ChanRobles Virtual law Library

ORDAINING AND INSTITUTING AN INSURANCE CODE OF THE PHILIPPINES

I, Ferdinand E. Marcos, President of the Philippines, by virtue of the powers in me vested by the Constitution, do hereby decree and order the following: chanroblesvirtuallawlibrary

GENERAL PROVISIONS

Sec. 1. This Decree shall be known as "The Insurance Code".

Sec. 2. Whenever used in this Code, the following terms shall have the respective meanings hereinafter set forth or indicated, unless the context otherwise requires: chanroblesvirtuallawlibrary

(1) A "contract of insurance" is an agreement whereby one undertakes for a consideration to indemnify another against loss, damage or liability arising from an unknown or contingent event.

A contract of suretyship shall be deemed to be an insurance contract, within the meaning of this Code, only if made by a surety who or which, as such, is doing an insurance business as hereinafter provided.

(2) The term "doing an insurance business" or "transacting an insurance business" , within the meaning of this Code, shall include: chanroblesvirtuallawlibrary

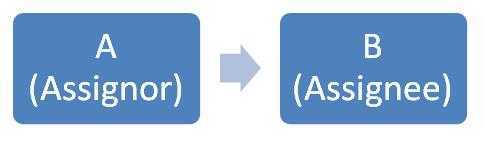

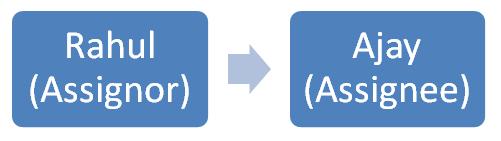

(b) making or proposing to make, as surety, any contract of suretyship as a vocation and not as merely incidental to any other legitimate business or activity of the surety;

(c) doing any kind of business, including a reinsurance business, specifically recognized as constituting the doing of an insurance business within the meaning of this Code;

(d) doing or proposing to do any business in substance equivalent to any of the foregoing in a manner designed to evade the provisions of this Code.

In the application of the provisions of this Code the fact that no profit is derived from the making of insurance contracts, agreements or transactions or that no separate or direct consideration is received therefor, shall not be deemed conclusive to show that the making thereof does not constitute the doing or transacting of an insurance business.

(3) As used in this code, the term "Commissioner" means the "Insurance Commissioner" . chanrobles virtual law library

Chapter 1 THE CONTRACT OF INSURANCE

Title 1 WHAT MAY BE INSURED

Sec. 3. Any contingent or unknown event, whether past or future, which may damnify a person having an insurable interest, or create a liability against him, may be insured against, subject to the provisions of this chapter.

The consent of the husband is not necessary for the validity of an insurance policy taken out by a married woman on her life or that of her children.

Any minor of the age of eighteen years or more, may, notwithstanding such minority, contract for life, health and accident insurance, with any insurance company duly authorized to do business in the Philippines, provided the insurance is taken on his own life and the beneficiary appointed is the minor's estate or the minor's father, mother, husband, wife, child, brother or sister.

The married woman or the minor herein allowed to take out an insurance policy may exercise all the rights and privileges of an owner under a policy.

All rights, title and interest in the policy of insurance taken out by an original owner on the life or health of a minor shall automatically vest in the minor upon the death of the original owner, unless otherwise provided for in the policy.

Sec. 4. The preceding section does not authorize an insurance for or against the drawing of any lottery, or for or against any chance or ticket in a lottery drawing a prize.

Sec. 5. All kinds of insurance are subject to the provisions of this chapter so far as the provisions can apply.

Title 2 PARTIES TO THE CONTRACT

Sec. 6. Every person, partnership, association, or corporation duly authorized to transact insurance business as elsewhere provided in this code, may be an insurer.

Sec. 7. Anyone except a public enemy may be insured.

Sec. 8. Unless the policy otherwise provides, where a mortgagor of property effects insurance in his own name providing that the loss shall be payable to the mortgagee, or assigns a policy of insurance to a mortgagee, the insurance is deemed to be upon the interest of the mortgagor, who does not cease to be a party to the original contract, and any act of his, prior to the loss, which would otherwise avoid the insurance, will have the same effect, although the property is in the hands of the mortgagee, but any act which, under the contract of insurance, is to be performed by the mortgagor, may be performed by the mortgagee therein named, with the same effect as if it had been performed by the mortgagor.

Sec. 9. If an insurer assents to the transfer of an insurance from a mortgagor to a mortgagee, and, at the time of his assent, imposes further obligation on the assignee, making a new contract with him, the act of the mortgagor cannot affect the rights of said assignee.

Title 3 INSURABLE INTEREST

Sec. 10. Every person has an insurable interest in the life and health: chanroblesvirtuallawlibrary

(b) Of any person on whom he depends wholly or in part for education or support, or in whom he has a pecuniary interest;

(c) Of any person under a legal obligation to him for the payment of money, or respecting property or services, of which death or illness might delay or prevent the performance; and

(d) Of any person upon whose life any estate or interest vested in him depends.

Sec. 11. The insured shall have the right to change the beneficiary he designated in the policy, unless he has expressly waived this right in said policy.

Sec. 12. The interest of a beneficiary in a life insurance policy shall be forfeited when the beneficiary is the principal, accomplice, or accessory in willfully bringing about the death of the insured; in which event, the nearest relative of the insured shall receive the proceeds of said insurance if not otherwise disqualified.

Sec. 13. Every interest in property, whether real or personal, or any relation thereto, or liability in respect thereof, of such nature that a contemplated peril might directly damnify the insured, is an insurable interest.

Sec. 14. An insurable interest in property may consist in: chanroblesvirtuallawlibrary

(b) An inchoate interest founded on an existing interest; or

(c) An expectancy, coupled with an existing interest in that out of which the expectancy arises.

Sec. 15. A carrier or depository of any kind has an insurable interest in a thing held by him as such, to the extent of his liability but not to exceed the value thereof.

Sec. 16. A mere contingent or expectant interest in anything, not founded on an actual right to the thing, nor upon any valid contract for it, is not insurable.

Sec. 17. The measure of an insurable interest in property is the extent to which the insured might be damnified by loss or injury thereof.

Sec. 18. No contract or policy of insurance on property shall be enforceable except for the benefit of some person having an insurable interest in the property insured.

Sec. 19. An interest in property insured must exist when the insurance takes effect, and when the loss occurs, but not exist in the meantime; and interest in the life or health of a person insured must exist when the insurance takes effect, but need not exist thereafter or when the loss occurs.

Sec. 20. Except in the cases specified in the next four sections, and in the cases of life, accident, and health insurance, a change of interest in any part of a thing insured unaccompanied by a corresponding change in interest in the insurance, suspends the insurance to an equivalent extent, until the interest in the thing and the interest in the insurance are vested in the same person.

Sec. 21. A change in interest in a thing insured, after the occurrence of an injury which results in a loss, does not affect the right of the insured to indemnity for the loss.

Sec. 22. A change of interest in one or more several distinct things, separately insured by one policy, does not avoid the insurance as to the others.

Sec. 23. A change on interest, by will or succession, on the death of the insured, does not avoid an insurance; and his interest in the insurance passes to the person taking his interest in the thing insured.

Sec. 24. A transfer of interest by one of several partners, joint owners, or owners in common, who are jointly insured, to the others, does not avoid an insurance even though it has been agreed that the insurance shall cease upon an alienation of the thing insured.

Sec. 25. Every stipulation in a policy of insurance for the payment of loss whether the person insured has or has not any interest in the property insured, or that the policy shall be received as proof of such interest, and every policy executed by way of gaming or wagering, is void.

Title 4 CONCEALMENT

Sec. 26. A neglect to communicate that which a party knows and ought to communicate, is called a concealment.

