Bitcoin.org is a community funded project, donations are appreciated and used to improve the website.

Donate to Bitcoin.org

Use this QR code or address below

- Individuals

- Getting started

- How it works

- White paper

- Documentation

- Bitcoin Core

- Buy Bitcoin

- Running a full node

- Development

- Bahasa Indonesia

- Português Brasil

- Slovenščina

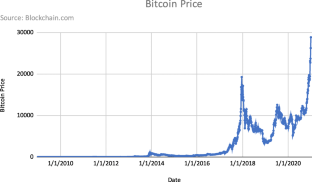

Empirical analysis of bitcoin price

- Published: 21 May 2021

- Volume 45 , pages 692–715, ( 2021 )

Cite this article

- Yuanyuan (Catherine) Chen ORCID: orcid.org/0000-0001-9462-4719 1

1170 Accesses

7 Citations

Explore all metrics

This paper, merging the stories of monetary theory, management analysis, computer science, and finance, comprehensively studies different forces that affect the bitcoin price. After conducting various stationarity tests and cointegration test, I choose the VEC model as the baseline to estimate the bitcoin price empirically. I also include competing methodologies, which have been used in previous studies, on my data set. These methodologies are VAR and ADRL models. With the daily data of 2009–2019, my baseline model shows that in the short run the bitcoin price is mainly affected by the medium of exchange and financial expectation forces, while blockchain technology factors only show a small impact on the bitcoin price. Moreover, using different econometric models yields different results in the short run. To investigate whether some conflicts among previous research can be explained by different specifications of the data, I also conduct two kinds of robustness checks. One is to estimate the same variables between bear and bull states. The states are found using Markov switching model. The other check is to focus on supply and demand forces, particularly during high volatility periods. Both checks find that in different states the effects can be different both in the size or in the significance. Lastly, I also find that effects are different between the short run and the long run.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Time-series forecasting of Bitcoin prices using high-dimensional features: a machine learning approach

The emergence of the global fintech market: economic and technological determinants

The Fama-French Five-Factor Model Plus Momentum: Evidence for the German Market

Athey S, Parashkevovz I, Sarukkaix V, Xia J (2016) Bitcoin pricing, adoption, and usage: theory and evidence. Working Paper, pp 1–70

Basher SA, Haug AA, Sadorsky P (2012) Oil prices, exchange rates and emerging stock markets. Energy Economics 34(1):227–240

Article Google Scholar

Bianchi D (2018) Cryptocurrencies as an asset class? An empirical assessment. In: Social science research network, June 6, pp 1–30

Bouoiyour J, Selmi R (2015) What does bitcoin look like?. Annals of Economics and Finance 16(2):449–492

Google Scholar

Bouoiyour J, Selmi R (2017) The Bitcoin price formation: beyond the fundamental sources (Technical Report). arXiv: 1707.01284 , July, pp 1–28

Chen Y (2019) Estimating bitcoin price: do methods matter? Working Paper, pp 1–23

Chiu J, Koeppl T (2017) The economics of cryptocurrencies - bitcoin and beyond. Queen’s Economics Department Working Paper No. 1389, pp 1–56

Ciaian P, Rajcaniova M, Kancs D (2016) The economics of BitCoin price formation. Applied Economics 48:1799–1815

Ciaian P, Kancs D, Rajcaniova M (2018) The price of BitCoin: GARCH evidence from high frequency data. EERI Research Paper Series, Dec, pp 1–18

Craig BR, Kachovec J (2019) Bitcoin’s decentralized decision structure. Economic Commentary-Federal Reserve Bank of Cleveland 12:1–5

Georgoula I, Pournarakis D, Bilanakos C, Sotiropoulos DN, Giaglis GM (2015) Using time-series and sentiment analysis to detect the determinants of bitcoin prices. Ninth Mediterranean conference on information systems paper, pp 1–12

Giudici P, Abu-Hashish I (2019) What determines bitcoin exchange prices? A network VAR approach. Finance Research Letters 29:309–318

Greaves A, Au B (2015) Using the bitcoin transaction graph to predict the price of bitcoin. Project Report, Stanford University

Gronwald M (2019) Is bitcoin a commodity? On price jumps, demand shocks, and certainty of supply. Journal of International Money and Finance 97:86–92

Hayes AS (2019) Bitcoin price and its marginal cost of production: support for a fundamental value. The Applied Economics Letters 26:554–560

Hale G, Krishnamurthy A, Kudlyak M, Shultz P (2018) How futures trading changed bitcoin prices. FRBSF Economic Letter 12:1–5

Kole E, van Dijk DJC (2016) How to Identify and forecast bull and bear markets? Journal of Applied Econometrics 32:120–139

