For the best Oliver Wyman website experience, please upgrade your browser to IE9 or later

- Global (English)

- India (English)

- Middle East (English)

- South Africa (English)

- Brazil (Português)

- China (中文版)

- Japan (日本語)

- Southeast Asia (English)

- Belgium (English)

- France (Français)

- Germany (Deutsch)

- Italy (Italiano)

- Netherlands (English)

- Nordics (English)

- Portugal (Português)

- Spain (Español)

- Switzerland (Deutsch)

- UK And Ireland (English)

This article was first published on May 17, 2021.

While change is the only constant in life, there are certainly periods where change is more amplified. We currently find ourselves in one of those periods. The world and our key industries are not immune to the ripple effects of the global pandemic. As an example, for the financial services industry, there are many drivers of change: in the short term, retail banks are facing downward pressures on net income due to record-low interest rates and increasing delinquency rates, and the need to trim costs quickly; in the medium term, new remote working routines are further accelerating digitization, automation, and disintermediation. As a result, business and operating models are trying to adapt to the “new normal.”

The firms able to effectively deliver change will thrive and are more likely to emerge stronger from these changes. However, as recent social science research has shown, delivering change is no easy task: humans have a natural bias against change. Failing to drive change is a challenge to the competitiveness and sustainability of any firm, creating monetary costs, eroding trust with customers and investors, and weighing on culture and employee engagement. On the flip side, firms that successfully deliver change set off a self-reinforcing feedback loop that increases profitability and productivity, builds trust with stakeholders, and attracts top talent.

An often forgotten institutional ‘muscle’ for firms is the ability to effectively manage change risk —the risk that a change program fails to deliver the desired goals. We believe that most firms do not proactively manage change risk in a way that commensurate with the benefits of success and the costs of failure. Effectively managing change risk is a necessary ‘muscle’ to reduce, preempt, mitigate, and manage the challenges that come with (intents of) transformation, without bringing decision paralysis or stifling innovation in the organization. We refer to change risk as a ‘silent risk’ because this ‘muscle’ is often neglected and, too often, that neglect is one of the root causes behind the inability to drive to the desired outcomes.

In our paper, we present an approach to proactively manage change risk, including:

- How to manage change across the end-to-end change lifecycle, to ensure firms develop fit for purpose mechanisms

- How change risk management is a key component of the journey, and the best ways to understand drivers of successful change

- Recommendation for four key change management capabilities, a change risk management framework, change delivery igniters, workforce change capacity management, and a process for initiative prioritization; and actions to help leaders make change management a priority

Below is an excerpt from the report, for the full PDF version, please click here .

Our views on successful change

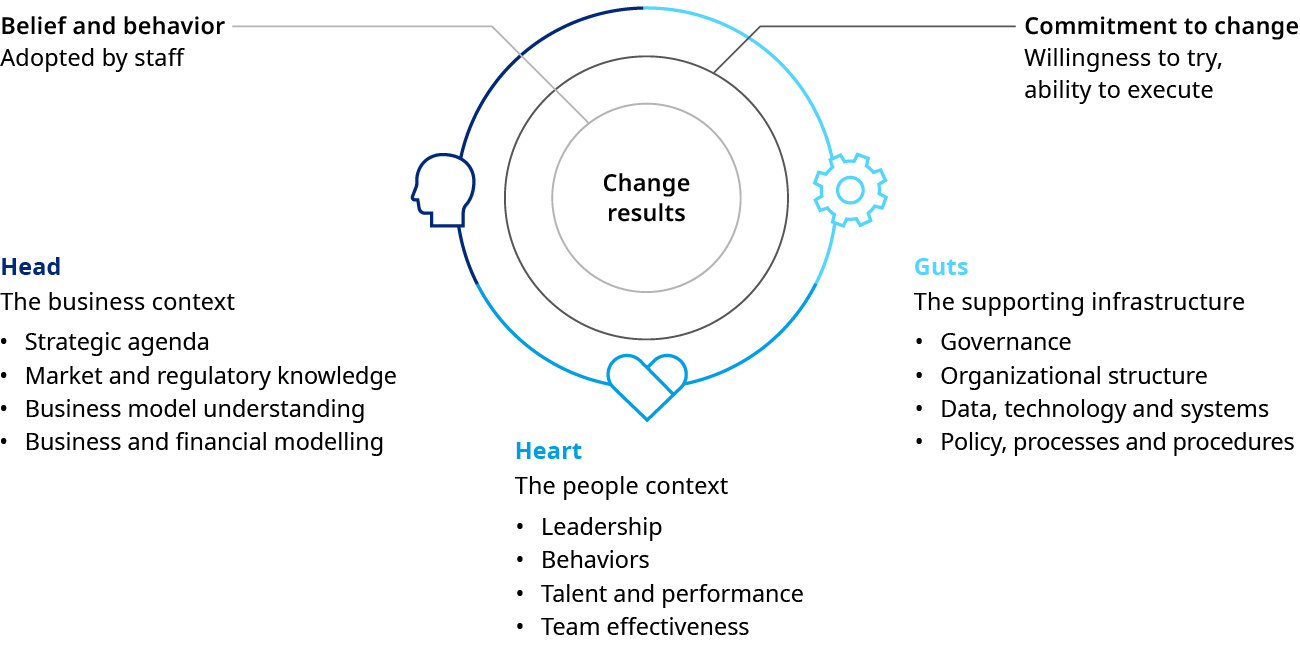

Effective change boils down to directing energy and aligning efforts toward three key elements:

- The strategy and thinking

- The people and behaviors

- The underlying infrastructure

We call these elements the Head, the Heart, and the Guts of an organization. Successful change should have risk management embedded into these key elements.

Successful change occurs when the Head, the Heart, and the Guts are fully aligned, resulting in an organization that has: (1) the willingness to change—through leadership, personal drive, and the identification of strategic value; and (2) the ability to execute—through an adequate workforce, the right infrastructure, and a clear roadmap.

Too often, firms facing change tend to focus on the Head at the expense of the Guts and, especially, the Heart. Such firms often struggle to achieve successful change because lasting change requires individuals to collectively change behaviors. For example, a firm does not become more customer-centric when rolling out a new top-down campaign or training module. Rather, the firm becomes customer-centric when the workforce begins adopting customer-centric behaviors—the way customer interactions play out; the way products are configured; and the way senior leadership communicates and makes decisions.

Change is the only constant in life Heraclitus, c. 535 BCE – 475 BCE.

Experience and research indicate that, for change to occur, each level of the organization needs to understand the objectives and purpose of the change, as well as the new behaviors to adopt. Change experts across the globe call these “vital behaviors”—the smallest actions that, if consistently repeated, will lead to the intended outcomes.

In driving change , the ability to manage change risk needs to be developed in the Guts (through risk management capabilities); the Heart (through an understanding of the workforce stoppers and capacity in the firm); and the Head (through the incorporation of change risk into the firm strategy). Our research shows that, historically, neither risk managers nor front-line risk owners have paid enough attention to managing change risk. If firms believe—as we do—that a better managed change risk is a key success factor, firms must pay more attention to driving alignment between Heart, Head, and Guts in order to achieve successful change, and also appropriately embed risk management capabilities across these elements.

