For enquiries call:

+1-469-442-0620

- Project Management

Control Account in Project Management: Example & How to Measure

Home Blog Project Management Control Account in Project Management: Example & How to Measure

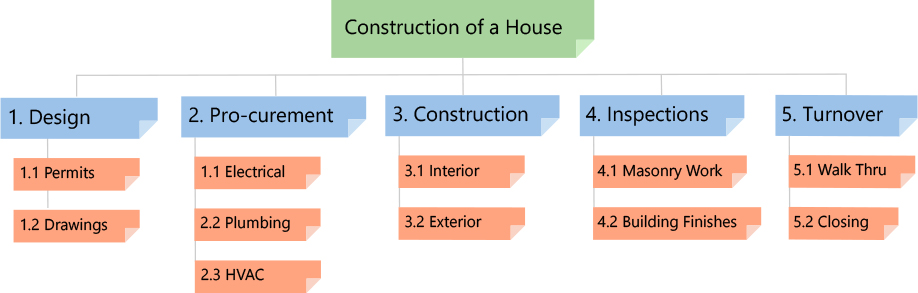

Project management is an art, and those who learn to master the subtle tools of communication, collaboration, and stakeholder engagement can only get things done and achieve the desired outcomes. In pursuit of achieving the desired outcomes, situations often go out of hand of the project manager , creating chaos and uncertainty for the project. Given this, the project manager strives to plan the project outcomes by creating a scope baseline and decomposing user requirements and specifications into manageable work components. This alone may not be enough. A level below this is that the project manager associates a control account in PMP with the work activities to establish a mechanism for monitoring project progress and controlling variations. Today's article lets us understand the purpose of such project placeholders and how they help the project manager come out of critical project situations.

Who Defines the Control Accounts?

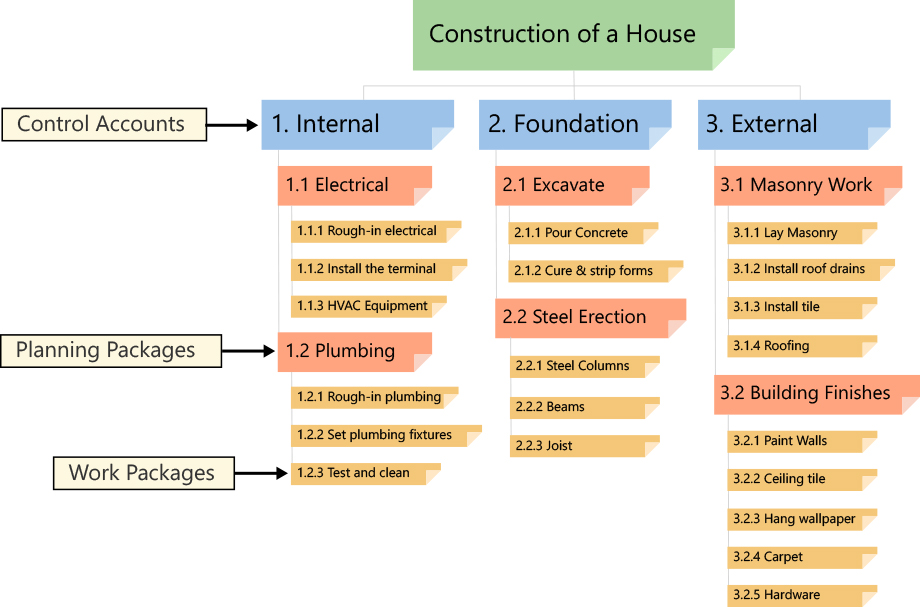

Before getting into who creates control accounts, let us first understand what a control account is in project management, the process in which it is created, and how the process functions. A control account is a placeholder work breakdown structure (WBS) component used as a point of control costing or accounting. Such WBS components or control accounts PMP become the control points for all the work packages underneath them in the project. Since all of this decomposition of tasks to formulate the WBS happens in the “Create WBS” process of project management , the control accounts are also defined as a part of this process. Hence, the creator of the WBS, i.e., the project manager, the sponsor, and the project team, defines the control accounts in the project.

Understand project cost management in detail and clarify how control accounts facilitate project management accounting with interactive and real-time scenario-based learning - enroll in KnowledgeHut’s most popular PMP certification online course today.

What is the Purpose of Control Accounts?

The purpose of a control accounts pdf, as defined by PMBOK , specifies that a control account pmp is chartered as a management control point at which the project constraints are integrated and project performance is measured. For a project manager looking to set up sound project management processes, it fulfills the following purposes:

- It serves as a tool to organize transactions of a type

- It acts as a general ledger to document and summarize transactions of a kind

- Control accounts become the measurement points for cost, scope, and schedule, thereby helping track project progress and performance and manage variances from planned activities

- Help manage stakeholder expectations and create a hierarchical process structure for deliverables and associated elements.

Imagine you shop monthly for groceries at a hypermarket, and even before you get there, you plan a specific category of items and allocate a budget according to your needs. A control account in PMP fulfills this very purpose, i.e., planning and managing expense categories, tracking variances, and implementing the required reconciliations to rectify accounts for errors. Take up co urses on Project Management to build a foundational understanding of the PMP certification and project management practices.

Integration of Control Accounts

A control account in PMP, abbreviated as CA, helps build a strategic structure by creating a point of intersection for the project constraints, i.e., scope, time, and cost, to come together. The control accounts are positioned in the WBS at points that help fulfill project measurement and define criteria for tracking the constraints. They help reconcile gaps or loopholes at the intersection points to minimize variances and enable strategic alignment. It is very important to note that a control account can have multiple work packages under it, while a work package will be under one and only one control account. This helps create a structure where items are monitored from the bottom of the project, building activity and assignment-based control processes.

KnowledgeHut’s best PMP trai ning prepares you to take up challenges and stabilize processes as an experienced project manager - get trained by the experts to be a leader in your space.

Timing of Control Account Plans

A control account plan (CAP) is similar to a project plan but only at a WBS component level, i.e., it is a subdivision of the project constraints - scope, schedule, and cost at a control account level. A control account plan helps roll items from a lower level to the plan level and vice-versa. Understanding the work breakdown structure and its components is key to where to position control account placeholders to create the proper framework to monitor and control project processes and progress.

A control account plan may have one or more deliverables associated with it, but in terms of timing, it must have at least that much length to measure and review the trend of the control account outcomes. It is generally advised to avoid short-length timings on plans to track control account PMI since the measurability becomes tepid. However, the right length or timing of measurement may depend on the type of project, organization governance framework, project length, etc.

How to Measure a Control Account?

Control accounts are implemented with the idea of answering the million-dollar project management question, i.e., how to measure control accounts?

