Consulter le journal

- Le Monde Afrique

- Téléphonie mobile

Wave, la tornade bleue qui s’impose dans le paiement mobile en Afrique de l’Ouest

La start-up américaine a bouleversé les opérateurs des télécoms et le marché des services financiers digitaux au Sénégal et en Côte d’Ivoire.

Par Théa Ollivier (Dakar, correspondance) et Yassin Ciyow (Abidjan, correspondance)

Temps de Lecture 5 min.

- Ajouter à vos sélections Ajouter à vos sélections

- Partager sur Twitter

- Partager sur Messenger

- Partager sur Facebook

- Envoyer par e-mail

- Partager sur Linkedin

- Copier le lien

Pour ne rien manquer de l’actualité africaine, inscrivez-vous à la newsletter du Monde Afrique depuis ce lien . Chaque samedi à 6 heures, retrouvez une semaine d’actualité et de débats traitée par la rédaction du Monde Afrique .

Dans la guerre que se livrent les opérateurs de paiement mobile en Afrique, la couleur a son importance. A Abidjan, derrière la grille de sa boutique orange et jaune, qui signale la vente de services Orange et MTN, Mariam Coulibaly, commerçante de 35 ans, se désole : « Les clients ne s’arrêtent plus, car ma devanture n’a pas de bleu ni le fanion avec le pingouin » , les emblèmes de Wave désormais omniprésents dans les rues de la capitale économique ivoirienne. « Cela fait plus d’un mois que j’ai demandé un agrément, mais je n’ai toujours rien reçu , poursuit la vendeuse, dépitée . Ils me disent qu’ils sont débordés. »

La start-up créée il y a une décennie par deux Américains – Drew Durbin et Lincoln Quirk – est arrivée en Côte d’Ivoire en avril 2021. En six mois, elle s’est déjà taillé une belle place sur le marché, à en juger par le « buzz » que son arrivée suscite et les commentaires inquiets tenus en privé par certains de ses concurrents (non cotée en bourse, elle ne communique pas de chiffres).

Prenant le contrepied des grilles tarifaires complexes des opérateurs historiques, l’entreprise s’est distinguée en offrant à ses clients la gratuité des opérations de dépôt et de retrait d’argent, ainsi qu’un taux fixe de 1 % sur les transferts nationaux.

« L’écosystème bouillonnant des fintechs »

Orange, MTN et Moov, les trois grands opérateurs locaux, qui taxaient entre 3 et 10 % les transactions similaires, ont d’abord semblé hésiter face à cette vague bleue. Dans un premier temps, ils ont multiplié les offres promotionnelles sans pour autant baisser leurs prix dans la durée. Les consommateurs ivoiriens ont réagi sur les réseaux sociaux en menaçant d’abandonner leurs opérateurs traditionnels. Entre août et octobre, ceux-ci ont donc fini par s’aligner sur les tarifs mis en place par le nouveau venu.

Un scénario comparable s’était déroulé au Sénégal, où la start-up a débuté ses activités dès 2018, attirée notamment par « l’écosystème bouillonnant des fintechs » , selon Coura Sène Tine, directrice générale de Wave dans ce pays d’Afrique de l’Ouest. L’entreprise y a installé son siège social africain et fait son trou en cassant les prix, forçant Orange Money, son principal concurrent, à baisser de 80 % ses tarifs en juin 2021.

Cette stratégie offensive a d’abord ciblé les personnes utilisant essentiellement du cash, comme les agriculteurs ou les pêcheurs dans les zones rurales, avant de s’attaquer aux centres urbains. Sans vouloir divulguer des chiffres précis, Coura Sène Tine affirme qu’environ la moitié de la population adulte sénégalaise utilise déjà ses services.

Depuis, avec Orange, la guerre est déclarée. Les deux opérateurs n’ont jamais réussi à s’entendre sur un partenariat, Wave se retrouvant ainsi empêché de distribuer du crédit téléphonique Orange via sa plate-forme. Pour avoir gain de cause, la start-up a saisi en mars l’autorité de régulation des télécommunications, qui a tranché en sa faveur.

« Casser les prix »

La fintech fait de plus en plus parler d’elle, et pas seulement à cause de ces bisbilles étalées sur la place publique par voie de communiqués. Les projecteurs se sont à nouveau braqués sur elle après la conclusion, en septembre, d’une levée de fond record de 200 millions de dollars.

Comptant des investisseurs de premier plan à son tour de table (les américains Stripe ou Founders Fund, le fonds Partech Africa…), Wave atteint désormais une valorisation de 1,7 milliard de dollars. Elle intègre ainsi le club prestigieux des « licornes » (start-up valorisée à plus d’un milliard de dollars), une première en Afrique francophone.

Wave est-elle là pour durer ? « Elle ne mise pas sur les gros montants mais sur le nombre de transactions effectuées. La stratégie, c’est de casser les prix, gagner des parts de marché puis de se diversifier sur le long terme » , analyse Cheikh Ndiaye, consultant en fintech pour la Société financière internationale (SFI), la banche de la Banque mondiale consacrée au secteur privé.

En Côte d’Ivoire, l’autorité de régulation des télécoms a indiqué, dans un communiqué publié le 26 octobre, « se réjouir de la dynamique concurrentielle sur ce marché [du mobile money] qui concourt efficacement à l’inclusion financière de nos populations, dans un contexte marqué par la lutte contre la cherté de la vie ».

Près de 20 000 distributeurs en difficulté

Certains s’interrogent toutefois sur la viabilité d’un modèle qui risque de mettre des années avant de devenir rentable. D’autres craignent que la guerre des prix entre opérateurs affecte la valeur du marché et fragilise, par ricochet, ceux qui en dépendent.

Ainsi, Abdoulaye*, gérant d’une boutique multiservice du centre-ville de Dakar, remarque que la majorité des clients demandent aujourd’hui les services de Wave. « Mais ce n’est pas évident pour les entrepreneurs comme moi, car avec la gratuité du service, nous touchons moins de commissions, certains ont même dû fermer boutique. Wave s’est imposé et ne nous a pas laissé le choix » , lance-t-il d’une traite.

« La valeur du marché a été divisée par quatre [au Sénégal] » depuis que les prix ont chuté sous la pression de Wave, affirme aussi Cheikh Tidiane Sarr, directeur d’Orange Money Sénégal. Selon lui, les distributeurs qui « n’ont pas les reins solides vont disparaître » . Ils seraient près de 20 000 dans le pays. Et les mêmes craintes s’expriment en Côte d’Ivoire, les commerçants spécialisés dans la monnaie électronique s’inquiétant d’une baisse de leurs revenus.

De son côté, Wave affirme que l’augmentation du volume des transactions permettra à chacun d’y trouver son compte. Pleine d’ambition, la start-up, qui vient de se lancer au Mali et en Ouganda, envisage désormais de se développer dans les transferts frontaliers entre les pays de l’Union économique et monétaire ouest-africaine (Uemoa). Un marché où tout reste à construire.

Et l’entreprise américano-sénégalaise pourrait bien ne pas se limiter à l’activité de transfert d’argent. « Avec l’augmentation massive du nombre d’utilisateurs, Wave a accès à leurs données et donc à leurs comportements financiers. A terme, cela pourrait leur permettre de proposer d’autres services, comme du crédit digital, quitte à demander un agrément bancaire » , anticipe Cheikh Ndiaye de la SFI.

De quoi étoffer la compétition avec Orange, même si les filiales du groupe français affichent leur sérénité. « Nous avons un écosystème de services très large qui n’a rien à voir avec celui de nos concurrents » , indique Cheikh Tidiane Sarr, en allusion aux services de paiements en ligne et de microcrédit pour lesquels l’entreprise estime avoir un temps d’avance sur son rival américain. La bataille ne fait sans doute que commencer.

* Le prénom a été modifié

Théa Ollivier (Dakar, correspondance) et Yassin Ciyow (Abidjan, correspondance)

Le Monde Mémorable

Le génie Chaplin

Personnalités, événements historiques, société… Testez votre culture générale

La fabrique de la loi

Boostez votre mémoire en 10 minutes par jour

Offrir Mémorable

Un cadeau ludique, intelligent et utile chaque jour

Culture générale

Approfondissez vos savoirs grâce à la richesse éditoriale du Monde

Mémorisation

Ancrez durablement vos acquis grâce aux révisions

Découvrez nos offres d’abonnements

Lecture du Monde en cours sur un autre appareil.

Vous pouvez lire Le Monde sur un seul appareil à la fois

Ce message s’affichera sur l’autre appareil.

Parce qu’une autre personne (ou vous) est en train de lire Le Monde avec ce compte sur un autre appareil.

Vous ne pouvez lire Le Monde que sur un seul appareil à la fois (ordinateur, téléphone ou tablette).

Comment ne plus voir ce message ?

En cliquant sur « Continuer à lire ici » et en vous assurant que vous êtes la seule personne à consulter Le Monde avec ce compte.

Que se passera-t-il si vous continuez à lire ici ?

Ce message s’affichera sur l’autre appareil. Ce dernier restera connecté avec ce compte.

Y a-t-il d’autres limites ?

Non. Vous pouvez vous connecter avec votre compte sur autant d’appareils que vous le souhaitez, mais en les utilisant à des moments différents.

Vous ignorez qui est l’autre personne ?

Nous vous conseillons de modifier votre mot de passe .

Lecture restreinte

Votre abonnement n’autorise pas la lecture de cet article

Pour plus d’informations, merci de contacter notre service commercial.

Le Bitcoin tout près de pulvériser la barre historique des 70 000 dollars

Sénégal : la première édition de ‘firifinance’ met l’accent sur la question de l’inclusion financière, le président iranien ebrahim raïssi introuvable suite au crash de son hélicoptère , rdc : le président tshisekedi échappe à une tentative de coup d’état, le cinquantième anniversaire de la badea célébré à riyad, royaume d’arabie saoudite .

Entretien exclusif avec Coura Tine Sène, Directrice Générale de Wave Mobile Money

«Nous restons concentrés sur notre mission qui est d’offrir un accès simple, rapide et à moindre coût aux services financiers de base pour tous… »

Une licorne qui change le quotidien de ses usagers. wave comme son nom l’indique est la nouvelle vague qui révolutionne en ce moment les services de transfert et de paiement au sénégal. «un business model plus juste pour tous les acteurs, allant des banques partenaires aux clients finaux en passant par les partenaires agents et marchands», comme le déclare coura tine sène, directrice générale de wave mobile money. entretien., comment présenteriez-vous wave dans son tour de table et ses investissements .

Wave Mobile Money est une Fintech à fort impact opérant exclusivement en Afrique. C’est aussi l’une des startups avec le plus fort taux de croissance du continent. Nous offrons des services financiers mobiles à forte proposition de valeur avec l’ambition de promouvoir l’inclusion financière en Afrique sub-saharienne où encore, en 2017, près de 60% des populations n’avait toujours pas accès à des services financiers. Nous rendons les transactions financières (envoi, retrait et dépôt d’argent, paiements de factures, etc.) aussi simples qu’envoyer un sms avec une solution extrêmement facile d’utilisation, financièrement abordable, et donc radicalement inclusive.

Aujourd’hui, après 3 ans d’activité au Sénégal, plus de la moitié de la population adulte utilise activement notre solution. Pour atteindre ces résultats, nous avons investi au niveau technologique, aussi bien pour les clients que pour notre réseau d’agents, en les dotant d’outils performants leur permettant de faire leurs opérations facilement, rapidement et en toute sécurité. Au delà du réseau d’agents et de la technologie, nous avons également investi pour mettre en place un business model plus juste pour tous les acteurs, allant des banques partenaires aux clients finaux en passant par les partenaires agents et marchands.

Wave s’est solidement implantée au Sénégal. Au delà des tarifs, qu’est-ce qui constitue la spécificité de votre démarche ?

L’obsession d’apporter une vraie solution adaptée aux besoins des utilisateurs et à leurs contraintes. Chez Wave, nous ne faisons pas de compromis avec notre mission. Nous restons inlassablement concentrés sur la proposition de valeur qui est centrée sur l’amélioration du quotidien des populations. L’idée est d’apporter véritablement de l’accessibilité et de la simplicité, même à ceux qui ne possèdent pas de smartphone. Cela se traduit aussi bien financièrement avec nos tarifs exceptionnellement abordables que techniquement avec une technologie de notre temps, la technologie QR qui rend l’expérience super intuitive et efficace pour les clients. A noter aussi que notre solution est à portée de tout détenteur de numéro de téléphone mobile, quelque soit son opérateur.

Vous avez récemment levé 200 millions de dollars. Quel est votre plan de développement dans l’espace sous régional et international?

Wave Mobile Money compte se développer là où se trouve les besoins de faciliter l’accès aux services financiers et de promouvoir l’inclusion financière, c’est à dire pratiquement partout en Afrique subsaharienne. Cependant, il nous faut y aller progressivement car nous sommes encore une startup qui doit garder la maîtrise de son développement et qui doit nouer des partenariats forts. En plus du Sénégal, nous opérons actuellement en Côte d’Ivoire, au Mali et en Ouganda. D’autres pays de la sous- région ouest-africaine sont dans notre plan de développement et nous ne manquerons pas de les annoncer officiellement au fur et à mesure que nous nous y lancerons.

Le fait de ne pas être adossé sur un opérateur des télécoms solide ne constitue- t-il pas un handicap à moyen terme ?

