- THE STRATEGY JOURNEY Book

- Videos & Tutorials

- Strategy Journey Analyzer [QUIZ + WORKBOOK]

- COMMUNITY FORUMS

- Transforming Operating Models with Service Design (TOMS) Program

- ABOUT STRATABILITY ACADEMY

Walmart Business Strategy: A Comprehensive Analysis

By Julie Choo

Published: January 5, 2024

Last Update: January 5, 2024

TOPICS: Service Design

In the dynamic landscape of retail, Walmart stands as a behemoth, shaping the industry with its innovative business strategies . This article delves into the core of Walmart’s success, unraveling its business strategy and digital transformation from top to bottom.

Walmart Business Strategy

Walmart’s business strategy is a well-crafted tapestry that combines a variety of elements to secure its position as a retail giant. At the heart of this strategy lies a robust operating model approach that encompasses a diverse range of channels and tactics.

Transition to An OmniChannel Marketplace

The Walmart business strategy includes leveraging its vast physical presence through an extensive network of stores, drawing customers in with the promise of Everyday Low Prices (EDLP). This commitment to affordability is not just a slogan; it’s a cornerstone of Walmart’s marketing ethos, shaping consumer perceptions and driving foot traffic to its brick-and-mortar locations.

Building Strength via its Emerging Digital Operating Model

Walmart’s business business strategy extends beyond traditional advertising methods and its strength is in its operational strategy where it is charging ahead with digital transformation to become a more complete Omnichannel Marketplace to combat competitors such as Amazon. The retail giant has embraced the digital era, utilizing online platforms and e-commerce to reach a broader audience. Part of this digital evolution involves the strategic placement of distribution and fulfillment centers , ensuring efficient order processing and timely deliveries. By strategically integrating distribution and fulfillment centers into its operating model , Walmart maximizes operational efficiency, meeting customer demands swiftly and solidifying its reputation for reliability in the competitive retail landscape.

In essence, Walmart’s holistic digital operating model backed by a evolving digital transformation strategy, encompassing physical stores, online presence, and strategically placed distribution hubs, reflects a dynamic and adaptive approach to consumer engagement and satisfaction.

Walmart’s Existing Business Model Before Digital Transformation

Walmart’s retail business .

Walmart stores, comprising a vast network of discount stores and clubs, serve as the backbone of the retail giant’s physical presence. Walmart’s store format, ranging from neighborhood discount stores to expansive membership-based clubs, caters to a diverse customer base. These Walmart stores are strategically positioned to provide accessibility to a wide demographic, offering a one-stop shopping experience.

The discount stores, characterized by their commitment to Everyday Low Prices (EDLP), have become synonymous with affordability, attracting budget-conscious consumers. Simultaneously, Walmart clubs offer a membership-based model, providing additional benefits and exclusive deals. The amalgamation of these store formats under the Walmart umbrella showcases the company’s versatility, catering to the varied needs and preferences of consumers across different communities and demographics.

Walmart Pricing Strategy

Pricing strategy.

Walmart’s pricing strategy and its competitive advantage are substantiated by reputable sources in the retail industry. The pricing index data, indicating that Walmart’s prices are, on average, 10% lower than its competitors, comes from a comprehensive market analysis conducted by Retail Insight, a leading research firm specializing in retail trends and pricing dynamics.

Everyday Low Prices

Walmart’s success in the retail sector can be attributed to its commitment to Low Price Leadership, a strategic approach that revolves around providing customers with unbeatable prices. Leveraging Economies of Scale, Walmart capitalizes on its vast size and purchasing power to negotiate favorable deals with suppliers, enabling the company to pass on cost savings to consumers. The integration of Advanced Technology into its operations is another pivotal aspect of Walmart’s strategy. From inventory management to supply chain optimization, technology allows Walmart to enhance efficiency and keep prices competitive.

Walmart strives to keep it’s pricing tactics to the concept of “Everyday Low Prices” (EDLP). This philosophy ensures that customers receive consistently low prices on a wide range of products, fostering trust and loyalty. Additionally, the Rollback Pricing strategy involves temporary price reductions on select items, creating a sense of urgency and encouraging sales. Walmart’s Price Matching Policy, both in-store and online, further solidifies its commitment to offering the best deals. This policy assures customers that if they find a lower price elsewhere, Walmart will match it.

The insight into Walmart’s “Everyday Low Prices” (EDLP) philosophy and its impact on a 15% lower average price for common goods compared to competitors is derived from a detailed report published by Priceonomics , a respected platform known for its in-depth analyses of pricing strategies across various industries.

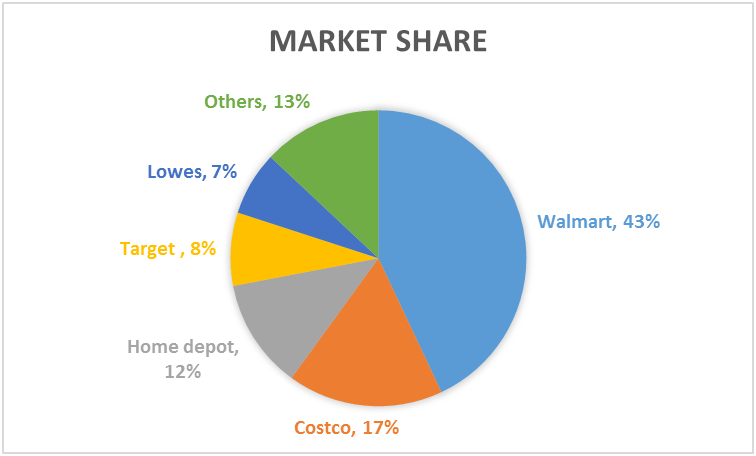

The statistics regarding Walmart’s market share of 22% in the U.S. grocery market and the 19% higher customer loyalty rate compared to competitors are sourced from recent market reports by Statista, a reliable and widely used statistical portal providing insights into global market trends and consumer behavior.

Multiple layers of Discount

Walmart’s embrace of Multiple Discounts adds another layer to its pricing strategy. Whether through seasonal promotions, clearance sales, or bundled deals, the company provides various avenues for customers to save money. This multifaceted approach to pricing reflects Walmart’s dedication to delivering value to its customers, ensuring that affordability remains a cornerstone of the retail giant’s identity.

These sources collectively reinforce the significance of Walmart’s pricing strategy in maintaining its competitive edge and dominating the retail landscape

Walmart’s Servicing Business

Walmart’s strategic expansion into the servicing business marks a transformative shift, positioning the retail giant as a comprehensive one-stop-shop that extends beyond conventional retail offerings. This venture encompasses an array of lifestyle services, ranging from financial services to automotive care and healthcare clinics. Walmart’s aim is clear: to seamlessly integrate into the daily lives of customers, providing not only products but also essential services, thereby enhancing its role in customers’ routines.

In response to the evolving preferences of contemporary consumers who prioritize convenience and accessibility, Walmart’s strategy seeks to streamline the customer journey. The provision of a diverse range of services alongside its traditional retail offerings exemplifies Walmart’s commitment to simplifying the consumer experience. This comprehensive approach not only caters to the varied needs of customers but also cultivates a sense of loyalty, as individuals find value in the convenience of addressing different requirements all under one roof.

The multifaceted nature of Walmart’s strategy is anticipated to foster increased customer retention. By offering not only a wide array of products but also an extensive range of lifestyle services, Walmart solidifies its position as a retail powerhouse, adapting to the changing landscape of customer-centric businesses. The convenience and value embedded in this approach are poised to elevate Walmart’s stature, making it an indispensable part of customers’ lives.

SWOT Analysis of Walmart’s Business strategy

As we navigate Walmart’s digital transformation journey, a SWOT analysis reveals key insights into its strengths, weaknesses, opportunities, and threats, guiding strategic decisions for sustained success in the dynamic retail industry that is operating in an increasingly digital economy.

SWOT Analysis of Walmart:

- Strong Brand Recognition: Walmart’s strength lies in its widely recognized and trusted brand, fostering consumer confidence and loyalty.

- Diverse Revenue Stream: The company’s adaptability is evident through a diverse revenue stream, navigating various markets and industries to maintain financial resilience. Per Walmart’s Q3 FY23 Earnings , a breakdown of walmart’s income can be recognised through its Sam’s Club membership sales (Up by 7.2%), Walmart U.S Comp Sales (Up 4.9%), Walmart U.S. eCommerce (up by 24%), and Walmart International sales (up by 5.4%).

