- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Assignment of Accounts Receivable: Meaning, Considerations

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Investopedia / Jiaqi Zhou

What Is Assignment of Accounts Receivable?

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

The borrower pays interest, a service charge on the loan, and the assigned receivables serve as collateral. If the borrower fails to repay the loan, the agreement allows the lender to collect the assigned receivables.

Key Takeaways

- Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables.

- This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.

- Usually, new and rapidly growing firms or those that cannot find traditional financing elsewhere will seek this method.

- Accounts receivable are considered to be liquid assets.

- If a borrower doesn't repay their loan, the assignment of accounts agreement protects the lender.

Understanding Assignment of Accounts Receivable

With an assignment of accounts receivable, the borrower retains ownership of the assigned receivables and therefore retains the risk that some accounts receivable will not be repaid. In this case, the lending institution may demand payment directly from the borrower. This arrangement is called an "assignment of accounts receivable with recourse." Assignment of accounts receivable should not be confused with pledging or with accounts receivable financing .

An assignment of accounts receivable has been typically more expensive than other forms of borrowing. Often, companies that use it are unable to obtain less costly options. Sometimes it is used by companies that are growing rapidly or otherwise have too little cash on hand to fund their operations.

New startups in Fintech, like C2FO, are addressing this segment of the supply chain finance by creating marketplaces for account receivables. Liduidx is another Fintech company providing solutions through digitization of this process and connecting funding providers.

Financiers may be willing to structure accounts receivable financing agreements in different ways with various potential provisions.

Special Considerations

Accounts receivable (AR, or simply "receivables") refer to a firm's outstanding balances of invoices billed to customers that haven't been paid yet. Accounts receivables are reported on a company’s balance sheet as an asset, usually a current asset with invoice payments due within one year.

Accounts receivable are considered to be a relatively liquid asset . As such, these funds due are of potential value for lenders and financiers. Some companies may see their accounts receivable as a burden since they are expected to be paid but require collections and cannot be converted to cash immediately. As such, accounts receivable assignment may be attractive to certain firms.

The process of assignment of accounts receivable, along with other forms of financing, is often known as factoring, and the companies that focus on it may be called factoring companies. Factoring companies will usually focus substantially on the business of accounts receivable financing, but factoring, in general, a product of any financier.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1329209757-f0022f8c3e97445c91f781b2d182760f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Double Entry Bookkeeping

learn bookkeeping online for free

Home > Accounts Receivable > Assignment of Accounts Receivable Journal Entries

Assignment of Accounts Receivable Journal Entries

The assignment of accounts receivable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable assignment.

The assignment of accounts receivable journal entries are based on the following information:

- Accounts receivable 50,000 on 45 days terms

- Assignment fee of 1% (500)

- Initial advance of 80% (40,000)

- Cash received from customers 6,000

- Interest on advances at 9%, outstanding on average for 40 days (40,000 x 9% x 40 / 365 = 395)

About the Author

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

- Receivables

- Notes Receivable

- Credit Terms

- Cash Discount on Sales

- Accounting for Bad Debts

- Bad Debts Direct Write-off Method

- Bad Debts Allowance Method

- Bad Debts as % of Sales

- Bad Debts as % of Receivables

- Recovery of Bad Debts

- Accounts Receivable Aging

- Assignment of Accounts Receivable

- Factoring of Accounts Receivable

Assignment of accounts receivable is an agreement in which a business assigns its accounts receivable to a financing company in return for a loan. It is a way to finance cash flows for a business that otherwise finds it difficult to secure a loan, because the assigned receivables serve as collateral for the loan received.

By assignment of accounts receivable, the lender i.e. the financing company has the right to collect the receivables if the borrowing company i.e. actual owner of the receivables, fails to repay the loan in time. The financing company also receives finance charges / interest and service charges.

It is important to note that the receivables are not actually sold under an assignment agreement. If the ownership of the receivables is actually transferred, the agreement would be for sale / factoring of accounts receivable . Usually, the borrowing company would itself collect the assigned receivables and remit the loan amount as per agreement. It is only when the borrower fails to pay as per agreement, that the lender gets a right to collect the assigned receivables on its own.

The assignment of accounts receivable may be general or specific. A general assignment of accounts receivable entitles the lender to proceed to collect any accounts receivable of the borrowing company whereas in case of specific assignment of accounts receivable, the lender is only entitled to collect the accounts receivable specifically assigned to the lender.

The following example shows how to record transactions related to assignment of accounts receivable via journal entries:

On March 1, 20X6, Company A borrowed $50,000 from a bank and signed a 12% one month note payable. The bank charged 1% initial fee. Company A assigned $73,000 of its accounts receivable to the bank as a security. During March 20X6, the company collected $70,000 of the assigned accounts receivable and paid the principle and interest on note payable to the bank on April 1. $3,000 of the sales were returned by the customers.

Record the necessary journal entries by Company A.

Journal Entries on March 1

Initial fee = 0.01 × 50,000 = 500

Cash received = 50,000 – 500 = 49,500

The accounts receivable don't actually change ownership. But they may be to transferred to another account as shown the following journal entry. The impact on the balance sheet is only related to presentation, so this journal entry may not actually be passed. Usually, the fact that accounts receivable have been assigned, is stated in the notes to the financial statements.

Journal Entries on April 1

Interest expense = 50,000 × 12%/12 = 500

by Irfanullah Jan, ACCA and last modified on Oct 29, 2020

Related Topics

- Sales Returns

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Classifications

- Cost Accounting Systems

- Cost Behavior

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

Accounts Receivable Assignment: Key Concepts and Business Impact

Explore the essential concepts and business impact of accounts receivable assignment, including cash flow effects and advanced techniques.

Efficient management of accounts receivable is crucial for maintaining a healthy cash flow in any business. Assigning these receivables can be an effective strategy to optimize liquidity and reduce financial risk.

Understanding the implications of this practice helps businesses make informed decisions that align with their financial goals.

Key Concepts of Accounts Receivable Assignment

Accounts receivable assignment involves transferring the rights to collect receivables from a business to a third party, often a financial institution. This practice is typically used to secure immediate cash flow, allowing businesses to meet short-term obligations without waiting for customer payments. The third party, known as the assignee, then assumes the responsibility of collecting the receivables.

One of the primary concepts in accounts receivable assignment is the distinction between recourse and non-recourse agreements. In a recourse agreement, the business retains some liability if the receivables are not collected, meaning they may need to compensate the assignee for any uncollected amounts. Conversely, a non-recourse agreement transfers the full risk of non-payment to the assignee, providing the business with greater financial security but often at a higher cost.

Another important aspect is the discount rate applied by the assignee. This rate reflects the cost of the service and the perceived risk associated with the receivables. Factors influencing the discount rate include the creditworthiness of the customers, the average collection period, and the overall economic environment. Businesses must carefully evaluate these rates to ensure that the benefits of immediate cash flow outweigh the costs.

Impact on Cash Flow

The assignment of accounts receivable can significantly influence a company’s cash flow dynamics. By converting receivables into immediate cash, businesses can bridge the gap between sales and actual cash inflows. This immediate liquidity can be particularly beneficial for companies facing seasonal fluctuations or those in industries with extended payment terms. For instance, a manufacturing firm might use receivable assignment to ensure it has the necessary funds to purchase raw materials, even if its customers take months to pay their invoices.

