- iPropertyManagement

- Real Estate Investing

- Start Rental Business

How to Start a Rental Property Business in 7 Steps

Last Updated: March 29, 2024 by Cameron Smith

To start a rental property business, you’ll need to figure out your financial goals, property acquisition, financing, property management, corporate business structure, and much more.

What is a Rental Property Business?

A rental property business simply means that you’re earning income from at least one rental property. Some people see their business as a way to earn a few extra hundred dollars per month while the property appreciates, while others have thousands of properties that earn millions of dollars per year.

One huge benefit of owning a rental property business is that rental income isn’t subject to self-employment tax. It’s reported to the IRS as ordinary income, so the government doesn’t categorize your rental income as coming from a business.

Why You Should Invest in Rental Properties

Many investors will tell you that owning property is the best investment out there. There are a lot of reasons for this, including:

- Appreciation. Your property is going to go up in value significantly over time.

- Leverage. You can purchase a property with only 20% down and finance the rest. Any gains made on the value come back to you as if you’d bought the entire property with cash.

- No mortgage payment. Your tenants cover the mortgage on your asset.

- Cash flow. Done right, you should also be earning some cash flow. This may be small in the beginning, but as rental prices increase, you’ll earn more and more.

- Tax benefits. You can deduct most expenses for your rental business. You can even deduct the value of the house spread out over 27.5 years (known as depreciation).

- Asset control. You get full control over when you decide to sell, the improvements you want to make, and who gets to live in the property. This isn’t the case when you buy a stock.

How to Start a Rental Property Business

To get your rental property business running, here are the steps you’ll want to take:

- Develop Your Goals

- Decide How You’ll Find Properties

- Determine Financing

- Get the Property Ready to Rent

- Manage the Property

- Plan for Unexpected Costs

- Systematize

1. Develop Your Goals

The main thing to ask yourself when developing your goals is this:

What does your perfect rental business look like?

From there, you can start brainstorming. Get as specific as you like, because it’s often those kinds of details that help your business solidify in your mind.

Here are a few things that you should consider addressing when answering this question and setting goals:

- How much money do you want to earn per month or year from rental income?

- How many properties do you need to hit this income goal?

- How long until you want to hit this goal?

- How many properties do you need to acquire per year?

- Are you only going to work with rental properties, or use other strategies as well?

- Are you planning to manage the properties yourself?

- What’s your exit plan for the properties? Do you want to sell them at a high point, when you retire, or never?

- Are you planning to pay off the rentals as quickly as you can or make the minimum mortgage payment?

There are plenty more that you can ask at this point, but much more will be answered in the next steps of starting your rental business.

2. Decide on Property Acquisition

If you’re considering a rental property business, then you’ve likely already thought about how you want to acquire properties.

However, it can be different for your first property than it is for acquiring many properties over the years.

Acquiring your first property

Many investors get into their first rental property when they want to move and turn their current home into a rental unit.

New investors like this strategy because it’s simple. You already know the neighborhood, the condition of the house, and what upkeep it needs. A new, strange house can be scarier to rent out.

It can also be cheaper to acquire a house this way, as you might be able to buy your new home using an FHA loan. This means you can pay 3.5% down rather than 20%.

If your current home is an FHA loan, you’ll need to refinance before you can purchase your next home with an FHA loan. You can’t hold two at the same time.

If you are interested in buying a separate rental property, you’ll likely be required to put 20% down. Some people choose to buy brand new properties, as they require less maintenance at first. Many new investors find that a less scary prospect.

3. Determine Financing

The scariest part of getting into a rental property is bringing that initial chunk of cash. Generally, if you’re looking at a $500k property, you’ll need $100k cash on hand to make the deal work.

However, there are other ways that you can find ways to finance your rentals:

- BRRRR – This stands for Buy, Rehab, Rent, Refinance, Repeat. Basically, you treat the house as if you’re going to do a fix and flip where you first secure a hard money loan (some have 0% down options). Then, instead of reselling the house, you refinance into a long-term loan and rent out the house.

- Find a Partner – If you’re willing to do the work of finding and managing the rental, you can often find someone who’s willing to put up some or all of the money upfront for you. You can go to your friends and family, but also networking at events is a great way to find partners.

- Refinance Your House – If you can pull $100k out of your home’s equity, that’s the easiest possible solution.

- Home Equity Loans – Rather than pulling out equity, you can borrow against your equity and pay it off over time.

4. Preparing the Property

Now, you’re the proud owner of a new rental property. Is it time to throw it up on the market?

Rarely will your property be 100% rental-ready. Consider a brand new home, for example. There’s a good chance you’ll need to landscape the yards, install curtains, purchase a fridge, and do whatever else is necessary to make it a liveable property.

If you’ve purchased an older house, some maintenance will be necessary.

With rentals, it’s important to make the place look nice, but not to go overboard. Sure, you may think the property would look better with new marble countertops, but how long will it take to earn back that cost in rental income?

In many cases, your best options are to fix anything that is obviously broken, give the walls a fresh coat of paint, and professionally clean the carpets. These are lower-cost activities that still make the property presentable.

5. Manage the Property

The ongoing management of the property takes a lot of work with many moving parts to sort out. Here are just some of the tasks you’ll have to figure out:

- Marketing your rental . Are you going to run Facebook ads? Put up signs in front of the property? Which rental listing sites are you going to use? You’ll also have to write headlines and descriptions for these sites as well.

- Screening applications. You’ll need to decide on a tenant screening service and what your minimum requirements are for credit scores, bankruptcies, and more. You’ll also need to check in on references (landlords, employer, personal) and also conduct open houses with a bit of an interview with attendees.

- Property maintenance requests. When something goes wrong, the tenants need to call someone to get it sorted out. Will that person be you? If so, you’ll need to have trusted vendors on speed dial.

- Emergency response. If the house floods in the middle of the night, you’ll need a plan for handling it.

- Regular communication. You’ll need to schedule inspections, handle complaints, and communicate about lease end dates and possible renewals.

DIY or Property Manager

Of course, much of managing a property can be outsourced to a property manager. You’ll sleep better at night and have more free time.

However, you might also eat through the last of your thin monthly margin. Is it worth having little-to-no passive income at the beginning to hire a property manager?

