Plan Projections

ideas to numbers .. simple financial projections

Home > Business Plan > Market Share in a Business Plan

Market Share in a Business Plan

… so our market share should be …

To illustrate suppose the served available market (SAM) is 4.5 million and we expect to obtain 1% of this market. In this case the serviceable obtainable market (SOM) is calculated as follows.

The SOM is not normally calculated using a bottom up approach. However, it is a useful exercise to perform the calculation to see whether the business is able to operate at a level indicated by the estimated market share.

To illustrate suppose we have market size estimates for SAM of 4.5 million in year one rising to 7.59 million in year five. Additionally based on available resources (staff, equipment, funding etc.), the business estimates that it can deal with 300 customers in year one and 1600 customers in year five. Assuming an average value per customer of 150, we can calculate a bottom up market share as follows.

Using its available resources the business can support the market share calculated above. Consequently if the top down estimate of SOM is much larger than this the business need to rethink its plan to ensure compatibility with resources available.

Market Share Presentation

The investor will view the SOM as the short term target for the business. They will be looking for this to be achieved without too many problems to show that the business idea has potential. If the business can achieve the SOM then with further investment, it should be able to penetrate the SAM even further.

This is part of the financial projections and Contents of a Business Plan Guide . The guide is a series of posts on what each section of a simple business plan should include. The next post in this series sets out details of the marketing strategy which the business intends to use to win its share of the market.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

What Is Market Share & How Do You Calculate It?

Published: December 07, 2022

In the marketing industry, you've likely heard the term "market share" from time to time, but what does it mean? Why is it necessary, and how is it calculated?

As marketers, it's important to understand market share so you know how your company ranks against competitors and can develop new marketing strategies to reach more potential customers. In this post, we’ll outline what market share is, how to calculate it, give real-life examples, and explain how you can increase yours.

What is market share?

Market share formula.

Relative Market Share

Relative Market Share Formula

Market share examples.

How to Expand Your Market Share

Understand Your Market Share to Increase Business Success

![determination of the market share business plan → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Market share is the percentage of an industry's sales that a particular company owns. Essentially, it is the share of your business's total industry revenue from selling your products and services. Businesses with larger market shares are industry leaders and competition for smaller companies.

Suppose consumers buy 100 T-shirts, and 70 are from Company A, 25 from Company B, and 5 from Company C. In that case, Company A owns a market share of 70% and is the leading industry competitor .

Market share is typically calculated for a specific period, like yearly or quarterly sales, and is sometimes separated by region.

How to Calculate Market Share

Find your business’s total sales revenue for your preferred period and divide that number by your industry’s total revenue during the same period. Once you have this result, multiply the number by 100 to generate your market share percentage.

Calculating your market share will give you an overall understanding of your position in the industry, but it’s also helpful to understand how you measure up to your direct competitors. By understanding the basics of the stock market , you can easily understand how each company and their share make up the entire industry.

Relative Market Share

Relative market share compares your performance to industry leaders.

Rather than using total industry revenue, you’re dividing your market share by your top competitor's market share, multiplying the result by 100. The result will show you the portion of the market you own in relation to your most significant competitor. The image below shows the relative market share formula.

It may be easier to understand market share with real-life examples, so we’ll go over some below for businesses you may already be familiar with.

Nike Market Share

Nike is part of the athletic footwear and apparel industry, selling various sports equipment, casual shoes, and accessories.

Nike’s global market share in sportswear is estimated to be 43.7% . The brand is an industry competitor for Adidas and Under Armour.

Tesla Market Share

Tesla is part of the automotive industry and produces electric vehicles (EVs). Within the U.S. EV industry, Tesla holds an over 70% market share.

It's essential to recognize that the market for EVs worldwide is significantly smaller than standard vehicles. EV’s market share in the automobile industry is 2.8%, and Tesla’s is .8% . These differences are significant, so it is vital to analyze relative market share to compare your business to your direct competitors rather than just the market as a whole.

Spotify is a music-streaming platform and has the highest music-streaming market share with 31% of the market.

The second-highest market share belongs to Apple Music (15%), followed by Amazon Music (13), Tencent (13%), and YouTube (8%).

E-commerce company Amazon has a U.S. e-commerce market share of 37.8% and is the leading online retailer in the country. Second place belongs to Walmart with 6.3%, and third place goes to Apple with 3.9%.

Most recent statistics show Target is the largest department store retailer in the U.S. with a 38% market share. Walmart and Macy's both rank second with 13%.

Chew is an online pet product and food retailer with a market share of 40% in the U.S. The company plans to expand into the global market in 2024 and is expected to gain a 20% market share outside of the U.S. by 2030.

Google Market Share

Google has a market share of 92.37% , making it the most popular search engine in the world. It dominates the competition, as the second-largest industry leader is Bing with a market share of just 3.57%.

Once you’ve calculated your market share and understand how you relate to your industry competitors, you can begin strategizing how to increase your overall revenue.

How To Expand Your Market Share

Below are a few strategies your company can use to expand your market share .

1. Lower prices.

A great way to compete in your industry is to offer low prices. This is the low-hanging fruit of expanding your market share because consumers typically look for lower-cost products.

However, it's also important to note that the cheap option isn't right for every brand. You want to ensure that you’re pricing products appropriately to provide value to customers but not lose out on revenue opportunities to beat the competition.

2. Innovate new products and features.

Companies innovating and bringing new technology to the table often see their market share increase.

New products and features attract new customers, also known as acquisition , which is a driving factor for generating revenue. New customers make new purchases and, in turn, contribute to higher profit margins and larger contributions to overall industry revenue. More significant contributions directly translate to increased market share.

3. Delight your customers.

One of the best ways to grow your market share is to work on existing customer relationships.

You can inspire customer loyalty by delighting current customers by providing exceptional experiences and customer loyalty. Loyal customers are more likely to make repeat purchases, which increases your business revenue and contribution to total industry revenue. As mentioned above, higher revenue contributions equal a higher market share percentage.

4. Increase brand awareness.

Branding awareness and national marketing play a significant role in capturing market share. Getting your name out there is important, so customers know who you are. Becoming a household name and the preferred brand in an industry will help increase your market share.

Generally, larger companies have the highest market share because they can provide products and services more efficiently and effectively.

But why is this so important? Below, let's figure out what impact market share can have on your company.

Why is market share important?

Calculating market share lets companies know how competitive they are in their industry. Additionally, the more market share a company has, the more innovative, appealing, and marketable they are.

Market share is more important in industries that are based on discretionary income. Market share doesn't always have a significant impact in constantly growing industries. However, it's important to remember that a company can have too much market share — also known as a monopoly.

For example, with growing industries with a growing market share, companies can still increase their sales even if they lose market share.

On the other hand, with discretionary income industries, such as travel or non-essential goods like entertainment and leisure, the economy can significantly impact market share. Sales and margins can vary depending on the time of year, meaning that competition is always at an all-time high.

Higher competition often leads to risky strategies. For instance, companies might be willing to lose money temporarily to force competitors out of the industry and gain more market share. Once they have more market share, they can raise prices.

Lower market shares can let you know that you need to focus on customer acquisition, marketing to raise brand awareness, and overall strategies to increase revenue. Higher percentages indicate that your current plan is adequate and that you should focus on customer retention and product innovation.

Whether your company is well-established or just starting, it’s important to understand your industry standing as it will help you meet business objectives and achieve desired success.

Don't forget to share this post!

Related articles.

25 Tools & Resources for Conducting Market Research

What is a Competitive Analysis — and How Do You Conduct One?

Market Research: A How-To Guide and Template

![determination of the market share business plan SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![determination of the market share business plan How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![determination of the market share business plan 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

![determination of the market share business plan 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Market Analysis for a Business Plan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A lot of preparation goes into starting a business before you can open your doors to the public or launch your online store. One of your first steps should be to write a business plan . A business plan will serve as your roadmap when building your business.

Within your business plan, there’s an important section you should pay careful attention to: your market analysis. Your market analysis helps you understand your target market and how you can thrive within it.

Simply put, your market analysis shows that you’ve done your research. It also contributes to your marketing strategy by defining your target customer and researching their buying habits. Overall, a market analysis will yield invaluable data if you have limited knowledge about your market, the market has fierce competition, and if you require a business loan. In this guide, we'll explore how to conduct your own market analysis.

How to conduct a market analysis: A step-by-step guide

In your market analysis, you can expect to cover the following:

Industry outlook

Target market

Market value

Competition

Barriers to entry

Let’s dive into an in-depth look into each section:

Step 1: Define your objective

Before you begin your market analysis, it’s important to define your objective for writing a market analysis. Are you writing it for internal purposes or for external purposes?

If you were doing a market analysis for internal purposes, you might be brainstorming new products to launch or adjusting your marketing tactics. An example of an external purpose might be that you need a market analysis to get approved for a business loan .

