Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

What Is Cost Allocation?

Table of Contents

Entrepreneurs, small business owners and managers need accurate, timely financial data to run their operations. Specifically, understanding and connecting costs to items or departments helps them create budgets, develop strategies and make the best business decisions for their organizations. This is where cost allocation comes in. Detailed cost allocation reports help businesses ensure they’re charging enough to cover expenses and make a profit.

While a detailed cost allocation report may not be vital for extremely small businesses, more complex businesses require cost allocation to optimize profitability and productivity.

What is cost allocation?

Cost allocation is the process of identifying and assigning costs to business objects, such as products, projects, departments or individual company branches. Business owners use cost allocation to calculate profitability. Costs are separated or allocated, into different categories based on the business area they impact. These amounts are then used in accounting reports .

For example, say you’re a small clothing manufacturer. Your product line’s cost allocation would include materials, shipping and labor costs. It would also include a portion of the operation’s overhead costs. Calculating these costs consistently helps business leaders determine if profits from sales are higher than the costs of producing the product line. If not, it can help the owner pinpoint where to raise prices or cut expenses .

For a larger company, cost allocation is applied to each department or business location . Many companies also use cost allocation to determine annual bonuses for each area.

Types of costs

If you’re starting a business , the cost allocation process is relatively straightforward. However, larger businesses have many more costs that can be divided into two primary categories: direct and indirect costs:

- Purchased inventory

- Materials used to make inventory

- Direct labor costs for employees who make inventory

- Payroll for those who work in operations

- Manufacturing overhead, including rent, insurance and utilities costs

- Other overhead costs, including expenses that support the company but aren’t directly related to production, such as marketing and human resources

What is a cost driver?

A cost driver is a variable that affects business costs, such as the number of invoices issued, employee hours worked or units of electricity used. Unlike cost objects, such as units produced or departments, a cost driver reflects the reason for the incurred cost amounts.

How to allocate costs

While cost objects vary by business type, the cost allocation process is the same regardless of what your company produces. Here are the steps involved.

1. Identify your business’s cost objects.

Determine the cost objects to which you want to allocate costs, such as units of production, number of employees or departments. Remember that anything within your business that generates an expense is a cost object. Review each product line, project and department to ensure you’ve gathered all cost objects for which you must allocate costs.

2. Create a cost pool.

Next, create a detailed list of all business costs. Categories should cover utilities, business insurance policies, rent and any other expenses your business incurs.

3. Choose the best cost allocation method for your needs.

After identifying your business’s cost objects and creating a cost pool, you must choose a cost allocation method. Several methods exist, including the following standard ones:

- Direct materials cost method: This cost allocation method assumes all products have the same allocation base and variable rate.

- Direct labor cost method: This cost allocation method is most helpful if labor costs can be allocated to one product or if expenses vary directly with labor costs.

- High/low method. This cost allocation method is best if you have more than one cost driver and each driver has different fixed or variable rates.

- Step-up or step-down method: With this cost allocation method, departments are first ranked and then the cost of services is allocated from one service department to another in a series of steps.

- Full absorption costing (FAC): This cost allocation method combines direct material and direct labor costs with a predetermined FAC rate based on company historical data or industry standards.

- Variable costing: Consider this cost allocation method if your business has many variable cost allocations (costs that vary by quantity) and uses significant direct labor.

4. Allocate costs.

Now that you’ve listed cost objects, created a cost pool and chosen a cost allocation method, you’re ready to allocate costs.

Here’s a cost allocation example to help you visualize the process:

Dave owns a business that manufactures eyeglasses. In January, Dave’s overhead costs totaled $5,000. In the same month, he produced 3,000 eyeglasses with $2 in direct labor per product. Direct materials for each pair of eyeglasses totaled $5. Here’s what cost allocation would look like for Dave: Direct costs: $5 direct materials + $2 direct labor = $7 direct costs per pair Indirect costs: Overhead allocation: $5,000 ÷ 3,000 pairs = $1.66 overhead costs per pair Direct costs: $7 per pair + Indirect costs: $1.66 per pair Total cost: $8.66 per pair

As you can see, cost allocation helps Dave determine how much he must charge wholesale for each pair of eyeglasses to make a profit. Larger companies would apply this same process to each department and product to ensure sufficient sales goals.

5. Review and adjust cost allocations.

Cost allocations are never static. To be meaningful, they must be monitored and adjusted constantly as circumstances change.

What are the benefits of cost allocation?

Accurate, regular cost allocation can bring your business the following benefits:

- Helps you run your business: The information you glean from cost allocation reports helps you perform vital functions like preparing income tax returns and creating financial reports for investors, creditors and regulators.

- Informs business decisions: Cost allocation is an excellent business decision tool that can help you monitor productivity and justify expenses. Cost allocation gives a detailed overview of how your business expenses are used. From this perspective, you can determine which products and services are profitable and which departments are most productive.

- Helps produce accurate business reports: Tax accounting, financial accounting and management accounting all require some kind of cost allocation. This information is the foundation of accurate business reports.

- Can reveal accurate production costs: Knowing what it costs to create a product, including all expenses allocated to it, is essential to making good pricing decisions and allocating resources efficiently.

- Helps you evaluate staff: Cost allocation can help you assess the performance of different departments and staff members. If a department is not profitable, staff productivity may need improvement.

Common cost allocation mistakes

To get the most from cost allocation, avoid these common mistakes:

- Equal or inflexible allocation : Cost allocation is not as simple as allocating any given cost over different product lines or departments. Some cost objects require more time, expense or labor than others, for example.

- Missing costs: Costing is meaningless if it doesn’t include all expenses. Don’t forget costs, such as overhead, time spent and intangible expenses.

- Failing to adjust as needed: Costs and priorities in business are changing constantly. Be sure your cost allocations are monitored and adjusted to meet your information needs.

- Not considering fluctuating revenue with indirect costs: If your business is seasonal or fluctuates over time, it’s important to account for that when allocating costs.

Cost allocation and your business

Even if you operate a very small business, it’s essential to properly allocate your expenses. Otherwise, you could make all-too-common mistakes, such as charging too little for your product or spending too much on overhead. Whether you choose to start allocating costs on your own with software or with the help of a professional small business accountant , cost allocation is a process no business owner can afford to overlook.

Dachondra Cason contributed to this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

BlackLine Blog

June 13, 2018

What is Cost Allocation? An Introduction to Cost Allocations

Michael shultz.

Share Article

- Cost Allocation Example & Definition

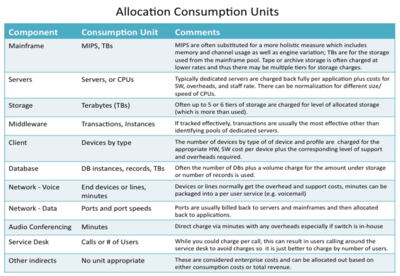

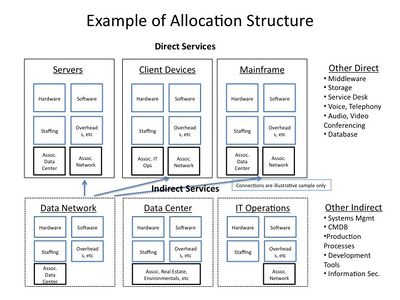

Cost allocation is the distribution of one cost across multiple entities, business units, or cost centers. An example is when health insurance premiums are paid by the main corporate office but allocated to different branches or departments.

