Accounting Quizzes

Home › Quizzes › Accounting Quizzes

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

HIGH SCHOOL

- ACT Tutoring

- SAT Tutoring

- PSAT Tutoring

- ASPIRE Tutoring

- SHSAT Tutoring

- STAAR Tutoring

GRADUATE SCHOOL

- MCAT Tutoring

- GRE Tutoring

- LSAT Tutoring

- GMAT Tutoring

- AIMS Tutoring

- HSPT Tutoring

- ISAT Tutoring

- SSAT Tutoring

Search 50+ Tests

Loading Page

math tutoring

- Elementary Math

- Pre-Calculus

- Trigonometry

science tutoring

Foreign languages.

- Mandarin Chinese

elementary tutoring

- Computer Science

Search 350+ Subjects

- Video Overview

- Tutor Selection Process

- Online Tutoring

- Mobile Tutoring

- Instant Tutoring

- How We Operate

- Our Guarantee

- Impact of Tutoring

- Reviews & Testimonials

- Media Coverage

- About Varsity Tutors

FREE Accounting Practice Tests

All accounting resources, free accounting practice tests, practice tests by concept, accounting and the business environment practice test, accounting for merchandising operations practice test, corporations: dividends, retained earnings, and income reporting practice test, current liabilities and payroll accounting practice test, statement of cash flows practice test, the adjusting process practice test, practice quizzes, accounting problem set 1.

Module 4: Completing the Accounting Cycle

Practice: preparing financial statements, learning outcomes.

- Prepare an income statement

- Prepare a statement of owner’s equity

- Prepare a balance sheet

- Identify the three main components of the statement of cash flows

- Practice: Preparing Financial Statements. Authored by : Mike Zerrahn. Provided by : Lumen Learning. License : CC BY: Attribution

Practice Accounting

Why practice accounting questions.

One of the best ways to study accounting is to do the homework problems. An even better way to study accounting is to practice accounting questions you'd see on your test or quiz. Here's why: homework problems are designed to take you step-by-step through the process of solving the problem. This helps build a foundation for solving these types of problems. Unfortunately, the format of the homework problems is usually different than the questions you'll see on your tests and quizzes. Additionally, your test and quiz grades are typically weighted heavier than your homework grade. So, doesn't it make sense to spend time on questions that best resemble what you'll see on your accounting tests and quizzes?

Prior to working with me, most of the students I tutor do well on homework but struggle on tests and quizzes. The main reason is that the format of the test or quiz questions confuses students. This inevitably results in poor grades and undermines their confidence. Maybe you can relate? It's a cycle that is hard to overcome without help. Fortunately, there's an easy solution!

When students start working with me, we focus on solving accounting practice questions. These questions change how you think about accounting and change your approach to answering the questions you'll see on your accounting tests and quizzes. Imagine not being stressed out while taking your test! You'll become more efficient at answering these questions correctly , so you'll feel calm, and confident while taking your test.

Practice Quizzes to the Rescue!

Practice doesn't make perfect. Perfect practice makes perfect! Accounting is like math; there's a right answer, many wrong answers, and no gray area (areas for interpretation). The answer is either right or it's wrong, period. This is why most questions on Accounting tests and quizzes are multiple choice or short answer. Since this is the case, it makes sense to practice these types of questions. Additionally, it's a good idea to practice a group of questions in a timed situation. This emulates your testing environment. It forces you to become more efficient at answering these questions. Use a timer app on your phone/computer while practicing these questions. The quicker you can correctly answer these questions, the more confident you'll become and the calmer you'll be. This trains you to be calm and confident for your test or quiz!

When taking accounting practice tests or quizzes initially focus on answering the questions to the best of your ability. Don't worry about getting the right answer, focus on understanding how to solve the question . Just like your homework problems, it's important to understand the "why" behind the answer, even if you answer the question correctly.

Accounting Practice Quizzes

Below are five practice quizzes. These quizzes are a great way to practice accounting. Answering these questions efficiently will prepare you for your tests and quizzes. Click the orange text below the quiz to view the answers. Watch the video below each practice quiz to see further explanation on how to solve these accounting practice questions.

Additionally, if this information is helpful, you might consider signing up for my monthly subscription . My monthly subscription has more training videos like the ones below, a message board where you can ask me your specific questions, and discounts on one-on-one tutoring with me.

Practice Accounting Quiz 1: The Accounting Equation

- At year end, Smith Co.’s Assets totaled $46,000 and their Liabilities totaled $6,000. What is the amount of their Owner's Equity? a) $52,000 b) $20,000 c) $40,000 d) $42,000

- During the year Jan Co.’s total Assets increased by $54,000 and total Liabilities increased by $21,000. How much did Owner's Equity change? a) A $75,000 increase b) A $33,000 increase c) A $75,000 decrease d) A $33,000 decrease

- When supplies are purchased on account: a) Assets decrease and Liabilities decrease b) Assets increase and Liabilities decrease c) Assets increase and Liabilities increase d) Assets decrease and Liabilities increase

- If an owner of a company withdraws money for personal use: a) Assets decrease and Owner’s Equity decreases b) Assets increase and Owner’s Equity decrease c) Assets increase and Owner’s Equity increase d) Assets decrease and Owner’s Equity increase

- When supplies are purchased for cash: a) Assets decrease and Liabilities increase b) Assets increase and Liabilities increase c) Total Assets remain the same and Liabilities decrease d) Total Assets remain the same

- When the current months utility bill is paid: a) Assets decrease and Owner’s Equity increases b) Assets decrease and Liabilities increase c) Assets decrease and Owner’s Equity decreases d) Assets decrease and Liabilities decrease

- The following are examples of Assets: a) Cash, Equipment, and Accounts Payable b) Cash, Supplies, and Equipment c) Cash, Supplies, and Accounts Payable d) Supplies, Equipment, and Accounts Payable

- When an owner invests cash in their business: a) Assets remain the same b) Assets increase and Liabilities increase c) Assets increase and Owner’s Equity increases d) Assets decrease and Liabilities increase

- Tech Co.’s Liabilities totaled $12,000 and their Owner's Equity totaled $32,000. What is the amount of their Assets? a) $20,000 b) $34,000 c) $44,000 d) $19,000

- A company had $4,000 in Revenue and $3,000 in Expenses for a period. How will this impact the accounting equation? a) A $4,000 increase in Owner’s Equity b) A $3,000 increase in Owner’s Equity c) A $7,000 increase in Owner’s Equity d) A $1,000 increase in Owner’s Equity

- An investment in a company made by the owner is referred to as: a) Accounts Receivable b) Capital c) Drawing d) Cash

- Angela Co. received payment from a customer on account. Angela Co. should: a) Decrease Cash b) Decrease Accounts Payable c) Increase Accounts Payable d) Decrease Accounts Receivable

- A Balance Sheet shows: a) Assets and Expenses b) Revenue and Expenses c) Assets and Revenues d) Assets and Liabilities

- Slim Co. has the following account balances: Cash $25,000, Accounts Receivable $24,600, Accounts Payable $2,000, and Supplies $3,000. Based on the given information, what is the amount of their Assets & Owner’s Equity? a) $54,600 & $50,600 b) $52,600 & $52,600 c) $54,600 & $52,600 d) $52,600 & $50,600

- On November 1, 2019, Jan Co.’s Balance Sheet showed Assets of $65,000, Liabilities of $30,000, and Owner’s Equity of $35,000. Jan Co. had the following activity during November: an increase in Assets of $24,000, a decrease in Liabilities of $7,500, an owner’s cash withdrawal from the company in the amount of $10,000, and Revenues of $50,000. What were Jan Co.’s Expenses for November? a) $13,500 b) $8,500 c) $66,500 d) Not enough information given

Answers to Accounting Equation Quiz:

Watch the video below to see how I solve the questions on the Accounting Equation Quiz:

Practice Accounting Quiz 2: Debits & Credits

- The left side of an account a) Increases the account balance b) Decreases the account balance c) Is the debit side of the account d) Is the credit side of the account

- Debiting an Asset account a) Has no effect on the account balance b) Decreases the account balance c) Increases the account balance d) None of the above

- A credit is not the normal balance for which of the following accounts? a) Jim Smith, Capital b) Rent Expense c) Notes Payable d) Accounts Payable

- For all transactions, the double-entry bookkeeping system requires that the a) Total amount of debits must equal the total amount of credits b) Total number of debits must equal the total number of credits c) Total Assets must equal total Liabilities d) Total Assets must be debited because a debit is the normal balance of an Asset