The comprehensiveness of your market analysis will depend on your objective. If you’re preparing for a new product launch, you might focus more heavily on researching the competition. A market analysis for a loan approval would require heavy data and research into market size and growth, share potential, and pricing.

Step 2: Provide an industry outlook

An industry outlook is a general direction of where your industry is heading. Lenders want to know whether you’re targeting a growing industry or declining industry. For example, if you’re looking to sell VCRs in 2020, it’s unlikely that your business will succeed.

Starting your market analysis with an industry outlook offers a preliminary view of the market and what to expect in your market analysis. When writing this section, you'll want to include:

Market size

Are you chasing big markets or are you targeting very niche markets? If you’re targeting a niche market, are there enough customers to support your business and buy your product?

Product life cycle

If you develop a product, what will its life cycle look like? Lenders want an overview of how your product will come into fruition after it’s developed and launched. In this section, you can discuss your product’s:

Research and development

Projected growth

How do you see your company performing over time? Calculating your year-over-year growth will help you and lenders see how your business has grown thus far. Calculating your projected growth shows how your business will fare in future projected market conditions.

Step 3: Determine your target market

This section of your market analysis is dedicated to your potential customer. Who is your ideal target customer? How can you cater your product to serve them specifically?

Don’t make the mistake of wanting to sell your product to everybody. Your target customer should be specific. For example, if you’re selling mittens, you wouldn’t want to market to warmer climates like Hawaii. You should target customers who live in colder regions. The more nuanced your target market is, the more information you’ll have to inform your business and marketing strategy.

With that in mind, your target market section should include the following points:

Demographics

This is where you leave nothing to mystery about your ideal customer. You want to know every aspect of your customer so you can best serve them. Dedicate time to researching the following demographics:

Income level

Create a customer persona

Creating a customer persona can help you better understand your customer. It can be easier to market to a person than data on paper. You can give this persona a name, background, and job. Mold this persona into your target customer.

What are your customer’s pain points? How do these pain points influence how they buy products? What matters most to them? Why do they choose one brand over another?

Research and supporting material

Information without data are just claims. To add credibility to your market analysis, you need to include data. Some methods for collecting data include:

Target group surveys

Focus groups

Reading reviews

Feedback surveys

You can also consult resources online. For example, the U.S. Census Bureau can help you find demographics in calculating your market share. The U.S. Department of Commerce and the U.S. Small Business Administration also offer general data that can help you research your target industry.

Step 4: Calculate market value

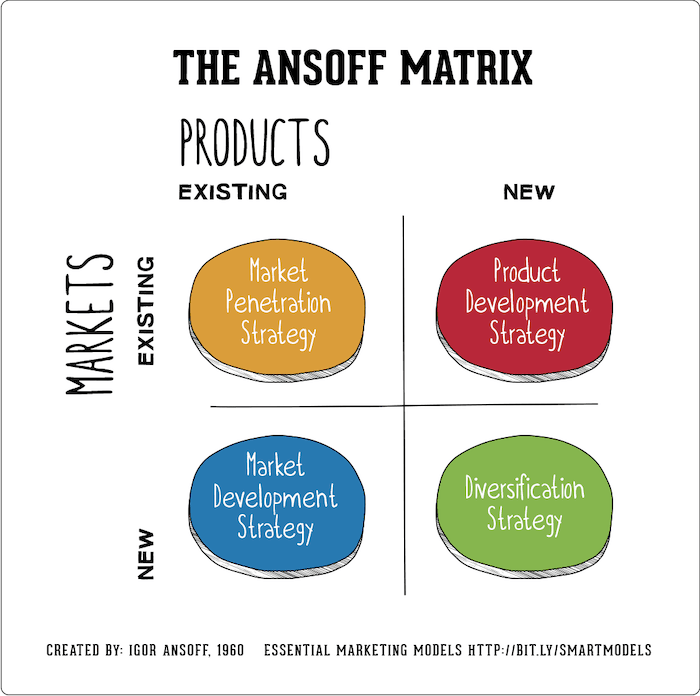

You can use either top-down analysis or bottom-up analysis to calculate an estimate of your market value.

A top-down analysis tends to be the easier option of the two. It requires for you to calculate the entire market and then estimate how much of a share you expect your business to get. For example, let’s assume your target market consists of 100,000 people. If you’re optimistic and manage to get 1% of that market, you can expect to make 1,000 sales.

A bottom-up analysis is more data-driven and requires more research. You calculate the individual factors of your business and then estimate how high you can scale them to arrive at a projected market share. Some factors to consider when doing a bottom-up analysis include:

Where products are sold

Who your competition is

The price per unit

How many consumers you expect to reach

The average amount a customer would buy over time

While a bottom-up analysis requires more data than a top-down analysis, you can usually arrive at a more accurate calculation.

Step 5: Get to know your competition

Before you start a business, you need to research the level of competition within your market. Are there certain companies getting the lion’s share of the market? How can you position yourself to stand out from the competition?

There are two types of competitors that you should be aware of: direct competitors and indirect competitors.

Direct competitors are other businesses who sell the same product as you. If you and the company across town both sell apples, you are direct competitors.

An indirect competitor sells a different but similar product to yours. If that company across town sells oranges instead, they are an indirect competitor. Apples and oranges are different but they still target a similar market: people who eat fruits.

Also, here are some questions you want to answer when writing this section of your market analysis:

What are your competitor’s strengths?

What are your competitor’s weaknesses?

How can you cover your competitor’s weaknesses in your own business?

How can you solve the same problems better or differently than your competitors?

How can you leverage technology to better serve your customers?

How big of a threat are your competitors if you open your business?

Step 6: Identify your barriers

Writing a market analysis can help you identify some glaring barriers to starting your business. Researching these barriers will help you avoid any costly legal or business mistakes down the line. Some entry barriers to address in your marketing analysis include:

Technology: How rapid is technology advancing and can it render your product obsolete within the next five years?

Branding: You need to establish your brand identity to stand out in a saturated market.

Cost of entry: Startup costs, like renting a space and hiring employees, are expensive. Also, specialty equipment often comes with hefty price tags. (Consider researching equipment financing to help finance these purchases.)

Location: You need to secure a prime location if you’re opening a physical store.

Competition: A market with fierce competition can be a steep uphill battle (like attempting to go toe-to-toe with Apple or Amazon).

Step 7: Know the regulations

When starting a business, it’s your responsibility to research governmental and state business regulations within your market. Some regulations to keep in mind include (but aren’t limited to):

Employment and labor laws

Advertising

Environmental regulations

If you’re a newer entrepreneur and this is your first business, this part can be daunting so you might want to consult with a business attorney. A legal professional will help you identify the legal requirements specific to your business. You can also check online legal help sites like LegalZoom or Rocket Lawyer.

Tips when writing your market analysis

We wouldn’t be surprised if you feel overwhelmed by the sheer volume of information needed in a market analysis. Keep in mind, though, this research is key to launching a successful business. You don’t want to cut corners, but here are a few tips to help you out when writing your market analysis:

Use visual aids

Nobody likes 30 pages of nothing but text. Using visual aids can break up those text blocks, making your market analysis more visually appealing. When discussing statistics and metrics, charts and graphs will help you better communicate your data.

Include a summary

If you’ve ever read an article from an academic journal, you’ll notice that writers include an abstract that offers the reader a preview.

Use this same tactic when writing your market analysis. It will prime the reader of your market highlights before they dive into the hard data.

Get to the point

It’s better to keep your market analysis concise than to stuff it with fluff and repetition. You’ll want to present your data, analyze it, and then tie it back into how your business can thrive within your target market.

Revisit your market analysis regularly

Markets are always changing and it's important that your business changes with your target market. Revisiting your market analysis ensures that your business operations align with changing market conditions. The best businesses are the ones that can adapt.

Why should you write a market analysis?

Your market analysis helps you look at factors within your market to determine if it’s a good fit for your business model. A market analysis will help you:

1. Learn how to analyze the market need

Markets are always shifting and it’s a good idea to identify current and projected market conditions. These trends will help you understand the size of your market and whether there are paying customers waiting for you. Doing a market analysis helps you confirm that your target market is a lucrative market.

2. Learn about your customers

The best way to serve your customer is to understand them. A market analysis will examine your customer’s buying habits, pain points, and desires. This information will aid you in developing a business that addresses those points.

3. Get approved for a business loan

Starting a business, especially if it’s your first one, requires startup funding. A good first step is to apply for a business loan with your bank or other financial institution.

A thorough market analysis shows that you’re professional, prepared, and worth the investment from lenders. This preparation inspires confidence within the lender that you can build a business and repay the loan.

4. Beat the competition

Your research will offer valuable insight and certain advantages that the competition might not have. For example, thoroughly understanding your customer’s pain points and desires will help you develop a superior product or service than your competitors. If your business is already up and running, an updated market analysis can upgrade your marketing strategy or help you launch a new product.