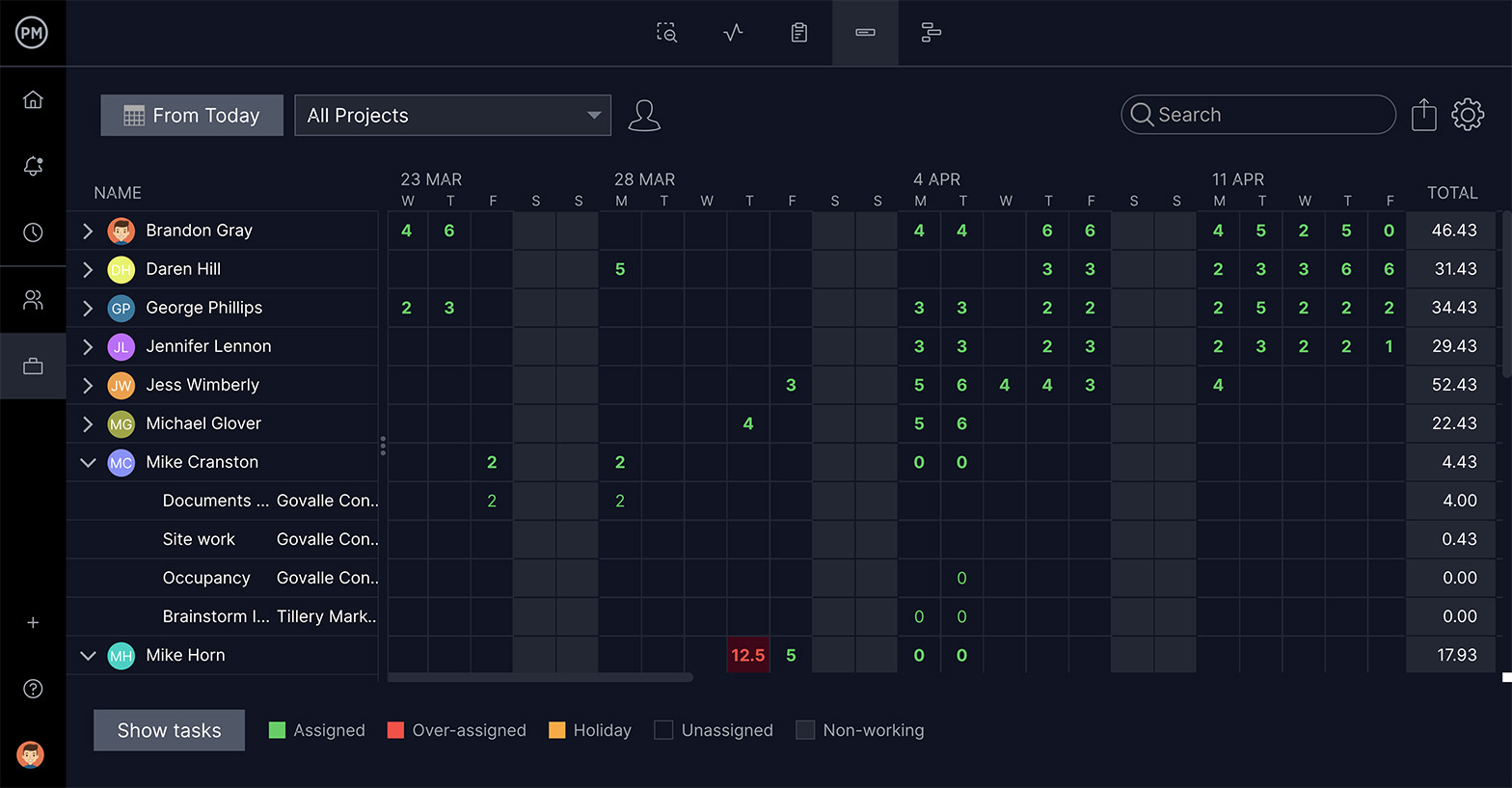

To measure control accounts, also known as cost accounts, it is essential to first identify them correctly, i.e., associate them with a unique identifier. Once the identifiers are added, control accounts can be measured at a project plan level, an individual assignment level, or control account plan level as per the organizational requirements/regulatory framework.

Cost accounts are also used to tie back assignment accountability to the performing or catering team and can be used to assess and improve their performance.

To define the proper measurement logic for the control accounts, it is important to correctly position them in the WBS hierarchy at a level higher than individual tasks or activities and above the items' lowest decomposition level.

Examples of Control Accounts

In my experience, control account PMP can be used as a strong project management measure to tie commitment to the participating team or organization and set a good example of accounting control. Some key project scenarios that outline control account plan examples include:

- Independent quality assurance activities involve establishing a control account for services availed from third-party or independent agencies to track the actuals against the scope of work, estimated timelines, and planned budgets.

- Blueprinting for a construction project - Blueprinting or design modeling is essential, as planned work cannot be started until the design/blueprint is finalized. In such cases, it is advisable to organize related activities for monitoring and control.

- Debtors and creditors accounts - Maintaining control accounts in PMP at receivables and payables helps manage the flow of cash/settlements at the debtors and creditors level, maintaining sufficient control and transparency.

Besides these, control accounts may be built to maintain and manage organizational payrolls, fixed assets, etc., per the organization’s needs and accounting practices.

Control account PMP is an important project management tool instituted in creating the WBS process to build alignment and create a hierarchical structure of deliverables that can be tracked and managed through the project lifecycle. Integrating control accounts in the WBS can strengthen the project governance model by creating subsets of project elements that can be managed with a unified focus. Control accounts help create points of intersection to eliminate possibilities of risks and gauge the performance of planned activities and the overall project.

Instituting control account systems at a WBS level also facilitates analysis of chargebacks to the project accounts and reconciliation of any missing/differential entries as per the accounting practices. To conclude, control accounts are a powerful mechanism by which project managers strive to bring accountability and transparency and facilitate utilizing organizational resources to fulfill project needs and assess progress from time to time.

Frequently Asked Questions (FAQs)

As control accounts are identified and added to the WBS process’s creation, key inputs include data from the project management plan, project documents, environmental enterprise factors (EEFs), and organizational process assets (OPAs). With these inputs together based on the principles of decomposition and availing expert judgment, the control accounts are ingrained for the project.

WBS provides the overall hierarchy and structure utilizing which the control accounts are created and placed to monitor the cost and assess the performance of a symbolic work element. WBS is the umbrella under which cost or control accounts are created and maintained. Control accounts are like a subset of activities on a WBS, with their scope, schedule, and budget to be monitored and controlled.

The three types of project management control accounts follow accounting principles to substantiate data sanctity and fair accounting practices. Apart from the commonly known accounts receivables (AR) and accounts payables (AP), the other 3 types of control accounts are - payroll accounts, inventory accounts, and fixed assets accounts.

Control accounts help project managers track costs and add earning rules to be applied for earned value analysis. They offer chargeback mechanisms for project-level tasks, activities, and resources to assess progress and track performance while reducing the PM’s efforts in managing finer project details. Besides this, control accounts help confirm reconciliation mechanisms for differences in the account balances as per periods.

Rohit Arjun Sambhwani

Rohit Arjun Sambhwani is an IT professional having over a decade and half of experience in various roles, domains & organizations, currently playing a leading role with a premier IT services organization. He is a post graduate in Information Technology and enjoys his free time learning new topics, project management, agile coaching, and writing apart from playing with his naughty little one Aryan

Avail your free 1:1 mentorship session.

Something went wrong

Upcoming Project Management Batches & Dates

- Search Search Please fill out this field.

- Building Your Business

What Is a Control Account?

:max_bytes(150000):strip_icc():format(webp)/147A5500-f15de52037fb4aa7b4eb886c0a1ffefc.jpg)

Definition and Examples of Control Account

- How Control Accounts Work

Types of Control Accounts

Tom Werner / Getty Images

A control account is a summary account in the general ledger. They show the balance of transactions detailed in the corresponding subsidiary account.

Key Takeaways

- Control accounts are summary accounts that make up the general ledger and inform financial reporting.

- The control account balances are determined by the transaction details of the associated subsidiary ledgers.

- Control accounts provide a high-level picture of a company’s transaction records. If the balances in the control account do not match the subtotal of the subledgers, then there is an error that must be remedied.

- Common types of control accounts are accounts payable and accounts receivable, though the individual control accounts depend on a company’s unique profile.

A control account is a general ledger account that only contains the balance of the associated subsidiary account or accounts. The details of a company’s transactions are recorded in various subsidiary ledgers and then balanced and summarized into the corresponding control account.

While subsidiary accounts are critical for recording a company’s transactions, control accounts allow for high-level analysis by simply focusing on the balances of each account. They are especially important for reconciliation in large companies with a high volume of transactions when only the balance of the account is needed.

- Alternate name: Controlling account, adjustment account

A company that sells products on credit may have many transactions in the accounts receivable subledger. The details of those transactions live in the subledger and the balance is reported to the control account. The control account for accounts receivable will only show the total amount that is owed to the company at a point in time without all the details of each customer’s transaction.

For example, say company XYZ has extended credit to 3,000 clients. Listing each debtor account individual account would clutter a general ledger, so those accounts could be listed in a subledger and consolidated in a control account.