Many investors will handle the upkeep for a few properties in order to pocket more money. However, upon expansion, you’ll certainly need a property manager who can spend much more time than you can (or want to).

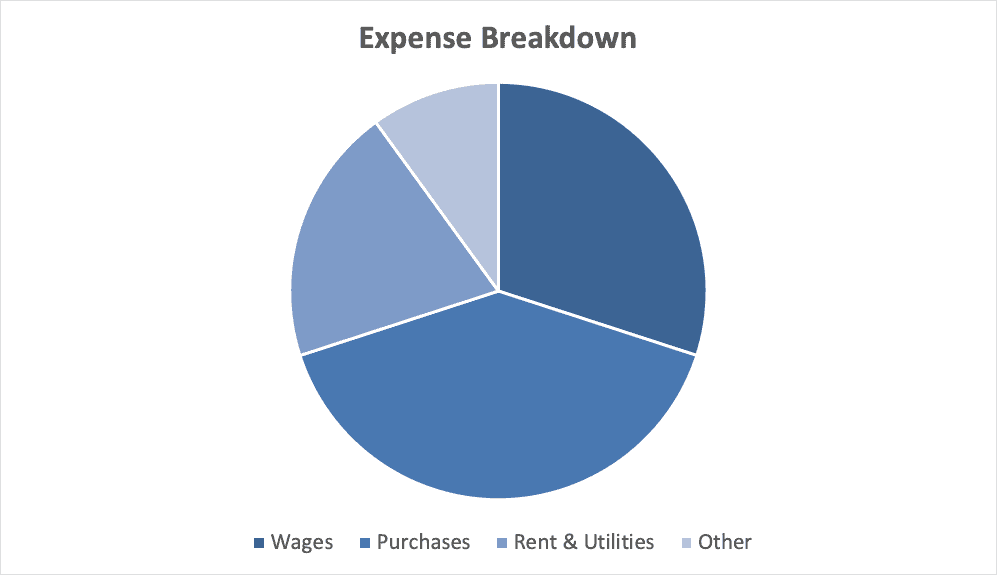

6. Manage Finances

If you’re going to run your rentals like a true business, that means that you need complete transparency and understanding about what’s happening to every penny.

There’s nothing worse than realizing you have a big tax bill with nothing set aside or confusion about why your business is in the red.

At the very least, you should keep a spreadsheet with all of your income and expenses. One of the easiest ways to manage this is to keep an entirely separate bank account so all of the funds are easy to manage.

Then, be sure that you understand future costs. This includes taxes, planned renovations, vacancies (where you have to cover the mortgage), and emergency repairs. Without money set aside for these, your business may be short-lived.

7. Systematize and Grow

All the steps covered so far are generally more for starting and managing your first few rental properties.

But if you’re planning to expand into dozens or hundreds of rentals, you’ll need to figure out a few more things along the way.

Mass Acquisition of Properties

When it’s time to scale, it’s likely going to become too time-consuming to evaluate every property from scratch. It’s not efficient to research an entirely new area or type of property with each property you want to acquire.

For this reason, it makes sense to pick a niche. For example, some people buy up student housing near a single university. You can quickly understand rent prices and know exactly how much you can pay for a new property. Research becomes automatic.

Or perhaps, you only buy new townhomes within a certain part of a single city. Or, you decide to do a lot of research at once and go in on a large apartment building.

Funding Properties

Funding a property or two at the beginning is much different than funding dozens in a short amount of time. If you’re lucky enough to have a bunch of cash on hand, perhaps you can afford to keep putting down 20% yourself on every property.

Or, maybe you’ll need to refinance those first few properties to afford adding more to your portfolio, although that isn’t a well that you can draw from forever.

Often, your best solution is to find a financing partner. Rather than a bank with strict rules and regulations, you can find a private lender who may be willing to put up all the money while you handle the business side of things.

This goes much easier once you already have a portfolio of successful properties.

Property Manager

As mentioned before, you’ll certainly need a property management company to handle your properties once you have several in your portfolio.

At some point, it may also make sense to hire a full-time property manager who works only for you. Many owners prefer this because they can retain more control than they could by handing everything to a third-party company.

You’ll likely need an online rental management software that can handle things like:

- Collecting rental applications

- Sending and collecting signed contracts

- Collecting rent

- Recording rent

- Taking maintenance requests

Business Structure

You’ll certainly want to form your rental business into an actual company, and there are plenty of options at your disposal.

A common one is to form an LLC , but be sure to talk to a lawyer before settling on a final decision. The tax implications alone can be enormous.

Top Reasons Rental Owners Quit and How to Avoid Them

Rental property owners often get frustrated and decide to sell their properties, sometimes on a whim to a fix & flip investor who sent them a postcard.

While it may end up being the right decision for you, it does mean you’re missing out on the long-term appreciation.

Here are three of the most common reasons rental owners quit and how you can protect yourself against those reasons.

Bad Tenant Behavior

Every rental owner has nightmares about showing up to their property one day and seeing the windows broken, the walls graffitied, and everything inside destroyed.

Landlords who get in this situation and then receive a postcard from an investor who wants to buy the home may find this offer tempting.

Tenants can also infuriate owners with behavior such as:

- Constant maintenance requests

- Refusal to follow all lease rules

- Poor communication

- Frequent complaints

- Late rent payments

How to Avoid Bad Tenant Behavior

There are two main solutions to handling bad tenant behavior:

- Hire a property manager . The bad behavior may still be there, it just won’t be you dealing with it on a day-to-day basis.

- Find top-notch tenants . Always follow up with their employers, previous landlords, and personal references. Get the most comprehensive tenant screening reports. It’s worth a bit extra time and money to get a tenant who will treat the property like they own it.

Unexpected Costs

Most landlords deal with fairly thin margins those first few years. There’s nothing more infuriating than unexpected costs showing up and wiping out any profit you thought you’d earned.

Some unexpected costs include:

- Roof replacement

- Burst pipes

- HVAC needs to be replaced

- Long vacancies

How to Avoid Unexpected Costs

Handling unexpected costs isn’t easy, because (by definition) you can’t predict them. But, you can run your business as if there’s always an unexpected cost around the corner.

There are a few ways experts suggest for determining how much money to set aside:

- 1% – 2% of the value of your home each year

- $1 per square foot per year

Whichever method you choose, try to be generous in what you set aside. One year, your maintenance might be minimal, while the next year you might replace a roof.