When cost allocations are carried out, a basis for the allocation must be established, such as the headcount in each branch or department.

- Cost Allocation Methodology

A cost allocation methodology identifies what services are being provided and what these services cost. It also establishes a basis for allocating these costs to business units or cost centers based on their appropriate share of such cost.

The basis for allocating costs may include headcount, revenue, units produced, direct labor hours or dollars, machine hours, activity hours, and square footage.

Companies will often implement a cost allocation methodology as a means to control costs. Under an effective cost allocation methodology, business units become directly accountable for the services they consume. As a result, both the service provider and the respective consumers of that service become aware of service requirements and usage, and how such usage influences the costs incurred.

As business units begin seeing the cost of the services they consume, they can make more informed choices—such as trade-off decisions between service levels and costs, and benchmarking internal costs against outsourced providers.

- Process for Performing Cost Allocations

Using a basis for allocation, costs are spread to each business unit or cost center that incurred the cost based on their proportional share of the cost. For example, if headcount forms the basis of allocation for insurance costs, and there are 1000 total employees, then a department with 100 employees would be allocated 10% of the insurance costs.

While there are numerous ways cost allocations can be calculated, it is important to ensure the reasoning behind them is documented. This is often done by establishing allocation formulas or tables.

Once the calculation is established and cost distributions are calculated, journal entries are created to transfer costs from the providing or paying entity to the appropriate consuming entities. During each financial period, as periodic expenses are incurred, this calculation is repeated and allocating entries are made.

- What Does a Cost Allocation System Do?

A cost allocation system consists of a way to track which entity within an organization provides a product and/or service, the entity that consumes the products and/or services, and a means of distributing this cost from the provider to the consumer or consumers. Depending on the operating structure of the company, the cost allocation may be performed by internal invoice, through a chargeback module in the ERP system, or more commonly, through journal entries performed by accounting staff each financial period.

In This Post

About the Author

Financial Close

- Account Analysis

- Account Reconciliations

- Journal Entry

- Smart Close

- Task Management

- Transaction Matching

Invoice-to-Cash

- eInvoicing & Payments

- Cash Application

- AR Intelligence

- Collections Management

- Credit & Risk Management

- Team & Task Management

- Disputes & Deductions Management

Intercompany

- Intercompany Create

- Intercompany Net & Settle

- Intercompany Balance & Resolve

Consolidation & Financial Analytics

- Financial Reporting Analytics

- Variance Analysis

Modern Accounting Playbook

- MAP for the Financial Close

- MAP for Cash Application

- Resources Library

- Events & Webinars

- Partner Portal

- Developer Portal

- About BlackLine

- Diversity, Equity & Inclusion

- Press Releases

- In The News

- Request a Demo

Trust is in the Balance™

- System Status

- Corporate Responsibility

- Privacy Policy

- Cookie Settings

- Cookie Policy

© 2024 BlackLine Inc.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Accounting Articles

Cost Allocation

The process of identifying a company’s costs and assigning those costs to cost objects

Chris currently works as an investment associate with Ascension Ventures, a strategic healthcare venture fund that invests on behalf of thirteen of the nation's leading health systems with $88 billion in combined operating revenue. Previously, Chris served as an investment analyst with New Holland Capital, a hedge fund-of-funds asset management firm with $20 billion under management, and as an investment banking analyst in SunTrust Robinson Humphrey 's Financial Sponsor Group.

Chris graduated Magna Cum Laude from the University of Florida with a Bachelor of Arts in Economics and earned a Master of Finance (MSF) from the Olin School of Business at Washington University in St. Louis.

Currently an investment analyst focused on the TMT sector at 1818 Partners (a New York Based Hedge Fund), Sid previously worked in private equity at BV Investment Partners and BBH Capital Partners and prior to that in investment banking at UBS.

Sid holds a BS from The Tepper School of Business at Carnegie Mellon.

- What Is Cost Allocation?

- Types Of Costs

- How To Allocate Costs

- Why Do We Need To Allocate Costs?

- Examples Of Cost Allocation & Calculations

What is Cost Allocation?

Cost allocation is the process of identifying a company’s costs and assigning those costs to cost objects. Cost objects are the products, services, and activities of different departments of a company.

This process of allocating costs helps a business determine which parts of the company are responsible for what costs.

Sometimes it is difficult to draw the connection between allocated costs and their cost objects. When this happens, companies can use spreading costs.

Spreading costs occur when businesses spread the responsibility for production expenses across various areas.

When businesses can accurately allocate their costs, they are able to easily assess what particular cost objects are creating profits and losses for the company. On the other hand, if businesses are unable to allocate their costs correctly, their profit and loss calculations will be off.

Also, businesses must charge a price for their goods and services that covers their expenses and allows them to make a profit.

Intuitively, one can recognize the importance of cost allocation for the optimal performance of a company. Incorrect cost allocation calculations are extremely detrimental to any business and disrupt the ability to operate properly.

Cost allocation is necessary for any business, but as companies get larger and more complex, it becomes even more important to allocate costs accurately.

Key Takeaways

Cost allocation is fundamental and necessary for any business, big or small.

It helps with assessing profits and losses and the management of staffing.

Cost allocation allows companies to explain the pricing of their goods and services to customers.

Allocating costs is necessary for companies to maintain efficiency and financial accountability.

Types of Costs

Companies have various types of costs, and it is important to be able to distinguish between the different types when allocating them.

We can break them down into a few different categories.

- Direct costs: direct costs are those that can be traced to a certain product or service offered by a company. Included in direct costs are materials and labor that go into the production of a good.

- Indirect costs : these expenses are those that go into the production of a good but do not have a connection to a specific cost object. Examples of indirect costs include rent, utilities, and office supplies.

- Fixed costs : these costs remain constant, regardless of a company’s production volume. (e.g., rent)

- Variable costs : these costs increase or decrease as a company’s volume of production changes (e.g., supplies).

- A few examples of fixed overhead costs include rent, insurance, and workers’ salaries. Variable overhead costs include supplies and energy expenses, which both change as the volume of production increases or decreases.

How to Allocate Costs

Now that we understand the different types of costs, we can better understand the processes involved in cost allocation. Regardless of what good or service a company produces, the process remains consistent across industries.

- Identify Cost Objects : anything within a business that creates an expense is considered a cost object. The first step for allocating costs is to note all the cost objects of your company.

Electricity usage

Water usage

Fuel consumption

- Fixed cost allocation: this method assigns particular direct costs with cost objects. Drawing direct connections between costs and cost objects makes this method one of the most simple.

