Business Law Today

November 2015

Assignment for the Benefit of Creditors: Effective Tool for Acquiring and Winding Up Distressed Businesses

David s kupetz.

Nov 15, 2015

12 min read

- Assignments for the benefit of creditors are an alternative to the formal burial process of a Chapter 7 bankruptcy.

- The ABC process may allow the parties to avoid the delay and uncertainty of formal federal bankruptcy court proceedings.

- ABCs can be particularly useful when fast action and distressed transaction and/or industry expertise is needed in order to capture value from the liquidation of the assets of a troubled enterprise.

An assignment for the benefit of creditors (ABC) is a business liquidation device available to an insolvent debtor as an alternative to formal bankruptcy proceedings. In many instances, an ABC can be the most advantageous and graceful exit strategy. This is especially true where the goals are (1) to transfer the assets of the troubled business to an acquiring entity free of the unsecured debt incurred by the transferor and (2) to wind down the company in a manner designed to minimize negative publicity and potential liability for directors and management.

The option of making an ABC is available on a state-by-state basis. During the meltdown suffered in the dot-com and technology business sectors in the early 2000s, California became the capital of ABCs. In discussing assignments for the benefit of creditors, this article will focus primarily on California ABC law.

Assignment Process

The process of an ABC is initiated by the distressed entity (assignor) entering an agreement with the party which will be responsible for conducting the wind-down and/or liquidation or going concern sale (assignee) in a fiduciary capacity for the benefit of the assignor’s creditors. The assignment agreement is a contract under which the assignor transfers all of its right, title, interest in, and custody and control of its property to the third-party assignee in trust. The assignee liquidates the property and distributes the proceeds to the assignor’s creditors.

In order to commence the ABC process, a distressed corporation will generally need to obtain both board of director authorization and shareholder approval. While this requirement is dictated by applicable state law, the ABC constitutes a transfer of all of the assignor’s assets to the assignee, and the law of many states provides that the transfer of all of a corporation’s assets is subject to shareholder approval. In contrast, shareholder approval is not required in order for a corporation to file a petition commencing a federal bankruptcy case. In some instances, the shareholder approval requirement for an ABC can be an impediment to the quick action ordinarily available in the context of an ABC, especially when a public company is involved as the assignor.

The board of directors of an insolvent company (a company with debt exceeding the value of its assets) should be particularly attentive to avoiding harm to the value of the enterprise and the interests of creditors. Under Delaware law, for example, the obligation is to maximize the value of the enterprise, which should result in protecting the interests of creditors.

It is not unusual for the board of a troubled company to determine that a going concern sale of the company’s business is in the best interests of the company and its creditors. However, generally the purchaser will not acquire the business if the assumption of the company’s unsecured debt is involved. Further, often the situation is deteriorating rapidly. The company may be burning through its cash reserves and in danger of losing key employees who are aware of its financial difficulties, and creditors of the company are pressing for payment. Under these circumstances, the company’s board may conclude than an ABC is the most appropriate course of action.

The Alternative of Voluntary Federal Bankruptcy Cases

Chapter 7 bankruptcy provides a procedure for the orderly liquidation of the assets of the debtor and the ultimate payment of creditors in the order of priority set forth in the U.S. Bankruptcy Code. Upon the filing of a Chapter 7 petition, a trustee is appointed who is charged with marshaling all of the assets of the debtor, liquidating the assets, and eventually distributing the proceeds of the liquidation to the debtor’s creditors. The process can take many months or even years and is governed by detailed statutory requirements.

Chapter 11 of the Bankruptcy Code provides a framework for a formal, court-supervised business reorganization. While the primary goals of Chapter 11 are rehabilitation of the debtor, equality of treatment of creditors holding claims of the same priority, and maximization of the value of the bankruptcy estate, Chapter 11 can be used to implement a liquidation of the debtor. Unlike the traditional common law assignment for the benefit of creditors (assignments are governed by state law and may differ from state to state), Chapter 7 and Chapter 11 bankruptcy cases are presided over by a federal bankruptcy judge and are governed by a detailed federal statute.

Advantages of an ABC

The common law assignment by simple transfer in trust, in many cases, is a superior liquidation mechanism when compared to using the more cumbersome statutory procedures governing a formal Chapter 7 bankruptcy liquidation case or a liquidating Chapter 11 case. Compared to bankruptcy liquidation, assignments may involve less administrative expense and are a substantially faster and more flexible liquidation process. In addition, unlike a Chapter 7 liquidation, where generally an unknown trustee will be appointed to administer the liquidation process, in an ABC the assignor can select an assignee with appropriate experience and expertise to conduct the wind-down of its business and liquidation of its assets. In prepackaged ABCs, where an immediate going concern sale will be implemented, the assignee will be involved prior to the ABC going effective. Further, in states that have adopted the common law ABC process, court procedures, requirements, and oversight are not involved. In contrast, in bankruptcy cases, the judicial process is invoked and brings with it additional uncertainty and complications, including players whose identity is unknown at the time the bankruptcy petition is filed, expense, and likely delay.

In situations where a company is burdened with debt that makes a merger or acquisition infeasible, an ABC can be the most efficient, effective, and desirable means of effectuating a favorable transaction and addressing the debt. The assignment process enables the assignee to sell the assignor’s assets free of the unsecured debt that burdened the company. Unlike bankruptcy, where the publicity for the company and its officers and directors will be negative, in an assignment, the press generally reads “assets of Oldco acquired by Newco,” instead of “Oldco files bankruptcy” or “Oldco shuts its doors.” Moreover, the assignment process removes from the board of directors and management of the troubled company the responsibility for and burden of winding down the business and disposing of the assets.

From a buyer’s perspective, acquiring a going concern business or the specific assets of a distressed entity from an Assignee in an ABC sale transaction provides some important advantages. Most sophisticated buyers will not acquire an ongoing business or substantial assets from a financially distressed entity with outstanding unsecured debt, unless the assets are cleansed either through an ABC or bankruptcy process. Such buyers are generally unwilling to subject themselves to potential contentions that the assets were acquired as part of a fraudulent transfer and/or that they are a successor to or subject to successor liability for claims against the distressed entity. Buying a going concern or specified assets from an assignee allows the purchaser to avoid these types of contentions and issues and to obtain the assets free of the assignor’s unsecured debt. Creditors of the assignor simply must submit proofs of claim to the assignee and will ultimately receive payment by the assignee from the proceeds of the assignment estate. Moreover, compared to a bankruptcy case, where numerous unknown parties (e.g., the bankruptcy trustee, the bankruptcy judge, the U.S. trustee, an unsecured creditors’ committee, and possibly others) will become part of the process and where court procedures and legal requirements come into play, a common law ABC allows for flexibility and quick action.

From the perspective of a secured creditor, in certain circumstances, instead of being responsible for conducting a foreclosure proceeding, the secured creditor may prefer to have an independent, objective third party with expertise and experience liquidating businesses of the type of the distressed entity act as an assignee. There is nothing wrong with an assignee entering into appropriate subordination agreements with the secured creditor and liquidating the assignor’s assets and turning the proceeds over to the secured creditor to the extent that the secured creditor holds valid, perfected liens on the assets that are sold.

As a common law liquidation vehicle that has been around for a very long time, ABCs have been used over the years for all different types of businesses. In the early 2000s, in particular, ABCs became an especially popular method for liquidating troubled dot-com, technology, and health-care companies. In large part, this was simply a reflection of the distressed nature of those industries. At the same time, ABCs allow for quick and flexible action that frequently is necessary in order to maximize the value that might be obtained for a business that is largely dependent on the know-how and expertise of key personnel. An ABC may provide a vehicle for the implementation of a quick transaction which can be implemented before key employees jump from the sinking ship.

The liquidation process in an ABC can take many different forms. In some instances, negotiations between the buyer and the assignee commence before the assignment is made and a prepackaged transaction is agreed on and implemented contemporaneously with the execution of the assignment. This type of turnkey sale can effectively allow the purchaser of a business to acquire the business without assuming the former owner’s unsecured debt in a manner where the business operations continue uninterrupted.