In addition, unexpected costs are generally lower on new properties. While a bit pricier to purchase, it might be worth it with higher rental rates and lower maintenance.

Need Liquid Money

Perhaps another investment opportunity comes your way that you’re more excited about than a rental. Or, you might need some cash to pay off another debt or life expenses if you lose your job.

While owning rentals can be profitable, they can also be frustrating with how effectively they tie up your cash.

How to Avoid Needing Liquid Money

The best advice here is to understand that owning a rental likely isn’t for you if money is tight elsewhere. Wait until you have sufficient cash reserves before investing in a rental property (this helps you avoid unexpected costs, as well).

If you have equity in the property, consider a cash-out refinance. This can raise your monthly mortgage payment, but may be worth it to pull out a considerable lump sum.

More Property Management Resources

Benefits of Owning Rental Property

Rental Properties Business Plan Template

Written by Dave Lavinsky

Rental Properties Business Plan

You’ve come to the right place to create your Rental Property business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their rental property business.

Rental Property Business Plan Example

Below is a template to help you create each section of your rental property business plan.

Executive Summary

Business overview.

Noble Properties is a rental property agency in Seattle, Washington, that specializes in managing, renting, and leasing properties. Our mission is to provide luxury rentals that tenants can call home for years to come. Noble Properties rents out hundreds of homes across the Seattle area, including apartments, single-family homes, and trailers. To help prospective tenants find the perfect home, the company has created an online platform that allows them to search by their specific criteria (number of bedrooms, amenities, rent, etc.). We aim to be one of the most popular rental agencies in the area that customers can depend on again and again for their housing needs.

Noble Properties is founded and run by Joseph Pierce. He has worked in the industry for decades and has extensive knowledge of all aspects of the business. He will be in charge of most of the operations but will hire other staff to help with marketing, accounting, and managing the rentals.

Product Offering

Noble Properties offers a variety of properties for prospective tenants to choose from. Some of the options we provide include:

- 1-3 bedroom apartments

- Single-family homes

- Multi-unit buildings

- Short-term rentals

- Mobile homes or trailers

Customer Focus

Noble Properties will target renters located throughout the Seattle area. Most renters are under the age of 40 and earn about the median income. This means that we will primarily market to younger demographics and those who earn around the local median income or more.

Management Team

Noble Properties is led by Joseph Pierce, who has been in the rental property industry for 20 years. Throughout that time, he worked in various positions in local rental property agencies but is now eager to start a rental property business of his own. During his extensive experience in the rental property industry, he acquired an in-depth knowledge of the local area, local regulations, facilities, and the characteristics of different neighborhoods. He also has extensive experience in handling business management activities.

Karen Miller has been Joseph Pierce’s loyal administrative assistant for over ten years at his former rental agency. Joseph relies strongly on Karen’s diligence, attention to detail, and focus when organizing his clients, schedule, and files. Karen has worked in the rental agency industry for so long that she has a thorough knowledge of all aspects required to run a successful rental agency. She will help out with administrative tasks and some of the initial marketing efforts.

Success Factors

Noble Properties will be able to achieve success by offering the following competitive advantages:

- The founder, Joseph Pierce, has decades of extensive experience and knowledge of the industry that will prove invaluable for the company.

- The company will purchase rentals in popular areas around the city, putting our rentals in high demand.

- Noble Properties offers reasonable and affordable rates for all our rentals. Our pricing will be far more cost-effective than the competition.

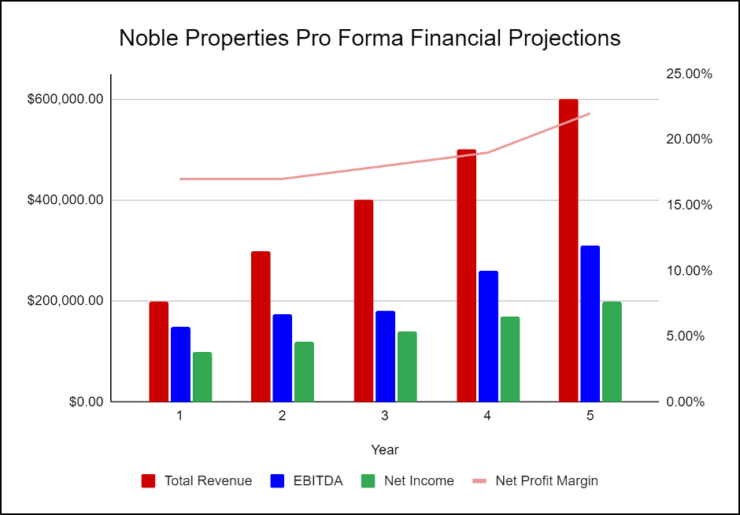

Financial Highlights

Noble Properties is seeking $1,100,000 in debt financing to launch its rental property agency. The funding will be dedicated to securing initial rental spaces, securing an office space, and purchasing office equipment and supplies. Funding will also be dedicated toward six months of overhead costs, including payroll, rent, and marketing costs. The breakdown of the funding is below:

- Purchasing initial rentals: $600,000

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $20,000

- Six months of overhead expenses (payroll, rent, utilities): $350,000

- Marketing costs: $50,000

- Working capital: $60,000

Company Overview

Who is noble properties, noble properties’ history.

After decades of working for other rental agencies, Joseph Pierce decided to launch an agency of his own. He conducted extensive research on the rental market in the Seattle area. This helped him determine the best spots to find in-demand rentals and how much he should rent them out for. He also did extensive marketing research to determine the best customer segments to market to. After conducting this research and finding a potential office location, Joseph Pierce incorporated Noble Properties as an S-Corporation.

Noble Properties’ operations are currently being run out of Joseph Pierce’s home office but will move to the office location once the lease is finalized.

Since incorporation, Noble Properties has achieved the following milestones:

- Developed the company’s name, logo, and website

- Determined rent/leasing and financing requirements

- Found a potential office location and signed a Letter of Intent to lease it

- Began recruiting key employees with experience in the rental homes/apartment industry

Noble Properties’ Products

Industry analysis.