How Control Accounts Work

Control accounts are an important component of double-entry accounting and make up the foundation of the general ledger. They serve as a summary report of the total balances for each subledger, and allow for a streamlined analysis of a company’s balance sheet without all of the clunky details contained in each subledger.

For financial reports, the summary balances provided by the control accounts are generally all that’s needed for analysis.

Depending on the size of a company and the complexity of operations, a general ledger can sometimes contain many control accounts, such as accounts receivable, that are informed by various subledgers. In the general ledger, each of those control accounts are associated with a summary balance. That number is a reconciliation of the many transactions contained in each subledger.

In the case of a company’s accounts receivable, for instance, the details of every transaction, including the customer information, the details of the sale, any refunds, returns, and the payment terms, are recorded and maintained by the accounts receivable subledgers. Those subledgers are totaled for each reporting period, and the totals make up the balance of the accounts receivable control account. In other words, the accounts receivable control account reflects the total amount that a company is owed, while the its subledger shows how much each individual customer owes.

Smaller companies may be able to rely on control accounts if they remain balanced using double-entry accounting. With accounts receivable, as invoices go out the control account is debited, which increases the balance. And as payments come in, the control account is credited, decreasing the balance.

Control accounting both helps produce clean financial reports , and provides checks and balances for accurate reconciliation. In the case of an accounts receivable control account, the subtotal of the customer balances in the subledger must match up to the control account. If it does not, then there is an error somewhere in the books that must be corrected.

With the double-entry accounting system, accounts receivable , and accounts payable are the common types of control accounts.

Depending on the size of the company, goods sold, and the industry, however, additional control accounts may be useful. Since control accounts make up the general ledger, which informs financial reporting, it’s important to make sure there is a control account associated with each aspect of your business.

Some common control accounts may include:

- Accounts Receivable

- Accounts Payable

- Fixed Assets

Accounting software will automatically categorize data and create control accounts and subledgers, allowing for simple data segmenting, as well as accurate accounting practices.

Colbourne College. “ Unit 10 - Financial Accounting .”

Control plan (Six Sigma) — definition and example

Project managers and business executives are always looking to optimize organizational processes. If you’re in a leadership role, you probably already know about Six Sigma, a continuous improvement framework that’s part of the Lean methodology. You may even be familiar with the five stages of Six Sigma — Define, Measure, Analyze, Improve, and Control (DMAIC).

A control plan is a crucial element of that last stage and is designed to standardize processes established in the four previous stages. Understanding control plans can help you make lasting process changes that improve your organization.

In this article, you’ll learn what a control plan is, including an example, so you can continue your educational journey into Six Sigma. This post will cover:

- What a control plan is

Control plan example

- How to get started with Six Sigma

What is a control plan?

A control plan is a document that provides guidance on how to monitor a process. Control plans are part of the fifth and final phase of the Six Sigma process improvement framework. They help businesses standardize newly adopted processes to increase their uptake and longevity.

Control plans should contain:

- An outline of what the process should look like

- Key variables or metrics to measure the process

- Information on how frequently to measure these variables

- What to do if the results stray from the desired outcomes

The goal of the control plan is to provide guidance so that a process can be successfully replicated over time by different individuals. Originally created for manufacturing, Six Sigma and the Lean methodology are now used in a range of industries including healthcare, education, and the service sector.

There are a variety of control plan formats, but some of the basic information would typically include the industry that the plan is for, the company’s goal, and how the sections of the plan help the company track its progress.

For example, a control plan for a manufacturing product might contain:

- The name of the product

- Its key characteristics, such as size, color, and material

- How to measure those characteristics, including the tool needed

- The acceptable range — also called the tolerance range — for each characteristic

- The testing frequency, possibly as a time period or amount

- How to visualize and evaluate the measurements, perhaps in a chart

- A specific person who will oversee quality control

- Contingencies for particular or unexpected situations

While this example is for a manufacturing product, the same structure and approach could be applied to any business process. Remember, maintaining hard-won gains is as important as making them in the first place. Project teams need to put guidelines in place to ensure processes stay efficient, for instance by creating monitoring and response plans. Process owners should then make sure process changes are maintained and kept current with best practices.

Get started with Six Sigma

Control is one of the critical steps in the Six Sigma framework because it ensures that the processes you’ve refined will be maintained into the future. Without a control plan, processes could revert back to the way they were before, resulting in a loss of essential progress.

If Six Sigma and Lean management sound like they might be right for your business, and you’re interested in learning more, check out one of the additional resources below:

- Learn about Six Sigma to Improve Workplace Processes

- Lean Project Management

- A Guide to Lean Management

Adobe can help

Adobe Workfront is enterprise work management software that can help you adopt or expand Lean Six Sigma, optimizing your workflow and bringing organization to your teams.

Take a product tour or watch the overview video to learn more about Workfront.

https://business.adobe.com/blog/basics/what-is-six-sigma

https://business.adobe.com/blog/basics/lean

https://business.adobe.com/blog/basics/lean-management

Control Accounts: What They Are and Why You Need Them

If you’re running a business, it’s important to understand accounting concepts well. One key concept is the purpose of control accounts. These special accounts are used to track and report the financial status of specific areas or divisions within a company. But how does this apply to your business? Edgewater CPA Group discusses this and why you need control accounts to manage business finances effectively.

What are Control Accounts & Their Purpose

Control accounts are used in accounting to help ensure the accuracy of financial statements. The purpose of these accounts is to provide a check on the math of individual transactions and to provide a means of reconciling errors. Controls are generally maintained by businesses with complex financial structures, such as multinational corporations. When control accounts are used, businesses can be confident that their financial statements accurately reflect their true financial position. This information allows businesses to make sound decisions based on accurate information.

Examples of These Accounts

There are many different types of accounts, but some of the most common include Accounts Receivable, Accounts Payable, Inventory, and Fixed Assets. Control accounts can be used to track both current and long-term items. For example, Accounts Receivable accounts are used to track customer invoices that have not yet been paid. Inventory accounts are used to track the quantity and value of inventory on hand. And Fixed Asset accounts are used to track the acquisition cost, depreciation expense, and remaining life of major property and equipment items.

Risks of These Accounts

While these accounts are an essential tool for businesses, they also come with a certain amount of risk. Errors in control accounts often lead to discrepancies in financial statements and incorrect tax returns. They can also fraudulently misrepresent a company’s financial position. For these reasons, it is important for businesses to have strict protocols in place. Businesses should also perform regular audits to ensure accuracy and compliance with regulations.

Edgewater CPA Group Can Help Manage Business Finances

When it comes to managing your business finances, Edgewater CPA Group can help! Our team of licensed and knowledgeable professionals loves working with businesses throughout Carmel, IN, and we’d love to work with you! We offer a wide array of services, including bookkeeping , controller, and tax prep . We’ve got everything you need to manage your business and grow . So, give us a call today at (317) 207-9269 .

Guide to Control Account - Earned Value Management

Control Account is a critical component of Earned Value Management in project management. It acts as a management control point to monitor and control cost and schedule performance. Why is it important? A control account is significant as it helps managers to track the performance and forecast the outcomes of a project more accurately. It allows for the integration of scope, schedule, and cost objectives and assists in performance measurement. What is it? Control Account is a management point at which scope, budget (resource plans), actual costs, and schedule are integrated and compared for the earned value performance measurement. It represents a task, work package or a group of work packages for which cost and schedule can be controlled. How it works? Control Account involves the process of planning, assessing, and controlling job costs. It uses Planned Value (PV), Earned Value (EV), and Actual Cost (AC) metrics. The difference between EV and PV is known as Schedule Variance (SV) and between EV and AC gives Cost Variance (CV). Any positive variance indicates good performance whereas negative variance indicates underperformance. Exam Tips: Answering Questions on Control Account 1. Understand the basic concept: Be able to define control account and its purpose. Understanding the structure of Control Account Plan (CAP) can also be very helpful. 2. Know how to apply it: Understand how to calculate Schedule Variance (SV) and Cost Variance (CV) in earned value analysis context. 3. Understand the implications: Understand what the variances indicate about the performance of the project. 4. Practice problems involving control account: Try to solve as many questions as possible. The more you practice, the more confident you'll be during the examination.

