- THE STRATEGY JOURNEY Book

- Videos & Tutorials

- Strategy Journey Analyzer [QUIZ + WORKBOOK]

- COMMUNITY FORUMS

- Transforming Operating Models with Service Design (TOMS) Program

- ABOUT STRATABILITY ACADEMY

Walmart Business Strategy: A Comprehensive Analysis

By Julie Choo

Published: January 5, 2024

Last Update: January 5, 2024

TOPICS: Service Design

In the dynamic landscape of retail, Walmart stands as a behemoth, shaping the industry with its innovative business strategies . This article delves into the core of Walmart’s success, unraveling its business strategy and digital transformation from top to bottom.

Walmart Business Strategy

Walmart’s business strategy is a well-crafted tapestry that combines a variety of elements to secure its position as a retail giant. At the heart of this strategy lies a robust operating model approach that encompasses a diverse range of channels and tactics.

Transition to An OmniChannel Marketplace

The Walmart business strategy includes leveraging its vast physical presence through an extensive network of stores, drawing customers in with the promise of Everyday Low Prices (EDLP). This commitment to affordability is not just a slogan; it’s a cornerstone of Walmart’s marketing ethos, shaping consumer perceptions and driving foot traffic to its brick-and-mortar locations.

Building Strength via its Emerging Digital Operating Model

Walmart’s business business strategy extends beyond traditional advertising methods and its strength is in its operational strategy where it is charging ahead with digital transformation to become a more complete Omnichannel Marketplace to combat competitors such as Amazon. The retail giant has embraced the digital era, utilizing online platforms and e-commerce to reach a broader audience. Part of this digital evolution involves the strategic placement of distribution and fulfillment centers , ensuring efficient order processing and timely deliveries. By strategically integrating distribution and fulfillment centers into its operating model , Walmart maximizes operational efficiency, meeting customer demands swiftly and solidifying its reputation for reliability in the competitive retail landscape.

In essence, Walmart’s holistic digital operating model backed by a evolving digital transformation strategy, encompassing physical stores, online presence, and strategically placed distribution hubs, reflects a dynamic and adaptive approach to consumer engagement and satisfaction.

Walmart’s Existing Business Model Before Digital Transformation

Walmart’s retail business .

Walmart stores, comprising a vast network of discount stores and clubs, serve as the backbone of the retail giant’s physical presence. Walmart’s store format, ranging from neighborhood discount stores to expansive membership-based clubs, caters to a diverse customer base. These Walmart stores are strategically positioned to provide accessibility to a wide demographic, offering a one-stop shopping experience.

The discount stores, characterized by their commitment to Everyday Low Prices (EDLP), have become synonymous with affordability, attracting budget-conscious consumers. Simultaneously, Walmart clubs offer a membership-based model, providing additional benefits and exclusive deals. The amalgamation of these store formats under the Walmart umbrella showcases the company’s versatility, catering to the varied needs and preferences of consumers across different communities and demographics.

Walmart Pricing Strategy

Pricing strategy.

Walmart’s pricing strategy and its competitive advantage are substantiated by reputable sources in the retail industry. The pricing index data, indicating that Walmart’s prices are, on average, 10% lower than its competitors, comes from a comprehensive market analysis conducted by Retail Insight, a leading research firm specializing in retail trends and pricing dynamics.

Everyday Low Prices

Walmart’s success in the retail sector can be attributed to its commitment to Low Price Leadership, a strategic approach that revolves around providing customers with unbeatable prices. Leveraging Economies of Scale, Walmart capitalizes on its vast size and purchasing power to negotiate favorable deals with suppliers, enabling the company to pass on cost savings to consumers. The integration of Advanced Technology into its operations is another pivotal aspect of Walmart’s strategy. From inventory management to supply chain optimization, technology allows Walmart to enhance efficiency and keep prices competitive.

Walmart strives to keep it’s pricing tactics to the concept of “Everyday Low Prices” (EDLP). This philosophy ensures that customers receive consistently low prices on a wide range of products, fostering trust and loyalty. Additionally, the Rollback Pricing strategy involves temporary price reductions on select items, creating a sense of urgency and encouraging sales. Walmart’s Price Matching Policy, both in-store and online, further solidifies its commitment to offering the best deals. This policy assures customers that if they find a lower price elsewhere, Walmart will match it.

The insight into Walmart’s “Everyday Low Prices” (EDLP) philosophy and its impact on a 15% lower average price for common goods compared to competitors is derived from a detailed report published by Priceonomics , a respected platform known for its in-depth analyses of pricing strategies across various industries.

The statistics regarding Walmart’s market share of 22% in the U.S. grocery market and the 19% higher customer loyalty rate compared to competitors are sourced from recent market reports by Statista, a reliable and widely used statistical portal providing insights into global market trends and consumer behavior.

Multiple layers of Discount

Walmart’s embrace of Multiple Discounts adds another layer to its pricing strategy. Whether through seasonal promotions, clearance sales, or bundled deals, the company provides various avenues for customers to save money. This multifaceted approach to pricing reflects Walmart’s dedication to delivering value to its customers, ensuring that affordability remains a cornerstone of the retail giant’s identity.

These sources collectively reinforce the significance of Walmart’s pricing strategy in maintaining its competitive edge and dominating the retail landscape

Walmart’s Servicing Business

Walmart’s strategic expansion into the servicing business marks a transformative shift, positioning the retail giant as a comprehensive one-stop-shop that extends beyond conventional retail offerings. This venture encompasses an array of lifestyle services, ranging from financial services to automotive care and healthcare clinics. Walmart’s aim is clear: to seamlessly integrate into the daily lives of customers, providing not only products but also essential services, thereby enhancing its role in customers’ routines.

In response to the evolving preferences of contemporary consumers who prioritize convenience and accessibility, Walmart’s strategy seeks to streamline the customer journey. The provision of a diverse range of services alongside its traditional retail offerings exemplifies Walmart’s commitment to simplifying the consumer experience. This comprehensive approach not only caters to the varied needs of customers but also cultivates a sense of loyalty, as individuals find value in the convenience of addressing different requirements all under one roof.

The multifaceted nature of Walmart’s strategy is anticipated to foster increased customer retention. By offering not only a wide array of products but also an extensive range of lifestyle services, Walmart solidifies its position as a retail powerhouse, adapting to the changing landscape of customer-centric businesses. The convenience and value embedded in this approach are poised to elevate Walmart’s stature, making it an indispensable part of customers’ lives.

SWOT Analysis of Walmart’s Business strategy

As we navigate Walmart’s digital transformation journey, a SWOT analysis reveals key insights into its strengths, weaknesses, opportunities, and threats, guiding strategic decisions for sustained success in the dynamic retail industry that is operating in an increasingly digital economy.

SWOT Analysis of Walmart:

- Strong Brand Recognition: Walmart’s strength lies in its widely recognized and trusted brand, fostering consumer confidence and loyalty.

- Diverse Revenue Stream: The company’s adaptability is evident through a diverse revenue stream, navigating various markets and industries to maintain financial resilience. Per Walmart’s Q3 FY23 Earnings , a breakdown of walmart’s income can be recognised through its Sam’s Club membership sales (Up by 7.2%), Walmart U.S Comp Sales (Up 4.9%), Walmart U.S. eCommerce (up by 24%), and Walmart International sales (up by 5.4%).

- Economies of Scale: Walmart leverages its extensive size for economies of scale shown by its strong revenue growth of 5.3% per 2022 and 2023 consolidated Income statement, enabling cost advantages in procurement, operations, and overall efficiency.

- Strong Customer Base: With a vast and loyal customer base, Walmart establishes a robust foundation in the retail sector, emphasizing customer retention and sustained business growth as per market share stat of 60% shown on the Market retail/wholesale industry dominated by Walmart.

Weaknesses:

- Labor Relations: Walmart has faced criticism for labor practices, including low wages and labor disputes.

- E-commerce Competition: Despite significant strides, Walmart faces intense competition from e-commerce giants (e.g, amazon, eBay), impacting its online market share.

- Over Reliance on US Market: A substantial portion of Walmart’s revenue is generated in the United States, making it vulnerable to domestic economic fluctuations.

- Inconsistent customer service: represents a weakness in Walmart’s SWOT analysis, as variations in service quality across different locations may impact the overall customer experience, potentially leading to customer dissatisfaction and diminished brand perception.