The rental market is expected to continue to grow over the next five years. According to RentCafe, the average rent for a Seattle apartment is around $2,300 per month. This value is only expected to increase as the demand for apartments and other rentals skyrockets. Furthermore, Seattle’s vacancy rate is incredibly low and expected to decrease further, meaning there aren’t enough rentals to keep up with demand.

The growth is primarily driven by increasing housing prices. Now that housing prices have increased substantially, fewer and fewer people can afford to buy a home. Therefore, many people seek out rentals to live in since they are far more affordable.

Another factor that will help the Seattle rental market is the increasing population. More people are moving to the city, meaning the demand for homes and rentals will continue to soar. This will only push rental prices even higher, which will increase the local rental market’s value substantially.

This is a great market to start a rental agency in. By capitalizing on these trends, Noble Properties is expected to have great success.

Customer Analysis

Demographic profile of target market.

Noble Properties’ target market includes people of all demographics. We are open to offering rentals to people of all ages and groups as long as they can afford to pay their rent. From our initial market research, we expect most of our marketing efforts will target young adults, medium and high-income individuals, and families.

The precise demographics for Seattle, Washington, are:

Customer Segmentation

Noble Properties will primarily target the following customer profiles:

- Young adults

- Individuals who earn the region’s median income or more

Competitive Analysis

Direct and indirect competitors.

Noble Properties will face competition from other companies with similar business profiles. A description of each competitor company is below.

Leasing Inc.

Leasing Inc. is a marketplace for finding rental homes and apartments in multiple metropolitan areas around the country. It originally started more than a decade ago as a networking tool for real estate agents, but today it is a fully searchable online database of homes for both sale and rent. Leasing Inc. offers ideal rental properties, all with different amenities that can best suit the tenant’s requirements. Leasing Inc.’s properties are well furnished with all modern accessories and priced competitively.

Rental Barn

Rental Barn is the most visited rental agency website in the United States. Rental Barn and its affiliates offer customers an on-demand experience for selling, buying, renting, and financing with transparency and nearly seamless end-to-end service. The company’s rental property portfolio provides multiple rental apartments according to the customer’s needs and requirements.

Seattle Properties

Seattle Properties is a local rental property business that has dominated the market since 1982. The company manages and rents out hundreds of properties all across the city, including apartments, single-family homes, and mobile homes. All prices are competitive, and some rentals qualify for government programs to help low-income individuals. The company also utilizes a well-designed website to help prospective tenants find their perfect home based on rent, location, and accessories.

Competitive Advantage

- The company will purchase rentals in popular areas around the city, making our rentals in high demand.

Marketing Plan

Brand & value proposition.

The Noble Properties brand will focus on the company’s unique value proposition:

- Offering homes/apartments for rent suited for families and working professionals.

- Offering a diverse range of rental homes in a prime location for a competitive rate.

- Providing excellent customer service.

Promotions Strategy

The promotions strategy for Noble Properties is as follows:

Print Advertising

Noble Properties will invest in professionally designed print ads to display in programs or flyers at industry networking events and relevant local establishments.

Website/SEO Marketing

Noble Properties has designed a website that is well-organized and informative, and lists all our available properties. The website also lists the company’s contact information and other services it provides. We will utilize SEO marketing tactics so that anytime someone types in the Google or Bing search engine “Seattle rental properties” or “rentals near me,” Noble Properties will be listed at the top of the search results.

Referrals

Noble Properties understands that the best promotion comes from satisfied tenants. The company will encourage its tenants to refer other individuals by providing economic or financial incentives for every new tenant produced. This strategy will increase effectiveness after the business has already been established.

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The company will use social media to develop engaging content that will increase audience awareness and loyalty. Engaging with prospective clients and business partners on social media platforms like Facebook, Instagram, Twitter, and LinkedIn will also help understand the changing customer needs.

The real estate industry fluctuates, and therefore, rental prices, for the most part, are usually out of a company’s control. However, Noble Properties will market its properties at a competitive rate to ensure we do not have vacant properties. We will also keep tight control of costs in order to maximize profits.

Operations Plan

The following will be the operations plan for Noble Properties.

Operation Functions:

- Joseph Pierce will be the Owner and President of the company. He will oversee all staff and manage tenant relations. Jay has spent the past year recruiting the following staff:

- Karen Miller will serve as the Office Manager. She will manage the office administration, client files, and accounts payable. She will also handle much of the marketing efforts until the agency becomes large enough to hire a marketing team.

- Tim Johnson will be the Maintenance Director, who will provide all maintenance at the properties.

- Joseph will outsource professionals to handle the accounting and human resources aspects of the business.

- Joseph will also hire Rental Managers for the various properties as the agency continues to grow.

Milestones:

Noble Properties will have the following milestones completed in the next six months.

5/1/202X – Finalize contract to lease office space.

5/15/202X – Finalize personnel and staff employment contracts for the Noble Properties team.

6/1/202X – Begin moving into Noble Properties office.

7/1/202X – Finalize purchases of initial properties that will be rented.

7/15/202X – Begin networking and marketing efforts.

8/1/202X – Noble Properties opens its office and rentals for business.

Financial Plan

Key revenue & costs.

Noble Properties’ revenue will come from rental income, property management fees and deposits received from tenants.

The major costs for the company will be staff salaries and property maintenance. In the initial years, the company’s marketing spending will be high to establish itself in the market.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Number of Managed Properties Per Month: 10

- Average Rent Per Month: $2,300

- Office Lease per Year: $100,000

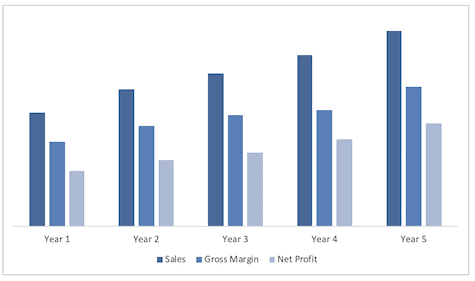

Financial Projections

Income statement, balance sheet, cash flow statement, rental properties business plan faqs, what is a rental property business plan.

A rental property business plan is a plan to start and/or grow your rental properties business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your rental properties business plan using our rental properties Business Plan Template here .

What are the Main Types of Rental Property Businesses?

There are a number of different kinds of rental property companies , some focus on Single family homes, Multi-family properties and others on Short-Term Rental properties.

How Do You Get Funding for Your Rental Property Business Plan?