Absolument pas. Il est vrai que les services mobile money les plus connus dans nos pays sont proposés par des filiales d’opérateur de télécommunications, mais il en existe d’autres, comme ceux proposés par les banques. Être adossé sur un opérateur de télécoms n’est donc pas la seule manière de faire du mobile money. Au contraire, à l’ère de l’innovation et de la transformation digitales, nous misons sur l’interopérabilité. Le statut indépendant de Wave est donc un atout qui permet de nouer des partenariats forts et sans contrainte, de collaborer avec les différents régulateurs, aussi bien financiers que télécoms, en ouvrant ainsi la voie à de nouvelles perspectives à différents niveaux : produits et services, canaux d’accès, business model, etc.

Confirmez-vous ce fait que Wave est la première licorne de l’Afrique francophone. « What Will be the next » comme on dit en bon français ?

Wave Mobile Money est devenue une licorne. C’est un fait mais nous restons concentrés sur notre mission qui est d’offrir un accès simple, rapide et à moindre coût aux services financiers de base pour tous, quel que soit le statut social, le revenu ou le lieu d’habitation. Cette mission répond parfaitement aux préoccupations de nos Etats et Banques Centrales dont l’objectif est l’inclusion financière des populations africaines. Ainsi, The next to come, c’est “Work goes on”, si je puis le dire ainsi. Le travail continue et s’intensifie. Il y a encore des millions de personnes partout en Afrique subsaharienne qui attendent d’être incluses financièrement et qui ont besoin de solutions adaptées à leur quotidien. Nous continuerons d’innover pour les satisfaire et de nous étendre partout où le besoin d’inclusion financière se fait sentir, en toute conformité avec les différentes réglementations.

Directeur de publication de Financial Afrik. Dans la presse économique africaine depuis plus de 20 ans, Adama Wade a eu à exercer au Maroc dans plusieurs rédactions, notamment La Vie Industrielle et Agricole, La Vie Touristique, Demain Magazine, Aujourd'hui Le Maroc et Les Afriques. Capitaine au Long Cours de la Marine Marchande et titulaire d'un Master en Communication des Organisations, Adama Wade a publié un essai, «Le mythe de Tarzan», qui décrit le complexe géopolitique de l’Afrique.

Lectures recommandées

Le sénégalais ousmane diagne nommé head of people and growth à la islamic corporation for development (icd), 2 commentaires.

Bonjour je suis interesser pour wave en guinee

J’ai besoin de parler à Coura Tine sinè

Save my name, email, and website in this browser for the next time I comment.

Média multi-support, Financial Afrik propose une information financière stratégique aux cadres et dirigeants. Une information factuelle, « Globale ».

Contactez-nous : [email protected]

- Confidentialité & Données personnelles

- Charte de Financial Afrik

- Guide de la contribution écrite

- Politique de cookies (UE)

- Clause de non-responsabilité

Type above and press Enter to search. Press Esc to cancel.

@2022 - All Right Reserved. Designed and Developed by PenciDesign

Sénégal, Côte d’Ivoire : qui est Wave, la fintech qui bouscule le mobile money ?

Créée par deux Américains pour baisser les frais des transactions en mobile money, la start-up est sous le feu des projecteurs depuis qu’Orange tente de freiner son développement au Sénégal.

Les yeux rivés sur Free, Orange Sénégal ne semble pas avoir vu venir la menace Wave sur le segment du mobile money. Pris de court par l’offre ultra concurrentielle que propose depuis mai 2020 cette start-up américaine spécialisée dans les transactions à bas coûts, le leader des télécoms a décidé début juin de lui bloquer la possibilité de distribuer du crédit téléphonique via son application mobile et par code USSD.

Désaccord commercial

« Après plusieurs échanges avec l’opérateur téléphonique, un accord nous permettant de vendre du crédit directement ou par l’intermédiaire d’un grossiste agréé n’a toujours pas été conclu », a ainsi confirmé Wave dans un communiqué publié le 5 juin, annonçant aussi que l’Autorité de régulation des télécoms et des postes (ARTP) a été saisie pour « qu’une décision équitable puisse être prise ».

« Wave a dû demander de pouvoir avoir la même commission que le circuit normal de distribution d’Orange et ce dernier a refusé », analyse un bon connaisseur des télécoms sénégalaises.

Quelques heures après la missive de Wave , Orange s’est à son tour fendu d’un communiqué assurant que l’opérateur a fait des propositions « conformes à celles offertes à [ses] autres prestataires ». Le groupe de télécoms estime que Wave réclame un traitement particulier.

Frais de 1 %

Créé en 2011 par Drew Durbin et Lincoln Quirk, deux Américains installés à New York, et enregistré en 2016 à Dakar, Wave applique des frais fixes de transaction à hauteur de 1 % entre particuliers et épargne à ses utilisateurs des frais supplémentaires sur les paiements de factures en les reportant sur les entreprises – au contraire de son concurrent qui fait payer cette charge à ses clients.

Avec ce modèle, la start-up dirigée à Dakar par Coura Sène – une ancienne d’ InTouch – a convaincu d’importants investisseurs d’entrer à son capital. Le français Partech et le prestigieux incubateur américain Y Combinator font ainsi partie de son tour de table, tout comme Founders Fund et Serena Ventures, deux sociétés californiennes de capital-risque. Au total, le service qui s’est lié aux banques UBA et Ecobank pour exercer au Sénégal a levé 13,8 millions de dollars depuis sa création.

« Les usagers se sentent insultés car ils pensent que pendant longtemps Orange leur a imposé des frais abusifs

Afin de s’aligner sur cette concurrence, Orange a décidé depuis le 1er juin de baisser ses frais de paiement de factures à 1 % et, pour compenser, de prélever à son tour un pourcentage sur les transactions entre particuliers, selon un principe de paliers calculé en fonction du montant envoyé (certaines transactions peuvent être ainsi taxées à hauteur de 10 %).

Cette baisse rapide et soudaine des prix ne passe pas à Dakar : « Les usagers se sentent insultés car ils pensent que pendant longtemps, Orange leur a imposé des frais abusifs », témoigne un entrepreneur dakarois.

Un litige qui va durer

Le litige entre Wave et Orange est désormais dans les mains du régulateur des télécoms. Cela ne veut pas dire que la question sera rapidement réglée : « En principe, cette affaire concerne un contrat commercial de distribution de gré à gré qui n’est pas régulé, [donc la démarche de Wave] est étonnante », confie à Jeune Afrique Fabrice André, directeur général adjoint de Sonatel.

Pour Sonatel, l’objectif est donc de miser sur l’absence de régulation du secteur du mobile money au Sénégal.

« L’ARTP pourrait bien se déclarer incompétente, car le marché qui est impacté par le comportement d’Orange GSM n’est pas le marché des télécommunications, mais celui du mobile money, confirme un spécialiste sénégalais de la régulation des télécoms, également dirigeant d’un opérateur panafricain. En soi, la discrimination n’est pas une pratique proscrite lorsqu’on arrive à démontrer que les deux entités discriminées n’appartiennent pas la même famille », poursuit-il.

Mais si le régulateur télécoms se déclarait incompétent, cette affaire complexe pourrait remonter au niveau de la Banque centrale des États d’Afrique de l’Ouest (BCEAO), ou encore retomber dans le droit commun au niveau de l’Autorité de la concurrence.

« La seule certitude que j’ai, c’est qu’Orange Money a été sérieusement bousculé par Wave et est en train de recevoir un coup de main de Orange GSM pour essayer de contenir la vague bleue [de l’identité commerciale de Wave] », estime notre expert de la régulation.

Même concurrence en Côte d’Ivoire ?

En Côte d’Ivoire, où Wave s’est lancé en avril 2021, le litige sénégalais est surveillé de près. « Chaque pays à son propre modèle de distribution. Dans le cas de la Côte d’Ivoire, nous pratiquons le zonage via quatorze distributeurs exclusifs avec lesquels nous travaillons depuis près de quinze ans. Les contrats ont été renouvelés en octobre 2020 et Wave n’a pas soumissionné », indique Mamadou Bamba, directeur général d’Orange Côte d’Ivoire.

Service encore récent dans ce pays d’Afrique de l’Ouest, Wave est en pleine opération de communication pour se faire connaître. Le 25 mai, l’application a organisé un panel à Abidjan autour du rôle des fintech dans l’inclusion financière.

Aux côtés de Daniel Ahouassa, cofondateur du groupe de media en ligne Weblogy, le cofondateur de Wave Drew Durbin ainsi que Coura Sène et Bruno Belinga, directeur des opérations de la fintech, en ont profité pour promouvoir leur modèle.

Jeune Afrique

Socialnetlink

Retrouvez toute l'actu Tech et des Nouveaux Médias en Afrique sur Socialnetlink.

dans la meme catégorie

Offre de 230 bourses d’études par le maroc, le cameroun confie la production de ses cni..., souveraineté numérique – le congo construit l’un des..., smart africa s’associe à gitex africa pour organiser..., nouvelles saisies de billets noirs au sud et..., abdoul aziz zoumarou :«l’etat doit prendre la souveraineté..., blockchain, nft…, bientôt un grand retour de wari….

il y’a 2 ans

Krach mondial dans les marchés de cryptomonnaies

il y’a 3 ans

La lutte contre les médicaments contrefaits : Et…

Vitalik buterin, 27 ans, plus jeune milliardaire au…, dogecoin, 3e cryptomonnaie la plus prometteuse après le…, cryptomonnaie : le bitcoin dépasse encore la barre…, sénégal numérique sa poursuit sa mission de digitalisation….

il y’a 1 an

AFRICA T-AWARDS, encourage les initiatives africaines dans le…

Le ministère de la fonction publique et de…, 30 milliards de fcfa pour la transformation du…, artisanat : le digital pour moderniser le secteur…, doolel admin – l’etat veut accélérer la transformation…, comportement inacceptable de certains de journalistes à la….

il y’a 4 mois

La CDP invite les banques sénégalaises à déclarer…

il y’a 10 mois

Cybermenace: comment se protéger?

il y’a 11 mois

Pénurie de main-d’œuvre qualifiée en cybersécurité : récession…

Cybersécurité – un expert plaide pour un ‘’investissement…, salon d’exposition de daust impact : un creuset….

il y’a 2 jours

Les algorithmes : des boîtes noires, vraiment ?

il y’a 2 semaines

Le programme des pluies provoquées toujours en cours

il y’a 3 semaines

Pour une éducation aux médias et à l’information…

il y’a 4 semaines

Sécurité des Données : Les directives présidentielles révèlent…

il y’a 1 mois

Alioune Sall, acteur du secteur IT, nouveau patron…

il y’a 2 mois

- Réseaux sociaux

- Applications

- Télécommunications

Sénégal – Le Black Friday de Jumia prévu…

il y’a 7 mois

IFC et l’OMC s’unissent pour libérer le potentiel…

Ecommerce : attention aux arnaques en ligne .

il y’a 8 mois

Cote d’ivoire – IFC investit 3,4 Millions de…

L’e-commerce en pleine progression dans la ville sainte….

il y’a 9 mois

L’e-commerce et l’emploi au Sénégal

El hadji malick gueye nommé directeur général de…, technologies, numérique, innovation… les promesses de bassirou diomaye…, proton vpn lance une campagne pour lutter contre….

il y’a 3 mois

Vous voulez stimuler le commerce transfrontalier en Afrique…

Coupure d’internet – une atteinte aux libertés fondamentales…, une gestion, moult interrogations.

- Economie Numerique

Le Cameroun confie la production de ses CNI…

il y’a 3 jours

Souveraineté numérique – Le Congo construit l’un des…

il y’a 4 jours

Smart Africa s’associe à GITEX Africa pour organiser…

Le groupe émirates réalise un bénéfice record de….

il y’a 7 jours

Afrique : un continent “pauvre” qui compte des…

il y’a 1 semaine

La Mauritanie attribue ses premières licences pour «…

Lutte contre la fraude et l’évasion fiscale en….

- Côte d’Ivoire

Le Sénégal réceptionne GAINDESAT, son premier satellite fabriqué…

il y’a 5 mois

Prix Jeunes Talents Afrique subsaharienne: 30 brillantes scientifiques…

il y’a 6 mois

Le prix Nobel de physique 2023 décerné à…

Une source de solutions pour l’afrique : comment…, 6e sommet transform africa – des experts africains…, le sénégalais mouhamed moustapha fall remporte le prestigieux…, uemoa: appel à candidatures pour des bourses d’excellence .

il y’a 21 heures

Les avancées et les défis de l’intelligence artificielle…

Deepfakes: créer du faux contenu pour comprendre la…, le service universel de télécommunications un droit social…, le dr. moustapha sow se penche sur l’histoire…, collaboration: senelec octroie à l’anst des locaux modernes, pour la souveraineté culturelle du sénégal : plaidoyer…, amadou ba annonce 11 recommandations pour un meilleur…, pr maïmouna ndour mbaye honore la communauté universitaire….

- Recherche scientifique

- Hydrocarbures

- Contributions

- Email : [email protected]

- Tel. +221 77 508 48 04

- Tel. +22177419 12 65

- Tel. +221 33 827 27 01

- Qui sommes nous ?

- Politique de confidentialité

- Partenaires

- Mentions légales

- IT business

Pour vos annonces et publicités

Email :[email protected] Tel. +22177419 12 65 +221 77 508 48 04 +221 33 827 27 01

- debt financing

- mobile money

- Venture capital

- Ask An Investor

- Centre Stage

- My Life In Tech

- Digital Nomads

- The BackEnd

- Entering Tech

- The Next Wave

- TC Weekender

- TC Insights

- Tech Women Lagos

How Wave is navigating the economic downturn with its radical business model

Image Source: Wave

Wave, a leading mobile money provider, became a household name 4 years ago across francophone West Africa for 2 different reasons: crushing monopoly and bringing the mobile money pricing structure down by 80% in Senegal. For the rest of the world, its popularity arrived when it became the first unicorn from the francophone Africa region following its $200 million fundraiser last year.