Final thoughts

There is a saying that the first step to cutting down a tree is to sharpen an axe. In other words, preparation is the key to success. In business, preparation increases the chances that your business will succeed, even in a competitive market.

The market analysis section of your business plan separates the entrepreneurs who have done their homework from those who haven’t. Now that you’ve learned how to write a market analysis, it’s time for you to sharpen your axe and grow a successful business. And keep in mind, if you need help crafting your business plan, you can always turn to business plan software or a free template to help you stay organized.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

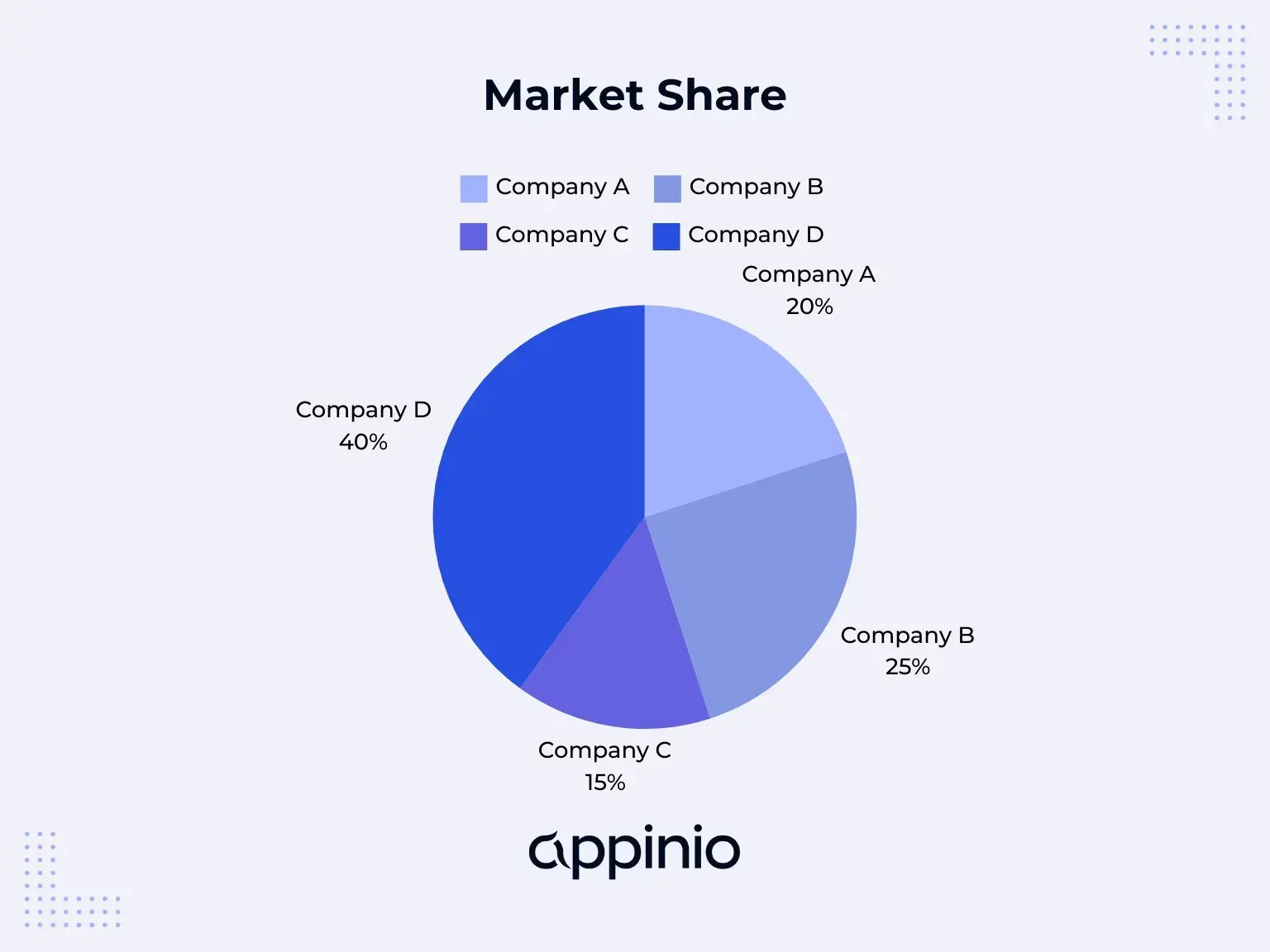

What is Market Share? Definition, Formula, Examples

Appinio Research · 15.04.2024 · 35min read

Ever wondered how businesses gauge their success in competitive markets? Market share holds the answer. In the dynamic world of commerce, understanding market share is like having a compass guiding you through the tumultuous seas of competition. But what exactly is market share? Simply put, it's the slice of the pie a company claims within its industry or market segment . It's the percentage of total sales or revenue a company captures compared to its competitors. But why does it matter? Well, imagine you're at a buffet. The dishes with the longest lines? They likely have the largest market share. Market share isn't just about bragging rights; it's about understanding where you stand in the grand scheme of things. It shapes how businesses strategize, invest, and innovate. It's a measure of competitiveness, a tool for growth, and a window into consumer preferences. From mom-and-pop shops to multinational corporations, market share is the compass guiding businesses towards success in the ever-evolving marketplace.

What is Market Share?

Importance of Market Share in Business

Market share plays a pivotal role in guiding strategic decision-making and shaping business performance across various dimensions. Its importance stems from its ability to provide valuable insights into a company's competitive standing, market dynamics, and growth opportunities.

Some key reasons why market share is crucial for businesses include:

- Competitive Positioning : Market share serves as a barometer of a company's competitive strength within its industry. A higher market share indicates a larger share of the market pie and a stronger competitive position relative to rivals.

- Strategic Planning : Market share data informs strategic planning initiatives by highlighting areas of strength and weakness. It helps businesses identify growth opportunities, competitive threats, and areas for improvement, guiding resource allocation and strategic priorities.

- Performance Evaluation : Monitoring changes in market share over time allows businesses to evaluate the effectiveness of their strategies and initiatives. It provides a yardstick for measuring performance, identifying trends, and assessing the impact of competitive actions or market dynamics.

- Customer Insights : Market share analysis provides insights into customer preferences, behavior , and market trends. By understanding which products or services resonate with customers and capture market share, businesses can tailor their offerings and marketing efforts to better meet customer needs and drive growth.

- Investor Perception : Market share is often viewed as a key performance indicator by investors, analysts, and stakeholders. A company with a growing market share is seen as more competitive, resilient, and attractive to investors, which can positively impact stock prices, valuations, and investor confidence.

How to Calculate Market Share?

Market share can be calculated based on various factors, such as units sold, revenue generated, or other relevant metrics, depending on the industry and market dynamics.

The formula for calculating market share is typically:

Market Share = (Company's Sales or Revenue/Total Market Sales or Revenue) × 100 Market Share = (Total Market Sales or Revenue/Company's Sales or Revenue) × 100

Suppose Company A and Company B are two leading players in the smartphone industry, competing for market dominance. To calculate their respective market shares, we'll use the following data:

- Company A's total smartphone sales revenue: $500 million

- Company B's total smartphone sales revenue: $700 million

- Total smartphone industry sales revenue: $3 billion

Calculating Company A's Market Share:

Company A's Market Share = (Company A's Sales Revenue / Total Industry Sales Revenue) * 100 Company A's Market Share = (500 million / 3 billion) * 100 = 16.67%

Calculating Company B's Market Share:

Company B's Market Share = (Company B's Sales Revenue / Total Industry Sales Revenue) * 100 Company B's Market Share = (700 million / 3 billion) * 100 = 23.33%

Interpretation:

- Company A holds a market share of 16.67%, indicating that it captures approximately 16.67% of the total smartphone industry's sales revenue.

- Company B boasts a higher market share of 23.33%, signifying its larger share of the smartphone market compared to Company A.

Market Share Analysis

Types of Market Share

When discussing market share, it's essential to recognize that there are different types that provide distinct insights into a company's position within its industry.

- Overall Market Share : This type of market share reflects the percentage of total sales or revenue that a company captures within its industry or market. It provides a broad perspective on the company's performance compared to its competitors.

- Segment Market Share : Segment market share focuses on a company's performance within specific segments or niches within the broader market . For example, a company may have a high segment market share in a particular geographic region or product category, even if its overall market share is lower.

- Relative Market Share : Relative market share compares a company's market share to that of its largest competitor. It helps gauge a company's competitive strength within its industry and its ability to command a significant portion of the market compared to its rivals.

Understanding the nuances of these different types of market share allows businesses to gain deeper insights into their competitive positioning and identify opportunities for growth within specific market segments.

Market Share vs. Market Size

While market share and market size are related concepts, they serve different purposes and provide distinct insights into a company's performance and the dynamics of its industry.