Sec. 27. A concealment whether intentional or unintentional entitles the injured party to rescind a contract of insurance. (As amended by Batasang Pambansa Blg. 874)

Sec. 28. Each party to a contract of insurance must communicated to the other, in good faith, all facts within his knowledge which are material to the contract and as to which he makes no warranty, and which the other has not the means of ascertaining.

Sec. 29. An intentional and fraudulent omission, on the part of one insured, to communicate information of matters proving or tending to prove the falsity of a warranty, entitles the insurer to rescind.

Sec. 30. Neither party to a contract of insurance is bound to communicate information of the matters following, except in answer to the inquiries of the other: chanroblesvirtuallawlibrary

(b) Those which, in the exercise of ordinary care, the other ought to know, and of which the former has no reason to suppose him ignorant;

(c) Those of which the other waives communication;

(d) Those which prove or tend to prove the existence of a risk excluded by a warranty, and which are not otherwise material; and

(e) Those which relate to a risk excepted from the policy and which are not otherwise material.

Sec. 31. Materiality is to be determined not by the event, but solely by the probable and reasonable influence of the facts upon the party to whom the communication is due, in forming his estimate of the disadvantages of the proposed contract, or in making his inquiries.

Sec. 32. Each party to a contract of insurance is bound to know all the general causes which are open to his inquiry, equally with that of the other, and which may affect the political or material perils contemplated; and all general usages of trade.

Sec. 33. The right to information of material facts may be waived, either by the terms of the insurance or by neglect to make inquiry as to such facts, where they are distinctly implied in other facts of which information is communicated.

Sec. 34. Information of the nature or amount of the interest of one insured need not be communicated unless in answer to an inquiry, except as prescribed by section fifty-one.

Sec. 35. Neither party to a contract of insurance is bound to communicate, even upon inquiry, information of his own judgment upon the matters in question.

Title 5 REPRESENTATION

Sec. 36. A representation may be oral or written.

Sec. 37. A representation may be made at the time of, or before, issuance of the policy.

Sec. 38. The language of a representation is to be interpreted by the same rules as the language of contracts in general.

Sec. 39. A representation as to the future is to be deemed a promise, unless it appears that it was merely a statement of belief or expectation.

Sec. 40. A representation cannot qualify an express provision in a contract of insurance, but it may qualify an implied warranty.

Sec. 41. A representation may be altered or withdrawn before the insurance is effected, but not afterwards.

Sec. 42. A representation must be presumed to refer to the date on which the contract goes into effect.

Sec. 43. When a person insured has no personal knowledge of a fact, he may nevertheless repeat information which he has upon the subject, and which he believes to be true, with the explanation that he does so on the information of others; or he may submit the information, in its whole extent, to the insurer; and in neither case is he responsible for its truth, unless it proceeds from an agent of the insured, whose duty it is to give the information.

Sec. 44. A representation is to be deemed false when the facts fail to correspond with its assertions or stipulations.

Sec. 45. If a representation is false in a material point, whether affirmative or promissory, the injured party is entitled to rescind the contract from the time when the representation becomes false. The right to rescind granted by this Code to the insurer is waived by the acceptance of premium payments despite knowledge of the ground for rescission. (As amended by Batasang Pambansa Blg. 874).

Sec. 46. The materiality of a representation is determined by the same rules as the materiality of a concealment.

Sec. 47. The provisions of this chapter apply as well to a modification of a contract of insurance as to its original formation.

Sec. 48. Whenever a right to rescind a contract of insurance is given to the insurer by any provision of this chapter, such right must be exercised previous to the commencement of an action on the contract.

After a policy of life insurance made payable on the death of the insured shall have been in force during the lifetime of the insured for a period of two years from the date of its issue or of its last reinstatement, the insurer cannot prove that the policy is void ab initio or is rescindible by reason of the fraudulent concealment or misrepresentation of the insured or his agent.

Title 6 THE POLICY

Sec. 49. The written instrument in which a contract of insurance is set forth, is called a policy of insurance.

Sec. 50. The policy shall be in printed form which may contain blank spaces; and any word, phrase, clause, mark, sign, symbol, signature, number, or word necessary to complete the contract of insurance shall be written on the blank spaces provided therein.

Any rider, clause, warranty or endorsement purporting to be part of the contract of insurance and which is pasted or attached to said policy is not binding on the insured, unless the descriptive title or name of the rider, clause, warranty or endorsement is also mentioned and written on the blank spaces provided in the policy.

Unless applied for by the insured or owner, any rider, clause, warranty or endorsement issued after the original policy shall be countersigned by the insured or owner, which countersignature shall be taken as his agreement to the contents of such rider, clause, warranty or endorsement.

Group insurance and group annuity policies, however, may be typewritten and need not be in printed form.

Sec. 51. A policy of insurance must specify: chanroblesvirtuallawlibrary

(b) The amount to be insured except in the cases of open or running policies;

(c) The premium, or if the insurance is of a character where the exact premium is only determinable upon the termination of the contract, a statement of the basis and rates upon which the final premium is to be determined;

(d) The property or life insured;

(e) The interest of the insured in property insured, if he is not the absolute owner thereof;

(f) The risks insured against; and

(g) The period during which the insurance is to continue.

Sec. 52. Cover notes may be issued to bind insurance temporarily pending the issuance of the policy. Within sixty days after the issue of the cover note, a policy shall be issued in lieu thereof, including within its terms the identical insurance bound under the cover note and the premium therefor. chanrobles virtual law library

Cover notes may be extended or renewed beyond such sixty days with the written approval of the Commissioner if he determines that such extension is not contrary to and is not for the purpose of violating any provisions of this Code. The Commissioner may promulgate rules and regulations governing such extensions for the purpose of preventing such violations and may by such rules and regulations dispense with the requirement of written approval by him in the case of extension in compliance with such rules and regulations.

Sec. 53. The insurance proceeds shall be applied exclusively to the proper interest of the person in whose name or for whose benefit it is made unless otherwise specified in the policy.

Sec. 54. When an insurance contract is executed with an agent or trustee as the insured, the fact that his principal or beneficiary is the real party in interest may be indicated by describing the insured as agent or trustee, or by other general words in the policy.

Sec. 55. To render an insurance effected by one partner or part-owner, applicable to the interest of his co-partners or other part-owners, it is necessary that the terms of the policy should be such as are applicable to the joint or common interest.

Sec. 56. When the description of the insured in a policy is so general that it may comprehend any person or any class of persons, only he who can show that it was intended to include him can claim the benefit of the policy.

Sec. 57. A policy may be so framed that it will inure to the benefit of whomsoever, during the continuance of the risk, may become the owner of the interest insured.

Sec. 58. The mere transfer of a thing insured does not transfer the policy, but suspends it until the same person becomes the owner of both the policy and the thing insured.

Sec. 59. A policy is either open, valued or running.

Sec. 60. An open policy is one in which the value of the thing insured is not agreed upon, but is left to be ascertained in case of loss.

Sec. 61. A valued policy is one which expresses on its face an agreement that the thing insured shall be valued at a specific sum.

Sec. 62. A running policy is one which contemplates successive insurances, and which provides that the object of the policy may be from time to time defined, especially as to the subjects of insurance, by additional statements or indorsements.

Sec. 63. A condition, stipulation, or agreement in any policy of insurance, limiting the time for commencing an action thereunder to a period of less than one year from the time when the cause of action accrues, is void.