In certain instances, the assignee may operate the assignor’s business post-ABC with the intent of selling the business as a going concern even if an agreement has not been reached with a purchaser. However, the assignee must weigh the risks and costs of continuing to operate the business against the anticipated benefits to be received from a going concern sale.

In many cases, the distressed enterprise has already ceased operations prior to making the assignment or will cease its business operations at the time the ABC is entered. In these cases, the assignee may be selling the assets in bulk or may sell or license certain key assets and liquidate the other assets through auctions or other private or public liquidation sale methods. At all times, the assignee is guided by its responsibility to act in a reasonable manner designed to maximize value obtained for the assets and ultimate creditor recovery under the circumstances.

Disadvantages of an ABC

As discussed above, an ABC can be an advantageous means for a buyer to acquire assets and/or a business in financial distress. However, unlike in a bankruptcy case, because the ABC process in California is nonjudicial, there is no court order approving the sale transaction. As a result, a buyer who requires the clarity of an actual court order approving the sale will not be able to satisfy that desire through an ABC transaction. That being said, the assignee is an independent, third-party fiduciary who must agree to the transaction and is responsible for the ABC process. The buyer in an ABC transaction will have an asset purchase agreement and other appropriate ancillary documents that have been executed by the assignee.

Unlike in a formal federal bankruptcy case, executory contracts and leases cannot be assigned in an ABC without the consent of the counter party to the contract. Accordingly, if the assignment of executory contracts and/or leases is a necessary part of the transaction and, if the consent of the counter parties to the contracts and leases cannot be obtained, an ABC transaction may not be the appropriate approach. Further, ipso facto default provisions (allowing for termination, forfeiture, or modification of contract rights) based on insolvency or the commencement of the ABC are not unenforceable as they are in a federal bankruptcy case.

Secured creditor consent is generally required in the context of an ABC. There is no ability to sell free and clear of liens, as there is in some circumstances in a federal bankruptcy case, without secured creditor consent (unless the secured creditor will be paid in full from sale proceeds). Moreover, there is no automatic stay to prevent secured creditors from foreclosing on their collateral if they are not in support of the ABC. The lack of an automatic stay is generally not significant with respect to unsecured creditors since assets have been transferred to the assignee and unsecured creditors claims are against the assignor.

While there is a risk of an involuntary bankruptcy petition being filed against the assignor, experience has shown that this risk should be relatively small. Further, when an involuntary bankruptcy petition is filed, it is generally dismissed by the bankruptcy court because an alternative insolvency process (the ABC) is already underway. In the context of an out-of-court workout or liquidation, there is always the risk that an involuntary bankruptcy petition may be filed against the debtor. Such a risk is substantially less, however, in connection with an assignment for the benefit of creditors because the bankruptcy court is likely to abstain when a process (the assignment) is already in place to facilitate liquidation of the debtor’s assets and distribution to creditors. A policy is in place that favors allowing general assignments for the benefit of creditors to stand.

Distribution Scheme in ABCs

ABCs in California are governed by common law and are subject to various specific statutory provisions. In states like California, where common law (with specific statutory supplements) governs the ABC process, the process is nonjudicial. An assignee in an assignment for the benefit of creditors serves in a capacity that is analogous to a bankruptcy trustee and is responsible for liquidating the assets of the assignment estate and distributing the net proceeds, if any, to the assignor’s creditors.

Under California law, an assignee for the benefit of creditors must set a deadline for the submission of claims. Notice of the deadline must be disseminated within 30 days of the commencement of the assignment and must provide not less than 150 and not more than 180 days’ notice of the bar date. Once the assignee has liquidated the assets, evaluated the claims submitted, resolved any pending litigation to the extent necessary prior to making distribution, and is otherwise ready to make distribution to creditors, pertinent statutory provisions must be followed in the distribution process. Generally, California law ensures that taxes (both state and municipal), certain unpaid wages and other employee benefits, and customer deposits are paid before general unsecured claims.

Particular care must be taken by assignees in dealing with claims of the federal government. These claims are entitled to priority by reason of a catchall-type statute which entitles any agency of the federal government to enjoy a priority status for its claims over the claims of general unsecured creditors. In fact, the federal statute provides that an assignee paying any part of a debt of the person or estate before paying a claim of the government is liable to the extent of the payment for unpaid claims of the government. As a practical result, these payments must be prioritized above those owed to all state and local taxing agencies.

In California, there is no comprehensive priority scheme for distributions from an assignment estate like the priority scheme in bankruptcy or priority schemes under assignment laws in certain other states. Instead, California has various statutes which provide that certain claims should receive priority status over general unsecured claims, such as taxes, priority labor wages, lease deposits, etc. However, the order of priority among the various priority claims is not clear. Of course, determining the order of priority among priority claims becomes merely an academic exercise if there are sufficient funds to pay all priority claims. Secured creditors retain their liens on the collateral and are entitled to receive the proceeds from the sale of their collateral up to the extent of the amount of their claim. Thereafter, distribution in California ABCs is made in priority claims, including administrative expenses, obligations owing to the federal government, priority wage and benefit claims, state tax claims, including interest and penalties for sales and use taxes, income taxes and bank and corporate taxes, security deposits up to $900 for the lease or rental of property, or purchase of services not provided, unpaid unemployment insurance contribution, including interest and penalties, and general unsecured claims. Interest is paid on general unsecured claims only after the principal is paid for all unsecured claims submitted and allowed and only to the extent that a particular creditor is entitled under contract or judgment to assert such claim for interest.

If there are insufficient funds to pay the unsecured claims in full, then these claims will be paid pro rata. If unsecured claims are paid in full, equity holders will receive distribution in accordance with their liquidation rights. No distribution to general unsecured creditors should take place until the assignee is satisfied that all priority claims have been paid in full.

Assignments for the benefit of creditors are an alternative to the formal burial process of a Chapter 7 bankruptcy. Moreover, ABCs can be particularly useful when fast action and distressed transaction and/or industry expertise is needed in order to capture value from the liquidation of the assets of a troubled enterprise. The ABC process may allow the parties to avoid the delay and uncertainty of formal federal bankruptcy court proceedings. In many instances involving deteriorating businesses, management engages in last-ditch efforts to sell the business in the face of mounting debt. However, frequently the value of the business is diminishing rapidly as, among other things, key employees leave. Moreover, the parties interested in acquiring the business and/or assets will move forward only under circumstances where they will not be taking on the unsecured debt of the distressed entity along with its assets. In such instances, especially when the expense of a Chapter 11 bankruptcy case may be unsustainable, an assignment for the benefit of creditors can be a viable solution.

Sulmeyerkupetz

David Kupetz specializes in troubled transactions, crisis avoidance consultation, workouts, restructurings, reorganizations, bankruptcies, receiverships, assignments for the benefit of creditors, municipal debt adjustment and...

View Bio →

- assignments benefits creditors abcs basics california

Assignments for the Benefits of Creditors - "ABC's" - The Basics in California

An assignment for the benefit of creditors (“ABC”) is a contract by which an economically troubled entity ("Assignor") transfers legal and equitable title, as well as custody and control, of its assets and property to an independent third party ("Assignee") in trust, who is required to apply the proceeds of sale of the property to the assignor's creditors in accord with priorities established by law.

ABCs are a well-established common law tool and alternative to formal bankruptcy proceedings. The method only makes sense if there are significant assets to liquidate. ABCs are most successful when the Assignor, Assignee and creditors cooperate but can be imposed even if the creditors are not supportive.

Assignors - Rights and Duties

Generally, any debtor – an individual, partnership, corporation or LLC - may make an assignment for the benefit of creditors. Individuals seldom utilize ABCs, though, because there is no discharge of all debts as there would normally occur in a completed bankruptcy filing. Thus, the protection and benefit of the process is quite limited for any personal obligor.

ABCs can benefit individual principals who have personally guaranteed company obligations or have personal liability on tax claims. Once the Assignment Agreement has been executed, a trust is automatically put in place over the assets transferred. The Assignor can neither rescind the contract nor control the proceedings, but the Assignor may be consulted as necessary and appropriate by the Assignee during the liquidation process.

