Assignment of Partnership Interest Agreement

An assignment of partnership interest agreement occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner. The new partner will receive the business partnership’s benefits and obligations (including profits and losses) in exchange for compensation to the previous partner.

An assignment of partnership interest agreement is a type of business structure in which two or more people or entities own and operate a business. When one owner sells their stake in the partnership to a third party, an assignment of partnership interest records the transaction to the new partner. The assignment of partnership interest involves two parties: the assignor or the partner transferring their stake and the assignee, the new partner. The document that details the transaction needs to include the following information:

- Information about the partnership like the name of the business

- The type of interest being transferred

- The names and information of both the assignor and the assignee

- Information about the remaining partners

Members of an assignment of partnership interest agreement often need to transfer some or all of their stake to a new partner. Doing so can be a delicate process because it affects the partnership as a whole, not just the seller and the buyer. To make the transaction as transparent as possible and to satisfy potential requirements in the partnership articles, the transfer should be recorded in an assignment of partnership interest agreement. As the document’s name implies, its successful execution transfers a portion of the interest in the partnership from a current partner to a new partner.

The assignment of partnership interest agreement definition is a portion of the common law that is in charge of transferring the rights of an individual or party to another person or party. Moreover, the assignment of partnership interest agreement is often seen in real estate but can occur in other contexts as well. An assignment is just the contractual transfer of benefits that will accrue or have accrued. Obligations don’t transfer with the benefits of an assignment. The assignor will always keep the obligations.

What is an assignment of partnership interest agreement?

The assignment of partnership interest agreement is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquired the right to receive benefits from the partnership per stake granted.

The particulars of the assignment of partnership interest agreement respond, in large part, to the type of partnership in question. In some case, the assignment of the partnership agreement under which the partnership is formed doesn’t allow for a transfer of interest to new members or does so only under specific circumstances. It is also worth noting that a partnership carries both rights and responsibilities. A new partner who receives an interest in the partnership assumes all the assignment of partnership interest agreement obligations. Nonetheless, some states place limitations on assignees’ rights that don’t recognize them on equal footing as the founding partners.

An assignment of partnership interest agreement occurs when one party to an existing contract (the “assignor”) hand off the contract’s obligations and benefits to another party (the “assignee”). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights. In order to do that, the other party to the contract must be properly notified. Read on to learn how assignments work, including how to keep an assignment option out of your contract.

What is a partnership?

A partnership is a type of business organization where two or more individuals or business entities operate a business with the goal of making a profit. Each partner typically has rights and obligations enforced by a Partnership Agreement including liabilities and rights to profits of the business.

Who are the parties in an assignment of partnership interest agreement?

There are two parties in the assignment of partnership interest agreement: assignor and assignee. The assignor is the business partner who is transferring their rights in the partnership in exchange for compensation. The assignee is a new partner who purchases the previous partner’s interest in the partnership.

Do other partners have a say in who buys the interest in a partnership?

If there is an assignment of partnership interest agreement in place the answer is most likely, yes. An assignment of partnership interest agreement governing the activities of the partnership and conduct of the partners will often place some restrictions on the nature of the interest which may be acquired.

For example, the transferring partner might be limited to transferring only their economic interests and rights which would prevent the recipient of transferred interest from becoming a full partner (with voting rights and managerial input) by assignment alone. Full admission to the partnership would be decided by the remaining partners based on the terms of the assignment of partnership interest agreement.

The category of assignee is something else the partnership might have good reason for restricting. For example, federal tax audit rules introduced in 2018 mean that partnerships will be treated as taxable entities if one or more of the partners is itself a partnership, a trust, or an LLC. To avoid such tax consequences, and preserve individual tax treatment for the partners, the partnership agreement might prohibit assignments of partnership interest may be sold to any such business entity.

How is an assignment of partnership interest under an assignment of partnership interest agreement created?

To create an assignment of partnership interest under an assignment of partnership interest agreement, there should be a drafted document that records the transfer of rights and benefits from one partner to another and the exchange of compensation.

The partnership interest document under the assignment of partnership interest agreement should include:

- Type of interest: either full partnership interest or limited to the economic rights in distribution

- Partnership information: partnership name (e.g., Smith and Associates), establishment date, and purpose

- Assignor details: name, address, and type of party (individual or business entity) of the partner transferring rights and benefits to a new partner

- Assignee details: name, address, and type of party of the new partner receiving rights and benefits of the assignor

- Remaining partner details (if applicable): name, address, and type of party of other partners still part of the partnership

- Consideration details: a description of the price and agreed value to be exchanged for interest in the partnership (e.g., a monetary value or shares in stock)

- Signing details: witness signatures (if applicable), party signatures, and the signing date

Common sections in assignment of partnership interest agreements

Below is a list of common sections included in assignment of partnership interest agreement. These sections are linked to the below sample agreement for you to explore.

- Assignment of Partnership Interest

- Consideration

- Agreement to be Bound

- Registration of Partnership Interests

- Representations and Warranties of Assignee

- Binding Effect

- Severability

- Counterparts

- Governing Law

Security agreement under assignment of partnership interest agreement

A part of contract law that is responsible for financial transactions is a security agreement which is often under the assignment of partnership interest agreement. These are also called a secured transaction and include a grantor that promises collateral to the grantee. In contract law, the security under the assignment of partnership interest agreement doesn’t cover actual real estate or land. Instead, this agreement covers stock, vehicle, livestock, or another type of personal property. In a security agreement under the assignment of partnership interest agreement, in the case where a grantee already has the collateral, the grantor can verbally acquire the transaction.

However, it’s preferred to have a security agreement under the assignment of partnership interest agreement that is written down instead of having a verbal agreement, just in case there’s a disagreement among the parties. Both a security agreement and an assignment may apply to a variety of property rights.

Example of using assignment of partnership interest agreement and security agreements in property rights

As an example, the assignment of partnership interest agreement may cover the promise to use stocks as collateral or to transfer the rights of stock investments. It may also be possible for the agreements to include properties that are less tangible. The assignment of partnership interest agreement may apply to creative rights, such as film production or written works. If it is a case of creative rights, any benefits often include future revenue that may be earned from the distribution or sale of said works.

Assistance from an attorney regarding an assignment of partnership interest agreement

You may want to hire an attorney to help you draft a security agreement, legal assignment, and assignment of partnership interest agreement. There are other services that you might want to use that don’t cost as much but will still help you draft your contracts. The following are ways to save money while drafting a contract:

- Buy software with a template that creates security agreements and assignments.

- Buy a generic contract form at the bookstore.

- Buy a book with advice.

- Unless your background includes knowing particular legal knowledge about security agreements and assignments, you’ll want to talk to an attorney before you use any contract forms that are self-generated. Both security agreements and assignments are complicated areas of contract law.

Lease under assignment of partnership interest agreement

An agent is someone who is licensed by the state where a property is established to aid in real-estate transactions such as leases, assignments, and property sales. An agent is usually either an attorney, sales agent, or real estate broker. The tenant from the initial lease is the assignor, and he transfers his whole interest to another person. The assignee obtains the lease interest from the assignor or original tenant and will become the new tenant.

Consideration is what the assignor gets from the assignee for transferring the lease interest to the assignee. The consideration is often a certain amount of money. Interests that other people hold are encumbrances, and they can affect the title and possibly the possession and use of the property by the assignee and the assignor.

If the property in question is a residential unit that’s above a commercial property, the lease is considered to be a residential one, even though the property is in a commercial building. The governing law is that of the jurisdiction in which the property is located, no matter what jurisdiction the landlord, assignee, and assignor reside in. The assignee is allowed to receive a copy of the master lease. The assignor can either give the assignee a copy directly or include the copy with the lease assignment.

