- Resident Resources

- Saving DC's Rental Housing Market Strike Force

- Continuing Conversations on Housing

- Resources to Learn More About Housing Segregation and Opportunity

- Publications

- Our Progress

Read Mayor Bowser's Housing Equity Report here

Are you interested in learning more about housing segregation and how that impacts opportunity? Check out our list of resources here !

1800 Martin Luther King Jr. Avenue, SE

- Read more about 1800 Martin Luther King Jr. Avenue, SE

Upcoming Events

View Past Events >

| A Framework for Equity and Growth

Housing affordability is critical for all residents to thrive. Lower housing costs mean residents can afford to live in high opportunity areas, afford medical treatments, buy healthy foods, invest in education, and maintain a high quality of life. How can we prioritize housing affordability for all? We can start by building more housing units for households at all income levels and preserving homes that are already affordable. Over the past 10 years, the District has grown by 34,000 housing units. However, this is still not enough. Our population is projected to keep growing. We must think differently and act boldly to ensure the District is a home for all residents, whether you’ve lived here your entire life or you’ve recently moved here. To make sure the District can be a home for all residents, we must build more housing units.

|

| The order calls on the District to create 36,000 new residential units by 2025 with at least 12,000 of those units being dedicated as affordable to low-income residents, and also calls on preserving an additional 6,000 affordable homes. How can we make this vision a reality? The Department of Housing and Community Development (DHCD) and the Office of Planning (OP) have launched the Housing Framework for Equity and Growth. This initiative has three goals: We’ll need your help reaching the District’s goals. Throughout this initiative, we will be calling on residents to make their voices heard. Ready to dive in? You can start by joining our Housing Framework for Equity and Growth newsletter to stay up-to-date and share your feedback with us.

|

| Throughout the summer, District residents made their voices heard by participating in our survey on the current distribution of affordable housing, participating in our Analysis of Impediments to Fair Housing (AI) hearing process, providing feedback during Urban Land Institute’s Technical Advisory Panel (TAP), taking our Comprehensive Plan Values survey, joining us at in-person events, and more.

--> --> --> --> gagement Summary. We will continue to create opportunities for community and resident engagement as the initiative moves forward with the next steps with the Housing Experience and Design Analysis and the Opportunities and Recommendations. |

Share this story

D.C.'s 10 largest residential developments under construction

The city’s built environment is transforming with these megaprojects

Washington, D.C. is changing, and it's changing quickly. The city continues to grow in population and incorporate dense developments like The Wharf and Capitol Crossing . This isn’t your grandparents’ D.C. (it’s not even your parents’ one).

In order to keep up with all of the construction cranes, the Washington D.C. Economic Partnership compiled the city's top 10 residential projects, based on number of housing units. Expected completion dates are also included, with some projects set to deliver as soon as 2020. That’s welcome news for the D.C. area’s housing crunch and those hoping for a more dynamic city.

Developer : Roadside Development / North America Sekisui House

Type : Mixed-use

Number of units : 687

Expected delivery : 2022

Estimated value : $700 million

The skinny : Located at the former Fannie Mae headquarters site , this historic-preservation project will provide over 1 million square feet of mixed-use development, including a highly anticipated Wegman’s . In sum, the site will have nine buildings, 194,000 square feet of retail, and 170,000 square feet of office.

- Open in Google Maps

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769560/City_Ridge_Roadside_view02_0920.jph.0.jpg)

Eckington Yard

Developer : JBG Smith

Number of units : 681

Expected delivery : 2021

Estimated value : $265 million

The skinny : In Eckington , this development will have public space and up to 80,000 square feet of retail. It will include four residential buildings and be located about a 10-minute walk from the NoMa–Gallaudet University Metro station.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769561/3_Woonerf_Eck_St.0.jpg)

Developer : Kettler / Carmel Partners

Number of units : 550

Estimated value : N/A

The skinny : In Union Market , this luxury project will offer retail and restaurants just a 10-minute walk from the NoMa Metro station. The Union Market building and Gallaudet University are also near the site.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769562/Highlight1.0.jpg)

Bryant Street (Phase I)

Developer : MRP Realty / FRP Development Corp.

Number of units : 487

The skinny : On a 13-acre site near the Rhode Island Avenue–Brentwood Metro station, a former shopping center is being transformed into a massive mixed-use development that will ultimately feature as many as 1,600 units and 275,000 square feet of retail. The first phase will include more than a fourth of those residential units, plus a nine-screen Alamo Draft Cinema and roughly 40,000 square feet of other retail.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769563/cam_plaza_1.0.jpg)

Developer : Akridge / Western Development Corp. / Jefferson Apartment Group / Orr Partners

Number of units : 481

Expected delivery : 2020

Estimated value : $220 million

The skinny : On the waterfront in Buzzard Point , this mixed-use project is redeveloping the former U.S. Coast Guard headquarters into nearly 500 apartments and 70,000 square feet of retail. The project will feature piers and an extension of the Anacostia Riverwalk Trail.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769564/2018_02_22_10_37_46_www.akridge.com_3025460998547965.0.jpg)

Number of units : 465

Estimated value : $228 million

The skinny : Just down the block from the Navy Yard–Ballpark Metro station and Nationals Park, this 11-story building will feature terraces facing the stadium and 42,000 square feet of retail, including Atlas Brew Works, Compass Coffee, and Union Kitchen. The Anacostia Waterfront and Yards Park are within walking distance.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769565/31801_westhalf_1500134437.0.jpg)

1900 Half Street

Developer : Douglas Development Corp.

