A Step-by-Step Guide to Budget Allocation

The business landscape is challenging and unpredictable, especially in Africa. This is why financial literacy is very important in running a successful business.

Many of us grasp the concept of constructing personal monthly budgets with relative ease. We allocate X for rent, Y for bills and groceries, and Z for leisure. Yet, when it comes to budget allocation for your business, the landscape alters significantly.

Suddenly, there are more zeros involved, diverse departments to consider, and complex questions to address:

- What should be earmarked for marketing?

- How do you handle HR expenses?

- How do you determine labor costs before a full team is hired?

- How do you reimburse employees for office expenses?

Some of these questions are ultimately answered in due time, and you may have to work with rough estimates.

In this article, we’ll talk about budget allocation—a tried and tested way to determine how to spread your budget across various departments to maximise returns.

Understanding Budget Allocation

Budget allocation forms the backbone of financial planning for businesses, outlining the distribution of funds across various departments. It generally operates at the department level, giving an overview of spending priorities.

For instance, instead of itemising every minor expense, a percentage of the budget is designated for each department. This allows department heads to manage their specific expenditures effectively without constant higher-level approvals.

This process is not exclusive to startups or SMEs, but is commonplace in organisations of all sizes.

With Bujeti, you have the power to create budgets and allocate funds to departments or projects, so you have precise control over your spending. See how it works here .

Steps for Effective Budget Allocation

Budget allocation can be complex but breaking it down into steps makes it manageable.

1 – Calculate Your Total Spending Requirements

Before dividing the budget, assess your expenses:

- Startup Costs: Initial expenses like equipment, property, and inventory.

- Fixed Costs: Regular, predictable expenses such as rent, salaries, website hosting, insurance, and utilities.

- Variable Costs: Fluctuating expenses tied to sales or production, e.g. advertising and marketing spend, sales commission, business income taxes, travel and transportation, contract vendors.

Consider using financial planning tools like Bujeti for accurate calculations.

2 – Identify Funding Sources

Know where your funds come from:

- Investments: Personal funds, family and friends, venture capital or angel investors.

- Revenue Model: Breakdown of funding sources (e.g., investment, revenue, expected growth).

Ensure your funding aligns with estimated costs; reassess if needed.

3 – Allocate Budget by Department

Divide your total calculated costs across key departments:

- Engineering

- Customer Success/Support

- Operations/Administration

Assign expenses to respective departments, calculating both spend and percentage of the total budget for each.

4 – Implement a Monitoring System

Tracking actual expenses against the budget is crucial:

- Use financial management platforms for forecasting cash flow, budget spend, and revenue growth.

- Maintain a financial metrics dashboard to monitor spend and make agile adjustments.

Budget Reallocation: Making Adjustments

Throughout the year, it’s likely that you’ll come to find that certain cost estimates were over or underestimated.

Budgets can fluctuate due to underestimated or overestimated costs in specific departments. When this happens, consider reallocating funds to balance the budget or adjust future spending accordingly.

Simplify Budget Allocation with Bujeti

The Bujeti team will be hosting a webinar with industry experts and entrepreneurs who have experience running and scaling businesses in Africa:

- Gerald Black (Tech Ecosystem Builder & Influencer, XConnect)

- Kolade Adewoye (Founder & CEO at Fusion Intelligence)

- Samy Chiba (COO, Bujeti)

We will cover:

- The strategies employed for financial resilience and survival during challenging economic climates.

- Approaches to financial management tailored for your business.

- Navigating the pitfalls of startup failures, even with funding.

- Key financial metrics crucial for assessing the health and potential growth of your business.

Register here https://live.zoho.com/siQK3gzeND

Allocating a budget, though daunting initially, can become manageable with Bujeti’s support.

Share this:

- Click to share on LinkedIn (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

Related Posts

Leave a reply cancel reply, discover more from bujeti.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

13 effective tips to allocate budget across departments

Sabrinthia Donnelly

To build a sustainable and profitable business, you need to know how to allocate budget across multiple departments.

As you can imagine, this can be a tricky process to get right. Everyone wants a bigger piece of the pie, and you can’t always please everyone. Instead, you must find a way to balance competing priorities with overarching business objectives – all while forecasting future needs.

So, how can you do that effectively?

This article highlights 13 tips for successful budget allocation across departments and covers:

- What we mean by ‘budget allocations'

- Why companies need to budget

- How to allocate budgets

- Roles responsible for budget management

13 tips to allocate budget across multiple departments

- How to allocate marketing budgets

- What types of budget allocation can be changed

How to create a budget allocation model

What are ‘budget allocations’.

Budget allocation is the process of designating specific amounts of money to each department within a company.

How much money each group receives depends on:

- Company priorities

- Revenue projections

- Departmental needs

These allocated budgets set spending limits for each department's operational costs, including:

- 🖥️ Software

- 💬 Marketing campaigns

- 🛠️ Equipment

- 📈 Projects tied to their goals

Done right, budget allocation provides clarity on available funds and is used to monitor spending.

Why do we need budget allocation?

The purpose of budget allocation is to guide spending and distribute financial resources.

It won’t come as a surprise to learn that most businesses have limited budgets. As much as you’d like to give every department the freedom to spend as much as they want, that's just not realistic. Budgets force departments to prioritize their needs and allocate resources efficiently. Without budgets, costs would likely spiral out of control and lead to overspending.

Some more reasons why budget allocation is so important include:

- Financial control

- Optimal resource use

- Risk mitigation

- Strategic alignment

- Operational efficiency

But what does ‘successful budget allocation’ look like?

How do companies allocate budgets?

Many companies start with an analysis of historical spending and revenue patterns . They’ll collect financial and operational data from all departments and use key performance indicators to help guide decisions.

Company-wide objectives and initiatives are confirmed by leadership to help construct budgets that align with those goals.

Collaboration is very important and you may find that you’ll work closely with department heads and other stakeholders to better understand their monetary requirements, operational challenges, and strategic importance.

From there, you may employ a certain budgeting methodology such as:

Each offers a unique approach to budgeting. The next step is to draft a preliminary budget , which will be reviewed by senior management. You may need to revise the budget plan before it's implemented.

Larger, more complex companies often take a bottoms-up approach – gathering proposed budgets from departments first. Small companies may use a top-down allocated amount to each group.

It’s worth noting that budget distribution can occur as a single annual allocation or be staged across the year.

Who is responsible for budget management?

Typically, budget management involves multiple roles and stakeholders within an organization, such as:

- CFO - The Chief Financial Officer is ultimately responsible for high-level budget strategy, financial planning, and oversight of the overall budget. This holds true across multiple industries with McKinsey reporting that 72% of CFOs say they're the most involved executives in allocating financial resources.

- Finance Department - The finance team manages day-to-day budget tracking, reporting, analysis, and controls. They also develop budget allocation models and processes.

- Department Heads - Leaders of business units are involved in budget requests, planning, and managing budgets for their departments.

- Controller - The controller plays a key role in budget control and variance analysis and often enforces compliance with budgets.

- Budget Analysts - Analysts assist with budget forecasts, data analysis, and preparation of budgets.

- Project Managers - Project leads maintain budgets for specific projects and initiatives.

- Executives - The CEO, COO, and other executives weigh in on high-level budget direction aligned to business strategy.

While the CFO may be the ultimate budget owner, effective budget management requires collaboration across these different roles to develop, track, control, and optimize budget performance.

Here are 13 tips for effectively allocating budget across multiple departments.

1. Involve department heads in the budgeting process

Have them provide input on their resource needs and strategic priorities. This buy-in helps to create shared ownership.

2. Employ a standardized approach

Implement a standardized budgeting process throughout the company to maintain consistency and fair allocation while considering each department’s unique needs.

3. Analyze historical spending

Search spending history to help identify trends and seasonal fluctuations. Use this data to forecast future budget needs.

4. Set organization-wide goals and communicate strategic priorities

Departmental budgets should align with these overarching objectives. This alignment not only ensures financial coherence but also enhances operational synergy.

5. Tie budgets to realistic forecasts

Allocate the budget in the context of revenue projections, not last year's numbers. By aligning budgets with realistic forecasts, you’ll ensure a more adaptive and forward-looking financial strategy positioned to navigate through evolving market conditions and emerging challenges.

