KPMG Personalization

- Rethinking new business models for banking

Adapting platforms, ecosystems, payments and data for the future, the banking business model has proven to be resilient to disruption.

- Share Share close

- Download Rethinking new business models for banking pdf Opens in a new window

- 1000 Save this article to my library

- View Print friendly version of this article Opens in a new window

- Go to bottom of page

- Home ›

- Insights ›

Tech trends | Adapting the business model | Essential building blocks | A roadmap for adoption | Call to action

Innovations that change the way value is offered to consumers threaten the integrity and resilience of the traditional banking model.

New trends in financial service offerings such as embedded finance and decentralized finance threatens the integrity of the traditional banking business model. Examples include Uber’s embedded payments and Afterpay’s cannibalization of unsecured consumer credit. These trends also eroded the value of the ‘trust premium’ banks have held for so long. For example, Nano Home Loans, a non-bank fintech lender established in 2019, offers to approve home loans at highly competitive rates within ten minutes of an online application; this value proposition has resulted in faster-than-system growth rates.

While fintech and innovators dismember the banking value chain, incumbents also face the very real threat of highly capitalized tech giants. Many with deep customer connections and loyalty, are stepping directly into financial services, potentially redefining the category. For example, although Google has abandoned plans to launch Google Plex (a transaction account for Google Pay), the proposition found strong consumer endorsement of innovative features that embedded financial services into everyday lifestyle choices.

Finally, regulators are deliberately adjusting their posture to help increase competition (e.g., open banking) and reduce entry barriers (e.g., the Restricted ADI offers a limited risk fast track for small challenger banks to start operating as a bank in Australia). Consequently, banks are (and should be) exploring alternative business models to deepen their value pools, entrench customer relationships and expand their value propositions.

As banks evolve their market role, they will likely also need to adapt their business models. Many of the innovations that have been a threat may also be a source of strategic strength as they incorporate them to complement their core.

Adapting the business model — platforms and ecosystems

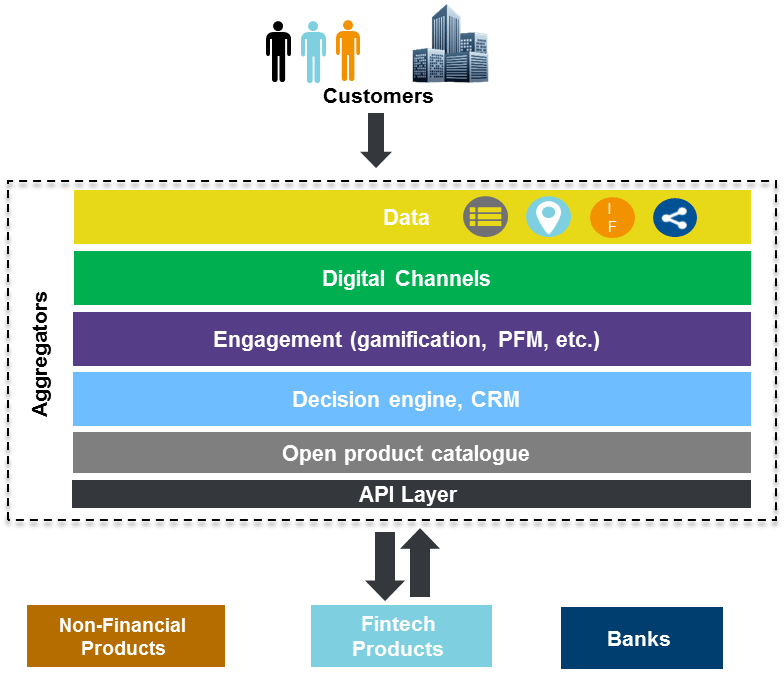

Although platforms and ecosystems are not mutually exclusive, they are distinct. Platforms can help reduce market friction by connecting suppliers with the consumer, while ecosystems orchestrate complementary value propositions focused on a pattern of customer needs (Fig. 1).

By adopting these innovative business model options, banks can complement their basic banking model (deposits, loans, transactions) and market strengths (e.g., scale of customer franchise, valuable banking licenses, strength of balance sheet) with new value propositions to help differentiate and deepen customer relationships.

For example, Goldman Sachs pivoted to become more like a platform, expanding its portfolio into consumer banking by deploying the Marcus offering, including a credit card partnership with Apple. A goal for Marcus has been to establish banking as-a-service — a platform business.

Meanwhile, DBS Singapore has built DBS Marketplace to orchestrate ecosystems of partnerships offering value propositions shaped to address specific lifecycle needs experienced by their customers, such as car ownership. This ecosystem model deepens the bank’s relationship with their customers and keeps value circulating within the ecosystem.

Essential building blocks

Three foundational capability building blocks are essential to establish either platform or ecosystem, business models:

- Value orchestration: This includes establishing, coordinating and governing participation (partner management) while also measuring the value of involvement (ecosystems or platforms) to help generate more value than the sum of the parts.

- Data-driven insights: This is the ability to convert raw data into valuable insights on customers and operations. Harnessing the power of data can lead to continuous improvement, validation through experimentation and innovation (including accidental discovery through sophisticated pattern analysis); increasingly, this is machine-driven as AI and other advanced analytics tools become mainstream and accessible.

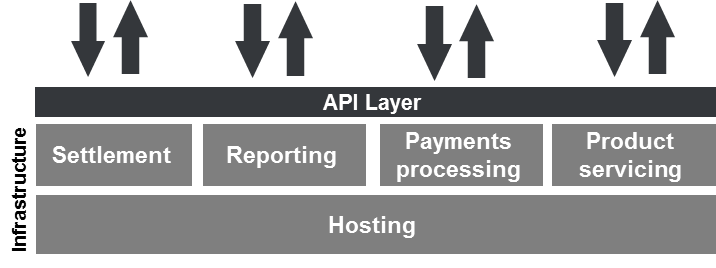

- Digital interoperability: This refers kpmg.com.au to the ability to safely exchange information and drive functionality between participants, including orchestrating end-to-end processes across multiple participants.

Bringing these to life in a banking context involves building blocks that need to be augmented by the basic banking capabilities of financial management, payments, and risk management.

Payments are a significant capability for banks battling for consumer relevancy. Payments provide a cohesive capability for both platforms or ecosystems and maintains a connection with the basic banking value proposition (cash, credit, and transaction). It also works to generate valuable contextual and behavioral data.

A roadmap for adoption

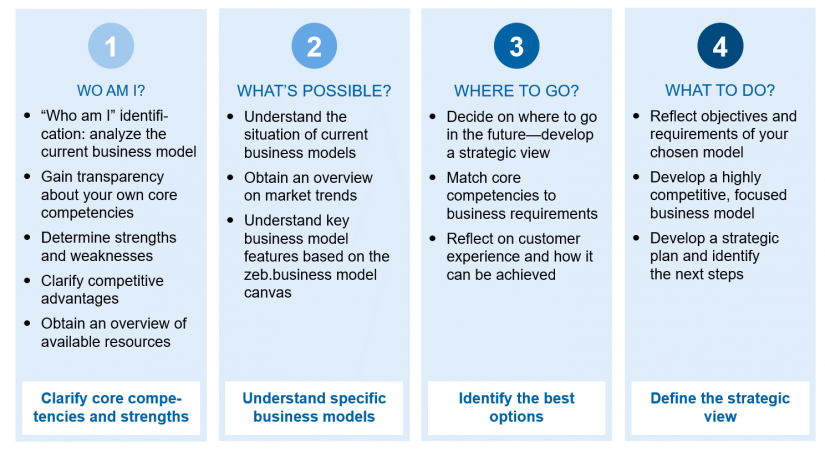

In KPMG professionals’ experience, banks that choose to adapt and future proof their business model should start the transformation by exploring three steps (see Fig. 2).

Assess capability maturity: Does the bank have the foundational capabilities needed to deploy the future business model effectively? If not, start work immediately as this is an investment with no regrets, while, in parallel, work on the other two steps.

Evaluate the bank’s role in the market: How will the bank differentiate along the spectrum of a ‘utility bank’ to an ‘intimate bank’? This can be unlocked by looking at what strengths the bank already has (e.g., if its cost discipline, it may be more suited to a ‘utility’ play).

Identify adaptions to the current business model: Does the bank need to adapt its historical business model by incorporating a platform or ecosystem play?

Fig. 2. Roadmap to adapt the banking business model

Call to action

The banking industry faces a volatile future, but one that is rich with opportunity. KPMG professionals believe banks that prepare to adapt their business models now by establishing the basic capabilities of the future and agreeing between the board and executive on the bank’s role will likely be best positioned to take advantage of those rich opportunities.

This article is featured in Frontiers in Finance – Resilient and relevant

Explore other articles › Subscribe to receive the latest financial services insights directly to your inbox ›

Frontiers in Finance

Download the report (pdf 2.5 mb), connect with us.

- Find office locations kpmg.findOfficeLocations

- Email us kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

- Request for proposal

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Browse articles, set up your interests , or View your library .