Project Management Professional Preparation Package (2024)

- Earn 35 PDUs needed for your PMP certification

- 8199 Superior-grade Project Management Professional practice questions.

- Accelerated Mastery: Deep dive into critical topics to fast-track your mastery.

- Unlock Effortless PMP preparation: 5 full exams.

- 100% Satisfaction Guaranteed: Full refund with no questions if unsatisfied.

- bonus: If you upgrade now you get upgraded access to all courses

Control Account practice test

A Control Account (CA) is a management control point in a project where scope, cost, and schedule management converge. It is a consolidated report of multiple subprojects, work packages, and project management processes, helping project managers maintain an organized approach to managing projects. Control Accounts are assigned to specific levels within a Work Breakdown Structure (WBS), with budgets and timelines calculated using the aggregated values of lower-level items. They play a central role in Earned Value Management by providing cost and schedule performance data, streamlining performance tracking, and assisting in decision-making.

Time: 5 minutes Questions: 5

Practice more Control Account questions

- Guide: Control Plan

Daniel Croft

Daniel Croft is an experienced continuous improvement manager with a Lean Six Sigma Black Belt and a Bachelor's degree in Business Management. With more than ten years of experience applying his skills across various industries, Daniel specializes in optimizing processes and improving efficiency. His approach combines practical experience with a deep understanding of business fundamentals to drive meaningful change.

- Last Updated: June 11, 2023

- Learn Lean Sigma

In business it is not uncommon for processes and outputs from processes to be out of control and need action to be taken to address them. This is where Control Plans become extremely useful. Control plans have been developed to support lean Six Sigma process and quality management systems in measuring critical-to-quality (CTQ) measures of processes and their outputs to ensure they remain in control with regular data collection and clear actions to be taken to address issues if they arise.

Control plans are mostly popularized and used within the manufacturing sector. However, they can be useful for a range of processes that output variables that can be measured and controlled.

Table of Contents

What is a control plan.

A Control Plan in its basic form is a document that outlines the process, steps and actions needed to manage, control, and ensure the quality of a process or product. Developed from the principles of Lean Six Sigma, the tool is used to many industries, such as manufacturing, logistics, automotive, and aerospace.

Control plans may vary slightly from business to business as teams and management tweak them to suit local business needs. However, the Control Plan typically consists of elements such as process input variables, output variables, control points (limits), what measurements are to be taken, and actions to be taken if a deviation occurs.

Below you can see a good example of how a control plan may look. You can also download this control plan from our template section.

A control plan is usually a tool you will use towards the end of an improvement project, such as in the Control phase of the DMAIC methodology, and continues to serve as a “living document,” which means it is continually reviewed and updated as the process evolves or new data becomes available.

How to Create a Control Plan

Creating a Control Plan is an important process that involves several steps. The guide below will clearly explain each step to guide you through creating a robust and effective Control Plan.

Step 1: Identify the Process

The first step in creating a control plan is to identify a process that you are looking to control. This should be a process that is critical to the quality of your product or service and would have a significant impact on customer satisfaction or operational efficiency if it were to go wrong. Therefore, lend them to a key candidate of a process to control

It is important to have a clear understanding of the flow of the process, including the inputs and outputs and all the steps involved. It can be useful to use a tool such as a flowchart to map out the process to ensure you fully understand all the elements and variables of the process.

Step 2: List CTQs (Critical to Quality Characteristics)

Once the process has been identified, the next step in the process is to identify the CTQ characteristics. These are the key attributes or features of the product or service that need to be controlled to ensure quality. The best way to identify what the CTQs are is to understand the customer requirements, such as product specifications.

For example, let’s say a business manufactures brake pads, and the CTQ is the thickness tolerance of the brake pads; this might be ±0.5mm.

Step 3: Select Measurement Methods

Once you have listed all the CTQs that you want to control, decide how you will measure these characteristics. The method that you decide on should be accurate, reliable, and repeatable and follow the principles of Attribute Agreement Analysis (AAA). The measurement method should consider what tools, instruments, or techniques will be used. Additionally, it is important to define the frequency with which the measurement is taken and what the acceptable limits or tolerances are for each CTQ.

Step 4: Determine Control Methods

Now that you know what CTQs you want to control and the methods used to measure them you need to determine the methods of control. Control methods are the strategies, tools or techniques used to ensure that the process stays within the defined limits or customer spec limits. Popular tools and techniques used to control processes and variables include Statistical Process Control (SPC) charts, Mistake Proofing (Poka Yoke) or Standard Operating Procedures (SOP) / Standard Work Instructions (SWI), which control method you use will depend on the type of process and CTQ identified.

Step 5: Develop Action Plans

If in the event a process or variable goes out of control it is important to take action to address and correct the process and bring it back under control. To do this action plans should be developed as part of the control plan. These action plans define what steps need to be taken to bring the process back within its acceptable limits.

Like any good action plan it needs make it clear what action needs to be taken and who is responsible for taking that action.

Step 6: Train the Team

Now that you have developed a control plan its important to ensure that in the event it is needed, it is used. Therefore, you should clearly communicate what the CTQs are, what the operators need to do to measure the process and clarify what actions need to be taken by whom if a process goes out of control.

Training is key to the success of the control plan being followed.

Step 7: Implement and Monitor

Now that you have developed and trained out the plan, the next step is to officially implement it. This involves putting all the required measures and controls into place. If special tools like calipers or software’s are needed to take measurements, ensure they have what they need. The process then needs to be continuously monitored to ensure the process remains within the stated control limits. Data should then be analyzed at regular intervals to detect and trends or deviations in the process outputs.

Step 8: Review and Update

Finally Step 8, it is important to remember that the control plan is a living document that should be reviewed and updated regularly as the process or CTQs change. Regular reviews will ensure the Control Plan remains effective and relevant.

By following this process you should be able to develop a robust Control Plan that will help you control your process and ensure quality and drive continuous improvement of the process.

Implementing a Control Plan is beneficial for controlling the quality and performance of processes and preventing defects or quality issues. From identifying the process to training your team, each step is geared towards ensuring that your business operations are as seamless as possible. The goal is not just to maintain current performance levels but to set the stage for continuous improvement.

As we’ve outlined in this guide, creating and implementing a Control Plan is a detailed process involving multiple steps, each is important and builds on the previous step. You should also remember, a Control Plan is a living document must be regularly monitored and updated to its sustain success.

- Westgard, J.O., 2003. Internal quality control: planning and implementation strategies. Annals of clinical biochemistry , 40 (6), pp.593-611.

- Mehrasa, M., Pouresmaeil, E., Jørgensen, B.N. and Catalão, J.P., 2015. A control plan for the stable operation of microgrids during grid-connected and islanded modes. Electric Power Systems Research , 129 , pp.10-22.

Q: What is a control plan?

A: A control plan is a documented framework that outlines the methods, procedures, and actions necessary to maintain process control and ensure consistent and acceptable outcomes. It helps identify critical control points, measurement methods, control limits, and corrective actions to monitor and manage process performance effectively.

Q: Why is a control plan important?

A: A control plan is important because it helps organizations maintain process stability, minimize process variations, and ensure consistent product or service quality. It provides a systematic approach to monitor, control, and improve processes, leading to reduced defects, improved customer satisfaction, and increased operational efficiency.

Q: How does a control plan fit into the DMAIC methodology?

A: A control plan is a key component of the Control phase in the DMAIC (Define, Measure, Analyze, Improve, Control) methodology. In this phase, the control plan is developed to sustain the improvements made during the earlier phases. It helps ensure that the process remains in control, deviations are promptly addressed, and continuous improvement efforts are sustained.

Q: What are critical control points?