Assets to be Assigned

Assignor may assign any non-exempt real, personal, and/or general intangible property that can be sold or conveyed. Note that such assets as intellectual property, trade names, logos, etc. may be so transferred and sold. When a corporation makes an assignment, all corporate property, tangible and intangible is transferred including accounts, and rights and credits of all kinds, both in law and equity. The assets only can be sold, not the corporation or its stock. Thus the corporation remains existing, albeit without any significant assets left. It becomes, effectively, a shell.

Assets are typically sold without representations or warranties. The sale is free and clear of known liens, claims and encumbrances - with the consent or full payoff of lien holders. Generally, Assignee warrants only that Assignee has title to the assets.

Assignees - Rights and Duties

The Assignee is generally an unrelated professional liquidator selected by the Assignor. The Assignee gathers the Assignor’s assets and sells the Assignor’s right, title and interest in those assets, then distributes the proceeds to Creditors in accordance with statutory priorities.

The Assignee has a fiduciary duty to the Creditors. Assignee’s duties include protecting the assets of the estate, administering them fairly and representing the estate. Assignee is free to enter into contracts to recover assets or liquidated claims, e.g. filing suit or taking other action.

The Assignee may be removed by a court for violations of the Assignment contract or nonfeasance (failure to act appropriately). The Assignee may not give up his/her/its duties without liability or a superior court order until creditors receive distribution of the proceeds of sale of the assets transferred.

Assignee usually prepares the Assignment documents, though the attorney for the Assignor may draft them as well. Often the terms are negotiated at length.

Preferential Claims and Avoidance

Assignee has statutory avoidance powers, similar to those granted to a Chapter 7 bankruptcy trustee. [See Calif. CCP § 493.030 (termination of lien of attachment or temporary protective order), § 1800 et seq. (avoidance of preferential transfers); Calif. Civ.C. § 3439 et seq. (avoidance of fraudulent conveyances)]

Even so, courts may question this right outside a bankruptcy proceeding. There is also disagreement between the Federal Court (Ninth Circuit) and California state courts whether the Bankruptcy Code preempts the assignee's preference avoidance power under California statutory law.

Creditors - Rights and Duties

While not required to consent to an Assignment, secured creditors often must agree in advance since their cooperation frequently affects the liquidation of the assets. Secured creditors are not barred from enforcing their security by such an assignment. The acceptance of an Assignment by unsecured creditors is not necessary, since under common law the proceedings are deemed to benefit them through equality of treatment.

Note that all Creditors must file their claims within the statutory 150-180 day claim filing period.

ABCs in California do not require a public court filing, but most corporations require both board and shareholder approval. Costs and expenses, including the assignee’s fees, legal expenses and costs of administration, are paid first, just as in a Chapter 7 bankruptcy . Because an assignee’s fee is often based on a percentage value of the assigned assets, it can be difficult to procure assignees for smaller estates.

- Assignment Agreement is executed and ratified. Assignor turns over and assigns to Assignee all right, title and interest in the assets being assigned.

- Assignor gives Assignee a complete, certified list of creditors, including addresses and amounts owed.

- Assignee notifies Creditors within 30 days of execution that assignment has been made, provides an estimate of the probable distribution, and provides a claim form for each Creditor to file a claim in the Assignment estate.

- Creditors have 150-180 days from the date of written notice of the assignment to file their claims.

- After claim forms are returned and/or the Bar Date has passed, Assignee reconciles the claims and/or objects to any improper claim amounts.

- After liquidation, Assignee determines distribution amounts. Claim priority is determined first by state statute, then by Bankruptcy Code. First are secured creditors, then follow tax & wage claims.

- Assignee generally informs the IRS that assignment has been made and files notice with local Recorder.

- Assignee immediately searches for any previously undisclosed liens (UCC or real estate) to ensure complete notice to all creditors and interest holders.

- Assignee secures all assets. In limited situations where the business has enough cash, Assignee may continue to operate the business to maintain going-concern value - if no further debt will be incurred.

It normally takes about 12 months to conclude an ABC.

Effects of ABC

An ABC generally is faster and less costly than a bankruptcy proceeding. Parties can often agree and determine what is going to happen prior to execution of the assignment.

However, ABCs do not discharge individual Assignors from their debts, and do not provide for the reorganization of the business. There is no automatic stay, though in practice an ABC results in an informal and/or incomplete automatic stay if the creditors determine that the assets are beyond their reach.

Creditors are able to continue to pursue the Assignor. ABCs often block judgment creditors from attaching assets because the Assignor no longer has title to or interest in the assigned assets. Sometimes the Assignee is willing to allow the judgment if the judgment creditor submits its claim as described above. The assignee may also defend against a claim if the plaintiff is seeking a judgment which is unjustified and not fair to other creditors.

An ABC also provides grounds for filing an involuntary bankruptcy petition within 120 days of assignment.

The Statutes: California Code of Civil Procedure

§§493.010-493.060 “Effect of Bankruptcy Proceedings and General Assignments for the Benefit of Creditors”

§§1800-1802 “Recovery of Preferences and Exempt Property in an Assignment for the Benefit of Creditors”

A Chapter 11 Reorganization can cost hundreds of thousands of dollars and even a business Chapter 7 Liquidation bankruptcy can easily cost tens of thousands or more. The Assignment method, which pays the Assignee normally by a percentage of the assets sold, is cost-efficient but limited in the protection it may afford the Assignor, as described above. Before this method is attempted, competent legal counsel and certified public accountants should be consulted.

Founded in 1939, our law firm combines the ability to represent clients in domestic or international matters with the personal interaction with clients that is traditional to a long established law firm.

Read more about our firm

© 2024, Stimmel, Stimmel & Roeser, All rights reserved | Terms of Use | Site by Bay Design

assignment for benefit of creditors

Primary tabs.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets. The trustee will manage the assets to pay off debt to creditors, and if any assets are left over, they will be transferred back to the debtor.

ABC can provide many benefits to an insolvent business in lieu of bankruptcy . First, unlike in bankruptcy proceedings, the business can choose the trustee overseeing the process who might know the specifics of the business better than an appointed trustee. Second, bankruptcy proceedings can take much more time, involve more steps, and further restrict how the business is liquidated compared to an ABC which avoids judicial oversight. Thirdly, dissolving or transferring a company through an ABC often avoids the negative publicity that bankruptcy generates. Lastly, a company trying to purchase assets of a struggling company can avoid liability to unsecured creditors of the failing company. This is important because most other options would expose the acquiring business to all the debt of the struggling business.

ABC has risen in popularity since the early 2000s, but it varies based on the state. California embraces ABC with common law oversight while many states use stricter statutory ABC structures such as Florida. Also, depending on the state’s corporate law and the company’s charter , the struggling business may be forced to get shareholder approval to use ABC which can be difficult in large corporations.

[Last updated in June of 2021 by the Wex Definitions Team ]

- commercial activities

- financial services

- business law

- landlord & tenant

- property & real estate law

- trusts, inheritances & estates

- wex definitions

Assignments for the Benefit of Creditors – an often-overlooked state law alternative to Chapter 7 bankruptcy

For some folks the three letters ABC are a reminder of elementary school and singing a song to learn the alphabet. For others, it is a throw back to the early 70’s when the Jackson Five and its lead singer Michael, still with his adolescent high voice, sang a catchy love song. Then there is a select group of people in the world of corporate workouts, liquidations and bankruptcies, who know those three letters to stand for the A ssignment for the B enefit of C reditors – a voluntary state law liquidation process that may arguably offer a hospitable and friendly alternative to federal bankruptcy. This article is a brief summary of this potentially attractive alternative to bankruptcy.