- If the Accounts Payable account has debit amounts totaling $5,000 and credit amounts totaling $6,000, the Accounts Payable account balance is a) A $6,000 debit balance b) A $6,000 credit balance c) A $1,000 debit balance d) A $1,000 credit balance

- Debits are used to a) Increase Liabilities b) Decrease Expenses c) Increase Assets d) Increase Owner’s Equity

- Which of the following account types have credits as normal balances? a) Liabilities and Revenues b) Assets and Expenses c) Liabilities and Expenses d) Assets and Revenues

- To record when a customer owes you money, you should: a) Debit Accounts Payable b) Credit Accounts Payable c) Debit Accounts Receivable d) Credit Accounts Receivable

- An incomplete transaction has a debit to an Asset account for $12,000 and a credit to a Liability account for $15,000. To complete the transaction, you should: a) Debit a Liability account for $25,000 b) Debit an Asset account for $25,000 c) Debit an Asset account for $3,000 d) Credit a Liability account for $3,000

- Normal balances are stated as follows: a) Assets (DR), Liabilities (CR), Owner’s Equity (CR), Revenues (DR), & Expenses (CR) b) Assets (DR), Liabilities (CR), Owner’s Equity (CR), Revenues (CR), & Expenses (DR) c) Assets (CR), Liabilities (DR), Owner’s Equity (DR), Revenues (CR), & Expenses (DR) d) Assets (CR), Liabilities (DR), Owner’s Equity (DR), Revenues (DR), & Expenses (CR)

- Which of the following is not true? a) Debit is the left side of the account and credit is the right side of the account b) Debits increase an account balance and credits decrease an account balance c) Debit is abbreviated as DR d) Credit is abbreviated as CR

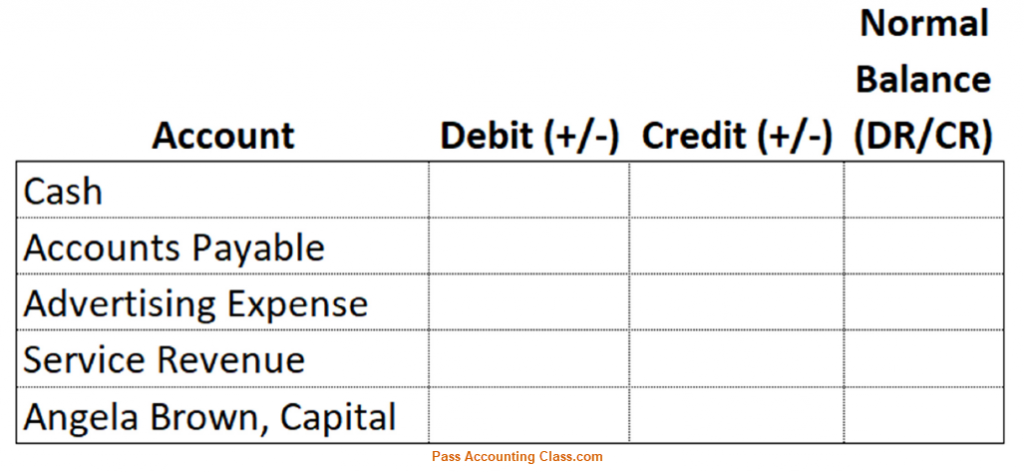

Answers to Debits & Credits Quiz:

Cash + - DR Accounts Payable - + CR Advertising Expense + - DR Service Revenue - + CR Angela Brown, Capital - + CR

Watch the video below to see how I solve the questions on the Debits & Credits Quiz:

Practice Accounting Quiz 3: Journal Entries

- When Angela Smith, the owner of Smith Co., withdrawals cash for personal use, the journal entry should a) Debit Angela Smith, Drawing and credit Angela Smith, Capital b) Debit Angela Smith, Drawing and credit Cash c) Debit Cash and credit Angela Smith, Drawing d) Debit Cash and credit Angela Smith, Capital

- A compound journal entry a) Has only one credit and one debit b) Has two debits c) Has two credits d) Affects more than one debit and/or more than on credit

- To record services performed for cash, you would a) Debit Service Revenue and credit Cash b) Debit Service Revenue and credit Accounts Receivable c) Debit Accounts Receivable and credit Cash d) Debit Cash and credit Service Revenue

- To journalize the purchase of equipment for $12,000 using a $3,000 cash down payment with the balance due in 15 days, you should a) Debit Equipment $12,000 and credit Cash $12,000 b) Debit Equipment $12,000, credit Cash $3,000, and credit Accounts Payable $9,000 c) Debit Cash $12,000, credit Equipment $3,000, and credit Accounts Payable $9,000 d) Debit Accounts Payable $12,000, credit Cash $3,000, and credit Equipment $9,000

- When a business writes a check for the current months’ advertising, the journal entry should a) Debit Cash and credit Advertising Expense b) Debit Advertising Expense and credit Cash c) Debit Advertising Expense and credit Accounts Payable d) Debit Accounts Receivable and credit Advertising Expense

- On June 30th, Jan Co. received a telephone bill for June’s phone services. This bill will be paid in July. What is the journal entry for the bill? a) Debit Telephone Expense and credit Cash b) Debit Cash and credit Telephone Expense c) Debit Telephone Expense and credit Accounts Payable d) Debit Accounts Payable and credit Telephone Expense

- Recording a journal entry for receiving payment from a credit customer on account includes a) Crediting Accounts Payable b) Debiting Accounts Payable c) Debiting Accounts Receivable d) Crediting Accounts Receivable

- List which accounts should be debited and which accounts should be credited. Use the accounts listed below. Cash, Accounts Receivable, Equipment, Accounts Payable, Chad Brown, Capital, Chad Brown, Drawing, Service Revenue, Advertising Expense, Rent Expense, & Utilities Expense a) Chad Brown contributed capital to his business. b) A credit customer paid on their account. c) Performed services for cash. d) Purchased equipment for cash. e) Issued a check to Chad Brown for personal use.

- Based on the transactions below, list which accounts should be debited and which accounts should be credited. a) Performed services for $2,000 cash b) Issued a check for $500 for new equipment c) Paid the monthly rent by issuing a check for $1,000 d) Rendered services for $1,500 on credit e) Collected $500 from a credit customer f) Wrote a $120 check for the monthly utility bill g) Paid a creditor by issuing a $600 check h) Purchased $2,000 worth of supplies on credit

Answers to Journal Entries Quiz:

A. Cash (DR), Chad Brown, Capital (CR) B. Cash (DR), Accounts Receivable (CR) C. Cash (DR), Service Revenue (CR) D. Equipment (DR), Cash (CR) E. Chad Brown, Drawing (DR), Cash (CR)

A. Cash $2,000 (DR), Service Rev. $2,000 (CR) B. Equipment $500 (DR), Cash $500 (CR) C. Rent Exp. $1,000 (DR), Cash $1,000 (CR) D. AR $1,500 (DR), Service Rev. $1,500 (CR) E. Cash $500 (DR), AR $500(CR) F. Utility Exp. $120 (DR), Cash $120 (CR) G. AP $600 (DR), Cash $600 (CR) H. Supplies $2,000 (DR), AP $2,000 (CR)

Watch the video below to see how I solve the questions on the Journal Entries Quiz:

Practice Accounting Quiz 4: T-Accounts

- On June 1st, the Cash account had a normal balance of $22,000. During June there were the following entries: a $4,000 credit, a $6,000 debit, a $5,000 credit, and a $2,000 debit. What is the account balance on June 30th? a) $23,000 debit balance b) $21,000 debit balance c) $23,000 credit balance d) $21,000 credit balance

- Kraft Co.’s Owner’s Equity was $30,000 on June 1st. During June, Kraft Co. reported $5,000 in revenue, $2,000 in expenses, and an Owner’s draw of $1,000. What is Kraft Co’s Owner’s Equity on June 30th? a) $32,000 credit balance b) $32,000 debit balance c) $28,000 credit balance d) $28,000 debit balance

- On December 1st, Angela Co.’s Accounts Payable account had a balance of $31,000. During December they had purchases on account totaling $21,000, collected from credit customers on account totaling $4,000, and made payments on account totaling $9,000. What is the Accounts Payable balance on December 31st? a) $43,000 credit balance b) $39,000 credit balance c) $43,000 debit balance d) $39,000 debit balance

- On April 1st, Jones Co.’s Accounts Receivable account had a balance of $23,000. During April they had sales on account totaling $14,000 and collected from credit customers on account totaling $8,000. What is the account balance on April 30th? a) $17,000 credit balance b) $17,000 debit balance c) $29,000 credit balance d) $29,000 debit balance

