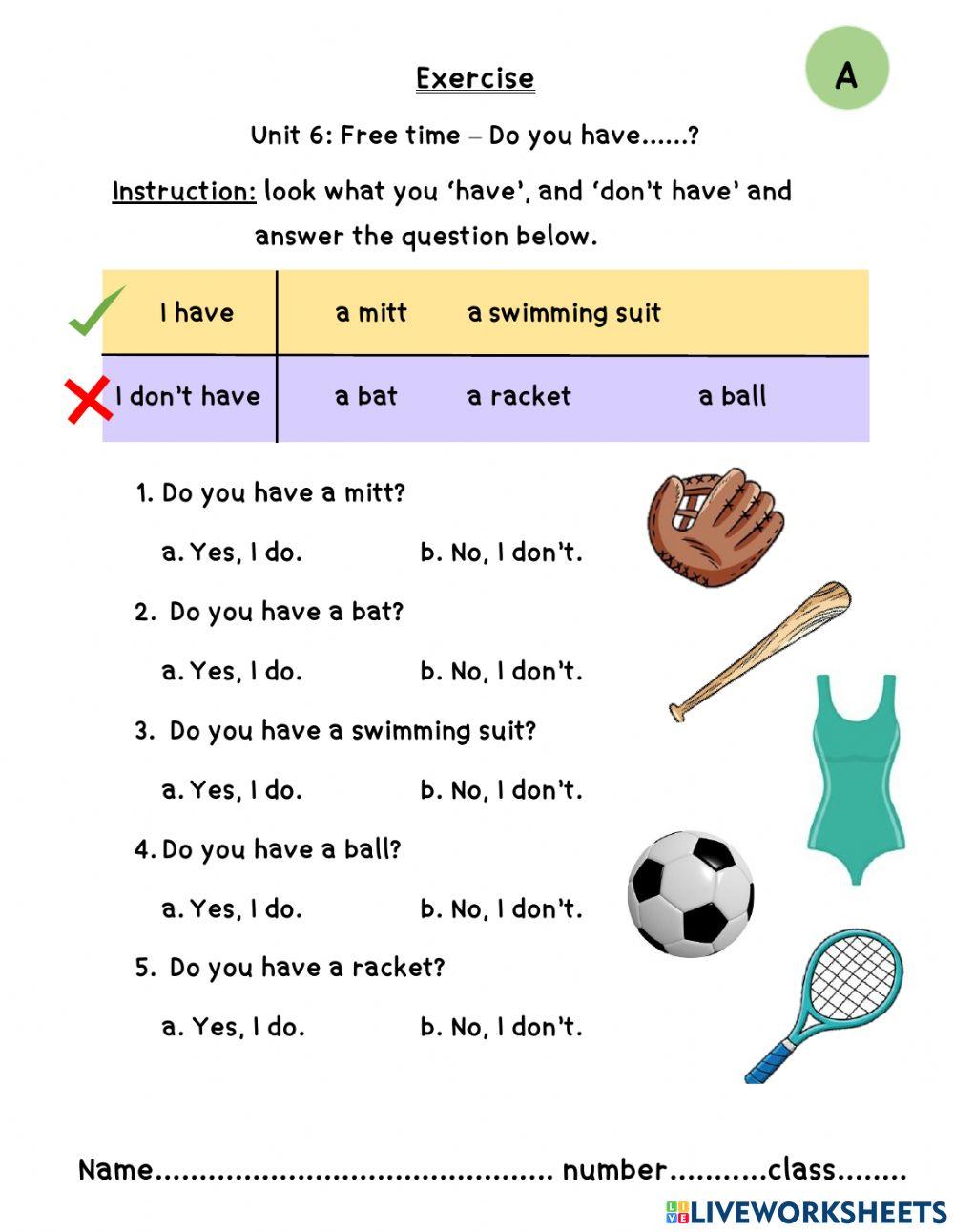

Do you have...?

Loading ad...

Do you have......? Yes, I do. No, I don't.

- Google Classroom

- Microsoft Teams

- Download PDF

- ESL Activities

- Classroom Management

- Online Teaching

- English Questions

- Famous Educators

- Teacher Tips

Live Worksheets Tutorial

As a source for thousands of live, interactive worksheets to use in the classroom, Liveworksheets.com is a tremendously helpful website for teachers. The site has a library of worksheets on 65 subjects in 99 languages. A tutorial guides teachers on how to create interactive, live worksheets and how to use them optimally in the classroom, for homework, and also for teaching online. Liveworksheets .com provides educators with the option of registering workbooks for their students, which enhances control and purpose with homework.

Table of Contents

What are “live” worksheets?

Liveworksheets.com enables teachers to transform their traditional printable worksheets (doc, pdf, jpg, etc.) into online exercises with self-correction, which is why it is called live worksheets or “ interactive worksheets .”

On their website, Liveworksheets.com furthermore incorporates new technologies such as sound bites , videos , memes, drag-and-drop features, multiple answer options , and even speaking exercises . Adapting to these live worksheets is easy for students, who are all familiar with using headphones or the recording functions of their phones, tablets or laptops. This makes interactive worksheets ideal for ESL and other language teachers.

Where to find live worksheets?

To find live worksheets to use, teachers simply go to the section marked interactive worksheets on the website of Liveworksheets.com and then select the subjects they are teaching. For example, I teach English as a second language, so, I can search for live worksheets providing grammar exercises in the past tense. The website has a tutorial and a video tutorial on how to make and use worksheets.

How to use live worksheets

The Liveworksheets.com website provides options that are great for class, using either a projector or the hybrid method of interacting with students via e-mail/ WhatsApp and other media, having shared the relevant worksheet with students for homework. The same applies if you’re teaching online. Simply copy and send worksheets to your students. They in turn must complete and mail it back for you to check on their homework. There are many types of worksheets; drag and drop the best ones for your lessons. It is also easy to create personalized interactive worksheets.

Step by step instruction

To get started, just log in on Liveworksheets.com. Then go to Upload . There are many worksheets, so first select a suitable one for your lesson. Next, proceed to type in questions and answers in the worksheet you have selected. It is very easy to use, just drag a square and then you type in the correct answer. Then save the document. There is also a preview function.

If you are uncertain about what to do, go to the Question Mark and it will explain everything. You can create a ‘ Select Box Choose ,’ so your students can pick between two answers. Otherwise, set up a Multiple Choice option where students have to select either yes or no. The questions and answers can also be joined with arrows. Students can drag and drop and connect the correct answers.

Using audio with live worksheets

Live worksheets can include listening exercises by loading up some audio. Explore the audio file on the website by using Word Search.

There is also a video explaining how to do that, and also on how to add Mp3 files, YouTube videos , or PowerPoint links to create interactive worksheets for students. These live worksheets can then be added to workbooks. Each student can be assigned a workbook that is then electronically sent to them.

You will have to register your students first, though. Otherwise, just go to the interactive worksheets and add the file to the workbook that you’ve already created.

Live worksheet examples:

Here are a few examples of live worksheets:

Single and Plural Nouns, Grade 4, My Body

This live worksheet incorporates soundbites and is aimed at Grade 4 (students between 6-10 years old). The topic is ‘My Body.’ Students must practice to distinguish between single and plural nouns.

Weather – Complete the sentences

This live worksheet is for ESL students of ages 9 to 15, teaching them about the weather. They must complete the sentences. It requires knowing the days of the week, weather forecast, activities, and hobbies, using the past simple and future tense.

Reading Comprehension Worksheet

This example is reading comprehension about ‘The Simpsons’ and focuses on the possessive ‘s’.

Live worksheet on Science – plants

This is an example of many similar live worksheets under the heading of Science. A total of 65 subjects are covered.

