The Definitive Guide to Valuing Your Financial Planning Practice

As a financial advisor, your practice is likely one of your most valuable assets. Whether you're considering selling, merging, or simply want to understand the true worth of your business, accurately valuing your financial planning practice is crucial. However, determining an accurate valuation can be a complex process with many factors to consider.

In this comprehensive guide, we'll explore the key elements that influence the value of a financial planning practice and provide you with a deep understanding of the valuation process. We'll cover various valuation methods, industry trends, challenges, and strategies to enhance your practice's value. By the end of this guide, you'll be equipped with the knowledge and insights needed to navigate the valuation process with confidence.

Understanding the Components of Value

Before delving into the valuation methods, it's essential to understand the key components that contribute to the overall value of your financial planning practice. These components can be broadly categorized into tangible and intangible assets.

Tangible Assets:

- Client Base: The foundation of any financial planning practice lies in its client base. Evaluate the size, diversity, loyalty, and growth potential of your client roster. Long-standing client relationships and a solid retention rate can significantly enhance the value of your practice.

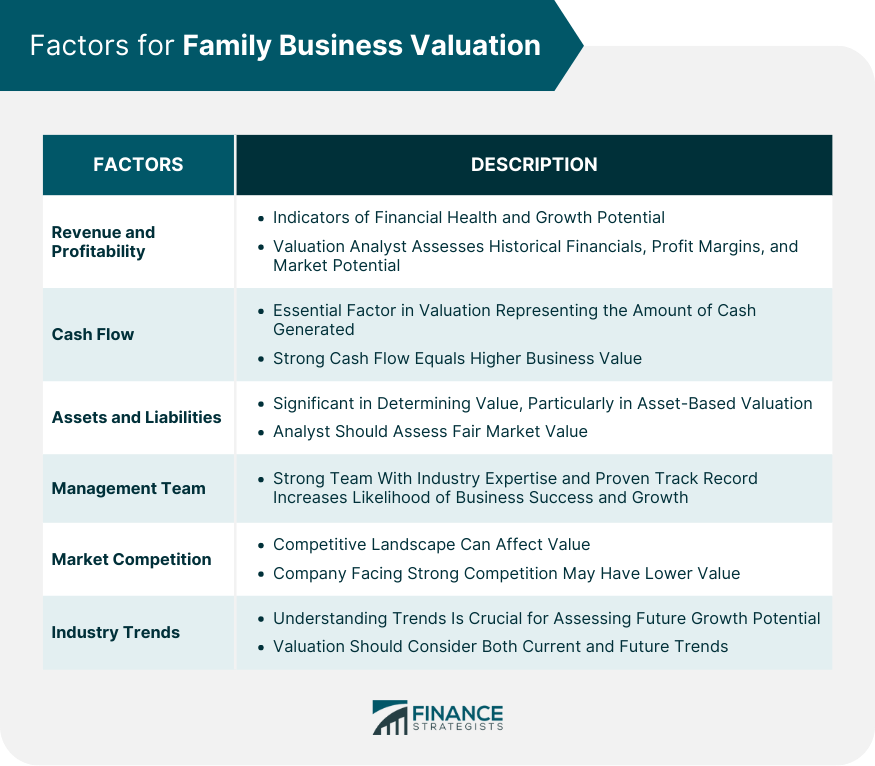

- Revenue and Profitability: Assess the financial performance of your practice by analyzing revenue streams, profit margins, and recurring revenue. Consistent revenue generation and healthy profitability demonstrate the stability and growth potential of your business, making it more attractive to potential buyers.

- Assets Under Management (AUM): The total value of assets you manage for your clients is a crucial factor in determining your practice's worth. A higher AUM generally translates to higher revenue and profitability, thus increasing the overall value of your business.

Intangible Assets:

- Brand Reputation: A strong brand reputation built on trust, experience, and client service can significantly enhance the perceived value of your practice. A well-established brand can attract new clients and retain existing ones, contributing to long-term growth and sustainability.

- Intellectual Property: Any proprietary methodologies, investment strategies, or exclusive financial products your practice owns can add substantial value. These unique assets differentiate your practice and can provide a competitive edge in the market.

- Human Capital: The experience and qualifications of your team are invaluable assets. A highly skilled and knowledgeable team can contribute to the overall value of your practice by delivering exceptional service and driving growth.

- Technology and Systems: The technology infrastructure and systems you have in place can streamline operations, enhance efficiency, and improve client experiences. A well-integrated and robust technology stack can be a significant value-add for potential buyers.

- Regulatory Compliance: A practice that strives to meet industry regulations and maintains robust compliance and risk management systems can minimize potential legal and financial risks, making it a more attractive opportunity.

By understanding and evaluating these tangible and intangible assets, you can gain a comprehensive view of your practice's strengths and areas for improvement, ultimately positioning yourself for a more accurate valuation.

Valuation Methods

There are several methods commonly used to value a financial planning practice. Each method has its own strengths, weaknesses, and applicability based on the specific circumstances of your practice. Let's explore the most widely used valuation methods:

- Multiples of Revenue 1 2 10

This method involves applying a multiple to your practice's recurring revenue, typically from the trailing 12 months. The multiple uses can vary based on industry standards, the size of your practice, and other factors such as growth potential and profitability.

For smaller practices generating less than $1 million in gross revenue, a gross revenue multiple (GRM) is often used. For practices between $1 million and $5 million in gross revenue, the focus shifts to earnings multiples, such as a multiple of seller's discretionary earnings (SDE) or earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Discounted Cash Flow (DCF) Analysis 2 6

The DCF method involves projecting your practice's future cash flows and discounting them to their present value using an appropriate discount rate. This method considers the time value of money and accounts for the risk associated with your practice's future cash flows.

The DCF analysis is particularly useful for larger practices with consistent cash flow patterns and reliable growth projections. It provides a more comprehensive view of your practice's value by considering its long-term earning potential.

- Asset-Based Valuation 6

The asset-based valuation method focuses on the fair market value of your practice's tangible and intangible assets. This approach is typically used when a practice is being liquidated or when its assets are more valuable than its ongoing operations.

Under this method, each asset is valued individually, and the sum of these values represents the overall value of your practice. However, it's important to note that this method may not capture the full value of your practice as a going concern.

- Market Approach 2 6

The market approach involves comparing your practice to similar businesses that have recently been sold or acquired. This method relies on finding comparable transactions and adjusting for differences in size, profitability, client base, and other relevant factors.

While the market approach can provide a good benchmark, it can be challenging to find truly comparable transactions, especially in smaller markets or niche practice areas.

It's important to note that these valuation methods are not mutually exclusive, and in many cases, a combination of methods may be used to arrive at a more accurate and comprehensive valuation.

Industry Trends and Market Conditions

When valuing your financial planning practice, it's crucial to consider the broader industry trends and market conditions that may influence the perceived value of your business. Here are some key trends and factors to keep in mind:

- Technological Advancements 3 9 15

The financial planning industry is rapidly evolving, with technology playing an increasingly significant role. Practices that embrace digital solutions, such as client portals, financial planning software, and automated investment platforms, are often viewed as more valuable and future-proof.

- Regulatory Changes 3 7

Regulatory shifts, such as changes in fiduciary standards, tax laws, or compliance requirements, can impact the value of a financial planning practice. Practices that are well-prepared for regulatory changes and have robust compliance systems in place may be perceived as lower-risk investments.

- Demographic Shifts 3 9

The aging population and the transfer of wealth to younger generations are reshaping the financial planning landscape. Practices that cater to the unique needs of different demographic groups, such as millennials or retirees, may be better positioned for long-term growth and increased valuations.