Kristoufek L (2013) Bitcoin meets google trends and wikipedia: quantifying the relationship between phenomena of the internet era. Scientific Reports 3:3415

Kristoufek L (2015) What are the main drivers of the bitcoin price? Evidence from wavelet coherence analysis. In: Plos One, April

Kurbucz MT (2019) Predicting the price of Bitcoin by the most frequent edges of its transaction network. Economic Letters 184:1–4

Makarov I, Schoar A (2019) Price discovery in cryptocurrency markets. AEA Papers and Proceedings 109:97–99

Mai F, Shan Z, Bai Q, Wang XS, Chiang RHL (2015) From Bitcoin to big coin: the impacts of social media on bitcoin performance. Thirty Sixth International Conference Paper on Information Systems, pp 1–16

Mai F, Shan Z, Bai Q, Wang XS, Chiang RHL (2018) How does social media impact bitcoin value? A test of the silent majority hypothesis. Journal of Management Information Systems 35:19–52

Nakamoto S (2008) Bitcoin: a peer-to-peer electronic cash system. https://bitcoin.org/en/bitcoin-paper

Shrestha MB, Bhatta GR (2018) Selecting appropriate methodological framework for time series data analysis. The Journal of Finance and Data Science 4:72–89

Van Wijk D (2013) What can be expected from the Bitcoin? Working Paper, pp 1–20

Download references

Author information

Authors and affiliations.

Federal Reserve Bank of Cleveland, Cleveland, OH, USA

Yuanyuan (Catherine) Chen

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Yuanyuan (Catherine) Chen .

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Chen, Y.(. Empirical analysis of bitcoin price. J Econ Finan 45 , 692–715 (2021). https://doi.org/10.1007/s12197-021-09549-5

Download citation

Accepted : 02 April 2021

Published : 21 May 2021

Issue Date : October 2021

DOI : https://doi.org/10.1007/s12197-021-09549-5

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Bitcoin price

- Empirical methods

- Model comparison

JEL Classification

- Find a journal

- Publish with us

- Track your research

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- 04 April 2022

Crypto and digital currencies — nine research priorities

- Andrew Urquhart 0 &

- Brian Lucey 1

Andrew Urquhart is professor of finance and financial technology at ICMA Centre, University of Reading, Henley Business School, Reading, UK.

You can also search for this author in PubMed Google Scholar

Brian Lucey is professor of international finance and commodities at Trinity Business School, Trinity College, Dublin, Ireland; Institute of Business Research, University of Economics, Ho Chi Minh City, Vietnam; and Institute for Industrial Economics, Jiangxi University of Economics and Finance, Nanchang, China.

Money is at a crossroads. A race is on to decide who creates it, who can access it and how, who controls it, and to what degree and how it is regulated. The outcome could decide whether governments have access to all our financial data, whether criminals can easily launder vast sums unseen, and whether the benefits of finance can be extended to the billions of people globally who lack access to banks.

Access options

Access Nature and 54 other Nature Portfolio journals

Get Nature+, our best-value online-access subscription

24,99 € / 30 days

cancel any time

Subscribe to this journal

Receive 51 print issues and online access

185,98 € per year

only 3,65 € per issue

Rent or buy this article

Prices vary by article type

Prices may be subject to local taxes which are calculated during checkout

Nature 604 , 36-39 (2022)

doi: https://doi.org/10.1038/d41586-022-00927-5

Nakamoto, S. Decentralized Business Rev. 21260 (2008).

Corbet, S., Lucey, B., Urquhart, A. & Yarovaya, L. Int. Rev. Finan. Anal. 62 , 182–199 (2019).

Article Google Scholar

Teichmann, F. M. J. & Falker, M.-C. J. Money Laundering Control 24 , 775–788 (2020).

Foley, S., Karlsen, J. R. & Putnins, T. J. Rev. Finan. Stud. 32 , 1798–1853 (2019).

Shen, D., Urquhart, A. & Wang, P. Eur. Finan. Manage. 26 , 1294–1323 (2020).

Corbet, S., Lucey, B., Peat, M. & Vigne, S. Econ. Lett. 172 , 23–27 (2018).

Lucey, B. M., Vigne, S. A., Yarovaya, L. & Wang, Y. Finan. Res. Lett. 45 , 102147 (2022).

Easley, D., O’Hara, M. & Basu, S. J. Finan. Econ. 134 , 91–109 (2019).

Baur, D. G., Hong, K. & Lee, A. D. J. Int. Finan. Markets Inst. Money 54 , 177–189 (2018).

Agur, I., Ari, A. & Dell’Ariccia, G. J. Monet. Econ. 125 , 62–79 (2022).

