Holding Company Business Plan Template

Written by Dave Lavinsky

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their holding companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a holding company business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Holding Company Business Plan?

A business plan provides a snapshot of your holding company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Holding Company

If you’re looking to start a holding company, or grow your existing holding company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your holding company in order to improve your chances of success. Your holding company business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Holding Companies

With regards to funding, the main sources of funding for a holding company are personal savings, credit cards, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

Finish Your Business Plan Today!

How to write a business plan for a holding company.

If you want to start a holding company or expand your current one, you need a business plan. Below are links to each section of your holding company business plan template:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of holding company you are operating and the status. For example, does your holding company include multiple startups or does it include established companies?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the industry in which you’re competing. Discuss the businesses you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of holding company you are operating.

For example, you might operate one of the following types of holding companies:

- Pure Holding Company : this type of holding company owns a controlling interest in one or more other companies but does not itself produce goods or services, or participate in any additional business operations.

- Mixed Holding Company: this type of holding company owns a controlling interest in one or more other companies and also operates its own business, providing goods or services.

- Immediate Holding Company: this type of business owns controlling interest in one or more other companies, and is itself controlled by another holding company.

- Intermediate Holding Company: this type of business owns controlling interest in one or more other companies, and is a subsidiary of a larger corporation.

In addition to explaining the type of holding company you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, amount of monthly revenue, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

While this may seem unnecessary, it serves multiple purposes.

First, researching the holding company industry educates you. It helps you understand the market in which you are operating.

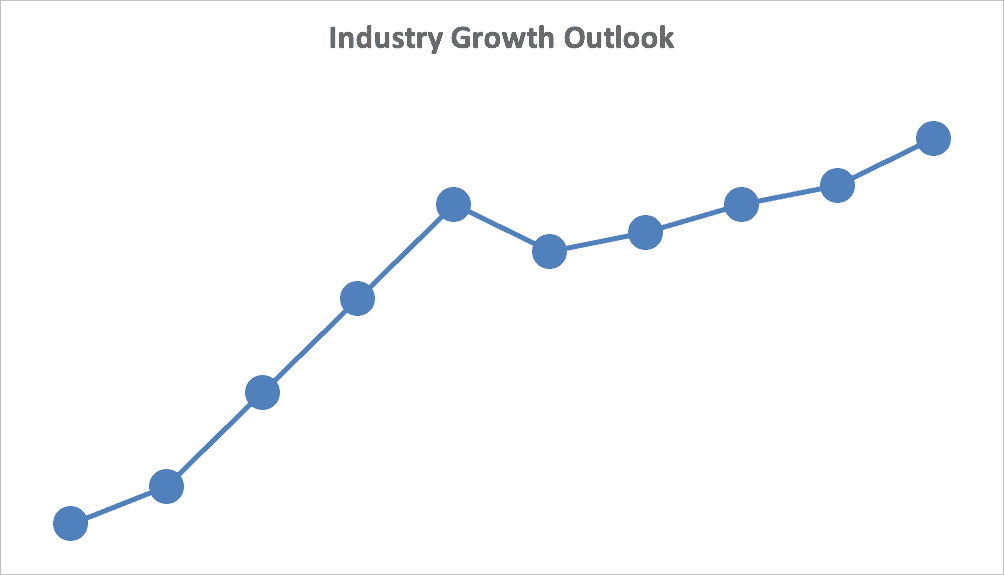

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your holding company business plan:

- How big are the industry(ies) in which you’re competing (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your holding company? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your holding company business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individual businesses such as banks and restaurants, other holding companies and larger corporations.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Holding Company Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

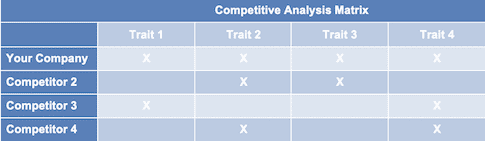

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other businesses that provide the same products and services as your company.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors.

With regards to direct competition, you want to describe the other businesses with which you compete.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What types of businesses do they control?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better services?

- Will you provide services that your competitors don’t offer?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

For a holding company business plan, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of holding company that you documented in your Company Analysis. Then, detail the specific products and services you will be offering.

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the products and services you offer and their prices.

Promotions : The final part of your holding company marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising

- Partnering with applicable websites

- Social media marketing

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your businesses, including running individual businesses, scouting companies to buy interest in, meeting with potential clients, and managing any legal and financial responsibilities for the companies you currently control.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your first and second controlling interests, or when you hope to reach $X in revenue. It could also be when you expect to expand your holding company to form multiple subsidiary companies or parent groups.

Management Team

To demonstrate your holding company business’ ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing holding or investment companies and individual operating companies. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing holding and/or investment companies or successfully running legal or financial businesses.

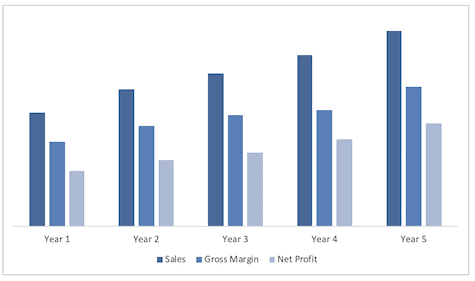

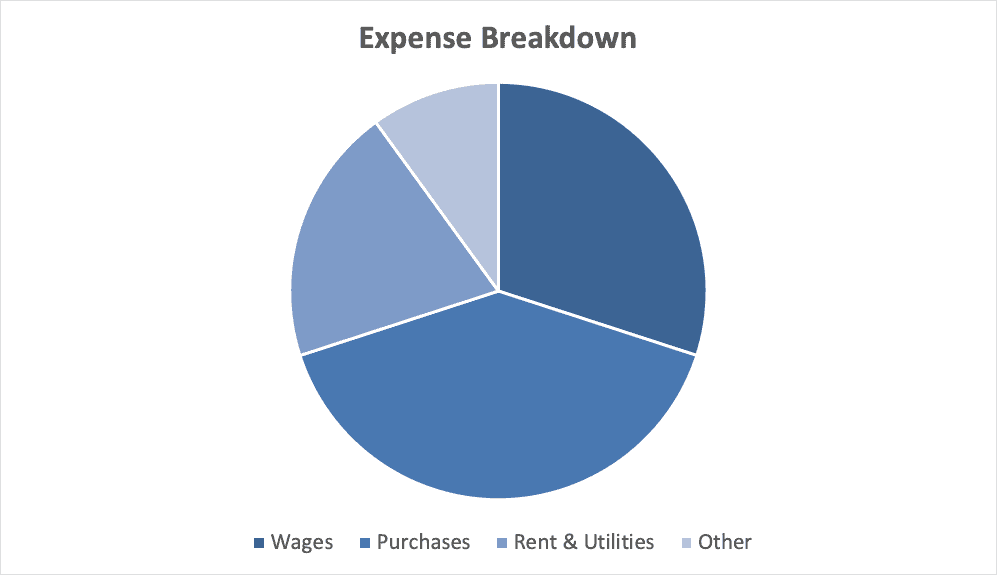

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you purchase controlling interest in one new company per quarter or per year? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $150,000 on acquiring a business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $150,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a holding company business:

- Location build-out including design fees, construction, etc.