- Industry Consolidation 9 15

The financial planning industry has seen a trend toward consolidation, with larger firms acquiring smaller practices or merging to gain economies of scale. This trend can impact valuations, as larger firms may be willing to pay a premium for established practices with a loyal client base and strong growth potential.

- Economic Conditions 2 3

Broader economic factors, such as interest rates, market volatility, and consumer confidence, can influence the demand for financial planning services and the perceived value of your practice. Practices that have demonstrated resilience during economic downturns may be viewed as more valuable investments.

By staying informed about these industry trends and market conditions, you can better position your practice for a favorable valuation and make strategic decisions to enhance its value.

Challenges in Valuing a Financial Planning Practice

While valuing a financial planning practice is essential, it's not without its challenges. Here are some common obstacles you may encounter:

- Lack of Standardized Valuation Methods 2 10

Unlike other industries, there is no universally accepted valuation method for financial planning practices. This lack of standardization can lead to varying valuations and make it challenging to compare your practice to others in the market.

- Subjectivity in Valuing Intangible Assets 6 8

Intangible assets, such as brand reputation and intellectual property, can be difficult to quantify and value objectively. Different valuation professionals may assign different weights to these assets, leading to variations in the final valuation.

- Data Availability and Accuracy 3 6

Accurate and comprehensive data is crucial for a reliable valuation. However, many financial planning practices may lack detailed financial records, making it challenging to assess historical performance and project future cash flows accurately.

- Client Retention and Portability 4 8

The value of a financial planning practice heavily relies on its ability to retain clients after a sale or merger. However, client relationships are often personal, and there is no guarantee that clients will remain with the new ownership or management.

- Regulatory and Compliance Risks 7 8

Potential regulatory changes, compliance issues, or legal disputes can significantly impact the value of a financial planning practice. Assessing these risks and their potential consequences can be complex and may require specialized expertise.

To overcome these challenges, it's essential to work with experienced valuation professionals who understand the nuances of the financial planning industry and can provide an objective and comprehensive assessment of your practice's value.

To overcome these challenges, it can be beneficial to work with experienced valuation professionals who understand the nuances of the financial planning industry and can provide an objective and comprehensive assessment of your practice's value.

Strategies to Enhance Your Practice's Value

While valuing your financial planning practice is crucial, it's equally important to implement strategies that can enhance its value over time. Here are some key strategies to consider:

- Focus on Client Relationships 4 8

Cultivate strong, long-lasting client relationships built on trust, transparency, and personalized service. Nurture these relationships by providing exceptional client experiences, proactive communication, and value-added services.

- Diversify Revenue Streams 2 8

Explore opportunities to diversify your revenue streams beyond traditional investment management fees. Consider offering fee-based financial planning services, insurance products, estate planning, or tax advisory services to attract a wider range of clients and increase revenue stability.

- Embrace Technology 3 9 15

Invest in robust financial planning software, customer relationship management (CRM) systems, and digital marketing tools to streamline operations, enhance client engagement, and position your practice for future growth.

- Develop a Succession Plan 8 12

Implement a well-defined succession plan that outlines the transition of ownership, management, and client relationships. A clear succession plan can mitigate risks and provide assurance to potential buyers or partners.

- Foster a Strong Team 8 12

Build a talented and dedicated team of professionals with diverse skills and expertise. Invest in their professional development and create a positive work culture that attracts and retains top talent.

- Maintain Robust Compliance and Risk Management 7 8

Implement robust compliance and risk management systems to minimize potential legal and financial risks. Stay up-to-date with regulatory changes and industry best practices to demonstrate a commitment to ethical and responsible business practices.

- Continuously Improve and Innovate 9 15

Regularly evaluate your practice's processes, services, and offerings to identify areas for improvement and innovation. Embrace a growth mindset and be open to adapting to changing market conditions and client needs.

By implementing these strategies, you can enhance the value of your financial planning practice, making it more attractive to potential buyers or partners and positioning yourself for long-term success.

Hiring a Valuation Expert

While it's possible to attempt a self-valuation of your financial planning practice, engaging a professional valuation expert is often recommended, especially for larger or more complex practices. Here are some key reasons to consider hiring a valuation expert:

- Objectivity and Expertise 2 6 10

Valuation experts bring an objective and unbiased perspective to the valuation process. They have specialized knowledge and expertise in valuation methodologies, industry trends, and regulatory requirements, ensuring a comprehensive and accurate assessment.

- Credibility and Defensibility 6 10

A valuation performed by a qualified expert carries more credibility and is more defensible, particularly in situations involving legal or regulatory scrutiny, such as mergers, acquisitions, or tax-related matters.

- Access to Industry Data and Resources 2 6

Valuation experts have access to industry-specific data, benchmarks, and resources that may not be readily available to individual practitioners. This information can provide valuable insights and context for the valuation process.

- Compliance with Standards and Regulations 6 10

Valuation professionals adhere to established standards and regulations, ensuring that the valuation process is conducted in accordance with best practices and legal requirements.

When hiring a valuation professional, it's essential to consider their qualifications, experience, and familiarity with the financial planning industry. Look for professionalswho hold relevant certifications, such as Accredited in Business Valuation (ABV), Certified Valuation Analyst (CVA), or Accredited Senior Appraiser (ASA).

Valuing your financial planning practice is a critical exercise that provides valuable insights into the worth of your business and its growth potential. By understanding the components of value, valuation methods, industry trends, and challenges, you can make informed decisions about the future of your practice.

Whether you're considering selling, merging, or simply want to benchmark your practice's performance, an accurate valuation is essential. Engaging a valuation professional can ensure objectivity, credibility, and compliance with industry standards and regulations.

References: 1 https://gitnux.org/financial-planning-trends/

2 https://www.joinbookway.com/post/how-to-value-your-financial-planning-practice

3 https://www.venasolutions.com/blog/top-financial-planning-challenges

4 https://www.investmentnews.com/industry-news/news/why-millionaires-value-their-advisors-for-their-long-term-financial-planning-243447

5 https://www.kitces.com/blog/future-of-financial-advice-technology-trends-value-service-engagement-attia/

6 https://peakbusinessvaluation.com/how-to-value-a-financial-advisory/

7 https://www.commonwealth.com/insights/8-potential-risks-in-your-financial-advisory-practice

8 https://beckbode.com/blog/valuing-financial-advisory-practice

9 https://integrated-financial-group.com/resources/10-key-industry-trends-developments-for-2024-every-financial-planner-should-know/

10 https://www.moneymanagement.com.au/news/financial-planning/how-value-financial-planning-practice

Material prepared herein has been created for informational purposes only and should not be considered investment advice or a recommendation. Information was obtained from sources believed to be reliable but was not verified for accuracy. It is important to note that federal tax laws under the Internal Revenue Code (IRC) of the United States are subject to change, therefore it is the responsibility of taxpayers to verify their taxation obligations.

Savvy Wealth Inc. is a technology company. Savvy Advisors, Inc. is an SEC registered investment advisor. For purposes of this article, Savvy Wealth and Savvy Advisors together are referred to as “Savvy”. All advisory services are offered through Savvy Advisors, while technology is offered through Savvy Wealth. The views and opinions expressed herein are those of the speakers and authors and do not necessarily reflect the views or positions of Savvy Advisors.

Related Articles

Table of Contents

Valuation of financial planning practices, so, what is the real value of a financial planning firm, realistic benefits, what is your financial planning practice really worth.

This article will help you understand the best way to value your business so you can better plan for succession.

The commonly cited valuation multiples for financial planning practices of 1.1x non-recurring revenues and 2.2x recurring revenues is no longer an appropriate basis for valuation . Revenues have dropped, but expenses have not; clients have more choices, competition is greater and market projections are flat.

