How to make a business plan

Table of Contents

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

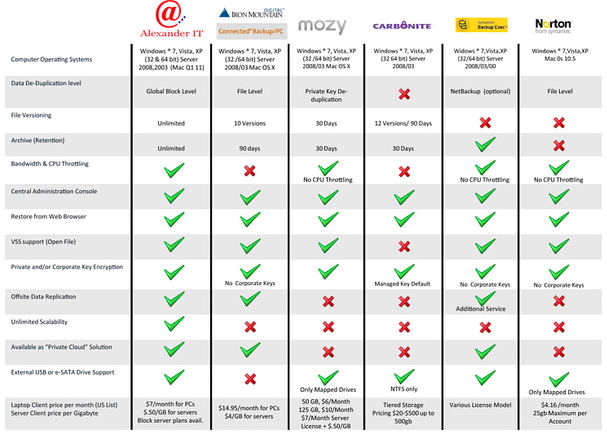

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

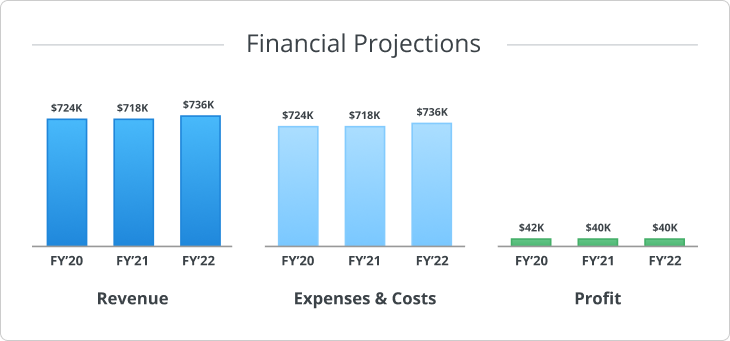

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Join thousands of teams using Miro to do their best work yet.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

How to Write a Professional Business Plan in 10 Easy Steps

Home » Blog » How to Write a Business Plan in 10 Easy Steps

During financial uncertainty, many of us press pause on our entrepreneurial aspirations.

Wondering if now’s the right time to start our business . Doubting our ideas and worrying about the what-ifs and maybes!

A business plan removes the uncertainty and what-ifs from the equation. It validates our business ideas, confirms our marketing strategies, and identifies potential problems before they arise.

Replacing our doubts with positivity, ensuring we see the complete picture, and increasing our chances of success.

Because you could be starting and running your own business . But you’ll only know for sure it’s the right move for you when you write your business plan.

Here’s everything you need to know to create the perfect business plan.

What is a business plan?

A well-written business plan contains the recipe for your new business’s growth and development.

It’s your compass.

It describes your goals and how you’ll achieve them by infusing the ingredients you need to turn your dream into a reality.

- Your business description- Tells readers about your idea, why it'll succeed, and how you'll make it happen.

- A market analysis- That backs up your company description.

- Your management and organization plan- Includes employees or contractors because even a one-person show may need a team's help on a contract basis, like bookkeeping services, graphic design, research, and if your business grows, with time, also full-time employees.

- Your products or services descriptions- Explaining how they work, where you'll get them, and how much they`ll cost.

- A target audience analysis- So, you know exactly who you`re selling to and what makes them buy what you`re offering.

- Your marketing and sales plan- Proving your chosen niche is profitable and how you'll reach your customers.

- A financial funding request/projections - What you need and how you'll get it.

Your business plan is like a GPS, guiding your business to its destination for the next 3 to 5 years.

Why is a business plan important?

Here’s the short answer.

A business plan enables you to convey your vision to those who can help you make it a reality.

It does it in 2 ways:

- It empowers you to evaluate your goals and confirm their viability before entering a marketplace.

- And equips you with the information, using a proven outline, that convinces others to help you achieve them.

A business plan does it by explaining who you are, what you are going to do, and how you’ll do it. It clarifies your strategies, identifies future roadblocks, and determines your immediate and future financial and resource needs.

Let’s look at what that means and why each part is important.

A business plan helps you evaluate your ideas

Do you have over one business idea or a range of products or services you believe you could bring to a single marketplace?

If so, a business plan helps determine which is worth focusing on and where to apply your energy and resources by evaluating your idea’s possible market share and profitability before investing.

Clarifies your costs

Your chosen market determines your initial investment and future revenue. And it would be best if you knew those before you invest a dollar in your business idea.

With your chosen idea, your business plan can help you understand your set-up and running costs, the resources you’ll need, and the time it’ll take to get started.

It’s also where you’ll calculate your future sales and revenue goals to ensure they fit your budget and required breakeven point.

And those are essential because every business needs a consistent cash flow to stay afloat!

Steers your business in the right direction

Your business plan guides you through every stage of starting and running your business .

It acts as your GPS, giving you a course to steer. Ensuring your business stays on track, helping you achieve your goals every step of the way.

Acts as your financial guide

As your new business grows, you might need to expand.

But with expansion come big spending decisions, such as purchasing expensive equipment, leasing a new location, or hiring your first employees.

Your business plan’s financial forecast gives you a solid foundation to build on by clarifying when you’re ready to make those investments, ensuring you don’t overreach.

And when you are ready to employ staff, it helps you with that too!

Helps recruit the people you need

Your business is often only as good as its employees. A business plan helps you communicate your vision and pitch your dream to the best candidates. Building their confidence in your venture and encouraging them to join you.

It's essential if seeking a loan or investment

Do you need a loan from a bank or a venture capitalist/angel investor?