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or plans you are working on for controlling another business.

Putting together a business plan for your own holding company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful holding company business.

Holding Company Business Plan FAQs

What is the easiest way to complete my holding company business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Holding Company Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of holding company you are operating and the status; for example, are you a startup, do you have a holding company that you would like to grow, or are you operating a chain of holding companies?

Don’t you wish there was a faster, easier way to finish your Holding Company business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Holding Company Business Plan Template

Written by Dave Lavinsky

Holding Company Business Plan

You’ve come to the right place to create your Holding Company business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Holding Companies.

Below is a template to help you create each section of your Holding Company business plan.

Executive Summary

Business overview.

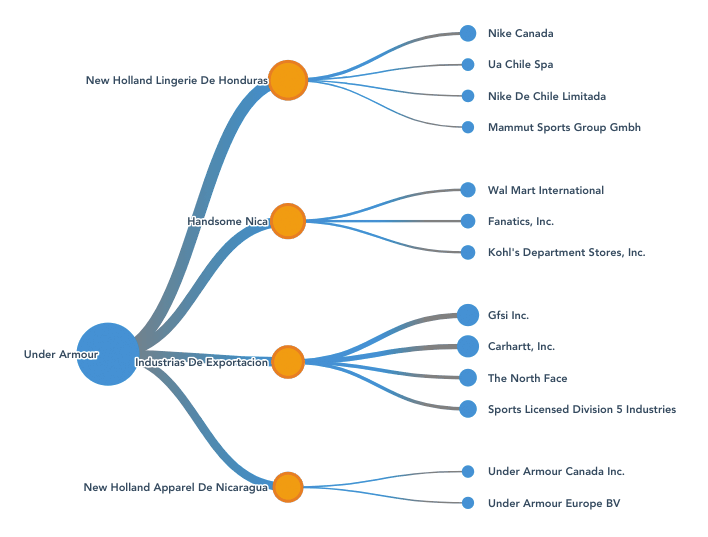

Caldwell Corporation, located in Los Angeles, California, is a newly established holding company that was formed to be the controlling stockholder in other companies it has invested in. It will initially control the Caldwell Group (Caldwell Products, Caldwell Entertainment, and Caldwell Technology) but will invest in other companies in the future. Caldwell Corporation will own assets in both public and private companies, ranging from real estate and manufacturing to entertainment and technology. The company solely performs oversight and is not involved in managing or day-to-day operations.

Caldwell Corporation is run by Timothy Caldwell. He has founded and run all the companies in the Caldwell Group with tremendous success. He is starting the Caldwell Corporation to create a more central point of control over his businesses and make it easier to invest in companies that will support the overall Caldwell Corporation mission.

Caldwell Corporation will provide a number of benefits and services to its subsidiaries. Those benefits include risk mitigation, asset protection, tax minimization, central control, flexibility for growth and development, and succession planning.

The primary benefit for Caldwell Corporation is to minimize the risk for its subsidiaries that forming and operating a company entails. If the subsidiary were to be sued, the liability would not exist, as the holding company would assume the risk as it is a controlling shareholder. Risk management is enhanced by dividing its assets across multiple companies.

Customer Focus

The initial focus will be to control the companies in the Caldwell Group. After that, Caldwell Corporation will primarily serve small to midsize companies across the United States. The demographics of these companies are as follows:

- Must have profits of at least $3 million per year

- Must be in business for at least two years

- Must have a board of directors in place

- Must be in a growing industry

- Has not been audited by the IRS or SEC

Caldwell Corporation will target new and growing businesses that show a growing profit margin for its shareholders.

Management Team

Caldwell Corporation is led by Timothy Caldwell. Over the past ten years, Timothy has started and successfully led the Caldwell Group of companies: Caldwell Products, Caldwell Entertainment, and Caldwell Technology. Now, he wishes to create a holding company to develop a more central point of control over his businesses as well as any companies that he will invest in in the future. Since he has run these three companies himself for the past ten years, he has an in-depth knowledge of their operations and financials.

Timothy is assisted by his executive team that runs the Caldwell Group of companies: Taylor Fisher (CFO), Andy Carrell (COO), Shelby Smith (CMO), and Dave Reddings (CTO).

Success Factors

Caldwell Corporation will be able to achieve success by offering the following competitive advantages:

- Senior Leadership: Timothy Caldwell is an active player in the stock market and is adept at studying companies and assessing their financial volatility.

- Oversight: While Caldwell Corporation will not act as an official oversight of leadership of the companies it acquires, the company will be available and able to provide knowledge and expertise when requested.

- Tax Minimization: Caldwell Corporation is skilled at providing tax scenarios for its companies that are more beneficial to the shareholders. It involves moving corporate locations to tax-friendly states, finding loopholes, and maximizing available tax credits.

- Asset Protection: Caldwell Corporation will employ the best legal, tax, and accounting teams to ensure that all entities involved are not burdened with heavy tax fines, lawsuits, or bankruptcies.