This valuation ignores the quality of the revenues being generated. If the practice has a 30% gross margin, its annual profit from operations would be $127,500. Repayment of debt on the purchase price of $750,000 over a five-year term would be $150,000 per year.

It can be argued that profit earned under the existing owner might not take into account the future potential of the acquired assets or the cost savings of the existing owner leaving the practice, but most owners do not leave immediately. Instead, they stay on to provide “continuity” and draw a salary or fees for some period. If we assume the seller wants to stay on for a year and the transition results in 90% retention, profit would be reduced substantially. Available free cash flow might not be sufficient to handle the debt repayments at this valuation level. It can be seen that the deal is negative coming out of the gate.

Several industry reports suggest that a debt-funded sale is simple and beneficial. What they fail to point out is the risk of something going wrong. When it does go wrong, it goes quickly and sometimes catastrophically. The cash flow issues are obvious, but profitability is also affected by challenges to morale, organizational stability and service models.

In the example of a practice with $500,000 GDC and 85% payout from the BD, assuming 6% compound growth and a modest discount rate of 20% over a 10-year period with a terminal valuation , the firm would be worth approximately $620,000.

This valuation increases the IRR for the buyer by 50%. In the model above, the reduction in the asking price from $750,000 to $620,000 pushes the IRR to 11% from 7%, which is the difference between making it attractive or not because the buyer has other ways to make 7% on his/her money.

You may reply, “But there are 50 buyers to every seller.” If this was true, practice valuations would be soaring. The fact is that many “interested buyers” are kicking tires. They do the math and recognize they cannot buy a practice that is priced above a point where cash flow will service the debt.

This reassessment of valuation is important to you because a debt-financed acquisition is leveraged and uses the firm’s cash flow to pay down the debt. If the debt cannot be paid because the firm bankrupts itself, the outcome benefits neither the seller nor the buyer. The last thing clients want is to be involved with a firm where the senior parties are in court! It is better to value a practice on its predictable cash flow, add a shared benefit bonus for the seller if the firm does well under new management, and enjoy a successful succession.

Buying practices and assets is a proven method for developing a financial services firm and it serves the industry well. Being realistic, rather than optimistic, about the value of our practices benefits all parties involved in the transaction. We have to recognize that our valuation models should be based on realize-able cash flow, not simply notional historical multiples.

Related Terms

- Valuation Approach

- Enterprise Value

- Free Cash Flow

- Working Capital Holdback

- Internal Rate of Return

- Non-Cash Working Capital

- Middle Market

- Multiple Accretion

- TTM Multiple

Written by Allen Duck

Related Articles

Magic Tricks to Help You Get the Valuation You Want

Do You Know What Your Company Is Worth?

Why Enterprise Value Doesn't Tell the Whole Story About a Company's Worth

7 Key Principles of Business Value

Subscribe To the Divestopedia Newsletter!

Stay on top of new content from Divestopedia.com. Join one of our email newsletters and get the latest insights about selling your business in your inbox every week.

Latest Articles

What Your M&A Transaction is Missing: How to Humanize the Transaction

By: Exit Planning Institute

The Pathway to Deeper Deal Flow

An Exploration of the Relationship Between Financial Advisors and M&A

How to Keep Your Deals from Falling Through

What Is My Practice Worth? What You Need to Know About Value and Valuation

Journal of Financial Planning: November 2017

Ryan Grau, CVA, CBA, is the valuations director and a principal for FP Transitions . He is an authority on the topics of value, valuation, and business continuity planning across multiple industries.

What is my practice worth? This is a question that every independent financial adviser should ask, or has asked, at one time or another. Given that the value of a fee-based advisory practice is often the largest asset that most advisers own, it is a good question in need of good answers.

Countless valuation services and tools are offered up to help answer this question—some good, some bad. Very few business owners understand the valuation process, myriad decisions, and judgment calls necessary to arrive at a value. When it is time for you to determine the value of your life’s work, you need to understand certain value, and valuation, fundamentals so that you can get the right answer from the right expert every time.

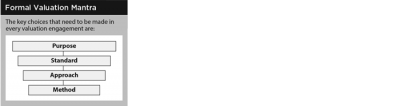

The starting place for most advisers who need a formal valuation is this simple mantra: purpose, standard, approach, and method. These are the key starting points in every valuation engagement. Any time a business appraisal is needed, the standard of value, approach, and method(s) used for estimating value should be tied directly to the purpose or reason that the valuation is being conducted. When you decide to sell your vehicle, for example, standards of value include both trade-in and private-party values, among others. Given the specific purpose (you want to sell your car), both values are correct even though it is the same vehicle. Still, only one standard is applicable based on the party you plan to sell to. This same concept applies to business appraisal valuations.

Value is a function of purpose, and the answer is not universally applicable to every situation. Why have your practice valued? The most common reasons include:

Non-tax valuation: general knowledge, reporting to an owner, buyer, investor, or judicial authority in cases of:

- Sale or merge with a third-party

- Internal sale

- Dissolution, either marital or corporate

- Damages and other disputed matters

Tax valuation: reporting value to a tax authority in cases of:

- Charitable contributions

- Transfers to related parties

- Grants and options

You need to articulate the answer to your chosen appraiser in order to determine the standard of value to be used, the approach (or approaches) to take, and the methods to be used. Incorrect assumptions regarding your purpose will yield an incorrect valuation result.

Any time you plan on making a business decision relating to the value of one of your largest assets, you should seek the assistance of a professional business appraiser (see the sidebar on page 27 for tips on doing so). When selecting an appraiser, ensure they have a thorough understanding of the financial services industry and that they have access to industry-specific, private-party transaction data. Most important, the appraiser needs to have a thorough understanding of your purpose and who will be on the receiving end of any value results.

The most common reason to value a practice is for mergers and acquisitions. The next most common reasons are divorces, internal sale of stock, and gifting/transfers to related parties. Depending on which purpose is applicable to your specific needs, the resulting value may vary significantly. The reason for the differences in value results from:

- The type of property being valued. Is it assets or stock?

- The standard of value. Value to whom and under what assumptions?

- Is the valued interest a controlling share or not?

- What is the level of marketability of the subject interest? Is it liquid?

For example, the most probable selling price of a 100 percent controlling interest of the assets of a practice being valued for the purpose of selling to a third-party in an arm’s length transaction, where the majority of the purchase price is financed over five or more years, will be valued higher than the fair market value of a 10 percent minority, non-controlling, non-marketable interest in the equity of the same practice on a cash or cash equivalent basis for the purpose of gifting stock. The delta between these values is much greater than a pro rata portion of the 100 percent interest. To clarify why, let’s explore how standards of value affect the value of your practice.

Although many standards of value are applicable to the appraisal of a business interest, the two most common standards in the financial services industry are fair market value and most probable selling price.

Fair market value. Fair market value is required when valuing shares and equity of a closely held practice for IRS/tax-related matters. The IRS wants to know what the cash value of the shares or units are worth. Often, financial advisers assume that a 10 percent interest in their company’s equity on a cash basis is worth a pro rata portion of what they could sell their practice for in the open market. Rarely is this the case. (Fair market value is also applicable when opining on the equity value of a business interest for a divorce, but this varies per jurisdiction.)

The term “fair market value” is one of the most commonly misunderstood and inaccurately used valuation terms. Of the last 5,000 practices we have appraised, valued, or offered opinions on, fair market value has almost never been an applicable standard of value for the purpose of valuing a practice when selling to a third-party in an arm’s length transaction; especially when the seller is providing post-closing consulting, an agreement to not compete, and is willing to finance the majority of the purchase price.