Rental Property Businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding. This is true for a real estate rental business plan or a rental property business plan.

A well-crafted rental property business plan is essential to securing funding from any type of potential investor.

What are the Steps To Start a Rental Properties Business?

Starting a rental property business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Rental Property Business Plan - The first step in starting a business is to create a detailed business plan for a rental property that outlines all aspects of the venture. This should include a market analysis, information on the services you will offer, marketing strategy, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your rental properties business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your rental properties business is in compliance with local laws.

3. Register Your Rental Properties Business - Once you have chosen a legal structure, the next step is to register your rental properties business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your rental properties business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Rental Properties Equipment & Supplies - In order to start your rental properties business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your rental properties business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful rental properties business:

- How to Start a Rental Properties Business

Search Product category Any value Sample Label 1 Sample Label 2 Sample Label 3

Property Rental Business Plan PDF Example

- February 28, 2024

- Business Plan

Creating a comprehensive business plan is crucial for launching and running a successful property rental business. This plan serves as your roadmap, detailing your vision, operational strategies, and financial plan. It helps establish your property rental business’s identity, navigate the competitive market, and secure funding for growth.

This article not only breaks down the critical components of a property rental business plan, but also provides an example of a business plan to help you craft your own.

Whether you’re an experienced entrepreneur or new to the real estate industry, this guide, complete with a business plan example, lays the groundwork for turning your property rental business concept into reality. Let’s dive in!

Our property rental business plan is structured to cover all essential aspects needed for a comprehensive strategy. It outlines the rental operations, marketing strategy , market environment, competitors, management team, and financial forecasts.

- Executive Summary : Offers an overview of the property rental business’s concept, market analysis , management, and financial strategy.

- Properties, Amenities & Services: Describes the diverse range of properties, from urban apartments to countryside cottages, each equipped with customized amenities and services to cater to various guest preferences.

- Properties Deep Dive: Offers a detailed look into each property, including design style, location, key features, and financials related to purchase and renovation.

- Key Stats: Shares industry size , growth trends, and relevant statistics for the short-term rental market.

- Key Trends: Highlights recent trends affecting the short-term rental sector, such as the rise of eco-friendly properties, technology integration, and the shift towards local experiences.

- Key Competitors : Analyzes main competitors and differentiates the business based on unique property offerings and guest experiences.

- SWOT: Strengths, weaknesses, opportunities, and threats analysis.

- Marketing Plan : Strategies for marketing the properties to maximize occupancy and revenue.

- Timeline : Key milestones and objectives from property acquisition and planning through launch and operational optimization.

- Management: Information on who manages the property rental business and their roles.

- Financial Plan : Projects the business’s financial performance, including revenue, profits, and expected expenses, with a focus on achieving profitability and sustainable growth.

Property Rental Business Plan (Airbnb / VRBO)

Download an expert-built 30+ slides Powerpoint business plan template

Executive Summary

The Executive Summary introduces your property rental business plan, providing a succinct overview of your rental operation and its offerings. It should detail your market positioning, the variety of properties you manage, their locations, sizes, and an overview of day-to-day management practices.

This section should also discuss how your property rental business will fit into the local real estate market, including the number of direct competitors in the area, identifying who they are, along with your business’s unique selling points that set it apart from these competitors.

Moreover, it’s important to include information about the management and co-founding team, detailing their roles and contributions to the business’s success. Additionally, a summary of your financial projections, including revenue and profits over the next five years, should be presented here to provide a clear picture of your property rental business’s financial plan.

Make sure to cover here _ Business Overview _ Market Overview _ Management Team _ Financial Plan

Dive deeper into Executive Summary

Business Overview

For a Property Rental Business, the Business Overview section can be effectively divided into 2 main sections:

Properties & Locations

Describe the range and types of properties within your portfolio, such as apartments, single-family homes, vacation rentals, or commercial spaces. Emphasize the diversity and quality of your properties, including any unique features or high-demand attributes they may have. Discuss the locations of your properties, stressing their accessibility and the convenience they offer to tenants.

Highlight properties that are strategically located near key amenities, such as public transport, business districts, schools, or recreational areas. Explain why these locations are beneficial in attracting and retaining your target tenants.

Amenities & Services

Detail the amenities and features available with your properties, such as in-unit laundry, security systems, fitness centers, communal spaces, or eco-friendly installations. Highlight how these amenities meet the needs and preferences of your target tenant demographic.

Outline your leasing terms and pricing strategy , ensuring they align with the value provided by your properties and the competitive market landscape. Discuss any flexible leasing options, promotional offers, or loyalty incentives you provide to enhance tenant retention and attract new tenants.

Make sure to cover here _ Properties, Amenities & Services _ Properties Deep Dive

Market Overview

Industry size & growth.

In the Market Overview of your property rental business plan, begin by examining the size of the property rental industry and its growth potential. This analysis is vital for understanding the market’s breadth and pinpointing opportunities for expansion.

Key Market Trends

Next, discuss recent trends in the property rental market, such as the growing demand for flexible leasing options, the rise of smart home technology in rental properties, and the increasing preference for properties with green, sustainable features. Highlight the shift towards more personalized tenant experiences and the popularity of properties that offer unique amenities, such as co-working spaces or pet-friendly environments.

Key Competitors

Finally, assess the competitive landscape, which ranges from large property management companies to individual landlords, as well as emerging short-term rental trends facilitated by platforms like Airbnb. Focus on what sets your rental business apart, be it superior tenant services, innovative property features, or niche market focus. This section will outline the demand for rental properties, the competitive environment, and how your business is uniquely positioned to succeed in this dynamic market.

Make sure to cover here _ Industry size & growth _ Key market trends _ Key competitors

Dive deeper into Key competitors

First, conduct a SWOT analysis for your property rental business, identifying Strengths (like diverse property portfolio and prime locations), Weaknesses (such as maintenance costs or vacancy rates), Opportunities (for instance, the growing demand for flexible housing and rental spaces), and Threats (like market saturation or regulatory changes impacting rental operations).

Marketing Plan

Then, devise a marketing strategy that details how to attract and retain tenants through strategic online listings, virtual tours, referral incentives, a strong online presence, and engagement with the local community.

