- Search Search Please fill out this field.

- Small Business

- How to Start a Business

Business Startup Costs: It’s in the Details

:max_bytes(150000):strip_icc():format(webp)/TimothyLi-picture1-4fb5c746f503451bacfee414a08f5c1f.jpg)

There's more to a business than furnishings and office space. Especially in the early stages, startup costs require careful planning and meticulous accounting. Many new businesses neglect this process , relying instead on a flood of customers to keep the operation afloat, usually with abysmal results.

Key Takeaways

- Startup costs are the expenses incurred during the process of creating a new business.

- Pre-opening startup costs include a business plan, research expenses, borrowing costs, and expenses for technology.

- Post-opening startup costs include advertising, promotion, and employee expenses.

- Different types of business structures—like sole proprietorships, partnerships, and corporations—have different startup costs, so be aware of the different costs associated with your new business.

Startup costs are the expenses incurred during the process of creating a new business. All businesses are different, so they require different types of startup costs. Online businesses have different needs than brick-and-mortars ; coffee shops have different requirements than bookstores. However, a few expenses are common to most business types.

Understanding Common Business Startup Costs

The business plan.

Essential to the startup effort is creating a business plan —a detailed map of the new business. A business plan forces consideration of the different startup costs. Underestimating expenses falsely increases expected net profit, a situation that does not bode well for any small business owner.

Research Expenses

Careful research of the industry and consumer makeup must be conducted before starting a business. Some business owners choose to hire market research firms to aid them in the assessment process.

For business owners who choose to follow this route, the expense of hiring these experts must be included in the business plan.

Borrowing Costs

Starting up any kind of business requires an infusion of capital. There are two ways to acquire capital for a business: equity financing and debt financing. Usually, equity financing entails the issuance of stock, but this does not apply to most small businesses, which are proprietorships.

For small business owners, the most likely source of financing is debt in the form of a small business loan . Business owners can often get loans from banks, savings institutions, and the U.S. Small Business Administration (SBA). Like any other loan, SBA business loans are accompanied by interest payments. These payments must be planned for when starting a business, as the cost of default is very high.

Insurance, License, and Permit Fees

Many businesses are expected to submit to health inspections and authorizations to obtain certain business licenses and permits. Some businesses might require basic licenses while others need industry-specific permits.

Carrying insurance to cover your employees, customers, business assets, and yourself can help protect your personal assets from any liabilities that may arise.

Technological Expenses

Technological expenses include the cost of a website, information systems, and software, including accounting and point of sale (POS) software , for a business. Some small business owners choose to outsource these functions to other companies to save on payroll and benefits.

Equipment and Supplies

Every business requires some form of equipment and basic supplies. Before adding equipment expenses to the list of startup costs, a decision has to be made to lease or buy.

The state of your finances will play a major part in this decision. Even if you have enough money to buy equipment, unavoidable expenses may make leasing, with the intention to buy at a later date, a viable option. However, it is important to remember that, regardless of the cash position , a lease may not always be best, depending upon the type of equipment and terms of the lease.

Advertising and Promotion

A new company or startup business is unlikely to succeed without promoting itself. However, promoting a business entails much more than placing ads in a local newspaper.

It also includes marketing —everything a company does to attract clients to the business. Marketing has become such a science that any advantage is beneficial, so external dedicated marketing companies are most often hired.

Employee Expenses

Businesses planning to hire employees must plan for wages, salaries, and benefits, also known as the cost of labor .

Failure to compensate employees adequately can end in low morale, mutiny, and bad publicity, all of which can be disastrous to a company.

Additional Startup Cost Considerations

Have some extra money set aside for any overlooked or unexpected expenses. Most companies fail because they lack the cash to deal with unexpected problems during the business season.

It is important to note that the startup costs for a sole proprietorship differ from the startup costs for a partnership or corporation. Some additional costs a partnership might incur include the legal cost of drafting a partnership agreement and state registration fees.

Other costs that may apply more to a corporation include fees for filing articles of incorporation, bylaws, and terms of original stock certificates.

Launching a new business can be invigorating. However, getting caught up in the excitement and neglecting the details can lead to failure. Above anything else, observe and consult with others who have traveled this road before—you never know where you might learn the business advice that helps your particular business succeed.

U.S. Small Business Administration. " Fund Your Business ."

U.S. Small Business Administration. " Loans ."

U.S. Small Business Administration. " Apply For Licenses and Permits ."

U.S. Small Business Administration. " Choose a Business Structure ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1382266021-15f118eca7eb429480644f8da216f296.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Small Business Startup Costs Explained

3 min. read

Updated March 4, 2024

What will it cost to start your business ?

While every business is unique, there’s a common approach to helping you figure out what it’s going to take to get your business off the ground and sustain it as sales ramp up.

And, knowing the startup costs for your new business is critical before you launch. Underestimating the funds required could leave you without enough cash in the bank and heading towards failure before you even get started.

Read this guide and learn to calculate, manage, and minimize your startup costs.

- What are startup costs?

Startup costs are what a business spends to get up and running before generating revenue.

Starting costs vary based on business type but often include expenses like lease payments, permits, and market research. They can also include asset purchases such as vehicles, real estate, and equipment. Crucially, starting costs also include the money that you need to have in the bank to cover expenses as your business launches until your sales have grown enough to cover those expenses.

- Startup cost examples

Starting costs typically include expenses that occur before you start selling and major purchases, otherwise know as assets.

Startup expenses

- Permits and licenses

- Incorporation fees

- Logo design

- Website design

- Brochure and business card printing

- Down payment on rental property

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Cash to cover operations until sales can cover expenses

- Improvements to your chosen location

- Vehicles used for business operations

- Intangible assets like trademarks, copyrights, and patents.

- Why calculate startup costs?

Knowing your initial costs and expenses improves your chances of launching successfully . It helps you:

Avoid unnecessary risks:

You can avoid unexpected financial pitfalls and make informed decisions by understanding potential expenses.

