- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

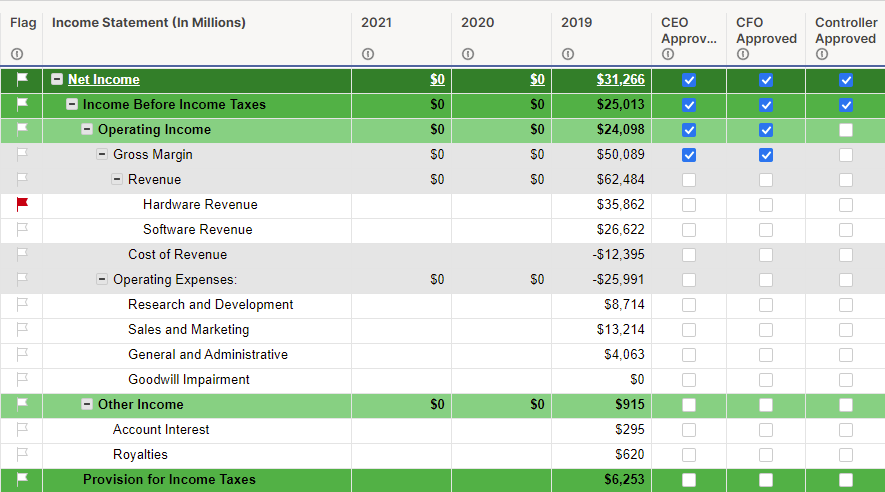

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

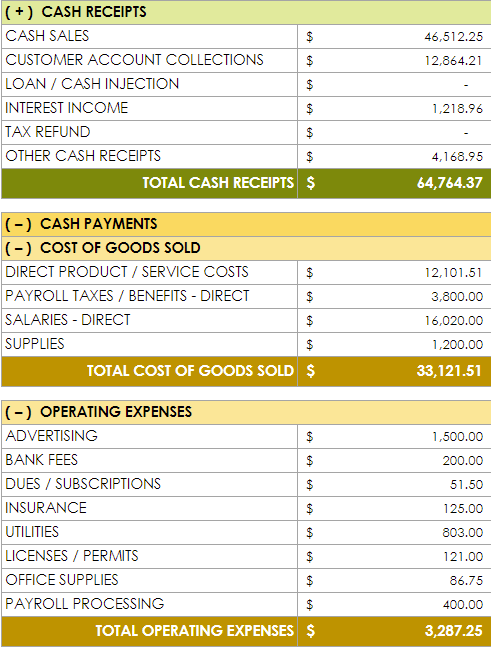

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

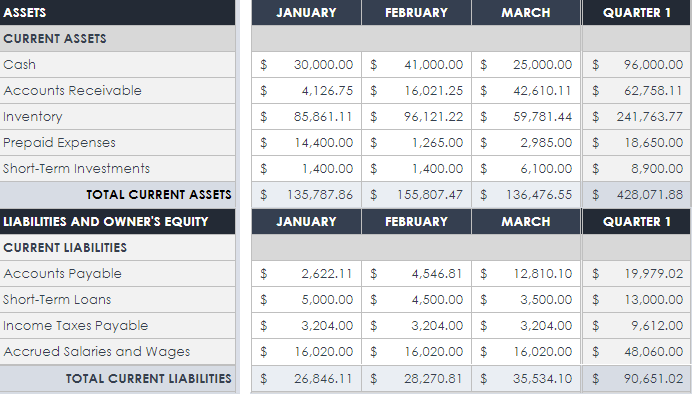

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

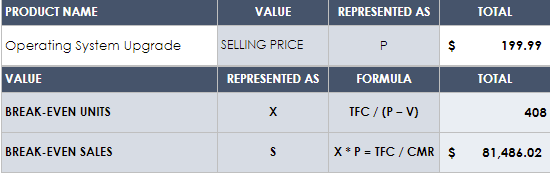

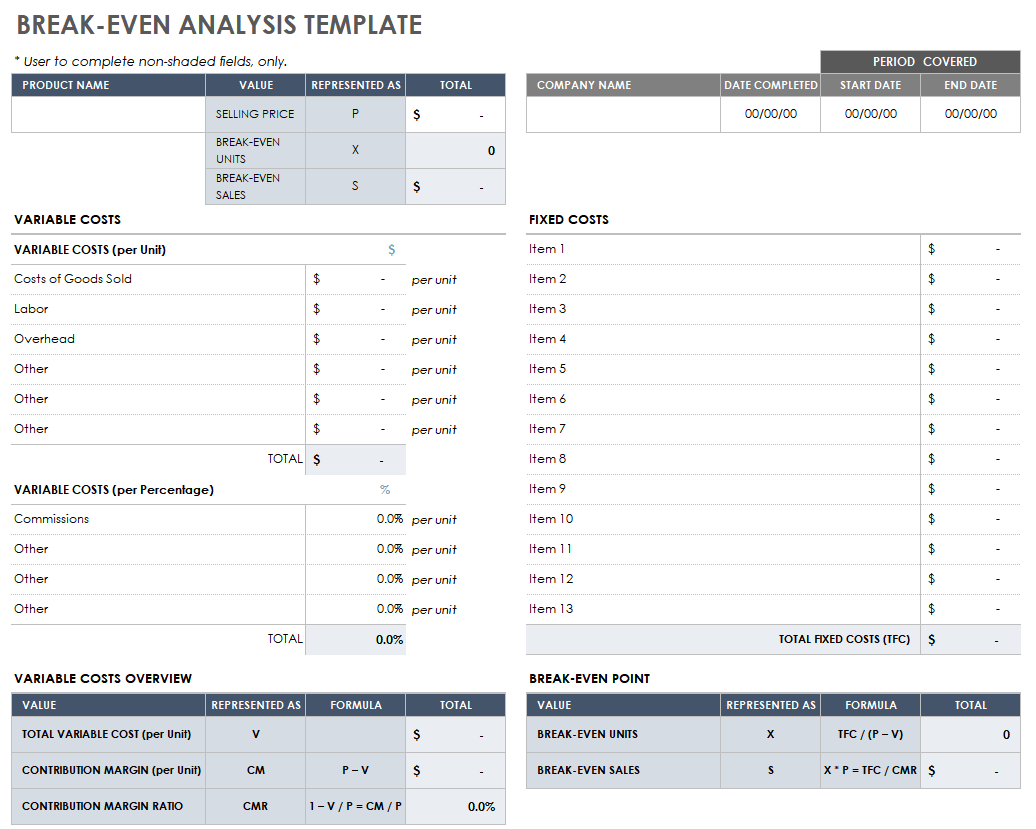

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

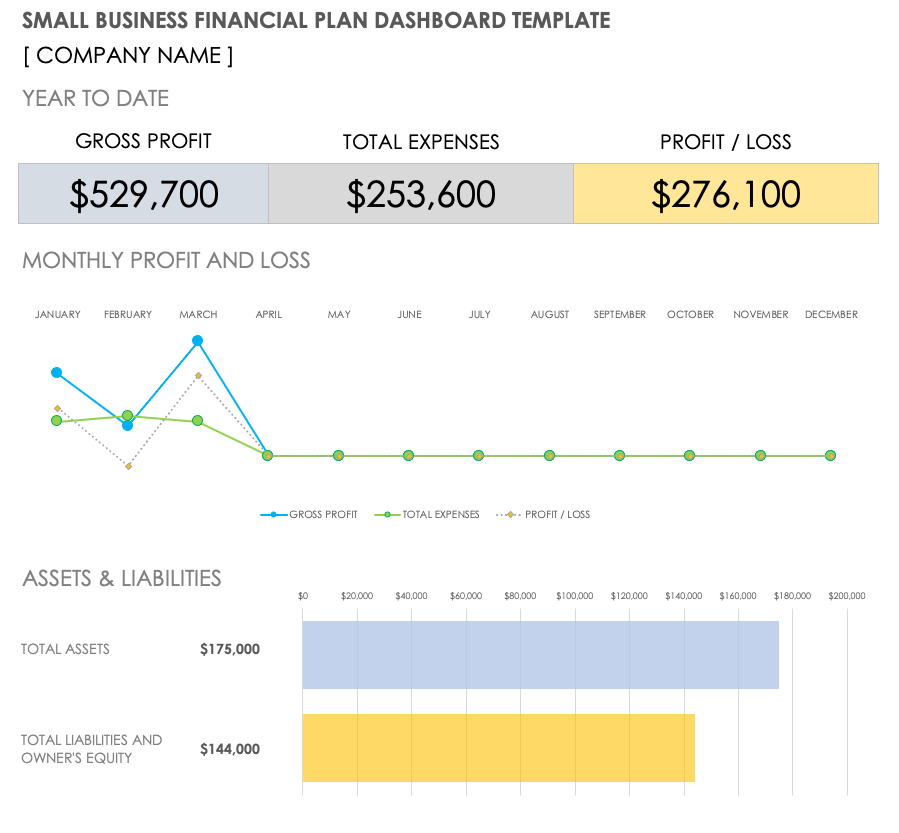

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

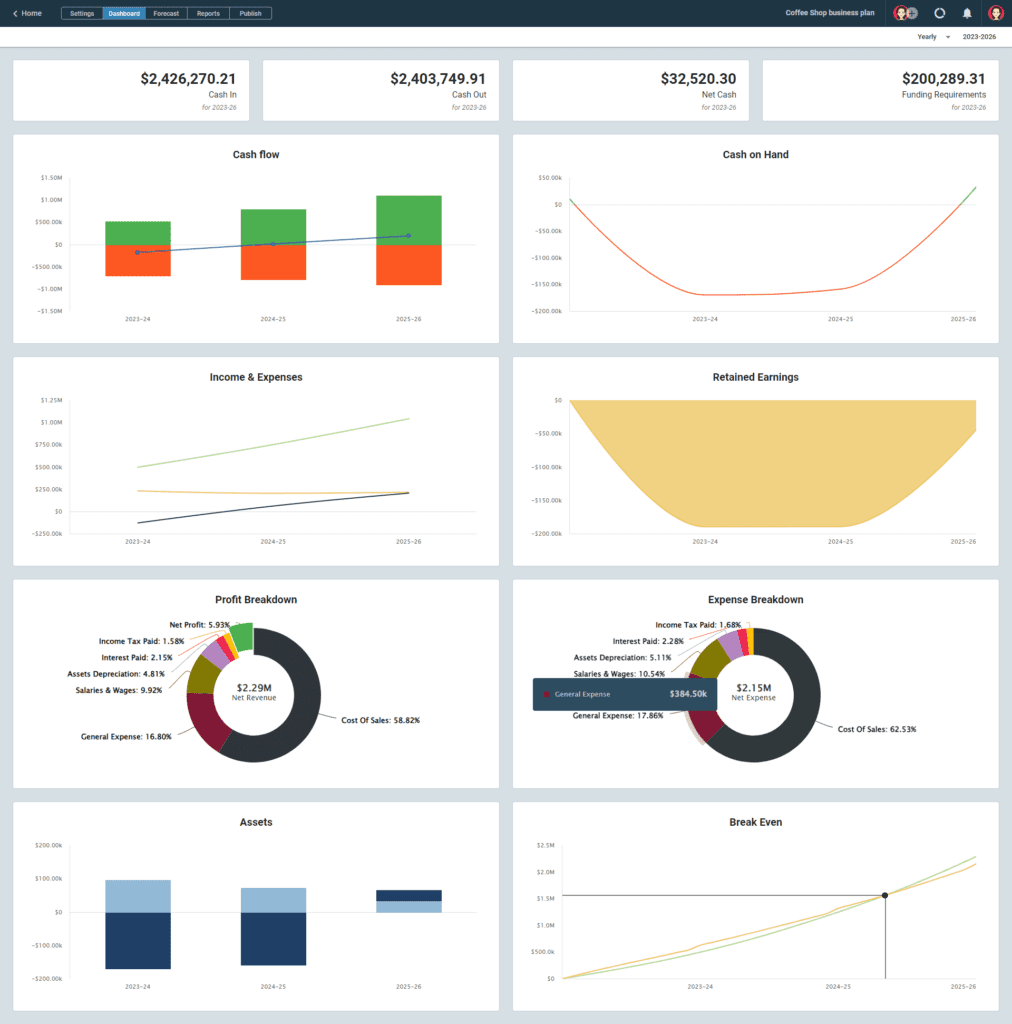

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

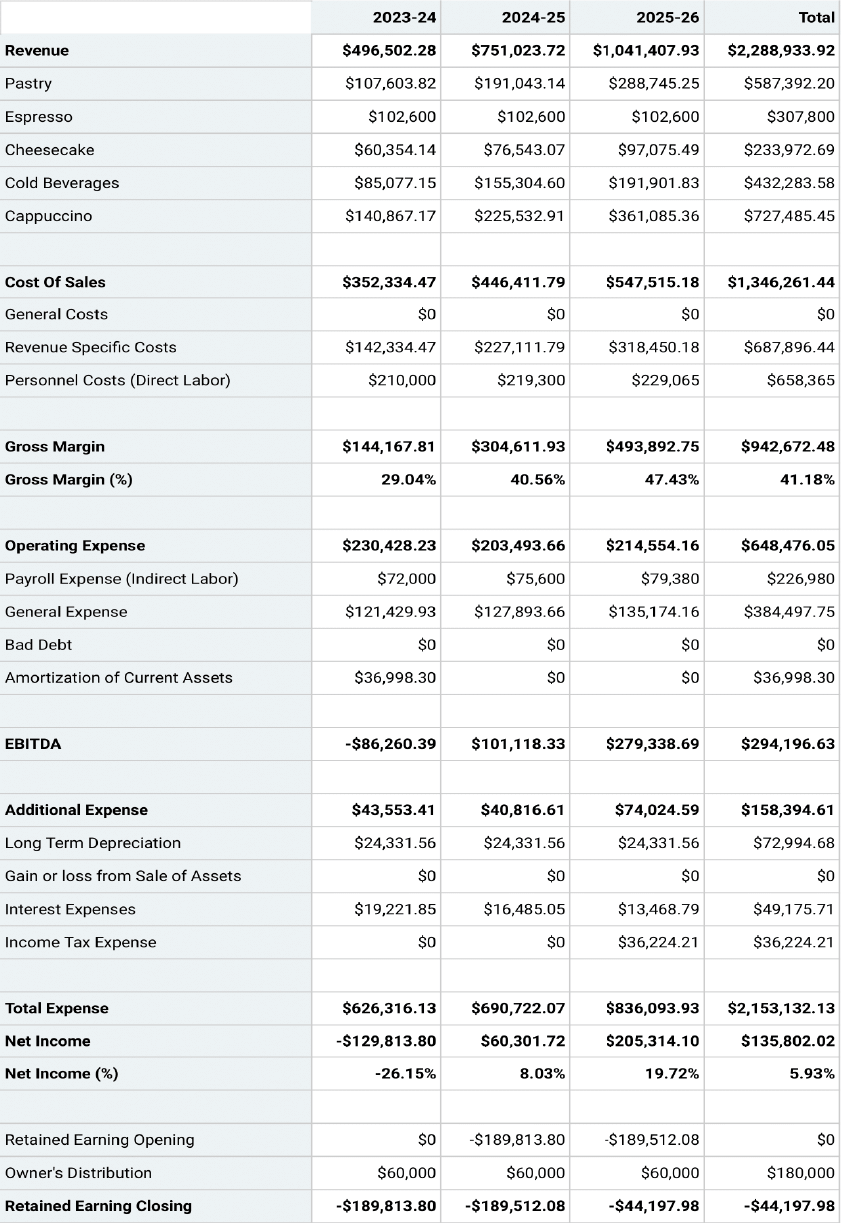

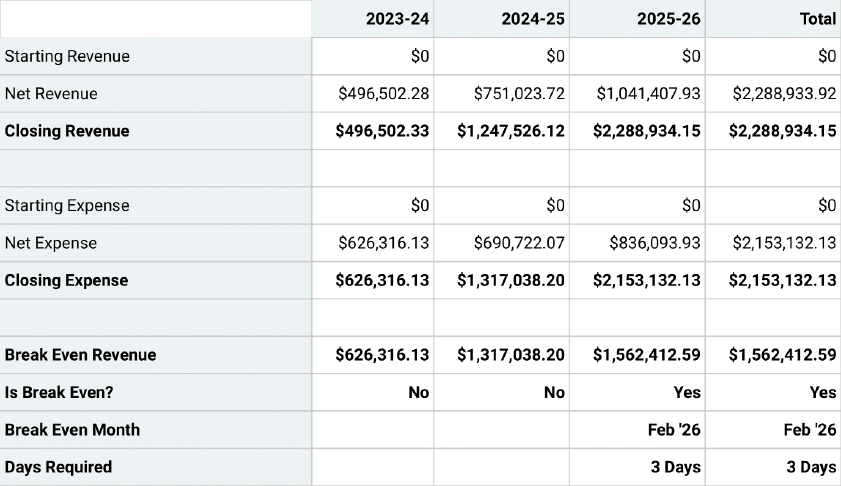

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

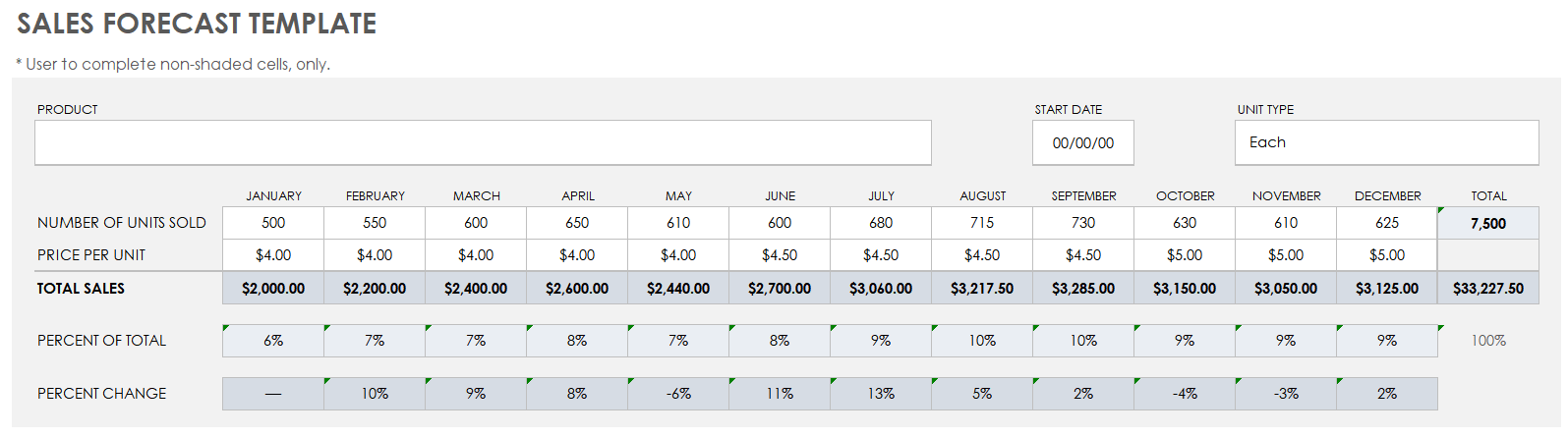

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

10 Min. Read

How to Set and Use Milestones in Your Business Plan

How to Write the Company Overview for a Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, business plan financials: 3 statements to include.

The finance section of your business plan is essential to securing investors and determining whether your idea is even viable. Here's what to include.

If your business plan is the blueprint of how to run your company, the financials section is the key to making it happen. The finance section of your business plan is essential to determining whether your idea is even viable in the long term. It’s also necessary to convince investors of this viability and subsequently secure the type and amount of funding you need. Here’s what to include in your business plan financials.

[Read: How to Write a One-Page Business Plan ]

What are business plan financials?

Business plan financials is the section of your business plan that outlines your past, current and projected financial state. This section includes all the numbers and hard data you’ll need to plan for your business’s future, and to make your case to potential investors. You will need to include supporting financial documents and any funding requests in this part of your business plan.

Business plan financials are vital because they allow you to budget for existing or future expenses, as well as forecast your business’s future finances. A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Sections to include in your business plan financials

Here are the three statements to include in the finance section of your business plan:

Profit and loss statement

A profit and loss statement , also known as an income statement, identifies your business’s revenue (profit) and expenses (loss). This document describes your company’s overall financial health in a given time period. While profit and loss statements are typically prepared quarterly, you will need to do so at least annually before filing your business tax return with the IRS.