If so, you’ll need a business plan that shows your past and future financial trajectory so potential investors can evaluate your business’ feasibility to determine whether you’re worth the risk.

It's an asset if you want to sell your business

Owners of legal entities, such as LLCs, can sell all or part of their business to raise funds for other business ventures or expand their existing ones.

A solid business plan with proven financial recordings and realistic forecasts based on current performance can make your business more attractive to potential investors.

And it makes sense because when buyers understand your business model and its potential growth, they’ll see the value in it for them.

All great reasons to write a business plan, don`t you agree?

Okay, here’s how you do it:

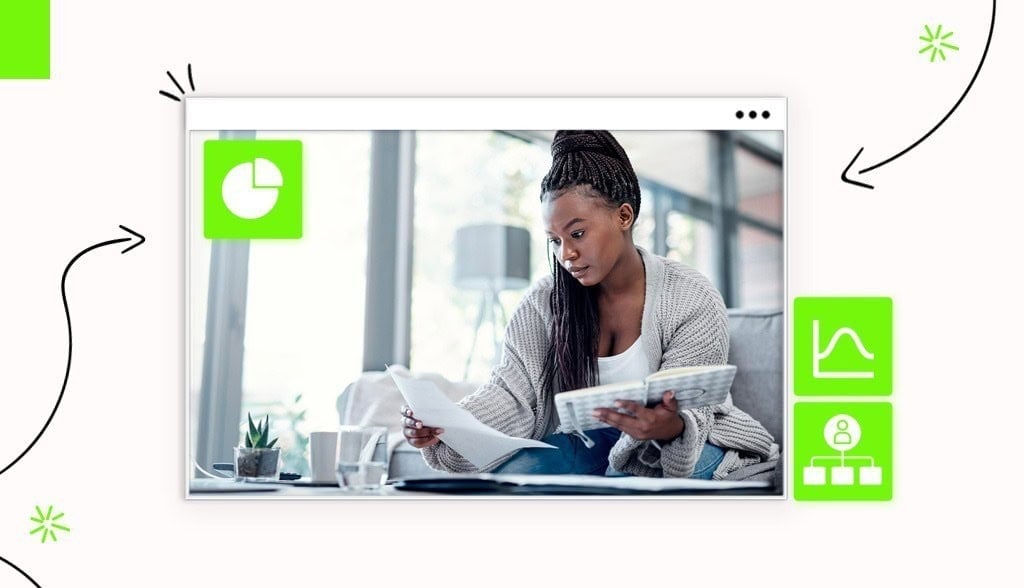

The steps for creating a business plan

Most business plan templates are similar, containing several steps for writing a conclusive plan. If you’re interested in a very short plan, we prepared a lean (one-page) version, including a template .

The perfect business plan isn’t one or the other; it’s the plan that meets your business needs.

That said, every business plan should contain crucial elements and essential details . And a rhythm to your outline that encourages action, growth, and investors to read it from start to finish. Our step-by-step guide, along with our template, will help you achieve both.

But first, you must choose the style that works for you:

Pick a business plan format that works for you

You can tackle creating a business plan in different ways; one could be a long-form, more traditional approach or a one-page business plan that acts as a summarized road map.

Traditional business plans use a standard, industry-expected structure, with each section written in great detail. They require a lot of research because businesses often use them to gain investment, and they can be anywhere from 10 to 50 pages long.

A one-page business plan uses a similar structure but summarizes each step by highlighting the key points.

You can write a one-page plan in an hour and use it as a personal blueprint for running your business or as a guide to writing a future traditional plan.

Here are the core component that create a great business plan:

1. An executive summary

2. Your company’s description

3. Market analysis

4. management and organization outline, 5. products and service description, 6. target audience analysis, 7. marketing and sales plan.

8. Financial funding request

9. Financial projections

10. an appendix, 1. an executive summary.

The first section of your business plan’s an executive summary that tells anyone reading in simple terms what your business is and why you believe it’ll be successful.

It’s the most crucial part of your plan because anyone reviewing it often decides whether to continue reading based on what’s in your executive summary.

Your executive should contain your mission statement (why you’re starting your business). A product/service description. Your leadership team and financial information.

Even though the first thing people read is your executive summary, it’s the last section you write.

The next step is about you:

2. Your company's description

Here you sell yourself and your business by telling readers why you’re starting your business and know it’ll succeed.

You must be realistic, business-like, and detailed.

Begin by explaining who you are, what you plan on doing, and how you’ll do it. Describe your future market, your target audience, and why they need your product/service.

Elaborate on your unique selling point (USP) and how your competitive advantage will ensure your success.

Describe your team, highlight their skills and technical expertise, and if you`re a brick-and-mortar business, discuss your location and why it’s right for your target audience or logistics.

Now your market:

A great business idea is only as good as its future marketplace. Enter a declining market with an insufficient or uninterested audience, and you’ll be toast.

Choose one on an upward trajectory with people you understand and need your product, and you’ll be in business.

That makes your market analysis a crucial step in your business plan outline. Here’s where you identify your target audience, competitors’ performance, strengths and weaknesses, and whether the market can sustain your business needs.

Your market analysis should include the following:

- Your market description and outlook- Provide a detailed outline defining your market, including its size, trends, growth rate, and outlook.

- Target Market- Describe your ideal customers, including their demographics such as age, gender, employment status, income level, and lifestyle preferences. Also, include your market size, what motivates your ideal clients, and how you'll reach them.

- Competitive Analysis- Identify your main competitors and list their strengths and weaknesses. Also, highlight any potential roadblocks that might prevent you from entering your chosen marketplace.