Opportunities:

- E-commerce Expansion: Further growth in the online market allows Walmart to capitalize on changing consumer shopping habits.

- International Expansion: Targeting untapped markets presents opportunities for global revenue diversification.

- Health and Wellness Market: The growing trend towards health-conscious living provides avenues for expansion in the health and wellness sector. Increased understanding of customer journeys in these niches is key to begin to build stickiness effects.

- Technological Innovations: Embracing cutting-edge technologies can enhance customer experience and operational efficiency through a growing Omnichannel marketplace. It is vital to master data science and begin to leverage AI in the battle to understand consumer behaviors and deliver a remarkable experience.

- Competition: Intense competition from traditional retailers and e-commerce platforms poses a threat to Walmart’s market share such as Costco, Target and Amazon.

- Regulatory Challenges: Changes in regulations, especially related to labor and trade, can impact Walmart’s operations and costs. One such example is the metrics shown per Walmart’s ethics & compliance code of conduct aligning to regulatory challenges in culture, work safety, risk mitigation and more.

- Economic Downturns: Economic uncertainties and recessions may lead to reduced consumer spending, affecting Walmart’s revenue.

- Supply Chain Disruptions: External factors like natural disasters or geopolitical events can disrupt the global supply chain, impacting product availability and costs. Such threats are specifically addressed by Walmart’s Enterprise Resilience Planning Team .

More on Walmart’s Online Competitors

Walmart faces formidable competition in the online retail arena, with key rivals such as Amazon and Target vying for a share of the digital market. Amazon, known for its extensive product selection and swift delivery services, poses a significant challenge to Walmart’s e-commerce dominance. Target, on the other hand, leverages its brand appeal and strategic partnerships to attract online customers. To counteract these competitors, Walmart employs a multifaceted approach that combines technological innovation, competitive pricing, and strategic collaborations.

Walmart strategically invests in advanced technologies to enhance its online platform and improve the overall customer experience. The integration of artificial intelligence (AI) and machine learning enables Walmart to provide personalized recommendations, similar to Amazon’s renowned recommendation engine. Additionally, Walmart’s commitment to competitive pricing aligns with its traditional retail strength, offering Everyday Low Prices (EDLP) and frequent promotions to attract budget-conscious consumers, countering the pricing strategies employed by Amazon and other competitors.

Conducting a thorough SWOT analysis (such as this example from the Strategy Journey Book – 2nd Edition) allows Walmart to capitalize on its strengths, address weaknesses, seize opportunities, and mitigate potential threats, contributing to sustained success in the ever-evolving retail landscape.

Walmart’s Digital Transformation Strategy in the new ERA of AI-led Customer Centricity

Walmart’s online business strategy.

Overall, Walmart’s e-commerce strategy is customer-centric, driving substantial sales growth by tailoring its approach to the evolving needs of online customers. Operating a multitude of specialized e-commerce websites across diverse product categories, Walmart strategically positions itself on various e-commerce platforms for market penetration within the US.

Servicing Relevant Customer Journeys & Sustainable Transformation

Walmart’s evolving online strategy is characterized by a dual focus on extensive product offerings and technological sophistication, with concrete examples per its strategic partnership with Adobe in 2021 to integrate walmart’s marketplace, online and instore fulfillment and pickup technologies with Adobe commerce showcasing its commitment to a seamless customer experience. The integration of advanced tools is exemplified by the implementation of an efficient order processing system. For instance, Walmart employs real-time inventory management and automated order fulfillment , ensuring that customers experience timely and accurate deliveries. Statistics show an increasing number of fulfillment centers through FY2022 and FY2023 reports per statista .

Emerging predictive capabilities supported by Data Science and AI

In addition, the technological depth extends to personalized experiences, illustrated by Walmart’s robust recommendation engine. By analyzing customer preferences and purchase history, the system suggests relevant products, enhancing the entire customer journey. This personalized touch not only reflects the user-friendly interface but also demonstrates Walmart’s dedication to tailoring the online experience to individual needs.

Focus on seamless CX and UX to improve customer stickiness

Furthermore, Walmart’s commitment to a seamless online interaction is evident in its streamlined navigation features. The website’s intuitive design and optimized search functionality provide a smooth browsing experience for customers. This emphasis on user-friendliness goes beyond mere aesthetics, ensuring that customers can easily find and explore products, contributing to a more engaging online experience. Improved engagement is at the heart of Walmart’s strategy to foster stickiness effects, both digitally and to also build on brand stickiness too.

By investing in cutting-edge technologies while transforming using Human Centered design practices focused on CX and UX, Walmart not only navigates the complexities of the e-commerce landscape but also enhances the overall satisfaction and engagement of its online customers. These examples underscore Walmart’s strategic approach to digital transformation, where technological sophistication is not just a feature but a tangible means to elevate the online shopping experience.

Walmart International Business

Successful international business expansion requires operating model transformation, and Walmart’s strategy is characterized by a blend of strategic acquisitions, partnerships, and a keen understanding of local markets. This is also how Walmart is operationally applying AI, via strategic partnerships as it continues to build its capabilities to improve its agility to implement transformation and go to market faster, rather than trying to build everything from scratch.

A Sustainable Diversification strategy that adapts to local markets

Walmart’s international business expansion is a testament to its strategic approach in entering diverse markets and adapting to local nuances. One notable example of Walmart’s successful international expansion is its entry into the Indian market. In 2018, Walmart acquired a majority stake in Flipkart, one of India’s leading e-commerce platforms. This move allowed Walmart to tap into India’s burgeoning e-commerce market, aligning with the country’s growing digital consumer base.

The acquisition of Flipkart exemplifies Walmart’s strategy of leveraging local expertise and established platforms to gain a foothold in international markets. Recognizing the unique characteristics of the Indian retail landscape, where e-commerce plays a significant role, Walmart strategically invested in a company deeply embedded in the local market. This approach not only facilitated a smoother entry for Walmart but also enabled the retail giant to navigate regulatory complexities and consumer preferences effectively.

Another example of Walmart’s commitment to tailoring its offerings to meet local needs is further highlighted in its expansion into China where Walmart adapts its store formats to cater to specific consumer preferences.

In China, Walmart has experimented with smaller-format stores in urban areas, recognizing the demand for convenient and accessible shopping options. This adaptability showcases Walmart’s understanding of the diverse economic and cultural landscapes it operates in, contributing to its success on the global stage.

Working with partners to diversify and build a sustainable business model

Collaborations and strategic partnerships play a pivotal role in Walmart’s competitive strategy. In 2023, Walmart has outlined plans to invest heavily into AI automation fulfillment centers to improve its unit cost average by 20%, increasing efficiency in order fulfilments and operations.

The acquisition of Jet.com in 2016 expanded Walmart’s digital footprint and brought innovative talent into the company. Furthermore, Walmart’s partnerships with various brands (such as Adobe, ShipBob) and retailers enable it to diversify its product offerings, providing a competitive edge against the more specialized approaches of some competitors. As part of Walmart’s strategy in marketing, Walmart has announced partnerships with social media giants such as TikTok, Snapchat, Firework and more further boosting its online digital footprint.

The acquisition of Jet.com in 2016 not only expanded Walmart’s digital footprint but it brought innovative talent into the company. It is clear Walmart sees the need for talent as key to its continued efforts to apply human centered design as part of its digital transformation strategy.

By continuously adapting and evolving its strategies, Walmart is clearly implementing digital transformation sustainably, to support its future operating model as Walmart remains a formidable force in the online retail landscape, navigating the challenges presented by its competitors.

In conclusion, Walmart’s business strategy is that of an growing Omnichannel marketplace, a multifaceted approach that combines physical and digital retail, competitive pricing, supply chain excellence, and a commitment to customer satisfaction. Understanding these elements provides insights into the retail giant’s enduring success in a rapid changing and competitive digital economy as it continues to combat emerging new business disruptions.

Q1: How did Walmart become a retail giant?

Walmart’s ascent to retail dominance can be attributed to a combination of strategic pricing, operational efficiency, and a customer-centric approach.

Q2: What sets Walmart’s supply chain apart?

Walmart’s supply chain is marked by innovation and technological integration, allowing the company to streamline operations and stay ahead in a competitive market.

Q3: How does Walmart balance physical and digital retail?

Walmart seamlessly integrates its brick-and-mortar stores with its online presence, offering customers a comprehensive shopping experience.

Q4: What is Walmart’s philosophy on pricing?