Download references

Reprints and permissions

Competing Interests

The authors declare no competing interests.

Related Articles

- Information technology

- Mathematics and computing

Daniel Kahneman obituary: psychologist who revolutionized the way we think about thinking

Obituary 03 MAY 24

Scientists urged to collect royalties from the ‘magic money tree’

Career Feature 25 APR 24

CERN’s impact goes way beyond tiny particles

Spotlight 17 APR 24

Japan can embrace open science — but flexible approaches are key

Correspondence 07 MAY 24

Beware of graphene’s huge and hidden environmental costs

Countering extreme wildfires with prescribed burning can be counterproductive

The dream of electronic newspapers becomes a reality — in 1974

News & Views 07 MAY 24

How scientists are making the most of Reddit

Career Feature 01 APR 24

A global timekeeping problem postponed by global warming

Article 27 MAR 24

Clinician Researcher/Group Leader in Cancer Cell Therapies

An excellent opportunity is available for a Group Leader with expertise in cellular therapies to join the Cancer Research program at QIMR Berghofer.

Herston, Brisbane (AU)

QIMR Berghofer

Faculty Positions at the Center for Machine Learning Research (CMLR), Peking University

CMLR's goal is to advance machine learning-related research across a wide range of disciplines.

Beijing, China

Center for Machine Learning Research (CMLR), Peking University

Faculty Positions at SUSTech Department of Biomedical Engineering

We seek outstanding applicants for full-time tenure-track/tenured faculty positions. Positions are available for both junior and senior-level.

Shenzhen, Guangdong, China

Southern University of Science and Technology (Biomedical Engineering)

Southeast University Future Technology Institute Recruitment Notice

Professor openings in mechanical engineering, control science and engineering, and integrating emerging interdisciplinary majors

Nanjing, Jiangsu (CN)

Southeast University

Staff Scientist

A Staff Scientist position is available in the laboratory of Drs. Elliot and Glassberg to study translational aspects of lung injury, repair and fibro

Maywood, Illinois

Loyola University Chicago - Department of Medicine

Sign up for the Nature Briefing newsletter — what matters in science, free to your inbox daily.

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Blockchain Analysis of the Bitcoin Market

In this paper, we provide detailed analyses of the Bitcoin network and its main participants. We build a novel database using a large number of public and proprietary sources to link Bitcoin addresses to real entities and develop an extensive suite of algorithms to extract information about the behavior of the main market participants. We conduct three major pieces of analysis of the Bitcoin eco-system. First, we analyze the transaction volume and network structure of the main participants on the blockchain. Second, we document the concentration and regional composition of the miners which are the backbone of the verification protocol and ensure the integrity of the blockchain ledger. Finally, we analyze the ownership concentration of the largest holders of Bitcoin.

We thank Jiageng Liu for excellent research assistance. We also thank Kyrylo Chykhradze for very helpful comments and help with the Crystal Blockchain data. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.

MARC RIS BibTeΧ

Download Citation Data

Conferences

Mentioned in the news, more from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

- Japanese (日本)