If the assignor isn’t liable for the assignee’s conduct, the landlord will need to go after the assignee if he or she causes property damage. However, if the assignor has liability for the conduct of the assignee, the landlord may then ask for compensation from both the assignee and assignor should the assignee cause any damage to the property.

How an assignment of partnership interest agreement works

How an assignment of partnership interest agreement plays out depends on many factors, especially the language of the contract. Some contracts may contain a clause prohibiting assignment; other contracts may require the other party to consent to the assignment.

Here’s an example of a basic assignment of partnership interest agreement: Tom contracts with a dairy to deliver a bottle of half-and-half to Tom’s house every day. The dairy assigns Tom’s contract to another dairy, and–provided Tom is notified of the change and continues to get his daily half-and-half–his contract is now with the new dairy.

An assignment of partnership interest agreement doesn’t always relieve the assignor of liability. Some contracts may include a guarantee that, regardless of an assignment, the original parties (or one of them) guarantees performance (that is, that the assignee will fulfill the terms of the contract).

When assignment of partnership interest agreement will not be enforced

An assignment of partnership interest agreement will not be enforced in the following situations. The contract prohibits assignment. Contract language, typically referred to as an anti-assignment clause, can prohibit (and “void”) any assignments. We provide a sample, below.

The assignment of partnership interest agreement materially alters what’s expected under the contract

If the assignment of partnership interest agreement affects the performance due under the contract, decreases the value or return anticipated, or increases the risks for the other party to the contract (the party who is not assigning contractual rights), courts are unlikely to enforce the arrangement. For instance, if Tom’s local, organic dairy assigned the contract to a factory farm dairy, this would be considered a material alteration.

The assignment of partnership interest agreement violates the law or public policy

Some laws limit or prohibit assignments. For example, many states prohibit the assignment of future wages by an employee, and the federal government prohibits the assignment of certain claims against the government. Other assignments, though not prohibited by a statute, may violate public policy. For example, personal injury claims cannot be assigned because doing so may encourage litigation.

Delegation or assignment of partnership interest agreement

In some cases, a party may not wish to assign the contract but only to get somebody else to fulfill its duties. Obviously, not all duties can be delegated–for example, some personal services are usually not delegated because they are so specific in nature. For example, if you hired Ted Nugent to perform at your event, he could not arbitrarily delegate his performing duties to Lady Gaga. To prohibit one party from delegating the responsibilities of the contract, the parties should include specific language to that effect in the agreement. For example, an anti-assignment clause might state, “Neither party shall assign or delegate its rights.”

Steps in the creation of an assignment of partnership interest agreement

There are three steps to follow if you want to assign a contract.

Step 1: Examine the assignment of partnership interest agreement for any limitations or prohibitions. Check for anti-assignment clauses. Sometimes the prohibition is not a separate clause but is included in another provision. Look for language that states, “This agreement may not be assigned.” If you find such language, you may not be able to assign the agreement unless the other party consents.

Step 2: Execute an assignment of partnership interest agreement. If you are not prohibited from assigning the contract, prepare and enter into an assignment of contract: an agreement that transfers the parties’ rights and obligations.

Step 3: Provide notice to the obligor. After you have assigned your contract rights to the assignee, you should provide notice to the other original contracting party (referred to as the obligor). This notice will effectively relieve you of any liability under the contract, unless the contract says differently (for instance, if the contracts says that the assignor guarantees the performance of the assigned contract or the contract prohibits an assignment) or the assignment is prohibited by law.

Anti-assignment clauses

If you’re making a contract and you don’t want assignment to be an option, you need to clearly state that in your agreement. Below are three variations of anti-assignment clauses that can be used in a contract.

Example 1: Consent required for assignment of partnership interest agreement

Assignment. Neither party may assign or delegate its rights or obligations pursuant to this Agreement without the prior written consent of the other. Any assignment or delegation in violation of this section shall be void.

Example 2: Consent not needed for affiliates or new owners

Assignment. Neither party may assign or delegate its rights or obligations pursuant to this Agreement without the prior written consent of the other. However, no consent is required for an assignment that occurs (a) to an entity in which the transferring party owns more than 50% of the assets, or (b) as part of a transfer of all or substantially all of the assets of the transferring party to any party. Any assignment or delegation in violation of this section shall be void.

Example 3: Consent not unreasonably withheld

Assignment. Neither party may assign or delegate its rights or obligations pursuant to this Agreement without the prior written consent of the other. Such consent shall not be unreasonably withheld. Any assignment or delegation in violation of this section shall be void.

Anti-assignment clauses can also be modified to prohibit only one of the parties from assigning rights. Also, when preparing an anti-assignment clause, keep in mind that you can prevent only “voluntary” assignments; you cannot prevent assignments that are ordered by a court or that are mandatory under law–for example, in a bankruptcy proceeding.

Examples of assignment of partnership interest agreement

Assignment of partnership interest agreements is great tools for contract parties to use when they wish to transfer their commitments to a third party. Here are some examples of contract assignments to help you better understand them:

Anna signs a contract with a local trash company that entitles her to have her trash picked up twice a week. A year later, the trash company transferred her contract to a new trash service provider. This contract assignment effectively makes Anna’s contract now with the new service provider.

Hasina enters a contract with a national phone company for cell phone service. The company goes into bankruptcy and needs to close its doors but decides to transfer all current contracts to another provider who agrees to honor the same rates and level of service. The contract assignment is completed, and Hasina now has a contract with the new phone company as a result.

Assignment of partnership interest agreements in real estate

Assignment of partnership interest agreement is also used in real estate to make money without going the well-known routes of buying and flipping houses. When real estate LLC investors use an assignment of contract, they can make money off properties without ever actually buying them by instead opting to transfer real estate contracts. This process is called real estate wholesaling.

Real estate wholesaling under assignment of partnership interest agreement

Real estate wholesaling consists of locating deals on houses that you don’t plan to buy but instead plan to enter a contract to reassign the house to another buyer and pocket the profit. The process is simple: real estate wholesalers negotiate purchase contracts with sellers. Then, they present these contracts to buyers who pay them an assignment fee for transferring the contract.

This process works because a real estate purchase agreement does not come with the obligation to buy a property. Instead, it sets forth certain purchasing parameters that must be fulfilled by the buyer of the property. In a nutshell, whoever signs the purchase contract has the right to buy the property, but those rights can usually be transferred by means of an assignment of contract.

This means that as long as the buyer who’s involved in the assignment of contract agrees with the purchasing terms, they can legally take over the contract. But how do real estate wholesalers find these properties?

It is easier than you might think. Here are a few examples of ways that wholesalers find cheap houses to turn a profit on:

- Direct mailers

- Place newspaper ads

- Make posts in online forums

- Social media posts

The key to finding the perfect home for an assignment of partnership interest agreement is to locate sellers that are looking to get rid of their properties quickly. This might be a family who is looking to relocate for a job opportunity or someone who needs to make repairs on a home but can’t afford it. Either way, the quicker the wholesaler can close the deal, the better.

Once a property is located, wholesalers immediately go to work getting the details ironed out about how the sale will work. Transparency is key when it comes to wholesaling. This means that when a wholesaler intends to use an assignment of contract to transfer the rights to buy to another person, they are always upfront about during the preliminary phases of the sale.

In addition to this practice just being good business, it makes sure the process goes as smoothly as possible later down the line. Wholesalers are clear in their intent and make sure buyers know that the contract could be transferred to another buyer before the closing date arrives.

After their offer is accepted and warranties are determined, wholesalers move to complete a title search. Title searches ensure that sellers have the right to enter into a purchase agreement on the property. They do this by searching for any outstanding tax payments, liens, or other roadblocks that could prevent the sale from going through. Wholesalers also often work with experienced real estate lawyers who ensure that all of the legal paperwork is forthcoming and will stand up in court. Lawyers can also assist in the contract negotiation process if needed but often don’t come in until the final stages. If the title search comes back clear and the real estate lawyer gives the green light, the wholesaler will immediately move to locate an entity to transfer the rights to buy.