Lastly, establish a comprehensive timeline that marks key milestones for the launch of your rental operations, marketing initiatives, tenant engagement plans, and growth or diversification goals, ensuring the business progresses with a focused and strategic approach.

Make sure to cover here _ SWOT _ Marketing Plan _ Timeline

Dive deeper into SWOT

Dive deeper into Marketing Plan

The Management section focuses on the property rental business’s management and their direct roles in daily operations and strategic direction. This part is crucial for understanding who is responsible for making key decisions and driving the property rental business towards its financial and operational goals.

For your property rental business plan, list the core team members, their specific responsibilities, and how their expertise supports the business.

Financial Plan

The Financial Plan section is a comprehensive analysis of your financial projections for revenue, expenses, and profitability. It lays out your property rental business’s approach to securing funding, managing cash flow, and achieving breakeven.

This section typically includes detailed forecasts for the first 5 years of operation, highlighting expected revenue, operating costs and capital expenditures.

For your property rental business plan, provide a snapshot of your financial statement (profit and loss, balance sheet, cash flow statement), as well as your key assumptions (e.g. number of customers and prices, expenses, etc.).

Make sure to cover here _ Profit and Loss _ Cash Flow Statement _ Balance Sheet _ Use of Funds

Privacy Overview

Rental Properties Business Plan Template

Written by Dave Lavinsky

Rental Property Business Plan

Over the past 20+ years, we have helped over 10,000 entrepreneurs and business owners create business plans to start and grow their rental property business. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a rental property business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Business Plan?

A business plan provides a snapshot of your rental property business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan

If you’re looking to purchase a rental property, multiple rental properties, or add to your existing rental properties business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your rental property business in order to improve your chances of success. Your rental property business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Rental Property Companies

With regards to funding, the main sources of funding for rental properties are personal savings, credit cards, mortgages, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a rental property is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan. Venture capitalists will not fund a rental property company. They might consider funding a rental property company with a national presence, but never an individual location. This is because most venture capitalists are looking for millions of dollars in return when they make an investment, and an individual location could never achieve such results.

Finish Your Business Plan Today!

How to write a business plan for a rental property company.

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of rental property you are operating and the status; for example, are you a startup, or do you have a portfolio of existing rental properties that you would like to add to?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the rental properties industry. Discuss the type of rental property you are offering. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of rental properties you are offering.

For example, you might offer the following options:

- Single family homes – This type of rental property is often owned by a single individual, rather than a company, who acts as both landlord and property manager.

- Multi-family properties – These types of properties can be subcategorized by the number of units per site. Buildings with 2 – 4 units are the most common (17.5%), while multistory apartment complexes with more than 50 units represent the next-largest, at 12.6% of the industry.

- Short-Term Rental properties – These are fully furnished properties that are rented for a short period of time – usually on a weekly basis for vacation purposes.

In addition to explaining the type of rental property you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include occupancy goals you’ve reached, number of property acquisitions, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the rental properties industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the rental property industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your rental property business plan:

- How big is the rental properties industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your rental property. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population or tourist arrivals.

Customer Analysis

The customer analysis section of your rental property business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: households, tourists, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of rental property you offer. Clearly, vacationers would want different amenities and services, and would respond to different marketing promotions than long-term tenants.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Rental Properties Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other rental property companies.

Indirect competitors are other options customers may use that aren’t direct competitors. This includes the housing market, or hotels. You need to mention such competition to show you understand that not everyone who needs housing or accommodation will seek out a rental property.

With regards to direct competition, you want to detail the other rental properties with which you compete. Most likely, your direct competitors will be rental properties in the vicinity.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What lease lengths or amenities do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior properties?

- Will you provide services that your competitors don’t offer?

- Will you make it easier or faster for customers to book the property or submit a lease application?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a rental property business plan, your marketing plan should include the following:

Product : in the product section you should reiterate the type of rental property business that you documented in your Company Analysis. Then, detail the specific options you will be offering. For example, in addition to long-term tenancy, are you offering month-to-month, or short-term rental?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the properties and term options you offer and their prices.

Place : Place refers to the location of your rental property. Document your location and mention how the location will impact your success. For example, is your rental property located in a tourist destination, or in an urban area, etc. Discuss how your location might draw customer interest.

Promotions : the final part of your rental property marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your rental property business, such as customer service, maintenance, processing applications, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect 100% occupancy, or when you hope to reach $X in sales. It could also be when you expect to acquire a new property.

Management Team

To demonstrate your rental property business’ ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in rental property management. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in real estate, and/or successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you have 1 rental unit or 10? And will revenue grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $200,000 on purchasing and renovating your rental property, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $200,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a rental property business:

- Location build-out including design fees, construction, etc.

- Cost of equipment like computers, software, etc.

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your property blueprint or map.

Putting together a business plan for your rental properties company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the rental property industry, your competition and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful rental properties business.

Rental Properties Business Plan FAQs

What is the easiest way to complete my rental properties business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Rental Properties Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of rental property business you are operating and the status; for example, are you a startup, do you have a rental properties business that you would like to grow, or are you operating multiple rental property businesses.

Don’t you wish there was a faster, easier way to finish your Rental Properties business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

- Real Estate & Rentals

Rental Property Business Plan

After getting started with Upmetrics , you can copy this rental property business plan example into your business plan and modify the required information and download your rental property business plan pdf and doc file. It’s the fastest and easiest way to start writing your business plan.

How to write a rental property business plan?

Before writing a business plan, it is always good to ask yourself a few questions. It would surely make the process shorter and easier.

You should think about the following questions:

- What do you wish to achieve with your business?

- Who is your target audience?

- How would your business model work?

- What are your sources of funding?

- What would be your marketing strategy and so on?

All these questions would help you understand what you are getting yourself into. After that, you can start writing a business plan that focuses on all the different aspects of your business.

You can easily write such a plan either by using a premade template on the internet or through an online business plan software that’ll help you write a flexible and ever-changing plan.

What to include in a rental property business plan?

This section would give you a brief overview of the segments you can include in your business plan to make it a well-rounded one. They are as follows:

1. Executive Summary

The executive summary section contains a precise summary of all that your business stands for. If written well, it can help your business in getting funded. As it is mostly the only page an investor would read.

Professionals frequently suggest that this section should be written at the very end while writing your business plan, even if it is the first page. This helps you in summing up your business ideas properly.

