- Netherlands

Crafting a Winning Business Plan: Your Step-by-Step Checklist for SMEs

Required field

It seems that it\'s not a valid email. Try one more time :)

It seems that it\'s not a valid name. Try one more time :)

The importance of a well-structured business plan

Understanding your target audience and market, business plan checklist, key elements of a winning business plan, tips for crafting an effective business plan, using business plan templates and resources, seeking professional assistance for business plan creation, reviewing and updating your business plan regularly, conclusion and next steps for smes.

- Blog Main →

- Incorporation →

- Business plan

a. Company overview

- What is the name of your company, and what does it do?

- When was your company established, and who are its founders?

- What is your company's mission statement and vision?

- What are your company's core values and guiding principles?

- What legal structure does your company operate under (e.g., sole proprietorship, partnership, corporation)?

- What are your company's primary products or services, and what sets them apart from the competition?

b. Market analysis

- What is the size and growth rate of your industry, and what are the key market trends?

- What is your target market, and what are their demographics, psychographics, and pain points?

- Who are your main competitors, and what are their strengths and weaknesses?

- What is your competitive advantage, and how will you differentiate your products or services?

- What are the barriers to entry in your industry, and how will you overcome them?

c. Marketing and sales strategy

- What are your marketing objectives, and how will you measure their success?

- What marketing channels and tactics will you use to reach your target audience?

- How will you position your products or services in the market, and what is your unique selling proposition?

- What is your pricing strategy, and how does it compare to your competitors' pricing?

- What is your sales process, and how will you train and support your sales team?

d. Management and organization

- Who are the members of your management team, and what are their roles and responsibilities?

- What is your organizational structure, and how does it support your business objectives?

- What are your plans for recruiting, training, and retaining employees?

- How will you maintain a positive company culture and promote employee engagement?

e. Financial plan and projections

- What are your historical financial statements, including balance sheets, income statements, and cash flow statements?

- What are your financial projections for the next three to five years, including projected revenue, expenses, and profits?

- What are your break-even analysis and profitability ratios?

- What are your plans for financing your business, and what are the potential sources of funding?

- What are the key financial risks and how will you mitigate them

- A clear and concise executive summary that provides an overview of your business, its goals, and its strategies.

- A detailed company overview that highlights your company's mission, vision, and core values.

- A thorough market analysis that demonstrates your understanding of your industry, target audience, and competition.

- A comprehensive marketing and sales strategy that outlines your objectives, tactics, and unique selling proposition.

- A strong management and organization section that showcases your leadership team and company culture.

- A robust financial plan and projections that provide a realistic outlook on your company's growth and profitability.

- Keep your business plan concise and focused, avoiding unnecessary jargon and fluff.

- Use clear and straightforward language that is easy to understand.

- Back up your claims with data, research, and evidence.

- Be realistic in your projections and assumptions, acknowledging potential challenges and risks.

- Regularly review and update yourbusiness plan to reflect changes in your industry, market, or company.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

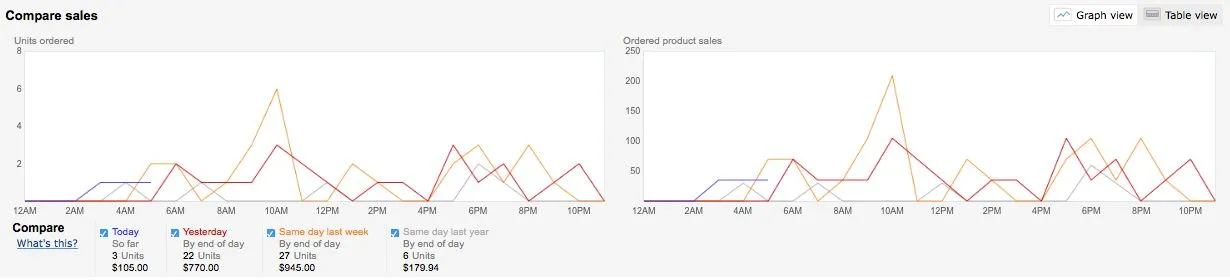

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

Small Business Resources is now the Center for Business Empowerment.

Suggested Keywords

Center for Business Empowerment

How to write an effective business plan in 11 steps (with workbook)

February 02, 2023 | 14 minute read

Writing a business plan is a powerful way to position your small business for success as you set out to meet your goals. Landmark studies suggest that business founders who write one are 16% more likely to build viable businesses than those who don’t and that entrepreneurs focused on high growth are 7% more likely to have written a business plan. 1 Even better, other research shows that owners who complete business plans are twice as likely to grow their business successfully or obtain capital compared with those who don’t. 2

The best time to write a business plan is typically after you have vetted and researched your business idea. (See How to start a business in 15 steps. ) If conditions change later, you can rewrite the plan, much like how your GPS reroutes you if there is traffic ahead. When you update your plan regularly, everyone on your team, including outside stakeholders such as investors, will know where you are headed.

What is a business plan?

Typically 15-20 pages long, a business plan is a document that explains what your business does, what you want to achieve in the business and the strategy you plan to use to get there. It details the opportunities you are going after, what resources you will need to achieve your goals and how you will define success.

Why are business plans important?

Business plans help you think through barriers and discover opportunities you may have recognized subconsciously but have not yet articulated. A business plan can also help you to attract potential lenders, investors and partners by providing them with evidence that your business has all of the ingredients necessary for success.

What questions should a business plan answer?

Your business plan should explain how your business will grow and succeed. A great plan will provide detailed answers to questions that a banker or investor will have before putting money into the business, such as:

- What products or services do you provide?

- Who is your target customer?

- What are the benefits of your product and service for customers?

- How much will you charge?

- What is the size of the market?

- What are your marketing plans?

- How much competition does the business face in penetrating that market?

- How much experience does the management team have in running businesses like it?

- How do you plan to measure success?

- What do you expect the business’s revenue, costs and profit to be for the first few years?

- How much will it cost to achieve the goals stated in the business plan?

- What is the long-term growth potential of the business? Is the business scalable?

- How will you enable investors to reap the rewards of backing the business? Do you plan to sell the business to a bigger company eventually or take it public as your “exit strategy”?

How to write a business plan in 11 steps

This step-by-step outline will make it easier to write an effective business plan, even if you’re managing the day-to-day demands of starting a new business. Creating a table of contents that lists key sections of the plan with page numbers will make it easy for readers to flip to the sections that interest them most.

- Use our editable workbook to capture notes and organize your thoughts as you review these critical steps. Note: To avoid losing your work, please remember to save this PDF to your desktop before you begin.

1. Executive summary

The executive summary is your opportunity to make a great first impression on investors and bankers. It should be just as engaging as the enthusiastic elevator pitch you might give if you bumped into a potential backer in an elevator.

In three to five paragraphs, you’ll want to explain what your business does, why it will succeed and where it will be in five years. The executive summary should include short descriptions of the following:

- Business concept. What will your business do?

- Goals and vision. What do you expect the business to achieve, both financially and for other key stakeholders, such as the community?

- Product or service. What does your product or service do — and how is it different from those of competitors?

- Target market. Who do you expect to buy your product or service?

- Marketing strategy. How will you tell people about your product or service?

- Current revenue and profits. If your business is pre-revenue, offer sales projections.

- Projected revenue and profits. Provide a realistic look at the next year, as well as the next three years, ideally.

- Financial resources needed. How much money do you need to borrow or raise to fund your plan?

- Management team. Who are the company’s leaders and what relevant experience will they contribute?

2. Business overview

Here is where you provide a brief history of the business and describe the product(s) or service(s) it offers. Make sure you describe the problem you are attempting to solve, for whom you will solve it (your customers) and how you will solve it. Be sure to describe your business model (such as direct-to-consumer sales through an online store) so readers can envision how you will make sales. Also mention your business structure (such as a sole proprietorship , general partnership, limited partnership or corporation) and why it is advantageous for the business. And be sure to provide context on the state of your industry and where your business will fit into it.

3. Business goals and vision

Explain what you hope to achieve in the business (your vision) as well as its mission and value proposition. Most founders judge success by the size to which they grow the business using measures such as revenue or number of employees. Your goals may not be solely financial. You may also wish to provide jobs or solve a societal problem. If that’s the case, mention those goals as well.

If you are seeking outside funding, explain why you need the money, how you will put it to work to grow the business and how you expect to achieve the goals you have set for the business. Also explain your exit strategy—that is, how you would enable investors to cash out, whether that means selling the business or taking it public.

4. Management and organization

Many investors say they bet on the team behind a business more than the business idea, trusting that talented and experienced people will be capable of bringing sound business concepts to life. With that in mind, make sure to provide short bios of the key members of your management team (including yourself) that emphasize the relevant experience each individual brings, along with their special talents and industry recognition. Many business plans include headshots of the management team with the bios.

Also describe more about how your organization will be structured. Your company may be a sole proprietorship, a limited liability company (LLC) or a corporation in one or more states.