Our new research: Enhancing blockchain analytics through AI

Elliptic Research

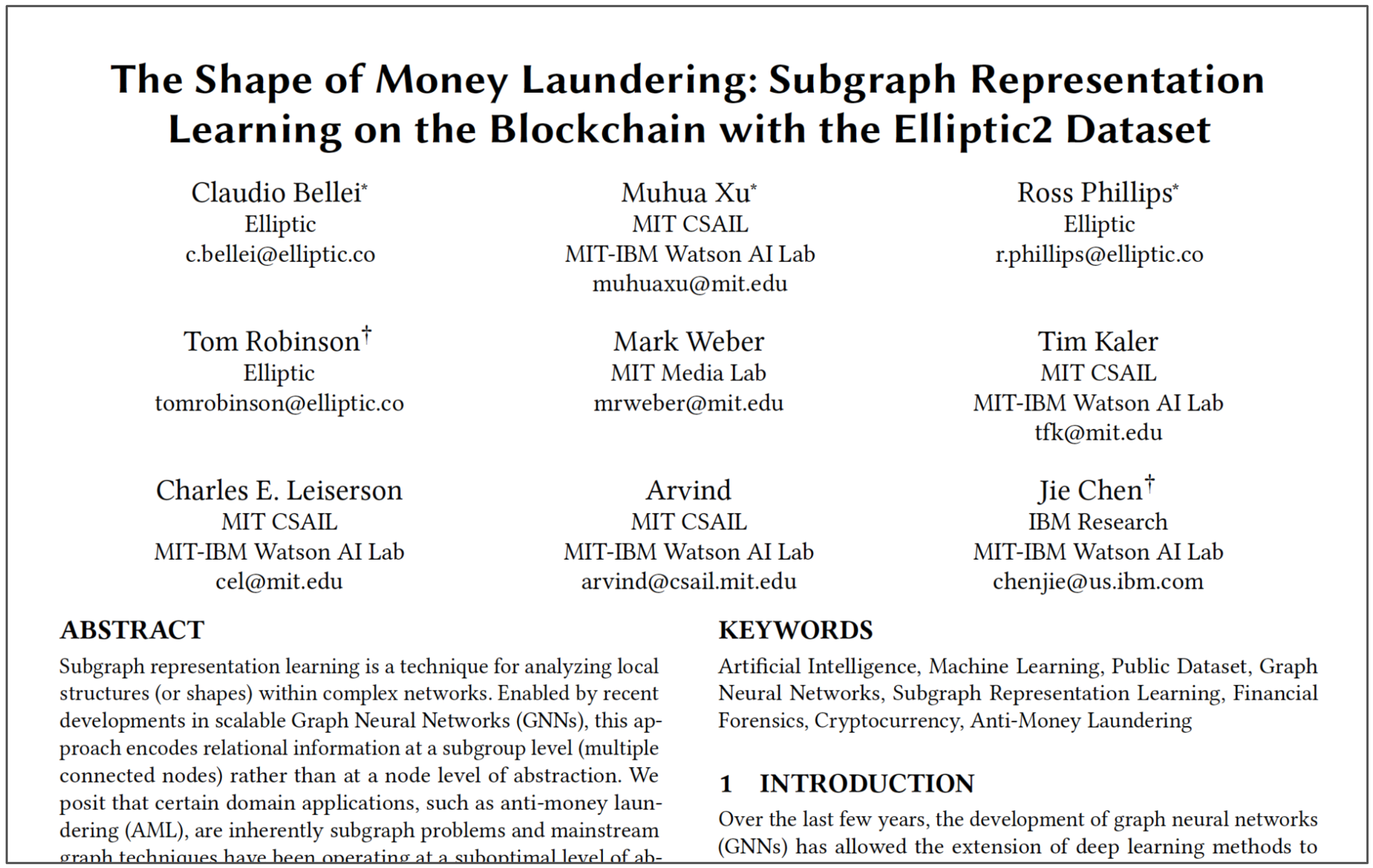

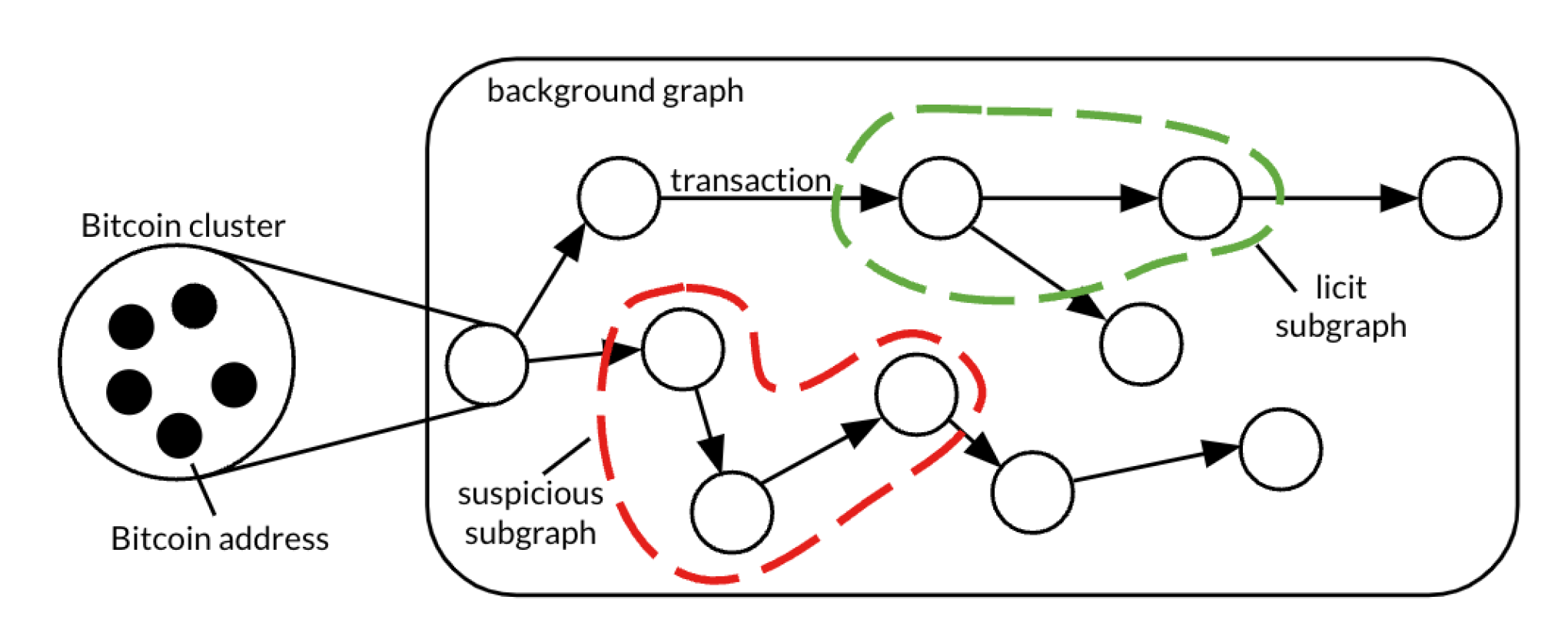

- Elliptic researchers have made advances in the use of AI to detect money laundering in Bitcoin. A new paper describing this work is co-authored with researchers from the MIT-IBM Watson AI Lab.

- A deep learning model is used to successfully identify proceeds of crime deposited at a crypto exchange, new money laundering transaction patterns and previously-unknown illicit wallets. These outputs are already being used to enhance Elliptic’s products.

- Elliptic has also made the underlying data publicly available . Containing over 200 million transactions, it will enable the wider community to develop new AI techniques for the detection of illicit cryptocurrency activity.

At Elliptic we have always pushed the boundaries of blockchain analytics, to enable our customers to more accurately and efficiently assess risk in cryptoassets. Part of this innovation has been exploring how artificial intelligence can be leveraged to improve the detection of money laundering and other financial crime on blockchains.

Blockchains provide fertile ground for machine learning techniques, thanks to the availability of both transaction data and information on the types of entities that are transacting, collected by us and others. This is in contrast to traditional finance where transaction data is typically siloed, making it challenging to apply these techniques.

Machine learning on the blockchain

We first published research on this topic in 2019, co-authored with researchers from the MIT-IBM Watson AI Lab. A machine learning model was trained to identify Bitcoin transactions made by illicit actors, such as ransomware groups or darknet marketplaces. The training data, compiled by Elliptic and containing over 200,000 bitcoin transactions, was made publicly available to encourage further experimentation and collaboration within this emerging field. That paper has now been cited nearly 400 times by researchers around the world, which demonstrates the impact it has had and continues to have in the fields of machine learning and anti-money laundering.

We have now released further research , applying new techniques to a much larger dataset, containing nearly 200 million transactions. This work is again co-authored by researchers from the MIT-IBM Watson AI Lab. Rather than identifying transactions made by illicit actors, a machine learning model is trained to identify “subgraphs”, chains of transactions that represent bitcoin being laundered. By identifying these subgraphs rather than illicit wallets, this approach allows us to focus on the “multi-hop” laundering process more generally rather than the on-chain behavior of specific illicit actors.