6. Reserve a percentage of the total budget for discretionary spending

This buffers against unforeseen expenses arising mid-year. Reserving some of the budget for a rainy day could prove to be vital for mitigating risks and safeguarding against financial strain.

7. Prioritize ROI-driven activities

Allocate more significant budget portions to departments or projects that exhibit higher Return on Investment (ROI), ensuring funds are applied in areas that create value.

8. Require departments to justify requests exceeding historical allocations

Scrutinize large variances before approving. This helps ensure that any significant deviations from past spending are thoroughly vetted and aligned with strategic objectives.

9. Stage budget distributions

Granting each department funds quarterly or monthly versus upfront. This improves oversight. Plus, allocating budgets in installments rather than lump sums allows closer monitoring of spending patterns and burn rates.

10. Establish policies on budget transfers between departments

Policies that allow flexibility while maintaining control enable resources to be shifted to higher-priority needs when necessary.

11. Compare the allocated budget to actual spending and hold department heads accountable

Regular check-ins on budget versus actuals reveal if departments are lagging or outpacing their plan. It’s also important to hear from department heads so that actuals vary from the budget by higher than expected, they can explain, and you can analyze root causes together.

12. Leverage technology

Implement budget management software and analytical tools to streamline the allocation process. If done right, technology can help ensure accurate tracking, and provide actionable insights that inform future allocations.

13. Review budgets regularly

Continually track budget usage against set benchmarks and revisit allocations if company priorities shift mid-year. Revising budgets is one of the biggest priorities of modern-day CFOs according to PwC , who say CFOs prefer to work closely with colleagues across the C-suite to adjust budgets and revisit pricing models.

How to allocate marketing budgets across channels

When it comes to allocating marketing budgets across channels, you might find the marketing team asking for your input and advice. Since it’s a common occurrence for many of our finance community members, we thought we’d address it here.

The most effective approach is to start by auditing historical performance data for each marketing channel and assessing engagement, conversions, and attributable revenue or pipeline. Look at both returns on ad spend and overall contribution to goals.

Based on the audit findings, prioritize the budget for the initiatives delivering the strongest results and ROI. Avoid spreading the budget too thin across marginal channels. Consolidate dollars into high-traction initiatives.

Balance short-term lead generation priorities with longer-term brand-building channels. Seek overall alignment to revenue goals while maintaining ROI accountability. Continuously evaluate new channel opportunities by funding initial tests out of existing budgets.

The key is taking a data-driven approach to fund the right mix of channels optimized for customer acquisition and financial return. And don’t forget to adjust allocations based on results.

Digital marketing budget allocation

For digital marketing budget allocation specifically, focus spending on platforms with the lowest CPA and highest conversion rates per your analytics.

Then, continue optimizing digital budget allocation based on campaign performance and emerging trends.

B2B marketing budget allocation

When it comes to B2B marketing budget allocation, prioritize high-touch channels like events and sales enablement .

Ensure a sufficient budget for product marketing and research. Invest in thought leadership content and account-based tactics.

What budget allocation can be changed?

While certain fixed costs like rent and payroll are less flexible, most discretionary spending budgets can be adjusted as business conditions and priorities evolve.

Areas, where budget allocation is typically more fluid, include:

- Marketing - Budget can shift across channels and campaigns based on performance.

- Technology - Upgrades can be accelerated or deferred; new tools funded.

- Travel - Conferences and other travel can be relatively easy to adapt to needs.

- Training/Development - Programs can expand or contract as capabilities shift.

- Contractors/Services - External spending can be reduced or surged as needed.

- Inventory - Purchases and production can align with demand forecasts.

- Capital Expenditures - Major equipment purchases can be postponed or funded faster.

A budget allocation model provides a structured framework for distributing financial resources across an organization's departments, divisions, projects, and other entities.

Key components of a budget allocation model include:

- Revenue forecasts: Projected sales and income provide the spending boundary.

- Historical data: Prior budgets and actuals inform future allocations.

- Performance metrics: KPIs help determine departmental budget sizes.

- Management input: Leaders provide top-down strategy and bottom-up requests.

- Allocation method: A proportional, incremental, zero-based, or activity-based approach.

- Policies: Guidelines for transfers, overages, contingencies, and processes.

Revisit and adjust the model regularly based on results and changing internal and external factors. Evolve the model of each cycle.

Want more finance tips and insights?

Subscribe to the Monthly Balance newsletter and stay up-to-date with the latest industry news, updates, events, and more – all sent straight to your inbox each month.

Keep up with the latest releases on the Finance Alliance blog and podcast and be the first to know about upcoming events, reports, and industry news!

Written by:

Sabrinthia is the Senior Copywriter at Finance Alliance and host of the Two Cents podcast. She's always happy to connect with new people in finance, so if you want to get involved, please reach out!

Get industry insights

- Media Guide

- Privacy Policy

- Terms of Service

Unlock peak financial performance at Perform24

Marketing Budget Allocation

A common struggle for marketers is the art of budget allocation – what to spend your money on for your marketing strategy to work. In this blog, we review marketing budget allocation, what’s typically included in a marketing budget, and allocation best practices to keep in mind.

There are a lot of factors that can affect the level of success of a marketing plan. To have a great marketing plan, you need to spend your marketing budget on campaigns and platforms that will bring you a good return on investment.

That’s where marketing budget allocation comes into play. Marketers that strategically spend budgets can execute your plan and bring the ROI you expect to see. In this blog, we highlight marketing budget allocation best practices to help guide you on how to spend your budget to see a great marketing return on investment (MROI).

- What is Marketing Budget Allocation?

- The Importance of Budget Allocation in Organizations

- What’s Included in a Marketing Budget?

- How to Allocate Marketing Budget

- Marketing Budget Allocation Best Practices

- In Closing: Marketing Budget Allocation

The definition of marketing budget allocation is the amount of budget an organization allocates to each item of expenditure in a marketing plan. Essentially, it is a limit of money that employees cannot exceed when charging expenses in a specified amount of time.

For marketers, budget allocation is the maximum amount to spend on a marketing plan. Marketers need to optimize marketing spend on efforts needed to reach their audience online and offline to see leads, sales, form fills, and other KPIs calculated into an ROI.

There’s no question that budget allocation is a critical part of a marketing plan. Marketing budget allocation is a needed skill for businesses and typically combines input from many C-level CEOs, CFOs, and CMOs. It also affects marketing, sales, and accounting teams and departments.

As previously mentioned, marketing budget allocation includes everything needed for marketers to reach their target audience and increase their ROI. This means all expenses, including advertising budgets, employee salaries, and the tools and software needed to aid marketers in this endeavor.

Several categories are included in a marketing budget. Here is a breakdown of what’s included when allocating spend for your marketing budget:

- Software/Tools

- In-House Marketing Employee’s Salaries

- Vendors & Consultants

- Advertising (Digital & Print)

- Public Relations

- Events/Trade-show cost

- Training & Conferences

- Additional Revenue Generation Tactics

Not only should these categories of expenses be included in your budget, but many of these are used to help marketers reach their goals.

So how can marketers allocate their budget to spend on things that will give you the best return?

Here are the steps to follow on how to allocate your marketing budget to get the best ROI on your marketing plan:

- Set marketing goals

- Determine budgets

- Outline your marketing plan

- Allocate budget toward channels, platforms, and campaigns

- Track the progress

- Measure return on investment

Regarding your marketing strategy vs. marketing goals, it’s a great idea to establish your goals first, then set a strategy, including budget allocation, to reach those goals. This will help you determine what budget you need to achieve your desired goals

What do your company stakeholders wish to accomplish? What does a marketer need to do to show the true business value of their marketing efforts?

Determine the marketing plan length, and set SMART goals (specific, measurable, achievable, relevant, and time-based).

Once you determine your goals, you need to determine your budget for a marketing plan. Budgets cover a specified period, whether monthly, quarterly, or yearly.

Knowing how much you should spend on marketing can help determine the budget of a marketing plan. Budgets can be set based on past data but should consider the goals you’re looking to achieve.

Planning and budgeting are very closely related. Creating a marketing plan will determine how you get there to achieve your goals. Use data to determine your marketing plan.