The definition of fair market value according to the International Glossary of Business Valuation Terms is: “The price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm’s length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.” This definition is nearly identical to the one found in IRS Revenue Ruling 59-60.

The often overlooked, but key issue is that fair market value is considered “value in exchange” on a cash or cash equivalent basis. In other words, transferable property is sold in exchange for something of value, namely cash. This is logically inconsistent with how a typical financial advisory practice is bought and sold: less than 5 percent of all sales are completed on a cash basis, and the industry standard pricing multiples assign a value attributable to non-transferable property such as (1) the seller’s agreement to provide post-closing consulting to help transfer the assets (a consulting agreement); and (2) an agreement to not compete or solicit the clients subject to the purchase agreement. These are services that only the seller can perform; they are not “transferable property.” By ignoring these facts, a statement of fair market value could be inaccurate by as much as 15 to 25 percent which—as you can imagine—is an issue when the opinion of value is used for tax, divorce-related, or disputed matters.

It is worth noting that this standard of value is more of an academic standard than the reality of what an adviser could expect if he or she actually sold their practice to a third party. Most buyers and sellers who participate in an open marketplace are under some level of compulsion to buy or sell. If compulsion were not present, it stands to reason that a seller would never accept anything less than absolutely favorable deal terms at the highest value from his or her point of view. The inverse of this argument is applicable to buyers as well.

Most probable selling price. This standard of value best describes the value that a seller could expect to receive if he or she sold their practice to a third party in the financial services industry. It is defined by the International Business Brokers Association (IBBA.org) as: “The price for the assets intended for sale which represents the total consideration most likely to be established between a buyer and seller considering compulsion on the part of either buyer or seller, and potential financial, strategic, or non-financial benefits to the seller and probable buyers.”

The most probable selling price reflects the reality of the marketplace. For the sale of financial service practices, this standard of value assumes the sale, transfer, or acquisition is accomplished using a standard tax allocation strategy for the sale of capital and personal assets, resulting in the majority of the value ultimately being realized at long-term capital gains tax rates (presuming an adequate holding period for the capital assets). This value further assumes a 100 percent transfer of ownership interest in the customer list and files, personal and enterprise goodwill, consulting agreements with the seller(s), and a non-competition and/or non-solicitation agreement(s) from the seller(s). The majority of the purchase price is expected to be seller financed over a four- to six-year period at interest rates that are substantially lower than what third-party lenders would require.

Both fair market value and the most probable selling price can be determined using either the income or market approach (see below), and a professional business appraiser should be able to produce similar estimates of value using either. The key to successfully determining value from each approach is understanding the standard of value inherently produced by each approach and the necessary adjustments required based on the standard of value for the given purpose.

An income approach, for example, is going to produce a value consistent with fair market value. If this approach is used for the purpose of valuing a practice that is going to be sold to a third party in an arm’s length transaction—especially when seller financing is involved— adjustments need to be included to account for the cost of seller financing and any additional services or agreements a seller is willing to provide post-closing, such as a consulting agreement, a non-compete/non-solicitation agreement, etc.

A market approach, relying on the use of private company transactions in the financial services industry, will most often produce a value consistent with the most probable selling price (depending on the source of the data). Using this approach for an opinion of fair market value requires an analysis of the deal structure of the transactions.

The appraisal discipline has three generally accepted approaches to value: asset, income, and market approaches. These approaches are broad categories for various ways to value a business. Under each of these approaches are commonly used and accepted methods of valuation. Without an understanding of the purpose for the valuation or the appropriate standard of value, the correct application of these approaches is limited to a best guess.

Of the three valuation approaches, the easiest to understand and the most commonly used is the market approach. The asset approach is rarely used in our industry due to the lack of physical capital assets needed to produce revenue. The income approach is the most complex approach to value a closely held practice.

Market approach methods. The market approach has three common methods: (1) Guideline Public Company Method (GPCM); (2) the Public Company Transaction Method (PCTM); and (3) the Guideline Private Company Transaction Method (GPCTM).

GPCM and PCTM are often used to value financial service practices by appraisers who do not have access to comparable private company transaction data. These methods compare the practice being valued to the enterprise value of public companies in the same industry, but with market capitalization rates 20 to 40 times the size of the typical practice. In other words, these methods rely on the possibility that closely held financial service practices will sell for a price similar to that of a publicly traded C-Corporation.

Alternatively, GPCTM develops a value based on a group of five or more transactions of closely held practices that sold in a free and open market. The results from this method are grounded to previous transactions of similar companies and arguably provide the most reliable estimates of value for most practices in the industry. Unfortunately, the usefulness and accuracy of the GPCTM approach is limited to the number of transactions and quality of the information available to the appraiser.

Transaction data on financial service practices is often not readily available through industry databases such as the Institute of Business Appraisers, Bizcomps, Pratt’s Stats, and PeerComps. Moreover, available information is typically limited to one year of financial statements that may be much older than the actual transaction date. The best source of data when using the GPCTM for valuing a financial services practice can be firms that provide certified valuations, business brokerage, and consulting services.

Income approach methods. The income approach is a suitable approach for allowing the appraiser to forecast income and expenses, and project the future economic benefits that will flow to the owner(s). The two methods that fall under the income approach are stylistically similar, but contain underlying assumptions that make them mutually exclusive.

The first method, capitalization of earnings method, makes the assumption that growth of the practice or business will be uniform into perpetuity. This assumption manifests itself through one long-term sustainable growth rate that is used to capitalize a benefit stream, typically net cash flow to invested capital.

The second method, the discounted cash flow method, is based on the concept that the growth of the company will vary for a determined forecast period, typically five to 10 years. When performed correctly, this method forecasts the practice’s revenues, expenses, capital expenditures, and working capital requirement of the business until it reaches maturity. These forecasts are then discounted to their present value.

It is important to understand that the value produced using either method from the income approach will produce a cash or cash equivalent value consistent with the definition of fair market value. This can be observed by analyzing the sources from which the discount rates are developed—publicly traded C-Corporations. When was the last time you saw a market cap rate quoted at a price other than cash? When was the last time you purchased stock of a publicly traded company and the quote included anything about how you might finance the purchase?

If the source of the discount rate is derived from transactions of minority shares in a freely traded marketplace, then the value calculated from this apporach will represent a marketable, liquid interest. The very nature of a closely held company is a marketable, illiquid interest, and, therefore, is less valuable than a marketable liquid interest. As such, an additional discount to reflect the decreased liquidity of a closely held company should be applied when an income approach is used. This is common practice among business appraisers who are familiar with the use of the income approach. However, it is often skipped in models developed by those who do not specialize in the appraisal profession. Omitting this step means value may be overstated by as much as 25 percent. Appraisal pundits Shannon Pratt, Gary Trugman, Jeffrey Jones, and Rand Curtiss, all accredited by the American Society of Appraisers and the Institute of Business Appraisers, reached this conclusion in a conference sponsored by Business Valuation Resources. 1

No single valuation approach and method works every time in every situation. If you’re told otherwise, it is usually by someone selling the one approach that they understand and that can be sold profitably. For this reason and others shared in this article, it is highly recommended that advisers wishing to sell their practices seek the professional assistance of a business appraiser or certified valuator who can employ the appropriate approaches and methods that tie value directly to the adviser’s purpose. This step is where the appraiser can help the adviser save money by accurately identifying the necessary scope of work to provide a defensible value.

Opining on the value of a financial services practice is contingent on the appraiser and on the adviser seeking to understand how the concepts of purpose, standard, approach, and method fit together to provide an accurate view of their practice’s value for a specific situation.

- See Business Valuation Resources' "Valuing Small Businesses" (teleconference, Dec. 16, 2004.