Testing our results

We worked with a cryptocurrency exchange to test whether this technique could be used to identify money laundering attempts through that business. Of 52 “money laundering” subgraphs predicted by the model and which ended with deposits to this exchange, the exchange confirmed that 14 had been received by users who had already been flagged as being linked to money laundering. On average less than one in 10,000 of these accounts are flagged as such, suggesting that the model performs very well * . Importantly, the exchange’s insights were based on off-chain information, suggesting that the model can identify money laundering that would not be identifiable using traditional blockchain analytical techniques alone.

We also investigated the types of money laundering patterns that the trained model was identifying. This revealed known money laundering patterns such as “peeling chains”, which can already be automatically detected in Elliptic’s transaction and wallet screening tools. However it also identified novel patterns such as the use of intermediary “nested services” in specific ways. Knowledge of these money laundering behaviors is of value to AML practitioners, and can be added to the suite of behaviours that can be detected with Elliptic’s tools.

.png?width=2500&height=1307&name=AI_Blog_image1_1200_627%20(1).png)

The machine learning model can also be used to help identify previously-unknown illicit wallets. When the model predicts that a given subgraph is an instance of money laundering, it implies that the funds have potentially originated from some type of illicit activity. Directed research can then be performed on these wallets to try to identify them. This approach has already enabled us to identify a number of previously unknown wallets used by illicit actors including ponzi schemes and darknet markets.

Sharing our data with the community

As well as releasing our research, we have also made the underlying data publicly available . The largest public dataset of its kind, “Elliptic2” will enable the development of new techniques for the detection of illicit cryptocurrency transactions by the wider community. It will also aid the development of the underlying graph neural network methods, used in applications including drug discovery, physics and computer vision.