You've been a member since

Explore more chapters

Latest market insights and forward-looking perspectives for financial services leaders and professionals.

Latest market insights and forward-looking perspectives for financial services leaders.

The leaders are uncovering new ways to accelerate and scale their innovation

Everyone from central banks to businesses are eyeing cryptoassets.

- Analytics – Customer Acquisition Cost (CAC)

- Business Model Toolkit

- Business Model Analytics

- Customer Development Framework – BM Validation

- Customer Development – Cashflow Forecast

- Dominate A Niche

- Rule of 3s – Business Competition

- Privacy Policy

- Terms And Conditions

The Digital Banking Business Model – 2023 Outlook

- by Joel Finningley

- Fintech-Banking

With 2022 officially wrapped up, it’s time to do a teardown of the Digital Banking Business Model for the top B2C Fintechs at this time.

Digital Bank Business Model

Publicly traded fintechs, privately traded fintechs, digital banking – risers, digital banking – fallers, what digital banks spend on cac, payments business model vs. banking business model.

- M&A for Big Banks Got A Lot Cheaper

More Digital Banking Posts

2022 was not kind to Fintechs. The following YTD (Year-to-Date) performances were logged for each major Fintech company with a presence in Digital Banking. For context, the Nasdaq index traded down 33.7% in 2022.

- Paypal ( +Venmo ) – Ticker: PYPL – Down 63.5% – $81.1B Market Cap

- Block [Square] – Ticker: SQ – Down 61.7% – $37.6B Market Cap

- Nubank – Ticker: NU – Down 59.2% – $18.9B Market Cap

- (Transfer)Wise – Ticker: WISE (London) – Down 24.5% – $5.7B Market Cap

- SoFi – Ticker: SoFi – Down 70.6% – $4.3B Market Cap

- Marqeta – Ticker: MQ – Down 66.1% – $3.3B Market Cap

- Affirm – Ticker: AFRM – Down 89.8% – $2.8B Market Cap

- MoneyLion – Ticker: ML – Down 84.3% – $0.2B Market Cap

- Dave.com – Ticker: DAVE – Down 96.5% – $0.1B Market Cap

- Stripe – Peak Valuation $90B (Q2 ’21) – Most Recent Valuation $74B ( Q2 ’22 ) – Down 28%

- Klarna – Peak Valuation $45B (Q2 ’21) – Most Recent Valuation $6.7B ( Q2 ’22 ) – Down 85%

- Revolut – Peak Valuation $33B (Q2 ’21) – No Fundraising in 2022 – Unknown

- Chime – Peak Valuation $25B (Q3 ’21) – No Fundraising in 2022 – Unknown

- N26 – Peak Valuation $9B (Q3 ’21) – No Fundraising in 2022 – Unknown

- Monzo – Peak Valuation $4.5B (Q4 ’21) – No Fundraising in 2022 – Unknown

- Varo – Peak Valuation $2.5B (Q3 ’21) – No Fundraising in 2022 – Unknown

- Afterpay – Afterpay sold to Square (Block) for $29 Billion in Q3 ’21 at near the peak of their valuation. Looking at Affirm (-89.8%) and Klarna (-85%) it is fair to say that their BNPL Business Model would have blown a pretty big hole in their valuation had they held on

- Nubank – Nubank received a vote of confidence when Warren Buffet doubled-down with a total of $1 Billion invested in 2021, topping up on the $0.5 Billion invested in Q1 ’21. They hit 70M+ users across Latin America, and their stock being down ~60% – while not good – keeps them at the top of the Challenger Banks in terms of market cap

- Revolut – Revolut and Klarna are two completely different companies (payments-centric retail bank vs. BNPL) but they both have young, brazen CEOs. Klarna took the big ‘down round’ in 2022, Revolut did not. The company continues to innovate, and while not at the top of the pack, they are still arguably in the Top 3 Digital Banks in the global game

- Wise – Wise (Transferwise) always flies under the radar as a London-based, publicly-traded Challenger Bank but they have a great business model (relatively speaking) and outperformed every other publicly-traded Fintech + the Nasdaq index on the back of a couple of really good quarters in 2022

- Klarna and Affirm – Klarna and Affirm both oversaw an aggressive growth strategy in 2020/2021, when the ‘pandemic years’ pushed BNPL into the spotlight. They expanded beyond the core BNPL product (‘Pay in 4’) into Financing where they ended in either a lending/credit-card type Customer Relationship. Delinquencies in these products (‘ex- Pay in 4’) began to increase in late 2021, and skyrocketed into 2022, thereby forcing both companies to take huge write-downs on Credit Losses

- Niche Fintech Banks – some of the niche Fintech Digital Banks mentioned above – Dave, Money Lion, Varo, etc. – saw their stocks collapse and are on life-support heading into 2023. These types of happenings are expected based on the Rule of 3s in markets (generally) where only the top players gain enough market share to be profitable. In the U.S., these companies rode the wave several years back, but offered nothing innovative enough to separate themselves from the pack

- Chime – Chime looked poised a year ago to launch an IPO and have a 2022 like Nubank had. But Chime’s business model is more oriented around payments, whereas Nubank’s is oriented around lending (ie. banking). Chime is still one of the top Digital Banks in the U.S., but there will be many questions going into 2023 and beyond about the sustainability of their business model without some major moves (they did try to acquire DailyPay for ~$2B in cash + stock in Q2 ’22).

Who Are Using Fintechs As Their Primary Financial Institutions?

Despite the hype in 2020/2021 and some early positive signals in the market, less than 1/5 of American consumers use a Fintech Digital Bank as their primary financial institution.

The FinTechs have gained limited traction. Only 17% of consumers use FinTechs as their primary financial institutions (FIs). Drill down a bit, and it turns out those digital upstarts are popular among low-income consumers who live paycheck to paycheck with issues paying bills. As many as 39% of these consumers use FinTechs and 22% use them as their primary FI. Pymnts

As we mentioned in our post on Fintech Customer Acquisition Costs (CAC):

Fintechs get by by offering a smoother, more digital-friendly version of a banking experience compared to incumbent Big Banks. But they also make a fraction of the prospective revenue per customer (Average Revenue Per User – ARPU).

A Fintech will be happy if they can acquire users on the cheap and then earn a margin greater than the CAC. That difference between the APRU and CAC can represent the margin on a short-term basis, but on a long-term basis it manifests as LTV (Lifetime Value).

Revolut, for example, spends on Customer Acquisition within a target range of 18 months to break-even on the acquisition.

Retail Banks that spend $300 – $600+ on Customer Acquisition can net that back in the mid-term through a multi-faceted banking model:

- consumer lending products (credit card, lines of credit, etc.)

- business banking

Thus Retail Banks can earn hundreds, if not thousands, of dollars per year on a customer. They are able to offer a full-suite of products/services that most Fintechs still cannot.

Some – like Revolut – are trying to become a ‘ Super App ‘ to compete with the Big Banks. Others – like Square – have separate pieces that can gel together into a comprehensive suite of products to take on the Banks.

But as of today, the offerings are just too thin from most Digital Banks to compete with Retail Banks for the majority to take them on as their Primary Financial Institution.

Then there is the business model side. At this juncture in market history, an interchange-based payments model does not appear sustainable as a standalone model for Digital Banks.

Numerous fintech startups have based their business model entirely on interchange. Credit cards earn higher interchange than debit cards but are substantially more complex of a product to deliver and manage. Challenger debit card products (aka neobanks) such as Chime innovated with free offerings and interchange-driven revenue models . In practice, interchange only is a business model that doesn’t appear sustainable. It may work at a very large scale. Still, between acquisition costs, fraud, and operating costs, most fintech companies have found that they need other products (such as lending) or other models (such as membership fees or merchant-funded rewards). Cards FTW Substack

The margins are too thin until companies get to a large scale and start to be able to muscle in on the ‘Issuing Bank’ margin.

And even a company like Square (via payment processing or Cash App ) will earn only a fraction of the top-line % in Net Revenue in the end.

Naturally, credit cards have much higher transaction rates (2 – 3%) relative to debit cards, but if we look at Square’s relationship with its banking partners based on the Marqeta S-1 , we can see how this works. Even among Fintechs the Interchange Take Rate is relatively low.

While Credit Cards have higher Transaction Take Rates, many Digital Fintech Banks will offer those back as Cash Rewards in order to entice more users.

Generally in the fintech world banks expect ~1.5 – 2.5% (i.e. 150-250 bps) in interchange, so hypothetically they would collect ~250 bps (2.5%) per transaction, give 200 bps back to the bank, and keep 50 bps as revenue. Most banking platforms (like Chime, etc.) will often have negative margins because they’re keeping 50 bps for revenue but then giving back ~150 bps to the customer as rewards or cash-back. Over time as they scale they expect that 200 bps they share with the bank to go down and for their margins to improve. Contrary Research

Thus lending is a necessary part of the mix in Digital Banking. Revolut – who is planning to launch mortgages in the future – shows a good example of this mix.