Number of units : 453

Estimated value : $190 million

The skinny : On the Anacostia Waterfront in Buzzard Point , this project involves redeveloping an existing office building into luxury apartments and more than 15,600 square feet of retail. There will be a rooftop infinity pool and two elevated courtyards. The site will also be accessible to a promenade along the river.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769566/1900_half_new_rendering.0.jpg)

Developer : MRP Realty / JBG Smith / Ellis Development Group

Number of units : 433

Estimated value : $153 million

The skinny : Anchored by a 46,000-square-foot Whole Foods, this planned development near the U Street NW corridor will feature over 400 apartments and will be located a five-minute walk from the neighborhood’s Metro stop. The project will have an interior courtyard, a rooftop pool, and a bridge connecting different wings of the development.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769567/The_Wren_rooftop_amenity_bridge.0.jpg)

Developer : Rappaport / WC Smith / Lustine Realty Company

Number of units : 419

Expected delivery : 2019

Estimated value : $200 million

The skinny : Right on H Street NE , this two-block project with over 400 units and 53,00 square feet of retail will boast eight stories of glassy facades and be accessible to the D.C. Streetcar. Union Station is about a 15-minute walk away and there are restaurants all along H Street NE.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769568/unspecified_3.0.jpg)

Crossing DC

Developer : Tishman Speyer

Number of units : 418

The skinny : This development in Capitol Riverfront is just a few blocks from the Navy Yard–Ballpark Metro station and is walkable to the U.S. Capitol. It will have housing and retail on what used to be a largely vacant lot.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65769569/Screen_Shot_2019_11_25_at_12.45.21_PM.0.png)

Site search

- Los Angeles

- San Francisco

- Archive.curbed.com

- For Sale in DC

- For Rent in DC

- Development News

- Architecture

- Neighborhoods

DMPED 36,000 by 2025 Dashboard

Deputy mayor for planning & economic development | muriel bowser, mayor.

- 36,000 by 2025

36,000 Housing Count

The purpose of this site is to track housing production in support of the Mayor’s goal of producing 36,000 new housing units and 12,000 affordable units by 2025. The dashboard below is updated monthly to reflect the total new housing units and new affordable units created each month. For more information on this target and an overview of how the District is working to achieve this goal, please visit https://housing.dc.gov/ .

Note: In order to more fully capture the District’s efforts to create new, dedicated affordable housing units and to better align with agency housing goals and strategies the unit tracking methodology was updated in September 2022, which is now used for each monthly update. You can read more about this update in the attached document.

Note: The September 2022 housing count included an update to the housing count methodology to incorporate 1) projects that create New Affordable Units by placing covenants on existing housing units without an affordability covenant and 2) projects funded through the Housing Preservation Fund that include New Affordable Units.

These changes bring the affordable unit count into alignment with goals and strategies stated in the Housing Equity Report and the 2021 DHCD Consolidated RFP for Affordable Housing Projects. You can read more about this update in the attached document.

Glossary of Terms

To add glossary terms, edit the glossary.yaml file in the _data folder.

Glossary terms need a term, slug, and definition attribute. The term attribute will appear above the definition. The slug is a unique identifier for the term. It should be lowercase, with no special characters or punctuation, and any spaces replaced with a dash.

Want to link to a specific glossary term in your text, like this one here ? You will need to edit your markdown like so:

Just place the text you want linked in the brackets and the correct slug within the quotes.

- 2024 Elections

- Get Involved

See all of DC’s new affordable housing in one map

Development By Claire Jaffe (Contributor) September 6, 2016 14

Thanks for reading!

We are reliant on support from readers like you to fund our work. If everyone reading this gave just $5, we could fund the publication for a whole year.

Can you make a one-time or recurring contribution today to keep us going strong?

Support our work!

GGWash is supported by our recurring donors, corporate supporters, and foundations.

Executive Office of the Mayor

- Mayor's Biography

- Executive Branch

- Mayor's Cabinet

- Newsletter Archives

- Open Government and FOIA

- Apply for a Job

- Government Services

- Public Information Officer List

- Fact Sheets

- Photo Gallery

- Request the Mayor

Amazon Commits $147 Million to Create and Preserve 1,260 Affordable Homes, Primarily With Minority-Led Developers Across Washington, DC

(Arlington, VA)— Today, Amazon (NASDAQ: AMZN) announced a commitment of $147 million to create and preserve 1,260 affordable housing units in six of Washington, D.C.’s eight wards and in nearby Maryland and Virginia communities—primarily in partnership with minority-led organizations.

This is the latest commitment from Amazon’s more than $2 billion Housing Equity Fund , which aims to combat affordable housing challenges and promote equity and inclusion in the communities the company calls home, including Washington state’s Puget Sound region; the Arlington, Virginia/Washington, D.C. region; and Nashville, Tennessee.

Today’s announcement brings Amazon’s total commitment to help create or preserve affordable housing in the Washington, D.C. area to $992 million in support of more than 6,200 affordable homes. This total includes Amazon’s marquee investment in Crystal House (which is over and above the $2 billion commitment), its $125 million transit commitment with the Washington Metropolitan Area Transit Authority (WMATA) and Amazon’s Real Estate Developers of Color Accelerator Program investments . Of this total, $696 million will be used to create or preserve nearly 3,600 units of affordable housing in partnership with minority-led organizations.

“We’re proud to work with a diverse set of experienced partners to create and preserve much-needed affordable homes that help keep long-term residents in the community while bolstering our diverse and historic neighborhoods,” said Catherine Buell, director of the Amazon Housing Equity Fund. “By working with these diverse development organizations, we can create long-lasting and inclusive affordable housing closer to public transit and other amenities that will improve quality of life for residents. We’ll also help ensure families across Washington, D.C. are not displaced from their communities.”

Since launching in January 2021, the Amazon Housing Equity Fund has increased the long-term committed multifamily affordable housing stock in Arlington by 22% (based on data provided by Arlington County). These newly announced projects will build on this success and increase access to affordable housing throughout Washington, DC. Amazon’s $147 million commitment was announced at an event held at Congress Heights – an affordable housing project being developed in Washington, D.C.’s Ward 8. Like many of the other affordable housing projects that are part of this announcement, Congress Heights (which is being developed by the National Housing Trust) is adjacent to public transit (in this case, a Washington Metropolitan Area Transit Authority (WMATA) transit station.)

“Today is about partnership, commitment, and perseverance,” said DC Mayor Muriel Bowser. “Partnership with Amazon, the National Housing Trust, WMATA, and our community partners. A commitment to build 36,000 new homes by 2025, with at least 12,000 of them affordable. And perseverance from the families who stuck with us and will soon be able to return home to this location – and what a location it is.”

This announcement aligns with Mayor Bowser’s goal of creating 36,000 new housing units, a third of which will be affordable, by 2025. Each of these commitments will ensure the long-term preservation of affordability (generally 99 years, with limited exception) and will make housing available to individuals and families earning 30-80% of the area median income (AMI). Today’s announcement showcases partnerships with the following organizations:

The Congress Heights Apartments in the Congress Heights neighborhood of Ward 8, which will include the construction of 179 new affordable units for households earning between 30-80% AMI. The apartments will be developed by National Housing Trust (NHT) , which works to ensure that privately owned rental housing remains in the affordable housing stock using the tools of real estate development, rehabilitation, finance, and advocacy—all with sustainability in mind.

