You also need your child’s social security card if you are planning on:

- Opening a bank account for your child

- Buying savings bond for your child

- Getting medical coverage for your child

- Applying for government services for your child

Getting a Social Security number for your child is not obligatory, however, applying for one is an easy enough process and will benefit you and your child.

If your child is adopted, the SSA can assign them a Social Security number . You can apply for the number using your child’s new name as well as your name and details as a parent.

Getting the Social Security number and card for your child does not carry a cost, in other words, Social Security services are free.

Whether you choose to complete the birth registration form at the hospital, or head to the SSA office later on, you will certainly need an authorized copy of your child’s birth certificate . USBirthCertificates is a convenient and secure way to get your child’s vital records .

Related: How to get a replacement Social Security card Related: How do I change my name on my Social Security Card?

Most popular Birth Certificate searches

- Arizona Birth Certificate

- Arkansas Birth Certificate

- California Birth Certificate

- Connecticut Birth Certificate

- Colorado Birth Certificate

- Florida Birth Certificate

- Georgia Birth Certificate

- Illinois Birth Certificate

- Indiana Birth Certificate

- Kentucky Birth Certificate

- Maine Birth Certificate

- Maryland Birth Certificate

- Massachusetts Birth Certificate

- Michigan Birth Certificate

- Minnesota Birth Certificate

- Mississippi Birth Certificate

- Missouri Birth Certificate

- New Hampshire Birth Certificate

- New Jersey Birth Certificate

- New York Birth Certificate

- New York City Birth Certificate

- North Carolina Birth Certificate

- Ohio Birth Certificate

- Oregon Birth Certificate

- Pennsylvania Birth Certificate

- Rhode Island Birth Certificate

- South Dakota Birth Certificate

- Tennessee Birth Certificate

- Texas Birth Certificate

- Virginia Birth Certificate

- Washington Birth Certificate

- Wisconsin Birth Certificate

- Alabama Birth Certificate

- Alaska Birth Certificate

- Delaware Birth Certificate

- District of Columbia Birth Certificate

- Hawaii Birth Certificate

- Idaho Birth Certificate

- Iowa Birth Certificate

- Kansas Birth Certificate

- Louisiana Birth Certificate

- Montana Birth Certificate

- Nebraska Birth Certificate

- Nevada Birth Certificate

- New Mexico Birth Certificate

- North Dakota Birth Certificate

- Oklahoma Birth Certificate

- South Carolina Birth Certificate

- Utah Birth Certificate

- Vermont Birth Certificate

- West Virginia Birth Certificate

- Wyoming Birth Certificate

This site uses cookies for web analytics. By browsing this site, you accept our Cookies Policy .

Is Your June Social Security Check Missing? Here's What To Do

Didn't receive your June Social Security payment? It could be for a few reasons. We'll fill you in.

Why is your Social Security payment late?

We're just a few days away from July, and Social Security payments should be rolling out soon, but some of you may still be waiting on your June payment. Your benefits check should arrive around the same time each month, which the agency sets based on how long you've received benefits and your date of birth.

But if you're still waiting, a late payment doesn't always mean you won't get your money. You may be missing a payment because you closed your bank account, for example, or moved. Whatever the case, it's best to call the Social Security Administration to find out what's going on. We'll explain how to do this below.

Here's why your Social Security benefits might be late and what to do about it. For more, here's what happens if you get a Social Security overpayment and why you might still need your cost-of-living adjustment letter .

Why your Social Security payment could be missing

Here's why your Social Security payment might not have made it into your bank account last month.

Your banking information has changed: If you recently changed your banking information and didn't update your Social Security account, this could be why you didn't receive your money.

You recently moved: If your address has changed since your last Social Security payment, this could cause a delay in your benefits.

You just applied for benefits: If you recently applied for Social Security benefits , it'll take a couple of months before you begin receiving benefits. Roughly 30 days after applying, you'll receive a letter that shows your anticipated benefits start date.

The Social Security Administration stopped your benefits: The SSA can terminate your benefits if you begin working and your income exceeds the maximum amount allowed. Your benefits can also be suspended if you've been in jail longer than 30 days. Here's more on how you could lose your benefits .

The Social Security offices are experiencing delays: If the Social Security office that handles your payments has a problem, like a staffing shortage, it could potentially delay your benefits.