Common items to include on a profit and loss statement :

- Revenue: total sales and refunds, including any money gained from selling property or equipment.

- Expenditures: total expenses.

- Cost of goods sold (COGS): the cost of making products, including materials and time.

- Gross margin: revenue minus COGS.

- Operational expenditures (OPEX): the cost of running your business, including paying employees, rent, equipment and travel expenses.

- Depreciation: any loss of value over time, such as with equipment.

- Earnings before tax (EBT): revenue minus COGS, OPEX, interest, loan payments and depreciation.

- Profit: revenue minus all of your expenses.

Businesses that have not yet started should provide projected income statements in their financials section. Currently operational businesses should include past and present income statements, in addition to any future projections.

[Read: Top Small Business Planning Strategies ]

A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Balance sheet

A balance sheet provides a snapshot of your company’s finances, allowing you to keep track of earnings and expenses. It includes what your business owns (assets) versus what it owes (liabilities), as well as how much your business is currently worth (equity).

On the assets side of your balance sheet, you will have three subsections: current assets, fixed assets and other assets. Current assets include cash or its equivalent value, while fixed assets refer to long-term investments like equipment or buildings. Any assets that do not fall within these categories, such as patents and copyrights, can be classified as other assets.

On the liabilities side of your balance sheet, include a total of what your business owes. These can be broken down into two parts: current liabilities (amounts to be paid within a year) and long-term liabilities (amounts due for longer than a year, including mortgages and employee benefits).

Once you’ve calculated your assets and liabilities, you can determine your business’s net worth, also known as equity. This can be calculated by subtracting what you owe from what you own, or assets minus liabilities.

Cash flow statement

A cash flow statement shows the exact amount of money coming into your business (inflow) and going out of it (outflow). Each cost incurred or amount earned should be documented on its own line, and categorized into one of the following three categories: operating activities, investment activities and financing activities. These three categories can all have inflow and outflow activities.

Operating activities involve any ongoing expenses necessary for day-to-day operations; these are likely to make up the majority of your cash flow statement. Investment activities, on the other hand, cover any long-term payments that are needed to start and run your business. Finally, financing activities include the money you’ve used to fund your business venture, including transactions with creditors or funders.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Join us for our Small Business Day event!