If you will need to hire people for specific roles, this is the place to mention those plans. And if you will rely on outside consultants for certain roles — such as an outsourced CFO — be sure to make a note of it here. Outside backers want to know if you’ve anticipated the staffing you need.

5. Service or product line

A business will only succeed if it sells something people want or need to buy. As you describe the products or services you will offer, make sure to explain what benefits they will provide to your target customers, how they will differ from competing offerings and what the buying cycle will likely be so it is clear that you can actually sell what you are offering. If you have plans to protect your intellectual property through a copyright or patent filing, be sure to mention that. Also explain any research and development work that is underway to show investors the potential for additional revenue streams.

6. Market/industry analysis

Anyone interested in providing financial backing to your business will want to know how big your company can potentially grow so they have an idea of what kind of returns they can expect. In this section, you’ll be able to convey that by explaining to whom you will be selling and how much opportunity there is to reach them. Key details to include are market size; a strengths, weaknesses, opportunities and threats (SWOT) analysis ; a competitive analysis; and customer segmentation. Make it clear how you developed any projections you’ve made by citing interviews or research.

Also describe the current state of the industry. Where is there room for improvement? Are most companies using antiquated processes and technology? If your business is a local one, what is the market in your area like? Do most of the restaurants where you plan to open your café serve mediocre food? What will you do better?

In this section, also list competitors, including their names, websites and social media handles. Describe each source of competition and how your business will address it.

7. Sales and marketing

Explain how you will spread the word to potential customers about what you sell. Will you be using paid online search advertising, social media promotions, traditional direct mail, print advertising in local publications, sponsorship of a local radio or TV show, your own YouTube content or some other method entirely? List all of the methods you will use.

Make sure readers know exactly what the path to a sale will be and why that approach will resonate with customers in your ideal target markets as well as existing customer segments. If you have already begun using the methods you’ve outlined, include data on the results so readers know whether they have been effective.

8. Financials

In a new business, you may not have any past financial data or financial statements to include, but that doesn’t mean you have nothing to share. Preparing a budget and financial plan will help show investors or bankers that you have developed a clear understanding of the financial aspects of running your business. (The U.S. Small Business Administration (SBA) has prepared a guide you can use; SCORE , a nonprofit organization that partners with the SBA, offers a financial projections template to help you look ahead.) For an existing business, you will want to include income statements, profit and loss statements, cash flow statements and balance sheets, ideally going back three years.

Make a list of the specific steps you plan to take to achieve the financial results you have outlined. The steps are generally the most detailed for the first year, given that you may need to revise your plan later as you gather feedback from the marketplace.

Include interactive spreadsheets that contain a detailed financial analysis showing how much it costs your business to produce the goods and services you provide, the profits you will generate, any planned investments and the taxes you will pay. See our startup costs calculator to get started.

9. Financial projections

Creating a detailed sales forecast can help you get outside backers excited about supporting you. A sales forecast is typically a table or simple line graph that shows the projected sales of the company over time with monthly or quarterly details for the next 12 months and a broader projection as much as five years into the future. If you haven’t yet launched the company, turn to your market research to develop estimates. For more information, see “ How to create a sales forecast for your small business. ”

10. Funding request

If you are seeking outside financing such as a loan or equity investment, your potential backers will want to know how much money you need and how you will spend it. Describe the amount you are trying to raise, how you arrived at that number and what type of funding you are seeking (such as debt, equity or a combination of both). If you are contributing some of your own funds, it is worth noting this, as it shows that you have skin in the game.

11. Appendix

This should include any information and supporting documents that will help investors and bankers gain a greater understanding of the potential of your business. Depending on your industry, you might include local permits, licenses, deeds and other legal documents; professional certifications and licenses; media clips; information on patents and other intellectual property; key customer contracts and purchase orders; and other relevant documents.

Some business owners find it helpful to develop a list of key concepts, such as the names of the company’s products and industry terms. This can be helpful if you do business in an industry that may not be familiar to the readers of the business plan.

Tips for creating an effective business plan

Use clear, simple language. It’ll be easier to win people over if your plan is easy to read. Steer clear of industry jargon, and if you must use any phrases the average adult won’t know, be sure to define them.

Emphasize what makes your business unique. Investors and bankers want to know how you will solve a problem or gap in the marketplace differently from anyone else. Make sure you’re conveying your differentiating factors.

Nail the details. An ideal business plan will be detailed and accurate. Make sure that any financial projections you make are realistic and grounded in solid market research. (If you need help in making your calculations, you can get free advice at SCORE.) Seasoned bankers and investors will quickly spot numbers that are overly optimistic.

Take time to polish it. Your final version of the plan should be neat and professional with an attractive layout and copy that has been carefully proofread.

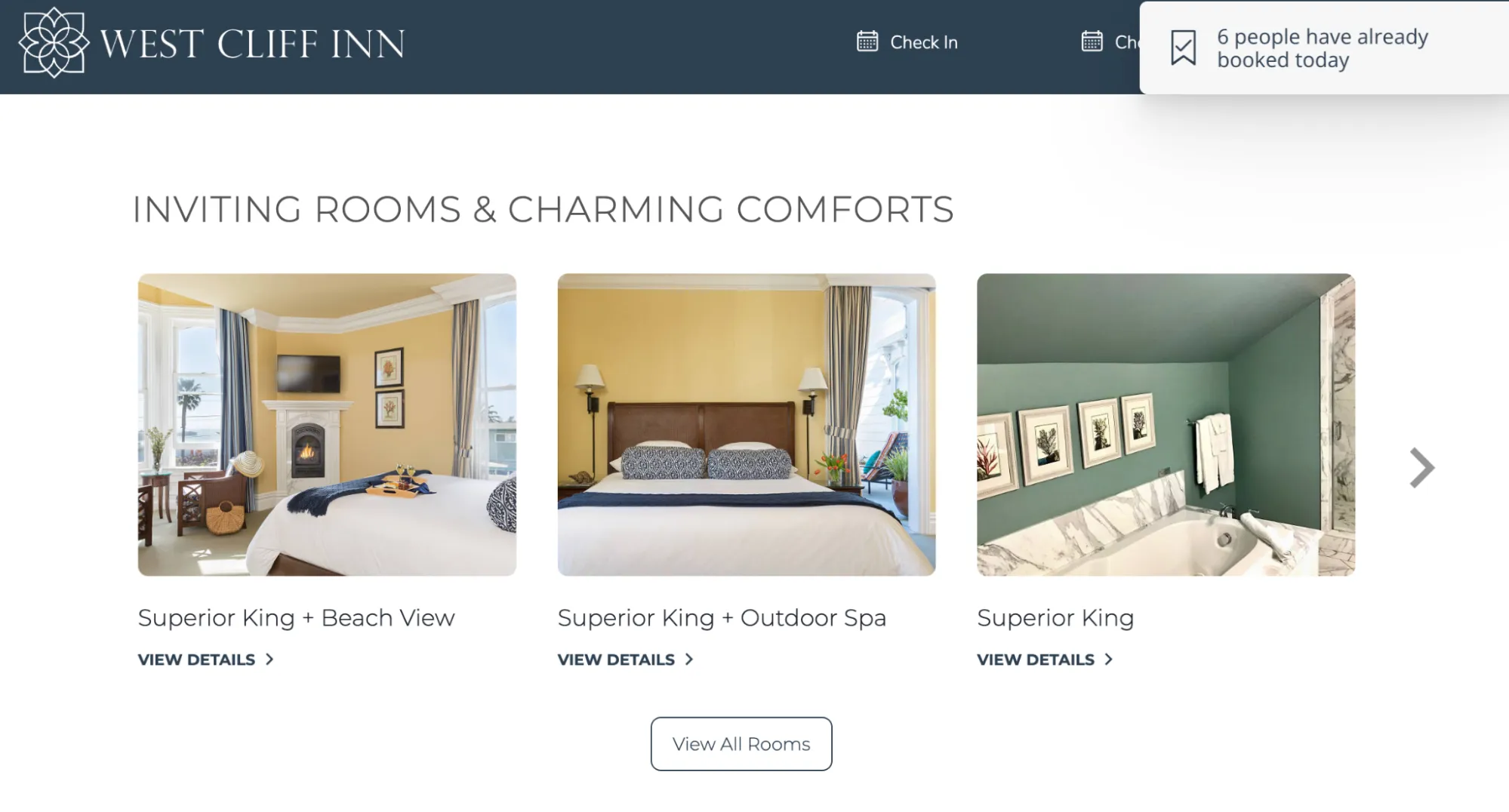

Include professional photos. High-quality shots of your product or place of business can help make it clear why your business stands out.

Updating an existing business plan

Some business owners in rapidly growing businesses update their business plan quarterly. Others do so every six months or every year. When you update your plan make sure you consider these three things:

- Are your goals still current? As you’ve tested your concept, your goals may have changed. The plan should reflect this.

- Have you revised any strategies in response to feedback from the marketplace? You may have found that your offerings resonated with a different customer segment than you expected or that your advertising plan didn’t work and you need to try a different approach. Given that investors will want to see a marketing and advertising plan that works, keeping this section current will ensure you are always ready to meet with one who shows interest.