We can see how having expertise and a significant % of revenue from Interchange Fees is good, but there needs to be other levers to bolster the bottom-line. Revolut has a subscription fee, which is more in-line with European standards – most American Digital Banks are free.

M&A for Big Banks Got A Lot Cheaper

While some will rise, others will fall. The Big Banks have been much maligned in recent years for their lack of innovation, predatory practices around lending, and lack of transparency around fees. According to many headlines, they were supposed to be dead by now.

And yet 2022 has turned the tables . Big Banks are beneficiaries of rising interest rates to a certain extent, as they hold huge deposit bases and earn NIM (Net Interest Margins) on the spread between what they lend money out at and what they pay depositors.

With huge balance sheets, Fintechs tanking, and 2023 not exactly looking like 2021 in public markets, Big Banks can step in and acquire rival Digital Banks. That is if they want them.

There are many threads being woven around the Future of Banking right now.

It is no longer just the Fintechs who they are competing with. Digital currencies are now in the mix and the specter of CBDCs (Central Bank Digital Currencies) looms in 2023. Credit Unions have made a dent in many of the Big Banks market share in different regions due to their more local touch and relationship-based banking model.

The point is, no Big Bank will go out and make a splashy acquisition just for the sake of it . The main reason they would likely do it is to acquire some kind of technological platform that they can scale into their own market. That, or they plan to launch a sub-brand to target the younger generation and want something cool to do so.

While neither Incumbent Retail Banks or upstart Fintech Digital Banks are in their tip-top shape, historically, opportunity still looms large. Empires will rise and fall in the world of banking in the years ahead, and even small players who appear down and out may have learned exactly the right lessons to take it to the bank in 2023 and beyond.

Digital Banks, IPOs & Consumer Trust

Business Model Canvas – Banking

Business Model Canvas – Payments

Future Banking Business Model

- Live Commerce, Influencers & Conversion

- Luxury, CAC & The Next Farfetch

- Is Social Commerce the next eCommerce?

IBS Intelligence

Financial Technology News & FinTech Research

Eight new digital business model archetypes for a post-Covid banking future

Api, app, apple pay, data, digital banking, fintech, mainframe, online payments, transactions, by gaia lamperti.

October 31, 2021

The pandemic escalated the creation of digital banking business ecosystems. In this article, Sanat Rao, CEO -Infosys Finacle, speaks about eight new and innovative digital business model archetypes that banks need to thrive in these ecosystems.

by Sanat Rao, Chief Executive Officer at Infosys Finacle

The conversation about digital business model innovation is not new, but it has never been more pressing. As CEOs grapple with their biggest challenge, namely, how to stay relevant amid rapid change and uncertainty, the legacy pipeline-based business model was often at the heart of the problem, and ecosystem-led business model, invariably, at the heart of the solution.

Digital technologies are unlocking opportunities to create, deliver, and realise value in new ways. By and large, the traditional universal bank is built on a pipeline model where the bank does everything, from manufacturing to selling to distributing, on its own, using in-house resources. This vertically-integrated pipeline business model is breaking apart, giving way to fragmenting value chains and new business model opportunities.

Our latest research study on digital banking business model innovation , conducted in association with 11:FS, organized the new models into 8 distinct archetypes, which are briefly described below:

Digital-only banks: Digital-only banks deliver banking services entirely (or almost) through digital touchpoints. Their key competitive advantages are high-quality self-service experiences and much lower operating costs than traditional banks. While digital banks mostly target digital-native/ tech-savvy consumers and small businesses, some start with narrower segments and gradually expand their reach to other groups. Digital banks are mobile-first, with some online banking offerings; and even their customer service is digital-first, chatbots led with limited human support. There is a long list of such banks, among them, Marcus by Goldman Sachs, Liv. By Emirates NBD, Digibank, Monzo and Kakao Bank.

Digital financial advisors: The digital financial advisor model brings the private banking experience to a much larger customer base. With data proliferating rapidly and becoming highly accessible in the open banking economy, firms, such as Plum, Snoop and TMRW by UOB, are able to run it through AI algorithms to understand a customer’s financial situation and offer highly personalized, appropriate financial advice. The traditional relationship manager is replaced by a hybrid of self-service and personal assistance rendered by both humans and chatbots.

Finance marketplaces: Finance marketplaces enable customers to choose financial services from a variety of third-party suppliers in an open environment. These marketplaces are accessed through websites and apps, and also developer portals and APIs. Examples include BankBazaar, Stripe, and Raisin. As the industry embraces open banking and open data paradigms, these marketplaces would increasingly democratize and facilitate easy access to the best products and services.

Non-finance marketplaces: Financial Institutions-led non-finance marketplaces – such as those from DBS Bank and Paytm – enable customers to choose a range of (non-financial) goods and services from suppliers in an open environment. For instance, DBS Marketplace is a one-stop portal to browse property listings, cars, book travel flights, book hotels, and compare utility providers, with financing options bundled along.

Banking as a service (BaaS): In this model, a bank offers complete banking processes around their financial products such as payments, loans or deposits as a service that third parties can embed into their products and services. BaaS enables integration of financial products seamlessly into the primary journeys of the customers such as getting instant auto loans at the dealer site. Typically delivered through well-defined APIs and business partnerships, BaaS is gaining significant traction across the globe. Banks of all sizes and persona such as BBVA, Goldman Sachs, Sutton Bank, ICICI Bank, and Solaris Bank are actively building their business using this approach. In addition, specialist BaaS intermediaries such as Galileo, Marqeta, and Setu, are also getting significant traction.

Banking industry utilities: Banking industry utilities specialize in delivering non-differentiating services by pooling resources, expertise, and capabilities to increase the efficiencies of all industry participants. The utilities offer a Business platform as a Service (BPaaS), combining technology, operations, and data. Examples include ClearBank – UK’s new clearing bank, Stater – The largest mortgage service provider of the Benelux that services 1.7 million mortgage and insurance loans for about 50 financial institutions in the Netherlands and Belgium

Banking curators: New-age digital banks following this model aim to offer best-of-breed products by combining basic accounts with financial advice and a curated set of third-party products on a single platform. N26, Monzo and Starling Bank are all examples of banking curators.

Embedded finance: Companies with frequent engagement and deep customer understanding are embedding banking and payments into non-financial products and services. The interest for embedded finance is rising across industries. Digital technology giants, e-commerce companies, retailers, travel – companies from across the spectrum are actively embedding financial products in their user’s customer journeys. For instance, buy now pay later proposition at the time of checkout or offering cash-flow based credit products to suppliers in association with banks. Shopify offers a good example here. It offers a ‘Buy Now, Pay Later’ option for consumers, a business debit card for merchants, and plans to offer business bank accounts with Stripe Treasury.

Like most businesses, banking is also going the way of the ecosystem. A scan of the landscape shows that few, if any, banks are succeeding by standing alone. But to thrive in an ecosystem, banks need to adopt new business models, such as those identified above.

Previous Article

October 28, 2021

Why was the global supply chain not prepared for the microchip shortage?

Next article.

November 03, 2021

What will power the future of FinTech?

May 13, 2024

PayNearMe taps Trustly to enhance Open Banking technology

- Daily insightful Financial Technology news analysis

- Weekly snapshots of industry deals, events & insights

- Weekly global FinTech case study

- Chart of the Week curated by IBSi’s Research Team

- Monthly issues of the iconic IBSi FinTech Journal

- Exclusive invitation to a flagship IBSi on-ground event of your choice

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related Blogs

February 02, 2024

API Technology

The role of API in banking: From personalised services to customer experiences

February 01, 2024

Data Security

Supporting retail banking sustainability with credible claims

Banking Tech

Unlocking the difference: How Data can allow banks to generate greater value

Related reports.

Sales League Table Report 2023

Global Digital Banking Vendor & Landscape Report Q1 2024

Wealth Management & Private Banking Systems Report Q1 2024

IBSi Spectrum Report: Supply Chain Finance Platforms Q4 2023

Treasury & Capital Markets Systems Report Q1 2024

The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

Digital and cloud transformation for banking

60% of business executives in our Pulse survey stated that digital transformation is their most critical growth driver in 2022. PwC Pulse Executive Views on Business, 2022

Simplify your way to growth through digital and cloud transformation

Today’s banking customers are hungry for digital banking products and services tailored to their individual needs. While traditional banks can be too product-centric and struggle to respond quickly to new opportunities and higher expectations, new banking models may be vulnerable when it comes to the safeguards that customers and regulators demand.

How can banks:

- Launch new products and services faster

- Simplify their business for customers and themselves, while they

- Instill rigor that builds trust with stakeholders?

They can do so now by delivering cloud-enabled digital banking experiences that can help fuel innovation, drive revenue growth and increase market share.

Rethink your bank for the digital age

- Your customer

- Your business

- Your services

- Your technology

By removing product-centric views and putting the customer at the heart of your design, you can exceed customer expectations and build trust:

- Leverage relationship management systems for deep insight

- Identify personas and create journeys for personalization

- Develop customer segments through primary research

Our customer-centric “Blueprinting” methodology can help. PwC’s transformation approach puts the customer at the center to guide design of the business and technology architecture.