Tips for Finding an Appraiser

A practice’s value is ultimately decided by a willing buyer and a willing seller. However, without the proper application of the tools shared here by an accredited appraiser who understands how to apply them correctly for the adviser’s specific purpose, you cannot expect to receive a beneficial outcome. The use of unaccredited appraisal services or an online calculator to solve the needs of a specific purpose is often a fool’s errand.

The valuation profession, like the financial advice profession, requires a higher level of qualification, education, and experience. To find an accredited appraiser, look for the following designations:

- Certified Valuation Analyst ( CVA )

- Certified Business Appraiser ( CBA )

- American Society of Appraisers ( ASA )

- Accredited in Business Valuation Credential ( ABV )

Using a professional appraiser doesn’t mean you need to pay a king’s ransom to have your practice valued. Just be sure to speak with the person or firm providing you the appraisal to ensure you have an understanding of the scope of work given your specific purpose.

Journal: November 2017

More from this issue, are your clients not spending enough in retirement, a fiduciary approach for clients who need long-term services and supports, need marketing ideas ask your target audience, related events, august 21, 2024 quarterly education meeting, november 20, 2024 quarterly education meeting.

The Methodology Behind a Financial Advisor Practice Valuation Calculator

How much are you worth? It’s a question advisors spend every day discussing with their clients, often without considering that question for their own firm. That’s where a valuation comes in.

The most common reason advisors seek a valuation is to prepare for a sale or merger of their business . There are other motivations to proactively pursue a valuation, such as granting internal equity to next-generation advisors or a business partner .

Yet you don’t have to be making a big change to benefit from a valuation. In fact, one of the best purposes for a valuation is simply to get into the habit of benchmarking your business. By tracking key metrics on an ongoing basis, you can set goals and measure your progress – for example, aiming to reach a certain percentage increase in net new assets year over year.

Carson’s Firm Valuation Calculator is a useful tool to delve deeper into your business, obtain an initial estimate of your market worth and more keenly understand your opportunities for growth. But what’s the methodology behind a financial advisor practice valuation calculator?

Let’s look at the various metrics that comprise a valuation and what they can tell you about the health of your business.

Six KPIs That Can Help You Evaluate Your Business

Carson’s Firm Valuation Calculator consists of six quick questions designed to give you a clearer picture of your firm’s market value . Here are the factors it explores, along with a brief summary of the insight each metric offers.

1. What assets under management (AUM) does the firm represent?

For this metric, it’s important to note Carson’s Firm Valuation Calculator specifies AUM, rather than assets under administration (AUA). That’s because AUM is a better indicator of recurring revenue as the amount you’re actively managing on an ongoing basis.

There’s no question that offering comprehensive financial management requires a holistic view of a client’s entire financial picture, which is the argument for AUA. However, including those assets that are outside your purview, such as commission-based and 401(k) investments, provides an inflated estimate that may not accurately reflect the reality of your firm’s revenue.

Since there is often confusion between AUM and AUA, it’s vital to distinguish between the two to make the data as accurate as possible.

2. What percentage of the AUM is advisory business?

This metric helps an outsider evaluate where your revenue and profit are derived from, giving preference to the recurring revenue that comes from fee-based advisory services. A potential suitor will also assess whether your accounts are primarily in growth mode or distribution mode, where clients are drawing down on retirement savings.

3. What is the gross revenue of the firm?

While this seems like a straightforward metric, annual revenue is not the sole factor determining your profitability. Although valuations used to be considered as a straight multiple of revenue, that methodology is now largely outdated. Today’s buyers have become more sophisticated as increased data availability allows valuations to be more accurate. Profit alone can offer a top-line look, but the devil lies in the granular detail. The goal is to buy for the future, not just today.

One metric to consider is earnings before interest, taxes, depreciation and amortization (EBITDA), a common measure of profitability that gives a snapshot of a company’s cash flow. However, there are factors that can throw that off.

For example, consider a firm that has recently been on a hiring spree to bolster the team with top talent. Due to those ancillary expenses, the EBITDA might not look as favorable at a glance, yet when examining the particulars more closely, they might discover a business with strong AUM and good revenue that has wisely staffed up for its next stage of growth. So maybe they have $200 million in AUM and, with this expanded team, they’ve built the infrastructure to support $400 million.

If Carson were making this valuation, we wouldn’t punish the business for what might appear to be temporarily relatively low profitability because we see the benefit: The buyer is unlikely to need to invest time and financial resources to source a deep pool of talent.

On the other hand, if we see that higher-than-usual expenses can be traced to an elite advisor and one operations team member, we might question how quickly that firm will be able to grow, or the repercussions if that advisor were to defect.

The point: The character of expenses is what drives the multiple, and low profitability doesn’t automatically equal a low valuation.

4. How many clients does the team serve?

Again, this is going to be a metric that will take some context. The number of households served can be a great indicator of growth and potentially serve as a powerful vehicle for future referrals. Yet it doesn’t tell the whole story.

Let’s say a firm has $200 million AUM, but the average account size is $100,000. That’s a lot of clients who probably require a considerable amount of service. It can be difficult to achieve economies of scale without larger clients, given that smaller account sizes often indicate clients who need more education. On the flip side, an advisory firm that serves just a few large clients could be at risk if these clients (or their beneficiaries) depart.

5. How many employees are on your team?

This metric helps determine the productivity of each team member, which ultimately has an important effect on profitability. As mentioned before, firms that have staffed up for future growth can be appealing to a prospective buyer, especially if they are actively acquiring new AUM.

6. What is your ownership percentage?

The more of the business you personally own, the larger your ultimate payout. Often, a buyer may prefer a firm where one owner isn’t dominant. That could foretell client defections if their prominence was the reason for the firm’s success.

What the Calculator Doesn’t Tell You

At first glance, arriving at a valuation seems like an easy exercise – just plug in these six metrics, and voila, an answer. Yet, once you look deeper, it’s easy to see how subjective it is and the high level of nuance in otherwise straightforward numbers.

While the valuation calculator offers a fine 30,000-foot view, you need a more granular perspective to pinpoint an accurate valuation. That’s Carson’s specialty.

We realize that much of a firm’s value is derived from the goodwill it has built with clients. This is why we want to spend time immersing ourselves in the details of your practice and how you run it. Then we can determine the story behind your profitability and whether you are poised for future growth.

How engaged are you with your next-gen clients? Have you increased your marketing budget to attract net new assets? These are the types of expenses that a smart buyer will appreciate, as they can be applied toward future growth.

Certainly, every advisor wants to see the most value they can, so it’s vital to consider how valuations are derived. It’s a bit like how comparison figures are used in real estate to help value a home.

Everything about two houses might look equal – a similar size and layout – but one might be priced higher because it was far better maintained, with lavish upgrades. That’s why advisors might hear of a firm being valued on a huge multiple and be puzzled when their firm doesn’t garner the same.

There’s no question valuations are complex, and since each situation is unique, now is the time to burnish the KPIs that matter. Consulting Carson’s Firm Valuation Calculator can be a crucial benchmarking exercise that allows you to set goals for the upcoming year. You can then prioritize the elements that will ideally drive higher enterprise worth down the road.

Are you ready to talk to Carson about how to fine-tune your advisory business to prepare for growth? Contact us today to learn more .

Get in Touch

In 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Stay Connected

Latest posts.

- Is It Time to Worry About Employment?

- Save the Date for Our Midyear Outlook Webinar

- Why A Good First Half For Stocks Bodes Well The Second Half

- Being Prepared for the Unexpected: What to Consider in Building a Key Person Continuity Plan

- A Different Kind of Growth: How Carson Helped One Partner Go from Advisor to CEO

The Essentials of Succession Planning for Financial Advisors

Related content, know your worth | laura delaney.