Using live worksheets in workbooks

The teacher can create an interactive workbook for each student with instructions on which worksheets to do. The students do the worksheets online and send their answers to the teacher. This motivates students to complete homework at a set time. It makes teachers’ work easier and saves time scoring students’ work, and communicating with students on an individual level in the comfort of being online. Having a workbook of each student’s worksheets make control and revision easy. It also saves schools a fortune on resources by not printing worksheets.

The Free Accounts version of Liveworksheets allows teachers to register ten groups of students and create ten workbooks per group of ten students for a total of 100 students! Each workbook can hold 120 worksheets.

How to create workbooks

This website enables the teacher to create a workbook for each student, scoring their work and thus communicating individually in the comfort of being online. The benefits of these workbooks with interactive worksheets for online teaching are obvious.

The other remarkable aspect of this website is that there are worksheets available on many subjects and in many languages that have been created by other teachers that are being shared.

Let’s investigate how teachers can use Liveworksheets to create workbooks for students and then find and use interactive worksheets optimally.

How to download live worksheets

Teachers can add interactive worksheets to their own websites or blogs. They can embed their own worksheets and even that of other teachers (when they’ve allowed the option). There is a special code to insert into your website, just open the worksheet and click “Embed in my website or blog” to receive the code. Many worksheets are downloadable in pdf format when the author (other teachers) has allowed this option, but there is a limit to downloading ten worksheets per day.

Live worksheets in 65 subjects

Another remarkable aspect of this website is that live worksheets are available on a large diversity of subjects and in 99 languages that have been created and shared by other teachers.

Live worksheets are available in the following 65 subjects:

- Aeronautica

- British History

- Business Studies

- CLIL Geography

- CLIL History

- Computer science

- Earth Science

- English as a Second Language (ESL)

- English for Academic Purposes (EAP)

- English for Specific Purposes (ESP)

- English language

- English Language Arts (ELA)

- Environmental education

- Environmental Studies (EVS)

- Financial Literacy

- General Knowledge (GK)

- Health science

- Human Communications

- Information and communication technology (ICT)

- Integrated Studies

- Islamic Education

- Lengua Castellana

- Life skills

- Moral Education

- Natural Science

Other subjects:

- Physical Education (PE)

- Principles of Accounts (POA)

- Religious Education

- Religious Studies

- Resolutions

- Social Emotional Learning

- Social Science

- Social Studies

- Special Education

- Tecnologías de la Información y la Comunicación (TIC)

Languages covered by Liveworksheets

Worksheets are available in the following 99 languages:

- Eastern Punjabi, Eastern Panjabi

- Greek (modern)

- Haitian, Haitian Creole

- Hebrew (modern)

- Marathi (Marāṭhī)

- Norwegian Bokmål

- Old Church Slavonic, Church Slavonic,Old Bulgarian

- Persian (Farsi)

- Sanskrit (Saṁskṛta)

- Sinhalese, Sinhala

- Zhuang, Chuang

📜 https://www.liveworksheets.com/

📘 1000 Questions and Answers to Learn English! ► https://amzn.to/3DisGfC

🎵 Audiobook ► https://bit.ly/etaudiobook

1 thought on “Live Worksheets Tutorial”

Pingback: Where is live located? - English Teacher Resources

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Live Worksheets

This tool has not been reviewed by our editors yet

Description

Live Worksheets are interactive worksheets that save paper, ink, and time, and are fun to complete. Teachers create an account and go to the website to upload a worksheet pdf, then drag text entry boxes on top of the worksheet. Student then enter the answers online. Questions can be fill in the blank, multiple choice, matching, drag and drop, join with arrows, recording audio, word search, and more, with new activities frequently added. Teacher enter in correct answers when they create the text boxes, which the program uses to give students instant feedback (correct answers are green and incorrect answers are red) with total score for the worksheet visible for each student.

- Sign in to add this tool to one of your shelves

Some People Using This

Related tools, more from developer, customer support.

7 Handy Websites to Create Awesome Worksheets

If you regularly find yourself making worksheets for school or your kids, these seven handy websites will help you make some awesome worksheets.

Worksheets are a great way for students to track their progress and review what they have learned. But creating good, interactive worksheets can be a challenging task for teachers or parents.

Thanks to online interactive worksheet makers, it’s now easy to design engaging and beautiful worksheets with minimal effort. Here, we mention seven websites that you can use to create awesome worksheets, both interactive and printable.

1. Quick Worksheets

Quick Worksheets is an interactive worksheet maker that allows you to build 27 different types of worksheets. These types are divided into categories like interactive, comprehension, vocabulary, grammar, and multipurpose worksheets.

The platform's templates and algorithms simplify the process of creating complex worksheets. This worksheet maker has a similar interface to Google Forms, making it a good choice for non-techies. The interactive worksheets are graded automatically, and then you can view the results.

The Help Center features tons of videos to help you build a great worksheet. You can also browse and download worksheets shared by other users. Quick Worksheets let you create worksheets in multiple languages.

Related: The Best Collection of Printable Math Worksheets on the Web

The free plan provides access to only four types of worksheets and a storage limit of 12 worksheets. The premium and pro plans cost around $5 and $8 a month, respectively. Quick Worksheets also offers group discounts for schools.

2. TopWorksheets

Using TopWorksheets, teachers can quickly and easily create interactive worksheets. The worksheet builder supports multiple types of questions and is relatively simple to use.

There are multiple ways you can create a worksheet. If you have a hard copy or a PDF, you can simply upload it to the app. Otherwise, you can build one from the scratch.

Even better, TopWorksheets has thousands of worksheets built by its community available on the website. So, you can download the worksheets from there and save yourself the trouble of building one. TopWorksheets has an auto-grading system, so you won't have to check and manually grade assignments.

After building a worksheet, you can create a custom link and send it out to your students. Once the students have submitted the answers, you’ll receive auto-graded results. TopWorksheets allows you to create your scoring system, analyze the answers, and manage your groups. It has three pricing plans: free, gold, and platinum.

3. Liveworksheets

Liveworksheets is another interactive worksheet maker that uses the latest technologies to help you provide a better learning experience to your students. It lets you convert traditional PDF worksheets to interactive, self-correcting ones.

What’s better is that you can create complete interactive workbooks on Liveworksheets. Your students can solve these after registering up on its website. Moreover, Liveworksheets supports comments, notes, email notifications, and feedback that enhances the online learning experience.

You can also add speaking exercises to the worksheets that the students can do using a microphone. Other than speaking exercises, you can add multiple choice questions, drag-and-drop exercises, join arrows, and videos. Liveworksheets allows you to embed the worksheets to your website and download them as a PDF file. But, it limits the number of private worksheets to 30.

Related: The Best Interactive Apps for Classrooms and Workplaces

Like other websites, Liveworksheets has a huge collection of ready-made worksheets in different languages and subjects. The advanced search feature helps you find relevant worksheets within seconds.

Although the app is a bit difficult to use, you can seek help from detailed guides and video tutorials. Liveworksheets offers multiple plans for teachers and schools, but they’re all free till December 31, 2021. So be an early bird and save some bucks.

4. My Worksheet Maker

My Worksheet Maker is a pretty simple worksheet maker with pre-built templates. It, too, has a library of nearly 70,000 community-built, printable worksheets. These worksheets cover a range of topics and grades. You can use filters to search the library by grade, subject, and type.

To create a worksheet, you can simply choose the template from its homepage. These include worksheets for:

- Multiple Choice

- Fill in the Blank

- Open Response

- Handwriting

- Word Scramble

- Bingo Cards

The worksheet builder app is feature-rich, giving you full control over how your worksheets look like. After creating the worksheet, you convert it to PDF format for downloading and printing. However, if you’re not a premium subscriber (which costs $10 a month) the worksheet will be made publicly available in its library.