Doing things for the sake of how they’ve always been done won’t just hold you back - it will make you irrelevant. Instead:

- Find your opportunities — dissect the market, competition and branch footprint

- Focus — define a clear mission and drive towards it

- Flex — take a disciplined but agile approach as your strategy evolves

- Foster — shepherd this vision consistent with regulatory guidelines and real-time risk management

Draw from our experience working across large financial institutions, FinTech companies, small business banking, corporate and investment banking, consumer finance, crypto, financial markets, and key regulatory agencies.

With a defined customer-centric mission, your entire operating model should follow suit. To enable services that will set you apart from your competitors both externally and internally, drive change across all functions:

- Develop customer-centered propositions and business models

- Iterate with prototypes and usability testing

- Look internally - revisit your employee experiences

Our community of solvers work together across all areas of business - operations, workforce, risk management, compliance - to enable a comprehensive transformation.

For many banks, simplifying customer experiences and business operations is limited by decades-old technical platforms and inflexible architecture. These are costly to maintain and limit innovation.

Modernized technology reduces costs and time-to-market, allowing quicker evolution of the organization and nimble development of new services. You can accelerate your transformation by taking clear steps to:

- Establish a modern, flexible core platform to enhance efficiency in operations

- Enable customizable services through robust data architecture and analytics

- Prioritize a flexible, modular architecture to provide individualized experiences and products

We work with multiple top Gen 2 and Gen 3 platforms to understand what the market has to offer and drive faster implementation. Whatever your speed, we can guide you through it.

Move faster with Industry Cloud for Banking

Take advantage of our Industry Cloud for Banking solution for the competitive advantage that comes from focus and speed.

Our Industry Cloud for banking and capital markets is a collection of pre-built integrations and assets that together with PwC’s consulting services, bring together the dozens of functionalities that make a bank what is is. It can help organizations stand up new customer-centric offerings that differentiate them from the competition.

PwC’s consulting services coupled with our asset-based, end-to end, modular approach enables us to flexibly build industry-centric solutions using the right assets at the right time, every time.

Connecting our industry specific knowledge with our repository of proprietary products, accelerators and digital assets enables us to help deliver agile, modular and sustainable solutions at scale.

Ecosystem-powered

Pairing a single cross-industry platform with our network of alliances with the major ERPs, CSPs, and SaaS providers, we’re able to easily connect, govern and maintain integration to help banks solve their most complex business and technology challenges.

How PwC can help

PwC has a proven record of delivering bespoke transformation for banks and in standing up new customer experiences. So, no matter where you are in your digital journey, let us help you understand, diagnose, baseline and strategize your transformation.

The below are common areas we can help you drive a broader transformation or a targeted change:

- Customer acquisition and retention

- Account opening

- Omni-channel customer servicing

- Payments transformation

- Core modernization

- Cloud migration

- Risk management and regulatory compliance

- Agile ways of working

{{filterContent.facetedTitle}}

{{item.publishDate}}

{{item.title}}

{{item.text}}

Peter Pollini

PwC Banking and Capital Markets Consulting Solutions Leader, PwC US

Alison Hoover

Financial Services Transformation Leader, PwC US

Murali Nallapaty

Principal, PwC US

Dean Nicolacakis

Justin O’Connor

Musarrat Qureshi

Sean Viergutz

Banking Transformation Lead Partner, Consulting Solutions, PwC US

Tanvi Patel

Thank you for your interest in PwC

We have received your information. Should you need to refer back to this submission in the future, please use reference number "refID" .

Required fields are marked with an asterisk( * )

Please correct the errors and send your information again.

By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). If you change your mind at any time about wishing to receive the information from us, you can send us an email message using the Contact Us page.

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

Core banking modernization: Unlocking legacy code with generative AI

Capture more of the finance market – 3 approaches, the ultimate guide to product innovation in banking, the ultimate guide to banking in the cloud, the time for generative ai in commercial banking is now, accenture banking blog other blogs banking blog capital markets blog insurance blog.

- Meet Our Bloggers

- More From Banking

- English US English

- Growth beyond digital banking: A new day dawns

Other parts of this series:

- Bold banks can grow by shattering the value chain

It's time to stop talking about digital banking as though it’s an end game. Today’s digitalization is just the first step in the more holistic transformation to come. In the first of my focused insights on the Future of Banking , I’ll discuss a few of the meaningful changes banks need to undertake in order to thrive and grow as banking moves into the future. Watch my blog for more of these insights in the months ahead.

Until quite recently, many incumbent banks were focused on a digital transformation that would migrate their current structures and services onto a digital infrastructure with a user-friendly interface. This was what they believed they had to do to compete against neobanks that were offering traditional banking products and services, but using a more convenient digital approach that tech-savvy customers were eager to try. However, the banking landscape was evolving in much more complex ways that some incumbents have yet to address.

Neobanks were initially seen as reinventing the customer experience—but that was just the tip of the iceberg. They also redefined the sellable units of financial offerings and componentized them, adding new pricing options. In the process they fragmented a value chain that had always seemed indivisible. And instead of owning everything and creating a copycat banking business model, they created adaptive business model opportunities. They are now enabling models that are collectively meaningful and exponentially expandable: super-apps, embedded models, and BaaS are just a few examples.

The future of banking: Time to rethink business models. An Accenture report outlines new banking business models that enable banks to reconfigure themselves to keep pace with disruption.

The 2020s have new goalposts

As 2020 ushered in a new decade and new, unexpected challenges, banks moved up their digitalization timelines—but most did not rethink their overall goals or business models. They continued to migrate their existing value chain and business model into the digital realm. That approach is now outdated. Digital-only players are rewriting the rules and innovating fast. The longer banks hold on to their traditional vertical-integration model, the more likely they are to lose customers to more forward-thinking competitors.

Today’s standard version of digital banking can improve a bank’s cost base and reduce inefficiencies, but capturing future growth can be achieved only by looking beyond digitalization to consider multiple new business models.

It’s time to see banking in a new light and understand the opportunities for growth in a market that’s limited only by imagination.

Customers are embracing “ best of ” banking

The landscape has changed, and will continue to change, in the financial services ecosystem. New players are going beyond emulating traditional banks in the digital world. Instead, they are creating new business models that leverage the opportunities of a delayered value chain. By doing this, they are chipping away at incumbent banks’ business.

Examples include these category killers:

- Chime : around 12 million customers, focusing on fee-free overdrafts and payroll acceleration

- Afterpay and Klarna : over 16 million and 90 million customers, respectively, expanding the credit market through “buy now, pay later” offerings

- Stripe : more than 50 of its clients process over $1 billion each in payments annually

- Wise : disrupting retail forex, it debuted on the London Stock Exchange with a market value of $11 billion

Customers are becoming less and less “brand loyal.” Instead, they are choosing which products they prefer from which providers, and in many cases using embedded services from third-party providers without even noticing them. Customers have the flexibility and opportunity to “build their own bank” by combining services from different players instead of searching for one incumbent that meets all of their expectations. There is no switching cost for them, and the result is incremental, more transparent, and more flexible.

The competitive arena has moved to product innovation, with new players attacking the incumbents in the areas where they are most exposed.

This “best of” approach has upended the vertical integration model that most banks have relied on for decades, if not centuries. The physical convenience of banks, together with the power of their detailed customer data, is no longer a differentiator: digital presence now trumps physical convenience, and data (unless it is intent-focused) is more accessible than ever before.

According to Accenture’s Banking Consumer Study , 27% of consumers opened an account with a new bank that year, but only 14% switched their main account. As customers spread their banking across more providers and platforms, incumbents will see their slice of the pie continue to shrink, even if they don’t lose those accounts entirely.

Trading one model for many

This fragmentation of the banking value chain can’t be ignored. The banks that are willing to embrace new business models and continually evolve them will lead the pack in innovation and profitability. It is time to think about the future of your business beyond your existing model and stop trying to simply adopt the latest digital trends.

Future banking business models will incorporate traditional vertical integration, but they won’t stop with that. Banks will unbundle products and re-bundle them in innovative ways to create new, additional business models. They will introduce new products and offerings into discrete parts of the banking value chain. Banks will replace one business model with many, that work together in order to maximize value for the bank.

Digital banking models are non-linear models that disrupt the traditional value chain by monetizing individual parts of it. For example, digital banking allows a bank to use customer data (both internal and from third parties) to better analyze credit risk and provide lending opportunities to more customers. Digital banking also allows a bank’s services to be integrated with those of its partners, or embedded into various platforms to create new offerings. In these ways, digital banking opens up many more business models for banks to consider.

BaaS provides banking products to companies that either bundle them seamlessly with their offerings or sell them on to their customers. The bank provides its regulatory capabilities and balance sheet to companies that don’t have those capabilities. The bank operates as a third-party service provider, invisibly in the background on a platform branded by the front-end service provider.