2026 Maryland Ave NE , located in the Carver-Langston neighborhood of Ward 5, will include the preservation of 320 affordable units for households earning between 30-60% AMI. These apartments will be preserved by Jair Lynch Real Estate Partners , a leading owner and developer of mixed-use properties and attainable housing.

The Residences at Benning Road will be the second affordable, assisted-living community in Ward 7. This transit-oriented development, located at the former site of an Industrial Bank branch (one of the first Black-owned banks in the region), will create 156 new affordable apartments for households at 60% AMI within one block of the Benning Road Metro station. The Residences will be developed by Gragg Cardona Partners , a company that has been working for more than two decades on revitalizing D.C.-area neighborhoods by using public/private partnerships to bring about new investments in housing, commercial space, and community facilities.

4111 Kansas Ave NW , a newly constructed residential building (originally designed as condominiums), to create 40 new affordable units for households earning between 50-80% AMI in Ward 4. With Amazon’s support, the property was purchased by So Others Might Eat (SOME) , a nonprofit with comprehensive programs that are designed to help neighbors experiencing homelessness and extreme poverty find pathways out of poverty and achieve long-term stability and success.

325 Vine will be a newly constructed apartment building in Ward 4 that will include 102 affordable units for households earning between 60-80% AMI and will feature the preservation of two historic homes. The property is located across the street from the Takoma Metro station. SGA Companies is a full-service firm specializing in transit-oriented, multifamily residential and mixed-use retail properties in the Washington, DC metro area.

S Street Village will be a new development with 90 units of affordable housing at 60% AMI in Ward 2. The site will be developed by Manna, Inc. , a nonprofit affordable housing consultancy and developer committed to helping low-income and moderate-income persons acquire affordable, quality housing across Washington, D.C.

The Mount Pleasant Preservation Project will consist of the preservation of Richman Towers, Sarbin Towers, and Park Marconi in the Mount Pleasant community in Ward 1. The Project will convert 165 apartment homes into affordable homes for households earning between 40-80% AMI. Jubilee Housing is a nonprofit housing developer focused on creating affordable homes with onsite and nearby services in thriving communities.

Holmead Place Apartments consists of 99 homes in Ward 1, all of which will be converted into affordable, accessible residential units for households earning between 30-80% AMI. Wesley Housing provides safe, quality, and affordable housing to across the Washington, DC metropolitan area.

In addition to these projects in Washington, DC, Amazon is providing funding to the following developers to create additional affordable housing in Maryland and Virginia:

Community First Development Corporation is a partnership between A. Wash & Associates, Inc . and Northern Real Estate Urban Ventures (NREUV) , both Black-led real estate development organizations with deep ties to the Washington, D.C. area. They are collaborating on 210 on the Park , which will be a newly constructed development containing 130 affordable units for households earning between 70-80% AMI. The apartment complex is located a short distance from the Capitol Heights Metro station in Prince George’s County, Maryland, and includes retail space that will offer discounted rates for local and minority businesses.

Montgomery Housing Partnership (MHP) is a nonprofit serving the residents of Montgomery County, Maryland and neighboring communities. The organization is committed to housing people, empowering families, and strengthening neighborhoods. Since 1989, MHP’s mission has been to preserve and expand access to quality, affordable housing. MHP is developing Nebel Street , which will be a new construction development containing 163 affordable homes for households earning between 30-80% AMI.

Good Shepherd Housing and Family Services ’ mission is to reduce homelessness, increase community support, and promote self-sufficiency. Good Shepherd Housing has served the housing needs of Northern Virginia families and individuals for more than 40 years. They are acquiring 18 homes in the Colchester Towne Condominiums , and will preserve these at 50% AMI in Alexandria, Virginia.

With today’s announcement, the Amazon Housing Equity Fund has committed to create or preserve more than 10,000 affordable homes across the company’s hometown communities so far. Amazon’s commitment focuses on low-to-moderate income individuals and families, representing first responders, teachers, and service industry employees whose wages haven’t kept pace with escalating rents. To learn more about the Amazon Housing Equity Fund, please visit us here .

- ☰ Menu

- Housing for Rent |

- Housing for Sale |

- Tools and Resources |

- Add Listing |

- Español

DCHousingSearch.org is the District of Columbia's free online housing locator service for individuals and property owners/managers. The site is funded through the DC Department of Housing and Community Development (DHCD).

- DHCD funded affordable housing projects.

- DC Housing Authority (DCHA) managed properties.

- A wide range of housing types, including private affordable units, multi and single-family dwellings, apartments, studios, accessible units, and other types of housing to fit your needs.

- Households can browse up-to-date, detailed listings and locate available affordable and Section 8 rental and for-sale properties that meet their housing needs.

- Property managers and landlords can showcase properties with free listings that include photos and details like number of bedrooms and baths, rent and deposit information, location (with map link), accessibility features, and other special amenities to make listings stand out.

- Renters can use the affordability calculator, rental checklist, and information on renter rights and responsibilities.

- All users can be connected to other housing resources through website links.

This site is managed by DHCD and maintained by MyHousingSearch.com. For additional information, call 1-877-428-8844 or email [email protected] .

The DC Department of Housing and Community Development (DHCD) is committed to creating pathways to the middle class through financing affordable housing development and building and sustaining inclusive and diverse communities and neighborhoods across the city. Collaborating with MyHousingSearch.com on an affordable housing locator service magnifies our ability to inform our residents about housing opportunities.

We recognize that creating and preserving affordable housing in the District is a collaborative effort. Our strong partnerships with our sister agencies, the DC Housing Authority and DC Housing Finance Agency, have resulted in many successful affordable housing development projects across the District. Please contact DHCD or our partner agencies to learn more about the many programs and services we provide.

- Housing for Rent

- Housing for Sale

- Add Property

- Tools and Resources

- How To Search

- Roots to Roofs DC

DC’s Tools to Create and Preserve Affordable Housing

As prosperity and population in DC grow, residents with low incomes increasingly struggle with the District’s high and rising housing costs. The disappearance of affordable housing is a result of many generations of policy choices. This lack of affordable housing, particularly for larger families, puts enormous stress on family budgets and leaves many at risk of eviction and homelessness.