Related: Multimodal Learning Apps to Power Virtual Classrooms

Wizer aims to help you create unforgettable worksheets that’ll save your time and make studies fun for your students. Wizer checks and grades automatically, though you can view answers and offer personalized feedback.

It supports multiple types of questions, including multiple-choice, fill in the blanks, open questions, matching pairs, tables, etc. You can also add videos, audio, and images. With beautiful design and rich media, Wizer makes learning fun and simple for your students.

The app is quite simple to use, both for teachers and students. You can integrate it with Google Classroom or any other LMS. It has two plans: a free one and a paid one. Paid plan costs almost $5/month. Educational institutions can request a group purchasing quote.

Canva is an online designing tool that you can use to create almost anything, including beautiful worksheets. Canva has professionally designed worksheets templates that serve as a good starting point. You can then customize, share, and print these worksheets.

Alternatively, you can use a blank canvas and build a worksheet from scratch. Canva has thousands of design elements and features that can help you to build engaging worksheets.

Related: Things You Can Create With Canva With Zero Effort

7. Design Hill

Like Canva, Design Hill is a graphic designing tool and creative marketplace with several tools. A handy worksheet maker is one of them.

Design Hill has numerous ready-made templates for different subjects. You can customize these templates and build your own worksheets, adding photos, elements, icons, and text. Design Hill is best for primary school teachers who need to create simple and beautiful worksheets.

Make Online Learning Fun

Online learning can either be great fun or completely boring. These websites can help you make interactive and beautiful worksheets to make learning enjoyable for your students.

Other than worksheets, there are tons of other ways through which you can make learning an enjoyable experience for your students.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Nonresident aliens.

Comments and suggestions.

Getting answers to your tax questions.

Getting tax forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

- Useful Items - You may want to see:

Gross income.

Self-employed persons.

Filing status.

Death of spouse.

Death of taxpayer.

U.S. Citizens or Resident Aliens Living Abroad

Residents of puerto rico, individuals with income from u.s. territories.

Responsibility of parent.

Earned income.

Child's earnings.

Unearned income.

Election to report child's unearned income on parent's return.

Other Situations

Form 1099-B received.

Unmarried persons.

Divorced persons.

Divorce and remarriage.

Annulled marriages.

Head of household or qualifying surviving spouse.

Married persons.

Considered married.

Spouse died during the year.

Married persons living apart.

Spouse died before January 1, 2023.

Spouse died.

Accounting period.

Joint responsibility.

Divorced taxpayer.

Relief from joint responsibility.

Signing a joint return.

Spouse died before signing.

Spouse away from home.

Injury or disease prevents signing.

Signing as guardian of spouse.

Spouse in combat zone.

Power of attorney (POA).

Nonresident alien or dual-status alien.

How to file.

Adjusted gross income (AGI) limits.

Individual retirement arrangements (IRAs).

Rental activity losses.

Community property states.

Joint Return After Separate Returns

Nonresident alien spouse.

Choice to treat spouse as resident.

Costs you include.

Costs you don't include.

Home of qualifying person.

Special rule for parent.

Death or birth.

Temporary absences.

Adopted child or foster child.

Kidnapped child.

- Table 4. Who Is a Qualifying Person Qualifying You To File as Head of Household?

Eligibility rules.

Adopted child.

Table 5. Overview of the Rules for Claiming a Dependent

Housekeepers, maids, or servants.

Child tax credit.

Credit for other dependents.

Exception for adopted child.

Child's place of residence.

Foreign students' place of residence.

U.S. national.

Foster child.

Child must be younger than you or your spouse.

Student defined.

Full-time student.

School defined.

Vocational high school students.

Permanently and totally disabled.

Death or birth of child.

Child born alive.

Stillborn child.

Children of divorced or separated parents (or parents who live apart).

Custodial parent and noncustodial parent.

Equal number of nights.

December 31.

Emancipated child.

Parent works at night.

Written declaration.

Post-1984 and pre-2009 divorce decree or separation agreement.

Post-2008 divorce decree or separation agreement.

Revocation of release of claim to an exemption.

Remarried parent.

Parents who never married.

Foster care payments and expenses.

Scholarships.

TANF and other governmental payments.

- Worksheet 2. Worksheet for Determining Support

Tiebreaker rules.

Applying the tiebreaker rules to divorced or separated parents (or parents who live apart).

Child of person not required to file a return.

Child in Canada or Mexico.

Relatives who don't have to live with you.

Joint return.

Local law violated.

Gross income defined.

Disabled dependent working at sheltered workshop.

How to determine if support test is met.

Person's own funds not used for support.

Child's wages used for own support.

Year support is provided.

Armed Forces dependency allotments.

Tax-exempt military quarters allowances.

Tax-exempt income.

Social security benefits.

Support provided by the state (welfare, food benefits, housing, etc.).

Foster care.

Home for the aged.

Fair rental value defined.

Person living in their own home.

Living with someone rent free.

Capital expenses.

Medical insurance premiums.

Medical insurance benefits.

Tuition payments and allowances under the GI Bill.

Childcare expenses.

Other support items.

Don't Include in Total Support

Multiple support agreement.

Child support under pre-1985 agreement.

Multiple support agreement.

Born and died in 2023.

Alien or adoptee with no SSN.

Taxpayer identification numbers for aliens.

Taxpayer identification numbers for adoptees.

Persons not eligible for the standard deduction.

Decedent's final return.

Not totally blind.

Earned income defined.

When to itemize.

Electing to itemize for state tax or other purposes.

Changing your mind.

Married persons who filed separate returns.

2023 Standard Deduction Tables

Preparing and filing your tax return.

Free options for tax preparation.

Using online tools to help prepare your return.

Need someone to prepare your tax return?

Employers can register to use Business Services Online.

IRS social media.

Watching IRS videos.

Online tax information in other languages.

Free Over-the-Phone Interpreter (OPI) Service.

Accessibility Helpline available for taxpayers with disabilities.

Getting tax forms and publications.

Getting tax publications and instructions in eBook format.

Access your online account (individual taxpayers only).

Get a transcript of your return.

Tax Pro Account.

Using direct deposit.

Reporting and resolving your tax-related identity theft issues.

Ways to check on the status of your refund.

Making a tax payment.

What if I can’t pay now?

Filing an amended return.

Checking the status of your amended return.

Understanding an IRS notice or letter you’ve received.

Responding to an IRS notice or letter.

Contacting your local TAC.

What Is TAS?

How can you learn about your taxpayer rights, what can tas do for you, how can you reach tas, how else does tas help taxpayers, low income taxpayer clinics (litcs), publication 501 - additional material, publication 501 (2023), dependents, standard deduction, and filing information.

For use in preparing 2023 Returns

Publication 501 - Introductory Material

Who must file. In some cases, the amount of income you can receive before you must file a tax return has increased. Table 1 shows the filing requirements for most taxpayers.

Standard deduction increased. The standard deduction for taxpayers who don't itemize their deductions on Schedule A (Form 1040) is higher for 2023 than it was for 2022. The amount depends on your filing status. You can use the 2023 Standard Deduction Tables near the end of this publication to figure your standard deduction.

Future developments. Information about any future developments affecting Pub. 501 (such as legislation enacted after we release it) will be posted at IRS.gov/Pub501 .

Taxpayer identification number for aliens. If you are a nonresident or resident alien and you don't have and aren't eligible to get a social security number (SSN), you must apply for an individual taxpayer identification number (ITIN). Your spouse may also need an ITIN if your spouse doesn't have and isn't eligible to get an SSN. See Form W-7, Application for IRS Individual Taxpayer Identification Number. Also see Social Security Numbers (SSNs) for Dependents , later.