Banks will continue to move toward multiple, non-linear business models. We expect them to respond to the continued growth in digital technologies and pressure from digital-first competitors by transforming their value chain. Banks that examine their value proposition and business models on a continuous basis are likely to gain a competitive advantage over those that change only when regulatory pressures or customer expectations drive them to do so.

In upcoming posts, I’ll examine how the banking value chain has been shattered, and why that’s actually good news and a big opportunity for banks. I’ll also examine the evolution of banking business models and explain why one model may no longer be enough. Be sure to follow my blog for those insights.

If you’re ready to discuss new business models for your bank, contact me here . To get the whole story on the Future of Banking, dow n load the full report .

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors. This document may refer to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied. Copyright© 2022 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.

Related posts, by michael abbott & jess murray & jared rorrer, by michael abbott & rohit mathew & oliver reppel, reviving the central bank: getting (everyone) on the data train, by jess murray, how banks can reimagine a winning loyalty strategy, by amit mallick, how can banks lead the pack in open finance growth, it’s now or never: time for central banks to embrace change, by michael abbott & jess murray & keri smith, breaking barriers: exploring how banks scale generative ai for growth, by michael abbott, 5 ways to reignite customer relationships for growth, by masashi nakano & christopher jaggard & olivia jeavons, big banks need to embrace embedded finance – and fast, by michael abbott & steve smith, why retail banking presents rare opportunities right now, by damian pettit, how can banking ops help increase productivity, get the latest blogs delivered straight to your inbox..

Next Post - Bold banks can grow by shattering the value chain

Suggested Post - Bold banks can grow by shattering the value chain

Subscribe Get the latest blogs delivered straight to your inbox.

Share

- FinTech Alliance

- News & Insights

Digital Banks - Business Models

10 June 2019

Written By Matyas Fekete

FinTech BusinessModel digitalbanks

Amongst the multitude of digital-only banks that emerged recently in Europe, the big five (Monzo, N26, TransferWise, Revolut and Starling) have developed a remarkable customer base, with their popularity ever increasing.

Given their short history and the maturity of the industry they operate in, this is some achievement. While looking at it from the customer’s point-of-view there is little difference amongst these FinTech unicorns; looking at the bigger picture, however, reveals significant differences in their business models.

Timeline of launch

What about the profit?

Unlike in the UK, in most of continental Europe, bank accounts and corresponding banking services are historically paid-for services. The fact that digital banks offer most of their services free of charge has undoubtedly helped them build a large customer base. On the other hand, despite comparatively low set-up and minimised operational costs compared to that of traditional banks and given the lack of revenue stemming from the typically no-fee model, profitability has proved difficult to achieve. Monzo, for instance, recorded a net loss of £30+ per customer in its most recent financial year.

In the start-up world, it is customary to focus on expansion rather than profit – see the case of Uber, for instance. Still, while profitability might not be their number one priority in their early stages of development it must be a long-term goal of any business. With their ever-growing customer base, digital banks are increasingly under pressure to turn their business from loss- to profit-making. Below, we look at the different approaches taken by some of the most successful digital banks in Europe in their attempts to achieve much-coveted profitability.

Credit where credit is due

Digital banks pride themselves on their fair (often meaning “free”) proposition and have so far stayed clear of offering loans (incl. credit cards & overdrafts), traditionally amongst the most lucrative products for traditional providers. Still, although somewhat reluctantly, newcomers are also realizing that offering lending products is one of the most straightforward ways to offset losses made on their free, often high-cost services (e.g. overseas ATM withdrawals). Monzo, N26 and Starling have recently started offering credit products to their customers, with their loan offering expected to be extended to a wide range of services, from mortgages to overdrafts. Correspondingly, creating a lending portfolio can also pave the way for launching an interest-paying savings offering – a proposition seen as a basic banking product that is yet to feature in most digital banks’ portfolios.

The premium customer

While most digital banks offer most of their products for free, some have extended their offering by paid-for premium services in order to create a revenue stream. As these premium features, including different types of insurance, unlimited free transfers/withdrawals, faster payment settlement or concierge services, are often offered in a subscription format, customers are typically prompted to pay for the full package rather than just the desired service(s), providing a significant revenue stream for the bank. Revolut, for instance, was amongst the first digital banks in Europe to break even earlier this year, a feat largely due to revenue from its premium subscription.

SMEs like digital too

Traditional banks typically service small and medium sized businesses under their retail rather than corporate banking arm. Having their product offering tested with consumers, and consequently gaining a reasonable customer base, digital banks have also identified SMEs as an ideal segment to extend their target audience to. The five FinTechs profiled have already gone, or plan to go, down this path by following up their consumer solution with a business account. While both propositions are typically built on similar features, some providers charge businesses a monthly subscription (e.g. Revolut), while others apply additional fees to specific services (e.g. TransferWise), banking on the expectation that businesses are more likely to be willing to pay for banking – something they are already used to doing.

The marketplace model

While most digital banks offer a wide range of banking services, some of these tend to come from partnering third-party providers. For instance, Starling Bank’s only proprietary product is its current account, which serves as a basis for the provision of ancillary services, ranging from loans to insurance, to investment opportunities. Instead of developing these services in-house, Starling enables a select group of partnering financial service providers access to its platform in exchange for a fee. In effect, Starling is using its customer base to create a market for its partners, charging a commission for each acquired customer. In such cases of digital banks applying this marketplace model, the majority of their income often comes from partners rather than customers. Naturally, only banks with a large enough customer base can be successful in this set-up, underlining the current intensity of competition amongst digital banks.

Starling’s marketplace model

Banking as a Service

While customer centricity is heralded amongst the main USPs of digital banks, some are looking beyond offering consumer-facing services to diversify their revenue streams. Starling, which is among the few digital banks built on its own proprietary platform, has recently leapt into the Banking as a Service (BaaS) industry, making its technology available to other start-ups looking to launch a digital bank. Naturally, this raises the question whether the two offerings could threaten each other’s success. Generally, as long as such partners operate in different markets, the two business lines should be able to thrive alongside each other. Further along the line, however, such partners could easily end up expanding their banking solution into the same market(s) as they aim for global success and by doing so, becoming direct competitors.

Different approach, same result?

It is fair to say that consumers in Europe looking to bank with a digital-only provider would have a difficult time finding relative advantages/disadvantages amongst the leading players in the industry. Still, despite the limited surface-level variety, exploring the business models of leading digital banks reveals different approaches to the challenge of making money. Alongside the more straightforward method of offering paid-for premium features/subscriptions, some are banking on the value that access to their customer base offers to third-parties, while others outsource their technology to neobanks wanting to focus on the Fin rather than the Tech. With competition amongst digital banks heating up, we are curious to see which business model(s) prove to be the winning formula in the long term.

Up Next ...

14 may 2024, meet cleo, london based fintech.

Using AI to close in on unicorn status In brief:Suddenly, all ...

Fintech Farm raises $32mn

Expanding its ‘neobank in a box’ model to India In brief:- The ...

Investcorp closes $570mn fund

Focusing on cybersecurity and FinTech In brief:- Investcorp manages $52 billion in ...

10 May 2024

Revolut launches trading platform.

Supporting XRP among other digital assets In brief:Revolut has marked its territory ...

More in Banking

- Knowledge Bank

British Business Bank appoints Kristen McLeod CBE as Chief Strategy Officer

26 april 2024.

Kristen joins the BBB from HM Treasury. In brief:- Kristen served ...

Targeting $180M in Revenue, Vault Aims to Lead the $50B Digital Crypto Banking Market

27 march 2024.

Vault's approach of providing personalized, effective, and affordable white label solutions for digital and crypto banking has captured the interest of a diverse range of...

Written By: Vault

Santander evolves in-person bank format

Tailors experience to meet customer needs.In brief:- Santander Bank, announced ...

White Papers Banking

Consumer banking report 2024, 29 february 2024.

In the fourth iteration of EPAM's report, we surveyed 9,000 retail banking consumers evenly distribu...

Navigating the challenges of working with banks

12 june 2023.

Banks and FinTechs are increasingly in need of each other. For incumbent banks, especially, the adop...

EPAM Continuum: Consumer Banking Report 2022

09 november 2022.

EPAAM Continuum has released its third annual consumer banking report. Surveying 26,000 people...

How to Choose the Right Core Banking Provider: 5 Key Takeaways

03 march 2022.

Market pressure, changing consumer expectations and rapid developments in technology; combined, thes...

There are no Events in this category

Hit enter to search or ESC to close Clear search

2022 Impact Factor

- About Publication Information Subscriptions Permissions Advertising Journal Rankings Best Article Award Press Releases

- Resources Access Options Submission Guidelines Reviewer Guidelines Sample Articles Paper Calls Contact Us Submit & Review

- Browse Current Issue All Issues Featured Latest Topics Videos

California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

Digital Transformation in Corporate Banking: Toward a Blended Service Model

Image Credit | Erol Ahmed

Volume 66 Issue 3

Recommended, current issue.