One of the most attractive advantages of real estate wholesaling is that very little money is needed to get started. The process of finding a seller, negotiating a price, and performing a title search is an extremely cheap process that almost anyone can do.

On the other hand, it is not always a positive experience. It can be hard for wholesalers to find sellers who will agree to sell their homes for less than the market value. Even when they do, there is always a chance that the transferred buyer will back out of the sale, which leaves wholesalers obligated to either purchase the property themselves or scramble to find a new person to complete an assignment of contract with.

Who handles assignment of contract?

The best person to handle an assignment of partnership interest agreement is an attorney. Since these are detailed legal documents that deal with thousands of dollars, it is never a bad idea to have a professional on your side.

Sample of an assignment of partnership interest agreement

This assignment agreement (this “Assignment Agreement”) is entered into as of [—], 2013, by and between Newcastle Investment Corp., a Maryland corporation (the “Assignor”), and New Media Investment Group, Inc., a Delaware corporation (the “Assignee”). Capitalized terms used but not defined herein shall have the meanings ascribed to them in that certain Stock Purchase Agreement, dated as of June 28, 2013 (as it may be amended in accordance with its terms, the “Stock Purchase Agreement”), by and among Dow Jones Ventures VII, Inc. (“Seller”), Dow Jones Local Media Group, Inc. (the “Company”), the Assignor, and, solely with respect to its obligations under Sections 7.3, 7.7, 7.13, 7.14, 9.2, 9.3 and 10.2 of the Stock Purchase Agreement, Dow Jones & Company, Inc.

WHEREAS, the Assignor wishes to transfer and assign to the Assignee all of the Assignor’s rights and interests in and to, and obligations under, the Stock Purchase Agreement, and the Assignee wishes to be the assignee and transferee of such rights, interests and obligations;

WHEREAS, pursuant to Section 12.11 of the Stock Purchase Agreement, the Assignor may not assign any of its rights, interests or obligations under the Stock Purchase Agreement, directly or indirectly (by operation of Law or otherwise), without the prior written approval of Seller; and

WHEREAS, on September [—], 2013, Seller provided its written approval to the assignment by the Assignor of all of its rights, interests and obligations in the Stock Purchase Agreement to the Assignee.

NOW, THEREFORE, the parties hereto, intending to be legally bound, do hereby agree as follows:

- Assignment and Assumption. The Assignor hereby transfers and assigns to the Assignee, and the Assignee hereby acquires from the Assignor all of the Assignor’s rights, and interests in and to the Stock Purchase Agreement, of whatever kind or nature, and the Assignee hereby assumes and agrees to perform all obligations, duties, liabilities and commitments of the Assignor under the Stock Purchase Agreement, of whatever kind or nature.

- Retention of Obligations. Notwithstanding anything in this Assignment Agreement to the contrary, the Assignor shall remain obligated, as a principal and not a guarantor, to Seller with respect to all of the Assignor’s obligations, duties, liabilities and commitments under the Stock Purchase Agreement, of whatever kind or nature.

- Effectiveness. This Assignment Agreement shall be effective as of the date set first set forth above.

- Governing Law; Binding Effect. This Assignment Agreement shall be governed by and construed in accordance with the laws of the State of Delaware applicable to contracts made and performed in such state without giving effect to the choice of law principles of such state that would require or permit the application of the laws of another jurisdiction.

- Counterparts. This Assignment Agreement may be executed in one or more counterparts, including facsimile counterparts, each of which shall be deemed to be an original copy of this Assignment Agreement, and all of which, when taken together, shall be deemed to constitute one and the same agreement. Delivery of such counterparts by facsimile or electronic mail (in PDF or .tiff format) shall be deemed effective as manual delivery.

https://www.rocketlawyer.com/business-and-contracts/business-operations/contract-management/document/assignment-agreement

https://www.contractscounsel.com/b/assignment-of-contract

https://eforms.com/assignment/

https://www.sec.gov/Archives/edgar/data/1579684/000119312513435497/d603516dex1031.htm

https://www.upcounsel.com/assignment-agreement-definition#:~:text=The%20assignment%20agreement%20definition%20is%20a%20portion%20of%20the%20common,in%20other%20contexts%20as%20well .

https://www.nolo.com/legal-encyclopedia/assignment-of-contract-basics-32643.html

https://law.lis.virginia.gov/vacode/title50/chapter2.1/section50-73.45/

https://www.lawinsider.com/clause/assignment-of-partnership-interests

https://law.justia.com/codes/indiana/2012/title23/article16/chapter8

https://malegislature.gov/Laws/GeneralLaws/PartI/TitleXV/Chapter109/Section40

https://www.googleadservices.com/pagead/aclk?sa=L&ai=DChcSEwid3qm5_M77AhXFDAYAHdCHAKEYABAAGgJ3cw&ohost=www.google.com&cid=CAESbeD2va9R09-GFddnmxxSa88fkzjuwje7mEvH-KyXlO68Nbaa90Eqy-QERilf7ySpZDCcfxA1VL60uPf2F3D1UIHs3fVe0tW5zYTyGpF1RnMu56nsB0RT5oqcCklDtbGWwcDXyq2vL30PkEwoOuw&sig=AOD64_248HONbK5J6wiDGdS78kDPSqOTcw&q&adurl&ved=2ahUKEwj8yaO5_M77AhWvT6QEHaqsBA0Q0Qx6BAgIEAE

At Legal writing experts, we would be happy to assist in preparing any legal document you need. We are international lawyers and attorneys with significant experience in legal drafting, Commercial-Corporate practice and consulting. In the last few years, we have successfully undertaken similar assignments for clients from different jurisdictions. If given this opportunity, we will be able to prepare the legal document within the shortest time possible. You can send us your quick enquiry here

Related Posts

Informed consent agreement, referral service agreement, asset finance agreement, services agreement, quick links.

- Terms And Conditions

- Revision Policy

- Money-Back Guarantee

Quick Inquiry

Sign up for an account

Sign up for partner account, sign in to your account, reset password.

Assignment Of Partnership Interest

When you want to transfer the stake in a partnership to a new member, you’ll use an Assignment of Partnership Interest to outline the terms of the transaction.

- About document

Related documents

How it works.

Members of a partnership often need to transfer some or all of their stake to a new partner. Doing so can be a delicate process because it impacts the partnership as a whole, not just the seller and buyer.

To make the transaction as transparent as possible and to satisfy potential requirements in the partnership articles, the transfer should be recorded in an Assignment of Partnership Interest. As the document's name implies, its successful execution transfers a portion of the interest in the partnership from a current partner to a new partner.

What Is an Assignment of Partnership Interest?

An Assignment of Partnership Interest is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquires the right to receive benefits from the partnership per the stake granted.

The particulars of the Assignment of Partnership respond, in large part, to the type of partnership in question. In some cases, the Partnership Agreement under which the partnership is formed doesn't allow for a transfer of interest to new members or does so only under specific circumstances.

It's also worth noting that a partnership carries both rights and responsibilities. A new partner who receives an interest in the partnership assumes all the Partnership Agreement obligations, including liabilities. However, some states place limitations on assignees' rights that don't recognize them on equal footing as the founding partners.

Other Names for Assignment of Partnership Interest

Depending on your state, an Assignment of Partnership Interest may also be known as:

Transfer of Partnership Interest

Partnership Interest Transfer Form

Transfer of Share in Partnership

Who Needs an Assignment of Partnership Interest

Most of the time, an Assignment of Partnership Interest is drafted by a partnership member who's looking to transfer their stake in a partnership. However, the interest assignee could also create the form if they believe specific clauses need to be included.