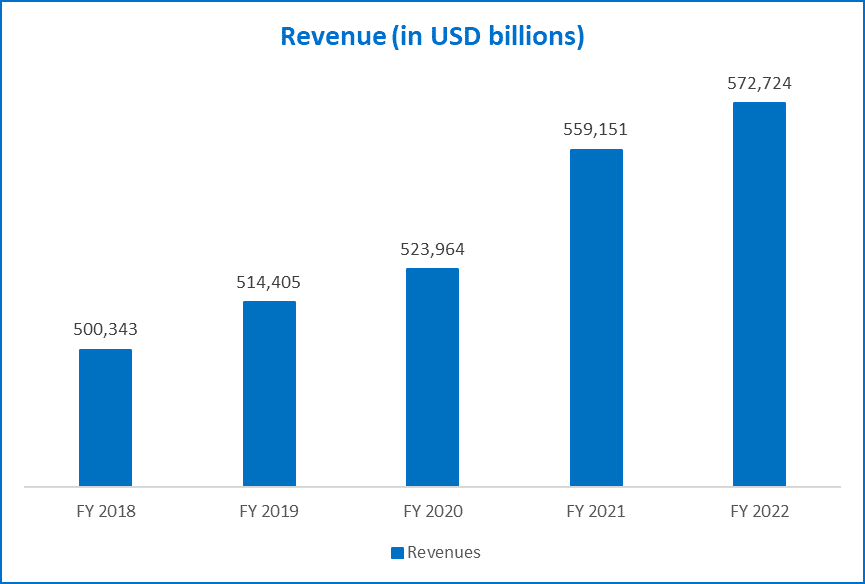

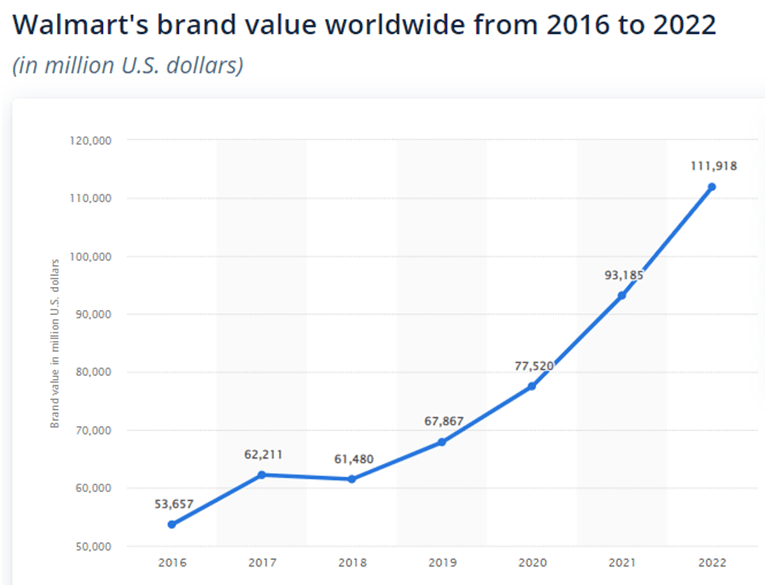

- Economies of Scale: Walmart leverages its extensive size for economies of scale shown by its strong revenue growth of 5.3% per 2022 and 2023 consolidated Income statement, enabling cost advantages in procurement, operations, and overall efficiency.

- Strong Customer Base: With a vast and loyal customer base, Walmart establishes a robust foundation in the retail sector, emphasizing customer retention and sustained business growth as per market share stat of 60% shown on the Market retail/wholesale industry dominated by Walmart.

Weaknesses:

- Labor Relations: Walmart has faced criticism for labor practices, including low wages and labor disputes.

- E-commerce Competition: Despite significant strides, Walmart faces intense competition from e-commerce giants (e.g, amazon, eBay), impacting its online market share.

- Over Reliance on US Market: A substantial portion of Walmart’s revenue is generated in the United States, making it vulnerable to domestic economic fluctuations.

- Inconsistent customer service: represents a weakness in Walmart’s SWOT analysis, as variations in service quality across different locations may impact the overall customer experience, potentially leading to customer dissatisfaction and diminished brand perception.

Opportunities:

- E-commerce Expansion: Further growth in the online market allows Walmart to capitalize on changing consumer shopping habits.

- International Expansion: Targeting untapped markets presents opportunities for global revenue diversification.

- Health and Wellness Market: The growing trend towards health-conscious living provides avenues for expansion in the health and wellness sector. Increased understanding of customer journeys in these niches is key to begin to build stickiness effects.

- Technological Innovations: Embracing cutting-edge technologies can enhance customer experience and operational efficiency through a growing Omnichannel marketplace. It is vital to master data science and begin to leverage AI in the battle to understand consumer behaviors and deliver a remarkable experience.

- Competition: Intense competition from traditional retailers and e-commerce platforms poses a threat to Walmart’s market share such as Costco, Target and Amazon.

- Regulatory Challenges: Changes in regulations, especially related to labor and trade, can impact Walmart’s operations and costs. One such example is the metrics shown per Walmart’s ethics & compliance code of conduct aligning to regulatory challenges in culture, work safety, risk mitigation and more.

- Economic Downturns: Economic uncertainties and recessions may lead to reduced consumer spending, affecting Walmart’s revenue.

- Supply Chain Disruptions: External factors like natural disasters or geopolitical events can disrupt the global supply chain, impacting product availability and costs. Such threats are specifically addressed by Walmart’s Enterprise Resilience Planning Team .

More on Walmart’s Online Competitors

Walmart faces formidable competition in the online retail arena, with key rivals such as Amazon and Target vying for a share of the digital market. Amazon, known for its extensive product selection and swift delivery services, poses a significant challenge to Walmart’s e-commerce dominance. Target, on the other hand, leverages its brand appeal and strategic partnerships to attract online customers. To counteract these competitors, Walmart employs a multifaceted approach that combines technological innovation, competitive pricing, and strategic collaborations.

Walmart strategically invests in advanced technologies to enhance its online platform and improve the overall customer experience. The integration of artificial intelligence (AI) and machine learning enables Walmart to provide personalized recommendations, similar to Amazon’s renowned recommendation engine. Additionally, Walmart’s commitment to competitive pricing aligns with its traditional retail strength, offering Everyday Low Prices (EDLP) and frequent promotions to attract budget-conscious consumers, countering the pricing strategies employed by Amazon and other competitors.

Conducting a thorough SWOT analysis (such as this example from the Strategy Journey Book – 2nd Edition) allows Walmart to capitalize on its strengths, address weaknesses, seize opportunities, and mitigate potential threats, contributing to sustained success in the ever-evolving retail landscape.

Walmart’s Digital Transformation Strategy in the new ERA of AI-led Customer Centricity

Walmart’s online business strategy.

Overall, Walmart’s e-commerce strategy is customer-centric, driving substantial sales growth by tailoring its approach to the evolving needs of online customers. Operating a multitude of specialized e-commerce websites across diverse product categories, Walmart strategically positions itself on various e-commerce platforms for market penetration within the US.

Servicing Relevant Customer Journeys & Sustainable Transformation

Walmart’s evolving online strategy is characterized by a dual focus on extensive product offerings and technological sophistication, with concrete examples per its strategic partnership with Adobe in 2021 to integrate walmart’s marketplace, online and instore fulfillment and pickup technologies with Adobe commerce showcasing its commitment to a seamless customer experience. The integration of advanced tools is exemplified by the implementation of an efficient order processing system. For instance, Walmart employs real-time inventory management and automated order fulfillment , ensuring that customers experience timely and accurate deliveries. Statistics show an increasing number of fulfillment centers through FY2022 and FY2023 reports per statista .

Emerging predictive capabilities supported by Data Science and AI

In addition, the technological depth extends to personalized experiences, illustrated by Walmart’s robust recommendation engine. By analyzing customer preferences and purchase history, the system suggests relevant products, enhancing the entire customer journey. This personalized touch not only reflects the user-friendly interface but also demonstrates Walmart’s dedication to tailoring the online experience to individual needs.

Focus on seamless CX and UX to improve customer stickiness

Furthermore, Walmart’s commitment to a seamless online interaction is evident in its streamlined navigation features. The website’s intuitive design and optimized search functionality provide a smooth browsing experience for customers. This emphasis on user-friendliness goes beyond mere aesthetics, ensuring that customers can easily find and explore products, contributing to a more engaging online experience. Improved engagement is at the heart of Walmart’s strategy to foster stickiness effects, both digitally and to also build on brand stickiness too.

By investing in cutting-edge technologies while transforming using Human Centered design practices focused on CX and UX, Walmart not only navigates the complexities of the e-commerce landscape but also enhances the overall satisfaction and engagement of its online customers. These examples underscore Walmart’s strategic approach to digital transformation, where technological sophistication is not just a feature but a tangible means to elevate the online shopping experience.

Walmart International Business

Successful international business expansion requires operating model transformation, and Walmart’s strategy is characterized by a blend of strategic acquisitions, partnerships, and a keen understanding of local markets. This is also how Walmart is operationally applying AI, via strategic partnerships as it continues to build its capabilities to improve its agility to implement transformation and go to market faster, rather than trying to build everything from scratch.