Sec. 64. No policy of insurance other than life shall be cancelled by the insurer except upon prior notice thereof to the insured, and no notice of cancellation shall be effective unless it is based on the occurrence, after the effective date of the policy, of one or more of the following: chanroblesvirtuallawlibrary

(b) conviction of a crime arising out of acts increasing the hazard insured against;

(c) discovery of fraud or material misrepresentation;

(d) discovery of willful or reckless acts or omissions increasing the hazard insured against;

(e) physical changes in the property insured which result in the property becoming uninsurable; or

(f) a determination by the Commissioner that the continuation of the policy would violate or would place the insurer in violation of this Code.

Sec. 65. All notices of cancellation mentioned in the preceding section shall be in writing, mailed or delivered to the named insured at the address shown in the policy, and shall state (a) which of the grounds set forth in section sixty-four is relied upon and (b) that, upon written request of the named insured, the insurer will furnish the facts on which the cancellation is based.

Sec. 66. In case of insurance other than life, unless the insurer at least forty-five days in advance of the end of the policy period mails or delivers to the named insured at the address shown in the policy notice of its intention not to renew the policy or to condition its renewal upon reduction of limits or elimination of coverages, the named insured shall be entitled to renew the policy upon payment of the premium due on the effective date of the renewal. Any policy written for a term of less than one year shall be considered as if written for a term of one year. Any policy written for a term longer than one year or any policy with no fixed expiration date shall be considered as if written for successive policy periods or terms of one year.

Title 7 WARRANTIES

Sec. 67. A warranty is either expressed or implied.

Sec. 68. A warranty may relate to the past, the present, the future, or to any or all of these.

Sec. 69. No particular form of words is necessary to create a warranty.

Sec. 70. Without prejudice to section fifty-one, every express warranty, made at or before the execution of a policy, must be contained in the policy itself, or in another instrument signed by the insured and referred to in the policy as making a part of it.

Sec. 71. A statement in a policy of matter relating to the person or thing insured, or to the risk, as a fact, is an express warranty thereof.

Sec. 72. A statement in a policy which imparts that it is intended to do or not to do a thing which materially affects the risk, is a warranty that such act or omission shall take place.

Sec. 73. When, before the time arrives for the performance of a warranty relating to the future, a loss insured against happens, or performance becomes unlawful at the place of the contract, or impossible, the omission to fulfill the warranty does not avoid the policy.

Sec. 74. The violation of a material warranty, or other material provision of a policy, on the part of either party thereto, entitles the other to rescind.

Sec. 75. A policy may declare that a violation of specified provisions thereof shall avoid it, otherwise the breach of an immaterial provision does not avoid the policy.

Sec. 76. A breach of warranty without fraud merely exonerates an insurer from the time that it occurs, or where it is broken in its inception, prevents the policy from attaching to the risk.

Title 8 PREMIUM

Sec. 77. An insurer is entitled to payment of the premium as soon as the thing insured is exposed to the peril insured against. Notwithstanding any agreement to the contrary, no policy or contract of insurance issued by an insurance company is valid and binding unless and until the premium thereof has been paid, except in the case of a life or an industrial life policy whenever the grace period provision applies.

Sec. 78. An acknowledgment in a policy or contract of insurance or the receipt of premium is conclusive evidence of its payment, so far as to make the policy binding, notwithstanding any stipulation therein that it shall not be binding until the premium is actually paid.

Sec. 79. A person insured is entitled to a return of premium, as follows: chanroblesvirtuallawlibrary

(b) Where the insurance is made for a definite period of time and the insured surrenders his policy, to such portion of the premium as corresponds with the unexpired time, at a pro rata rate, unless a short period rate has been agreed upon and appears on the face of the policy, after deducting from the whole premium any claim for loss or damage under the policy which has previously accrued; Provided, That no holder of a life insurance policy may avail himself of the privileges of this paragraph without sufficient cause as otherwise provided by law.

Sec. 80. If a peril insured against has existed, and the insurer has been liable for any period, however short, the insured is not entitled to return of premiums, so far as that particular risk is concerned.

Sec. 81. A person insured is entitled to return of the premium when the contract is voidable, on account of fraud or misrepresentation of the insurer, or of his agent, or on account of facts, the existence of which the insured was ignorant without his fault; or when by any default of the insured other than actual fraud, the insurer never incurred any liability under the policy.

Sec. 82. In case of an over-insurance by several insurers, the insured is entitled to a ratable return of the premium, proportioned to the amount by which the aggregate sum insured in all the policies exceeds the insurable value of the thing at risk.

Title 9 LOSS

Sec. 83. An agreement not to transfer the claim of the insured against the insurer after the loss has happened, is void if made before the loss except as otherwise provided in the case of life insurance.

Sec. 84. Unless otherwise provided by the policy, an insurer is liable for a loss of which a peril insured against was the proximate cause, although a peril not contemplated by the contract may have been a remote cause of the loss; but he is not liable for a loss which the peril insured against was only a remote cause.

Sec. 85. An insurer is liable where the thing insured is rescued from a peril insured against that would otherwise have caused a loss, if, in the course of such rescue, the thing is exposed to a peril not insured against, which permanently deprives the insured of its possession, in whole or in part; or where a loss is caused by efforts to rescue the thing insured from a peril insured against.

Sec. 86. Where a peril is especially excepted in a contract of insurance, a loss, which would not have occurred but for such peril, is thereby excepted although the immediate cause of the loss was a peril which was not excepted.

Sec. 87. An insurer is not liable for a loss caused by the willful act or through the connivance of the insured; but he is not exonerated by the negligence of the insured, or of the insurance agents or others.

Title 10 NOTICE OF LOSS

Sec. 88. In case of loss upon an insurance against fire, an insurer is exonerated, if notice thereof be not given to him by an insured, or some person entitled to the benefit of the insurance, without unnecessary delay.

Sec. 89. When a preliminary proof of loss is required by a policy, the insured is not bound to give such proof as would be necessary in a court of justice; but it is sufficient for him to give the best evidence which he has in his power at the time.

Sec. 90. All defects in a notice of loss, or in preliminary proof thereof, which the insured might remedy, and which the insurer omits to specify to him, without unnecessary delay, as grounds of objection, are waived.

Sec. 91. Delay in the presentation to an insurer of notice or proof of loss is waived if caused by any act of him, or if he omits to take objection promptly and specifically upon that ground.

Sec. 92. If the policy requires, by way of preliminary proof of loss, the certificate or testimony of a person other than the insured, it is sufficient for the insured to use reasonable diligence to procure it, and in case of the refusal of such person to give it, then to furnish reasonable evidence to the insurer that such refusal was not induced by any just grounds of disbelief in the facts necessary to be certified or testified.

Title 11 DOUBLE INSURANCE

Sec. 93. A double insurance exists where the same person is insured by several insurers separately in respect to the same subject and interest.

Sec. 94. Where the insured is overinsured by double insurance: chanroblesvirtuallawlibrary

(b) Where the policy under which the insured claims is a valued policy, the insured must give credit as against the valuation for any sum received by him under any other policy without regard to the actual value of the subject matter insured;

(c) Where the policy under which the insured claims is an unvalued policy he must give credit, as against the full insurable value, for any sum received by him under any policy;

(d) Where the insured receives any sum in excess of the valuation in the case of valued policies, or of the insurable value in the case of unvalued policies, he must hold such sum in trust for the insurers, according to their right of contribution among themselves;

(e) Each insurer is bound, as between himself and the other insurers, to contribute ratably to the loss in proportion to the amount for which he is liable under his contract.

Title 12 REINSURANCE

Sec. 95. A contract of reinsurance is one by which an insurer procures a third person to insure him against loss or liability by reason of such original insurance.

Sec. 96. Where an insurer obtains reinsurance, except under automatic reinsurance treaties, he must communicate all the representations of the original insured, and also all the knowledge and information he possesses, whether previously or subsequently acquired, which are material to the risk.