Photographs of missing children. The Internal Revenue Service is a proud partner with the National Center for Missing & Exploited Children® (NCMEC) . Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. You can help bring these children home by looking at the photographs and calling 1-800-THE-LOST (1-800-843-5678) if you recognize a child.

Introduction

This publication discusses some tax rules that affect every person who may have to file a federal income tax return. It answers some basic questions: who must file, who should file, what filing status to use, and the amount of the standard deduction.

Who Must File explains who must file an income tax return. If you have little or no gross income, reading this section will help you decide if you have to file a return.

Who Should File helps you decide if you should file a return, even if you aren't required to do so.

Filing Status helps you determine which filing status to use. Filing status is important in determining whether you must file a return and whether you may claim certain deductions and credits. It also helps determine your standard deduction and tax rate.

Dependents explains the difference between a qualifying child and a qualifying relative . Other topics include the SSN requirement for dependents, the rules for multiple support agreements, and the rules for divorced or separated parents.

Standard Deduction gives the rules and dollar amounts for the standard deduction—a benefit for taxpayers who don't itemize their deductions. This section also discusses the standard deduction for taxpayers who are blind or age 65 or older, as well as special rules that limit the standard deduction available to dependents. In addition, this section helps you decide whether you would be better off taking the standard deduction or itemizing your deductions.

How To Get Tax Help explains how to get tax help from the IRS.

This publication is for U.S. citizens and resident aliens only. If you are a resident alien for the entire year, you must follow the same tax rules that apply to U.S. citizens. The rules to determine if you are a resident or nonresident alien are discussed in chapter 1 of Pub. 519.

If you were a nonresident alien at any time during the year, the rules and tax forms that apply to you may be different from those that apply to U.S. citizens. See Pub. 519.

We welcome your comments about this publication and suggestions for future editions.

You can send us comments through IRS.gov/FormComments . Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications. Don’t send tax questions, tax returns, or payments to the above address.

If you have a tax question not answered by this publication or the How To Get Tax Help section at the end of this publication, go to the IRS Interactive Tax Assistant page at IRS.gov/Help/ITA where you can find topics by using the search feature or viewing the categories listed.

Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

Useful Items

Publication

559 Survivors, Executors, and Administrators

Form (and Instructions)

1040-X Amended U.S. Individual Income Tax Return

2848 Power of Attorney and Declaration of Representative

8332 Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent

8814 Parents' Election To Report Child's Interest and Dividends

Publication 501 - Main Contents

Who must file.

If you are a U.S. citizen or resident alien, whether you must file a federal income tax return depends on your gross income, your filing status, your age, and whether you are a dependent. For details, see Table 1 and Table 2 . You must also file if one of the situations described in Table 3 applies. The filing requirements apply even if you owe no tax.

Table 1. 2023 Filing Requirements Chart for Most Taxpayers

You may have to pay a penalty if you are required to file a return but fail to do so. If you willfully fail to file a return, you may be subject to criminal prosecution.

Gross income is all income you receive in the form of money, goods, property, and services that isn't exempt from tax. If you are married and live with your spouse in a community property state, half of any income defined by state law as community income may be considered yours. For a list of community property states, see Community property states under Married Filing Separately , later.

If you are self-employed in a business that provides services (where products aren't a factor), your gross income from that business is the gross receipts. If you are self-employed in a business involving manufacturing, merchandising, or mining, your gross income from that business is the total sales minus the cost of goods sold. In either case, you must add any income from investments and from incidental or outside operations or sources.

Your filing status generally depends on whether you are single or married. Whether you are single or married is determined at the end of your tax year, which is December 31 for most taxpayers. Filing status is discussed in detail later in this publication.

Age is a factor in determining if you must file a return only if you are 65 or older at the end of your tax year. For 2023, you are 65 or older if you were born before January 2, 1959.

Filing Requirements for Most Taxpayers

You must file a return if your gross income for the year was at least the amount shown on the appropriate line in Table 1 . Dependents should see Table 2 instead.

Deceased Persons

You must file an income tax return for a decedent (a person who died) if both of the following are true.

Your spouse died, or you are the executor, administrator, or legal representative.

The decedent met the filing requirements described in this publication at the time of the decedent’s death.

For more information, see Final Income Tax Return for Decedent—Form 1040 or 1040-SR in Pub. 559.

If your spouse died in 2023, read this before using Table 1 or Table 2 to find whether you must file a 2023 return. Consider your spouse to be 65 or older at the end of 2023 only if your spouse was 65 or older at the time of death. Even if your spouse was born before January 2, 1959, your spouse isn't considered 65 or older at the end of 2023 unless your spouse was 65 or older at the time of death.

A person is considered to reach age 65 on the day before the person’s 65th birthday.

Your spouse was born on February 14, 1958, and died on February 13, 2023. Your spouse is considered age 65 at the time of death. However, if your spouse died on February 12, 2023, your spouse isn't considered age 65 at the time of death and is not 65 or older at the end of 2023.

If you are preparing a return for someone who died in 2023, read this before using Table 1 or Table 2. Consider the taxpayer to be 65 or older at the end of 2023 only if the taxpayer was 65 or older at the time of death. Even if the taxpayer was born before January 2, 1959, the taxpayer isn't considered 65 or older at the end of 2023 unless the taxpayer was 65 or older at the time of death.

Table 2. 2023 Filing Requirements for Dependents

To determine whether you must file a return, include in your gross income any income you earned or received abroad, including any income you can exclude under the foreign earned income exclusion. For more information on special tax rules that may apply to you, see Pub. 54.

If you are a U.S. citizen and also a bona fide resident of Puerto Rico, you must generally file a U.S. income tax return for any year in which you meet the income requirements. This is in addition to any legal requirement you may have to file an income tax return with Puerto Rico.

If you are a bona fide resident of Puerto Rico for the whole year, your U.S. gross income doesn't include income from sources within Puerto Rico. It does, however, include any income you received for your services as an employee of the United States or any U.S. agency. If you receive income from Puerto Rican sources that isn't subject to U.S. tax, you must reduce your standard deduction, which reduces the amount of income you can have before you must file a U.S. income tax return.

For more information, see Pub. 570.

If you had income from Guam, the Commonwealth of the Northern Mariana Islands, American Samoa, or the U.S. Virgin Islands, special rules may apply when determining whether you must file a U.S. federal income tax return. In addition, you may have to file a return with the individual territory government. See Pub. 570 for more information.

A person who is a dependent may still have to file a return. It depends on the person’s earned income, unearned income, and gross income. For details, see Table 2 . A dependent must also file if one of the situations described in Table 3 applies.

If a dependent child must file an income tax return but can't file due to age or any other reason, a parent, guardian, or other legally responsible person must file it for the child. If the child can't sign the return, the parent or guardian must sign the child's name followed by the words “By (your signature), parent for minor child.”

Earned income includes salaries, wages, professional fees, and other amounts received as pay for work you actually perform. Earned income (only for purposes of filing requirements and the standard deduction) also includes any part of a taxable scholarship. See chapter 1 of Pub. 970 for more information on taxable and nontaxable scholarships.

Amounts a child earns by performing services are included in the child’s gross income and not the gross income of the parent. This is true even if under local law the child's parent has the right to the earnings and may actually have received them. But if the child doesn't pay the tax due on this income, the parent is liable for the tax.

Unearned income includes income such as interest, dividends, and capital gains. Trust distributions of interest, dividends, capital gains, and survivor annuities are also considered unearned income.