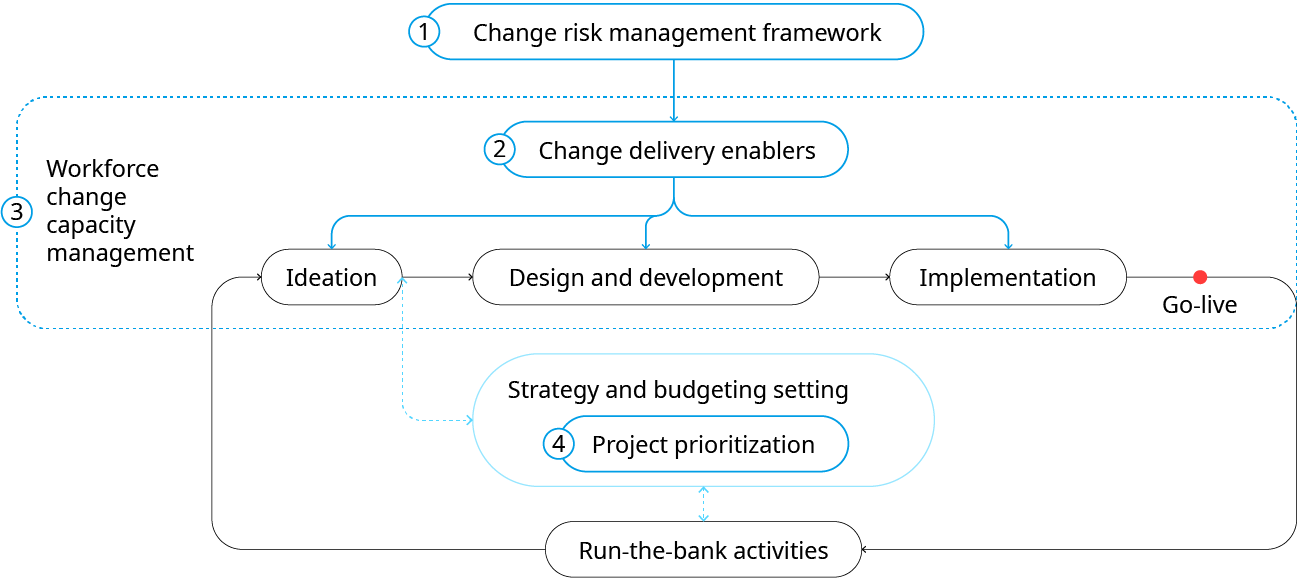

We have identified four capabilities for firms that can increase opportunities to drive effective change management:

1. Change risk management framework: Adapt the firm’s overall risk management framework to cover change risk across the lifecycle

2. Change igniters: Clear obstacles to build a change-oriented organization by diagnosing and addressing organizational weaknesses

3. Workforce change capacity management: Monitor change load and change fatigue, as well as improve organizational agility

4. Initiative prioritization: Develop a process for assessing change initiatives to maximize impact within change capacity

We believe firms that achieve these four capabilities will see an increased efficacy and decreased risk associated with the change programs. Returning to the change lifecycle in the exhibit below, we show how these capabilities can reinforce each stage and broaden the role risk management teams play well beyond the implementation and go-live steps.

Actions for effective change risk management

Given both, the necessity of achieving successful change in the current tumultuous world and the high cost of failure, organizations cannot afford to take a reactive or narrow approach to change risk management.

We recommend front-line and risk management leaders:

Overall, firms that succeed in incorporating change risk management into processes and culture will become more agile and more resilient, while firms that lag will run the risk of being caught flat-footed when the next disruption arrives. Firms that proactively manage change risk will be able to overcome the silent risk that hinders growth and emerge as winners.

The authors would like to acknowledge and thank Jonathan Lee and Rutger von Post for their contributions to this paper.

- Financial Services

- Risk Management for Financial Services

- Ramy Farha,

- Chris DeBrusk, and

- Antonio Tugores

Striving For Operational Resilience: The Questions Boards And Senior Management Should Ask

Operational resilience has become a key agenda item for boards and senior management. Increasing complexity in processes and IT, dependence on third parties, interconnectedness and data sharing, and sophistication of malicious actors have made disruptions more likely and their impact more severe. High-profile examples of business and operational disruptions abound, covering all segments of the financial services industry.

Non-Financial Risk Convergence And Integration

Non-Financial Risk Management has become more complex due to rapid shifts in technology, automation and greater dependence by banks on systems instead of people.

How to Conduct Change Management Risk Assessment

Are you preparing to transition your organization or team through a period of significant change?

With any change comes some inherent risk, which can be both exciting and anxiety provoking.

To ensure the success of such an endeavor it’s important to plan for, mitigate and manage risks as they arise throughout the process.

In this blogpost we’ll discuss why business leaders and managers needs to pay attention to potential risks and learn how to conduct change management risk assessment in order to execute a successful transition.

What is Change Management Risk?

The factors which can negatively affect achieving desired change outcome, primarily due to insufficient planning or lack of change-readiness among stakeholders.

Change management risk can lead to delays in implementation and results, increased costs and compromised quality standards, ultimately impacting an organization’s bottom line.

It is essential for organizations to mitigate change management risks by creating a clear change strategy with well-defined objectives, monitoring change goals and gathering feedback from stakeholders along the way.

Why it is important to identify change management risk?

Change is inherent in any business, and change management can be challenging. Adequately assessing change management risks helps to minimize unexpected outcomes, increases efficiency and effectiveness, and bolsters the flexibility of organizational processes.

It is essential that organizations acknowledge the need to identify change management risks, as failure to do so may lead to project delays, budget overruns and costly repair work.

By critically diagnosing change management risk associated with specific projects or events, an organization is better equipped to develop tailored strategies for successful change implementation. Ultimately, change management risk identification is a critical step for ensuring key change objectives are met on time and within budget.

Change Management Risk Assessment

Change management risk assessment is a crucial process for organizations to mitigate the risks associated with change. It involves looking at potential change initiatives, and examining how they may affect an organization’s resources and operations.

The results of change management risk assessment allow us to make well-informed decisions on the implementation and potential success of change initiatives.

To successfully complete change management risk assessment, it is important to determine objectives, analyze relevant data sources, identify risks and their root causes, and create viable response plans.

This is ultimately done through establishing processes that help organizations develop stability during a time of transition, enabling them to achieve successful outcomes more efficiently.

04 Steps to Conduct Change Management Risk Assessment

In order to conduct change management risk assessment, there are several key steps that need to be taken.

Step 1: Define change management risk assessment framework

It is important to have a clear understanding of what the change initiative is aiming to accomplish, as this will inform the risk assessment process. During this step, it is also important to establish a change management risk assessment framework. This framework should provide the foundation for identifying change management risks and understanding their potential impact on the organization.

The change management risk assessment framework should be tailored to the specific change initiative and take into account any existing organizational change processes. This will ensure that all stakeholders are fully aware of the change objectives, can recognize change management risks, and have an understanding of the steps needed to effectively address risk.

Step 2: Analyze data

The second step to conducting change management risk assessment is to analyze data sources. This involves gathering information from a variety of sources such as internal documents, reports, and interviews with stakeholders. It is important to identify the key change components and assess their potential impacts in order to recognize change management risks.

Through data analysis, organizations can gain greater insight into change management risks and their impacts on their operations. Data analysis allows organizations to identify change management risks and the underlying causes, evaluate the solutions available to them, and make informed decisions when managing change initiatives.

Step 3: Identify and analyze risks

The third step to conducting change management risk assessment is to analyze the change management risks identified. This involves understanding their root causes and evaluating their potential impacts on the organization. It is important to identify any assumptions, dependencies, or interdependencies that could affect change management risk assessment outcomes.

Organizations should also assess whether existing change processes are adequate enough toeffectively manage change risk. This includes considering the impact that change initiatives will have on existing structures, processes and systems, as well as understanding the resources available to address change risks.

Step 4: Develop response plans

The next step to conducting change management risk assessment is to develop response plans. This involves formulating strategies and tactics to mitigate change risks, as well as determining possible contingencies in the event that change initiatives do not succeed. During this stage, organizations should identify resources necessary for successful change implementation, such as personnel and technology.

