This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

Financial Accounting and Reporting Classroom Materials

Financial Accounting and Reporting is an important part of the accounting curriculum. The skills students learn in your classroom will not only prepare them for more advanced courses, but to one day succeed in a career. The below are supplemental curriculum resources that the AICPA Academics team have reviewed and think can be used in the classroom.

Award-Winning Curricula

The Academics team is proud to offer award-winning curricula designed to encourage faculty and expand the knowledge of accounting students. The curricula below is from the Accounting Professors Curriculum Resource tool and has been recognized for excellence with the Bea Sanders/AICPA Innovation and Teaching Award , the George Krull/Grant Thornton AAA Innovation in Junior and Senior-Level Teaching Award, or the Mark Chain/FSA Innovation in Graduate Teaching Award .

- A Better Way to Teach Effective Interest Method Related Problems in Accounting This resource presents a simpler method of teach accounting problems involving the use of the effective interest method. The method stimulates student interest by focusing on the economics of the transaction and relating it to real-life examples.

- Accounting in the Headlines: A News Blog for the Introductory Accounting Classroom This resource shares Wendy Tietz's "Accounting in the Headlines" blog in which she writes stories about real-life companies and events that can be used in the accounting classroom to illustrate introductory financial and managerial accounting concepts.

- Accounting Challenge (ACE): Mobile-Gaming App for Learning Accounting Accounting Challenge is the first mobile-gaming app for teaching financial accounting. ACE aims to enhance learning of accounting outside the classroom by engaging students to play and learn accounting on the go.

- A FASB Accounting Standards Codification Project for Introductory Financial Accounting This exercise is designed as a team project in which introductory accounting students act as a consultants to a client seeking guidance on issues surrounding a start-up venture. Students must access and cite the Codification as the basis for the materials they submit in fulfillment of the project requirements.

- Attracting the Best and Brightest to Accounting: Establishing an Honors Accounting Course This resource presents one school's approach to attracting and recruiting the best and brightest students toward accounting by offering an honors accounting course.

- Beyond Debits and Credits... Service Learning in Accounting This resource presents a service learning project implemented in two accounting courses to enhance student skills in communication and teamwork.

- Business From the Idea to the Seasoned Offering: Accounting and Financial Statements Reflecting Business Activities This project takes accounting education from bookkeeping to holistic active business learning including how financial statements build to reflect the business.

- Chocolate: Accounting as a First year Seminar This resource provides a thematic approach at combining first year seminars and accounting programs using student activities that are simultaneously engaging and assessable.

- Creative Strategies for Teaching MBA Level Accounting This resource presents a new concept for teaching accounting to MBA level students. At its heart, accounting centers on measurement of historical transactions or the measurement of future opportunities. this course turns the focus from rules, to the tools leaders need to manage a complex organization.

- Cultivating Deep Learning in the Principles of Accounting Classes through Philanthropy-Based Education This philanthropy project goes beyond service learning or volunteerism. Students make real decisions that have immediate impacts on their community. Students award funding to not-for-profit agencies based on a competitive proposal process.

- Digital Storytelling for Engaged Student Learning This resource uses digital story telling, a movie, to enhance students' technical competence in accounting. The story uses 12 episodes to follow three young business graduates who started their own business and discover along the way the role of financial information in managing a business venture.

- FASB Accounting Standards Codification: Student-Authored Research Exercises This resource is based on the notion that the best way to learn something is to teach it. Students in a financial accounting graduate class demonstrate their master of GAAP research skills by creating research assignments using the FASB Accounting Standards Codification.

- Forming Groups in the Age of YouTube This resource uses a variation of speed dating as a means for forming groups in an introductory accounting class. By learning more about their classmates prior to self-selecting a group this method allows students to choose better groups.

- Getting Started in the Throughbred Horse Business: A Review of Some Basic Accounting Principles This resource provides reinforcement of common accrual accounting concepts centered on the breeding and racing operations of a small thoroughbred horse business. This curriculum is appropriate to use after students have been exposed to fixed assets, inventory, profit and loss and cash flow reporting.

- IFRS Immersion This resource provides instructions for teaching an IFRS course from the standpoint of foreign companies that have already dealt with the problems and issues associated with converting from local GAAP to international GAAP.

- IFRS Projects Using Dual Reporting of IFRS and U.S. GAAP This resource illustrates integrating IFRS learning into financial accounting curricula by incorporating valuable contrasting information from the dual reporting.

- Integrated Accounting Principles: A New Approach to Traditional Accounting Principles Courses This resource describes an integrated accounting principles course that combines traditional financial and managerial accounting courses into a single six hour course.

- Introducing Freshmen Students in the Accounting/Finance Course to the Library This resource describes a series of online, interactive tutorials and quizzes to help students learn fundamental concepts and skills of company and industry related research.

- Introduction to Financial Accounting Case Project: Arctic Blast Ice Cream Store This case provides an opportunity for students to apply accounting concepts to a simple business venture. The project lasts 4-6 weeks and covers three distinct phases of the management process: business decision making, performance and evaluation.

- Let's Go to the Movies: Using Movies as an Ethics Assignment This project involves students watching a series of predetermined movies and noting the ethical dilemma. At the end of the semester each student must defend one of the movies as a nominee for "A Must See Ethics Movie" for accounting/business students.

- Mini-responsibility Centers: A Strategy for Learning by Leading This resource explains the concept of using mini-responsibility centers (MRCs) to decentralize large financial, managerial and cost accounting courses. In return the students are more focused and engaged.

- Modeling Uncertainty in C-V-P Assignments: Going Beyond the Basics! This resource provides an outline for using the Monte Carlo Simulation to offer graduate students an opportunity to rapidly come to insights about probabilistic model building and interpretation. The simulation combines quantitative skills and qualitative skills along with reports and presentations.

- Northwind Data Query Exercise This project encourages students to consider the evolution of data sources for financial reporting and evaluate how to acquire and manipulate information in this emerging business reality; by actually practicing queries and exporting information to worksheets.

- Reinventing Student Engagement and Collaboration within Introductory Accounting Courses This resource provides ideas for increasing engagement and collaboration in the introductory accounting class. Examples include student projects, flipped classroom applications and in-class problems.

- Responsibilities and Choices: An Active Engagement Exercise for Introductory Accounting Courses This exercise provides students with an opportunity to perform a basic due diligence task, complete a relatively simple working paper to document their work and make a decision. The exercise has embedded moral temptation and ethical issues and examines ethical choices that students make in the presence of time pressure and reward structures that encourage aggressive performance.

- TeachingIFRS.com This document provides information on TeachingIFRS.com which was created in response to the rapid growth of IFRS and lack of high quality and effective teaching resources. The site consolidates and provides links to numerous freely available IFRS pedagogical materials.

- Testing Critical Thinking Skills in Accounting Principles This resource describes a method for testing critical thinking skills in an accounting principles course. Using this method, each testing period is divided into two parts. First, students complete an individual traditional test. The second part is a critical thinking exercise called "the challenge problem".

- The Accounting Profession Post Sarbanes-Oxley: An Approach to Impart Knowledge About the Conceptual Framework and Attract Students to the Accounting Major This document provides the description of a program entitled "The Accounting Profession Post Sarbanes-Oxley". The program provides students with an opportunity to better understand important elements of the conceptual framework. It also provides an overview of the career opportunities in accounting.

- The Accounting Tournament - March Madness in Financial Accounting This resource describes implementation of an end of year comprehensive review using brackets as a model. Students are randomly placed in the bracket and compete against each other for extra credit points.

- The Amazing Accounting Race: An Introductory Accounting Semester Project This project engages students with an exciting internet race around the professional world of accounting. Students obtain clues to complete tasks, encounter detours, road blocks and fast forwards. The assignments utilize students' synthesis skills and computer application skills as they collect facts about accounting careers from the internet and assemble data in an organized format.

- The College to Professional Experience This resource outlines a program that serves to better prepare students for the "real world" by changing the perception of education from "learning by doing" to "doing and making to learn with technology". The project aims to move beyond traditional models of education to leverage technology to facilitate new methods of delivery and understanding.

- The Farming Game and the Introductory Financial Accounting Course: An Accounting Simulation The Farming Game enables students to develop many of the skill-based competencies needed by students entering the accounting profession, regardless of career path. The Game provides experiential learning of various accounting principles. It is a learning opportunity that offers students a degree of reality and a larger view of the system.

- Understand FX Risk by Playing Monopoly This resource uses a short version of Monopoly to understand the FX risk impact on net income.

- Back to the Future: Using Accounting History to Explore Professional Opportunities In this project students read an article about a period of time in accounting history and present their findings to the class in a video format. Students then tie what they have learned in the presentations to the field of accounting today as well as the future.

- From Pacioli to Picasso: Using Art to Enhance Critical Thinking in Accounting Capstone Courses This resource outlines using name cards, picture drawings and classic artwork to help students enhance their critical thinking skills. The exercise sets the tone for a course that requires them to think about more than rules and regulations and instead delve into the "why" and "what could be."