Other current members of the partnership are also typically involved in creating the document to ensure it's in line with the terms established in the Partnership Agreement. The terms of the agreement frequently place restrictions on the type and amount of interest transferred by each partner.

Situations calling for a transfer of interest may include the business's cash flow requirements, a need to reallocate business assets, changes in the overall partnership strategy, and changes in the regulatory landscape, among others.

Why Use 360 Legal Forms for Your Assignment of Partnership Interest

Customized for you, by you.

Create your own documents by answering our easy-to-understand questionnaires to get exactly what you need out of your Assignment of Partnership Interest.

Specific to Your Jurisdiction

Laws vary by location. Each document on 360 Legal Forms is customized for your state.

Fast and easy

All you have to do is fill out a simple questionnaire, print, and sign. No printer? No worries. You and other parties can even sign online.

How to Create an Assignment of Partnership Interest with 360 Legal Forms

An Assignment of Partnership Interest needs to satisfy several parties. The assignor and assignee need to have their rights protected, and it must fall within the terms of the original Partnership Agreement. It's essential to use a form addressing all the details involved.

Let 360 Legal Forms help with our extensive library of attorney-vetted legal forms. The process is fast and easy. All you have to do is fill out our easy-to-understand questionnaire. Once complete, simply download your form as a PDF or Word document from your secure online account.

What Information Will I Need to Create My Assignment of Partnership Interest

To create your document, please provide:

Assignor: Full name and address of the partner transferring the business interest

Assignee: Full name and address of the incoming partner receiving the business interest

Partnership Details: Legal name and address of the partnership in which interest is being transferred, along with business purposes and other details

Remaining Partners: Names and addresses of the other members of the partnership

Consideration: Payment that the assignor will receive for the transfer of interest

Closing Date: When the assignment of interest will be executed

Assignment of Partnership Interest Terms

Warranties: A section of the Assignment of Partnership Interest clearly stating what the assignor promises are right about the interest and the terms of the partnership

Indemnification clause: A clause releasing each party from responsibility created by the other party's failure to act as the document requires

Implied terms: Terms and clauses including an agreement under law or custom even if they're not spelled out directly in the agreement

Exclusion clauses: A part of an agreement releasing a party from responsibility under a specific circumstance

Assignment of Partnership Interest Signing Requirements

To be legally enforceable, an Assignment of Partnership Interest must be signed by the assignor, the assignee, and all the remaining members of the partnership. If applicable, witnesses to the signing need to sign the document as well.

The signatures do not need to be notarized to be valid. However, you may choose to notarize the signatures to prevent any challenge arising at a later time.

What to Do with Your Assignment of Partnership Interest

Once the Assignment of Partnership Interest is signed (and signatures notarized if you so choose), distribute signed copies to every partnership member and the assignee. Keep a copy for your records and make sure the partnership's secretary records the transfer of interest in the minutes of the partnership. In some states, it may be necessary to file a document with the Commissioner of Corporations, and tax liabilities may arise based on the value of the interest.

Frequently Asked Questions

No. You can choose to notarize the signatures on the assignment document, but it’s not required for it to be legal and valid.

In theory, yes. However, this is not only inadvisable but could also result in legal issues down the line. Without the document to establish each party’s obligations, either may choose to back out of the transaction. Furthermore, it puts the partnership at risk, since the assignee ends up with a controlling stake in the business without explicitly being bound to the terms of the original Partnership Agreement.

When partnership interest is transferred, the assignor’s proceeds are typically treated as a capital gain/loss. But, some or all of the capital gains may end up as ordinary income if the assignor attributes it to unrealized receivables. State and local laws may also play a role and you’re well-advised to consult a tax attorney or CPA licensed to practice in your state.

Yes, the document can be used to transfer a partner’s interest to natural or legal persons in a general sense. However, it should be noted that federal tax audit rules may be affected for a partnership if one or more members is itself a partnership and the original agreement may prohibit this type of transfer specifically.

Why choose 360 Legal Forms?

Our exhaustive library of documents covers your personal, business, and real estate needs with all of your DIY legal forms.

Easy legal documents at your fingertips

Create professional documents for thousands of purposes.

Easily customized

Make unlimited documents and revisions. Sign online in seconds.

Applicable to all 50 states

Our documents are vetted by lawyers and are applicable to all 50 states.

Know someone who needs this document?

Users that make a Assignment Of Partnership Interest sometimes need additional documents.

- Shareholders’ Organizational Meeting Minutes

- LLC Operating Agreement Amendment

- Partnership Agreement Amendment

- Partnership Dissolution Agreement

- Partnership Agreement

Assignment of Interest Form: Everything You Need to Know

An assignment of interest form allows a limited liability company (LLC) member to assign their interest or ownership stake in the company to another person. 3 min read updated on January 01, 2024

Updated November 25, 2020:

An assignment of interest form allows a limited liability company (LLC) member to assign their interest or ownership stake in the company to another person. The information that you will need to include in this form depends on the laws governing LLCs in your state.

Assigning LLC Interest

LLCs are a popular business structure that offers certain features of both corporations and partnerships. Owners of a limited liability company are members, and each member's stake in the company is their interest. LLC members have the ability to transfer their interest by making an assignment of interest.

An LLC's operating agreement describes how the company will be run and dictates the requirements and limitations of members' interests in the company. If this agreement allows members to transfer their company interests, they can do so with an assignment of interest form. Every state will have specific rules for what you must include in this form before a member's interest can be assigned.

In most cases, an assignment of interest does not constitute a sale of a member's LLC interest. In many states, an assignment of interest only transfers the financial advantage of the stake or share, so the member who initially possessed the interest still retains his or her voting and managerial rights in the company while the assignee will not. Assignments of interest are commonly used as loan collateral, and once the loan is paid off, the assignment ends.

Furthermore, an assignment will only transfer a percentage of an LLC member's interest. You are not required to assign all of your stakes' financial benefits. Having the ability to transfer a portion of interest allows members of an LLC to use their ownership stake very flexibly. However, partial assignments can only be made if the LLC's operating agreement allows them.

Assignments and Partnerships

An assignment of partnership interest is similar to an assignment of LLC interest. Assigning a partnership interest involves a business partner assigning their right to financially benefit from the partnership to a new partner.

When writing an assignment of partnership interest form, you should be sure to include the correct information:

- Details about the partnership, including the business's legal name and its formation date.

- Contact information of the new partner who is receiving the partnership interest.

- Contact information of the old partner who is assigning their interest.

- Contact information of the other business partners.

- The monetary amount being exchanged for the partnership interest.

- The date where the assignment will be revoked.

- Signatures of all parties, including the assignor, assignee, and remaining partners.

The main purpose of this legal document is to record the assignment of the partnership interest.

Without a valid assignment of interest form, the new partner would have no way to force the old partner to fulfill the terms of the assignment. In addition to making sure that the assignment is enforceable, this document outlines what role the new partner will play in the business. For instance, the assignment of partnership interest form can dictate if the new partner will have any management or financial responsibilities in the business. Full partners, for instance, can usually make decisions for the business and will also have access to the business's financial records.

There are countless reasons that a business partner may wish to assign their partnership interest to a new partner:

- The business's needed cash flow has changed.

- A change has occurred in how the business allocates its assets.

- Implementation of a new partnership strategy.

- New regulations pose challenges for the business.

When assigning a partnership interest, there are several issues you must address:

- Which partner will assign their interest and who will receive the assignment.

- The rights of the assignee to participate in managing or operating the business.

- The location of the business partnership.

- The establishment date of the partnership.

- What the assigning partner will receive in exchange for assigning their partnership interest.