Sec. 97. A reinsurance is presumed to be a contract of indemnity against liability, and not merely against damage.

Sec. 98. The original insured has no interest in a contract of reinsurance.

Chapter II CLASSES OF INSURANCE

Title I MARINE INSURANCE

Sub-Title 1- A DEFINITION

Sec. 99. Marine Insurance includes: chanroblesvirtuallawlibrary

(b) Person or property in connection with or appertaining to a marine, inland marine, transit or transportation insurance, including liability for loss of or damage arising out of or in connection with the construction, repair, operation, maintenance or use of the subject matter of such insurance (but not including life insurance or surety bonds nor insurance against loss by reason of bodily injury to any person arising out of ownership, maintenance, or use of automobiles);

(c) Precious stones, jewels, jewelry, precious metals, whether in course of transportation or otherwise;

(d) Bridges, tunnels and other instrumentalities of transportation and communication (excluding buildings, their furniture and furnishings, fixed contents and supplies held in storage); piers, wharves, docks and slips, and other aids to navigation and transportation, including dry docks and marine railways, dams and appurtenant facilities for the control of waterways.

Sub-Title 1-B INSURABLE INTEREST

Sec. 100. The owner of a ship has in all cases an insurable interest in it, even when it has been chartered by one who covenants to pay him its value in case of loss: Provided, That in this case the insurer shall be liable for only that part of the loss which the insured cannot recover from the charterer.

Sec. 101. The insurable interest of the owner of the ship hypothecated by bottomry is only the excess of its value over the amount secured by bottomry.

Sec. 102. Freightage, in the sense of a policy of marine insurance, signifies all the benefits derived by the owner, either from the chartering of the ship or its employment for the carriage of his own goods or those of others.

Sec. 103. The owner of a ship has an insurable interest in expected freightage which according to the ordinary and probable course of things he would have earned but for the intervention of a peril insured against or other peril incident to the voyage.

Sec. 104. The interest mentioned in the last section exists, in case of a charter party, when the ship has broken ground on the chartered voyage. If a price is to be paid for the carriage of goods it exists when they are actually on board, or there is some contract for putting them on board, and both ship and goods are ready for the specified voyage.

Sec. 105. One who has an interest in the thing from which profits are expected to proceed has an insurable interest in the profits.

Sec. 106. The charterer of a ship has an insurable interest in it, to the extent that he is liable to be damnified by its loss.

Sub-Title 1-C CONCEALMENT

Sec. 107. In marine insurance each party is bound to communicate, in addition to what is required by section twenty-eight, all the information which he possesses, material to the risk, except such as is mentioned in Section thirty, and to state the exact and whole truth in relation to all matters that he represents, or upon inquiry discloses or assumes to disclose.

Sec. 108. In marine insurance, information of the belief or expectation of a third person, in reference to a material fact, is material.

Sec. 109. A person insured by a contract of marine insurance is presumed to have knowledge, at the time of insuring, of a prior loss, if the information might possibly have reached him in the usual mode of transmission and at the usual rate of communication.

Sec. 110. A concealment in a marine insurance, in respect to any of the following matters, does not vitiate the entire contract, but merely exonerates the insurer from a loss resulting from the risk concealed: chanroblesvirtuallawlibrary

(b) The liability of the thing insured to capture and detention;

(c) The liability to seizure from breach of foreign laws of trade;

(d) The want of necessary documents;

(e) The use of false and simulated papers.

Sub-Title 1-D REPRESENTATION

Sec. 111. If a representation by a person insured by a contract of marine insurance, is intentionally false in any material respect, or in respect of any fact on which the character and nature of the risk depends, the insurer may rescind the entire contract.

Sec. 112. The eventual falsity of a representation as to expectation does not, in the absence of fraud, avoid a contract of marine insurance.

Sub-Title 1-E IMPLIED WARRANTIES

Sec. 113. In every marine insurance upon a ship or freight, or freightage, or upon any thing which is the subject of marine insurance, a warranty is implied that the ship is seaworthy.

Sec. 114. A ship is seaworthy when reasonably fit to perform the service and to encounter the ordinary perils of the voyage contemplated by the parties to the policy.

Sec. 115. An implied warranty of seaworthiness is complied with if the ship be seaworthy at the time of the of commencement of the risk, except in the following cases: chanroblesvirtuallawlibrary

(b) When the insurance is upon the cargo which, by the terms of the policy, description of the voyage, or established custom of the trade, is to be transhipped at an intermediate port, the implied warranty is not complied with unless each vessel upon which the cargo is shipped, or transhipped, be seaworthy at the commencement of each particular voyage.

Sec. 116. A warranty of seaworthiness extends not only to the condition of the structure of the ship itself, but requires that it be properly laden, and provided with a competent master, a sufficient number of competent officers and seamen, and the requisite appurtenances and equipment, such as ballasts, cables and anchors, cordage and sails, food, water, fuel and lights, and other necessary or proper stores and implements for the voyage.

Sec. 117. Where different portions of the voyage contemplated by a policy differ in respect to the things requisite to make the ship seaworthy therefor, a warranty of seaworthiness is complied with if, at the commencement of each portion, the ship is seaworthy with reference to that portion.

Sec. 118. When the ship becomes unseaworthy during the voyage to which an insurance relates, an unreasonable delay in repairing the defect exonerates the insurer on ship or shipowner's interest from liability from any loss arising therefrom.

Sec. 119. A ship which is seaworthy for the purpose of an insurance upon the ship may, nevertheless, by reason of being unfitted to receive the cargo, be unseaworthy for the purpose of the insurance upon the cargo.

Sec. 120. Where the nationality or neutrality of a ship or cargo is expressly warranted, it is implied that the ship will carry the requisite documents to show such nationality or neutrality and that it will not carry any documents which cast reasonable suspicion thereon.

Sub-Title 1-F THE VOYAGE AND DEVIATION

Sec. 121. When the voyage contemplated by a marine insurance policy is described by the places of beginning and ending, the voyage insured in one which conforms to the course of sailing fixed by mercantile usage between those places.

Sec. 122. If the course of sailing is not fixed by mercantile usage, the voyage insured by a marine insurance policy is that way between the places specified, which to a master of ordinary skill and discretion, would mean the most natural, direct and advantageous.

Sec. 123. Deviation is a departure from the course of the voyage insured, mentioned in the last two sections, or an unreasonable delay in pursuing the voyage or the commencement of an entirely different voyage.

Sec. 124. A deviation is proper: chanroblesvirtuallawlibrary

(b) When necessary to comply with a warranty, or to avoid a peril, whether or not the peril is insured against;

(c) When made in good faith, and upon reasonable grounds of belief in its necessity to avoid a peril; or

(d) When made in good faith, for the purpose of saving human life or relieving another vessel in distress.

Sec. 125. Every deviation not specified in the last section is improper.

Sec. 126. An insurer is not liable for any loss happening to the thing insured subsequent to an improper deviation.

Sub-Title 1-G LOSS

Sec. 127. A loss may be either total or partial.

Sec. 128. Every loss which is not total is partial.

Sec. 129. A total loss may be either actual or constructive.

Sec. 130. An actual total loss is cause by: chanroblesvirtuallawlibrary

(b) The irretrievable loss of the thing by sinking, or by being broken up;

(c) Any damage to the thing which renders it valueless to the owner for the purpose for which he held it; or

(d) Any other event which effectively deprives the owner of the possession, at the port of destination, of the thing insured.

Sec. 131. A constructive total loss is one which gives to a person insured a right to abandon, under Section one hundred thirty-nine.

Sec. 132. An actual loss may be presumed from the continued absence of a ship without being heard of. The length of time which is sufficient to raise this presumption depends on the circumstances of the case.