- On March 1st, Smith Co.’s supplies account totaled $3,000. During March, Smith Co. used $2,000 of supplies and purchased $4,000 in supplies. What is the supplies account balance on March 31st? a) $5,000 credit balance b) $5,000 debit balance c) $1,000 credit balance d) $1,000 debit balance

- On January 1st, Jones Co. had the following account balances: Cash 12,000; Accounts Receivable 15,000; Supplies 2,000; Prepaid Rent 0; Accounts Payable 7,000; Adam Jones, Capital 22,000; Adam Jones, Drawings 0; Sales 0; Advertising Expense 0; Rent Expense 0. During January, Jones Co. had the following transactions: a) Paid $2,500 cash for supplies. b) Received $4,000 from credit customer on their account. c) Made sales of $6,000 on account. d) Issued a check in the amount of $500 for the current months’ advertising. e) Issued a check in the amount of $4,500 for the next 3 months rent. What is the balance on January 31st for the following accounts? -Cash -Accounts Receivable -Prepaid Rent

- Create T-Accounts for the following transactions and total the account balances. All accounts start with zero balances. Use the following accounts: Cash, Accounts Receivable, Equipment, Supplies, Accounts Payable, Service Revenue, Rent Expense, & Utilities Expense a) Performed services for $20,000 cash b) Issued a check for $500 for new equipment c) Paid the monthly rent by issuing a check for $1,000 d) Rendered services for $1,500 on credit e) Collected $500 from a credit customer f) Wrote a $120 check for the monthly utility bill g) Purchased $2,000 worth of supplies on credit h) Paid a creditor by issuing a $600 check

Answers to T-Account Quiz:

Cash 8,500 (DR) Accounts Receivable 17,000 (DR) Prepaid Rent 4,500 (DR)

Cash 18,280 (DR) Accounts Receivable 1,000 (DR) Equipment 500 (DR) Supplies 2,000 (DR) Accounts Payable 1,400 (CR) Service Revenue 21,500 (CR) Rent Expense 1,000 (DR) Utilities Expense 120 (DR)

Watch the video below to see how I solve the questions on the T-Account Quiz:

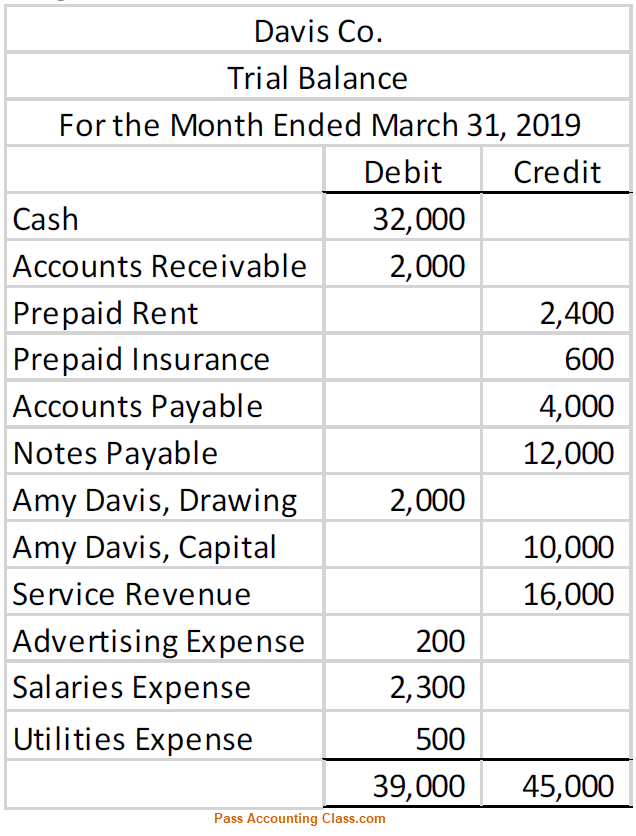

Practice Accounting Quiz 5: The Trial Balance

- Which of the following errors would you discover in the Trial Balance? a) A journal entry that’s not been posted b) A transaction that’s not been journalized c) Incorrect accounts used when journalizing a transaction d) An error transferring a debit balance to the credit column

- The following would cause the Trial Balance to be out of balance: a) Putting the Cash balance in the debit column b) Putting the Equipment balance in the debit column c) Putting the Accounts Receivable balance in the credit column d) Putting the Notes Payable balance in the credit column

- How would posting a journal entry to the wrong accounts impact the Trial Balance? a) It wouldn’t impact the Trial Balance b) Total credits would be understated and total debits would be understated c) Total credits and total debits would be properly stated and individual account balances would be correct d) Total credits and total debits would be properly stated, but individual account balances would be incorrect

Answers to Trial Balance Quiz:

Prepaid Rent and Prepaid Insurance should be Debited, not Credited.

Accounts Payable should be Credited, not Debited. Advertising, Salaries, & Utilities Expenses should be Debited, not Credited.

Total Debits = 306,000 Total Credits = 306,000

Watch the video below to see how I solve the questions on the Trial Balance Quiz:

As I'm sure you know, there is a lot of information to learn for your accounting class. My my goal is to help you pass your accounting class, so if you need help, reach out to me! I have more practice tests and practice quizzes like the ones above. The best way to learn accounting is to practice accounting! I can get you up to speed and back on track quickly. I'm available for one-on-one tutoring here , have a bunch of video training here (scroll to the bottom to see all the lesson topics), or check out some of my free videos on YouTube here .

Privacy Overview

35 Basic Accounting Test Questions

Take this short quiz to assess your knowledge of basic accounting. The 35 questions include many topics covered in a typical Accounting 101 class. Answers with explanations are at the end of the test.

Which of the following is not a core financial statement?

- The Income Statement

- Statement of Cash Flows

- The Trial Balance

- The Balance Sheet

The income statement, which presents the results of operations, can be prepared in many forms including:

- Single Step Income Statement

- Condensed Income Statement

- Common Sized Income Statement

- All of the above

Which of the following account types increase by debits in double-entry accounting?

- Assets, Expenses, Losses

- Assets, Revenue, Gains

- Expenses, Liabilities, Losses

- Gains, Expenses, Liabilities

Which of the following is true?

- Accounts receivable are found in the current asset section of a balance sheet.

- Accounts receivable increase by credits.

- Accounts receivable are generated when a customer makes payments.

- Accounts receivable become more valuable over time.

A company that uses the cash basis of accounting will:

- Record revenue when it is collected.

- Record revenue when it is earned.

- Record revenue at the same time as accounts receivable.

- Record bad debt expense on the income statement.

What are the main sections on a balance sheet?

- Assets, liabilities, income

- Assets, liabilities, equity

- Assets, liabilities, expenses

- Assets, gains, revenue

How are a company’s financial statements used?

- For internal analysis

- For external negotiation

- For compliance

Which of the following scenarios increases accounts payable?

- A customer fails to pay an invoice.

- A supplier delivers raw materials on credit.

- Office supplies are purchased with cash.

- None of the above

Which of the following must a certified public accountant (CPA) have in-depth knowledge of to pass the CPA licensing exam? (Check all that apply.)

- Accounting software packages

- Derivatives

- International banking laws

What is the result of the following transaction for Company A? Company A’s customer is unable to pay for a previous credit sale in accordance with Company A’s 90-day payment terms. The customer makes a promissory note to Company A that extends payment over a 24-month term including 5% interest.

- No result because the customer didn’t pay.

- Accounts receivable increases because of the interest.

- A note receivable is recorded in non-current assets.

- Company A records the loan as a liability.

When are liabilities recorded under the accrual basis of accounting?

- When incurred

- At the end of the fiscal year

- When bank accounts are reconciled

Which is true about time in accounting?

- Current liabilities are debts payable within 2 years.

- Balance sheets reflect a company’s financial position at a certain point in time.

- The time value of money is a finance concept, not relevant in accounting.

- Accounts receivable are more easily collected as time passes.

When a company purchases property, plant, and equipment, how is it reflected on the statement of cash flows?

- As a source of cash in the "cash from investing activities" section

- As a source of cash in the "cash from financing activities" section.

- As a use of cash in the "cash from investing activities" section.

- As a use of cash in the "cash from operating activities" section.

What would the journal entry be for a company that takes out a five-year, $100,000 business loan?

- Debit $100,000 non-current asset, Credit $100,000 non-current liabilities

- Debit $100,000 current asset, Credit $100,000 non-current liabilities

- Debit $100,000 non-current liabilities, Credit $100,000 non-current assets

- Debit $100,000 current liabilities, Credit $100,000 current assets

Which accounts are associated with cost of goods sold?

- Accrued interest

- Depreciation

Which organizations are involved in development of US Generally Accepted Accounting Principles (GAAP)? (Check all that apply.)