Whether you are a partner in a business or a member of an LLC, your ownership stake in the business entity likely provides you with a variety of rights. For instance, you may have the right to receive profits from the business and the right to receive business assets after the company dissolves. Depending on your operating or partnership agreement , you may be able to transfer these rights to another party in exchange for consideration.

If you need help with an assignment of interest form, you can post your legal needs on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Assignment of Interest

- Assignment of Interest In LLC

- Assignment Law

- Assignment Legal Definition

- Assignment Of Contracts

- Legal Assignment

- Assignment and Novation Agreement: What You Need to Know

- What is an Assignment and Assumption Agreement

- Assignment of Rights and Obligations Under a Contract

- Assignment Contract Law

Free Assignment of Partnership Interest Template for Microsoft Word

Download this free Assignment of Partnership Interest template as a Word document to make it easy to assign your interest in a partnership to a third party.

Assignment of Partnership Interest

THIS ASSIGNMENT (the “Assignment”) made and entered into on [Insert Date]

AMONGST: [Insert Name] of [Insert Address] (the “Assignor”)

– AND- [Insert Name] of [Insert Address] (the “Assignee”)

– AND-

[Insert Name] of [Insert Address] (the “Remaining Partner”)

A. The Assignor is the holder of a partnership interest (the “Interest”) in [Insert name of partnership interest] (the “Partnership”), a partnership previously established on [Insert date of initial partnership agreement] for the purpose of and formed in accordance with an agreement (the “Partnership Agreement”).

B. The Assignor desires to assign the Interest to the Assignee and the Assignee desires to acquire the Interest from the Assignor.

C. The Interest acquired by the Assignee will include all rights in the Partnership previously afforded to the Assignor including the status as partner. The Remaining Partner has agreed and gives consent to such assignment according to the terms and conditions of this Assignment.

IN CONSIDERATION OF and as a condition of the parties entering into this Assignment and other valuable consideration, the receipt and sufficiency of which consideration is acknowledged, the parties to this Assignment agree as follows:

Sale and Purchase

1. By this Assignment the Assignor withdraws from the Partnership and to the fullest extent permitted by the Partnership Agreement, assigns all its rights, interests, title and benefits in the Partnership to the Assignee. The Assignee will become a partner in the Partnership taking the place of the Assignor in the Partnership with all the rights and obligations previously afforded to the Assignor. The Assignee, as a partner in the Partnership, will be bound by the terms and conditions of the Partnership Agreement as amended. On assignment of the Interest to the Assignee, the Assignor will cease to be a partner in the Partnership.

Consideration

2. As full consideration for the assignment of the Interest the Assignee has submitted and the Assignor has accepted the following consideration: [Enter consideration]

3. The closing of the purchase and sale of the Interest (the “Closing”) will take place on [Insert closing date] (the “Closing Date”) at the offices of the Assignor or at such other time and place as the Assignor and Assignee mutually agree.

Representations and Warranties of the Assignor

4. The Assignor warrants that the Assignor has a general partnership interest in the Partnership and that the Assignor has the legal right to execute and perform an assignment of the Interest exclusive of the Assignor’s status as partner.

5. The Assignor warrants that the Interest is free and clear of all liens, encumbrances, restrictions and claims.

6. The Assignor warrants that on completion of this Assignment the Assignor will retain no residual interest or interests in the Partnership.

7. The Assignor warrants that the Assignor is not in any way in default of any of the expressed or implied terms and conditions of the Partnership Agreement. The Assignor also warrants that this Assignment is in full compliance with all terms and conditions of the Partnership Agreement.

8. The Assignor warrants that the Assignor is not bound by any other contractual agreement or legal requirement that would be violated by this Assignment.

9. The Assignor warrants that it has provided the Assignee with the most current copy of the Partnership Agreement inclusive of all amendments.

10. The Assignor warrants that no other consent is required from any third party or government entity authorising this Assignment except for those consents of the Remaining Partner contained in this Assignment.

Assignee’s Obligations

11. On Closing of this Assignment, the Assignee will observe and perform any and all terms and conditions of the Partnership Agreement, relating to the newly acquired rights, that were previously binding on the Assignor. Transitional Rights and Obligations

12. To the full extent permitted by the Partnership Agreement, all income, rights, benefits, obligations and liabilities of the Interest will belong to the Assignor before the Closing and will transfer to the Assignee after the Closing. Consent of Remaining Partner

13. The Remaining Partner consents to the terms and conditions of this Assignment with the intent that the Assignee will become a partner in the Partnership with all of the rights, benefits, obligations and liabilities previously afforded to the Assignor under the Partnership Agreement as amended.

Governing Law and Jurisdiction

14. This Assignment will be construed in accordance with, and exclusively governed by the laws of the [Insert state or country].

15. The Assignor and the Assignee submit to the jurisdiction of the courts of the [Insert state or country] for the enforcement of this Assignment or any arbitration award or decision arising from this Assignment.

Miscellaneous

16. Time is of the essence in this Assignment.

17. This Assignment may be executed in counterpart. Facsimile signatures are binding and are considered to be original signatures.

18. All warrants and representations of the Assignor and the Assignee connected with this Assignment will survive the Closing.

19. This Assignment will not be assigned either in whole or in part by any party to this Assignment without the written consent of the other party.

20. Headings are inserted for the convenience of the parties only and are not to be considered when interpreting this Assignment. Words in the singular mean and include the plural and vice versa. Words in the masculine gender include the feminine gender and vice versa. Words in the neuter gender include the masculine gender and the feminine gender and vice versa.

21. If any term, covenant, condition or provision of this Assignment is held by a court of competent jurisdiction to be invalid, void or unenforceable, it is the parties’ intent that such provision be reduced in scope by the court only to the extent deemed necessary by that court to render the provision reasonable and enforceable and the remainder of the provisions of this Assignment will in no way be affected, impaired or invalidated as a result.

22. This Assignment contains the entire agreement between the parties. All negotiations and understandings have been included in this Assignment. Statements or representations which may have been made by any party to this Assignment in the negotiation stages of this Assignment may in some way be inconsistent with this final written Assignment. All such statements are declared to be of no value in this Assignment. Only the written terms of this Assignment will bind the parties.

23. This Assignment and the terms and conditions contained in this Assignment apply to and are binding upon the Assignor, the Assignee, the Remaining Partner and their respective successors, assigns, executors, administrators, beneficiaries, and representatives.

24. Any notices or delivery required here will be deemed completed when hand-delivered, delivered by agent, or seven (7) days after being placed in the post, postage prepaid, to the parties at the addresses contained in this Assignment or as the parties may later designate in writing.

25. All of the rights, remedies and benefits provided by this Assignment will be cumulative and will not be exclusive of any other such rights, remedies and benefits allowed by law.

IN WITNESS WHEREOF the Assignor, the Assignee and the Remaining Partner have duly affixed their signatures under hand and seal on [Insert date]

_____________________________ WITNESS: ___________________________ Address: _____________________________ Occupation: __________________________ _____________________________ ______________________________

_____________________________ WITNESS: ___________________________ Address: _____________________________ Occupation: __________________________ _____________________________ _________________________

Related Documents

Advertising agreement, arbitration agreement, barter agreement, business sale agreement.

Lawyer for Assignment of Partnership Interest

Jump to section.

A lawyer for the assignment of partnership interests writes up contracts for the assignment of partnership interests, which entail the sale of shares from an existing owner to a new partner. By definition, a partnership is an association between two or more individuals. Transferring ownership interests is one important aspect of any partnership. Voluntary sale, inheritance, or gifting of partnership interest is, however, such cases where it is necessary to consult with a competent attorney at law. This article provides insight into how lawyers assist in the assignment of partnership interest and outlines some key terms that should be known by the assignor and assignee.