This novel work demonstrates that AI methods can be applied to blockchain data to identify illicit wallets and money laundering patterns, which were previously hidden from view. This is made possible by the inherent transparency of blockchains and demonstrates that cryptoassets, far from being a haven for criminals, are far more amenable to AI-based financial crime detection than traditional financial assets. We have barely scratched the surface of what is possible in this domain, but this work has already led to benefits for Elliptic’s users. Further collaboration and data-sharing will be key to advancing these techniques further and combating financial crime in cryptoassets.

You can read the research paper in full here , and the Elliptic2 dataset is now available to access. To discuss the research, and find out more about how we are applying these new techniques to enhance our products, get in touch .

Featured Articles

Found this interesting? Share to your network.

The latest deep-dives and data-driven analysis from our Research team covering their own investigations, as-its-happening monitoring of hacks and thefts, and more.

This blog is provided for general informational purposes only. By using the blog, you agree that the information on this blog does not constitute legal, financial or any other form of professional advice. No relationship is created with you, nor any duty of care assumed to you, when you use this blog. The blog is not a substitute for obtaining any legal, financial or any other form of professional advice from a suitably qualified and licensed advisor. The information on this blog may be changed without notice and is not guaranteed to be complete, accurate, correct or up-to-date.

Get the latest insights in your inbox

Why Bitcoin Might Drop Another 20%: 10x Research

C rypto research firm 10x Research on Wednesday underscored its prediction that the ongoing Bitcoin (CRYPTO: BTC) correction may take prices into the low $50,000s.

What Happened : In their latest email newsletter , the team around lead analyst Markus Thielen highlight the differing risk management approaches between institutional investors and retail traders.

Their research suggests the average entry price for U.S. Bitcoin ETF holders sits around $57,300, potentially even higher, a level Bitcoin prices are rapidly approaching.

Despite the predicted correction, 10x Research maintains a positive long-term outlook.

Bitcoin’s recent one-year high validates their early 2023 prediction of a new bull market, further reinforced by its proximity to their forecasted halving price of $63,160.

Trending: Trump Says If Supreme Court Decides President Doesn't Get Immunity Then Biden 'Will Be Prosecuted For All

Must Read: Home Prices Outpace 1990s, 2010s In Just 4 Years: Is It Sustainable?

Additionally, their 2023 year-end target of $45,000 was nearly achieved, and their post-ETF approval target of $57,000, later revised to $70,000, underscores their continuous analysis and adaptation.

Their ability to accurately predict market movements stems from a deep understanding of historical trends and the driving forces within the crypto industry.

As 10x Research points out in their previous reports, analyzing these factors has been instrumental in their successful predictions throughout the current bull market.

Also Read: Don’t Get Left Behind: Web3 Wallets Offer More Than You Think In Today’s Market

Why It Matters : Looking back, the August 2023 correction was attributed to rising 10-year Treasury bond yields and a hawkish Fed stance, mirroring the situation during the August 2015 RMB devaluation.

While the initial impact was a sharp decline, Bitcoin ultimately recovered significantly by year-end.

Similar foresight was applied in January 2024, where 10x Research anticipated a correction to $36,000/$38,000, citing the historical tendency for corrections following major Bitcoin product approvals.

They recommended hedging long exposure but turned bullish again as Bitcoin rebounded, reiterating their $70,000 target.

March 2024 saw another crucial turning point.

Recognizing the potential for a +/-10% move, 10x Research established a line in the sand at $68,300, indicating a potential significant top if breached.

This aligns with their current prediction of a correction towards $52,000/$55,000 within the ongoing bull market.

Several factors contribute to this anticipated correction.

The research highlights a shift in ETF buying behavior, with six consecutive days of outflows observed.

What’s Next : As the average entry price of $57,300 is approached, further ETF unwinding is expected, potentially pushing prices down.

Additionally, the estimated all-in mining cost of $53,000/$55,000 for Bitcoin miners could trigger selling to protect operations.

While a 25% to 29% correction is anticipated, 10x Research acknowledges the possibility of a consolidation period instead of a sharp snapback rally.

As industry leaders gather at events like Benzinga’s Future of Digital Assets on Nov. 19th, insights from 10x Research and other experts will be invaluable in navigating the complexities of the current bull market and preparing for potential corrections within the broader landscape.

Read Next: Ex-Binance CEO Changpeng Zhao Sees Crypto Industry Entering ‘New Phase’

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This article Why Bitcoin Might Drop Another 20%: 10x Research originally appeared on Benzinga.com .