Step 4 is where you tell readers how you’ll construct your business and who’ll run it.

Describe your business’s legal structure, whether you’re a sole proprietor intending to form an LLC or a limited/general partnership with dreams of incorporating an S or C corps.

Include your registered business name and any DBA brand name you have. And any member’s percentage ownership and managerial duties per your operating agreement.

And consider using a chart to show who runs what section of the business. Explain how each employee, manager, or owner’s experience and expertise will contribute to your venture’s success. And if you have them, include your team’s resumes and CVs.

Now you must get technical about what you plan to offer.

List your products or services and explain how they work. If in the development stage, describe the process and when you’ll be market ready.

Include the following product/service information:

- Describe how your product/service will benefit your target audience.

- Provide a breakdown of costs per unit made/sold, life cycle, and expected profit margins.

- Explain your supply chain, order fulfillment, and sales strategy.

- Include your plans for intellectual property, like trademarks and patents.

Your product and service description brings you to those who matter most. Your target audience:

The target audience section of your business plan is the most important one to get right. After all, your customers are your business. And the better you know them, the easier it’ll be to sell to them.

To gain a clear picture of your ideal clients, learn about their demographics and create a client persona.

Those include:

- Their location

- Education level

- Employment status

- Where they work

- How much they earn

- How they communicate

- Preferred social media platforms

- Common behavior patterns

- Free time interests

- And what their values and beliefs are

You need your target audience’s demographics to create a branding style that resonates with them. To build marketing strategies that engage their interest. And to identify where to spend your advertising dollars.

Target market’s persona in place, your next step is to describe how you’ll reach and sell to them:

Your marketing plan outlines your strategies to connect with and convert your ideal clients.

Here’s where you explain how you’ll reach your audience, describe your sales funnel, and develop customer loyalty to keep customers.

Your business plan doesn’t require your complete marketing/sales plan but should answer basic questions like:

- Who's your target market?

- Which channels will you use to reach them? (Social media, email, website, traditional marketing, etc.)

- What sales strategies will you use?

- Which resources do you need to implement those strategies?

- Do you have the resources, and if not, where will you get them?

- What are the potential marketing obstacles, and how you'll overcome them?

- What's your initial marketing campaign timeline and budget?

- What your success metrics are, and how you'll measure them?

8. Financial funding request

This step applies if you require funding to start or grow your business.

Similar to the marketing plan step, including your entire financial plan is unnecessary. However, you’ll need to answer specific questions to explain how much investment you require and how you’ll use it.

The following financial funding outline will suffice:

- Your current capital balance and how much future capital you'll need.

- Specify whether you want equity or debt.

- The terms and conditions you need and the duration of any loan repayments.

- Provide a detailed description of why you need investment, IE., to pay salaries, buy equipment or stock, and what percentage will go where.

Start-ups that need investment must rely on something other than past sales and balance sheets. Here, you’ll need to use financial projections to persuade lenders you’ll generate enough profit to repay their loans. And that investors will get a worthwhile return.

Your goal is to convince potential lenders or investors that your business will make enough profit to repay any loans or fulfill your equity promises.

Depending on your loan requirements and market, these projections can vary from 3 to 5 years.

Financial projections aren’t an exact science; you’re forecasting the future! However, accuracy is essential (meaning your projected numbers must add up correctly). And while your goals should be positive, they must also be realistic.

What to include in your financial forecast:

- Forecasted income statements.

- Capital expenditures, fixed and variable.

- Quarterly and annual balance sheets.

- Projected cash flow statements.

Be specific with your projections and ensure they match your funding requests. And if you have collateral to put against a loan, include it at the end of your financial projections to improve your chances of approval.

Also, consider using charts and graphs to tell your financial story, as visuals are great for conveying your message.

Use your appendix to list and provide supporting information, documents, or additional materials you couldn’t fit in elsewhere.

If the appendix is lengthy, start it with a table of contents.

What to include:

- Key employee resumes.

- Letters of reference.

- Licenses and permits.

- Intellectual property - patents or trademarks.

- Legal documents.

- Any current contracts.

- Product pictures and information.

- Bank statements/credit history.

Financial uncertainty shouldn`t stop you from following your dreams. In fact, recessions are often the best time to start a business .

And your business plan is one of the main things that can help you make your dream of owning a business a reality.

Take it one step at a time, do your research, and use your business plan to remove the uncertainty of the unknown.

Because then you’ll know if the time is right to start your business.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness.

- Form an LLC

- Licenses & permits

- Sales tax permit

- Business insurance

- Business banking

- Business email

- Taxes & accounting

- Invoices & bookkeeping

- Legal documents

- Business cards

- Digital business card

- Graphic design

- Print store

- Help center

- LLC by state

- Affiliate program

- Partner with us

- Brand guidelines

@2024 Copyright Tailor Brands

- Privacy Policy

- Cookie Policy

- Do not sell my personal information

- The Definitive Guide to Writing a Business Plan

- Startup Culture

- Business Skills

Last Updated: July 25, 2023 By TRUiC Team

This free step-by-step guide to writing a business plan was built just for you, if you aren't really sure what planning a business is all about. To save time, stress and energy we'll walk you through everything you need to know without fluff or heavy brain work.

Instead, we're focusing on the basics. If you're looking to create a super-dense collegiate 40-page plan, then you should probably take a business planning course at the nearest college.

This guide just covers what your average startup needs to dramatically increase chances of follow-through and success. Enjoy!

Note: Business planning software can help you write a professional business plan that will lead you to success.