- Have your staffing needs changed? If you set ambitious goals, you may need help from team members or outside consultants you did not anticipate when you first started the business. Take stock now so you can plan accordingly.

Final thoughts

Most business owners don’t follow their business plans exactly. But writing one will get you off to a much better start than simply opening your doors and hoping for the best, and it will be easier to analyze any aspects of your business that aren’t working later so you can course-correct. Ultimately, it may be one of the best investments you can make in the future of your business.

Business plan FAQs

What are common mistakes when writing a business plan.

The biggest mistake you can make when writing a business plan is creating one before the idea has been properly researched and tested. Not every idea is meant to become a business. Other common mistakes include:

- Not describing your management team in a way that is appealing to investors. Simply cutting and pasting someone’s professional bio into the management section won’t do the trick. You’ll want to highlight the credentials of each team member in a way that is relevant to this business.

- Failing to include financial projections — or including overly optimistic ones. Investors look at a lot of business plans and can tell quickly whether your numbers are accurate or pie in the sky. Have a good small business accountant review your numbers to make sure they are realistic.

- Lack of a clear exit strategy for investors. Investors may want the option to cash out eventually and would want to know how they can go about doing that.

- Slapdash presentation. Make sure to fact-check any industry statistics you cite and that any charts, graphs or images are carefully prepared and easy to read.

What are the different types of business plans?

There are a variety of styles of business plans. Here are three major types:

Traditional business plan. This is a formal document for pitching to investors based on the outline in this article. If your business is a complicated one, the plan may exceed the typical length and stretch to as many as 50 pages.

One-page business plan. This is a simplified version of a formal business plan designed to fit on one page. Typically, each section will be described in bullet points or in a chart format rather than in the narrative style of an executive summary. It can be helpful as a summary document to give to investors — or for internal use. Another variation on the one-page theme is the business model canvas .

Lean plan. This methodology for creating a business plan is ideal for a business that is evolving quickly. It is designed in a way that makes it easy to update on a regular basis. Lean business plans are usually about one page long. The SBA has provided an example of what this type of plan includes on its website.

Is the business plan for a nonprofit different from the plan for other business types?

Many elements of a business plan for a nonprofit are similar to those of a for-profit business. However, because the goal of a nonprofit is achieving its mission — rather than turning a profit — the business plan should emphasize its specific goals on that front and how it will achieve them. Many nonprofits set key performance indicators (KPIs) — numbers that they track to show they are moving the needle on their goals.

Nonprofits will generally emphasize their fundraising strategies in their business plans rather than sales strategies. The funds they raise are the lifeblood of the programs they run.

What is the difference between a business plan, a strategic plan and a marketing plan?

A strategic plan is different from the type of business plan you’ve read about here in that it emphasizes the long-term goals of the business and how your business will achieve them over the long run. A strong business plan can function as both a business plan and a strategic plan.

A marketing plan is different from a business plan in that it is focused on four main areas of the business: product (what you are selling and how you will differentiate it), price (how much your products or services will cost and why), promotion (how you will get your ideal customer to notice and buy what you are selling) and place (where you will sell your products). A thorough business plan may cover these topics, doing double duty as both a business plan and a marketing plan.

Explore more

Editable business plan workbook

Starting a new business

1 . Francis J. Green and Christian Hopp. “Research: Writing a Business Plan Makes Your Startup More Likely to Succeed.” HBR. July 14, 2017. Available online at https://hbr.org/2017/07/research-writing-a-business-plan-makes-your-startup-more-likely-to-succeed.

2 . CorpNet, “The Startup Business Plan: Why It’s Important and How You Can Create One,” June 29, 2022.

Important Disclosures and Information

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S" or “Merrill") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp."). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC , and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC , and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products:

Simple Business Plan Template (2024)

Updated: May 4, 2024, 4:37pm

Table of Contents

Why business plans are vital, get your free simple business plan template, how to write an effective business plan in 6 steps, frequently asked questions.

While taking many forms and serving many purposes, they all have one thing in common: business plans help you establish your goals and define the means for achieving them. Our simple business plan template covers everything you need to consider when launching a side gig, solo operation or small business. By following this step-by-step process, you might even uncover a few alternate routes to success.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Whether you’re a first-time solopreneur or a seasoned business owner, the planning process challenges you to examine the costs and tasks involved in bringing a product or service to market. The process can also help you spot new income opportunities and hone in on the most profitable business models.

Though vital, business planning doesn’t have to be a chore. Business plans for lean startups and solopreneurs can simply outline the business concept, sales proposition, target customers and sketch out a plan of action to bring the product or service to market. However, if you’re seeking startup funding or partnership opportunities, you’ll need a write a business plan that details market research, operating costs and revenue forecasting. Whichever startup category you fall into, if you’re at square one, our simple business plan template will point you down the right path.

Copy our free simple business plan template so you can fill in the blanks as we explore each element of your business plan. Need help getting your ideas flowing? You’ll also find several startup scenario examples below.

Download free template as .docx

Whether you need a quick-launch overview or an in-depth plan for investors, any business plan should cover the six key elements outlined in our free template and explained below. The main difference in starting a small business versus an investor-funded business is the market research and operational and financial details needed to support the concept.

1. Your Mission or Vision

Start by declaring a “dream statement” for your business. You can call this your executive summary, vision statement or mission. Whatever the name, the first part of your business plan summarizes your idea by answering five questions. Keep it brief, such as an elevator pitch. You’ll expand these answers in the following sections of the simple business plan template.

- What does your business do? Are you selling products, services, information or a combination?

- Where does this happen? Will you conduct business online, in-store, via mobile means or in a specific location or environment?

- Who does your business benefit? Who is your target market and ideal customer for your concept?

- Why would potential customers care? What would make your ideal customers take notice of your business?

- How do your products and/or services outshine the competition? What would make your ideal customers choose you over a competitor?

These answers come easily if you have a solid concept for your business, but don’t worry if you get stuck. Use the rest of your plan template to brainstorm ideas and tactics. You’ll quickly find these answers and possibly new directions as you explore your ideas and options.

2. Offer and Value Proposition

This is where you detail your offer, such as selling products, providing services or both, and why anyone would care. That’s the value proposition. Specifically, you’ll expand on your answers to the first and fourth bullets from your mission/vision.

As you complete this section, you might find that exploring value propositions uncovers marketable business opportunities that you hadn’t yet considered. So spend some time brainstorming the possibilities in this section.

For example, a cottage baker startup specializing in gluten-free or keto-friendly products might be a value proposition that certain audiences care deeply about. Plus, you could expand on that value proposition by offering wedding and other special-occasion cakes that incorporate gluten-free, keto-friendly and traditional cake elements that all guests can enjoy.

3. Audience and Ideal Customer

Here is where you explore bullet point number three, who your business will benefit. Identifying your ideal customer and exploring a broader audience for your goods or services is essential in defining your sales and marketing strategies, plus it helps fine-tune what you offer.

There are many ways to research potential audiences, but a shortcut is to simply identify a problem that people have that your product or service can solve. If you start from the position of being a problem solver, it’s easy to define your audience and describe the wants and needs of your ideal customer for marketing efforts.

Using the cottage baker startup example, a problem people might have is finding fresh-baked gluten-free or keto-friendly sweets. Examining the wants and needs of these people might reveal a target audience that is health-conscious or possibly dealing with health issues and willing to spend more for hard-to-find items.

However, it’s essential to have a customer base that can support your business. You can be too specialized. For example, our baker startup can attract a broader audience and boost revenue by offering a wider selection of traditional baked goods alongside its gluten-free and keto-focused specialties.

4. Revenue Streams, Sales Channels and Marketing

Thanks to our internet-driven economy, startups have many revenue opportunities and can connect with target audiences through various channels. Revenue streams and sales channels also serve as marketing vehicles, so you can cover all three in this section.

Revenue Streams

Revenue streams are the many ways you can make money in your business. In your plan template, list how you’ll make money upon launch, plus include ideas for future expansion. The income possibilities just might surprise you.

For example, our cottage baker startup might consider these revenue streams:

- Product sales : Online, pop-up shops , wholesale and (future) in-store sales

- Affiliate income : Monetize blog and social media posts with affiliate links

- Advertising income : Reserve website space for advertising

- E-book sales : (future) Publish recipe e-books targeting gluten-free and keto-friendly dessert niches

- Video income : (future) Monetize a YouTube channel featuring how-to videos for the gluten-free and keto-friendly dessert niches

- Webinars and online classes : (future) Monetize coaching-style webinars and online classes covering specialty baking tips and techniques

- Members-only content : (future) Monetize a members-only section of the website for specialty content to complement webinars and online classes

- Franchise : (future) Monetize a specialty cottage bakery concept and sell to franchise entrepreneurs

Sales Channels

Sales channels put your revenue streams into action. This section also answers the “where will this happen” question in the second bullet of your vision.