The Assignment for the Benefit of Creditors (“ABC”), also known as a General Assignment, is a state law procedure governed by state statute or common law. Over 30 states have codified statutes, and the remainder of states rely on common law. See Practical Issues in Assignments for the Benefit of Creditors , by Robert Richards & Nancy Ross, ABI Law Review Vol. 17:5 (2009) at p. 6 (listing state statutes). In some states, the statutory authority and common law can coexist. At its most basic, the ABC process involves the transfer of all assets by a financially distressed debtor (the assignor) to an individual or entity (the assignee) with fiduciary obligations who then liquidates the assets and pays creditors. The assignment agreement is essentially a contract involving the transfer and control of property, in trust, to a third party. In some states that have enacted a statute, state courts may supervise the process (and at different levels of involvement depending on the statute). The statutory scheme in other states such as California and Nevada, and in states where common law govern, do not provide for judicial oversight..

ABCs are promoted as less expensive and more flexible than a chapter 7 liquidation and may proceed substantially faster than bankruptcy liquidation. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 8 (citations omitted). In addition, the ABC process may provide four other noteworthy benefits not available in a bankruptcy. First, the liquidating company chooses the assignee, there is no appointment of a random trustee or formal election required like in a bankruptcy. This freedom of choice allows the assignor to evaluate the reputation and experience of proposed assignees, as well as select an assignee with familiarity in the nature of the assignor’s business and/or with more expansive contacts in the industry to facilitate the sale/liquidation. Second, the ABC process generally falls under the radar of the media (particularly in states that do not require court supervision), and the assignor may avoid publicity, often negative, that can be associated with bankruptcy proceedings. Third, with an ABC, the assignee has the ability to sell the assets without the imposition of potentially cumbersome requirements of Section 363 of the Bankruptcy Code, and in some cases, can conduct a sale the same day as the general assignment. Finally, the ABC process generally authorizes the sale of assets free of unsecured creditor debt. In essence, in an ABC, a company buying assets from a distressed business does not acquire the debt of the assignor.

On the down side, ABCs do not provide the protection of the automatic stay that is triggered upon the filing of a bankruptcy petition. In some situations, the debtor entity needs to stop the pursuit of creditors immediately, and a bankruptcy proceeding will supply this relief. Unlike bankruptcy, the sale through an ABC: i) is not free and clear of liens; ii) unexpired leases cannot be assumed and assigned without the consent of the contract counter-party; and iii) insolvency can trigger a default under an unexpired lease or executory contract. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 20. In general, an ABC is not a good choice for debtors that have secured creditors that do not consent because there is no mechanism for using cash collateral or transferring assets free and clear of liens without the secured creditors’ consent. In cases where junior lienholders are out of the money, there is no incentive for those creditors to voluntarily release their liens. In addition, while unsecured creditors do not have to consent to the general assignment for it to be valid, choosing this alternative forum may cause concern for creditors (particularly those used to the transparency of a court-supervised bankruptcy or receivership proceeding) and invite the filing of an involuntary bankruptcy. Therefore, it is prudent to involve major creditors in the process, and perhaps even in the pre-assignment planning. In addition, if an involuntary petition is filed, the assignee could request that the bankruptcy court abstain in order to proceed with the ABC.

Using the ABC state process in lieu of filing for bankruptcy in federal court may result in a more streamlined, efficient liquidation process that is less expensive and likely completed quicker than a federal bankruptcy proceeding. In some jurisdictions, such as New Jersey, workout professionals note anecdotally that corporate clients fare better under this state law alternative rather than the lengthy, more complicated federal bankruptcy proceedings.

Many bankruptcy professionals are unfamiliar with the procedures of ABC and are reluctant to recommend it as a method for liquidating assets and administering claims. This lack of familiarity may be a disservice to potential clients.

[ View source .]

Related Posts

- Who’s a Party in Interest? The Supreme Court’s Ruling in Truck Insurance Exchange v. Kaiser Gypsum Co. Inc. Opens the Door for Insurers to Intervene in Certain Bankruptcy Proceedings

- The More Things Change, The More They Stay The Same? Survival Of Small Businesses Again Dependent On Action From Congress

- Mediation in Bankruptcy: A Glimpse

- In re The Hacienda Company, LLC – Round 2: Bankruptcy Courts May be Available to Non-Operating Cannabis Companies to Liquidate Assets

- PAGA Dischargeable in Bankruptcy?

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

Refine your interests »

Written by:

PUBLISH YOUR CONTENT ON JD SUPRA NOW

- Increased visibility

- Actionable analytics

- Ongoing guidance

Published In:

Fox rothschild llp on:.

"My best business intelligence, in one easy email…"

Assignment For The Benefit Of Creditors: An Overview

Contributor.

What is an assignment for the benefit of creditors? An assignment for the benefit of creditors ("ABC") is an alternative to a chapter 7 bankruptcy proceeding. As in a chapter 7, the debtor's assets are shepherded and liquidated for the benefit of the debtor's creditors. An ABC is governed by statute and can either be court-supervised or conducted out of court. In New York, an ABC is governed by Article 2 of the Debtor and Creditor Law.

In an ABC proceeding, the debtor is referred to as an assignor, because it makes a transfer of all its assets to an assignee who serves as a trustee. The assignee is charged with placing all the assets in trust in order to liquidate and distribute the proceeds to creditors. While an ABC has many similarities with a chapter 7 liquidation, the two do differ in two important regards:

- an ABC does not afford a debtor an automatic stay from creditor collection; and

- a sale does not provide the purchaser with the right to purchase the assets free and clear of liens – unlike a 363 sale in Bankruptcy.

To commence an ABC, an assignor executes an assignment conveying all its assets to the assignee, who becomes a fiduciary on behalf of the assignor and its creditors. The assignee then collects and liquidates assets by collecting accounts receivable, conducting an auction sale, sometimes to a stalking horse bidder who starts the bidding, or through a going out of business sale.

An assignor also has powers under state law to recover fraudulent pre-ABC transfers of assets and preferential payments made to creditors. In New York, the "look-back period" for recovering these transfers is four years.

When it comes to distribution of the assets collected by the assignee, an ABC proceeding follows an established order of priority, which is set forth in either the state's unique ABC laws or in the deed of assignment. The assignee tallies the proofs of claim that were filed by the creditors in the proceeding and pays the claims, either in full or on a pro rata basis in accordance with the priority scheme.

After the assignor's assets have been liquidated and creditors have been paid out, the assignee must prepare an accounting detailing the flows of monies in and out of the estate during the case, which may have to be filed with the court supervising the proceedings. As part of the accounting process, the assignee asks the court to close the estate, which notifies all interested parties that (i) the estate has been fully administered, (ii) that the assignee's work is complete, (iii) that no further distributions need be made, and (iv) that the assignment is terminated.

An ABC is a useful, cost-effective alternative to a traditional chapter 7 bankruptcy liquidation, and may suitably serve liquidation requirements in some situations.

Originally published 03/07/2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Insolvency/Bankruptcy/Re-Structuring

United states.

Mondaq uses cookies on this website. By using our website you agree to our use of cookies as set out in our Privacy Policy.

- More Blog Popular

- Who's Who Legal

- Instruct Counsel

- My newsfeed

- Save & file

- View original

- Follow Please login to follow content.

add to folder:

- My saved (default)

Register now for your free, tailored, daily legal newsfeed service.

Find out more about Lexology or get in touch by visiting our About page.

Assignment for the Benefit of Creditors: General Overview

If you are considering bankruptcy for your insolvent business, an Assignment for the Benefit of Creditors (“ABC”) might be your answer. An ABC is a less expensive, quicker, quieter, and simpler alternative to traditional bankruptcy. An ABC is a state law procedure utilized to liquidate a failed, insolvent, or no longer viable business. Fla. Stat. § 727.101 . An ABC is normally much simpler and usually less expensive than a comparable bankruptcy proceeding. This savings means larger payouts to both unsecured and secured creditors. This blawg provides a general overview of the ABC process, and highlights a few benefits of ABC as compared to a Chapter 7 bankruptcy.

An ABC is a conveyance by an assignor of substantially all of the assignor’s property to an assignee for the purpose of applying the property or its proceeds to the payment of the assignor’s debts and returning any surplus to the assignor after administration. ABCs share some similarities with federal bankruptcy: ABCs ensure full reporting to creditors, and require equal distribution of an assignor’s assets. However, there are several clear differences between the two, and each has its own advantages and disadvantages.