Moreover, the infusion of cash from receivable assignments can enable businesses to capitalize on growth opportunities. With more liquid assets on hand, companies can invest in new projects, expand operations, or take advantage of bulk purchasing discounts. This proactive approach to cash management can lead to increased profitability and a stronger market position. For example, a retail business might use the funds from assigned receivables to open new store locations, thereby increasing its market reach and revenue potential.

However, it’s important to recognize that while receivable assignment can provide immediate financial relief, it also comes with costs. The discount rate applied by the assignee reduces the total amount of cash received compared to the face value of the receivables. This reduction must be carefully weighed against the benefits of improved cash flow. Additionally, businesses must consider the potential impact on customer relationships, as the assignee will now be responsible for collections. Ensuring that the assignee maintains a professional and courteous approach is essential to preserving customer goodwill.

Accounting Treatment and Reporting

When it comes to the accounting treatment and reporting of accounts receivable assignments, businesses must adhere to specific guidelines to ensure accurate financial statements. The first step involves recognizing the assignment transaction in the accounting records. This typically requires debiting a cash account to reflect the immediate influx of funds and crediting the accounts receivable account to remove the assigned receivables from the company’s books. The difference between the receivables’ face value and the cash received, often due to the discount rate, is recorded as a financing expense or loss.

Proper disclosure is another critical aspect of accounting for receivable assignments. Financial statements must clearly indicate the nature and extent of the receivables assigned, including any recourse obligations if applicable. This transparency helps stakeholders understand the company’s financial position and the potential risks associated with the assigned receivables. For instance, notes to the financial statements should detail the terms of the assignment agreement, the discount rate applied, and any contingent liabilities that may arise from recourse provisions.

Additionally, businesses must consider the impact of receivable assignments on their financial ratios. Metrics such as the current ratio, quick ratio, and accounts receivable turnover can be significantly affected by the removal of receivables from the balance sheet. Analysts and investors often scrutinize these ratios to assess a company’s liquidity and operational efficiency. Therefore, it is essential to provide context and explanations for any substantial changes in these metrics due to receivable assignments.

Advanced Techniques in Receivable Assignment

Advanced techniques in receivable assignment can offer businesses more sophisticated ways to manage their cash flow and financial risk. One such technique is the use of securitization, where receivables are pooled together and sold as securities to investors. This method not only provides immediate liquidity but also diversifies the risk among multiple investors, making it an attractive option for companies with large volumes of receivables. Securitization can be particularly beneficial for industries like telecommunications or utilities, where customer bases are extensive and receivables are substantial.

Another advanced approach is dynamic discounting, which allows businesses to offer early payment discounts to their customers in exchange for quicker cash inflows. Unlike traditional discounting, dynamic discounting uses a flexible rate that can change based on the timing of the payment. This technique leverages technology platforms to automate and optimize the discounting process, ensuring that businesses can maximize their cash flow without sacrificing too much revenue. For example, a software company might use dynamic discounting to encourage its clients to pay invoices within 10 days instead of the standard 30, thereby improving its liquidity.

Relevance in Accounting: Concepts and Practical Applications

Modern accounting statements: techniques, technology, global standards, you may also be interested in..., understanding book transfers: types, accounting, and financial impact, accounting for warrants issued with debt: key practices and considerations, revenue recognition and its impact on financials, sell or process further: effective decision-making strategies.

The Difference Between Assignment of Receivables & Factoring of Receivables

- Small Business

- Money & Debt

- Business Bank Accounts

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Decrease Bad Debt Expenses to Increase Income

What does "paid on account" in accounting mean, what is a financing receivable.

- What Do Liquidity Ratios Measure?

- What Are Some Examples of Installment & Revolving Accounts?

You can raise cash fast by assigning your business accounts receivables or factoring your receivables. Assigning and factoring accounts receivables are popular because they provide off-balance sheet financing. The transaction normally does not appear in your financial statements and your customers may never know their accounts were assigned or factored. However, the differences between assigning and factoring receivables can impact your future cash flows and profits.

How Receivables Assignment Works

Assigning your accounts receivables means that you use them as collateral for a secured loan. The financial institution, such as a bank or loan company, analyzes the accounts receivable aging report. For each invoice that qualifies, you will likely receive 70 to 90 percent of the outstanding balance in cash, according to All Business . Depending on the lender, you may have to assign all your receivables or specific receivables to secure the loan. Once you have repaid the loan, you can use the accounts as collateral for a new loan.

Assignment Strengths and Weaknesses

Using your receivables as collateral lets you retain ownership of the accounts as long as you make your payments on time, says Accounting Coach. Since the lender deals directly with you, your customers never know that you have borrowed against their outstanding accounts. However, lenders charge high fees and interest on an assignment of accounts receivable loan. A loan made with recourse means that you still are responsible for repaying the loan if your customer defaults on their payments. You will lose ownership of your accounts if you do not repay the loan per the agreement terms.

How Factoring Receivables Works

When you factor your accounts receivable, you sell them to a financial institution or a company that specializes in purchasing accounts receivables. The factor analyzes your accounts receivable aging report to see which accounts meet their purchase criteria. Some factors will not purchase receivables that are delinquent 45 days or longer. Factors pay anywhere from 65 percent to 90 percent of an invoice’s value. Once you factor an account, the factor takes ownership of the invoices.

Factoring Strengths and Weaknesses

Factoring your accounts receivables gives you instant cash and puts the burden of collecting payment from slow or non-paying customers on the factor. If you sell the accounts without recourse, the factor cannot look to you for payment should your former customers default on the payments. On the other hand, factoring your receivables could result in your losing customers if they assume you sold their accounts because of financial problems. In addition, factoring receivables is expensive. Factors charge high fees and may retain recourse rights while paying you a fraction of your receivables' full value.

- All Business: The Difference Between Factoring and Accounts Receivable Financing

Related Articles

The advantages of selling accounts receivable, buying accounts receivable, difference between payables and receivables in accounting, the role of factoring in modern business finance, the prevention of dilution of ownership, how to remove an empty mailbox in outlook, the importance of factoring in business, how to factor inventory, setting up webmail on mail for the imac, most popular.

- 1 The Advantages of Selling Accounts Receivable

- 2 Buying Accounts Receivable

- 3 Difference Between Payables and Receivables in Accounting

- 4 The Role of Factoring in Modern Business Finance

Our Insights

Assignment of Accounts Receivable – Trap for the Unwary

By Steven A. Jacobson

Most businesses are familiar with the mechanics of an assignment of accounts receivable. A party seeking capital assigns its accounts receivable to a financing or factoring company that advances that party a stipulated percentage of the face amount of the receivables.

The factoring company, in turn, sends a notice of assignment of accounts receivable to the party obligated to pay the factoring company’s assignee, i.e. the account debtor. While fairly straightforward, this three-party arrangement has one potential trap for account debtors.

Most account debtors know that once they receive a notice of assignment of accounts receivable, they are obligated to commence payments to the factoring company. Continued payments to the assignee do not relieve the account debtor from its obligation to pay the factoring company.

It is not uncommon for a notice of assignment of accounts receivable to contain seemingly innocuous and boilerplate language along the following lines:

Please make the proper notations on your ledger and acknowledge this letter and that invoices are not subject to any claims or defenses you may have against the assignee.

Typically, the notice of assignment of accounts receivable is directed to an accounting department and is signed, acknowledged and returned to the factoring company without consideration of the waiver of defenses languages.