Start your financial plan :

It helps you budget and determine if you have adequate funds to launch and operate until you’re profitable.

Convince investors :

A detailed breakdown of startup costs can make your business more appealing to investors, as you’ll demonstrate thorough planning and financial acumen.

Improve decisions:

With a clear view of costs, you can make decisions about pricing , scaling, and other critical areas more confidently.

- What are your startup costs?

Starting costs vary from business to business. So, how do you know your costs and, more importantly, how much money you need to cover them?

Check out the following resources to answer those questions.

How to calculate your startup costs

Accurately estimate startup costs by accounting for expenses, assets, and cash.

3 Steps to Figure Out How Much Money You Need to Start a Business

How much cash will it take to start your business? Your total cash must go beyond startup costs and ensure you’re prepared to cover emergencies and initial growth.

How Much Should You Personally Cover for Startup Costs?

Before covering any business expenses, consider the impact on your personal finances. What’s the right amount? How will you pay yourself back? And are the rewards worth the risk?

- Tips for managing startup costs

Follow these steps to minimize unnecessary expenses and prioritize the right things.

How to reduce your startup costs

Keep your startup expenses in check and save money through proper planning, tracking, and exploring possible tax deductions.

Hidden startup costs you may overlook

It’s challenging to account for everything. Don’t let overlooked fees and expenses immediately throw off your budget.

What you won’t regret spending money on as a business owner

There is such a thing as being too frugal. But where should you invest more money? While it depends on your business, you can start with these recommendations from a seasoned entrepreneur.

Get the rest of your business finances in order

Knowing what it costs to start your business will make it far easier to get your finances in order.

Check out the rest of our startup financial resources to better understand your path to profitability.

- Create your financial plan

- Set up accounting and payroll

- Prepare for funding

One-page business plan template

A quick and easy way to list out your expenses and explore how they fit into your overall business.

Download Template

AI-powered revenue and expenses

Instantly generate possible revenue streams and expenses with the AI-powered LivePlan Assistant.

Clarify your ideas and understand how to start your business with LivePlan

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

Table of Contents

- Get your business finances in order

Related Articles

<1 Min. Read

How to Write a Business Plan

3 Min. Read

How to Separate Your Small Business and Personal Finances

4 Min. Read

When Is the Right Time to Pay Yourself a Salary?

6 Min. Read

How to Open a Business Bank Account

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

Salesforce is closed for new business in your area.

Planning, Startups, Stories

Tim berry on business planning, starting and growing your business, and having a life in the meantime., business plan financials: starting costs.

It’s really important to have an idea of what you need before you start. Continuing with my series on standard business plan financials , startups need to project starting costs. Starting costs set up a starting balance, which is necessary to plan cash flow. And the starting costs are critical to determining whether a startup can bootstrap or needs outside funding. For existing companies that already have financial results, projections start with the expected ending balance of the previous period. But for startups, it’s about starting costs.

Starting costs are essentially the sum of two kinds of spending. You can estimate them both in two simple lists:

- Startup expenses : These are expenses that happen before the beginning of the plan, before the first month of operations. For example, many new companies incur expenses for legal work, logo design, brochures, site selection and improvements, and signage. If there is a business location, then normally the startup pays rent for a month or more before opening. And if employees start receiving compensation before the opening, then those disbursements are also startup expenses.

- Startup assets : Typical startup assets are cash (the money in the bank when the company starts), business or plant equipment, office furniture, vehicles, and starting inventory for stores or manufacturers.

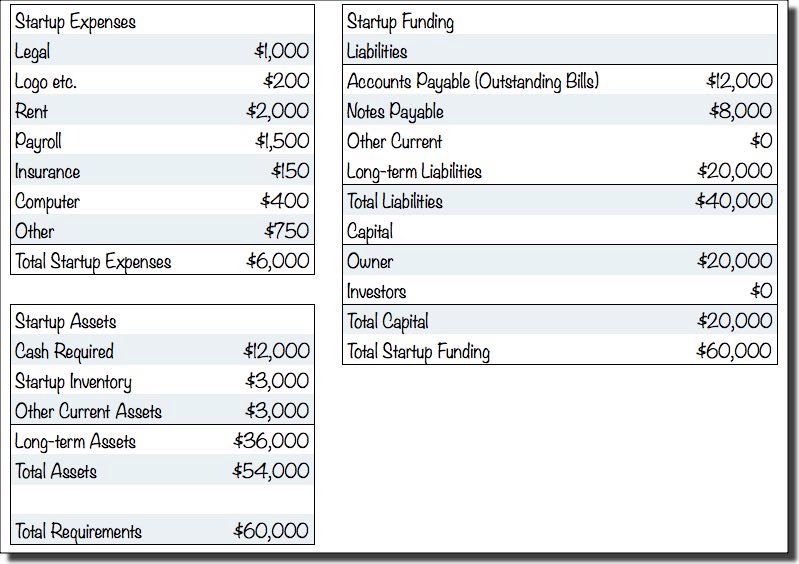

A Simple Starting Costs Example

I’ve used a bicycle store as an example in several posts that are part of this series of standard business plan financials. Here’s a visual in spreadsheet form, of sample starting costs for a hypothetical bicycle store.

Notice that the lists for estimating starting costs, on the left in the illustration above, are matched to another list of starting funding, on the right side of the illustration. Books have to balance, so the initial estimates need to include not just the money you spend, but also where it comes from. In the case above, Garrett had to find $124,500, and you can see that he financed it with Accounts Payable, debt, and investment in various categories.

Another Simple Starting Costs Example

Here is another simple example: the starting costs worksheet that Magda developed for the restaurant I used for a sample sales forecast . Magda’s list includes rent and payroll, the same as in her monthly spending, but here they are included in starting costs because these expenses happen before the launch.