The plan should outline campaigns and expenses to allocate your marketing budget. You can use Planful’s online marketing plan builder to streamline the process.

Today, marketing plans break down into many channels or facets of digital marketing:

- Advertising/SEM

- Email marketing

- Social media

- Public relations

More importantly, how will you use these campaigns to reach your goals?

What do you need to spend to reach your goals for certain campaigns? More importantly, what else do you need to get you there? This is where marketing budget allocation best practices come into play.

Deciding how much to spend for different channels, platforms, and campaigns will get you the results needed to hit your goals. Employees, software, trainings, freelancers, and consultants hired should be factored into your campaign-specific tracking.

Are you hitting your goals? You can use a marketing budget tracker to see how your marketing plan is progressing. Tracking your progress and measuring that against your goals will help you determine the plan’s level of success.

For certain marketing channels and platforms, you’ll likely use data from specific platforms. For example, Facebook advertising has data on clicks, conversions, and spend.

In addition to your ad spend, including the costs that come with manpower, tools, and other costs needed. You can track your success on a weekly, monthly, quarterly, or even yearly basis – whatever is appropriate for the length of time your marketing plan is.

Planful’s marketing operations dashboard is a great way to track progress and measure marketing performance.

We break down some best practices to help you spend your marketing budget seeing a great MROI.

5 Best Practices for Marketing Budget Allocation That Will Set You Up For Success

Now that you know how to navigate the bourgeois allocation process, we want to fully prepare you for what to expect. Here are some of our best practices for allocating marketing budgets.

Now that you know how to navigate the bourgeois allocation process, we want to fully prepare you for what to expect. Here are some of our best practices for allocating marketing budgets.

Best Practice #1: Allocate your budget based on where your audience is

Invest in platforms and channels to reach your ideal target audience. This seems simple, but it’s true for any successful marketing plan.

Knowing your audience inside and out will help you choose marketing channels to reach your audience. Persona research and the buyer’s journey will help you best understand how to allocate your marketing budget to reach your target audience.

Best Practice #2: Diversify Your Strategy

Omni-channel campaigns are extremely important in marketing. Yes, you should invest in campaigns and strategies that bring success, but you should not put all of your eggs in one basket.

For example, if you spend too heavily on one campaign or channel, and suddenly, something happens to negatively affect that, it can greatly hurt your performance. Instead, invest in multiple integrated campaigns to see which ones work and which do not.

Best Practice #3: Sync with Sales Team

Marketing budget allocation isn’t just for marketing teams. Sales teams should be included in a digital marketing plan to help you reach your goals. When marketing and sales collaborate on budget allocation, they can create a plan that puts both teams in the best position to succeed and reach their goals.

Best Practice #4: Leverage Data

When approaching marketing budget allocations, data should be used throughout the process. When you create your marketing plan and allocate budgets, data will provide the insights to decide what to spend on and how to formulate the plan. Not only can data help with marketing planning, but it can be used to track your progress.

Over time, you may find that some campaigns and strategies are more successful than others. For those campaigns that are not effective, don’t be afraid to call it a loss and end the campaign.

Changing your plan and reallocating your marketing budget to be more successful across all channels and campaigns can help you reach your goals more quickly.

Best Practice #5: Practice Bottom-Of-The Funnel Marketing

Take a bottom-up approach to your marketing, and invest more in marketing that targets the bottom of the conversion funnel. Invest in lead generation (for example, SEO, or Google Ads) to maximize bottom-of-funnel marketing. Investing in those close to converting online minimizes your risk and increases your potential marketing ROI.

Allocating your marketing budget for the right things can be tricky, but with historical data and established goals, you can create a marketing plan to spend money that will bring the best ROI.

Best Practices Summary

To summarize our list of best practices for marketing budget allocation:

- Allocate your marketing budget based on your audience

- Diversify your strategy

- Sync with your sales team

- Leverage data

- Practice bottom-of-the-funnel marketing

While these tips aim to help you, marketing budget allocation is something that you will learn with experience creating marketing plans. As you move forward with future marketing plans, we hope these tips provide some good insight into marketing budget allocation best practices.

Learn more about Planful’s markerting planning software and how it helps you allocate budgets and manage marketing goals, plans, and campaigns.

Latest Posts

Interviews, tips, guides, industry best practices, and news.

Get Started with Planful

What Is Budget Allocation and How to Allocate Budget Correctly

George Fullerton

Strategy & Operations

Get Our Financial Planning Blueprint

Your budgeting process requires strong collaboration from department heads and executive leadership. Yet if you’re only going to each department once, asking them what they need, and simply saying, “Here you go” once you get executive approval, then you haven’t done enough testing around your top-line goal metrics.

If you want to pave a path toward sustainable growth, you need to embrace agility and proactivity — and one way to do that is through budget allocation. Running a budget variance analysis and rolling forecast helps you set baselines and growth goals, but these processes can still take weeks to gather and manipulate data from multiple departments and source systems.

Here, we explore how quarterly budget allocation creates a path for more agile, strategic planning and spend.

Table of Contents

What Are Budget Allocations?

Budget allocations refer to the amount of money each department receives from the general fund to execute their strategic plans. Budget allocation breaks department spend down into an approved maximum amount each department can spend per resource, whether it’s on software, contractor or freelance assistance, or ad spend for a marketing campaign.

The Importance of Allocating Budgets

Budgeting, at its core, is an optimization and constraint problem. You need to optimize operational efficiency yet understand your constraints to ensure ample runway and team support as you track the company’s growth trajectory.

You dictate the company roadmap based on expected return on investment (ROI), which has to tie out at the department level. The R&D department is integral for Seed and Series A companies, yet once the product is ready to launch, you want to allocate budget to your sales and marketing teams. Once the budget goes toward sales and marketing, and you begin acquiring customers, you now have new constraints that impact your budget: your customer acquisition cost (CAC), CAC payback period , and your annual recurring revenue (ARR).

Budget allocation fuels overall efficiency, in that department leaders don’t need to ask for approval to expense individual tools, assign projects to freelancers, or add seats for software. By allocating budget to general categories, each department can cherry-pick when and how to apply the budget. Of course, departments need to ensure they use their budget. While saving money is generally seen as positive, departments may not receive the same budget allotment in the next cycle — which may be detrimental to department-level goals and planning.

If departments experience strain, such as requiring more seats on a specific tool or running into production issues, you run into employee retention issues that stem from operational efficiency and satisfaction. To hire more employees costs more, which digs into your runway. By keeping an eye on your goals and constraints, you can then proactively figure out where you’ll get the highest ROI.

How to Optimize Budget Allocations in 6 Steps

Knowing your startup costs (for each employee and desk space), fixed costs, and variable costs and how they impact your total budget is one thing — but to optimize budget management and allocation requires ample cross-collaboration to keep goals top of mind and realistic.

Your budget allocation strategy will depend on your industry, your growth stage, and overall macroeconomic environment. But here’s how you can optimize your budget allocation with more strategic and agile decision-making from everyone involved regardless of stage.

1. Set Company Goals and Priorities

While knowing your total budget is technically the first step, the real strategic insights begin with a simple question: What are your North Star metrics?

Naming your company goals and priorities is the key to driving how you think about and create departmental budgets across the company.

In ideal market conditions, many executive leaders say that their top priority is to grow at all costs. Yet during a market downturn, priorities shift toward keeping a closer eye on burn and preserving runway. Depending on how those priorities shake out, there’s two ways to approach budgeting:

- Growth goals: A focus on growth goals requires high confidence in achieving them. Your growth goal is the starting point, then you work backwards to allocate your budget to achieve that goal. A focus on top-line revenue growth leads to creating a sales and marketing budget around cost per lead and win rates/conversions. The question becomes “How much do I have to spend in order to get this growth goal?” which then spits out your sales and marketing budget.

- Capital efficiency : A more conservative approach begins by asking, “How much can I spend in order to only burn X number of dollars a month, or to make sure I have runway for 24 months into the future?” You can also focus on a certain set of unit economics, meaning you’d build your budget to hit a particular CAC number or set a payback period within a particular period of time.

Regardless of your approach, tying your budget back to goals (i.e. strategic budgeting ) and target metrics is critical. If you believe growth goals are most important, for example, then your ROI on spending additional sales and marketing dollars could be higher than hiring a different engineer where you may have a longer-term payoff.