- Market Share : Market share represents the portion of total market sales or revenue that a company captures. It indicates the company's relative strength within its industry and its ability to compete effectively against other players in the market.

- Market Size : Market size refers to the total sales or revenue generated within a specific market or industry. It provides an understanding of the overall opportunity available within the market and helps businesses assess the potential for growth and expansion.

Understanding the relationship between market share and market size is essential for strategic planning and resource allocation. While market share indicates a company's competitive standing within its industry, market size provides context for assessing the scale of the opportunity and the potential for capturing additional market share.

Market Share Trends and Patterns

Analyzing market share trends and patterns provides valuable insights into the dynamics of an industry, shifts in consumer behavior, and emerging market opportunities. By tracking changes in market share over time, businesses can identify patterns, anticipate trends, and adjust their strategies accordingly.

- Seasonal Trends : Many industries experience seasonal fluctuations in demand, which can impact market share. Understanding seasonal trends allows businesses to adjust their strategies and resources accordingly to capitalize on peak periods of demand.

- Competitive Dynamics : Monitoring changes in competitors' market share can reveal valuable insights into shifts in competitive dynamics, emerging threats, and opportunities for differentiation.

- Consumer Preferences : Changes in consumer preferences and buying behavior can influence market share trends. By staying attuned to consumer preferences and adapting their offerings accordingly, businesses can maintain or increase their market share.

- Technological Advancements : Technological innovations and disruptions can significantly impact market share within certain industries. Companies that embrace new technologies and adapt their strategies accordingly can gain a competitive edge and capture market share from less agile competitors.

By analyzing market share trends and patterns, businesses can identify growth opportunities, anticipate challenges, and make informed decisions to enhance their competitive position within their industry.

Incorporating Appinio into market share analysis can revolutionize how businesses interpret and act upon market trends. By leveraging real-time consumer insights, companies can uncover hidden opportunities and stay ahead of industry shifts with agility and precision. With Appinio's intuitive platform and comprehensive global reach, conducting market share analysis becomes a seamless and efficient process. Book a demo today and discover the power of Appinio in unlocking actionable insights for your business!

Book a Demo

Examples of Market Share Analysis

To better understand how market share analysis works in practice, let's explore some real-world examples across various industries:

Technology Sector

Consider the smartphone market, where major players like Apple, Samsung, and Huawei compete for market share. By analyzing sales data, customer preferences, and competitive strategies, companies can gain insights into their market share position and identify opportunities for growth .

For instance, Apple's market share dominance in premium smartphone segments highlights its brand strength and customer loyalty, while Huawei's focus on mid-range and budget-friendly devices has allowed it to capture market share in emerging markets.

Automotive Industry

In the automotive industry, market share analysis is crucial for understanding competitive dynamics and consumer trends. For example, Tesla's disruptive entry into the electric vehicle market has challenged traditional automakers like Ford and General Motors.

By monitoring Tesla's market share growth and innovative product offerings, competitors can adjust their strategies and investments to remain competitive in the evolving market landscape .

Fast-Moving Consumer Goods (FMCG)

In the FMCG sector , brands like Coca-Cola and PepsiCo fiercely compete for market share in the beverage industry. Through market share analysis, these companies track sales performance, consumer preferences, and market trends to inform product development and marketing strategies.

For instance, Coca-Cola's dominance in the carbonated soft drink market has prompted PepsiCo to diversify its product portfolio and invest in healthier beverage options to capture market share in the growing health-conscious consumer segment.

In the retail sector , e-commerce giants like Amazon and traditional brick-and-mortar retailers like Walmart engage in intense competition for market share. By leveraging data analytics and customer insights, these companies optimize pricing strategies, product assortments, and customer experiences to attract and retain customers.

For example, Amazon's market share dominance in online retail has prompted Walmart to invest heavily in e-commerce capabilities and omnichannel initiatives to compete effectively in the digital marketplace.

Pharmaceutical Industry

In the pharmaceutical industry, companies like Pfizer and Novartis analyze market share data to assess the performance of their drug portfolios and therapeutic areas. By tracking prescription volumes, market penetration, and competitor activities, pharmaceutical companies can identify opportunities for portfolio optimization and strategic partnerships.

For instance, Pfizer's market share leadership in certain therapeutic categories has led to strategic acquisitions and collaborations to expand its market presence and address unmet medical needs.

Benefits of Monitoring Market Share

Understanding the benefits of monitoring market share is crucial for businesses seeking to gain a competitive edge and drive growth. By tracking and analyzing market share data, companies can unlock valuable insights that inform strategic decision-making across various aspects of their operations.

Competitive Positioning

One of the primary benefits of monitoring market share is gaining insights into your competitive positioning within the industry. By comparing your company's market share to that of competitors, you can assess your relative strength and identify areas where you may be lagging behind or excelling.

- Benchmarking : Market share data serves as a benchmark against which you can measure your performance compared to competitors. It provides valuable context for evaluating your market presence and identifying opportunities for improvement.

- Competitor Analysis : Monitoring changes in competitors' market share allows you to gauge their strategies, strengths, and weaknesses. This insight enables you to adjust your own strategies accordingly, whether it involves fortifying your competitive advantages or capitalizing on competitors' vulnerabilities.

- Market Dynamics : Understanding your competitive positioning within the market helps you anticipate shifts in market dynamics and respond proactively. By staying ahead of the competition, you can maintain or enhance your market share and strengthen your position in the industry.

Identifying Growth Opportunities

Monitoring market share provides businesses with valuable insights into potential growth opportunities within their industry or market segments. By analyzing market share data, you can identify underserved market segments, emerging trends, and areas where you have the potential to expand your presence.

- Market Segmentation : Segment-level analysis of market share data allows you to identify specific market segments or niches where you have the opportunity to gain traction. This insight enables you to tailor your strategies to address the unique needs and preferences of different customer segments .

- Untapped Markets : Market share analysis helps uncover untapped or underexploited markets where you have the potential to increase your presence and capture additional market share. By identifying these opportunities, you can allocate resources strategically to pursue growth in new markets.

- Innovation Opportunities : Understanding market share dynamics can inspire innovation by revealing gaps in the market or unmet customer needs. By leveraging market share insights, you can develop innovative products or services that resonate with customers and differentiate your brand in the marketplace.

Evaluating Marketing Strategies

Market share analysis plays a crucial role in evaluating the effectiveness of your marketing strategies and campaigns. By tracking changes in market share following marketing initiatives, you can assess their impact on your brand's visibility, customer engagement, and market penetration.

- Campaign Performance : Analyzing market share data allows you to measure the effectiveness of your marketing campaigns in driving brand awareness, customer acquisition, and sales. By correlating changes in market share with specific marketing activities, you can identify which strategies are yielding the highest return on investment.

- Competitive Advantage : Market share analysis helps you identify opportunities to gain a competitive advantage through strategic marketing initiatives. By understanding your strengths and weaknesses relative to competitors, you can develop targeted marketing campaigns that capitalize on your unique selling propositions and resonate with your target audience.

- Optimization Opportunities : Market share data provides insights into areas where your marketing efforts may be falling short or underperforming. By identifying areas for improvement, you can refine your marketing strategies, allocate resources more effectively, and optimize your marketing mix to drive better results.

Assessing Product Performance

Monitoring market share is essential for assessing the performance of your products or services within the marketplace. By analyzing changes in market share for specific products or product categories, you can gauge their competitiveness, customer appeal, and overall contribution to your company's success.

- Product Differentiation : Market share analysis helps you assess the degree of differentiation and competitive advantage offered by your products compared to alternatives in the market. By understanding how your products stack up against competitors, you can refine your product offerings to better meet customer needs and preferences.

- Customer Satisfaction : Changes in market share can be indicative of shifts in customer satisfaction and loyalty. By correlating changes in market share with customer feedback and satisfaction metrics, you can identify areas where improvements are needed to enhance the customer experience and drive loyalty.

- Portfolio Management : Market share analysis enables you to evaluate the performance of your product portfolio and make informed decisions about product development, expansion, or discontinuation. By identifying products with declining market share or low profitability, you can reallocate resources to more promising opportunities and streamline your product portfolio for greater efficiency and effectiveness.

In summary, monitoring market share offers numerous benefits for businesses, including insights into competitive positioning, growth opportunities, marketing effectiveness, and product performance. By leveraging market share data, companies can make informed strategic decisions that drive sustainable growth and competitive advantage in their respective industries.

Factors Influencing Market Share

Understanding the various factors that influence market share is essential for businesses seeking to maintain or increase their competitive position within their industry. From product quality and pricing strategies to distribution channels and customer experience, numerous elements can impact a company's ability to capture and retain market share.

Product Quality and Innovation

Product quality and innovation are fundamental drivers of market share. A company that consistently delivers high-quality products that meet or exceed customer expectations is likely to gain market share over competitors offering inferior products.