Duties of a Lawyer for Assignment of Partnership Interests

Assignment of partnership interest has to adhere to various state and federal laws and regulations. Additionally, the assignor and the partner receiving the interest are required to sign multiple legal documents . However, they may not know about them; hence, it is vital to engage an experienced legal adviser’s counsel. The duties that attorneys have towards performing their roles in the assignment of this particular type of property include:

- Reviewing Partnership Agreement : The assignor and assignee must first go through the entire document containing provisions relating to the assignment or transferability of limited liability company interests like restrictions, valuation methods, and procedures for consent from partners or other partnerships. Based on this information, legal advisers may offer help in reviewing contracts and making certain changes later.

- Determining Value: Assessing the current worthiness of assigned assets by partners becomes very crucial at this point. To learn what should be applied while valuing these properties in future times, there are methods contained within the agreement reached between partners themselves. Enlisting legal advisors who have experience in valuing properties can greatly assist both parties involved.

- Obtaining Consents and Waivers : In reality, in a partnership firm, partners are interdependent, meaning that one partner answers for all activities being performed by the company. If so provided in their partnership agreement, the assignor may need to obtain consent from other partners or the partnership itself before proceeding with the assignment of partnership interest. Moreover, a “ROFR” term may be embedded in some agreements that allow other partners to buy the same interest at similar terms as would apply to a third party.

- Drafting Legal Documents: Drafting legal documents necessary for the assignment of partnership interest is perhaps the most crucial role a legal adviser has when all consents and valuations have been obtained. These documents normally include such instruments as “assignment of partnership interest,” “ bill of sale ,” and other contracts that are essential for this process.

- Filing and Record-keeping: The parties involved in such agreements should hire lawyers as they need to learn about filing procedures and recordkeeping, among others. After that, every document relating to a change in ownership should be lodged with appropriate government bodies by a lawyer representing any party. Finally, observing legal compliance is very important for this purpose since, without it, a later claim by one of these parties can render the transfer invalid.

- Analyzing of Taxes: Any assignment of a partnership interest can have significant tax impacts on both the assignor and the assignee. A specialist in the particular state’s tax law can help these parties minimize their tax exposure. As regards tax compliance, a legal expert would also have to be involved. Each state has different provisions that deal with deductions and other benefits related to taxation.

Merits of Engaging a Lawyer for Assignment of Partnership Interests

The lawyer helps both the assignor and the assignee in various ways. Read further to learn why a legal consultant is important in the assignment of partnership interests:

- Providing Legal Knowledge: The laws governing partnership agreements and assignments within partnerships are complicated and may vary from one jurisdiction to another. Such complexities can only be dealt with by business and partnership law attorneys.

- Safekeeping Interest: When assigning a partnership interest, a legal advisor keeps each party’s best interests at heart. This includes helping clients negotiate terms, conduct due diligence , and address any legal issues.

- Resolving Disputes: Conflicts are likely to occur during the assignment process, for example, when there are more than two partners or there are some external interested parties. On this line, an advocate who is knowledgeable about conflict resolution should intervene so that all parties reach an agreement.

- Ensuring Compliance: To be lawful, a transfer must satisfy specific terms stated under the partnership agreement and meet federal guidelines or those specified by a given state regarding taxation policy concerning property rights upon changing ownership hands under such partnerships. Concerning these regulations, a lawyer will assist you in not breaching them, fully aware of their meaning.

- Facilitating Documentation and Formalities: There is plenty of paperwork involved when transferring shareholding, i.e., drafting and reviewing documents like contracts or agreements that must be notarized before going into effect, among other things; lawyers expedite processes, making sure all necessary formalities are done properly, reducing the chances of errors later on that may lead to future litigation.

- Offering Legal Representation: It may be helpful for the assignor or assignee to have a lawyer involved in their assignment of partnership interests. In case any issues come up, such lawyers offer legal representation or at least advocacy for their clients in court trials and arbitration. This legal representation can be crucial in safeguarding the rights and assets of both the assignor and assignee.

Benjamin W.

Key Terms for an Assignment of Partnership Interest Lawyer

- Assignor: An assignor is someone who sells his/her share to another entity, be it a company or an individual. The owner could trade shares under different circumstances, including retirement, financial problems, and personal needs change.

- Assignee: The assignee gets the ownership interest assigned to him/her by its original holder. This party might either be one of the existing partners, a new partner, or an external player.

- Right of First Refusal: In most cases, partnerships include a “first refusal” clause, giving existing partners the right to buy out this interest before selling it elsewhere to non-partners.

- Valuation: Assessing the value placed on a stake being disposed of from a partnership is known as streamlined valuation. Normally, valuation methods incorporate assessing the current worthiness associated with entire assets owned by the group or else following some stipulations made within the initial agreement that have predetermined its outcome.

- Non-Disclosure Clause: Upon transferring partnership interest, the partners will sign a confidentiality agreement to prevent the new partner from sharing sensitive information about the company with anyone else.

- Compensation: This refers to the sum of money that is paid by an assignee to an assignor as consideration for the assignment of a partnership interest.

Final Thoughts on an Assignment of Partnership Interest Lawyer

The assignment of partnership interests marks a crucial point in business partnerships ; it necessitates careful planning, legal expertise, and compliance with various legal and financial concerns. Both the Assignor and Assignee should be guided by a Legal Consultant who has specialized in Partnership Law. To carry out the process, there is a need for advice from an attorney specializing in partnership law who can walk them through this process. This assignment must also be carried out with mutual understanding between all parties involved, including any lawyers representing each side, but ultimately finalized by one attorney simultaneously closing both sides’ files for ownership exchange, flawlessly avoiding unnecessary bickering or argumentation among lawyers, which would result from instead using individual attorneys on either side alone thereby causing an undue delay before a successful conclusion is reached at.’ A well-versed attorney could rightly review every party’s rights as well as obligations during signing this document.’

If you want free pricing proposals from vetted lawyers that are 60% less than typical law firms, Click here to get started . By comparing multiple proposals for free, you can save the time and stress of finding a quality lawyer for your business needs.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Need help with a Partnership Agreement?

Meet some of our lawyers.

I work with private tech companies on entity formation, corporate governance, and commercial agreements. I was an in-house counsel for a unicorn fintech startup and am currently associated with a startup boutique while operating my solo practice. I received my JD from Berkeley Law, and served in the US Navy for 5 years as a combat linguist. I am fluent in Korean.

I am an experienced transactional attorney with substantial experience (10 years, including at a large national law firm and a public company) in the review/markup and drafting of a wide variety of commercial contracts. I am efficient and business-minded and am capable of taking an aggressive or more modest approach, depending on your preferences, leverage, and urgency. I look forward to working with you! https://www.linkedin.com/in/owenkirk/

My legal practice is focused on business transactions like general corporate matters, fundraising, technology contract negotiation, blockchain, crypto or token analysis, and others. I hope to be a good asset to you and looking forward to finding out how I can be of help!

I build legal solutions which create extraordinary value for my clients. I am a partner in Alliance Law Firm International PLLC in Washington. My specialties include tax, wealth management, estates, corporations/business, venture capital, private equity, and natural resources. Prior to practicing law, I had a decade-long career in international private equity and investment banking. I have worked on building and managing companies in technology, energy, materials, retail, and natural resources. I am licensed to practice in the District of Columbia and Pennsylvania. I have degrees from the Georgetown University Law Center (JD) and the Yale School of Management (MBA).

Alexandra I.