A: Critical control points are specific stages or activities within a process where variations can significantly impact the quality or outcome. These points need to be closely monitored and controlled to prevent defects or deviations from the desired target. Examples include temperature control, pressure control, or specific steps in a manufacturing process.

Q: How are control limits determined?

A: Control limits are determined based on historical data, customer specifications, or statistical analysis. Historical data provides insights into the process performance, while customer specifications define the acceptable range for product quality. Statistical techniques, such as process capability analysis, can help determine control limits based on the process’s inherent variation and the desired level of performance.

Q: What is the role of corrective actions in a control plan?

A: Corrective actions are specified in a control plan to address deviations from control limits or target values. These actions provide a systematic approach to identify and resolve the root causes of variations, ensuring that the process is brought back into control. Corrective actions may involve adjusting process parameters, modifying procedures, retraining employees, or conducting equipment maintenance, among other steps.

Q: Who is responsible for implementing a control plan?

A: Responsibility for implementing a control plan typically falls on the process owner or a designated team responsible for process management and improvement. These individuals or teams are accountable for monitoring the process, collecting data, analyzing it for deviations, and implementing corrective actions when necessary.

Q: How often should a control plan be reviewed and updated?

A: A control plan should be reviewed and updated regularly to ensure its effectiveness and alignment with changing process requirements. It is recommended to review the control plan during regular process performance reviews or when significant changes occur in the process or customer requirements. This helps to adapt the control plan to evolving conditions and continuously improve its efficacy.

Daniel Croft is a seasoned continuous improvement manager with a Black Belt in Lean Six Sigma. With over 10 years of real-world application experience across diverse sectors, Daniel has a passion for optimizing processes and fostering a culture of efficiency. He's not just a practitioner but also an avid learner, constantly seeking to expand his knowledge. Outside of his professional life, Daniel has a keen Investing, statistics and knowledge-sharing, which led him to create the website learnleansigma.com, a platform dedicated to Lean Six Sigma and process improvement insights.

Download Template

Free Lean Six Sigma Templates

Improve your Lean Six Sigma projects with our free templates. They're designed to make implementation and management easier, helping you achieve better results.

Other Guides

- Knowledge Base

- Control Account Plan

- Scope Management

A control account plan, also referred to by the anagram CAP, is a tool that is used to create a plan for all of the efforts and work to ultimately take place within a control account. Each individual control account plan is made up of some common, distinctive, and specific elements. These elements include a statement of work, in which the general breakdown of tasks to be conducted are delineated, a work schedule, which may be specifically broken down, or may be more broad-based, with the intention of breaking it down further at a later date, as well as a budget, typically broken down in a time-phased manner. Control account plans are typically the most effective to the management of a project when they are developed and implemented at the onset of a project; however they are effective tools to use whenever they are implemented within a project’s life cycle. The term control account plan had previously been referred to as a cost account plan.

Was this article helpful?

Need more information on trainings we’re a click away, upcoming courses :-.

- Privacy Policy

- Terms & Conditions

- Refund Policy

- Complaints Policy

Copyright © 2024. Project Victor Co., Ltd. All Rights Reserved.

- Fundamentals

- Managing and Controlling Projects

- PMP Exam Prep Bootcamp

- PMP Exam Sneak Peek

- CAPM Exam Prep Bootcamp

- Introduction to PMBOK v7

- Exam Prep Practice Questions

- PMBOK v6 vs PMBOK v5 Exam Prep

- Agile Management Fundamentals

- PMI-ACP Exam Prep

- ACP Exam Sneak Peek

- Disciplined Agile Scrum Master (DASM) Certification

- Disciplined Agile Senior Scrum Master (DASSM) Certification

- Disciplined Agile Coach (DAC) Certification

- Disciplined Agile Value Stream Consultant (DAVSC) Certification

- Selected Topics in Project Management

- Managing Stakeholders using Soft Skills

- Communications Management Workshop

- Presentation Skills for Project Managers

- Managing Projects with Microsoft Project

- Contract Management for Non-Lawyers

- FIDIC Conditions of Contract

- Technical Writing

- Managing Claims and Risks in Engineering and Construction Contracts

- PMI RMP Exam Preparation

- Technical Skills

- Setting up a PMO (Step by Step) Workshop

- Organizational Project Management Maturity Model (OPM3)

- PgMP Exam Preparation

- PMI PBA Certification

- Business Analysis Foundations

- Group Training

- PMP Simulator

- 1-to-1 Training

- Event Calendar

- Testimonials

- Order Books

Control Account: Understanding its Role in Financial Management

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Control Account Definition

A “control account” is a general ledger account that summarizes and provides a check on the accuracy of all the detailed subsidiary data. It helps ensure individual transaction records are consistent with the overall total amounts in financial statements.

Understanding Control Accounts in Context

While the control account exists as a pivot of sorts within bookkeeping, it plays an integral role in the wider landscape of financial management and the general accounting system.

Role in Financial Management

Part of financial management hinges on accuracy and timeliness. The crux of a control account’s role in financial management is to enable easy cross-verification of data. Control accounts ensure balances and transactions align correctly with the detailed entries in corresponding subsidiary accounts.

Control accounts simplify the process of large-scale financial reporting, provide a macro-level overview of the company’s financial status, and help streamline financial planning. By compartmentalizing the different types of transactions into sub-accounts and summarizing them together in control accounts, businesses have a more organized view of diverse aspects like inventory or accounts receivable. These control accounts thus facilitate effective decision-making in managing and planning financial strategies.

Control Accounts and the Accounting System

Control accounts function as an inherent component in the broader accounting system architecture. They provide a basis for auditing as auditors often function at higher levels of information summarization. The auditors can thus verify the accuracy of control accounts without a detailed analysis of all the individual entries.

Control accounts further accelerate the financial investigations process. Any discrepancies in the overall figures can quickly be traced back to the associated control account and eventually to the underlying sub-account causing the error.

Relationships with Subsidiary Accounts

Within the financial ecosystem, control accounts and subsidiary accounts share a symbiotic relationship, creating a balanced financial structure. The balance in a control account should be equivalent to the collective balance of linked subsidiary accounts. By creating a correlation between a control account and its subsidiary accounts, a company ensures that any discrepancies or errors can quickly be identified and rectified.

Every transaction that concerns a control account also involves an associated subsidiary ledger. This “control-subsidiary” relationship ensures that the detailed, granular-level transactions conducted on a day-to-day basis (captured in subsidiary accounts) align perfectly with the aggregated, broader-level balances reflected in control accounts.

Importance of Control Accounts

With the global financial landscape growing more complex, the importance of control accounts for businesses cannot be overstated. They serve as a critical line of defense against errors and fraud and provide a clear, organized view of a business’s financial status at any given time.

Control Accounts and Error Prevention

Control accounts help identify discrepancies in financial data quickly and accurately. When the balances in the subsidiary ledgers do not match the balance in the respective control account, it points to an error that needs investigating. This preventative approach can save a company significant time and resources in rectifying financial mistakes.

Control Accounts as a Deterrent against Fraud

The structure of a control account – an aggregate of several similar transactions – naturally acts as a deterrent against fraudulent activities. Given that fraud often involves manipulations of individual transactions, control accounts can bring attention to these illicit activities at an early stage. With each subsidiary ledger scrutinized against the corresponding control account, fraud becomes more difficult to execute and easier to spot.

Encouraging Transparency through Control Accounts

Control accounts’ role in promoting financial transparency in an organization cannot be understated. By providing a snapshot of multiple transactions and accounts, they paint a clear and cohesive picture of financial activity, making it accessible to various stakeholders, from business leadership to external auditors. This type of visibility encourages openness and reduces the chance of misunderstandings or miscommunications about the company’s financial health.

Maintaining Accountability with Control Accounts

Another advantage of control accounts is the principle of accountability they instill within an organization. Staff members responsible for financial transactions know they will be held accountable if discrepancies arise. This responsibility develops a culture of integrity within the business – an invaluable asset for maintaining trust among stakeholders.