2. Set Your Constraints

Your goals establish whether you’re approaching budget allocations from a bottom-line or top-line growth perspective. Utilizing both allows you to gain a sense of customer retention (with your top line) alongside expenses (bottom line), which helps you strike the right balance or priorities. Applying constraints to your goals allows you to set realistic expectations.

Company-wide, you want to keep an eye on runway and burn multiple. Yet when diving deeper into department budgets, you’ll need to focus on different metrics. For example, CAC payback period impacts your sales and marketing budget.

Your CAC payback period sets a precedent for how long potential customers stay in the sales funnel. Incorporating sales funnel metrics into this equation provides invaluable insights — and setting constraints around your payback period requires sales and marketing to scrutinize and optimize these metrics within the funnel.

3. Check Your Goals Around Budget Allocation Benchmarks

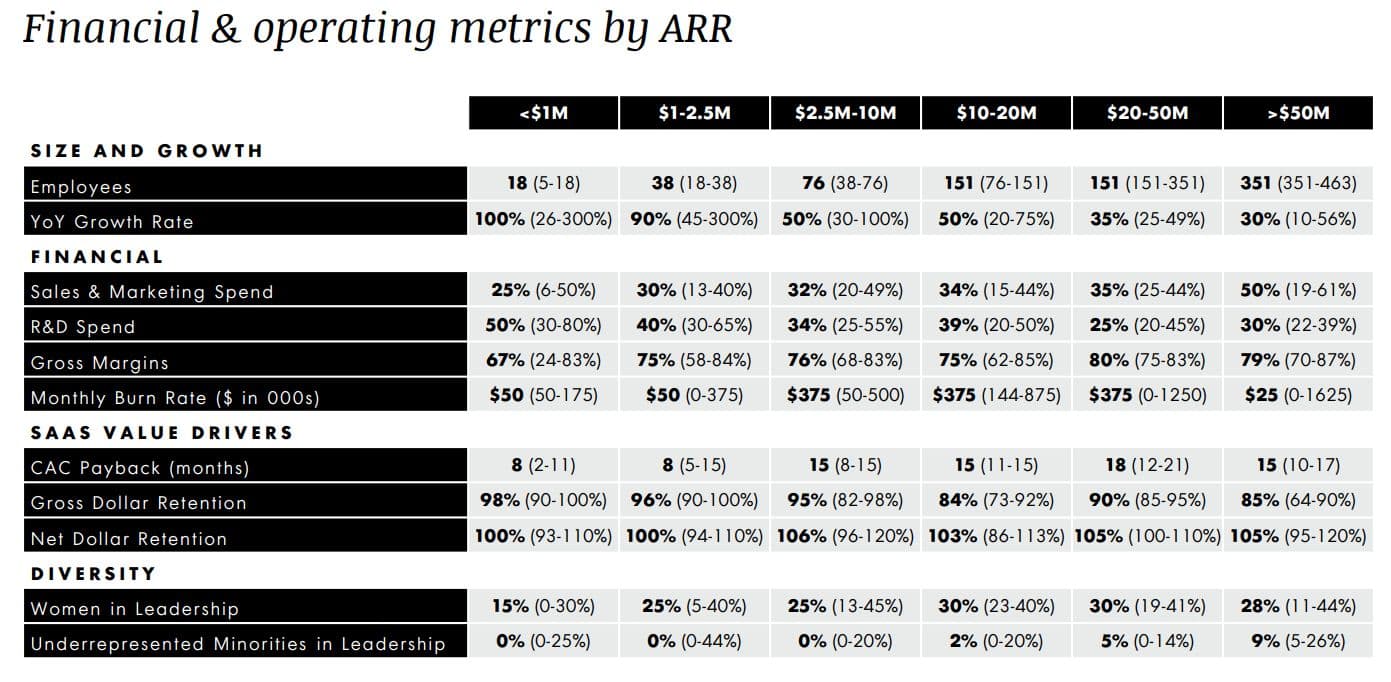

Your company’s growth stage impacts where your goals and constraints stay relevant and applicable to ensure strategic growth. OpenView runs a SaaS Benchmarks Survey that explores budgetary benchmarks in correlation with your growth stage. Here’s their chart from 2021:

OpenView SaaS Benchmarks Survey 2021 Results, courtesy of Curtis Townshend , Senior Director of Growth at OpenView.

The top row indicates the stage of the business per million dollar revenue. The numbers in bold represent a median, with percentages assigned for how much each company would allocate per category. For example, a company with $1-2.5 million in revenue would allocate 30% of their budget to sales and marketing and 40% in R&D, while aiming for 75% in gross margins.

While the above table does not mention a ratio for general and administrative costs , the standard spend for SaaS companies is about 10-12% of your total budget.

After you establish your goals and constraints to ensure financial efficiency , you can approach your budget and measure against these benchmarks.

4. Establish Your Headcount Plans

Headcount accounts for 70% of overall company spend in SaaS, and each department has different ROI.

Sales and marketing headcount should directly produce returns — but to drive the sales and marketing machine, you need to continuously spend. You need to ensure you have a strong control and understanding of your product-market fit to keep the engine running. If the company is not at the point of understanding the output of each dollar spent across the sales funnel, the budget should focus on product or internal system process data.

Work closely with human resources partners to decide how much to set aside for workforce growth in every department. Decide how many full-time hires you’ll need in the next budget year, where it might be appropriate to hire out to contractors, and where your stakeholders need the most help.

5. Conduct Scenario Planning with Mosaic

Optimizing budget allocation helps you optimize ROI of operational initiatives by forcing you to constantly check where you think you’ll get the most out of your dollars and how that spend relates to company-level goals.

Mosaic’s financial modeling and scenario planning tool integrates with your source systems to offer scenario analysis that elevates the strategy behind your budget allocation. Scenario analysis examples include looking at how cutting a fixed cost (like office space) impacts your runway, or how your product release plan may hinge on engineer headcount or come down to asking, “ How much should you spend on ads to promote the product — and when?”

Being able to quickly see how adjustments to specific budgets affects your downstream metrics is extremely helpful. Mosaic syncs in real time so you can easily integrate your historical and actual data into your scenarios. If you want to see how increasing spend by $500,000 impacts your sales and marketing budget, you can simply apply the change in one model to see how it affects your CAC, CAC payback, burn multiple, and other key metrics.

You don’t need to build entirely new models or scenarios — instead, you can tweak your budget assumptions in different scenarios and see the immediate downstream effects on the metrics that you want to employ as your constraints.

Keep in mind that your strongest models align on two or three metrics: Too many inputs leads to an overlap in ideology, which causes clutter and slows you down.