Even though a party may have a valid defense to payment to its assignee, it still must pay the face amount of the receivable to the factoring company if it has signed a waiver. In many cases, this will result in a party paying twice – once to the factoring company and once to have, for example, shoddy workmanship repaired or defective goods replaced. Despite the harsh result caused by an oftentimes inadvertent waiver agreement, the Uniform Commercial Code validates these provisions with limited exceptions. Accordingly, some procedures should be put in place to require a review of any notice of assignment of accounts receivable to make sure that an account debtor preserves its rights and defenses.

- Announcement

What is the Assignment of Accounts Receivable?

Share This...

Assignment of accounts receivable.

Assignment of accounts receivable is a financing arrangement in which a company uses its accounts receivable as collateral to obtain a loan or financing from a financial institution or a lender. In this arrangement, the company “assigns” or transfers the rights to collect payments from the outstanding accounts receivable to the lender.

The lender then provides the company with a percentage of the assigned accounts receivable value as a loan, while retaining a portion as collateral or to cover potential defaults. The company is still responsible for collecting payments from its customers. When the customers make payments, the company forwards the collected amount to the lender, who applies the payment to the outstanding loan balance.

The assignment of accounts receivable is a common financing option for businesses with cash flow constraints or those that need immediate funding for working capital requirements or other short-term financial needs.

Example of the Assignment of Accounts Receivable

Let’s consider a fictional company, ABC Corp., that manufactures and sells electronics. ABC Corp. has $200,000 worth of outstanding accounts receivable, but it needs immediate cash to purchase raw materials and pay its employees.

ABC Corp. approaches XYZ Bank to obtain financing using its accounts receivable as collateral. XYZ Bank agrees to provide a loan of 85% of the total accounts receivable value, which amounts to $170,000 (85% of $200,000).

In this arrangement, ABC Corp. assigns the accounts receivable to XYZ Bank, and XYZ Bank provides the company with $170,000 in financing. ABC Corp. remains responsible for collecting payments from its customers.

As customers of ABC Corp. pay their invoices, the company forwards the collected payments to XYZ Bank. XYZ Bank then applies these payments to reduce the outstanding loan balance. Once all the outstanding invoices are collected and the loan balance is paid off, the assignment of accounts receivable is considered complete.

This arrangement allows ABC Corp. to obtain the immediate cash it needs to continue its business operations, while XYZ Bank takes on the risk associated with the accounts receivable collection process.

Other Posts You'll Like...

TCP CPA Practice Questions Explained: Municipal Bonds

How to Calculate Gains or Losses on the Disposal of Long-Lived Assets

TCP CPA Practice Questions Explained: Equity Securities and Corporate Bonds

Common Journal Entries for Net and Gross Property, Plant, and Equipment Balances

How to Calculate Gross and Net Property, Plant, and Equipment Balances

TCP CPA Practice Questions Explained: Self-Employed and Small Business Retirement Plans

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

How Melodie Passed Her CPA Exams by Making Every Morning Count

Inconsistent CPA Study? Try These 4 Strategies

When More Study Time Isn’t the Answer: How Thomas Passed His CPA Exams

How Ekta Passed Her CPA 6 Months Faster Than She Planned

2024 CPA Exams F.A.Q.s Answered

How Jackie Got Re-Motivated by Simplifying Her CPA Study

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

Assignment of Accounts Receivable

The financial accounting term assignment of accounts receivable refers to the process whereby a company borrows cash from a lender, and uses the receivable as collateral on the loan. When accounts receivable is assigned, the terms of the agreement should be noted in the company's financial statements.

Explanation

In the normal course of business, customers are constantly making purchases on credit and remitting payments. Transferring receivables to another party allows companies to reduce the sales to cash revenue cycle time. Also known as pledging, assignment of accounts receivable is one of two ways companies dispose of receivables, the other being factoring.

The assignment process involves an agreement with a lending institution, and the creation of a promissory note that pledges a portion of the company's accounts receivable as collateral on the loan. If the company does not fulfill its obligation under the agreement, the lender has a right to collect the receivables. There are two ways this can be accomplished:

General Assignment : a portion of, or all, receivables owned by the company are pledged as collateral. The only transaction recorded by the company is a credit to cash and a debit to notes payable. If material, the terms of the agreement should also appear in the notes to the company's financial statements.

Specific Assignment : the lender and borrower enter into an agreement that identifies specific accounts to be used as collateral. The two parties will also outline who will attempt to collect the receivable, and whether or not the debtor will be notified.

In the case of specific assignment, if the company and lender agree the lending institution will collect the receivables, the debtor will be instructed to remit payment directly to the lender.

The journal entries for general assignments are fairly straightforward. In the example below, Company A records the receipt of a $100,000 loan collateralized using accounts receivable, and the creation of notes payable for $100,000.

In specific assignments, the entries are more complex since the receivable includes accounts that are explicitly identified. In this case, Company A has pledged $200,000 of accounts in exchange for a loan of $100,000.

Related Terms

Contributors

Moneyzine Editor

- Trade Finance

- Letters of Credit

- Trade Insurance & Risk

- Shipping & Logistics

- Sustainable Trade Finance

- Incoterms® Rules 2020

- Research & Data

- Conferences

- Purchase Order Finance

- Stock Finance

- Structured Commodity Finance

- Receivables Finance

- Supply Chain Finance

- Bonds and Guarantees

- Find Finance Products

- Get Trade Finance

- Incoterms® 2020

- Letters of Credit (LCs)

Receivables Finance And The Assignment Of Receivables

Tfg legal trade finance hub, receivables finance and the assignment of receivables.

A receivable represents money that is owed to a company and is expected to be paid in the future. Receivables finance, also known as accounts receivable financing, is a form of asset-based financing where a company leverages its outstanding receivables as collateral to secure short-term loans and obtain financing.

In case of default, the lender has a right to collect associated receivables from the company’s debtors. In brief, it is the process by which a company raises cash against its own book’s debts.

The company actually receives an amount equal to a reduced value of the pledged receivables, the age of the receivables impacting the amount of financing received. The company can get up to 90% of the amount of its receivables advanced.

This form of financing assists companies in unlocking funds that would otherwise remain tied up in accounts receivable, providing them with access to capital that is not immediately realised from outstanding debts.

FIG. 1: Accounts receivable financing operates by leveraging a company’s receivables to obtain financing. Source: https://fhcadvisory.com/images/account-receivable-financing.jpg

Restrictions on the assignment of receivables – New legislation

Invoice discounting products under which a company assigns its receivables have been used by small and medium enterprises (SMEs) to raise capital. However, such products depend on the related receivables to be assignable at first.

Businesses have faced provisions that ban or restrict the assignment of receivables in commercial contracts by imposing a condition or other restrictions, which prevents them from being able to use their receivables to raise funds.

In 2015, the UK Government enacted the Small Business, Enterprise and Employment Act (SBEEA) by which raising finance on receivables is facilitated. Pursuant to this Act, regulations can be made to invalidate restrictions on the assignment of receivables in certain types of contract.

In other words, in certain circumstances, clauses which prevent assignment of a receivable in a contract between businesses is unenforceable. Especially, in its section 1(1), the Act provides that the authorised authority can, by regulations “make provision for the purpose of securing that any non-assignment of receivables term of a relevant contract:

- has no effect;

- has no effect in relation to persons of a prescribed description;

- has effect in relation to persons of a prescribed description only for such purposes as may be prescribed.”