Regulatory Compliance and Control Accounts

Lastly, control accounts play a significant role in regulatory compliance. Business regulations, especially in the financial sector, often require meticulous record-keeping and evidence of a sound financial management system. Having well-kept, accurate control accounts not only assists in meeting these requirements but also provides a safeguard during audit inspections.

In essence, control accounts are an essential tool for any business firm looking to effectively manage its finances and meet external regulatory demands.

Types of Control Accounts

Among the variety of control accounts available, some of the most commonly utilized include Accounts Receivable, Accounts Payable, and Inventory Control.

Accounts Receivable

Accounts Receivable refers to the money owed to a business by its clients or customers for goods or services provided on credit. The primary function of this control account is to track all the pending payments that a company is expected to receive in a specific period. The balance in this account increases when sales are made on credit and decreases when payments are received.

Accounts Payable

Opposite to the Accounts Receivable, Accounts Payable represents the amount a company owes for purchasing goods or services on credit from its suppliers or vendors. The role of this control account is to monitor all the pending payments that a company must make. The balance in this account increases with every purchase made on credit and decreases when payments are made.

Inventory Control

Inventory Control account represents the value of goods a business currently owns that are expected to be sold in the future. This control account plays a crucial role in tracking and managing the company’s stock levels. An increase in this account reflects an acquisition of inventory, while a decrease indicates that inventory has been sold or used.

Each of these control accounts serves a unique function and helps in efficient and effective management of a company’s finances. Their proper maintenance and regular reconciliation can provide a business with accurate, timely, and useful financial information, ensuring sound financial health.

Structure of a Control Account

A control account typically follows a structured layout to ensure accurate and efficient recording of all financial processes. At its core, the control account structure consists of various columns that capture specific information.

Columns in a Control Account

This column records the date that a specific transaction takes place. It’s also the date the transaction is entered into the control account for tracking and auditing purposes.

This column will usually contain a brief description or reference of the transaction. It might include the supplier or customer name, an invoice number, or a brief narration of the transaction that helps to provide context around the transaction.

Debit and Credit

These two columns in the control account record the value of the transaction. If the account is being debited, the amount is entered into the debit column. If it is being credited, the amount is entered into the credit column.

The balance column keeps track of the running balance of the control account after each transaction. This is usually a running total that cumulatively adds or subtracts each debit or credit to the previous balance to show the current balance at each point in time.

Recording Transactions

When transactions occur, they are recorded in the control account based on whether they are a debit or a credit transaction. For example, in the case of a sales control account, when a sale is made it would be recorded as a debit in the control account. On the other hand, payments received from debtors would be credited to the account.

Keeping track of the balance column is essential to determine the financial position represented by the control account. For example, a creditor control account’s balance would represent the total amount payable to the company’s suppliers.

In conclusion, the structure of a control account is designed to provide clarity and ease in recording, tracking, and auditing financial transactions. Its structure is central to maintaining accurate financial records and ensuring fiscal accuracy.

Benefits and Limitations of Control Accounts

Utilizing control accounts can offer several significant benefits, particularly in terms of efficiency, accuracy, and risk management.

Control accounts can significantly enhance the efficiency of financial operations. These accounts streamline the accounting process by consolidating transactions from multiple sub-ledgers into a single account. This consolidation saves administrative time and effort, as transactions do not need to be individually verified against the main ledger.

Control accounts also enhance the accuracy of an organization’s financial reporting. By comparing the balances in control accounts with the sum of corresponding sub-ledger accounts, discrepancies can be quickly identified and addressed. This routine reconciliation process helps to maintain the integrity of accounting records, reducing errors and preventing fraud.

Risk Management

From a risk management perspective, control accounts act as an additional checkpoint to detect fraudulent transactions or irregularities. By revealing discrepancies between the main ledger and sub-ledgers, control accounts help safeguard an organization’s financial assets and maintain its fiscal health.

However, like any financial tool, control accounts also come with their potential limitations and complexities.

Complexities

Implementing control accounts can be complex, particularly in large organizations with diverse operations. To use control accounts effectively, organizations must first have a detailed and accurate breakdown of their financial transactions across sub-ledgers. This can involve considerable time and expertise to set up and maintain. Also, resolving discrepancies between the control account and sub-ledgers can sometimes be a time-consuming process, requiring meticulous tracking and investigation.

Limitations in Scope

Lastly, it’s worth noting that control accounts have a somewhat limited scope. They are primarily designed to consolidate and validate transactions for specific types of accounts like accounts payable or receivable, not all transactions within an organization. As such, control accounts alone cannot provide a comprehensive overview of an organization’s overall financial status.

The Role of Control Accounts in Internal Auditing

Control accounts hold a critical role in internal auditing. They serve as a reference point, highlighting the overall picture of numerous economic elements such as sales, purchases, wage expenses, etc. Without control accounts, auditors would be forced to review individual transactions in audit trails, which can be both time-consuming and ineffective due to the complexity of data management.

One of the primary functions of control accounts is maintaining the integrity of financial data. They do this by simplifying the tracking process, allowing auditors to spot discrepancies or irregularities more easily. Control accounts follow the principle of double-entry bookkeeping, thus ensuring that for every financial transaction recorded, there’s a corresponding counter entry.

Ensuring Accuracy

Control accounts serve as a bridge between source data (individual sales invoices, for example) and the general ledger. They help auditors verify accuracy as they summarize transaction information in a manner that can be cross-checked with pertinent sub-ledger balances. This means auditors can validate the figures in general ledger against the total of sub-ledgers, ensuring that the overall account balances are accurate.

Ensuring Completeness

In addition to validity, control accounts help ensure the completeness of financial data. By summarizing all transaction information into one account, auditors can readily assess if any entries are missing or if there are discrepancies between the control account and the detailed listings in related subsidiary accounts. If the total of a control account doesn’t match with the sum of the corresponding subsidiary ledger accounts, it indicates that transactions are either missing or duplicated.

Thus, control accounts act as a safeguard against human error and deliberate fraud, enhancing the robustness of internal auditing. They facilitate an efficient, organized system that enables auditors to confirm the reliability of a company’s financial reports, bringing value to operations and providing assurance to stakeholders.

Control Accounts and CSR

Through effective financial management and accountability, control accounts can indirectly serve Corporate Social Responsibility (CSR) initiatives.

Financial Management and Responsibility

Control accounts are usually the fiduciary responsibility of a company’s financial manager. They manage these accounts to ensure the accuracy and integrity of financial data. Timely financial reports, derived from well-managed control accounts, can reveal whether a company is adhering to its budget, meeting its performance goals, and whether resources are being allocated effectively.

The ability to demonstrate financial accountability is not only important for business operations, but it can also support CSR goals. For instance, accurate financial data can demonstrate to stakeholders that the company is using its resources responsibly and operating sustainably. This transparent financial reporting can help a company reinforce its commitment to ethical business practices, thereby enhancing its CSR profile.

Enforcing Fiscal Discipline

Control accounts indirectly enforce fiscal discipline within the company. They assist in improving financial performance by reducing errors and discrepancies and ensuring that all transactions are recorded and validated.

Moreover, the regular reconciliation process associated with control accounts helps to detect fraud and misuse of funds, thus enhancing the overall fiscal discipline within the organization. This fosters a culture of integrity, reinforcing CSR goals related to ethical corporate behavior.

Enhancing Stakeholder Confidence

Through such financial discipline and accountability, control accounts help to build stakeholder confidence. Stakeholders often seek assurance that the organisations they associate with demonstrate good financial stewardship.

Accurate and transparent financial reports, backed by properly maintained control accounts, help to provide such assurance. They indicate the organisation’s financial stability and its commitment to adhering to regulatory standards and ethical business practices. This can indirectly correlate to higher stakeholder confidence and enhanced reputation, further contributing to CSR objectives.