6. Make Cross-Department Collaboration a One-Stop Shop

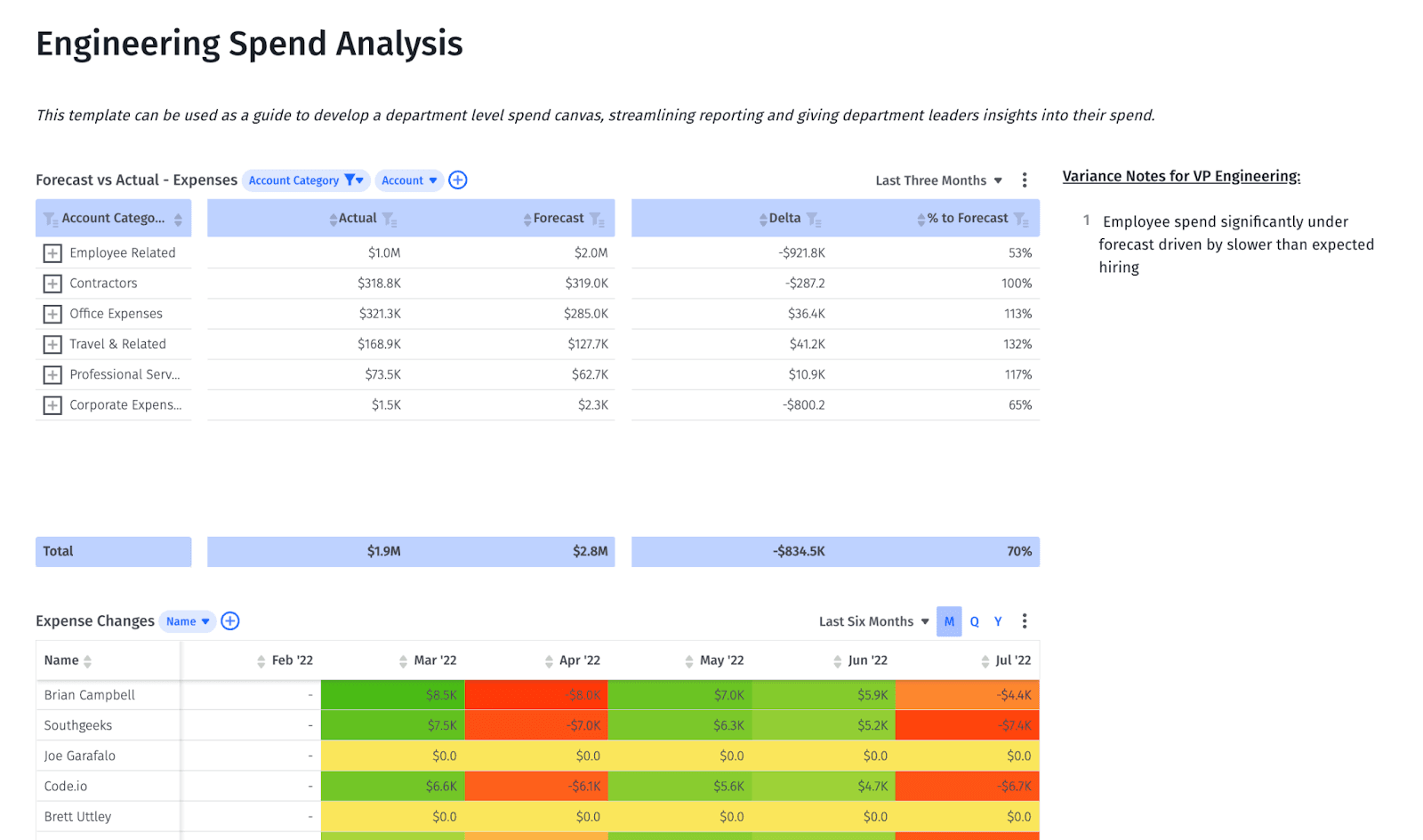

The budgeting process is notorious for multiple Excel sheets and communication across multiple emails or Zoom meetings. Mosaic allows you to create department-level dashboards that align leaders and give them one place to stay updated on budget allocation and spend.

Department leaders can look at a graph or table in Mosaic’s variance analysis software to see where their budget currently is and where it was spent. Mosaic can immediately generate a budget analysis that allows them to make strategic decisions on what they want to do with their remaining budget or where they need to cut back to hit their budget for the month or quarter.

Mosaic also allows reports to be easily accessible for department leaders. Since Mosaic offers real-time updates, finance teams can help establish one report that automatically updates so department leaders can make plans with actual numbers. This leads to not just saving time between going back and forth to establish numbers, but more proactive decision-making that keeps leader engagement high into understanding the “why” behind their budgeting line items.

Focus more on telling the story behind your numbers with this Financial Waterfall Template Bundle.

When to review budget allocations — and why you’re not doing it enough.

A “one and done” annual budget process doesn’t work for high-growth companies. A more adaptable or flexible budget approach is essential, especially for those experiencing rapid changes. Keeping it to even twice a year causes everyone to miss out on key drivers for overall success. Proactive budget development should happen at least on a quarterly schedule, where you can change resource allocation based on historical data from the previous year to last quarter.

While establishing a quarterly financial plan review is good in practice, you also need to allow for some flexibility. Here are some other reasons to perform financial audits on budget allocation:

- Macroeconomic events. Anything from a market downturn or industry collapse signals immediate action. Budget allocation should transition into a monthly schedule to stay as ahead as possible.

- Not hitting topline goals. You may need to redistribute your budget to ensure you get as high of an ROI as possible. You may need to allocate more budget toward supporting sales and marketing than hiring another engineer, for example.

- Runway cost. If you predict that you’ll burn $5 million, but realize that headcount needs to increase in the second half of the year, you need to factor that cost in. You also need to keep track of your burn and when it occurs: If it increases from $2 to $3 million in one month due to headcount, you carry this cost throughout the rest of the year. You can then take budget away to make up the costs — it’s much harder to try and get the budget back once people start spending it.

- Capital efficiency metrics are off. Analyzing capital efficiency metrics like burn multiple on a regular basis can help you proactively address inefficiencies in the business. Drill down into your expenses and see how you can reevaluate spend.

Embrace a Smarter Way to Allocate Budgets with Mosaic

Mosaic offers preloaded, out-of-the-box metrics, templates, and dashboards that allow you to cut the budget allocation and planning process from two weeks to two days. Mosaic offers a SaaS acquisition metrics dashboard that considers CAC and CAC payback alongside other important metrics, like your SaaS magic number , to gain granular insights that craft your company’s growth narrative. You can also customize financial reports to include other key metrics, such as your burn multiple and runway, to help establish and keep your benchmarks in mind.

With Mosaic, budget planning can be a quicker, more collaborative, strategic process that keeps your company moving along toward its goals. Request a personalized demo today .

Give Department Leaders Deep Financial Insights for Better Budgeting

Budget allocation FAQs

Why is budget allocation important.

Understanding your budget allocations and appropriations can help your company maximize ROI. Knowing where your money goes ahead of time reduces discretionary spending and leaves a strategic roadmap for spending and expenditures . And, since this is done ahead of time, departments can run more efficiently on their allocated budget.

What is an example of a budget allocation?

An example of budget allocation is a predetermined percentage of company funding that goes to research and development, or sales and marketing. This can be done monthly, per quarter, or per fiscal year . The percentage of the allocated budget is based on importance, productivity, company profits, and other considerations. If the department needs more funding, they can submit a budget request , but ultimately, the budget allocation should be taken care of beforehand.

What is the best way to allocate your budget?

There’s no one-size-fits-all answer here. To optimize your budget allocation you need to proactively and periodically review how you’re allocating resources and reassess your priorities. What are your goals? What are your budget constraints? What ROI are you getting on your current allocations? These are all questions you need to ask in collaboration with different teams and departments to ensure your budgets are allocated properly at all times.

Related Content

- The 12 Most Important Operational Metrics & KPIs to Track in SaaS

- How To Choose the Best Pricing Model for Your SaaS Business

- What Is Spend Forecasting and How Can It Benefit Your Business?

Never miss new content

Subscribe to keep up with the latest strategic finance content.

The latest Mosaic Insights, straight to your inbox

Own the of your business.

What Is a Budgetary Allocation?

- Small Business

- Accounting & Bookkeeping

- Management Accounting

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Develop an Operating Budget for a Nursing Unit

How to show percentage of income and expenses ytd in quickbooks pro, program management practice & techniques.

- What Is a Budgeted Income Statement?

- What Is the Difference Between Audited Financial Statements & a Budget?

Budgetary allocations are integral components to an annual financial plan, or budget, of all organizations. They indicate the level of resources an organization is committing to a department or program. Without allocation limits, expenditures can exceed revenues and result in financial shortfalls. Anyone working with budgets should understand how they are used and the limitations they provide.

A budgetary allocation is the amount of cash, or budget, you allocate to each item of expenditure in your financial plan.

What is a Budget Allocation?

A budget is a financial plan used to estimate revenues and expenditures for a specific period of time. It is a management and planning tool, not just an accounting document. It assists in the allocation of resources.

A budget allocation is the amount of funding designated to each expenditure line. It designates the maximum amount of funding an organization is willing to spend on a given item or program, and it is a limit that is not to be exceeded by the employee authorized to charge expenses to a particular budget line.

Developing Budgetary Allocations

Budgets are usually developed for 12-month periods. When developing a budget, revenues are usually estimated first to determine the level of resources that will be available in the upcoming budget year. Based on the estimated resources, expenditure limits, also called budgetary allocations, are assigned to each budget category. When developing budgetary allocations, all needs of the organization are taken into account and decisions are made where best to allocate available money.