Walmart’s commitment to everyday low prices is a fundamental philosophy that underpins its strategy, ensuring affordability for consumers.

Q5: How has Walmart expanded globally?

Walmart’s global expansion involves adapting its strategy to diverse markets, understanding local dynamics, and leveraging its core strengths.

About the author

Julie Choo is lead author of THE STRATEGY JOURNEY book and the founder of STRATABILITY ACADEMY. She speaks regularly at numerous tech, careers and entrepreneur events globally. Julie continues to consult at large Fortune 500 companies, Global Banks and tech start-ups. As a lover of all things strategic, she is a keen Formula One fan who named her dog, Kimi (after Raikkonnen), and follows football - favourite club changes based on where she calls home.

You might also like

Culture & Careers , Data & AI , Gameplans & Roadmaps , Operating Model , Service Design , Strategy Journey Fundamentals , Transformation

The Impact of Co Creation in Modern Business

Culture & Careers , Data & AI , Gameplans & Roadmaps , Operating Model , Service Design , Transformation

4 steps to create a Winning Game Plan

Service Design

9 Steps to your Winning Customer Journey Strategy

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Asking for a Trend

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Walmart’s strategic business priorities and their impact.

A Walmart Investor Update: 3-Year Earnings and Growth Outlook

( Continued from Prior Part )

Walmart’s strategy to grow its top line

At its 22nd Annual Meeting for the Investment Community, Walmart (WMT) dialed down its earnings outlook on higher near-term investments in pricing, wages, and technology. Walmart insisted that the additional investments are essential if the retailer is to grow its top line while providing a superior customer experience and keeping pace with changing shopper preferences. The company outlined the following four strategic priorities:

building its omni-channel capabilities while gaining scale across product categories and countries

growing its top line at a faster pace than the overall market

focusing on core assets and capital discipline

generating stronger shareholder returns

Implications

Walmart’s wage investments are obviously a long-term decision designed to improve the lives of workers and customer satisfaction scores. As the largest private sector employer in the United States, these hikes may also be a precursor to a hike in the minimum wage.

To learn more on their impact, read our article How Walmart’s Pay Hikes Affect The Retail Sector .

Peers Kroger (KR) and Costco (COST) already pay higher wages than Walmart. A high level of customer (FXG) (XRT) (VDC) service is also a key element of their store strategies.

The economics of omni-channel

Enhancing omni-channel capabilities is, to a large extent, a must for retailers. It’s a key sales and traffic driver. Like Walmart, retailers such as Target (TGT) and The Home Depot (HD) are looking at future sales growth as an integration between brick-and-mortar and online.

But it’s also undeniable that some companies tend to make more money at web sales than others by offering premium and customization options, differentiating them from the competition. It’s doubtful whether Walmart and Target can get the same level of profitability by selling largely undifferentiated products, product mix notwithstanding.

Enhancing the availability of private and exclusive brands may be one way to get around this. But competitive pressures may constrain pricing and margins. Amazon (AMZN), the world’s largest e-retailer, has more than tripled its revenue over the past five years, while its operating profitability has steadily declined.

Walmart and Costco together constitute 1.4% of the portfolio holdings in the iShares S&P 100 ETF (OEF).

In its updated guidance, Walmart reduced its capital expenditure plan for digital and tech investments. We’ll look at this in the next article.

Continue to Next Part

Browse this series on Market Realist:

Part 1 - Walmart Stock Suffers as the Company Slashes Earnings Outlook

Part 2 - Can Walmart Achieve Its Three-Year Revenue Growth Target?

Part 3 - Forex Headwinds Hold Back Walmart’s Overseas Performance

Walmart's Strategic Initiatives

WalmartCorporate / Flickr

- Supply Chain Management

- Sustainable Businesses

- Operations & Technology

- Market Research

- Business Law & Taxes

- Business Insurance

- Business Finance

- Becoming an Owner

Walmart introduced a plan that was hoped to ensure that the company would remain the industry leader. Project Impact is based on three strategic initiatives that will improve the benefits to the customer. The three initiatives are:

Save Money, Live Better

Win, play, show.

- Fast, Friendly, Clean

Walmart is aiming to keep consumers happy and returning to their store once the economy improves. Over the last decade, the company had lost customers as they frequented the newer stores of its competitors such as Target.

By implementing Project Impact Walmart is renovating its stores in the US by widening the aisles, lowering fixtures, improving signage, and adding natural light to give consumers a store that fees friendlier.

The first of the three initiatives is called Save Money, Live Better. This initiative has a number of components that Walmart is following.

- Price Leadership: The Company is well known for its “Everyday Low Pricing”, but Walmart is aiming to give the consumer greater value for each product category. By achieving price leadership Walmart hopes to ward off attempts by other retailers such as Target from gaining market share.

- Consumables: This component is an area where Walmart is looking to reduce outlay. Changes will be made in promotional cadence, seasonal advertising, and in-store signage.

- Private Label: One area where Walmart can increase revenue is to expand their private label categories. The current economic climate has consumers looking to save money and the value of Wal-Mart’s private label products should be good for the consumer as well as the company.

- Integrated Brand Communication: Although Walmart is looking to reduce the overall number of suppliers and products, the company will be looking for remaining vendors to increase co-branded advertising campaigns.

- Leverage Selling General and Administrative Expenses (SG&A): The Company can ask suppliers to introduce efficiencies in the transportation of items. This can be the supplier to the distribution center, distribution center to the store and also within the store.

This initiative sees Walmart optimizing the products in each of its stores. Reducing the number of products, and perhaps reducing the number of overall suppliers, Walmart can encourage suppliers to reduce prices . It also produces an opening for private label products and subsequently increased revenue. With regards to product optimization, the plan is to put each of the product categories into one of three buckets; win, play or show.

- Win: This is the top priority categories for Walmart. With these products, the company aims to gain market share, be first to market on all new products, lead with price and value, as well as stocking an assortment of items.

- Play: These are strategic categories. Walmart will be aiming to grow these categories, but using a balance growth and profit in the context of overall market performance. Vendors who find themselves with products in this area should be looking to aggressively market to Walmart so that their items are not removed from store shelves.

- Show: This category is where Walmart can reduce the number of products they stock, but not exit the category altogether. For example, Walmart has decided to go from four plastic food storage bag brands in its stores to only two. Pactiv Corp.'s Hefty and Clorox's Glad brand products have been removed from store shelves, leaving SC Johnson's Ziploc and Walmart's own Great Value private label the only products to be displayed.

Fast, Friendly, and Clean

Walmart wants to improve the customer’s in-store experience as well as becoming more efficient in and out of each store through the following;

- Merchandise Flow: Walmart has a merchandise replenishment cycle of no more than 48 hours. Wal-Mart has adopted efficient processes such as cross-docking which as reduced operating costs, increased throughput, reduces inventory levels and eliminates unnecessary handling and storage of the product.

- Zero Waste Facilities: Sustainability is a key component of Walmart’s green policies. The company is dedicated to maximizing the efficiency from the raw material phase to the manufacturing phase, from supplier to distribution center, from distribution center to store, stockroom to the shelf, shelf to the consumer, from store to home, from the pantry to consumption with the ultimate goal of Zero Waste.

- Supply Chain Transformation : Walmart is working to improve efficiencies in the supply chain and especially in transportation. The Company has seen some successes such as a 21 percent increase in fuel efficiency (MPG), 5.5 percent increase in pallets per truck, 6.5 percent reduction in empty truck miles and 3.8 percent increase in cases shipped with 7.8% reduction in miles.

- About / Contact

- Privacy Policy

- Alphabetical List of Companies

- Business Analysis Topics

Walmart Five Forces Analysis (Porter Model), Recommendations

Walmart Inc. competes with Costco , Home Depot , Amazon and its subsidiary, Whole Foods , and many other retailers. The variety of competition compels Walmart to develop strategies to protect the business from the issues in its industry environment, such as the ones linked to external factors identified in this Five Forces analysis of the business. Michael E. Porter’s Five Forces analysis model is a strategic management tool that evaluates the effects of external factors that determine the competitive landscape of the industry. These external factors define the bargaining power of customers or buyers, the bargaining power of suppliers, the threat of substitution, the threat of new entrants, and competitive rivalry. In this case, the five forces refer to the retail industry, where Walmart focuses its operations. The company’s strategic direction is representative of strategic responses to competitive forces in the retail industry environment.