But none of this happened without heaps of recurring challenges. The fintech company first launched in Senegal in 2018 and charged a 1% transaction fee on transfers while offering withdrawals, deposits and bill payments (water, airtime, and electricity) for free. The low fees/free model looked like a bogus customer acquisition strategy that’d die a natural death. Before Wave’s entry, telecoms companies like Orange, whose mobile money operation Orange Money dominated the market, were charging between 6–10% transaction fee. As expected, Orange frowned at Wave’s alien idea and referred to it as “a dangerous method that would destroy the country’s economic fabric.”

Ndiaye Alioune, managing director at Orange, once claimed in an interview that “Wave’s strategy led to Orange Money’s network of distributors, who used to share half of the telecom company’s turnover, losing 50% of their income, and also caused the loss of more than 20,000 jobs in Senegal and could have more damage in the future.”

Get the best African tech newsletters in your inbox

But the users thought otherwise as they migrated to Wave in mass. After all, Wave was the market saviour who’d come to provide them with affordable alternatives. It would soon become apparent that the model of charging customers for cash withdrawals was certain to fail and the entire mobile money market must quickly adjust to Wave’s radical rulebook to stay relevant. Since June 1, 2021, Orange, particularly, has maintained a flat charge of 1% on transfers and other players like Free and E-Money have since followed suit.

And that was how the entire market aligned to and validated Wave’s radical business model. The startup has since expanded into Cote d’Ivoire and quickly snagged millions of users. Following its successful blueprint, the company expanded into Mali, Uganda, and Burkina Faso. Even though Wave didn’t respond to TechCabal’s question about its profitability, business seemed to be good, and the open war between the players appeared to have subsided. But a few weeks ago, Wave announced that it was laying off 15% of its 2000-strong workforce and would be pausing its expansion effort while centering focus back on its 2 major markets (Senegal and Côte D’Ivoire) where it has combined users of over 10 million. This development signals to competitors and market commentators to put the sustainability of Wave’s model back under scrutiny.

The concerns are: Maybe the venture funding has stopped coming; is this the end of growth for Wave? How long can it stay afloat without the fast growth enabled by VC cash? Why can’t Wave expand seamlessly?

“When you are a fast-growing and regulated financial services business like Wave is, you have to constantly navigate new paradigms (the global economic downturn and capital markets) and quickly adapt and alter strategies to prioritize our customers and keep on delivering on our promises of always reliable and affordable financial services.” Sid Sridhar , the company’s global head of business, told TechCabal. “The company is still growing rapidly but we have to slow down the pace of entry into new markets to ensure we’re focused on serving the 10 millions+ active users in existing markets.”

“We weren’t motivated to become a unicorn”: Wave’s West Africa head reflects on startup’s rapid growth

This response from Sridhar confirmed the speculation that the company was adjusting to the current VC funding market. After all, the company must continue deploying huge cash to take on the big telecoms and banks to see its “cashless Africa” vision to fruition, and it must do so in every market it expands into. The low fees/free model alone can’t cut it for the company anymore, not now that competitors have adopted the model at scale.

Alioune, the Orange boss, had also said that Wave’s model is disruptive because it is financed by venture capital funds with little regard for short-term profitability. “They invest money in the hope that the startup will manage to take over the entire market and then exit, recovering 10x to 15x of their initial investment,” he said. “It’s like the Amazon model: they burn cash—the e-commerce site has been doing this for over a decade—in the hopes of eliminating the competition.”

It’s true that the mega venture funding shot Wave’s ambition to the moon and gave it leverage to really compete. Now in the absence of big-ticket VC financing due to the global economic downturn, what would realistically be the fate of the francophone unicorn? The answer is simple: cut costs, source alternative funding, or both. Wave then went for both. It cut costs by calling off its expansion plan, downsizing its workforce and then raising a debt fund of $92 million, the biggest debt funding yet in Africa, from the International Finance Corporation (IFC) and some other big lenders.

“Debt funding is always a desired source of capital, as it’s generally much cheaper than equity (where you have to give up ownership). Like most large and established businesses, a mix of debt and equity is the ideal way to capitalise a growing company,” Sridhar said. “Also, our businesses in Senegal and Cote d’Ivoire are more mature and stable whilst still growing rapidly, which is something lenders look for. We’ve optimized our balance sheet by raising both debt and equity capital and found a great partner in IFC to lead the debt round. We’ll continue to raise both debt and equity capital going forward.”

This means that while expansion has now been undrafted, the new capital injection provides Wave a war chest wide enough to continue snagging market share from Orange and its cohorts in Senegal and Cote d’Ivoire.

”When a business continues to put customers first with a viable model, it will continue to grow sustainably as there are still tens of millions of people that need access to affordable financial services in Africa,” Sridhar concluded.

Comparing Wave to Amazon is spot on. Besides the huge capital invested in both businesses, their long-term pricing strategy and the plethora of products make them the real market winners.

More from this author

Notre mission, faire de l’Afrique le premier continent cashless du monde

Sur un continent où plus de la moitié de la population n’a pas de compte bancaire, Wave offre le premier réseau de services financiers sans frais de gestion de compte, disponible instantanément et partout !

Nous construisons une infrastructure financière qui facilite le quotidien

Le succès du mobile money au Kenya a sorti près d’un million de personnes de la pauvreté. Pourtant, plus de 10 ans plus tard, la plupart des Africains n’ont toujours pas accès à des outils d’épargne, de transfert ou de crédit abordables qui leur permettraient d’entreprendre et assurer les besoins de leurs familles.

Wave apporte une solution au problème en utilisant la technologie pour bâtir un réseau financier radicalement inclusif et extrêmement abordable.

L’équipe dirigeante

Nos Co-fondateurs Drew Durbin (à gauche, Directeur Général) et Lincoln Quirk (à droite, Directeur Produit) se sont rencontrés en première année d’université où ils étaient voisins de palier. Leur amour pour le développement de produits simples à fort impact social en fit rapidement des amis.

Ils ont d’abord développé Sendwave , à ce jour leader dans les transferts d’argent digitaux vers l’Afrique. Wave est ensuite né de la volonté de vulgariser la finance digitale en Afrique.

Directrice Régionale

Kizito Okute

Directeur des opérations agent.

Directeur technique

Chris Williamson

Directeur paiements.

Sid Sridhar

Directeur des affaires.

Emily Austin

Directrice talents et culture.

Katier Bamba

Directeur général côte d'ivoire.

Kevin Odiorne

Directeur financier, soutenu par des investisseurs réputés.

Économie Publié le jeudi 21 juillet 2022 | Abidjan.net

Publireportage - Inclusion financière : Wave, la start-up au service des Africains

En seulement quatre années, Wave a bousculé le marché du mobile money au Sénégal et en Côte d’Ivoire. Fort de ses premiers succès, le groupe voit plus loin, plus grand. Objectif : rendre l’accès aux services financiers facile et universel pour les millions d’Africains qui en sont aujourd’hui privés.

LA VAGUE BLEUE a déferlé sur l’Afrique de l’Ouest. Arrivée en 2018 au Sénégal, Wave Mobile Money, a lancé une offre sans équivalent à l’époque : baisser les frais de transaction entre particuliers à un niveau plancher, soit 1% pour les transferts, et supprimer, pour leurs usagers, les frais de dépôts et de retraits sur leurs portefeuilles électroniques. Une offre novatrice et ultra-concurrentielle, qui a bousculé le marché sénégalais du mobile money jusqu’alors dominé par quelques autres acteurs.

Dans une période marquée par la pandémie de Covid-19, qui imposait partout des restrictions de déplacement, l’offre de Wave Mobile Money a remporté un succès immédiat. « Facile d’accès, rapide dans son exécution et sécurisé techniquement, Wave Mobile Money est devenu un canal privilégié pour contrer les effets de la pandémie », souligne, depuis Dakar, Coura Carine Sène, directrice régionale de Wave pour l’espace de l’Union économique et monétaire ouest-africaine (Uemoa).

Selon le rapport de la GSMA, en 2020, l’Afrique était de loin le premier continent dans le domaine du mobile money, avec un volume annuel de 27,5 milliards de transactions. Plus de 500 millions d’utilisateurs et quelque 495 milliards de dollars échangés sur l’ensemble du continent, dont 80% du territoire sont couverts par ce type de services.

Des produits simples à fort impact social

L’histoire de Wave Mobile Money prend sa source au Sénégal en 2018 avec une mission: «faire de l'Afrique le premier continent sans cash. Notre ambition est de construire un réseau financier radicalement inclusif et accessible, soutiennent les cofondateurs de Wave. Aucun frais de gestion de compte, disponible instantanément et accepté partout. Nous avons développé, pour le continent africain, la plateforme de monnaie électronique la plus abordable, centrée sur l’utilisateur et propulsée par la technologie, » affirme l’un de ces co-fondateurs, Drew Durbin.

En Septembre 2021, la jeune fintech Wave lève 200 millions de dollars (soit environ 128 milliards de FCFA) pour faire une différence durable dans le quotidien des populations. Wave mobile money qui a gagné le cœur de millions de Sénégalais poursuit sa marche pour faire de l’inclusion financière une réalité pour tous. L’Objectif: vulgariser la finance digitale en Afrique. Et toujours la même passion : développer des produits simples à fort impact social. Coura Tine Sène et les fondateurs ont bouclé le tour de table financier avec des partenaires de renom comme Partech, Sequoia Heritage, Founders Fund, Stripe et Ribbit, fidèles de la première heure. Doté de la confiance des investisseurs, qui lui offrent des moyens à l’échelle de ses objectifs, Wave Mobile Money a vu son activité croître de façon exponentielle ces dernières années.

Et le pingouin, animal symbole de sociabilité, poursuit ainsi sa marche et gagne la confiance et le cœur de millions d’utilisateurs au Sénégal, en Côte d'Ivoire, au Mali, au Burkina Faso, et en Ouganda.

Le 14 avril 2022 marque une nouvelle ère dans la vie de la Fintech. Wave Digital Finance, filiale du Groupe Wave Mobile Money (Wave), devient la première structure non-bancaire, non-opérateur de télécommunications au Sénégal à obtenir une licence d’Établissement de Monnaie Électronique (EME) par la Banque Centrale des États de l’Afrique de l’Ouest - BCEAO. Cette première dans l’Union Économique Monétaire Ouest Africaine, UEMOA, est un signal fort qu’il faudra désormais compter sur les fintechs pour réussir l’inclusion financière en Afrique.

La première licorne d’Afrique francophone

Wave Mobile Money compte quelque dix millions d’utilisateurs actifs dans cinq pays : côté francophone, le Sénégal, son premier marché avec six millions d’usagers, la Côte d’Ivoire, le Mali et le Burkina Faso ; côté anglophone, l’Ouganda. Le groupe est désormais valorisé à plus d’un milliard de dollars, ce qui en fait la première licorne d’Afrique francophone.

Dans un continent où plus de la moitié de la population n’a pas de compte bancaire, Wave offre le premier réseau de services financiers sans frais de gestion de compte, disponible instantanément et partout.

«Ce qui fait la différence avec Wave, c’est que nous offrons des produits qui sont conçus pour offrir la meilleure expérience possible au client qui est au centre de notre proposition de valeurs. », explique Manou Guilé Mbodj, directeur de Wave Sénégal.

Nouvelle étape clé dans son développement, Wave annonce, le 6 juillet dernier, un accord de financement de 90 millions d’euros avec la Société Financière Internationale (IFC) pour renforcer l'inclusion financière et soutenir la croissance économique au Sénégal et en Côte d'Ivoire. Ce financement de l’IFC comprend un prêt de 25 millions pour son propre compte, ainsi que des prêts de 41 millions de plusieurs investisseurs (Symbiotics, Blue Orchard, responsAbility et Lendable) et de 24 millions des fonds souverains scandinaves Finnfund et Norfund.

« Favoriser l'accès aux services financiers pour les populations à faible revenu non bancarisées est une priorité pour IFC, a déclaré à cette occasion Aliou Maïga, directeur régional d'IFC pour l'Afrique de l'Ouest et centrale. Notre investissement dans Wave va non seulement promouvoir un secteur financier plus inclusif, mais il va aussi grandement contribuer à favoriser l'essor des solutions numériques en Afrique de l'Ouest. »

Avec ce nouveau soutien de poids de la Société Financière Internationale, membre du Groupe de la Banque mondiale, Wave Mobile Money contribuera à démocratiser toujours plus l’accès à des services financiers adaptés et à des coûts abordables, améliorant les conditions de vie de millions d’Africains sur le continent.

Articles du dossier

Plus d'articles

Playlist Économie

Toutes les vidéos économie à ne pas rater, spécialement sélectionnées pour vous.

Accounting | What is

What Is Wave Financial Software & What Does It Do?

Published May 22, 2023

REVIEWED BY: Tim Yoder, Ph.D., CPA

WRITTEN BY: Danielle Bauter

This article is part of a larger series on Accounting Software .