- Financial Accounting Standards Board (FASB)

- Government Accounting Standards Board (GASB)

- Securities and Exchange Commission (SEC)

- Federal Accounting Standards Advisory Board (FASAB)

Which inventory valuation method reflects the most current market value for inventory on hand?

- Last-in-First-Out (LIFO)

- Average Costs

- First-in-First-Out (FIFO)

- Specific Identification

Which of the following statements is not true about intercompany accounting?

- Intercompany transactions are between two units within the same legal entity.

- Intercompany transactions are eliminated in consolidated parent financial statements.

- They can significantly impact taxes.

- Intercompany transactions are between different legal entities under the same parent control.

Which is the method of depreciation used for US tax returns that is not GAAP-compliant?

- Straight-line method

- Modified accelerated cost recovery systems

- Double-declining balance method

- Units of production method

What is the most-used method to amortize intangible assets on a company’s financial statements?

- Sum of the years’ digits method

Which financial statement is a report of a company’s revenues and expenses during a certain time period?

- Statement of Changes in Equity

- Income Statement

- Statement Of Cash Flows

After making a sale of $3,000, where $1,200 is paid in cash and $1,800 is sold on credit, how would a company go about updating its balance sheet?

- $1,800 debit in accounts receivable; $3,000 credit in retained earnings; $1,200 debit in cash

- $3,000 debit in retained earnings; $1,200 credit in cash; $1,800 credit in accounts receivable

- $1,800 debit in accounts payable; $1,200 debit in cash; $3,000 credit in retained earnings

- $1,200 credit in cash; $1,800 credit in accounts payable; $3,000 debit in retained earnings

Which is not an example of financing cash flow?

- Paying off a debt of $25,000

- Investing in equipment worth $90,000

- Paying $12,000 worth of dividends to shareholders

- Issuing $42,000 worth of shares

Which side of the ledger account are debits recorded on?

- Depends on the debit

Are assets on the balance sheet recorded at their estimated fair market value?

- Sometimes; it’s situational

Increasing an asset involves crediting the account.

Unearned revenues are recorded on a company’s balance sheet under which kind of account?

- Current asset

- Owners’ or stockholders’ equity

- Non-current asset

What is the minimum number of accounts that accounting entries can have?

The listing of all the financial accounts within a company’s general ledger is called the _____.

- Chart of accounts

- Journal entry

- Balance sheet

- P&L statement

Which is not classified as a current asset?

- Product inventory

- Liquid assets

- Prepaid liabilities

Which formula is used to calculate operating income?

- Revenue + Direct Operating Cost = Operating Income

- Indirect Operating Cost - Revenue = Operating Income

- Gross Income - Operating Expenses = Operating Income

- Gross Profit - Indirect Operating Cost = Operating Income

Which of these statements about accrual accounting is true?

- Revenue is recorded only when payments are received, while expenses are recognized when they're incurred.

- All revenue from prepayments should be recognized when the payment is received, while expenses accrue over the life of the obligation.

- If the business has provided the goods or services and can reasonably expect to receive cash, it can recognize the revenue in that period.

- The matching principle dictates that expenses should be recognized when they are incurred, regardless of when revenue is recognized.

In a journal entry, a debit decreases which of the following accounts?

- Accounts Payable

- Supplies Expense

- Both a and c

Which describes the double-declining balance depreciation method?

- Estimated salvage value is greater at the end of the assets’ useful life than with straight-line depreciation.

- It yields reports of higher income in the early years and lower income later on.

- This method decreases the useful life of the asset and disposal costs by half.

- The depreciation expense is larger in the first few years and gets smaller as time goes on.

Which one of these WILL NOT yield earnings before interest and taxes (EBIT)?

- Revenue - Cost of goods sold - Operating expenses

- Net income + Tax expense + Interest expense

- Sales + Taxes + Interest

- Gross profit - Operating expenses

Answer Key With Explanations

C — Running a trial balance is an intermediary step in the financial close, not a core financial statement. Core financial statements are: the income statement, the balance sheet, statement of cash flows, statement of retained earnings and the notes to the financial statements.

D — All are correct. A single step income statement has a section for revenue and expenses and only requires one subtraction to arrive at net income/loss. A condensed income statement only includes summary totals. Common sized income statements add a column to show the calculation of each line item as a percentage of revenue.

A — Assets, expenses and losses increase with debits. Revenue, liabilities and gains increase with credits.

A — Accounts receivable is a short-term asset included in the current asset section of a balance sheet and increases by debits. They come about when customer sales are made on credit, not cash. Accounts receivable become harder to collect, and therefore less valuable, as they age.

A — Cash basis accounting records revenue when paid. Accrual accounting reflects revenue when it is earned. Accounts receivable and its related bad debt are part of accrual accounting only.

B — Assets, liabilities and equity are found on the balance sheet. Revenue (or sales), expenses, gains, losses and net income (or earnings) are income statement accounts.

D — All are correct. Financial statements are used for internal analysis, like trending and calculating key performance indicators. External negotiations, such as applying for loans and credit cards, require financials statements. Compliance agencies, such as the Securities & Exchange Commission (SEC), require financial statements from public companies.

B — When a supplier delivers raw material a liability is incurred. Customer payments relate to accounts receivable, not accounts payable. Expenses paid with cash do not generate accounts payable because the payment is made concurrent with incurring the liability.

B — The four sections of the CPA exam are Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, and Regulation. While knowledge of accounting software, derivative financial instruments and international banking law are helpful, they are not mandatory for licensure.

C — Company A records a note receivable from its customer. It is a non-current asset because the term is greater than 12 months. A non-paying customer would cause accounts receivable to be written off. Interest payments are not recorded in accounts receivable. Company A is the payee of the promissory note, not the debtor, and has no liability.

A — Under the accrual basis of accounting, liabilities are recorded in the fiscal period that they are incurred or committed, regardless of when paid.

B — Balance sheets are prepared "as of" a specified date. Current liabilities are due within the next 12 months. Time value of money, or net present value, is often used by accountants such as for lease accounting. Accounts receivable become less likely to be paid as they age.

C — Acquisitions of property, plant and equipment are uses of cash/cash equivalents and categorized as an investing activity. The operating activities section of the statement of cash flows captures the inflow/outflows from business operations, such as sales or labor expenses, rather than investments.

B — The transaction increases cash, a current asset, via a debit. It also increases loans payable, which is a non-current liability because it is due in five years, via a credit.

D — Cost of goods sold is an interim step on the income statement and is calculated as: Beginning Inventory + Purchases - Ending Inventory = Cost of Goods Sold.

A, B, C & D — All of the organizations listed are involved in development of financial accounting standards.

C — The FIFO method assumes that the oldest inventory is sold first, and inventory on hand at the end of a period is the newest. The newest purchases reflect the most current market values.

B — The IRS requires the MACRS method for most fixed assets. MACRS is not GAAP-compliant because salvage values are ignored and because it relies on an IRS-determined table of useful lives that is inconsistent with GAAP principles.

A — The straight-line method is the only GAAP-compliant method for amortizing intangible assets.

B — An income statement is a financial report that documents a company’s earnings over a specific time period — yearly, quarterly or monthly — and records the expenses and costs associated with earning that revenue.

A — $1,800 debit in accounts receivable; $3,000 credit in retained earnings; $1,200 debit in cash. Cash is classified as a current asset and therefore expected to be consumed, sold or exhausted within a year, so it’s recorded on the balance sheet as a debit when it's received. When a customer makes a payment, cash is debited. Conversely, when a customer buys something on credit, the sale is documented in accounts receivable, where all funds owed to a company are accounted for. Retained earnings are a portion of the profits earned that are not used as dividends and are often reserved for reinvesting into the business.

B — Cash flow is defined as the movement of cash in and out of a business, and cash flow from financing activities (CFF) — or cash flow financing — is a section of the cash flow statement that includes transactions involving debt, equity and dividends. The purchase of plant, property and equipment (PP&E) would fall under cash flow from investing.

A — Debits are recorded on the left side of the ledger account because they decrease equity, liability and revenue and increase expense or asset accounts.

B — Assets are recorded at their historical cost values, which means that they are documented at their original cost and time acquired.

B — Increasing an asset involves debiting the account, because assets and expenses have natural debit balances.

D — Unearned revenues are incurred when businesses or individuals receive payment for a product or service that has yet to be delivered or provided. Until the item is delivered, these types of transactions are marked as liabilities.

D — All accounting entries must contain at least two accounts: one that is debited and another that is credited.