A Sustainable Diversification strategy that adapts to local markets

Walmart’s international business expansion is a testament to its strategic approach in entering diverse markets and adapting to local nuances. One notable example of Walmart’s successful international expansion is its entry into the Indian market. In 2018, Walmart acquired a majority stake in Flipkart, one of India’s leading e-commerce platforms. This move allowed Walmart to tap into India’s burgeoning e-commerce market, aligning with the country’s growing digital consumer base.

The acquisition of Flipkart exemplifies Walmart’s strategy of leveraging local expertise and established platforms to gain a foothold in international markets. Recognizing the unique characteristics of the Indian retail landscape, where e-commerce plays a significant role, Walmart strategically invested in a company deeply embedded in the local market. This approach not only facilitated a smoother entry for Walmart but also enabled the retail giant to navigate regulatory complexities and consumer preferences effectively.

Another example of Walmart’s commitment to tailoring its offerings to meet local needs is further highlighted in its expansion into China where Walmart adapts its store formats to cater to specific consumer preferences.

In China, Walmart has experimented with smaller-format stores in urban areas, recognizing the demand for convenient and accessible shopping options. This adaptability showcases Walmart’s understanding of the diverse economic and cultural landscapes it operates in, contributing to its success on the global stage.

Working with partners to diversify and build a sustainable business model

Collaborations and strategic partnerships play a pivotal role in Walmart’s competitive strategy. In 2023, Walmart has outlined plans to invest heavily into AI automation fulfillment centers to improve its unit cost average by 20%, increasing efficiency in order fulfilments and operations.

The acquisition of Jet.com in 2016 expanded Walmart’s digital footprint and brought innovative talent into the company. Furthermore, Walmart’s partnerships with various brands (such as Adobe, ShipBob) and retailers enable it to diversify its product offerings, providing a competitive edge against the more specialized approaches of some competitors. As part of Walmart’s strategy in marketing, Walmart has announced partnerships with social media giants such as TikTok, Snapchat, Firework and more further boosting its online digital footprint.

The acquisition of Jet.com in 2016 not only expanded Walmart’s digital footprint but it brought innovative talent into the company. It is clear Walmart sees the need for talent as key to its continued efforts to apply human centered design as part of its digital transformation strategy.

By continuously adapting and evolving its strategies, Walmart is clearly implementing digital transformation sustainably, to support its future operating model as Walmart remains a formidable force in the online retail landscape, navigating the challenges presented by its competitors.

In conclusion, Walmart’s business strategy is that of an growing Omnichannel marketplace, a multifaceted approach that combines physical and digital retail, competitive pricing, supply chain excellence, and a commitment to customer satisfaction. Understanding these elements provides insights into the retail giant’s enduring success in a rapid changing and competitive digital economy as it continues to combat emerging new business disruptions.

Q1: How did Walmart become a retail giant?

Walmart’s ascent to retail dominance can be attributed to a combination of strategic pricing, operational efficiency, and a customer-centric approach.

Q2: What sets Walmart’s supply chain apart?

Walmart’s supply chain is marked by innovation and technological integration, allowing the company to streamline operations and stay ahead in a competitive market.

Q3: How does Walmart balance physical and digital retail?

Walmart seamlessly integrates its brick-and-mortar stores with its online presence, offering customers a comprehensive shopping experience.

Q4: What is Walmart’s philosophy on pricing?

Walmart’s commitment to everyday low prices is a fundamental philosophy that underpins its strategy, ensuring affordability for consumers.

Q5: How has Walmart expanded globally?

Walmart’s global expansion involves adapting its strategy to diverse markets, understanding local dynamics, and leveraging its core strengths.

About the author

Julie Choo is lead author of THE STRATEGY JOURNEY book and the founder of STRATABILITY ACADEMY. She speaks regularly at numerous tech, careers and entrepreneur events globally. Julie continues to consult at large Fortune 500 companies, Global Banks and tech start-ups. As a lover of all things strategic, she is a keen Formula One fan who named her dog, Kimi (after Raikkonnen), and follows football - favourite club changes based on where she calls home.

You might also like

Culture & Careers , Data & AI , Gameplans & Roadmaps , Operating Model , Service Design , Strategy Journey Fundamentals , Transformation

The Impact of Co Creation in Modern Business

Culture & Careers , Data & AI , Gameplans & Roadmaps , Operating Model , Service Design , Transformation

4 steps to create a Winning Game Plan

Service Design

9 Steps to your Winning Customer Journey Strategy

How does Walmart make money: Business Model & Supply Chain Strategy

Walmart helps people worldwide save money and live better – anytime and anywhere – by providing the opportunity to shop in retail stores and through eCommerce and access its other service offerings.

Through innovation, Walmart strives to continuously improve a customer-centric experience that seamlessly integrates its eCommerce and retail stores in an omnichannel offering that saves time for the customers. Each week, Walmart serves approximately 230 million customers who visit more than 10,500 stores and numerous eCommerce websites under 46 banners in 24 countries.

Walmart’s business strategy is to make every day easier for busy families, operate with discipline, sharpen the culture and become more digital, and trust a competitive advantage.

Price leadership has been a cornerstone of Walmart’s business strategy and model. By leading on price, Walmart earns customers’ trust by providing a broad assortment of quality merchandise and services at everyday low prices (“EDLP”).

EDLP is Walmart’s pricing philosophy and business strategy under which it prices items at a low price daily, so customers trust that prices will not change under frequent promotional activity. Everyday low cost (“EDLC”) is Walmart’s commitment to control expenses so the cost savings can be passed to customers.

Let’s closely analyze the business model and supply chain strategy of Walmart.

Business Model Analysis of Walmart

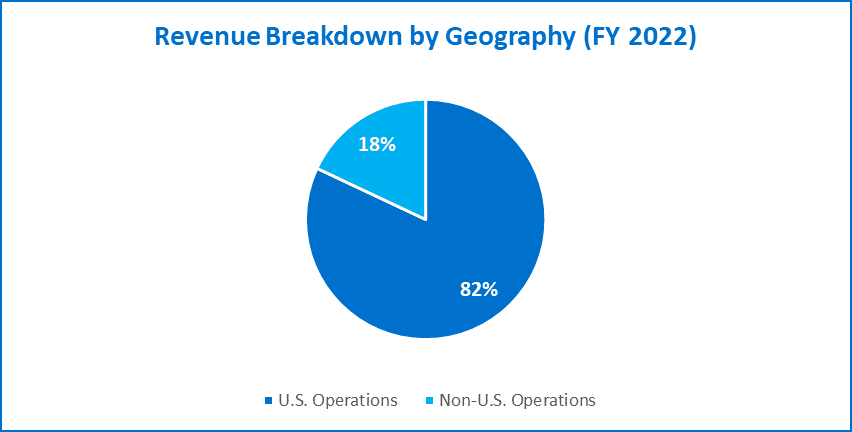

Walmart has global operations of retail, wholesale and other units, as well as eCommerce, located throughout the U.S., Africa, Canada, Central America, Chile, China, India, and Mexico. The business model of Walmart makes money from three segments: Walmart U.S., Walmart International, and Sam’s Club. Walmart made $567.8 billion in fiscal 2022 through these three segments. Each component contributes to the Company’s operating results differently.

Walmart U.S. Segment

Walmart U.S. is the largest segment and operates in the U.S., including in all 50 states, Washington D.C. and Puerto Rico. Walmart U.S. is a mass merchandiser of consumer products, operating under the “Walmart” and “Walmart Neighborhood Market” brands and walmart.com and other eCommerce brands. Walmart U.S. had net sales of $393.2 billion for fiscal 2022, representing 69% of Walmart’s revenue in fiscal 2022.

Omni-channel : Walmart U.S. provides an omnichannel experience to customers, integrating retail stores and eCommerce through services such as pickup and delivery, ship-from-store, and digital pharmacy fulfillment options. As of January 2022, Walmart had approximately 4,600 pickup locations and more than 3,500 same-day delivery locations.

Walmart+ membership offers enhanced omnichannel shopping benefits that include unlimited free shipping on eligible items with no order minimum, unlimited delivery from the store, fuel and pharmacy discounts, and mobile scan & go for a streamlined in-store shopping experience.

Merchandise : Walmart U.S. does business in three strategic merchandise units, listed below:

- Grocery consists of a full line of grocery items, including dry groceries, snacks, dairy, meat, produce, deli & bakery, frozen foods, alcoholic and nonalcoholic beverages, as well as consumables such as health and beauty aids, pet supplies, household chemicals, paper goods, and baby products;

- General merchandise includes Entertainment (e.g., electronics, toys, seasonal merchandise, wireless, video games, movies, music, and books); Hardlines (e.g., automotive, hardware and paint, sporting goods, outdoor living, and stationery); Apparel (e.g., apparel for men, women, girls, boys, and infants, as well as shoes, jewelry, and accessories); and Home (e.g., housewares and small appliances, bed & bath, furniture and home organization, home furnishings, home decor, fabrics, and crafts).

- Health and wellness include pharmacy, over-the-counter drugs, medical products, optical services, and other clinical services.