It is important to prioritize change management risks in order to ensure that the most critical risks are addressed first. This involves understanding the potential impact of each change risk on the organization, and identifying which risks should be addressed to mitigate their effects.

What are common risks of change management

Following are some common risks of change management:

lack of understanding or buy-in from stakeholders

The lack of understanding or buy-in from stakeholders is one of the most common change management risks. This risk can arise when stakeholders are not fully aware of change objectives, or do not agree with the change initiatives being undertaken. In such cases, stakeholders may resist change initiatives or take actions that undermine their success.

Inadequate change management practices and processes

Inadequate change management practices and processes can also be a major risk to change initiatives. Organizations must ensure that change strategies are understood, agreed upon, and implemented effectively in order to maximize the chances of change success. Without an effective change management process in place, organizations may find themselves unable to adjust quickly enough to address risks.

Ineffective communication

Organzations often make mistake by having one-way communication with employees and other stakeholders. This is one of the biggest risk of change management. Change is not successful if its message is only coming from top and voices of employees or other stakeholders are unheard. If organizational culture fails to exchange ideas and share experience then it’s hard to implement transformative change.

An excessive change implementation timeline

An excessive change implementation timeline can pose a serious risk to change management, as it often leads to delays, slowdowns, and potential abandonment of change initiatives. When change initiatives take too long to implement, they can become costly and complex affairs that may not yield the desired results.

Inadequate change control measures

Inadequate change control measures are one of the most common change management risks. These typically arise when change initiatives are not reviewed and approved on a timely basis. Without proper change control mechanisms in place, change initiatives can go unchecked and progress without proper risk assessment and validation.

Misaligned change initiatives with organizational objectives

Misaligned change initiatives with organizational objectives can be a major change management risk. When change initiatives are not in alignment with the organization’s overall goals and objectives, they can lead to wasted resources, reduced efficiency, and even failure of the change initiative.

Final Words

Assessing risks is a key component of successful change management. By understanding what could go wrong and taking steps to mitigate those risks, you can increase the chances of your change initiative being successful. There are many different ways to assess risks and some common risks associated with change management initiatives include resistance to change, lack of resources etc. By taking the time to understand these risks and develop a plan to address them, you can set your change initiative up for success. Do you have a plan in place to assess risks to your change management initiative? What are some of the most common risks you’ve encountered during past initiatives?

About The Author

Tahir Abbas

Related posts.

Why Change Management is Important in an Organization

Emotional Reactions to Change in the Workplace

From Crisis to Comeback: Maggi Crisis Management Case Study

What Could Go Wrong? How to Manage Risk for Successful Change Initiatives

David Shore, instructor of Strategies for Leading Successful Change Initiatives, shares six steps to effective risk management.

David Shore

Every change initiative comes with inherent risk. But too often we shy away from exploring the potential pitfalls at the outset. If we are to succeed, however, we should embrace risk. After all, change initiatives are born from a risk analysis — a conclusion that the risk of doing nothing is higher than the risk of embarking on an experimental initiative.

When leading a change initiative, you should focus on acknowledging, anticipating, and managing risk — instead of avoiding it at all costs.

The good news is that risk management is not rocket science. Through my extensive work with change initiatives, I’ve identified six key steps to effective risk management. By following these steps on your initiative, I hope you’ll discover how embracing risk can lead to success.

Six Steps to Effective Risk Management

1. at the start, identify the risks you face..

Make a list. Formalize this process by holding a premortem . Just as a postmortem enables the team to assess what went right or wrong after the fact, a premortem provides a space for thinking in advance about what could go wrong during the project. As you and your team brainstorm, you should cast a wide net. Consider factors intrinsic to the project and also those outside the team’s control. For example, consider the risk of potential resistance from stakeholders, which nearly always arises in change initiatives.

2. Quantify the Risks.

Not all risks are created equal. The risk of a slight delay in funding might be very different from the risk of a major partner pulling out of a joint venture. By quantifying the risk, you decrease the influence emotions can play and allow different risks to be compared. One method is to assess the risk along two dimensions: the probability of the risk occurring, and the impact the risk would have if it actually occurred. Using a scale from one to five, you can evaluate each of these dimensions for the risks you’ve identified. Then, you can multiply the two numbers to produce a risk factor from 1 to 25.

3. Establish a Risk Threshold.

Consider your initiative’s tolerance for risk and then establish a threshold. If you are not sure where to start, set your threshold at the center of your risk scale. For example, on a scale of 1 to 25, start with 12 as your threshold. Compare your quantified risks to the threshold and then spend some time thinking about the ones that exceed the threshold and then adjust as needed.

Search all Business Strategy programs.

4. Create Contingency Plans.

For each risk, engage in a thought experiment. First, think about what steps you can take, if any, to eliminate or mitigate the risk. It may be that a small adjustment to your plan will reduce the probability to zero. Second, think about what you plan to do if that possibility becomes reality — in other words, if the risk becomes an issue. Will the team be able to work around it easily? Or will the magnitude of that risk require rethinking your entire initiative? The more you plan for risks ahead of time, the better prepared you will be — and the more successful you will be in keeping your initiative on track

5. Monitor Risks over Time.

Along with the Gantt charts, status reports, dashboards, and other tools that help you assess your progress, you can also create a Risk Register (also called a Risk Log) that sets out all the risks, their risk factors, and current status. As you reach a particular milestone, perhaps one risk can be eliminated from consideration because it is no longer possible. Perhaps another risk has created an issue that needs to be dealt with. Or perhaps a new risk has been identified and should be evaluated. Your goal is to keep a close eye on risk throughout the project.

6. Consider Assigning a Risk Watcher.

You may want to identify a particular team member who has the responsibility to monitor risks and raise flags. Teams working on change initiatives are by definition optimistic. While everyone else on the team might be saying, “This will go fine,” someone needs to be able to say, “Clouds are rolling in” or “We’ve said that for the last six meetings and it hasn’t happened.”

To manage risk successfully, you need to be proactive in anticipating it. And to lead a change initiative successfully, you need to be an honest communicator. Talk with your team and with upper management about risks to the project and issues that crop up along the way. As a manager, you can improve your ability to manage risk by fostering a culture that values positive thinking while encouraging open discussions about problems.

Embracing change means embracing risk. With the right pragmatic approach, you can become a more effective change agent by understanding risk as a natural part of change — and by anticipating and managing it.

Find related Business Strategy programs.

Browse all Professional & Executive Development programs.

About the Author

Shore is an authority on change management recognized as distinguished professor at Tianjin University of Finance and Economics and 2015 Top Thought Leader in Trust.

Why Marketers Should Start Thinking Like Designers

Follow this 5-step process for applying design thinking to your marketing strategy.

Harvard Division of Continuing Education

The Division of Continuing Education (DCE) at Harvard University is dedicated to bringing rigorous academics and innovative teaching capabilities to those seeking to improve their lives through education. We make Harvard education accessible to lifelong learners from high school to retirement.

Jira Software

Project and issue tracking

Content collaboration

Jira Service Management

High-velocity ITSM

Visual project management

- View all products

Marketplace

Connect thousands of apps and integrations for all your Atlassian products

Developer Experience Platform

Jira Product Discovery

Prioritization and roadmapping

You might find helpful

Cloud Product Roadmap

Atlassian Migration Program

Work Management

Manage projects and align goals across all teams to achieve deliverables

IT Service Management

Enable dev, IT ops, and business teams to deliver great service at high velocity

Agile & DevOps

Run a world-class agile software organization from discovery to delivery and operations

BY TEAM SIZE

Small Business

BY TEAM FUNCTION

Software Development

BY INDUSTRY

Telecommunications

Professional Services

What's new

Atlassian together.