The underlying aim is to enable SMEs to use their receivables as financing to raise capital, through the possibility of assigning such receivables to another entity.

The aforementioned regulations, which allow invalidations of such restrictions on the assignment of receivables, are contained in the Business Contract Terms (Assignment of Receivables) Regulations 2018, which will apply to any term in a contract entered into force on or after 31 December 2018.

By virtue of its section 2(1) “Subject to regulations 3 and 4, a term in a contract has no effect to the extent that it prohibits or imposes a condition, or other restriction, on the assignment of a receivable arising under that contract or any other contract between the same parties.”

Such regulations apply to contracts for the supply of goods, services or intangible assets under which the supplier is entitled to be paid money. However, there are several exclusions to this rule.

In section 3, an exception exists where the supplier is a large enterprise or a special purpose vehicle (SPV). In section 4, there are listed exclusions for various contracts such as “for, or entered into in connection with, prescribed financial services”, contracts “where one or more of the parties to the contract is acting for purposes which are outside a trade, business or profession” or contracts “where none of the parties to the contract has entered into it in the course of carrying on a business in the United Kingdom”. Also, specific exclusions relate to contracts in energy, land, share purchase and business purchase.

Effects of the 2018 Regulations

As mentioned above, any contract terms that prevent, set conditions for, or place restrictions on transferring a receivable are considered invalid and cannot be legally enforced.

In light of this, the assignment of the right to be paid under a contract for the supply of goods (receivables) cannot be restricted or prohibited. However, parties are not prevented from restricting other contracts rights.

Non-assignment clauses can have varying forms. Such clauses are covered by the regulations when terms prevent the assignee from determining the validity or value of the receivable or their ability to enforce it.

Overall, these legislations have had an important impact for businesses involved in the financing of receivables, by facilitating such processes for SMEs.

Digital platforms and fintech solutions: The assignment of receivables has been significantly impacted by the digitisation of financial services. Fintech platforms and online marketplaces have been developed to make the financing and assignment of receivables easier.

These platforms employ tech to assess debtor creditworthiness and provide efficient investor and seller matching, including data analytics and artificial intelligence. They provide businesses more autonomy, transparency, and access to a wider range of possible investors.

Securitisation is an essential part of receivables financing. Asset-backed securities (ABS), a type of financial instrument made up of receivables, are then sold to investors.

Businesses are able to turn their receivables into fast cash by transferring the credit risk and cash flow rights to investors. Investors gain from diversification and potentially greater yields through securitisation, while businesses profit from increased liquidity and risk-reduction capabilities.

References:

https://www.tradefinanceglobal.com/finance-products/accounts-receivables-finance/ – 28/10/2018

https://www.legislation.gov.uk/ukpga/2015/26/section/1/enacted – 28/10/2018

https://www.legislation.gov.uk/ukdsi/2018/9780111171080 – 28/10/2018

https://www.bis.org/publ/bppdf/bispap117.pdf – Accessed 14/06/2023

https://www.investopedia.com/terms/a/asset-backedsecurity.asp – Accessed 14/06/2023

https://www.imf.org/external/pubs/ft/fandd/2008/09/pdf/basics.pdf – Accessed 14/06/2023

International Trade Law

1 | Introduction to International Trade Law 2 | Legal Trade Finance 3 | Standard Legal Charges 4 | Borrowing Base Facilities 5 | Governing law in trade finance transactions 6 | SPV Financing 7 | Guarantees and Indemnities 8 | Taking security over assets 9 | Receivables finance and the assignment of receivables 10 | Force Majeure 11 | Arbitration 12 | Master Participation Agreements 13 | Digital Negotiable Instruments 14 | Generative AI in Trade Law

Access trade, receivables and supply chain finance

Contact the trade team, speak to our trade finance team, want to learn more about trade finance download our free guides.

Learn more about Legal Structures in Trade Finance

Digital Negotiable Instruments

Electronic Signatures

Force Majeure

Master Risk Participation Agreements In Trade Finance

What is a Creditor?

What is a debtor (debitor).

About the Author

Trade Finance Global (TFG) assists companies with raising debt finance. While we can access many traditional forms of finance, we specialise in alternative finance and complex funding solutions related to international trade. We help companies to raise finance in ways that is sometimes out of reach for mainstream lenders.

- Frost Brown Todd

When Your Vendor’s Lender Demands You Pay It Instead of Your Vendor

Apr 22, 2020

Categories:

Blockchain and Banking Blog Blogs Coronavirus Response Team

Vincent E. Mauer

A commercial lender’s favorite collateral is often a borrower’s accounts receivable. This collateral is the building block of countless revolving lines of credit that provide borrowers with working capital and flexibility. Lenders prefer accounts receivable as collateral because it is similar to cash, unlike collateral that must be fed and liquidated (assets that must be insured, stored, marketed and sold). Additionally, the Uniform Commercial Code (“UCC”) permits lenders to collect accounts receivable directly from the borrower’s customers without using judicial process, thus saving time and money. [1]

After a loan agreement “goes bad” and the lender declares a default, the lender’s options for collection of accounts receivable collateral include giving notice to persons whose accounts owed to a borrower were pledged by that borrower to the lender (the borrower’s customer is a “payor”), [2] that is, accounts receivable in which the lender has a UCC Article 9 Security interest. [3] The primary operative provision is UCC 9-406, which states in part:

- Subject to subsections (b) through (i), an account debtor on an account , chattel paper , or a payment intangible may discharge its obligation by paying the assignor [borrower] until, but not after, the account debtor receives a notification, authenticated by the assignor or the assignee that the amount due or to become due has been assigned and that payment is to be made to the assignee. After receipt of the notification, the account debtor [ payor] may discharge its obligation by paying the assignee [Lender] and may not discharge the obligation by paying the assignor [Borrower] .

- Subject to subsection (h), notification is ineffective under subsection (a): (1) if it does not reasonably identify the rights assigned; (2) . . . [a limitation applicable to payment intangibles that are not accounts receivable, for example insurance settlements]; or (3) at the option of an account debtor, if the notification notifies the account debtor to make less than the full amount of any installment or other periodic payment to the assignee, even if: (A) only a portion of the account , chattel paper , or payment intangible has been assigned to that assignee; (B) a portion has been assigned to another assignee; or (C) the account debtor knows that the assignment to that assignee is limited. [4]

- Subject to subsection (h), if requested by the account debtor [ payor], an assignee [lender] shall seasonably furnish reasonable proof that the assignment has been made . Unless the assignee complies, the account debtor may discharge its obligation by paying the assignor, even if the account debtor has received a notification under subsection (a).

(Emphases added.) Ordinarily, the above-quoted statute means that, after a borrower defaults, the lender can give a “notification” to its borrower’s customers ( payors) [5] and demand that amounts owed to the borrower instead be paid to the lender if the lender has a perfected security interest in its borrower’s receivables.

There are a few common concerns faced by our payor clients who receive notifications from their secured vendor’s secured lenders.

The first thing a payor must understand is that neither (a) the borrower’s granting of a security interest in its accounts receivable, nor (b) a lender’s notification under UCC 9-406, will change the amount owed, the terms of the account debt, or the payor’s rights such as a discount for returned merchandise or prompt payment. A payor who receives a lender’s notification should, therefore, take a deep breath and determine exactly what is owed to the vendor that granted the security interest to the lender.