Step 1) Create A Business Plan Shortcut

For the sake of argument, let’s say you’re the most gifted cat burglar on earth-- a real savvy savant of the steal. Put yourself in the mindset where strategy and planning are time-erasing pleasures, delicious treats that reward you with immense prosperity-- not complex tasks that can be skipped or shelved.

Too many entrepreneurs perceive putting a business plan together as some kind of chore. It's not. When the product or service is something you believe in, it’s as awesome as it is for those cat burglars in the movies, except you're plotting honest work.

Fact : It’s possible to create your initial business plan in less than an hour!

Let’s build a “lean plan” that’s simple to create and helps you identify core assets. You start with a pitch, a single page overview which can become your executive summary later on. It’s your business strategy all on one page that's easy to update as you evolve.

You may be thinking,

“ Wait a minute. If I’m not raising money from investors, why do I need a pitch? ”

Well, after years working with entrepreneurs we've found a pitch is really the ideal format to document your business idea , share it with others, and quickly adjust as you learn more about/analyze how you’re going to build your brand.

Furthermore, once you have your pitch done you can easily convert it into a presentation-ready business plan with massive clarity. To begin, follow the simple outline below or allow tools like LivePlan (what we used for Startup Savant) to walk you through the entire process with examples and video tutorials.

What To Include in Your Pitch

As you tackle your one-pager, mentally channel Twitter and try to keep each section as short/concise as possible-- the size of a solid tweet.

- Mini-Pitch : Typically a refined sentence summarizing your USP (unique selling proposition).

- Market Need : The problem your business solves for your customers.

- Your Solution : How you’re solving the problem through your products and services.

- Primary Competition : The products and services your customers choose today instead of yours.

- Target Market : This is where you detail your ideal client and niche.

- Sales & Marketing : How you plan on marketing.

- Budget & Sales Goals : How much do you project/calculate you’ll sell and how much is it going to cost to make your product or deliver your service? Also, show other key expenses when your business is up and running.

- Milestones : What you’ve achieved so far and your major goals for the next few months and years.

- Team : Why you and your team are the right people to make your company successful.

- Partners & Resources : List primary companies/organizations needed to go the distance.

- Funding Needs : If you need to raise money, how much and where will this capital be going (channels)?

That might seem like a fair amount of work if you’ve never put together a real pitch before, but remember, that’s just one page of content. Another way to look at it is a one page resume for your business.

A Couple Writing Tips

First, you start with the putty. Don’t try to self-edit or curate, just barf everything out on paper as it flows from your brilliant mind. Format each section out and just let it go. That’s putting the basic shape together.

Now you need to let it dry, so walk away for a day (week) or two. After that, begin chipping away and condensing. Cut the fat and keep tightening the ideas until you’re down to one page. Be brutal! Stick to the facts. Numbers are easier, but when you’re tackling words remember the average person these days has a shorter attention span (if not compelled by your ideas) than a goldfish.

Taking Action on This Step

Create a pitch outline from the points mentioned above and refine down to one or two sentences. If you need help, check out LivePlan. It’s a solid tool that walks you through the entire process. Plus, they offer a 50% Discount .

Step 2) What To Include in Your Plan

Now that you have a running outline, it’s time to go deeper into the framework of your platform.

Perhaps you’re thinking the one-page pitch is all you’ll need? That would be like going on a road trip in unfamiliar territory with a map that only shows destinations-- no routes, no roads, no other icons whatsoever. Even if you never plan on showing this to anyone, the process of creating a solid plan optimizes everything about you and your business! Here’s a quick overview of what you need to include in your business plan:

- Cover Page/Pitch

- Executive Summary

- Products & Services

- Target Market

- Marketing & Sales Plan

- Milestones & Metrics

- Company & Management Team

- Financial Plan

If you need extra space for product images, detailed financial forecasts, or general additional info, use the appendix. There are three layers of complexity here. First, your pitch with a very brief summary. Then, your Executive Summary that adds details and context. Then into the finer points of the overall business plan.

Not too shabby, right?

Taking Action on The Step

Please revisit your pitch and find a good way to optimize it just a smidgen. The better your pitch, the better the overall plan.

As you fill in the structure, first focus on providing “mental barf” data you can go through and optimize later. Remember, if you need help, LivePlan will walk you through the entire process with video tutorials and examples.

Step 3) Create a Unique Selling Proposition

When copywriters are given a business idea to optimize, they often begin by defining the USP (unique selling proposition) and mini-pitch. A USP can be just a couple words or an incomplete sentence, while the mini-pitch is usually one or two concise sentences.

Just in case you’re fuzzy on the whole copywriter thing, these folks are paid big bucks to write sales and marketing copy which often includes core slogans.

As an example, here’s what the USP and Pitch for Startup Savant sound like:

USP : " Entrepreneurship Simplified "

Pitch : " Startup Savant is a free website that shows you how to start a business and own your future ." Now let’s get past the “How to Write Your USP 101” stuff and dive straight into three core truths.

USPs & Pitches Evolve

The first thing a copywriter will tell you if you’re struggling with this is to relax. They know sales and branding copy optimizes (matures) over time, especially in the first 2-5 years in business.

If possible, avoid thinking your USP is set in stone, never to be altered. It’s more like a sculpture that the market chips away at. Your pitch evolves as you and your platform do. What matters is whether your USP & Pitch are as refined as they can be based on where you are now.

- USPs can be creative & full of personality, but they also need to make sense.

- Is your pitch wordy and confusing? Hazy or unclear?

- Sometimes you have the right words, they just need to be in an optimized order.