2. Company Description

This section would consist of all the information about your business including its location, the services you offer, and your team.

It would also have information about your company’s history and its current position in the market. You can also include information about the projects you have worked on in the past.

3. Market Analysis

This is one of the chief sections of any business plan. It helps you understand what you are getting yourself into.

In this section, write down everything you can find out about the market. Include your target market, ways of reaching out to them, your market position, etc. Also, it is a good practice to include competitive analysis and take note of what your direct and indirect competitors are doing.

4. Marketing Strategy

While market analysis helps you in understanding the market, a marketing strategy helps you while getting into the market.

While formulating a marketing strategy, the most important thing is to have your target audience and market position in mind. Besides, keep in mind that your branding campaign should resonate with the client base you plan on serving.

5. Organization and management

This section includes information about the functioning aspects of your firm as well as about your team.

Include the roles and responsibilities of your team members as well as the progress they are making in their work.

If you write this section clearly and precisely, you’ll be able to identify the gaps you have in your team and your management system. This helps you in resolving those issues on time.

6. Financial Plan

This is one of the most crucial aspects of your business plan. More so in the rental property business. Planning your finances early on saves you from having financial troubles later on.

A financial plan section includes everything from your financial history, funding options, and requirements to projected cash flow and profits.

Download a sample rental property business plan

Need help writing your business plan from scratch? Here you go; download our free rental property business plan pdf to start.

It’s a modern business plan template specifically designed for your rental property business. Use the example business plan as a guide for writing your own.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Rental property business plan summary

In conclusion, a good business plan can help you have good finances, a proper marketing strategy, a well-managed company and team as well as clear business goals.

Especially, in the rental property business, planning the flow and structure of your business as well as your finances can take you a long way.

A rental property business depends highly upon well-managed finances and strategies. Planning your business is necessary to make it a good source of passive or primary income.

Moreover, it also makes the process of carrying out your business easier and smoother. So, if you are ready to start your rental property business, go ahead and start planning.

Related Posts

Party Rental Business Plan

Real Estate Investment Business Plan

400+ Business Plan Samples

How to Write Business Plan Step By Step

10 Main Components of a Business Plan

Important Location Strategy for a Business

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Business plans

Rental Property Business Plan

Used 4,872 times

Develop a rental property business plan tailored to serve as a valuable resource for entrepreneurs to organize their rental business.

e-Sign with PandaDoc

Created by:

[Sender.FirstName] [Sender.LastName]

[Sender.Company]

Prepared for:

[Recipient.FirstName] [Recipient.LastName]

[Recipient.Company]

Executive Summary

[Sender.Company] is a reputable rental business located in [Sender.StreetAddress] [Sender.City] [Sender.State] [Sender.PostalCode] (Company Location), specializing in property management, rental, and leasing.

Through expert knowledge and technological innovation, [Sender.Company] strives to make the property rental journey as straightforward as possible. The online platform, in particular, serves as a user-friendly hub where clients can effortlessly navigate and find properties that precisely align with their unique preferences and requirements. This emphasis on simplification ensures clients enjoy a hassle-free and tailored experience throughout their rental process.

[Sender.Company] 's commitment to enhancing the rental experience underscores its mission to provide clients with a seamless and customized journey, setting it apart as a leader in the industry.

Company Description

Who is [sender.company] .

[Sender.Company] is located in [Sender.StreetAddress] [Sender.City] [Sender.State] [Sender.PostalCode] and operates as a rental property agency specializing in providing short-term and long-term rentals and leased properties to the local community. The rental properties offered by [Sender.Company] are distinguished by their clean and modern aesthetics, perfectly aligned with the preferences of today's renters.

All properties managed by [Sender.Company] are fully furnished and equipped with high-end technology and modern accessories, ensuring tenants a hassle-free and comfortable living experience.

[Sender.Company] is under the ownership of (Owner Name), a seasoned professional in the rental property industry. [Sender.FirstName] [Sender.LastName] (Founder's Name) decided to launch [Sender.Company] in (month, date), driven by a recognition of the growing demand from students, working professionals, and individuals relocating from overseas.

With a keen focus on meeting the diverse housing needs of the local community, [Sender.Company] is committed to delivering outstanding rental property services. Under (Owner Name)'s guidance, the company is well-positioned to thrive and make a lasting impact in the rental property industry.

[Sender.Company] ’s Products

Some of the offerings available through [Sender.Company] include:

(Company Product/Option): (Insert description)

Industry Analysis

Customer analysis, profile of target market.

The target market of [Sender.Company] includes consumers from all demographics. The market [Sender.Company] serves value-conscious, with a preference for excellent comfort and basic amenities aimed at families, students, and the working population.

The following are the exact demographics of (Location) where the business is located:

Localities:

Economic levels:

Customer Segmentation

[Sender.Company] will target the following customer segments:

Working Professionals

High-Income Earners

Competitive Analysis

Main competitors.

(Competitor Name 1) – (Brief Overview of Competitor 1)

(Competitor Name 2) – (Brief Overview of Competitor 2)

(Competitor Name 3) – (Brief Overview of Competitor 3)

Competitive Advantage

[Sender.Company] has several competitive edges over its competitors. These edges are the following:

(Competitive Advantage 1)

(Competitive Advantage 2)

(Competitive Advantage 3)

Marketing and Strategy Implementation

[sender.company] ’s branding and positioning.

[Sender.Company] places a strong emphasis on its unique value proposition, which encompasses several key aspects:

Rental Offerings

[Sender.Company] specializes in offering various rental properties designed to meet different customer segments' specific needs and preferences. From spacious family homes to budget-friendly options for students, upscale residences for working professionals, and welcoming accommodations for international migrants.

Strategic Location

[Sender.Company] is dedicated to offering a broad range of rental homes in carefully selected areas. This variety in locations means that residents can enjoy different amenities and services and choose the lifestyle that best suits their preferences and requirements.

Exceptional Customer Service

Exceptional customer service is the cornerstone of the [Sender.Company] . Their dedicated team is always available to assist with inquiries, property viewings, lease agreements, and maintenance requests.

Innovative Technology Integration

[Sender.Company] stays at the forefront of technology trends by integrating smart home solutions and digital platforms to enhance convenience and security for their tenants. This includes keyless entry systems, remote property management tools, and online rent payment options.