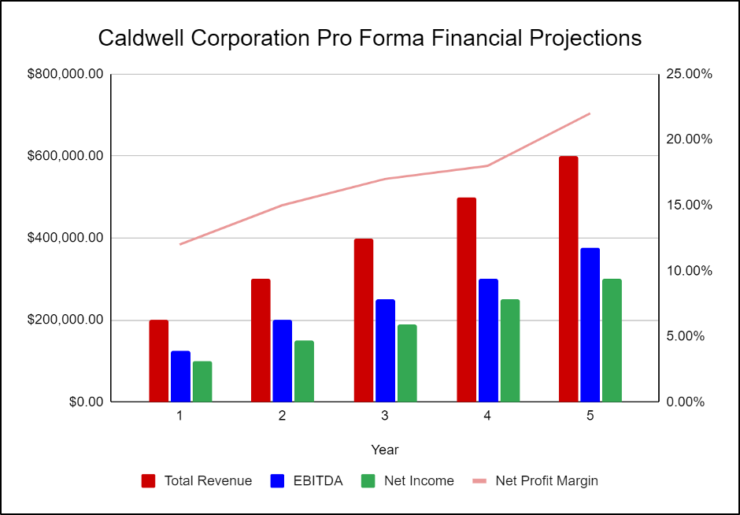

Financial Highlights

Caldwell Corporation is seeking a total funding of $300,000 of debt capital to launch. The capital will be used for funding office buildout, legal fees, overhead expenses, and working capital.

- Office design/build-out: $50,000

- Legal fees and retainer: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Working capital: $50,000

Company Overview

Who is caldwell corporation, caldwell corporation history.

Timothy Caldwell incorporated Caldwell Corporation as an S-Corporation on 1/10/2023. Soon after, he found an office location that will serve as the headquarters of the company.

Since its incorporation, Caldwell Corporation has achieved the following milestones:

- Found an office location and signed a Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Engaged a legal and accounting team

Caldwell Corporation Services

Industry analysis.

Holding companies have fared well for decades and are expected to continue to perform well for the foreseeable future. Success will be driven by strong company leadership, robust and efficient operational models, and talent management.

Holding companies offer numerous benefits to their subsidiaries. These include risk mitigation, asset protection, tax minimization, central control, flexibility for growth and development, and succession planning. With so many benefits, numerous companies join or create holding companies every year.

Some of the most high-profile companies benefit from a holding company. Some examples include Google, which is controlled by Alphabet, and the high-profile companies (like Dairy Queen and Duracell) that are controlled by Berkshire Hathaway. With so many profitable companies benefiting from the arrangement, holding companies are bound to continue to succeed in the future.

Customer Analysis

Demographic profile of target market.

Caldwell Corporation will primarily serve small to midsize companies across the United States. There are numerous startup businesses or organizations that have been in business for at least two years that have already achieved profits exceeding at least $2 million. These companies are in industries such as entertainment, technology, and real estate.

Customer Segmentation

Caldwell Corporation will primarily target the following three customer segments:

- Technology companies

- Entertainment companies

- Real estate ventures

Competitive Analysis

Direct and indirect competitors.

The following businesses have the same business profile as Caldwell Corporation, thus providing either direct or indirect competition for customer clients:

Lithium Holdings

Lithium Holdings buys and grows mid-sized technology companies. Upon acquiring technology companies, Lithium Holdings delivers high-quality equipment along with janitorial and technology supplies. As a veteran-owned company, they are able to tap into the veteran and military-owned community. Lithium offers a much-needed layer of oversight for mid-sized technology companies that do not have the operational expertise or bank account for operational expenses. Lithium Holdings has the financial backing and creditworthiness to apply for small business loans for the technology companies it acquires. The company is able to provide a strategic growth plan for a technology company that it otherwise does not have. At this time, the company focuses on companies in the southwestern United States but may grow to other regions as their geographic footprint allows.

Deer Holdings

In business for over 50 years, Deer Holdings has acquired, invested in, grown, and sold companies across various industries. Today, Deer Holdings invests in businesses that operate within the real estate, infrastructure, and financial services space. Deer’s real estate companies are specifically focused on infrastructure assets, single-family rentals, federal and state low-income housing, tax credits, large living communities, mixed-use communities, development, and military communities.

Deer’s financial services companies focus on providing debt capital to owners of multifamily, senior housing, office, retail, technology, and self-storage properties through proprietary loan products as well as products offered through Fannie Mae, Freddie Mac, and FHA. They also focus on companies that deliver high-quality investment ideas and investment banking services to institutional investors and corporate clients. In addition to real estate and banking, Deer has invested in a multitude of companies that are within the energy and utility industries. One of their most successful companies is an electrical contractor and owner of utility systems that specializes in the provision of services to the military under privatization contracts.

Greenfield Companies

Greenfield Companies is a multinational conglomerate that operates in the United States. Headquartered in Los Angeles, Greenfield prefers to invest in companies in long-term investments in publicly traded companies and has recently begun to invest in wholly-owned subsidiaries. Their diverse range of businesses includes confectionery, retail, railroads, home furnishings, home products, jewelry, retail clothing, and several regional electric and gas utilities.

Greenfield was established over a hundred years ago when it got its start investing in textile manufacturers and railroads. The company was one of the few large shareholder companies that were able to survive the Great Depression, despite it being a freshman company at the time. Throughout the decades, Greenfield has maintained being a family-led company, with the great great great grandson of Benjamin Greenfield now at the company’s helm.

Greenfield Companies is a major player in the stock market and is often studied as a model of how to ride market volatility during recessions and instability in the national economy.

Competitive Advantage

Caldwell Corporation enjoys several advantages over its competitors. Those advantages include the following:

Marketing Plan

Caldwell Corporation seeks to position itself as a premier holding company in the Los Angeles area. Subsidiaries can expect to place their interests in the companies’ hands so they can focus on providing the specific products and services that it intends to specialize in.

Brand & Value Proposition

The Caldwell Corporation brand will focus on the company’s unique value proposition:

- Proven leadership

- Complete asset protection

- Beneficial tax scenarios

- Oversight and accountability

- Knowledgeable team of experts

Promotions Strategy

Caldwell Corporation expects its target market to be companies operating in certain industries. The company’s promotion strategy to reach these companies includes:

Industry Publications

Caldwell Corporation will invest in strategically placing ads in industry publications such as newsletters, magazines, and journals. The target audience for these publications usually includes the decision-makers in their companies.

Social Media

Caldwell Corporation will invest heavily in a social media advertising campaign. The brand manager will create the company’s social media accounts and invest in ads on social media. It will use targeted marketing to appeal to the target demographics. It will focus mainly on LinkedIn social media accounts rather than other social media channels like Facebook and Instagram.

Website/SEO

Caldwell Corporation will invest heavily in developing a professional website that displays all of the benefits the holding company has to offer. It will also invest heavily in SEO so that the brand’s website will appear at the top of search engine results.