- Proportional allocation: proportional allocation deals with the distribution of indirect costs across associated cost objects. Sometimes proportional allocation divides costs equally across cost objects, while other times, it considers other factors (i.e., size) and divides costs accordingly.

- Activity-based allocation: this method is commonly considered the more accurate method of allocating costs. Activity-based allocation utilizes precise documentation to determine costs within departments and allocates the costs appropriately.

Why Do We Need to Allocate Costs?

A company must allocate its costs in order to optimize its business activities.

Recognizing Profits And Losses

Understanding the distribution of expenses helps companies analyze which areas of their business may be profitable or which areas may be causing a loss. This allows companies to determine whether or not certain expenses can be justified or not.

Companies do not know how much to charge the customer’s goods and services without cost allocation. Once non-profitable cost objects are identified, companies can cut expenses in those departments and focus their efforts on profitable cost objects.

Management Decisions

Cost allocation is also important for a company to manage its staff. In areas where the company is not profitable, it can evaluate the staff performance of that department. Often, the losses incurred by part of a company are due to the underperformance of employees.

Similarly, companies can analyze the allocation of their costs to determine where they are profitable and award the employees of that department.

Using cost allocation to motivate employees offers the administration of a company an objective, quantitative justification for their management decisions.

Transfer Pricing

Transfer pricing is the practice of charging for goods and services at an arm's length. The practice is used by departments the organization to charge for the goods and services exchanged within the same firm.

Cost allocation is vital for deriving transfer pricing, the exchange price of goods or services between two companies.

Examples of Cost Allocation & Calculations

Now we understand cost allocation, the different types, and why we need it. Here are several examples of different ways a company might allocate its costs.

Example 1: Square Footage

Christina’s business has an office and a manufacturing space. The square footage of the office is 1,000 square feet, and the manufacturing space is 1,500 square feet. The rent for the two spaces is $10,000 per month. The company will allocate the rent expense between the two spaces.

$10,000 (rent) / 2,500 square feet = $4 per square foot

- Calculate the rental cost for the office

$4 x 1,000 = $4,000

This means that Christina will allocate $4,000 of the rent to the office.

- Calculate the rental cost for the manufacturing space

$4 x 1,500 = $6,000

This means that Christina will allocate $6,000 of the rent to the manufacturing space.

Example 2: Units Produced

Alex’s manufacturing company makes water bottles. In January, Alex produced 5,000 water bottles with direct material costs of $2.50 per water bottle and $3.00 in direct labor costs per water bottle.

Alex also had $6,500 in overhead costs in January. Using the number of units produced as his allocation method, Alex can calculate his overhead costs using the overhead cost formula.

- Calculate the overhead costs:

$6,500 / 5,000 = $1.30 per water bottle

- Add the overhead costs to the direct costs to find the total costs:

$1.30 + $2.50 + $3.00 = $6.80 per backpack

So, Alex’s total costs in January were $6.80 per backpack. If Alex had not allocated the overhead costs, he would have most likely underpriced the backpacks, which would have resulted in a loss of income.

Everything You Need To Build Your Accounting Skills

To Help you Thrive in the Most Flexible Job in the World.

Researched and authored by Rachel Kim | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Accounting Ratios

- Amortization

- Depreciated Cost

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

- Cost Classifications

- Relevant Cost of Material

- Manufacturing Overhead Costs

- Conversion Costs

- Quality Costs

- Revenue Expenditure

- Product Cost vs Period Cost

- Direct Costs and Indirect Costs

- Prime Costs and Conversion Costs

- Relevant vs Irrelevant Costs

- Avoidable and Unavoidable Costs

- Cost Allocation

- Joint Products

- Accounting for Joint Costs

- Service Department Cost Allocation

- Repeated Distribution Method

- Simultaneous Equation Method

- Specific Order of Closing Method

- Direct Allocation Method

Cost allocation is the process by which the indirect costs are distributed among different cost objects such as a project, a department, a branch, a customer, etc. It involves identifying the cost object, identifying and accumulating the costs that are incurred and assigning them to the cost object on some reasonable basis.

Cost allocation is important for both pricing and planning and control decisions. If costs are not accurately calculated, a business might never know which products are making money and which ones are losing money. If cost are mis-allocated, a business may be charging wrong price to its customers and/or it might be wasting resources on products that are wrongly categorized as profitable.

Cost allocation is a sub-process of cost assignment , which is the overall process of finding total cost of a cost object. Cost assignment involves both cost tracing and cost allocation. Cost tracing encompasses finding direct costs of a cost object while the cost allocation is concerned with indirect cost charge.

Steps in cost allocation process

Typical cost allocation mechanism involves:

- Identifying the object to which the costs have to be assigned,

- Accumulating the costs in different pools,

- Identifying the most appropriate basis/method for allocating the cost.

Cost object

A cost object is an item for which a business need to separately estimate cost.

Examples of cost object include a branch, a product line, a service line, a customer, a department, a brand, a project, etc.

A cost pool is the account head in which costs are accumulated for further assignment to cost objects.

Examples of cost pools include factory rent, insurance, machine maintenance cost, factory fuel, etc. Selection of cost pool depends on the cost allocation base used. For example if a company uses just one allocation base say direct labor hours, it might use a broad cost pool such as fixed manufacturing overheads. However, if it uses more specific cost allocation bases, for example labor hours, machine hours, etc. it might define narrower cost pools.

Cost driver

A cost driver is any variable that ‘drives’ some cost. If increase or decrease in a variable causes an increase or decrease is a cost that variable is a cost driver for that cost.

Examples of cost driver include:

- Number of payments processed can be a good cost driver for salaries of Accounts Payable section of accounting department,

- Number of purchase orders can be a good cost driver for cost of purchasing department,

- Number of invoices sent can be a good cost driver for cost of billing department,

- Number of units shipped can be a good cost driver for cost of distribution department, etc.

While direct costs are easily traced to cost objects, indirect costs are allocated using some systematic approach.

Cost allocation base

Cost allocation base is the variable that is used for allocating/assigning costs in different cost pools to different cost objects. A good cost allocation base is something which is an appropriate cost driver for a particular cost pool.

T2F is a university café owned an operated by a student. While it has plans for expansion it currently offers two products: (a) tea & coffee and (b) shakes. It employs 2 people: Mr. A, who looks after tea & coffee and Mr. B who prepares and serves shakes & desserts.

Its costs for the first quarter are as follows:

Total tea and coffee sales and shakes sales were $50,000 & $60,000 respectively. Number of customers who ordered tea or coffee were 10,000 while those ordering shakes were 8,000.

The owner is interested in finding out which product performed better.

Salaries of Mr. A & B and direct materials consumed are direct costs which do not need any allocation. They are traced directly to the products. The rest of the costs are indirect costs and need some basis for allocation.

Cost objects in this situation are the products: hot beverages (i.e. tea & coffee) & shakes. Cost pools include rent, electricity, music, internet and wi-fi subscription and magazines.

Appropriate cost drivers for the indirect costs are as follows:

Since number of customers is a good cost driver for almost all the costs, the costs can be accumulated together to form one cost pool called manufacturing overheads. This would simply the cost allocation.