Sec. 133. When a ship is prevented, at an intermediate port, from completing the voyage, by the perils insured against, the liability of a marine insurer on the cargo continues after they are thus reshipped. Nothing in this section shall prevent an insurer from requiring an additional premium if the hazard be increased by this extension of liability.

Sec. 134. In addition to the liability mentioned in the last section, a marine insurer is bound for damages, expenses of discharging, storage, reshipment, extra freightage, and all other expenses incurred in saving cargo reshipped pursuant to the last section, up to the amount insured. Nothing in this or in the preceding section shall render a marine insurer liable for any amount in excess of the insured value or, if there be none, of the insurable value.

Sec. 135. Upon an actual total loss, a person insured is entitled to payment without notice of abandonment.

Sec. 136. Where it has been agreed that an insurance upon a particular thing, or class of things, shall be free from particular average, a marine insurer is not liable for any particular average loss not depriving the insured of the possession, at the port of destination, of the whole of such thing, or class of things, even though it becomes entirely worthless; but such insurer is liable for his proportion of all general average loss assessed upon the thing insured.

Sec. 137. An insurance confined in terms to an actual loss does not cover a constructive total loss, but covers any loss, which necessarily results in depriving the insured of the possession, at the port of destination, of the entire thing insured.

Sub-Title 1-H ABANDONMENT

Sec. 138. Abandonment, in marine insurance, is the act of the insured by which, after a constructive total loss, he declares the relinquishment to the insurer of his interest in the thing insured.

Sec. 139. A person insured by a contract of marine insurance may abandon the thing insured, or any particular portion thereof separately valued by the policy, or otherwise separately insured, and recover for a total loss thereof, when the cause of the loss is a peril insured against: chanroblesvirtuallawlibrary

(b) If it is injured to such an extent as to reduce its value more than three-fourths;

(c) If the thing insured is a ship, and the contemplated voyage cannot be lawfully performed without incurring either an expense to the insured of more than three-fourths the value of the thing abandoned or a risk which a prudent man would not take under the circumstances; or

(d) If the thing insured, being cargo or freightage, and the voyage cannot be performed, nor another ship procured by the master, within a reasonable time and with reasonable diligence, to forward the cargo, without incurring the like expense or risk mentioned in the preceding sub-paragraph. But freightage cannot in any case be abandoned unless the ship is also abandoned.

Sec. 140. An abandonment must be neither partial nor conditional.

Sec. 141. An abandonment must be made within a reasonable time after receipt of reliable information of the loss, but where the information is of a doubtful character, the insured is entitled to a reasonable time to make inquiry.

Sec. 142. Where the information upon which an abandonment has been made proves incorrect, or the thing insured was so far restored when the abandonment was made that there was then in fact no total loss, the abandonment becomes ineffectual.

Sec. 143. Abandonment is made by giving notice thereof to the insurer, which may be done orally, or in writing; Provided, That if the notice be done orally, a written notice of such abandonment shall be submitted within seven days from such oral notice.

Sec. 144. A notice of abandonment must be explicit, and must specify the particular cause of the abandonment, but need state only enough to show that there is probable cause therefor, and need not be accompanied with proof of interest or of loss.

Sec. 145. An abandonment can be sustained only upon the cause specified in the notice thereof.

Sec. 146. An abandonment is equivalent to a transfer by the insured of his interest to the insurer, with all the chances of recovery and indemnity.

Sec. 147. If a marine insurer pays for a loss as if it were an actual total loss, he is entitled to whatever may remain of the thing insured, or its proceeds or salvage, as if there had been a formal abandonment.

Sec. 148. Upon an abandonment, acts done in good faith by those who were agents of the insured in respect to the thing insured, subsequent to the loss, are at the risk of the insurer and for his benefit.

Sec. 149. Where notice of abandonment is properly given, the rights of the insured are not prejudiced by the fact that the insurer refuses to accept the abandonment.

Sec. 150. The acceptance of an abandonment may be either express or implied from the conduct of the insurer. The mere silence of the insurer for an unreasonable length of time after notice shall be construed as an acceptance.

Sec. 151. The acceptance of an abandonment, whether express or implied, is conclusive upon the parties, and admits the loss and the sufficiency of the abandonment.

Sec. 152. An abandonment once made and accepted is irrevocable, unless the ground upon which it was made proves to be unfounded.

Sec. 153. On an accepted abandonment of a ship, freightage earned previous to the loss belongs to the insurer of said freightage; but freightage subsequently earned belongs to the insurer of the ship.

Sec. 154. If an insurer refuses to accept a valid abandonment, he is liable as upon actual total loss, deducting from the amount any proceeds of the thing insured which may have come to the hands of the insured.

Sec. 155. If a person insured omits to abandon, he may nevertheless recover his actual loss.

Sub-Title 1-I MEASURE OF INDEMNITY

Sec. 156. A valuation in a policy of marine insurance in conclusive between the parties thereto in the adjustment of either a partial or total loss, if the insured has some interest at risk, and there is no fraud on his part; except that when a thing has been hypothecated by bottomry or respondentia, before its insurance, and without the knowledge of the person actually procuring the insurance, he may show the real value. But a valuation fraudulent in fact, entitles the insurer to rescind the contract.

Sec. 157. A marine insurer is liable upon a partial loss, only for such proportion of the amount insured by him as the loss bears to the value of the whole interest of the insured in the property insured.

Sec. 158. Where profits are separately insured in a contract of marine insurance, the insured is entitled to recover, in case of loss, a proportion of such profits equivalent to the proportion which the value of the property lost bears to the value of the whole.

Sec. 159. In case of a valued policy of marine insurance on freightage or cargo, if a part only of the subject is exposed to the risk, the evaluation applies only in proportion to such part.

Sec. 160. When profits are valued and insured by a contract of marine insurance, a loss of them is conclusively presumed from a loss of the property out of which they are expected to arise, and the valuation fixes their amount.

Sec. 161. In estimating a loss under an open policy of marine insurance the following rules are to be observed: chanroblesvirtuallawlibrary

(b) The value of the cargo is its actual cost to the insured, when laden on board, or where the cost cannot be ascertained, its market value at the time and place of lading, adding the charges incurred in purchasing and placing it on board, but without reference to any loss incurred in raising money for its purchase, or to any drawback on its exportation, or to the fluctuation of the market at the port of destination, or to expenses incurred on the way or on arrival;

(c) The value of freightage is the gross freightage, exclusive of primage, without reference to the cost of earning it; and

(d) The cost of insurance is in each case to be added to the value thus estimated.

Sec. 162. If cargo insured against partial loss arrives at the port of destination in a damaged condition, the loss of the insured is deemed to be the same proportion of the value which the market price at that port, of the thing so damaged, bears to the market price it would have brought if sound.

Sec. 163. A marine insurer is liable for all the expenses attendant upon a loss which forces the ship into port to be repaired; and where it is stipulated in the policy that the insured shall labor for the recovery of the property, the insurer is liable for the expense incurred thereby, such expense, in either case, being in addition to a total loss, if that afterwards occurs.

Sec. 164. A marine insurer is liable for a loss falling upon the insured, through a contribution in respect to the thing insured, required to be made by him towards a general average loss called for by a peril insured against; provided , that the liability of the insurer shall be limited to the proportion of contribution attaching to his policy value where this is less than the contributing value of the thing insured.

Sec. 165. When a person insured by a contract of marine insurance has a demand against others for contribution, he may claim the whole loss from the insurer, subrogating him to his own right to contribution. But no such claim can be made upon the insurer after the separation of the interests liable to the contribution, nor when the insured, having the right and opportunity to enforce the contribution from others, has neglected or waived the exercise of that right.