A Porter’s Five Forces analysis of Walmart Inc. shows the implications of the competitive rivalry or intensity of competition on the business and the retail industry. This condition of the industry environment pushes the company to explore strategic measures to manage the negative effects of competition. Considering that the retail market is saturated, Walmart is in a continuous process of improvement to counteract the impact of strong competition shown in this Five Forces analysis.

Summary: Five Forces Analysis of Walmart

Summary . In determining the degree of competitive rivalry in the retail industry, a basic consideration is market saturation. The retail services market is highly saturated. As a result, Walmart Inc. faces tough competition, which warrants strategies and tactics that build on the company’s strengths. The SWOT analysis of Walmart enumerates a number of strengths that the business can utilize to maintain its industry position despite aggressive competitors. Based on the external factors enumerated in this Porter’s Five Forces analysis, Walmart experiences the following intensities of the five forces in the retail industry environment:

- Competitive rivalry or competition – Strong

- Bargaining power of buyers – Weak

- Bargaining power of suppliers – Weak

- Threat of substitutes or substitution – Weak

- Threat of new entrants – Strong

Recommendations . Walmart’s strategic planning must prioritize competition and new entry in the retail industry. Based on this Five Forces analysis, the business needs to continually improve its capabilities to sustain its competitive advantages. Walmart’s generic competitive strategy and intensive growth strategies establish the basic approaches to grow the business and keep it competitive. However, this Five Forces analysis shows that the company needs to develop additional enhancements. It is recommended that the company increase its investment in the automation of internal business processes, including its supply chain. This recommendation aims to improve overall efficiency and, as a result, improve cost effectiveness to satisfy Walmart’s corporate vision and mission statements . It is also recommended that the company further enhance its human resource management. Such improvements can contribute to workforce competencies that support business growth. These resulting improvements based on these recommendations can help counteract the effects of the strong forces of competition and new entry, which are the most significant issues determined in the results of this Five Forces analysis.

Intensity of Competitive Rivalry or Competition (Strong Force)

The intensity of competitive rivalry is strong in the retail industry. This Five Forces analysis considers that there are many firms of different sizes competing in this industry environment. The following external factors are the most significant considerations in Walmart’s strategic management of the strong force of competition:

- Large number of firms in the retail market (strong force)

- Large variety of retail firms (strong force)

- High aggressiveness of retail firms (strong force)

Walmart experiences the strong force of these external factors that define the competitive rivalry in the retail industry environment. In Porter’s Five Forces analysis model, a large number of firms typically strengthen competition. In relation, the high variety of firms imposes challenges in developing Walmart’s competitive advantages, considering the diversity of approaches that these competitors use. Also, higher firm aggressiveness leads to stronger competitive rivalry. Thus, the company must remain aggressive to remain competitive. Walmart must keep growing to remain in its position as a major global retailer.

Bargaining Power of Buyers or Customers (Weak Force)

Walmart faces the weak intensity of the bargaining power of buyers in the retail industry environment. Based on Porter’s Five Forces analysis model, the large population of buyers makes it difficult for them to impose significant pressure on retail firms. Walmart is subject to the following external factors concerning the weak bargaining power of buyers or customers:

- Large population of consumers (weak force)

- High diversity of consumers (weak force)

- Small size of individual purchases (weak force)

The large population of buyers exerts a weak force on Walmart and the retail industry. Individual buyers have a negligible impact on the company’s global revenues. The weak force of buyer diversity and the weak force of small individual purchases further weaken the bargaining power of customers. Higher buyer diversity makes it more difficult for customers to collectively impose pressure on the company. In effect, the bargaining power of buyers is weak in influencing Walmart and other firms in the industry.

Bargaining Power of Suppliers (Weak Force)

The bargaining power of suppliers has weak intensity in the retail industry environment. This Five Forces analysis considers that there are many suppliers in the industry. Large firms like Walmart can easily affect these suppliers. Based on this condition, Walmart experiences the weak force of the bargaining power of suppliers, based on the following external factors:

- Large population of suppliers (weak force)

- Tough competition among suppliers (weak force)

- High availability of supply (weak force)

This Porter’s Five Forces analysis of Walmart Inc. considers the large population of suppliers as having weak potential to impact the company. Individual suppliers have minimal influence on large retailers like Walmart. Also, there are many suppliers competing for limited space in retail stores. The high availability of supply makes it difficult for suppliers to impact the strategic growth of Walmart. Thus, the company faces the weak intensity of the bargaining power of suppliers. Walmart’s corporate social responsibility strategy helps in managing suppliers’ influence on the business.

Threat of Substitutes or Substitution (Weak Force)

The threat of substitutes or substitution has weak intensity in affecting the retail industry environment. Walmart offers a wide variety of goods and services that have few or no substitutes. The following external factors impose the weak threat of substitution against Walmart:

- Moderate availability of substitutes (moderate force)

- Low variety of substitutes (weak force)

- Higher cost of substitutes (weak force)

Some substitutes for Walmart’s goods and services are readily available. However, the external factor of the low variety of substitutes makes it difficult for consumers to move away from products available from retailers like Walmart. Also, some substitutes are more expensive than the low-cost goods and services available at the company’s stores. In Porter’s Five Forces analysis model, the combination of these external factors leads to the weak threat of substitutes or substitution in Walmart’s industry environment.

Threat of New Entrants or New Entry (Strong Force)

Walmart must address the strong intensity of the threat of new entrants. New entry of retail firms is easily achieved even in the presence of giants like Walmart. Small retailers can enter the market and compete on the basis of convenience, location, specialty, and other factors. Based on this Porter’s Five Forces analysis, the strong force of new entry is broken down into the following component external factors:

- Moderate to high cost of brand development (moderate force)

- Low cost of doing business (strong force)

- Moderate capital costs (strong force)

It is costly to develop a new entrant’s brand. Nonetheless, some large new entrants have the financial resources to build a strong brand. This condition exerts a moderate force on Walmart Inc. The cost of establishing a new retail firm and the cost of running it are low to moderate. For example, small retailers have low costs of doing business relative to larger firms. This condition makes it possible for many smaller retailers to compete against Walmart. Initial capital outlay varies, but it is typically high in terms of funding for business space, human resources, and equipment, among other variables. Still, smaller new entrants can establish their operations with low to moderate capital outlay. These external factors in the context of the Five Forces analysis show that new entrants can keep operating and become potential threats to firms like Walmart.

- Gupta, A., Pachar, N., Jain, A., Govindan, K., & Jha, P. C. (2023). Resource reallocation strategies for sustainable efficiency improvement of retail chains. Journal of Retailing and Consumer Services, 73 , 103309.

- Kheng, L. (2023). Walmart: A Business Case Study in Knowledge Management, Walmart’s Secret Sauce – The Use of Machine Learning, Automation, and Virtual Reality. In Cases on Enhancing Business Sustainability Through Knowledge Management Systems (pp. 33-46). IGI Global.

- Kostetska, N. (2022). M. Porter’s Five Forces model as a tool for industrial markets analysis. Innovative Economy , (4), 131-135.

- Sforcina, K. (2023). Digitalizing Sustainability: The Five Forces of Digital Transformation . Taylor & Francis.

- Walmart Inc. – Form 10-K .

- Walmart’s E-commerce Website .

- U.S. Department of Commerce – International Trade Administration – Retail Trade Industry .

- Yi, S. (2023). Walmart Sales Prediction Based on Machine Learning. Highlights in Science, Engineering and Technology, 47 , 87-94.

- Copyright by Panmore Institute - All rights reserved.

- This article may not be reproduced, distributed, or mirrored without written permission from Panmore Institute and its author/s.

- Educators, Researchers, and Students: You are permitted to quote or paraphrase parts of this article (not the entire article) for educational or research purposes, as long as the article is properly cited and referenced together with its URL/link.

Walmart Innovation Strategy Uses Emerging Tech and Acquisitions

Walmart, the world’s largest brick-and-mortar retailer, has been pushing the envelope for becoming a tech-centric company from being a traditional retailer . It has shifted its focus and strategies to become a high-tech innovator.

For nearly a decade, Walmart has been investing heavily in technologies and startups and is one of the reasons that it still sits on the throne of the Fortune 500 Company List despite seeing immense competition from its rivals such as Amazon.

For the fiscal year 2022, Walmart set an investment of $14 billion for automation, technology, and other business areas like supply chain and customer-facing initiatives.