Join us at our next event on Wednesday, May 1, at 12:00 p.m., where we’ll be kicking off Small Business Month alongside business experts and entrepreneurs. Register to attend in person at our Washington, D.C., headquarters, or join us virtually!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

More tips for your startup

Micro-business vs. startup: what’s the difference, micro businesses: what are they and how do you start one, how to use ai tools to write a business plan.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

How to Develop a Small Business Financial Plan

By Andy Marker | April 29, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

Financial planning is critical for any successful small business, but the process can be complicated. To help you get started, we’ve created a step-by-step guide and rounded up top tips from experts.

Included on this page, you’ll find what to include in a financial plan , steps to develop one , and a downloadable starter kit .

What Is a Small Business Financial Plan?

A small business financial plan is an outline of the financial status of your business, including income statements, balance sheets, and cash flow information. A financial plan can help guide a small business toward sustainable growth.

Financial plans can aid in business goal setting and metrics tracking, as well as provide proof of profitable ideas. Craig Hewitt, Founder of Castos , shares that “creating a financial plan will show you if your business ideas are sustainable. A financial plan will show you where your business stands and help you make better decisions about resource allocation. It will also help you plan growth, survive cash flow shortages, and pitch to investors.”

Why Is It Important for a Small Business to Have a Financial Plan?

All small businesses should create a financial plan. This allows you to assess your business’s financial needs, recognize areas of opportunity, and project your growth over time. A strong financial plan is also a bonus for potential investors.

Mark Daoust , the President and CEO of Quiet Light Brokerage, Inc., explains why a financial plan is important for small businesses: “It can sometimes be difficult for business owners to evaluate their own progress, especially when starting a new company. A financial plan can be helpful in showing increased revenues, cash flow growth, and overall profit in quantifiable data. It's very encouraging for small business owners who are often working long hours and dealing with so many stressful decisions to know that they are on the right track.”

To learn more about other important considerations for a small business, peruse our list of free startup plan, budget, and cost templates .

What Does a Small Business Financial Plan Include?