Budget Category Allocations

Budgets are usually divided into departments and program units. This allows for easier identification of the resources allocated to specific programs and functions. Each category can be made of several budget allocations, referred to as line items, for the specific needs necessary to support the program or overall department operation.

Adjusting Budgetary Allocations

Budgetary allocations might not always be sufficiently estimated. This can happen when adequate funding for predictable or reoccurring expenses are not included in the budget. This might require the budget to be modified after adoption to account for the shortfall. Typical corrections will include transferring funds from other allocation categories or from the organization's surplus, sometimes referred to as savings.

Just as budgetary allocation estimates can be insufficient, revenues can be underestimated. This can happen if a downturn in the economy occurs after a budget is adopted, thus harming revenue streams. Insufficient revenues might require the need to reduce budgetary allocations in order for expenditures not to exceed revenues at the end of the budget year.

Monitoring Budgetary Allocations

Budgetary allocations should be routinely monitored to ensure the amounts budgeted are sufficient to meet expenditures. It is important to have a tracking system in place for all purchase orders and bills. The purchase orders and bills should be matched regularly against the budgetary allocation to ensure sufficient funds exist for the remainder of the budget year.

- Investopedia: What is a Budget?

- Corporate Finance Institute: Top Down Budgeting

Mark L. Ryckman has more than 20 years of senior management and leadership experience. He provides a wide variety of consulting services through MLR Management, LLC. Ryckman holds a Bachelor of Arts in public management and a Master of Public Administration, both from the University of Maine.

Related Articles

How to establish strong internal controls over a non-profit, incremental budgeting formula, what is the role of budgets & performance reports, what does "surplus as a percent of revenue" mean, common business budgeting line items, actual cost vs. projected cost, the advantages of capacity requirement planning, budgetary control techniques, how is a budget used to motivate a staff, most popular.

- 1 How to Establish Strong Internal Controls Over a Non-Profit

- 2 Incremental Budgeting Formula

- 3 What Is the Role of Budgets & Performance Reports?

- 4 What Does "Surplus as a Percent of Revenue" Mean?

The value of a budget allocation plan for businesses

What is a budget allocation plan.

A budget allocation plan is a blueprint of how much you can spend on a program, event, person, or product within an organization. Essentially, it is the amount allocated to expenditures, telling staff how much funding is available, and having them to stick to the allocations.

Usually, businesses create a budget by taking into account expenditures, resources, and expenses from each department from the previous year. Identifying the needs, program expenses, and available resources of the company in the coming months can help to allocate monetary resources better. This can boost employees' confidence and productivity.

Overall, the goal of the plan is to account for the monetary resources of a company, thus ensuring money is spent as planned. In other words, the plan keeps the company in check by allowing management members to understand when they are spending too much.

However, with only 54% of small businesses having a budget many companies are vulnerable to overspending. So how can a business make a plan that works?

How to make a plan for budget allocations

A good question to ask yourself is, what is a good budget allocation plan? A good plan entails the allocation of resources. It is a realistic, transparent, and professional approach to an organization's finances.

The first thing that management and sales teams should do is understand and outline all the expenditures, allocation limits, revenue, and standard budget categories of the last few months or years. By looking at the amount spent on direct costs and indirect costs, the company can account for, limit, or adjust its expenses, thus conserving its resources.

Some companies keep subscriptions on for many years without using them. Looking back at these costs can help determine overall expenses, determine direct costs, and the assigned expenditure for these services.

Furthermore, analyzing past spending can help companies form a performance trend to predict expenses and expenditures in the future. After all, if we write an unrealistic budget, no department, employee, or staff member will truly follow it since it just isn't realistic.

Allocating Budgets across Departments

You already understand the importance of a budget. But it is crucial that your employees know that the maximum amount of money they can obtain for a fiscal year stays within the allocation plan. Therefore, consider allocating across departments by;

Determine spending requirements

No allocation plan is as good as facts and figures, so you want to make spending estimates based on historical data. Have each team discuss and provide details. Furthermore, you may find it helpful to consider all business costs, especially fixed costs and variable costs.

Of course, you may be past the startup stage, but if your allocation plan will be effective, it is essential to include this cost. Fixed costs, on the other hand, are consistent expenses that occur weekly, monthly, or yearly.

For example, salaries, health insurance, travel and subsistence item, etc. The variable costs fluctuate and may be dependent on sales and revenue. For example, your sales team may have to attend a conference, so paying for round trip airfare, and accommodation will increase your personnel expenses for that period.

Since it may be challenging to set a fixed price for variable costs, it is best if you considered buffering this part of your allocation plan (to the nearest hundred or thousand) - to accommodate increments and unforeseen expenses.

Generating a reliable revenue

It is imperative for companies to have reliable revenue so that they can have a reliable budget. It is also reasonable to have an expenditure line with the maximum amount payable. If a company has an inconsistent revenue source, it is tough to devise a competent way of calculating its budget or predicting overall performance.

A better way to secure a reliable revenue plan is through long-term contracts and partnerships that yield monthly revenue.

If an organization has yet to have a reliable revenue, it is crucial that the company knows where to make cuts in case of an economic downturn to ensure that the company will not be in the negative. However, if that is not feasible, it is crucial to find new ways to generate reliable funding sources so that they can still continue to survive in the long term.

Executing your allocation plan

The first few months after developing an allocation plan should focus on execution. Note that it may be slightly challenging to get used to the changes that come with cutting costs.

Ultimately, the first few months of execution determine the success of your plan. However, if the company can not follow up with the plan or there has been no change, it may mean that the plan needs changes. An unsuccessful plan may not be a negative. Instead, it should be an opportunity to improve your company.

Monitor the allocation plan

Monitoring the allocation plan is great for accountability, especially with economic inflation. It is essential for the company to look back at the budget allocations every few months.

Furthermore, recording your spending, expenses, budget allocations, and purchase orders will further promote accountability in the company. This will help employees determine allocated funds per department, what they have spent, and how expensive it is.

It will create a sense of responsibility and accountability and promote an ideal management culture in several organizations.

Adjusting your allocation plan

Your plan may not be perfect. Chances are, it won't be. It is not unusual to make some corrections that include fund transfers from one category of the plan to another. This is especially ideal for a category with surplus funds. Adjusting the budget keeps your results in view and prevents the adverse effects of an economic downturn.

Allocation costs

There are usually two classifications of allocation costs: direct and indirect costs.

Direct costs

Direct expenses that are directly related to a product or service. These typically include raw materials, personnel, allowance, vehicle costs, holiday pay, services rendered, and more.

These costs are usually very easily traced since they fluctuate with production levels, such as inventory. If a company is doing well, the direct costs are usually higher than before.

Indirect costs

Indirect costs are not so easily traced. They're "overhead expenses" which cannot be easily traced back to a project or product. A few examples of indirect costs are utilities, premise rent, equipment, security, operation and maintenance, and more.

Indirect costs usually fluctuate quite a lot monthly since they don't tie into how the company is doing.

Business Budgeting Methods

Organizations use different methods in determining the best budget for their resources. However, four are common: incremental budgets, zero-based budgets, value proposition budgets, and activity-based budgets.

Incremental budget

An increment budget reviews last year's budget to determine the current year's performance. It is last year's figure plus or minus the allocated percentage. This method is ideal for any business. A factor to consider in this program is funding and the change in primary cost.

Zero-based budget

This method assumes that all departments have zero budgets. Each department in the organization must justify its expenses. Money management is good because it avoids non-essential costs and spending. It is an excellent example of when you want to shake things up in your business.

Value proposition: this falls between incremental and zero-based budget to produce a sweet balance and profitability. It analyzes different expenditures and seeks to;

- Understand why a department spends a certain amount of money.

- Justify expenses

- Determine the value expenditures provided to various departments within the organization.

Activity-based:

The activity-based budget is prepared based on targets, especially for a newer organization interested in budget allocation and funds maintenance. The activity-based approach promotes performance and is a better way for the organization to allocate its funds. If you don't spend more time analyzing the program, it could prove detrimental to your developing enterprise.

Overall, a budget allocation plan is crucial for any business. It is a good habit to track and control the costs related to your business and improve the financial health of a company while eliminating wasteful or toxic spending habits.