In this month’s Know Your Worth livestream, Carson’s Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, welcome Laura Delaney, Vice President, Practice Management & Consulting, at Fidelity. They’ll go through a macro overview of the M&A landscape, including how 2023 shook out, the trends so far this year and more. …

Know Your Worth | Tray Wiltse

In this month’s Know Your Worth livestream, Carson’s Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, welcome Tray Wiltse, Managing Director & Wealth Advisor at Carson Wealth in Kansas City. They’ll go through the process of Tray selling his book of business and the factors that went into his decision. …

Know Your Worth | Mike Wieger

We’re diving into expert insights, sharing real-life case studies, and giving you practical tools to boost your M&A strategy and and understand the options for succession planning. Stay ahead in the fast-paced world of wealth management mergers and acquisitions with our engaging livestream sessions.

Discover the Value of Your Business!

Get your free consultation today.

Highest Rated and Most Reviewed Valuation Firm in the United States

Read Reviews

Free Consultation Is a valuation right for you?

Valuation Multiples for a Financial Advisory

Nov 19, 2020 | Business Valuation , Financial Advisory , Small Business

Financial advisory firms are fascinating businesses. One of the “quick and dirty ways” a valuation expert values a financial advisory firm is using multiples. A valuation multiple is like a ratio. A ratio compares two things to each other, for example, one of the more commonly used ratios in valuation is a revenue multiple. A revenue multiple compares the revenue of the company, with the implied value of the company. The calculation for these multiples come from other firms that recently sold on the open market. (The calculation for these other firms is Sale price/Revenue.) A valuation expert can then apply these multiples to your company to give you a range of value .

For example, if a company has $500,000 in Revenue, and transacts at a 0.5x revenue multiple, then the business would be worth $250,000. ($500,000 time 0.5) On the contrary, a 2.0x multiple would imply the value of the company is $1,000,000. ($500,000 times 2)

Peak Business Valuation , business appraiser Texas, works with numerous practices that are looking to sell or expand their book of business. As we work with multiple financial advisory firms, we have come to recognize some of the common multiples financial advisory firms transact and are valued at. We are happy to answer any additional questions you may have. Reach out by scheduling a free consultation.

***Disclaimer: These multiples have been provided for educational purposes only. As such, the information provided does not constitute valuation advice and should not be acted as such. These multiples do not represent the valuation opinion of Peak Business Valuation or any of its valuation professionals. Instead, you should seek the guidance and advice of a qualified business valuation professional with respect to any matter contained in this article.

Schedule a Free Consultation!

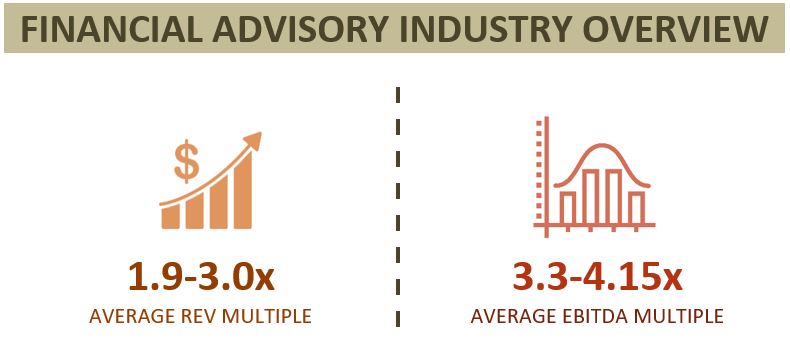

Most Common Industry Multiples

The two most common multiples to look at include revenue and EBITDA multiples. A multiple of SDE ( Seller’s Discretionary Earnings ) is not as common as an EBITDA multiple. The reason why an SDE multiple is not as common as an EBITDA multiple goes back to one of the foundations of business valuation. This has to do with the valuation being completed on the premise of a hypothetical sale.

A “hypothetical sale is one that takes place between a hypothetical willing buyer and a hypothetical willing seller.” In this hypothetical situation, the buyer is most likely to be a financial advisor with an already established firm that is looking to increase their book of business with the acquisition of another book of business. As such, the buyer generally already takes a form of compensation from their current book of business. And, therefore, would not take an additional salary from the book of business they are acquiring. As such, EBITDA and SDE are generally the same metric for this exercise. Therefore, revenue and EBITDA are the most common multiples that Peak Business Valuation , business appraiser Texas, recognizes in the industry.

Revenue Multiple

Average Revenue Multiple Range in 2020: 1.9-3.0x

According to our data, in 2020 financial advisory and investment management companies transacted between a 1.9-3.0 average revenue multiple. To derive an implied value of a business, apply the multiple by the most recent 12-month period revenue. The calculation is as follows:

Revenue X Multiple = Value of the Business

For instance, if a financial advisory firm generates $400,000 in revenue and transacts at a 2.54x multiple, then the business value is worth approximately $1,016,000.

$400,000 X 2.54x = $1,016,000

This calculation is straightforward. However, most financial advisory firms do not transact wholly on a revenue multiple. The reason being a revenue multiple does not consider the operations of a business. As such, this multiple is generally not the best indication of value. If a revenue multiple is relied upon, it is usually relied upon in conjunction with a cash flow multiple. It is important to look at cash flow multiples because cash flow multiples consider expenses that impact the cash flow. For instance, rent, operating expenses, and salaries.

EBITDA Multiple

Average EBITDA Multiple Range in 2020: 3.3-4.15x

The average EBITDA multiples for financial advisory companies in 2020 range between 3.3-4.15. Apply this multiple to the EBITDA of a business to derive an implied value of the business. The calculation is as follows:

EBITDA X Multiple = Value of the Business

For example, a financial advisory firm has an EBITDA of $275,000 and transacts at an EBITDA multiple of 3.71x. Using the above metrics, the financial advisory firm is worth approximately $1,020,250.

$275,000 X 3.71x = $1,020,250

The EBITDA multiple measures a company’s return on investment (ROI). This multiple is preferred as it is normalized for differences in capital structure, taxation, and fixed assets. Normalized ratios allow for comparisons to similar businesses.

As you can see, in this example both approaches to valuing a financial advisory firm give us similar implied values. However, these multiples are not always the best way to value a company, they are simply rules of thumb. These multiples are also based on what Peak Business Valuation , business appraiser Texas, has seen in the last few months as we have worked with numerous financial advisory firms. There are many more complex details that affect the valuation of a Financial Advisory firm including value drivers for a financial advisory.

Sometimes, when circumstances warrant, a much lower or higher multiple is appropriate. For more information check out our blog on Valuing a Financial Advisory , How to Value a Financial Advisory , and Value Drivers for a Financial Advisory Firm .. Or reach out with questions! Peak Business Valuation , business appraiser Texas, is always happy to help. Schedule your free consultation below!

Looking to Buy or Sell a Business?

- Business Valuation for Selling a Security Alarm Company

- Business Valuation for Buying a Funeral Home

- Business Valuation for Selling a Roofing Business

- Business Valuation for Buying a Laundromat

- Business Valuation for Selling a Dry Cleaning Business

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

Schedule Your Business Valuation

Uncover The Secrets Of Small Business Growth

...and build a business that thrives.

- Buying a Business

- Selling a Business

- Growing a Business

- Gift & Estate Tax Valuations

- SBA Business Valuations

- Machinery and Equipment Appraisals

- Peak Matching Process

- SBA Loans or SBA Financing

- Quality of Earnings

- Market Feasibility Studies

- Testimonials

- Search Search Please fill out this field.