Total manufacturing overheads for the first quarter are $19,700. Total number of customers who ordered either product are 18,000. This gives us a cost allocation base of $1.1 per customer ($19,700/18,000).

A detailed cost assignment is as follows:

Manufacturing overheads allocated to Tea & Cofee = $1.1×10,000

Manufacturing overheads allocated to Shakes = $1.1×8,000

by Irfanullah Jan, ACCA and last modified on Jul 22, 2020

Related Topics

- Cost Behavior

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Receivables

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Accounting Systems

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

Workflow Solutions

FloQast Close

FloQast Reconciliation Management

FloQast Variance Analysis

FloQast Analyze

FloQast Compliance Management

FloQast Ops

FloQast ReMind

Accounting Operations Platform

Platform Overview

Scalability

Trust & Security

Integrations

FloVerse Community

FloQast Studios

FloQast Blog

Controller Manifesto

FloQademy - Join / Sign In

Charting the Future of Accounting eBook

Your next step: navigating the future amidst changes and challenges

Chief Accounting Officer

Accounting Manager

Compliance Manager

Internal Audit Manager

By Workflow

Financial Close

Account Reconciliations

Audit Findings

Controls and Risk Management

SOX Compliance

Audit Readiness

Oracle NetSuite

Sage Intacct

FloQast Connect API

By Platform

The IPO Playbook for Finance & Accounting Teams

An at-a-glance guide to going public

Success Stories

Video Testimonials

PulteGroup Constructs Faster Close and Team Productivity with FloQast

Learn how FloQast helped PulteGroup reduce paper consumption, speed up its monthly Close, and streamline compliance reporting.

Closing Collaboration in a Multinational Accounting Team: How Emma Improved Team Collaboration and Internal Controls Together with FloQast

Emma's 70-person geographically distributed accounting team improved internal controls and streamlined the audit thanks to FloQast.

Qualys Modernizes SOX Compliance and Improves the Annual Audit with FloQast

Read how in just a matter of weeks, Qualys leveraged FloQast to standardize the close process and organize controls and documentation for a more simplified SOX compliance.

Partner Program

Become a Partner

Take Your Business to the Next Level

FloQast’s suite of easy-to-use and quick-to-deploy solutions enhance the way accounting teams already work. Learn how a FloQast partnership will further enhance the value you provide to your clients.

All Resources

Checklists & Templates

Customer Video Testimonials

Whitepapers

Customer Success Stories

Month-End Close Checklist

SOX RCM Template

Leverage best practices to build a SOX RCM that focuses on what’s most important for SOX compliance.

Customer Success Management

Customer Success

Global Community

Request Support

Earn Free CPE with FloQademy

FloQademy, FloQast’s learning portal, provides over 100+ hours of free CPE, on-demand, 24/7, and is open to everyone.

The FloQast Advantage

Initiatives

Diversity, Inclusion, & Community

Contact FloQast

Get In Touch

FloQast raises $100M at a $1.6B valuation

The Series E round was led by ICONIQ Growth to supercharge FloQast's global expansion and Innovation with Artificial Intelligence.

What is Cost Allocation? Definition & Process

Jul 16, 2020 Michael Whitmire

Working with the former accountants now working at FloQast, we decided to take a look at some of the pillars of the accounting professions.

The key to running a profitable enterprise of any kind is making sure that your prices are high enough to cover all your costs — and leave at least a bit for profit. For a really simple business — like the proverbial lemonade stand that almost every kid ran — that’s pretty simple. Your costs are what you (or your parents) paid for lemons and sugar. But what if it’s a more complex business? Then you might need to brush up on cost accounting, and learn about allocation accounting . Let’s walk through this using the hypothetical company, Lisa’s Luscious Lemonade.

What is cost allocation ?

The cost allocation definition is best described as the process of assigning costs to the things that benefit from those costs or to cost centers . For Lisa’s Luscious Lemonade, a cost center can be as granular as each jug of lemonade that’s produced, or as broad as the manufacturing plant in Houston.

Let’s assume that the owner, Lisa, needs to know the cost of a jug of lemonade. The total cost to create that jug of lemonade isn’t just the costs of the water, lemons, sugar and the jug itself, but also includes all the allocated costs to make it.

Let’s start by defining some terms…

Direct costs are costs that can be traced directly to the product or service itself. For manufacturers, these consist of direct materials and direct labor. They appear in the financial statements as part of the cost of goods sold .

Direct materials are those that become an integral part of the finished product. This will be the costs of the water, sugar, lemons, the plastic jug, and the label.

Direct labor includes the labor costs that can be easily traced to the production of those finished products. Direct labor for that jug will be the payroll for the workers on the production line.

Indirect costs are the costs that can’t be easily traced to a product or service but are clearly required for making whatever an enterprise sells. This includes materials that are used in such insignificant quantities that it’s not worth tracing them to finished products, and labor for employees who work in the factory, but not on the production line.

Overhead costs encompass all the costs that support the enterprise that can’t be directly linked to making the items that are sold. This includes indirect costs , as well as selling, marketing, administration, and facility costs.

Manufacturing overhead includes the overhead costs that are directly related to making the products for sale. This includes the electricity, rent, and utilities for the factory and salaries of supervisors on the factory floor.

Product costs are all the costs in making or acquiring the product for sale. These are also known as manufacturing costs or total costs . This includes direct labor, direct materials, and allocated manufacturing overhead.

What is the process?

The first step in any cost allocation system is to identify the cost objects to which costs need to be allocated. Here, our cost objec t is a jug of lemonade. For a more complex organization, the cost object could be a product line, a department, or a branch.

Direct costs are the simplest to allocate. Last month, Lisa’s Luscious Lemonades produced 50,000 gallons of lemonade and had the following direct costs:

Total costs Cost per gallon Direct materials $142,500 $2.85 Direct labor $37,500 $.75

How are costs allocated?

Allocating overhead costs is a bit more complex. First, the overhead costs are split between manufacturing costs and non-manufacturing costs. Some of this is pretty straightforward: the factory floor supervisor’s salary is clearly a manufacturing cost, and the sales manager’s salary is a non-manufacturing cost. But what about the cost of human resources or other service departments that serve all parts of the organization? Or facilities costs, which might include the rent for the building, insurance, utilities, janitorial services, and general building maintenance?

Human resources and other services costs might be logically split based on the headcount of the manufacturing versus non-manufacturing parts of the business. Facilities costs might be split based on the square footage of the manufacturing space versus the administrative offices. Electricity usage might be allocated on the basis of square footage or machine hours , depending on the situation.

Let’s say that for Lisa’s Luscious Lemonades, after we split the overhead between manufacturing and non-manufacturing costs, we have the following annual manufacturing overhead costs :

Supervisor salary $84,000 Indirect costs $95,000 Facility costs $150,000 Human resources $54,000 Depreciation $65,000 Electricity $74,000 Total manufacturing overhead $522,000

In a perfect world, it would be possible to keep an accurate running total of all overhead costs so that management would have detailed and accurate cost information. However, in practice, a predetermined overhead rate is used to allocate overhead using an allocation base .