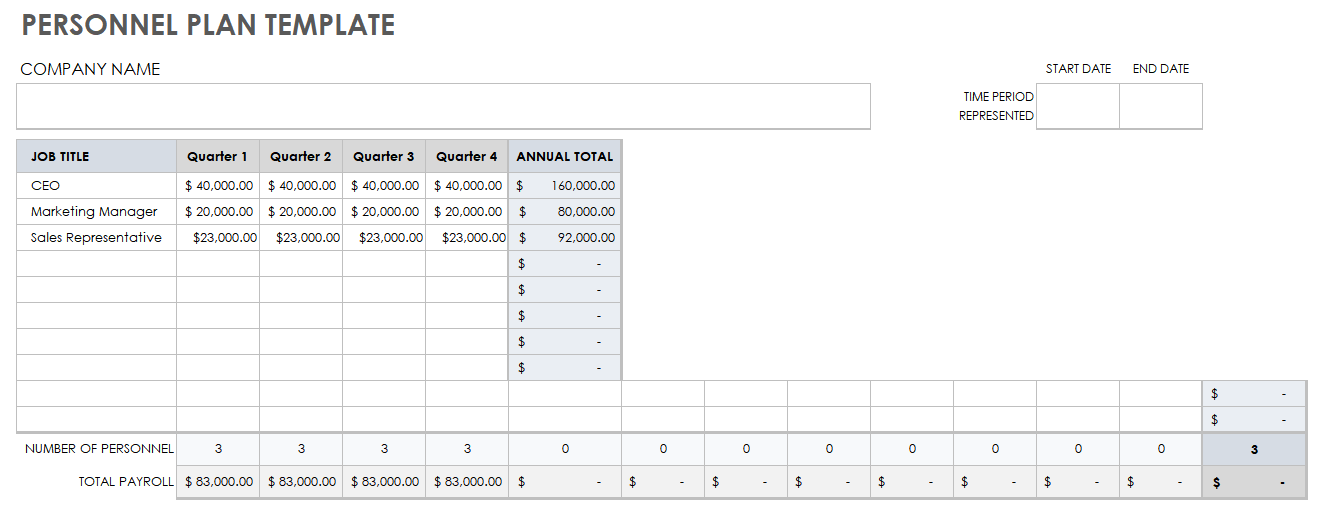

All small businesses should include an income statement, a balance sheet, and a cash flow statement in their financial plan. You may also include other documents, such as personnel plans, break-even points, and sales forecasts, depending on the business and industry.

- Balance Sheet: A balance sheet determines the difference between your liabilities and assets to determine your equity. “A balance sheet is a snapshot of a business’s financial position at a particular moment in time,” says Yüzbaşıoğlu. “It adds up everything your business owns and subtracts all debts — the difference reflects the net worth of the business, also referred to as equity .” Yüzbaşıoğlu explains that this statement consists of three parts: assets, liabilities, and equity. “Assets include your money in the bank, accounts receivable, inventories, and more. Liabilities can include your accounts payables, credit card balances, and loan repayments, for example. Equity for most small businesses is just the owner’s equity, but it could also include investors’ shares, retained earnings, or stock proceeds,” he says.

- Cash Flow Statement: A cash flow statement shows where the money is coming from and where it is going. For existing businesses, this will include bank statements that list deposits and expenditures. A new business may not have much cash flow information, but it can include all startup costs and funding sources. “A cash flow statement shows how much cash is generated and used during a given period of time. It documents all the money flowing in and out of your business,” explains Yüzbaşıoğlu.

- Break-Even Analysis: A break-even analysis is a projection of how long it will take you to recoup your investments, such as expenses from startup costs or ongoing projects. In order to perform this analysis, Yüzbaşıoğlu explains, “You need to know the difference between fixed costs and variable costs. Fixed costs are the expenses that stay the same, regardless of how much you sell or don't sell. For example, expenses such as rent, wages, and accounting fees are typically fixed. Variable costs are the expenses that change in accordance with production or sales volume. “In other words, [a break-even analysis] determines the units of products or services you need to sell at least to cover your production costs. Generally, to calculate the break-even point in business, divide fixed costs by the gross profit margin. This produces a dollar figure that a company needs to break even,” Yüzbaşıoğlu shares.

- Personnel Plan: A personnel plan is an outline of various positions or departments that states what they do, why they are necessary, and how much they cost. This document is generally more useful for large businesses, or those that find themselves spending a large percentage of their budget on labor.

- Sales Forecast: A sales forecast can help determine how many sales and how much money you expect to make in a given time period. To learn more about various methods of predicting these figures, check out our guide to sales forecasting .

How to Write a Small Business Financial Plan

Writing a financial plan begins with collecting financial information from your small business. Create income statements, balance sheets, and cash flow statements, and any other documents you need using that information. Then share those documents with relevant stakeholders.

“Creating a financial plan is key to any business and essential for success: It provides protection and an opportunity to grow,” says Yüzbaşıoğlu. “You can use [the financial plan] to make better-informed decisions about things like resource allocation on future projects and to help shape the success of your company.”

1. Create a Plan

Create a strategic business plan that includes your business strategy and goals, and define their financial impact. Your financial plan will inform decisions for every aspect of your business, so it is important to know what is important and what is at stake.

2. Gather Financial Information

Collect all of the available financial information about your business. Organize bank statements, loan information, sales numbers, inventory costs, payroll information, and any other income and expenses your business has incurred. If you have not already started to do so, regularly record all of this information and store it in an easily accessible place.

3. Create an Income Statement

Your income statement should display revenue, expenses, and profit for a given time period. Your revenue minus your expenses equals your profit or loss. Many businesses create a new statement yearly or quarterly, but small businesses with less cash flow may benefit from creating statements for shorter time frames.

4. Create a Balance Sheet

Your balance sheet is a snapshot of your business’s financial status at a particular moment in time. You should update it on the same schedule as your income statement. To determine your equity, calculate all of your assets minus your liabilities.

5. Create a Cash Flow Statement

As mentioned above, the cash flow statement shows all past and projected cash flow for your business. “Your cash flow statement needs to cover three sections: operating activities, investing activities, and financing activities,” suggests Hewitt. “Operating activities are the movement of cash from the sale or purchase of goods or services. Investing activities are the sale or purchase of long-term assets. Financing activities are transactions with creditors and investments.”

6. Create Other Documents as Needed

Depending on the age, size, and industry of your business, you may find it useful to include these other documents in your financial plan as well.

- Sales Forecast: Your sales forecast should reference sales numbers from your past to estimate sales numbers for your future. Sales forecasts may be more useful for established companies with historical numbers to compare to, but small businesses can use forecasts to set goals and break records month over month. “To make future financial projections, start with a sales forecast,” says Yüzbaşıoğlu. “Project your sales over the course of 12 months. After projecting sales, calculate your cost of sales (also called cost of goods or direct costs). This will let you calculate gross margin. Gross margin is sales less the cost of sales, and it's a useful number for comparing with different standard industry ratios.”

7. Save the Plan for Reference and Share as Needed

The most important part of a financial plan is sharing it with stakeholders. You can also use much of the same information in your financial plan to create a budget for your small business.

Additionally, be sure to conduct regular reviews, as things will inevitably change. “My best tip for small businesses when creating a financial plan is to schedule reviews. Once you have your plan in place, it is essential that you review it often and compare how well the strategy fits with the actual monthly expenses. This will help you adjust your plan accordingly and prepare for the year ahead,” suggests Janet Patterson, Loan and Finance Expert at Highway Title Loans.

Small Business Financial Plan Example

Download Small Business Financial Plan Example Microsoft Excel | Google Sheets

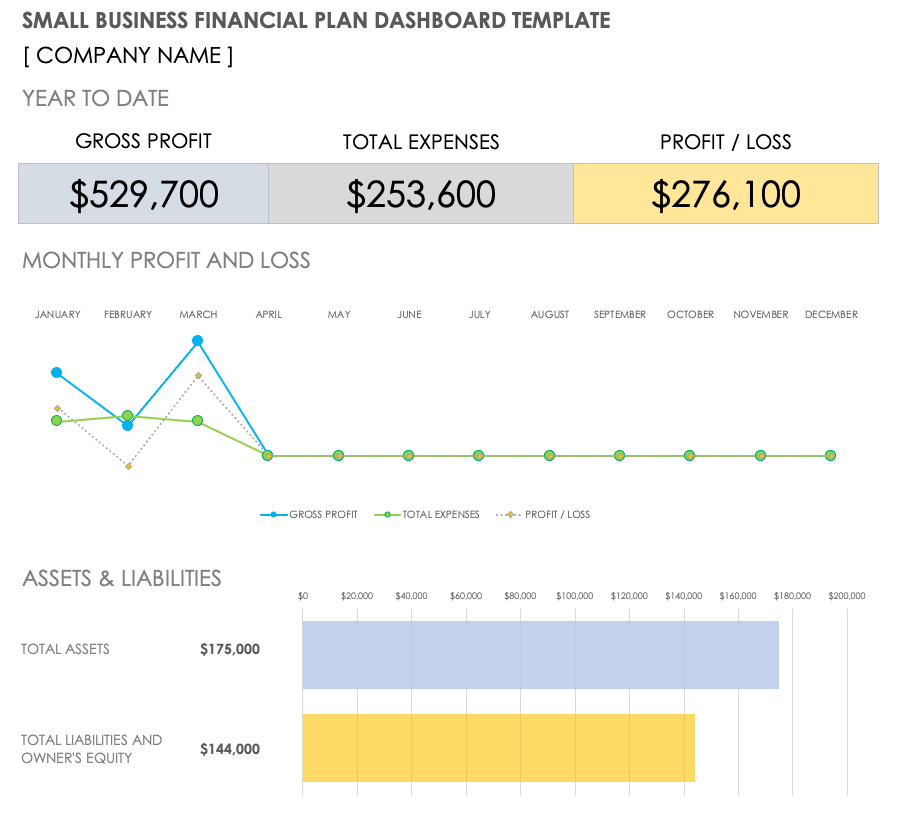

Here is an example of what a completed small business financial plan dashboard might look like. Once you have completed your income statement, balance sheet, and cash flow statements, use a template to create visual graphs to display the information to make it easier to read and share. In this example, this small business plots its income and cash flow statements quarterly, but you may find it valuable to update yours more often.