A — A chart of accounts helps companies break down all financial transactions made during a certain period into subcategories. That enables them to gain deeper insight into the profitability and effectiveness of various products, services or business units.

E — Considering that current assets are expected to be converted to cash within a year, property, which is a long-term asset often held for multiple years, would not be classified as such.

C — Gross Income - Operating Expenses = Operating Income. A company’s operating income is, in other words, its income from core operations. Operating income is calculated by subtracting operating costs from gross income.

C — If the business has provided the goods or services and can reasonably expect to receive cash, it can recognize the revenue in that period. The accrual concept requires that revenues and costs are recognized when they are earned or incurred, rather than when they are received in cash or paid. This method tends to provide companies with better and more comprehensive insights into their profitability and overall financial health.

B — Accounts payable tracks the money businesses owe to their creditors, so when businesses begin to pay off their purchases, which are recorded as debits, the balance in accounts payable decreases.

D — The depreciation expense is larger in the first few years and gets smaller as time goes on. Double-declining balance depreciation is an accelerated depreciation method that is used to offset an asset’s increased maintenance costs with lower depreciation expenses throughout its lifetime. For example, in knowing that assets will have lower repair and maintenance expenses in their early years, companies allocate higher depreciation expenses to newer assets.

C — Sales + Taxes + Interest. Earnings before interest and taxes (EBIT) is a business’s net income before interest and taxes are deducted, and it’s often used as a measure of operating profit. There are multiple ways to calculate EBIT; no matter which you use, the metric provides a look at a company’s profitability regardless of its capital structure.

How did you do? It’s accrual world , but continue studying to become audit you can be. (Did you catch our accounting jokes there?). Accounting is a challenging field that requires years of initial education, experience and continuing professional education. Specialties within the field include managerial accounting, cost accounting, project accounting, forensic accounting, nonprofit accounting, tax accounting and financial accounting — which is the type of accounting covered by this test.

#1 Cloud Accounting Software

Accounting Basics FAQ

What are the five basic accounting principles.

There are many principles of accounting that guide the way accountants record transactions. Four accounting principles are considered basic: historical cost, revenue recognition, matching and full disclosure. When referring to "5 basic accounting principles," the fifth is objectivity.

What are basic accounting questions?

Basic accounting questions focus on topics concerning the financial statements and how transactions are recorded.

What are the basics of accounting?

Accounting basics include how to value business transactions, how to record activity in a company’s books and how to report business results using financial statements.

What is an accounting assessment test?

An accounting assessment test gauges an individual’s knowledge of basic accounting information, often used to screen potential candidates for bookkeeping and lower-level accounting jobs.

21 Sales KPIs for Sales Teams to Track in 2021

High-performing sales teams use data as the foundation for their success. Whether looking to increase sales, maximize profit, grow the sales team or beat the competition…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

Journal Entry Problems and Solutions

Click here to download journal entry problems and solutions.

Previous Lesson: Accounting Variation Proforma Problems and Solutions

Next Lesson: General Ledger Practice Questions

On April 01, 2016 Anees started business with Rs. 100,000 and other transactions for the month are:

2. Purchase Furniture for Cash Rs. 7,000.

8. Purchase Goods for Cash Rs. 2,000 and for Credit Rs. 1,000 from Khalid Retail Store.

14. Sold Goods to Khan Brothers Rs. 12,000 and Cash Sales Rs. 5,000.

18. Owner withdrew of worth Rs. 2,000 for personal use.

22. Paid Khalid Retail Store Rs. 500.

26. Received Rs. 10,000 from Khan Brothers.

30. Paid Salaries Expense Rs. 2,000

Click Here To Download Journal Entry Problems

Journal Entry Format Download

>> Read explanation and examples of Journal Entry …

Problems 2:

Prepare general journal entries for the following transactions of a business called Pose for Pics in 2016:

Aug. 1: Hashim Khan, the owner, invested Rs. 57,500 cash and Rs. 32,500 of photography equipment in the business.

04: Paid Rs. 3,000 cash for an insurance policy covering the next 24 months.

07: Services are performed and clients are billed for Rs. 10,000.

13: Purchased office supplies for Rs. 1,400. Cash paid Rs. 400 and remaining outstanding.

20: Received Rs. 2,000 cash in photography fees earned previously.

24: The client immediately pays Rs. 15,000 for services to be performed at a later date.

29: In addition, the business acquires photography equipment. The purchase price is Rs. 100,000, pays Rs. 25,000 cash and signs a note for the balance.

>> Understanding Chart of Accounts is required…

On March 2017, Farhan Rahim, starts wholesaling business. Following transactions as follows:

1. He started business with capital of Rs. 15,000 and Land worth Rs. 10,000.

8. Bought goods from Bilal and Friends Rs. 1,000 and by cash from XYZ Co. Rs 2,000.

13. However , sold goods to Rehman & sons Rs. 1,500 and sale by cash Rs. 5,000.

17. Gave away charity of cash Rs. 50 and merchandising worth Rs. 30.

21. Paid Bilal and Friends cash Rs. 975; discount received Rs. 25.

28. Received cash from Rehman & Sons Rs. 1,450; allowed him discount of Rs. 50.

Journal Entry Format Download

>> More reading Normal Balance …

Shah Sauood Marine is a boat repair yard. During August 2016, its transactions included the following:

03. Loan taken from Habib Bank Ltd. of Rs. 25,000. Rs. 20,000 withdrawn for business and remaining in the bank a/c.

06. Paid rent for the month of August Rs. 4,400 and accrued rent expenses was Rs. 600.

12. At request of Kiwi Insurance, Inc, made repairs on boat of Jon Seaways. Sent bill for Rs. 5,620 for services rendered to Kiwi Insurance Inc. (credit Repair Service Revenue).

18. Made repairs to boat of Dennis Copper and collected in full the charge of Rs. 2,830.

20. After that , placed Advertisement in The Dawn of Rs. 165, payment to be made within 30 days.

25 . Received a check for 5,620 from Kiwi Insurance Inc representing collection of the receivable of August 12.

30. Sent check to The Dawn in payment of the liability incurred on August 20.

>> Golden Rules of Accounting …

Problems 5:

1 st January, 2017 , Saeed Ahmad started business other transactions for the month of June as follows:

02. Purchased from Kareem goods of list price of Rs. 6,000 subject to 10% trade discount by cash.

04. Sold goods to Din Muhammad Rs. 800 and cash sales of Rs. 200.

10. Distributed goods worth Rs. 200 as free samples and goods taken away by the proprietor for personal use Rs. 100.

12. Received discount Rs 20 and Commission Rs 500.

17. Goods returned by Din Muhammad Rs. 200 and payment other outstanding amount.

24. Furniture lost by fire of worth Rs. 500.

30. Bad Debts during the period was Rs.100.

>> See more Journal Entry Examples …

Related Questions

Journal Entry

Journal Entry MCQs

Journal Entry Examples

Journal Entry Questions

Journal Entry Format

Related Problems

Journal Entry Exam Questions

Journal Entry Proforma Exercises

Journal Entry Problems PDF

Golden Rule of Accounts

Accounting Variation Proforma

Related Exams

Principles of Accounting

Accounting MCQs

Accounting Problems

Accounting Papers

Accounting Workbook

Ramchandran, N., & Kakani, R. K. (2007). Financial Accounting for Management. (2nd, Ed.) New Delhi: Tata McGraw Hill.

Sehgal, A., & Sehgal, D. (n.d.). Advanced Accountancy (Vol. I & II). New Delhi: Taxmann Publication Pvt. Ltd.

Shukla, M. C., Grewal, T. S., & Gupta, S. C. (2008). Advanced Accountancy (Vol. I & II). New Delhi: S Chand & Co.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2012). Accounting Principles (10th ed.). Hoboken: John Wiley & Sons, Inc.

Williams, M., & Bettner, H. (1999). Accounting (The basic for business decisions). (11th, Ed.) USA: Irwin McGraw- Hill.

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Submit Comment

Oblivious Investor

Low-Maintenance Investing with Index Funds and ETFs

- 2024 Tax Brackets

- 2023 Tax Brackets

- How Are S-Corps Taxed?

- How to Calculate Self-Employment Tax

- LLC vs. S-Corp vs. C-Corp

- SEP vs. SIMPLE vs. Solo 401(k)

- How to Calculate Amortization Expense

- How to Calculate Cost of Goods Sold

- How to Calculate Depreciation Expense

- Contribution Margin Formula

- Direct Costs vs. Indirect Costs

- 401k Rollover to IRA: How, Why, and Where

- What’s Your Funded Ratio?

- Why Invest in Index Funds?

- 8 Simple Portfolios

- How is Social Security Calculated?