Black and brown residents are disproportionately harmed by the disappearance of affordable housing. Nationwide, nearly half of all Black renters are housing insecure whereas about a quarter of white renting households are housing insecure. A dramatic increase in the cost of housing in DC has led to a decades-long wave of displacement. An analysis of census data shows that in 2000, 32 of DC’s 62 residential neighborhoods were majority Black but by 2020, only 22 residential areas remained majority Black. In that time period, the Black population declined by nearly 58,000 while the white population grew by almost 86,000.

Having a safe, stable, and affordable place to call home is intrinsically connected to positive life outcomes in school performance, job retention, physical and mental health, and economic security. It ensures families aren’t forced to make difficult decisions between paying the rent or putting food on the table. When individuals and families don’t have to spend most of their income on housing, they may be able to save for and invest in their futures.

The District has many tools to create and preserve affordable housing and end displacement of residents with limited or low incomes, who because of longstanding racial inequities are likelier to be Black and brown. This guide gives a brief overview of the District’s programs designed to either create or preserve affordable housing, or to help make existing housing more affordable to residents through rent subsidies.

Affordable for Whom?

The idea of what’s affordable is relative. Usually, housing is considered affordable when a household spends no more than 30 percent of its income on housing and utilities. In DC, Black residents are nearly twice as likely as white residents to spend more than 30 percent or more of a household’s income on rent. This “rule of thumb” dates back to 1969 and is widely used in housing policy. While useful, the measure has its flaws—namely that it does not take into account ability to pay. A household that spends 30 percent of a $300,000 income on housing will have a lot more left to spend on other necessities than a household with a $25,000 income.

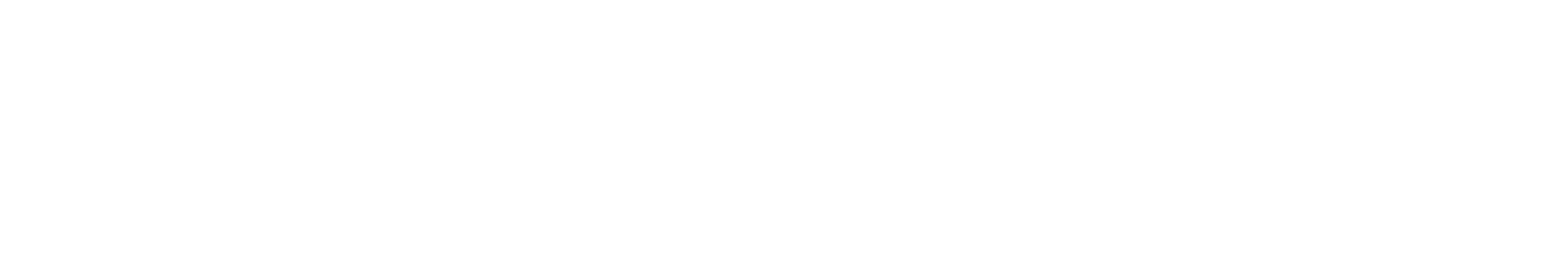

Eligibility for certain housing assistance programs is based on an individual’s or family’s income and how it compares with average income levels and costs ( Table 1). In federal and DC affordable housing programs, a person’s eligibility is based on how their income compares with the area median income (AMI). That is the income for the middle household in the DC region, which includes not only DC but the suburbs. Currently, the Washington region’s AMI is $142,300 for a family of four, which skews higher due in part due to the inclusion of suburban regions that have higher income levels.

Some housing programs, like public housing, serve primarily “extremely low-income” households, or those below 30 percent of AMI, or $42,700 for a family of four in DC. This includes many residents on fixed incomes such as seniors living on Social Security payments. Other programs, such as project-based vouchers (see below) help “very-low income” families (under $71,150 in DC for a family of four) and “low-income” families (under $113,850). The wide range of incomes that can qualify as “low” –particularly when there is a lack of targeting or poor accountability for reaching targets—sometimes allows developers receiving subsidies to meet their affordable housing commitments with high rents and results in less housing being made affordable for those with extremely low incomes.

While families at many incomes struggle with the cost of housing in DC, where the average rent for a one bedroom is $ 2,428 as of October 2022, extremely low-income renters struggle the most. Most DC families with incomes below 30 percent of AMI spend more than half their income on rent, meaning many are at risk of eviction and have little left over for other basics such as health care, transportation, and educational expenses. More than 25 percent of households with incomes under 50 percent of AMI also spend more than half their income on rent.

What Tools Do We Have for Affordable Housing?

The current shortage of affordable housing is a result of deliberate policy and spending choices, past and present, at both the federal and local level. However, federal and local governments can and do step in to help subsidize costs. They can do that in a variety of ways, including subsidizing the construction of housing to ensure that new developments include affordable units, or by providing renters or homeowners direct cash assistance so that those residents can stay in their homes.

Production and Preservation

The District uses grants and low-cost loans to incentivize developers to create and preserve affordable housing.

- Housing Production Trust Fund (HPTF) – DC’s largest affordable housing tool provides low-cost loans and grants to developers to help build and preserve affordable homes. Though the target has never been met, DC law requires that 50 percent of HPTF funds be used to produce housing affordable to those with incomes below 30 percent of AMI.

- Preservation Fund – A revolving loan fund that allows the District to leverage private dollars in a three-to-one match to offer acquisition and predevelopment financing to developers for projects that preserve existing affordable housing

- First Right to Purchase Assistance Program (FRPP) – When active, this DC program helped tenants with lower incomes exercise their right to purchase their apartment buildings under the Tenant Opportunity to Purchase Act (TOPA). The program has not accepted applications for several years.

Local Rent Supplement Program (LRSP)

Through this program, the DC government uses local dollars, as opposed to federal funding, to help cover the difference between the rent a family can afford to pay and the full rent. The program operates through three different voucher types.

- Tenant-based – Tenant-based vouchers are provided directly to families or individuals for use with any rental unit with priced within 185% of the Fair Market Rent in the District. The voucher stays with the family or individual, even if they decide to move to another rental unit in the District.

- Project-based – The District awards project-based vouchers to for-profit or nonprofit developers for specific units that these developers make affordable to residents earning “low incomes,” which includes incomes up to 30 percent, 50 percent, or 80 percent AMI. Developers receiving financing from the HPTF (described above) rely on these vouchers to cover ongoing operating and maintenance costs and keep rents low for tenants with low incomes. Unlike tenant-based vouchers, these vouchers are not portable and stay with the unit. The units must be made affordable over the life of the building. Although it is not required, many project-based vouchers are awarded to developments that also provide supportive services, such as counseling, to residents.