- 1 Products, Services & Integrations

- 2 Pricing & Business Model

- 3 The History

- 5 Bottom Line

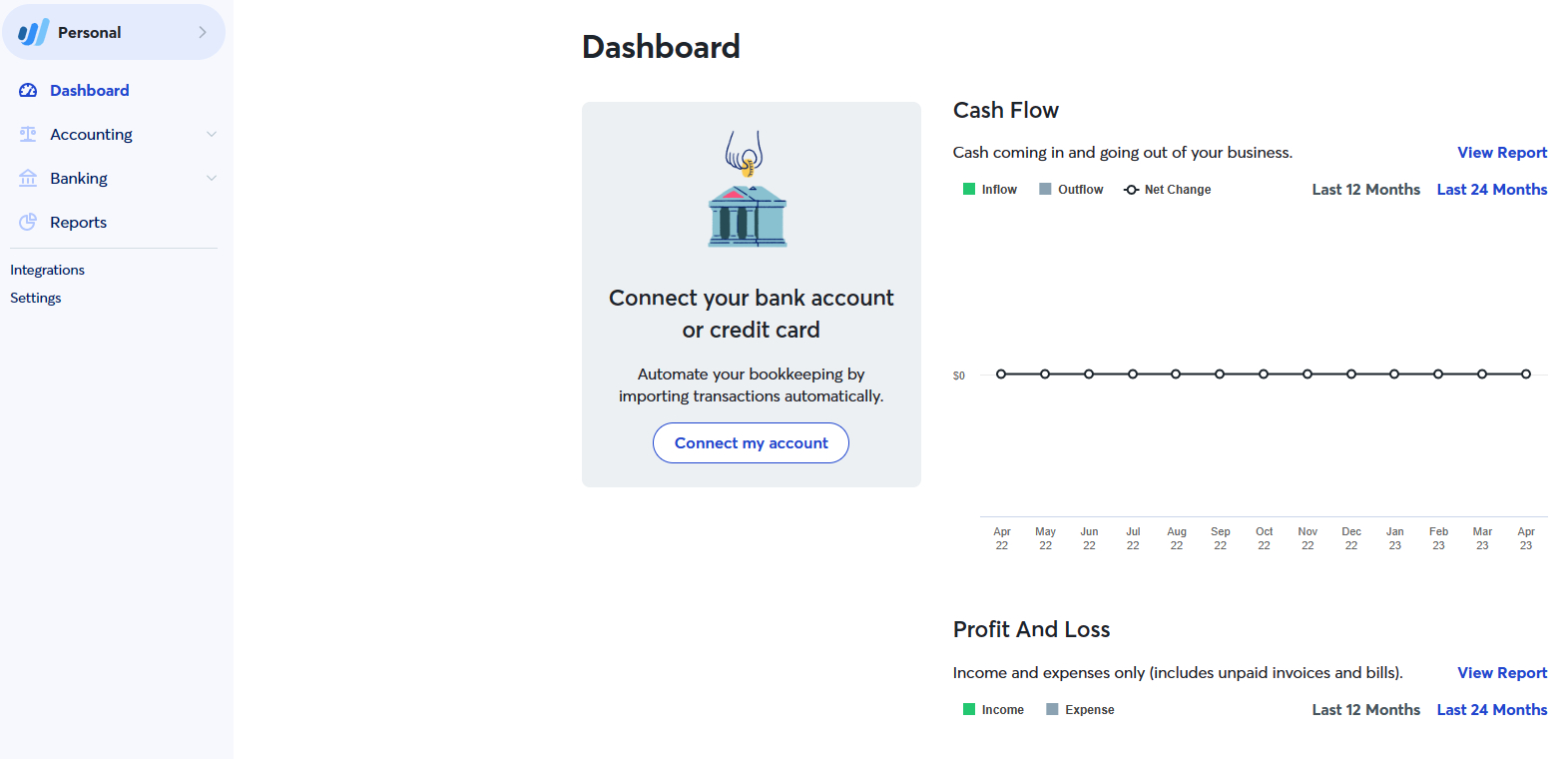

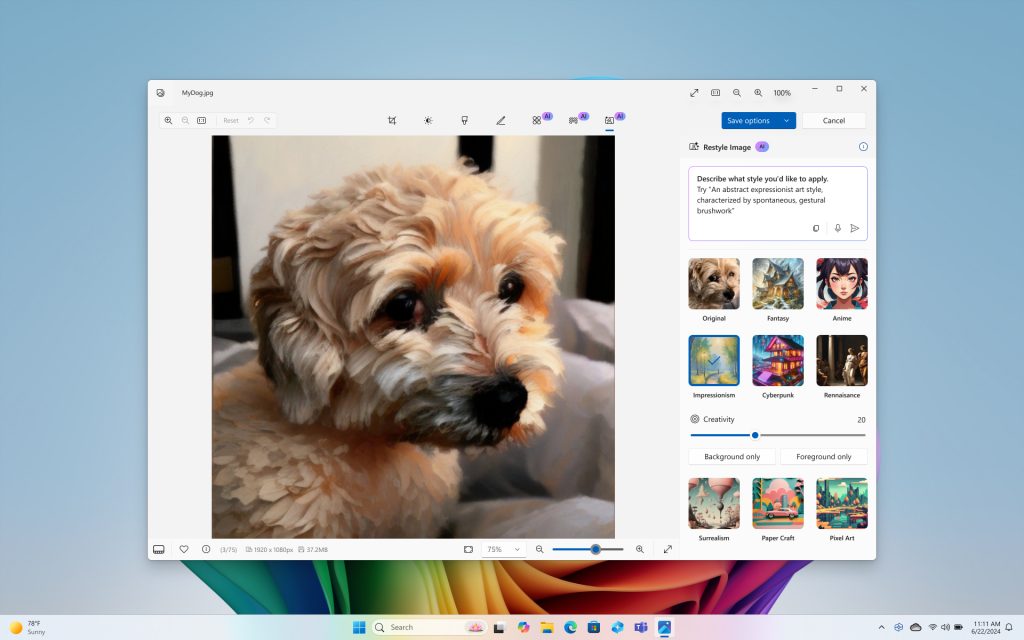

Wave Financial is a financial management software designed specifically for small businesses. It offers a suite of tools that includes accounting, invoicing, payroll, payment processing, receipt scanning, and a business checking account for select users. Wave Accounting is known for its user-friendly interface and is often recommended to small business owners who aren’t accounting experts. We even selected it as one of the best QuickBooks alternatives .

Wave Financial’s services are centered on and integrated with Wave Accounting, which is free forever. To learn more about what is Wave Financial best for, sign up for an account with Wave Accounting and explore your options.

Visit Wave Accounting

Wave Financial Products, Services & Integrations

One of the benefits of using Wave Financial’s software is the ease of using products and services that integrate seamlessly together. It offers payroll, invoicing, an assisted bookkeeping service, the ability to accept online payments, and a Wave Money account for qualified users.

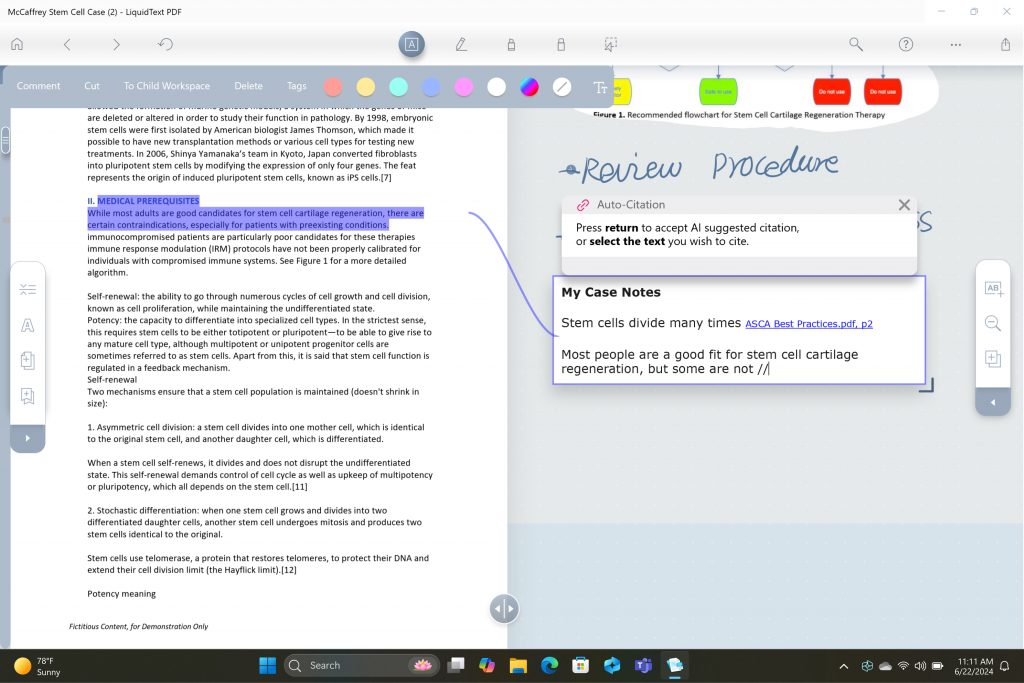

Wave Accounting

Wave Accounting provides all of the standard accounting features. We chose it as one of the leading small business accounting software , specifically as the best free solution for tracking income and expenses.

It allows you to connect your bank and credit card accounts, invoice customers, manage unpaid bills, add sales tax to invoices, bills, estimates, and expense and income transactions. However, since Wave Accounting is free, it has some limitations. For instance, its reconciliation features are limited, and it doesn’t allow you to print checks.

Wave dashboard (Source: Wave)

One of its strengths is that there is no limit to the number of users. Also, in our review of Wave Accounting , the platform scored relatively well in reporting. This is given its ability to generate several common reports, like profit and loss (P&L) statements, accounts receivable (A/R) aging, accounts payable (A/P) aging, general ledger (GL), and expenses by vendor.

Wave Accounting works seamlessly with Wave Financial’s other solutions, such as Wave Payroll, Wave Invoicing, and Wave Payments, to help you manage your finances.

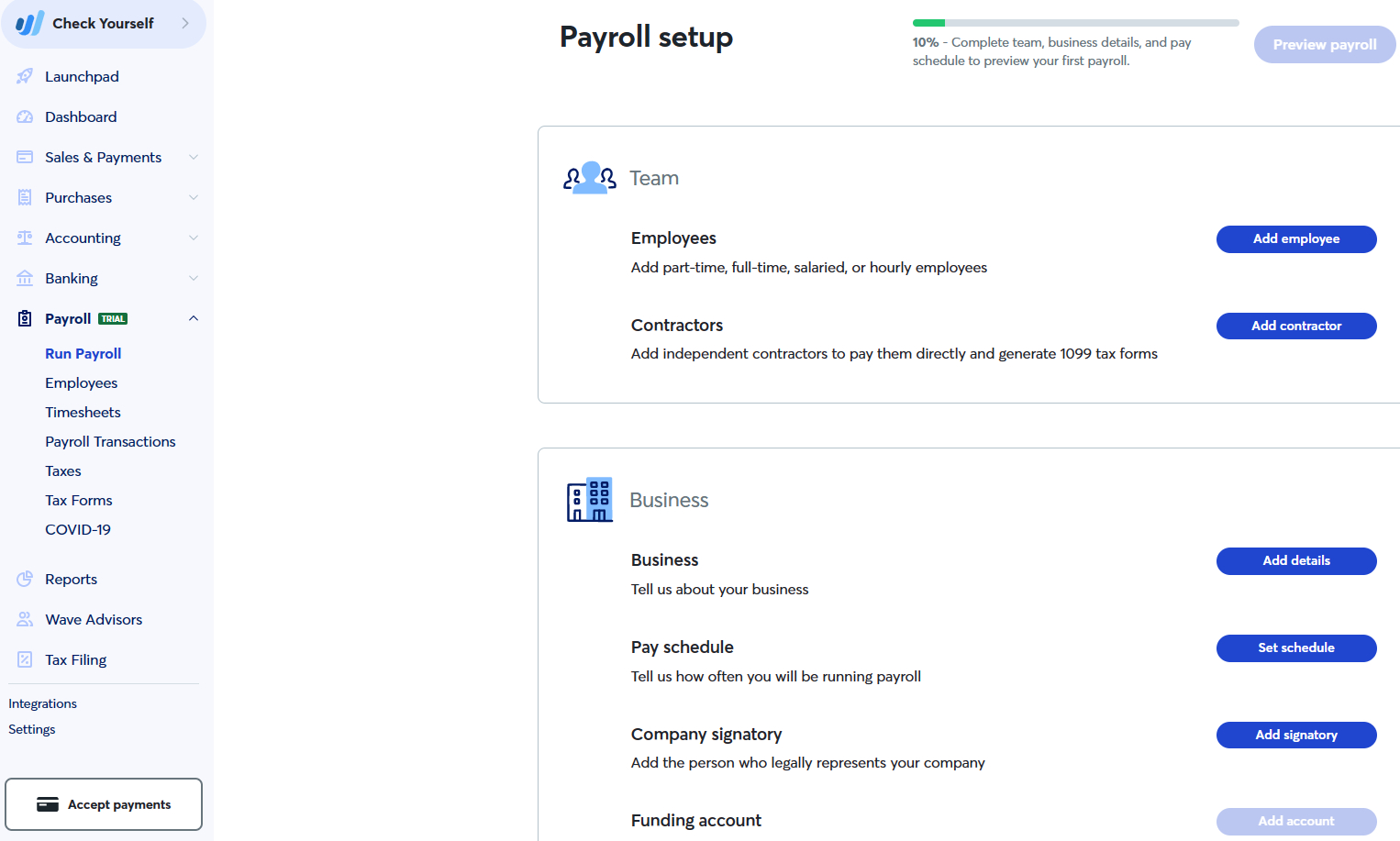

Wave Payroll

Starting at $20 per month plus $6 per employee, Wave Payroll streamlines the payroll process for small businesses by automating tasks such as calculating and filing taxes, generating paystubs, and issuing direct deposits to employees. It can also manage payroll tax filings, including year-end tax forms, such as W-2s and 1099s.