And not just in technology but the company is also planning to hire thousands of the workforce in 2022 including cybersecurity professionals, architects, developers, software engineers, data scientists, data engineers, technical program managers, and product managers.

It makes one wonder – What made Walmart take that approach? What strategies did it use to overcome the challenges it had been facing? We did some digging and found a lot of insights that other businesses can take a lesson or two. These insights include Walmart’s patent strategy, its similarity to Amazon’s strategy, the innovations Walmart is working on, and how it is integrating next-gen technologies to improve every area of its operations.

The table of contents below gives a sneak peek into every facet we’d be discussing in our brief time together today. If you’d like a particular section of your interest, you can click on the relevant hyperlink to get to that section.

One more thing, I’ve converted this entire analysis into PDF form that you can download and save for later reading (or sharing with your friends). You can download it using the form below:

Table of Contents

Walmart’s Tough Time

Before 2014, the condition of Walmart in the market was chaotic . Here are some of the factors substantiating its situation:

- Not only that, Walmart had faced a financial breakdown during the years 2013–14. The annual report of Walmart in 2014 stated: “Fiscal 2014 was a tough year for Walmart. Sales and earnings were not where we wanted them to be, as we faced a number of economic headwinds around the world.”

- Consequently, in 2014, it was noticed that the ROI of Walmart had dropped rapidly when compared to 2010.

Walmart’s Strategies to Overcome Challenges

After 2014, the headlines seemed to change. Walmart began emerging as a rising player — one to watch out . If we try and look for the reasons behind this positive turnaround, we’d find the following:

- Walmart shifted its focus towards becoming a technology-centric company: In June 2014, Walmart started its new aim , which was to transform itself into a tech-innovating company instead of just having some retail stores. Doug McMillon, Walmart’s CEO, said: “We will also develop new capabilities to serve customers in new ways. It is important that we all understand the shift that has happened in technology and retail, what it means for us and what we’re doing to win. There’s a lot of innovation and opportunity available to us.”

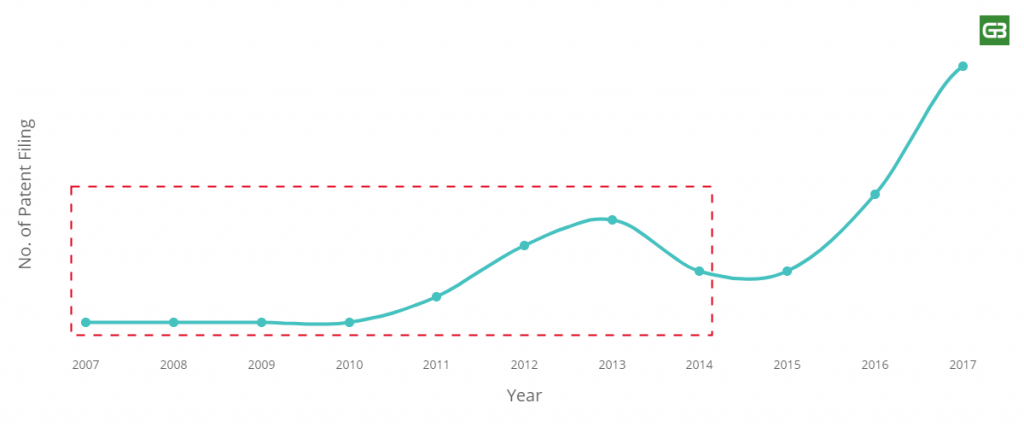

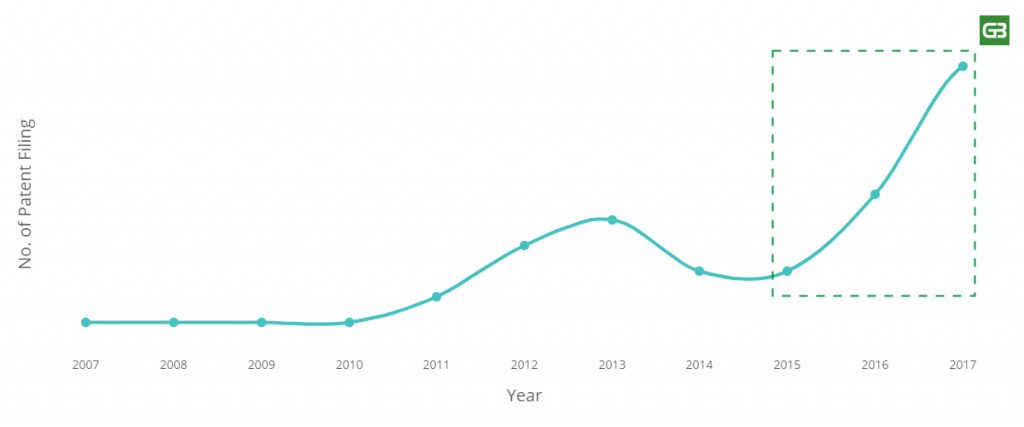

- Walmart realized that it must protect the tech it’s using: Walmart had been facing continuous litigations and had realized that in order to avoid these costly litigation cases, it had to secure a patent arsenal.

Patents are mostly used for defensive purposes rather than offensive — and having a strong patent portfolio often helps in avoiding litigation as chances of counterclaim or retaliation increase hence the possibility of settlement becomes more viable.

Considering this, it can be considered that the continuous litigation pushed Walmart to develop a patent portfolio of its own, and subsequently, an exponential rise was observed in Walmart’s patent filing trend post-2014 — in fact, the count of patents filed in 2017 was 5 times when compared to 2014–15.

Result? The number of lawsuits dropped down like a stone.

Being sued multiple times made Walmart smart about protecting their technology. This means that their plans to expand or invest in a domain are reflected directly and clearly in their patent filing. This can be lucky for their competitors as they can assess Walmart’s plans through their patent portfolio and strategize their business accordingly. If you’d like to see Walmart’s patent filing trends, which countries they are protecting their IP in and more, in the form of an interactive dashboard, then you can find that treasure of information here. hbspt.forms.create({ portalId: "1791848", formId: "c5f043a4-97cc-4e0f-943e-6fe14863ae99" });

In 2015, Walmart topped the list of the biggest IT spenders worldwide ; the amount being spent was more than USD 10.5 billion. This IT spending entailed the money spent on hardware, software, IT services, telecommunication services, etc. One of Walmart’s recent announcements substantiates the impact of this decision clearly: “ A 43% increase in its e-commerce sales”, which was fueled by increased investment in digital assets.

In 2020, Walmart upgraded its infrastructure to support the data workloads and bandwidth required for machine learning capabilities. Walmart’s machine learning model optimizes the timing and pricing of markdowns, which saved the company $30 million.

As it is said, “Innovation without protection is philanthropy” , Walmart realized the importance of innovation, and moreover, of protecting its innovation.

Like Amazon, Like Walmart

Walmart and Amazon have been competing in almost every aspect of their businesses. While Walmart’s revenue surpasses Amazon’s drastically, Amazon beats Walmart in online sales with a huge gap. Amazon covered 38.7% of US online sales while Walmart only had a share of 5 .3%. But the game is not limited to the US, globally both companies are struggling to make bucks.

But, as per Scott Galloway, a marketing professor at NYU’s Stern School of Business, “ Walmart is the only firm that has the management, capital, and the scale to compete with Amazon . They’ve probably done as good a job of getting off their heels and on their toes as any retailer in the world.“

There is no doubt in stating that IP lawsuits played a key role in pushing the development of Walmart’s patent portfolio. But Walmart is not the only case. It seems that Amazon’s patent portfolio was also kick-started by the rising number of lawsuits against it.

Well, as is apparent, the plots of litigations against Amazon and that of the patent filing of Amazon look similar to those of Walmart. This seems if Walmart has actually been following the business strategy that had previously been adopted by Amazon.

Walmart’s strategy aims for technologies, innovation, and acquisitions to be the best retailer. The company has been utilizing the latest technologies and startups to make the customer experience better. Further, doing in-house innovation to stand out in the market and then using patents to protect its innovation.

Walmart Patent Strategy

A step towards monopoly.