Industry Conferences

Caldwell Corporation will participate in all of the industry conferences and tradeshows to network with decision-makers of certain companies. This will be done to increase brand awareness and recognition.

Operations Plan

The following will be the operations plan for Caldwell Corporation.

Operation Functions:

- Timothy Caldwell will be the CEO of Caldwell Corporation. He will continue to run his other companies while handling the general operations of Caldwell Corporation.

- Taylor Fisher has been Tim’s CFO for several years and will take on this role for Caldwell Corporation. He will handle all the concerns related to finances, investments, and taxes.

- Andy Carrell is the COO of Tim’s other companies and will assist Caldwell Corporation with the operations and administrative aspects of the business.

- Shelby Smith has been Tim’s CMO for several years and will expand her role to help with the marketing efforts for Caldwell Corporation.

- Dave Reddings has been Tim’s CTO for several years and will handle all the major decisions and actions relating to technology.

Milestones:

The following are a series of steps that lead to our vision of long-term success. Caldwell Corporation expects to achieve the following milestones in the following six months:

4/202X Finalize lease agreement

5/202X Design and build out Caldwell Corporation

6/202X Hire and train initial staff

7.202X Kickoff of promotional campaign

8/202X Launch Caldwell Corporation

9/202X Reach break-even

Financial Plan

Key revenue & costs.

Caldwell Corporation’s revenues will come primarily from its stockholder distributions. The company will acquire various subsidiaries. It will position itself to be the majority stockholder and will receive quarterly and annual distributions.

The office lease, office equipment, supplies, and labor expenses will be the key cost drivers of Caldwell Corporation. The major cost drivers for the company’s operation will consist of salaries, equipment, lease, taxes, and overhead expenses. Ongoing marketing expenditures are also notable cost drivers for Caldwell Corporation.

Funding Requirements and Use of Funds

Caldwell Corporation is seeking a total funding of $300,000 of debt capital to open the holding company. The capital will be used for funding office buildout, legal fees, overhead expenses, and working capital.

Key Assumptions

Below are the key assumptions required in order to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Annual office lease: $20,000

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Holding Company Business Plan FAQs

What is a holding company business plan.

A holding company business plan is a plan to start and/or grow your holding company business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Holding Company business plan using our Holding Company Business Plan Template here .

What are the Main Types of Holding Companies?

There are a number of different kinds of holding companies , some examples include: Pure Holding Company, Mixed Holding Company, Immediate Holding Company, or Intermediate Holding Company.

How Do You Get Funding for Your Holding Company Business Plan?

Holding Company businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Holding Company Business?

Starting a holding company business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Holding Company Business Plan - The first step in starting a business is to create a detailed holding company business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your holding company business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your holding company business is in compliance with local laws.

3. Register Your Holding Company Business - Once you have chosen a legal structure, the next step is to register your holding company business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your holding company business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Holding Company Equipment & Supplies - In order to start your holding company business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your holding company business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Holding Company Business Plan PDF Template (Free Download)

- Recent Posts

- Why Forex Automated Trading is Better than Manual Trading? - May 1, 2024

- GBPUSD Forex Signal Update: Bullish Trend with Retracement on the Horizon (April 18, 2024) - April 18, 2024

- EURUSD Forex Signal Update: Bullish Trend with Potential Dip (April 18, 2024) - April 18, 2024

Last Updated on January 4, 2024 by Arif Chowdhury

In the fast-paced and ever-evolving world of business, a well-crafted business plan is crucial for holding companies looking to thrive. A holding company business plan serves as a roadmap, guiding your organization toward its goals and ensuring strategic decision-making.

It provides a comprehensive overview of your corporation, including an executive summary, operational plan, income statement, platform company details, balance sheet projections, and more.

Crafting a compelling holding company business plan involves carefully outlining the key components that will drive your success. From providing a brief yet informative summary of your business plans and business strategy to describing the unique value proposition it offers, each section of your company analysis plays a vital role in capturing investors’ attention and securing partnerships to achieve your business goals.

With a clear roadmap in place, you can navigate the complex landscape of holding companies with confidence.

Here is the download link of your Holding Company Business Plan PDF Template.

Business History and Services Offered by Holding Companies

Holding corporations, also known as parent companies, have come a long way in the business world, evolving and growing over time. The company structure of holdings has played a significant role in their success.

These business entities, such as corporations, have become an integral part of various industries, offering a diverse range of services to their subsidiaries. This business overview is important to understand the role of these entities within their parent company.

Let’s delve into the fascinating history of holding companies and explore the wide array of services they provide to further their corporation’s business plan and mark their presence in the market.

Evolution and Growth of Holding Companies

Holding companies have witnessed significant evolution throughout history. Originally, they emerged as a means for wealthy individuals or families to consolidate their assets under one entity.

This consolidation allowed the corporation to exercise control over multiple businesses in their holdings while minimizing risk and maximizing profits. Over time, holding companies expanded their holdings beyond individual businesses, venturing into new industries and sectors. The corporation’s scope grew as it explored different sections of the market.

Today, holding companies such as Berkshire Hathaway led by Warren Buffett, and Alphabet Inc., the parent corporation of Google, are recognized as powerful players in the business world. These successful holding companies have achieved remarkable growth through strategic investments, mergers, acquisitions, and diversification into various sectors. The company business and corporation holdings have played a significant role in their success.

Diverse Range of Services Provided by Holding Companies

One of the key advantages offered by holding corporations is their ability to provide a wide range of services to their subsidiaries and holdings. By leveraging their expertise and resources across multiple businesses, holding companies facilitate collaboration and synergy among different entities within their portfolio.

Holding companies, also known as corporations, play a crucial role in fostering collaboration and synergy among the various entities they hold.

Here are some common services that holding companies offer:

- Financial Management: Holding corporations excel at managing finances across all subsidiaries under their holdings. They optimize capital allocation strategies, streamline financial reporting processes, and ensure efficient use of resources.

- Strategic Planning: Developing long-term plans for every subsidiary in their holdings and corporate portfolio is a critical function of holding companies. They evaluate the holding company’s market trends, spot business growth prospects, and create all-encompassing plans that will propel the organization to success.

- Operational Support: From supply chain management to human resources support, holdings corporations provide operational assistance to individual businesses within their network. This support helps subsidiaries optimize their operations, enhance efficiency, and achieve economies of scale.