What’s more, you can set up and run your payroll online, eliminating the need for manual calculations and paperwork. Various features, such as employee self-service and automatic reminders for important deadlines, will help your business stay compliant with payroll regulations. Our in-depth review of Wave Payroll provides more information about its payroll features.

Setting up payroll in Wave (Source: Wave)

Worker’s compensation insurance is also included in the payroll plan—this is offered through Next Insurance, which you can learn about through our Next Insurance review . And in addition to integrating with Wave Accounting, Wave Payroll integrates with popular accounting software like QuickBooks and Xero by using Zapier.

We consider Wave Payroll a cost-effective solution whether or not you live in one of the 14 states it offers tax filings and payments in (the full-service tax states are Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin). All of the data integrates with Wave Accounting, making it easy for you to generate reports. Its robust tax engine automatically calculates federal, state, and local taxes.

Visit Wave Payroll

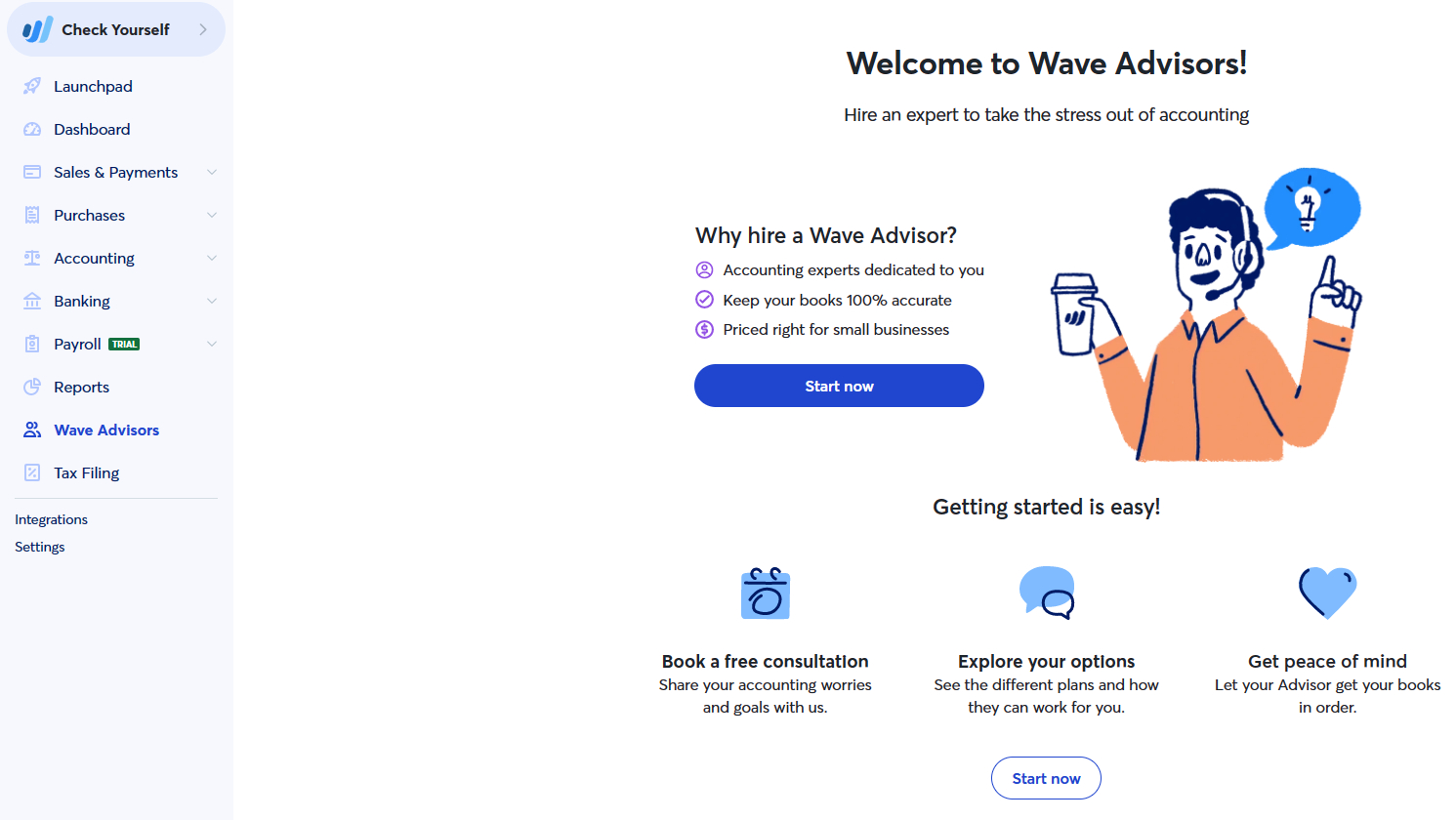

Wave Advisors

Wave Advisors, which costs $149 per month, is a bookkeeping service offered by Wave Financial. It provides assisted bookkeeping services to small businesses, helping them with tasks such as managing accounts payable and receivable, reconciling bank accounts, and generating financial reports.

There are currently two main tiers of service: Bookkeeping and Bookkeeping + Payroll.

- Bookkeeping includes monthly bookkeeping services, reconciliation of accounts, and customized reports.

- Bookkeeping + Payroll has all of the services above plus payroll management, tax filing, and compliance support

Signing up for Wave Advisors (Source: Wave)

One of the benefits of using Wave Advisors is that it integrates with Wave’s accounting software, which allows businesses to have a complete view of their financials in one place. Additionally, Wave Advisors offers a team of dedicated bookkeeping professionals to help businesses manage their finances.

Visit Wave Advisors

Wave Invoicing

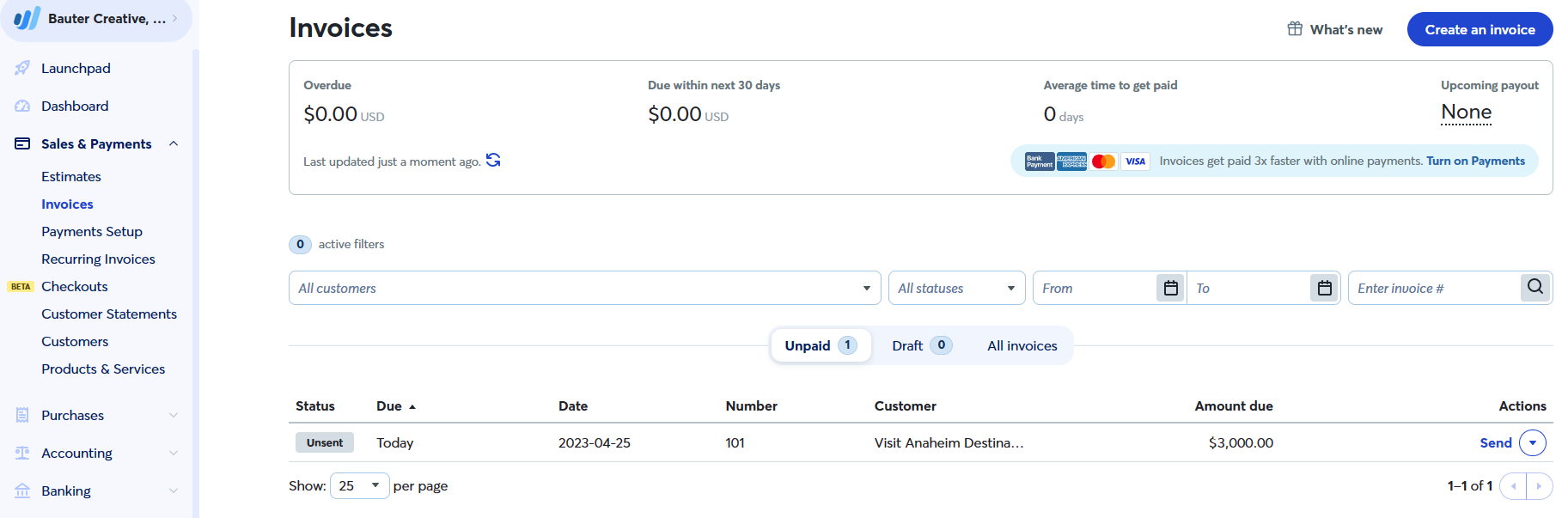

Wave Invoicing can be accessed from the Wave Accounting dashboard, under Sales and Payments. To invoice a customer, you simply have to click on the “Create an Invoice” button on the upper right corner.

The solution excels with its customization options, including the ability to select from different templates, add your logo, add a personalized message, and change colors. You can also set up recurring invoices and track sales tax collected and remitted by jurisdiction.

Invoicing in Wave (Source: Wave)

It is free, but it works especially well with Wave Payments, a paid service that lets customers click on a “Pay Now” link on their invoice so that you can accept quicker payments. You have the added benefit of being able to invoice on the go, as invoicing is available on the mobile app for both iOS and Android users. It also syncs automatically with Wave Accounting once you have downloaded the app and linked accounts.

Visit Wave Invoicing

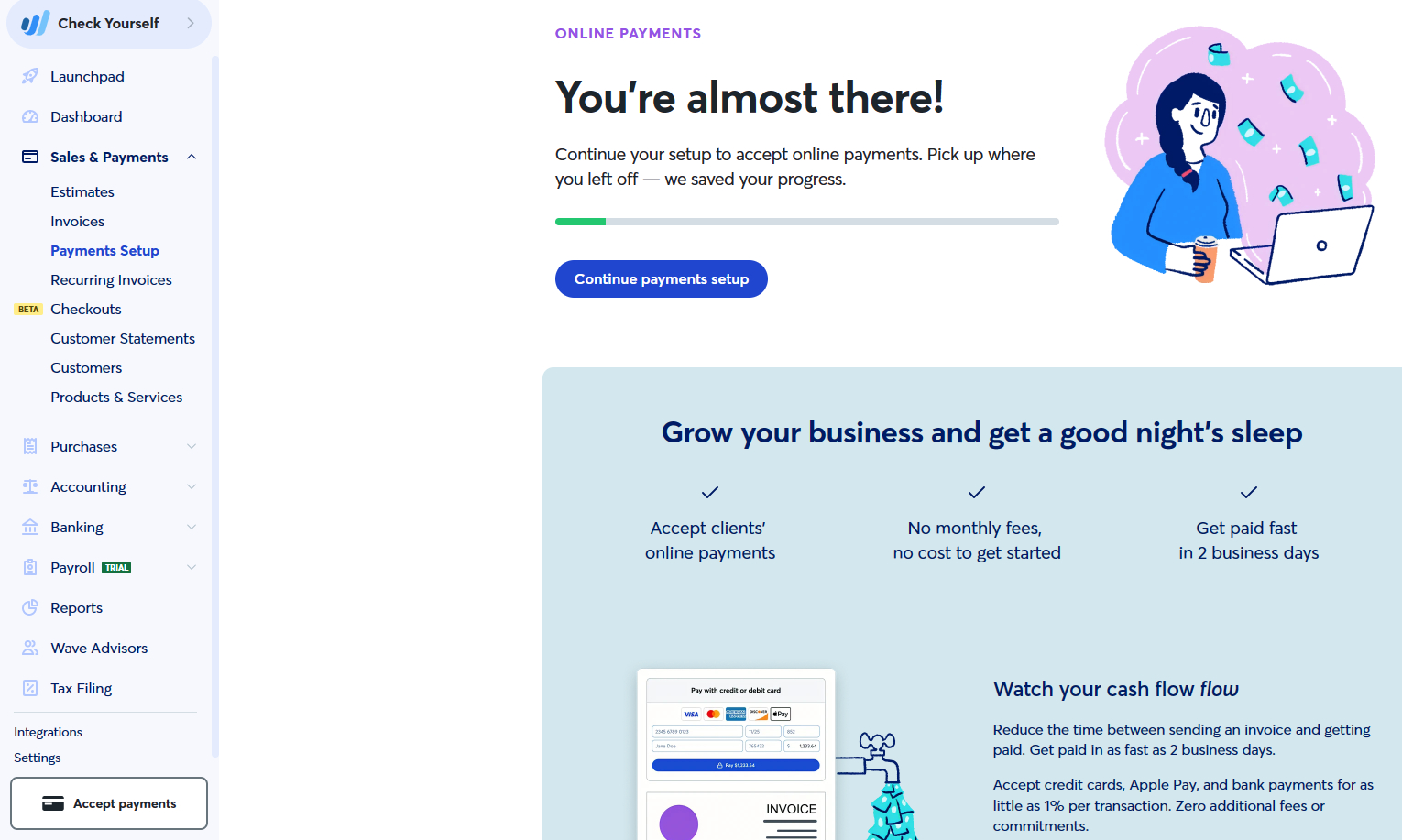

Wave Payments

Wave Payments, which connects seamlessly with Wave Accounting, is a payment solution that allows you to add a “Pay Now” button on your invoices by enabling the online payments option. This gives customers another way to pay your invoices and allows you to potentially get paid faster.

Customers can pay your invoice with their bank account, credit card, or Apple Pay, and the funds will be deposited to your account within two business days. You can also set up recurring billing for repeat customers.

Accepting online payments in Wave (Source: Wave)

Both payments and processing fees are recorded automatically in Wave Accounting, and you can choose the payment method per invoice. You can also create a unique payment link with checkouts, where no invoice is needed.