Get Atlassian work management products in one convenient package for enterprise teams.

Atlassian Trust & Security

Customer Case Studies

Atlassian University

Atlassian Playbook

Product Documentation

Developer Resources

Atlassian Community

Atlassian Support

Enterprise Services

Partner Support

Purchasing & Licensing

Work Life Blog

Support for Server products ends February 15, 2024

With end of support for our Server products fast approaching, create a winning plan for your Cloud migration with the Atlassian Migration Program.

Assess my options

Atlassian Presents: Unleash

Product updates, hands-on training, and technical demos – catch all that and more at our biggest agile & DevOps event.

- Atlassian.com

ITSM for high-velocity teams

How teams share change management roles and responsibilities.

The primary objective of any change management practice is reducing incidents as updates are shipped so customers stay happy and you stay ahead of the competition. Today, customers have heightened expectations for always-on, high-performing services.

It is critical to properly manage service interruptions and ship frequent improvements with care. Today’s teams have embraced risk mitigation tactics while delivering customer value in the most streamlined, agile manner possible, often leveraging tools like Jira Service Management .

To achieve these goals, companies have designated various roles and responsibilities associated with change management. For enterprise companies, these roles are typically shared by multiple employees or teams.

For smaller companies, a single employee may take on change management responsibilities alongside other duties. Someone with change management responsibilities may also be a developer or team lead, for example. Alternatively, change management responsibilities might be integrated into the role of an IT administrator. In other cases, automated processes may be slowly built and shared among existing teams.

While there is no one-size-fits-all model for assigning change management responsibilities, companies should adopt a framework that best suits their needs. Teams of every size can benefit from reevaluating the practice of giving change responsibilities to individuals with specific titles, especially when they are far removed from the projects they are reviewing.

By embracing new opportunities to automate change processes and integrate best practices into existing workflows, team members assuming change management responsibilities can step into more strategic roles and recoup precious time better spent on pursuing core business objectives.

Common change management roles

The roles involved in change management depend on a number of factors, including the type and size of an organization. Below are several common change management roles.

Change manager/coordinator

Change managers—sometimes called change coordinators—are typically responsible for managing all aspects of IT changes. They prioritize change requests, assess their impact, and accept or reject changes. Jira Service Management can significantly enhance these tasks by providing advanced ticketing systems and streamlined communication channels. Change managers also document change management processes and change plans. Most importantly, they organize change management strategies and act as chairs of change advisory board (CAB) meetings. A change manager’s success is typically assessed by whether they meet timing and budget objectives.

Change manager job description

Change managers within an organization take charge of change management initiatives, guiding their implementation. They design and execute strategies to facilitate employee adoption of workplace changes, such as overseeing the smooth transition to a new project management software or implementing a flexible remote work policy.

These senior leaders collaborate closely with other key stakeholders to ensure changes align with corporate strategic objectives. They also work with project managers to ensure smooth operations, continuously monitor progress and make necessary adjustments. Change managers may also analyze employee experiences and offer solutions for a smooth transition.

What is the difference between a change manager and a project manager?

The change manager's primary focus is on minimizing the adverse effects of organizational changes and optimizing positive results. This role places a strong emphasis on addressing the human aspect of change, including understanding its impact on individuals and facilitating their adaptation to new circumstances. In contrast, the project manager concentrates on delivering the actual product, ensuring it is completed within established timelines, budget constraints, and in line with stakeholder expectations.

Change authorities/approvers

A change authority is a person who decides whether or not to authorize a change. Sometimes, this is a single person—usually a senior manager or executive. Sometimes, it’s a group on a change advisory board. Sometimes, it’s a peer reviewer.

According to ITIL 4 , “In high-velocity organizations, it is common practice to decentralize change approval, making the peer review a top predictor of high performance.” Jira Service Management supports this approach, providing a platform for effective peer reviews and decentralized decision-making.

Change managers typically work closely with the change authority to approve and implement strategies to move changes forward. In some cases, particularly in small companies, the change manager is the change authority and, as such, has the power to make decisions without looping in additional teams.

Business stakeholders

Business stakeholders are often involved in change management and may be looped into the authorization process. This is increasingly common, given the critical importance of software services to most enterprises. For example, suppose a change impacts the connection between the finance team’s payment tracking software and the sales team’s CRM. In that case, senior leaders from the finance and sales teams may need to be involved in CAB meetings and the decision-making process.

Engineers/developers

Development teams typically submit changes for approval and document the case for its necessity. Once a change is approved, change managers or CABs adopting the you-built-it-you-run-it approach may direct dev teams to deploy changes, monitor them, and respond to any incidents arising from them. In other cases, an incident management team may be responsible for responding to any problems. This team may be separate from the development team.

Service desk agents

Service desk agents play a vital role in change management, offering a unique front-line perspective on incidents and common service issues that may arise due to changes. Their close interaction with end-users equips them to identify potential challenges and gather valuable feedback, making them essential in ensuring smooth transitions during change implementation. Their insights help craft effective communication strategies and swift problem resolution, ultimately contributing to the overall success of change initiatives. Jira Service Management, a comprehensive service desk solution , further enhances the capabilities of service desk agents in change management. By leveraging its robust features, such as advanced ticketing systems and streamlined communication channels, service desk agents can efficiently track and manage change requests, ensuring a smooth integration of changes while maintaining a high level of customer satisfaction.

Operations managers

Operations managers, responsible for the continuous functioning of systems on a daily basis, play a pivotal role in assessing and managing risk and dependencies. Their expertise in maintaining system stability and performance allows them to provide project managers with critical insights into the potential impact of changes, ensuring a balanced approach to change management that prioritizes innovation and operational reliability.

Customer relationship managers

With exceptional communication skills, customer relationship managers act as a bridge between the organization and its customers, enabling them to represent the voice of the customer effectively to key stakeholders. They offer valuable insights into customer mindsets, concerns, and evolving requirements, helping companies stay attuned to the ever-changing needs of their clientele. By providing this essential feedback, they contribute to shaping customer-centric change initiatives and enhancing overall customer satisfaction.

Information security officers and network engineers

Information security officers and network engineers, possessing specialized expertise in network security and cloud infrastructure, play a critical role in identifying and addressing threats and vulnerabilities. Their insights and recommendations help strengthen an organization’s security posture, ensuring that changes are implemented with a keen awareness of potential risks.

By collaborating with these professionals, companies can fortify their defenses and maintain the integrity of their digital infrastructure and business processes in the face of evolving security challenges.

Transforming the role of change advisory boards (CABs)

Change advisory boards have historically played a crucial role in assessing the risks associated with change requests and approving or rejecting them. Traditional CABs often acted as gatekeepers controlling the release of proposed changes.

However, they have been criticized for poor time management skills, lengthy change request backlogs, and their detachment from the actual work. Fortunately, CABs are evolving to become more strategic advisors, transforming their role in the change management process.

Challenges of traditional CABs

Traditional CABs have often been criticized for their inefficiency, resulting in unproductive meetings that waste time and involve too many stakeholders. This is likely due to the fact that they have been burdened with broad responsibilities.

Consider a control tower at an airport. Its sole purpose is to clear planes for landing, not assess aircraft safety or pilot credentials. Many CABs, on the other hand, are tasked with making extensive safety decisions about various changes, often during the week when participants are eager to leave for the weekend. This setup hinders their effectiveness.

Furthermore, CABs often prioritize the risk of changes causing incidents but may overlook the risk of delaying valuable changes, which can harm customers and have a negative impact on an organization’s ability to compete within the market.