One of the biggest advantages of an ABC in comparison to traditional bankruptcy is that the assignor chooses the assignee. Fla. Stat. § 727.104 ; 11 U.S.C. § 702 . This is significant for a few reasons. Two problems with Chapter 7 bankruptcies, as compared to ABCs, are (1) many bankruptcy trustees appointed by the court are lawyers or accountants who operate independently, they are assigned cases in large numbers, and do not maintain staffs of people experienced in operating a business; and (2) when the trustee takes over, the debtor will be foreclosed from participating in the liquidation process. In an ABC, a professional assignee, chosen by the assignor, is not only an expert in liquidating assets, but is also best suited to operate a business as long as need be to maximize return by realizing some form of going-concern value. Another major advantage of an ABC over Chapter 7 bankruptcy is that the assignor can decide largely what is going to happen before and during the ABC.

The ABC proceeding is commenced with the execution of an irrevocable assignment in writing. Upon execution of this assignment, the legal estate in the assigned property passes to the assignee, and the assignor loses all power over the property. Then, the assignee records the original assignment in the public records and files a petition with the clerk of the court commencing the assignment proceeding.

Most of the powers of the assignee parallel those of the bankruptcy trustee. The assignee has many duties, including, but not limited to, collection of the assets and reducing them to money, giving notice to creditors, conducting the business of the assignor for limited periods, if appropriate, hiring professionals as may be necessary, and submitting a final report. The assignee is required to provide notice of the assignment by publication in a newspaper of general circulation published in the county where the petition is filed, once a week for four consecutive weeks, within ten days of filing of the petition, and by mailing notice to all known creditors within twenty days after filing of the petition. Fla. Stat. § 727.107 . The assignee may reject leases of both real and personal property under which the assignor is the lessee. If the rejection creates a claim for damages, the lessor may claim the back rent plus future rent not to exceed the greater of one year’s rent or fifteen percent of the rent remaining term, plus attorney’s fees and costs. Fla. Stat. § 727.112 . The assignee may collect any asset by suit in any court of competent jurisdiction. The assignee has the power to enforce tort claims regardless of any generally applicable law concerning the non-assignability of tort claims. The assignee may assign causes of action to a second party pursuant to the assignee’s business judgment and subject to notice. Fla. Stat. 727.111 .

The ability to operate the business is one of the most important of the assignee’s powers. Assets sold off piece by piece normally bring far lower return. The assignee may conduct the assignor’s business, without court approval for a limited period not to exceed 45 days. If no timely objection is filed with the court after seeking court approval, the assignee may continue to operate the assignor’s business for an additional 90 days. The court may even extend the 90-day period if it finds an extension to be in the best interest of the estate. Fla. Stat. § 727.108 .

The assignee is empowered to maintain an action to avoid any conveyance or transfer void or voidable by law. Fla. Stat. § 727.110 . This clearly contemplates avoidance of transfers under Florida’s Uniform Fraudulent Transfer Act. Fla. Stat. Ch. 726 . Importantly, it has been held that only an assignee has standing to pursue fraudulent transfers, preferential transfers, or other derivative claims. Moffat & Nichol v. B.E.A ., 48 So.3d 896 (Fla. 3d DCA 2010) .

ABCs do not impose an automatic stay in favor of assignors, do not grant an assignee authority to avoid preferential transfers, and do not provide a discharge of any debt. This last reason is why many individuals and partnerships do not elect ABCs. However, this presents minimal disadvantage to a corporation or limited liability company, as Chapter 7 bankruptcy does not offer discharge to corporations or limited liability companies. While there is no automatic stay in an ABC, for practical reasons the ABC filing has the effect of an automatic stay—actions to reach the assets are stopped while the assignee acts to liquidate the assets. The assignor no longer has any assets to pursue.

In an ABC, unsecured creditors must file a proof of claim and are prohibited from commencing proceedings against the assignee. However, consensual lienholders may pursue collection by levy, execution, attachment or foreclosure of its collateral. Fla. Stat. § 727.105 . This means that if substantial assets are subject to a consensual lien, and if continued use is important to the estate, as where the assignee intends to continue operating the business for a limited time, the lack of an automatic stay could be a severe disadvantage to creditors. Here, it is important that the assignee work with the secured creditor, persuading it to trust that continued operation of the business will result in a greater return to that creditor. It is common for the assignor and assignee to arrive at an agreement with dominant secured creditors before or concurrently with executing the assignment, agreeing that secured creditors will be patient and comply with the ABC.

Last, but certainly not least, any Florida corporation considering “closing its doors” should examine ABC as a cost-effective, clean and simple part of the wind-down process. Closing a business can lead to personal liability for the owner. The ABC process can be used to take the weight off of the business owner and minimize an owner’s liability potential. ABC gives your business a proper burial, tight and neat.

Filed under

- Insolvency & Restructuring

- Jimerson & Cobb P.A.

Popular articles from this firm

What are consequential damages on a construction contract *, riparian rights in florida: the right to accretions and relictions *, pleading the fifth amendment against self-incrimination in civil cases filed in florida *, the five most common ways to pierce the corporate veil and impose personal liability for corporate debts *, corporations or llc’s cannot amend bylaws to impair vested shareholder contract rights *.

If you would like to learn how Lexology can drive your content marketing strategy forward, please email [email protected] .

Related practical resources PRO

- How-to guide How-to guide: The legal framework for resolving disputes in England and Wales (UK)

- Checklist Checklist: Considerations prior to issuing court proceedings (UK)

- How-to guide How-to guide: How to manage the risk of contracting with a company in financial difficulty (UK)

Related research hubs

- +1 786.837.6787

Assignment for the Benefit of Creditors

- January 16, 2020

- • Business Law

When a business is unfortunately forced to shut down due to debt, there are a variety of paths that can be taken to wind up the business. While bankruptcy is a well-known approach, businesses have another option known as the Assignment for the Benefit of Creditors.

What is an Assignment for the Benefit of Creditors?

An Assignment for the Benefit of Creditors, commonly referred to as ABC, is an alternative to bankruptcy in which the business turns over its assets to creditors. An ABC is similar in many ways to bankruptcy but is often a cheaper and faster process. Additionally, an ABC permits the liquidating business to retain more control over the process than it would in a bankruptcy. Specifically, the liquidating business selects the assignee to oversee the process.

How does the Assignment for the Benefit of Creditors Process work?

In Florida, an ABC process is governed by statutes §§ 727.101-727.117. First, the business that wishes to liquidate its assets, selects an assignee to act in a capacity similar to a bankruptcy trustee. This assignee is typically a professional, such as a lawyer or accountant, familiar with the ABC process. Once an assignee is selected, an Assignment document containing, amongst other things, a list of creditors and the debtor’s assets is filed with the clerk of court in which the debtor is located. Once the Assignment is file, the assignee must file notice of the Assignment by publication in a newspaper once a week for four consecutive weeks. Additionally, the assignee must mail notice to all known creditors within twenty days after filing the Assignment petition. Like the trustee in bankruptcy, the assignee then is responsible for liquidating the business assets and distributing them to creditors. The statutes outline the order for distributing assets and various procedures the assignee must follow.

Overall, the Assignment for the Benefit of Creditors process is a faster and quicker way for businesses to wind-down their business without the stigma of bankruptcy.

EPGD Business Law is located in beautiful Coral Gables. Call us at (786) 837-6787 , or contact us through the website to schedule a consultation.

*Disclaimer: this blog post is not intended to be legal advice. We highly recommend speaking to an attorney if you have any legal concerns. Contacting us through our website does not establish an attorney-client relationship.*

Share this post

EPGD Business Law

Our team of highly trained attorneys have over 100 years of combined higher education, are fluent in 8 languages, and use cutting edge technology to beat the competition.