This overhead rate is determined by dividing the total estimated manufacturing overhead by the estimated total units in the allocation base . At the end of the year or quarter, the allocated costs are reconciled to actual costs.

Ideally, the allocation base should be a cost driver that causes those overhead costs . For manufacturers, direct labor hours or machine-hours are commonly used. Since Lisa only makes one product — gallon jugs of lemonade — the simplest cost driver is the number of jugs produced in a year.

If we estimate that 600,000 gallons of lemonade are produced in a year, then the overhead rate will be $522,000 / 600,000 = $.87 per gallon.

Our final cost to produce a gallon of Lisa’s Luscious Lemonade is as follows:

Direct materials $2.85 Direct labor $0.75 Manufacturing overhead $0.87 Total cost $4.47

What is cost allocation used for?

Cost allocation is used for both external reporting and internally for decision making. Under generally accepted accounting principles (GAAP), the matching principle requires that expenses be reported in the financial statements in the same period that the related revenue is earned.

This means that manufacturing overhead costs cannot be expensed in the period incurred, but must be allocated to inventory items, where those costs remain until the inventory is sold, when overhead is finally expensed as part of the cost of goods sold. For Lisa’s Luscious Lemonade, that means that every time a jug of lemonade is produced, another $4.47 goes into inventory. When a jug is sold, $4.47 goes to the cost of goods sold.

However, for internal decision-making, the cost allocation systems used for GAAP financials aren’t always helpful. Cost accountants often use activity-based costing , or ABC, in parallel with the cost allocation system used for external financial reporting .

In ABC, products are assigned all of the overhead costs that they can reasonably be assumed to have caused. This may include some — but not all — of the manufacturing overhead costs , as well as operating expenses that aren’t typically assigned to products under the costing systems used for GAAP.

AutoRec to keep you sane

Whatever cost accounting method you use, it’s going to require spreadsheets that you have to reconcile to the GL. Combine that with the other reconciliations you have to do to close out the books, and like Lisa’s controller, you might be ready to jump into a vat of lemonade to drown your sorrows.

Enter FloQast AutoRec. Rather than spend hours every month reconciling accounts, AutoRec leverages AI to match one-to-one, one-to-many, or many-to-many transactions in minutes. Simple set up means you can start using it in minutes because you don’t need to create or maintain rules. Try it out, and see how much time you can save this month.

Ready to find out more about how FloQast can help you tame the beast of the close?

Michael Whitmire

As CEO and Co-Founder, Mike leads FloQast’s corporate vision, strategy and execution. Prior to founding FloQast, he managed the accounting team at Cornerstone OnDemand, a SaaS company in Los Angeles. He began his career at Ernst & Young in Los Angeles where he performed public company audits, opening balance sheet audits, cash to GAAP restatements, compilation reviews, international reporting, merger and acquisition audits and SOX compliance testing. He holds a Bachelor’s degree in Accounting from Syracuse University.

Related Blog Articles

Report: Accountants Want Financial Transformation, but Lack of Fulfillment and Confidence Stand in the Way

Study: Compliance and Controls Processes Are Struggling

Report: Analyzing Accountants’ Relationship with Technology as Stressor in the Workplace – and at Home

The Comprehensive Guide to Cost Allocation in Accounting

Accounting is a fascinating field, and cost allocation is one of the most important concepts in accounting. Whether you’re an accounting student or an accountant just starting out, it’s important to understand how to allocate costs.

In this comprehensive guide, we’ll cover everything from what it means to its pros and cons.

How Can Costs Be Allocated Among Departments or Product Lines When There Is No Clear Source?

Allocation is distributing costs among different departments or product lines in an organization. Trying to accurately estimate the cost of producing a good or rendering a service is a common challenge for many businesses.

This is especially true when there is no apparent source of the costs, as it requires the use of various techniques and methods to distribute the expenses fairly and reasonably.

What Is the Concept of Allocation?

Allocation (also known as “cost allocation”) is a process used to distribute the costs of a shared resource or expense among different departments, product lines, or activities within an organization.

This process is necessary to accurately determine the cost of producing a product, providing a service, or running a business. Allocation allows firms to identify the expenses incurred by each department or product line and helps make informed decisions about allocating resources.

The allocation concept has existed for centuries and is a fundamental part of modern accounting and financial management. The cost allocation process involves assigning costs to specific departments or product lines based on objective criteria, such as resource use or the benefit received from the expense.

The objective criteria used in the allocation process may vary depending on the type of business, but the goal is always to distribute the costs fairly and reasonably.

One of the main challenges of allocation is that many expenses cannot be traced directly to a specific department or product line. For example, the cost of electricity used to run a manufacturing plant cannot be directly traced to one particular product line.

In such cases, the cost of electricity must be allocated to different departments or product lines based on objective criteria, such as the number of hours each department uses the electricity or the production output of each product line.

There are different methods of allocation, each with its strengths and weaknesses. Some of the most common ways include direct allocation, step-down allocation, sequential allocation, and activity-based allocation. Each mode uses a different approach to allocating costs, but the goal is always to ensure that the costs are distributed fairly and reasonably.

What Doesn’t the Term Allocation Mean?

The term allocation” is commonly used in various contexts, such as finance, economics, project management, and resource management. However, it’s essential to understand that allocation ” doesn’t mean “equal distribution” or “uniform distribution” of resources.

Allocation refers to assigning a portion of resources, such as time, money, or labor, to specific tasks or activities. The goal of allocation is to optimize the use of resources to achieve the desired outcomes.

One of the most common misunderstandings about allocation is that it means dividing resources equally among tasks or activities. However, this is only sometimes the case. Resources are often not distributed evenly because different tasks or activities have different requirements and priorities.

For example, in project management, some jobs may require more time, money, or labor than others. In such cases, the project manager must allocate more resources to these critical tasks to ensure the project’s success.

Another misunderstanding about allocation is that it means distributing resources inflexibly and rigidly. Allocation is a flexible process that can be adjusted based on priorities or changes in resource availability. For example, in a business setting, the budget allocation may change based on market conditions or changes in customer demand. In these situations, the business must be able to reallocate its resources to respond to these changes.

The allocation also doesn’t mean that the resources are assigned once and never adjusted. Allocation is an ongoing process requiring constant monitoring and adjustments to ensure that resources are used optimally.

For example, in finance, the allocation of investments must be reviewed regularly to ensure that the portfolio is aligned with the investor’s goals and objectives.

Another misconception about allocation is that it only applies to tangible resources, such as money or equipment. However, allocation also applies to intangible resources like time and labor. These intangible resources are often more critical and limited than tangible ones. For example, allocating time is crucial in project management to ensure that projects are completed on time and within budget.

As you can see, allocation is a complex and flexible process that requires careful consideration of multiple factors, such as resource availability, priorities, and goals. It’s essential to understand that allocation doesn’t mean equal distribution or limited distribution of resources.