The product sales channels for our cottage bakery example can include:

- Mobile point-of-sale (POS) : A mobile platform such as Shopify or Square POS for managing in-person sales at local farmers’ markets, fairs and festivals

- E-commerce platform : An online store such as Shopify, Square or WooCommerce for online retail sales and wholesale sales orders

- Social media channels : Facebook, Instagram and Pinterest shoppable posts and pins for online sales via social media channels

- Brick-and-mortar location : For in-store sales , once the business has grown to a point that it can support a physical location

Channels that support other income streams might include:

- Affiliate income : Blog section on the e-commerce website and affiliate partner accounts

- Advertising income : Reserved advertising spaces on the e-commerce website

- E-book sales : Amazon e-book sales via Amazon Kindle Direct Publishing

- Video income : YouTube channel with ad monetization

- Webinars and online classes : Online class and webinar platforms that support member accounts, recordings and playback

- Members-only content : Password-protected website content using membership apps such as MemberPress

Nowadays, the line between marketing and sales channels is blurred. Social media outlets, e-books, websites, blogs and videos serve as both marketing tools and income opportunities. Since most are free and those with advertising options are extremely economical, these are ideal marketing outlets for lean startups.

However, many businesses still find value in traditional advertising such as local radio, television, direct mail, newspapers and magazines. You can include these advertising costs in your simple business plan template to help build a marketing plan and budget.

5. Structure, Suppliers and Operations

This section of your simple business plan template explores how to structure and operate your business. Details include the type of business organization your startup will take, roles and responsibilities, supplier logistics and day-to-day operations. Also, include any certifications or permits needed to launch your enterprise in this section.

Our cottage baker example might use a structure and startup plan such as this:

- Business structure : Sole proprietorship with a “doing business as” (DBA) .

- Permits and certifications : County-issued food handling permit and state cottage food certification for home-based food production. Option, check into certified commercial kitchen rentals.

- Roles and responsibilities : Solopreneur, all roles and responsibilities with the owner.

- Supply chain : Bulk ingredients and food packaging via Sam’s Club, Costco, Amazon Prime with annual membership costs. Uline for shipping supplies; no membership needed.

- Day-to-day operations : Source ingredients and bake three days per week to fulfill local and online orders. Reserve time for specialty sales, wholesale partner orders and market events as needed. Ship online orders on alternating days. Update website and create marketing and affiliate blog posts on non-shipping days.

Start A Limited Liability Company Online Today with ZenBusiness

Click to get started.

6. Financial Forecasts

Your final task is to list forecasted business startup and ongoing costs and profit projections in your simple business plan template. Thanks to free business tools such as Square and free marketing on social media, lean startups can launch with few upfront costs. In many cases, cost of goods, shipping and packaging, business permits and printing for business cards are your only out-of-pocket expenses.

Cost Forecast

Our cottage baker’s forecasted lean startup costs might include:

Gross Profit Projections

This helps you determine the retail prices and sales volume required to keep your business running and, hopefully, earn income for yourself. Use product research to spot target retail prices for your goods, then subtract your cost of goods, such as hourly rate, raw goods and supplier costs. The total amount is your gross profit per item or service.

Here are some examples of projected gross profits for our cottage baker:

Bottom Line

Putting careful thought and detail in a business plan is always beneficial, but don’t get so bogged down in planning that you never hit the start button to launch your business . Also, remember that business plans aren’t set in stone. Markets, audiences and technologies change, and so will your goals and means of achieving them. Think of your business plan as a living document and regularly revisit, expand and restructure it as market opportunities and business growth demand.

Is there a template for a business plan?

You can copy our free business plan template and fill in the blanks or customize it in Google Docs, Microsoft Word or another word processing app. This free business plan template includes the six key elements that any entrepreneur needs to consider when launching a new business.

What does a simple business plan include?

A simple business plan is a one- to two-page overview covering six key elements that any budding entrepreneur needs to consider when launching a startup. These include your vision or mission, product or service offering, target audience, revenue streams and sales channels, structure and operations, and financial forecasts.

How can I create a free business plan template?

Start with our free business plan template that covers the six essential elements of a startup. Once downloaded, you can edit this document in Google Docs or another word processing app and add new sections or subsections to your plan template to meet your specific business plan needs.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best LLC Services

- Best Registered Agent Services

- Best Trademark Registration Services

- Top LegalZoom Competitors

- Best Business Loans

- Best Business Plan Software

- ZenBusiness Review

- LegalZoom LLC Review

- Northwest Registered Agent Review

- Rocket Lawyer Review

- Inc. Authority Review

- Rocket Lawyer vs. LegalZoom

- Bizee Review (Formerly Incfile)

- Swyft Filings Review

- Harbor Compliance Review

- Sole Proprietorship vs. LLC

- LLC vs. Corporation

- LLC vs. S Corp

- LLP vs. LLC

- DBA vs. LLC

- LegalZoom vs. Incfile

- LegalZoom vs. ZenBusiness

- LegalZoom vs. Rocket Lawyer

- ZenBusiness vs. Incfile

- How To Start A Business

- How to Set Up an LLC

- How to Get a Business License

- LLC Operating Agreement Template

- 501(c)(3) Application Guide

- What is a Business License?

- What is an LLC?

- What is an S Corp?

- What is a C Corp?

- What is a DBA?

- What is a Sole Proprietorship?

- What is a Registered Agent?

- How to Dissolve an LLC

- How to File a DBA

- What Are Articles Of Incorporation?

- Types Of Business Ownership

Next Up In Company Formation

- Best Online Legal Services

- How To Write A Business Plan

- Member-Managed LLC Vs. Manager-Managed LLC

- Starting An S-Corp

- LLC Vs. C-Corp

- How Much Does It Cost To Start An LLC?

15 Ways to Advertise Your Business in 2024

What Is a Proxy Server?

How To Get A Business License In North Dakota (2024)

How To Write An Effective Business Proposal

Best New Hampshire Registered Agent Services Of 2024

Employer Staffing Solutions Group Review 2024: Features, Pricing & More

Krista Fabregas is a seasoned eCommerce and online content pro sharing more than 20 years of hands-on know-how with those looking to launch and grow tech-forward businesses. Her expertise includes eCommerce startups and growth, SMB operations and logistics, website platforms, payment systems, side-gig and affiliate income, and multichannel marketing. Krista holds a bachelor's degree in English from The University of Texas at Austin and held senior positions at NASA, a Fortune 100 company, and several online startups.

Simple Business Plan Templates

By Joe Weller | April 2, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve compiled a variety of simple business plan templates, all of which are free to download in PDF, Word, and Excel formats.

On this page, you’ll find a one-page business plan template , a simple business plan for startups , a small-business plan template , a business plan outline , and more. We also include a business plan sample and the main components of a business plan to help get you started.

Simple Business Plan Template

Download Simple Business Plan Template

This simple business plan template lays out each element of a traditional business plan to assist you as you build your own, and it provides space to add financing information for startups seeking funding. You can use and customize this simple business plan template to fit the needs for organizations of any size.

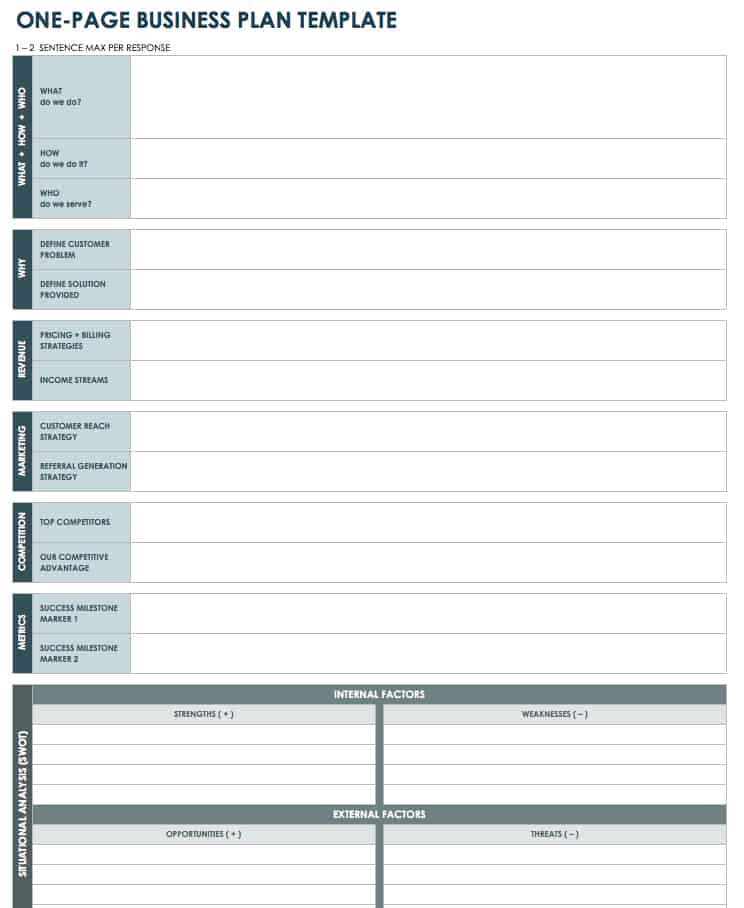

One-Page Business Plan Template

Download One-Page Business Plan Template

Excel | Word | PDF | Smartsheet

Use this one-page business plan to document your key ideas in an organized manner. The template can help you create a high-level view of your business plan, and it provides easy scannability for stakeholders. You can use this one-page plan as a reference to build a more detailed blueprint for your business.