- Digging Deep: Using Forensic Analytics as a Context to Teach Microsoft Excel and Access This resource describes a graduate level case that focuses on the development of technology skills through the lens of forensic analysis.

- Who Moved My Classroom? Community Linked Learning and Assessment This resource describes three exercises that expand learning beyond the classroom. The first exercise allows students to discover the linkage between classroom studies and what practitioners do in the "real world". The second allows students to apply the COSO model to internal controls. The third requires students to interpret financial statements for a friend.

Additional Materials

Here are additional materials we reviewed and think are useful to incorporate into the classroom.

- IIRC Database of Research on Integrated Reporting The International Integrated Reporting Council (IIRC) launched the <IR> Academic Database, a searchable collection of more than 200 articles, books, chapters, dissertations, and other pieces of scholarly research on the advancement, adoption, and practice of integrated reporting.

- A destination is only as good as its compass. The new My 360 is here to help you create a free plan personalized to your financial needs by helping guide you through all the resources 360 Degrees of Financial Literacy has to offer.

We are the American Institute of CPAs, the world’s largest member association representing the accounting profession. Our history of serving the public interest stretches back to 1887. Today, you'll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education and consulting.

About AICPA

- Mission and History

- Annual Reports

- AICPA Media Center

- AICPA Research

- Jobs at AICPA

- Order questions

- Forgot Password

- Store policies

Association of International Certified Professional Accountants. All rights reserved.