I am a licensed attorney in California specializing in consumer contract law. My areas of expertise include contract law and employment law, including independent contractor compliance, work-for-hire compliance and general corporate law. I appreciate getting to know my clients and enjoy providing legal guidance, whether they are large corporations, young start-ups about to take off, or just one person in need of legal advice. Some of my recent work has included the drafting of corporate purchase and sale agreements, independent contractor agreements, nondisclosure agreements, and software as a service (SaaS) agreements. I am well-versed in intellectual property law and have successfully obtained trademarks for former clients. My passion for learning, reading and writing has proved advantageous in my practice. I complete continuing education courses to stay current on industry best practices. I take great satisfaction in offering precise and helpful legal advice free from fancy terminology. I look forward to discussing your particular needs and supporting you in achieving your objectives. Please get in touch to learn more about my approach and see whether we are a good fit.

I am a Silicon Valley tech lawyer with over 13 years of in-house experience and additional years in BigLaw. I provide tech licensing, data privacy, employment, international expansion, go to market, and other corporate and commercial legal services to clients in software, SaaS, bio-tech, cryptocurrency, financing, and construction business. I currently run my own practice concentrating on transactional, commercial, corporate or employment matters. Prior to starting my own practice, I joined as the first in-house counsel to lead the global legal strategy to bring tech products to market, increase revenue, decrease exposure to risk, and raise venture funding for HashiCorp Inc., currently an unicorn technology company with evaluation over $5 billion and venture funding over $350 million; Sysdig Inc., a technology company with venture funding of $195 million; and Anaplan Inc., currently a publicly traded company on the US Stock Market. Furthermore, I acted as in-house counsel advising leading technology enterprise companies such as HP, VMware, and Genentech and currently act as member of strategic advisory boards to several technology companies located globally

I'm a tenants rights attorney based (and licensed) in New York. My expertise includes filing complaints and responsive pleadings as well as reviewing leases and contracts and motion practice.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

CONTRACT LAWYERS BY TOP CITIES

- Austin Corporate Lawyers

- Boston Corporate Lawyers

- Chicago Corporate Lawyers

- Dallas Corporate Lawyers

- Denver Corporate Lawyers

- Houston Corporate Lawyers

- Los Angeles Corporate Lawyers

- New York Corporate Lawyers

- Phoenix Corporate Lawyers

- San Diego Corporate Lawyers

- Tampa Corporate Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

All Formats

Table of Contents

Assignment of partnership interest definition & meaning, what is an assignment of partnership interest, 10 types of assignment of partnership interest, assignment of partnership interest uses, purpose, importance, what’s in an assignment of partnership interest parts, how to design assignment of partnership interest, assignment of partnership interest vs. cover letter, what’s the difference between assignment of partnership interest, legal form, and affidavit, assignment of partnership interest sizes, assignment of partnership interest ideas & examples, assignment of partnership interest.

Assignment of partnership interest is a legal document transferring the rights from the initial business owner to a new business owner. This documentation involves two parties, which are the assignor (the party transferring the ownership) and the assignee (the party receiving the ownership).

Wyoming Assignment of Partnership Interest

Rhode Island Assignment of Partnership Interest

Wisconsin Assignment of Partnership Interest

Vermont Assignment of Partnership Interest

West Virginia Assignment of Partnership Interest

Utah Assignment of Partnership Interest

Washington Assignment of Partnership Interest

Texas Assignment of Partnership Interest

South Dakota Assignment of Partnership Interest

Tennessee Assignment of Partnership Interest

Provides Legal Transfer of Rights

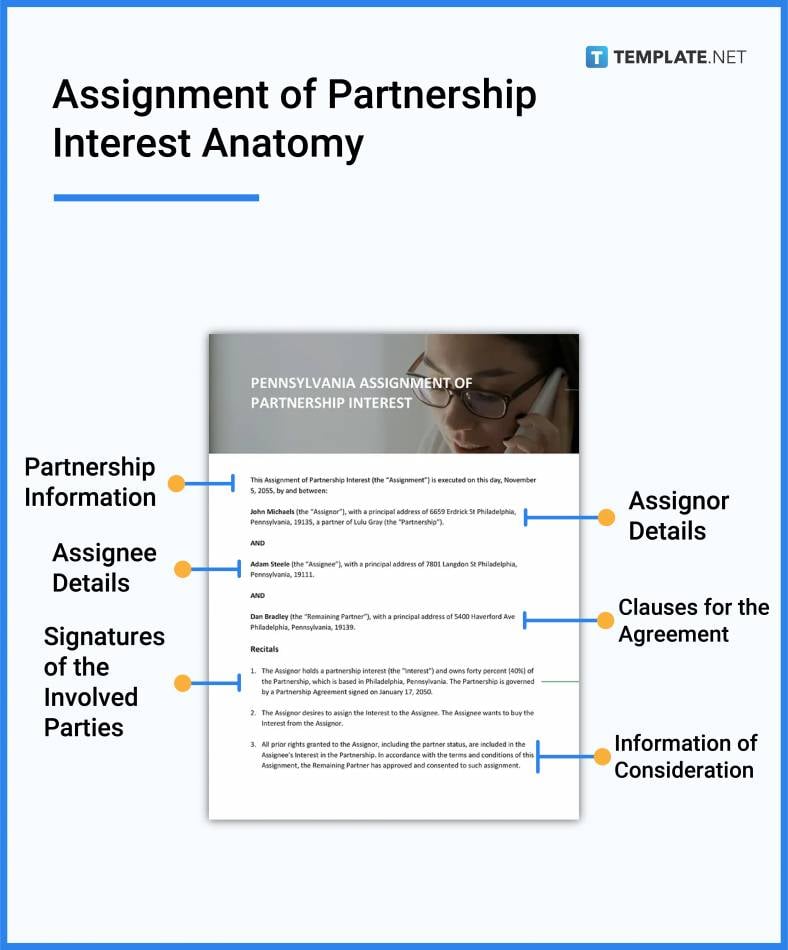

Secures proof of transfer, both parties have consent with the agreement, states a limited liability partnership, reliable and effective, partnership information, assignor details, assignee details, clauses for the agreement, signatures of the involved parties, information of consideration.

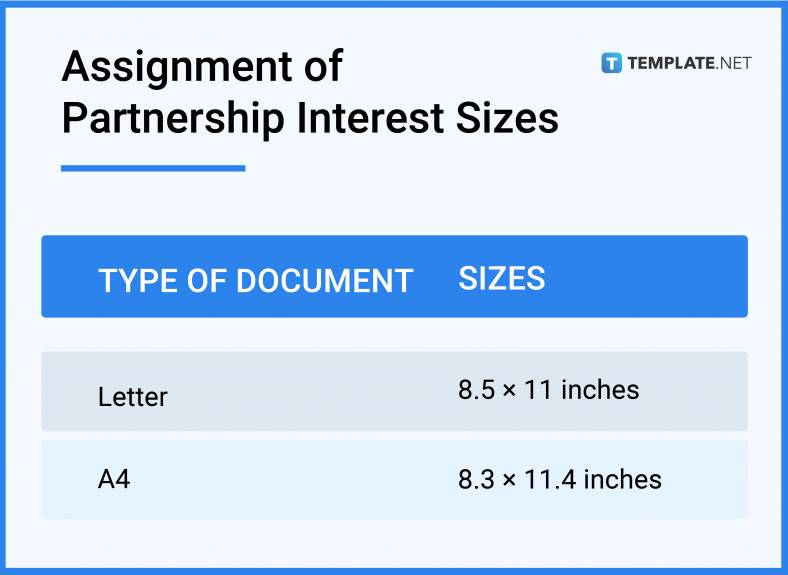

- Letter (8.5 × 11 inches)

- A4 (8.3 × 11.7 inches)

- Virginia Assignment of Partnership Interest Ideas and Examples

- South Carolina Assignment of Partnership Interest Ideas and Examples

- Pennsylvania Assignment of Partnership Interest Ideas and Examples

- Oregon Assignment of Partnership Interest Ideas and Examples

- New York Assignment of Partnership Interest Ideas and Examples

- Michigan Assignment of Partnership Interest Ideas and Examples

- Louisiana Assignment of Partnership Interest Ideas and Examples

- Kentucky Assignment of Partnership Interest Ideas and Examples

- Indiana Assignment of Partnership Interest Ideas and Examples

- Hawaii Assignment of Partnership Interest Ideas and Examples

What should an assignment of partnership interest include?