For additional single page plans, take a look at " One-Page Business Plan Templates with a Quick How-To Guide ."

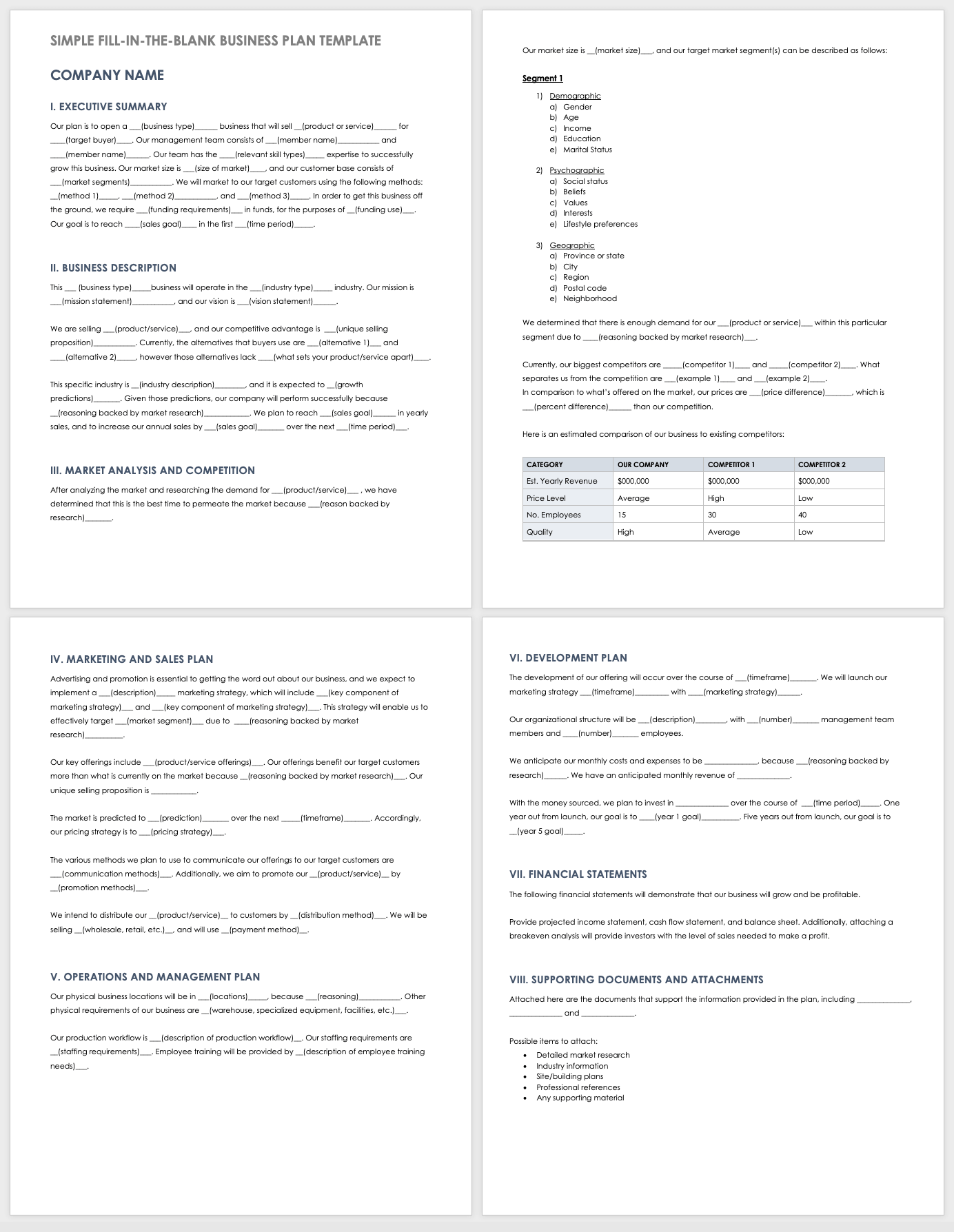

Simple Fill-in-the-Blank Business Plan Template

Download Simple Fill-in-the-Blank Business Plan Template

Use this fill-in-the-blank business plan template to guide you as you build your business plan. Each section comes pre-filled with sample content, with space to add customized verbiage relevant to your product or service.

For additional free, downloadable resources, visit " Free Fill-In-the-Blank Business Plan Templates ."

Simple Business Plan for Startup

Download Startup Business Plan Template — Word

This business plan template is designed with a startup business in mind and contains the essential elements needed to convey key product or service details to investors and stakeholders. Keep all your information organized with this template, which provides space to include an executive summary, a company overview, competitive analysis, a marketing strategy, financial data, and more. For additional resources, visit " Free Startup Business Plan Templates and Examples ."

Simple Small-Business Plan Template

Download Simple Small-Business Plan Template

This template walks you through each component of a small-business plan, including the company background, the introduction of the management team, market analysis, product or service offerings, a financial plan, and more. This template also comes with a built-in table of contents to keep your plan in order, and it can be customized to fit your requirements.

Lean Business Plan Template

Download Lean Business Plan Template

This lean business plan template is a stripped-down version of a traditional business plan that provides only the most essential aspects. Briefly outline your company and industry overview, along with the problem you are solving, as well as your unique value proposition, target market, and key performance metrics. There is also room to list out a timeline of key activities.

Simple Business Plan Outline Template

Download Simple Business Plan Outline Template

Word | PDF

Use this simple business plan outline as a basis to create your own business plan. This template contains 11 sections, including a title page and a table of contents, which details what each section should cover in a traditional business plan. Simplify or expand this outline to create the foundation for a business plan that fits your business needs.

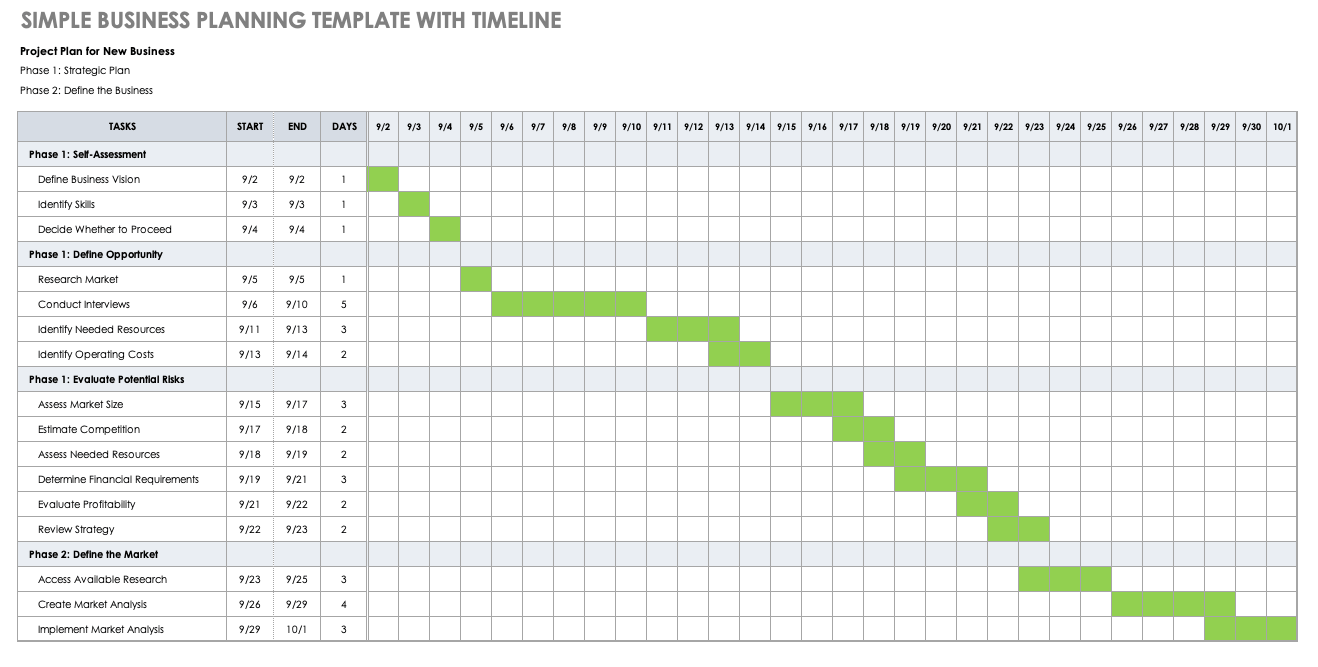

Simple Business Planning Template with Timeline

Download Simple Business Planning Template with Timeline

Excel | Smartsheet

This template doubles as a project plan and timeline to track progress as you develop your business plan. This business planning template enables you to break down your work into phases and provides room to add key tasks and dates for each activity. Easily fill in the cells according to the start and end dates to create a visual timeline, as well as to ensure your plan stays on track.