Instead, it’s a dynamic process that requires ongoing monitoring and adjustments to ensure the optimal use of resources. By avoiding common misconceptions about allocation, individuals and organizations can more effectively allocate their resources and achieve their desired outcomes.

Where the Term Allocation Originated From?

The word “allocation” comes from the Latin word “allocare.” The word allocation ” refers to setting aside or assigning a particular portion, amount, or portion of something for a specific purpose or recipient.

The allocation comes from the Latin prefix ad- (meaning “to”) and the noun loci (meaning “place”). The combination of these two words implies the idea of assigning a place, or portion of something, for a specific purpose.

In finance and economics, “allocation” refers to distributing resources, such as money, to different projects or initiatives based on their perceived importance and likelihood of success.

The allocation concept is ancient and can be traced back to the earliest civilizations, where resources were allocated based on the community’s needs. In early societies, central planning or direct control by the ruling class were common methods of allocation.

However, with the advent of market-based economies, the allocation has become more decentralized and is now primarily done through the market mechanism of supply and demand.

In modern economies, allocation is crucial in ensuring that resources are used efficiently and effectively. For example, in capital allocation, investors allocate their funds to different projects and businesses based on the perceived potential return on investment. This helps direct investment toward the most promising and profitable opportunities, thereby increasing the economy’s overall efficiency.

Similarly, prices play a crucial role in allocating goods and services in directing resources to where they are most needed. In a market economy, the interaction of supply and demand determines prices. When demand for a particular good or service is high, the price will increase, directing more resources toward its production. On the other hand, when demand is low, the price will decrease, reducing the allocation of resources to its production.

Government policies and regulations can also have an impact on allocation in addition to the market mechanism. For example, the government may allocate resources to specific sectors through funding or subsidies, such as education or healthcare.

Similarly, government regulations and taxes can also impact the allocation of resources by affecting the incentives for businesses and individuals to allocate their resources in a particular way.

How Allocation Relates to Accounting?

In accounting, allocation determines the cost of producing a product or providing a service. This information is then used to create accurate financial statements and make informed decisions about allocating resources in the future.

For example, a company may allocate resources to a new product line based on the expected revenue it will generate or distribute costs to specific departments based on their usage of resources.

The allocation also plays a crucial role in cost accounting . Cost accounting involves analyzing the cost of production, including direct and indirect costs, and using this information to make decisions about pricing and resource allocation.

By accurately allocating costs, a company can determine the actual cost of production and make informed decisions about pricing , production volume, and resource allocation.

In addition, allocation is used to allocate the costs of long-term assets, such as property, plant, and equipment. This is done through the process of depreciation, which is a systematic allocation of the cost of an asset over its useful life. Depreciation is used to determine the value of an investment for financial reporting purposes and the amount of tax that a company must pay.

Finally, allocation is also used in the budgeting process. In budgeting, an organization allocates resources to various departments and activities based on their priorities and goals. By accurately allocating resources, a company can ensure that it has enough resources to meet its goals and objectives while staying within its budget.

3 Examples of Allocation Being Used in Accounting Practice

Example #1 of allocation being used in accounting practice.

Allocating the Cost of Goods Sold In accounting, “cost of goods sold” (COGS) refers to the direct costs associated with producing a product or providing a service. These costs include the raw materials, labor, and overhead expenses incurred to produce the goods. COGS is crucial in determining a company’s gross profit because it represents the cost of producing and selling a product.

One example of allocation in accounting practice is when a company allocates the cost of goods sold to each product. This is done to understand the cost of producing each product and identify the most profitable products.

The allocation process involves dividing the total COGS by the number of units sold to arrive at an average cost per unit. This average cost per unit is then applied to each unit of product sold to determine the COGS for that specific product.

This allocation process is vital because it allows the company to accurately determine the cost of producing each product. This information is then used to make informed business decisions such as pricing strategies, production decisions, and cost control measures.

For example, suppose a company realizes that the cost of producing one product is much higher than the cost of producing another. In that case, it may choose to discontinue the higher-cost product or find ways to reduce the cost of production.

Example #2 of Allocation Being Used in Accounting Practice

One example of allocation in accounting practice is allocating indirect costs to different departments or products within a company. Indirect costs, such as rent, utilities, and office supplies, cannot be directly traced to a specific product or department. These costs must be allocated among different departments or products to calculate the cost of each accurately.

For example, consider a manufacturing company with three departments: production, research and development, and administration. The company has a total indirect cost of $100,000 for the year, which includes rent, utilities, and office supplies.

The company might determine the proportion of space each department uses to allocate these costs. If production uses 40% of the total space, R&D uses 30%, and administration uses 30%, the company would allocate 40% of the indirect costs to production, 30% to R&D, and 30% to administration.

Next, the company might allocate indirect costs based on the number of employees in each department. If production has 20 employees, R&D has 15, and administration has 10, the company would allocate indirect costs based on the ratio of employees in each department.

In this example, production would receive 40% of the indirect costs, R&D would receive 30%, and administration would receive 30%.

Finally, the company might allocate indirect costs based on the number of products produced in each department. If production produces 1000 products, R&D produces 500, and administration produces none, the company would allocate indirect costs based on the ratio of products produced in each department.

In this example, production would receive 67% of the indirect costs, R&D would receive 25%, and administration would receive 8%.

Example #3 of Allocation Being Used in Accounting Practice

Suppose a manufacturing company produces two products: Product A and Product B. To determine the cost of each product, the company must allocate the factory overhead costs, including utilities, rent, maintenance, and supplies, among other expenses. The overhead costs must be assigned to each product based on the proportion of total machine hours used to produce each product.

For example, if the company uses 60% of the total machine hours to produce Product A and 40% to produce Product B, then 60% of the factory overhead costs would be allocated to Product A and 40% to Product B. The company would then use the allocated overhead costs and the direct costs of material and labor to calculate the total cost of each product.

The allocation of overhead costs to each product is critical for the company to accurately determine the cost of goods sold and price its products competitively. The company can use an allocation method to ensure a fair and accurate picture of the costs of producing each product.

How to Do Cost Allocation in Simple Steps?

Cost allocation can be complex, but it doesn’t have to be. Here are five simple steps for cost allocation:

Step 1: Identify the Costs That Need to Be Allocated

The first step in cost allocation is identifying the costs that need to be allocated. This includes both direct and indirect costs. Direct costs can be easily traced to specific products or services, while indirect costs, such as rent and utilities, cannot.

Step 2: Choose the Appropriate Method of Cost Allocation

Once you have identified the costs that need to be allocated, the next step is to choose the appropriate cost allocation method. The most common methods include direct cost allocation, step-down allocation, sequential allocation, and activity-based costing. The method chosen will depend on the nature of the costs and the objectives of the cost allocation process.

Step 3: Determine the Allocation Base

The allocation base is the basis on which the costs will be allocated. This can be the number of units produced, the number of employees, or any other relevant factor that can be used to determine the cost of goods or services.