Sec. 166. In the case of a partial loss of ship or its equipment, the old materials are to be applied towards payment for the new. Unless otherwise stipulated in the policy, a marine insurer is liable for only two-thirds of the remaining cost of repairs after such deduction, except that anchors must be paid in full.

Title 2 FIRE INSURANCE

Sec. 167. As used in this Code, the term "fire insurance" shall include insurance against loss by fire, lightning, windstorm, tornado or earthquake and other allied risks, when such risks are covered by extension to fire insurance policies or under separate policies.

Sec. 168. An alteration in the use or condition of a thing insured from that to which it is limited by the policy made without the consent of the insurer, by means within the control of the insured, and increasing the risks, entitles an insurer to rescind a contract of fire insurance.

Sec. 169. An alteration in the use or condition of a thing insured from that to which it is limited by the policy, which does not increase the risk, does not affect a contract of fire insurance. chanrobles virtual law library

Sec. 170. A contract of fire insurance is not affected by any act of the insured subsequent to the execution of the policy, which does not violate its provisions, even though it increases the risk and is the cause of the loss.

Sec. 171. If there is no valuation in the policy, the measure of indemnity in an insurance against fire is the expense it would be to the insured at the time of the commencement of the fire to replace the thing lost or injured in the condition in which at the time of the injury; but if there is a valuation in a policy of fire insurance, the effect shall be the same as in a policy of marine insurance.

Sec. 172. Whenever the insured desires to have a valuation named in his policy, insuring any building or structure against fire, he may require such building or structure to be examined by an independent appraiser and the value of the insured's interest therein may then be fixed as between the insurer and the insured. The cost of such examination shall be paid for by the insured. A clause shall be inserted in such policy stating substantially that the value of the insured's interest in such building or structure has been thus fixed. In the absence of any change increasing the risk without the consent of the insurer or of fraud on the part of the insured, then in case of a total loss under such policy, the whole amount so insured upon the insured's interest in such building or structure, as stated in the policy upon which the insurers have received a premium, shall be paid, and in case of a partial loss the full amount of the partial loss shall be so paid, and in case there are two or more policies covering the insured's interest therein, each policy shall contribute pro rata to the payment of such whole or partial loss. But in no case shall the insurer be required to pay more than the amount thus stated in such policy. This section shall not prevent the parties from stipulating in such policies concerning the repairing, rebuilding or replacing of buildings or structures wholly or partially damaged or destroyed.

Sec. 173. No policy of fire insurance shall be pledged, hypothecated, or transferred to any person, firm or company who acts as agent for or otherwise represents the issuing company, and any such pledge, hypothecation, or transfer hereafter made shall be void and of no effect insofar as it may affect other creditors of the insured.

Title 3 CASUALTY INSURANCE

Sec. 174. Casualty insurance is insurance covering loss or liability arising from accident or mishap, excluding certain types of loss which by law or custom are considered as falling exclusively within the scope of other types of insurance such as fire or marine. It includes, but is not limited to, employer's liability insurance, motor vehicle liability insurance, plate glassinsurance, burglary and theft insurance, personal accident and health insurance as written by non-life insurance companies, and other substantially similar kinds of insurance.

Title 4 SURETYSHIP

Sec. 175. A contract of suretyship is an agreement whereby a party called the surety guarantees the performance by another party called the principal or obligor of an obligation or undertaking in favor of a third party called the obligee. It includes official recognizances, stipulations, bonds or undertakings issued by any company by virtue of and under the provisions of Act No. 536, as amended by Act No. 2206.

Sec. 176. The liability of the surety or sureties shall be joint and several with the obligor and shall be limited to the amount of the bond. It is determined strictly by the terms of the contract of suretyship in relation to the principal contract between the obligor and the obligee. (As amended by Presidential Decree No. 1455).

Sec. 177. The surety is entitled to payment of the premium as soon as the contract of suretyship or bond is perfected and delivered to the obligor. No contract of suretyship or bonding shall be valid and binding unless and until the premium therefor has been paid, except where the obligee has accepted the bond, in which case the bond becomes valid and enforceable irrespective of whether or not the premium has been paid by the obligor to the surety: Provided , That if the contract of suretyship or bond is not accepted by, or filed with the obligee, the surety shall collect only reasonable amount, not exceeding fifty per centum of the premium due thereon as service fee plus the cost of stamps or other taxes imposed for the issuance of the contract or bond: Provided, however, That if the non-acceptance of the bond be due to the fault or negligence of the surety, no such service fee, stamps or taxes shall be collected.

In the case of a continuing bond, the obligor shall pay the subsequent annual premium as it falls due until the contract of suretyship is cancelled by the obligee or by the Commissioner or by a court of competent jurisdiction, as the case may be. chanrobles virtual law library

Sec. 178. Pertinent provisions of the Civil Code of the Philippines shall be applied in a suppletory character whenever necessary in interpreting the provisions of a contract of suretyship.

Title 5 LIFE INSURANCE

Sec. 179. Life insurance is insurance on human lives and insurance appertaining thereto or connected therewith.

Sec. 180. An insurance upon life may be made payable on the death of the person, or on his surviving a specified period, or otherwise contingently on the continuance or cessation of life.

Every contract or pledge for the payment of endowments or annuities shall be considered a life insurance contract for purpose of this Code.

In the absence of a judicial guardian, the father, or in the latter's absence or incapacity, the mother, or any minor, who is an insured or a beneficiary under a contract of life, health or accident insurance, may exercise, in behalf of said minor, any right under the policy, without necessity of court authority or the giving of a bond, where the interest of the minor in the particular act involved does not exceed twenty thousand pesos. Such right may include, but shall not be limited to, obtaining a policy loan, surrendering the policy, receiving the proceeds of the policy, and giving the minor's consent to any transaction on the policy.

Sec. 180-A. The insurer in a life insurance contract shall be liable in case of suicides only when it is committed after the policy has been in force for a period of two years from the date of its issue or of its last reinstatement, unless the policy provides a shorter period: Provided, however , That suicide committed in the state of insanity shall be compensable regardless of the date of commission. (As amended by Batasang Pambansa Blg. 874).

Sec. 181. A policy of insurance upon life or health may pass by transfer, will or succession to any person, whether he has an insurable interest or not, and such person may recover upon it whatever the insured might have recovered.

Sec. 182. Notice to an insurer of a transfer or bequest thereof is not necessary to preserve the validity of a policy of insurance upon life or health, unless thereby expressly required.

Sec. 183. Unless the interest of a person insured is susceptible of exact pecuniary measurement, the measure of indemnity under a policy of insurance upon life or health is the sum fixed in the policy.

Chapter III THE BUSINESS OF INSURANCE

Title 1 INSURANCE COMPANIES, ORGANIZATION, CAPITALIZATION AND AUTHORIZATION

Sec. 184. For purposes of this Code, the term "insurer" or "insurance company" shall include all individuals, partnerships, associations, or corporations, including government-owned or controlled corporations or entities, engaged as principals in the insurance business, excepting mutual benefit associations. Unless the context otherwise requires, the terms shall also include professional reinsurers defined in section two hundred eighty. "Domestic company" shall include companies formed, organized or existing under the laws of the Philippines. "Foreign company" when used without limitation shall include companies formed, organized, or existing under any laws other than those of the Philippines.

Sec. 185. Corporations formed or organized to save any person or persons or other corporations harmless from loss, damage, or liability arising from any unknown or future or contingent event, or to indemnify or to compensate any person or persons or other corporations for any such loss, damage, or liability, or to guarantee the performance of or compliance with contractual obligations or the payment of debt of others shall be known as "insurance corporations" .