- How Social Security Benefits Are Taxed

- When to Claim Social Security

- Social Security Strategies for Married Couples

- Deduction Bunching

- Donor-Advised Funds: What’s the Point?

- Qualified Charitable Distributions (QCDs)

Get new articles by email:

Oblivious Investor offers a free newsletter providing tips on low-maintenance investing, tax planning, and retirement planning.

Join over 20,000 email subscribers:

Articles are published every Monday. You can unsubscribe at any time.

Example Accounting Problems

These sample problems are intended as a supplement to my book Accounting Made Simple: Accounting Explained in 100 Pages or Less .

Chapter 1: The Accounting Equation

Question 1: Define the three components of the Accounting Equation.

Question 2: If a business owns a piece of real estate worth $250,000, and they owe $180,000 on a loan for that real estate, what is owners’ equity in the property?

Answer to Question 1:

- Assets: All the property owned by a business.

- Liabilities: A company’s outstanding debts.

- Owners’ Equity: The company’s ownership interests in its property after all debts have been repaid.

Answer to Question 2: $70,000

Chapter 2: The Balance Sheet

Question 1: Categorize the following accounts as to whether they’re Asset, Liability, of Owners’ Equity accounts.

- Common Stock

- Accounts Receivable

- Retained Earnings

- Notes Payable

Question 2: For each of the following assets or liabilities, state whether it is current or non-current:

- Accounts Payable

- Property, Plant, and Equipment

- Note Payable

- Common Stock: Owners’ Equity

- Accounts Receivable: Asset

- Retained Earnings: Owners’ Equity

- Cash: Asset

- Notes Payable: Liability

Answer to Question 2:

- Accounts Payable: current liability

- Cash: current asset

- Property, Plant, and Equipment: non-current asset

- Note Payable: non-current liability (Though if a portion of the note is due within the next twelve months, that portion should be shown as a current liability.)

- Inventory: current asset

Chapter 3: The Income Statement

Question 1: Given the following information, calculate ABC Corp’s Net Income:

- Sales: $260,000

- Cost of Goods Sold: $100,000

- Salaries and Wages: $20,000

- Rent Expense: $15,000

- Advertising Expense: $35,000

- Cost of repairs resulting from fire: $50,000

Question 2: Using the above information, calculate ABC Corp’s Operating Income.

Question 3: Using the above information, calculate ABC Corp’s Gross Profit.

Answer to Question 1: $40,000 (Sales of $260,000 minus $220,000 of total expenses.)

Answer to Question 2: $90,000 (Operating Income is intended to represent income from typical business operations. As a result, expenses resulting from a fire would certainly not be included when calculating Operating Income.)

Answer to Question 3: $160,000 (Sales minus Cost of Goods Sold)

Chapter 4: The Statement of Retained Earnings

Question 1: Using the following information, calculate the ending balance in Retained Earnings:

- Beginning Retained Earnings: $10,000

- Net Income: $5,000

- Dividends Paid: $4,000

Question 2: Calculate Net Income given the following information:

- Consulting Revenue: $50,000

- Rent Expense: $5,000

- Software Licensing Fees: $3,000

- Dividends Paid: $6,000

- Advertising Expense:$20,000

Question 3: Using the following information, calculate how much was paid out in dividends during the year:

- Beginning Retained Earnings: $40,000

- Net Income: $15,000

- Ending Retained Earnings: $30,000

Answer to Question 1: $11,000

Answer to Question 2: $22,000 (Remember, dividends are not an expense! They are a distribution of net income rather than a reduction of net income.)

Answer to Question 3: $25,000

Chapter 5: The Cash Flow Statement

Question 1: Calculate cash flow from operating activities using the following information:

- Cash sales: $10,000

- Credit sales: $15,000

- Cash received from prior credit sales: $8,000

- Rent paid: $3,000

- Inventory purchased: $6,000

- Wages paid:$5,000

Question 2: Categorize the following cash flows as to whether they are operating, investing, or financing activities:

- Dividends paid to shareholders

- Interest paid on loans

- Dividends received on investments

- Purchase of new office furniture

Answer to Question 1: Net cash inflow of $4,000. (Remember not to include the $15,000 of credit sales when calculating cash flow.)

- Taxes paid: Operating Activities

- Dividends paid to shareholders: Financing Activities

- Interest paid on loans: Operating Activities (Note: Principal paid on loans is a financing activity.)

- Dividends received on investments: Operating Activities

- Cash sales: Operating Activities

- Purchase of new office furniture: Investing Activities

Chapter 6: Financial Ratios

Questions 1-3: Use the following income statement and balance sheet to answer the following questions.

Question 1: Calculate the company’s current ratio and quick ratio.

Question 2: Calculate the company’s return on assets and return on equity.

Question 3: Calculate the company’s debt ratio and debt to equity ratio.

Answer to Question 1: Current ratio = 1.5 (30,000 current assets ÷ 20,000 current liabilities). Quick ratio = 0.75 (15,000 non-inventory current assets ÷ 20,000 current liabilities).

Answer to Question 2: Return on assets = 21.4% (60,000 net income ÷ 280,000 total assets). Return on equity = 27.3% (60,000 net income ÷ 220,000 shareholders’ equity)

Answer to Question 3: Debt ratio = 21.4% (60,000 liabilities ÷ 280,000 assets). Debt to equity ratio = 27.3% (60,000 liabilities ÷ 220,000 shareholders’ equity).

Chapter 7: What is GAAP?

Question 1: Who is required to follow GAAP?

Question 2: Who creates the rules for GAAP?

Question 3: What is the purpose of Generally Accepted Accounting Principles (GAAP)?

Answer to Question 1: Publicly-traded companies. (Governmental entities are required to follow GAAP as well, but the rules that make up GAAP for governmental entities are significantly different from the rules for publicly-traded companies.)

Answer to Question 2: The Financial Accounting Standards Board (FASB)

Answer to Question 3: To purpose of GAAP is to ensure that companies’ financial statements are prepared using a similar set of rules and assumptions. This helps to enable meaningful comparisons between the financial statements of multiple companies.

Chapter 8: Debits and Credits

Questions 1-3: Show how the following transactions would affect the Accounting Equation

Question 1: James purchases a $5,000 piece of equipment.

Question 2: James writes his monthly check for rent: $3,000.

Question 3: James takes out a $25,000 loan with his bank.

Questions 4-6: Create journal entries to record the following transactions

Question 4: James purchases a $5,000 piece of equipment.

Question 5: James writes his monthly check for rent: $3,000.

Question 6: James takes out a $25,000 loan with his bank.

Answer to Question 3:

Answer to Question 4:

Answer to Question 5:

Answer to Question 6:

Chapter 9: Cash vs. Accrual

Questions 1-5: Prepare journal entries to record each of the following events.

Question 1: Tom’s Tax Prep’s monthly rent is $3,500. At the end of February, they had not yet received their monthly rent invoice.

Question 2: In early March, Tom’s Tax Prep receives and pays their rent bill for February.

Question 3: Marla, a marketing consultant, performs services for a client. The agree-upon price was $10,000, due 30 days from the date the services were completed.

Question 4: ABC Hardware makes a sale (on credit) for $2,500 worth of lumber. The lumber originally cost them $1,300.

Question 5: Julie takes out a $10,000 loan for her business. Repayment is due in one year along with $1,200 interest.

When the loan is taken out:

At the end of each month during the year:

When the loan is repaid:

Chapter 10: The Accounting Close Process

Prepare closing journal entries for Mario’s Mobile Products, which has the following end-of-year trial balance:

Alternatively, the above can be combined into one journal entry:

In either case, the following closing journal entry is also required in order to close out the Income Summary account and transfer the balance — representing the business’s net income for the period — into Retained Earnings:

Chapter 11: Other GAAP Concepts and Assumptions

Question 1: Andy runs a real estate development firm. Five years ago, he purchased a piece of land for $250,000. This year, an appraiser tells Andy that the land is worth $300,000. At what value should Andy report the land on his balance sheet? Why?

Question 2: Andy is the sole owner of his firm. In June, he moves $30,000 from his business checking account to his personal checking account. If Andy wants his financial records to be in accordance with GAAP, should he record the transaction or not? Why?

Answer to Question 1: Andy should report the land at its original cost: $250,000. Under GAAP’s “Historical Cost” assumption, assets are reported at their historical cost rather than at their current market value. This is done in order to remove subjective asset valuations from the reporting process.

Answer to Question 2: Yes, in order to be in compliance with GAAP, Andy must record the transaction. GAAP’s “Entity Assumption” considers businesses to be separate entities from their owners. As such, transactions between a business and its owners must be recorded as if they were between the business and an entirely separate party.