You may be able to include your child's interest and dividend income on your tax return. If you do this, your child won't have to file a return. To make this election, all of the following conditions must be met.

Your child was under age 19 (or under age 24 if a student) at the end of 2023. (A child born on January 1, 2005, is considered to be age 19 at the end of 2023; you can't make the election for this child unless the child was a student. Similarly, a child born on January 1, 2000, is considered to be age 24 at the end of 2023; you can't make the election for this child.)

Your child had gross income only from interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends).

The interest and dividend income was less than $12,500.

Your child is required to file a return for 2023 unless you make this election.

Your child doesn't file a joint return for 2023.

No estimated tax payment was made for 2023 and no 2022 overpayment was applied to 2023 under your child's name and SSN.

No federal income tax was withheld from your child's income under the backup withholding rules.

You are the parent whose return must be used when making the election to report your child's unearned income.

For more information, see Form 8814, Parents’ Election To Report Child’s Interest and Dividends, and its instructions.

You may have to file a tax return even if your gross income is less than the amount shown in Table 1 or Table 2 for your filing status. See Table 3 for those other situations when you must file.

Table 3. Other Situations When You Must File a 2023 Return

Who should file.

Even if you don't have to file, you should file a tax return if you can get money back. For example, you should file if one of the following applies.

You had income tax withheld from your pay.

You made estimated tax payments for the year or had any of your overpayment for last year applied to this year's estimated tax.

You qualify for the earned income credit. See Pub. 596 for more information.

You qualify for the additional child tax credit. See the Instructions for Form 1040 for more information.

You qualify for the refundable American opportunity credit. See Form 8863.

You qualify for the credit for federal tax on fuels. See Form 4136.

You qualify for the premium tax credit. See Form 8962.

Even if you aren't required to file a return, you should consider filing if all of the following apply.

You received a Form 1099-B, Proceeds From Broker and Barter Exchange Transactions (or substitute statement).

The amount in box 1d of Form 1099-B (or substitute statement), when added to your other gross income, means you have to file a tax return because of the filing requirement in Table 1 or Table 2 that applies to you.

Box 1e of Form 1099-B (or substitute statement) is blank.

Filing Status

You must determine your filing status before you can determine whether you must file a tax return, your standard deduction (discussed later), and your tax. You also use your filing status to determine whether you are eligible to claim certain other deductions and credits.

There are five filing statuses.

Married filing jointly.

Married filing separately.

Head of household.

Qualifying surviving spouse.

Marital Status

In general, your filing status depends on whether you are considered unmarried or married.

You are considered unmarried for the whole year if, on the last day of your tax year, you are either:

Unmarried, or

Legally separated from your spouse under a divorce or separate maintenance decree.

State law governs whether you are married or legally separated under a divorce or separate maintenance decree.

If you are divorced under a final decree by the last day of the year, you are considered unmarried for the whole year.

If you obtain a divorce for the sole purpose of filing tax returns as unmarried individuals, and at the time of divorce you intend to and do, in fact, remarry each other in the next tax year, you and your spouse must file as married individuals in both years.

If you obtain a court decree of annulment, which holds that no valid marriage ever existed, you are considered unmarried even if you filed joint returns for earlier years. File amended returns (Form(s) 1040-X) claiming single or head of household status for all tax years that are affected by the annulment and not closed by the statute of limitations for filing a tax return. Generally, for a credit or refund, you must file Form(s) 1040-X within 3 years (including extensions) after the date you filed your original return or within 2 years after the date you paid the tax, whichever is later. If you filed your original tax return early (for example, March 1), your return is considered filed on the due date (generally April 15). However, if you had an extension to file (for example, until October 15) but you filed earlier and we received it on July 1, your return is considered filed on July 1.

If you are considered unmarried, you may be able to file as head of household or as a qualifying surviving spouse. See Head of Household and Qualifying Surviving Spouse , later, to see if you qualify.

If you are considered married, you and your spouse can file a joint return or separate returns.

You are considered married for the whole year if, on the last day of your tax year, you and your spouse meet any one of the following tests.

You are married and living together.

You are living together in a common law marriage recognized in the state where you now live or in the state where the common law marriage began.

You are married and living apart but not legally separated under a decree of divorce or separate maintenance.

You are separated under an interlocutory (not final) decree of divorce.

If your spouse died during the year, you are considered married for the whole year for filing status purposes.

If you didn't remarry before the end of the tax year, you can file a joint return for yourself and your deceased spouse. For the next 2 years, you may be entitled to the special benefits described later under Qualifying Surviving Spouse .

If you remarried before the end of the tax year, you can file a joint return with your new spouse. Your deceased spouse's filing status is married filing separately for that year.

If you live apart from your spouse and meet certain tests, you may be able to file as head of household even if you aren't divorced or legally separated. If you qualify to file as head of household instead of as married filing separately, your standard deduction will be higher and your tax may be lower. See Head of Household , later.

Your filing status is single if you are considered unmarried and you don't qualify for another filing status. To determine your marital status, see Marital Status , earlier.

Your filing status may be single if your spouse died before January 1, 2023, and you didn't remarry before the end of 2023. You may, however, be able to use another filing status that will give you a lower tax. See Head of Household and Qualifying Surviving Spouse , later, to see if you qualify.

On Form 1040 or 1040-SR, show your filing status as single by checking the “Single” box on the Filing Status line near the top of the form. Use the Single column of the Tax Table, or Section A of the Tax Computation Worksheet, to figure your tax.

Married Filing Jointly

You can choose married filing jointly as your filing status if you are considered married and both you and your spouse agree to file a joint return. On a joint return, you and your spouse report your combined income and deduct your combined allowable expenses. You can file a joint return even if one of you had no income or deductions.

If you and your spouse decide to file a joint return, your tax may be lower than your combined tax for the other filing statuses. Also, your standard deduction (if you don't itemize deductions) may be higher, and you may qualify for tax benefits that don't apply to other filing statuses.

On Form 1040 or 1040-SR, show your filing status as married filing jointly by checking the “Married filing jointly” box on the Filing Status line near the top of the form. Use the Married filing jointly column of the Tax Table, or Section B of the Tax Computation Worksheet, to figure your tax.

If your spouse died during the year, you are considered married for the whole year and can choose married filing jointly as your filing status. See Spouse died during the year under Married persons , earlier.

If your spouse died in 2024 before filing a 2023 return, you can choose married filing jointly as your filing status on your 2023 return.

If you are divorced under a final decree by the last day of the year, you are considered unmarried for the whole year and you can't choose married filing jointly as your filing status.

Filing a Joint Return

Both you and your spouse must include all of your income and deductions on your joint return.

Both of you must use the same accounting period, but you can use different accounting methods.

Both of you may be held responsible, jointly and individually, for the tax and any interest or penalty due on your joint return. This means that if one spouse doesn't pay the tax due, the other may have to. Or, if one spouse doesn't report the correct tax, both spouses may be responsible for any additional taxes assessed by the IRS. One spouse may be held responsible for all the tax due even if all the income was earned by the other spouse.

You may want to file separately if:

You believe your spouse isn't reporting all of their income, or

You don't want to be responsible for any taxes due if your spouse doesn't have enough tax withheld or doesn't pay enough estimated tax.

You may be held jointly and individually responsible for any tax, interest, and penalties due on a joint return filed before your divorce. This responsibility may apply even if your divorce decree states that your former spouse will be responsible for any amounts due on previously filed joint returns.

In some cases, one spouse may be relieved of joint responsibility for tax, interest, and penalties on a joint return for items of the other spouse that were incorrectly reported on the joint return. You can ask for relief no matter how small the liability.

There are three types of relief available.

Innocent spouse relief.