- Technology Integration: Technology integration and investments are common areas of expertise for holding firms. These holdings make them a major player in the tech sector because they frequently concentrate on technology integration and investments. The company uses its experience to deploy state-of-the-art technologies among its various subsidiaries, facilitating innovation and smooth cooperation among its holdings.

- Industry Expertise: Holding companies contribute expertise and experience unique to their industry. For example, a holding firm or other technology-focused corporation can offer its tech industry subsidiary companies insightful advice and assistance.

Examples of Successful Holding Companies

Several prominent holding companies, including corporations, have achieved remarkable success in various industries. Let’s take a look at two notable examples:

- Berkshire Hathaway, a renowned corporation led by investor Warren Buffett, is a prime example of a successful holding company. With diverse holdings ranging from insurance corporations (GEICO) to consumer goods corporations (Coca-Cola), Berkshire Hathaway exemplifies the power of vertical integration and strategic investments.

- Alphabet Inc., the influential corporation and parent company of Google, has transformed multiple industries through its subsidiaries such as YouTube, Waymo (self-driving cars), and Verily (life sciences). Alphabet Corporation’s focus on innovation and technological advancements has propelled its subsidiaries to great heights.

Recommended Reading: Handyman Business Plan PDF Template (Free Download)

Quick Note: Unlocking synergies and amplifying growth, joint business plans (JBPs) offer a dynamic roadmap for holding companies. By fostering collaboration among subsidiaries, JBPs streamline strategies, synchronize goals, and leverage collective strengths. This cooperative approach enhances innovation, bolsters market presence, and optimizes resources, magnifying the overall success of a holding company’s diverse portfolio.

Market Analysis and Competitive Analysis for Holding Companies

To create a solid business plan for your holding corporation, it’s crucial to conduct thorough market research and analyze the competition within the industry. This will help your corporation identify opportunities for growth and gain a competitive edge in the market.

Understanding market trends and customer preferences is also essential in determining the focus areas of your corporation.

Conducting thorough market research to identify opportunities for growth

Market research plays a vital role in developing an effective business plan for your corporation. By conducting comprehensive research, you can gather valuable insights about your target market, including their needs, preferences, purchasing behavior, and how it relates to your corporation.

This information will guide your corporation in identifying potential growth opportunities and developing strategies to capitalize on them.

During the market research process, consider gathering data on key aspects such as demographics, psychographics, geographic location, and corporation of your target audience.

Explore factors like market size, growth rate, and any emerging trends that could impact your corporation’s operations.

Analyzing competition within the industry to gain a competitive edge

Analyzing your direct competitors, including corporations, is essential in understanding how they operate and what sets them apart from others in the industry. By evaluating the strengths and weaknesses of your corporation, you can identify areas where your holding company can excel or differentiate itself.

Start by identifying who your main competitors are – those offering similar services or targeting similar markets. Analyze their business models, pricing strategies, marketing efforts, and customer satisfaction levels.

This analysis will provide valuable insights into what works well in the industry and help you determine how to position your holding company effectively.

Understanding market trends and customer preferences about holding companies

Keeping up with current market trends is crucial for any successful business. The same applies to holding companies. Stay informed about changes happening within the industry that may affect customer preferences or alter the demand for specific services.

For example, if there is a growing trend towards sustainable investing or increased interest in technology-focused holdings, it’s important to adapt your business plan accordingly. By aligning your services with market trends and customer preferences, you can position your holding company as a relevant and attractive option for potential clients.

To stay updated on market trends, consider subscribing to industry publications, attending conferences or webinars, and engaging with experts in the field. This will help you gain insights into the latest developments and make informed decisions for your holding company’s growth.

Recommended Reading: Candle Business Plan PDF Template (Free Download)

Quick Note: Let me tell you a secret: The LinkedIn Sales Navigator Chrome Extension is a game-changer for holding companies aiming to supercharge their sales. Seamlessly integrated with Chrome, this tool empowers businesses by providing invaluable insights, targeted leads, and enhanced networking opportunities. Elevate your sales strategy, maximize connections, and witness exponential growth within your holding company’s diverse ventures using this powerful extension.

Sales Strategies and Revenue Streams for Holding Companies

To succeed as a holding company, it is crucial to develop effective sales strategies tailored specifically to the unique needs and challenges of this business model.

Exploring various revenue streams available to holding companies can greatly contribute to their financial success.

Developing Effective Sales Strategies

One must consider the diverse portfolio of subsidiary businesses under its umbrella. Each subsidiary may have its target customers, products or services, and marketing approach.

The holding company needs to understand the individual strengths and weaknesses of each subsidiary to leverage cross-selling opportunities effectively.

Here are some key considerations when developing sales strategies for a holding company:

- Identify target customers : Analyze the market segments that each subsidiary serves and identify potential synergies among them. This will help in identifying new customer segments that can benefit from multiple offerings within the holding company structure.

- Leverage conglomerates strategy : Utilize the power of a diversified portfolio by cross-promoting products or services across subsidiaries. This can create additional value for customers and increase revenue streams by tapping into existing customer bases.

- Invest in marketing : Develop a comprehensive marketing plan that highlights the unique selling propositions of each subsidiary while also showcasing the benefits of being part of a larger holding company. This will help build brand awareness and attract potential customers who value the stability and expertise offered by a well-established conglomerate.

- Explore potential acquisitions : As a holding company, actively seek out potential acquisitions that align with your overall business strategy. Acquiring complementary businesses can not only expand your product or service offerings but also provide access to new markets or customer segments.

Exploring Revenue Streams

Holding companies have various avenues through which they generate revenue beyond simply owning shares in their subsidiaries. Understanding these revenue streams is essential for creating an effective business plan.

Here are some common revenue streams for holding companies:

- Dividends : Holding companies can earn income through dividends paid by their subsidiary businesses. This is a direct result of the holding company’s ownership stake in these subsidiaries.

- Capital gains : Selling shares in subsidiary companies at a profit exceeds the holding company’s initial investment, allowing the holding company to make money. Gains in capital can have a major impact on a holding company’s overall profitability.

- Management fees : Some holding companies provide management services to their subsidiaries in exchange for fees. These fees can be based on a percentage of revenue or profit generated by the subsidiary, providing an additional source of income for the holding company.