If you run into any issues, you can access a live support agent via chat or email. The cost for Wave Payments is 1% per transaction with a $1 minimum fee for automated clearing house (ACH) payments, 2.9% plus 60 cents per transaction for credit cards, and 3.4% plus 60 cents per transaction for AMEX.

Visit Wave Payments

Wave Financial also offers a business banking account and debit card via Wave Money, which is completely free. It is currently only available to single-owner businesses in the United States, and each Wave bank account can be linked to one business.

Banking eligibility is based on factors, including business category and location, currency, and security. All of the Wave Money transactions are automatically accounted for in Wave Accounting, with a Wave Money asset account that is created in your chart of accounts.

Wave Money in Wave’s mobile app

You can access Wave Money on the Wave mobile app by clicking Banking on the bottom menu. Once you sign up, you can send money directly from the app and receive payments directly into your Wave checking account. You’ll also be issued a virtual card, which you can use right away both online and in-store.

There are no minimum daily balance requirements, account opening fees, monthly fees, transaction fees, and cash withdrawal fees on Wave’s surcharge-free ATM network. However, you can only view Wave Money information on your mobile device as it’s unavailable on desktop. See Wave on Google Play or Wave on App Store .

Are you interested in learning about other free options and how Wave compares? Our guide to the best free accounting software evaluates Wave and its competitors.

Spoiler alert: We chose Wave as the best overall for unlimited users.

How Wave Makes Money: Pricing & Business Model

Wave’s pricing.

Wave’s accounting, invoicing, and receipt scanning features are completely free. Wave Financial also offers the following services for an additional fee:

- Credit card payments: 2.9% plus 60 cents per transaction or 3.4% plus 60 cents per AMEX transaction

- Bank payments: 1% per transaction with a $1 minimum fee

- Wave Payroll: Fixed monthly cost of $40 for tax service states or $20 for self-service states plus an additional $6 per month per active employee or independent contractor.

- Wave Advisors: $149 per month for bookkeeping support

- Accounting and payroll coaching: $379 per coaching session and email support

Wave’s Business Model

Wave makes money by attracting businesses with Wave Accounting, which is free and offers good accounting, invoicing, bill pay, and receipt scanning features. Businesses that sign up for Wave Accounting are offered additional services that easily integrate with the free accounting software.

The additional services are reasonably priced, and there is no pressure or effort to force users to subscribe. Users who decline the paid services can continue to use Wave Accounting for free. Here’s a breakdown of Wave’s revenue-generating sources:

- Payment processing fees: Wave offers payment processing services that allow small business owners to accept credit card payments and bank transfers from customers. It charges a transaction fee for each payment processed through its platform, which typically is a percentage of the transaction value.

- Payroll processing: Wave also offers a payroll processing service, which lets small business owners manage their employees’ payroll and compliance needs. The company charges a fee for each payroll transaction processed through its platform.

- Partnerships and integrations: Wave also generates revenue from partnerships and integrations with other financial service providers. It partners with banks, financial institutions, and other software providers to offer its users additional financial services and integrations, which can result in referral fees or revenue-sharing agreements.

The History of Wave Financial, Inc.

Wave Financial, Inc. was founded in 2009 by Kirk Simpson and James Lochrie in Toronto, with the mission of helping small business owners manage their finances more efficiently. The company initially started as a free online accounting software but has since expanded its offerings to include payment processing, payroll, and invoicing tools.

In 2019, H&R Block, a leading tax preparation company, acquired Wave Financial for approximately $405 million. The acquisition was aimed at expanding H&R Block’s digital offerings and providing more services to small business owners. Despite the acquisition, Wave Financial continues to operate independently and serves more than 400,000 small business owners across the globe.

The company’s success has been driven by its user-friendly platform, affordable pricing, and commitment to providing high-quality financial management tools to small business owners. With the continued growth of the small business sector and the continued demand for digital financial services, Wave Financial is well-positioned to continue its growth trajectory and expand its services to serve a wider range of customers.

Frequently Asked Questions (FAQs)

How much does wave accounting cost.

The Wave Accounting platform is free to use for its core features such as accounting, invoicing, and receipt scanning. However, Wave Financial charges a fee for additional features, such as payroll and payment processing.

Is Wave Accounting easy to use?

Yes, Wave is known for its user-friendly interface and intuitive design. The software is designed to be simple to use, even if you don’t have an accounting background.

Does Wave Accounting have a mobile app?

Yes, Wave has a mobile app for Android and iOS devices, though there are very limited features. It offers invoicing, receipt scanning, and expense tracking, but you can’t set up and create projects, track time worked, categorize bank transactions, and view reports.

Does Wave Accounting provide customer support?

Yes, Wave provides customer support via a chatbot, email, and self-help library. Live chat is also available to customers using one of Wave’s paid services.

Bottom Line

Wave Financial is a comprehensive financial management solution that can help small business owners manage their finances easily and efficiently. With its user-friendly features, such as invoicing, payment processing services, assisted bookkeeping, payroll, and access to free business checking for single-owner businesses, it is an excellent choice for small business owners seeking an affordable solution for accounting, payroll, invoicing, and payment processing.

About the Author

Find Danielle On LinkedIn

Danielle Bauter

Danielle Bauter is a writer for the Accounting division of Fit Small Business. She has owned Check Yourself, a bookkeeping and payroll service that specializes in small business, for over twenty years. She holds a Bachelor's degree from UCLA and has served on the Board of the National Association of Women Business Owners. She also regularly writes about business for various consumer publications.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

API Reference

Api key management, rate limiting, error details, status codes, transaction type, the balance object, retrieve balance, request parameters, return attributes, the checkout session object, create a checkout session, retrieve a checkout, retrieve a checkout by transaction id, refund a checkout, expire a checkout, checkout session errors, payment errors.

Wave Business APIs provide a programmatic means to work with your Wave business account. Using these REST APIs, you can collect money and check the balance on your wallet. To use these APIs, you need a Wave business account.

For an overview and quick start instructions, see our Getting Started with the Wave Checkout API guide.

All the endpoint paths referenced in the API document are relative to a base URL, https://api.wave.com .

Authentication

Wave APIs use HTTP bearer authentication with API keys. Each request must contain an authorization header specifying the bearer scheme with the api key, for example Authorization: Bearer wave_sn_prod_YhUNb9d...i4bA6 (note that the actual key is much longer but for documentation purposes most of the characters have been replaced by an ellipses).

Wave will assign an API key to identify your account. Since API keys can be used to perform any API request, including those which move money and access sensitive information, you must take care to keep your key secret. Your key should not be shared, stored anywhere but your own servers, or used from client-side code.

You manage your API keys through the developer's section in the Wave Business Portal . You can create, view, and revoke keys, and define which specific APIs each key has access to.

When you create a new API key, you will only see the full key once. Make sure you copy it without missing any characters, since it will be masked afterwards for security reasons. Wave doesn't know your full key, but if you contact API support we can identify them by the last 4 letters that you see displayed in the business portal.

Wave APIs are rate limited to prevent abuse that would degrade performance for all users. If you send many requests in a short period of time, you may receive 429 error responses.

Here's an example of how you can construct a POST request with Authorization and Content-Type headers and JSON data:

Wave API requests use HTTP bearer authorization and, for those with a body, JSON format and UTF-8 encoding. All requests should be sent with HTTPS.

Wave API requests use the HTTP GET or POST methods.

The GET method is used to retrieve resources. GET requests are idempotent and will not change any data on the server.

The POST method is used to create new resources.

For authentication, the Authorization header must be included in the request. The value consists of the auth scheme, Bearer followed by the api key:

Authorization: Bearer <API key>

For requests which include a body, the Content-Type header must specify that the body is JSON:

Content-Type: application/json

Some Wave API requests include data. That data must be in JSON format and use UTF-8 encoding.

Wave API responses use HTTP status codes to indicate whether a request has been completed successfully. 2xx codes indicate that the request was successful received, understood and accepted. 4xx codes signal a problem with the request from the client and 5xx codes indicate a problem on the server end. See Errors for more information about error responses.

For a response to a successful API request, the message body contains information provided by the server in JSON format (using UTF-8 encoding).

For a response to an unsuccessful request, the message body includes details about the error in JSON format (using UTF-8 encoding). Minimally, this includes a short error code and a longer user-readable message describing the reason for the failure.

When an API request cannot be completed successfully, the response provides information about the failure in the message body and in the HTTP status code.

Here's what the message body of a response to an invalid request might look like:

In response to unsuccessful requests, Wave provides details about the error in the message body. This includes, minimally, a short code and longer user-readable message describing the error. For validation errors, Wave may also provide details of what failed including the field that failed validation and the problem with it.

The general reason for the failure is reflected in the HTTP response status code. 4xx codes signal a problem with the request from the client and 5xx codes indicate a problem on the server end. Specific details of the problem are provided in the message body.

Some of the status codes we return are listed below.

Data formats

Some of the parameters in Wave API requests or attributes in API objects follow specific data formats.

All amounts are represented as strings. When the amount includes decimal places, the separator is a period ( . ). The following rules apply to valid amounts:

- Include between zero and two decimal places. (See Currency for the maximum number of allowed decimal places for each currency.)

- No leading zeroes where the value is one or greater.

- One leading zero where the value is less than one.

- May include trailing zeroes.

- Must be positive for requests. May be zero or negative in object attributes.

Standard ISO 4217 three-letter codes in upper case are used to specify currency. The code for the West African Franc is XOF . Decimal places are not allowed for XOF currency amounts.

Timestamp values follow the ISO 8601 standard. Timestamps that we provide in API objects will be of the form YYYY-MM-DDThh:mm:ssZ where the Z indicates the UTC time zone.

Visit the Webhooks documentation

Balance API

ENDPOINTS: GET /v1/balance

The Balance API provides a programmatic means to retrieve the balance on your wallet.

BALANCE OBJECT

The Balance object represents the amount of money in a Wave wallet.

amount string Balance amount.

currency currency Three-letter ISO 4217 currency code.

GET /v1/balance

Retrieves the current balance of the account associated with the API key used to make the request.

No parameters.

Returns a balance object for the account associated with the API key used to make the request.

Retrieve your transactions

GET /v1/transactions

Example response

Returns a list of transactions of your account for a given day. Uses pagination if the number of transactions exceeds 1000 entries. The transactions are ordered from older to newer.

URL parameters are passed in the form of https://api.wave.com/v1/transactions?date=value1&after=value2 .

Example page info object

If the number of items of an API request is too many to return in a single request, then the results are paginated. The cutoff amount depends on the API, for example the Balance API transactions export is limited to 1000 transactions.

You can simply iterate through the pages by calling https://api.wave.com/v1/<endpoint>?after=<end_cursor> .

Checkout API

ENDPOINTS: POST /v1/checkout/sessions GET /v1/checkout/sessions/:id GET /v1/checkout/sessions GET /v1/checkout/sessions/search POST /v1/checkout/sessions/:id/expire POST /v1/checkout/sessions/:id/refund

The Checkout API provides a programmatic means to allow you to prompt users from a website or a mobile app to send payments.

CHECKOUT SESSION OBJECT

The Checkout Session object contains details about the requested payment and its status.

id string Unique identifier for the Checkout Session object. Up to 20 characters.

amount string Total amount to collect from the customer (gross of fees).

checkout_status enum The status of the checkout, one of open , complete , or expired .

client_reference string (optional) A unique string which can be used to correlate the checkout session and subsequent payment with your system. You provide this value in the request to create a checkout session.

currency string Three-letter ISO 4217 currency code.

error_url string The URL the customer will be directed to if an error occurs on a payment attempt.

last_payment_error hash (optional) The reason for the last failed payment attempt. Can only be populated when the payment_status is processing or cancelled . Contains the following fields:

code string A short string indicated the error code.

message string A human-readable description of the error.

business_name string The name of the business as it will be shown to the customer.

payment_status enum The status of the associated payment, one of processing , cancelled , or succeeded .

aggregated_merchant_id : string (optional) The aggregated merchant id used for this checkout transaction.

restrict_payer_mobile : string (optional) This checkout session can only be paid by the Wave account with this number. Note: this field was previously called enforce_payer_mobile , so both are currently returned.

success_url string The URL the customer will be directed to if the payment succeeds.

transaction_id string A Wave transaction ID that is also visible in the user's app.

wave_launch_url string A URL which will open the Wave app to initiate the checkout or give instructions for completing the checkout if Wave is not installed on the device.

when_completed ISO 8601 timestamp UTC time at which the checkout session either succeeded or expired. Not populated when the checkout_status is open .

when_created ISO 8601 timestamp UTC time that the checkout session was created.

when_expires ISO 8601 timestamp UTC time at which the checkout session will expire. By default, checkout sessions expire 30 minutes after their creation. After expiration, payments will not be accepted for the checkout session.

POST /v1/checkout/sessions

Creates a Checkout Session object.

aggregated_merchant_id string (required for Aggregators) An aggregated merchant ID to use when making this transaction. This is only available to specific businesses and will return an error if you provide it but don't have permission. If you would like to use this feature, please contact your Wave support representative.

client_reference string (optional, up to 255 characters) A unique string that you provide which can be used to correlate the checkout in your system.

restrict_payer_mobile string (optional) If you provide this, then the checkout session can only be paid by the Wave account with the specified mobile number. This is a feature that can help you protect your users from scams. Phone numbers follow the E.164 standard. They must include a country code preceded by +. Note: this field was previously called enforce_payer_mobile . This field is also still accepted for compatibility reasons, but the new name is preferred.

error_url string The URL the customer will be directed to if an error occurs on a payment attempt. You must provide a fully-qualified address using https as the scheme. You may include any information you need in the path itself or in query parameters.

override_business_name string (optional, up to 255 characters) DEPRECATED If Wave has supplied you an aggregated_merchant_id , please use that instead. This field will eventually be removed in favor of an aggregated_merchant_id .