- Terms & Conditions

- CRM Asignment Help

- MBA Assignment Help

- Statistics Assignment Help

- Market Analysis Assignment Help

- Business Development Assignment Help

- 4p of Marketing Assignment Help

- Pricing Strategy Assignment Help

- Operations Management Assignment Help

- Corporate Strategy Assignment Help

- Change Management Assignment Help

- Supply Chain Management Assignment Help

- Human Resource Assignment Help

- Management Assignment Help

- Marketing Assignment Help

- Strategy Assignment Help

- Operation Assignment Help

- Marketing Research Assignment Help

- Strategic Marketing Assignment Help

- Project Management Assignment Help

- Strategic Management Assignment Help

- Marketing Management Assignment Help

- Business Assignment Help

- Business Ethics Assignment Help

- Consumer Behavior Assignment Help

- Conflict Management Assignment Help

- Business Statistics Assignment Help

- Managerial Economics Assignment Help

- Project Risk Management Assignment Help

- Nursing Assignment Help

- Clinical Reasoning Cycle

- Nursing Resume Writing

- Medical Assignment Help

- Financial Accounting Assignment Help

- Financial Services Assignment Help

- Finance Planning Assignment Help

- Finance Assignment Help

- Forex Assignment Help

- Behavioral Finance Assignment Help

- Personal Finance Assignment Help

- Capital Budgeting Assignment Help

- Corporate Finance Planning Assignment Help

- Financial Statement Analysis Assignment Help

- Accounting Assignment Help

- Solve My Accounting Paper

- Taxation Assignment Help

- Cost Accounting Assignment Help

- Managerial Accounting Assignment Help

- Business Accounting Assignment Help

- Activity-Based Accounting Assignment Help

- Economics Assignment Help

- Microeconomics Assignment Help

- Econometrics Assignment Help

- IT Management Assignment Help

- Robotics Assignment Help

- Business Intelligence Assignment Help

- Information Technology Assignment Help

- Database Assignment Help

- Data Mining Assignment Help

- Data Structure Assignment Help

- Computer Network Assignment Help

- Operating System Assignment Help

- Data Flow Diagram Assignment Help

- UML Diagram Assignment Help

- Solidworks Assignment Help

- Cookery Assignment Help

- R Studio Assignment Help

- Law Assignment Help

- Law Assignment Sample

- Criminology Assignment Help

- Taxation Law Assignment Help

- Constitutional Law Assignment Help

- Business Law Assignment Help

- Consumer Law Assignment Help

- Employment Law Assignment Help

- Commercial Law Assignment Help

- Criminal Law Assignment Help

- Environmental Law Assignment Help

- Contract Law Assignment Help

- Company Law Assignment Help

- Corp. Governance Law Assignment Help

- Science Assignment Help

- Physics Assignment Help

- Chemistry Assignment Help

- Sports Science Assignment Help

- Chemical Engineering Assignment Help

- Biology Assignment Help

- Bioinformatics Assignment Help

- Biochemistry Assignment Help

- Biotechnology Assignment Help

- Anthropology Assignment Help

- Paleontology Assignment Help

- Engineering Assignment Help

- Autocad Assignment Help

- Mechanical Assignment Help

- Fluid Mechanics Assignment Help

- Civil Engineering Assignment Help

- Electrical Engineering Assignment Help

- Ansys Assignment Help

- Humanities Assignment Help

- Sociology Assignment Help

- Philosophy Assignment Help

- English Assignment Help

- Geography Assignment Help

- History Assignment Help

- Agroecology Assignment Help

- Psychology Assignment Help

- Social Science Assignment Help

- Public Relations Assignment Help

- Political Science Assignment Help

- Mass Communication Assignment Help

- Auditing Assignment Help

- Dissertation Writing Help

- Sociology Dissertation Help

- Marketing Dissertation Help

- Biology Dissertation Help

- Nursing Dissertation Help

- MATLAB Dissertation Help

- Law Dissertation Help

- Geography Dissertation Help

- English Dissertation Help

- Architecture Dissertation Help

- Doctoral Dissertation Help

- Dissertation Statistics Help

- Academic Dissertation Help

- Cheap Dissertation Help

- Dissertation Help Online

- Dissertation Proofreading Services

- Do My Dissertation

- Business Report Writing

- Programming Assignment Help

- Java Programming Assignment Help

- C Programming Assignment Help

- PHP Assignment Help

- Python Assignment Help

- Perl Assignment Help

- SAS Assignment Help

- Web Designing Assignment Help

- Android App Assignment Help

- JavaScript Assignment Help

- Linux Assignment Help

- Mathematics Assignment Help

- Geometry Assignment Help

- Arithmetic Assignment Help

- Trigonometry Assignment Help

- Calculus Assignment Help

- Arts Architecture Assignment Help

- Arts Assignment Help

- Case Study Assignment Help

- History Case Study

- Case Study Writing Services

- Write My Case Study For Me

- Business Law Case Study

- Civil Law Case Study Help

- Marketing Case Study Help

- Nursing Case Study Help

- ZARA Case Study

- Amazon Case Study

- Apple Case Study

- Coursework Assignment Help

- Finance Coursework Help

- Coursework Writing Services

- Marketing Coursework Help

- Maths Coursework Help

- Chemistry Coursework Help

- English Coursework Help

- Do My Coursework

- Custom Coursework Writing Service

- Thesis Writing Help

- Thesis Help Online

- Write my thesis for me

- CDR Writing Services

- CDR Engineers Australia

- CDR Report Writers

- Homework help

- Algebra Homework Help

- Psychology Homework Help

- Statistics Homework Help

- English Homework Help

- CPM homework help

- Do My Homework For Me

- Online Exam Help

- Pay Someone to Do My Homework

- Do My Math Homework

- Macroeconomics Homework Help

- Jiskha Homework Help

- Research Paper Help

- Edit my paper

- Research Paper Writing Service

- Write My Paper For Me

- Buy Term Papers Online

- Buy College Papers

- Paper Writing Services

- Research Proposal Help

- Proofread My Paper

- Report Writing Help

- Story Writing Help

- Grant Writing Help

- DCU Assignment Cover Sheet Help Ireland

- CHCDIV001 Assessment Answers

- BSBWOR203 Assessment Answers

- CHC33015 Assessment Answers

- CHCCCS015 Assessment Answers

- CHCECE018 Assessment Answers

- CHCLEG001 Assessment Answers

- CHCPRP001 Assessment Answers

- CHCPRT001 Assessment Answers

- HLTAAP001 Assessment Answers

- HLTINF001 Assessment Answers

- HLTWHS001 Assessment Answers

- SITXCOM005 Assessment Answers

- SITXFSA001 Assessment Answers

- BSBMED301 Assessment Answers

- BSBWOR502 Assessment Answers

- CHCAGE001 Assessment Answers

- CHCCCS011 Assessment Answers

- CHCCOM003 Assessment Answers

- CHCCOM005 Assessment Answers

- CHCDIV002 Assessment Answers

- CHCECE001 Assessment Answers

- CHCECE017 Assessment Answers

- CHCECE023 Assessment Answers

- CHCPRP003 Assessment Answers

- HLTWHS003 Assessment Answers

- SITXWHS001 Assessment Answers

- BSBCMM401 Assessment Answers

- BSBDIV501 Assessment Answers

- BSBSUS401 Assessment Answers

- BSBWOR501 Assessment Answers

- CHCAGE005 Assessment Answers

- CHCDIS002 Assessment Answers

- CHCECE002 Assessment Answers

- CHCECE007 Assessment Answers

- CHCECE025 Assessment Answers

- CHCECE026 Assessment Answers

- CHCLEG003 Assessment Answers

- HLTAID003 Assessment Answers

- SITXHRM002 Assessment Answers

- Elevator Speech

- Maid Of Honor Speech

- Problem Solutions Speech

- Award Presentation Speech

- Tropicana Speech Topics

- Write My Assignment

- Personal Statement Writing

- Narrative Writing help

- Academic Writing Service

- Resume Writing Services

- Assignment Writing Tips

- Writing Assignment for University

- Custom Assignment Writing Service

- Assignment Provider

- Assignment Assistance

- Solve My Assignment

- Pay For Assignment Help

- Assignment Help Online

- HND Assignment Help

- SPSS Assignment Help

- Buy Assignments Online

- Assignment Paper Help

- Assignment Cover Page

- Urgent Assignment Help

- Perdisco Assignment Help

- Make My Assignment

- College Assignment Help

- Get Assignment Help

- Cheap Assignment Help

- Assignment Help Tutors

- TAFE Assignment Help

- Study Help Online

- Do My Assignment

- Do Assignment For Me

- My Assignment Help

- All Assignment Help

- Academic Assignment Help

- Student Assignment Help

- University Assignment Help

- Instant Assignment Help

- Powerpoint Presentation Service

- Last Minute Assignment Help

- World No 1 Assignment Help Company

- Mentorship Assignment Help

- Legit Essay

- Essay Writing Services

- Essay Outline Help

- Descriptive Essay Help

- History Essay Help

- Research Essay Help

- English Essay Writing

- Literature Essay Help

- Essay Writer for Australia

- Online Custom Essay Help

- Essay Writing Help

- Custom Essay Help

- Essay Help Online

- Writing Essay Papers

- Essay Homework Help

- Professional Essay Writer

- Illustration Essay Help

- Scholarship Essay Help

- Need Help Writing Essay

- Plagiarism Free Essays

- Write My Essay

- Response Essay Writing Help

- Essay Assistance

- Essay Typer

- APA Reference Generator

- Harvard Reference Generator

- Vancouver Reference Generator

- Oscola Referencing Generator

- Deakin Referencing Generator

- Griffith Referencing Tool

- Turabian Citation Generator

- UTS Referencing Generator

- Swinburne Referencing Tool

- AGLC Referencing Generator

- AMA Referencing Generator

- MLA Referencing Generator

- CSE Citation Generator

- ASA Referencing

- Oxford Referencing Generator

- LaTrobe Referencing Tool

- ACS Citation Generator

- APSA Citation Generator

- Central Queensland University

- Holmes Institute

- Monash University

- Torrens University

- Victoria University

- Federation University

- Griffith University

- Deakin University

- Murdoch University

- The University of Sydney

- The London College

- Ulster University

- University of derby

- University of West London

- Bath Spa University

- University of Warwick

- Newcastle University

- Anglia Ruskin University

- University of Northampton

- The University of Manchester

- University of Michigan

- University of Chicago

- University of Pennsylvania

- Cornell University

- Georgia Institute of Technology

- National University

- University of Florida

- University of Minnesota

- Help University

- INTI International University

- Universiti Sains Malaysia

- Universiti Teknologi Malaysia

- University of Malaya

- ERC Institute

- Nanyang Technological University

- Singapore Institute of Management

- Singapore Institute of Technology

- United Kingdom

- Jobs near Deakin University

- Jobs Near CQUniversity

- Jobs Near La Trobe University

- Jobs Near Monash University

- Jobs Near Torrens University

- Jobs Near Cornell University

- Jobs Near National University

- Jobs Near University of Chicago

- Jobs Near University of Florida

- Jobs Near University of Michigan

- Jobs Near Bath Spa University

- Jobs Near Coventry University

- Jobs Near Newcastle University

- Jobs Near University of Bolton

- Jobs Near university of derby

- Search Assignments

- Connect Seniors

- Essay Rewriter

- Knowledge Series

- Conclusion Generator

- GPA Calculator

- Factoring Calculator

- Plagiarism Checker

- Word Page Counter

- Paraphrasing Tool

- Living Calculator

- Quadratic Equation

- Algebra Calculator

- Integral Calculator

- Chemical Balancer

- Equation Solver

- Fraction Calculator

- Slope Calculator

- Fisher Equation

- Summary Generator

- Essay Topic Generator

- Alphabetizer

- Case Converter

- Antiderivative Calculator

- Kinematics Calculator

- Truth Table Generator

- Financial Calculator

- Reflection calculator

- Projectile Motion Calculator

- Paper Checker

- Inverse Function Calculator

Australian accounting standards - Financial Reporting Assignment Sample

Instructions for the report AASB 9 (and IFRS 9) Financial Instruments was initially released in December 2014, but it will become effective from financial reporting periods beginning on or after January 1, 2018. This will bring fundamental change to financial instrument accounting when it replaces the existing accounting standard: AASB 139 (IAS 139) Financial Instruments: Recognition and Measurement. Entities reporting financial instruments will need to make several decisions and choices in relation to the transition to the new standard. Many businesses, especially banks and other financial institutions, will be affected by the implementation of the new standard. You can find more information regarding some changes made by the new accounting standard in 2018 and industry impact for various entities from the following links: https://www.pwc.com.au/ifrs/new-standard-financial-instruments.html https://nexia.com.au/news/accounting/aasb-9-financial-instruments-understanding-the basics.

This task requires you to prepare a report to evaluate and comment on information regarding financial instruments provided in the annual report of a company listed on the Australian Stock Exchange (ASX). Your comments or evaluation should comply with the requirements of relevant Australian accounting standards (AASBs)

- Discuss the recognition for financial instruments including financial asset, financial liabilities and equity instruments according to relevant AASBs.

- Discuss the measurement of finical instruments according to related to relevant AASBs.

- Identify different types of financial instruments available in the chosen company. Provide at least one example of each type of financial instrument available in the chosen company and specify recognition and measurement of that financial instrument.

Part B From the perspective of the investors, discuss the potential impact of the adoption of new AASB 9 on assets, liabilities, financial performance and one of selected financial ratios (such as debt/equity ratio) of the chosen company.

Executive Summary The increased globalization and cross-border business relations have made it mandatory for the financial reports of different countries to communicate a similar language. This is achieved through the convergence to IFRS which makes interpretation of financial statements easier and more apt to suit the business requirements. With the effective implementation of the IFRS, entities could have significant changes in their financial reporting. Its implementation is not just restricted to equity instruments or such other long terms loans and receivables but can extend to a few items on the profit and loss account also. This report discusses the financial instruments concepts that are in tune with the IFRS with practical examples from the annual report of a listed company.

Financial instrument recognition IFRS 9 specifies an entity’s classification and its measurement. Further it relates to financial asset or financial liability and other contracts to buy or sell non-financial items. IFRS 9 allows an entity to account for an asset or liability of financial type only when it has become a party to the contract in accordance with the contractual provisions affected by the relevant instruments. At the prior stage, the financial asset recognition and financial liability is made at the fair value with an addition of the costs of transaction that are incurred to acquire the asset or issue the liability. Hence, it is imperative that the recognition should happen at the time when the entity links to obligations of contractual nature, unlike the other IFRS where the emphasis is laid on the future economic benefits (Horton & Serafeim, 2010).

Derecognition of financial asset or removal happens from the financial statements when the expiry happens from that of contractual rights or cash flows or when there is a transfer of the entity and such a transfer leads to the qualification for derecognition (Deegan, 2005).

Derecognition of a financial liability happens when it gets extinguished or in other words, its obligations are discharged or canceled or expires.

1. Measurement of financial instruments according to the relevant AASBs.

Financial Assets : Every entity is expected to follow a business model to manage its financial assets and the cash flows of contractual nature arising and flowing from the assets. Based on this business model, the financial asset recognition is made according to the following criteria:

- Amortized Cost: The financial asset recognition is done at the cost of amortization only if both the conditions listed below are met:

- The asset is held by the entity for the purpose of collection of cash flows of contractual nature and the entity aim is to hold the assets for business purposes.

- Due to the possession of the financial asset, cash flow arises that are solely payments of principal and interest amounts outstanding on the assets (Landsman et. al, 2011)

- FV from a different comprehensive income: In a business model when the aim of holding financial assets is both for the generation of cash flows and for selling financial assets, the classification happens through fair value through income of comprehensive nature (IFRS, 2016). IFRS 9 also provides guidance on whether the business model is meant for managing the assets or for the contractual cash flows or collection of both.

- FV through P/L: If the recognition of financial assets is not done in any of the above two methods, then the financial assets are recognized at FV through P/L. IFRS 9 states that when the business model changes, then a reclassification of all the financial assets has to be done.

Financial Liabilities: Financial liabilities are ascertained in the following ways:

- At FV through PL: The financial liabilities that are not ascertained at amortized cost fall in this category like derivative instruments, other financial liabilities for trading and such liabilities that the entity has specifically classified to be evaluated at the concept (Lai et. al, 2013).

- At cost of Amortization: All financial liabilities are evaluated at amortized cost leaving those measured at fair value through profit and loss (Maria, 2016).