The Walmart U.S. business also includes an in-house advertising offering via Walmart Connect, supply chain and fulfillment capabilities to online marketplace sellers via Walmart Fulfillment Services, and access to quality, affordable healthcare via Walmart Health.

In Fiscal 2022, Walmart’s U.S. initiatives also included the launch of a B2B last-mile delivery service platform via Walmart GoLocal, and Walmart Luminate, which provides a suite of data products to merchants and suppliers.

Additional service offerings include fuel, financial services, and related products (including through digital channels, stores, and clubs as well as its previously announced fintech joint venture), such as money orders, prepaid access, money transfers, check cashing, bill payment, and certain types of installment lending.

Distribution & supply chain strategy : Walmart U.S. has a total of 157 distribution facilities from which the majority of Walmart U.S.’s purchases of store merchandise are shipped. General and dry grocery merchandise are transported primarily through the segment’s private truck fleet. Walmart ships merchandise purchased through eCommerce platforms by many methods from multiple locations, including its 31 dedicated eCommerce fulfillment centers, or delivers directly from more than 3,500 stores.

Walmart International Segment

Walmart International is the second largest segment, operating in 23 countries outside the U.S. as of January 2022. Walmart International operates through wholly-owned subsidiaries in Canada, Chile, and China and majority-owned subsidiaries in Africa, India, Mexico, and Central America. Walmart International had net sales of $101.0 billion for fiscal 2022, representing 18% of Walmart’s revenue.

Walmart International includes numerous formats divided into two major categories: retail and wholesale. These categories consist of many formats, including supercenters, supermarkets, hypermarkets, warehouse clubs (including Sam’s Clubs), cash & carry, and eCommerce through walmart.com.mx, walmart.ca, flipkart.com, and other sites.

Walmart International’s strategy is to create strong local businesses powered by Walmart, which means being locally relevant and customer-focused in each market it operates.

Omni-channel : Walmart International provides an omnichannel experience to customers, integrating retail stores and eCommerce, such as through pickup and delivery services in most of its markets, its marketplaces such as Flipkart in India, and a digital transaction platform anchored in payments such as PhonePe in India.

Same-day delivery capacity continues to expand in Mexico, including the launch of a membership model which provides unlimited same-day delivery from stores. In China, Walmart’s partnerships with JD.com and JD Daojia provide customers with one-hour delivery by leveraging Walmart stores as fulfillment centers.

A value-based internet and telephone service was recently launched in Mexico, allowing customers to enjoy digital connectivity. Generally, retail units’ selling areas range from 1,400 square feet to 186,000 square feet. Walmart’s wholesale stores’ selling areas range from 24,000 square feet to 158,000 square feet. On January 31, 2022, Walmart International had approximately 2,900 pickup locations and over 1,900 delivery locations.

Merchandise : The merchandising strategy for Walmart International is similar to that of Walmart U.S. in terms of the breadth and scope of merchandise offered for sale. While brand name merchandise accounts for most of its sales, Walmart has leveraged U.S. private brands and developed market-specific private brands to serve customers with high-quality, low-priced items.

In addition, Walmart has developed relationships with regional and local suppliers in each market to ensure reliable sources of quality merchandise equal to national brands at low prices. Walmart International also offers advertising, financial services, and related products in various markets, but they do not contribute significantly to Walmart’s revenue.

TESCO – British Retailer that redefined Grocery Shopping

Distribution & supply chain strategy : Walmart has 179 distribution facilities in Canada, Central America, Chile, China, India, Mexico, and South Africa. Through these facilities, Walmart processes and distributes both imported and domestic products to the operating units of the Walmart International segment.

Across the segment, Walmart connects physical stores and distribution and fulfillment centers which facilitate the movement of goods. Walmart ships merchandise purchased on its eCommerce platforms from its 83 dedicated eCommerce fulfillment centers, more than 3,400 eCommerce sort centers, last-mile delivery facilities in India, and physical retail stores.

Sam’s Club Segment

Sam’s Club operates in 44 U.S. and Puerto Rico states. Sam’s Club is a membership-only warehouse club that also operates samsclub.com. Sam’s Club had net sales of $73.6 billion for fiscal 2022, representing 13% of Walmart’s revenue. As a membership-only warehouse club, membership income is a significant component of the segment’s operating income.

Membership : The following two options are available to members.

All memberships include a spouse/household card at no additional cost. Plus Members are also eligible for free shipping on most merchandise, with no minimum order size, and receive discounts on prescriptions and glasses. Members may redeem Sam’s Cash on purchases in the Club and online to pay for membership fees or cash in clubs.

Omni-channel : Sam’s Club provides an omnichannel experience to customers, integrating retail stores and eCommerce through such services as Curbside Pickup, mobile Scan & Go, ship-from-club, and delivery-from-club. The warehouse facility sizes generally range between 32,000 and 168,000 square feet, with an average size of approximately 134,000 square feet.

Merchandise : Sam’s Club offers merchandise in the following five merchandise categories:

- Grocery and consumables include dairy, meat, bakery, deli, produce, dry, chilled or frozen packaged foods, alcoholic and nonalcoholic beverages, floral, snack foods, candy, other grocery items, health and beauty aids, paper goods, laundry and home care, baby care, pet supplies, and other consumable items;

- Fuel, tobacco, and other categories;

- Home and apparel includes home improvement, outdoor living, gardening, furniture, apparel, jewelry, tools and power equipment, housewares, toys, seasonal items, mattresses, and tire and battery centers;

- Technology, office and Entertainment include consumer electronics and accessories, software, video games, office supplies, appliances, and third-party gift cards; and

- Health and wellness include pharmacy, optical and hearing services, and over-the-counter drugs.

Distribution & supply chain strategy : Walmart has 28 dedicated distribution facilities located strategically throughout the U.S. Some of the Walmart U.S. segment’s distribution facilities service the Sam’s Club segment for certain items. Most of Sam’s Club’s non-fuel club purchases are shipped from these facilities, while the remainder is shipped directly to Sam’s Club locations by suppliers.

Sam’s Club ships merchandise purchased on samsclub.com and through its mobile commerce applications by several methods, including shipments made directly from clubs, 12 dedicated eCommerce fulfillment centers, and other distribution centers. Sam’s Club uses a combination of Walmart’s private truck fleet and common carriers to transport non-perishable merchandise from distribution facilities to clubs.

Overall Supply Chain strategy of Walmart

As a retailer and warehouse club operator, Walmart utilizes a global supply chain strategy that includes U.S. and international suppliers from whom it purchases merchandise in its stores, clubs, and online.

In many instances, Walmart purchases merchandise from producers near the stores and clubs where such merchandise will be sold, particularly products in the “fresh” category. Walmart offers its suppliers the opportunity to sell significant quantities of their products to Walmart efficiently.

These relationships enable Walmart to obtain pricing that reflects the volume, certainty, and cost-effectiveness these arrangements provide to such suppliers, allowing it to offer low prices to customers.

Walmart’s ability to acquire from its suppliers the assortment and volume of products, to receive those products within the required time through its robust supply chain strategy, and to distribute those products to its stores and clubs, determines the attractiveness of Walmart’s merchandise assortment.

Walmart strongly focuses on building a sustainable supply chain in its business model.

- With respect to people, Walmart’s sustainability efforts focus on sourcing responsibly, helping prevent forced labor, empowering women, creating inclusive economic opportunities, and selling safer, healthier products.

- With respect to the planet, Walmart’s efforts aim to enhance the sustainability of product supply chains by reducing emissions, protecting and restoring nature, and reducing waste.

To help address the effects of climate change, Walmart has set science-based targets for emissions reduction to achieve zero emissions in operations by 2040 —without offsets—and to reduce or avoid one billion metric tons of emissions in its value chain by 2030.

Information Source: Walmart Annual Report Fiscal 2022

A passionate writer and a business enthusiast having 6 years of industry experience in a variety of industries and functions. I just love telling stories and share my learning. Connect with me on LinkedIn. Let's chat...

Related Posts

How does Instacart work and make money: Business Model

What does Zscaler do | How does Zscaler work | Business Model

What does Chegg do | How does Chegg work | Business Model

What does Bill.com do | How does Bill.com work | Business Model

What does Cricut do | How does Cricut work | Business Model

What does DexCom do? How does DexCom business work?

What does CarMax do? How does CarMax business work?

What does Paycom do? How does Paycom work?

What does FedEx do | How does FedEx work | Business Model

How does Rumble work and make money: Business Model

Dollar General Business Model & Supply Chain Explained

What does C3 AI do | Business Model Explained

What does Aflac do| How does Aflac work| Business Model

How does Booking.com work and make money: Business Model

What does Okta do | How does Okta work | Business Model

What does Alteryx do | How does Alteryx work | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Industries Overview

Latest articles, beauty tops us store brand sales growth in 2023, chase pioneers targeted in-app advertising with banking customer data, how big will amazon get, amazon accounted for 40% of ecommerce sales, 4% of retail sales in 2023, tiktok won’t dial back on tiktok shop content, but it may not matter for time spent, ctv, identity consolidation, and more: ad trends that cookie deprecation will—and won’t—change, rebrand lessons from jell-o and its agency partner, google contemplates hubspot deal in what would be its biggest-ever acquisition, pubmatic and instacart join forces to marry retail media data with programmatic advertising, two more banks with baas partnerships hit with fdic consent orders, about emarketer, guide to walmart for marketers, advertisers, and retailers.