Your business will enjoy growth when you have a good picture of your finances. Remember that all spending information is relevant in the process. If you need to keep your records safe and accessible, you may consider opting for software.

Latest Posts

Recapitalization: Altering Debt to Equity Ratio

To recapitalize a business means to reorganize its finances by adjusting the balance between debt and equity. Infusing capital via debt or equity financing can help with day-to-day operations, boost expansion plans, or to explore opportunitites.

Introduction to De-SPACs

A de-SPAC transaction refers to the process where a privately held company becomes a publicly traded firm by merging with a special purpose acquisition company (SPAC).

Why Redaction Software Matters for Private Equity and Venture Capital Firms

A redaction software helps in eliminating sensitive details like information from various digital files such as PDFs, Word documents, Excel sheets, images, videos, legal documents, papers, and more.

Mastering Budget Allocation Management for Finance Teams

Effectively managing budget allocations is crucial for the financial health and sustainability of any organization. Finance teams play a pivotal role in overseeing budget allocation , ensuring that spending aligns with strategic objectives and financial plans. In this article, we explore best practices for finance teams in the realm of budget allocation management.

Regular Monitoring of Budget Allocations

Finance teams should establish a routine for monitoring budget allocations to ensure adherence to the predefined spending plans. Regular reviews enable teams to identify deviations early on and take corrective action promptly. This practice helps prevent overspending and ensures that financial resources are allocated efficiently.

Creation of a Comprehensive Spending Record

Maintaining a detailed spending record is a fundamental practice for effective budget allocation management. This record should encompass all purchase orders and bills, providing a comprehensive overview of financial transactions. By having a centralized record, finance teams can easily track expenditures, compare them against budget allocations, and identify any discrepancies.

Comparison of Spending Against Budget Allocations

A key aspect of budget allocation management is the ongoing comparison of actual spending against the allocated budget. This involves regularly assessing the spending record and identifying areas where expenditures exceed or fall short of the budgeted amounts. This proactive approach allows finance teams to address budget variances promptly and make informed decisions to reallocate resources if necessary.

Promotion of Accountability

Creating a spending record not only facilitates tracking and comparison but also promotes accountability within the organization. Finance teams can use the spending record to verify whether procurement activities were conducted in accordance with established protocols. This transparency enhances accountability among teams and encourages responsible spending practices throughout the organization.

Insights for Future Budget Planning

A well-maintained spending record serves as a valuable resource for future budget planning. Finance teams can analyze historical spending patterns, identify trends, and use this information to refine future budget allocations. Understanding past expenditures provides insights into areas of potential optimization and aids in creating more accurate and realistic budgets.

Highlighting Saving Opportunities

Monitoring budget allocations and maintaining a spending record can uncover saving opportunities for the organization. By identifying areas where expenditures are consistently below budget, finance teams can explore cost-saving initiatives or reallocate resources to areas with higher priority. This strategic approach contributes to financial efficiency and optimization.

Collaborative Budget Review

Effective budget allocation management involves collaboration among different departments and teams within the organization. Finance teams should work closely with department heads and managers to review budget allocations, discuss spending needs, and ensure alignment with organizational goals. This collaborative effort enhances communication and fosters a shared understanding of budget priorities.

In the dynamic landscape of business, mastering budget allocation management is essential for financial stability and growth. Finance teams, through regular monitoring, comprehensive spending records, and collaborative efforts, can navigate the complexities of budget allocation successfully. By promoting accountability, gaining insights for future planning, and identifying saving opportunities, finance teams become key contributors to the overall financial health of the organization. Adopting these best practices ensures that budget allocation becomes a strategic tool for optimizing resources and achieving long-term financial objectives .

- Financial Analysis

- Investment Management

- Mergers & Acquisitions

- Risk and Compliance

- Business Plan Analysis

- Lease Agreement

- Private Placement Memo

- Real Estate Opportunity

¿Qué es el Budget?

Fabian Quiroga | enero 21, 2024 |

El término Budget significa presupuesto, es decir, la planificación financiera y la estimación de los ingresos, gastos e inversiones de una empresa.

La elaboración de un budget (es decir, el acto de hacer un presupuesto) es importante porque esboza los objetivos de la empresa, permitiendo que se tomen medidas de ajuste para lograr los objetivos estipulados.

Importado del inglés, el término “budgeting” se ha popularizado con el establecimiento de empresas multinacionales. Aunque la traducción de budget es simplemente “presupuestación”, en el mundo corporativo, el significado de presupuestación corresponde más específicamente a la presupuestación de tipo estático.

La presupuestación empresarial estática es aquella en la que los datos pronosticados no pueden modificarse cuando ya están en funcionamiento, incluso si se producen acontecimientos imprevistos. Por ejemplo, si una empresa establece un volumen de producción o de ventas en su presupuesto, no podrá ajustar los objetivos durante el año aunque haya algún cambio en el mercado.

A pesar de la falta de flexibilidad, la elaboración de presupuestos es muy popular entre las grandes organizaciones, especialmente las multinacionales. Esto se debe a que el método facilita la consolidación de los presupuestos de todas las unidades de la empresa, que a menudo están repartidas en varios países, en un único presupuesto global.

Aunque el pronóstico es rígido, las empresas utilizan mecanismos para acercar el budget a la realidad. Cada mes, el presupuesto se revisa para comparar los valores previstos con los valores realizados. Sobre la base de este análisis se hace la previsión, es decir, se revisa el presupuesto de los meses siguientes teniendo en cuenta los valores realmente realizados. La presupuestación y la previsión es uno de los métodos más populares de la presupuestación corporativa.

2 comentarios en «¿Qué es el Budget?»

En el Budget deben registrarse los montos a erogarse por adqusicion de bienes de capital o inversion?

Sí, en el presupuesto se deben registrar los montos a erogarse por la adquisición de bienes de capital o inversiones. Estos gastos se planifican a largo plazo y se clasifican como gastos de capital o inversiones de capital en el presupuesto.

Deja un comentario Cancelar la respuesta

Guarda mi nombre, correo electrónico y web en este navegador para la próxima vez que comente.

- Search Search Please fill out this field.

What Is a Cash Budget?

How a cash budget works.

- Short-Term vs. Long-Term Budgets

Special Considerations

- Cash Budget FAQs

- Corporate Finance

Cash Budget Definition: Parts and How to Create One

:max_bytes(150000):strip_icc():format(webp)/InvestopediaHeadShot-988693bb87b54bb095bd3789cd117a50.jpg)

A cash budget is an estimation of the cash flows of a business over a specific period of time. This could be for a weekly, monthly, quarterly, or annual budget. This budget is used to assess whether the entity has sufficient cash to continue operating over the given time frame. The cash budget provides a company insight into its cash needs (and any surplus) and helps to determine an efficient allocation of cash.

Key Takeaways

- A cash budget is a company's estimation of cash inflows and outflows over a specific period of time, which can be weekly, monthly, quarterly, or annually.

- A company will use a cash budget to determine whether it has sufficient cash to continue operating over the given time frame.

- A cash budget will also provide a company with insight into its cash needs and any surpluses, which help it determine if the business is using cash effectively.

- Cash budgets can be viewed as short-term cash budgets, usually, a time frame of weeks to months, or long-term cash budgets, which are viewed as years.

- A company must manage its sales and expenses to reach optimal cash flow.

Investopedia / Ellen Lindner

Companies use sales and production forecasts to create a cash budget, along with assumptions about necessary spending and accounts receivable collections. A cash budget is necessary to assess whether a company will have enough cash to continue operations. If a company does not have enough liquidity to operate, it must raise more capital by issuing stock or taking on more debt.

A cash roll forward computes the cash inflows and outflows for a month, and it uses the ending balance as the beginning balance for the following month. This process allows the company to forecast cash needs throughout the year, and changes to the roll forward to adjust the cash balances for all future months.

Short-Term Cash Budget vs. Long-Term Cash Budget

Cash budgets are usually viewed in either the short-term or the long-term. Short-term cash budgets focus on the cash requirements needed for the next week or months whereas long-term cash budget focuses on cash needs for the next year to several years.