Chapter 12: Depreciation of Fixed Assets

Questions 1-6: Prepare journal entries to record each of the following events:

Question 1: Liliana spends $20,000 (cash) on a piece of equipment for use in her restaurant. She plans to use the straight-line method to depreciate the equipment over 5 years. She expects it to have no value at the end of the 5 years.

Question 2: After 4 years, Liliana sells the equipment for $4,000.

Question 3: Same as question 2, except she sells the equipment for $6,000.

Question 4: Same as question 2, except she sells the equipment for $2,000.

Question 5: Oscar is a self-employed electrician. He purchases a piece of equipment for $30,000 cash. He plans to use it for 10 years, at which point he plans to sell it for approximately $4,000.He elects to use the straight-line method of depreciation.

Question 6: Sandra runs a business making embroidered linens for wedding receptions. She purchases a new piece of equipment for $15,000 in credit. She plans to use the units of production method of depreciation. The equipment is expected to produce approximately 5,000 linens, at which point it will be valueless. During the first year after buying the equipment, Sandra uses it to produce 1,500 linens.

To record the purchase:

To record depreciation every year:

(Depreciable value is $26,000. If depreciated over 10 years, that’s $2,600 depreciation per year.)

When the purchase is eventually paid for:

To record depreciation for the first year:

($15,000 depreciable value ÷ 5,000 units = $3 of depreciation per unit. 1,500 units produce x $3 per unit = $4,500 depreciation expense.)

Chapter 13: Amortization of Intangible Assets

Questions 1-2: Prepare journal entries to record each of the following events.

Question 1: Trent runs a business as an engineering consultant. He invents a new system for preparing bridges to deal with extreme weather conditions. He spends $28,000 securing a 14-year patent for his invention. He expects the system to be used for the next few decades at least.

Question 2: Tina runs a business creating medical supplies for surgeries. Her team develops a new tool for assisting in heart surgery. She spends $42,000 on getting it patented. She receives a 14-year patent, but she only expects the technology to be used for about 7 years before a newer technology comes along to replace it.

To record receiving the patent:

To record amortization expense each year:

Chapter 14: Inventory and Cost of Goods Sold

Question 1: Using the following information, calculate Cost of Goods Sold:

- Beginning Inventory: $3,000

- Ending Inventory: $4,500

- Purchases: $6,000

Question 2-4: Use the following information to answer questions 2-4.

- Beginning Inventory: 1,000 units at $4/unit.

- Purchases: 600 units at $5/unit.

- Ending Inventory: 900 units.

Question 2: Calculate Cost of Goods Sold using First-In-First-Out (FIFO)

Question 3: Calculate Cost of Goods Sold using Last-In-First-Out (LIFO)

Question 4: Calculate Cost of Goods Sold using the Average Cost Method

Answer to Question 1: CoGS = $4,500

Answer to Question 2: CoGS = $2,800

Explanation:

The first thing to calculate is how many units were sold. In this case, 700 units must have been sold. Now we just have to figure out the cost for each unit of sold inventory.

Using FIFO, we assume that the first units purchased were the first units sold. Therefore, all 700 sold units must have been from the older ($4 per unit) inventory. 700 units x $4 per unit = $2,800

Answer to Question 3: CoGS =$3,400

Again, we know that 700 units were sold. Under LIFO, we assume that the most recently purchased units are sold first. Therefore, all 600 of the $5 units must have been sold. The remaining 100 sold units must have been from the older ($4/unit) inventory.

(600 units x $5 per unit) + (100 units x $4 per unit) = $3,400

Answer to Question 4: CoGS =$3,062.50

Using the Average Cost Method, we have to calculate the average cost per unit of inventory. We know that there were a total of 1,600 units available for sale and that–in total–they cost $7,000. That gives us an average cost per unit of $4.38 (or $4.375 to be precise).

To calculate CoGS, we multiply this average cost per unit by the number of units sold. 700 units x $4.375 per unit = $3,062.50

To Learn More, Check Out the Book:

- How to read and prepare financial statements

- Preparing journal entries with debits and credits

- Cash method vs. accrual method

- Click here to see the full list .

- Read other reviews on Amazon

Click here to read more, or enter your email address in the blue form to the left to receive free updates.

Recommended Reading

Accounting Made Simple: Accounting and Bookkeeping Explained in 100 Pages or Less See it on Amazon Read customer reviews on Amazon

My Latest Books

After the Death of Your Spouse: Next Financial Steps for Surviving Spouses See it on Amazon

More than Enough: A Brief Guide to the Questions That Arise After Realizing You Have More Than You Need See it on Amazon

Adjusting Entries

Easy practice test, financial accounting, key things to know, practice as you learn, on your test, quick study sheet, medium practice test, hard practice test.

Click the “Check Your Answer” box below each problem to reveal the correct answer and explanation.

1. An adjusting journal entry will

a. never include the cash account b. be made at the end of the accounting period c. will always adjust an income statement and a balance sheet account d. all of the above

Check Your Answer

D. Adjusting journal entries are required when cash is paid in a different period that a revenue is earned or an expense is incurred. Since cash is paid/received in a different period, the adjusting entry never includes the cash account. Adjusting entries are made at the end of the period to record economic events that occurred this period and have not been recorded. The adjustment will never include both a revenue and an expense and therefore must adjust an income statement account and a balance sheet account. If you earned something, you exchanged it for an asset it or unearned revenue decreased. If you incurred something you owe for it.

2. An adjustment that credits wages payable will also

a. decrease net income b. increase net income c. decrease an expense d. decrease the liability when the expense is recorded

A. A credit to wages payable is an increase. You owe your employees more when they have worked for you, which is an increase in an expense (debit). An increase in expenses is a decrease to net income.

3. An adjustment that debits interest receivable will also

a. decrease net income b. increase net income c. decrease an expense d. increase an expense

B. A debit to interest receivable is an increase. This means the company is owed something for earning, which is a revenue (credit). Revenues increase net income. Receivables are related to revenues; payables are related to expenses.

4. Depreciation expense is recorded to reflect

a. the change in fair market value of the asset b. the appraised value of the asset c. the cost of using the asset during this period d. the exact wear and tear on the asset

C. Depreciation expense is the cost of using a long-term asset during this period. It has no relationship to fair market or appraised value. It often represents the replacement cost of the wear and tear that has occurred as the asset is used, but this is not the purpose of recording depreciation expense (some assets like buildings actually appreciate as they are used).

5. Wages earned and not yet paid should be recorded

a. as an expense in the period earned by the employee b. as a revenue in the period earned c. as an expense in the period paid d. as a revenue in the period paid

A. Wages earned by employees is an expense to the company. The expense has not yet been recorded since it was not paid. Since it was not paid (c.) can not be correct. Wages are earned by employees and not earned by the company so this is not revenue (b. & d.).

6. A company adjusting for the use of a long-term asset will

a. debit accumulated depreciation expense and credit the asset b. debit depreciation expense and credit the asset c. debit depreciation expense and credit accumulated depreciation d. debit accumulated depreciation and credit depreciation expense

C. The use of a long-term asset is recorded as depreciation expense. Expenses increase with a debit. The credit always used with depreciation expense is accumulated depreciation.

7. The adjusting entry that is made when the company has notes payable is

a. debit interest expense and credit notes payable b. debit interest revenue and credit interest payable c. debit interest expense and credit interest payable d. credit interest revenue and debit interest receivable

C. A note payable always carries interest. As time goes by interest is incurred and this must be recorded with an adjusting entry. Interest incurred is an expense. The expense is the company’s cost of being provided the service using the money. Interest incurred that has not been paid is a liability (interest payable, credit).

8. Payments made prior to the company incurring an expense are recorded to

a. accrued expenses b. unearned revenues c. prepaid expenses d. depreciation expense

C. This is the definition of a prepaid expense. (a. & b.) are liabilities. Depreciation expense is not paid.

9. Which of the following is not an adjusting journal entry?

a. debit cash, credit interest revenue b. debit depreciation expense, credit accumulated depreciation c. debit interest expense, credit interest payable d. debit bad debt expense, credit allowance for uncollectible accounts

A. Adjusting entries never use the account cash. (b.) is recording the use of a long- term asset. (c.) is recording interest incurred and not yet paid. (d.) is recording an estimate of the amount customers will not pay.

10. Which of the following will never be an adjusting journal entry?

a. interest expense interest revenue b. interest expense interest payable c. interest receivable interest revenue d. all of the above are adjusting journal entries

A. Adjusting entries do not use a revenue and an expense in the same entry. The company can not provide and be provided at the same time. Adjusting entries always use a balance sheet account and an income statement account. Adjusting entries adjust revenues or expenses and do not have both in the same adjusting entry.