- Web3 Community beta

- Crypto Prices

More From Forbes

‘beyond’ $20 trillion by 2030—jack dorsey’s plan to turbocharge the bitcoin price.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Bitcoin Bitcoin has stormed into 2024, topping its previous all-time high and now braced for a predicted "enormous" China earthquake .

Subscribe now to Forbes' CryptoAsset & Blockchain Advisor and "uncover blockchain blockbusters poised for 1,000% plus gains" in the aftermath of bitcoin's halving earthquake!

The bitcoin price has more than doubled since this time last year, powered by a wave of institutional adoption that could be just getting started .

Now, as former U.S. president Donald Trump and the U.S. Federal Reserve could be about to trigger a $4 trillion bitcoin price boom , Twitter founder and Block chief executive Jack Dorsey has said he expects the bitcoin price to rocket to $1 million by 2030—which would give bitcoin a market capitalization of $20 trillion—partly driven by Block's bitcoin work.

Sign up now for the free CryptoCodex — A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

Netflix: Marvel Dud Among Movies New On Streaming Service This Week

Houston rockets land third pack in upcoming nba draft, northern lights might be visible again tonight here s the updated aurora forecast.

Twitter founder and Block chief executive Jack Dorsey has said he expects bitcoin to become the ... [+] native cryptocurrency of the internet—and issued a huge bitcoin price prediction.

"At least a $1 million," Dorsey said in an interview with Mike Solana Solana , the founder of media company Pirate Wires when asked what he expects the bitcoin price will be in by 2030. "I do think it hits that number and goes beyond."

Dorsey said he believed the bitcoin price will grow rapidly due to people and companies working to grow use of bitcoin and improving the "ecosystem."

"The most amazing thing about bitcoin, apart from the founding story, is anyone who works on it, or gets paid in it, or buys it for themselves—everyone who puts any effort in to make it better—is making the entire ecosystem better, which makes the price go up," Dorsey said. "It's a fascinating ecosystem and movement, more than anything else. It taught me a lot."

Dorsey's huge bitcoin price prediction echos similar bitcoin price bets by Ark chief executive Cathie Wood—who in January said bitcoin could hit $1.5 million by 2030—and Balaji Srinivasan, the former chief technology officer at crypto exchange Coinbase and former partner at venture capital company Andreessen Horowitz, who last year made headlines with a bet bitcoin would hit $1 million.

Sign up now for CryptoCodex —A free, daily newsletter for the crypto-curious

The bitcoin price has bounced back this year, erasing the losses from its 2022 crash.

Earlier this month, Dorsey revealed his payments-focused bitcoin company Block will put 10% of its gross profit made off its bitcoin products into buying bitcoin every month.

"Our investment in bitcoin transcends technology; it is an investment in a future where economic empowerment is the norm," Dorsey wrote in a shareholder letter alongside the company's better-than-expected first-quarter results.

Block has recently launched a bitcoin hardware wallet and earlier this year announced it is building a "full bitcoin mining system."

"The internet will have a native currency; it’s just a matter of time," Dorsey wrote. "This won’t happen overnight. The existing and emerging financial systems will operate in parallel for some time."

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

IMAGES

VIDEO

COMMENTS

Abstract. Cryptocurrency, an encrypted, peer- to -peer network for facil itating digital barter, is a technology. developed eight years ago. Bitcoin, the first and most popular cryptocurrency, is ...

Read the original paper that introduced Bitcoin by Satoshi Nakamoto. Choose from different translations of the paper in various languages.

The three Bitcoin research stages are conceptualisation and fundamentals of Bitcoin (2012-2016), cryptocurrency and market efficiency (2017-2018), and technical analysis, big data, data privacy, and the connection between Bitcoin and financial markets (2019-2022). ... The Bitcoin white paper, i.e. Bitcoin: A peer-to-peer electronic cash ...

the Bitcoin network and its participants is required for any decision about how and whether to integrate Bitcoin into the traditional nancial system. In this paper, we aim to shed light on these open questions by developing a novel database that allows us to document the evolution of the Bitcoin market and its dif-ferent participants over time.

Bitcoin is designed as a peer-to-peer cash system. To work as a currency, it must be stable or be backed by a government. In this paper, we show that the volatility of Bitcoin prices is extreme and almost 10 times higher than the volatility of major exchange rates (US dollar against the euro and the yen). The excess volatility even adversely affects its potential role in portfolios. Our ...

This research paper provides a comprehensive analysis of Bitcoin, delving into its evolution, adoption, and potential future implications. As the pioneering cryptocurrency, Bitcoin has sparked significant interest and debate in recent years, challenging traditional financial systems and introducing the world to the power of blockchain technology. This paper aims to offer a thorough ...