I included rent and payroll because they point out the importance in timing. The difference between these as startup expenses and running expenses is timing, and nothing else. Magda could have chosen to plan startup expenses as a running worksheet on expenses, starting a few months before launch, as in the illustration below. The launch in this case is early January, so the expenses for October through December are startup expenses. I prefer the separate lists, because I like the way the two lists create an estimate of starting costs. But that’s an option.

The LivePlan Alternative

If you’re a LivePlan user, the LivePlan interface assumes this method and has a more intuitive interface than the spreadsheet version I’m showing in this post. For LivePlan, you start your plan when you start spending, regardless of launch date. So the spending you do for rent and salaries and such, before launch, is part of the flow, as above. Also, LivePlan has its own guided way of helping you figure out what assets you need, how much they cost, and how you are going to finance starting costs, to set up your balance. And the LivePlan cash flow estimator will help you decide how much cash you need, so you don’t have to follow the spreadsheet method here (below).

How to Estimate Your Starting Costs

Obviously the goal with starting costs isn’t just to track them, but to estimate them ahead of time so you have a better idea, before you start a new business, of what the financial costs might be. Breaking the items down into a practical list makes the educated guess a lot easier. Ideally, you know the business you want to start, you are already familiar with the industry, so you can do a useful estimate for most of the startup costs from your own experience. If you don’t have enough firsthand knowledge, then you should be talking to people who do. For others, such as insurance, legal costs, or graphic design for logos, call some providers or brokers, and talk to partners; educate those guesses.

Starting Cash is the Hardest and Most Important

How much cash do you need in the bank, as you launch? That’s usually the toughest starting cost question. It’s also prone to misinformation, such as those alleged rules of thumb you can find everywhere, saying you need to have a year’s worth of expenses, or six months’ worth, before you start. It’s not that simple. For most businesses, the startup cash isn’t a matter of what’s ideal, or what some expert says is the rule of thumb – it’s how much money you have, can get, and are willing to risk.

The best way is to do a Projected Cash Flow while leaving the supposed starting cash balance at zero, which shows how much (at least in theory, according to assumptions) the startup really needs in cash to support the business as it grows, before it reaches a monthly cash flow break-even point. Magda did that to determine the $12,000 needed as starting cash for her restaurant. Note how, in the illustration here, the lowest point in cash is slightly less than $12,000:

That low point comes, theoretically, in the third month of the business, March. The low point is $11,609. Obviously that’s just an educated guess, but it’s based on assumptions for sales forecast, expense budget, and important cash flow factors including sales on account and purchasing inventory. So it’s better than a stab in the dark, or some rule of thumb. Just as an example, the total spending with the estimates shown here, the theoretical “year’s worth of spending,” is $182,000 (which you don’t see on the illustration, by the way, but take my word for it). The total for the first six months is $93,000. If Magda sticks to those old formulas, she can’t start the business. She is able to raise enough money, between loans and her savings, to put $12,000 into the starting cash balance. So that’s what she does. Then she launches and continues to have her monthly reviews, and watch the performance of all key indicators very carefully.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

How to Calculate Business Startup Costs

Starting a business from scratch takes a lot out of you, even before you begin operating—whether it’s about selecting a revenue model, securing startup funding, or estimating startup costs.

I already knew it was challenging for entrepreneurs to calculate the startup costs accurately.

However, when I turned up to my computer, researching this article, I discovered so many challenges new business owners face while estimating startup costs that I had overlooked or didn’t pay much attention to earlier.

Thousands of startups close down every single year. 38% of them fail solely because they underestimated their startup costs and ran out of cash. You can’t ignore something like that, can you?

That said, I’m ready to pour my research into the article to help you calculate your business startup costs .

So, you’re ready to begin? Let’s dive right in.

Key Takeaways

- Startup costs are the expenses a startup must bear in the process of starting a new business, while operational costs are the expenses that are incurred during daily operations.

- Different types of business structures, such as sole proprietorships, partnerships, and corporations, have different costs.

- Business insurance, formation fees, licensing and permits, and marketing are some of the most common business startup costs.

- A modern financial forecasting tool is the most efficient method for calculating startup costs.

How much does it cost to start a business?

Startup costs for a small business depend on various factors like business model, location, industry, and scale of operations. Although it’s tough to estimate precisely, Guidant Financial’s 2023 survey reported that the average cost of starting a small business falls between $50K and $1 million .

You must consider the industry, business category, working capital requirements, and other common expenses associated with the business for the accurate estimation of startup costs.

Let’s kickstart this guide by discussing the common startup expenses to consider while starting a new venture.

Common Business Startup Costs to Consider

It is a typical list of expected business startup costs with rough cost estimates you must plan for while starting a new business. Your actual startup costs will entirely depend on your business category and the industry you serve.

Following are some of the most common startup costs to consider:

1. Equipment and tools

It’s no surprise we’re starting the list with equipment and tools. There’s no way a business can operate without the necessary equipment. The equipment costs may range from $10,000 to $120,000 . However, these costs will entirely depend on the business type and equipment requirements.

For instance, starting a food truck would require financing a food truck and expensive kitchen equipment, while starting a small daycare would only require purchasing a few play area equipment.

Here are the average equipment costs for some of the popular business types:

- Restaurant and food trucks: $24,000 to $120,000+

- Small Bakery: $6,000 to $8,000

- Clothing line: $2,000 to $15,000+

- Construction: $10,000 to $50,000

- Law firm: $5,000 to $25,000+

- Barbershop: $1,000 to $2,000

2. Incorporation fees

The first thing you should do is choose a business entity when you plan to form a new business. The most common and preferred business structure types include sole proprietorship, partnership, corporation, and LLC.

The business incorporation or filing fees can range from $50 to $725 in the United States depending on your industry, the state you operate in, and the business structure you choose.

However, the average incorporation fee is $300 in the majority of the states in the US. You may contact your secretary of state’s website to learn more about the filing fees or process for the articles of incorporation or articles of organization.