Always be ready to “kill your darlings” as copywriters would say. Meaning, get rid of any and all words,

“ That aren’t necessary for the idea or concept you’re conveying to make perfect sense within the context it’s delivered, and to whom it’s being written to. ”

You can begin with half a page, but systematically chisel down to a core concept like, Entrepreneurship Simplified.

Your Ideal Customers Will Do It For You

Copywriters care what you have to say as a business owner or marketing manager, but they know you’re not the ultimate authority in terms of advertising copy.

They’re writing for buyers. In any and all ways your business can optimize over the years, your customers, clients and users should steer the course as much as possible. Be on the lookout for their valuable signals and indications!

Hop at 20 Questions

Copywriters ask TONS of questions. They’re a bit like copy-detectives in how they search high and low for very precise data from their clients. Never fear giving your users, clients or customers a megaphone with which to bark their concerns.

We all love sharing our opinions, right? Yes we do. Let us. Prompt us. Ask us. Bribe us with incentives and discounts… then listen… carefully. Easily 9 out of 10 entrepreneurs are given the ultimate USPs on silver platters by their customers but fail to recognize when they see, read, or hear them.

- If you’ve been stressing on your USP, relax. If it doesn’t feel perfect right now, or 100% distilled, let it happen naturally.

- Your audience can and will steer the course if you choose to notice their cues. Ask three people you haven’t spoken to before how they feel about your product or service.

- Are there any indications out there waiting to be plucked? Blog or social media comments and reviews are primary starting points. It only takes one solid indicator for the magic “pivots” to cause your business or brand to see huge boosts.

Step 4) Crafting the Executive Summary

In brief, what exactly is an executive summary? An executive summary (ES) is an overview of your business and your vision. It comes first in formal/informal business plans and is ideally 1-2 pages.

The ES introduces your business to your reader. If you don’t nail it, no one’s going to read any further. And if an ES sucks, despite it being professionally crafted, then the business model itself needs work or isn’t worth your time. Every ES should include a brief overview of the following:

- The problem your business addresses.

- Your solution.

- Your target market.

- Why the timing’s right for your brand.

- Financial forecast highlights, along with initial/current customer acquisition costs (CAC) and lifetime customer value (LCV).

If you’re raising money or presenting to investors, you’ll also want to cover:

- Your existing team and partners.

- How much money you’re looking to raise and the type of exit strategies in place.

Ideally your ES should fit on one or two pages and be able to stand alone, apart from your business plan. A common strategy is to send your ES out to investors/family/friends and then the complete plan if more detail is requested.

Remember to try and position your writing for people who don’t know anything about your business before they start reading. Explain things simply so that anyone can understand your opportunity, whether they be an in-tune player, an 8th grader, or a grandma.

- Over the next couple weeks, refresh your ES!

- Who is the first person you’re going to send your ES to that has no real previous knowledge of what your business is? It helps having someone in mind when writing.

- Find one amazing ES to read over and see what you can learn from it. Here and here are two great examples.

Well done, in the next step we’ll help you explain your product or service and how it makes an impact on customers.

Step 5) Understanding Customers

Once upon a time there was this lovely, vibrant and ambitious entrepreneur who decided to sell organic breast enlargement cream. It sold well for a while, but then her numbers plateaued, and eventually began to decline.

She knew her business needed a makeover after years in the trenches. So, she created an automated incentive program, a 25% discount coupon code offer sent with every order in exchange for an anonymous review with a photograph. Just a simple before/after image showing the front of their body from neckline to belly button (to confirm usage).

They started rolling in and here are the gems she unearthed :

- A small portion of her customers were husbands buying a discreet gift for their wives/girlfriends, but most (85%) were transgender folks in transition.

- For the vast majority of her cis-female customers, larger breasts had more to do with enhancing self-esteem/identity and filling out clothes than attracting mates.

- Almost 100% really hammered down on the fact her cream was all-natural, organic and didn’t cause irritation or allergic reactions.

She went back and dusted off her original copy she put together years before.

From: “ A certified organic breast enlargement cream. ”

To something more along the lines of: “ Increase confidence and femininity through an organic non-allergenic breast enlargement cream. ”

When stuck in a rut, and we all get there as entrepreneurs, the quickest and most effective way out is to look at your predicament from different perspectives.

Begin with the fundamental question, “What problem does my product/service solve for customers?” then look deeper and from unique angles. Who are your buyers? They have the answer. And remember, actions speak louder than words.

Oftentimes we rationalize buying things for one reason, but in reality have a more potent ulterior motive. Sure, her customers want larger breasts, that’s what prompt initial sales. But the needs her product solves in their day-to-day lives are more interesting. It actually made her customers feel more confident, happy, and healthy.

Find one deeper way your product or service materializes in everyday life for your customers. Pay close attention to the simple verbiage you and others use to describe it, e.g. “Your earphones really get rid of all the noise on the bus.”

If possible, get hold of one fresh buyer perspective. Who and where are they? That woman in our example had spent years excluding nearly half her customer base in her advertorial copy. Do you use your own product or service? If so, find a way to record yourself explaining it in the most natural language possible. Use a smartphone or leave yourself a voicemail. Then, just listen.

But wait, what if you’re just starting out and don’t have much to draw on in terms of direct customer or user feedback? Glad you asked! In the next section we’re going to talk about competition, which is another valuable source of indicators.

Step 6) Leveraging Competition

What products and/or services are people choosing instead of yours?

Whether you’re new to the market or not, these so-called “competitors” are really the ideal source of optimization for your brand. And it’s not about being better per se. All things equal, it’s more about uniqueness.

Would you rather be a prettier, more flashy brand trying desperately to stand out, or develop intense brand-character that the right people notice? Once you’ve narrowed down your competitors, look at them from new angles to discover what makes you distinctive.