In my experience, payors who receive a lender’s notification nearly always choose to alert their vendor (the lender’s borrower) of the notification. The statute neither permits nor prohibits such action. Typically, the payor’s communication is, in part, an effort by the payor to (i) alert its vendor that a payment may not be coming, (ii) assess the vendor’s stability so the payor can determine if it needs to find a new source for the goods and services supplied by the vendor, and (iii) to seek information on whether the lender’s notification is real and appropriate.

Contacting the vendor is understandable. It is natural for a payor to seek information from the party with whom it regularly does business rather than a probable stranger, the lender. Vendor-provided information, however, comes with a caveat: If the vendor asserts that the lender’s notice to the payor is in error and should be ignored, the payor accepts that advice at its own risk. The UCC provision quoted above clearly states that a payor who has received an appropriate lender’s notification cannot discharge its debt to the vendor by paying the vendor instead of the lender.

Rather, or in addition to, contacting the vendor, a payor can choose to contact the lender and request evidence that payment to the lender is appropriate. In this event, the UCC requires the lender to provide “reasonable proof that the assignment was made.” This usually means evidence that the vendor granted a security interest to the lender and that the accounts receivable created by the payor’s debt to the vendor is covered by that security interest. A payor should take advantage of this opportunity to communicate with the lender and request “proof,” if either (a) the vendor asserts that the lender’s notice to payor is wrongful, or (b) the lender’s “notification” seems inadequate. This is a proper response to payor’s concerns. [6]

In my experience, lenders often ignore a payor’s request for “proof” following a lender’s “notification.” There are many possible reasons for this inaction by the lender. [7] Whatever the rationale, however, the result is the same. According to UCC 9-406 comment 4:

[e]ven if the proof is not forthcoming, the notification of assignment would remain effective, so that, in the absence of reasonable proof of the assignment, the account debtor could discharge the obligation by paying either the assignee or the assignor. Of course, if the assignee [lender] did not in fact receive an assignment, the account debtor [ payor] cannot discharge its obligation by paying a putative assignee who is a stranger [a fraudster] .

(Emphasis added). Given the last sentence in this comment, the only safe action by payor is payment to the vendor, not the lender, if the lender failed to respond to payor’s request for “proof.”

As noted above, the lender’s notification to payor does not alter the terms of the payor’s obligations to the vendor. For example, if a payor has received a notification from a lender and has requested reasonable proof of the assignment, payor may discharge its obligation by paying the assignor at the time when payment is due, even if the account debtor has not yet received a response to its request for proof. This is a warning for lenders to think about their borrower’s collection cycle when sending notifications to payors.

If a payor deals with a large vendor or one with diverse operations, the vendor may have more than one secured lender. Vendors can have two or more secured creditors each with a security interest in the vendor’s accounts payable. [8] Sophisticated payors will often discover this fact when they do an online search with the appropriate Secretary of State’s office. Unfortunately, the UCC’s official commentary is silent on the payor’s duties in this situation. See, however, comment 7 to UCC 9-406:

For example, an assignor [vendor] might assign the same receivable to multiple assignees [. . . .] Or, the assignor could assign the receivable to assignee-1, which then might re-assign it to assignee-2, and so forth. The rights and duties of an account debtor in the face of multiple assignments and in other circumstances not resolved in the statutory text are left to the common-law rules. See, e.g., Restatement (2d), Contracts Sections 338(3), 339.

When faced with this problem, counsel must determine which state’s common law applies and find the non-UCC answer from applicable law.

Finally, clients often ask whether a particular lender notification is an appropriate and effective “authenticated” notification. The answer depends on the circumstances of the notification. Fortunately, there are plenty of court decisions that can provide guidance on this question. One example is Swift Energy Operating, LLC v. Plemco-South Inc. , 157 So.3d 1154 (La. Ct. App. 2015), where a borrower did business with an account receivable factor, the secured party. The borrower and factor sent an email to the payor which was the alleged lender notification under Louisiana’s version of UCC 9-406. In response to that email, the payor’s employee directed the lender to contact the payor’s appropriate office. The payor’s employee, however, did not sign and return the acknowledgment that payor received the lender’s notification. The lender subsequently failed to contact the payor’s accounts payable office as directed and the payor paid its obligation to the vendor rather than the lender/account receivable factor. Litigation was initiated in an effort to determine if payor was nonetheless liable to the lender for failure to follow the lender’s notification.

The Louisiana Court of Appeals held that the email was not an “authenticated” notification in compliance with the statute. The court reasonably held that the required notice must be directed to the appropriate payor department or employee when the lender has notice of that department. The court ruled:

[W]e find that the notice required by La.R.S. 10:9-406(a) was not effected prior to Swift Energy’s payment to Plemco–South. Given the size of its operation, we find that Swift Energy maintained reasonable routines for communicating significant information through its departmentalization policy, and both Factor King and Plemco–South were timely made aware of the proper department for delivery of the required notice. Had either Ms. Gleberman or Mr. Stigall followed Ms. Keo’s instruction, notice would have been effected to the appropriate department well before the payment to Plemco–South at issue.

Id. at 1164.

The UCC’s provision for nonjudicial collection of accounts receivable collateral is important and valuable to lenders. Unfortunately, it regularly raises questions and concerns for recipients of lender notifications. Experienced counsel can help their payor clients resolve concerns, determine who to pay, and possibly smooth any tensions between the payor and its vendor by demonstrating that the payor exercised every opportunity to protect the vendor before paying the lender.

For more information, please contact Vince Mauer or any attorney in Frost Brown Todd’s Financial Services industry team.

[1] This post does not address a lender’s efforts to control accounts receivable collateral while the lending relationship is intact, such as use of a lockbox to receive payments and control over the borrower’s bank accounts into which the accounts receivable payments are deposited by the borrower (whether by check or wire transfer).

[2] For purposes of this blog post, I will use the term “Payor” for the borrower’s customer who owes money to the borrower and whose debt to borrower is subject to a security interest in favor of the lender. This blog post is written from a Payor’s perspective.

[3] A warning for lenders: According to the Ohio Supreme Court, this remedy is not fully available against the collateral of a borrower whose customer, the Payor, is a government entity. See MP Star Financial Inc. v. Cleveland State Univ. , 837 N.E.2d 758 (Ohio 2005) ( “provision of UCC making an account debtor liable to an assignee of accounts receivable, for payments made to assignor after receiving notice of assignment, does not apply to payments made by an account debtor that is a governmental unit.”).

[4] Under subsection (b)(3), an account debtor that is notified to pay an assignee less than the full amount of any installment or other periodic payment has the option to treat the notification as ineffective, ignore the notice, and discharge the assigned obligation by paying the assignor [vendor]. This is a convenience for Payors and a warning to lenders.

[5] For the typical recipient of this notice (a Payor), the borrower whose account was assigned is a vendor, a business that sells goods or services to you and grants its lender a security interest in the account receivable generated by that sale.

[6] Comment 3 to UCC 9-406 states: “[i]f an account debtor [Payor] has doubt as to the adequacy of a notification, it may not be safe [for the Payor] in disregarding the notification unless it [Payor] notifies the assignee [lender] with reasonable promptness as to the respects in which the account debtor considers the notification defective.” So, a Payor with concerns may be better off to seek information from the lender rather than making its own decision concerning the adequacy of the notification.