Check the status of your Social Security benefits

If you applied for benefits but haven't received a letter in the mail and it's been 30 or more days, you can check the status of your application. You'll need to log in to your My Social Security account or create one if you haven't already.

Once you're in, you can see your current claim location , as well as the scheduled hearing date and time.

If it's been more than 30 days and you haven't heard from the Social Security Administration, it may be best to call or visit your local office for more information.

How to report a missing payment

If your Social Security direct deposit didn't arrive in your bank account on the typical scheduled day , call your bank. They might be able to tell you if there's a delay in posting your payment.

If your bank doesn't see any pending payments, it may be time to call the Social Security Administration at 800-772-1213 or contact your local Social Security office. Someone in the office will review your case and if they find a payment is due to you, they will send it.

For more information, here's the maximum amount of Social Security money you can receive each month. Here's a Social Security cheat sheet for all your questions.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Social Security Matters

How to change your second factor authentication for your personal my social security account.

September 2, 2021 • By Dawn Bystry, Associate Commissioner, Office of Strategic and Digital Communications

Last Updated: November 2, 2023

Did you recently get a new cell phone number or email address? If you did, you will need to update your personal my Social Security account to reflect the new number or email. You will be required to use the second factor process to access your account. Second factor authentication provides an extra level of security for your account. Here’s what you need to know to help you keep your account safe and secure.

To update the second factor authentication on your account, go to the Sign In page . Enter your username and password. Then, follow these steps:

- On the page that asks you to “Please verify your cell phone number” or “Please verify your email address”—depending on which one is currently listed as your second factor, choose, “No, it is no longer valid and must be changed.” If you registered both your cell phone and email address, you will get a screen with both options. Choose this option to let us know that you can no longer access it.

- Click “Next.”

- Scroll down and check the “I agree to the Terms of Service” box.

- Enter your mailing address and primary phone number in the “Provide Information” page.

- Click “Mail Reset Code Instructions.”

- Then, click “Done” on the next page.

After completing these steps, you’ll receive a letter by mail in 5 to 10 business days. Your letter will contain a reset code and step-by-step instructions for changing where you receive security codes.

When you receive the letter with your reset code, go to the Sign In page , enter your username, and include your password. Then, you can:

- Click “Sign In.”

- Click “Yes, let’s begin” on the “Do you have your reset code letter?” page.

- Fill in the appropriate field to let us know how you want to receive your security code—whether by text message or email.

- Enter the security code you received—by text message or email—in the space provided.

- Then, click “Submit Security Code.”

- Enter the reset code from your letter on the following page.

- Then, click “Next” again.

- Click “Next.” This will take you to your my Social Security account.

Be sure to refer to our Frequently Asked Questions page for any additional questions—and check out our most asked questions and main topics. Please share this information with your friends and family—and subscribe to our blog for the latest updates.

Did you find this Information helpful?

Tags: my Social Security , my Social Security account , social security , Social Security benefits

About the Author

Dawn Bystry, Associate Commissioner, Office of Strategic and Digital Communications

Deputy Associate Commissioner, Office of Strategic and Digital Communications

Related Articles

During hurricane season, be prepared with electronic payments, social security — national reentry week (april 24th-30th), my reflections on public service, remembrances on patriot day.

February 25, 2022 8:49PM

I have tried several times to establish the mysocial security account. When I tried to set up IDme, after accepting the photo of my driver’s license and the picture of my face, the system asked for my phone number and then said it did not authenticate my identity! When I’ve tried login.gov, I reached the point where it says to “use Face or Touch unlock … then your security key with secure.login. gov.” I have no security key! I received a letter outlining the steps to finish setting up the online account, but I can’t get past that security key step! I’ve called the national and local office, waited on hold, and had the calls dropped. When I finally got through to 1-800-772-1213, the agent did not know how to get past the step of putting in my (non-existent) security key. Her only suggestion was to set up an appointment for a phone meeting with the local office–for 7 weeks from now! I am trying to sign up for Medicare and do not want to further delay this process.

March 2, 2022 10:00AM

Hi, Abby. We are sorry to hear about your experience. For assistance with ID.me registration and/or the authentication process, please contact ID.me through their customer support page on https://help.id.me/hc/en-us/categories/360005564453-Verifying-for-the-Social-Security-Administration . You can also submit your requests for any i nquiries at https://help.id.me/hc/en-us/requests/new . We hope this helps.