- Can they help you better define your target market/sub-markets?

- How effective are their social media marketing methods and website copy?

- What do you know about their buyers’ needs?

- What do they make “stand out” when shoulder to shoulder with your brand?

A common practice entrepreneurs use in pitch presentations to venture capitalists or investors is the Comparison Matrix.

You’ve seen these a zillion times. In short, list your competitors across the top of the page and your features and benefits along the side, then check the boxes for which company offers each. Don’t forget you can be creative here. You may even already use one of these on your website, or within some other marketing media.

- Could these features and benefits be communicated in different, more compelling ways?

- What real need-based copy is being left out?

- How can you simplify it? An easy way is to reduce the number of competitors, so shoot for less players with more interesting copy.

Got time to put something simple together? In reality what we’re looking for are the things about your competitors that help you stand out.

- Think about your biggest competitor: what do they make obvious about your brand?

- What are you doing with more personality from the perspective of ideal clients or customers?

- Could you take your primary competitor’s copy and make it clearer, or more optimized?

All in all, understanding your competition is an important part of the planning process. This is where you find your true competitive advantage.

For a more in-depth look at how you stand up to the competition, check out LivePlan's Benchmark feature. You can see at-a-glance how you compare to companies just like yours. Tell LivePlan your industry and location, and it shows if/how you're doing better or worse than your competition.

Now let's talk about your unique marketing approach. This will help you stand out and connect with your customers on multiple levels.

Step 7) Create a Marketing Plan

Fred is a brand spanking new entrepreneur with a neat new fitness product he believes is going to make a big splash.

He knows exactly who his ideal customers are and his niche is carved out like a Renaissance marble sculpture. Fred’s also managed to get his hands on $100k in debt-free funding (don’t ask us how, this is hypothetical)…

- His product costs exactly $32 to source, make and package.

- To be competitive, and account for shipping/processing, he’s going live at $55.

- Initial margin is about $13 per sale.

Admittedly, that would be pretty amazing, but that’s because we’re coming from a standpoint of experience. Fred’s just showing up to the 21st-Century party. He’s never built, owned, or managed a business before, let alone an ecommerce platform.

He’s never outsourced a graphic artist or content writer before; never had to choose which analytic dashboard to use; never designed a conversion model or tangled with paid advertising platforms. Let’s say Fred called and begged us to lunch. We accepted. And so there we are, the three amigos with Fred sitting on a huge meal ticket drooling for answers.

“ How Do I Market My Product? ”

Once the table conch gets passed to us, we’re going to hit him hard with massive bombshells:

- Tight responsive funnels can be constructed in a couple months with the right designer, or design agency (website, landing pages, ecommerce setup, branding packages, etc.).

- Initial market testing and adjustment can be bootstrapped.

- There are a variety of intuitive and relatively simple software tools, apps, plugins, add-ons, and cloud-based solutions that range from free to expensive.

- It takes a savvy mix of highly-focused content, social exposure and paid advertising.

- It takes a team.

Question is, what advice would you give Fred? That’s what we’d like you to consider. And it needs to be marketing-based. The money’s there, the production system’s in place, it’s just a matter of reaching his fitness-based audience and selling.

Let’s imagine Fred’s offered you a lifetime, no questions asked, 5% share of his company from now till doomsday. All you have to do is provide valuable direction in these three areas:

- Content : What kind of content should he invest in? Blogs, video, infographics, imagery, etc.

- Social : How to handle social media if he a) doesn’t have the time, b) has no clue what works?

- Paid Advertising : AdWords? Facebook? TV? Magazine ads? How does he get to buyers?

Just let your mind wander, and don’t worry, in the next section we’ll talk about setting milestones for your business.

Step 8) Set Milestones

If there’s one specific part of the entrepreneurial journey that we get really nerdy about, it’s the way people verbally describe their trials and successes. We’re listening intently for clues as to how they set milestones and metrics and then track them.

Let's spend some time pondering the way(s) you’re measuring your journey and how you approach KPIs (key performance indicators) in relation to both your marketing and your competition. Or, if you’re trying to figure out how viable a product idea is, how you’re calculating acceptable setbacks and struggle.

What have you achieved so far and what are your major goals for the next few months or years?

Sure, it’s cliché to talk about tracking milestones in an era of big data, but truth be told too many aspiring entrepreneurs either skip this part until much further down the road when it can’t be ignored anymore, or they only take it seriously in the beginning then fail to stick to the plan.

Avoid Drowning Out Customer Journey!

Of course there are folks who obsess on this part and try to manage a small army of analytic dashboards and amazing software solutions like FreshBooks or Xero.

Once it becomes too much they end up transforming their perspective of the customer journey from something organic into a mesh of math and graphs. Most of their day is spent pouring over dense numbers or marketing data and trying to figure out how to alter this metric or that.

- How many of your milestones are focused entirely on your customers instead of you and your business?

- Instead of views, likes, and shares, what about the amount of service calls you’re getting? How many people are actually reaching out with questions and concerns?

- How well do your metrics allow you to understand each part of their trek from initially discovering your business to making a purchase?

Find ways to do more with less data. It’s always within reach these days, especially when you’re tuned in to your customers!

- Find one way to streamline how you’re dealing with milestones/metrics, or how you intend to.

- Also, look for one single way to be more holistic in your approach to setting goals.

- Find a part of your customer journey/behavior and decide if current metrics help or hinder it.

Need help in this area? LivePlan has a really impressive dashboard to help you set goals and stay accountable over the lifetime of your business. This dramatically increases your chances of success.