How the giant is growing its retail business through click-and-collect grocery, subscriptions, and retail media

Powerful data and analysis on nearly every digital topic

Want more research .

Sign up for the EMARKETER Daily Newsletter

Walmart is one of the biggest and most accessible retailers in the country. It’s the second-largest retailer by US ecommerce sales, behind Amazon, thanks in part to its strengths in grocery and its third-party marketplace.

Though its core retail business is going strong, Walmart is also investing heavily in its other business units, including its retail media network, a B2B membership program, fulfillment services, financial and payment services, and healthcare services.

In this guide, we break down Walmart’s business units; where it could be facing competition; and what this all means for retail marketers, advertisers, and more.

- Want to learn more about Walmart and other retail trends? Sign up for the Retail Daily newsletter.

Walmart’s history, business units, and revenues

Founded in 1962, Walmart has evolved from a brick-and-mortar retail store in Arkansas to a global retail powerhouse with multiple banners. Ninety percent of the US population lives within 10 miles of the nearly 4,616 Walmart stores across the country, per the retailer. These retail stores give Walmart US a vast network of distribution centers and supply chain networks. Outside the US, Walmart International operates more than 5,200 physical locations across 19 countries.

The Walmart Inc. corporation also includes Sam’s Club, a club retailer that was founded by Sam Walton in 1983 to help small businesses save money on merchandise purchased in bulk. Today, there are nearly 600 Sam’s Club stores in the US.

Walmart’s business model includes its physical retail and ecommerce business, its retail media network, a B2B membership program, fulfillment services, financial and payment services, and healthcare services.

Here’s a deeper dive into each business unit:

Walmart Retail

Walmart’s retail business includes its 4,616 Walmart US locations across the country, Walmart.com, and the Walmart mobile app . The grocery category is one of the driving forces of Walmart’s ecommerce and in-person retail success. The retailer also hopes to drive retail sales through its Walmart+ membership program.

Despite the fact that its ecommerce business has more than tripled from 2019 to 2024, Walmart is still a distant second in a market dominated by Amazon. Walmart Inc. will grow its US ecommerce sales by 13.5% in 2024 to reach $94.11 billion, a fraction of Amazon’s 2024 US ecommerce sales, totaling $492.23 billion, per EMARKETER’s forecasts.

Walmart’s US ecommerce business is being driven both by its strength in grocery and its third-party marketplace.

Walmart’s digital grocery business surged in 2020 as consumers leaned on online shopping and delivery during the pandemic. But even now that pandemic-era habits have normalized, Walmart’s grocery business is still booming as inflation on food and beverage prices has increased average transaction values and attracted more higher-income consumers looking to save money.

In 2024, Walmart Inc.’s US grocery ecommerce sales will reach $58.92 billion and make up 26.9% of total grocery ecommerce sales in the US, per EMARKETER’s November 2023 forecast.

Click and collect, online grocery ordering that a customer picks up either in-store or curbside at the store, will be a big contributor to Walmart’s grocery success, according to EMARKETER’s The Power of Walmart report. Click and collect’s share of total grocery ecommerce sales will continue to grow through 2027, when it will represent 40.7% of total US grocery ecommerce sales, per a January 2024 EMARKETER forecast. This shift will directly favor Walmart, giving it an advantage over Amazon and Instacart, its two biggest competitors in digital grocery.

Walmart Marketplace

In 2024, EMARKETER forecasts Walmart’s marketplace ecommerce sales will reach $10.60 billion, a 17.5% increase YoY. A retail marketplace is an ecommerce site selling products from multiple third parties, sometimes in addition to their own products.

By October 2023, Walmart Marketplace had doubled in size within 18 months to reach 100,000 active sellers, according to Marketplace Pulse research. It also offers around 400 million SKUs from marketplace sellers, per EMARKETER’s US Retail Ecommerce Marketplaces Forecast 2023 report.

To keep current sellers loyal and attract new ones to the platform, Walmart announced a slate of new marketplace features at its seller summit, including enhanced fulfillment and logistics services for merchants.

Walmart+, the company’s subscription membership service, launched with a bang in September 2020 but has struggled to sustain its initial growth, per The Power of Walmart . Five months after its launch, Walmart+ had between 7.4 million and 8.2 million members, according to Consumer Intelligence Research Partners as reported by Forbes.

“Walmart hasn’t disclosed the number of Walmart+ subscribers, but estimates from Morgan Stanley, cited by The Wall Street Journal, claimed Walmart+ had 16 million members in May 2022, up from 15 million in November 2021. Consumer Intelligence Research Partners said subscribers reached 11 million in July 2022, which was unchanged from April 2022,” as detailed in The Power of Walmart .

In 2024, the number of Walmart+ users will grow 8.8% to reach 31.8 million, according to EMARKETER’s March 2023 forecast.

Twenty-five percent of respondents ages 18 to 34 had access to a Walmart+ membership, according to a December 2023 EMARKETER survey conducted by Bizrate Insights. That’s a higher figure than for other age groups.

In the hopes of competing better with Amazon Prime, Walmart has added a variety of perks to its Walmart+ membership, including a cash-back rewards program, a members-only sales event, free home pickup for returns, and exclusive access to a limited-edition Oreo flavor, per EMARKETER’s Retail Memberships Forecast 2023 report. However, Prime still offers more comprehensive media features than Walmart+, including video streaming, music, and podcasts.

Private label

In early 2023, Walmart said it would begin marketing its private label products as less expensive alternatives to name-brand goods. In addition, CEO Doug McMillon said the retailer would keep its private label brands—which include Great Value, Equate, George, and Wonder Nation—priced low in an effort to bring inflation down.

Consumer preference for private label has remained strong despite easing grocery inflation, with 90% of consumers saying they are likely to keep purchasing store brands even if inflation and grocery prices fall, per a report by FMI—The Food Industry Association.

Advertising and Walmart’s retail media network

Though ad revenues remain a small fraction of its business, Walmart Connect will be the fastest-growing retail media network we track in 2024, growing 39.5% to reach $4.45 billion in ad revenues, per EMARKETER’s October 2023 forecast.

Once again, Walmart is a distant second to Amazon, which will generate $44.26 billion in US ad revenues in 2024.

Walmart’s advertising capabilities include search, display, connected TV (CTV) , social, and in-store digital media.

- Search represents the majority of the Walmart Connect business today, but other capabilities are growing in importance as retail media moves further up the funnel.

- Walmart DSP, Walmart’s demand-side platform (DSP) built in partnership with The Trade Desk, provides access to digital ad inventory on third-party publishers and CTV, likely encouraging more brand advertising investment.

- Walmart’s partnerships with Roku, TikTok, and Snap offer marketers the ability to advertise across social and CTV.

- As it continues to build out its advertising business, Walmart is bringing retail media in-store , focusing on ad formats like audio and product demos, per the company.

To help advertisers better understand and leverage its retail media network, Walmart introduced an ad certification program that covers the breadth of Walmart’s ad capabilities, including on-site, off-site, in-store, and omnichannel ad formats.

- It also provides more in-depth coverage on sponsored products, sponsored brands, and sponsored video ads.

- Eventually, Walmart Connect plans to add courses on display ads, Walmart’s DSP, in-store advertising, and its new Brand Shops, which the retailer announced at its first seller summit in August 2023.

As the retail media channel evolves, Walmart’s physical footprint, strong ties to consumer packaged goods brands, and partnerships with streaming and social platforms will help it attract and keep advertiser clients looking to reach customers across many different channels.

Walmart’s other business units

Outside of its core retail business, Walmart has several other business units, including a B2B membership, fulfillment services, financial and payment services, and healthcare services.

Walmart Business

Launched in January 2023, Walmart Business is a membership for small and medium-sized businesses that offers free shipping, free pickup and delivery from store, as well as rewards and savings opportunities.

Since then, Walmart has also launched a Walmart Business app , revamped the ordering process to make it easier to order in large quantities, partnered with professional services platform Angi, and added a tool to help businesses track their organizational spending.

With this membership service, Walmart hopes to gain a piece of the $2.091 trillion in B2B ecommerce site sales that EMARKETER forecasts for 2024.

Walmart Fulfillment Services

Walmart Fulfillment Services (WFS), which launched in February 2020, is tightly linked to the expansion of Walmart Marketplace and is crucial to fueling an Amazon-style flywheel , according to The Power of Walmart.

“Third-party sellers are strongly encouraged to take advantage of WFS benefits, which include prioritized search results that highlight two-day shipping, management of customer service, and acceptance of returns via Walmart’s extensive store network, including the recent addition of curbside returns,” the report said.