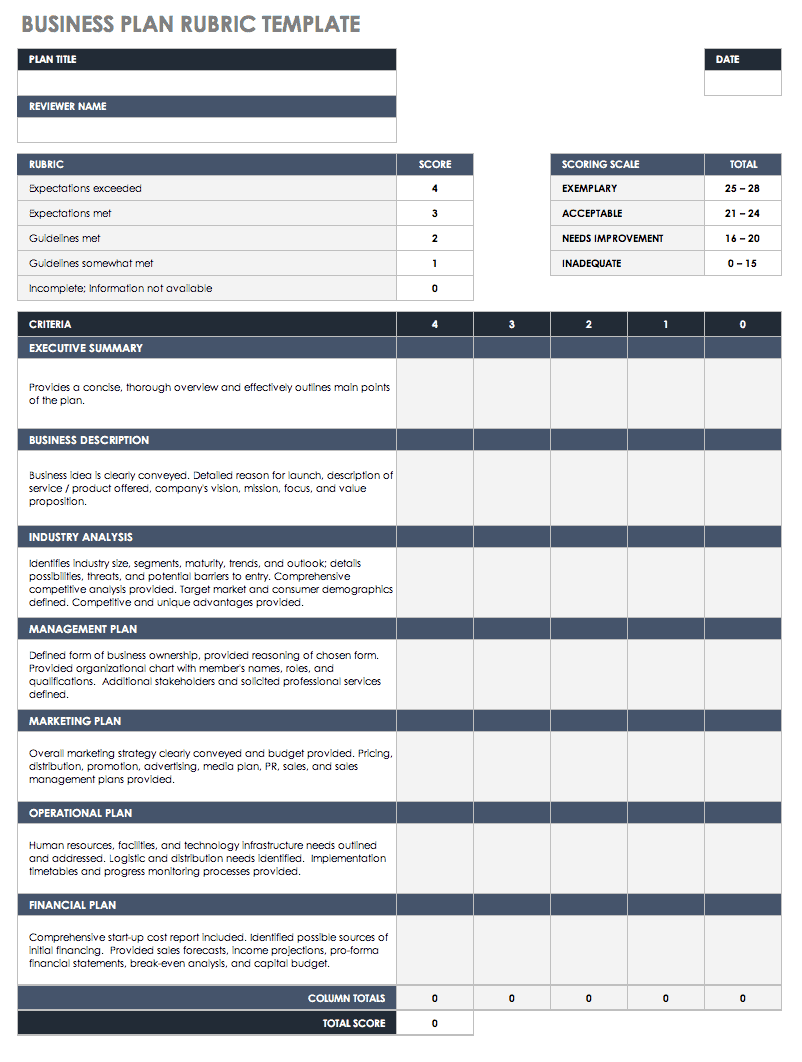

Simple Business Plan Rubric Template

Download Simple Business Plan Rubric

Excel | Word | PDF | Smartsheet

Once you complete your business plan, use this business plan rubric template to assess and score each component of your plan. This rubric helps you identify elements of your plan that meet or exceed requirements and pinpoint areas where you need to improve or further elaborate. This template is an invaluable tool to ensure your business plan clearly defines your goals, objectives, and plan of action in order to gain buy-in from potential investors, stakeholders, and partners.

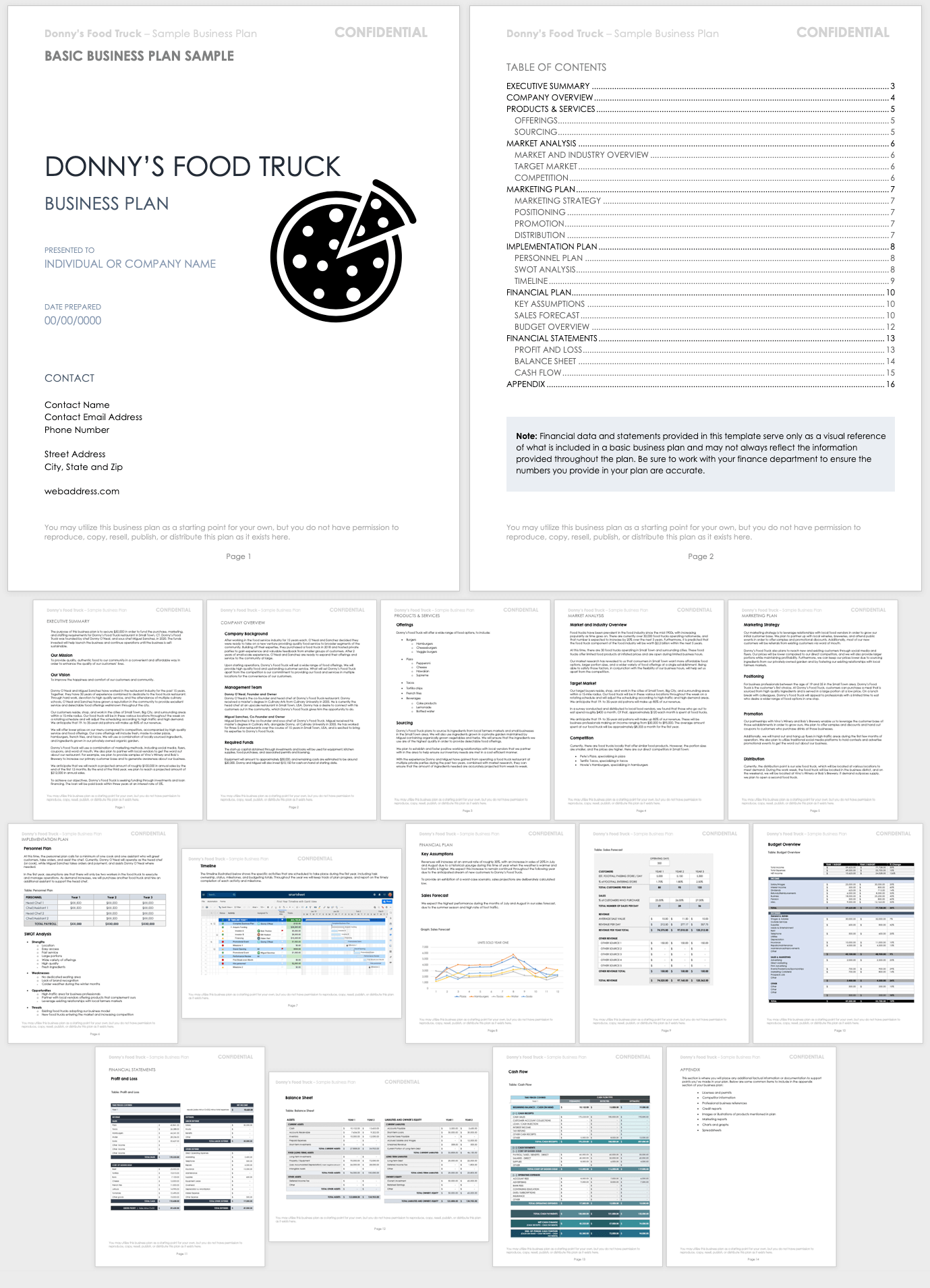

Basic Business Plan Sample

Download Basic Business Plan Sample

This business plan sample serves as an example of a basic business plan that contains all the traditional components. The sample provides a model of what a business plan might look like for a fictional food truck business. Reference this sample as you develop your own business plan.

For additional resources to help support your business planning efforts, check out “ Free Strategic Planning Templates .”

Main Components of a Business Plan

The elements you include in your business plan will depend on your product or service offerings, as well as the size and needs of your business.

Below are the components of a standard business plan and details you should include in each section:

- Company name and contact information

- Website address

- The name of the company or individual viewing the presentation

- Table of Contents

- Company background and purpose

- Mission and vision statement

- Management team introduction

- Core product and service offerings

- Target customers and segments

- Marketing plan

- Competitive analysis

- Unique value proposition

- Financial plan (and requirements, if applicable)

- Business and industry overview

- Historical timeline of your business

- Offerings and the problem they solve

- Current alternatives

- Competitive advantage

- Market size

- Target market segment(s)

- Projected volume and value of sales compared to competitors

- Differentiation from competitors

- Pricing strategy

- Marketing channels

- Promotional plan

- Distribution methods

- Legal structure of your business

- Names of founders, owners, advisors, etc.

- Management team’s roles, relevant experience, and compensation plan

- Staffing requirements and training plans

- Physical location(s) of your business

- Additional physical requirements (e.g., warehouse, specialized equipment, facilities, etc.)