Small Business Financial Plan Starter Kit

Download Small Business Financial Plan Starter Kit

We’ve created this small business financial plan starter kit to help you get organized and complete your financial plan. In this kit, you will find a fully customizable income statement template, a balance sheet template, a cash flow statement template, and a dashboard template to display results. We have also included templates for break-even analysis, a personnel plan, and sales forecasts to meet your ongoing financial planning needs.

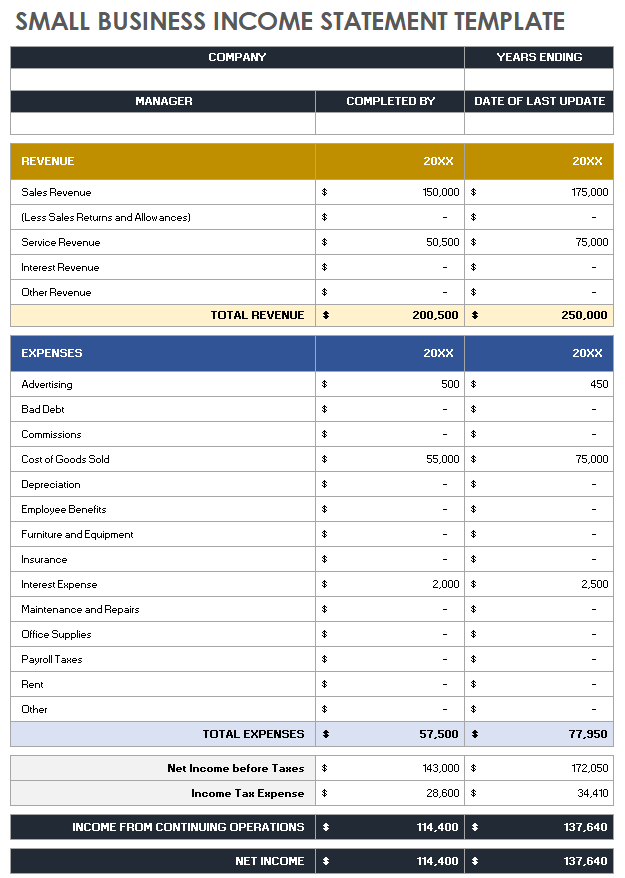

Small Business Income Statement Template

Download Small Business Income Statement Template Microsoft Excel | Google Sheets

Use this small business income statement template to input your income information and track your growth over time. This template is filled to track by the year, but you can also track by months or quarters. The template is fully customizable to suit your business needs.

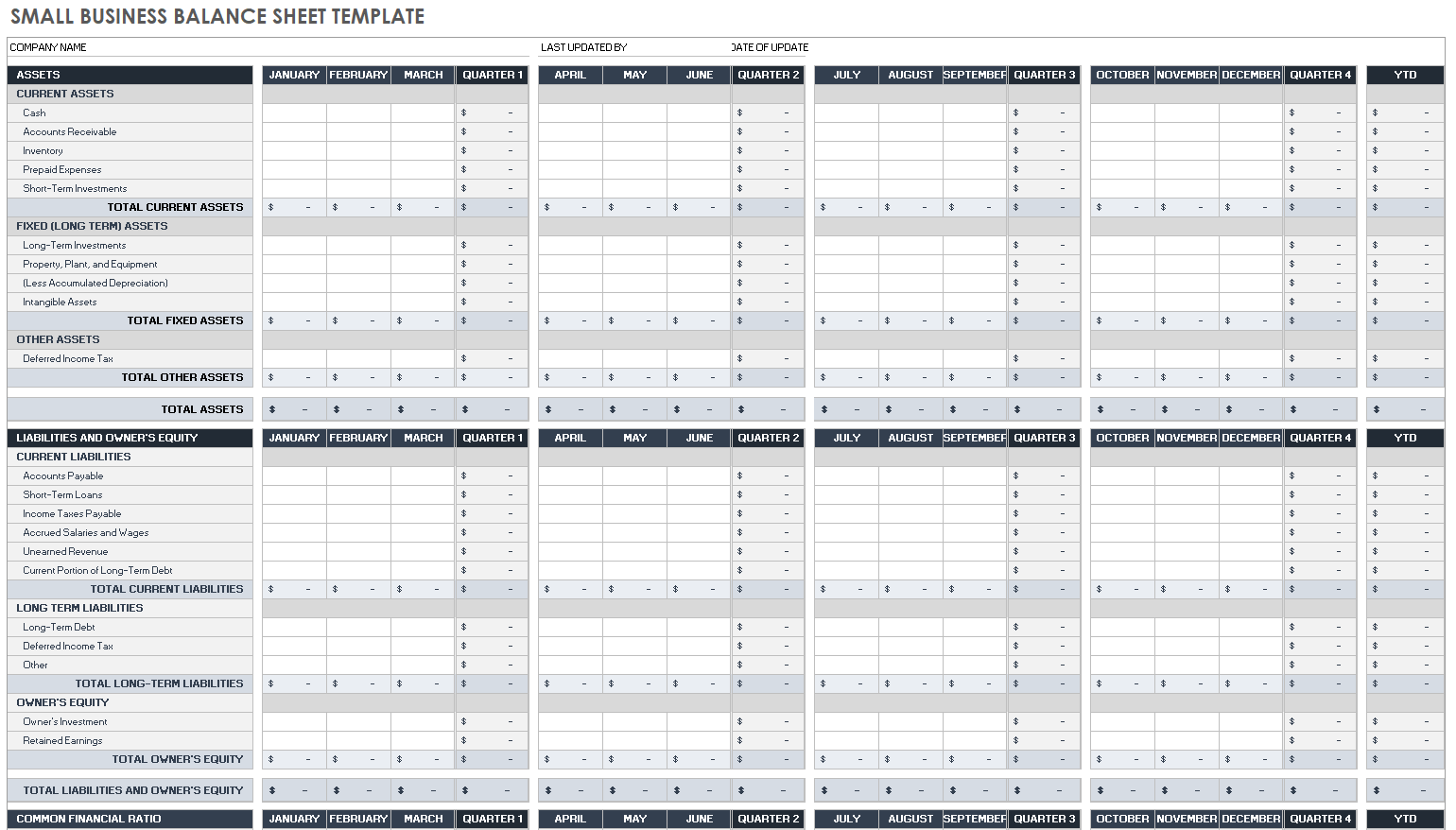

Small Business Balance Sheet Template

Download Small Business Balance Sheet Template Microsoft Excel | Google Sheets

This customizable balance sheet template was created with small businesses in mind. Use it to create a snapshot of your company’s assets, liabilities, and equity quarter over quarter.