In some cases, you may want to show the customer a different business name than is on your Wave account. This is only available to specific businesses and will return an error if you provide it but don't have permission. If you would like to use this feature, please contact your Wave support representative.

success_url string The URL the customer will be directed to if the payment succeeds. You must provide a fully-qualified address using https as the scheme. You may include any information you need in the path itself or in query parameters.

Returns a Checkout Session object.

GET /v1/checkout/sessions/:id

Retrieves a Checkout Session object.

Returns a Checkout Session object if a valid identifier was provided. Returns an checkout session error otherwise.

GET /v1/checkout/sessions

Search for checkouts

Retrieves a list of Checkout Session objects that match the search criteria.

GET /v1/checkout/sessions/search

POST /v1/checkout/sessions/:id/refund

Refunds the user payment associated with a Checkout Session.

Returns an empty body and an HTTP 200 Success code when the payment is refunded, and an error otherwise. If the Checkout Session doesn't exists this returns an HTTP 404 Not Found error.

If you try to refund a checkout twice, no additional transaction will be created, but this endpoint will simply return HTTP 200 Success again.

All normal transaction restrictions apply: if the recipient has reached their monthly limit or their account is for any reason blocked then the corresponding error is returned as well.

POST /v1/checkout/sessions/:id/expire

Expires an open Checkout Session, preventing it from being completed by any user.

Returns an empty body and an HTTP 200 Success code when successfully expiring the session. Can also return the following errors:

- 404 Not Found : If no Checkout Session is found with the provided id

- 403 Forbidden : If your API key has no permission for this endpoint

- 409 Conflict : If the Checkout Session was already completed or expired

Checkout API errors

A couple of things can go wrong when attempting to create a checkout session, or when a user tries to pay an existing session. The following is the list of errors that can occur when using this API.

This is in addition to the general HTTP code that can be returned as described in the errors section.

These errors will be delivered as part of the webhook that notifies your system of a failed checkout payment attempt. They basically answer why the payment of the user failed. The code will be under the last_payment_error field of the webhook body.

Added aggregated_merchant_id details to the Checkout API.

The Checkout API now validates decimal places following the rules described in the Amount section.

Adds override_business_name details to Checkout API

Initial release of Checkout and Balance APIs.

Most popular funds

- Vontobel Fund - Emerging Markets Corporate Bond

- Vontobel Fund - Emerging Markets Debt

- Vontobel Fund - Euro Corporate Bond

- Vontobel Fund - Global Corporate Bond

- Vontobel Fund - Global Environmental Change

- Vontobel Fund - Global Equity

- Vontobel Fund - mtx Sustainable Asian Leaders (ex Japan)

- Vontobel Fund - mtx Sustainable Emerging Markets Leaders

- Vontobel Fund - TwentyFour Absolute Return Credit Fund

- Vontobel Fund - TwentyFour Strategic Income Fund

- Vontobel Fund - US Equity

- Vontobel Fund II - Active Beta

- Vontobel Fund II - Global Impact Equities

The Vescore Wave – a superior business-cycle model

The Vescore Wave is our proprietary business-cycle model. We use it to identify the current state of the business cycle for 50 countries, based on a big-data approach.

From our standpoint, timely anticipation of the transition between business cycle states is key for the success of tactical asset allocation decisions. The models we developed deliver information about the current state (state model) and the most probable future state (transition model). Our Vescore Wave has a strong track record in anticipating business-cycle developments usually ahead of standard economic leading indicators. Therefore, we believe it is relevant for investors and policy makers alike.

Why should investors care about the business cycle?

It is not easy to dispel skepticism among those investors who doubt that economic forecasts are useful for investment decisions. Are they discouraged by the fact that downward revisions often come too late because the accuracy of predictions tends to wane in the run-up to economic downturns or recessions 1 ? Or do they refrain from relying on economic forecasts because these usually depend on assumptions of many unknown parameters?

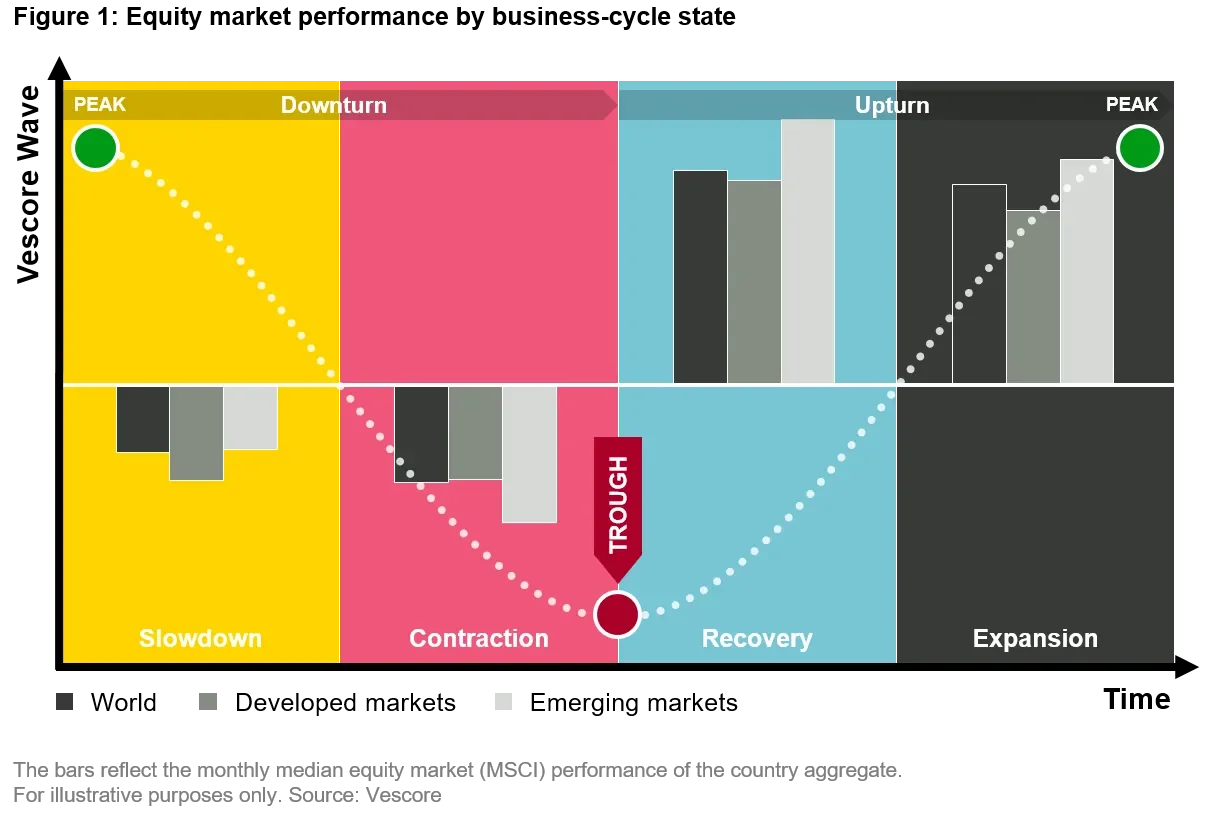

In this respect, we have good news: There is no need for complex economic forecasts to make fruitful investment decisions. In our view, the key for successful asset allocation is deriving the right information about business-cycle states rather than making accurate GDP forecasts. We know from the past that risky assets tend to deliver positive returns in the upturn, whilst their performance is underwhelming in the downturn 2 . Hence knowing the state of the business cycle is sufficient to make a big difference in the asset allocation (see figure 1). This is why, by means of our Vescore Wave, we aim to derive information about the current business-cycle state and the most likely transition path ahead (transition probabilities).

State model

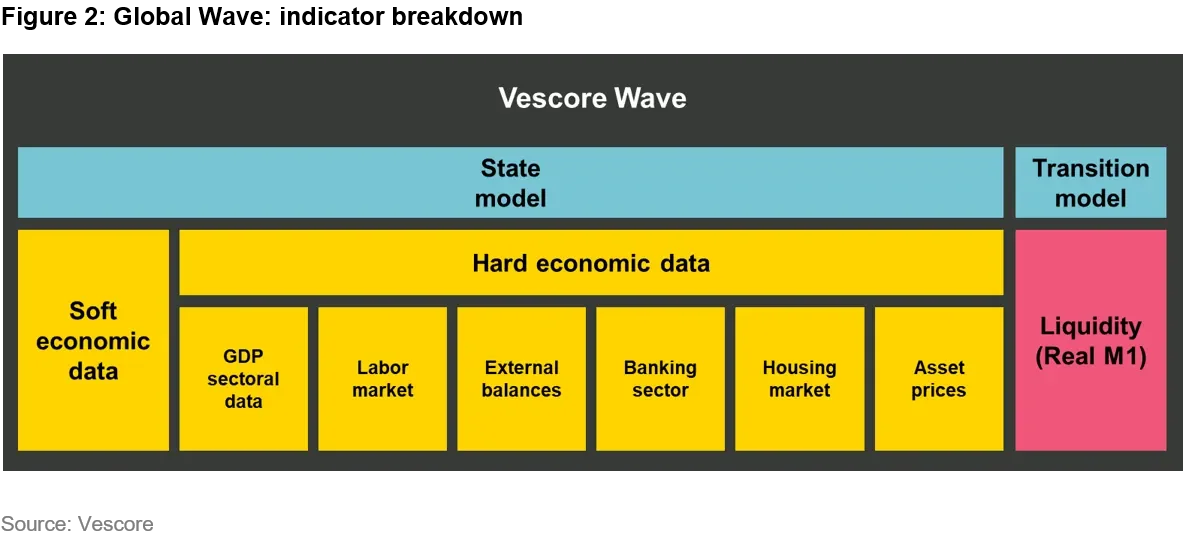

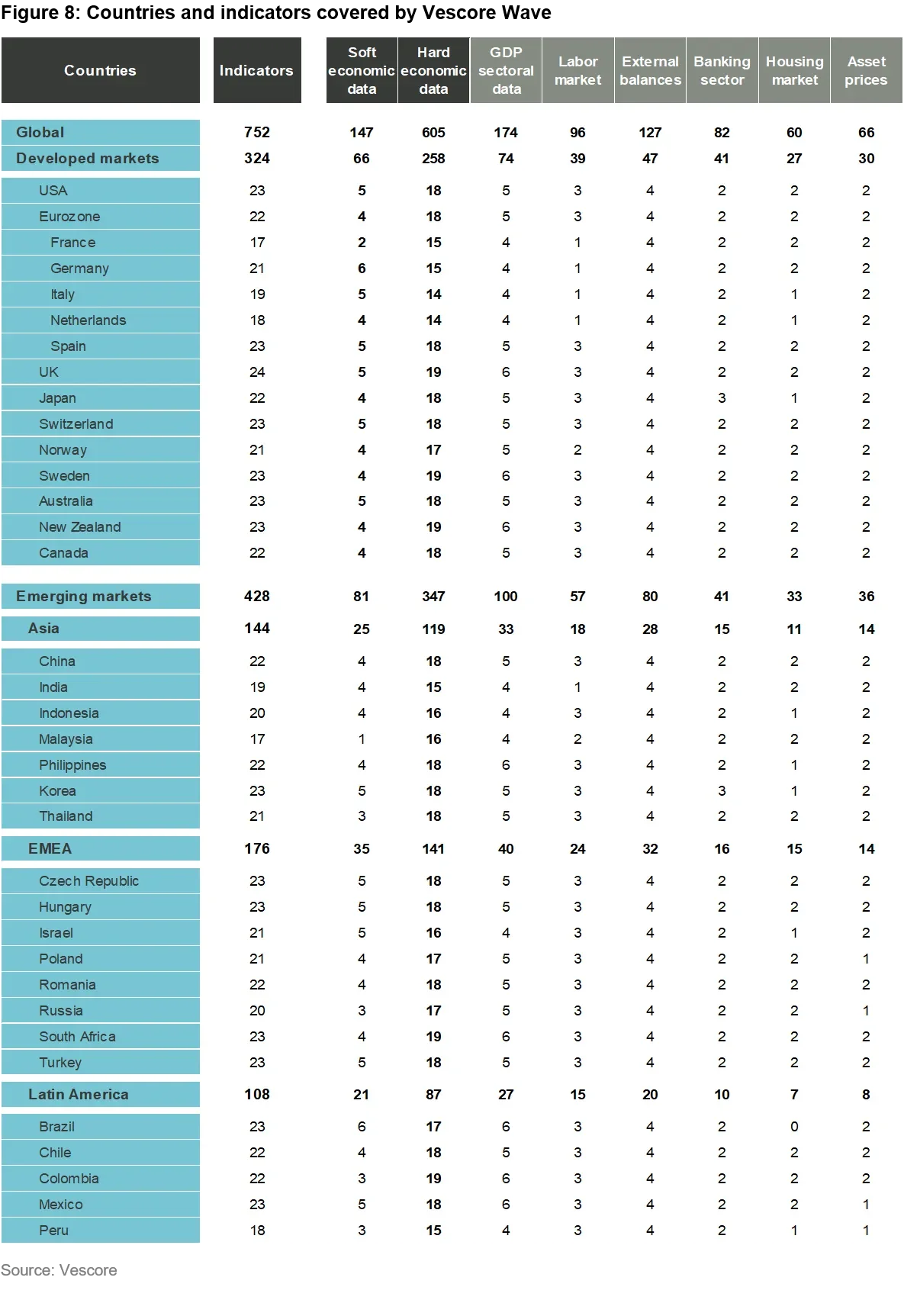

The state model signals in which of the four states of the business cycle – slowdown, contraction, recovery, or expansion (shown in figure 1) – we are. Model output is available on country, regional, and global level. We apply a big-data approach to derive information about the state. On the highest level of aggregation – the Global Wave – we currently process more than 750 economic-data time series, dating back to the 1990s where available, to compute the current business-cycle state of the global economy. Computation of the state starts on a country level, considering 50 countries. The algorithm derives the necessary information from 20 to 25 economic-data time series. Data may slightly vary from country to country, depending on data availability and individual economic structures. On a country level, we weight the indicators equally with the aim to get insight into the breadth of economic developments. All indicators used are grouped in categories (see figure 2; for a detailed overview of countries and indicators covered see figure 8).