11. Prepare adjusting journal entries using the following information pertaining to the company on December 31 st , the company’s year end. Adjustments are made annually.

a. The “prepaid rent” account contains a balance of $6,000 representing payment made on October 1 st of the current year for six months rent for a warehouse. b. The company borrowed $50,000 at a 6% interest rate on August 1 st of the current year. No interest was paid during this year. c. The company received $12,000 on August 1 st of the current year for the use of a portion of its parking lot from a neighboring business for one year and recorded it all to “unearned rent revenue”. d. Services provided to clients during December in the amount of $3,000 were recorded as accounts receivable and revenue. e. The beginning balance in the supplies account was $150. Supplies purchased during the year, recorded to the “supplies” account, totaled $2,400. Supplies costing $1,500 remained on hand at year-end.

a. The “prepaid rent” account contains a balance of $6,000 representing payment made on October 1st of the current year for six months rent for a warehouse.

Adjust the account the company has already recorded – “prepaid rent”

The prepaid rent account balance must be equal to the amount of future benefit on December 31st. The cost per month is $6,000 / 6 months = $1,000 per month.

As of December 31st, the company has 3 months of future benefit (Jan – Mar of next year). 3 months of benefit was used up as time passed (October to December).

To get the prepaid account balance of $6,000 to the $3,000 future benefit as of 12/31 it must be decreased by $3,000. Assets are decreased with a debit.

Rent Expense 3,000 Prepaid Rent 3,000

The use of the asset is also an expense that must be recorded. Expenses increase with a debit. The $3,000 rent expense is 3 months used up this period (October to December)

b. The company borrowed $50,000 at a 6% interest rate on August 1st of the current year. No interest was paid during this year.

Borrowing money and agreeing to pay interest causes interest expense to be incurred as time passes. The amount of interest incurred this period is calculated by

principle x rate x time

50,000 x .06 x 5 / 12 months out of the year = $1,250

Interest Expense 1,250 Interest Payable 1,250

A liability must also be recorded since interest has not yet been paid on 12/31 and is owed. Liabilities increase with a credit.

c. The company received $12,000 on August 1st of the current year for the use of a portion of its parking lot from a neighboring business for one year and recorded it all to “unearned rent revenue”.

Adjust the account that the company already used – “unearned rent revenue”. The company has provided service as of 12/31 and revenue must be recorded for the amount earned. Unearned revenue is decreased for the same amount. The amount earned is calculated by:

$12,000 / 12 months = $1,000 x 5 months provided = $5,000 earned

Unearned Revenue 5,000 Rent Revenue 5,000

The amount earned was originally put in unearned revenue and since it is no longer owed, unearned revenue must also be reduced.

Unearned revenue is now $7,000 (12,000 original – 5,000 adjust) representing the 7 months the customer has paid for prior to use. This is the amount still owed on 12/31.

d. Services provided to clients during December in the amount of $3,000 were recorded as accounts receivable and revenue.

No adjustment is required. The services were provided and recorded as revenue in the same period.

An adjustment is required when revenue is earned and not recorded or when too much revenue has been recorded and some of it was not earned this period.

e. The beginning balance in the supplies account was $150. Supplies purchased during the year, recorded to the “supplies” account, totaled $2,400. Supplies costing $1,500 remained on hand at year-end.

First – record what is currently in the supplies accounts. The company recorded the purchase of supplies as an asset assuming they would not be used this period. If some are used an adjustment must be made to show the asset used, which is supplies expense.

The asset supplies is what the company has. The company really has 1,500 so the balance in supplies must be 1,500. To get supplies to 1,500 you must decrease it by 1,050 which is done with a credit.

Supplies Expense 1,050 Supplies 1,050

When supplies are used up, this is an expense. You must also increase the expense with a debit.

12. Prepare adjusting journal entries from the following information pertaining to a company on December 31st, the company’s year end. Adjustments are made annually.

a. The “rent revenue” account contains a balance of $10,000, representing payment received on August 1st of the current year for 6 months use of the warehouse.

b. The company borrowed $75,000 at a 6% interest rate on March 1st of the prior year. No interest was paid during this year.

c. The company loaned $100,000 to another company on November 1st of the current year. The note carries interest of 12%. No cash has been exchanged for interest.

d. Services provided to clients during December, in the amount of $3,000 has not been recorded. The customer is expected to pay in January.

e. Supplies purchased during the year, recorded to the “supplies expense” account totaled $2,400. Supplies costing $1,500 remained on hand at year-end. The beginning balance of the “supplies” account was $1,600. Supplied purchased during the year and recorded to the “supplies” account was $1,200.

a. The “rent revenue” account contains a balance of $10,000, representing payment received on August 1st of the current year for 6 months use of the warehouse.

You must adjust the revenue account to what has been earned this period, not what is collected.

First determine how much is earned per month. Only amounts earned this period can be in the revenue account.

$10,000 / 6 = $1,666.67 is earned per month x 5 months = $8,333 total earned

To get the revenue account current balance of 10,000 to 8,333 you must decrease it by 1,667. Decrease a revenue with a debit

Rent Revenue 1,667 Unearned Rent Revenue 1,667

Revenue that is not earned yet is unearned revenue. This liability must also be recorded with a credit.

This is a note payable and the company incurs interest as time passes. This has not yet been recorded since no payment is made.

Principle x Rate x Time

$75,000 x .06 x 12/12 (Jan to Dec) = $4,500 incurred, not yet paid

Important: You record the amount earned this year only . You have used the money for the entire year this year. The adjustment made last year would be for the partial year amount. You are adjusting for this year, not last year and not both years, since you already made last years adjustment last year.

Interest Expense 4,500 Interest Payable 4,500

This is a notes receivable which means the company loaned money in return for earning interest. The company earns interest as time passes. Interest has not yet been collected so nothing related to interest has been recorded. Interest has been earned and is owned to the company.

Principle x Rate x Time

$100,000 x 12% x 2/12 (Nov to Dec) = $2,000 amount earned, not yet collected.

Interest Receivable 2,000 Interest Revenue 2,000

Services were provided this period, so revenue must be recorded this period. The customer owes the company and a receivable must be recorded this period.

Accounts Receivable 3,000 Service Revenue 3,000

First – record what is currently in the two accounts. The company recorded the purchase of supplies as an asset when they assumed it would not be used this period and to supplies expense for those assumed to be used this period. If some are used an adjustment must be made to show the asset used and which is also an expense.

The asset supplies is what the company has. The company really has 1,500 so the balance in supplies must be 1,500. To get supplies to 1,500 you must decrease it by 1,300 which is done with a credit.

Supplies Expense 1,300 Supplies 1,300

Supplies that are no longer on hand have been used up which is an expense (increased with a debit).

13. Prepare adjusting journal entries from the following information pertaining to a company on December 31st, the company’s year end. Adjustments are made annually.

a. The company recorded $6,000 to rent expense when payment was made on October 1st of the current year for six months of rent for a warehouse.

b. The company borrowed $50,000, at a 6% interest rate on August 1st of the current year. Accrued interest is paid on September 30th and June 30th.

c. The company received $8,000 on August 1st of the current year for the use of a portion of its parking lot from a neighboring business for one year and recorded it all to “rent revenue”.

d. Equipment that cost $75,000 and has a useful life of 10 years was used to produce revenues the entire year.

e. Equipment that cost $75,000 and has a useful life of 10 years was used to produced revenues for the first five months of the year.

f. The company estimated that $2,000 would not be collected from customers for current period sales.

a. The company recorded $12,000 to rent expense when payment was received on September 1st of the current year for six months of rent for a warehouse.

Adjust what is currently recorded to “rent expense”

The company recorded the entire payment to expense which means all of the rent was incurred which is not true on 12/31. The rent expense account must equal the rent incurred for this period only.

$12,000 / 6 months = $2,000 per month incurred x 4 months = $8,000 incurred (used)

If $8,000 was incurred, then $8,000 must be the balance in the rent expense account.

To get the current rent expense balance of $12,000 to $8,000 it must be decreased (credit) by $4,000.

Prepaid Rent 4,000 Rent Expense 4,000

The rent that was paid for and is not yet incurred is a prepaid. The prepaid must be increased with a debit. The company has 2 months paid ahead left. (2 x 2,000 = 4,000)

This is a note payable and the company incurs interest as time passes. The amount not yet recorded is the amount not yet paid.

$50,000 x 6% x 3/12 (Oct to Dec) = $750 incurred and not yet paid