- Exit strategy : Restructuring subsidiaries into distinct organizations or selling them as a whole through initial public offerings (IPOs) are two more exit methods that holding companies may use to make money. This enables the holding company to produce significant returns on investment and monetize the assets it has produced.

Recommended Reading: Business Plan Workshop: How to Make the Master Plan?

Funding Options and Financial Planning for Holding Companies

To ensure the smooth operations and future growth of a holding company, it is crucial to have a solid financial plan in place. This involves identifying various funding options that can support the company’s expansion plans and mitigate financial risks.

Creating a comprehensive financial plan that accounts for both short-term goals and long-term sustainability is essential.

Identifying Different Funding Options

There are several funding options available. It’s important to explore these options to determine which ones align with the company’s objectives and requirements.

Some common funding options include:

- Equity Financing: This involves raising capital by selling shares of the holding company to investors. It provides an opportunity for investors to become partial owners of the business while providing funds for expansion or acquisitions.

- Debt Financing: Holding companies can also secure loans from banks or other financial institutions to finance their operations or investment opportunities. Debt financing allows companies to access capital without diluting ownership but comes with interest payments and potential debt obligations.

- Internal Cash Flow : Utilizing internal cash flow generated from existing holdings can be an effective way to fund new investments or cover overhead expenses within the holding company.

- Asset Sales : Selling underperforming assets or non-core businesses within the holding’s portfolio can generate funds that can be reinvested in more lucrative opportunities.

Creating a Comprehensive Financial Plan

A robust financial plan is vital for any holding company as it helps guide decision-making processes, manage resources effectively, and ensure long-term sustainability.

Here are some key elements that should be included in a comprehensive financial plan:

- Financial Projections: Developing realistic projections based on historical data and market trends helps estimate future revenues, costs, and profitability. These projections serve as benchmarks for tracking performance against targets.

- Balance Sheets and Income Statements : Regularly reviewing balance sheets and income statements provides insights into the financial health of the holding company. It helps identify areas of improvement, assess liquidity, and monitor profitability.

- Diversification Strategies : Holding companies can mitigate financial risks by diversifying their holdings portfolio across different industries or asset classes. This strategy helps reduce dependence on a single investment and provides opportunities for growth in various sectors.

- Asset Protection Measures : Implementing appropriate asset protection measures safeguards the holdings from potential risks or legal liabilities. This may involve establishing separate legal entities for each investment to limit liability exposure.

Mitigating Financial Risks

Financial risks are inherent in any business, including holding companies. However, some strategies can be employed to mitigate these risks and protect the company’s financial stability:

- Risk Assessment : Conducting thorough risk assessments allows holding companies to identify potential threats and develop contingency plans accordingly.

- Cost Control : Monitoring overhead expenses and implementing cost control measures help optimize cash flow and improve profitability.

- Capital Structure Analysis : Analyzing the optimal capital structure ensures that the right mix of debt and equity is utilized to minimize financing costs while maintaining financial flexibility.

Recommended Reading: 3 Best Lip Gloss Business Starter Kit (Reviewed)

Organizational Structure and Management Team in Holding Companies

To run a successful holding company, it is crucial to design an efficient organizational structure that aligns with the goals and objectives of the company.

This structure serves as the foundation for managing subsidiary businesses effectively and ensuring smooth operations across all divisions.

Designing an efficient organizational structure

Careful consideration must be given to its legal structure, horizontal integration, and overall company operations. The goal is to create a framework that allows for central control while providing autonomy to individual subsidiaries.

One approach is to divide the company into different sections or divisions based on industry or business type. Each division can then have its management team responsible for overseeing the operations within its specific area.

Another option is to establish an advisory board consisting of key members from each subsidiary. This board can provide guidance and strategic direction while ensuring collaboration between different parts of the organization.

Having a central office that oversees overall operations, finance, and governance can help maintain consistency and coordination among subsidiaries.

Building a strong management team

A strong management team is essential for the success of any holding company. It should consist of individuals with diverse skill sets who can effectively oversee subsidiary businesses and drive growth.

Key members of the management team should possess expertise in areas such as finance, marketing, operations, and strategy. This ensures that all aspects of the business are well-managed.

The team should also have individuals who excel in leadership roles and can inspire and motivate employees within each subsidiary.

By carefully selecting individuals with complementary skills and experiences, a well-rounded management team can be formed that brings together different perspectives and fosters innovation.

Establishing clear lines of communication

Effective communication is vital within a holding company as it connects subsidiaries, management teams, stakeholders, and investors. Clear lines of communication ensure transparency, facilitate decision-making processes, and enable timely dissemination of information.

- Regular meetings , both within the management team and between subsidiaries, should be scheduled to discuss progress, challenges, and opportunities.

- Utilizing technology platforms such as project management tools or collaboration software can enhance communication efficiency.

- It is important to establish open channels for feedback and encourage a culture of open dialogue within the organization.

Recommended Reading: How to Start a Vending Machine Business PDF Template (Free Download)

Writing an Effective Business Plan for a Holding Company

To ensure the success of your holding company, it is crucial to have a well-structured and comprehensive business plan. This will serve as a roadmap for your company’s growth and provide a clear direction for its operations.

Structuring Your Business Plan

There are several key elements that you should address:

- Executive Summary : Begin with a concise summary of your holding company’s purpose, goals, and unique value proposition. This section should provide an overview of your entire business plan.

- Market Analysis : Conduct thorough research on the industries in which your subsidiary companies operate. Identify market trends, competitors, and potential growth opportunities.

- Financial Projections : Include detailed financial projections for both the holding company and its subsidiaries. This should cover revenue forecasts, expense budgets, cash flow analysis, and any potential risks or challenges.

- Management Team : Highlight the qualifications and experience of your management team members who will be overseeing both the holding company and its subsidiaries.

- Subsidiary Companies : Provide individual profiles for each subsidiary within your holding company structure. Include information about their products or services, target markets, competitive advantages, and growth strategies.

Professional Language with Clarity

While writing your business plan, it is important to strike a balance between using professional language and maintaining clarity and conciseness:

- Use industry-specific terminology where appropriate but avoid jargon that may confuse readers who are not familiar with the industry.

- Clearly articulate your vision, mission statement, and core values in simple terms that can be easily understood by anyone reading the plan.

- Break down complex financial information into digestible sections with clear explanations so that stakeholders can easily comprehend the financial projections.