Equity Instruments: IFRS 9 states that the measurement of equity instruments has to be done at FV. The changes in the equity instruments have to be recognized in the P/L account. The exception being for the equity instruments that the entity has opted to present the variances in the comprehensive income.

IFRS 9 provides the option to designate the instrument of equity at FV through other comprehensive income and this option can opt at the initial time. It is an irrevocable option. This classification will result in all the gains and losses being presented under the other comprehensive income except the dividend income which is seen in the income statement.

IFRS 9 even projects way on when the cost might is feasible for FV and when should not be used for fair value.

Thus these are the measurement criteria laid down in IFRS 9.

2. Different types of financial instruments available in ARB Corporation Limited The company selected for discussion and analysis is ARB Corporation Limited. It deals with the manufacture, design, and other engineering matter related to motor vehicles.

The performance of the company has been pretty good and in a growing phase. The revenue, profits, and dividends have all seen a steady increase. It needs to be noted that the companies demand for the products are healthy. It is thus well poised for a long-term business growth (ARB Corporation, 2017).

The financial statements notes contain the details and explanations about the financial assets, financial liabilities, and equity. The below has been extracted from the same. The derivatives that are designated as effective hedging instruments are forward exchange contracts and these are carried at fair values (ARB Corporation, 2017).

- Derivative Financial Instruments are classified under Current Assets. Example – Loans & Receivables Recognition – These financial assets are recognized when the company enters into a contract and the other party is under an obligation and also bound by the performance of the contact. Measurement – These assets are ascertained at the fair value at inception. The subsequent measurement is at the cost of amortization utilizing the method of interest rate. It is tested for impairment at the date of reporting and any impairment gain or loss is recognized in the profit and loss account (ARB Corporation, 2017).

- Derivative financial instruments are classified under current liabilities. Recognition – On similar lines as a financial asset, financial liabilities are recognized upon entering into contractual obligations where both the parties agree to undertake their obligations (Hanlon et. al, 2014).

- Measurement – The financial liabilities mentioned above from third parties are measured at the amortized cost since these are fixed sums of liabilities and do not alter with time (ARB Corporation, 2017). Hence fair value measurement is not adopted for these liabilities. The amortized cost is checked for on the reporting date and the amount of liability outstanding is disclosed in the statement.

- Consolidated statement of changes in equity presents the movements and profit or loss made by the company. Retained Earnings recognize and take into account the movements in FV of cash flow hedges, net of tax (Goodwin, 2008).

Example – Cash Flow Hedges Recognition – There are derivatives of specific nature that are allotted to be instruments of hedging and such derivatives are recognized as Cash flow hedges. For classification under this category of cash flow hedge, the items that generate the cash flows should be realistic (Hanlon et. al, 2014).

Measurement – The changes in the FV of the derivatives on the reporting date are recognized under the equity account in a reserve of hedging of cash flow. The profit or loss arising is passed on to the Income Statement during the same period when such transactions occur, thus mitigating the chances of fluctuations of exchange rate that would have occurred when hedging is not present (Goodwin, 2008).

Part B As the adoption of IFRS is at a phased stage, there are a few standards that are currently in force and being adopted by the company whereas the other IFRS are not currently to be mandatorily followed but available for early adoption by the company (Byard, 2011).

As IFRS 9 simplifies the approach towards the financial assets and liabilities classification and measurement in comparison to AASB 139, there could be a change in the recognition, classification, and measurement of financial assets when the standard is adopted (ARB Corporation, 2017). The change is due to the fact that the standard allows the provision of the fair value of gains or losses in income of comprehensive nature that are not held for trading. This would be the impact of the change in the financial assets recognition and measurement (Byard et. al, 2011).

As per the needs of IFRS 9, the financial liabilities accounting that are provided at FV through PL will only be influenced. Hence no influence will be there on the accounting for entity’s for financial liabilities (ARB Corporation, 2017).

With reference to the cash flow hedge, the requirements of IFRS 9 state that a new model has to be developed which is deeply aligned with the risk management and application will be easy. The implementation cost will be reduced but the model requires extended disclosures. Thus the impact of this new hedge accounting model is yet to be assessed by the company as it is applicable from 1 January 2018.

Out of the items discussed above, financial assets like loans and receivables will not be influenced by IFRS 9. Financial liabilities like trade payables, other creditors and liabilities will also not undergo a significant change in the adoption of IFRS 9 (ARB Corporation, 2017).

The debt-equity ratio of the company is currently Nil as the company is not having borrowings as per the statement of financial position.

Hence another ratio is discussed which is a return on equity which is currently 18.83. Upon adoption of IFRS 9, it is possible that due to the recognition of the financial assets and liabilities which are to be concerned at FV through P/L account, the net profits of the company might increase or decrease (ARB Corporation, 2017). This increase or decrease is largely dependent upon the measurement of fair value which is a result of the overall market conditions on the reporting date. Hence the ratio will accordingly increase or decrease.

Conclusion The significance of IFRS 9 is thus seen in terms of recognition and measurement of financial assets, financial liabilities, and equity. The accounting and disclosure for cash flow hedge is the only item that will require more efforts in terms of the development of a model and extended disclosures. From the investor perspective, it would be evident that the adoption of IFRS 9 will bring the financial statements closer to the current market scenario. Most of the items that were being shown at the current or historical cost figures will now be disclosed at fair values and hence the profitability of the company can either increase or decrease. It will also not facilitate one on one comparison with the prior year figures due to the changed recognition and measurement criteria.

References ARB Corporation. (2017). ARB Corporation Annual report and accounts 2017. Retrieved from: http://www.annualreports.com/Company/ARB-Corporation-Limited [Accessed 25 May 2018]

Byard, D, Li, Y, & Yu, Y. (2011). The effect of mandatory IFRS adoption on financial analysts’ information environment. Journal of Accounting Research, 49(1), 69-96.

Deegan, C. (2005). Australian Financial Accounting. McGraw Hill, Sydney.

Goodwin, J, Ahmed, K & Heaney, R. (2008). The Effects of International Financial Reporting Standards on the Accounts and Accounting Quality of Australian Firms: A Retrospective Study. Journal of Contemporary Accounting & Economics, 4(2), 89-119.

Goodwin, J. & Ahmed, K. (2006). The Impact of International Financial Reporting Standards: Does Size Matter?. Managerial Auditing Journal, 21(5), .460- 475.

Hanlon, D., F. Navissi & G. Soepriyanto (2014). The value relevance of deferred tax attributed to asset revaluations. Journal of Contemporary Accounting & Economics, 10(2): 87-99.

Horton, J. & Serafeim, G. (2010). Market reaction to and valuation of IFRS reconciliation adjustments: first evidence from the UK. Review of Accounting Studies, 15(4): 725-751.

IFRS. (2016). IFRS Application around the world jurisdictional profile. Retrieved from: http://www.ifrs.org/Use-around-the-world/Documents/Jurisdiction-profiles/Australia-IFRS-Profile.pdf [Accessed 25 May 2018]

Lai, C., Lu, M & Shan, Y. (2013).Has Australian financial reporting become more conservative over time?. Accounting & Finance, 53, 731-761.

Landsman, W. R, Maydew, E. L & Thornock, J. R. (2011). The information content of annual earnings announcements and mandatory adoption of IFRS. Journal of Accounting and Economics, 53(2), 34-54.

Maria, W. (2016). The Big Consequences of IFRS: How and When Does the Adoption of IFRS Benefit Global Accounting Firms?. The Accounting Review , 91(4), 1257-1283

CHECK THE PRICE FOR YOUR PROJECT

Number of pages/words you require, choose your assignment deadline, related samples.

- Financial Review assignment on Univeler PLC in a post Pandemic World

- Finance assignment depicting the ratio analysis of Nestle and Unilever and comparing which one is better than the other.

- Finance assignment using budgets and variance analysis for business planning

- Finance assignment evaluating the financial performance of MCDONALD for two consecutive years

- international finance assignment on the effect of Covid 19 on the major global economies

- (AF7006 / AF7011) Finance assignment a critical appreciation for strategic advantage for BHP and Rio Tinto

- Compliance with AASB Standards in JB Hi-Fi Limited Method of Depreciation: Improving Relevance and Authenticity of Financial Reports

- A finance assignment on estimation of the fair value of Alphabet Inc and the suggestion whether the firm may be a profitable choice for investment or not

- Finance assignment providing comparative ratio analysis of British Airways and Virgin Atlantic

- Finance assignment evaluating the reliance on EBITD Aand finding its alternatives

- (BUSM4741) Financial assignment analysing the financial statements of Kogan Com Ltd

- (BUSM1010) Finance assignment analysing the financial performance of Tassal Group Limited(TGR) and Motorcycle Holdings Limited(MTO)

- Finance Management assignment on tax havens for tax management

- (CBE6382) corporate financial management assignment exploring investment strategies for Mcdomalds

- financial resources management assignment for Aus Biotech

- (MBA6003)Finance assignment on adding value when capital markets are seen efficient

- Critical evaluation of the capital structure of Burberry in the finance assignment

- (SOE11444)The role of financial performance assignment research techniques towards determining financial performance measures and targets

- (BU7006)SWOT and PESTLE analysis strategic finance management assignment for JD group

- (BMG704) International finance assignment on the financial performance and the impact of two recent developments of Good year Tire & Rubber

- Financial Decision Making Assignment Focusing On The How Financial Decision Must Be Made By Organisation Heads

- (ACFI7013) International Finance Assignment: Questions and Answers

- Finance Assignment: Risk and Return Analysis in Corporate Finance

- (FIN200) Corporate Financial Management Assignment: Questions and Answers

- Finance Assignment: Impact of US Political and Economic Event on Australian Share Price

Looking for Your Assignment?