Thus, while control accounts primarily serve financial and regulatory purposes, their influence extends to the broader realm of CSR by promoting a culture of fiscal discipline, accountability, and transparency.

Sustainability and Control Accounts

An important perspective to consider in management accounting is how the diligent and strategic use of control accounts can support sustainability. Given their capacity for streamlining financial processes and mitigating risks, controlling accounts can be crucial in advancing a company towards its sustainability goals.

Greater Resource Efficiency

One of the central ways in which control accounts support sustainability is through promoting efficient use of resources. These accounts aggregate all similar transactions into a single account. With this consolidation, the process of recording and tracking each transaction becomes significantly smoother and more manageable, which ultimately minimizes administrative workload. Consequently, this efficiency allows for human and financial resources to be re-allocated in support of other sustainability efforts.

Mitigating Losses from Errors and Fraud

Unintentional errors or intentional fraud can lead to substantial financial losses, which are undeniably detrimental to any organization’s sustainability. Control accounts act as a safeguard against this risk by providing a built-in system for cross-verification. By comparing the balance of the control account with the total of individual customer or supplier accounts, discrepancies can be swiftly detected and rectified. This function not only prevents financial loss, but also enhances accountability and transparency, which are key to sustainable business operations.

Strategic Financial Planning

Control accounts also underpin sustainability by supporting strategic financial planning. The regular reconciliation of control accounts provides timely and accurate financial data, which aids management in making informed decisions about the company’s future direction. This forward-focused, proactive approach ensures that the organization remains financially healthy and agile, further contributing to its overall sustainability.

In conclusion, control accounts play a significant yet often overlooked role in promoting sustainability within organizations. By cultivating efficiency, mitigating financial risk and supporting strategic planning, they serve as an indispensable tool in the pursuit of a more sustainable future.

Share this article with a friend:

About the author.

Inspired Economist

Related posts.

Accounting Close Explained: A Comprehensive Guide to the Process

Accounts Payable Essentials: From Invoice Processing to Payment

Operating Profit Margin: Understanding Corporate Earnings Power

Capital Rationing: How Companies Manage Limited Resources

Licensing Revenue Model: An In-Depth Look at Profit Generation

Operating Income: Understanding its Significance in Business Finance

Cash Flow Statement: Breaking Down Its Importance and Analysis in Finance

Human Capital Management: Understanding the Value of Your Workforce

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Start typing and press enter to search

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Project Management Knowledge

Simply explained by a PMI-certified Project Manager

Control Account Plan

A control account plan, also referred to by the anagram CAP, is a tool that is used to create a plan for all of the efforts and work to ultimately take place within a control account . Each individual control account plan is made up of some common, distinctive, and specific elements. These elements include a statement of work , in which the general breakdown of tasks to be conducted are delineated, a work schedule, which may be specifically broken down, or may be more broad-based, with the intention of breaking it down further at a later date, as well as a budget , typically broken down in a time-phased manner. Control account plans are typically the most effective to the management of a project when they are developed and implemented at the onset of a project; however they are effective tools to use whenever they are implemented within a project’s life cycle. The term control account plan had previously been referred to as a cost account plan.

This term is defined in the 3rd edition of the PMBOK but not in the 4th.

Related Articles:

- Landing Page This is an example of a WordPress post, you could edit this to put information about yourself so readers know...

- Contact Us Add a contact form to this page with the pre-installed WPForms Lite plugin (Third Party). Learn how to create a...

- Get free Project Management updates!...

- Data Science and Project Management II A few years ago, I wrote my first article about data science and project management. Since then, I have done...

- Get free Project Management updates!...

Mudassir Iqbal

WBS is a hierarchal deliverable-oriented graphical representation of all the work needed to be done on the project. The following represents a different level of this hierarchical representation.

Control Account

A control account is associated with a particular structural module in the Organizational Breakdown Structure (OBS). Control accounts are usually positioned at selected levels in work packages. There may be many control accounts associated with every work package, though, a control account is linked with only one work package at a time.

A control account is a management point in the WBS that provides a way to monitor and control project performance, cost, and schedule.

A control account is an important project management tool that involves the integration of specific and key elements of project-specific constitutes. Once a successful integration takes place, a measurement of the performance to date occurs. The elements that are frequently integrated using the control account tool comprises of the scope of a project, the actual cost, and the project schedule.

Control accounts are typically positioned at diverse strategic points of the project’s work breakdown structure. This is thought to be useful interchanges along with the way of the process and points at which the work is finished in every one of these particular areas that can be integrated and differences are addressed.

Work Package

A Work Package is a collection of related tasks in a project and they are often considered as sub-projects in one major project.

Work packages refer to the lowest unit of work that a project can be segmented when developing your Work Breakdown Structure (WBS). A work package typically comprises of the nature of work involved, specific stakeholders, results of the tasks, technical material used, duration, and geographic location where these tasks will take place. By placing all related tasks together, a work package becomes an easier division to understand. Team members can easily see the association between varying tasks and emphasize those elements that apply to them. As a sub-division of a work breakdown structure, work packages offer a significant level of clarity as every block of associated tasks can be quickly envisaged.

A work package is a smaller, more specific component of the WBS that represents a single, well-defined piece of work that can be planned, executed, and controlled independently. Work packages are typically assigned to a single person or team for completion.

Work packages let for concurrent work to be performed on different components of a project that is parallel to several teams. Every team follows a certain list of defined tasks for the work package and completes in the given time period. As soon as the team finishes their individual work packages, the whole project comes together with perfect integration.

The work package is the work defined at the lowest level of the WBS for which cost and duration can be estimated and managed. The work package should be defined with a unique identifier

Planning Package

Planning Package offers a valuable means of categorization for the project managers to efficiently collect important elements of the project. The concept refers to the project specific work breakdown structure that exists on the entire scheme below the decoded and already break down control account without any detailed schedule activities. For a comprehensive understanding of a planning package, it is helpful to evaluate the term control accounts. It can be developed at any phase of the project, though its best to be outlined at the beginning of a project.

Planning packages are typically used to define the work that will be performed during a specific phase of the project.

A planning package is a work breakdown structure component below the control account and above the work package with known work content but without detailed schedule activities. It holds the future work.

Before dwelling into the concept of Planning Package and Work Package, let me explain the very important concept of project scope identification i.e progressive elaboration of scope. A detailed scope is planned for the short term while the far/long term is planned at a high level. WBS is segmented at different levels according to the availability of information while duration and costs are estimated with a reasonable degree. Considering the components where details are not evident to the degree to produce verifiable subcomponents of products, services, and outcomes. Here, we are aware of the work through the detailed schedule activities are not possible to determine. This level of decomposition refers to Planning Package. A planning package can be converted into a work package with the lowest level details in defining budget and schedule. Individual work packages form the building blocks of project deliverables and the foundation at which the project is evaluated and monitored.

The planning package concept refers specifically to the project’s particular work breakdown structure component which resides on the grand and total scheme below the already deciphered and already broken down control account however lacking a carefully crafted and elaborately detailed itemization of the project’s defined schedule activities, yet nonetheless containing a fairly lucid delineation of

- A control account has two or more work packages, though each work package is associated with a single control account.

- A control account may include one or more planning packages

- A planning package will be decomposed into a work package when the needed details regarding scope, budget and schedule are defined.

- A control account is a natural management point for planning and control since it represents the work assigned to one responsible organizational element on one project work breakdown structure element.

- Work packages constitute the basic building blocks used in planning, measuring accomplishment, and controlling project work.

- Planning packages are created to describe work within a control account that will occur in the future. Planning packages must have a work scope, schedule, and time-phased budget.

https://www.workbreakdownstructure.com/

Share this:

- Share on Tumblr

- PMP Certification

- PMP Certification Exam

- PMP Training Course

- Project Management

- Project Scope Management

- Work Breakdown Structure

5 thoughts to “ Control Account, Work Package, Planning Package : PMP/CAPM ”

Excellent explanation !! could please send me a schem represents : Work package; Planning package and Control account (my email is: [email protected] ) Respectfully

so;when we have details about a planning package (scheduled activities, ..etc) it becomes a Work package ?