3. Business licensing and permits

Operating any small business requires specific licenses and permits depending on the industry compliance and regulations. For instance, a trucking company requires a USDOT number, heavy vehicle use tax, and others, while a restaurant may need licenses like food safety and liquor licenses to operate.

Similar to different filing fees for other business structures, the business licensing and permit fees vary depending on the business industry and regulatory compliance. You can expect to spend between $1,000 to $5,000 for your licensing and permitting requirements.

4. Office or retail space

If you’re starting a small business that can be operated from home like a home bakery or an online clothing store, you may not have to worry about office space costs.

But if it’s not the case, paying for an office or a retail space would make up a sizable portion of your fixed expenses, no matter whether you rent or buy the place.

Based on our research, you should spend around $100 to $1200 per employee monthly on your workspace.

However, the actual office space expense will entirely depend on your location and the type of space you’re using.

5. Legal and professional fees

Professional and legal fees may sound like an additional expense while starting up with limited resources, but it’s essential to ensure compliance with regulations and maintain accurate financial records.

You may choose legal assistance for business licensing, EIN registration, and legal paperwork, a business consultant for market research and strategic planning, and an accountant for bookkeeping and tax planning.

You can hire these professional consultants on an hourly basis; their services typically cost around $40 to $150 per hour. You should spend around $2,000 to $10,000 per year on professional and legal fees.

6. Inventory

Retail, wholesale, distribution, and manufacturing—if your small business falls under any of the mentioned categories, you need an inventory to operate your business. Finding the ideal inventory size to carry can be challenging when entering a new marketplace.

You want to attract more and more customers and make sales in your early days. However, you can’t also risk having too much inventory since it can increase spoilage.

Consider allocating 15% to 25% of your budget to inventory, depending on your industry. You will eventually learn more about inventory management once your business starts operating and making sales.

7. Marketing and advertising

Although it’s an optional expense, marketing is something worth investing in. Your marketing expenses may include physical materials like sign boards, banners, hoarding, paid social media advertising and search ads, or money paid to marketing agencies or consultants.

It is suggested to keep your advertising and promotion costs under 10% of your budget. If you’re working on a really tight budget, there’s no need to spend big bucks on marketing or hire fancy consultants or agencies.

With social media being a free marketing platform, over 47% of small business owners run their marketing efforts themselves, and you can do it, too.

8. Website development

A business website is like an online office where customers can contact you, learn more about your offerings, and seek assistance.

When building a website, make sure it looks professional, is easy to navigate, and displays the relevant information about your product and service offerings, as well as the contact information.

You can either develop a business website using website builders like Wix and Squarespace or hire a developer to do it for you.

Creating a website can range between $1,000 to $10,000 when you hire a developer, whereas you can do it on your own with website builders by spending around 40 dollars a month.

9. Business Insurance

Like you have a house, car, and health insurance, you need business insurance to ensure your business remains intact in troublesome and inevitable times, be it a natural disaster or a customer filing a lawsuit against your business.

The level of security and type of business insurance your business will require depends entirely on your business, industry, and the number of employees you have. For instance, a big-scale manufacturing company with over a thousand employees would require much stronger insurance compared to a home bakery.

Some of the must-have business insurance types include:

- General liability insurance—for all online, offline, and home-based businesses.

- Worker’s compensation insurance—for businesses with 1 or more employees.

- Professional liability insurance—for businesses offering consulting services.

You must expect to spend approximately $500 to $1500 annually on business insurance.

10. Payroll

Payroll is undoubtedly one of the major business expenses most businesses incur. However, there’s no denying how crucial it is to hire quality employees to make your business thrive.

Of course, payroll expenses are employee salaries, but there’s more to it. Your payroll expenses may also include:

- Incentive or bonus

- Commissions

- Paid time off

- Overtime pay

- Travel allowance

- Other benefits

Most businesses spend around 20% to 50% of their monthly budget on payroll. It can be more or less for your business depending on your business and the number of employees you have.

11. Office furniture and supplies

Those planning to have a traditional nine-to-five corporate workplace, be ready to spend some severe bucks on office furniture and office supplies.

When you operate from a corporate workspace, you need a desk, chair, telephone extension, computer, computer programs like accounting software, and, of course, a coffee machine or two.

The cost of furniture and supplies depends solely on your employee strength and the size of the office. However, it’s recommended to keep your furniture and supply costs to 10% of your total startup costs.

12. Utilities

No matter whether you plan to rent or purchase a workspace, you are bound to pay utility bills that include electricity, gas, water, internet, and phone bills for your office.

Unlike other fixed costs, it’s hard to estimate utility expenses, but the average cost of utilities for commercial buildings is $2.10 per square foot , according to a report by Iota Communications .

Besides the electricity, internet, and phone bills, the utility expenses may also incur the HVAC unit installation costs. This heating and cooling system will add a few additional thousand dollars to your startup expenses.

13. Business taxes

How much you’d spend on business taxes will depend on your business entity, tax-deductible expenses, and revenue. Since it’s hard to predict your revenue, estimating the exact amount to allocate for tax preparation may feel a bit challenging.

Under US federal law, corporations pay a flat 21% corporate income tax . If you’re a pass-through entity(a legal entity that passes all its income on to the owners), the business income or losses will pass through to your personal taxes.

However, you, as a pass-through entity, can claim a 20% deduction on income before paying taxes.

14. Other expenses

Since you’ve reached this section, you must already have a clear understanding of all the expected startup costs, whether they are one-time or recurring expenses.

Here, we will discuss the other costs most small business owners tend to miss or overlook while estimating the startup costs— research expenses and borrowing costs .

Capital is required for starting a business, and equity financing and debt financing are considered to be the most preferred ways to acquire the initial working capital.

Equity financing, however, does not apply to most small businesses since it requires stock issuance. So, securing a small business loan seems to be the most likely source of debt financing for small business owners.

Research expenses, on the other hand, are the expenses incurred even before you started operating, spent on conducting a careful industry analysis and market research.