Promotions Strategy

[Sender.Company] anticipates its primary target audience to consist of students, international migrants, the working population, and local families residing primarily in the [Sender.StreetAddress] [Sender.City] [Sender.State] [Sender.PostalCode] . To effectively engage with these potential clients, the company has developed a comprehensive promotion strategy, which encompasses the following key elements:

Referrals: (Description).

Advertisement: (Description).

Public Relations: (Description).

Social Media Marketing: (Description).

Print Advertising: (Description).

Website/SEO Marketing: (Description).

Pricing Strategy

[Sender.Company] is dedicated to offering a variety of flexible payment alternatives tailored to accommodate diverse customer preferences. The following list provides a comprehensive overview of these payment options, which can be customized as necessary:

(Payment Option 1)

(Payment Option 2)

(Payment Option 3)

By offering these flexible payment choices, [Sender.Company] aims to ensure that its valued customers have a range of selections to suit their financial requirements and preferences, thus enhancing their overall satisfaction.

Operations Plan

Organizational structure.

At [Sender.Company] , the rental property management team is composed of a diverse and skilled group of individuals, each contributing their unique talents to drive the success of the company's property ventures.

CEO/Founder

As the visionary leader of the rental property management team, (Mr./Mrs./Ms.) (Name) is deeply committed to excellence. He/she lays the foundation for the creative journey while guiding everyone towards new heights of achievement in the rental property sector.

Office Manager

(Mr./Mrs./Ms.) (Name) is the creative force behind [Sender.Company] 's property management efforts, ensuring rental properties provide exceptional living experiences. He/she meticulously oversees property details, from maintenance to tenant satisfaction.

Maintenance Director

(Mr./Mrs./Ms.) (Name) leads maintenance and property improvement initiatives, consistently exceeding industry standards in property upkeep, repairs, and enhancement.

Additional Team Members

Beyond the core team, [Sender.Company] has a dedicated group of professionals, including property managers, maintenance staff, leasing agents, and administrative personnel, who work cohesively to deliver exceptional rental property management services.

Over the following (Number of Months) months, [Sender.Company] has set ambitious milestones to accomplish in its journey toward establishing a strong and prosperous presence in the (Industry Name).

Financial Plan

Source and use of funds.

[Sender.Company] will get (Amount) from (Source of Fund) to start its rental property business.

[Sender.Company] will use the funds to secure the initial rental and office space and purchase supplies and equipment. The proposed startup costs are shown in the table below:

Financial Projections

These are [Sender.Company] 's pro forma financial statements for the next five (5) years. It contains the business's income statement, balance sheet, and cash flow statement.

[Recipient.FirstName] [Recipient.LastName]

Care to rate this template?

Your rating will help others.

Thanks for your rate!

Useful resources

- Featured templates

- Sales proposals

- NDA agreements

- Operating agreements

- Service agreements

- Sales documents

- Marketing proposals

- Rental and lease agreement

- Quote templates

BUSINESS STRATEGIES

How to start a rental property business: A comprehensive guide

- Annabelle Amery

- 14 min read

Owning rental properties can be a great way to generate passive income and build wealth over time. But it's not as easy as buying a few properties and collecting rent checks. There's a lot of work involved in managing tenants, maintaining properties and staying up-to-date on the latest laws and regulations.

In this comprehensive guide, we will walk you through the fundamental steps of starting a rental property business. Learn everything from creating your business plan to build your business website and spreading the word about your new venture.

What is a rental property business?

A rental property business is a business venture in which an investor purchases and manages one or more income-producing properties. These properties can have one or more units leased out to tenants in exchange for monthly rental fees. Rental property businesses can be operated by individuals, or they can be more complex operations involving multiple properties and team members.

Is your rental property a business?

Whether or not your rental property is considered a business depends on a number of factors, including:

Your level of involvement in the management of the property. If you're actively involved in managing the property, such as by handling maintenance requests, showing the property to prospective tenants and collecting rent, then your rental property is more likely to be considered a business.

The number of properties you own. If you own multiple rental properties, then your rental activity is more likely to be considered a business.

The amount of income you generate from your rental properties. If you generate a significant amount of income from your rental properties, then your rental activity is more likely to be considered a business.

If you meet all of the following criteria, then your rental property is likely to be considered a business:

You rent the property to earn a profit.

You work at the property regularly and continuously.

You provide significant services to your tenants, such as maintenance and repairs.

You have a significant investment in the property.

If your rental property meets all of these criteria, then you may be able to deduct certain expenses related to the property from your personal income taxes. You may also be able to claim certain tax credits, such as the qualified business income (QBI) deduction.

If you're not sure whether your rental property is considered a business, you should consult with a tax advisor.

Why should you start a rental property business?

Approximately 10.6 million in the U.S. declared rental income when filing taxes, with the average landlord bringing in $61,920 annually . Along with the financial benefits, there are many reasons to start a business in rental property and enter the real estate market.

Firstly, it allows you to create passive income with minimal daily involvement by generating consistent rental payments. You also have the potential for long-term wealth accumulation through property appreciation and the combo of cash flow and equity growth. On top of that, owning rental properties enables you to diversify your investment portfolio, providing stability and acting as a hedge against stock market volatility. There are also various tax advantages to consider, such as depreciation, mortgage interest deductions, property tax deductions and eligible expenses.

How to start a rental property business

To set yourself up for success, follow these steps to start your rental property business:

Define your business goals

Conduct market research

Create a business plan

Secure financing

Identify and acquire properties

Set up property management systems

Market and advertise your rental properties

01. Define your business goals

Determine your investment goals and strategy. Consider factors like property types (residential or commercial), location preferences, target tenant market and desired return on investment (ROI). Establish a clear vision for your rental property business.

02. Conduct market research

Thoroughly research your target market to identify areas with strong rental demand, favorable vacancy rates and potential for property appreciation. Analyze rental rates, property prices, local regulations and economic indicators. Evaluate the competition and your unique selling proposition to assess the viability of your rental business in the chosen market.

03. Create a business plan

Develop a comprehensive business plan that outlines your investment strategy, financial projections, marketing strategies, executive summary , property management processes and risk management strategies. A well-crafted rental property business plan serves as a roadmap for your rental property business and helps you attract potential investors or secure financing.

04. Secure financing