Volume 66, Issue 3 Spring 2024

Recent CMR Articles

Global Sustainability Frontrunners: Lessons from the Nordics

Essential Capabilities for Successful Digital Service Innovation at the Bottom of the Pyramid

Digital Platform Grafting: Strategies for Entering Established Ecosystems

Berkeley-Haas's Premier Management Journal

Published at Berkeley Haas for more than sixty years, California Management Review seeks to share knowledge that challenges convention and shows a better way of doing business.

Home » Innovation & Digital » Retail banking business models—defining the future

Retail banking business models—defining the future

By Dr. Marc Buermeyer , Katja Heuschröck , Wieland Weinrich , Konrad Holtkamp , Oliver Lehner

- Reading time: 6 minutes

Key takeaways of zeb ’s current European Banking Study

The European Banking study illustrates the partly precarious situation in which European banks find themselves.

These are the key takeaways:

- Even a decade after the financial crisis, the top European banks’ profitability is still below capital market requirements

- Only a few banks rank digitalization at the top of their agenda—yet institutions with this focus tend to outperform the market average

- Business models must be future-proofed to meet current and upcoming challenges

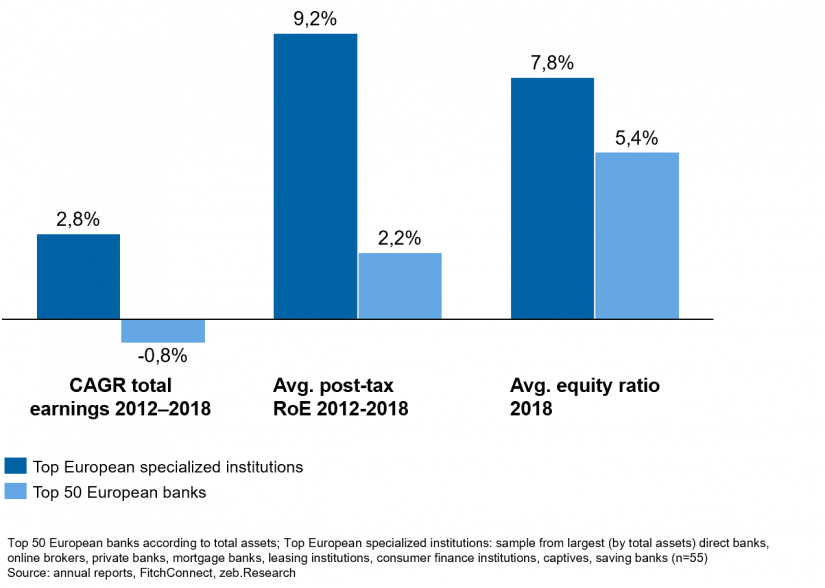

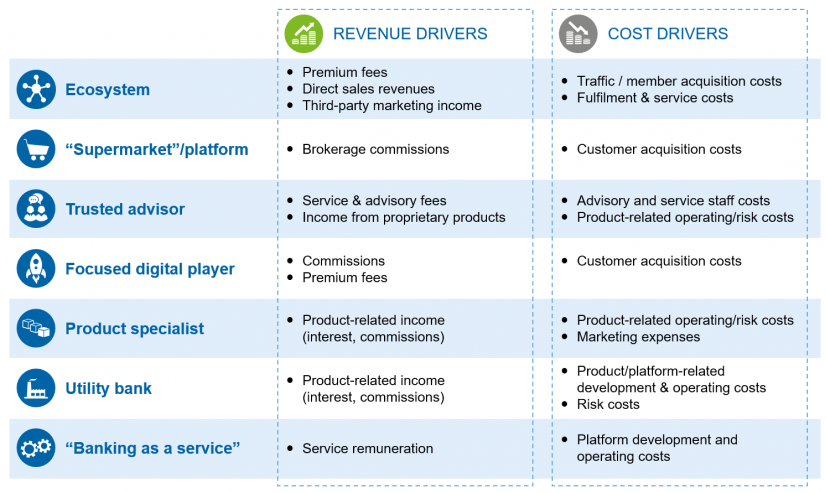

Specialized and mostly more innovative business models have achieved better profitability and equity ratios in the past year, as illustrated by last year’s European Banking Study as well as in figure 1. zeb believes this trend to be one of the key drivers of change in the retail banking sector over the next decade.

Irrespective of the current financial situation, digitalization requires all companies to invest heavily and to develop new competencies to make intelligent use of it:

Automation will lead to the introduction of end-to-end digital processes in all parts of the economy (e.g. automated household controls or large industrial control systems)— access anywhere & anytime will lead to a demand for simplicity— transparency will exert further pressure on competition— connectivity will lead to ubiquitous access to computing power (e.g. IoT connectivity, enabling new services)— advanced algorithms will predict customers’ behavior/needs— bionics will combine digital and personal interactions to leverage the advantages of both.

Unsurprisingly, global tech giants are equipped to incorporate all these digital drivers. Based on this strength, they are now striving towards specialized sub-areas of the banking business models. Mostof the global tech giants – Amazon, Google, Facebook, Apple, Tencent, Ant Financial – offer payment services, for example. As this mainly happens in the USA and China, European banks may yet feel safe. Once, however, technologies and customer behavior are fully advanced and applied throughout Europe, the need for change could hit them all the harder.

Further reading

- The market data trap – managing complex issues

- Final EBA requirements for the estimation of downturn LGDs

- Digital Factory—Banking 4.0 at Deutsche Bank

While big tech companies start out with very focused and simple elements of banking, many banks do the opposite. Hoping to transform themselves into tech companies by trying to incorporate all digital drivers within various digitalization initiatives, without, however, having a suitable business model strategy. The business models of full-scale tech companies, on the other hand, are predominantly capable of incorporating most digital drivers. Amazon, for example, is highly automated (e.g. capable of same-day delivery) and easily accessible with a transparent service offering and advanced algorithms that contribute to improvement throughout their business.

It will be difficult for banks to create something comparable to Amazon’s high-end platform . However, being the owner of a platform is only one way to participate. Producers offering services on a platform or consumers demanding services can benefit as well. Therefore, not only a comprehensive approach, but specialized business models can help reap the advantages of digital drivers.

In summary, retail banking business models are under severe pressure to proactively change to face the challenges of the decades to come.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

" (Required) " indicates required fields

- 8.000+ people are already getting a step ahead in banking.

- E-Mail (Required)

- Einwilligung in die Datenverarbeitung (Required) I have read the information on data processing in the context of the newsletter subscription and accordingly consent thereto by submitting my data. (Required)

Sustainable retail business models of the future

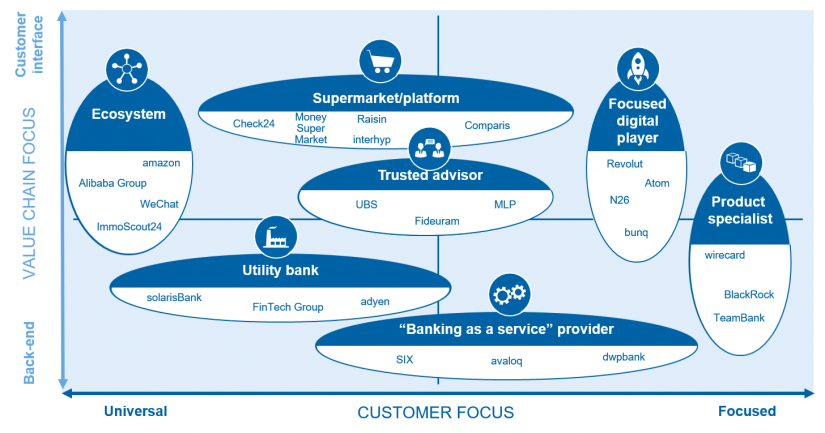

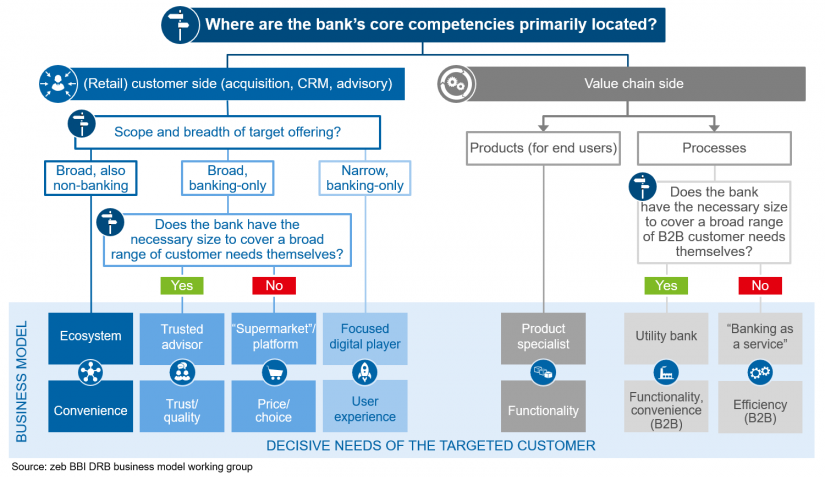

In light of the current challenges, retail banks need to focus on their strengths. There are two core strengths that define a bank’s business model: first, a clear customer centricity and second, a strong value chain focus.