When calculating your startup costs, make sure to include these two as well.

Since we have already discussed common business expenses, let’s move on discussing calculating the startup costs.

How to Calculate the Costs of Starting a Business

There are various ways to calculate the cost of starting a business. Still, drafting a business plan remains the best way to estimate startup costs.

The financial forecasting section of your plan provides three to five-year projections of revenue, profit, and expense.

The other resources for estimating startup costs include using Upmetrics’ startup costs worksheet or calculator . These resources will help you estimate the initial investment required and determine how much capital or financing you’ll need.

Know that many of the common business expenses we discussed earlier are recurring, with some of them being one-time expenses.

Be sure to categorize them and calculate the recurring expenses on a monthly, quarterly, and annual basis. In contrast, consider expenses like incorporation fees and equipment financing one-time costs.

Sounds like a lot to digest? Get a business planning software like Upmetrics and calculate startup costs in minutes with AI-powered financial forecasting .

Save hours estimating startup costs with Upmetrics

Estimate costs, forecast financials, and prepare a business plan all in one place

Plans starting from $7/month

Calculating Startup Costs for Your Small Business

Does your business fall under one of these categories? Excellent. We have startup cost guides for all the business categories listed below. Get a cost estimate for starting the business you plan to launch.

How to Reduce Your Business Startup Costs

Starting a business means being prepared to bear some non-negotiable expenses; there’s no other way around. However, sound research and thoughtful planning can help you save on high-ticket purchases—ultimately reducing your startup costs.

For instance, hiring professional business plan writers can be expensive for a business owner on a tight budget to create a business plan, so they can opt for a business planning software like Upmetrics to draft a business plan at a much lesser cost.

It was just an example, here are a few tips to help you reduce your business startup costs.

1. Create a business plan

It doesn’t make sense. Isn’t it another business expense? How will it reduce costs? Some of you must be having this line of questioning in your mind, but let us clear it up for you.

Brainstorming and listing all the important business costs, and estimating your total startup costs is challenging. Missing out on some critical expenses tends to happen. However, creating a comprehensive business plan makes things easier.

An AI-powered tool like Upmetrics makes sure you don’t miss out on any critical information and helps you properly estimate your startup costs.

Remember, accurate estimation of startup costs is your first step to reducing them.

2. Start small

You don’t need everything or a perfect business setup when you are not making any sales, forget about the business profits. Start small with limited resources and grow your business as it grows financially.

For instance, instead of having a big fancy office for your startup, start with a remote team or a co-working space until you raise capital or gather the necessary resources.

One way of doing that would be listing all the major high-ticket expenses and researching competitive alternatives for them.

3. Lease instead of purchasing

Of course, having your own office or a retail space feels good, but not at the cost of more than 70% of your budget for starting a business. Prefer leasing the place instead of purchasing.

It will leave you with enough working capital or cash to efficiently manage your business operations and handle the other non-negotiable costs.

Furthermore, there’s no guarantee your storefront will find success at the very first location; you may have to relocate if things don’t work out. The further process will be more straightforward with leasing, whereas the same won’t be the case when you own the place.

4. Buy used equipment, tools, or furniture

Since you’re looking for ways to reduce costs and save money, there’s no way for you to have brand-new business equipment, tools, and furniture. You can look for used equipment, tools, and furniture on online selling sites like eBay and Etsy.

Be sure to thoroughly check the equipment before purchasing to avoid any future restoration or repair costs.

5. Funding and business credit card

Now that you have a long list of capital expenditures, you will need financing or funding to manage all these costs. You can’t simply do it all on your own, can you?

It won’t reduce the startup costs but will help you get resources to manage them. Your funding options include debt and equity financing. You may apply for a business loan, reach out to angel investors, or apply for business grants to secure the initial investment for your business.

With limited debt financing options, it could be tough to get through. Applying for a business credit card can be a more accessible alternative to a business loan. You can easily qualify for it while also gaining a higher credit limit than your personal credit card.

Make sure you’re not totally relying on it or taking out more than you can repay. This can negatively impact your credit score, making it harder for you to secure business loans in the future.

And, the final section leads us to our conclusion!

And there you have it. We hope now you have a better understanding of startup cost calculation. What’s next? It’s time to estimate the actual costs of starting a business, be it a bakery, restaurant, or hot shot trucking, and start budgeting.

Get your hands on the modern and AI-powered business planning solution, Upmetrics—and create precise startup cost projections in minutes, just like that.

Frequently Asked Questions

What is the average cost to start a small business.

It is a question with a broad scope for the answer since you can start a business with an initial investment of $100, $1,000, and up to a million dollars or even more. However, the startup and first-year operational expenses fall somewhere between $30,000 to $40,000.

How do you calculate startup costs?

The most easy-to-use method to calculate startup costs is to create a business plan. It’s easier than ever to calculate your startup costs using a tool like Upmetrics.

Simply head to the financial forecasting feature, get AI suggestions to list your startup and organizational costs, add remaining costs, and let it make the automated calculations for you.

What are business startup costs?

Business startup costs are expenses incurred when starting a new business. These can be your marketing costs, payroll expenses, or any other costs involved. These can either be recurring or one-time costs.

For instance, your advertising costs are recurring, whereas incorporation fees are a one-time expense. Although there can be some common startup expenses, the value or costs for them may not be the same for two different businesses.

What is the difference between startup costs and operational expenses?

Startup costs are the expenses small businesses incur when starting a new business, whereas operational expenses are those incurred during normal day-to-day business operations.

For instance, equipment financing can be considered a startup cost, whereas inventory or marketing costs can be your operational expenses.

What are the examples of start-up costs?

The following can be considered as a few examples of startup costs:

- Equipment costs

- Inventory expenses

- Business licenses and permits

- Marketing and advertising expenses

- Payroll expenses

- And others.