Can a partner transfer his interest in partnership, how do you assign a partnership interest, why do you need assignment of partnership interest, what is a transfer of interest in partnership firm, what makes a good assignment of partnership interest, what does the assignment of partnership interest do, what is the role of assignment of partnership interest in business, how is an assignment of partnership interest created, what happens when you sell partnership interest, more in documents, assignment of limited partnership interest template, wyoming assignment of partnership interest template, wisconsin assignment of partnership interest template, simple assignment of partnership interest template, west virginia assignment of partnership interest template, washington assignment of partnership interest template, virginia assignment of partnership interest template, vermont assignment of partnership interest template, utah assignment of partnership interest template, texas assignment of partnership interest template.

- How To Create a Schedule in Microsoft Word [Template + Example]

- How To Create a Schedule in Google Docs [Template + Example]

- How To Create a Quotation in Google Docs [Template + Example]

- How To Create a Quotation in Microsoft Word [Template + Example]

- How To Make a Plan in Google Docs [Template + Example]

- How To Make a Plan in Microsoft Word [Template + Example]

- How To Make/Create an Inventory in Google Docs [Templates + Examples]

- How To Create Meeting Minutes in Microsoft Word [Template + Example]

- How To Create Meeting Minutes in Google Docs [Template + Example]

- How To Make/Create an Estimate in Microsoft Word [Templates + Examples] 2023

- How To Make/Create an Estimate in Google Docs [Templates + Examples] 2023

- How To Make/Create a Manual in Google Docs [Templates + Examples] 2023

- How To Make/Create a Manual in Microsoft Word [Templates + Examples] 2023

- How To Make/Create a Statement in Google Docs [Templates + Examples] 2023

- How To Make/Create a Statement in Microsoft Word [Templates + Examples] 2023

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Exhibit 10.3

ASSIGNMENT AND ASSUMPTION OF LIMITED PARTNER INTEREST AND SECOND AMENDMENT TO THE AGREEMENT AND AMENDED CERTIFICATE OF LIMITED PARTNERSHIP

(VISTA HOUSING ASSOCIATES)

This Assignment and Assumption of Limited Partner Interests and Second Amendment to the Agreement and Amended Certificate of Limited Partnership (this “ Amendment ”) of VISTA HOUSING ASSOCIATES, a limited partnership organized under the laws of the State of California (the “ Partnership ”), is dated and effective as of December 14, 2012 (the “ Effective Date ”), by and among REAL ESTATE ASSOCIATES LIMITED III, a California limited partnership (the “ Assignor ”), ALVAREZ BRACERO LP, LLC, a Delaware limited liability company (the “ Assignee ”), BUCARE DEVELOPMENT CORPORATION, a Puerto Rico corporation (the “ General Partner ”).

W I T N E S S E T H:

WHEREAS, the Assignor acquired a limited partner interest in the Partnership (the “ LP Interest ”) pursuant to the Partnership’s Agreement and Amended Certificate of Limited Partnership, dated as of May 5, 1981, by and between the General Partner, and the Assignor, as amended by the First Amendment to Agreement and Amended Certificate of Limited Partnership (collectively, the “ Partnership Agreement ”), including but not limited to a 99% interest in all profits, losses and tax credits under Section 42 of the Code;

WHEREAS, Section 8.2.1 of the Partnership Agreement permits the Assignor to transfer and assign all or any part of the LP Interest to the Assignee;

WHEREAS, Section 8.2.2 of the Partnership Agreement authorizes the substitution of the Assignee as a Substitute Limited Partner in the Partnership;

WHEREAS, the Assignor wishes to assign the LP Interest to the Assignee as of the Effective Date for $21,900.00, and the Assignee wishes to accept such assignment of the LP Interest for the consideration and upon the terms and conditions of this Amendment;

WHEREAS, the Assignee is willing to undertake all of the obligations of the Assignor under the Partnership Agreement (the “ Obligations ”); and

WHEREAS, the General Partner desires to acknowledge such undertaking of the Obligations by the Assignee and to release the Assignor from the Obligations and all other liabilities in connection with the LP Interest.

NOW, THEREFORE, in consideration of the foregoing premises and for other good and valuable consideration hereinafter described, the receipt and sufficiency of which are acknowledged, the parties agree as follows:

1. Capitalized terms used but not defined herein shall have the respective meanings attributed thereto in the Partnership Agreement.

2. As of the Effective Date and in consideration of Twenty-One Thousand Nine Hundred Dollars and 00/100 ($21,900.00) paid by the Assignee to the Assignor, and provided such consideration has in fact been paid to the Assignor, the Assignor assigns to the Assignee and the Assignee accepts from the Assignor, one hundred percent (100%) of the Assignor’s right, title and interest in and to the LP Interest, including, without limitation, the Assignor’s entire right to allocations of Profits and Losses and tax credits under Section 42 of the Code and all items entering into the computation thereof, and to all distributions of Cash from Operations, Net Refinancing Cash and surplus cash from a Disposition, however denominated, under the Partnership Agreement; provided, however, that (i) solely for purposes of allocating the Profits and Losses and tax credits from operations (collectively, the “ Tax Benefits ”) between the Assignor and the Assignee, the Assignor shall receive all Tax Benefits attributable to any day before December 1, 2012, and the Assignee shall receive all Tax Benefits attributable to December 1, 2012, and any day thereafter; and (ii) the Assignee shall receive all distributions of Cash from Operations or the Net Refinancing Cash or the surplus cash from a Disposition distributed by the Partnership after the Effective Date regardless of whether such distributions are attributable to any period prior or subsequent to the Effective Date.

3. The Assignor hereby represents and warrants the following:

a. Authorization . The Assignor has the power and authority to execute, deliver and perform its obligations under this Amendment.

b. Conflicts . To the Assignor’s actual knowledge, the execution, delivery and performance by the Assignor of this Amendment and the performance of the transactions contemplated hereby and thereby will not (A) violate (1) any provision of law, statute, rule or regulation the effect of which would be to cause or be reasonably expected to have a material adverse effect on the ability of the Assignor to perform any of its obligations under this Amendment, (2) any order of any governmental authority having proper jurisdiction over the Assignor, or (3) any provision of any indenture, loan agreement or other material agreement to which the Assignor is a party or by which it or any of its property is or may be bound, (B) be in conflict with, result in a breach of or constitute (alone or with notice or lapse of time or both) a default under any such indenture, loan agreement or other material agreement or (C) result in the creation or imposition of any mortgage, deed of trust, lien, pledge, claim, equity interest, participation interest, security interest or other charge or encumbrance of any kind with respect to the LP Interest.

c. Enforceability . This Amendment has been duly authorized, executed and delivered by the Assignor and the terms hereof constitute the legal, valid and binding obligations of the Assignor enforceable against the Assignor in accordance with its terms, subject to bankruptcy, insolvency, reorganization, moratorium or similar laws affecting creditors’ rights generally and subject to general principles of equity (regardless of whether enforcement is sought in a proceeding in equity or at law).

d. Title and Ownership . Assignor is the sole legal and beneficial owner of the LP Interest and has full power and lawful authority to transfer, convey and assign to the Assignee all of the Assignor’s right, title and interest in and to the LP Interest in the manner contemplated hereby. . After giving effect to the consummation of the transactions contemplated hereby, neither the Assignor nor any person claiming under or through the Assignor has any valid claim to or interest in the LP Interest.