[7] I have occasionally counseled lender clients to ignore a Payor’s request for “proof.” The reasons for this advice are beyond the scope of this blog post.

[8] Hopefully, there is an Intercreditor Agreement addressing lien priorities and which lender(s) can send a lender notification.

Before you send us any information, know that contacting us does not create an attorney-client relationship. We cannot represent you until we know that doing so will not create a conflict of interest with any existing clients. Therefore, please do not send us any information about any legal matter that involves you unless and until you receive a letter from us in which we agree to represent you (an "engagement letter"). Only after you receive an engagement letter will you be our client and be properly able to exchange information with us. If you understand and agree with the foregoing and you are not our client and will not divulge confidential information to us, you may contact us for general information.

Account Receivables

- First Online: 04 November 2018

Cite this chapter

- Felix I. Lessambo 2

3943 Accesses

Receivable is a general term which refers to all monetary obligations owed to the business by its customers or debtors. As long as a business expects to recover the money from the debtors, it records its receivables as assets in its balance sheet because it expects to derive future benefits from them. It does not matter whether they are due in the current period or not.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Author information

Authors and affiliations.

Central Connecticut State University, New Britain, CT, USA

Felix I. Lessambo

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Felix I. Lessambo .

Rights and permissions

Reprints and permissions

Copyright information

© 2018 The Author(s)

About this chapter

Lessambo, F.I. (2018). Account Receivables. In: Financial Statements. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-99984-5_4

Download citation

DOI : https://doi.org/10.1007/978-3-319-99984-5_4

Published : 04 November 2018

Publisher Name : Palgrave Macmillan, Cham

Print ISBN : 978-3-319-99983-8

Online ISBN : 978-3-319-99984-5

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Join us on LinkedIn

- Follow us on Twitter

Notice of Assignment of Accounts Receivable Under the PPSA: What Every Factor Should Know

- Share on LinkedIn

- Share on Twitter

- Share on Facebook

INTRODUCTION

Factoring is the legal relationship between a financial institution (the “Factor”) and a business (the “Client”) selling goods or providing services to a trade customer (the “Customer”), pursuant to which the Factor purchases the accounts receivable owing to the Client by its Customer. The Courts in Ontario have determined that a factoring agreement creates a security interest and, as such, is subject to the provisions of the Ontario Personal Property Security Act R.S.O. 1990 c.P.10 (the “PPSA”). This means, among other things, that the Factor must register a financing statement against the Client under the PPSA claiming a security interest in the Client’s accounts receivable. A factoring agreement may be on a notification or a non-notification basis.

A factoring agreement on a notification basis requires that the Client’s Customer be notified regarding the purchase of the accounts receivable by the Factor and the assignment of the accounts receivable by the Client to the Factor. One purpose of notifying the Customer is to require the Customer to make payment on the accounts receivable directly to the Factor, instead of to the Client.

A notice of assignment is governed by Section 40(2) of the PPSA, which states that an account debtor (i.e., the Customer) may pay the assignor (i.e., the Client) until the Customer receives notice, reasonably identifying the relevant rights, that the accounts receivable have been assigned. If requested by the Customer, the Factor is required, within a reasonable period of time, to furnish proof of the assignment and, if the Factor fails to do so, the Customer may pay the Client.

What constitutes adequate notice of an assignment of accounts receivable? The PPSA does not set out a statutory form of notice of assignment. In RPG Receivables Purchase Group Inc. v. Krones Machinery Co. Limited , 2010 ONSC 2372, C. W. Hourigan J. of the Ontario Superior Court of Justice was required to review a notification of assignment and to determine whether it was adequate. The Court’s decision is an important guide to the essential elements that should be included in the notice of assignment.

The facts were as follows:

1. On July 14, 2005, RPG Receivables Purchase Group Inc. (“RPG”) entered into a factoring agreement with its client Kennedy Automation Limited (“Kennedy”), pursuant to which RPG agreed to purchase certain of Kennedy’s accounts receivable, including accounts receivable due from its customer Krones Machinery Co. Limited (“Krones”).

2. On July 14, 2005, Kennedy faxed a notification of assignment to Krones, which read as follows:

“NOTIFICATION OF ASSIGNMENT

In order to grow and serve you better, we have retained the services of RPG Receivables Purchase Group Inc. to accelerate and stabilize our cash flow. Through their accounts receivable program, RPG has purchased and we have assigned to them all of our right, title and interest in all currently outstanding as well as all future accounts receivable from your company.

We request that all payments be made payable and mailed directly to:

RPG Receivables Purchase Group Inc. (“RPG”)

Suite 300, 221 Lakeshore Road East

Oakville, ON L6J 1H7

Tel (905) 338-8777 (800) 837-0265

Fax (905) 842-0242

This notice of assignment and payment instructions will remain in full force and effect until RPG advises you otherwise in writing. Please note that their receipt of payment is the only valid discharge of the debt and that RPG’s interest has been registered under the Personal Property Security Act of the Province of Ontario.

Although this notification is effective upon receipt by you, in order to complete RPG’s records, we would appreciate your acknowledgement of this notification and your confirmation that:

- the invoices on the attached statement are for goods and/ or services completed to your satisfaction (please note any exceptions or simply provide a listing from your accounts payable); and

- that payments will be scheduled in accordance with the invoice terms and that your accounts payable records have been modified to ensure payment of the full invoice amounts directly to RPG or you will notify RPG of any disputes or potential chargebacks in a timely manner.

Please fax and mail the signed copy of this letter to RPG Receivables Purchase Group Inc., who shall be entitled to rely upon your notification and confirmation as a separate agreement made between you and them. Thanks for your help and cooperation. We look forward to serving you in the future.”

3. On August 5, 2006, Krones executed the notification of assignment and returned the executed copy to RPG.

4. In 2007, Kennedy entered into agreements with Krones for the supply of services and materials to Krones in relation to various projects including projects in Etobicoke, Edmonton, and Moncton.

5. Before Kennedy submitted its invoices to Krones, Kennedy provided the invoices to RPG and RPG stamped each invoice as follows:

“NOTICE OF ASSIGNMENT All payments hereunder have been assigned and are to be made directly to:

RPG RECEIVABLES PURCHASE GROUP INC.

221 Lakeshore Road East, Suite 300

Any offsets or claims should be reported to:

(905) 338-8777 Ontario

(800) 837-0265

Fax (905) 842-0242”

6. Krones paid 13 of the 16 invoices issued by Kennedy. RPG did not receive any notice from Krones regarding any disputes, off-sets, chargebacks or claims arising out of the Edmonton or Etobicoke projects.

7. At or about the time that the three unpaid invoices were rendered, Kennedy began to experience difficulty in paying its subcontractors on the Moncton project.

8. When the Moncton project ran into difficulty, Krones stopped making payments on the Edmonton and Etobicoke invoices in a timely fashion.

9. RPG commenced an action against Krones in respect of the unpaid invoices for the Moncton project that RPG had factored.

10. Krones also commenced an action for damages against Kennedy relating to the Moncton project.

11. Krones denied liability in respect of the unpaid invoices on the grounds that it had a right to set- off due to alleged overpayments, chargebacks, and damages relating to the Moncton project. It also raised issues with respect to the validity of the assignment of the invoices by Kennedy to RPG and the validity of the invoices.