The provisions of the Corporation Law shall apply to all insurance corporations now or hereafter engaged in business in the Philippines insofar as they do not conflict with the provisions of this chapter.

Sec. 186. No person, partnership, or association of persons shall transact any insurance business in the Philippines except as agent of a person or corporation authorized to do the business of insurance in the Philippines, unless possessed of the capital and assets required of an insurance corporation doing the same kind of business in the Philippines and invested in the same manner; nor unless the Commissioner shall have granted to him or them a certificate to the effect that he or they have complied with all the provisions of law which an insurance corporation doing business in the Philippines is required to observe.

Every person, partnership, or association receiving any such certificate of authority shall be subject to the insurance laws of the Philippines and to the jurisdiction and supervision of the Commissioner in the same manner as if an insurance corporation authorized by the laws of the Philippines to engage in the business of insurance specified in the certificate.

Sec. 187. No insurance company shall transact any insurance business in the Philippines until after it shall have obtained a certificate of authority for that purpose from the Commissioner upon application therefor and payment by the company concerned of the fees hereinafter prescribed.

The Commissioner may refuse to issue a certificate of authority to any insurance company if, in his judgment, such refusal will best promote the interest of the people of this country. No such certificate of authority shall be granted to any such company until the Commissioner shall have satisfied himself by such examination as he may make and such evidence as he may require that such company is qualified by the laws of the Philippines to transact business therein, that the grant of such authority appears to be justified in the light of economic requirements, and that the direction and administration, as well as the integrity and responsibility of the organizers and administrators, the financial organization and the amount of capital, notwithstanding the provisions of section one hundred eighty-eight, reasonably assure the safety of the interests of the policyholders and the public.

In order to maintain the quality of the management of the insurance companies and afford better protection to policyholders and the public in general, any person of good moral character, unquestioned integrity and recognized competence may be elected or appointed director or officer of insurance companies. The Commissioner shall prescribe the qualifications of the executive officers and other key officials of insurance companies for purposes of this section.

No person shall concurrently be a director and/or officer of an insurance company and an adjustment company.

Incumbent directors and/or officers affected by the above provisions are hereby allowed to hold on to their positions until the end of their terms or two years from the effectivity of this decree, whichever is shorter.

Before issuing such certificate of authority, the Commissioner must be satisfied that the name of the company is not that of any other known company transacting a similar business in the Philippines, or a name so similar as to be calculated to mislead the public.

Such certificate of authority shall expire on the last day of June of each year and shall be renewed annually if the company is continuing to comply with the provisions of this Code or the circulars, instructions, rulings or decisions of the Commissioner. Every company receiving any such certificates of authority shall be subject to the provisions of this Code and other related laws and to the jurisdiction and supervision of the Commissioner.

No insurance company may be authorized to transact in the Philippines the business of life and non-life insurance concurrently unless specifically authorized to do so: Provided , That the terms "life" and "non-life" insurance shall be deemed to include health, accident and disability insurance.

No insurance company shall have equity in an adjustment company and neither shall an adjustment company have an equity in an insurance company.

Insurance companies and adjustment companies presently affected by the above provision shall have two years from the effectivity of this Decree within which to divest of their stockholdings. (As amended by Presidential Decree No. 1455).

Sec. 188. Except as provided in section two hundred eighty-one, no domestic insurance company shall, in a stock corporation, engage in business in the Philippines unless possessed of a paid-up capital stock equal to at least five million pesos: Provided , That a domestic insurance company already doing business in the Philippines with a paid-up capital stock which is less than five million pesos shall have a paid-up capital stock of at least three million pesos by December thirty-one, nineteen hundred seventy-eight, four million pesos by December thirty-one, nineteen hundred seventy-nine and five million pesos by December thirty-one, nineteen hundred eighty: Provided, further, that the Secretary of Finance may, upon recommendation of the Insurance Commissioner, increase such minimum paid-up capital stock requirement, under such terms and conditions as he may impose, to an amount which, in his opinion, would reasonably assure the safety of the interests of the policyholders and the public. chanrobles virtual law library

The Commissioner may, as a pre-licensing requirement of a new insurance company, in addition to the paid-up capital stock, require the stockholders to pay in cash to the company in proportion to their subscription interests a contributed surplus fund of not less than one million pesos, in the case of a life insurance company, or not less than five hundred thousand pesos, in the case of an insurance company other than life. He may also require such company to submit to him a business plan showing the company's estimated receipts and disbursements, as well as the basis therefor, for the next succeeding three years.

If organized as a mutual company, in lieu of such capital stock, it must have available cash assets of at least five million pesos above all liabilities for losses reported, expenses, taxes, legal reserve, and reinsurance of all outstanding risks, and the contributed surplus fund equal to the amounts required of stock corporations. A stock insurance company doing business in the Philippines may, subject to the pertinent law and regulations which now are of hereafter may be in force, alter its organization and transform itself into a mutual insurance company. (As amended by Presidential Decree No. 1455).

Sec. 189. Every company must, before engaging in the business of insurance in the Philippines, file with the Commissioner the following: chanroblesvirtuallawlibrary

(b) If incorporated under the laws of the Philippines, a copy of the articles of incorporation and by-laws, and any amendments to either, certified by the Securities and Exchange Commission to be a copy of that which is filed in its Office;

(c) If incorporated under any laws other than those of the Philippines, a certificate from the Securities and Exchange Commission showing that it is duly registered in the mercantile registry of that Commission in accordance with the Corporation Law . A copy of the articles of incorporation and by-laws, and any amendments to either, if organized or formed under any law requiring such to be filed, duly certified by the officer having the custody of same, or if not so organized, a copy of the law, charter or deed of settlement under which the deed of organization is made, duly certified by the proper custodian thereof, or proved by affidavit to be a copy; also, a certificate under the hand and seal of the proper officer of such state or country having supervision of insurance business therein, if any there be, that such corporation or company is organized under the laws of such state or country, with the amount of capital stock or assets and legal reserve required by this Code;

(d) If not incorporated and of foreign domicile, aside from the certificate mentioned in paragraph (c) of this section, a certificate setting forth the nature and character of the business, the location of the principal office, the name of the individual or names of the persons composing the partnership or association, the amount of actual capital employed or to be employed therein and the names of all officers and persons by whom the business is or may be managed.

The certificate must be verified by the affidavit of the chief officer, secretary, agent, or manager of the company; and if there are any written articles of agreement of the company, a copy thereof must be accompany such certificate.

Sec. 190. The Commissioner must require as a condition precedent to the transaction of insurance business in the Philippines by any foreign insurance company, that such company file in his office a written power of attorney designating some person who shall be a resident of the Philippines as its general agent, on whom any notice provided by law or by any insurance policy, proof of loss, summons and other legal processes may be served in all actions or other legal proceedings against such company, and consenting that service upon such general agent shall be admitted and held as valid as if served upon the foreign company at its home office. Any such foreign company shall, as further condition precedent to the transaction of insurance business in the Philippines, make and file with the Commissioner an agreement or stipulation, executed by the proper authorities of said company in form and substance as follows: chanroblesvirtuallawlibrary

Whenever such service of notice, proof of loss, summons, or other legal process shall be made upon the Commission, he must, within ten days thereafter, transmit by mail, postage paid, a copy of such notice, proof of loss, summons, or other legal process to the company at its home or principal office. The sending of such copy by the Commissioner shall be a necessary part of the service of the notice, proof of loss, or other legal process.