- Production workflow

- Raw materials and sourcing methods

- Projected income statement

- Projected cash flow statement

- Projected balance sheet

- Break-even analysis

- Charts and graphs

- Market research and competitive analysis

- Information about your industry

- Information about your offerings

- Samples of marketing materials

- Other supporting materials

Tips for Creating a Business Plan

It’s easy to feel overwhelmed at the thought of putting together a business plan. Below, you’ll find top tips to help simplify the process as you develop your own plan.

- Use a business plan template (you can choose from the variety above), or refer to the previous section to create a standard outline for your plan.

- Modify your outline to reflect the requirements of your specific business. If you use a standard business plan outline, remove sections that aren’t relevant to you or aren’t necessary to run your business.

- Gather all the information you currently have about your business first, and then use that information to fill out each section in your plan outline.

- Use your resources and conduct additional research to fill in the remaining gaps. (Note: It isn’t necessary to fill out your plan in order, but the executive summary needs to be completed last, as it summarizes the key points in your plan.)

- Ensure your plan clearly communicates the relationship between your marketing, sales, and financial objectives.

- Provide details in your plan that illustrate your strategic plan of action, looking forward three to five years.

- Revisit your plan regularly as strategies and objectives evolve.

- What product or service are we offering?

- Who is the product or service for?

- What problem does our product or service offering solve?

- How will we get the product or service to our target customers?

- Why is our product or service better than the alternatives?

- How can we outperform our competitors?

- What is our unique value proposition?

- When will things get done, and who is responsible for doing them?

- If you need to obtain funding, how will you use the funding?

- When are payments due, and when do payments come in?

- What is the ultimate purpose of your business?

- When do you expect to be profitable?

To identify which type of business plan you should write, and for more helpful tips, take a look at our guide to writing a simple business plan .

Benefits of Using a Business Plan Template

Creating a business plan can be very time-consuming, especially if you aren’t sure where to begin. Finding the right template for your business needs can be beneficial for a variety of reasons.

Using a business plan template — instead of creating your plan from scratch — can benefit you in the following ways:

- Enables you to immediately write down your thoughts and ideas in an organized manner

- Provides structure to help outline your plan

- Saves time and valuable resources

- Helps ensure you don’t miss essential details

Limitations of a Business Plan Template

A business plan template can be convenient, but it has its drawbacks — especially if you use a template that doesn’t fit the specific needs of your business.

Below are some limitations of using a business plan template:

- Each business is unique and needs a business plan that reflects that. A template may not fit your needs.

- A template may restrict collaboration with other team members on different aspects of the plan’s development (sales, marketing, and accounting teams).

- Multiple files containing different versions of the plan may be stored in more than one place.

- You still have to manually create charts and graphs to add to the plan to support your strategy.

- Updates to the plan, spreadsheets, and supporting documents have to be made in multiple places (all documents may not update in real time as changes are made).

Improve Your Business Plan with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

smallbusiness.wa.gov.au

- Business planning

Effective business planning can be the key to your success. A business plan can help you secure finance, prioritise your efforts and evaluate opportunities.

It may initially seem like a lot of work; however a well prepared business plan can save you time and money in the long run.

Free download

Free business plan template

You can download our business plan template and guide to writing a business plan to assist you to complete your plan.

What should a business plan include?

There are no rules about what your plan should cover or the level of detail. In general, plans need to include information regarding:

- business profile

- vision, mission and goals

- market research

- operational strategy

- products and/or services

- marketing plan

- financial strategy.

Before starting your business plan

You may want to consider the following key questions to help determine if you are ready to start writing your business plan.

- Have you thoroughly refined your business idea so you have a good understanding of how your business will operate?

- Have you researched your business concept to determine if there is a need for it in the marketplace?

- Have you completed a feasibility study to determine expected level of success?

- Do you have the money required to start and grow the business?

- Are you prepared to invest significant time into the business to get it up and running?

How often should I review my business plan?

Business planning is an ongoing activity. Review plans regularly and update whenever your circumstances change.

Useful resources

Business plan template

Guide to using the business plan template, business plan on a page template.

small business helpline

Can't find what you're looking for?

If you can't quite find the right information our business advisers are here to discuss any business questions or concerns.

Call us on 133 140

Book an online or phone appointment

Chat to us online

- Builders’ Support Facility

- Business information

- Business advisory

- Starting and growing

- Business premises

- Legal and risk

- Dispute resolution

- Exiting a business

- Steps to starting a business

- Essential business skills

- Licences and permits

- Business structures

- Business names

- Buying a business

- Franchising

- 8 steps to marketing your business

- Marketing and promotion strategies

- Market research

- Digital marketing

- Types of business premises

- Understanding commercial leases

- Negotiating a lease

- Commercial Tenancy Act

- Resolving leasing problems

- Ending a lease

- Processes and procedures

- Business finance and loans

- Financial planning documents

- Providing credit to customers

- Tax requirements

- Tax reporting requirements

- Tax deductions and concessions

- Business grants

- Debt recovery

- Legal responsibilities

- Competition and consumer law

- Contracts and agreements

- Hiring a lawyer

- Intellectual property

- Risk management

- Cyber security

- Industrial relations systems

- Types of employment

- Employer obligations

- Recruiting and managing staff

- Ending employment

- Managing stress and anxiety

- Avoiding disputes

- Handling customer complaints

- Writing a letter of demand

- Resolving a dispute

- Types of disputes we can help with

- Essential exiting tasks

- Closing a business

- Selling a business

- Selling a franchise

- Succession planning

Search SBDC

- Starting a business

- Business advice

- Business skills

Download Free Business Plan Examples

Download a free business plan in pdf or word doc format to make writing a plan fast and easy, find your sample plan.

Discover the sample plan that best fits your business. Search our gallery of over 550 sample business plans and find the one that's right for you.

View the Gallery

What You'll Get:

A complete business plan Unlike other blank templates, our business plan examples are complete business plans with all of the text and financial forecasts already filled out. Edit the text to make the plan your own and save hundreds of hours.

A professional business plan template All 550 of our business plans are in the SBA-approved format that’s proven to raise money from lenders and investors.

Instructions and help at every step Get help with clear, simple instructions for each section of the business plan. No business experience necessary.

A Word doc you can edit We don’t just have PDF documents that make editing a challenge. Each plan is available in Word format so you can start editing your business plan example right away.

Key Sections Included in our Example Business Plans:

Executive Summary : A quick overview of your plan and entices investors to read more of your plan.

Company : Describes the ownership and history of your business.

Products and Services : Reviews what you sell and what you’re offering your customers.

Market Analysis : Describes your customers and the size of your target market.

Strategy and Implementation : Provides the details of how you plan on building the business.

Management Team : An overview of the people behind the business and why they’re the right team to make the business a success.

Financial Plan : A complete set of forecasts including a Profit and Loss Statement, Cash Flow Statement, and Balance Sheet.

Looking for a sample business plan PDF? You can download a few PDF examples below:

- Accounting and Bookkeeping Sample Business Plan PDF

- Agriculture Farm Sample Business Plan PDF

- Cleaning Service Sample Business Plan PDF

Need a faster way to write your business plan? LivePlan is the #1 planning tool for over 1 million businesses.

Your download should begin immediately

If your download doesn't begin after 5 seconds, please click here .

View our entire gallery of free downloads

Tweet about it

I just downloaded a free business plan from Bplans.com!#smb #startup

Recommended Articles

Recommended Download

You might also enjoy:

The Small Business Toolkit

Access a free list of must–have resources for new and growing businesses in any industry.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

70 Small Business Ideas for Anyone Who Wants to Run Their Own Business

Published: March 19, 2024

A good business idea may seem hard to come by, but with some planning and preparation, you can easily launch a small business to supplement your income — or become your own full-time boss.

Maybe you already have an idea of the business you’d like to start. But while you might feel ready for a new venture and passionate about your idea, you might be looking for some direction.

To help get you started, here's a list of small business ideas separated into a few sections:

- What makes a good small business?

Best Small Business Ideas

Best businesses to start with little money, home business ideas.

- Online Businesses Ideas

Easy Businesses to Start

Business ideas for students, creative small business ideas, how to start a small business at home, starting a small business: faq.

The first step to becoming a successful entrepreneur is finding a business idea that works for you. In this article, you’ll find dozens of small business ideas you can start from home and scale up as your clientele grows. Let’s get started.

What makes a good small business idea?

Not all small business ideas are made equal: Some require more effort and funding than others, while some can be launched with few resources — or resources you already have. As a potential small business owner, you’ll want to save as much money as possible on training, rent, supplies, and other necessities.

Let’s go over what makes a good business idea:

- Requires little to no training . A good small business idea will ideally leverage your existing field of expertise and require little to no training. That will not only shorten your time-to-launch, but also lessen your expenses, since training courses can cost a significant amount of money. Plus, you’ll be more confident offering services that you feel prepared to deliver.

- Requires low setup costs. Your business should be cheap to start. Maybe you only need to purchase a website domain or buy a desk for your garage.