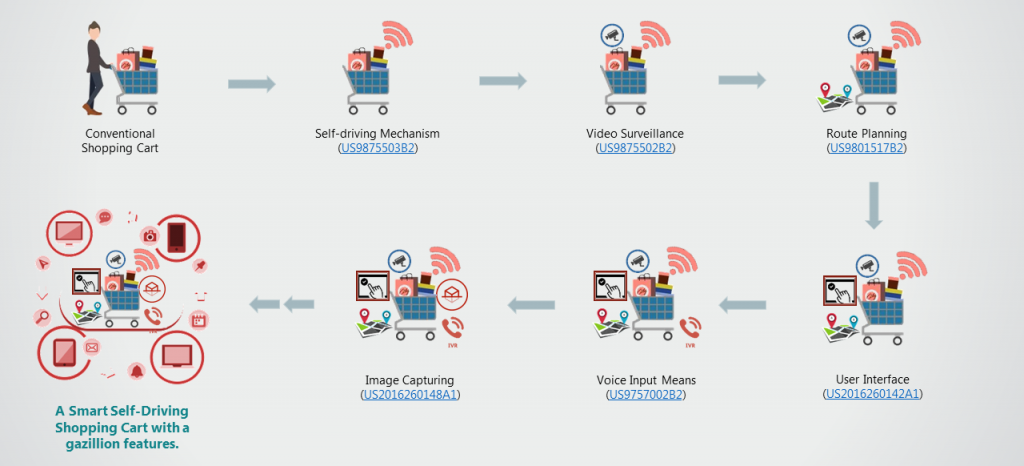

Here is how Walmart’s invention of the ‘self-driving shopping cart’ incorporated more and more features over time.

- Self-driving Mechanism ( US9875503B2 )

- Video Surveillance ( US9875502B2 )

- Route Planning ( US9801517B2 )

- User Interface ( US2016260142A1 )

- Voice Input Means ( US9757002B2 )

- Image Capturing ( US2016260148A1 )

Furthermore, Walmart recently filed a patent application for a shopping cart with a biometric handle, which would track customers’ stress levels , and read pulse rate, and temperature. Additionally, these carts would warn associates when customers may need help.

It looks like Walmart has been actively researching which exceptional features can still be added to a shopping cart. Thus, it can very well be a possibility that Walmart is monopolizing the shopping cart space.

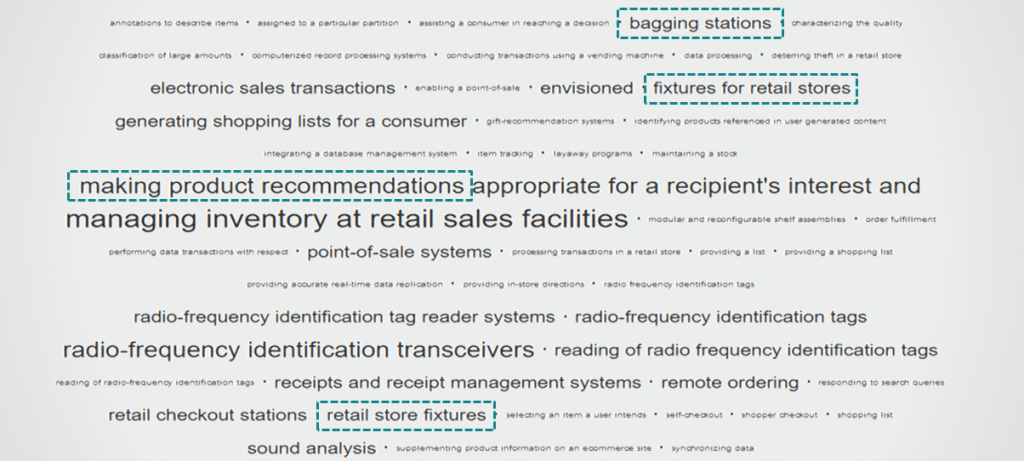

Areas in which Walmart might think of monopolizing

These are some areas in which Walmart has cited itself repeatedly. As we have seen in the case of Shopping Carts and Conversational Interfaces, Walmart might develop patent thickets in these technological areas, and try to monopolize here too.

Two Trends of Walmart Patent Strategy

Now, one thing to ponder over is the way Walmart is monopolizing ‘Self-Driving Shopping Cart Systems’. Well, as it turns out, there are two trends that we can see by looking at the way Walmart files its patent applications. Let’s have a look.

File First. File Often

Walmart leans towards filing multiple provisional applications for a single invention. The concept here is that with any invention, there would be a stream of additions and reductions to practice. Thus, when Walmart decides to work on an invention for long, it files numerous provisional applications as and when the additional versions of the invention are developed.

Self Citation

Apart from filing often, Walmart has been practicing self-citations for incremental innovations. In a considerable number of cases, Walmart has cited its own patents — indicating that most of its research is intertwined. Further, for such cases, Walmart generally files a continuation application — again indicating that it aims to cover each and every aspect of a single invention.

All this can be boiled down to the term ‘patent thicket’, which means a cluster of patents revolving around one big invention , thereby creating a monopoly in that space.

Walmart has applied both these strategies in the case of Self-Driving Shopping carts — and seems to be on the verge of successfully capturing the market.

There’s another patent that talks about conversational interfaces between a user and a computer system without human intervention for enhancing the consumer experience. This patent has 9 provisional applications and around 20 INPADOC family members. Though there’s no recent activity by Walmart on this patent, it is a possibility that Walmart applies the same strategy on this invention and gains a monopoly here as well.

Walmart, with its tech-centric approach and a focus on patent filings, is slowly getting a hold of the IP space in the eCommerce industry. Check out where Walmart’s patents are becoming a roadblock for other companies – companies who are working in similar areas but are unable their patents are being rejected because of Walmart’s patents. Fill out this form and with the help of our tool – BOS – we’ll help you find out which patents are being blocked by Walmart’s patents.

Walmart Technology Strategy

Earlier, Walmart’s purpose in using technologies was to solve certain problems. And the new technologies (like Blockchain, IoT, AI, etc.) did help Walmart overcome industry issues and support improving every area of its operations. That’s why they have been investing so much money and effort to become a technology company and this strategy certainly helps the company to a great extent.

But now, Walmart wants to try different technologies not just to solve certain problems but to find white spaces where they can manage to make a space for themselves.

Below we have provided examples that Walmart is using for either solving a certain issue or to create a new revenue stream.

Blockchain and IOT for tracking food safety

Industry Challenge

The contamination of food leads to significant losses to the suppliers. In 2018, many customers and grocers were forced to throw away large amounts of romaine lettuce when an E. coli contamination in the lettuce spread through the food industry.

Since most supply chains are bogged down in manual processes, tracking such an issue is difficult and time-consuming.

Solution via tech-integration

Walmart partnered with IBM to implement the Food Trust blockchain for its live food business. It quickened tracing the food from farm to store in real-time, thus making the process more transparent.

Moreover, Walmart asked its suppliers of leafy greens to use Blockchain to trace their products all the way back to the farm. This will let them see and validate with certainty where that product was grown, handled, stored, and inspected.

Furthermore, Walmart has implemented the Internet of Things to manage food safety. IoT aggregates data from sensors at each point in the supply chain: farm, transportation, warehousing, and marketplace, and provides information about the product’s attributes.

The retail giant has joined hands with JD.com to back blockchain food tracking efforts in China.

Walmart collaborated with IBM and Tsinghua University to create the Blockchain Food Safety Alliance. Walmart had, in fact, piloted the use of Blockchain in food safety back in 2016 — to explore its usability for food tracking, traceability, and safety — with IBM and Tsinghua.

AI for stock management and store cleanliness

- Items get misplaced on the wrong shelf.

- Refilling is needed when the stock is running low.

- Retail stores are prone to dangers from wet surfaces.

- Repetitive tasks such as cleaning/scrubbing the floor require a lot of time and effort.

Walmart is working on an Artificial Intelligence Lab in its stores, which will use cameras to track misplaced items and identify low-running stocks. Walmart has also partnered with the California-based Bossa Nova to implement AI-based robots, who’d roam around the store and identify shelves that’d need to be taken care of.

Walmart sponsored Texas A&M University for its computer vision projects. One of the projects involves creating camera systems that would detect water on the floor and let the employees know — so that they can remove the water.

To implement this, Walmart had also partnered with Brain Corporation to create floor-scrubbing robots. Such a robot uses multiple sensors to scan its surroundings for people and obstacles, identify the areas on the floors that need scrubbing, and clean the floor when needed.

Augmented Reality for customer’s enhanced experience

- It is not feasible to facilitate a one-go comparison of different products based on prices, ratings, etc.