Sec. 191. No insurance company organized or existing under the government or laws other than those of the Philippines shall engage in business in the Philippines unless possessed of paid-up unimpaired capital or assets and reserve not less than that herein required of domestic insurance companies, nor until it shall have deposited with the Commissioner for the benefit and security of the policyholders and creditors of such company in the Philippines, securities satisfactory to the Commissioner consisting of good securities of the Philippines, including new issues of stock of "registered enterprises" , as this term is defined in Republic Act No. 5186, otherwise known as the Investment Incentives Act , as amended, to the actual market value of not less than the minimum paid-up capital required of domestic insurance companies: Provided , That at least fifty per centum of such securities shall consist of bonds or other evidences of debt of the Government of the Philippines, its political subdivisions and instrumentalities, or of government-owned or controlled corporations and entities, including the Central Bank. The total investment of a foreign insurance company in any registered enterprise shall not exceed twenty per centum of the net worth of said foreign insurance company nor twenty per centum of the capital of the registered enterprise, unless previously authorized in writing by the Commissioner.

For purposes of this Code, the net worth of a foreign insurance company shall refer only to its net worth in the Philippines.

Sec. 192. The Commissioner shall hold the securities, deposited as aforesaid, for the benefit and security of all the policyholders of the company depositing the same, but shall as long as the company is solvent, permit the company to collect the interest or dividends on the securities so deposited, and, from time to time, with his assent, to withdraw any of such securities, upon depositing with said Commissioner other like securities, the market value of which shall be equal to the market value of such as may be withdrawn. In the event of any company ceasing to do business in the Philippines the securities deposited as aforesaid shall be returned upon the company's making application therefor and proving to the satisfaction of the Commissioner that it has no further liability under any of its policies in the Philippines.

Sec. 193. Every foreign company doing business in the Philippines shall set aside an amount corresponding to the legal reserves of the policies written in the Philippines and invest and keep the same therein in accordance with the provisions of this section. The legal reserve therein required to be set aside shall be invested only in the classes of the Philippine securities described in section two hundred: Provided, however , That no investment in stocks or bonds of any single entity shall, in the aggregate exceed twenty per centum of the net worth of the investing company or twenty per centum of the capital of the issuing company, whichever is the lesser unless otherwise approved in writing by the Commissioner. The securities purchased and kept in the Philippines under this section, shall not be sent out of the territorial jurisdiction of the Philippines without the written consent of the Commissioner.

Title 2 MARGIN OF INSOLVENCY

Sec. 194. An insurance company doing business in the Philippines shall at all times maintain a margin of solvency which shall be an excess of the value of its admitted assets exclusive of its paid-up capital, in the case of a domestic company, or an excess of the value of its admitted assets in the Philippines, exclusive of its security deposits, in the case of a foreign company, over the amount of its liabilities, unearned premium and reinsurance reserves in the Philippines of at least two per mille of the total amount of its insurance in force as of the preceding calendar year on all policies, except term insurance, in the case of a life insurance company, or of at least ten per centum of the total amount of its net premium written during the preceding calendar year, in the case of a company other than a life insurance company: Provided , That in either case, such margin shall in no event be less than five hundred thousand pesos: and Provided, further , That the term "paid-up capital" shall not include contributed surplus and capital paid in excess of par value. Such assets, liabilities and reserves shall exclude assets, liabilities and reserves included in separate accounts established in accordance with section two hundred thirty-seven. Whenever the aforementioned margin be found to be less than that herein required to be maintained, the Commissioner shall forthwith direct the company to make good any such deficiency by cash, to be contributed by all stockholders of record in proportion to their respective interest, and paid to the treasurer of the company, within fifteen days from receipt of the order: Provided , That the company in the interim shall not be permitted to take any new risk of any kind or character unless and until it make good any such deficiency: Provided, further , that a stockholder who aside from paying the contribution due from him, pays the contribution due from the another stockholder by reason of the failure or refusal of the latter to do so, shall have a lien on the certificates of stock of the insurance company concerned appearing in its books in the name of the defaulting stockholder on the date of default, as well as on any interests or dividends that have accrued or will accrue to the said certificates of stock, until the corresponding payment or reimbursement is made by the defaulting stockholder. (As amended by Presidential Decree No. 1455).

Sec. 195. No domestic insurance corporation shall declare or distribute any dividend on its outstanding stocks except from profits attested in a sworn statement to the Commissioner by the president or treasurer of the corporation to be remaining on hand after retaining unimpaired: chanroblesvirtuallawlibrary

(b) The margin of solvency required by section one hundred ninety-four;

(c) In the case of life insurance corporation, the legal reserve fund required by section two hundred eleven;

(d) In the case of corporations other than life, the legal reserve fund required by section two hundred thirteen;

(e) A sum sufficient to pay all net losses reported, or in the course of settlement, and all liabilities for expenses and taxes.

Any dividend declared or distributed under the preceding paragraph shall be reported to the Commissioner within thirty days after such declaration or distribution.

If the Commissioner finds that any such corporation has declared or distributed any such dividend in violation of this section, he may order such corporation to cease and desist from doing business until the amount of such dividend or the portion thereof in excess of the amount allowed under this section has been restored to said corporation.

Title 3 ASSETS

Sec. 196. In any determination of the financial condition of any insurance company doing business in the Philippines, there shall be allowed and admitted as assets only such assets owned by the insurance company concerned and which consist of: chanroblesvirtuallawlibrary

2. Investments in securities, including money market instruments, and in real property acquired or held in accordance with and subject to the applicable provisions of this Code and the income realized therefrom or accrued thereon.

3. Loans granted by the insurance company concerned to the extent of that portion thereof adequately secured by non-speculative assets with readily realizable values in accordance with and subject to the limitations imposed by applicable provisions of this Code.

4. Policy loans and other policy assets and liens on policies, contracts or certificates of a life insurance company, in an amount not exceeding legal reserves and other policy liabilities carried on each individual life insurance policy, contract or certificate.

5. The net amount of uncollected and deferred premiums and annuity considerations in the case of a life insurance company which carries the full mean tabular reserve liability.

6. Reinsurance recoverable by the ceding insurer: chanroblesvirtuallawlibrary

(b) from an insurer not authorized in this country, in an amount not exceeding the liabilities carried by the ceding insurer for amounts withheld under a reinsurance treaty with such unauthorized insurer as security for the payment of obligations thereunder if such funds are held subject to withdrawal by, and under the control of, the ceding insurer. The Commissioner may prescribe the conditions under which a ceding insurer may be allowed credit, as an asset or as a deduction from loss and unearned premium reserves, for reinsurance recoverable from an insurer not authorized in this country but which presents satisfactory evidence that it meets the applicable standards of solvency required in this country.

7. Funds withheld by a ceding insurer under a reinsurance treaty, provided reserves for unpaid losses and unearned premiums are adequately provided.

8. Deposits or amounts recoverable from underwriting associations, syndicates and reinsurance funds, or from any suspended banking institution, to the extent deemed by the Commissioner to be available for the payment of losses and claims and values to be determined by him.

9. Electronic data processing machines, as may be authorized by the Commissioner to be acquired by the insurance company concerned, the acquisition cost of which to be amortized in equal annual amounts within a period of five years from the date of acquisition thereof.

10. Other assets, not inconsistent with the provisions of paragraphs 1 to 9 hereof, which are deemed by the Commissioner to be readily realizable and available for the payment of losses and claims at values to be determined by him.

Sec. 197. In addition to such assets as the Commissioner may from time to time determine to be non-admitted assets of insurance companies doing business in the Philippines, the following assets shall in no case be allowed as admitted assets of an insurance company doing business in the Philippines, in any determination of its financial condition: chanroblesvirtuallawlibrary

2. Prepaid or deferred charges for expenses and commissions paid by such insurance company.

3. Advances to officers (other than policy loans), which are not adequately secured and which are not previously authorized by the Commissioner, as well as advances to employees, agents, and other persons on mere personal security.