Step 9) Refine Aquisition Costs

Without question, failure to clearly know the cost of acquiring customers is a mighty new business demolisher. It’s crushed more entrepreneurial dreams than every economic collapse combined since the creation of fiat currency. To come to grips, or optimize your Customer Acquisition Costs (CAC), begin by figuring out exactly how you’re reaching customers.

Or, if you’re building an initial business plan, how much will it cost to reach buyers on the platforms where they spend their time? Your financials should easily allow you to calculate CAC.

Now, in the simplest terms here’s how:

- Take (estimate) the entire cost of sales and marketing over whatever period of time you’re dealing with, for example when forecasting sales and financials. Make sure to include salaries and any other headcount-related costs.

- Divide that number by the amount of buying customers/clients/users that were acquired within this time.

If you happen to run a purely web-based business, headcount likely doesn’t need to grow as you scale customer acquisition, but it’s a useful metric to include nonetheless.

The second part of this is your Lifetime Customer Value, or LCV, because in most cases 80% of your revenue will come from 20% of overall customers and happen AFTER the initial sale. Never shortchange the follow-through!

If your CAC is too high, it must be able to come down through optimization. If LCV is horrid, then in the long run it’s an unsustainable business model. Or in other words, once CAC exceeds LCV, something needs to change or you’ll have to close shop.

- Begin looking at one stream of cost per lead. So for example, maybe a Google AdWords or Facebook advertising campaign.

- What’s one single way you could get more in touch with a hot-spot within your customers’ buyer experience?

- Let your mind stew a little on the level of ‘touch’ required to increase LCV. How can you up-sell or generate more revenue from each customer long term?

After you make these calculations three or four times, it starts becoming second nature. LivePlan's forecasting handles this pretty well. It walks you through creating expenses that are a certain percentage of sales.

Step 10) Forecast Sales

Smart entrepreneurs start forecasting sales early on.

And while ‘the numbers’ part of business planning can be intimidating, this exercise is definitely a small mountain worth karate chopping down.

Keep in mind that if you get stuck at any point, LivePlan's Forecasting and Budgeting feature is extremely helpful. Whether you're starting a bakery, a subscription software business, or a manufacturing company, LivePlan walks you through the entire forecasting process within a few clicks.

How Detailed Does it Need to Be?

Don’t be too generic and just forecast sales for your entire business. But on the other hand, don’t go nuts and create a forecast for everything you sell if you’ve got a large assortment.

For example, if you’re starting a restaurant you don’t want to create forecasts for each item on the menu.

Instead, focus on broader categories like lunch, dinner, and drinks. Or if you’re starting a clothing brand, forecast key categories like outerwear, casual wear, and so on.

Top-Down or Bottom-up?

In our humble opinion, forecasting “from the top down” can be costly. What that means is figuring out the total size of the market you’re in and trying to capture a small percentage.

For example, in 2015, more than $1.4 billion smartphones were sold worldwide. It’s pretty tempting for a startup to say they’re going to get 1% of that total market. After all, 1% is such a tiny little sliver it’s got to be believable, right?

The problem is this kind of guessing isn’t based on reality. Sure, it looks like it might be credible on the surface, but you have to dig deeper.

- What’s driving those sales?

- How are people finding your new smartphone company?

- Of the people that find out, how many will buy?

Instead of “from the top down,” do a “bottom-up” forecast. Just like the name suggests, bottom-up starts at the bottom and works its way up to a forecast. Start by thinking about how many potential customers you might be able to make contact with.

This could be through advertising, sales calls, or other marketing methods. Of the people you can reach, how many do you think you’ll be able to bring in the door or get onto your website?

And finally, of the people that come in the door, get on the phone, or visit your site, how many will buy?

Here’s an example:

- 10,000 people see my company’s ad online,

- 1,000 people click from the ad to my website,

- 100 people end up making a purchase.

Obviously, these are all nice round numbers, but it should give you an idea of how bottom-up forecasting works. The last step of the bottom-up forecasting method is to think about the average amount that each of those 100 people in our example ends up spending (remember LCV).

On average, do they spend $20? $100? It’s fine to guess here, and the best way to refine your guess is to go out and talk to potential customers. You’ll be surprised how accurate a number you can get with a few simple interviews.

How Far to Forecast

Try forecasting monthly for a year into the future and then just annually for another three to five years.

The further your forecast into the future, the less you’re going to know and the less benefit it’s going to have for your company. After all, the world’s going to change, your business is going to change, and you’ll be updating your forecast to reflect them.

And don’t forget, all forecasts are wrong—that’s fine. Your forecast is just your best guess at what’s going to happen. As you learn more about your business and your customers, you’ll adjust. It’s not set in stone.

- First, remind yourself that ALL forecasts are wrong. Forecasting is more about learning and evolving.

- Without adding too much to your plate, take a look at your monthly sales chart and see what kinds of optimizations forecasting might bring to light. If you aren’t already charting sales, start today or begin planning how.

- Try two easy bottom-up projections with nice round numbers to get the feel for it.

Just remember that sales forecasting doesn’t have to be hard. Anyone can do it and you, as an entrepreneur, are the most qualified to do it for your business. You know your customers and you know your market, so you can forecast your sales.

But if you decide you'd appreciate help, we highly recommend forecasting your sales with LivePlan. LivePlan automatically generates all the charts and graphs you need and automatically includes them in your plan.

Wrapping Up: Formatting Your Plan

The format of your business plan is critical. It goes a long way toward refining and achieving your goals: raising money, setting the strategy for your team and growing your platform. That being the case, let's breeze through seven tips that can help you create, refine, and optimize your brilliant business plan.