Short-term cash budgets will look at items such as utility bills, rent, payroll , payments to suppliers, other operating expenses, and investments. Long-term cash budgets focus on quarterly and annual tax payments, capital expenditure projects, and long-term investments. Long-term cash budgets usually require more strategic planning and detailed analysis as they require cash to be tied up for a longer period of time.

It's also prudent to budget cash requirements for any emergencies or unexpected needs for cash that may arise, particularly if the business is new and all aspects of operations are not fully realized.

At the end of each budgetary term, the ending balance of the cash budget is carried forward to the next term's cash budget.

Managing a cash budget also comes down to carefully managing the growth of the business. For example, all businesses want to sell more and grow, but it is crucial to do so in a sustainable way.

For example, a company may implement a marketing strategy to boost brand awareness and sell more products. The ad campaign is successful and demand for the product takes off. If the company isn't prepared to meet this increase in demand, for example, it may not have enough machinery to produce more goods, enough employees to conduct quality checks, or enough suppliers to order the required raw materials , then it could have many unhappy customers.

The company may want to build out all these aspects to meet demand, but if it doesn't have enough cash or financing to be able to do so, then it cannot. Therefore, it is important to manage sales and expenses to reach an optimal level of cash flow.

Example of a Cash Budget

For example, let's assume ABC Clothing manufactures shoes, and it estimates $300,000 in sales for the months of June, July, and August. At a retail price of $60 per pair, the company estimates sales of 5,000 pairs of shoes each month. ABC forecasts that 80% of the cash from these sales will be collected in the month following the sale and the other 20% will be collected two months after the sale. The beginning cash balance for July is forecast to be $20,000, and the cash budget assumes 80% of the June sales will be collected in July, which equals $240,000 (80% of $300,000). ABC also projects $100,000 in cash inflows from sales made earlier in the year.

On the expense side, ABC must also calculate the production costs required to produce the shoes and meet customer demand. The company expects 1,000 pairs of shoes to be in the beginning inventory, which means a minimum of 4,000 pairs must be produced in July. If the production cost is $50 per pair, ABC spends $200,000 ($50 x 4,000) in the month of July on the cost of goods sold , which is the manufacturing cost. The company also expects to pay $60,000 in costs not directly related to production, such as insurance.

ABC computes the cash inflows by adding the receivables collected during July to the beginning balance, which is $360,000 ($20,000 July beginning balance + $240,000 in June sales collected in July + $100,000 in cash inflows from earlier sales). The company then subtracts the cash needed to pay for production and other expenses. That total is $260,000 ($200,000 in cost of goods sold + $60,000 in other costs). ABC’s July ending cash balance is $100,000, or $360,000 in cash inflows minus $260,000 in cash outflows.

What Are the Steps of Creating a Cash Budget?

The first step to creating a cash budget is to establish reliable forecasts of the company's cash inflows and outflows. Some of these flows will be predictable, such as rent and payroll costs. Others, like sales figures, will tend to be more variable. Once these figures have been estimated, it is possible to prepare a cash budget that accounts for all expected inflows and outflows.

What Expenses Should Be Included in a Cash Budget?

A cash budget should take into account expected cash flows, such as revenue, as well as operational outflows due to returns, payroll, rent, utilities, supplies, and other costs of running the business.

How Do You Prepare a Cash Budget?

This will depend on the time frame for which the budget is being prepared. A short-term cash budget of a few weeks will only account for day-to-day expenses related to funding and supplying a company's operations, while a cash budget for a quarter or longer might also account for larger expenses like equipment, capital investment, and corporate taxes. In each case, any remaining cash surplus at the end of one budget period will be carried on to the beginning of the next.

OpenStax. " Principles of Accounting, Volume 2 ," Page 366 of PDF.

:max_bytes(150000):strip_icc():format(webp)/looking-mor-money-959324602-fa756e8a1de8445e9edd469b30c1bb33.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What Is a Budget Allocation?

by RachelBennett

Published on 26 Sep 2017

Budget allocation is an important part of all business and not-for-profit financial plans. Budgets are typically set annually and involve allocating anticipated income and resources between different departments and business interests. The amount of funding allocated to each area imposes restrictions on the scope of a department’s development. For example, if there is a reduction in funding, then some staff may have to be made redundant.

Budgets are normally reviewed annually and set for a 12- to 24-month period. Budgets are normally set on the basis of the previous year’s expenditures, plus or minus any changes in spending, such as the recruitment of new staff or adjustments in staff salaries. For example, in a university or school, each department or faculty is given a set amount of money to spend over the course of the year. The department head normally takes responsibility for allocating the funding to his staff. A budget aims to take into account all expenditures, including staff salaries, the cost of buying resources as well as miscellaneous expenses for any unforeseen needs. In an educational institution, the expenditure is normally calculated at a cost per child for the purposes of grant writing and funding.

Typically, budgets are divided into allocation components. These are often based on the business' or institution's core priorities. For example, in a university setting, typical components are student enrollment and research. Many institutions also include performance incentives in the budget to boost staff morale. The components are divided into a matrix, and a monetary value is allocated for each component. This is further divided into a value for the subcomponents.

Budgets normally include a percentage rate of adjustment, which is typically between 2 and 5 percent. This allows for unforeseen expenses and under or over estimation of expenditures. Budgets are reviewed and adjusted periodically throughout the year to account for changes in expenditures and income.

Geographic Differential

If a business or educational institution operates in multiple geographic areas, a geographic location adjustment is included in the budget. This accounts for different living costs and wage levels in different areas, often including a hardship allowance for those living in developing countries. Typically, a cost-of-living index is used to calculate the typical cost in each area and the budget is adjusted accordingly.

Example sentences budget allocation

The process allows the management to monitor their expenses and review whether they operate within their budget allocation .

Research group leaders (principal and associate investigators) meet annually to decide on budget allocation .

Witnessing the impact, the education sector received a 17% increase in budget allocation for the programme.

A competitor's media strategy reveals budget allocation , segmentation and targeting strategy, and selectivity and focus.

Additionally, budget allocation via management in research departments will be independent of investment departments.

Definition of 'allocation' allocation

Definition of 'budget' budget

COBUILD Collocations budget allocation

Browse alphabetically budget allocation

- budget accommodation

- budget account

- budget allocation

- budget analyst

- budget bill

- budget carefully

- All ENGLISH words that begin with 'B'

Quick word challenge

Quiz Review

Score: 0 / 5

Wordle Helper

Scrabble Tools

- Cambridge Dictionary +Plus

- +Plus ayuda

- Cerrar sesión

Significado de budget en inglés

Your browser doesn't support HTML5 audio

- The school budget is going to be cut again this year .

- The project went over budget because of a miscalculation at the planning stage .

- She managed to complete her last film well within budget.

- I propose that we wait until the budget has been announced before committing ourselves to any expenditure .

- People on limited budgets should avoid travelling during the holiday season if they can.

- budget something for something

- draw/pull in your horns idiom

- economy drive

- on a shoestring idiom

- put/lay something on/to one side idiom

- save (something) up

- save on something

- set someone against someone

- tighten your belt idiom

También encontrarás palabras, frases y sinónimos relacionados con los temas:

- They simply said that they had not budgeted for pay increases this year .

- More people are using home computers to help them plan and budget efficiently .

- The financial director says he's budgeting for a full computer upgrade in the New Year .

- Make sure you've budgeted carefully and know that you can actually afford the expense .

- This price rise means that the bill is going to be much higher than we have budgeted for.

- He is responsible for ensuring that project schedules are realistic and that time and money are properly budgeted.

- accountancy

- creative accounting

- double entry bookkeeping

- expense account

- false accounting

- forensic accountant

- forensic accounting

- unreconciled

- write something down

Palabra relacionada

- cheap The meal was cheaper than I expected.

- affordable There's very little affordable housing around here.

- inexpensive They sell inexpensive children's clothes.

- reasonable I thought the food was very reasonable.

- dirt cheap Most of the books they sell are dirt cheap.

- affordable housing

- economically

- economy pack

- mates' rate

- small change

- something for nothing idiom

- super-cheap

- there's no such thing as a free lunch idiom

- ultra-cheap

- worthlessly

- accommodative

- anti-economic

- anti-inflation

- anti-inflationary

- anti-recession

- buyer's market

- deindustrialization

- Great Recession

- gross domestic product