- Sponsor-based – Sponsor-based vouchers are awarded to a landlord or non-profit group for affordable units they make available to families with low incomes. Unlike project-based vouchers, these vouchers are portable and can be moved to another unit run by the non-profit or the landlord. Sponsor-based vouchers are awarded only to groups that agree to provide supportive services to residents housed in the affordable units.

Federal Programs with Local Administration

The federal government provides funding for public housing and a range of affordable housing programs aimed at increasing the supply of affordable housing and making existing housing more accessible.

- Low Income Housing Tax Credit (LIHTC) – This is the largest federal program for subsidizing the construction of apartments with rents below market rates. The federal government gives states and local agencies authority to issue tax credits for acquisition, rehabilitation, or new construction of housing that is affordable to households with low and moderate incomes.

- Public housing – Funded by the federal government and operated and subsidized by the DC Housing Authority (DCHA), public housing provides deeply affordable housing to District tenants. The rent charged to each tenant depends on their income and changes as their income changes. Due to DC’s high levels of economic struggle, public housing is in high demand. In 2022, 40,000 people were on DCHA’s waiting list for affordable housing.

- Housing Choice Voucher Program (HCV) – This federal program, administered by DCHA, operates much like DC’s tenant-based (LRSP) vouchers but is funded with federal, rather than local, money.

Legal Requirements and Restrictions

Elected officials have passed laws to incentivize or mandate the creation or preservation of affordable housing and to stabilize housing for existing renters.

- Public land disposition – When DC sells public land for housing development of a building of ten or more units, up to one-third of the new units must be affordable for the life of the building.

- Inclusionary Zoning (IZ) – This program requires private-market developments to set aside a share of their buildings as affordable, at 80 percent AMI for homeownership and 60 percent AMI for rentals. The District runs a lottery to allocate IZ units to people seeking housing.

- Tenant Opportunity to Purchase Act (TOPA) – By law, when a building owner decides to sell, tenant associations have the right either to, 1) purchase their building to convert it to a co-op or condominiums or 2) assign their rights to a developer to purchase the building. Tenants must form an association and file an intent to purchase in order to take advantage of TOPA.

- District Opportunity to Purchase Act (DOPA) – If the tenants’ attempt to purchase their apartment building under TOPA fails, the District can intervene and preserve some affordable homes, though the District has never taken advantage of this option.

- Rent Control – The local Rental Housing Act of 1985 limits increases in rent charged for units in certain buildings. Rent control only applies to buildings (mainly multi-unit properties) built before 1975, meaning that no new rent-controlled buildings have been added to DC’s housing supply in almost 40 years.

Paths to Homeownership

Generations of exclusionary, racist practices have led to a large racial wealth gap and homeownership gap: in DC, only 34 percent of Black residents own thei r homes compared with nearly 49 percent of white residents. In response to this racial wealth gap, In 2022, Mayor Bowser created the Black Homeownership Strike Force, which released a list of recommendations to increase Black homeownership. Right now, the District provides low- or no-interest loans to eligible residents through a range of programs in order to expand access to homeownership.

- Home Purchase Assistance Program (HPAP) – This program offers interest-free loans and closing cost assistance to people looking to buy a home in the District. The level of financing is dependent on household income and size, need, and the availability of funds. In FY 2023, the District increased the maximum loan amount from $80,000 to $202,000 per homebuyer, in response to increased property costs.

- Employer-Assisted Housing Program ( EAHP ) – This program is similar to HPAP but is available only to District government employees. There is no income cap for EAHP applicants, but it is available only to first time homebuyers.

- DC Open Doors ( DCOD ) – Administered by the DC Housing Finance Agency, this program offers assistance to eligible buyers for home purchase loans, down payments, and closing costs.

How Can DC Strengthen Existing Affordable Housing Tools?

A growing gap between rents and housing prices and wages for those with lower paid jobs has made it increasingly difficult for residents with low and moderate incomes to remain in the District. Given the enormity of its affordable housing crisis, lawmakers should adopt a thoughtful, holistic anti-displacement strategy that pairs long-term solutions with programs that meet residents’ urgent needs. Lawmakers must also ensure strong oversight to support the success of this strategy.

Plan for Long-term Affordability

DC will only make progress towards addressing its housing affordability crisis if lawmakers commit to making that affordability permanent. Lawmakers can achieve this in a number of ways, including expanding and strengthening rent control and ensuring that HPTF investments are both paired with ongoing operating subsidies to keep tenant rents low.

Invest in Resources for Residents with Urgent Housing Needs

While recent major investments in production tools such as the HPTF help the District increase the amount of affordable housing, progress toward production goals is slow and residents need access to housing now. The District must also provide stable and affordable housing to residents in the immediate term.

To do that, lawmakers can invest money in the Emergency Rental Assistance Program (ERAP). ERAP prevents evictions by helping residents pay overdue rent and legal costs. District leaders can also increase funding for, and improve implementation of, its voucher programs to ensure that residents are able to quickly find housing that meets their needs. Policymakers can also work closely with District agencies and community-based organizations to strengthen tenant protections and prevent evictions and other forms of displacement.

Commit to Transparency, Oversight, and Improved Management

As DC invests more in affordable housing programs, lawmakers must hold DC agencies accountable to implementing these programs effectively via increased oversight. Oversight is only possible with transparency, or publicly accessible information. With regular, standardized, and clear reporting about program implementation from agencies, DC Council can make appropriate legislative or funding changes in order to meet goals such as the production of affordable housing , the provision of vouchers, or the upkeep of public housing .

Download the PDF

Latest publications, hidden price of justice: fines and fees in dc’s criminal legal system, dc must grow revenue and spending to pursue more transformative change, a resident’s guide to the dc budget.

- Revenue & Budget

- Inclusive Economy

- Early Child & Pre-K to 12 Education

- Health Equity

- Affordable Housing & Ending Homelessness

- Income & Poverty

- All Publications & Resources

- Budget Resources

- Fact Sheets

- Testimonies

- Upcoming Events

- Past Events

- Event Speakers

- Press Releases

- In The News

- Vision & Mission

- Board of Directors

- Jobs & Internships

- Get Involved

1631 Euclid St NW, #P-5, Washington, DC 20009 | (202) 299-1240

- Jubilee Team

- Financial Reports

- Career Opportunities

- Apartments – Resident Log-in

- Reentry Program Application

- Support Jubilee to College

Jubilee Housing builds diverse, compassionate communities that create opportunities for everyone to thrive. Jubilee Housing creates justice through housing –Justice Housing®

Justice housing is deeply affordable homes with onsite and nearby services in thriving communities..