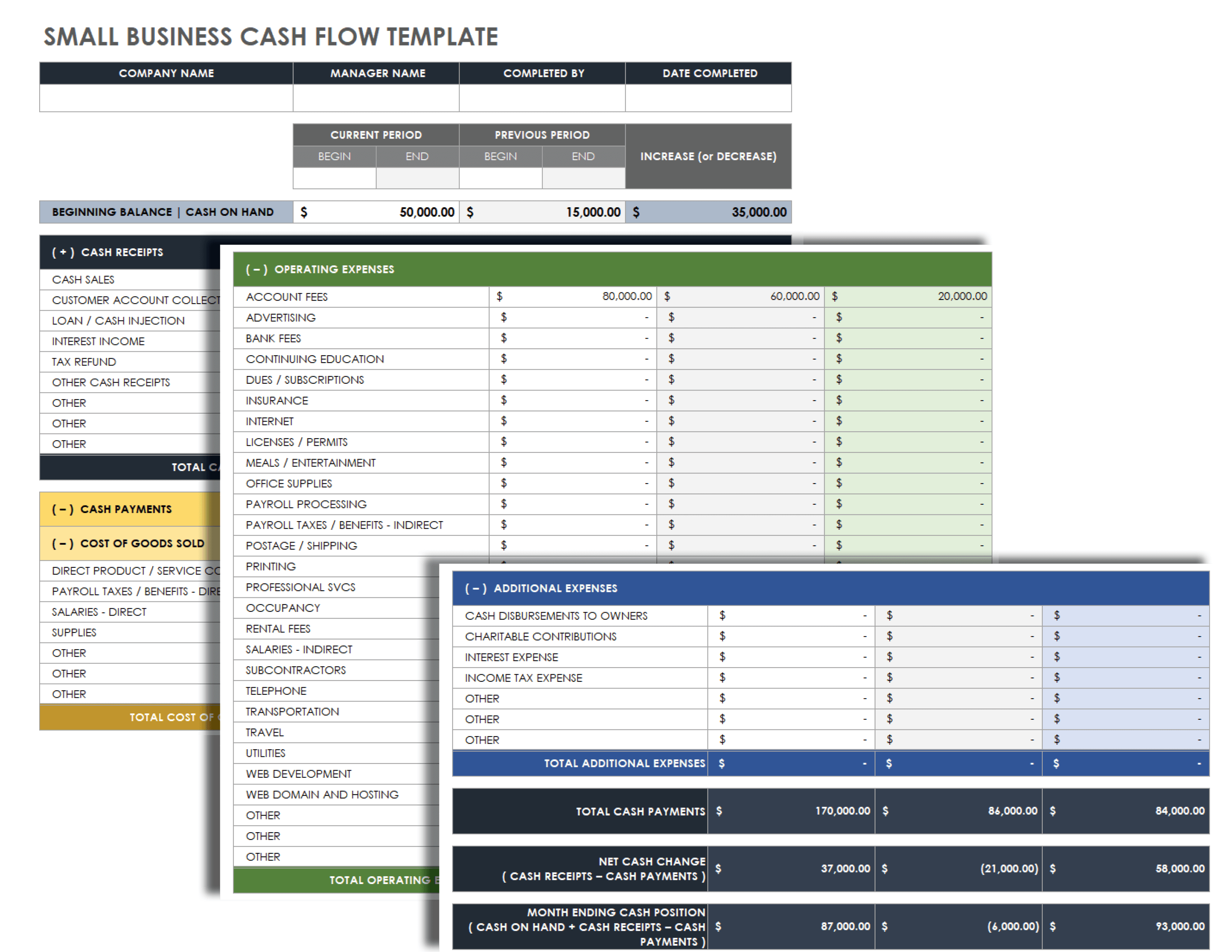

Small Business Cash Flow Statement Template

Download Small Business Cash Flow Template Microsoft Excel | Google Sheets

Use this customizable cash flow statement template to stay organized when documenting your cash flow. Note the time frame and input all of your financial data in the appropriate cell. With this information, the template will automatically generate your total cash payments, net cash change, and ending cash position.

Break-Even Analysis Template

Download Break-Even Analysis Template Microsoft Excel | Google Sheets

This powerful template can help you determine the point at which you will break even on product investment. Input the sale price of the product, as well as its various associated costs, and this template will display the number of units needed to break even on your initial costs.

Personnel Plan Template

Download Personnel Plan Template Microsoft Excel | Google Sheets

Use this simple personnel plan template to help organize and define the monetary cost of the various roles or departments within your company. This template will generate a labor cost total that you can use to compare roles and determine whether you need to make cuts or identify areas for growth.

Sales Forecast Template

Download Sales Forecast Template Microsoft Excel | Google Sheets

Use this customizable template to forecast your sales month over month and determine the percentage changes. You can use this template to set goals and track sales history as well.

Small Business Financial Plan Dashboard Template

Download Small Business Financial Plan Dashboard Template Microsoft Excel | Google Sheets

This dashboard template provides a visual example of a small business financial plan. It presents the information from your income statement, balance sheet, and cash flow statement in a graphical form that is easy to read and share.

Tips for Completing a Financial Plan for a Small Business

You can simplify the development of your small business financial plan in many ways, from outlining your goals to considering where you may need help. We’ve outlined a few tips from our experts below:

- Outline Your Business Goals: Before you create a financial plan, outline your business goals. This will help you determine where money is being well spent to achieve those goals and where it may not be. “Before applying for financing or investment, list the expected business goals for the next three to five years. You can ask a certified public accountant for help in this regard,” says Thé. The U.S. Small Business Administration or a local small business development center can also help you to understand the local market and important factors for business success. For more help, check out our quick how-to guide on writing a business plan .

- Make Sure You Have the Right Permits and Insurance: One of the best ways to keep your financial plan on track is to anticipate large expenditures. Double- and triple-check that you have the permits and insurances you need so that you do not incur any fines or surprise expenses down the line. “If you own your own business, you're no longer able to count on your employer for your insurance needs. It's important to have a plan for how you're going to pay for this additional expense and make sure that you know what specific insurance you need to cover your business,” suggests Daost.

- Separate Personal Goals from Business Goals: Be as unbiased as possible when creating and laying out your business’s financial goals. Your financial and prestige goals as a business owner may be loftier than what your business can currently achieve in the present. Inflating sales forecasts or income numbers will only come back to bite you in the end.

- Consider Hiring Help: You don’t know what you don’t know, but fortunately, many financial experts are ready to help you. “Hiring financial advisors can help you make sound financial decisions for your business and create a financial roadmap to follow. Many businesses fail in the first few years due to poor planning, which leads to costly mistakes. Having a financial advisor can help keep your business alive, make a profit, and thrive,” says Hewitt.

- Include Less Obvious Expenses: No income or expense is too small to consider — it all matters when you are creating your financial plan. “I wish I had known that you’re supposed to incorporate anticipated internal hidden expenses in the plan as well,” Patterson shares. “I formulated my first financial plan myself and didn’t have enough knowledge back then. Hence, I missed out on essential expenses, like office maintenance, that are less common.”

Do Small Business Owners Need a Financial Planner?

Not all small business owners need a designated financial planner, but you should understand the documents and information that make up a financial plan. If you do not hire an advisor, you must be informed about your own finances.

Small business owners tend to wear many hats, but Powell says, “it depends on the organization of the owner and their experience with the financial side of operating businesses.” Hiring a financial advisor can take some tasks off your plate and save you time to focus on the many other details that need your attention. Financial planners are experts in their field and may have more intimate knowledge of market trends and changing tax information that can end up saving you money in the long run.

Yüzbaşıoğlu adds, “Small business owners can greatly benefit from working with a financial advisor. A successful small business often requires more than just the skills of an entrepreneur; a financial advisor can help the company effectively manage risks and maximize opportunities.”

For more examples of the tasks a financial planner might be able to help with, check through our list of free financial planning templates .

Drive Small Business Success with Financial Planning in Smartsheet

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today .

Connect your people, processes, and tools with one simple, easy-to-use platform.

Financial Statement: What Is It and Why It Matters For Your Business

The humble financial statement. It’s never been more important for business owners to learn how to create and track one. Not only does the statement record critical financial data within a set period, but it has the potential to identify trends, potential opportunities, and lingering threats before they affect your bottom line.

But for the small startup or growing ecommerce brand, financial statements can seem extremely daunting. What are financial statements in the first place, and how are they supposed to be created and used in an ecommerce setting?

Thankfully, the conversations surrounding financial statements sound a lot more complicated than they really are. Let’s explore the many different types of financial statements, as well as their benefits and the tools available to create one for yourself.

Start selling online now with Shopify

What is a financial statement?

A financial statement is a type of accounting document that details sensitive financial information in an easy-to-understand way. Any activities related to your income, expenses, or cash flow are recorded in a spreadsheet, chart, or similarly visualized report.

In the ecommerce industry, there are many types of people who may be responsible for financial statements. Very small brands may delegate this process to the owner, while larger companies may rely on CPAs or accountants to get the job done. Other businesses may have outsourced professionals or freelancers who specialize solely in financial statements.

→ Click Here to Launch Your Online Business with Shopify

It’s strongly encouraged to have your financial statements completed on a regular basis. Lending institutions and investors will request these financial documents to get an idea of your financial standing.

The benefits of financial statements

Creating a financial statement benefits businesses of any size — from upstart companies to growing enterprises. These financial documents will clearly and succinctly detail information that is used to spur action, whether it shows dropping profits or highlights clear growth indicators. They are instrumental in protecting your brand from abject failure, keeping you informed about everything that might be impacting your business (and potentially where problems are coming from).

The use of financial statements for your business may also help you to:

- Get money from a third party . Well-kept financial statements prove whether or not your company is worthy of investor attention, crowdsourced funding, or bank loans.

- Stay within tax compliance . The stress of an audit on your business may be lessened by accurate, timely financial statements that correspond to any pressing questions.

- Forecast and plan for the future . Knowing what your profits have been for the past few years may help you to identify busy seasons or product trends that will be more profitable in the future.

Depending on the size and scope of your business, financial statements may be used to craft annual reports. These provide a bird’s-eye view of your company’s yearly profits, which may or may not be necessary to prepare for next year. If you are a publicly owned company, you are required by law to provide shareholders with certain annual financial statements.