Innovation plays a crucial role in maintaining relevance and competitiveness in rapidly evolving markets. By continuously innovating and introducing new features or technologies, companies can differentiate themselves from competitors and attract customers seeking innovative solutions.

Pricing Strategy

Pricing strategy directly influences market share by affecting customer purchasing decisions and competitive positioning. A company that adopts a competitive pricing strategy, offering products at prices that are perceived as fair and reasonable relative to their value, is likely to capture a larger share of the market.

However, pricing too low may erode profitability, while pricing too high may deter price-sensitive customers and result in a loss of market share. Strategic pricing decisions should consider factors such as production costs, competitor pricing, and perceived value to customers.

Distribution Channels

Effective distribution channels play a critical role in reaching target customers and increasing market share. Companies with efficient distribution networks can ensure that their products are readily available to customers when and where they need them.

Whether through direct sales, retailers, e-commerce platforms, or partnerships with distributors, choosing the right distribution channels is essential for maximizing market penetration and expanding reach. Additionally, seamless logistics and supply chain management are essential for ensuring timely delivery and maintaining customer satisfaction.

Branding and Marketing Efforts

Strong branding and effective marketing efforts are essential for building awareness, credibility, and preference for a company's products or services. Branding goes beyond logos and visual identity ; it encompasses the overall perception and reputation of a brand in the minds of consumers.

By investing in branding initiatives that communicate value, differentiate the brand from competitors, and resonate with the target audience, companies can increase market share and foster customer loyalty. Similarly, strategic marketing efforts that target the right audience , convey compelling messages, and utilize the appropriate channels can drive customer acquisition and retention, ultimately leading to increased market share.

Customer Experience and Satisfaction

Customer experience and satisfaction are critical drivers of market share. In today's competitive marketplace, delivering exceptional customer experiences at every touchpoint is essential for retaining existing customers and attracting new ones. Positive experiences lead to higher levels of customer satisfaction, loyalty, and advocacy, which, in turn, translate into increased market share through repeat purchases and positive word-of-mouth referrals.

Conversely, poor customer experiences can result in customer churn, negative reviews, and damage to brand reputation, ultimately leading to loss of market share. Therefore, companies must prioritize customer-centricity, listen to customer feedback , and continuously strive to improve the overall customer experience across all interactions.

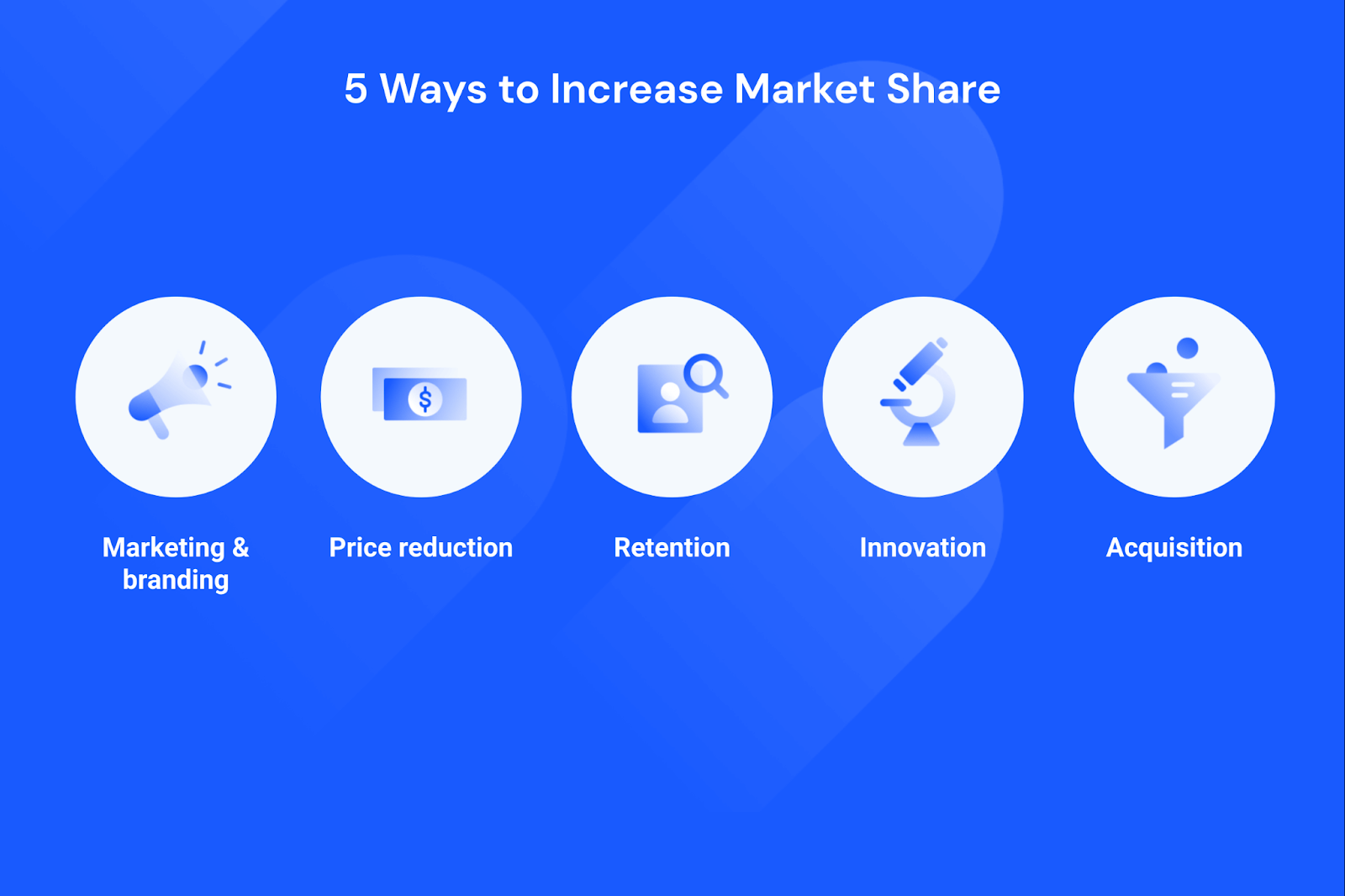

How to Increase Market Share?

Expanding your market share requires a strategic approach that encompasses various tactics and initiatives aimed at attracting new customers, retaining existing ones, and outperforming competitors. From product development and pricing strategies to market penetration tactics and strategic partnerships, there are numerous methods businesses can employ to increase their market share.

Product Development and Innovation

- Continuous Improvement : Regularly assess customer needs and preferences to identify areas for product enhancement or innovation.

- Research and Development : Invest in research and development efforts to stay ahead of the competition and introduce new products or features that address emerging market trends or customer demands.

- Differentiation : Differentiate your products from competitors by offering unique features, superior quality, or innovative solutions that provide tangible value to customers.

- Customer Feedback : Gather feedback from customers through surveys , focus groups , or social media to understand their preferences and incorporate their input into product development processes.

Pricing Strategies

- Competitive Pricing : Analyze competitors' pricing strategies and adjust your prices to remain competitive while still maintaining profitability.

- Value-Based Pricing : Emphasize the value proposition of your products or services to justify premium pricing and differentiate yourself from lower-priced competitors.

- Promotional Pricing : Offer discounts, promotions, or bundled pricing strategies to attract price-sensitive customers and encourage trial or repeat purchases.

- Dynamic Pricing : Utilize dynamic pricing algorithms to adjust prices in real-time based on demand, competitor pricing, or other market variables to maximize revenue and market share.

Market Penetration Tactics

- Expand Distribution Channels : Increase market penetration by expanding into new geographic regions or distribution channels to reach untapped customer segments.

- Product Bundling : Bundle complementary products or services together to offer greater value to customers and encourage larger purchases.

- Aggressive Marketing : Launch targeted marketing campaigns or promotions to raise awareness, generate interest, and drive customer acquisition.

- Price Leadership : Establish yourself as a price leader in the market by consistently offering the lowest prices or best value proposition, attracting price-conscious consumers.

Strategic Partnerships and Alliances

- Collaborative Ventures : Form strategic partnerships or alliances with complementary businesses or industry stakeholders to leverage each other's strengths and resources.

- Joint Marketing Efforts : Collaborate on marketing campaigns or co-branding initiatives to amplify reach, increase brand visibility, and attract new customers.

- Distribution Partnerships : Partner with distributors, retailers, or online platforms to expand your product's distribution reach and access new markets or customer segments.

- Technology Partnerships : Collaborate with technology partners to integrate your products or services with theirs, offering enhanced value propositions or expanded functionality to customers.

Marketing and Advertising Campaigns

- Targeted Advertising : Utilize data-driven insights to identify and target specific customer segments with personalized advertising messages and offers.

- Content Marketing : Create informative, engaging content that positions your brand as a thought leader in your industry and attracts potential customers through inbound marketing efforts.