Deeply Affordable Homes

Deeply Affordable is affordable for those with the fewest resources. Two-thirds of our apartment homes are available for households earning 30% or below of Area Median Income, and one-third of our homes are available for households earning 60% of Area Median Income or below.

Onsite & Nearby Services

Along with affordable homes, Jubilee offers opportunities for families to thrive through onsite supportive programming and partnerships with neighborhood organizations. Combining housing and support services is critical to creating opportunity.

Thriving Communities

Based on research by Raj Chetty & other economists, Jubilee knows that low-income families who live in mixed-income neighborhoods have better outcomes. In and around thriving Adams Morgan, Jubilee connects residents to resources, opportunities, and a supportive community.

News and Celebrations

Wusa9 feature: jubilee x solar.

Hear Jubilee resident and longtime board member Samuel Buggs speak about what Solar For All means to him and his neighbors in the Maycroft.

Introducing Hameed Haqparwar

Hameed is Jubilee’s Director of Research, Impact, and Evaluation who oversees data-based analysis, monitoring, and evaluation of Jubilee’s programs.

You are using an outdated browser. Please upgrade your browser to improve your experience.

District of Columbia Housing Authority

Public Housing

The District of Columbia Housing Authority (DCHA) is proud to offer the Low Income Public Housing Program, a foundational initiative designed to provide safe, quality, and affordable housing options to individuals and families with limited incomes. As a key component of DCHA’s mission, the Public Housing Program is more than just housing—it’s about creating a stable foundation that supports the well-being and growth of our residents. Our Public Housing Program serves a diverse community of residents, offering them a range of housing options from apartments to townhouses, all located within neighborhoods throughout Washington, D.C. These homes are maintained to high standards, ensuring a safe and dignified living environment for all residents.

© 1990-2024 DCHA. All rights reserved

- Meetings and Documents

- Plans and Reports

- Board Committees

- Speaker Request

- Three-Year Recovery Plan

- Senior Team

- DCHA Moving to Work (MTW)

- Media Inquiry

- Document and forms

- Login – Voucherholder

- Customer Service Centers

- Rent Reasonableness FAQ

- Utility Allowance Schedule

- Login – Landlord

- Become Landlord

- Landlord Town Halls

- Landlord Committee

- Document and Forms – Public Housing

- Login – Tenant

- Properties List

- Family Self-Sufficiency

- Scholarship Opportunities

- DCHA Bidders Application

- Portfolio Investment Plan

- Solicitations

- Account Details

- Email Preferences

- Member FAQs

© 2024 Observer Media · Terms · Privacy

D.C. ‘Flatiron’-Style Multifamily Development Receives Full Funding

By nick trombola june 25, 2024 12:26 pm.

Oh, the irony.

As the owners of Manhattan’s Flatiron Building prepare the iconic property for an office-to-residential makeover, developers in Washington, D.C., have finally received full funding to build their own “flatiron” apartment tower in the District’s NoMa neighborhood after nearly a decade of bureaucracy.

A venture between The NRP Group and Marshall Heights Community Development Organization (MCHDO) has secured a large, and diverse, financing package for the 115-affordable-unit project at 301 Florida Avenue NE , according to Bisnow , citing property records.

The D.C. Housing Finance Agency provided the most funding by issuing $47.6 million in tax-exempt bonds, as well as underwriting $32.3 million in Low-Income Housing Tax Credits toward the project. D.C.’s Housing Production Trust Fund also provided $33.1 million, with another $9.5 million coming from Green Bank and state Low-Income Housing Tax Credit funds.

Construction on the long-awaited project, dubbed Emblem , is set to begin next month, with an expected completion by June 2026, per Bisnow.

Yet previous developers have tried to get their version of the flatiron building off the ground since 2016, when a venture between Ditto Residential and Zusin Development sketched out a plan for a 56-unit tower at the lot, which is located just a few blocks away from Union Market.

Despite D.C. Zoning Commission approval, plans for that project stalled until the partnership ultimately decided to sell the parcel in 2021. The NRP and MCHDO venture pounced on it, getting their own development plan approved about a year later.

“Emblem has been designed to provide housing for the District’s working professionals, particularly service and hospitality professionals who might otherwise endure long commutes from home to work,” Chris Marshall , vice president of development at NRP Group, told Commercial Observer.

NoMa is one of the fastest growing areas in D.C., but not all of the news coming out of the neighborhood has been positive lately. The 99-unit Tribeca building at 40 N Street NE went to a foreclosure auction this month as its tens of millions in debt piled up and its developers fell behind on interest payments.

Just across the street from Emblem, meanwhile, a 110-unit building dubbed The Lanes sold at a foreclosure auction in May for $38.3 million, just a year after its delivery date , according to Bisnow.

Nick Trombola can be reached at [email protected] .

First Foundation Bank Provides $30M Refi for Hollywood Apartments

Brookfield, queensland on verge of $265m socal retail refi, northwestern mutual supplies $71m construction loan on n.j. apartments , rilea buys wynwood site for short-term condo development.

By Nick Trombola

By Andrew Coen

U Street corridor redevelopment sparks debate on displacement, density

by Carl Willis

WASHINGTON (7News) — A redevelopment project in the U Street corridor has been billed as the next step in addressing the desperate need for housing in the District.

The proposal is a high-density, mixed-use development.

Initial concerns about the displacement of lower-income residents, and disruption of the community's character around 1617 U Street and 1620 V Street led to a change in the proposal.

In their resolution in support of the project, the Office of Planning shrank the portion of the site that would be upzoned to high density.

Still, some who live in the U Street corridor voiced doubts and lingering questions about what they call luxury rezoning of the site.

It currently houses the Metropolitan Police Department's 3rd District station and a fire station.

"Have any displacement studies been done at all," one resident asked the members of Advisory Neighborhood Commission 1B. "The numbers were pretty stark actually. You didn't find that compelling?"

Those questions came up at a special meeting Thursday night.