Additional Tips

Here are a few additional tips to consider when crafting your holding company’s business plan:

- Keep it concise: Aim for a document that is clear, concise, and easy to navigate. Avoid unnecessary fluff or lengthy paragraphs that may overwhelm readers.

- Use visuals: Incorporate charts, graphs, and tables to present data and financial information in a visually appealing manner. This can help readers grasp complex information more easily.

- Seek professional assistance: If you are unsure about certain aspects of writing the business plan or need guidance, consider seeking assistance from professionals such as consultants or mentors who have experience in the field.

Recommended Reading: How to Start a Parking Lot Business? (Practical Guide)

Key Takeaways

Well done on finishing the portions of your business plan for your holding company! You’ve made a lot of progress in laying the groundwork for your business.

You are well on your road to success if you have defined your organizational structure, identified revenue streams, and conducted a market analysis. It’s time to put everything together now and create a strong business plan that will attract investors and direct your expansion.

Don’t forget to highlight your holding company’s unique value proposition in your business strategy. Emphasize how your services are unique from those of your rivals and the advantages that clients will experience from working with you.

Use real-life examples and success stories to demonstrate how you can help businesses thrive in today’s competitive landscape. Ensure that your financial projections are realistic, and backed by thorough research and analysis.

Frequently Asked Questions (FAQs)

What should i include in my holding company business plan.

In your holding company business plan, be sure to include sections such as an executive summary, a description of services offered by holding companies, market analysis, sales strategies, funding options, organizational structure, management team details, and financial projections.

These elements provide a comprehensive overview of your business model and demonstrate its potential for success.

How can I make my holding company stand out from competitors?

To differentiate your holding company from competitors, focus on developing a unique value proposition. Identify what sets you apart in terms of services offered or target market specialization.

Emphasize the benefits clients will gain by choosing you over other options available in the market.

What are some effective sales strategies for holding companies?

Effective sales strategies for holding companies include building strong relationships with potential clients through networking events or industry conferences. Providing exceptional customer service is also crucial in retaining existing clients and attracting new ones.

Leveraging digital marketing techniques like content creation and social media engagement can help generate leads and increase brand visibility.

How do I determine the right funding options for my holding company?

When determining the right funding options for your holding company, consider factors such as your financial needs, risk tolerance, and long-term goals.

Explore traditional options like bank loans or seek out investors who align with your business vision. Crowdfunding platforms can also provide an alternative avenue for raising capital.

What should I look for in a management team for my holding company?

When assembling a management team for your holding company, seek individuals with diverse skill sets and experience in relevant industries.

Look for leaders who are adaptable, strategic thinkers, and possess strong communication skills. A well-rounded team will help ensure effective decision-making and drive the success of your holding company.

Holding Company Business Plan: the Ultimate Guide for 2024

Pro Business Plans

Last Updated: 12/17/2023

Starting a holding company is a complex process that requires careful planning and preparation. Like any business, a holding company needs a well-developed business plan to outline its objectives and the steps required to achieve them. A good holding company business plan considers factors such as the company’s purpose, services, financials, and target market.

Why You Need a Holding Company Business Plan

A holding company business plan is essential for success because it provides a roadmap for the company to follow. It helps ensure the company achieves its goals and allows it to track its progress. A solid plan can also help attract investors and partners by demonstrating the company’s potential. For any new holding company, a business plan is a must.

Need a Holding Company Business Plan? Create a custom business plan with financial projections and market research in minutes with ProAI’s business plan generator.

How to Write a Holding Company Business Plan

Here are the main sections to include in a holding company business plan:

Executive Summary

The executive summary provides an overview of the key points of the business plan. It should include the company’s mission and goals, proposed strategy, projected costs and returns, company history, and other relevant details. The purpose of the executive summary is to give readers a quick understanding of the company’s plans without reading the full document.

Company Overview

This section provides an overview of the company, including its purpose, goals, management team, services, ownership, financial position, and projections. Discuss the company’s legal structure, licenses, and permits. Describe the services offered and their pricing. Summarize the company’s current financials and future outlook.

Market Analysis

The market analysis examines the industry, competitors, and target market. Discuss industry trends, key players, and their strategies. Evaluate competitors’ strengths and weaknesses. Explain how your company will differentiate itself. Discuss your target market and marketing strategies to reach them. Consider demographic, psychographic, and other characteristics. Explain how you will build customer relationships.

Define the services you will offer and how you will provide them. Create service packages and pricing structures for your target market. Consider in-person, online, and hybrid approaches. Your pricing should be competitive while allowing you to be profitable. Discuss how you will market and promote your services.

Financial Overview

Provide a financial overview including start-up costs and funding sources. Include sales and profit projections for three years. Discuss financial statements from any current or previous businesses. Include a cash flow analysis outlining income, expenses, and timelines. Discuss how you will use funding and remain financially secure.

Target Market

Identify your target market in detail. Consider age, gender, income, location, interests, and other attributes. Discuss how you will reach your target market through digital marketing, traditional marketing, or a combination of both. Explain how you will build and maintain relationships with customers.

Marketing Plan

Develop a marketing plan identifying your target audience and strategies to reach them. Consider paid media (ads), earned media (PR), owned media (your channels), and shared media (influencers, guest posts). Decide which channels to focus on and how much to invest in each. Determine metrics to measure success. A strong plan will help you reach your audience and maximize ROI.

Operational Plan

Create an operational plan outlining daily operations, policies, resource needs, timelines, and budgets. Discuss your legal structure, risks, and risk mitigation. Identify any business partners or vendors and your relationships with them. The operational plan shows how you will manage the business and comply with laws.

Financial Plan

The financial plan is the foundation of your business plan. Outline costs to launch and operate the company and provide a operating budget. Include revenue projections from investments and other income. Do a break-even analysis to show when you will become profitable. The financial plan demonstrates your knowledge of the resources and funding required to start and run the company.

Exit Strategy

Discuss how you will unwind investments and liquidate assets to exit the business. Provide timelines and projected ROI. Include contingency plans if you cannot exit as expected. Explain how you will distribute profits to investors and transition management responsibilities. The exit strategy shows you have considered how to end the business in an organized fashion.

Holding Company Financial Forecasts

Startup expenses, monthly operating expenses, revenue forecast.

Q: What is a holding company?

A: A holding company is a company that owns other companies as its primary business. It provides organization, management, and financial benefits to the subsidiaries it owns. Holding companies allow business owners to diversify investments without diluting ownership.

Q: What are the benefits of a holding company?