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Popular Templates

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

Save up to 500 Hours on Paperwork 🙌 50% Off for 3 Months. BUY NOW & SAVE

50% Off for 3 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

- Online Accountants

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Track project status and collaborate with clients and team members

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Businesses With Employees

- Businesses With Contractors

- Self-Employed

- Freelancers

- Marketing & Agencies

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- A Beginner’s Guide to MTD

- Reports Library

- FreshBooks vs Quickbooks

- FreshBooks vs Xero

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Help Center

- Business Loan Calculator

- Markup Calculator

- VAT Calculator

Call Sales: +44 (800) 047 8164

- All Articles

- Productivity

- Project Management

- Making Tax Digital

Resources for Your Growing Business

How to calculate business startup costs: an essential guide.

You might think that starting a business is simple, financially. Unfortunately, not all business startup costs are clear. There are some that you may not consider until you’ve begun the process. Some business expenses might occur that you’ve never even heard of. Business owners will tell you that startup expenses are more than just office space and furnishings. If you’re contemplating starting a business , learn how to calculate your costs here!

Here’s What We’ll Cover:

What are Business Startup Costs?

Common business startup costs, costs that occur after business has started, how much does it cost to start a business in the uk, key takeaways.

Any good business plan will go through the task of calculating business startup costs. These are the organizational costs that occur during the creation of a new business. Some are one-time expenses, while others are ongoing expenses. Regardless, understanding and budgeting for all of the possible costs is crucial to success. Startup costs require planning and accounting, and if a business neglects this then they are less likely to thrive.

There are some common business startup costs that should always be considered when doing calculations. They’re all listed below and are all necessary to start a business.

A Business Plan

Believe it or not, a business plan should be part of your startup costs. Business plans take time to create, and often require professional services to polish. They’re a road map and a financial plan to present to possible investors. Without this part of your financial plan, you’ll be less likely to secure funding. Startup funding is crucial to getting a business off the ground.

Research is a necessary part of any startup. The company needs to be able to prove that it’s viable in the market. If research is neglected, a company may enter the market offering products that are unnecessary.

Borrowing Costs

Borrowing costs take into account the business loans received for a startup. This includes interest on loan payments, as well as any fees applied to debts over time. Borrowing costs make up a large portion of startup costs until they are paid off.

Business Insurance and Business License Fees

Businesses are required to have insurance, and as such they will have insurance payments to make. There may also be a requirement for commercial property insurance when selecting where your business will live. Business licensing and permitting are also necessary costs to factor in.

Tech Expenses

In today’s world, businesses need technology to thrive. This includes digital marketing costs and software needs. Many businesses can’t function without business accounting software . They also need content marketing and advertisements to create an online presence. Without it, they may be doomed.

Office Equipment and Basic Supplies

If your business is going to exist in a physical space, office equipment and basic supplies are necessary. You’ll need office furniture, fixtures, and office supplies to get started. Without them, daily tasks won’t be completed.

Everything mentioned prior to this is related to setting a business up. However, they aren’t the only business startup costs. Startup also includes post-opening costs, such as the ones below:

- Employee Costs: Hiring employees will require additional funding. You’ll need to take into account employee salaries, employee benefits, and employee training. All of these will cost money for your business.

- Promotion: While online advertising was mentioned prior, it’s worth mentioning again. Promotion is key in this world. Without paying for promotion and advertising, a business likely won’t get far.

Most businesses have reported that it takes about £5,000 to launch. However, that doesn’t take into account all of the costs spent during the startup period. As a general rule of thumb, the startup period is about a year before everything is off the ground. Small businesses have reported that additional startup costs amount to about £23,000 in the first year. Those costs break down into the following categories:

- Legal Costs: £6,500

- Accountancy: £4,000

- Human Resources: £4,500

- Company Formation: £8,000

Most people state that they underestimated their startup costs by about £2,000. As such, building a cushion to provide that is recommended.

Starting a business isn’t cheap. In fact, it takes a lot of work and money before you can start earning money. As such, calculating your startup costs before you dive in is suggested. Understanding the needs of your business and their associated costs is a recipe for success. If you want more small business articles like this, visit our resource hub ! We love supporting small businesses.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

Business Startup Costs in 2022: What Small Business Owners Can Expect

Starting a new business is exciting, but it also may come with intimidating startup costs. Before you become a business owner, you’ll want to sit down and estimate the total price tag of the venture. In this article, we walk you through the process of calculating each business startup cost so you can launch your business on the right foot.

What Are Business Startup Costs?

Every new business owner will run into costs associated with launching a business — but the amount you’ll pay depends on your business type and your needs. You’ll want to know ahead of time estimates of the business expenses you can expect so you aren’t hit with surprising costs you can’t afford during the launch process.

Business startup costs depend largely on the type of business you open, which can be:

- Brick-and-mortar

- Service provider

When you start a new business, you may pay for things like business formation fees, marketing costs, business insurance, a website, and more. We cover each possible expense in detail below.

Compare Business Formation Services

Form an LLC, corporation, or nonprofit, and get an EIN, business license, or registered agent service. Use Nav to find the right business formation service for your business.

How Much Does It Typically Cost to Start a Business?

The amount you’ll pay to start a small business will depend on the business itself. According to a 2021 Shopif y survey , small business entrepreneurs spent $40,000 on average in the first year of launching a new business. But this is an average.

A small business with a physical location will come with a heavier price tag than a business that is run completely out of a home. You’ll have to pay for things like rent or a commercial mortgage, furniture, and physical marketing materials. But you’ll also need more insurance coverage since you’ll have a business location where customers or employees could hurt themselves.

You can use this startup costs worksheet from the U.S. Small Business Administration (SBA) to help guide you through your estimate process.

10 Most Common Startup Expenses

In the first year of running a small business, you’ll likely encounter two types of costs:

- Capital expenditure : One-time purchase or debt that invests in the future of your business. This can include purchasing new property, facility upgrades, updated equipment, or patents.