- It is needed that retailers create engaging and fun experiences for shoppers for enhancing the customer experience.

Walmart recently introduced an AR scanner in its mobile app; the camera, when pointed at items on a shelf, brings out the products’ names, prices, customer ratings, and other details while moving the phone from one product to another. The technology was first developed by a team at an internal Walmart hackathon using Apple’s ARKit technology.

Walmart also partnered with the augmented-reality developer Zappar , to bring this tech to their retail stores. Shoppers can scan the Zapcodes at the stores to activate the AR experience, which is being sponsored by many brands like Pepsi, Nickelodeon, etc. The AR-related activities include encounters with brand mascots like Tony the Tiger or Chester the Cheetah, mini-games, 3D animations, and face filters. All of this greatly enhances the customer experience.

Walmart’s purpose in making its stores AR-enabled is to get more attention from customers and enhance their in-store experience. Walmart is doing its best to transform a regular shopping trip into an adventure, thereby boosting customer engagement.

Virtual Reality for enhancing the employee-customer experience

- It is difficult to train employees without creating a life-like store environment.

Walmart has been using virtual reality to train its associates . The associates can learn by watching modules through the headsets. This lets them recreate a real-life store environment to experiment, learn, and handle difficult situations. In fact, “ Walmart was one of the first companies to benefit from VR’s ability to enrich employee education ”.

Walmart even acquired virtual reality startup Spatialand to create VR software to be used in Walmart’s retail stores. Spatialand had already worked with Walmart’s technology incubator, Store No. 8, on a project in 2017 — this resulted in a proof-of-concept VR experience for shoppers. As stated by officials, what Spatialand is creating for Walmart might not be visible for 12-18 months. It seems that the VR products in Walmart’s store would be seen at a future time interval when the tech becomes widespread and the cost of VR products is reduced.

Wireless Charging for Store Maintenance

In-store devices, like battery-powered barcode scanners and electronic shelf labels in retail stores, need to be plugged into conventional power sources. This is one extra task that leads to a decrease in employees’ productivity due to the time and energy that could have been utilized elsewhere. More importantly, such devices also increase battery costs for the retailer.

In Sep 2018, Walmart partnered with Ossia to pilot wireless charging technology across its retail stores.

Walmart selected Ossia innovation at the Walmart Innovation Summit in April 2018, out of hundreds of applications, when they showcased how Cota Real Wireless Power would transform the retail experience.

Walmart’s director of public relations, Ravi Jariwala stated: “ When we find ways to lower costs, it means we can lower our prices even further for customers, and that’s something we’re always looking to do. One interesting technology we’re excited to test is wireless power transfer from a company named Ossia, Inc., which could one day reduce and even eliminate our daily dependence on batteries and wired connections for power. ”

Autonomous Driving for product delivery

For the customers that prefer home delivery, there needs to be a proper channel of delivery service. Moreover, it is not very convenient for the customers to go to a retail store every time they want to buy something new.

In November 2018, Walmart teamed up with Ford to test the ways in which the latter’s self-driving vehicles could be used to deliver products, such as groceries, toiletries, pet food, and other consumer items. The collaboration would focus on “gathering crucial data about consumer preferences” and learning the best way to connect people with goods that they’d need.

Walmart has also partnered with Waymo to work on an online grocery pilot project. The purpose, they say, is to learn more about the customers and give them a unique convenient experience.

Cloud Computing for enhancing the customer’s experience

It is a task to manage data on thousands of proprietary servers when a retailer is renting all the computing capacity that they need in order to serve their customers effectively.

In mid-2018, Walmart entered into a five-year agreement with Microsoft to use the latter’s cloud platform, Azure. With this, Walmart would convert all of its websites and applications to run natively on Azure.

In late 2018, they also announced the opening of a joint engineering office in Austin, Texas , as part of the cloud partnership.

This has enabled Walmart to more effectively store and analyze data that could be used to drive online sales and boost retail efforts.

Drone Delivery

As the FAA increasingly embraces commercial drone operations, drone delivery in the United States is closer than ever to reality. Amazon is already looking forward to the race of drone delivery as the company researching drones for years and securing many drone-related inventions.

Walmart too has buckled in the race but rather than following Amazon, the retail giant chose partnership to speed up. Walmart has struck three deals with drone operators to test different uses for drones.

In the first deal, it teamed up with Flytrex to deliver groceries and household essentials in Fayetteville, North Carolina. The second deal includes Zipline for delivering medical and healthcare products.

The third deal with DroneUp is proving to be successful as Walmart (with DroneUp) has rolled out the first of its drone “Hubs,” which are co-located with Walmart stores.

Walmart has 90 percent of the U.S. population within 10 miles of its stores, and each store is optimized for that particular area’s audience. And this fact alone could give it a good edge over Amazon in the drone delivery race.

Walmart said to expand drone delivery across 6 states by 2022. it will be able to reach 4 million households in parts of Arizona, Arkansas, Florida, Texas, Utah, and Virginia. The deliveries by air will be fulfilled from a total of 37 stores — with 34 of those run by DroneUp.

Sustainable Packaging

Being the world’s biggest retail company, Walmart is bound to adopt sustainable packaging. Though the company is to replace single-use plastic for some time, now it has chosen an alternate option to search for sustainable packaging solutions .

Walmart launched an online platform called Circular Connector. The goal of the platform is to accelerate innovation in sustainable and circular packaging and providing this innovation to companies that are looking for such solutions.

Via the new platform suppliers can submit their sustainable packaging innovations for review and potential online publication for brands to consider.

Voice-Search AI

Voice-Search is a feature that Walmart lacks drastically, especially if compared to Amazon which has Alexa. Amazon Alexa’s everywhere strategy is proving a goldmine for them. Whereas Walmart doesn’t have a personal assistant that can rival Siri let alone Alexa. Still, the company has been experimenting with different ways of implementing voice AI for a few years due to its immense potential in the coming years.

The company implemented direct ordering through Google Home devices in 2017 before switching to Google Assistant integration in 2019. Integration with Siri quickly followed. The company has also begun trying out voice AI for use by its employees.

Walmart might not be getting success in voice search but its Indian e-commerce subsidiary Flipkart seems to be doing well in this department, although the tech was developed in-house and not as part of Walmart’s overall R&D efforts.

Automated Delivery

Delivery is one of the biggest strengths of Walmart and the company wants to be better at it with the passing of every day. Apart from strengthening the supply chain, Walmart is using emerging tech to improve its delivery services.

For example, Walmart has built a tech platform that uses automation and machine learning to turn a near-infinite number of factors into usable data which helps in improving its last-mile delivery ecosystem. As it learns through artificial intelligence (AI), the platform is designed to improve.

Further, Walmart wants to provide its delivery expertise to merchants both large and small.

In Aug 2021, Walmart announced a new delivery service business called Walmart GoLocal, which allows other merchants, to tap into Walmart’s own delivery platform to get orders to their customers.

Merchants can choose to use the service for a variety of delivery types, including scheduled and unscheduled deliveries, including same-day delivery, and they can expand their delivery capacity and coverage as their own customer demand requires.

GoLocal is powered by services Walmart first developed for its own delivery needs. Over the past three years, Walmart has been working to scale its in-house Express Delivery service, which promises delivery in two hours or less. This service now offers 160,000+ products at some 3,000 stores, reaching nearly 70% of the U.S. population, the company says. Now it believes it’s ready to make these same capabilities available to other merchants across the U.S. with GoLocal.

Fintech is perhaps one of the important sectors for Walmart to enter. And considering Amazon’s growth in fintech, it’s an obvious choice for Walmart to make a space in the fintech market.

In 2021, Walmart announced that it will be creating a new fintech startup in collaboration with investment firm Ribbit Capital. Behind the scene, both successfully launched a startup that aims to be a super-app rather than a bank of Walmart, per Forbes.

Later in 2022, the start-up, called Hazel , acquired two more companies , One Finance and Even. The combined company will be called ONE .

The start-up plans to capitalize on Walmart’s huge reach: its 1.6 million U.S. employees and more than 100 million weekly shoppers. It has also pointed to an untapped customer base of millions of Americans who don’t have a bank account, can’t access credit, and struggle to build up savings — including many who already shop at Walmart stores.

Robotic Automation in Fulfillment Centers

Automation is not new to Walmart but the company now is aggressively seeking automation for its fulfillment centers.