Step 4: Allocate the Costs

Once you have determined the allocation base, the next step is to allocate the costs. This can be done by dividing the total cost by the number of units, employees, or another relevant factor and multiplying this by the number of units, employees, or another relevant factor for each product, service, or department.

Step 5: Review and Adjust the Cost Allocation

Once the costs have been allocated, the final step is to review and adjust the cost allocation as necessary. This may involve reallocating costs based on new information or changes in the business.

Which Industries Can Cost Allocation Be Applied?

With the proper guidance, cost allocation can be applied to almost any industry. It’s all about the data you have and how you use it.

Let’s take a look at some of the industries that could benefit from cost allocation:

The healthcare industry is one of the most expensive in the world. It is also one of the most heavily regulated. These factors make cost allocation a necessity for many healthcare providers.

Healthcare organizations have many different costs, but the most significant sources are labor and supplies. Labor costs can be very high in this industry because it requires highly skilled people to perform various tasks, including surgery, patient care, and patient education. Supplies like bandages and IV bags are also expensive because they have to be sterile and meet regulatory requirements.

A hospital’s supply department has much control over its budget, but it also has little control over what happens in other departments, such as surgery or patient care. This makes it difficult to allocate costs accurately when they don’t know how much they will spend on supplies or how many patients they’ll see each year.

Cost allocation helps solve these problems by allowing managers to see which departments are consuming the most resources. They can adjust accordingly without guessing what’s happening behind closed doors (or behind locked doors).

Manufacturing

The manufacturing industry is one of the most common places where cost allocation can be applied. In this industry, it is crucial to know how much it costs to make each product and how much it costs to produce goods (including materials and labor) for sale.

With this information, manufacturers can determine how much they need to charge for their products to cover all of their expenses, including overhead costs like rent or electricity bills.

Cost allocation can also help manufacturers determine which products are more profitable than others so that they can focus on those areas instead of wasting time and money on less popular lines of goods. For example, suppose a company produces clothing and electronics but finds its clothing line more popular among consumers than its electronics line.

In that case, it may want to stop producing electronics altogether because there would need to be more demand for these products for them to make any money off of them.

This is an industry that benefits from cost allocation. Energy companies have long been able to allocate costs to different projects and branches, but they often face challenges when assigning overhead expenses. That’s because overhead costs are shared among the company’s functions, making them difficult to track.

Cost allocation software can help energy companies assign overhead expenses in a way that makes sense for each project or branch. The software also allows them to better understand where their money is going and gives them more flexibility in budgeting and forecasting future expenses.

Retailers are a great example of an industry that can benefit from cost allocation.

Retailers are often sold on the idea of one-stop shopping: you go to a store and buy everything you need, from clothing to food to furniture. But in reality, there are many different types of retailers, such as grocery stores, department stores, clothing stores, etc. And each has its own distinct set of costs for running that type of business. So how do these retailers know how much each product line contributes to their overall profits? They use cost allocation.

Cost allocation is a technique for allocating overhead costs across product lines based on their relative importance to the company’s overall performance. This way, retailers can determine which products contribute most (or least) to their bottom line and make decisions accordingly.

Information Technology

Information technology (IT) is one of the most significant cost allocation areas. IT costs are often divided into two categories: direct costs and indirect costs. The former refers to those costs that can be directly attributed to a particular project or product, while the latter refers to those costs that cannot be directly attributed.

Cost allocation in IT has many benefits. It helps managers determine how much it costs to develop a new product or service and where inefficiencies lie in their IT departments.

It also allows them to understand better how much revenue they’re generating from each product or service line, which will help them make better decisions about future investments in the company’s infrastructure.

Construction

This is one of the most apparent industries to apply cost allocation. Construction projects are often massive and complex, with many different stakeholders involved in the planning, execution, and completion of a project. It’s common for construction projects to have hundreds or thousands of contracts with hundreds or thousands of different suppliers.

Cost allocation helps ensure that those involved in the project are paid what they’re owed without overpaying anyone else who participated. It’s also used to ensure that a company only spends a little money on a project by ensuring that every expense is only charged once.

Transportation

This is the industry that can benefit the most from cost allocation.

Transportation has many parts that must work in unison to transport goods or passengers. It can be difficult to determine which part of a vehicle’s operation should be allocated to specific parts, and it usually requires a lot of math.

Cost allocation can make it easier for companies in this industry to understand which parts are costing them more than they expected so that they can make changes accordingly.

Food and Beverage

Food and beverage companies can benefit significantly from cost allocation. These companies are typically comprised of many different departments that must be managed to ensure the entire business runs smoothly. Each department has specific costs that it incurs, so allocating those costs among all of the departments will help you understand where your money is going and how it can be used most effectively.

Cost allocation is also helpful when dealing with food or beverage products because it allows you to track the costs associated with each product line and make sure you profit on every product line. This way, you know what kinds of products are selling well, which ones aren’t selling as well, and how much money each product line has made for your company.

Real Estate

This is one of the most common industries to use cost allocation methods. Real estate developers often create multiple project phases, which must be accounted for separately. The costs of these phases are usually allocated to determine how much profit (or loss) will be made in each phase.

This lets developers decide which phases should be completed first and what incentives may be offered to convince buyers to purchase units from those phases.

Utilities are another excellent example of an industry where cost allocation can be used.

They must deal with various costs, including purchasing raw materials, paying for labor, and buying equipment. The type of utility and the sector it operates in determine the cost of each of these. For example, a water utility may have very high costs for purchasing raw materials but low costs for labor and employee benefits because they only need a few employees or benefit packages.

Cost allocation can help utilities determine how much money they should spend on each part of their business so that they’re not overspending on one part while underinvesting in another.

Pros of Cost Allocation

Cost allocation is a common business practice. Companies use it to help determine the profitability of individual products, services, and departments within a company. Here are the pros of cost allocation:

Improved Decision Making

Cost allocation helps businesses make informed decisions by accurately determining the cost of goods or services. Companies can make informed decisions on pricing, production, and marketing strategies with a better understanding of the costs associated with producing a product or offering a service.

Better Resource Allocation

Cost allocation helps businesses to determine the costs associated with different departments, products, or services. This information can then be used to allocate resources more efficiently and allocate more resources to more profitable areas.

Increased Profitability

By allocating costs accurately, businesses can identify less profitable areas and make changes to improve profitability. This could involve reducing costs, improving efficiency, or adjusting pricing.

Better Budget Planning

Cost allocation helps businesses to create more accurate budgets. Companies can plan their budgets more effectively as they understand the costs associated with each product, service, or department.

Improved Internal Control

Cost allocation helps businesses to maintain better internal control over their operations. By allocating costs accurately, companies can track expenses and identify improvement areas. This helps to prevent fraud and embezzlement and increases accountability within the company.

Better Understanding of Overhead Costs

Overhead costs can be challenging to understand and allocate accurately. Cost allocation helps businesses to understand these costs better and allocate them to the proper departments or products. This allows companies to make informed decisions on pricing and production.