FREE PARAPHRASING TOOL

FREE PLAGIARISM CHECKER

FREE ESSAY TYPER TOOL

Other assignment services.

- SCM Assignment Help

- HRM Assignment Help

- Dissertation Assignment Help

- Marketing Analysis Assignment Help

- Corporate Finance Assignment Help

FREE WORD COUNT AND PAGE CALCULATOR

QUESTION BANK

ESCALATION EMAIL

To get answer.

Please Fill the following Details

Thank you !

We have sent you an email with the required document.

- Introduction to Financial Accounting

(4 reviews)

David Annand, Athabasca University

Henry Dauderis

Copyright Year: 2017

Last Update: 2021

Publisher: Lyryx

Language: English

Formats Available

Conditions of use.

Learn more about reviews.

Reviewed by Katheryn Zielinski, Assistant Professor, Minnesota State University Mankato on 6/14/23

The text reading follows typical financial accounting flow. Beginning with the foundational introduction to what accounting is through the full accounting cycle, while including financial statement analysis towards the end of the book. Students... read more

Comprehensiveness rating: 5 see less

The text reading follows typical financial accounting flow. Beginning with the foundational introduction to what accounting is through the full accounting cycle, while including financial statement analysis towards the end of the book. Students will find the format helpful; the voice is student-friendly. There is online homework help for students. Instructors will find the text format friendly to semester-long class as concepts broken down into 13 chapters. The chapters explain the learning outcomes, use examples to express concepts, with chapter summary at end. The topics included are consistent with intro accounting courses.

Content Accuracy rating: 5

No issues noticed with accuracy. The text includes accurate financial accounting information.

Relevance/Longevity rating: 5

For an introductory accounting class with focus on US the concepts covered are typical.

Clarity rating: 5

The content is presented in a student friendly manner. Answers are provided. The extra information is helpful for students wanting extra practice.

Consistency rating: 5

The format and layout of the book chapters are consistent. All users will quickly understand the format as it is applied the same to each chapter. This helps provide consistency for students learning introductory accounting.

Modularity rating: 5

The content within the chapters can be broken-down and assigned as instructor plans for the course length. The manner is which the material is presented flows easily as reading.

Organization/Structure/Flow rating: 5

The text organization is consistent and coherent. Each chapter is presented in same manner.

Interface rating: 5

No observed tech issues. PDF downloaded and used with ease.

Grammatical Errors rating: 5

No grammar or language issues.

Cultural Relevance rating: 5

No cultural insensitive or offensive context noted.

This is a student friendly text. However, students might find a glossary helpful, as well as an index.

Reviewed by Lawrence Overlan, Part-time Professor, Bunker Hill Community College on 6/4/20

I appreciate how the Statement of Cash Flows has a separate chapter towards the end of the book. Might be better to wait until that chapter instead of also discussing it in Chapter One.....lots of material for opening week.... read more

Comprehensiveness rating: 4 see less

I appreciate how the Statement of Cash Flows has a separate chapter towards the end of the book. Might be better to wait until that chapter instead of also discussing it in Chapter One.....lots of material for opening week....

I sampled several problems...all correct.

Hard to make accounting obsolete. All the required material is present.

Problems are presented clearly and with good font size. Excellent color schemes and graphics.

Yes....no problems detected in this area. Very straightforward.

Chapters contain the right amount of content. Not too long with out breakup diagrams or examples etc.

Standard flow of chapters with excellent subdivisions.

To the contrary, the graphics and flow charts break up the material very nicely.

No issues noticed in this area.

Nice work! I will definitely consider adopting.

Reviewed by Patty Goedl, Associate Professor, University of Cincinnati Clermont College on 3/27/18

The text covers all of the topics normally found in an introductory financial accounting (principles of accounting I) text. The table of contents essentially mirrors the table of contents found in the leading texts in this field. I like that... read more

The text covers all of the topics normally found in an introductory financial accounting (principles of accounting I) text. The table of contents essentially mirrors the table of contents found in the leading texts in this field. I like that this text also covers the classified balance sheet, financial disclosures and partnerships.

Content is error-free, accurate, and unbiased.

Relevance/Longevity rating: 4

The content is up-to-date. Introductory accounting does not change often so future updates should be minimal. The authors used the year 2015 in most of the problem and examples. This might make the text "seem" out-of-date in a few years.

The book is clear and concise. The topics are clearly explained and the technical terminology is appropriate for an introductory level.

The writing, style, and formatting are consistent throughout this text.

The text is divided into topical chapters, which is appropriate considering that the concepts build on each other. The chapters are further subdivided into sub-topics. This makes it easy for an instructor to pick which sub-topics to cover.

Excellent organization and flow. The concepts logically build upon each other and the material is presented in a clear fashion.

The HTML interface is excellent. The book has good graphics, end of chapter content, and even video examples.

I did not notice grammatical errors.

The text is not culturally insensitive or offensive in any way

Excellent book that is comparable to any of the leading financial accounting titles. The authors even provide end of chapter problems, videos, and interactive Excel problems for students. Overall, a great resource! I commend the authors for making something of this caliber freely available.

Reviewed by Margarita Maria Lenk, Associate Professor, Colorado State University on 1/7/16

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It is written by Canadian authors, but is relevant to US students. The text begins by explaining the role of financial... read more

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It is written by Canadian authors, but is relevant to US students. The text begins by explaining the role of financial accounting in society, and then describes the underlying structure of double entry accounting systems and the process of recording economic events that impact the value of the organization through the journals and the ledger. The records of these events are then summarized into the primary financial statements. The numeric subtotals and totals on these statements are used to calculate standard financial measures and ratios used to evaluate the organization's performance. The text's organization then proceeds sequentially through the balance sheet accounts, explaining in more detail how the accounting for each category of economic value is recorded and reported. The author's decision to move the most complex content to the end of the book matches how most faculty choose to organize their coverage of these topics.

My reviewed resulted in highest marks regarding accuracy. The only possible concern I would mention here is that the authors use a commonly used technique in chapter two which sometimes leads to students misunderstanding that revenues and expenses are not part of owners' equity until the revenues and expenses are closed at year end to retained earnings. It is my preference to teach introductory students that revenues and expenses are distinct and separate from equity, and then explain that revenues and expenses ultimately get closed to equity. So, this is not an inaccuracy by the authors, just a point that some instructors may want to know before adopting the textbook.

It is my opinion that the content of this textbook will be relevant and current for at least a decade. Any changes made to accounting principles, Canadian or International, will be very easy and straightforward to update.

It is my opinion that the clarity of this text is very high. The authors are succinct and use visuals often to highlight the theoretical structures.

This test is very consistent with the framework that is set up by the authors in the beginning of the text.

The textbook is very clearly divided into separable modules, making it easy for both students to read and for instructors to choose which modules to include in their course.

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It begins by explaining the role of financial accounting in society, and then describes the underlying structure of double entry accounting systems and the process of recording economic events that impact the value of the organization through the journals and the ledger. The records of these events are then summarized into the primary financial statements. The numeric subtotals and totals on these statements are used to calculate standard financial measures and ratios used to evaluate the organization's performance. The text's organization then proceeds sequentially through the balance sheet accounts, explaining in more detail how the accounting for each category of economic value is recorded and reported. The author's decision to move the most complex content to the end of the book matches how most faculty choose to organize their coverage of these topics.

The online text worked perfectly in my Chrome browser. The end of chapter exercises and problems are perfectly formatted on the screen. All assessment materials (quizzes, exams, etc.) are located on a different site that requires registration to have access.

I found the grammar to be very clear, concise and very effective. Because the book is written by Canadians, expenses are sometimes referred to as revenue expenditures, which does not match how US textbooks refer to expenses, but is perhaps a better learning tool, as the expenses are always recorded in the period in which they match the revenue generation, so I support the authors' choices regarding how they refer to the difference between assets (capital expenditures) and expenses (revenue expenditures).

The textbook adequately refers to the international accounting standards. That is the only cultural relevance which is relevant to introductory financial accounting.

I found this textbook and its exercises to be a useful teaching and learning tool. Instructors and students have access to pre-made PowerPoint slides, exercises and problems, and there is the option to enrol in an online service for online assessments, which seem to have student feedback capabilities in addition to assessment gathering capabilities.