Repositioning CABs as strategic advisors

To transform CABs into strategic advisors, companies should reconsider the traditional, heavyweight change management processes that often hinder software delivery performance. Data from the State of DevOps Report 2019 indicates that procedures requiring CAB approval can negatively affect performance, with no evidence suggesting lower change fail rates due to formal approval processes.

Today’s teams are taking the following steps to improve their CABs:

- Customized approach : Stop treating change requests uniformly. Each change request presents an opportunity to gather valuable data, allowing for pre-approval and automation of less consequential changes.

- Integration of change and release management : Bring change and release management closer together and avoid bundling large packages of changes for review and approval, which can lead to significant incidents and delays.

- Progressive releases : Implement progressive deploys to test and iterate changes on a small subset of users, reducing the scope of potential incidents and ensuring deployment success.

- Automation : Rethink approval models and embrace automation to streamline change management processes, making them more efficient and reducing manual tasks.

- Shift left : Implement peer review as a common strategy to replace or reduce CAB approvals, putting the responsibility for identifying issues in the code on those who understand it best. Ensure meticulous documentation to comply with regulations.

- Convene experts : Rather than approving individual requests, CABs can focus on process improvement, offering recommendations, providing resources, and using change management tools to enhance performance and speed up value delivery to the market.

Defining change management principles and responsibilities

When defining roles and responsibilities in change management teams, there is no one-size-fits-all approach. Consider your company’s culture, team structures, skills, and regulatory requirements. Engage teams in discussion to understand their essential contributions and needs, considering various frameworks like DevOps, CI/CD, and ITIL. Evaluate your current change process, identify areas for improvement, and work on shifting regular changes to standard or pre-approved status.

Change management is an essential practice, and there is always room for improvement. Whether you are just starting in business management or seeking to enhance your change management practices, there are ways to track changes, implement risk assessment and automation systems, and empower your operations teams to manage change with tools like Jira Service Management .

Atlassian's guide to agile ways of working with ITIL 4

ITIL 4 is here—and it’s more agile than ever. Learn tips to bring agility and collaboration into ITSM with Atlassian.

Knowledge Management Explained | Atlassian

Knowledge management processes create, curate, share, use, and manage knowledge across an organization and even across industries. Learn more here.

Don’t stop deploying: Practicing change management in uncertain times

Some companies are reverting to heavy-weight change management processes. Here’s guidance on how you can avoid adding controls and even improve your practice.

Value and resilience through better risk management

Today’s corporate leaders navigate a complex environment that is changing at an ever-accelerating pace. Digital technology underlies much of the change. Business models are being transformed by new waves of automation, based on robotics and artificial intelligence. Producers and consumers are making faster decisions, with preferences shifting under the influence of social media and trending news. New types of digital companies are exploiting the changes, disrupting traditional market leaders and business models. And as companies digitize more parts of their organization, the danger of cyberattacks and breaches of all kinds grows.

Stay current on your favorite topics

Beyond cyberspace, the risk environment is equally challenging. Regulation enjoys broad popular support in many sectors and regions; where it is tightening, it is putting stresses on profitability. Climate change is affecting operations and consumers and regulators are also making demands for better business conduct in relation to the natural environment. Geopolitical uncertainties alter business conditions and challenge the footprints of multinationals. Corporate reputations are vulnerable to single events, as risks once thought to have a limited probability of occurrence are actually materializing.

The role of the board and senior executives

Risk management at nonfinancial companies has not kept pace with this evolution. For many nonfinancial corporates, risk management remains an underdeveloped and siloed capability in the organization, receiving limited attention from the most senior leaders. From over 1,100 respondents to McKinsey’s Global Board Survey for 2017 , we discovered that risk management remains a relatively low-priority topic at board meetings (exhibit).

A long way to go

Boards spend only 9 percent of their time on risk—slightly less than they did in 2015. Other questions in the survey revealed that only 6 percent of respondents believe that they are effective in managing risk (again, less than in 2015). Some individual risk areas are relatively neglected, and even cybersecurity, a core risk area with increasing importance, is addressed by only 36 percent of boards. While many senior executives stay focused on strategy and performance management, they often fail to challenge capabilities or strategic decisions from a risk perspective (see sidebar, “A long way to go”). A reactive approach to risks remains too common, with action taken only after things go wrong. The result is that boards and senior executives needlessly put their companies at risk, while personally taking on higher legal and reputational liabilities.

Boards have a critical role to play in developing risk-management capabilities at the companies they oversee. First, boards need to ensure that a robust risk-management operating model is in place. Such a model allows companies to understand and prioritize risks, set their risk appetite, and measure their performance against these risks. The model should enable the board and senior executives to work with businesses to eliminate exposures outside the company’s appetite statement, reducing the risk profile where warranted, through such means as quality controls and other operational processes. On strategic opportunities and risk trade-offs, boards should foster explicit discussions and decision making among top management and the businesses. This will enable the efficient deployment of scarce risk resources and the active, coordinated management of risks across the organization. Companies will then be prepared to address and manage emerging crises when risks do materialize.

A sectoral view of risks

Most companies operate in a complex, industry-specific risk environment. They must navigate macroeconomic and geopolitical uncertainties and face risks arising in the areas of strategy, finance, products, operations, and compliance and conduct. In some sectors, companies have developed advanced approaches to managing risks that are specific to their business models. These approaches can sustain significant value. At the same time companies are challenged by emerging types of risks for which they need to develop effective mitigation plans; in their absence, the losses from serious risk events can be crippling.

- Automotive companies are controlling supply-chain risks with sophisticated monitoring models that allow OEMs to identify potential risks upfront across the supply chain. At the same time, auto companies must address the strategic challenge of shifting toward electric-powered and autonomous vehicles.

- Pharma companies seek to manage the downside risk of large investments in their product portfolio and pipeline, while addressing product quality and patient safety to comply with relevant regulatory requirements.

- Oil and gas, steel, and energy companies apply advanced approaches to manage the negative effects of financial markets and commodity-price volatility. As social and political demands for cleaner energy are increasing, these companies are actively pursuing growth opportunities to shift their portfolios in anticipation of an energy transition and a low-carbon future.

- Consumer-goods companies protect their reputation and brand value through sound practices to manage product quality as well as labor conditions in their production facilities. Yet they are constantly challenged to meet consumers’ ever-changing tastes and needs, as well as consumer-protection regulations.

Toward proactive risk management

An approach based on adherence to minimum regulatory standards and avoidance of financial loss creates risk in itself. In a passive stance, companies cannot shape an optimal risk profile according to their business models nor adequately manage a fast-moving crisis. Eschewing a risk approach comprised of short-term performance initiatives focused on revenue and costs, top performers deem risk management as a strategic asset, which can sustain significant value over the long term. Inherent in the proactive approach are several essential components.

Strategic decision making

More rigorous, debiased strategic decision making can enhance the longer-term resilience of a company’s business model, particularly in volatile markets or externally challenged industries. Research shows that the active, regular reevaluation of resource allocation, based on sound assessments of risk and return trade-offs (such as entering markets where the business model is superior to the competition), creates more value and better shareholder returns. 1 See, for example, Yuval Atsmon, “ How nimble resource allocation can double your company’s value ,” August 2016; William N. Thorndike, Jr., The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success , Boston, MA: Harvard Business Review Press, 2012; Rebecca Darr and Tim Koller, “ How to build an alliance against corporate short-termism ,” January 2017. Flexibility is empowering in a dynamic marketplace. Many companies use hedging strategies to insure against market uncertainties. Airlines, for example, have been known to hedge future exposures to fuel-price fluctuations, a move that can help maintain profitability when prices climb. Likewise, strategic investing, based on a longer-term perspective and a deep understanding of a company’s core proposition, generates more value than opportunistic moves aiming at a short-term bump in the share price.