12. The Court decided in favour of RPG and granted it summary judgment in the amount of $183,172.61, plus interest, for payment of the three outstanding invoices.

THE DEFENCE OF SET-OFF

The primary defence of Krones was that it had a valid defence of set- off. In reviewing this defence, the Court referred to the legal principle of “mutuality”. In order to establish a valid claim of legal set-off, there must be mutuality which requires that the debts be between the same parties and that the debts be in the same right. The Court stated that this mutuality is lost where the debt has been assigned to another party (i.e., the Factor), unless the rights to set-off have accrued between the debtor (i.e., the Customer) and the original creditor (i.e., the Client) prior to receipt of the notice of assignment by the debtor. At the time that the accounts receivable owing by Krones to Kennedy were assigned to RPG, no right of set- off had accrued in respect of the alleged overpayments, chargebacks, and damages relating to the Moncton property. Therefore, Krones had no legal right to set-off, because the mutuality required for this defence was lost when the accounts receivable were assigned by Kennedy to RPG.

The Court also reviewed the purchase order for the Moncton project to see whether it contained a contractual right of set-off. The Court rejected this claim by Krones and found that there was no contractual right of set-off.

Finally, the Court considered the issue of equitable set-off and concluded that it was not available to Krones.

OTHER DEFENCES

In its other defences, Krones took issue with the validity of the invoices and the validity of the assignment by Kennedy to RPG. Krones argued that the notification of the assignment was limited to the invoice attached to the notification of assignment. The Court rejected this argument for three reasons:

1. This argument ignored the clear statement in the notice of assignment that “RPG has purchased and we have assigned to them all of our right, title and interest in all currently outstanding as well all future accounts receivable from your company”.

2. Each of the disputed invoices contained a stamped notification of assignment; and

3. Krones paid RPG directly for 13 of the 16 invoices. The Court also rejected a number of other arguments raised by Krones in its defence relating to the validity of the invoices.

CONCLUSIONS

In a notification factoring arrangement, a Factor needs to protect its interest in the purchased accounts receivable by giving written notice of the assignment to the Client’s Customer. According to Section 40(2) of the PPSA, the Customer may continue to pay the Client until the Customer receives notice that the accounts receivable have been assigned to the Factor. However, the PPSA does not set out a statutory form of notice, nor does the PPSA deal with any right of set- off that the Customer may claim with respect to the purchased accounts receivable. In general, a Factor can only “step into the shoes” of his Client and assert the same right that his Client has against the Customer. This means that, if the Customer has any right to claim a set-off against the accounts receivable owing to the Client, then the Factor is required to accept the reduction in payment as a result of any legitimate claim asserted by the Customer.

In order to protect its interest in the purchased accounts receivable, the Factor should send a notice of assignment, which when signed by the Customer, should accomplish the following purposes:

1. it should require the Customer to make payment on the purchased invoices directly to the Factor, instead of to the Client;

2. it should request the Customer to verify the accuracy of the purchased invoices;

3. it should eliminate the Customer’s right to claim any set-off or reduction in the amount payable on the accounts receivable in respect of the Client’s obligations arising after the delivery of the notice; and

4. It should create an enforceable direct contract between the Factor and the Customer.

Since the notification of assignment in the RPG case has been given the “judicial seal of approval”, it is recommended that this form be used by a Factor in Ontario. It is also recommended that the Factor follow the procedure referred to in the RPG case pursuant to which the Customer is requested to acknowledge and confirm the terms of the notification of assignment and return a signed copy to the Factor.

The Court in RPG also referred to the “stamped notification of assignment” on each of the disputed invoices as one of the reasons for rejecting the Customer’s defences. For this reason, it is recommended that this form of stamp also be used by a Factor in Ontario on each factored invoice before the invoice is submitted to the Customer.

If a Factor follows the above procedures, then the Factor should be able to collect from the Customer on the invoice, regardless of what issues arise between the Client and the Customer subsequent to the delivery of the notice of assignment. If the Customer refuses to acknowledge and sign the notice of assignment, then the Factor will have limited recourse against the Customer and will have to make a business decision regarding the risk involved in funding the invoice. Even if the Customer acknowledges and signs the notice of assignment, the Factor will still have to be on the alert for any future disputes between the Client and the Customer. For example, the form of notification used in the RPG case requires the Customer to notify the Factor of “any disputes or potential chargebacks” and the stamp on the invoices in this case requires the Customer to report “any offsets or claims”. If the Customer notifies the Factor about any such disputes, chargebacks, offsets, or claims, then the Factor will also have to evaluate the funding of the invoice.

A properly drafted notice of assignment will put the Factor in a stronger position to resist any reduction in payment claimed by the Customer. As a practical matter, however, the Factor should also try to confirm with the Customer prior to funding an invoice that there are no disputes between the Customer and the Client. This extra step could avoid the time and expense of litigation over the purchased accounts receivable.

Jeffrey Alpert

- T. 416 777 5418

- E. [email protected]

Banking & Financial Services

Publications, working for workers act – take five, federal budget 2024: the impact of the changes to the capital gains inclusion rate.

Torkin Manes LegalPoint

Pharmacies and Benefits Managers: Dancing with the Devil

Ontario passes working for workers four act, termination clauses and fixed term contracts: significant court decisions, the cra’s “how to guide” for charities making grants to non-qualified donees.

- Jobs & Internships

- Micro-Internships and Mentoring Program

- Calendar of Upcoming Events

- Students: Preparing for Career Fairs

- Employers: Just In Time Fair Details

- Employers: Agriculture & Food Systems Career Expo Details

- Employers: University Career and Internship Pre-Fair Details

- Employers: Education Pre-Fair Details

- Agriculture and Food Systems

- Architecture, Engineering & Construction

- Arts, Entertainment, Media & Design

- Computing, Software, & Data Analytics

- Economics, Banking & Finance

- Government, Policy, International Affairs & Law

- Health & Wellness

- Hospitality, Sports & Recreation

- Human Services, Teaching & Training

- Management, Marketing & Sales

- Science, Research & Development

- The Environment, Sustainability & Natural Resources

- College of Agricultural Sciences & Natural Resources

- College of Architecture

- College of Arts & Sciences

- College of Business

- College of Education & Human Sciences

- College of Engineering

- College of Fine and Performing Arts

- College of Journalism & Mass Communications

- School of Criminology and Criminal Justice

- Alumni Association

- Explore Center

- International & National Fellowships

- Military & Veteran Success Center

- Undergraduate Research

- University Career Services

- DIY Resources

- Career Coaching

- Diversity, Equity, & Inclusion Resources

- DACA and Undocumented Students

- First Generation

- International Students

- Military & Veteran

- Black, Indigenous, and People of Color

- Students with Disabilities

- Women’s Career Resources

- Recruiting at UNL

- Internship & Early Talent Toolkit

- Connect With Campus

- Fairs & Events

- Husker Circle

- Micro-Internship Program

- UNL HuskerWork

Spring Meadow Nursery, Inc. / Proven Winners

Accounts receivable specialist.

- Share This: Share Accounts Receivable Specialist on Facebook Share Accounts Receivable Specialist on LinkedIn Share Accounts Receivable Specialist on X

Spring Meadow Nursery Inc. is currently seeking a detail oriented team player to join our accounting team. This is a great opportunity for anyone looking for a flexible schedule, has an eye for numbers and enjoys customer service.