Separation of liability (available only to joint filers whose spouse has died, or who are divorced, who are legally separated, or who haven't lived together for the 12 months ending on the date the election for this relief is filed).

Equitable relief.

You must file Form 8857, Request for Innocent Spouse Relief, to request relief from joint responsibility. Pub. 971 explains the kinds of relief and who may qualify for them.

For a return to be considered a joint return, both spouses must generally sign the return.

If your spouse died before signing the return, the executor or administrator must sign the return for your spouse. If neither you nor anyone else has been appointed as executor or administrator, you can sign the return for your spouse and enter “Filing as surviving spouse” in the area where you sign the return.

If your spouse is away from home, you should prepare the return, sign it, and send it to your spouse to sign so it can be filed on time.

If your spouse can't sign because of injury or disease and tells you to sign for them, you can sign your spouse's name in the proper space on the return followed by the words “By (your name), Spouse.” Be sure to sign in the space provided for your signature. Attach a dated statement, signed by you, to the return. The statement should include the form number of the return you are filing, the tax year, and the reason your spouse can't sign, and it should state that your spouse has agreed to your signing for them.

If you are the guardian of your spouse who is mentally incompetent, you can sign the return for your spouse as guardian.

You can sign a joint return for your spouse if your spouse can't sign because they are serving in a combat zone (such as the Persian Gulf area, Serbia, Montenegro, Albania, or Afghanistan), even if you don't have a power of attorney or other statement. Attach a signed statement to your return explaining that your spouse is serving in a combat zone. For more information on special tax rules for persons who are serving in a combat zone, or who are in missing status as a result of serving in a combat zone, see Pub. 3, Armed Forces' Tax Guide.

In order for you to sign a return for your spouse in any of these cases, you must attach to the return a POA that authorizes you to sign for your spouse. You can use a POA that states that you have been granted authority to sign the return, or you can use Form 2848. Part I of Form 2848 must state that you are granted authority to sign the return.

Generally, a married couple can't file a joint return if either one is a nonresident alien at any time during the tax year. However, if one spouse was a nonresident alien or dual-status alien who was married to a U.S. citizen or resident alien at the end of the year, the spouses can choose to file a joint return. If you do file a joint return, you and your spouse are both treated as U.S. residents for the entire tax year. See chapter 1 of Pub. 519.

Married Filing Separately

You can choose married filing separately as your filing status if you are married. This filing status may benefit you if you want to be responsible only for your own tax or if it results in less tax than filing a joint return.

If you and your spouse don't agree to file a joint return, you must use this filing status unless you qualify for head of household status, discussed later.

You may be able to choose head of household filing status if you are considered unmarried because you live apart from your spouse and meet certain tests (explained later under Head of Household ). This can apply to you even if you aren't divorced or legally separated. If you qualify to file as head of household, instead of as married filing separately, your tax may be lower, you may be able to claim certain tax benefits, and your standard deduction will be higher. The head of household filing status allows you to choose the standard deduction even if your spouse chooses to itemize deductions. See Head of Household , later, for more information.

If you file a separate return, you generally report only your own income, credits, and deductions.

Select this filing status by checking the “Married filing separately” box on the Filing Status line near the top of Form 1040 or 1040-SR. Enter your spouse's full name in the entry space at the bottom of the Filing Status section and enter your spouse's SSN or ITIN in the space for spouse's SSN on Form 1040 or 1040-SR. If your spouse doesn't have and isn't required to have an SSN or ITIN, enter “NRA” in the entry space below the filing status checkboxes. For electronic filing, enter the spouse's name or “NRA” if the spouse doesn't have an SSN or ITIN in the entry space below the filing status checkboxes. Use the Married filing separately column of the Tax Table, or Section C of the Tax Computation Worksheet, to figure your tax.

Special Rules

If you choose married filing separately as your filing status, the following special rules apply. Because of these special rules, you usually pay more tax on a separate return than if you use another filing status you qualify for.

Your tax rate is generally higher than on a joint return.

Your exemption amount for figuring the alternative minimum tax is half that allowed on a joint return.

You can't take the credit for child and dependent care expenses in most cases, and the amount you can exclude from income under an employer's dependent care assistance program is limited to $2,500 (instead of $5,000 on a joint return). However, if you are legally separated or living apart from your spouse, you may be able to file a separate return and still take the credit. See What’s Your Filing Status? in Pub. 503, Child and Dependent Care Expenses, for more information.

You can't take the earned income credit unless you have a qualifying child and meet certain other requirements.

You can't take the exclusion or credit for adoption expenses in most cases.

You can't take the education credits (the American opportunity credit and lifetime learning credit), or the deduction for student loan interest.

You can't exclude any interest income from qualified U.S. savings bonds you used for higher education expenses.

If you lived with your spouse at any time during the tax year:

You can't claim the credit for the elderly or the disabled, and

You must include in income a greater percentage (up to 85%) of any social security or equivalent railroad retirement benefits you received.

The following credits and deductions are reduced at income levels half those for a joint return.

The child tax credit and the credit for other dependents.

The retirement savings contributions credit.

Your capital loss deduction limit is $1,500 (instead of $3,000 on a joint return).

If your spouse itemizes deductions, you can't claim the standard deduction. If you can claim the standard deduction, your basic standard deduction is half the amount allowed on a joint return.

If your AGI on a separate return is lower than it would have been on a joint return, you may be able to deduct a larger amount for certain deductions that are limited by AGI, such as medical expenses.

You may not be able to deduct all or part of your contributions to a traditional IRA if you or your spouse was covered by an employee retirement plan at work during the year. Your deduction is reduced or eliminated if your income is more than a certain amount. This amount is much lower for married individuals who file separately and lived together at any time during the year. For more information, see How Much Can You Deduct? in chapter 1 of Pub. 590-A.

If you actively participated in a passive rental real estate activity that produced a loss, you can generally deduct the loss from your nonpassive income up to $25,000. This is called a special allowance. However, married persons filing separate returns who lived together at any time during the year can't claim this special allowance. Married persons filing separate returns who lived apart at all times during the year are each allowed a $12,500 maximum special allowance for losses from passive real estate activities. See Rental Activities in Pub. 925, Passive Activity and At-Risk Rules.

Community property states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. If you live in a community property state and file separately, your income may be considered separate income or community income for income tax purposes. See Pub. 555.

You can change your filing status from a separate return to a joint return by filing an amended return using Form 1040-X.

You can generally change to a joint return any time within 3 years from the due date of the separate return or returns. This doesn't include any extensions. A separate return includes a return filed by you or your spouse claiming married filing separately, single, or head of household filing status.

Separate Returns After Joint Return

Once you file a joint return, you can't choose to file separate returns for that year after the due date of the return.

A personal representative for a decedent can change from a joint return elected by the surviving spouse to a separate return for the decedent. The personal representative has 1 year from the due date (including extensions) of the return to make the change. See Pub. 559 for more information on filing income tax returns for a decedent.

Head of Household

You may be able to file as head of household if you meet all the following requirements.

You are unmarried or considered unmarried on the last day of the year. See Marital Status , earlier, and Considered Unmarried , later.

You paid more than half the cost of keeping up a home for the year.

A qualifying person lived with you in the home for more than half the year (except for temporary absences, such as school). However, if the qualifying person is your dependent parent, your dependent parent doesn't have to live with you. See Special rule for parent , later, under Qualifying Person .

Indicate your choice of this filing status by checking the “Head of household” box on the Filing Status line near the top of Form 1040 or 1040-SR. If the child who qualifies you for this filing status isn't claimed as your dependent in the Dependents section of Form 1040 or 1040-SR, enter the child's name in the entry space at the bottom of the Filing Status section. Use the Head of a household column of the Tax Table, or Section D of the Tax Computation Worksheet, to figure your tax.