- Operating cost : Ongoing expense that allows your business to run in an efficient and productive way. Marketing, payroll, insurance, and research falls into this category.

The amount you pay for each operating cost depends on how much of the work you do yourself and how much you offload onto a professional that you’ll have to pay.

Here are the 10 startup expenses you’re most likely to encounter.

1. Research costs

Conducting market research before you launch a business can bring clarity to how effective your products or services will be. You can subscribe to a marketing research platform for a more affordable but more do-it-yourself option. Or you can hire a market research firm. According to the Vernon Research Group , hiring a market research firm can cost anywhere from $4,000 to $50,000, depending on the type of research you conduct.

2. Getting a business plan written

A business plan is an essential document that establishes your business structure and goals. You can write your own informal business plan or subscribe to software like LivePlan to guide you through the process, which charges a monthly fee.

Otherwise, you can turn to a business plan company to complete it for you. If you hire a professional service to write your business plan, you can expect costs to start around $1,500 and increase with complexity.

3. Business formation fees

How much you’ll pay for business formation depends on the business entity type you choose. A sole proprietor won’t have costs directly associated with founding a business, but an LLC will need to pay to file articles of organization (or if you’re incorporating, articles of incorporation). Filing fees depend on the state you live in but typically cost between $50 and $100, and may cost as much as $300.

You may also have to pay for a state or federal business license , depending on your industry. Associated costs depend on the license.

4. Insurance and permits

Business insurance can provide protection if you need to pay for claims against your business. Without insurance, you’ll have to pay upfront for the damages and potential legal fees. You’ll likely need different business insurance if you run a fully online business than if you operate an office space, for example.

The most common types of business insurance are:

- General liability insurance : Protects against “general” claims for property damage, bodily injury, or personal injury. The cost is determined by how risky your industry is, like retail vs. construction.

- Errors and omissions insurance : Covers mistakes you or your employees make against customers or clients. The price depends on factors like the size of your business, the industry, revenue, and its employee training process.

- Commercial property insurance : Protects offices or brick-and-mortar locations against damages from instances like flooding, fire, theft, or vandalism. The cost depends on factors like the property value and its assets, as well as its location.

- Workers compensation insurance : Pays for medical and benefit costs for employees that get hurt or ill while working. The cost of your workers’ compensation policy depends on the state, business size, payroll, and your industry’s risk.

Having a business website that looks good and is functional is essential — it acts as the face of your business. Hiring a web design company to create a website for you can cost into the tens of thousands of dollars, but it can be worthwhile to pay this cost upfront to ensure that your site is everything you need it to be. You’ll also need to consider hosting options, which can determine how quickly your website loads when customers visit, and how much traffic your site can handle.

There are several affordable do-it-yourself website builders and hosting services out there, including:

- Squarespace : You can use this website builder to create a business website for between $16 and $49 per month.

- Weebly : Create a business website for between $0 and $26 per month.

- Wix : Its website plans cost between $16 and $45 per month.

- Shopify : You can set up an online shop for between $29 and $299 per month.

6. Setting up accounting systems

You don’t want to skip figuring out your accounting process before you start a business — or you may find yourself under a mountain of paperwork come tax time. Some accounting solutions cost money. To start with, opening a business bank account is a great way to separate your personal and business expenses from the beginning. (And you may pay a monthly fee, depending on the account).

In terms of tracking your transactions, you can do it for free manually using a spreadsheet or pay for software that automates much of the process:

- QuickBooks : $30 to $100 per month

- FreshBooks : $15 to $50 per month

- Xero : $12 to $65 per month

- Wave : Accounting software is free

Connecting your business checking account to accounting software can simplify your bookkeeping and accounting. You can import your transaction information to easily see your business’s cash flow and expenditures. When it comes time to pay your business taxes, you can send this information directly to your bookkeeper or CPA.

7. Marketing expenses

You may not need to pay for marketing, but if you do, it’s good to keep costs below 10% of your total budget. Your business may benefit from physical marketing materials, like signs or mailers, or from online marketing. Social media marketing can be free or paid.

Come up with a small business marketing plan to make sure you are clear on your goals and not spending money without getting results.

8. Technology and equipment fees

An office or physical location can eat up a large portion of your budget. Whether or not you have an office that staff comes into, you’ll need to equip it. You’ll need reliable technology like a computer and internet access to run any modern business. If you have a physical location or staff office, you’ll need things like office supplies and office furniture. Costs depend on how large the location is and the types of equipment you need.

9. Inventory fees

If you’re opening a business that requires you to keep inventory, like retail or wholesale, you’ll need to estimate how much your initial inventory supply will cost. You’ll want to consider stocking up more inventory in the beginning than you might later. The cost depends on how much inventory you need and what you’re ordering.

10. Hiring employees

According to Glassdoor, it costs around $4,000 on average to hire someone new. These costs include background checks and drug testing, marketing, posting on job boards, and any internal expenses. These expenses will vary based on your business, but if you’re planning to hire employees for your new business, you’ll need to budget accordingly.

In Total, How Much Startup Cash Will You Need?

As mentioned, the average business startup costs fall around $40,000, but you can do it for much less or much more. The amount you pay for organizational costs depends on factors like your business size, the industry, the state it’s located in, and whether or not you have employees.

If you complete your startup cost estimate and realize you don’t have enough cash on hand to launch — even though you’re ready in every other way — consider turning to lenders. Small business lenders can give you a leg up to start a new business and help you avoid waiting around for years before launching.

Nav shows you your best options for small business loans if you need cash for things like capital expenses or business credit cards for help with cash flow. Create a free account at Nav.com to see the financing options you’re most likely to qualify for instantly.

Can You Write Off Startup Costs?

Yes, you can deduct certain startup costs on your tax return, but not all of them. The IRS provides a useful breakdown of what is allowed for a tax deduction for a new business. However, it’s a smart idea to hire a professional accountant to complete your tax return for you because of the complexity involved.