February 13, 2022 9:10AM

How can I change my security from sending a code to my mail to sending it to my email. I no longer live at that address and I can’t get the code. Please Help!!! Thank!

February 18, 2022 9:20AM

Hi, Penny. For assistance with your personal my Social Security account , please call us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday from 8:00 a.m. to 7:00 p.m. At the voice prompt, say “help desk.” We hope this helps.

February 12, 2022 10:26AM

Can I delete my account & start over?

February 18, 2022 9:06AM

Hi, Diana. No, however, if you are encountering a problem with your personal my Social Security account , please call us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday from 8:00 a.m. to 7:00 p.m. At the voice prompt, say “help desk.” We hope this helps.

December 10, 2021 9:13AM

I have a pre-2018 mySSA account. I also have a login.gov account. Can I switch my mySSA account so that I can log in with my login.gov account? (I want to make the change because login.gov uses stronger token-based MFA.)

December 15, 2021 10:36AM

Hi, Neil. Thanks for your question. Yes, you are able to sign in with your Login.gov credentials instea d of your previous my Social Security credentials. You can continue to have both sets of credentials if you wish. We hope this helps.

Christian V.

November 22, 2021 4:06AM

Hello, I am having an issue with updating my phone number (which is used for 3 ways security). My new number is a French number, your site doesn’t allow for such international number change. Without this update I can’t access any longer to my online account. I saw that you have the 800-772-1213 number Helpdesk, I will attempt calling it at the appropriate time. Thank you for any help you could give me. Christian V.

Comments are closed.

You're reading a free article with opinions that may differ from The Motley Fool's Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

This Is the Average Social Security Benefit for Age 67

- Waiting until the full retirement age of 67 results in receiving the full Social Security retirement benefit.

- There are a few wrinkles to consider when reviewing the Social Security Administration's average benefits by age.

- Individuals can top the average retirement benefit in two ways.

- Motley Fool Issues Rare “All In” Buy Alert

Here's the latest Social Security average benefit for 67-year-olds. But you can beat this average.

Patience often pays off. That's true whether we're talking about fishing, gardening, or learning something new. And it's definitely applicable to the decision about when to claim Social Security retirement benefits.

All Americans born in 1960 or after will receive lower monthly checks if they begin collecting Social Security retirement benefits before reaching their full retirement age of 67. How much you receive depends on several factors, but the Social Security Administration (SSA) provides updated average benefits by age each year.

Image source: Getty Images.

Full retirement age, full benefit

As of the end of December 2023, the average monthly Social Security benefit for retired workers aged 67 was $1,883.50. This amounts to $22,602 per year.

The averages differ based on the sex of the beneficiary, though. Men aged 67 received an average of $2,903.70 per month ($34,844.40 per year), while women aged 67 received an average of $1,676.20 per month ($20,114.40 per year).

The average monthly retirement benefit at younger ages is significantly lower. For example, 62-year-olds received only $1,298.26 per month ($15,579.12 per year). Retired workers aged 65 received an average monthly check of $1,563.06 ($18,756.72 per year).

These lower averages aren't surprising because SSA applies an early retirement penalty. Benefits are reduced by five-ninths of 1% for each month before a person reaches his or her full retirement age for up to 36 months. The penalty for retiring earlier than 36 months before the full retirement age is five-twelfths of 1% per month.

A few wrinkles with the Social Security average

Mark Twain popularized the saying, "There are three kinds of lies: lies, damned lies, and statistics." While I wouldn't categorize the above Social Security statistical average as a lie, there are a few wrinkles to note with the figure.

Importantly, the average doesn't only include retired workers who wait until age 67 to begin receiving benefits. It reflects the average benefits for all retired workers age 67, including many individuals who retired at an earlier age.

The average monthly benefit for retired workers age 67 is also undoubtedly higher than $1,883.50 today. Because SSA's data is from December 2023, the numbers don't include the impact of the Social Security cost-of-living adjustment (COLA) of 3.2% that went into effect in January 2024.

Remember, too, that any retirees who began receiving Social Security benefits in 2024 could skew the average. If the lifetime earnings of these workers are higher than the lifetime earnings of previous Social Security beneficiaries, the average monthly benefit for 67-year-olds could be pushed even higher.