1. Always Start with Your Executive Summary

An ES should be written for ideal readers, customers, potential investors or team members, or even just to help you ‘goal-map’ your way to where you need to be. Regardless, nailing the Executive Summary is critical in terms of understanding the potential behind your business idea.

2. End with Supporting Documents

The appendix is composed of key numbers and other details that support your plan. At a minimum, your appendix should include financial forecasts and budgets. Typically, it’s wise to include a Profit & Loss statement, Cash Flow forecast, and a Balance Sheet. With practice and a smidgen of savvy software like LivePlan these pages can take a couple hours or so.

You might also use your appendix to include product diagrams or detailed research findings, depending on your business, your industry, and how deep your business plan needs to go given the reader/purpose.

Quick Recap of the Lineup Pitch Executive Summary Products & Services Target Market Marketing & Sales Plan Milestones & Metrics Company & Management Team Financial Plan & Appendix

3. Keep it Short

Let’s face it: no one has time to read a 40-page business plan. If you’ve nailed your ES, you’ll want to follow up with 8 to 12 additional pages at most in support. Instead of trying to cram everything in using small fonts and tiny margins, focus on trimming down your writing (‘kill your darlings’). Use direct, simple language that gets to the point.

4. Get Visual

As the old adage goes, “ A picture is worth a thousand words. ” This is especially true when you’re formatting a business plan. Use charts and graphs to explain forecasts. Add pictures of your product(s). Again, there are plenty of software solutions that make it easy to do more showing and less telling. That said…

5. Don’t Obsess on Looks

It’s your ideas that matter. A beautiful plan that talks about an ill-conceived business with incomplete financial forecasts is never going to beat a plan that’s formatted poorly but discusses a great, clearly explained vision. Spending days making a beautiful plan isn’t going to make your business ideas better. Instead, focus on polishing the words. Trim extra content you don’t need, and make sure ideas are well-presented.

6. Keep Formatting Simple

- For general formatting use single spacing with an extra space between paragraphs.

- If you’re printing your plan, use a nice serif font like Garamond or Baskerville.

- If your plan will mostly be read on a computer screen, go with a sans serif font like Verdana or Arial.

Why choose different fonts for on-screen versus off-screen? Well, research shows readers have higher comprehension when they read a document with a serif font on paper, and higher comprehension reading with a sans serif font on a screen.

Don’t stress too much about this, though. Choose any one of the four fonts mentioned above and move forward.

- For font size, 10 to 12 point is usually ideal and readable for most people. If you need to reduce the font size to make your plan shorter, then you should be cutting content, not adjusting the font size.

- The same rule goes for margins: use typical one-inch margins to make the plan readable.

Cover pages are always a good idea, too. Use the cover page to show off your logo, tagline, and pitch.

Finally, make sure your plan document flows well and doesn’t have any “widows” or “orphans” when it prints out. A “widow” is when the last line of a paragraph appears alone at the top of a page, and an “orphan” is a single word that gets left behind at the bottom of a paragraph.

7. Get a Second Pair of Eyes

The last piece of advice is to get a second pair of eyes. When you’re the only one working on your plan, you can become blind to common errors. Recruit a friend or family member, or even hire a copy-editing professional to give it that last bit of polish. There’s nothing worse than a plan with grammatical or spelling errors. A second pair of eyes will go a long way toward catching the majority of those potential problems or holes.

- Who’s your second, third, and possibly fourth pair of eyes going to be?

- What’s one part of your business plan you could optimize today?

- What’s one piece of visual content you could add to your appendix?

Exclusive Bonus

If you'd like to try LivePlan yourself, here's an exclusive 50% off LivePlan promo code offered to our readers. You'll have 60 days of risk free planning with their 100% money back guarantee. Enjoy!

Featured Articles

The Top 7 LLC Formation and Incorporation Services

How to Form an LLC

What is an LLC?

- Case Studies

- Flexible Products

- Expert Insights

- Research Studies

- Creativity and Culture

- Management and Leadership

- Business Solutions

- Member Spotlight

- Employee Spotlight

How to write a business plan in seven simple steps

When written effectively, a business plan can help raise capital, inform decisions, and draw new talent.

Companies of all sizes have one thing in common: They all began as small businesses. Starting small is the corner for those just getting off the ground. Learn about how to make that first hire, deal with all things administrative, and set yourself up for success.

Writing a business plan is often the first step in transforming your business from an idea into something tangible . As you write, your thoughts begin to solidify into strategy, and a path forward starts to emerge. But a business plan is not only the realm of startups; established companies can also benefit from revisiting and rewriting theirs. In any case, the formal documentation can provide the clarity needed to motivate staff , woo investors, or inform future decisions.

No matter your industry or the size of your team, the task of writing a business plan—a document filled with so much detail and documentation—can feel daunting. Don’t let that stop you, however; there are easy steps to getting started.

What is a business plan and why does it matter?

A business plan is a formal document outlining the goals, direction, finances, team, and future planning of your business. It can be geared toward investors, in a bid to raise capital, or used as an internal document to align teams and provide direction. It typically includes extensive market research, competitor analysis, financial documentation, and an overview of your business and marketing strategy. When written effectively, a business plan can help prescribe action and keep business owners on track to meeting business goals.

Who needs a business plan?

A business plan can be particularly helpful during a company’s initial growth and serve as a guiding force amid the uncertainty, distractions, and at-times rapid developments involved in starting a business . For enterprise companies, a business plan should be a living, breathing document that guides decision-making and facilitates intentional growth.