In October 2023, Walmart announced plans to open its fifth “next-generation” fulfillment center in Stockton, California, in 2026. The 900,000-square-foot facility will increase its fulfillment capacity for West Coast online orders. The retailer said that the next-generation facilities operate far more efficiently than its other centers because they use automation to condense its 12-step fulfillment process down to five steps.

Financial and payment services

Walmart offers low-cost banking and alternative financial services at more than 4,700 Walmart stores, which contribute close to $2 billion to the retailer’s bottom line, per The Power of Walmart. Usually housed within its MoneyCenter store-within-a-store concept, shoppers can find prepaid cards and gift cards as well as a host of payment-related services , including check cashing, tax preparation, and money transfer services. Customers can also pay bills, reload prepaid accounts, and apply for Walmart’s private label and co-branded credit cards. In fact, 700 retail store locations include full-service bank branches operated via lease agreement.

Walmart Pay, the retailer’s proprietary mobile wallet, lets customers make mobile payments at its more than 3,500 US Supercenters (i.e., larger stores that offer full ranges of merchandise beyond grocery). It lets customers select a payment method (including credit, debit, prepaid, and gift cards) before using the app to scan a QR code displayed on the register. It cannot be used at fuel pumps or Sam’s Club stores.

Healthcare services

“ Walmart’s healthcare ambitions are decidedly retail-centric: It aims to give consumers another reason to visit a Walmart Supercenter. That philosophy is built into the 48 Walmart Health clinics now operating in five states. But that modest footprint isn’t going to impact the US healthcare industry in any major way,” per The Power of Walmart.

However, its health and wellness division (including Walmart Health), is a tightly integrated part of its flywheel.

Walmart’s retail ecommerce competitors

Walmart faces competition from both the ecommerce and physical retail sides.

Amazon is the top ecommerce retailer in the US . In fact, it’s larger than the next 15 largest US ecommerce retailers combined. In 2024, Amazon will grow its retail ecommerce sales by 11.5% to reach $492.23 billion, according to EMARKETER’s November 2023 forecast.

To better compete with Amazon and steal market share from its Prime Day events, Walmart has begun hosting its own version of the sales event during the same time period.

As a third-party marketplace platform, Shopify directly competes with Walmart’s marketplace model . Shopify’s retail ecommerce sales will reach $117.34 billion in 2024, an 8.5% increase YoY, per EMARKETER’s April 2023 forecast.

Previously, Shopify also offered logistics services, but in May 2023, the company announced it would offload the offering to cut costs.

Target competes with Walmart in both brick-and-mortar and ecommerce sales, but without Walmart’s strong grocery business, it struggles to keep up . In 2024, Target’s US grocery ecommerce sales will grow 7.5% to reach just $8.10 billion (compared with Walmart Inc.’s estimated $58.92 billion), per EMARKETER’s November 2023 forecast. Target’s total US retail ecommerce sales will grow slower at 4.1%, reaching $21.01 billion in 2024.

The opportunity Walmart offers marketers and advertisers

Walmart’s flywheel—powered by its ecommerce, advertising, and fulfillment businesses—enable marketers to promote, sell, and ship their products to customers across the US. The retailer’s physical reach helps brands connect with hard-to-reach customers, like older generations who prefer to shop in-store or those in rural areas.

Walmart’s innovation within its retail media business also provides value to its advertisers. New ad formats like CTV and in-store media offer creative ways to engage with customers, while its ad certification program ensures marketers are able to maximize the effectiveness of their campaigns.

The retailer’s other business units, including its healthcare and payment networks, help the retailer embed itself into every facet of customers’ lives, giving advertisers a multitude of touchpoints to reach their audience.

Want more retail & ecommerce insights?

Sign up for EMARKETER Retail Daily, our free newsletter.

By clicking “Sign Up”, you agree to receive emails from EMARKETER (e.g. FYIs, partner content, webinars, and other offers) and accept our Terms of Service and Privacy Policy . You can opt-out at any time.

Thank you for signing up for our newsletter!

Editor's Picks

The 10 biggest retail companies in the US, by ecommerce sales

Ecommerce Statistics: Industry benchmarks & growth

Industries →, advertising & marketing.

- Social Media

- Content Marketing

- Email Marketing

- Browse All →

- Value-Based Care

- Digital Therapeutics

- Online Pharmacy

Ecommerce & Retail

- Ecommerce Sales

- Retail Sales

- Social Commerce

- Connected Devices

- Artificial Intelligence (AI)

Financial Services

- Wealth Management

More Industries

- Real Estate

- Customer Experience

- Small Business (SMB)

Geographies

- Asia-Pacific

- Central & Eastern Europe

- Latin America

- Middle East & Africa

- North America

- Western Europe

- Data Partnerships

Media Services

- Advertising & Sponsorship Opportunities

Free Content

- Newsletters

Contact Us →

Worldwide hq.

One Liberty Plaza 9th Floor New York, NY 10006 1-800-405-0844

Sales Inquiries

1-800-405-0844 [email protected]

- Search 58728

- Search 10182

- Search 53991

Walmart Business Model | How does Walmart Make Money ?

Company: Walmart Inc. (NYSE: WMT) Founders : Sam Walton Year founded: 1962 CEO: Doug McMillan Headquarter: Bentonville, Arkansas Number of Employees (2023): 2.1 million Type: Public Market Capitalization (July 2023): $432.17 billion Annual Revenue (FY 2022) : $572.75 billion Net Income (FY 2022) : $13.67 billion

Products & Services: Grocery, electronics, apparel, toys, and home furnishings (some stores also sell fuel) Means of Sales: Physical Stores and E-commerce. Competitors: Target Corp , Costco , Dollar General, Dollar Tree, Family Dollar, Kroger , Amazon , Best Buy , and BJ’s Wholesale Holdings.

Table of Contents

Introduction to Walmart

Walmart is the largest enterprise in the world in terms of revenue. The retail giant operates 10,500 stores in 24 countries, offering thousands of products to over 230 million customers annually. Besides selling products from its stores, it also sells them via several E-commerce sites like Walmart, Sam’s Club, and Flipkart .

Walmart attracts customers by offering some of the industry’s lowest prices for groceries and merchandise. It does this by buying directly from the manufacturers and is precise with its expenses.

Sam Walton founded Walmart in 1962. He entered the variety retail industry when he opened a Ben Franklin chain variety store, threw away the traditional rules of running a retail shop, and developed his own. Even though he had to shut shop in a little while, the experience was a strategic success and helped him start Walmart.

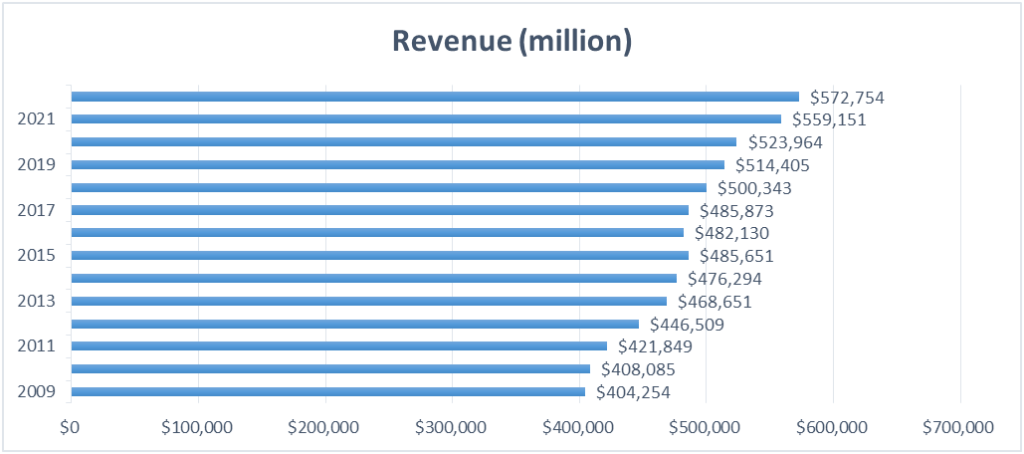

Today Walmart is a retail behemoth . The company’s revenue grew from $44 million in 1970 to $572 billion in 2022, with share prices rocketing from $0.77 in 1982 to $146.67 in 2022.

Walmart’s Business Model

1. customer segments.

Walmart’s customer base comprises two segments:

- Individual customers

- Business customers

The firm markets to consumers through its two distinct brands . Walmart’s target demographic consists of middle-income and lower-income families who prefer to shop in one location. On the other hand, Sam’s Club caters primarily to the middle and upper-income groups.

Together, the two businesses have a massive customer base that spans the entire country and encompasses virtually every demographic.