- Practice Management

Key Steps To Building A Great Financial Planning Practice

:max_bytes(150000):strip_icc():format(webp)/brianheadshot__brian_oconnell-5bfc262446e0fb0083bf830b.jpeg)

As a financial planner , building your own advisory practice requires hard work and hustle. There is plenty of competition. According to the Bureau of Labor Statistics , an estimated 263,000 personal financial advisors were employed in the United States in 2019, and an additional 11,600 are expected to join the ranks by 2029.

So what's the best way to stand apart from the crowd and establish a successful practice? Try these tips from advisors who have years of experience in the field — and who have learned via trial and error what works and what doesn't in the financial planning industry.

Key Takeaways

- One way financial planners can establish themselves is by finding a market niche, be it female entrepreneurs, widows, or dentists.

- It also helps to understand each client's mission, vision, values, and goals.

- Volunteering in the community is a great way for financial planners to build relationships that may one day turn into a client relationship.

- Finally, financial planners should not overlook the needs of young people, who stand to inherit trillions of dollars in assets in the coming years.

Find Your Market Niche

Pamela Plick , a Certified Financial Planner (CFP) with more than 25 years of experience, found success as a "money mentor to women." Her practice focuses on providing women with the education, strategies, and tools they need to become more financially confident and secure.

"As financial planners, we cannot be all things to all people," Plick says. "By targeting a niche, you become an expert in providing solutions for this particular group."

For example, Plick says you can choose to work with female entrepreneurs , widows, or dentists, or the niche can also be based on location. "Or, you could target retirees in a certain gated community or country club," she says.

Plick also advises financial planners to concentrate on what's important and what you are good at and delegating or outsourcing the rest. "Focus on important tasks like marketing, networking, and meeting with clients," she says. "If you can, outsource the administrative tasks."

Understand Your Client's Mission, Vision, Value and Goals

Leonard Wright , wealth management advisor at Northwestern Mutual, has been a financial planner since 1995. He realized his calling after a one-hour conversation helped a former employee save for a home and retirement .

Good financial planners, Wright says, get to know their client's mission, vision, values, and goals. "While they may not know them specifically, it is our job to bring them out," he says.

"If the planning and advice related to the planning does not connect to the client's mission, vision, values, and goals, the client will migrate away. If the client does not understand why the advisor makes recommendations for their benefit, they will wonder why the advisor does what they recommend and have an instinctive emotional reaction to seek someone that understands them."

Get Involved With Your Community

Steven Kolinsky , who founded Kolinsky Wealth Management in 1982, focuses on the client relationship and not the investment product. He advises getting to know your community and getting involved in your town.

" Being generous with your time and talent in your community raises your profile and lets you get to know the people around you," Kolinsky says. "We recently had a meeting with a young couple who was not ready to invest, but was looking for advice about their financial parameters in buying their first home."

Kolinsky says that connecting with local Certified Public Accountants (CPAs) is a great way to improve your assets under management .

"A great deal of business has been referred to us through the genuine relationships we have cultivated with CPAs, showing them how we do business and that they can entrust their clients to us. These relationships have taken time to build, but have been mutually beneficial."

Aim for Younger Clients

There's a dramatic shift in assets underway, and it's trending toward younger investors. Coldwell Banker Global Luxury estimated that Millennials will inherit $68 trillion in assets by 2030, increasing their wealth by five times what it is today.

"The key takeaway is servicing the younger generation doesn't have to dramatically change an advisor's practice management and recommendations," says Jill Jacques , global financial services lead and partner at North Highland. "Instead, it's all about incorporating engaging online and in-person tools that will create a two-way conversation to stay relevant to evolving audiences."

Jacques recommends that financial advisors build a younger audience by courting them on social media .

Prune Your Client List

When it comes to maintaining a roster of clients, more clients doesn't necessarily translate into more income. While it's true that financial advisors just starting in the business need to add clients to grow their revenue, the highest-income earners serve fewer clients, not more.

Financial advisors who earned less than $150,000 annually had 167 client households on average, according to a 2012 study from CEG Worldwide. Those earning between $150,000 and $500,000 annually had an average of 225 clients, while those earning between $500,000 and $1 million had 240 clients on average. But once financial advisors top $1 million in annual earnings, the number of clients they serve drops off significantly, to 179 on average.

Having fewer clients allows financial advisors to give high-net-worth individuals special attention. And as the numbers suggest, less is actually more: the highest-income earners had an average of 83 clients who had at least $1 million in assets invested with them.

The Bottom Line

As the above experts show, working as a financial planner can be both personally and financially rewarding. Building a better financial advisory practice is all about focusing on a few game-changing steps and doing them well.

"If you are knowledgeable about the products you recommend, continue to educate yourself on the investment industry, and always put your clients needs above your own, that's a great head start," Kolinsky says.

Beyond that, be creative, get out there in the community and online, and build your own unique financial advisory brand — one that keeps you a step or two ahead of your competition.

U.S. Bureau of Labor Statistics. " Personal Financial Advisors ."

Coldwell Banker Global Luxury. " A Look at Wealth 2019: Millennial Millionaires ," Page 2.

CEG Worldwide. " Best Practices of Elite Financial Advisors: 2012 Report ," Pages 12-14.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-692025519-7804dee3ae3347249fac4c752bb45ca8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

617.209.2224

- CLIENT PORTAL

Beyond Revenue: 8 Determinants of Valuation for a Financial Advisory Business

If you’re thinking you’d like to sell your practice at some point, you’ll want to know what it’s worth. As a prospective seller, it makes sense to get a valuation from a third-party professional valuation firm, and to update it periodically. A big chunk of a third-party valuation is based on revenue. Let’s be clear here, revenue is an essential component of the valuation, but there is more to the story than revenue.

As prospective buyers - my business partner, Ben, and I have purchased several practices over the past decade. We have learned that while a professional valuation is helpful, we also like to look more closely at several factors that may or may not be spelled out in the valuation report.

Here are 8 additional aspects of a practice that we like to investigate. Some of them seem obvious, but don’t underestimate them – it’s easy to overlook these things, so it’s worth paying attention.

8 Questions When Considering Buying or Selling a Financial Advisory Practice

1. is it real growth or are you simply riding market trends.

When we look at the practice over the past 3-5 years, a buyer will want to see that you have been growing your practice, as opposed to relying on the markets being up. Say your practice is up 20% - how much of that is attributable to your bringing in new assets, versus simply riding the rising markets?

Our firm, Beck Bode, is a growth company and as such we want to acquire companies that have historically shown the ability to bring in and grow assets regardless of current market conditions. Stale practices are not exciting or desirable to us. Any practice that is not growing actively, in our book, is a dying practice. If the practice isn’t growing, we are going to lower our overall margin on the acquisition. That’s a problem we don’t want to have.

2. Is Your Client Base Diversified?

Who your clients are contributes a lot to the value of the practice. Any buyer would want to know the profile of the client base. Even so, this is tricky, because what looks like a solid client base on paper isn’t always so in reality. We like to drill down into specifics. How many high-net-worth clients do you have? What is the age distribution across your entire client base? What portion of your clients are actively accumulating assets, versus how many are drawing down on their accounts?

While in our industry it’s common to only go after big prospects, some of our largest clients today started out with small IRA or 401(k) rollovers. They might have had no more than $20,000 or $25,000 to begin with. But they've grown with us over time, and they could be our most valuable clients now because they’ve been with us for 20 years and hopefully for another 20, 30 or more.

On the one hand it’s nice to have clients who are close to retirement, because that’s when they are saving the most. But you can’t simply look at a business based on today. Anyone who is at or near retirement age will be looking to access their wealth soon. That means they will want to live off those assets, requiring them to take a distribution. You need fresh money coming in the door.