Tiffany Verbeck

Tiffany Verbeck is a Digital Marketing Copywriter for Nav. She uses the skills she learned from her master’s degree in writing to provide guidance to small businesses trying to navigate the ins-and-outs of financing. Previously, she ran a writing business for three years, and her work has appeared on sites like Business Insider, VaroWorth, and Mission Lane.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

BRAND NEW Two-Day LIVE Summit with 20+ Ecommerce Trailblazers.

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, business startup costs checklist: how much and where to spend.

Written by Kevin Conner | July 18, 2022

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Many aspiring business owners don’t know where to get started. They have a vision, but thinking about marketing, hiring, product development, and more can become overwhelming. In most cases, the best place to start is crunching the numbers—determining your business startup costs.

Without a budget, you can’t make good decisions, and you can’t make a budget without understanding your expenses.

So to help you keep your business from being one of the many that go under each year, we wanted to outline some examples of typical startup costs so you can better budget your business and know what to expect. After consulting this cost checklist, you should be able to determine a forward plan of action for your new enterprise.

Note that we wanted to focus mostly on online businesses, but other businesses can still greatly benefit and do some quick adjustments and research to make sure they’re on the right track as well.

Business Startup Costs

Supplies, furniture, and office space, marketing and web presence, inventory and production, fees, taxes, and licenses, having a backup fund, setting up your budget, paying yourself adequately.

You need to be able to support yourself without hurting yourself. If you cut corners in your own personal life (by deeply cutting your salary), it can affect your physical and mental health, which can be a contributing factor to business failure. The Global Benefits Attitudes survey shows a clear link between reduced workplace productivity and increased stress levels. Don’t sell yourself short, and don’t try to cut your own salary first.

Review the real cost of living in your area and be honest with yourself about what you would be comfortable with. Be sure to add health insurance and other benefits (for yourself and your household, if applicable) into that equation.

This is your business. Your personal well-being is a core need to consider. When calculating your salary needs, include:

• Rent or mortgage payments • Utility costs • Child care costs • Property, luxury, excise, and other taxes • Insurance (car, home, and/or other) • Vehicle payments or maintenance costs • Debt or credit card payments. • Groceries • Entertainment costs • Gifts • Clothing

Your payroll for your business, especially an online business, can be a complicated item on your startup costs list. As a general rule, payroll is the greatest startup cost for a business. Fundera considers it to be 25-50% of a total budget.

At the same time, your employees, if you have any, will make or break your business.

An online business has many options and few constraints. It might be in your best long-term financial interest to have someone on your permanent payroll. But you almost never need onsite employees, and you can look to the growing pool of remote workers .

There’s a strong possibility that you’ll want to use freelance help as you start your business, as there are a series of specialized tasks (web development, perhaps some initial marketing, graphic design, and more) that you’ll want help with.

Freelancers vary in cost greatly depending on the level of experience you are looking for. This is also the department where “you get what you pay for” matters most. Don’t let working for your business become a race to the bottom for subpar freelancers desperate for any gig.

You can find freelancers either through job boards, contacts you might have in the industry, Facebook groups, and sites such as UpWork and Fiverr . Each platform has its advantages and disadvantages, so look for what would be best for your needs. If you need help, consult this resource on how to hire remote workers or hire for small businesses .

As for the business startup costs relating to freelancers, try to tally up the estimated hours and multiply that by the rates you are willing to pay.

Here are a few common examples of freelancers you might hire and what they might cost:

• Freelance writers (for initial copy) – They are generally paid per word. For quality work you can expect to pay 15 to 25 cents per word. Some writers also charge per project. • Freelance designers – $25-$300 per hour • Web Development or Programming – $30-$150 per hour • Virtual Assistants – $5 to $25 per hour

The rates vary due to location, service, and what the freelancer charges. Typically, US-based freelancers charge the highest rates. Here’s a more detailed breakdown of average freelancer hourly rates .

Just because your business doesn’t have a physical storefront doesn’t mean that you don’t need a space and tools to work with. Many owners don’t consider this until too late when compiling their business startup costs list. We’re here to help you flesh out the ideas likely already floating around your head.

Computer Equipment, Programs, Apps, etc.

Computer equipment can be a notable business startup cost. For security and organizational reasons, we recommend having a separate setup for your online business than for your personal use. Unless you’re in video production or another business that will require a much more powerful setup, the following examples of startup costs can serve as a decent guide:

- A desktop with a monitor or two. We recommend something in the $1,000-$1,500 price range for most people.

- A laptop in the same price range ($1,000-$1,500) is a great choice, although you won’t get as much screen space and performance.

- A printer and scanner will prove necessary, and we recommend you pick something that will last your business a few years ($100-$200 should be a good range to start with).

- Software such as Word and Excel, and a finance tracking program. A point of sale program might also be necessary. These might run you $100-$300 a year for the relevant subscriptions.

- Data breaches can be extremely costly. With this in mind, a security suite and a password manager ( McAfee and Kaspersky are common choices) and a password manager ( LastPass is a fine option) are great investments for about $100 a year. You might also want protective measures for your websites and other online assets.

Home Office Space

You can run your business from your couch, but it is far from the most productive option. You need to invest in a space or working environment free from distractions for hours at a time. It doesn’t need to be extravagant, but it does need to be comfortable and meet your needs.

As far as furnishing it, you don’t need to let it take over your business startup costs list. You should be able to find everything quite cheaply if you don’t mind things that might be used or mismatched. You can easily find a desk for at or less than $50 and a good chair for the same price. You can find a working lamp for $10 and a filing cabinet for $40-$50. Consider looking at Facebook Marketplace , Craigslist , or similar sites.

Working from home can actually ease your tax burden, but if you can’t make it work, this can easily balloon into one of your largest expenses. Another idea would be to find a coworking space or startup incubator in your area. They often have tiered options, from floating desks to private offices, that can grow with your business.

Read more: Learn How to Start a Small Business at Home