2. Value Propositions

Walmart offers customers a range of products at the best possible price and in the most convenient way, living up to its motto of

“ Save Money. Live Better, “

It achieves this by focusing on a strategy that revolves around four key ideas:

- Buy Cheap, Sell Cheap

- Earn profits on volumes

- Focus on customers

- Avoid pointless expenses

The company has also renewed its focus on technology, investing more than $14 billion in automation technology , supply chain, and customer-facing initiatives in FY 2022.

3. Key Partners

Being the largest retailer in the world necessitates establishing a global network of distributors, suppliers, and manufacturers for the company to manage its massive supply chain effectively.

Over 100,000 vendors and 210 warehouses are on-board with the organization. Walmart’s distribution network is among the largest in the world, providing service to shops, warehouse clubs, and home delivery.

In addition, more than 11,000 individuals contribute to Walmart’s transportation system, which includes a fleet of 9,000 tractors, 80,000 trailers, and several other vehicles.

Some of the primary suppliers to Walmart include-

- Plug Power Inc.

- Proctor & Gamble

- Hewlett-Packard

- Green Dot Corp

- Primo Water Corp

4. Key Activities

- Buying Goods : Since Walmart is in the retail sector, it must frequently purchase various products from numerous categories. This method involves extensive negotiations and bulk purchases from suppliers and manufacturers. The company also distributes products under the Great Value

- Transporting and Delivering Goods : The corporation sells around 120,000 distinct types of products. Most of these commodities are purchased in bulk, so the corporation must devote substantial resources to transportation. Additionally, the business must organize conveyance for home deliveries and in-store pickups.

- Inventory Control : To ensure that its shelves are always stocked, it has to confirm an appropriate amount of inventory.

5. Key Resources

- Human Resources : With approximately 2.1 million employees, the corporation is the largest private employer in the world. These individuals are vital to managing its over 10,500 stores, distribution hubs, and virtual infrastructure.

- Mobile app and website: The corporation already reigns supreme among retail outlets. After experiencing intense competition from online retailers like Amazon , the company’s website and shopping app now account for a significant amount of its overall sales.

- Stores: The company operates 10,500 Walmart and Sam’s Club locations. These retail locations generate the majority of Walmart’s revenue.

6. Key Acquisitions

After a certain point, every company augments the traditional organic growth route with strategic acquisitions . Walmart has also followed the same path, with some of its notable acquisitions such as:

- Asda : Walmart Inc. owned this British supermarket until last year when it was sold to the EG group for more than GBP 6.8 billion.

- Seiyu Group : Walmart owns a 15% stake in the Japanese retail company. Seiyu has more than 400 stores in Japan and is worth an estimated $13 billion.

- Flipkart : Walmart acquired a 77% stake in the Indian E-commerce giant in 2018. Currently, Flipkart is India’s second-largest E-commerce company. It also owns other notable online companies like Myntra and PhonePe.

- Massmart : It is the second largest distributor of goods in Africa. The company owns local brands like Makro, Game, and Jumbo, each occupying a different space in the consumer necessity and discretionary market. Walmart bought the company for $2.54 billion in 2011.

7. Key Competitors

The retail industry is ancient, mature, and overcrowded. Even though Walmart is the largest retail chain in the world, it still faces stiff competition from-

- Amazon: Amazon has changed the game in the retail industry. It can offer customers products are extremely low prices since its overhead costs are next to nothing. The online retailer received a significant boost during the pandemic when retail stores were forced to shut down.

- Costco: Costco offers the best hotdog and soda combo in the US and is also one of the favorite places to shop for consumers. Its strategy of a no-frills warehouse-like store that offers everything in bulk is a real challenge to the savings promised by Walmart.

- Target: Just like Walmart, Target also focuses on savings, but it also focuses on online sales, with more than 18% of its revenue coming from online channels. It also has smaller stores with more premium-looking interiors and a youthful feel.

- Dollar General: Dollar General is the largest discount retail chain in the US, with more than 18,000 stores. The company generally targets low-income demography and offers products at significantly low costs. In the current inflationary environment, with forecasts of a recession, Dollar General is expected to increase its footfall.

8. Channels

These are mid-sized stores offering a variety of value-priced items. The discount stores are spread across 107,000 square feet, employ about 225 associates and offer 120,000 items each.

These 24/7 large stores focus on offering customers the convenience of a one-stop shop. These stores have third-party restaurants, hair salons, banks, fuel stations etc.

Supercenters average 187,000 square feet, employ 350 or more associates on average and offer 142,000 different items.

These stores are the smallest of the lot and focus on delivering everyday items like groceries, pharmaceuticals and general merchandise. Neighborhood Markets have an average size of 42,000 square feet, employ 95 associates on average, and offer about 29,000 items.

This members-only warehouse club offers general merchandise and large-volume items at value prices to small business owners and families.

The average size of Sam’s Clubs stores is 132,000 square feet, employ around 160-175 associates, and roughly have 5,500 products.

The company generates a majority of its online revenue in the US from the following two sites:

- samsclub.us

It also has a majority stake in the Indian E-commerce giant Flipkart.

9. Customer Service

Walmart has a long and distinguished history of putting customers first. The company’s founder, Sam Walton, invented the concept of door greeters. The organization also employs a workforce to provide customer service via chat, internet, and telephone, besides in-store customer support representatives.

Today, Walmart’s CRM strategy, customer service strategy , and customer experience initiatives work in tandem to develop customer loyalty that rivals most other retailers. According to InMarket , Walmart has the most loyal customer base of all retailers in the United States.

10. Walmart’s Cost Structure

Walmart is a wholesaler and retailer, acquiring goods from producers and suppliers.

- The cost of buying and transporting these goods (cost of sales) was $429 billion in FY 2022, $9.3 billion more than FY 2021’s cost of sales of $420.3 billion.

- Operating and SG&A costs (short for selling, general, and administrative) amounted to $117.8 billion in FY 2022, up $1.5 billion from $116.29 billion in FY 2021.

11. Walmart’s Revenue Streams

- The company posted revenue of $567.76 billion for FY 2022, an increase of 2% over FY 2021.

- Most of Walmart’s revenue (82%) was from the US, followed by its International business (18%).

- In FY 2022, groceries accounted for 56% of Walmart’s total income in the US, followed by general merchandise (32%), health and wellness (11%), and other categories (1%).

- The company posted a net profit of $13.67 billion in FY 2022, slightly higher than the $13.5 billion profit in FY 2021.

- Walmart also witnessed a surge in inventory from $44.95 billion in FY 2021 to $56.5 billion in FY 2022, indicating a slow movement of products.

Final Thoughts

Walmart is #1 on the list of Fortune 500 companies in the United States for 2022. The annual list of Fortune 500 companies, compiled and published by Fortune magazine, ranks the most significant corporations in the United States in terms of revenue for the fiscal year.

The changes implemented by the company on how consumers shop have influenced the overall culture, leading to its robust growth.

Walmart’s business ethics have also provided investors with astronomical returns on equity. For instance, an investor who bought $1,000 worth of shares in 1972 when the company first listed on the NYSE would have seen its value rise to nearly $3 million at the end of 2022.

References & more information

- Walmart SEC filings: https://stock.walmart.com/financials/sec-filings/default.aspx

- SimilarWeb: https://www.similarweb.com/top-websites/category/e-commerce-and-shopping/

- Linda Shepherd for NCESC: https://www.ncesc.com/companies-owned-by-walmart/

- Liz Flynn (2019, April 19): https://moneyinc.com/companies-you-didnt-know-walmart-owned/

- Marianne Wilson (2021, November 06): https://chainstoreage.com/walmart-has-most-loyal-customers-us-followed-fred-meyer-meijer-and-target

- Sandra Gudat (2022, May 2): https://www.customer.com/blog/retail-marketing/how-walmart-customer-loyalty-rose-to-the-top-and-stayed/

- Elvin Mirzayev (2019, September 03): https://www.investopedia.com/articles/active-trading/070715/target-vs-walmart-whos-winning-big-box-war.asp

- Walmart corporate website: https://corporate.walmart.com/

- Yahoo Finance: https://finance.yahoo.com/quote/WMT?p=WMT&.tsrc=fin-srch

- Richard Best (2022, May 02): https://www.investopedia.com/articles/insights/050116/walmart-stock-analyzing-5-key-suppliers-wmt.asp

- James Moore (2014, January 10): https://www.talkativeman.com/sam-walton-frugality-wal-mart/

- Featured image by Marques Thomas

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Kevin Johnson

Add comment, cancel reply, you may also like.

How does Letgo make money?

Company: Letgo CEO: Enrique Linares Plaza Founders: Alec Oxenford, Enrique Linares Plaza, and Jordi Castello Year founded: 2015 Headquarter: New York, New York Number of Employees (Dec 2018): 270+ Type:...

How Does Credit Karma Work and Make Money?

Last updated: May 19, 2020 Company: Credit Karma CEO: Kenneth Lin Founders: Kenneth Lin, Nichole Mustard, Richard Graciano Year founded: 2007 Headquarter: San Francisco, CA Number of...