Debiasing and stress-testing

Approaches that include debiasing and stress-testing help senior executives consider previously overlooked sources of uncertainty to judge whether the company’s risk-bearing capacity can absorb their potential impact. A utility in Germany, for example, improved decision making by taking action to mitigate behavioral biases. As a result, it separated its renewables business from its conventional power-generation operations. In the aftermath of the Fukushima disaster, which sharply raised interest in environmentally friendly power generation, the utility’s move led to a significant positive effect on its share price (15 percent above the industry index).

Higher-quality products and safety standards

Investments in product quality and safety standards can bring significant returns. One form this takes in the energy sector is reduced damage and maintenance costs. At one international energy company, improved safety standards led to a 30 percent reduction in the frequency of hazardous incidents. Auto companies with reputations built on safety can command higher prices for their vehicles, while the better reputation created by higher quality standards in pharma creates obvious advantages. As well as the boost in demand that comes from a reputation for quality, companies can significantly reduce their remediation costs—McKinsey research suggests that pharma companies suffering from quality issues lose annual revenue equal to 4 to 5 percent of cost of goods sold.

Comprehensive operative controls

These can lead to more efficient and effective processes that are less prone to disruption when risks materialize. In the auto sector, companies can ensure stable production and sales by mitigating the risk of supply-chain disruption. Following the 2011 earthquake and tsunami, a leading automaker probed potential supply bottlenecks and took appropriate action. After an earthquake in 2016, the company quickly redirected production of affected parts to other locations, avoiding costly disruptions. In high-tech, companies applying superior supply-chain risk management can achieve lasting cost savings and higher margins. One global computer company addressed these risks with a dedicated program that saved $500 million during its first six years. The program used risk-informed contracts, enabling suppliers to lower the costs and risks of doing business with the company. The measures achieved supply assurance for key components, particularly during market shortages, improved cost predictability for components that have volatile costs, and optimized inventory levels internally and at suppliers.

Stronger ethical and societal standards

To achieve standing among customers, employees, business partners, and the public, companies can apply ethical controls on corporate practices end to end. If appropriately publicized and linked to corporate social responsibility, a program of better ethical standards can achieve significant returns in the form of heightened reputation and brand recognition. Customers, for example, are increasingly willing to pay a premium for products of companies that adhere to tighter standards. Employees too appreciate being associated with more ethical companies, offering a better working environment and contributing to society.

The three dimensions of effective risk management

Ideally, risk management and compliance are addressed as strategic priorities by corporate leadership and day-to-day management. More often the reality is that these areas are delegated to a few people at the corporate center working in isolation from the rest of the business. By contrast, revenue growth or cost savings are deeply embedded in corporate culture, linked explicitly to profit-and-loss (P&L) performance at the company level. Somewhere in the middle are specific control capabilities regarding, for example, product safety, secure IT development and deployment, or financial auditing.

Would you like to learn more about our Risk Practice ?

To change this picture, leadership must commit to building robust, effective risk management. The project is three-dimensional: 1) the risk operating model, consisting of the main risk management processes; 2) a governance and accountability structure around these processes, leading from the business up to the board level; and 3) best-practice crisis preparedness, including a well-articulated response playbook if the worst case materializes.

1. Developing an effective risk operating model

The operating model consists of two layers, an enterprise risk management (ERM) framework and individual frameworks for each type of risk. The ERM framework is used to identify risks across the organization, define the overall risk appetite, and implement the appropriate controls to ensure that the risk appetite is respected. Finally, the overarching framework puts in place a system of timely reporting and corresponding actions on risk to the board and senior management. The risk-specific frameworks address all risks that are being managed. These can be grouped in categories, such as financial, nonfinancial, and strategic. Financial risks, such as liquidity, market, and credit risks, are managed by adhering to appropriate limit structures; nonfinancial risks, by implementing adequate process controls; strategic risks, by challenging key decisions with formalized approaches such as debiasing, scenario analyses, and stress testing. While financial and strategic risks are typically managed according to the risk-return trade-off, for nonfinancial risks, the potential downside is often the key consideration.

Finding the right level of risk appetite

Companies need to find the right level of risk appetite, which helps ensure long-term resilience and performance. Risk appetite that is too relaxed or too restrictive can have severe consequences on company financials, as the following two examples indicate:

Too relaxed. One nuclear energy company set its standards for steel equipment in the 1980s and did not review them even when the regulations changed. When the new higher standards were applied to the manufacture of equipment for nuclear power plants, the company fell short of compliance. An earlier adaptation of its risk appetite and tolerance levels would have been significantly less costly.

Too restrictive. A pharma company set quality tolerances to produce a drug to a significantly stricter level than what was required by regulation. At the beginning of production, tolerance intervals could be fulfilled, but over time, quality could no longer be assured at the initial level. The company was unable to lower standards, as these had been communicated to the regulators. Ultimately, production processes had to be upgraded at a significant cost to maintain the original tolerances.

As well as assessing risk based on likelihood and impact, companies must also assess their ability to respond to emerging risks. Capabilities and capacities needed to manage these risks should be evaluated and gaps filled accordingly. Of particular importance in crisis management is the timeliness of an effective response when things go awry. The highly likely, high-impact risk events on which risk management focuses most of its attention often emerge with disarming velocity, taking many companies unawares. To be effective, the enterprise risk management framework must ensure that the two layers are seamlessly integrated. It does this by providing clarity on risk definitions and appetite as well as controls and reporting.

- Taxonomy. A company-wide risk taxonomy should clearly and comprehensively define risks; the taxonomy should be strictly respected in the definition of risk appetite, in the development of risk policy and strategy, and in risk reporting. Taxonomies are usually industry-specific, covering strategic, regulatory, and product risks relevant to the industry. They are also determined by company characteristics, including the business model and geographical footprint (to incorporate specific country and legal risks). Proven risk-assessment tools need to be adopted and enhanced continuously with new techniques, so that newer risks (such as cyberrisk) are addressed as well as more familiar risks.

- Risk appetite. A clear definition of risk appetite will translate risk-return trade-offs into explicit thresholds and limits for financial and strategic risks, such as economic capital, cash-flow at risk, or stressed metrics. In the case of nonfinancial risks like operational and compliance risks, the risk appetite will be based on overall loss limits, categorized into inherent and residual risks (see sidebar, “Finding the right level of risk appetite”).

- Risk control processes. Effective risk control processes ensure that risk thresholds for the specified risk appetite are upheld at all levels of the organization. Leading companies are increasingly building their control processes around big data and advanced analytics. These powerful new capabilities can greatly increase the effectiveness and efficiency of risk monitoring processes. Machine-learning tools, for example, can be very effective in monitoring fraud and prioritizing investigations; automated natural language processing within complaints management can be used to monitor conduct risk.

- Risk reporting. Decision making should be informed with risk reporting. Companies can regularly provide boards and senior executives with insights on risk, identifying the most relevant strategic risks. The objective is to ensure that an independent risk view, encompassing all levels of the organization, is embedded into the planning process. In this way, the risk profile can be upheld in the management of business initiatives and decisions affecting the quality of processes and products. Techniques like debiasing and the use of scenarios can help overcome biases toward fulfilment of short-term goals. A North American oil producer developed a strategic hypothesis given uncertainties in global and regional oil markets. The company used risk modelling to test assumptions about cash flow under different scenarios and embedded these analyses into the reports reviewed by senior management and the board. Weak points in the strategy were thereby identified and mitigating actions taken.