- Social Media Marketing : Leverage social media platforms to engage with customers, build brand awareness , and drive traffic to your website or online store.

- Influencer Partnerships : Partner with influencers or industry experts to endorse your products or services and reach their followers with authentic, trusted recommendations.

Implementing a combination of these methods tailored to your business's unique strengths, market conditions, and target audience can help drive sustained growth and increase your market share over time.

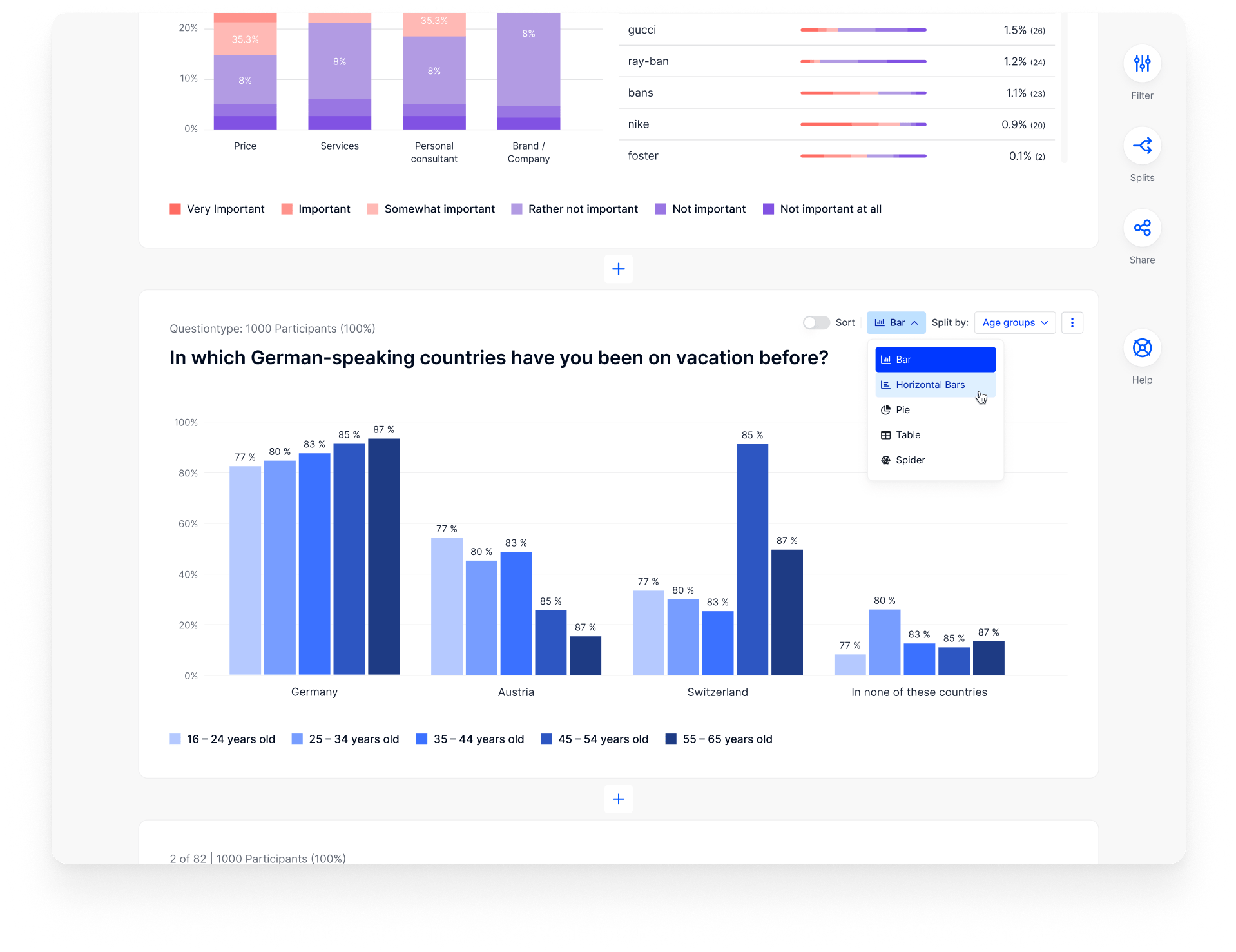

Market Share Analysis Tools and Techniques

Analyzing market share requires the utilization of various tools and techniques to gather data, gain insights, and make informed strategic decisions. From traditional market research methods to advanced data analytics and software solutions, businesses have a plethora of options available to conduct comprehensive market share analysis.

Surveys and Market Research

Surveys and market research serve as foundational tools for gathering valuable insights into consumer preferences, behavior, and market dynamics. By collecting data directly from customers or target demographics, businesses can obtain actionable information to inform their market share analysis and strategic planning efforts.

- Customer Surveys : Conducting surveys allows businesses to gather feedback directly from customers regarding their preferences, satisfaction levels, and purchasing behavior. This data provides valuable insights into factors influencing market share and helps identify opportunities for improvement.

- Market Segmentation : Market segmentation studies divide the target market into distinct groups based on demographic , psychographic , or behavioral characteristics. By understanding the unique needs and preferences of different customer segments, businesses can tailor their strategies to effectively target and capture market share within each segment.

When conducting market share analysis, leveraging tools like Appinio for data collection can be a game-changer. By seamlessly integrating consumer feedback into your analysis process, you gain invaluable insights that drive strategic decision-making and bolster your market share. With Appinio's intuitive platform and global reach, unlocking actionable insights has never been easier.

Ready to supercharge your market share strategies? Book a demo today and see the power of real-time consumer insights in action!

Competitive Intelligence

Competitive intelligence involves gathering and analyzing information about competitors' strategies, strengths, weaknesses, and performance to gain insights and identify opportunities for competitive advantage. By monitoring competitors' market share, product offerings, pricing strategies, and marketing initiatives, businesses can benchmark their performance and develop strategies to outperform competitors and gain market share.

- Competitor Analysis : Conducting thorough competitor analysis allows businesses to assess competitors' market share position, identify areas of vulnerability, and capitalize on opportunities for differentiation. By understanding competitors' strategies and tactics, businesses can refine their own strategies to gain a competitive edge and increase market share.

- Benchmarking : Benchmarking compares key performance metrics, such as market share, sales growth, and profitability, against industry peers or best-in-class competitors. Benchmarking provides valuable insights into areas where a company may be underperforming relative to competitors and informs strategic initiatives to close performance gaps and improve market share.

Data Analytics and Software Solutions

Advancements in data analytics and software solutions have revolutionized market share analysis by enabling businesses to analyze large volumes of data quickly and efficiently, uncovering actionable insights and trends that drive strategic decision-making.

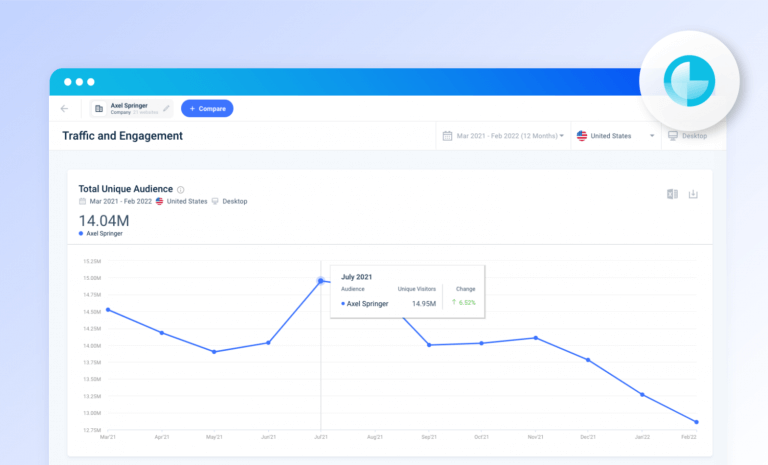

- Market Share Tracking Tools : Market share tracking tools aggregate data from various sources, such as sales data, customer surveys, and industry reports, to provide real-time visibility into market share trends and performance metrics. These tools enable businesses to monitor changes in market share, assess the impact of strategic initiatives, and make data-driven decisions to optimize market share growth.

- Predictive Analytics : Predictive analytics leverages historical data and statistical algorithms to forecast future market trends, customer behavior, and competitive dynamics. By identifying patterns and correlations in market data, predictive analytics empowers businesses to anticipate market shifts, proactively respond to changing conditions, and position themselves for success in the marketplace.

SWOT Analysis

SWOT analysis is a strategic planning tool that evaluates a company's strengths, weaknesses, opportunities, and threats to inform decision-making and strategy development. By conducting a SWOT analysis, businesses can assess their internal capabilities, external market conditions, and competitive landscape to identify areas for improvement and opportunities for growth.

Market Share Dashboards and Reports

Market share dashboards and reports provide comprehensive visualizations and analysis of market share data, enabling businesses to track performance, identify trends, and communicate insights effectively across the organization.