Practice Areas

- Business & Commercial Law

- Trusts & Estates

- Tax & Finance

- Client Payment Center

- 786.837.6787

- [email protected]

- 777 SW 37th Ave Suite 510 Miami, FL 33135

- Miami Law Office

- Privacy Policy & Disclaimer

The Entrepreneur's Handbook

This is a quick legal reference guide covering 16 topics that every business owner needs to have to start a business.

- Vendor Agreeements

El Manual del Empresarios

Esta es una guía rápida de referencia jurídica que cubre 16 temas que cada empresario necesita saber para empezar un negocio.

- Entidades Comerciales

- Contratos de propiedad

- Propiedad Intelectual

- Acuerdos de Proveedores

- Y mucho más...

(858) 481-1300 [email protected]

- Health & Safety Receiverships

- Partition Referee Matters

- Business Dispute Receiverships

- Cannabis Receiverships

- Rents & Profits Receiverships

- Post-Judgment Receiverships

- Legal Representation of Receivers & Referees

- Property Examples

- Meet the Team

- In the News

- Career Opportunities

Assignment for the Benefit of Creditors: A Remedy to Avoid Bankruptcy

May 24, 2021

When it comes to California contract law, ABC contracts are a well-established tool that can help individuals and entities avoid a formal bankruptcy filing. “ABC” stands for “Assignment for the Benefit of Creditors,” and the term describes a contract in which an economically troubled “Assignor” transfers control of its assets and property to an independent third party. This third party is called the “Assignee,” and they liquidate and wind-up the entity.

How Do ABCs Work?

When a business is struggling financially without much hope of recovery, bankruptcy isn’t the only option. ABC contracts can help the entity avoid traditional or formal bankruptcy proceedings.

These contracts work when there are significant assets that are ready to be liquidated. If the entity doesn’t have valuable assets, then an ABC contract is not typically a realistic option. However, in these circumstances where there are significant assets, the Assignor transfers all custody, control, and title to a neutral third party.

This neutral third party navigates and facilitates the liquidation of assets and transfer of funds to the assignor’s creditors.

Benefits of Using an ABC

There are several benefits to using an ABC.

One of the biggest factors for most entities is avoiding Chapter 11 or Chapter 7 bankruptcy. Because ABCs are governed by state law, not federal law, struggling companies can pursue an ABC contract on their own without going through the courts.

Working with a neutral third party can take away a lot of the stress that accompanies economic difficulties. Instead of trying to liquidate assets and transfer funds to creditors, struggling companies can pass those challenges on to the Assignee.

Lastly, Assignors get to choose their own Assignees. That means that they are not at the mercy of the court to assign a bankruptcy trustee they don’t know or trust. When a company pursues an ABC contract, they maintain more control over process and costs.

Going through financial difficulties can lead to feelings of helplessness and a loss of control, but this is something that you continue to have control over.

Responsibilities of an Assignee

When the Assignor assigns property to the Assignee, that can include all corporate property, both tangible and intangible, as well as accounts, rights, and credits, including law and equity credits.

The Assignee liquidates and sells these assets. (Note that the Assignee cannot sell the corporation or the stock.) Importantly, the corporation continues to exist during this process, even though there are no assets left by the end of the process.

The Assignee typically sells all assets without any representation or warranty. An as-is sale allows things to proceed quickly; ABCs are known for being one of the fastest ways to address significant debt issues.

Assignees protect the assets of the estate or corporation. They are required to administer those assets fairly and in the interest of the Assignor and its creditors.

How to Choose an Assignee

Choosing an Assignee is about finding the right third party representative. We recommend that you look for the following characteristics in your chosen Assignee:

- Experience: Choose an Assignee who has significant experience with managing and liquidating assets for struggling businesses.

- Reputation: These days, reputation means everything. It’s easy to find out through some searching if a potential Assignee is qualified and reputable.

- Knowledge: A knowledgeable Assignee will be able to answer your questions about the process and chart out likely outcomes.

Do You Need an Assignee?

Griswold Law regularly manages and sells business assets. We serve as court-appointed receivers as well as ABC-contracted Assignees. To learn more about ABCs and how we can help you avoid bankruptcy, reach out today .

- There are no suggestions because the search field is empty.

- Court-Appointed Receivership (65)

- Real Estate (55)

- Partition Referee (30)

- Real Estate Finance (29)

- Real Estate Transaction (29)

- Partition Action (27)

- Commercial Properties (23)

- Enforcing Judgments (21)

- Hoarding (21)

- Commercial Leases (20)

- Business Litigation (19)

- Foreclosure Law (18)

- Tenants' Rights (18)

- Contract Disputes (17)

- receivership (17)

- Business Owners (16)

- Construction Law (15)

- Uncategorized (15)

- Collections Law (14)

- Business Formation: Asset Protection (11)

- California (10)

- Loan Modification (9)

- abandoned property (9)

- health & safety (9)

- receiver (9)

- Consumer Class Action (8)

- Receivership Remedy (8)

- receiverships (8)

- Consumer Fraud (7)

- health and safety code (6)

- healthy & safety receiver (6)

- Fraud against Senior Citizens (5)

- Health & Safety Code (5)

- Health and Safety receivership (5)

- code enforcement (5)

- Employment Law (4)

- Landlord (4)

- Marijuana Dispensaries (4)

- San Diego (4)

- Trade Secrets (4)

- abandoned (4)

- creditor (4)

- fire hazard (4)

- money judgment (4)

- nuisance property (4)

- Cannabis (3)

- Employment Class Action (3)

- Employment Discrimination (3)

- Health & Safety Code Receiver (3)

- Trademark Law (3)

- abandoned building (3)

- business disputes (3)

- code enforcement officers (3)

- collection (3)

- court-appointed receiver (3)

- health and safety (3)

- hoarder (3)

- real estate. california (3)

- real property (3)

- rents and profits (3)

- substandard conditions (3)

- Attorneys' Fees Clauses (2)

- City of San Diego (2)

- Health and Safety Receivership Process (2)

- Post-Judgment Receiver (2)

- Unlawful Detainer (2)

- bankruptcy (2)

- business (2)

- complaint (2)

- debt collection (2)

- dispute (2)

- distressed properties (2)

- foreclosure (2)

- habitability (2)

- health and saftey code (2)

- hoarders (2)

- hoarding support (2)

- judgment (2)

- judgment creditor (2)

- judgment debtor (2)

- partnership agreement (2)

- property (2)

- property value (2)

- san diego county (2)

- slumlord (2)

- tenant rights (2)

- Animal Hoarding (1)

- City of Chula Vista (1)

- Distressed Business (1)

- Historic Properties (1)

- Liquor License Receiverships (1)

- Mills Act (1)

- Neighborgood Blight (1)

- Partition Remedy (1)

- Post-Judgment Receivership(s) (1)

- Reimbursement of Employee Business Expenses (Labor (1)

- The Health and Safety Receivership Process (1)

- absentee landlord (1)

- abstract of judgment (1)

- account levy (1)

- assignment for the benefit of creditors (1)

- bank garnish (1)

- bank levy (1)

- bitcoin (1)

- board of directors (1)

- business formation (1)

- business owner (1)

- california receivership laws (1)

- city attorney (1)

- collecting judgment (1)

- commercial project (1)

- company (1)

- confidential information (1)

- confidentiality agreement (1)

- court award (1)

- court order (1)

- covid-19 (1)

- cryptocurrency (1)

- deceased owner (1)

- demolition (1)

- diliberti (1)

- disposable earnings (1)

- family law (1)

- general partnership (1)

- habitability requirements (1)

- hospitality assets (1)

- human smuggling (1)

- illegal business (1)

- illegal cannabis dispensary (1)

- illegal gambling parlor (1)

- initial inspection (1)

- joseph diliberti (1)

- judgment collection (1)

- judgment lien (1)

- lease term (1)

- liquidation (1)

- litigation (1)

- lodging properties (1)

- massage parlors (1)

- misappropriation (1)

- negligent landlord (1)

- new business (1)

- occupant relocation (1)

- partnership (1)

- partnership disputes (1)

- post-judgment collection (1)

- provisional director (1)

- public safety (1)

- real property lien (1)

- real property receiver (1)

- relocation (1)

- residential zoning laws (1)

- retail center (1)

- right of possession (1)

- san diego real estate (1)

- sex trafficking (1)

- short-term rental (1)

- sober living house (1)

- squatters (1)

- struggling hotels (1)

- substandard hotel (1)

- tenancy (1)

- unlicensed in-home business (1)

- wage garnishment (1)

- warranty of habitability (1)

- weed abatement (1)

- writ of execution (1)

Recent Posts

For more information please contact Griswold Law

Phone: (858) 481-1300

Email: [email protected]

Address: 171 Saxony Road, Suite 205, Encinitas, CA 92024

No communication via email or content posted on this website creates an attorney-client privilege. The information on this website is purely hypothetical. The information on this website should not be relied upon. If you have legal questions or are seeking legal assistance, you should contact an attorney immediately.