READ MORE | DC residents question proposal for U Street development

7News met with Gregory Adams back in May. He lives next door to the site, and is one of the neighbors who fear the development will only push the remaining lower-income residents out of the neighborhood.

Thursday night, he said he found little reassurance.

"It seems to me that the Office of Planning has failed to follow its own racial equity action plan," Adams said. "They didn't speak to any Black businesses, churches, residents, or anyone. Which means they're not making an informed decision."

At the same time, other neighbors are happy for high-density housing to move in.

Several support letters were listed in the exhibits for the project.

"D.C. is in a housing crisis and we need to expand our inventory as much as possible," wrote one resident.

"It would likewise reduce pressure on the housing market in the neighborhood (which is too expensive) and increase diversity of businesses (potentially!)," wrote another neighbor.

Adams said an amendment in the ANC's resolution to include extremely low-income residents is a step in the right direction.

"I think that's a positive movement, but it's just a resolution and we have no guarantees," he said.

The ANC said it supports setbacks including lower heights on the North and West side of the property.

They also said they would like to see family-sized units included.

- Health Equity

- Managed Care

- Maternal & Early Childhood Health

- Rural Health

- Unwinding the PHE

- State Data Hub

- Research & Reports

- Comments on Federal Regulations

- Faculty and Staff

CMS Awards 18 States Up to $2.5 Million Each to Advance Medicaid and CHIP School-Based Services

- share this post on Facebook

- share this post on Twitter

- share this post on LinkedIn

- share this post through Email

This week, on the two-year anniversary of the Bipartisan Safer Communities Act, the Centers for Medicare & Medicaid Services (CMS) announced it is awarding grants to 18 states for implementation, enhancement, and expansion of Medicaid and the Children’s Health Insurance Program (CHIP) school-based health services. As previously discussed on Say Ahhh! , the 2022 Bipartisan Safer Communities Act included a number of provisions related to school-based health services and Medicaid including updated guidance , a new technical assistance center , and $50 million for the Secretary of the Health and Human Services (HHS) to award grants to states.

States each receiving up to a $2.5 million over three years fall into three buckets:

Implementation states – including states that have yet to expand coverage of and billing for Medicaid and CHIP services provided to schools beyond students with individualized education programs (IEPs):

- Rhode Island

- West Virginia

Expansion states – including states that have expanded coverage and billing of Medicaid or CHIP services provided in schools beyond what is in a student’s IEP but not yet to every Medicaid or CHIP coverable service:

- New Hampshire

- North Carolina

- Pennsylvania

Enhancement states – including states that have expanded coverage and billing of Medicaid services provided in schools beyond IEPs to include any Medicaid or CHIP covered service provided to a Medicaid- or CHIP-enrolled student by a Medicaid- or CHIP-participating provider:

- Massachusetts

CMS also announced two new resources from the technical assistance (TA) center including a Medicaid school-based services readiness checklist tool to help state Medicaid agencies draft a state plan amendment and additional technical assistance FAQs on the TA website including FAQs related to managed care and CHIP.

Subscribe to Updates from our Team

Supreme court (yet again) destroys long-standing precedent in another power grab: this time federal agencies greatly weakened.

Four years of RAPID Survey Project Highlights Young Families’ Biggest Stressors: Child Care, Housing, Health Care

Ccf.georgetown.edu.

Department of Housing and Community Development

Dc agency top menu.

- Agency Directory

- Online Services

- Accessibility

document.write(document.getElementById("site-slogan").innerHTML);

Search form

- Registration

- Housing Counseling

- Housing Locator

- Tenant Purchase

- Preservation

- Records Search

- Accessory Apartments

- Heirs Property

- Safe and Healthy

- Rent Control

- Conversion and Sales

- Asset Management

- Provider Resources

- Small Building Program

- Facade Program

- Technical Assistance

- Current Projects

- Solicitations

- Vacant/Blighted

- Fair Housing

- HUD Section 3

- Rental Income Limits

- Inclusionary Zoning Development

- Mission and Vision

- Open Government and FOIA

- Career Opportunities

- Executive Staff

- Federal Rules

- Income Limits

- Regulations

- Consolidated Plan

- Annual Action Plan

- Consolidated Annual Performance and Evaluation Reports (CAPER)

- Publications

- Media Inquiries

2021 Consolidated Request for Proposals for Affordable Housing Projects

This RFP seeks impactful proposals to produce new affordable housing units for households earning less than half of the Median Family Income (MFI). DHCD also seeks to fund projects that preserve existing, occupied affordable housing units reserved for low-income, very low-income, and extremely low-income households.

Application materials and further instructions can be found at: https://octo.quickbase.com/db/brp3r63qr?a=showpage&pageid=40

Click the following link to view the virtual orientation held on October 21, 2021: https://youtu.be/iXqOpntdyAM

The 2021 Consolidated RFP has been updated as of February 10, 2022. See the updated document below.

More Resources

COMMENTS

DCHousingSearch.org is a free affordable housing locator that that provides easy access to information about housing opportunities in ... Current Projects; Solicitations; Vacant/Blighted; Project Monitoring. Fair Housing; HUD Section 3 ... 1909 Martin Luther King Jr. Avenue SE, Washington, DC 20020 Phone: (202) 442-7200 TTY: 711 Email: [email ...

The Department of Housing and Community Development (DHCD) and the Office of Planning (OP) have launched the Housing Framework for Equity and Growth. This initiative has three goals: We'll need your help reaching the District's goals. Throughout this initiative, we will be calling on residents to make their voices heard.

Department of Housing and Community Development. The Housing Production Trust Fund (HPTF) Advisory Board (Board) was established by the Council of the District of Columbia, under the Housing Production Trust Fund Act of 1988, effective on June 8, 1990 (DC Law 8-133; D.C. Official Code section 42-2802.01), as amended.

In order to keep up with all of the construction cranes, the Washington D.C. Economic Partnership compiled the city's top 10 residential projects, based on number of housing units. Expected ...

Tuesday, June 30, 2020. (Washington, DC) - Today, Mayor Bowser announced the selection of 10 projects that will produce and preserve 940 affordable homes and more than 300 market rate homes. The affordable housing projects are being funded primarily through a $66 million investment from the Housing Production Trust Fund (HPTF).

36,000 Housing Count. The purpose of this site is to track housing production in support of the Mayor's goal of producing 36,000 new housing units and 12,000 affordable units by 2025. The dashboard below is updated monthly to reflect the total new housing units and new affordable units created each month. For more information on this target ...