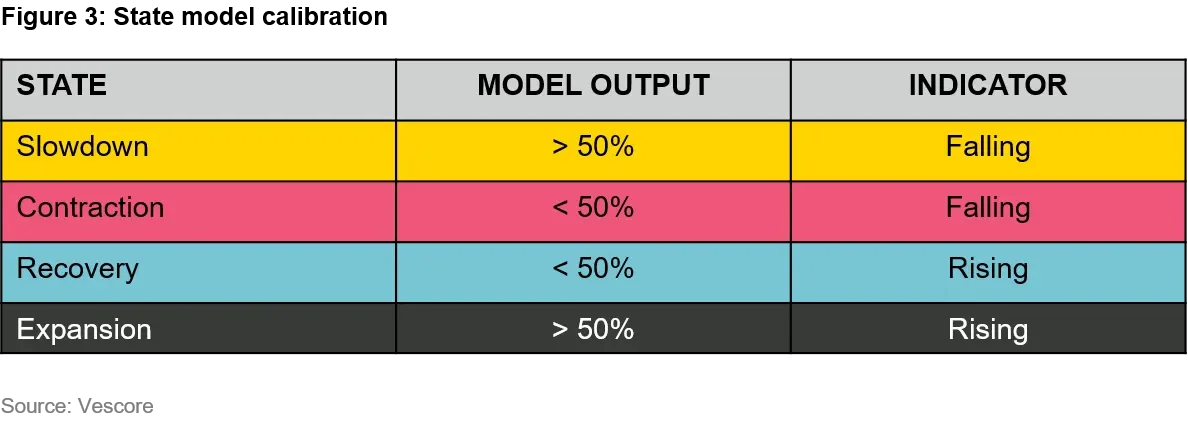

The state model’s output shows the percentage share of those indicators that lie above trend 3 . Regional and global aggregates are weighted according to the size of each country’s nominal GDP (in USD). The Vescore Wave defines that we are at the threshold between the upper and lower half of the business cycle when 50% of the indicators lie above trend. As shown in figure 3, we can derive from a falling indicator that we are in an economic downturn (left half in figure 1) and from a rising indicator that we are in an upturn (right half in figure 1).

How astute is our state model?

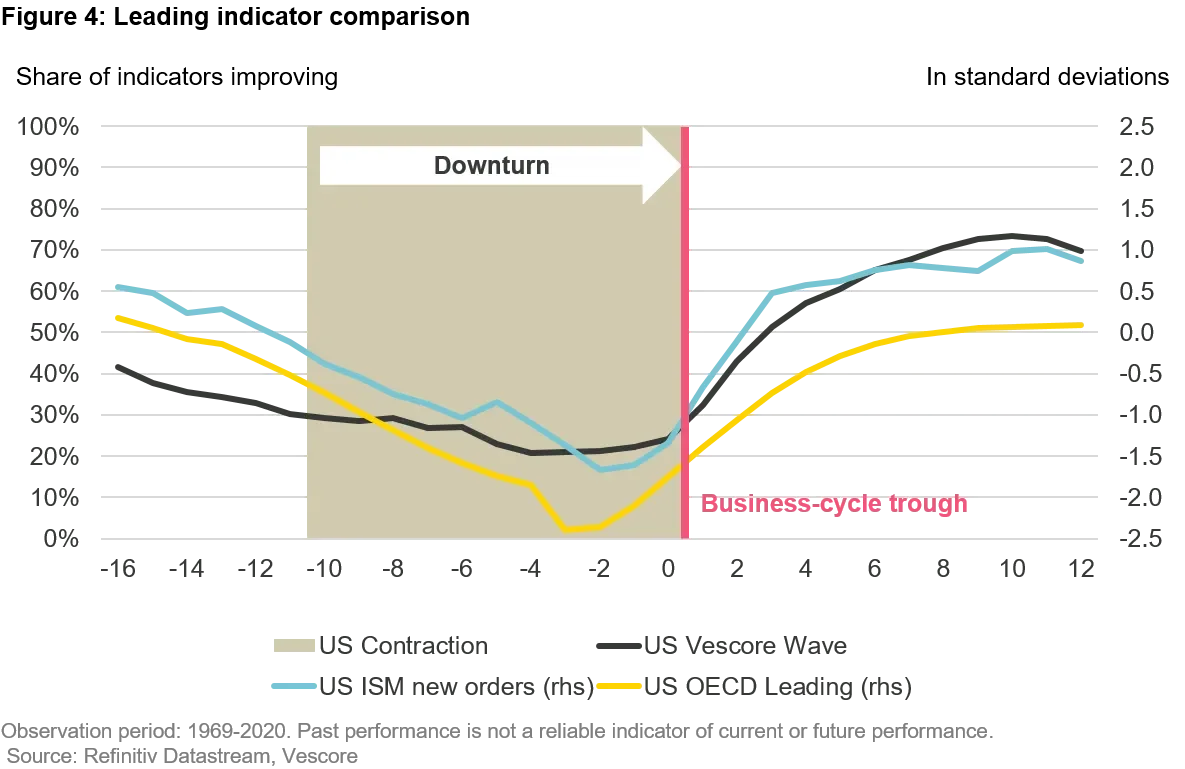

Figure 4 shows the behavior of different leading indicators around the economic trough for the US economy, and figure 5 summarizes the results for the US economy. On average over the past 50 years, both the PMI and OECD indicator anticipated the economic trough two to three months in advance, whilst our Vescore Wave’s state model beat them by anticipating the trough more than one month earlier than they did. Therefore, our state model has the potential to harvest higher equity market gains when it is used for tactical asset allocation.

What drives investors into risky assets well ahead of the economic trough?

The answer is simple: their belief that the worst is over and things are improving. This makes the equity market another early forecaster of turning points in the business cycle (see figure 5), and corroborates how important it is to know when the cycle is in transition from one to another state in order to make the right investment decisions.

Transition model

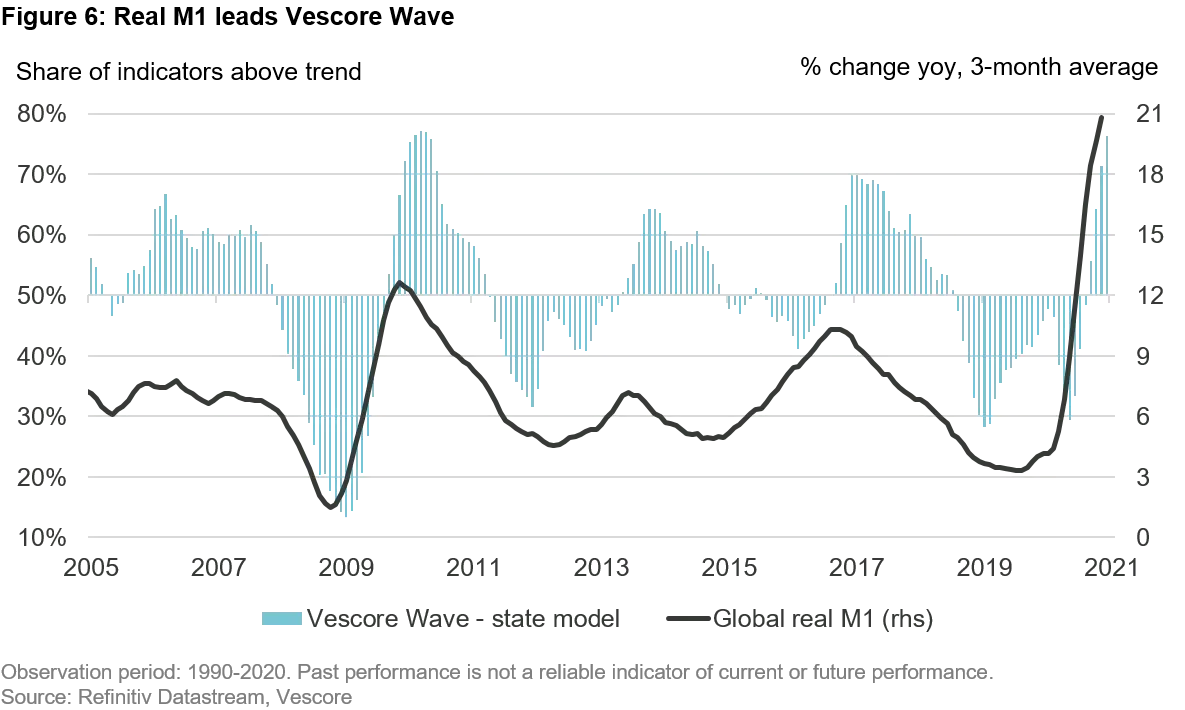

Our transition model derives information by evaluating the effectiveness of policy stimulus measures. Its output are transition probabilities indicating how likely it is that the economy will move into a different business cycle state in the month to come. There are different ways of measuring policy stimulus. Central bank stimulus, for example, can be assessed directly at the source via changes in the central banks’ policy rates or balance sheets, or indirectly via financial market indicators. None of these indicators by itself can provide a complete picture, but if the policy measures are credible, and thus effective, they are likely to impact the money supply of the economy. As policy shifts need time until they trickle through to the economy, economic data tends to reflect policy stimulus much later than money supply data. Therefore, we are using the information from our preferred liquidity indicator, real M1, which has a good track record in anticipating shifts between business cycle states 4 (see figure 6). This further improves our model’s signaling of transitions between business cycle states.

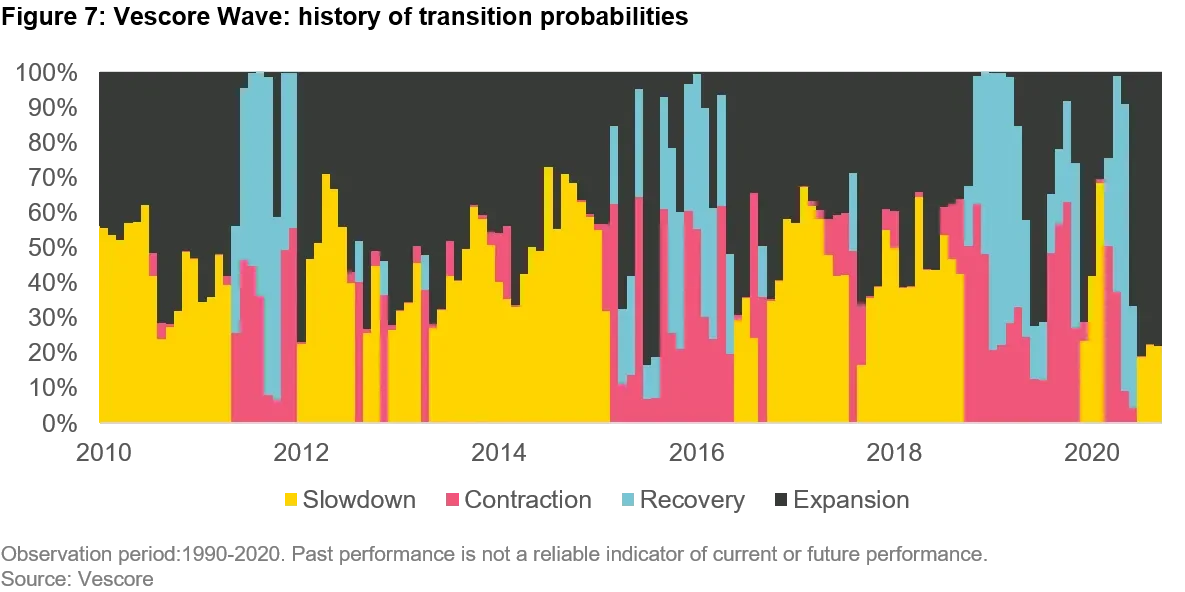

The transition model capitalizes on the lag between the policy stimulus, measured by real M1, and the current state of the business cycle. We use our liquidity indicator to assess how probable it is that the economy will remain in the current state or enter one of the three other states. Figure 7 shows the state probabilities calculated in each month for the month to come. In the current expansion state, our transition model predicts a high probability (black bar) that we will remain in expansion next month. On average over the past 20 years, our transition model was able to anticipate turning points in the business cycle one month earlier than our state model with an accuracy of 65%.

We are convinced that knowing the current business-cycle state and the transition probabilities between the states gives an advantage for tactical asset allocation decisions and thus matters to investors. In this respect, our Vescore Wave can serve well because, on average over the long-term past, it has proven superior to standard private- and public-sector leading indicators in anticipating turning points in the business cycle.