- California Department of Real Estate

- California Secretary of State

- State of California Courts

- U.S. Department of Housing and Urban Development

- United States District Court, Southern District of California

- United States Patent and Trademark Office

- Download PDF

- Pursuing Assignments for the Benefit of Creditors

- Pursuing Assignments for the Benefit of Creditors Overview

- Bankruptcy and Restructuring

- Security Agreements and UCC Filings in Bankruptcy

- Acquiring Assets from Bankruptcy Estates and Distressed Borrowers

- Workout, Refinancing, and Restructuring Opportunities Outside of Bankruptcy

- Representing Creditors in Bankruptcy Court and Pre-Petition Negotiations

- Debtor-in-Possession Financing and Cash Collateral

- Preventing Debtor Bankruptcy Through Liquidation, Restructuring, and Reorganization

- Proofs of Claim

- Estate Disputes Over the Treatment of Differing Creditor Claims, Transfer Avoidance, Breach of Fiduciary Duty, and Alter Ego Liability

- Reconciling Creditors Committee Interests to Avoid Litigation and Expedite Recovery

- Litigating Parasitic State Court Claims on Behalf of the Estate

- Adversary Proceedings to Set Aside Preference Payments and Fraudulent Transfers

- Creditors’ Committees and Trustees

- Defending Against Involuntary Bankruptcy Petitions

- Advising Insolvent Companies on Fiduciary Duties and Winding Down

- Establishing a Restructuring Agenda

- Recovering from Non-Debtor Entities

- Filing Involuntary Bankruptcy Petitions

- Foreclosure or Repossession During Bankruptcy

- The Impact of Commercial Reorganization on Creditors

- Assigning Bankruptcy Claims to Claims Traders

- Trade Supplier Relations with Financially Distressed Customers

- Creditor’s Committees and Trustees

- Adversary Proceedings in Bankruptcy

- Relief from the Automatic Stay

- Bankruptcy Defense: Fraudulent Transfers and Preferential Payments

What are assignments for the benefit of creditors?

Assignments for the benefit of creditors (ABCs) are an alternative to formal bankruptcy proceedings. Under Florida law, an ABC is a voluntary, out-of-court process where a debtor transfers their assets to an assignee, who then liquidates these assets and distributes the proceeds to the debtor’s creditors.

For example, a struggling business in Florida may pursue an ABC instead of filing for bankruptcy. This choice can be advantageous because it is often faster, less expensive, and less public than a formal bankruptcy filing. The business would transfer its assets to an assignee responsible for selling these assets and distributing the proceeds to the creditors following the priorities established by Florida law.

Need a bankruptcy law advocate? Schedule your consultation today with a top bankruptcy and restructuring attorney.

Which Florida laws and regulations apply to assignments for the benefit of creditors?

The primary source of law governing ABCs in Florida is Chapter 727 of the Florida Statutes . This chapter outlines the process for initiating an ABC, the assignee’s role, and the creditors’ rights. Additionally, the Florida Rules of Civil Procedure may apply to certain aspects of an ABC, such as serving notice to creditors and managing creditor claims.

Federal laws, such as the Bankruptcy Code , generally do not apply to ABCs because they are state law alternatives to bankruptcy. However, it is essential to note that federal laws may still impact an ABC in certain situations, such as when a debtor’s assets are subject to federal tax liens or other federal claims. In these cases, debtors must consult a knowledgeable attorney to navigate the interplay between state and federal laws.

How do assignments for the benefit of creditors connect to the bankruptcy process?

The connection between pursuing an ABC and bankruptcy legal services for debtors lies in their shared goal of providing relief to financially distressed individuals or businesses. Both processes involve the liquidation of assets and the distribution of proceeds to creditors. However, ABCs are generally less formal, less expensive, and more private than bankruptcy filings, making them an attractive option for debtors seeking to avoid the stigma and complexities associated with bankruptcy.

In an ABC, a debtor voluntarily transfers their assets to an assignee who liquidates them and distributes the proceeds to creditors. This process differs from a bankruptcy proceeding, where a court-appointed trustee oversees the operation. Furthermore, while strict federal rules and procedures bind bankruptcy cases, ABCs offer more flexibility, allowing parties to tailor the process to their needs.

When a set of facts is appropriate for bankruptcy services, there are many paths a claimant may take. We are value-based attorneys at Jimerson Birr, which means we look at each action with our clients from the point of view of costs and benefits while reducing liability. Then, based on our client’s objectives, we chart a path to seek appropriate remedies.

To determine whether your unique situation may necessitate litigation or another form of specialized bankruptcy advocacy, please contact our office to set up your initial consultation.

What are the prerequisites for debtors to pursue assignments for the benefit of creditors?

Consider the following:

- Voluntary action: The debtor must willingly initiate an ABC, as this process is a voluntary alternative to bankruptcy.

- Valid assignment: The debtor must properly execute and deliver the assignment to a qualified assignee, who is often an attorney, accountant, or insolvency professional.

- Recording the assignment: The assignee must record the assignment in the county’s public records containing the debtor’s principal place of business.

- Filing notice: The assignee must file a notice of the assignment with the circuit court clerk in the county where the debtor recorded the assignment.

- Notifying creditors: The assignee must provide written notice to all known creditors of the debtor within 20 days of the assignment, informing them about the ABC process and their rights.

By satisfying these requirements, the debtor can effectively pursue an ABC in Florida, which allows for a more personal and flexible approach to resolving financial difficulties compared to bankruptcy.

Please contact our office to set up your initial consultation to see what forms of legal protection and advocacy may be available for your unique situation.

Frequently Asked Questions

- Can a debtor choose any person as an assignee for an ABC?

No, not just anyone can be an assignee. The assignee must be a disinterested person who is not an insider of the debtor and is qualified to manage the debtor’s assets and affairs. Assignees are typically professionals, such as attorneys, accountants, or insolvency experts.

- Does an ABC in Florida prevent creditors from pursuing legal action against the debtor?

Unlike bankruptcy, an ABC does not automatically halt legal actions by creditors. However, creditors may agree to a standstill or moratorium on legal actions while the ABC process is ongoing. This outcome may depend on the specific circumstances and the willingness of the creditors to cooperate.

- How does an ABC affect the debtor’s credit rating?

Although an ABC may be less public and stigmatizing than bankruptcy, it can still harm the debtor’s credit rating. Credit reporting agencies may treat an ABC as a similar event to a default, which can lower the debtor’s credit score and make it more difficult for them to obtain future credit or loans. However, the impact on the credit rating may vary depending on the specific circumstances of the case and the debtor’s credit history before the ABC. Therefore, debtors must work closely with financial advisors and credit counselors to rebuild their credit after an ABC process.

Have more questions about how bankruptcy services could positively impact your business operations and relationships?

Crucially, this overview of assignments for the benefit of creditors does not begin to cover all the laws implicated by this issue or the factors that may compel the application of such laws. Every case is unique, and the laws can produce different outcomes depending on the individual circumstances.

Jimerson Birr attorneys guide our clients to help make informed decisions while ensuring their rights are respected and protected. Our lawyers are highly trained and experienced in the nuances of the law, so they can accurately interpret statutes and case law and holistically prepare individuals or companies for their legal endeavors. Through this intense personal investment and advocacy, our lawyers will help resolve the issue’s complicated legal problems efficiently and effectively.