Customer-centric banks have the ability to differentiate themselves through effective customer access across the buying process and to meet requirements along the customer journey.

These business models include ecosystems with a broad (potentially non-banking) offering on the one end and focused digital players with a narrow banking-only offering on the other end. In between, there are trusted advisors with a broad customer range, who particularly target service-oriented individuals, as well as supermarkets serving self-directed customers in a narrower setting.

Value chain-focused banks, on the other hand, maintain their competitive advantage by differentiating themselves with effective resources and competences along the banking value chain.

Value chain-oriented companies operate as one of three business model archetypes: one concentrates on products for end customers; these companies are leaders in specific categories and therefore product specialists . The other two focus on processes and are further differentiated by their ability to cover a broad range of B2B customer needs themselves. Where possible, they position themselves as a utility bank , or else offer banking as a service .

Customer-centric retail banking business models of the future

Ecosystems are (digital) gateways that aggregate suppliers to comprehensively fulfill different customer needs, often by combining complementary services. For customers, ecosystems are convenient one-stop shops that offer personalized solutions tailored to the customer’s profile, history and current situation. Network effects enhance the attractiveness by significantly reducing transaction costs.

To service such a broad offering, ecosystems rely on many partnerships, among which are traditional financial product specialists (asset managers, credit institutions, payment service providers, insurers, …), fintech companies (alternative credit/payment providers, …) and consumer goods companies.

Trusted advisors focus less on self-service than on service and advice. They serve sophisticated customers looking for expert advice on commonly non-standardized needs. Therefore, individuals who are insecure, time-restricted or assistance-seeking will most likely turn to trusted advisors.

The appeal of a trusted advisor is in large part derived from the fact that they are part of a well-trained, highly qualified staff. They facilitate access to extended services along the typical household finance customer journey. This leads to an outstanding quality of advice and truly personalized solutions, securing mutual long-term interests (potentially life-long and even spanning generations).

Supermarkets provide a wide transparency and access to goods in complex markets by aggregating products and services on one platform. Their target customers are financially savvy and price-sensitive individuals who strive to manage their personal finances themselves. Thus summarized, the service offering should include an easy-to-use marketplace with high-quality products and services at competitive prices. To create an outstanding offer with the right products and services, successful partnerships are essential. This may include collaborating with asset managers, credit institutions, payment service providers, insurance companies, fintech companies, search engines and many more.

Focused digital players are among the more recently established business models. They offer convenient, lean, digital banking solutions in a state-of-the art design. In this context, customer centricity is of fundamental importance, as the targeted customers value convenience. One means to achieve this is to offer nearly everything their target customers would ever want, but not all of which can be reflected in a standardized approach. This approach ensures high delivery capabilities for target customers who value attractive prices but also accept that cornucopia doesn’t come cheap.

Back-end-focused retail banking business models of the future

Product specialists focus on succeeding in (at least) one category through mostly back-end skills, i.e. leadership in innovation, performance or cost. Products can be placed in two ways: First, product placement with B2B distribution partners such as financial supermarkets or trusted advisors with an open platform. Second, direct B2C placement with self-directed individuals who share an appreciation for price and performance leadership. Fintech companies acting as product specialists for payment solutions, for example, have established a basis for seamless payment transactions (such as instant payments).

Utility banks provide plug-and-play solutions for non-banks, which can henceforth integrate financial services into their customer journey without having to create their own products. These solutions can either be a finished financial product or enable the cooperating company to offer financial products themselves without having a full back-end or even a banking license. A utility bank could, for example, support an e-commerce retailer in offering credit products directly to customers who wish to make a purchase but lack sufficient funds to do so.

Banking-as-a-service providers offer banking solutions to other financial service providers. They either possess outstanding expertise in a specific business area, resulting in a leading-edge performance, or, as B2B partners, use their size advantages to offer low-cost solutions. With their offering, they can help heavily front-end-based financial services providers to source back-end products. Banking as a service, for example, could provide portfolio and asset managers with modeling tools that enable them to develop and maintain investment strategies.

Retail banking business models—so what?

Altogether, the seven business models show that a market with more focused banking business models will be a tough environment to compete in.

Holding up a universal banking approach will be impossible for most banks, as the vast majority lack the critical size and the required capabilities to operate as such, especially when challenged with focused competition.

We believe that banks need to ask themselves the “who-am-I” question of their identity. Once this is resolved, banks need to decide on where to go. The options are described in the zeb.business model canvas (see figure above ).

zeb has both the experience and capabilities to support the analysis of current business models as well as the development of a highly competitive focused business model. We help CEOs make changes and set up business models that deliver the type of services and customer experience that allow banks to emerge as winners in the digital economy.

Sources: Bloomberg, FitchConnect, Federal Ministry of FinanceGermany, ECB, zeb.research

most read Innovation & Digital

Feel free to contact us!

Dr. Marc Buermeyer

Katja Heuschröck

Wieland Weinrich

Konrad Holtkamp

Oliver Lehner

The news you can look forward to on mondays.

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2 weeks

BankingHub recommends

Generating earnings through digitalization

Share article

More about this topic

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Social Media

More From Forbes

Navigating the future of technology in banking: insights and innovations.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Josh Scriven, Global VP of Technology at Neudesic : Driving Strategy and Transformation Through Innovative Technologies.

In an era marked by rapid technological advancements and shifting market dynamics, the banking sector stands at a crossroads. I'll share insights from a recent corporate banking modernization panel I had the pleasure of joining, highlighting the pivotal areas where technology not only addresses current challenges but also shows unique opportunities for innovation and efficiency.

The Evolution Of Modern Technology Platforms

Modernizing your technology platform is not merely about updating old systems; it's about reimagining the infrastructure, process and people to thrive in the digital age. Key advancements such as cloud-native architectures, microservices, DevSecOps and the integration of AI have paved the way for platforms that are scalable, resilient and future-proof.

Four areas stand out in their potential to drive significant business outcomes: data mesh architecture, edge computing's expanding horizon, the strategic application of multicloud and hybrid cloud, and the rapid advancements in GenAI.

Data Mesh: A Paradigm Shift In Data Management

The shift toward data mesh architecture represents a radical rethinking of data management. By emphasizing domain-oriented decentralized data ownership, this approach ensures that data is not just an asset but a product—managed with the same rigor and focus as any other product in an organization. For trade banking, this means agile and informed decision-making powered by accessible, high-quality data across the organization.

Northern Lights Might Be Visible Again Tonight Here s The Updated Aurora Forecast

Apple iphone 16 pro design upgrade shines in new leak, it s possible the russian army is tricking the ukrainian army with a fake offensive, edge computing: bringing processing closer to the source.

"The edge is here" is more than a statement; it's a reality reflecting the move toward edge computing. This evolution brings computing resources closer to data generation and consumption points. In banking, edge computing offers new opportunities for real-time analytics, high-frequency trading enhancements and immediate fraud detection—directly impacting customer satisfaction and operational efficiency.

Multicloud And Hybrid Cloud: Flexibility At Scale

The adoption of multicloud and hybrid cloud strategies offers unprecedented flexibility and resilience. Banks are now leveraging the best-in-class services, optimizing infrastructure costs, and ensuring data sovereignty and regulatory compliance. This strategic flexibility enables rapid deployment of new applications and services, fostering innovation and maintaining competitiveness.

Artificial Intelligence: The Catalyst For Transformation

Artificial intelligence (and now GenAI) is quickly pushing the next technological revolution. From automating tedious processes to enhancing customer service with predictive analytics and personalized advice, AI's role cannot be overstated. In trade banking, AI algorithms play a critical role in fraud detection, risk management and offering tailored financial products, marking a significant leap toward efficient, secure and customer-centric services.

The integration of these technologies extends beyond traditional banking, catalyzing the rise of collaborative finance. This paradigm shift toward technology-enabled shared platforms is not just redefining financial services; it's fostering new business models, expanding markets and facilitating unprecedented levels of collaboration across the tech industry.

A Supply Chain Finance Revolution

As the global trade landscape continually evolves, supply chain finance institutions are at the forefront of embracing cutting-edge technologies to overhaul their operations and services. By integrating the Internet of Things (IoT), AI, data mesh architecture and cloud computing solutions, these institutions are pioneering a revolution that promises to redefine industry standards for efficiency, reliability and financial empowerment.

Revolutionizing Visibility With IoT And AI

At the forefront of this transformation is the application of IoT devices across supply chains. Global leaders like Maersk have set a precedent by using such technologies to gain real-time visibility into container conditions and locations. Additionally, top-performing supply chain organizations are investing in AI and machine learning (AI/ML) to optimize their processes at more than twice the rate of low-performing peers, using productivity rather than efficiency or cost savings as their key focus to sustain business momentum over the next three years.