Four major types of financial statements

There are quite literally thousands of different financial statements used in the modern world. However, only three are generally used for private companies, plus an additional one for publicly traded organizations.

According to the SEC , these are income statements, balance sheets, cash flow statements, and equity statements. Let’s explore each of these in greater detail.

- Income statement

An income statement is a type of financial statement that calculates your total income for a given period. This is done by subtracting your expenses and overhead from your gross profits, as seen in this example :

Income statements are typically completed at monthly, quarterly, or yearly intervals. But it’s not a bad idea to complete them once a month to have the best possible idea of your business growth.

Keep in mind that the income statement should be the first financial report completed in a given period. The information it provides will serve as the basis for all other reports.

- Balance sheet

A balance sheet is a financial report used to measure the actual value of your company. The document will “balance” the income and expenses of your company by comparing business assets (items, vehicles, profits, etc.) to your liabilities (debts, taxes, equities). If the number is still in the green, the actual value of your business is positive. If not, your business may be held back by its debts.

A typical small business balance sheet may look something like this:

The more your business is positively valued, the more attention it will get from banks, lenders, and stakeholders. As you track your assets and liabilities over time, you can start to get a clearer picture of upcoming financial opportunities.

- Cash flow statement

More than 82% of businesses fail because of poor cash flow management skills. Relying on a cash flow financial statement helps avert a part of this crisis, supplying the information you need to make objective and clear decisions.

The average small business cash flow statement doesn’t have to be complicated, as evidenced by this example template :

Done right, these cash flow statements accurately depict the amount of money moving to and from your specific brand. This lets you make objective decisions regarding expenses to cut and income to leverage —l eading to bigger profits in the next quarter.

- Shareholders’ equity statement

If you are a publicly traded company, you will need to make a shareholders’ equity statement. The purpose of this statement is to inform shareholders about the changing value of your brand. Similar to the balance sheet, positive equity shows excellent health and strong growth — something shareholders are extremely keen to monitor.

Here’s an example of what a shareholders’ equity statement might look like for your business:

Keep in mind that some brands choose to build shareholders’ equity statements into their balance sheet rather than create a whole new report. Again, this largely depends on the size of your business and its unique needs.

Tools to prepare financial statements

Ecommerce financial statements no longer need to be created with paper and pencil. In the age of technology, there are many different types of tools you could rely on to prepare your financial statements quickly, cleanly, and professionally.

- Microsoft Excel (or Google Sheets) is a great way to get started. You can download Shopify’s Financial Worksheet Template to get a head start or focus on other downloadable templates that make your life easier.

- Platforms like QuickBooks and FreshBooks allow you to keep a close eye on regular financial activity. However, keep in mind these platforms may not have everything you’re looking for — including the features and integrations.

- Visyond allows users to instantly generate cash flow statements, income statements, and balance sheets. But be warned: this is going to cost you.

If you still don’t feel comfortable creating financial statements on your own, know that partnering with a CPA or accountant in your area is also acceptable. Just be sure to choose an expert with the time, talent, and experience you need to succeed.

Optimize your financial statements over time

The truth is, anyone in the modern ecommerce industry has the ability to create financial statements. Armed with countless tools and resources, it’s easy to simply plug and play in order to create reports for internal and external teams.

Today, the real difficulty is found in optimizing said financial statements, or finding ways to leverage them for greater success. There’s a big difference between good and great, and a less-than-satisfactory financial statement has the potential to limit your business growth.

As your ecommerce brand continues to grow and mature, do what you can to:

- Simplify the process as much as possible with technology and tools

- Spot growth opportunities by mapping trends with visualized data

- Partner with a financial statement expert such as a CPA for help

The key to creating successful, accurate, and optimized financial statements is to constantly look for ways to improve. As your business continues to grow, lean heavily into your statements’ reporting process to discover new opportunities both now and in the future.

Financial statements FAQ

Why is a financial statement important.

Preparing a financial statement is important for tracking and understanding your company’s financial health. The statement also plays a vital role in managing taxes, dealing with audits, and securing external funding.

What are the four basic financial statements?

Can a bookkeeper prepare financial statements.

Yes, a bookkeeper is qualified to prepare financial statements. You can also use a CPA or prepare the financial statement yourself.

Want to learn more?

- 10-Step Formula to Achieve Financial Freedom in 2022

- How to Register a Business in the USA

- Business Plan Template: Guide for Ecommerce Businesses

- 10 Small Business Statistics You Need to Know in 2022

Oberlo uses cookies to provide necessary site functionality and improve your experience. By using our website, you agree to our privacy policy.

Simple Business Plan Template for Startups, Small Businesses & Entrepreneurs

Financial plan, what is a financial plan.

A business’ financial plan is the part of your business plan that details how your company will achieve its financial goals. It includes information on your company’s projected income, expenses, and cash flow in the form of a 5-Year Income Statement, Balance Sheet and Cash Flow Statement. The plan should also detail how much funding your company needs and the key uses of these funds.

The financial plan is an important part of the business plan, as it provides a framework for making financial decisions. It can be used to track progress and make adjustments as needed.

Why Your Financial Plan is Important

The financial section of your business plan details the financial implications of running your company. It is important for the following two reasons:

Making Informed Decisions

A financial plan provides a framework for making decisions about how to use your money. It can help you determine whether or not you can afford to make a major purchase, such as a new piece of equipment.

It can also help you decide how much money to reinvest in your business, and how much to save for paying taxes.

A financial plan is like a roadmap for your business. It can help you track your progress and make adjustments as needed. The plan can also help you identify potential problems before they arise.

For example, if your sales are below your projections, you may need to adjust your budget accordingly.

Your financial plan helps you understand how much outside funding is required, when your levels of cash might fall low, and what sales and other goals you need to hit to become financially viable.

Securing Funding

This section of your plan is absolutely critical if you are trying to secure funding. Your financial plan should include information on your revenue, expenses, and cash flow.

This information will help potential investors or lenders understand your business’s financial situation and decide whether or not to provide funding.

Include a detailed description of how you plan to use the funds you are requesting. For example, what are the key uses of the funds (e.g., purchasing equipment, paying staff, etc.) and what are the future timings of these financial outlays.

The financial information in your business plan should be realistic and accurate. Do not overstate your projected revenues or underestimate your expenses. This can lead to problems down the road.

Potential investors and lenders will be very interested in your future projections since it indicates whether you will be able to repay your loans and/or provide a nice return on investment (ROI) upon exit.

Financial Plan Template: 4 Components to Include in Your Financial Plan

The financial section of a business plan should have the following four sub-sections:

Revenue Model

Here you will detail how your company generates revenues. Oftentimes this is very straightforward, for instance, if you sell products. Other times, your answer might be more complex, such as if you’re selling subscriptions (particularly at different price/service levels) or if you are selling multiple products and services.

Financial Overview & Highlights

In developing your financial plan, you need to create full financial forecasts including the following financial statements.

5-Year Income Statement / Profit and Loss Statement

An income statement, also known as a profit and loss statement (P&L), shows how much revenue your business has generated over a specific period of time, and how much of that revenue has turned into profits. The statement includes your company’s revenues and expenses for a given time period, such as a month, quarter, or year. It can also show your company’s net income, which is the amount of money your company has made after all expenses have been paid.

5-Year Balance Sheet

A balance sheet shows a company’s financial position at a specific point in time. The balance sheet lists a company’s assets (what it owns), its liabilities (what it owes), and its equity (the difference between its assets and its liabilities).

The balance sheet is important because it shows a company’s financial health at a specific point in time. A strong balance sheet indicates that a company has the resources it needs to grow and expand. A weak balance sheet, on the other hand, may indicate that a company is struggling to pay its bills and may be at risk of bankruptcy.

5-Year Cash Flow Statement

A cash flow statement shows how much cash a company has on hand, as well as how much cash it is generating (or losing) over a specific period of time. The statement includes both operating and non-operating activities, such as revenue from sales, expenses, investing activities, and financing activities.

While your full financial projections will go in your Appendix, highlights of your financial projections will go in the Financial Plan section.

These highlights include your Total Revenue, Direct Expenses, Gross Profit, Other Expenses, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), and Net Income projections. Also include key assumptions used in creating these future projections such as revenue and cost growth rates.

Funding Requirements/Use of Funds

In this section, you will detail how much outside funding you require, if any, and the core uses of these funds.

For example, detail how much of the funding you need for:

- Product Development

- Product Manufacturing

- Rent or Office/Building Build-Out

Exit Strategy

If you are seeking equity capital, you need to explain your “exit strategy” here or how investors will “cash out” from their investment.

To add credibility to your exit strategy, conduct market research. Specifically, find other companies in your market who have exited in the past few years. Mention how they exited and the amounts of the exit (e.g., XYZ Corp. bought ABC Corp. for $Y).