As a result, Robotic technology from GreyOrange will be used at Walmart Canada’s new $118 million sortable fulfillment center in Rocky View County, Alberta.

The facility will be capable of: shipping 20 million items annually from the facility to Walmart customers; storing 500,000 items to fulfill direct-to-home and in-store pickup orders; and designed to optimize packaging, minimize waste, and reduce transportation costs.

The new center is part of Walmart Canada’s $3.5 billion investment to make the online and in-store shopping experience simpler, faster, and more convenient for its customers.

Further, the company announced plans to build four new fulfillment centers . These will implement automation technology that provides customers and Walmart+ members with access to next or two-day shipping on millions of items.

The retailer says that this results in double the storage capacity and double the number of customer orders it’s able to fulfill in a day.

As new technologies are emerging, Walmart trying to find how it can use them for its customers’ benefit. Keeping that in mind, Walmart has chosen to venture into the Metaverse , one of the more trending technology of current times.

Walmart plans to create its own cryptocurrency and collection of NFTs. It filed several new trademarks in Dec 2021 that indicate its intent to make and sell virtual goods, including electronics, home decorations, toys, sporting goods, and personal care products.

Its Indian subsidiary, Flipkart, also launched an in-house innovation arm called ‘Flipkart Labs’ to explore the metaverse and Web3 . One of the first areas of focus for Flipkart Labs is to collaborate with the web3 community and set the standard for commerce in the metaverse.

Web3, the next iteration of the internet, will have a profound impact across e-commerce solutions, said Naren Ravula, vice president, product strategy and deployment at Flipkart Labs adding that it “leverages the best of latest technology like blockchain for real-world use cases that can digitally transform businesses like ours.”

Following its acquisition last year of Zeekit, creator of a virtual fitting room platform, Walmart is rolling out the venture’s tech , starting with a Choose My Model feature, to users of the retailer’s app and website.

New Services

Walmart is interested in expanding its profit pools beyond its core retail business. And to achieve that Walmart has started selling its technologies to small-and-medium size retailers.

It allows shoppers to buy items online and pick up the purchase at the store. These businesses also will be able to add products to Walmart’s online marketplace with just a few clicks. To offer a suite of cloud-based services, Walmart has partnered with Adobe, which will sell the software through a subscription.

Walmart Acquisition Strategy

Walmart acquisitions.

Walmart has been snapping up start-ups aggressively in recent years. Even they are pouring big money for making acquisitions.

- The acquisition spree looks to have started with the $3.3-billion acquisition of Jet.com, which continued with Walmart’s acquisition of ShoeBuy (retailer), Moosejaw (retailer), Bonobos (retailer), Parcel (logistics company), Hayneedle (retailer), Modcloth (retailer), Flipkart, etc.

- Walmart had launched a “Technology Open Call” back in 2016 to look for innovative tech ideas and startups.

- Further, in 2017, Walmart announced its Store No. 8 , which would be an incubator to nurture startup businesses internally.

- In Aug 2018, Walmart completed a $16 billion Flipkart acquisition which makes the company the largest shareholder of the acquired e-commerce company. This is the biggest acquisition ever made by Walmart .

After Flipkart, Walmart made a few more acquisitions that were related to the online shopping platforms.

- In Oct 2018, Walmart acquired Eloquii , an online plus-size clothing store featuring women’s plus-size fashion, clothes, and accessories, for $100 million. Women’s plus-size apparel is a $21 billion dollar market that every retailer wishes to have.

- On Nov 20, 2018, Walmart added art.com to its portfolio . Art.com is an online platform that sells wall art and decor items. Neither of the companies disclosed the acquisition amount.

- In 2019, Walmart made two acquisitions both with an undisclosed amount. The first one is an Israeli Natural Language Processing Startup, Aspectiva that has the ability to turn product reviews into a smart shopping experience. Another is Polymorph Labs , an ad-tech startup to help the company to maximize its ad revenue.

- In Jun 2020, Walmart acquired CareZone , a medication management software for reportedly $200 million. The recent acquisition is a hint of where Walmart could want to expand.

The startups can help Walmart to fulfill their technological needs, whereas big acquisitions like jet.com or Flipkart could help to gain more market. The only purpose of acquiring Flipkart is so they can obtain a sufficient online sales portion in one of the biggest markets in the world, India.

Walmart also had many retail stores in India but acquiring Flipkart would help them in getting online sales as well.

Amazon is pouring a good budget for the Indian market as both companies know the value of the market. Last year, Amazon acquired a food and grocery retail chain, More, for making their offline presence strong in India.

Walmart would be providing these businesses with capital and support. The incubator would, thus, have a strong focus on futuristic technologies such as in-store drones, VR-enabled shopping, beacon technology, etc.

Transformation of Retail’s Future

Walmart’s wholly-owned subsidiary, Sam’s West, operates the Sam’s Club chain of membership warehouse stores, which has set up a cash-less digital store called Sam’s Club Now for the retail giant.

The retailer’s recent plans to launch such a store in Dallas called it ‘a real-world test lab for technology-driven shopping experiences. The store would comprise technology-enabled retail features such as electronic shelf labels, wayfinding technology for in-store navigation, augmented reality, and artificial intelligence-infused shopping.

Here are certain notable features of the store:

- The store would be staffed with “Member Hosts” instead of cashiers who would act more like concierges.

- Instead of scanning items at a POS cashier stand, customers would use a specialized Sam’s Club Now mobile app . The app leverages Sam’s Club existing “Scan & Go” technology across its retail locations to help speed up the checkout. It would also be infused with other features the company wants to try out, including an integrated wayfinding and navigation system, augmented reality features, an AI-powered shopping list, and more.

- At the launch of the app, it was planned to offer ‘a built-in map’; but over time, the map would be upgraded to use beacon technology and provide routes to customers according to their shopping list. Also, the shopping list would be powered by A.I., which would use a combination of machine learning and customer purchase history to pre-populate the list as per the customers’ history of purchases.

- It would also include new inventory management and tracking technology. On the shelves, it’s also testing electronic shelf labels that would update the prices of displayed products instantly.

Key Takeaways for the Decision Makers

We can take several key takeaways from Walmart’s strategies and implement them in any industry.

- Walmart’s approach to collaborating with a university to look for the possibility of solving a particular problem, then entering into a partnership with a startup to get a more advanced solution for a similar problem, portrays its determination to build intelligent stores, thus enhancing customer experience at its retail locations.

- By acquiring companies, in order to integrate advanced tech and futuristic approaches, it depicts its determination to build intelligent stores — all to become more customer-centric by being tech-centric.

- Using the latest technologies, Walmart is not only saving its manual labor on incompetent tasks but also saving its money on power costs by eliminating the daily dependence.

- Walmart seems to be literally going out of its way to provide customers with the most convenient experience. With this initiative, Walmart would explore how grocery delivery can help them expand their reach to people all over the globe — effectively.

- Walmart is also making efforts to stay competitive with Amazon to control its data-intensive functions smoothly. Not to mention how the cloud initiative imitates Amazon’s use of cloud-powered big data to drive digital sales.

- Walmart is, well, doing an excellent job of leveraging the power of innovative start-ups in order to elevate its own hold in the e-commerce business. Their strategy, so far, has been to buy companies and pull them into Store No.8 where they can provide all the required backing and get innovative advancements.

- The vast majority of technologies that Walmart is and would be using have been developed in-house, though there might be pieces of modules that it is using from third parties. The store also plans to rapidly iterate on new and different experiences across computer vision, AI, AR, machine learning, and robotics.

The use of the latest technologies and acquiring startups are some of the key takeaways which a company can implement. Further, being technology innovative and then securing those inventions using patents is another strategy that is one of the reasons for Walmart’s rise.

Knowing the potential market and paying a huge amount for it so that it might give benefit in the future is another strategy of Walmart that the company implemented in the Indian market by acquiring Flipkart. They paid a big amount to date for the acquisition but it’s a good decision.

Walmart seems all set for more future growth and so is its main competitor, Amazon. How the future will be going for both, that’s a little complicated, but it is evident that a tough competition has already been started.

And one can learn from both companies as their strategies are what made them pioneers in their industry.

Authored by : Vipin Singh (Sr. Research Analyst, Market Research), Mitthatmeer Kaur (Sr. Research Analyst, Patent Analytics), and Priya Vashishth (Sr. Research Analyst, Patent Analytics), Sushant Kumar (Team Lead, Patent Analytics).