Having a Jimerson Birr attorney on your side means securing a team of seasoned, multi-dimensional, cross-functional legal professionals. Whether it is a transaction, an operational issue, a regulatory challenge, or a contested legal predicament that may require court intervention, we remain tireless advocates at every step. Being a value-added law firm means putting the client at the forefront of everything we do. We use our experience to help our clients navigate even the most complex problems and come out the other side triumphant.

If you want to understand your case, the merits of your claim or defense, potential monetary awards, or the amount of exposure you face, you should speak with a qualified Jimerson Birr lawyer. Our experienced team of attorneys is here to help. Call Jimerson Birr at (904) 389-0050 or use the contact form to schedule a consultation .

We live by our 7 Superior Service Commitments

- Conferring Client-Defined Value

- Efficient and Cost-Effective

- Accessibility

- Delivering an Experience While Delivering Results

- Meaningful and Enduring Partnership

- Exceptional Communication Based Upon Listening

- Accountability to Goals

Assumption, Assignment and Sale of SBA Loans

3 Main Considerations When Obtaining Assignments of Lawsuits or Judgments as a Judgment Collection Tool

Assignment for the Benefit of Creditors: Stay of Litigation

latest Blog Posts

Professional services industry legal blog.

Reasonable and Effective Non-Compete Clauses from the Employer’s Perspective Read More

Join our mailing list.

Call our experienced team., we’re here to help, connect with us., call our experienced team..

Parsippany: (973) 538-4700

Fein Such Kahn & Shepard

Is an Assignment for the Benefit of Creditors like a Bankruptcy?

At first, an assignment for the benefit of creditors (ABC) may seem similar to a bankruptcy claim. However, upon a deeper look, it is clear that an assignment for the benefit of creditors is different. Similar to liquidation proceedings in chapter 7 or chapter 11 bankruptcy proceedings, an ABC can be used by either an individual or a business if they are going through significant financial difficulties. In both cases, the struggling debtor sells off all its assets in order to pay back its outstanding debts to its creditors. This mechanism helps to maximize the return for creditors.

An assignment for the benefit of creditors is distinct from bankruptcy proceedings because it is a much less formal process governed by state law rather than federal law. The informal nature of these proceedings means that it is faster and easier to marshal a debtor’s assets, liquidate same, and distribute proceeds equitably to creditors under an assignment rather than under federal bankruptcy law. Furthermore, an ABC often requires less court involvement and provides more flexibility to the assignee to make liquidation decisions as required. This is generally beneficial for both creditors and debtors because it is faster, less expensive, and more private than traditionally afforded bankruptcy liquidations.

Understanding Assignment for the Benefit of Creditors in New Jersey

In New Jersey, an assignment for the benefit of creditors is governed by New Jersey statutes that codify the preexisting common law. The proceedings are voluntary processes whereby the debtor designates an assignee who is empowered to marshal and liquidate (sell) the assets of the debtor and then distribute the proceeds of the sale to the debtor’s creditors. The assignee must ensure that all of the financial liquidations are done for the benefit of the creditors and with the sole goal of repaying outstanding debts. This is significant because in New Jersey, the debtor can choose its assignee rather than relying on a court-appointed trustee in bankruptcy who may not understand the nuances of the debtor’s finances. The ability to choose the assignee can be beneficial because an assignee with an understanding of the debtor’s finances can expedite the liquidation process rather than spend valuable time learning the ropes.

An ABC in New Jersey is generally cheaper than filing formal bankruptcy proceedings because it is faster and usually requires less litigation. The expeditious nature cuts down on the debtor’s and creditor’s legal bills and other costs associated with ongoing litigation. Still, creditors should be counseled to make sure that the liquidation is being conducted properly, and that the assignee is obtaining a fair return on the sale of the assets to maximize the recovery of the debts owed to the creditors.

FSKS is on Your Side

At FSKS, our attorneys are experienced in both bankruptcy and assignments for the benefit of creditors in New Jersey. We have a strong track record of success in the area of creditor’s rights and pride ourselves on being one of the strongest and most successful Creditors’ Rights firms in New Jersey, New York, and Pennsylvania. We’re ready to give you trusted advice and help maximize your return.

If you require assistance with or have questions regarding an assignment for the benefit of creditors in New Jersey, please contact Vincent DiMaiolo, Jr. ( [email protected] ), Nicholas Canova ( [email protected] ), or Tammy L. Terrell-Benoza ( [email protected] ) at (973) 538-4700 .

Related Posts

FSKS Celebrates Jennifer L. Holowach’s Joyous Marriage and New Chapter as Jennifer L. Saint-Louis

Real Estate Practice Alert: New Flood Risk Disclosure Requirements in New Jersey Take Effect on March 20, 2024

Navigating the Corporate Transparency Act: Key Considerations & Compliance Guidelines

Introducing Suneeta Thadani Dewan, Esq., Of Counsel Immigration Law Services

Our Services

Business advisory.

Turnaround & Restructuring

Appraisals & Valuations

Fiduciary Services

Forensic Accounting

Financial Advisory

Litigation Support

Interim Management

Real Estate Solutions

Corporate trust, what is assignment for the benefit of creditors, explaining an emerging alternative to bankruptcy to resolve distress.

What is an ABC?

Assignment for the benefit of creditors (ABC) is a state law winddown procedure that allows for the orderly winddown of a company. The ABC provides for the appointment of an independent fiduciary representative – known as an assignee. The assignee manages the orderly wind down of the business and monetizes the company’s assets for the benefit of the company’s creditors. The assignee will then distribute the proceeds generated from the sale of the company’s assets to the company’s creditors according to state law.

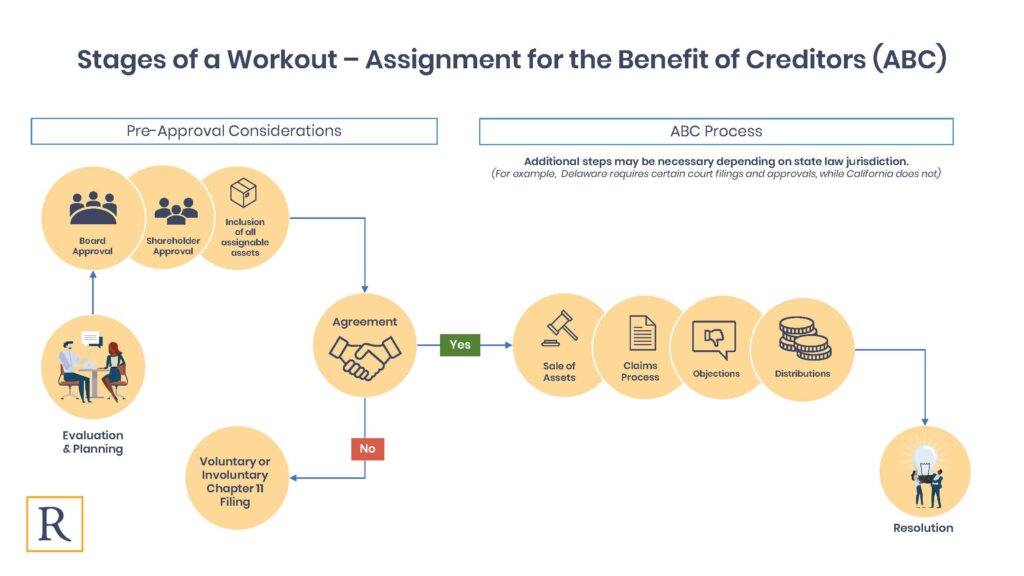

Important pre-approval considerations :

- The decision must be approved by both the board and shareholders.

- Jurisdiction matters – 35 states have some form of an ABC in its laws. Each state will have different considerations and procedures to follow.

What are the benefits of an ABC?

- Choice: Unlike a receivership or a Chapter 7 Case, the board has the ability to select the assignee.

- Time: A bankruptcy case is a lengthy process with many procedural requirements. Most ABCs are significantly less time-consuming than a bankruptcy case or a receivership.