Business Plan Financial Plan FAQs

What is a financial plan template.

A financial plan template is a pre-formatted spreadsheet that you can use to create your own financial plan. The financial plan template includes formulas that will automatically calculate your revenue, expenses, and cash flow projections.

How Can I Download a Financial Plan Template?

Download Growthink’s Ultimate Business Plan Template which includes a complete financial plan template and more to help you write a solid business plan in hours.

How Do You Make Realistic Assumptions in Your Business Plan?

When forecasting your company’s future, you need to make realistic assumptions. Conduct market research and speak with industry experts to get a better idea of the key trends affecting your business and realistic growth rates.

You should also use historical data to help inform your projections. For example, if you are launching a new product, use past sales data to estimate how many units you might sell in Year 1, Year 2, etc.

Learn more about how to make the appropriate financial assumptions for your business plan.

How Do You Make the Proper Financial Projections for Your Business Plan?

Your business plan’s financial projections should be based on your business model and your market research. The goal is to make as realistic and achievable projections as possible.

To create a good financial projection, you need to understand your revenue model and your target market. Once you have this information, you can develop assumptions around revenue growth, cost of goods sold, margins, expenses, and other key metrics.

Once you have your assumptions set, you can plug them into a financial model to generate your projections.

Learn more about how to make the proper financial projections for your business plan.

What Financials Should Be Included in a Business Plan?

There are a few key financials that should be included in a traditional business plan format. These include the Income Statement, Balance Sheet, and Cash Flow Statement.

Income Statements, also called Profit and Loss Statements, will show your company’s expected income and expense projections over a specific period of time (usually 1 year, 3 years, or 5 years). Balance Sheets will show your company’s assets, liabilities, and equity at a specific point in time. Cash Flow Statements will show how much cash your company has generated and used over a specific period of time.

Growthink's Ultimate Business Plan Template includes a complete financial plan template to easily create these financial statements and more so you can write a great business plan in hours.

BUSINESS PLAN TEMPLATE OUTLINE

- Business Plan Template Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

- 10. Appendix

- Business Plan Summary

Other Helpful Business Planning Articles & Templates

Financial Statements for Small Businesses: Tips & Samples

Regardless of your business’ size or the industry in which it operates, there are several financial statements you need to complete and update on a regular basis.

These financial statements will comprise a main part of your business plan, and that business plan will play an integral role in securing the investments or loans needed to grow your company. Financial statements will also help you understand how money flows into and out of your business, which leads to smarter decisions around which investments to make, which loans to pursue and more.

What Is a Financial Statement?

Financial statements provide a formal record of an organization’s financial activity, its current financial status and an idea of how well it may (or, may not) perform in the future. Financial statements can help to show business activity and financial performance. They are required for audits and are often used for tax, financing or investing purposes.

Financial statements are broken down into three main items: a current balance sheet, a profit and loss (P&L) statement , and a cash flow statement. Together, they provide an understanding of profits and a basis on which to make predictions about the company’s financial future. Here’s a look at each and the purpose it serves:

- The balance sheet shows assets and liabilities.

- The P&L statement, or income statement, records company revenues and expenses for a particular period.

- The cash flow statement demonstrates how much cash a company has on hand and its ability to manage its cash, as well its ability to meet current liabilities, pay operating expenses and fund any potential investments.

Key Takeaways

- Financial statements are an important part of running a profitable, financially-sound business.

- Financial statements comprise three individual items, all of which help both internal and external stakeholders make good decisions regarding the company.

- A financial plan is equally as important, and helps business owners chart their courses for the future based on their current and historical financial positions, resources and contingency plans.

Why Is a Financial Statement Important?

Financial statements (opens in new tab) include all of a small business’s operational results, its current financial position and its current cash flow. Financial statements are important because:

- They create a documented “paper trail” for a company’s financial activities.

- They summarize important financial accounting information about the company.

- They give both internal and external stakeholders an accurate picture of the organization’s current financial situation.

Financial statements are also used by lenders to determine an entity’s level of risk. These statements also include information that may be required by law and/or accounting standards. They also provide accountants with the data they need to be able to complete a company’s tax returns and other required documentation.

Individually, the three main financial statements for small businesses each serve a different purpose. The income statement, for example, shows whether a company is generating a profit, while the balance sheet reveals the current status of the business as of the date listed on that document (vs. for the year or quarter overall, as with the income statement). Finally, a company’s cash receipts and cash disbursements can be found on its cash flow statement.

Video: Understanding Financial Statements

What Should Be Included in a Financial Statement?

Business owners and their accountants use income statements, balance sheets and cash flow statements to analyze a company’s financial performance.

The income statement (opens in new tab) includes all of a company’s revenues, cost of goods (or cost of sales for services companies) sold and other expenses across a specified time period (e.g., a quarter or a year). Listed vertically, the entries on this statement typically appear in this order: revenue, expenses, and net income

The balance sheet includes all of a company’s assets, liabilities and shareholder equity. In most instances, these numbers are represented in two different columns.

Finally, the cash flow statement summarizes all of a company’s operating, financing and investment inflows and outflows, including but not limited to changes in the value of inventory, accounts receivable and payable and long-term debt.

How Do I Write a Financial Plan for my Business?

You can create a financial plan whether you’re just launching your business, preparing to expand it in some way or readying to pursue a new source of funding. Using the financial statements outlined in this article, you’ll create a financial plan that not only covers the organization’s progress and current status but also factors in future growth. This is an exercise you can do for yourself, potential investors including venture capitalists , or any other business stakeholder.

At minimum, the plan should include a sales forecast for the next three to four years, a budget for business expenses and overhead, a cash flow statement and a projection of anticipated net profits over time. The plan should also factor in the company’s assets and liabilities, an estimate of cash on-hand (and expected cash on-hand over the next few months) and current accounts payable .

Combined, these key data points will help you chart a course for the future by 1) assessing the company’s current financial status and 2) predicting a path forward based on historical performance. The plan will help you manage cash flow, prepare for potential cash shortages (e.g., due to industry or economic downturns) and set attainable goals for the next three to five years.

By putting a plan together and then reviewing and updating it annually, companies can readily pursue new opportunities, ride out the low points and achieve their short- and long-term goals.

#1 Cloud Accounting Software

5 Steps to Writing a Financial Plan for my Business

Here are the five steps you’ll want to take when writing a financial plan for your company:

Lay out your goals. Do you want to expand? Do you want to add new customer segments? Do you need more equipment? Do you need financing? The answers to these questions will help you kick off the financial plan writing process.

Create monthly financial projections. Small businesses don’t typically have the kind of reserves or business footprint to plan too far ahead. They need monthly projections. Calculate your anticipated income based (opens in new tab) on monthly projections for sales and expenses for items like labor, supplies and overhead, and then add in the costs for the goals you identified in the previous step.

Prepare a cash flow statement, income statement and balance sheet. Use these financial statements to create an accurate, current picture of your company’s financial health.

Calculate your business ratios. Used to rate the overall financial health of a small firm and decide whether its current operating model is viable, financial ratios are a key factor in assessing a company's basic financial health. In most cases, you will use either the current ratio or quick ratio.

Current ratio = Current assets / Current liabilities

Quick ratio = (Cash + Cash equivalents + Current Accounts Receivable) / Current liabilities

From these calculations, you can determine whether your company has the funds available to cover its short-term obligations.

Include contingency plans. You’ll want to have enough emergency sources of money before your business faces challenges that warrant using them. Maintain a cash reserve of three to six months, for example, or ensure that there’s money available on your line of credit. Like anything in life, the key is to not wait until it’s too late to secure these fund sources and ensure that they are there when you need them.

Financial Management

Building a Finance and Accounting Team for a Small Business

Every small business needs an accounting and finance function. How many people are on that team and what their jobs entail depends on the size of the business and the…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

- Search Search Please fill out this field.

- Building Your Business

How To Create Financial Projections for Your Business

Learn how to anticipate your business’s financial performance

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-26at1.24.14PM-16d178cb2ee74d71946d658ab027e210.png)

- Understanding Financial Projections & Forecasting

Why Forecasting Is Critical for Your Business

Key financial statements for forecasting, how to create your financial projections, frequently asked questions (faqs).

Maskot / Getty Images

Just like a weather forecast lets you know that wearing closed-toe shoes will be important for that afternoon downpour later, a good financial forecast allows you to better anticipate financial highs and lows for your business.

Neglecting to compile financial projections for your business may signal to investors that you’re unprepared for the future, which may cause you to lose out on funding opportunities.

Read on to learn more about financial projections, how to compile and use them in a business plan, and why they can be crucial for every business owner.

Key Takeaways