Inshallah amazing explanation… subahanallah

Leave a Reply Cancel reply

- Agile Project Management (3)

- Business Analysis (5)

- Digital Transformation (2)

- Leadership (4)

- Project Management (9)

- Soft Skill Articles (14)

- World of ERP (2)

- Other Authors (25)

- Agile & Scrum (27)

- PMP Articles (7)

- PMP Concepts (168)

Control Accounts

Locked lesson.

- Lesson resources Resources

- Quick reference Reference

About this lesson

Explain the importance control accounts play in balancing the model when used effectively. When to create control accounts, how to create them and where to link their line items.

Exercise files

Download this lesson’s related exercise files.

Quick reference

Understand Control Accounts

When to use

It is necessary to understand how control accounts work when building a Financial Model.

Instructions

Control accounts tell you three key things:

- Number of calculations that need to be entered into the financial statement so that they balance: This is always one less than the number of rows in the control account. The reason it is one less is because the opening balance is simply the closing balance calculated from the period before.

- The order to build the calculations into the financial statements: This is always row 2 first, then row 3, then row 4 and so on. Think of it this way: assuming no opening balance (which there would not be in the beginning), if there were no sales, there could be no payments received. If there are no sales and no receipts, the difference between them (the amount owed, the Accounts Receivable) would also be zero. It is a logical order.

- It identifies the key driver: Often you want to undertake sensitivity and scenario analysis in your models, but sometimes you may be unsure which variables should be included in the analysis. Line 2 of the control account is always the key driver. As above, if there were no sales, there could be no payments received. If there are no sales and no receipts, the difference between them (the amount owed, the Accounts Receivable) would also be zero.

In the example above, if the opening balance of Accounts Receivable is $120,000 and we make further sales in the period of $64,700, assuming there are no bad debts (more on that later) and the cash received is $82,750, then the closing balance for Accounts Receivable has to be $101,950. In other words, assuming the opening balance was $120,000, entering:

- Sales of $64,700 in the Income Statement;

- Cash Receipts of $82,750 (as a positive number) in the Cash Flow Statement; and

- Closing Accounts Receivable of $101,950 in the Balance Sheet

- 00:04 Let's keep moving, then, as I set the scene about how we build a financial

- 00:08 model, the order we build it in, why, and what tools are at our disposal.

- 00:13 In particular, I want to look at a very useful tool for

- 00:16 making the balance sheet balance.

- 00:18 You might not know what a balance sheet is yet, but

- 00:20 you know that the name actually implies that it balances.

- 00:23 So that's going to mean net assets equals total equity.

- 00:27 Let's just have a reminder from last time out.

- 00:32 Essentially, there are three financial statements you should be modeling in

- 00:35 a financial model, namely the income statement, the cash flow statement and

- 00:38 the balance sheet.

- 00:40 Link together, put in the checks, and you have it three-way integrated.

- 00:44 That's what the point is.

- 00:46 But, okay, so that's how they link together mathematically.

- 00:51 How do they link together conceptually?

- 00:54 Now, don't be put off by the fact that this slide says conceptual order.

- 00:57 This is the conceptual order from building a model.

- 01:00 What I want to do now is look at the theoretical concept as well, and

- 01:03 to do that, we need to balance the balance sheet.

- 01:06 It's always gotta work.

- 01:07 Now bear in mind,

- 01:08 when we build a model, we will have to have an opening balance sheet.

- 01:13 No matter where we start from, whatever our start date is in a model,

- 01:16 the company either exists at that point in time or it doesn't.

- 01:20 If it doesn't, then its balance sheet is empty.

- 01:22 There's nothing in there, and all the transactions commence thereafter.

- 01:26 If it's already there, then it's going to have a pre-existing balance sheet.

- 01:29 Either way, be it zero or it's populated, we're going to have an opening balance

- 01:34 sheet that somebody, somewhere will have to give to us.

- 01:37 It's got to balance.

- 01:39 It's got to balance.

- 01:40 If it doesn't balance, we mustn't accept it or we can be held responsible for

- 01:45 in building a financial model is that the movement in net assets,

- 01:49 the delta equals the movement in total equity, the corresponding delta.

- 01:53 That's how we can be held responsible for.

- 01:55 Now your day job might also mean that you have to look after the financial

- 01:57 statements.

- 01:58 That's fine, that's a little low on responsibility for you.

- 02:01 But as a modeller, we can only be held accountable for the movement in net assets

- 02:06 equaling the movement in total equity and that's going to be important for

- 02:09 a trick I'm going to employ in the modeling shortly.

- 02:14 The thing I want to bring up in this session in particular

- 02:17 is the concept of control accounts to show in another way how the financial

- 02:21 statements link together.

- 02:22 Even if you are not an accountant, this is very useful for

- 02:26 showing how to get the financial statements to integrate and

- 02:29 how to get that that balance sheet to blessed well balance.

- 02:33 Very, very simple, for

- 02:36 example, let's assume at the beginning of a period you're owed $120,000.

- 02:41 You've sent all these invoices out, and people owe you this amount of money.

- 02:46 In the period, people also give you $64,700.

- 02:48 That means at that point in time, if there's no cash coming in,

- 02:54 and there's no bad debts to write off, you owed $184,700.

- 03:00 You get in the period $82,750.

- 03:02 Now I don't know if that's for money for

- 03:06 a previous period, the current period, whatever.

- 03:08 But I do know that going forward I've actually still got $101,950 owing to me.

- 03:15 And this is what the control account does, it has this b/f and c/f.

- 03:19 B/f stands for brought forward, means from the previous period.

- 03:22 And c/f means carried forward to the next period.

- 03:26 And this is what a balance sheet looks like.

- 03:28 It has four or more, line items typically.

- 03:32 And the opening and closing are always balance sheet items.

- 03:36 No exception.

- 03:37 Always balance sheet items.

- 03:39 And if you think about it, the balance sheet item is just the previous period.

- 03:43 So the top and the bottom are the same account.

- 03:46 So we've only got three accounts here that we need to populate in the financial

- 03:50 statements, and then it will balance.

- 03:52 So a key rule here is that when you construct a balance sheet

- 03:56 control account like this one, you subtract one from the number of rows.

- 04:01 So, we've got four rows here, so you have three.

- 04:03 And that will give you how many calculations you have to put into

- 04:07 the financial statements to get them to balance.

- 04:10 Now most of us were brought up on this idea of debits and credits and

- 04:13 double entry and goodness knows what, and so

- 04:15 there always needs to be an even number of calculations.

- 04:18 As an accountant myself,

- 04:20 I hear of concepts like reversing journals and things like that.

- 04:23 A reversing journal.

- 04:25 Let's just be clear here, let's put back what we should have put

- 04:28 in in the first place because we had to fill it to make double entry work.

- 04:31 If you don't follow that, good, because I'm not gonna teach you that way and

- 04:35 the last time you're going to hear about debits and

- 04:37 credits I hope will be in that last sentence.

- 04:39 This is how it works.

- 04:40 It makes sense to people.

- 04:42 I've started off around $120k.

- 04:46 I have $64,700 coming in.

- 04:48 That means I'm owed $184,700.

- 04:49 People will pay me $82,750.

- 04:50 So if there were no bad debts which could also go in the control account if there

- 04:55 are that would be another deduction that I'm going to be out at the end

- 04:59 of the period, 101,950.

- 05:01 So what if I would populate this in

- 05:05 the financial statements 120,000 would go into the previous period.

- 05:11 64,700 would go into the P and L for the current period.

- 05:15 82,750 will go into the cash flow statement for

- 05:17 the current pay period, as a positive number.

- 05:20 Gotta remember cash receipts is a good thing and therefore,

- 05:24 we put into the balance sheet for this period 101,950 and it would balance.

- 05:27 And I'm gonna actually show you that when we actually build the model.

- 05:31 This is what it's about.