- Visualizations : Market share dashboards utilize charts, graphs, and other visualizations to present market share data in a clear and intuitive format, enabling stakeholders to quickly understand trends and performance metrics.

- Key Performance Indicators (KPIs) : Market share dashboards typically include key performance indicators, such as market share by product category, geographic region, or customer segment, to provide insights into performance drivers and areas for improvement.

- Customization : Market share dashboards can be customized to meet the specific needs of different stakeholders, allowing users to drill down into detailed data, compare performance over time, and generate actionable insights tailored to their roles and responsibilities.

By leveraging a combination of these tools and techniques, businesses can conduct comprehensive market share analysis, gain valuable insights into market dynamics, and develop strategies to increase their market share and drive sustainable growth.

Market Share Analysis Challenges

Analyzing market share comes with its own set of challenges and potential pitfalls that businesses must navigate to ensure accurate interpretation and effective decision-making. Understanding these challenges is essential for mitigating risks and maximizing the value derived from market share analysis.

- Data Accuracy and Reliability : Market share analysis relies on accurate and reliable data sources. However, obtaining accurate market share data can be challenging due to factors such as incomplete or outdated data, inaccuracies in reporting, and discrepancies between different data sources. Ensuring data accuracy and reliability requires rigorous validation processes and cross-referencing multiple sources to verify the integrity of the data .

- Interpreting Market Share Changes : Fluctuations in market share can be influenced by various factors, including changes in consumer behavior, competitive dynamics, and market conditions. However, interpreting the reasons behind these changes accurately can be complex and requires careful analysis of multiple factors. Failing to accurately interpret market share changes can lead to misguided strategic decisions or missed opportunities for growth.

- External Factors Impacting Market Dynamics : Market share analysis is influenced by external factors beyond the company's control, such as economic conditions, regulatory changes, and geopolitical events. These external factors can have a significant impact on market dynamics, customer behavior, and competitive dynamics, making it challenging to predict and respond effectively to market shifts.

- Overemphasis on Market Share Metrics : While market share is an important metric for assessing competitive positioning and performance, it should not be viewed in isolation or given undue weight in decision-making. Overemphasizing market share metrics can lead to a narrow focus on short-term gains at the expense of long-term sustainability and profitability. It's essential to consider other key performance indicators, such as profitability, customer satisfaction, and brand equity , in conjunction with market share metrics to gain a holistic view of performance.

- Competitive Response and Counterstrategies : Changes in market share can trigger competitive responses from rivals, such as price adjustments, product innovations, or aggressive marketing campaigns. Anticipating and responding effectively to competitive actions requires proactive monitoring of competitors' strategies and market dynamics. Failing to anticipate competitive responses can undermine the effectiveness of market share initiatives and impede market share growth.

Navigating these challenges requires a proactive approach to market share analysis, leveraging robust data sources, advanced analytical tools, and strategic insights to overcome obstacles and capitalize on growth opportunities. By addressing these challenges head-on and continuously refining market share analysis processes, businesses can enhance their competitive position and drive sustainable success in their respective markets.

Conclusion for Market Shares

Market share isn't just a number; it's a powerful indicator of a company's competitive prowess and market position. By understanding and leveraging market share data, businesses can make informed decisions that drive growth, innovation, and customer satisfaction. Whether it's identifying untapped market segments, refining pricing strategies, or strengthening brand positioning, market share analysis is a cornerstone of strategic planning in today's dynamic business environment. So, as you navigate the ever-changing currents of the marketplace, remember the importance of market share as your guiding compass to success. In the end, market share isn't about simply grabbing the biggest slice of the pie; it's about continuously adapting and evolving to stay ahead of the competition. By embracing market share analysis as a strategic tool, businesses can identify opportunities, anticipate challenges, and chart a course towards sustainable growth and profitability. So, as you embark on your journey in the world of business, let market share be your trusted ally, guiding you toward success in the ever-shifting landscape of commerce.

How to Conduct Market Share Analysis in Minutes?

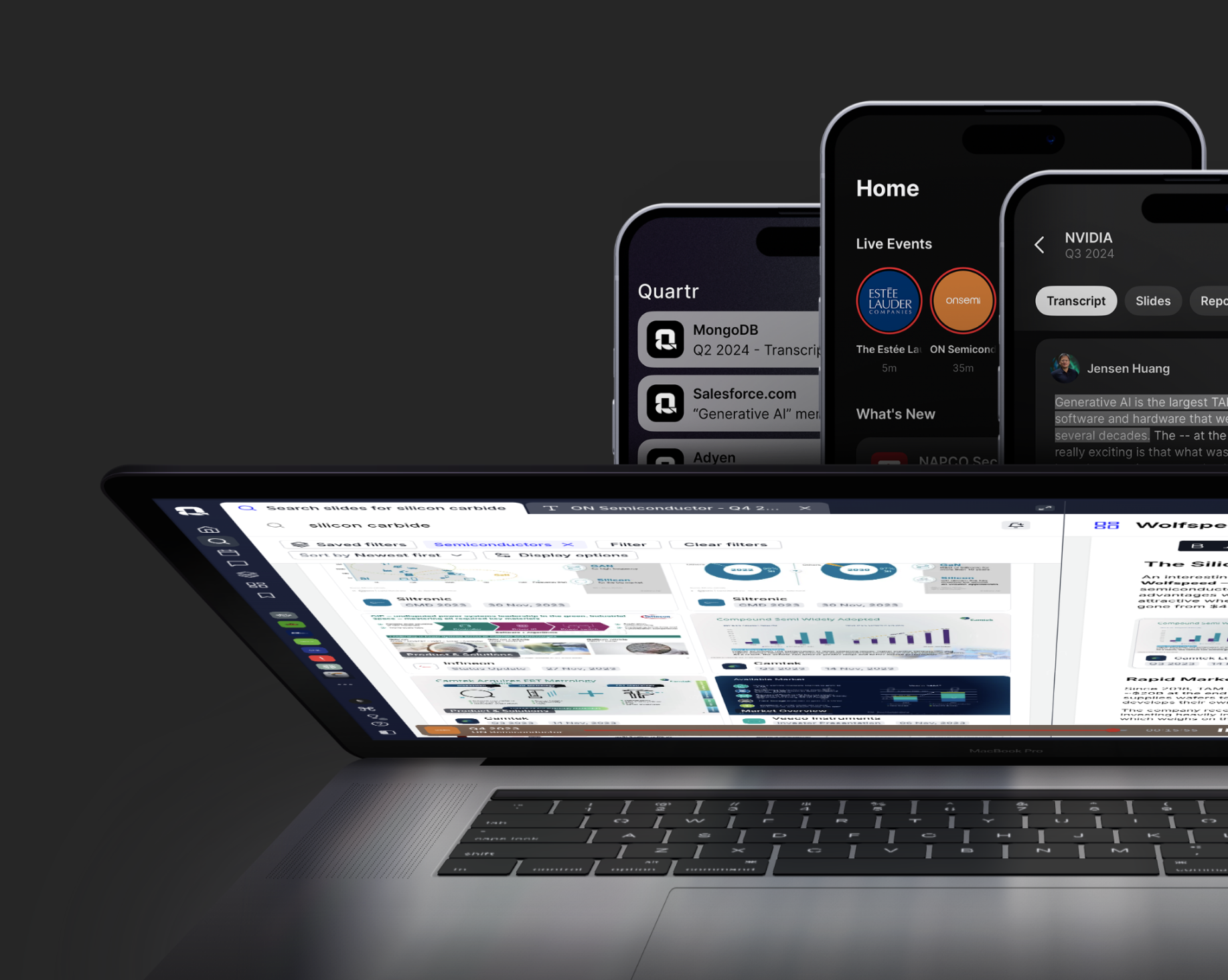

Introducing Appinio , the real-time market research platform that revolutionizes market share analysis. With Appinio, companies can conduct their own market research in minutes, gaining actionable insights that drive strategic decision-making and enhance their market share.

Here's why Appinio is your ultimate tool for market share analysis:

- Instant Insights : From posing questions to uncovering insights, Appinio delivers results in minutes, ensuring that businesses stay ahead of the curve with real-time data-driven decisions.

- User-Friendly Platform : Appinio's intuitive interface empowers users of all levels to conduct market research effortlessly, without the need for specialized research expertise.

- Global Reach : With access to over 90 countries and the ability to define target groups based on 1200+ characteristics, Appinio enables businesses to gather insights from diverse consumer demographics, ensuring comprehensive market share analysis.

Get free access to the platform!

Join the loop 💌

Be the first to hear about new updates, product news, and data insights. We'll send it all straight to your inbox.

Get the latest market research news straight to your inbox! 💌

Wait, there's more

07.05.2024 | 29min read

Interval Scale: Definition, Characteristics, Examples

03.05.2024 | 29min read

What is Qualitative Observation? Definition, Types, Examples

02.05.2024 | 32min read

What is a Perceptual Map and How to Make One? (+ Template)

- Search Search Please fill out this field.