2. Toward robust risk governance, organization, and culture

The risk operating model must be managed through an effective governance structure and organization with clear accountabilities. The governance model maintains a risk culture that strongly reinforces better risk and compliance management across the three lines of defense—business and operations, the compliance and risk functions, and audit. The approach recognizes the inherent contradiction in the first line between performance (revenue and costs) and risk (losses). The role of the second line is to review and challenge the first line on the effectiveness of its risk processes and controls, while the third line, audit, ensures that the lines one and two are functioning as intended.

- Three lines of defense. Effective implementation of the three lines involves the sharp definition of lines one and two at all levels, from the group level through the lines of business, to the regional and legal entity levels. Accountabilities regarding risk and control management must be clear. Risk governance may differ by risk type: financial risks are usually managed centrally, while operational risks are deeply embedded into company processes. The operational risk of any line of business is managed by the business owning the product-development, production, and sales processes. This usually translates into forms of quality control, but the business must also balance the broader impact of risk and P&L. In the development of new diesel engines, automakers lost sight of the balance between compliance risk and the additional cost to meet emission standards, with disastrous results. Risk or compliance functions can only complement these activities by independently reviewing the adequacy of operational risk management, such as through technical standards and controls.

- Reviewing the risk appetite and risk profile. Of central importance within the governance structure are the committees that define the risk appetite, including the parameters for doing business. These committees also make specific decisions on top risks and review the control environment for enhancements as the company’s risk profile changes. Good governance in this case means that risk decisions are considered within the existing divisional, regional, and senior-management governance structure of a company, supported by risk, compliance, and audit committees.

- Integrated risk and compliance governance setup. A robust and adequately staffed risk and compliance organization supports all risk processes. The integrated risk and compliance organization provides for single ownership of the group-wide ERM framework and standards, appropriate clustering of second-line functions, a clear matrix between divisions and control functions, and centralized or local control as needed. A clear trend is observable whereby the ERM layer responsible for group-wide standards, risk processes, and reporting becomes consolidated, whereas the expert teams setting and monitoring specific control standards for the business (including standards for commercial, technical compliance, IT or cyberrisks) become specialized teams covering both regulatory compliance as well as risk aspects.

- Resources. Appropriate resources are a critical factor in successful risk governance. The size of the compliance, risk, audit, and legal functions of nonfinancial companies (0.5 for every 100 employees, on average), are usually much smaller than those of banks (6.9 for every 100 employees). The disparity is partly a natural outcome of financial regulation, but some part of it reflects a capability gap in nonfinancial corporates. These companies usually devote most of their risk and control resources in sector-specific areas, such as health and safety for airlines and nuclear power companies or quality assurance for pharmaceutical companies. The same companies can, however, neglect to provide sufficient resources to monitor highly significant risks, such as cyberrisk or large investments.

- Risk culture. An enhanced risk culture covers mind-sets and behaviors across the organization. A shared understanding is fostered of key risks and risk management, with leaders acting as role models. Especially important are capability-building programs on risk as well as formal mechanisms to assess and reinforce sound risk management practices.

An enhanced risk culture covers mind-sets and behaviors across the organization. A shared understanding is fostered of key risks and risk management, with leaders acting as role models.

3. Crisis preparedness and response

A high-performing, effective risk operating model and governance structure, with a well-developed risk culture minimize the probability of corporate crises , without, of course, completely eliminating them. When unexpected crises strike at high velocity, multinational companies can lose billions in value in the first days and soon find themselves struggling to keep their market position. A best-in-class risk management environment provides the ideal conditions for preparation and response.

- Ensure board leadership. The most important action companies can take to prepare for crises is to ensure that the effort is led by the board and senior management. Top leadership must define the main expected threats, the worst-case scenarios, and the actions and communications that will be accordingly rolled out. For each threat, hypothetical scenarios should be developed for how a crisis will unfold, based on previous crises within and beyond the company’s industry and region.

- Strengthen resilience. By mapping patterns that arose in previous crises, companies can test their own resilience, challenging key areas across the organization for potential weaknesses. Targeted countermeasures can then be developed in advance to strengthen resilience. This crucial aspect of crisis preparedness can involve reviewing and revising the terms and conditions for key suppliers, shoring up financials to ensure short-term availability of cash, or investing in advanced cybersecurity measures to protect essential data and software in the event of failures and breaches.

- Develop action plans and communications. Once these assessments are complete and resilience-building countermeasures are in place, the company can then develop action plans for each threat. The plans must be well articulated, founded on past crises, and address operational and technical planning, financial planning, third-party management, and legal planning. Care should be taken to develop an optimally responsive communications strategy as well. The correct strategy will enable frontline responders to keep pace with or stay ahead of unfolding crises. Communications failures can turn manageable crises into irredeemable catastrophes. Companies need to have appropriate scripts and process logic in place detailing the response to crisis situations, communicated to all levels of the organization and well anchored there. Airlines provide an example of the well-articulated response, in their preparedness for an accident or crash. Not only are detailed scripts in place, but regular simulations are held to train employees at all levels of the company.

- Train managers at all levels. The company should train key managers at multiple levels on what to expect and enable them to feel the pressures and emotions in a simulated environment. Doing this repeatedly and in a richer way each time will significantly improve the company’s response capabilities in a real crisis situation, even though the crisis may not be precisely the one for which managers have been trained. They will also be valuable learning exercises in their own right.

- Put in place a detailed crisis-response playbook. While each crisis can unfold in unique and unpredictable ways, companies can follow a few fundamental principles of crisis response in all situations. First, establish control immediately after the crisis hits, by closely determining the level of exposure to the threat and identifying a crisis-response leader, not necessarily the CEO, who will direct appropriate actions accordingly. Second, involved parties—such as customers, employees, shareholders, suppliers, government agencies, the media, and the wider public—must be effectively engaged with a dynamic communications strategy. Third, an operational and technical “war room” should be set up, to stabilize primary threats and determine which activities to sustain and which to suspend (identifying and reaching out to critical suppliers). Finally, a deliberate effort must be made to address and neutralize the root cause of the crisis and so bring it to an end as soon as possible.

In a digitized, networked world, with globalized supply chains and complex financial interdependencies, the risk environment has grown more perilous and costly. A holistic approach to risk management, based on the lessons, good and bad, of leading companies and financial institutions, can derive value from that environment. The path to risk resilience that is emerging is an effort, led by the board and senior management, to establish the right risk profile and appetite. Success depends on the support of a thriving risk culture and state-of-the-art crisis preparedness and response. Far from minimal regulatory adherence and loss avoidance, the optimal approach to risk management consists of fundamentally strategic capabilities, deeply embedded across the organization.

Daniela Gius is a senior expert in McKinsey’s Hamburg office, Jean-Christophe Mieszala is a senior partner in the Paris office, Ernestos Panayiotou is a partner in the Athens office, and Thomas Poppensieker is a senior partner in the Munich office.

Explore a career with us

Related articles.

The business logic in debiasing

Are you prepared for a corporate crisis?

Nonfinancial risk today: Getting risk and the business aligned

How To Mitigate Change Management Risk

Change Strategists

Affiliate Disclaimer

As an affiliate, we may earn a commission from qualifying purchases. We get commissions for purchases made through links on this website from Amazon and other third parties.

So, you’ve decided to make some changes in your organization. That’s great! After all, change is necessary for growth and progress. However, before you jump headfirst into the deep end of change management, it’s important to recognize the potential risks involved.

To mitigate change management risk, it is important to have a clear plan in place before implementing any changes. This includes identifying potential risks and developing strategies to address them. Communication and training are also key components, as they can help employees understand the changes and how to adapt to them.