The A/R Specialist position is responsible for creating A/R invoices & posting payments, processing customer credit applications, supporting the Accounting Assistant, and completing general office administration tasks.

Primary Responsibilities:

- Process and maintain sales order files

- Prepare and send customer invoices and statements

- Process and post customer payments, receipts, and other financial transactions

- Update customer account information and records, including exemption certificates and filing

- Respond to customer inquiries

- Perform collection activities, including making reminder calls and sending past due notices

- Prepare monthly analysis of accounts and assist in month-end & year-end closings

- Process customer credit applications and maintain credit application files

- Respond to credit reference requests

- Assist with customer claims

- Assist with breeder payments and licensee sales reports

- Provide backup to all A/R Tasks

- Postmark outgoing mail from department and distribute incoming mail

- Order and maintain office supplies; Maintain office equipment

- Reception desk and answer phones

- Box paper files at year-end

- Write and update procedures

Additional Responsibilities:

- Perform other related duties as required.

- Follow Spring Meadow Nursery, Inc. Employee Handbook

- Follow Spring Meadow Nursery, Inc. Safety Handbook.

Knowledge and Skill Requirements:

- High School diploma or equivalent required; Associate’s or Bachelor’s degree in Accounting or Business preferred. At least two years of related experience preferred.

- Proficient in MS Office (Outlook, Excel, Word)

- Experience in Microsoft Dynamics preferred

- Solid understanding of basic accounting principles and general business workflow

- Highly accurate and attentive to details

- Well-organized with the ability to manage multiple priorities

- Ability to problem-solve independently and grow into new tasks as they are required

- Effective verbal and written communication skills with a strong focus on customer service

- Excellent interpersonal skills – a team player

- Must possess the ability to lift, carry, or otherwise move 20 pounds

Performance Requirements:

- Must maintain a level of performance equivalent to company standards, that being a “Meets Expectations” in all areas of your performance evaluations (including but not limited to, Self and Management reviews).

*The above statements are intended to describe the general nature and level of work being performed by people assigned to this job. They are not intended to be an exhaustive list of all responsibilities, duties, and skills required of personnel so classified.

This organization participates in E-Verify Employment Eligibility Verification. If you require an accommodation in the application process, please contact a member of our Human Resources team at (616) 846-4729 .

Job Type: Part Time- 20-29hrs a week (exempt).

Pay: starting at $18.50 hr dependent upon experience. Amount is not inclusive of total compensation package.

Benefits: Eligible for part time benefit package, subject to new hire waiting period. Including but not limited to 401k plan, and paid time off.

Career Services

225 Nebraska Union Lincoln, NE 68588-0451 402-472-3145 [email protected]

Related Links

- Counseling and Psychological Services (CAPS)

- Office of the Registrar

- Office of Scholarships and Financial Aid

- Student Affairs

- Undergraduate Admissions

Campus Links

- Office of the Chancellor

- Report an Incident

Policies & Reports

- Emergency Planning and Preparedness

- Institutional Equity and Compliance

- Notice of Nondiscrimination

- Security and Fire Safety Report

- Student Information Disclosures

- Privacy Policy

- Terms of Service

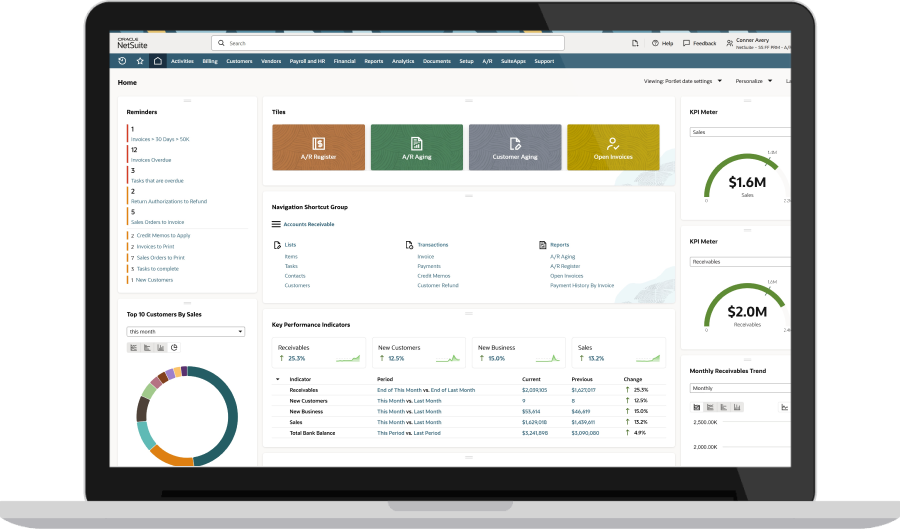

NetSuite ERP

- Accounting Software

NetSuite Accounts Receivable

Optimize receivables, accelerate cash flow

What is NetSuite Accounts Receivable?

NetSuite accounts receivable (AR) enables businesses to easily and quickly generate and send invoices, define credit terms, manage collections — and gain the liquidity needed to fund growth, shorten the credit-to-cash cycle and seize new investment opportunities as they arise. With real-time visibility throughout the entire AR process, finance teams can check the status of receivables anytime, at the macro level as well as down to each individual customer and invoice.

Simplify and Automate

Automatically post order transactions to general and AR ledgers, with accurate tax calculations on each invoice, for rapid, precise tax processing and billing. NetSuite automates manual accounts receivable processes and empowers finance teams to issue digital invoices and offer multiple payment options to speed collections.

Reporting and Insights

NetSuite delivers the insights you need. Configurable dashboards, reports and KPIs provide a real-time view into customer aging, invoice analyses, recurring invoices and deferred and recognized revenue calculations, with exception reports to flag account anomalies.

Power of the Suite

Built to run your entire business, NetSuite delivers an end-to-end accounting solution, enabling cash flow and revenue management, automatic quote-to-order fulfillment and integrated planning and budgeting. Go beyond basic bookkeeping with functionality that can free finance teams from mundane tasks and reduce the need for additional headcount.

NetSuite Accounts Receivable Features

NetSuite accounts receivable offers real-time insights and robust automation capabilities. The system is readily configurable, with AR-specific dashboards that put you in total control of your company’s AR process.

Accounts Receivable Dashboard

Customer records, automated invoicing, invoice consolidation, payment management, dunning and collections.

Role-based dashboards can be personalized with reminders and links to commonly used actions and reports. NetSuite’s “at-a-glance” format helps finance teams zero in on important information and activities to accelerate collections and minimize days sales outstanding (DSO).

Maintain accurate customer data, including contacts, transaction history, items purchased, open invoices, communications history and more. Configurable user roles and privileges enable finance teams to specify who can access accounts and modify records, helping keep customer information secure.

Automatically convert sales orders to invoices as orders are fulfilled. Easily customize invoice templates to meet customers’ unique billing needs. Bill by mail, email, fax or electronically. Easily calculate VAT, sales and other taxes. Posting transactions to the general ledger automatically saves time, avoids error-prone manual data entry and ensures accounts receivable data is always up to date.

Streamline the billing process with consolidated invoicing. When customers place multiple orders within a single billing period, NetSuite combines statements into a unified invoice. When payment is made, it is allocated to each order. Finance teams get faster billing and more efficient invoice processing. Customers pay once, increasing convenience while reducing days sales outstanding (DSO).