43 Recession Proof Businesses (2023)

Last updated: Sept 09, 2021 Recession is undoubtedly a time of high crisis, and you’d think that everything will slowly start crumbling. Well, that is not true in most cases. By most cases we mean businesses. We...

ALDI Business Model | How Does ALDI make money?

Grocery stores are a staple of the American economy and raked in over $848.4 billion in sales last year alone. Interestingly, this sector is domineered by international supermarket chains, like ALDI, instead of...

How Does Coffee Meet Bagel Work?

Company: Coffee Meets Bagel Founders: Arum Kang, Dawoon Kang, Soo Kang Year founded: 2012 Headquarter: San Francisco Products & Services: Online Dating, Internet Competitors: Tinder, Bumble, Hinge...

How does Uber Eats work?

Last updated: April 20, 2020 Company: Uber Eats Founders: Travis Kalanick and Garrett Camp Year founded: 2014 CEO: Dara Khosrowshahi Headquarter: San Francisco, CA Number of Employees (Dec 2018): Est. 5,000 Type:...

Etsy Business Model | How Does Etsy Make Money?

Technological advancements, increased adoption of mobile devices, globalization, better and cheaper internet connection, and safe payment gateways are driving the growth of online marketplaces like Etsy. But what is...

What is ProctorU, how it works and makes money?

Company: ProctorU Founders: Jarrod Morgan Year founded: 2008 CEO: Scott McFarland Headquarter: Birmingham, Alabama Number of Employees (Dec 2018): 400+ Type: Private Ticker Symbol: NYSE: UBER Annual Revenue (Dec...

How does Sweatcoin work and make money?

Company: Sweatcoin Founders: Oleg Fomenko and Anton Derlyatka Year founded: 2015 CEO: Oleg Fomenko and Anton Derlyatka Headquarter: London, England Type: Private Investor Funding: 6.3M Products &...

Amazon Business Model | How does Amazon make money

Last updated: Feb 13, 2021 Company : Amazon CEO : Andrew Jassy Year founded : 1994 Headquarter : Seattle, Washington United States Business world has never been the same since the inception of...

Recent Posts

- Who Owns TracFone

- Who Owns Rolex?

- Who Owns Bellagio?

- Who Owns Skechers?

- Who Owns JetBlue?

- Who Owns Ciroc?

- Who owns Aston Martin?

- Top 10 Bed Bath and Beyond Competitors and Alternatives

- Who Owns Sheraton?

- Who owns Volkswagen?

Business Strategy Hub

- A – Z Companies

- Privacy Policy

Buy us Coffee

If you like our work and would like to show appreciation to our team, buy us coffee!

Subscribe to receive updates from the hub!

- Red Queen Effect

- Blue Ocean Strategy

- Only the paranoid survives

- Co-opetition Strategy

- Mintzberg’s 5 Ps

- Ansoff Matrix

- Target Right Customers

- Product Life Cycle

- Diffusion of Innovation Theory

- Bowman’s Strategic Clock

- Pricing Strategies

- 7S Framework

- Porter’s Five Forces

- Strategy Diamond

- Value Innovation

- PESTLE Analysis

- Gap Analysis

- SWOT Analysis

- Strategy Canvas

- Business Model

- Mission & Vision

- Competitors

- Buy Us Coffee!

Our Segments Walmart U.S.

The Walmart business model focuses on our unique assets. Assets that work together in a mutually reinforcing way to bring customers into our ecosystem and serve them seamlessly across their everyday journeys. We call it the flywheel.

We start with the customer and design for them. They come to Walmart for the things they want and need, and they also like that we’re a force for good in local communities and for the planet. Our priority is to continue being the first, best place to shop. We’re doing this today with refreshed experiences in stores, services like pickup and delivery, a Walmart+ membership, or delivery directly into the refrigerator. Underpinning this is our aggressive approach with investments in capacity, fulfillment, and automation to ensure Walmart is the primary destination.

We aim to serve families more broadly, deepen our relationship with them, and create a healthy mix of merchandise and services. We’ll continue to add new brands and grow the assortment, especially in general merchandise, through our own assortment and the Walmart marketplace.

Beyond merchandise, we know we can do more to expand the reach of health and wellness. We already play a meaningful role in businesses like pharmacy, optical, hearing, and OTC, and we’re also one of the largest sellers of food in the U.S., which is important as we think about health overall. We recently announced the opening of new healthcare clinics, and we plan to open more. Customers and members want high quality, preventative, accessible, and affordable healthcare – and we can help make it a reality.

Like healthcare, customers are looking for better solutions for their money. Walmart can help them save money, reduce friction, and strengthen their finances through the new fintech startup we’ve announced, which will operate under the "One" brand going forward. We have an opportunity to positively affect the financial well-being of millions of families across the U.S., and we’re working quickly to develop solutions.

We operate at the lowest cost to serve, and we do it in a way that’s sustainable and fits within our goal of becoming a regenerative company. Being more productive and more digital in how we work helps fuel investments in important areas that diversify our profit base. Areas like advertising, data, and last mile delivery.

We are deepening our relationship with customers as we introduce new products and services, which allows them to seamlessly interact with the Walmart brand on their terms and in a way that fits their wants and needs. Connecting these pieces allows us the opportunity to expand our profit pools and pull it together in a way that’s good for shareholders.

We're sorry, but this browser is no longer supported

You will experience limited functionality and unusable pages with your current browser. We recommend upgrading to one of the latest versions of the following browsers:

Walmart Business Model Explained: The Tactics That Led to Its Success

Key takeaways, the beginnings, innovation era, becoming the best, sustainability and longevity.

- Walmart Business Model Explained - How Does It Work?

Leading on Price

Competing on assortment, differentiating on access, providing a great shopping experience, money-back guarantee.

- Walmart's Operations

Procter & Gamble

Green dot corporation, plug power inc., primo water corporation, other partners, customer segments, customer relations, marketing strategy.

- Walmart's Marketing Mix

SWOT Analysis

Opportunities, question: how does walmart afford to have such low prices, question: what is the main business strategy that walmart relies on, question: why does walmart have so many customers.

- Walmart Business Model Explained - Bottom Line

Everyone knows Walmart, the famous US retailer, but few know its unbelievable history and steady growth. Walmart appeared in the ’60, and now operates a wide range of stores, including supermarkets, hypermarkets, neighborhood markets, department stores, grocery stores, and discount shops. Below, you’ll find Walmart’s business model explaine d in detail.

This will give you further insight into how this business developed and became successful nationwide. Walmart would be the world’s largest business if we considered annual revenue. Keep reading for the full Walmart business model explained.

- Walmart was launched in the ’60, and it quickly became one of the largest chain stores in the US;

- By 2022, the company became the most successful business in the world, with annual revenues of approximately $570 billion;

- Walmart is the world’s second-largest employer in the private sector, with around 2.2 million employees. Amazon occupies the first place;

- The company’s business model focuses on four important market segments: within the US, the international market, Sam’s Club, and the brand’s mobile app.

Walmart’s Business History

Let’s see how Walmart went from one store to a vast network of brick-and-mortar and online shops .

The first Walmart store was opened in 1962 in Rogers, Arkansas. Sam Walton, the founder, had a clear marketing strategy: providing the lowest prices on the market, anywhere, anytime. By 1967, Walmart had become a store chain with 24 physical locations. As a result, sales were rising, reaching nearly $13 million.

In 1970, Walmart’s national appeal spread more than ever before. The company had had incredible growth over its first decade of existence. Around this time, the business becomes publicly traded, with one share costing $16.50.

By 1975, Walmart had already been listed on the NYSE (New York Stock Exchange). Before opening its first pharmacy, in 1978, Walmart had over 50 stores and a whopping sales total of almost $80 million. The company established the Walmart Foundation in 1979.

The ’80s represented a decade of many new and exciting things for the business, including the opening of the original Walmart Supercenter. This store mixed general merchandise with supermarket items. The chain had 21,000 employees, 276 stores, and annual sales of $1 billion.

Another fantastic innovation that Walmart revealed was computerized point-of-sale systems. These revolutionized the process of grocery shopping while offering customers quick and accurate checkouts.

The Walton Family Foundation appeared in 1987, the same year in which Walmart linked the corporation’s communication systems and its operations through video, voice, and data, all combined. That’s possible due to the most extensive private satellite system ever seen in the US.

By 1990, Walmart becomes US’s number one retailer. The company’s strategy focuses more on boosting convenience and going international. The first international location was opened in Mexico City in 1991.

Sam Walton, the owner, died in 1992 at the age of 74. His son, Rob Walton, takes on the family’s business and responsibilities. In 1994, the first Canadian stores appeared, followed by an expansion into the Chinese market in 1996. The growth continues because Walmart acquired the UK-based Asda. By 2002, Walmart’s clients could do their shopping online.

After the company’s penetration into the Japanese market, its representatives state their commitment to environmental sustainability. They focused on three main aspects:

- Using renewable energy;

- Creating zero waste;

- Selling sustainable products.