Table of Contents

- The Accounting Process

- Financial Accounting and Adjusting Entries

- The Classified Balance Sheet and Related Disclosures

- Accounting for the Sale of Goods

- Assigning Costs to Merchandise

- Cash and Receivables

- Long-lived Assets

- Debt Financing: Current and Long-term Liabilities

- Equity Financing

- The Statement of Cash Flows

- Financial Statement Analysis

- Proprietorships and Partnerships

Ancillary Material

About the book.

This textbook is an adaptation by Athabasca University of the original text written by D. Annand and H. Dauderis. It is intended for use in entry-level college and university courses in financial accounting. A corporate approach is utilized consistently throughout the book.

The adapted textbook includes multiple ancillary student and instructor resources. Student aids include solutions to all end-of-chapter questions and problems, and randomly-generated spreadsheet problems that cover key concepts of each chapter. These provide unlimited practice and feedback for students. Instructor aids include an exam bank, lecture slides, and a comprehensive end-of-term case assignment. This requires students to prepare 18 different year-end adjusting entries and all four types of financial statements, and to calculate and analyze 16 different financial statement ratios. Unique versions can be created for any number of individual students or groups. Tailored solutions are provided for instructors.

The original Annand/Dauderis version of the textbook including .docx files and ancillary material remains available upon request to D. Annand ([email protected]).

About the Contributors

David Annand, EdD, MBA, CA, is a Professor of Accounting in the Faculty of Business at Athabasca University. His research interests include the educational applications of computer-based instruction and computer mediated communications to distance learning, the effects of online learning on the organization of distance-based universities, and the experiences of instructors in graduate-level computer conferences.

David completed his Doctorate in Education in 1998. His thesis deals with the experiences of instructors in graduate-level computer conferences.

Contribute to this Page

The Importance Of Financial Reporting And Analysis: Your Essential Guide

Table of Contents

1) What Is Financial Reporting?

2) Why Is Financial Reporting Important?

3) The Benefits Of Financial Reporting

4) Who Uses Financial Reporting And Analysis?

5) 5 Use-Cases For Financial Reporting

6) Different Ways Of Financial Reporting

7) Common Types Of Financial Reporting

8) Key Elements Of Financial Reporting Systems

9) Financial Reporting And Analysis Trends

While you may already know that a detailed business financial reporting process is important (mainly because it’s a legal requirement in most countries), you may not understand its untapped power and potential. In fact, financial analysis is one of the bedrocks of modern businesses. It offers insight that helps companies remain compliant while streamlining their income or expenditure-centric initiatives.

Utilizing finances data with the help of online data analysis allows you to not only share vital information internally and externally but also leverage metrics or insights to make significant improvements to the area that helps your business flow.

To help you unlock the potential of financial analysis and reporting, we’ve produced this guide to tell you everything you need to know about the topic. Let’s hit it off with a detailed definition.

What Is Financial Reporting And Analysis?

Financial reporting and analysis is the process of collecting and tracking data on a company’s finances on a monthly, quarterly, or yearly basis. Businesses use them to inform their strategic decisions, gain new investors, and comply with tax regulations.

Each of these financial KPIs is incredibly important because they demonstrate a company's overall ‘health’ – at least when it comes to the small matter of money. These types of KPI reports don’t offer much insight into a company’s culture or management structure, but they are vital to success, nonetheless.

As we continue, we’ll explore financial company analysis use cases. But first, it’s worth noting that these reports are crucial for anyone looking to make informed decisions about their business. Financial reporting software and BI reporting tools offer invaluable information on investments, credit extensions, cash flow, and so on. It is also legally required for tax purposes.

That said, various types of financial reporting and analysis can serve different purposes. Some of the most common ones include:

- Income Statement : Also known as profit and loss, an income statement is a financial analysis report that shows the company’s income and expenses over a given period with a focus on four key elements: revenue, expenses, gains, and losses. The main goal of this statement is to understand if the business is making money or not. It does this by summarizing key sales activities, costs of production, and any other operational expenses during an accounting period. The report subtracts the revenue from all expenses to understand how much profit (or loss) the business had.

- Balance Sheet: It provides a detailed overview of a company's assets, liabilities, and stockholders’ equity. Essentially, a balance sheet summarizes the business’s economic health at a given point, usually monthly or quarterly, and can be used for internal or external purposes. On the one hand, it can be reviewed internally by any stakeholder, such as managers or employees, to understand if the company is going in the right direction. On the other hand, anyone interested in investing can use a balance sheet externally, as the report provides useful information about the available resources and how they were financed.

- Cash Flow Statement: In simple words, a cash flow statement shows the amount of cash the company generates and the costs for which the cash is being spent. It contains elements of the income statement and the balance sheet, making it critical to successfully managing a business. A cash flow statement is usually divided into 3 different areas that classify all the cash received and paid. First, we see the operating cash flow, which shows revenue, expenses, gains, and losses, and then we have the investing one, which shows the cash from debt and equity purchases and sales. Lastly, we have the financial one, which reports on long-term liabilities such as loan payments and equity items such as the sales of company stock.

- Statement of shareholder equity: As its name suggests, this report shows the changes in shareholders' equity from the beginning to the end of an observed accounting period, typically a year. It gives investors transparency regarding their equity, how it is fluctuating, and what business activities are responsible for those changes. It does this by calculating the difference between the company’s assets and liabilities, constituting a key part of a balance sheet. However, big corporations might generate it as a separate statement. The statement of shareholders' equity is usually composed of the following elements: preferred and common stock, treasury stock, additional paid-up capital, retained earnings, and unrealized gains and losses, among other things.

- Statement of retained earnings: Connected to the previous report type, the statement of retained earnings shows the accumulated profit of a business after net income has been summed and dividends paid to shareholders. It shows how much earnings a company has made during an observed period and helps owners and decision-makers assess the business's financial situation and evaluate potential reinvestments or growth opportunities based on the retained earnings left for the coming accounting period. It can be generated as a part of a balance sheet, income statement, or separate document.

- ESG reporting: ESG stands for environmental, social, and governance reports. This reporting type has become increasingly popular now that legislators, societal expectations, and investors are turning their attention to the environmental impact of businesses, pressuring them to be transparent about the climate impact of their activities and operations. Because of this growing interest, ESG factors are now considered indicators of a company's long-term success; investors and key stakeholders request that these factors be included in the company's statements. That said, a well-constructed ESG report should include environmental performance metrics such as energy use, greenhouse gas emissions, water usage, and waste generated, social metrics such as labor practices, human rights impact, and diversity efforts, and lastly, governance metrics such as regulatory compliance, board structure, and political contributions, among others. This is especially important now that sustainable technology is considered amongst the biggest growing technology trends of 2024.

Whatever your company’s goals are, with the right analytical approach, you can significantly accelerate the growth of your business. In this post, we will see the power of financial analysis and reporting in detail, look at real-world finance reporting examples, and discuss why this approach should be vital to every modern business strategy.

Now that we’ve explored what we consider a good definition of corporate financial reporting, let’s glance at the importance of these kinds of reports.

Why Is Financial Reporting Important?

A report from McKinsey suggests that leveraging data to create more proficient marketing reports and to make more informed decisions can boost marketing productivity by 15 to 20%, which translates to as much as $200 billion based on the average annual global marketing spend of $1 trillion per year .

If you apply that same logic to the finance sector or department, it’s clear that reporting tools could benefit your business by giving you a more informed snapshot of your activities.

Financial reports offer a wealth of insight that can streamline your business’s fiscal activities. To illustrate the importance of this process further, let’s break these ten primary reasons for corporate financial reporting down into more detail.

1) For taxes

You may have heard the phrase: the only two certainties in this world are death and taxes (or something similar).

That said, taxes are arguably the biggest reason for the importance of financial statement analysis – basically, you have to do it! The government utilizes such reports to ensure you pay your fair share of taxes. If financial reports weren’t legally required, most companies would probably use management dashboards instead (at least for internal decision-making purposes).

The government’s requirements for these documents have created an entire industry of auditing firms (like the “Big 4” of KPMG, Ernst & Young, Deloitte, and PWC, among others) that exist to review companies’ financial reports independently. This auditing process is also a legal requirement.

2) For other companies, investors, shareholders, etc.

If you’re considering investing in a company, it only makes sense that you’ll want to know how well it is doing.

This is where the importance of financial statements comes into play for investors, credit vendors, and banks considering lending money to a company. In these situations, you will need to understand how likely you are to be paid back so that you can charge interest accordingly.