Considered Unmarried

To qualify for head of household status, you must be either unmarried or considered unmarried on the last day of the year. You are considered unmarried on the last day of the tax year if you meet all the following tests.

You file a separate return. A separate return includes a return claiming married filing separately, single, or head of household filing status.

You paid more than half the cost of keeping up your home for the tax year.

Your spouse didn't live in your home during the last 6 months of the tax year. Your spouse is considered to live in your home even if your spouse is temporarily absent due to special circumstances. See Temporary absences , later.

Your home was the main home of your child, stepchild, or foster child for more than half the year. (See Home of qualifying person , later, for rules applying to a child's birth, death, or temporary absence during the year.)

You must be able to claim the child as a dependent. However, you meet this test if you can't claim the child as a dependent only because the noncustodial parent can claim the child using the rules described later in Children of divorced or separated parents (or parents who live apart) under Qualifying Child or in Support Test for Children of Divorced or Separated Parents (or Parents Who Live Apart) under Qualifying Relative . The general rules for claiming a child as a dependent are explained later under Dependents .

You may be considered unmarried for the purpose of using head of household status but not for other purposes, such as claiming the EIC. Different tests apply depending on the tax benefit you claim.

You are considered unmarried for head of household purposes if your spouse was a nonresident alien at any time during the year and you don't choose to treat your nonresident spouse as a resident alien. However, your spouse isn't a qualifying person for head of household purposes. You must have another qualifying person and meet the other tests to be eligible to file as head of household.

You are considered married if you choose to treat your spouse as a resident alien. See chapter 1 of Pub. 519.

Keeping Up a Home

To qualify for head of household status, you must pay more than half of the cost of keeping up a home for the year. You can determine whether you paid more than half of the cost of keeping up a home by using Worksheet 1 .

Worksheet 1. Cost of Keeping Up a Home

Include in the cost of keeping up a home expenses such as rent, mortgage interest, real estate taxes, insurance on the home, repairs, utilities, and food eaten in the home.

Don't include the cost of clothing, education, medical treatment, vacations, life insurance, or transportation. Also don't include the value of your services or those of a member of your household.

Qualifying Person

See Table 4 to see who is a qualifying person. Any person not described in Table 4 isn't a qualifying person.

Example 1—child.

Your unmarried child lived with you all year and was 18 years old at the end of the year. Your child didn't provide more than half of their own support and doesn't meet the tests to be a qualifying child of anyone else. As a result, this child is your qualifying child (see Qualifying Child , later) and, because this child is single, this is your qualifying person for head of household purposes.

Example 2—child who isn't qualifying person.

The facts are the same as in Example 1 , except your child was 25 years old at the end of the year and your child’s gross income was $5,000. Because your child doesn't meet the age test (explained later under Qualifying Child ), your child isn't your qualifying child. Because the child doesn't meet the gross income test (explained later under Qualifying Relative ), the child isn't your qualifying relative. As a result, this child isn't your qualifying person for head of household purposes.

Example 3—your friend.

Your friend lived with you all year. Even though your friend may be your qualifying relative if the gross income and support tests (explained later) are met, your friend isn't your qualifying person for head of household purposes because your friend isn't related to you in one of the ways listed under Relatives who don't have to live with you , later. See Table 4 .

Example 4—friend's child.

The facts are the same as in Example 3 , except your friend's 10-year-old child also lived with you all year. Your friend’s child isn't your qualifying child and, because the child is your friend's qualifying child, your friend’s child isn't your qualifying relative (see Not a Qualifying Child Test , later). As a result, your friend’s child isn't your qualifying person for head of household purposes.

Generally, the qualifying person must live with you for more than half of the year.

If your qualifying person is your parent, you may be eligible to file as head of household even if your parent doesn't live with you. However, you must be able to claim your parent as a dependent. Also, you must pay more than half the cost of keeping up a home that was the main home for the entire year for your parent.

If you pay more than half the cost of keeping your parent in a rest home or home for the elderly, that counts as paying more than half the cost of keeping up your parent's main home.

You may be eligible to file as head of household even if the qualifying person who qualifies you for this filing status is born or dies during the year. To qualify you for head of household filing status, the qualifying person (as defined in Table 4 ) must be one of the following.

Your qualifying child or qualifying relative who lived with you for more than half the part of the year they were alive.

Your parent for whom you paid, for the entire part of the year your parent was alive, more than half the cost of keeping up the home your parent lived in.

You are unmarried. Your parent, who you claim as a dependent, lived in an apartment alone. Your parent died on September 2. The cost of the upkeep of the apartment for the year until your parent’s death was $6,000. You paid $4,000 and your sibling paid $2,000. Your sibling made no other payments toward your parent’s support. Your parent had no income. Because you paid more than half of the cost of keeping up your parent’s apartment from January 1 until your parent’s death, and you can claim your parent as a dependent, you can file as head of household.

You and your qualifying person are considered to live together even if one or both of you are temporarily absent from your home due to special circumstances such as illness, education, business, vacation, military service, or detention in a juvenile facility. It must be reasonable to assume the absent person will return to the home after the temporary absence. You must continue to keep up the home during the absence.

You may be eligible to file as head of household if the person who qualifies you for this filing status was an adopted child or foster child and you kept up a home for this person in 2023, the person was lawfully placed with you for legal adoption by you in 2023, or the person was an eligible foster child placed with you during 2023. The person is considered to have lived with you for more than half of 2023 if your main home was this person's main home for more than half the time since the child was adopted or placed with you in 2023.

You may be eligible to file as head of household even if the child who is your qualifying person has been kidnapped. You can claim head of household filing status if all the following statements are true.

The child is presumed by law enforcement authorities to have been kidnapped by someone who isn't a member of your family or the child's family.

In the year of the kidnapping, the child lived with you for more than half the part of the year before the kidnapping.

In the year of the child’s return, the child lived with you for more than half the part of the year following the date of the child’s return.

You would have qualified for head of household filing status if the child hadn't been kidnapped.

This treatment applies for all years until the earlier of:

The year there is a determination that the child is dead, or

The year the child would have reached age 18.

Qualifying Surviving Spouse

If your spouse died in 2023, you can use married filing jointly as your filing status for 2023 if you otherwise qualify to use that status. The year of death is the last year for which you can file jointly with your deceased spouse. See Married Filing Jointly , earlier.

You may be eligible to use qualifying surviving spouse as your filing status for 2 years following the year your spouse died. For example, if your spouse died in 2022 and you haven't remarried, you may be able to use this filing status for 2023 and 2024. The rules for using this filing status are explained in detail here.

This filing status entitles you to use joint return tax rates and the highest standard deduction amount (if you don't itemize deductions). It doesn't entitle you to file a joint return.

Indicate your choice of this filing status by checking the “Qualifying surviving spouse” box on the Filing Status line near the top of Form 1040 or 1040-SR. If the child who qualifies you for this filing status isn’t claimed as your dependent in the Dependents section of Form 1040 or 1040-SR, enter the child’s name in the entry space at the bottom of the Filing Status section. Use the Married filing jointly column of the Tax Table, or Section B of the Tax Computation Worksheet, to figure your tax.

Table 4. Who Is a Qualifying Person Qualifying You To File as Head of Household? 1

You are eligible to file your 2023 return as a qualifying surviving spouse if you meet all the following tests.

You were entitled to file a joint return with your spouse for the year your spouse died. It doesn't matter whether you actually filed a joint return.

Your spouse died in 2021 or 2022 and you didn't remarry before the end of 2023.