It is also important to have a process for monitoring and evaluating the effectiveness of the changes, and making adjustments as needed.

Change management can be a tricky business. It’s not just about implementing new processes or technologies, but also about managing people’s emotions, expectations, and resistance to change. Without proper planning and execution, change can result in chaos, confusion, and even failure.

But fear not, dear reader! In this article, we will guide you through the process of mitigating change management risk, step-by-step.

From identifying potential risks to celebrating success, we’ll cover everything you need to know to ensure a smooth and successful transition.

So, let’s get started!

Identify Potential Risks

You need to start by looking for possible challenges that could come up in the process of change management. This is called risk assessment, and it involves identifying potential risks that may cause delays or failure of the project.

Some of the risks that should be considered during the assessment include employee resistance, lack of communication, inadequate training, and budget constraints.

Once you have identified the potential risks, you can then develop mitigation strategies to reduce the impact of these risks. For instance, to mitigate employee resistance, you can involve them in the change process by communicating the benefits of the change and providing them with adequate training.

To mitigate the lack of communication, you can establish clear communication channels and set up regular meetings to update stakeholders on the progress of the project.

In conclusion, identifying potential risks and developing mitigation strategies is crucial in mitigating change management risk. By doing so, you can ensure that the change process is smooth and successful, and that the project is completed within the set timeline and budget. Remember that risk assessment is an ongoing process, and it’s important to regularly review and update your mitigation strategies as the project progresses.

Develop a Change Management Plan

Crafting a solid plan is key to successfully navigating and adapting to any shifts in your organization. Change readiness is essential to ensure that your plan is effective and sustainable.

Assessing your team’s readiness for change will help you develop a plan that is tailored to their needs. To do this, consider conducting surveys, focus groups, or interviews to gain insights into how your team perceives the change, what they need to feel comfortable with it, and what challenges they anticipate. By taking these steps, you can ensure that your plan is well-informed and addresses any potential obstacles.

Stakeholder engagement is another crucial component of change management planning. Engaging stakeholders early on and throughout the change process can help you build buy-in and support for your plan. It can also help you identify potential resistance or challenges early on and address them before they become major roadblocks.

Consider involving stakeholders in planning, communicating, and implementing the change. This can include senior leaders, front-line employees, customers, and any other groups that may be impacted by the change. By engaging stakeholders in a meaningful way, you can ensure that your plan is well-informed, collaborative, and successful.

In summary, developing a change management plan requires careful consideration of change readiness and stakeholder engagement. Crafting a solid plan that is tailored to your team’s needs and involves stakeholders early on can help you mitigate risk and ensure long-term success. By investing time and effort in planning and engaging stakeholders, you can navigate change more effectively and build a stronger, more resilient organization.

Communicate Effectively

In this section, effectively communicating your change management plan is like a conductor leading an orchestra. Just as a conductor brings all the different instruments together in harmony towards a common goal, you must bring your team together towards a successful change implementation.

The importance of empathy and clarity cannot be overstated when it comes to effective communication. Empathy allows you to understand your team’s perspective and concerns, while clarity ensures that everyone is on the same page.

Building trust is crucial in any change management initiative, and effective communication is key to achieving it. Transparency and consistency are the building blocks of trust. Ensure that you communicate every step of the change process with transparency, keeping your team informed about what’s coming and what’s expected of them. Consistency in communication helps to establish trust, so maintain a regular cadence of communication with your team.

In summary, effective communication is vital to mitigate change management risk. Empathy and clarity are crucial components of effective communication, as is building trust through transparency and consistency. As you communicate your change management plan, remember that you’re the conductor leading your team towards a successful change initiative.

Build a Strong Team

Together, you’ll be assembling a team of skilled individuals who will work in harmony towards a common goal, much like a group of musicians in an orchestra. The success of your change management plan will depend on how effectively you build and lead your team.

To start, you should identify the key competencies required for your team and select individuals who have those skills. Once you have your team in place, it’s important to foster a culture of collaboration and communication.

To build a strong team, you can engage in team building activities that promote trust and open communication. This can be as simple as having regular team meetings or as elaborate as organizing a retreat or team-building workshop. The goal is to help your team members get to know each other better, understand their strengths and weaknesses, and develop a sense of camaraderie.

Additionally, it’s important to provide leadership development opportunities for your team members. This can include training, mentoring, and coaching to help them grow and develop their leadership skills.

In summary, building a strong team is essential to mitigating change management risk. By assembling a group of skilled individuals who work well together and providing leadership development opportunities, you can ensure that your team is equipped to handle any challenges that may arise during the change management process. Remember that team building is an ongoing process, so continue to foster a culture of collaboration and communication to maintain a high-performing team.

Monitor Progress

Monitoring progress is crucial to the success of your change management plan, so keep an eye on how things are going and adjust as needed. Set up regular feedback sessions with your team and stakeholders to ensure that everyone is on the same page. Use performance metrics to track progress and identify any areas that need improvement.

Stakeholder engagement is a critical component of change management, and regular feedback loops can help you keep your stakeholders informed and engaged. Make sure that you’re communicating with your stakeholders regularly and that you’re providing them with the information they need to understand the changes that are happening. Encourage feedback and be open to suggestions for improvement.

Using performance metrics to monitor progress is an effective way to ensure the success of your change management plan. By tracking key performance indicators, you can identify any areas that need improvement and make adjustments as needed. Regular feedback sessions with your team and stakeholders can also help you identify any issues early on and address them before they become major problems.

Remember that change management is an ongoing process, and monitoring progress is essential to ensuring that your plan is successful.

Anticipate and Address Resistance

Don’t let resistance hold you back – anticipate and address it head-on to ensure the success of your plan. Resistance is a natural part of change management, but it can also be a major obstacle.

To mitigate this risk, it’s important to have a clear understanding of the potential sources of resistance. This could include a fear of the unknown, a lack of understanding about the benefits of the change, or concerns about job security. Once you have identified these potential sources of resistance, you can develop targeted training strategies and communication plans to address them.

One effective strategy for mitigating resistance is to focus on leadership buy-in. If key leaders within the organization are on board with the change, they can help to create a culture that is supportive of the transition. This can include providing training and resources to help employees adapt to the change, as well as modeling the desired behaviors and attitudes.

By engaging these leaders early on in the process and making them part of the planning and implementation, you can help to build a coalition of support that can help to overcome resistance.

Another important aspect of addressing resistance is to be transparent and open to feedback. Employees are more likely to support a change if they feel that their concerns and opinions are being heard and valued. This means providing regular updates on the progress of the change, soliciting feedback from employees, and being willing to make adjustments as needed.

By creating a culture of openness and transparency, you can help to build trust and engagement, which can ultimately lead to a more successful change management process.

Manage Operational Disruptions

As you dive deeper into managing operational disruptions, it’s important to develop contingency plans to prepare for unexpected events. In doing so, you’ll be able to minimize disruptions and keep your business running smoothly.

Effective communication with customers and suppliers is also crucial. This will help maintain strong relationships and ensure that everyone is on the same page.

By taking a proactive approach and being prepared for potential disruptions, you can minimize their impact and keep your business moving forward.

Develop Contingency Plans

The key to successfully navigating unexpected obstacles is to have backup plans in place that are as solid as a rock. Developing contingency plans is a crucial step in mitigating change management risk. Here are three things to keep in mind when creating these plans:

Identify the potential risks: Start by conducting a thorough risk assessment to identify all possible risks that could disrupt your operations. This will help you develop contingency plans that address the most critical risks first.

Prioritize your response: Not all risks require the same level of response. Identify which risks are most likely to occur and which ones would have the greatest impact on your business. This will help you prioritize your response and allocate resources accordingly.