This research paper provides a comprehensive analysis of Bitcoin, delving into its evolution, adoption, and potential future impli-cations. As the pioneering cryptocurrency, Bitcoin has sparked ... Finally, the paper addresses the future of Bitcoin and cryptocur-rencies, identifying emerging trends, technological innovations,

This paper systematized the growing research on Bitcoin published. It has segmented the publications on the basis of various elements of economics and finance such as price, demand and supply, market efficiency, volatility and returns, and investment prospects and regulatory aspects. It also highlights the impact of social media on these factors.

Bitcoin, as the first decentralized cryptocurrency, pioneers the cryptocurrency markets, both in terms of market capitalization and scientific interest. In this paper, we performed a comprehensive bibliometric study of the Bitcoin-related literature. Using the Scopus database, we created a sample that comprises 4495 documents written in the 2011-2020 period. Furthermore, we provided insights ...

This paper provides a comprehensive review of blockchain technology focusing on the historical background, underlying principles, and the sudden rise in the popularity of blockchain technology. ... It was in 2008 when blockchain made its public debut with a paper titled "Bitcoin: ... The National Research Council of Canada is using an ...

Related to the previous paper in this special, Kalyvas et al. (Citation 2023) studyied the mediating effect of behavioural factors on the relationship between Bitcoin returns and industry indices. This paper studies four industry indices which may have a relationship with Bitcoin, namely technology, energy, clean energy and banking indices.

agreement, portending Bitcoin's scripting capabilities. In 2008, Bitcoin was announced and a white paper penned under the pseudonym Satoshi Nakamoto was posted to the Cypherpunks mailing list [90], followed quickly by the source code of the original reference client. Bitcoin's genesis block was mined on or around January 3, 2009.2 The first

1. Introduction. Bitcoin, invented in 2008 to solve the inherent weakness of the trust-based model of transactions and initially defined as a purely peer-to-peer electronic cash system [1], has become an asset or commodity-like product traded in more than 16,000 markets around the world. 1 Although proponents hold that one of Bitcoin's important application is to take the place of fiat ...

This paper, merging the stories of monetary theory, management analysis, computer science, and finance, comprehensively studies different forces that affect the bitcoin price. After conducting various stationarity tests and cointegration test, I choose the VEC model as the baseline to estimate the bitcoin price empirically. I also include competing methodologies, which have been used in ...

Nine priorities. Although there's been much progress 2, research is urgently needed on four fronts: legality, scalability, usability and acceptability. These are interconnected; solutions in one ...

The research purpose of this paper is to obtain an algorithm model with high prediction accuracy for the price of Bitcoin on the next day through random forest regression and LSTM, and to explain which variables have influence on the price of Bitcoin. There is much prior literature on Bitcoin price prediction research, and the research methods mainly revolve around the ARMA model of time ...

Eric Budish analyzes the economic challenges of Bitcoin and other decentralized blockchains, such as security, scalability, and sustainability. He argues that Bitcoin faces a trade-off between being attacked and being valuable, and that the blockchain technology has intrinsic constraints.

In this paper, we provide detailed analyses of the Bitcoin network and its main participants. We build a novel database using a large number of public and proprietary sources to link Bitcoin addresses to real entities and develop an extensive suite of algorithms to extract information about the behavior of the main market participants.

Abstract. A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without the burdens of going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending.

This paper systematized the growing research on Bitcoin published. It has segmented the publications on the basis of various elements of economics and finance such as price, demand and supply, market efficiency, volatility and returns, and investment prospects and regulatory aspects. It also highlights the impact of social media on these factors.

By providing a flexible framework for evaluating various scenarios, this research contributes to the broader discourse on sustainable energy and the Bitcoin network, proposing a novel, market-driven strategy to help mitigate methane emissions and improve environmental sustainability.

Elliptic Research. 01 May, 2024. Elliptic researchers have made advances in the use of AI to detect money laundering in Bitcoin. A new paper describing this work is co-authored with researchers from the MIT-IBM Watson AI Lab. A deep learning model is used to successfully identify proceeds of crime deposited at a crypto exchange, new money ...

March 2024 saw another crucial turning point. Recognizing the potential for a +/-10% move, 10x Research established a line in the sand at $68,300, indicating a potential significant top if ...

Getty Images. "At least a $1 million," Dorsey said in an interview with Mike Solana Solana -1%, the founder of media company Pirate Wires when asked what he expects the bitcoin price will be in by ...

A recent research paper from the National Bank of Rwanda recommends a two-tier, universal, zero-interest central bank digital currency (CBDC) with partial pseudo-anonymity. Although the research ...