You have a child or stepchild (not a foster child) whom you can claim as a dependent or could claim as a dependent except that, for 2023:

The child had gross income of $4,700 or more,

The child filed a joint return, or

You could be claimed as a dependent on someone else’s return.

If the child isn’t claimed as your dependent in the Dependents section on Form 1040 or 1040-SR, enter the child’s name in the entry space at the bottom of the Filing Status section. If you don’t enter the name, it will take us longer to process your return.

This child lived in your home all year, except for temporary absences. See Temporary absences , earlier, under Head of Household . There are also exceptions, described later, for a child who was born or died during the year and for a kidnapped child.

You paid more than half the cost of keeping up a home for the year. See Keeping Up a Home , earlier, under Head of Household .

Your spouse died in 2021 and you haven’t remarried. During 2022 and 2023, you continued to keep up a home for you and your child who lives with you and whom you can claim as a dependent. For 2021, you were entitled to file a joint return for you and your deceased spouse. For 2022 and 2023, you can file as a qualifying surviving spouse. After 2023, you can file as head of household if you qualify.

You may be eligible to file as a qualifying surviving spouse if the child who qualifies you for this filing status is born or dies during the year. You must have provided more than half of the cost of keeping up a home that was the child's main home during the entire part of the year the child was alive.

You may be eligible to file as a qualifying surviving spouse if the child who qualifies you for this filing status you adopted in 2023 or was lawfully placed with you for legal adoption by you in 2023. The child is considered to have lived with you for all of 2023 if your main home was this child's main home for the entire time since this child was adopted or placed with you in 2023.

You may be eligible to file as a qualifying surviving spouse even if the child who qualifies you for this filing status has been kidnapped. You can claim qualifying surviving spouse filing status if all the following statements are true.

You would have qualified for qualifying surviving spouse filing status if the child had not been kidnapped.

The term “dependent” means:

A qualifying child, or

A qualifying relative.

All the requirements for claiming a dependent are summarized in Table 5 .

If these people work for you, you can't claim them as dependents.

You may be entitled to a child tax credit for each qualifying child who was under age 17 at the end of the year if you claimed that child as a dependent. For more information, see the Instructions for Form 1040.

You may be entitled to a credit for other dependents for each qualifying child who does not qualify you for the child tax credit and for each qualifying relative. For more information, see the Instructions for Form 1040.

Even if you have a qualifying child or qualifying relative, you can claim that person as a dependent only if these three tests are met.

Dependent taxpayer test .

Joint return test .

Citizen or resident test .

Dependent Taxpayer Test

If you can be claimed as a dependent by another taxpayer, you can't claim anyone else as a dependent. Even if you have a qualifying child or qualifying relative, you can't claim that person as a dependent.

If you are filing a joint return and your spouse can be claimed as a dependent by another taxpayer, you and your spouse can't claim any dependents on your joint return.

If you can be claimed as a dependent by another taxpayer, you can claim someone else as a dependent if the person who can claim you (or your spouse if filing a joint return) as a dependent files a return only to claim a refund of income tax withheld or estimated tax paid.

Joint Return Test

You generally can't claim a married person as a dependent if that person files a joint return.

You can claim a person as a dependent who files a joint return if that person and that person’s spouse file the joint return only to claim a refund of income tax withheld or estimated tax paid.

Example 1—child files joint return.

You supported your 18-year-old child who lived with you all year while your child’s spouse was in the Armed Forces. Your child’s spouse earned $35,000 for the year. The couple files a joint return. You can't claim your child as a dependent.

Example 2—child files joint return only as claim for refund of withheld tax.

Your 18-year-old child and your child’s 17-year-old spouse had $800 of wages from part-time jobs and no other income. They lived with you all year. Neither is required to file a tax return. They don't have a child. Taxes were taken out of their pay, so they file a joint return only to get a refund of the withheld taxes. The exception to the joint return test applies, so you aren't disqualified from claiming each of them as a dependent just because they file a joint return. You can claim each of them as dependents if all the other tests to do so are met.

Example 3—child files joint return to claim American opportunity credit.

The facts are the same as in Example 2 , except no taxes were taken out of your child’s pay or your child’s spouse’s pay. However, they file a joint return to claim an American opportunity credit of $124 and get a refund of that amount. Because they filed a joint return claiming the American opportunity credit, they aren’t filing it only to get a refund of income tax withheld or estimated tax paid. The exception to the joint return test doesn't apply, so you can't claim either of them as a dependent.

Citizen or Resident Test

You generally can't claim a person as a dependent unless that person is a U.S. citizen, a U.S. resident alien, a U.S. national, or a resident of Canada or Mexico. However, there is an exception for certain adopted children, as explained next.

If you are a U.S. citizen or U.S. national who has legally adopted a child who isn't a U.S. citizen, U.S. resident alien, or U.S. national, this test is met if the child lived with you as a member of your household all year. This exception also applies if the child was lawfully placed with you for legal adoption and the child lived with you for the rest of the year after placement.

Children are usually citizens or residents of the country of their parents.

If you were a U.S. citizen when your child was born, the child may be a U.S. citizen and meet this test even if the other parent was a nonresident alien and the child was born in a foreign country.

Foreign students brought to this country under a qualified international education exchange program and placed in American homes for a temporary period generally aren't U.S. residents and don't meet this test. You can't claim them as dependents. However, if you provided a home for a foreign student, you may be able to take a charitable contribution deduction. See Expenses Paid for Student Living With You in Pub. 526.

A U.S. national is an individual who, although not a U.S. citizen, owes allegiance to the United States. U.S. nationals include American Samoans and Northern Mariana Islanders who chose to become U.S. nationals instead of U.S. citizens.

Qualifying Child

Five tests must be met for a child to be your qualifying child. The five tests are:

Relationship ,

Residency ,

Support , and

Joint return .

Relationship Test

To meet this test, a child must be:

Your son, daughter, stepchild, or foster child, or a descendant (for example, your grandchild) of any of them; or

Your brother, sister, half brother, half sister, stepbrother, or stepsister, or a descendant (for example, your niece or nephew) of any of them.

An adopted child is always treated as your own child. The term “adopted child” includes a child who was lawfully placed with you for legal adoption.

A foster child is an individual who is placed with you by an authorized placement agency or by judgment, decree, or other order of any court of competent jurisdiction.

Under age 19 at the end of the year and younger than you (or your spouse if filing jointly);

A student under age 24 at the end of the year and younger than you (or your spouse if filing jointly); or

Permanently and totally disabled at any time during the year, regardless of age.

Your child turned 19 on December 10. Unless this child was permanently and totally disabled or a student, this child doesn't meet the age test because, at the end of the year, this child wasn't under age 19.

To be your qualifying child, a child who isn't permanently and totally disabled must be younger than you. However, if you are married filing jointly, the child must be younger than you or your spouse but doesn't have to be younger than both of you.

Example 1—child not younger than you or your spouse.

Your 23-year-old sibling, who is a student and unmarried, lives with you and your spouse, who provide more than half of your sibling’s support. Your sibling isn't disabled. Both you and your spouse are 21 years old, and you file a joint return. Your sibling isn't your qualifying child because your sibling isn't younger than you or your spouse.

Example 2—child younger than your spouse but not younger than you.

The facts are the same as in Example 1 , except your spouse is 25 years old. Because your sibling is younger than your spouse and you and your spouse are filing a joint return, your sibling is your qualifying child, even though your sibling isn't younger than you.

To qualify as a student, your child must be, during some part of each of any 5 calendar months of the year:

A full-time student at a school that has a regular teaching staff and course of study, and a regularly enrolled student body at the school; or

A student taking a full-time, on-farm training course given by a school described in (1), or by a state, county, or local government agency.