Monday, March 11, 2024. Housing in Downtown Program Expected to Support District in Reaching 90% of the Goal to Add 15,000 Residents Downtown by 2028. (Washington, DC) - Today, Mayor Muriel Bowser and the Office of the Deputy Mayor for Planning and Economic Development (DMPED) launched the District's Housing in Downtown Program.

Over 2,000 new affordable housing units have gone up in DC since 2015, and another 8,000 are under construction or in the pipeline. Check out this map to explore the most up-to-date data on the last two years' worth of completed, under construction, and planned affordable housing in DC. var divElement = document.getElementById('viz1472758147350'); …

(Washington, DC) - Today, Mayor Muriel Bowser and the Department of Housing and Community Development (DHCD) announced the selection of 9 projects that will produce and preserve over 1,100 affordable homes, including approximately 660 new homes. ... The affordable housing projects are being funded primarily through a $66 million investment ...

Cost is a factor in why DC's subsidy tools have funded affordable housing in Ward 3. There is an obvious tension between expanding affordable housing in high-opportunity, high-cost areas, and trying to build the most affordable housing with available funds. While the District's housing subsidies are awarded to projects based on multiple ...

These newly announced projects will build on this success and increase access to affordable housing throughout Washington, DC. Amazon's $147 million commitment was announced at an event held at Congress Heights - an affordable housing project being developed in Washington, D.C.'s Ward 8. Like many of the other affordable housing projects ...

DCHousingSearch.org is the District of Columbia's free online housing locator service for individuals and property owners/managers. The site is funded through the DC Department of Housing and Community Development (DHCD). Housing opportunities listed on this site include the following and more: DHCD funded affordable housing projects.

Among the 10 projects is the first affordable housing development in Ward 3 to be backed by the HPTF. The development will add 93 units to a Friendship Heights senior living facility known as the ...

Other programs, such as project-based vouchers (see below) help "very-low income" families (under $71,150 in DC for a family of four) and "low-income" families (under $113,850). ... Public housing - Funded by the federal government and operated and subsidized by the DC Housing Authority (DCHA), public housing provides deeply ...

The District of Columbia Housing Authority and its contractors provide job training and employment opportunities to eligible low-income individuals in Washington, D.C. In addition, DCHA also offers training and support for low-income clients who are seeking employment opportunities. The basis of these employment opportunity programs is Section ...

REAL ESTATE. There are more than 8,300 units in 52 traditional public housing developments. Of those properties, 14 serve the elderly and disabled. DCHA maintains an occupancy rate of approximately 95 percent. Tenants pay 30 percent of their adjusted income towards rent. The average rent paid by a public housing household is approximately $250.

Washington, DC - Today, Mayor Muriel Bowser and the Department of Housing and Community Development (DHCD) announced the selection of 11 affordable housing projects from the General Evaluation Round of the 2021 Consolidated Request for Proposals (RFP) for Affordable Housing Projects.

Jubilee Housing builds diverse, compassionate communities that create opportunities for everyone to thrive. Jubilee Housing creates justice through housing -Justice Housing® ... Washington, DC 20009 [email protected] Phone: (202) 299-1240 Fax: (202) 299-1246.

Public Housing. The District of Columbia Housing Authority (DCHA) is proud to offer the Low Income Public Housing Program, a foundational initiative designed to provide safe, quality, and affordable housing options to individuals and families with limited incomes. As a key component of DCHA's mission, the Public Housing Program is more than ...

Project Summary In 2022 and 2023, the District got funding to provide more than 5,000 new permanent housing vouchers, the largest ever two-year increase. ... The resident still needs to apply to the DC Housing Authority to be approved for a voucher. Once approved, the resident will need to find a unit to accept the voucher before then moving in ...

The project also received $33.1M from D.C.'s Housing Production Trust Fund, $6.5M in state LIHTC funds and another $3M from DC Green Bank. The project, expected to cost $110.8M, is now fully ...

The D.C. Housing Finance Agency provided the most funding by issuing $47.6 million in tax-exempt bonds, as well as underwriting $32.3 million in Low-Income Housing Tax Credits toward the project. D.C.'s Housing Production Trust Fund also provided $33.1 million, with another $9.5 million coming from Green Bank and state Low-Income Housing Tax ...

WASHINGTON (7News) — A redevelopment project in the U Street corridor has been billed as the next step in addressing the desperate need for housing in the District. The proposal is a high ...

The D.C. Council approved the fiscal 2025 budget, launching the Central Washington Activation Program to convert office buildings into hotels, retail, and restaurants. This new initiative, distinct from the existing residential conversion program, offers a 15-year property tax abatement for eligible projects. The abatement cap is set at $5 million in 2027, $6 million ...

1133 North Capitol Street N.E. Washington, DC 20002 Phone: (202) 535-1000 Contact Us Tyrone Garrett, Executive Director District of Columbia Housing Authority.

(Washington, DC) - Today, Mayor Muriel Bowser announced that the District Department of Transportation (DDOT) was awarded a $25 million federal grant for a transformative project that will enhance transportation infrastructure along the New York Avenue NE corridor. The New York Avenue Bridge and Lincoln Connector Trail Project will include the construction of a nearly two-mile multimodal ...

Evanston, Ill., for example, became the first U.S. city to deliver reparations in the form of a restorative housing initiative — but is now being sued by a conservative advocacy group that ...

This week, on the two-year anniversary of the Bipartisan Safer Communities Act, the Centers for Medicare & Medicaid Services (CMS) announced it is awarding 18 states grants for implementation, enhancement, and expansion of Medicaid and the Children's Health Insurance Program (CHIP) school-based health services. As previously discussed on Say Ahhh!, the 2022 Bipartisan Safer Communities Act ...

Group A housing providers (with units in city portfolio of affordable housing projects, including those affordable housing owners with 20 or fewer units) may submit applications here.If you have questions about your application, you can contact the DC Housing Finance Agency by emailing [email protected] or calling 1-833-201-9989.. Group B housing providers (with ownership interests in 20 or ...

This RFP seeks impactful proposals to produce new affordable housing units for households earning less than half of the Median Family Income (MFI). DHCD also seeks to fund projects that preserve existing, occupied affordable housing units reserved for low-income, very low-income, and extremely low-income households. Application materials and further instructions can be found at: https://octo ...