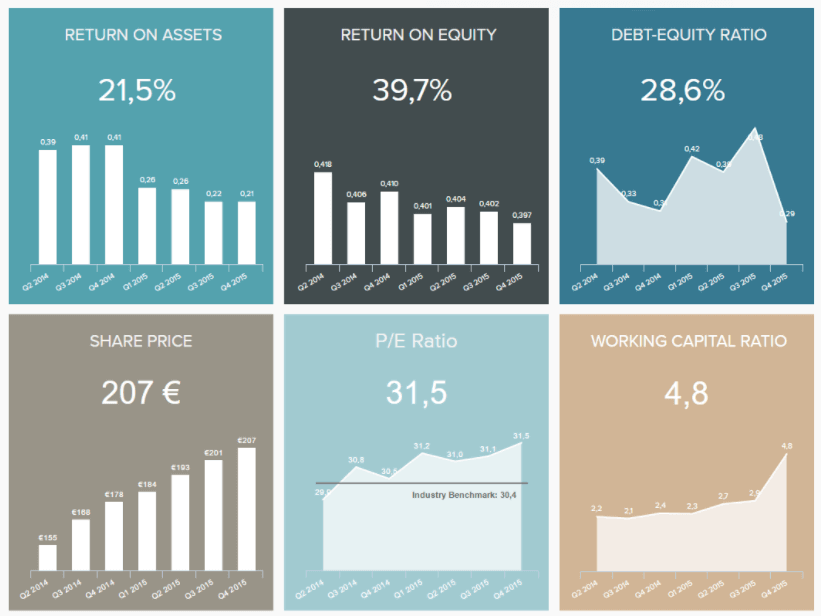

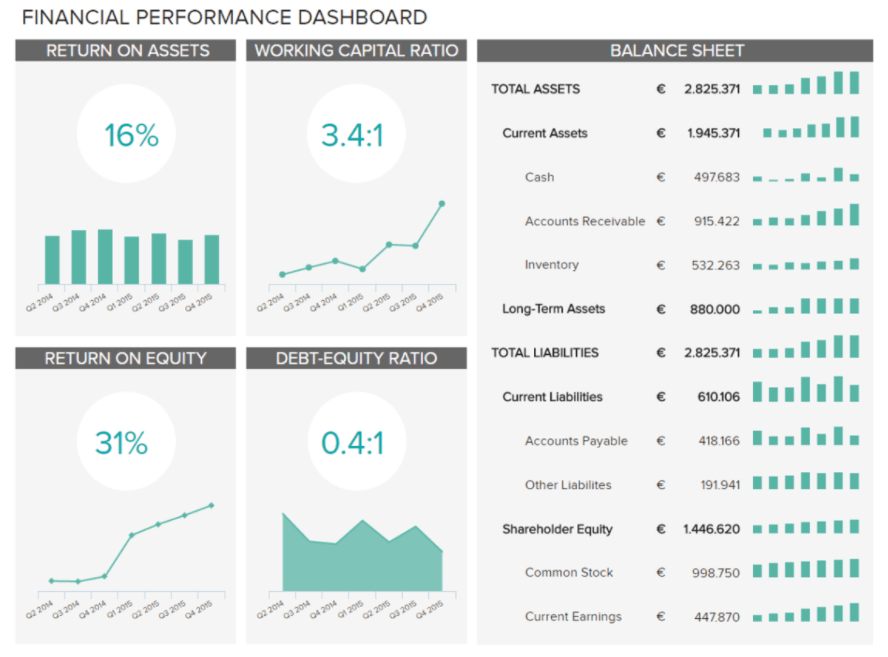

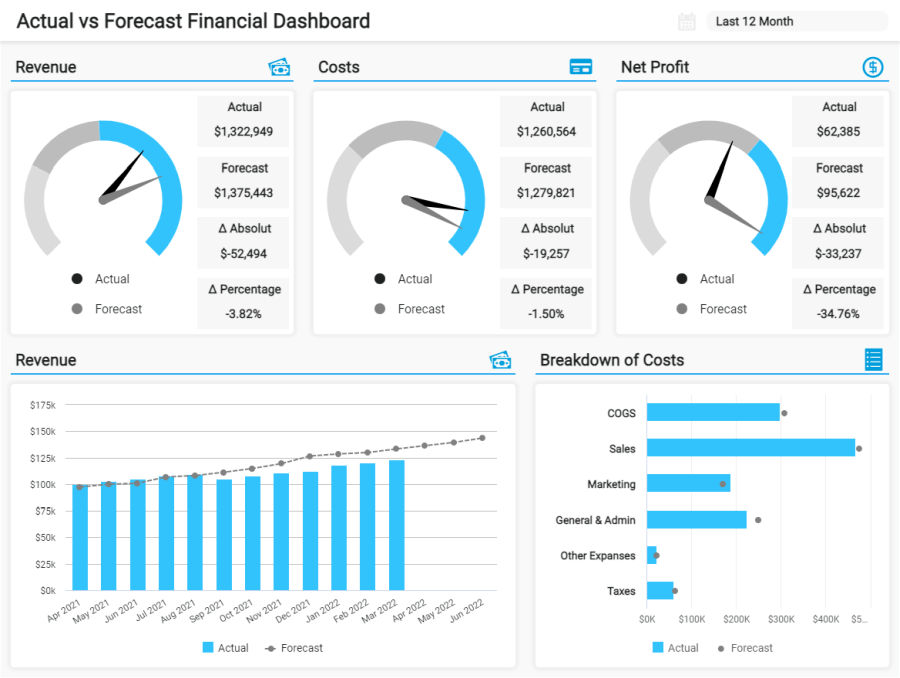

For this purpose, it’s great to have an investor relations dashboard at hand. With metrics such as the return on assets, return on equity, debt-equity ratio, and more, the investor’s dashboard displayed below offers a detailed overview of the company’s performance tracked over a period of time. The value of this tool lies in its interactivity. If you want to take a deeper look at some of these indicators, you just need to click on them, and the entire report will be filtered based on that.

**click to enlarge**

The importance of financial analysis and statements also applies to stakeholders. If you own equity in a firm or are an activist investor who owns a major equity position, then having full disclosure of all assets, liabilities, use of cash, revenues, and associated costs is essential. You will also want to understand if the business is doing something it shouldn’t (such as in the case of Enron).

Due to a series of laws known as Sarbanes-Oxley , there is more standardization/legal cooperation within the world of financial data analysis and reporting. These laws are designed to prevent another situation like, and we’ll say it again – Enron – from happening.

3) For internal decision-making

As mentioned, financial reports are not the best tools for making all internal business decisions. However, they can serve as the ‘bedrock’ for other reports (such as management reports ) that CAN and SHOULD be used to make decisions.

These reports must be as accurate as possible – otherwise, any management reports (and ensuing decisions) based on them will be sitting on a shaky foundation. This is where companies can run into trouble, using legacy methods (such as one massive spreadsheet that multiple users have access to) rather than reaping the benefits of reporting by utilizing financial dashboards instead.

In fact, a survey conducted by Deloitte to generate awareness about the value of good financial analytics reporting states that most respondents have identified an “insufficient level of details” as the main issue when it comes to reporting on finances. This is because the techniques and templates used are too old. Modern online dashboards put these problems in the past by providing at-a-glance information on your company's financial health for both yourself and others in a way that is intuitive and detailed.

Remember: the government (and outside investors) don’t care WHY your financial reports are inaccurate. They’ll just penalize you for being wrong – it’s that cut and dry.

4) For improved internal vision,

Things can quickly fall apart if your financial insights or data are fragmented. Financial analysis and reporting are accurate, cohesive, and widely accessible ways of sharing critical financial information throughout your organization. They help answer a host of vital questions on all aspects of your company’s financial activities, giving internal and external stakeholders an accurate, comprehensive snapshot of the strategic and operational metrics they need to make decisions and take informed action.

5) For building strategies and ensuring profitability

Expanding on the previous point, financial analysis and reporting are critical to building informed strategies and ensuring the business stays profitable. In fact, going back to the Deloitte survey we mentioned earlier, 67% of the respondents believe that the information included in their financial statements is key to “identifying effective ways to reduce costs and to eliminate potential losses to maintain profitability.”

That said, these types of reports become critical to the financial health of a business. It allows managers and other stakeholders to build informed strategies to make the company more profitable while empowering every key player to rely on data for decision-making. With the help of modern online reporting software , companies can find trends and patterns in real-time and monitor their income and expenses to allocate resources smartly.

6) For raising capital and performing audits

Financial reporting and analysis assist organizations, regardless of industry, in raising domestic and overseas capital in a well-managed, fluent way – an essential component to ongoing commercial success in today's competitive digital world.

Also, financial analysis and reporting facilitate statutory audits. Statutory auditors are required to audit an organization's financial statements to express their opinion. Reporting tools or software will give this official, concise, accurate, and compliant information – which, of course, is vital.

7) For managing financial ratios

Ratios are essential to a business’s fiscal management initiatives - and there are many to consider. In this context, ratios represent the fine juggling act businesses must perform to ensure the operation runs efficiently.

Financial ratios also help investors break down the colossal data sets accrued by businesses. A ratio gives your information form and direction, facilitating valuable comparisons on different reporting periods.

Displayed visually, modern financial graphs and dashboards provide invaluable performance-based information at a glance, offering essential tools for accurate benchmarking and real-time decision-making.