Decentralizing Data For Agility

Confronted with the data deluge, institutions are adopting a data mesh architecture, championing decentralized data stewardship. Each node, from suppliers to distributors, becomes autonomous in managing and sharing its data, echoing the strategies of innovators like JPMorgan Chase, the Department of Defense ( DoD ) and IBM. This paradigm shift enhances data integrity and access and accelerates responsiveness to market dynamics, equipping stakeholders with critical, actionable intelligence.

Flexibility For Global Operations: A Synergistic Infrastructure

In navigating the complexities of international operations, leaders are opting for a hybrid cloud strategy augmented by edge computing. This dual approach maximizes the utility of expansive public cloud resources while maintaining sensitive data securely within private clouds. Edge computing, as employed by Maersk and DHL, brings computational power closer to data sources , allowing for immediate, informed actions that are essential for scaling and instantaneous decision-making.

A New Era Of Supply Chain Finance

As organizations incorporate these technologies into their supply chain and trade finance systems, they can push a shift toward a more interconnected, streamlined and equitable ecosystem. Suppliers gain access to faster financial support, mitigating the traditional woes of payment delays. Buyers, in turn, enjoy an optimized supply chain that supports superior inventory control and strategic planning, marking the dawn of a new era in supply chain finance.

By weaving together these technological threads, the institution not only anticipates the future of global trade but actively shapes it—ensuring that its network remains resilient, competitive and at the forefront of innovation.

This is just the beginning of modernizing technology platforms in banking. As we look ahead, the ongoing collaboration between technology providers, financial institutions and regulators will be crucial in shaping a banking sector that is agile, secure and ready to meet the challenges of tomorrow.

Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify?

- Editorial Standards

- Reprints & Permissions

Chris Skinner's blog

Shaping the future of finance

Four banking business models for the digital age

I spotted a lengthy, but very insightful post, on LinkedIn the other day by Ben Robinson, Chief Strategy and Marketing Officer for Temenos. I don’t usually highlight such pieces, but felt this worth replicating here, and Ben kindly agreed. Enjoy …

Digitization of the banking industry is making new banking business models possible. But, it is the combination of regulation and technology that is making new business models a necessity.

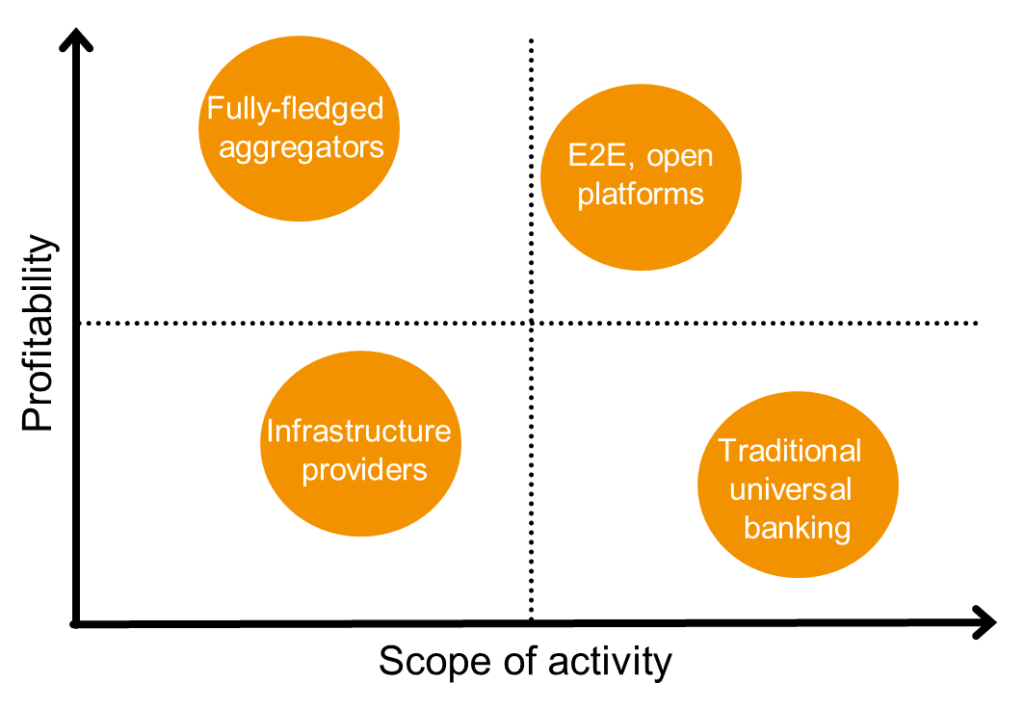

There are 4 strategic options open to banks, shown below. These vary in terms of the scope of banks’ own activities as well as in terms of profitability. The traditional universal banking model and the infrastructure provider model are both asset intensive and low margin, which makes them unattractive. In addition, the universal banking model, in that it requires the bank to manufacture and distribute all of its products, is probably unsustainable. The aggregator model, top left, offers the possibility for very high profitability with low asset intensity, but will be difficult to defend. Thus, it is the vertically integrated but open platform model which offers the best route to sustainably high margins.

From a producer to a creator economy

If you have a spare 90 mins, you should definitely check out this presentation from Paul Saffo which gives an interesting take on the economic history of the last 120 years. Paul argues that the first part of the 20th century was the “Producer Economy”, where economic efforts were employed in systemizing production, organising people and capital in the most efficient way possible to overcome scarcity. The most iconic image of this age is the Ford Model T, available in any colour as long as it was black. But, the peak of the producer economy came with the Second World War when the US economy was able to produce 8 aircraft carriers per month and a new plane every 15 mins.

Post the Second World War, the “Producer Economy” gave way to the “Consumer Economy”, where scarcity moved from production to desire and where it was necessary to foster the latter through advertising and credit. The peak of the consumer economy came with the financial crash of 2008 when the economy couldn’t be leveraged up anymore.

Today, Saffo argues, we are in the “Creator Economy” where the scarcity is consumer engagement (a “poverty of attention”) and the means to overcome it is to offer services through platforms, where the consumer becomes at once a producer and consumer. Making the consumer a creator produces network effects , where the consumer’s input makes the product better - like Facebook where more users means more content and interactions attracting more users - and leads to a positive feedback loop of increasing customer numbers and increasing engagement. The only way to stop the increasing returns to scale and tendency to monopoly in the creator economy is to create better platforms, as MySpace, Yahoo and other companies stand testament. Which is why, incidentally, Europe needs to get busy developing platform companies rather than trying to legislate against the ones that exist.

Banking in the context of the creator economy

How well does this model of economic history explain the evolution of banking over the same period?

Well, the first observation is that it is only really a model of the developed world, not the developing world. In the developing world, there is still a scarcity of banking provision as evidenced by the 2bn adults who don’t have access to banking. However, digitization is also helping to solve the problem of financial exclusion , by lowering the cost of banking and making it accessible anywhere and anytime (increasing the supply of banking to a point where the price meets demand).

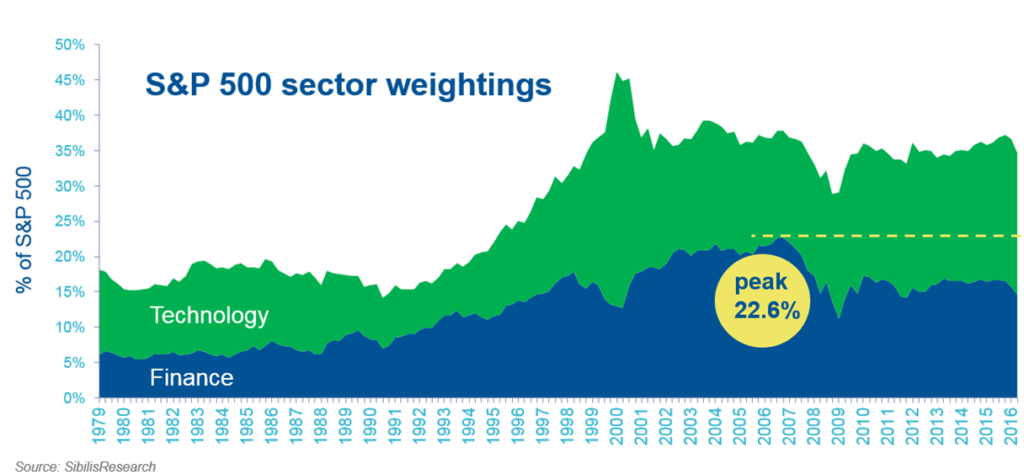

But, as regards the developed world, Saffo’s history reflects very well the changing role of banking. Given the pivotal role of banking in underpinning growth in the “Consumer Economy” – underwriting the sustained rise in demand for consumer goods and, then, for housing (which successive rounds of de-regulation were happy to fuel) - it explains why banking became so oversized relative to historical norms and relative to other sectors of the economy. For example, in 1945, the year the Second World War concluded, financial services made up 2.1% of US GDP. In 2007, the year before the financial crash, financial services constituted 7.6% of the US economy. Similarly, in 1979 (the first year for which data is available), financial stocks represented 6.1% of S&P500 compared to 22% in 2007.