What Is Market Share?

Calculating market share, benefits of market share, market share impact.

- How to Increase Market Share

Market Share Example

- Market Share FAQs

The Bottom Line

- Business Essentials

Market Share: What It Is and the Formula for Calculating It

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

Market share is the percent of total sales in an industry generated by a particular company. Market share is calculated by dividing the company's sales over the period by the industry's total sales over the same period. This metric is used to give a general idea of the size of a company in relation to its market and competitors. The market leader in an industry is the company with the largest market share.

Key Takeaways

- Market share represents the percentage of an industry, or a market's total sales, earned by a particular company over a specified period.

- Market share is calculated by dividing a company's sales by the total sales of the industry over a period.

- This metric is used to give a general idea of the size of a company in relation to its market and competitors.

- A market leader is a company in an industry that has the highest market share and generally wields the most influence.

- Ways to increase market share include implementing new technologies, generating customer loyalty, and acquiring competitors.

Investopedia / Candra Huff

A company's market share is its portion of total sales in relation to the market or industry in which it operates. To calculate a company's market share, first determine a period you want to examine. It can be a fiscal quarter, year, or multiple years .

Next, calculate the company's total sales over that period. Then, find out the total sales of the company's industry. Finally, divide the company's total revenues by its industry's total sales. For example, if a company sold $100 million in tractors last year domestically, and the total amount of tractors sold in the U.S. was $200 million, the company's U.S. market share for tractors would be 50%.

The calculation for market share is usually done for specific countries or regions, e.g., North America or Canada. Investors can obtain market share data from various independent sources, such as trade groups and regulatory bodies, and often from the company itself; however, some industries are harder to measure accurately than others.

Formula for Market Share

Market Share = Total Company Sales / Total Industry Sales

Investors and analysts monitor increases and decreases in market share carefully, as this can be a sign of the relative competitiveness of the company's products or services. As the total market for a product or service grows, a company that is maintaining its market share is growing revenues at the same rate as the total market. A company that is growing its market share will be growing its revenues faster than its competitors.

Gains or losses in market share can have a significant impact on a company's stock performance , depending on industry conditions.

Market share increases can allow a company to achieve greater scale with its operations and improve profitability. A company can try to expand its market share by lowering prices, using advertising, or introducing new or different products. In addition, it can also grow the size of its market share by appealing to other audiences or demographics .

Changes in market share have a larger impact on the performance of companies in mature or cyclical industries where there is low growth. In contrast, changes in market share have less impact on companies in growth industries . In these industries, the total pie is growing, so companies can still be growing sales even if they are losing market share. For companies in this situation, the stock performance is affected more by sales growth and margins than other factors.

In cyclical industries , competition for market share is brutal. Economic factors play a larger role in the variance of sales, earnings, and margins, more than other factors. Margins tend to be low, and operations run at maximum efficiency due to competition. Since sales come at the expense of other companies, they invest heavily in marketing efforts or even loss leaders to attract sales.

In these industries, companies may be willing to lose money on products temporarily to force competitors to give up or declare bankruptcy . Once they gain greater market share and competitors are ousted, they attempt to raise prices. This strategy can work, or it can backfire, compounding their losses; however, this is the reason why many industries are dominated by a few big players, such as discount wholesale retail with stores including Sam's Club, BJ's Wholesale Club, and Costco.

How Can Companies Increase Market Share?

A company can increase its market share by offering its customers innovative technology, strengthening customer loyalty, hiring talented employees, and acquiring competitors.

New Technology

Innovation is one method by which a company may increase market share . When a firm brings to market a new technology its competitors have yet to offer, consumers wishing to own the technology buy it from that company, even if they previously did business with a competitor. Many of those consumers become loyal customers, which adds to the company's market share and decreases market share for the company from which they switched.

Customer Loyalty

By strengthening customer relationships, companies protect their existing market share by preventing current customers from jumping ship when a competitor rolls out a hot new offer. Better still, companies can grow market share using the same simple tactic, as satisfied customers frequently speak of their positive experiences to friends and relatives who become new customers. Gaining market share via word of mouth increases a company's revenues without concomitant increases in marketing expenses.

Talented Employees

Companies with the highest market share in their industries almost invariably have the most skilled and dedicated employees. Bringing the best employees on board reduces expenses related to turnover and training and enables companies to devote more resources to focus on their core competencies . Offering competitive salaries and benefits is one proven way to attract the best employees; however, employees in the 21st century also seek intangible benefits such as flexible schedules and casual work environments.

Acquisitions

Lastly, one of the surest methods to increase market share is acquiring a competitor . By doing so, a company accomplishes two things. It taps into the newly acquired firm's existing customer base, and it reduces the number of firms fighting for a slice of the same pie. Shrewd executives, whether in charge of small businesses or large corporations, always have their eye out for a good acquisition deal when their companies are in a growth model.

All multinational corporations measure success based on the market share of specific markets. China has been an important market for companies, as it is still a fast-growing market for many products. Apple Inc., for example, uses its market share numbers in China as a key performance indicator for the growth of its business.

Apple's market share in China's smartphone market has varied over the years. For instance, in Q3 2022, it had 14% of the market. In Q4 of 2023, it controlled 21% of the market.

Market share shows the size of a company, a useful metric in illustrating a company’s dominance and competitiveness in a given field. Market share is calculated as the percentage of company sales compared to the total share of sales in its respective industry over a period. A company’s market share can influence its operations significantly, namely, its share performance, scalability, and prices that it asks for its products or services.

Why Is Market Share Important?

Simply put, market share is a key indicator of a company's competitiveness. When a company increases its market share, this can improve its profitability. This is because as companies increase in size, they can also scale, offering lower prices and limiting their competitors' growth .

In some cases, companies may go so far as operating at a loss in some divisions to push out the competitors or force them into bankruptcy. After this point, the company may increase its market share and further increase prices. In financial markets, market share can significantly affect stock prices, especially in cyclical industries when margins are narrow and competition is fierce. Any marked difference in market share may trigger weakness or strength in investor sentiment.

What Strategies Are Used to Gain Market Share?

To gain greater market share, a company may apply one of many strategies. First, it may introduce new technology to attract customers that may have otherwise purchased from its competitor. Second, nurturing customer loyalty is a tactic that can result in both a solid existing customer base and expansion through word of mouth. Third, hiring talented employees prevents costly employee turnover expenses, allowing the company to prioritize its core competencies instead. Finally, with an acquisition, a company can reduce the number of competitors and acquire their base of customers.

How Do You Measure Market Share?

To determine a company's market share, you divide its total sales by its industry's total sales over a given period. For example, if a company sold $2 million worth of dishwashing liquid and the industry's total sales were $15 million, the company would have a market share of 2/15 = 13.3%

What Is a Low Market Share?

A low market share is considered to be less than half of the market share of the industry leader. So if the industry leader has a market share of 40% and another company has a market share of 10%, that company would be considered to have a low market share as 10% is less than 20% (half of 40%).

Market share is the percent of total industry sales a company has. The higher the market share, the more sales a company has than its competitors in their industry. Market share indicates how large a company is and how much influence it has in its industry. It can also be an indicator of growth and success.

Companies generally seek to increase their market share. Ways to do this are implementing new technologies, delivering a higher quality product, implementing good marketing, acquiring competitors, and generating customer loyalty.

Counterpoint. " China Smartphone Market Share: By Quarter ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-457983783-571b660e3df78c5640efb463.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

When & How to Calculate Market Share (With Formulas)

What is Market Share?

One of the first steps to building a business is understanding the market and understanding the viability of a successful business. Regardless if the goal is to be a multi-billion dollar company or a local joint that can sustain a few employees — understanding the market, and your share of the market is vital.

As Investopedia puts it , “Market share is the percent of total sales in an industry generated by a particular company. Market share is calculated by taking the company’s sales over the period and dividing it by the total sales of the industry over the same period. This metric is used to give a general idea of the size of a company in relation to its market and its competitors. The market leader in an industry is the company with the largest market share.”

Why is Market Share Important to Understand?

Understanding the market share is vital to determining the viability, and success of a company. In the earliest days, market share will help understand if a business is worth pursuing. Later in a business’s life, it can help stakeholders understand how they are performing compared to their competitors and can help shape roadmaps for future markets and products.

When building out financial models and projections , market share can certainly play a role. Market share has the opportunity to help shape and impact your future go-to-market strategy and product development. \

On the flip side, understanding your market share can oftentimes help shape your financing options. Your ability to capture a % of a market, large or small, will help funders and lenders understand the likelihood of receiving a return at a later date. For example, if you’re pursuing venture capital you need to demonstrate you can build a large business that will generate returns for them.

How to Calculate Market Share

Revenue vs. units/customer count.