A diversified client base – in terms of age and life stage – will affect the value of your practice.

3. What is the Longevity of Your Client Relationships?

Client longevity indirectly and directly affects how we view the value of a practice. Clients who have been around for a while have shown that they trust your guidance and that they are loyal to the practice. In our experience, longer term clients tend to stay with the firm even post acquisition. This is important, because no buyer wants to buy a practice only to watch clients leave right after the deal closes.

The savvy buyer will want to have to understand the nature of your relationship with your clients – how will they react when the original owner is no longer in the picture? These are tough questions without hard and fast answers.

Obviously, the handoff from seller to buyer needs to be good and carefully planned . In general, practices with higher client tenure will have higher client retention post acquisition.

4. How Are Retirement Distributions Affecting Your AUM?

In an ideal world, buyers look to buy practices that are either roughly equal on distributions versus contributions, or skew higher toward contributions. Both indicators signal that the practice will be a money maker. (Of course, there are many other factors at work.) Money-making firms will be valued higher, naturally.

A smart buyer will look for tranches of clients in your practice; some of the clients need to be younger, perhaps even starting out, some need to be in their 30’s and 40’s, and some need to be in their 50’s and 60’s and above. The older clients typically provide the wealth you need to build a practice, but the younger clients bring the assets that you need to continue to grow your business. If you don’t grow the younger segment, your practice can become stale because at some point in time you will be sending out more distributions than you are going to be receiving contributions.

The amount of dollars that are leaving the practice in the form of RMD (Requirement Minimum Distributions) says a lot about the phase of growth that your practice is in. Just as important is how many clients are set up for automatic contributions into their investment accounts. That, too, tells a lot about the value of the practice.

5. How Consistent is Your Fee Structure?

Every RIA will have a unique fee structure; in my opinion there is no perfect fee or fee structure. However, when assessing the value of a firm, the fee structure does play a role. We have found that sometimes advisors are discounting their fees so much that it devalues their firm in the eyes of a prospective buyer. If you are an advisor who has given into fee compression you run the risk of reaching a fee threshold that’s so low that an acquirer may say your firm is simply not worth the money. Firms that over-discount to attract or retain clients aren’t necessarily doing a good thing for anyone.

On the other hand, a consistent fee structure helps improve the value of the business. I’d advise that whatever you write in your ADV your fee is, stick to it. Try not to make exceptions to your own rule, don’t discount fees for certain people. If you do find that you have been inconsistent in structuring your fees, it helps to have a clear explanation as to how they are different, and why.

6. Are The Buyer and The Seller’s Investment Strategies in Alignment?

If the buyer is looking to absorb your practice into their own, it’s important that the investment strategies of both firms be at least compatible. You may say what does this have to do with the value of my practice? Well, a compatible investment strategy may make your practice more desirable and therefore more valuable to a buyer who is seeking that profile. Ultimately, buyers want to invest in practices with high retention rates and any incompatibility will again impact retention.

7. How Strong is the Referral Network?

In a perfect world, new clients come by organic referral from your very best clients who refer you because they believe in you and appreciate the service you provide. A buyer will want to see healthy referral activity, not only because that brings in new assets to the firm, but because it says a lot about the overall health of the practice. It says that you have a solid service model, delivered by a trustworthy and competent team, that your clients are loyal to you, that they are willing to share you with their friends, their family and extended network. All these things contribute to increasing the value of your practice.

8. What is the Level of Client Engagement?

Speaking of service, service metrics are a great indicator of the value of a practice. A seasoned buyer will want to know how you are communicating with your clients. If you have close relationships with your clients, it means that you’re likely communicating with them on a more regular basis, not just doing an annual review.

When we assess a firm, we will look into their customer relationship management software (CRM) to see how frequently they are engaging with their clients. If you’re not speaking with your clients frequently but suddenly you tell them that you’re selling your practice (this happens more often than not), they could have a lot of concerns. No buyer will want to buy a book of concerned clients.

Alternately, say you talk to your clients three or four or more times a year. You let them know that you won’t be staying with the firm forever, that you must retire at some point , too. Then one day you pick up the phone and say, “Hey, I've sold my practice, and these are great people, and I know you will be in good hands.” It goes a long way toward ensuring a smoother transition, and that contributes to the overall value of your practice.

Taking A Holistic Approach to Practice Valuation

If you’re looking to buy a practice, I would advise you to look way beyond revenue. The value of the practice cannot rely entirely on dollars and cents. Unfortunately, a successful acquisition is much more complicated than that, and the accuracy of the buyer’s due diligence is only revealed long after the deal is closed.

If you’re looking to sell your firm, I would advise you to invest time and energy into structuring your practice (or re-structuring your practice) so that you incorporate many of the areas I discussed here - that directly and indirectly impact the value of your business.

James Bode is Managing Partner at Beck Bode , a deliberately different wealth management firm with a unique view on investing, business and life.

Subscribe Now

Popular articles.

- Is the Stock Market Rigged? Here's What You Need to Know

- Are Bonds a Good Investment in 2024?

- Feeling Stuck? A Personal Story of Overcoming Challenges

- Don't Buy Bonds Without Understanding the Risks

8 Centers of Influence Tips for Financial Advisors

Posts by topic.

- Investing (48)

- Financial Planning (34)

- Financial Advisor (31)

- Retirement Planning (12)

- Market Volatility (11)

- Inflation (9)

- Market Uncertainty (7)

- No Bonds Podcast (3)

- Succession Planning (3)

- Dividend (2)

- Financial Wellness (2)

- Lifestyle (2)

- Debt Management (1)

- Estate Planning (1)

- Longevity Risk (1)

Additional Reading

Financial advisor practice acquisition: 8 lessons we learned, the ideal clients for financial advisors: learnings from working with crossfit athletes.

- DEDHAM TEAM

- PORTSMOUTH TEAM

- TRAVERSE CITY TEAM

- FINANCIAL PLANNING

- INVESTMENT MANAGEMENT

- RELENTLESS - THE BLOG

- WHAT'S UP BECK BODE

- NO BONDSCAST

LATEST ARTICLES

Navigating Emotional Investing: 3 Investment Mistakes That Hinder Financial Success

June 27, 2024

You may know that I love to spend time in Aruba. It’s where I go to unwind, to spend time with my family, and work for ...

JOIN WITH US

Join our newsletter to get more information.

858 Washington St. Suite 100 Dedham, MA 02026

(617) 209–2224

(617) 249–0298

Copyright © 2024 Beck Bode, LLC

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- BUSINESS VALUATION

Breaking Into Business Valuation

Steps for small firms to consider when entering the valuation market.

- Valuation Services

- Business Valuation

- Professional Development

An aging population, increased regulation and the move toward fair value reporting have led to increased demand for valuation services in recent years. As baby boomers approach retirement and start thinking about succession and estate planning, the first step is often valuing the family business. Changes to the tax code require people doing valuations on certain assets to be a “qualified appraiser,” and the new fair value standards require valuation expertise to implement them.

While it is difficult to establish a valuation practice, it can be a rewarding specialization for your firm. Diversifying your practice will help with client retention, expand your client base, and drive revenue growth. Consider these steps for establishing a valuation practice:

Begin with your current client base. When advising clients on tax planning or estate planning issues, you will see instances where a business valuation is needed. Good first-time valuation projects could be for small family limited partnerships or small businesses.

Plan on spending a lot of time on your first valuations. Preparing checklists, learning how to comply with standards, and setting up models will be time-consuming. Use caution with software valuation packages as some have been found to have significant errors in their models and report-writing modules. It is important to understand the models used to develop your valuations as you should always assume you are preparing a valuation that will be defended in court.