- Requires little hands-on inventory or supply management . A great business idea needs few supplies and little inventory management. If you want to sell physical goods, you can either try drop-shipping and manually make goods in small batches.

- Is based online . The best small business ideas are based online and can be carried out from your personal computer. This will automatically lower your commuting costs and give you greater flexibility over your personal and work life.

- Can sustainably be managed by few people . As a small business owner, you won’t have the funds to hire other people to help you run your business — at least not at first. A good business idea should give you the ability to run your business on your own.

Free Business Startup kit

9 templates to help you brainstorm a business name, develop your business plan, and pitch your idea to investors.

- Business Name Brainstorming Workbook

- Business Plan Template

- Business Startup Cost Calculator

You're all set!

Click this link to access this resource at any time.

Airbnb Co-founder, Brian Chesky, said, “If we tried to think of a good idea, we wouldn’t have been able to think of a good idea. You just have to find the solution for a problem in your own life.”

If you’re like Brian and you’ve already thought about a solution for a problem you encounter in your life — or you’re on the path to doing so — then starting a small business may be in your future. It may also be for you if you dream of clocking out of your nine-to-five job for the last time and becoming your own boss.

Below, we include the best ideas for you to start your small business — with resources and examples to help you get started.

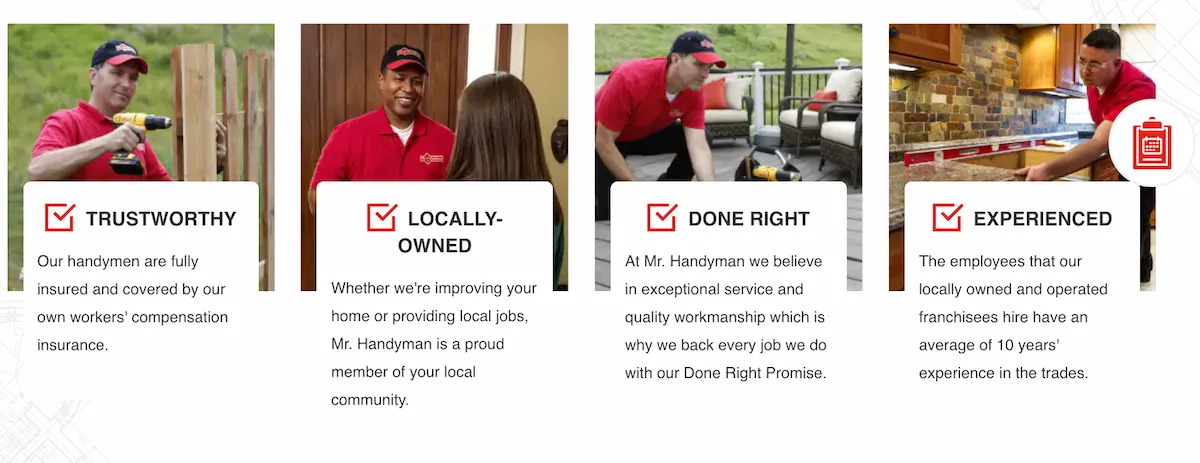

1. Handyman

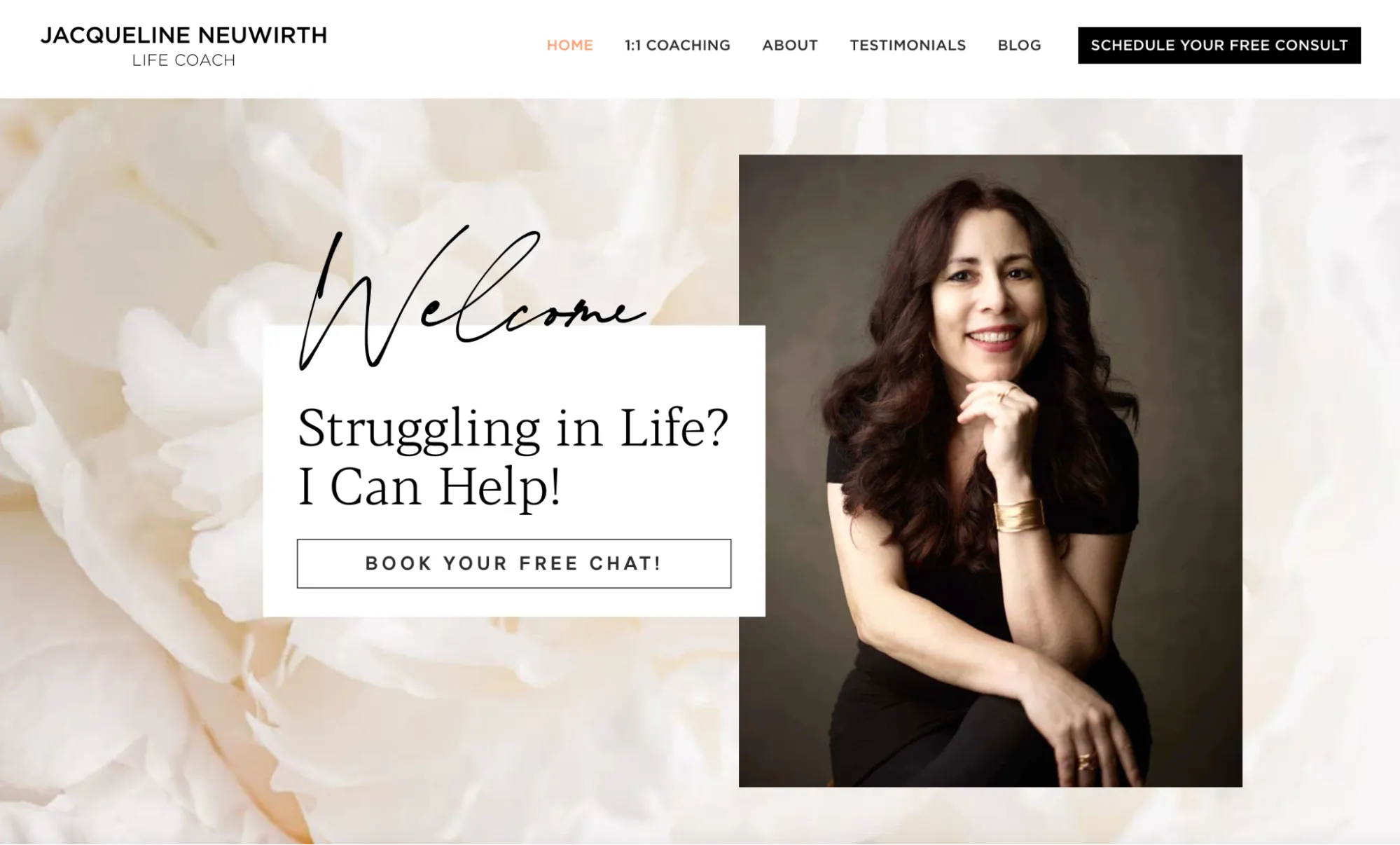

8. Life/Career Coach

If you have experience navigating career, personal, and social transitions successfully, put it to good use as a life or career coach. Many of us are looking for guidance in our careers — and finding someone with the time to mentor us can be tough.

Life/career coaches don’t come cheap, but they are able to offer clients the intense and hands-on training and advice they need to make serious moves in their personal and professional lives. After all, everyone needs some uplifting advice from time to time.

To start your life/career coaching business with confidence, you can look for a certification program (like the Life Coach School’s or Diane Hudson’s ), then apply your skills as you acquire new clients.

A resume writing business is economical, has few overhead costs, and has few educational requirements. We still recommend having an Associate’s or Bachelor’s degree and a few resume samples on hand. If you still feel that you need to brush up on your resume writing skills, you can take a course like Coursera’s or LinkedIn Learning’s .

Once you’ve gotten resume writing down, you can expand your business to include cover letter writing and even offer career coaching services in conjunction with these services.

10. Freelance Writer

If you have writing skills , there’s someone out there willing to pay you for them. Write blog posts, magazine articles, and website copy galore — just make sure you have a body of work built up to share with potential clients. Even if you create a few sample pieces to have on hand, they’ll help exhibit your work and attract new business.

To become a freelance writer, it’s essential to choose a specialty. For instance, you might choose to only write for publications in the healthcare industry (maybe because you were previously a healthcare worker) or focus on lifestyle publications. Whatever the case, specializing will help you find your niche market and gain confidence as a new freelancer writer.

There are no educational requirements for freelance writing, but you do need strong writing skills. It also helps to enjoy writing. While certification may be beneficial, getting practice and writing every day is more important. Try these writing prompts to start.

11. Landscaper

Mowing, tree-trimming, and seasonal decor are all neighborhood needs. If you have or can acquire the equipment, a landscaping business can be a lucrative affair. It’s also a great choice if you enjoy doing it for your own home and have a good eye for landscape design.

The good news is that you can start small. For instance, you could offer your neighbors seasonal planting services and start with a few perennial plants, or simply offer mulching services.

To grow your landscaping business, you should consider taking some formal training. The following organizations offer courses:

- New York Botanical Gardens