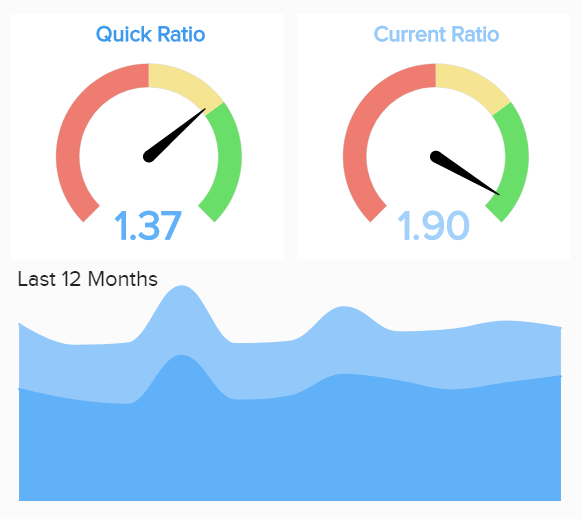

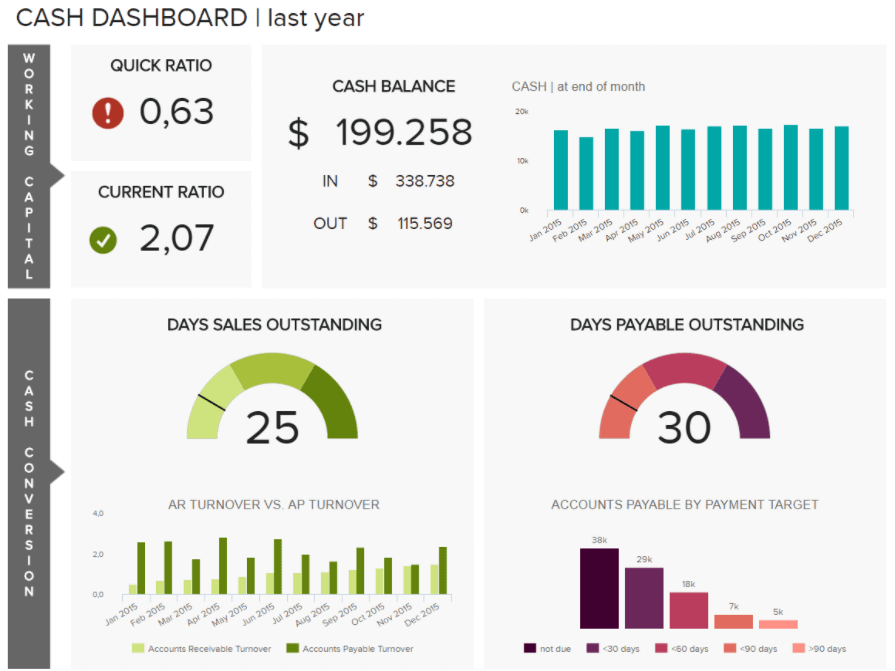

Critical finance analysis ratios include the Working Capital Ratio, Quick Ratio, Return on Equity (ROE), and Berry Ratio. Armed with this wealth of insight, it’s possible to preserve your company’s financial health while developing initiatives that tip the fiscal balance in your favor, boosting your bottom line. The image below is a visual example of financial reporting tracking the quick ratio.

Generated with a professional financial KPI tool , the quick ratio is a metric that tracks the short-term liquidity or near-cash assets that can be turned quickly into cash. The point of this KPI, also known as the acid test ratio, is to include only the assets that can be easily converted into cash, usually within 90 days or so, such as accounts receivable.

8) For accurate projections & predictive strategies

When considering the importance of financial statements to stakeholders, it’s worth mentioning the predictive power of financial analysis.

We’ve explored how financial dashboards offer dynamic visualizations from trend spotting and real-time decision-making. Digging a little deeper, fiscal reporting tools also provide comprehensive insights into a range of financial performance and processes. Historic, real-time, and predictive data combined offer a balanced snapshot of metrics that help users make incredibly accurate projections based on past or emerging trends.

By making projections based on concrete visual data, developing strategies that benefit financial health while nipping any potential issues in the bud is possible.

For example, personal financial management provider Mint.com used predictive analytics to grow its user base and increase its bottom line. Analyzing a mix of consumer data and key financial performance metrics, the company was able to streamline its processes while offering its customers an end goal and working backward.

By providing a predictive goal or aspiration, the business worked in reverse (both internally and externally), developing accurate solutions or strategies that offered the best return on investment (ROI). Not only did this predictive strategy streamline Mint’s internal processes, but the company grew from zero to 1 million subscribers in a relatively short period.

Senior executive Noah Kagan explained the company’s financial triumph:

“Think of it as a road trip. You start with a set destination in mind and then plan your route there. You don’t get in your car and start driving without the hope that you magically end up where you wanted to be.”

9) To lower risk and prevent fraudulent activities

Expanding on our previous point, the depth of data and predictive capabilities of the financial BI dashboard software can significantly mitigate financial risk.

Working with the right mix of metrics, you will begin to see any potential dips in performance or negative patterns unfold intuitively, which means you can take critical actions that prevent potentially devastating monetary calamities.

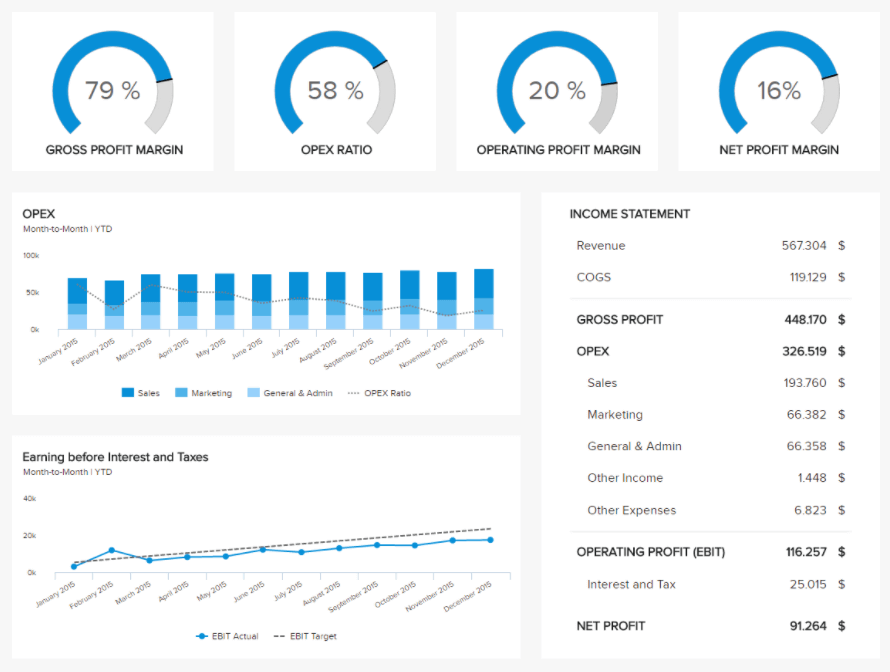

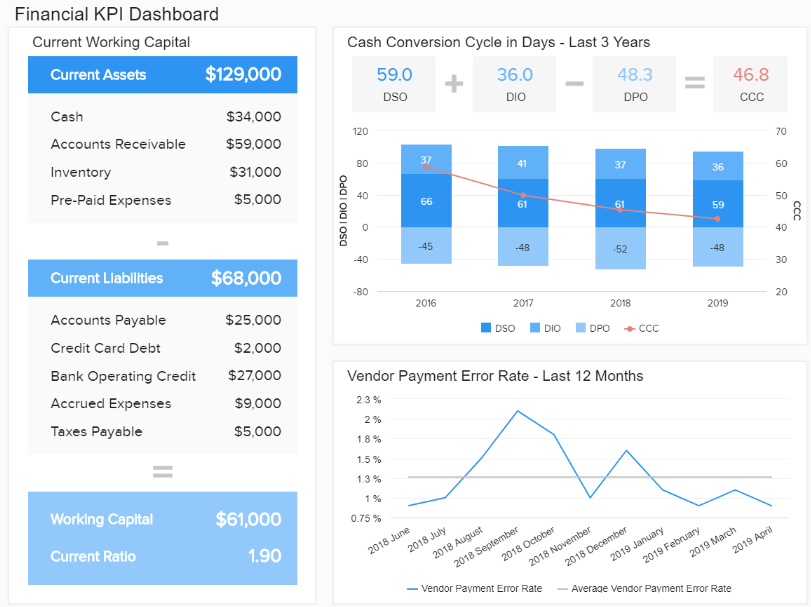

Armed with dynamic, visual, and interactive KPIs, not only can you mitigate financial risk and protect your company from glaring inefficiencies, but you will also be able to make smarter investments and decisions. Here are some of the KPIs that you should focus on for financial protection and growth:

- Gross Profit Margin

- Net Profit Margin

- Working Capital

- Operating Expense Ratio

- Return on Assets

- Return on Equity

- Cash Conversion Cycle

- Vendor Payment Error Rate

In addition to reducing financial risk across the board, an analytics dashboard can also protect your business from fraudulent activity. And, considering 46% of companies across sectors have fallen victim to financial fraud in the past two years, protecting yourself from internal or external cyber-related crime matters now more than ever.