Improved Cost Reporting

Cost allocation helps businesses to produce more accurate cost reports. This allows companies to make informed pricing, production, and marketing strategies decisions. Cost reports are also essential for tax purposes and to meet regulatory requirements.

Better Negotiations

Cost allocation helps businesses to understand their costs better, which can be used in negotiations with suppliers and customers. Companies can better understand costs and negotiate better prices, terms, and conditions with suppliers and customers. This helps businesses to maintain better relationships and increase profitability.

Cons of Cost Allocation

Cost allocation can be an excellent tool for helping you understand where your money is going and how to save it, but this method has some drawbacks.

Time-Consuming Process

Cost allocation can be time-consuming and requires significant effort from various departments within the company. This can divert resources from other important tasks and may slow down other processes.

Increased Complexity

Cost allocation can be complex, especially for large organizations with multiple departments and products. This complexity can result in errors and misunderstandings, negatively impacting the accuracy of cost reports and other important financial information.

Implementing a cost allocation system can be expensive and require a significant investment in technology, software, and training. This cost can be a barrier for smaller organizations or those with limited resources.

Unreliable Data

Cost allocation is only as accurate as the data used in the process. Poor quality data, errors in data entry, and outdated data can all result in inaccurate cost reports and inefficient resource allocation.

Resistance to Change

Some employees may resist implementing a cost allocation system, especially if they feel the process may negatively impact their department or lead to job loss.

Limited Flexibility

Cost allocation systems are often rigid and lack the flexibility to adapt to changes in business conditions. This can result in inefficiencies and limit the ability of the company to respond to new opportunities or challenges.

Potential for Misallocation

If not implemented correctly, cost allocation can misallocate costs, negatively impacting decision-making and profitability.

Dependence on Cost Allocation

Overreliance on cost allocation can lead to a lack of creativity and initiative within departments. Employees may become too focused on cost allocation and need to be more focused on driving innovation and growth for the company. This can limit the ability of the company to adapt to changing market conditions.

Frequently Asked Questions- Cost Allocation in Accounting

What are the main objectives of cost allocation.

The main objectives of cost allocation are to accurately determine the cost of goods or services, improve resource allocation, increase profitability, create more accurate budgets, improve internal control, and provide better cost reporting.

What Is Direct Cost Allocation?

Direct cost allocation refers to assigning costs directly to specific products or services. This method is used when the costs can be easily traced to specific business areas.

What Is Step-Down Allocation?

Step-down allocation refers to allocating costs from one department to another department or product. This method is used when costs cannot be directly traced to specific products or services.

What Is Sequential Allocation?

Sequential allocation refers to allocating costs based on the sequence in which they are incurred. This method is used when costs cannot be directly traced to specific products or services.

What Is Activity-Based Costing?

Activity-based costing refers to allocating costs based on the activities involved in producing a product or offering a service. This method is used when multiple activities are involved in creating a product or service.

Why Is Cost Allocation Important for Businesses?

Cost allocation is essential for businesses as it helps them understand the costs associated with each business area and make informed pricing, production, and resource allocation decisions. This leads to improved profitability and better resource allocation.

How Does Cost Allocation Impact Resource Allocation?

Cost allocation helps companies determine the costs associated with each department, product, or service, which are used to allocate resources more efficiently. By allocating resources based on accurate cost

How Does Cost Allocation Impact Pricing Decisions?

Cost allocation helps companies understand the costs associated with each product or service used to make informed pricing decisions. By accurately determining the cost of goods or services, companies can ensure that their pricing is based on a solid understanding of the costs involved.

The Comprehensive Guide to Cost Allocation in Accounting – Conclusion

Allocation of costs is a critical component of any business. By allocating costs, you can ensure that your company makes the best use of its resources and operates efficiently.

The ability to allocate costs allows you to make strategic decisions about your business’s operations and management and take appropriate actions regarding financial reporting.

The Comprehensive Guide to Cost Allocation in Accounting – Recommended Reading

Corporate Accountant: What Are the Responsibilities, Duties, & Salary of a Corporate Accountant?

How Can Business Intelligence Help with Budget Planning (in 2023)

Standard Costing- Common Problems (And How to Solve Them)

Updated: 5/19/2023

Meet The Author

Danica De Vera

Related posts.

The Price of Happiness: Examining Trade-Offs Between Wealth and Well-Being

In today’s society, the pursuit of wealth often leads to trade-offs in well-being. True contentment encompasses mental, emotional, and physical health, purpose, and relationships. Wealth does not guarantee happiness and can impact mental health, relationships, and sustainable living. Balancing wealth with well-being results in a more fulfilling life.

How Can Diversity of Thought Lead to Good Ethical Decisions?

Diversity of thought, or cognitive diversity, encompasses varied perspectives and beliefs. Embracing this diversity leads to better ethical decision-making by broadening perspectives, enhancing critical thinking, mitigating groupthink, fostering cultural competence, strengthening stakeholder engagement, promoting ethical leadership, improving risk management, and fostering employee engagement.

The 26 Most Influential Leadership Quotes from Silicon Valley Icons

Silicon Valley, a hotbed of innovation and entrepreneurship, is driven by a unique culture of risk-taking, an abundant talent pool, access to capital, and a strong sense of community. The region’s success is propelled by visionary leadership, resilience, innovation, risk-taking, and customer-centric approaches.

Subscribe to discover my secrets to success. Get 3 valuable downloads, free exclusive tips, offers, and discounts that we only share with my email subscribers.

Social media.

Quick links

- Terms of Service

Other Pages

Contact indo.

- 302-981-1733

- [email protected]

© Accounting Professor 2023. All rights reserved

Discover more from accounting professor.org.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Resource Planning

Schedule right specialists to the right projects

Resource Management

Manage your employee’s skills, generate blind CV, see contract history and manage leaves

Project Portfolio Management

Deliver projects on time and at the estimated margin

Project Accounting

Plan, track and forecast budgets

Timesheets & Time Tracking

Track people’s work and compare it to your plans

Business Intelligence

Generate powerful reports & improve

Integrations

Integrate with your favourite apps

Learn more about Primetric

Stay updated

Data safety is #1 priority. See how we care about it.

Help Center

Find answers on the most common questions

Find out who is behind the Primetric

Check out our job openings

Cost Allocation Uncovered: Methods & Calculations

What was that invoice for and where does the other bill come from? Unfortunately for numerous service companies, these questions are posed way too often, resulting in tons of additional spendings appearing out of thin air. Fortunately, there is one way to prevent this situation from happening - it’s called cost allocation.

.JPG)

Arkadiusz Terpiłowski

Table of contents

Get proven tips on optimizing workload, project delivery, and finances - monthly.

Cost allocation - key takeaways

After reading this article, you should be able to:

- define cost allocation and factor that affect it,

- identify the cost objects that need to be taken into account in the process,

- use the cost allocation formula and cost allocation method to assign spendings to departments and projects with great accuracy.

Cost allocation - definition

Cost allocation is the process of matching the cost objects with the departments or operations that generate them. It is mostly used for calculating the financial performance of a company or its parts, such as teams or projects and determining where given costs objects came from.