A: The main benefits of a holding company include:

• Tax savings: Assets and income can be shifted between subsidiaries to minimize taxes.

• Limited liability: The holding company reduces legal liability exposure from subsidiaries. Creditors can only pursue holding company assets.

• Centralized management: The holding company can oversee and support multiple subsidiaries efficiently. It can provide shared services like HR, accounting, and legal to subsidiaries.

• Flexibility: The holding company structure makes buying, selling, merging or liquidating subsidiaries easier. It provides more flexibility than directly owning multiple companies.

• Diversification: The holding company allows investors to diversify investments across many subsidiaries and industries to reduce risk. Losses in one subsidiary may be offset by gains in another.

Q: What types of holding companies are there?

A: The main types of holding companies are:

• Diversified holding companies: Own subsidiaries in unrelated industries to diversify investments. Examples are Berkshire Hathaway and General Electric.

• Conglomerate holding companies: Own subsidiaries in many unrelated industries. Examples are Koch Industries and Cargill.

• Pipeline holding companies: Own subsidiaries that are related through a supply chain or production process. The outputs of one subsidiary become the inputs of another. Examples are petroleum and natural gas pipeline companies.

• Hub-and-spoke holding companies: Own central subsidiaries that support smaller satellite subsidiaries in a shared corporate function like HR, IT or accounting. The hub subsidiaries provide services to the satellite subsidiaries.

• Family holding companies: Often own controlling interests in private family-owned operating companies to preserve family ownership and control across generations. Very common for private family businesses.

• Investment holding companies: Primarily holding equity positions in other companies. The focus is making investments for financial gain instead of operational control. Berkshire Hathaway is also an example.

- Shell holding companies: Have few or no assets or operations. They are used primarily as a legal entity to own subsidiaries. Often used for tax planning purposes.

Written by Pro Business Plans

Text to speech

Holding Business Plans

Financial holding company business plan.

Domino Comptech Holdings purchases profitable existing businesses with a history of strong revenue production. DCH provides the management, marketing, and financial expertise to assist in continuing to maintain a strong and steady growth pattern.

Holding Company Business Plan

JTB Technologies is the holding company for 3 related sub-corporations, doing technology, catalog sales, and manufacturing for multiple industries.

Are you looking to expand your business holdings into owning stock in other organizations? You may want to consider establishing a holding, or parent company to do so. While it may not produce or sell goods or services, it is still beneficial to have a solid business plan in place in order to succeed. Check out our holding company and financial holding company sample plans to get started.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Holding Company Business Plan Sample

Published Jul.30, 2018

Updated Apr.23, 2024

By: Noor Muhammad

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

Table of Content

Do you want to start holding company?

Are you planning to start a holding company? In the corporate world, mergers and acquisitions are part of doing business and for any holding company to succeed, it must strategize itself to tap into existing business opportunities. The key role of a holding company is buying and owning shares or stocks in other companies with an aim of obtaining returns on their investment and controlling company corporate affairs. This is a highly strategic business and to succeed, a good holding company business plan that clearly outlines your acquisition strategy should be put in place. A large financial base and a team of experienced investment experts are key for business success.

Executive Summary

2.1 the business.

The business holding company will be registered as Benton Holdings and will have its headquarters in downtown Manhattan, New York. The business is owned by Mark Ford who is an experienced Investment Expert.

2.2 Management Team

Mark Ford, the owner of Benton Holdings is an experienced investment expert with in-depth knowledge of the U.S merger and acquisitions industry. He boasts of over 15 years of experience in the investment industry and has worked for various top blue chip U.S. companies.

2.3 Customer Focus

With his caliber of experience, Mark has extensive technical and industry knowledge on investment having worked in numerous holding companies as an advisor. With these skills, he has the right customer segment in perspective.

2.4 Business Target

Mark Ford has been in the industry for long and knows how acquisitions for investment are handled and the best strategies to use to reach out to the appropriate business targets.

Company Summary

3.1 company owner.

Mark Ford is an experienced investment analyst whose career has spanned almost two decades. In the course of his career, Mark worked for numerous top brands such as JP Morgan Chase, Citigroup and NYSE (New York Stock Exchange) among others.

3.2 Aim of Starting the Business

Corporates take various strategic decisions to help advance their course towards profitability and achieving financial goals. Mergers and acquisitions happen for various reasons and holding companies have a good opportunities to capitalize on these arrangements to generate revenue. A holding company business plan also doesn’t offer any products or services, its mandate is to simply find opportunities to invest in other businesses. Mark is aware of the dynamics and knows how to start a holdings company .

3.3 How the Business will be started

Benton Holdings will be started based on a careful market research to identify opportunities available for the holding company. Mark has the technical and business skills but has sought help from financial gurus to craft a detailed comprehensive analysis.

| Legal | $4,000 |

| Consultants | $2,500 |

| Insurance | $18,000 |

| Rent | $12,000 |

| Research and Development | $10,000 |

| Expensed Equipment | $13,000 |

| Signs | $3,000 |

| TOTAL START-UP EXPENSES | $60,500 |

| Start-up Assets | $0 |

| Cash Required | $110,000 |

| Start-up Inventory | $35,000 |

| Other Current Assets | $25,000 |

| Long-term Assets | $7,000 |

| TOTAL ASSETS | $22,000 |

| Total Requirements | $24,000 |

| $0 | |

| START-UP FUNDING | $85,000 |

| Start-up Expenses to Fund | $37,000 |

| Start-up Assets to Fund | $20,000 |

| TOTAL FUNDING REQUIRED | $0 |

| Assets | $18,000 |

| Non-cash Assets from Start-up | $12,000 |

| Cash Requirements from Start-up | $0 |

| Additional Cash Raised | $45,000 |

| Cash Balance on Starting Date | $20,000 |

| TOTAL ASSETS | $0 |

| Liabilities and Capital | $0 |

| Liabilities | $0 |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| TOTAL LIABILITIES | $0 |

| Capital | $0 |

| Planned Investment | $0 |

| Investor 1 | $15,000 |

| Investor 2 | $18,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| TOTAL PLANNED INVESTMENT | $120,000 |

| Loss at Start-up (Start-up Expenses) | $50,000 |

| TOTAL CAPITAL | $45,000 |

| TOTAL CAPITAL AND LIABILITIES | $30,000 |

| Total Funding | $110,000 |

Services for Customers