12 Fun Budgeting Activities PDFs for Students (Kids & Teens)

By: Author Amanda L. Grossman

Posted on Last updated: May 8, 2024

Looking for fun budgeting activities PDFs? You'll love this collection of budgeting scenarios for high school students, and money management worksheets for students (PDFs).

Teaching students how to budget doesn't have to be a drag, especially if you do it through fun budgeting activities.

But, have you noticed how difficult it is to find GOOD, fun budgeting activities with PDFs?

After spending a few hours scouring the internet, searching for the best FREE options out there, I've now become aware of the problem.

Still, there are some good options you should know about (plus, I'm releasing my own – for free!).

Fun budgeting activities (with PDFs) and money management worksheets for students are two of the best ways to teach your kids and teens about money.

Article Content

Budgeting Scenarios for High School Students (PDFs to Print)

I'd like to start this list off with my own budgeting scenarios I created for high school students (parents, you can use these, too!).

This budgeting worksheet for students (pdf) was originally part of my Money Prodigy Online Summer Camp, but I'm carving it out for you to use, for free.

Here's how this works:

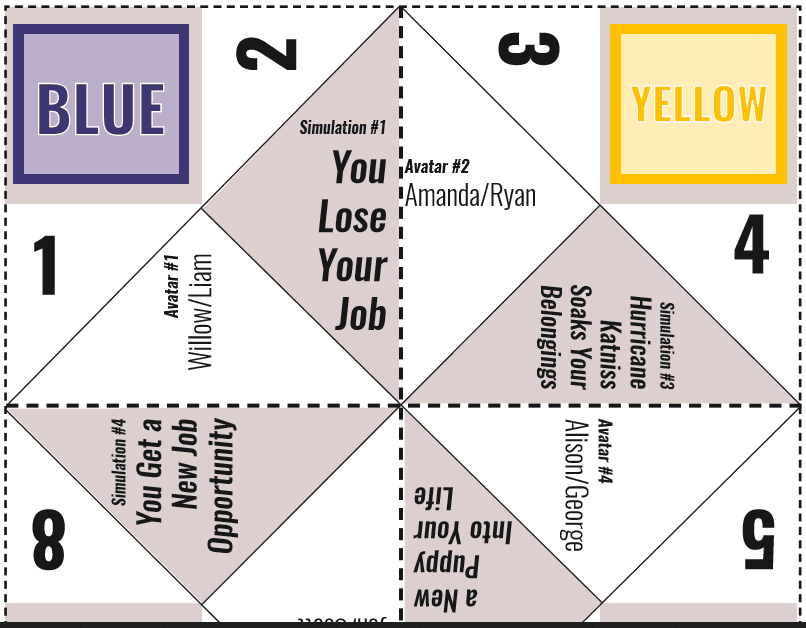

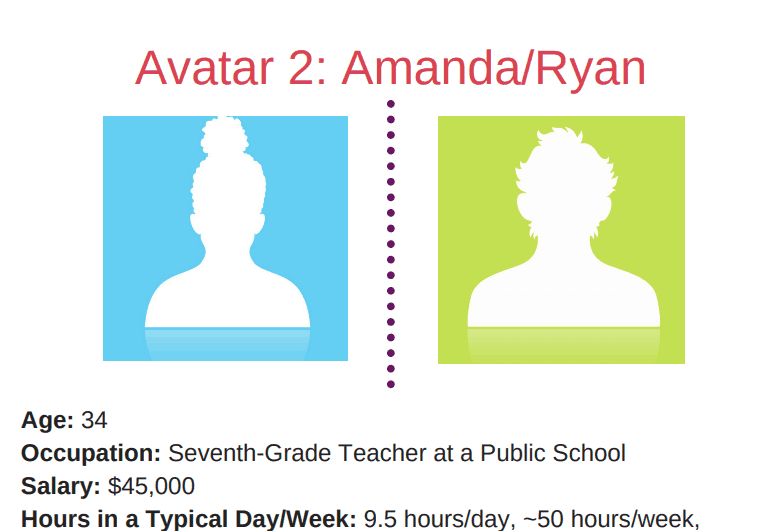

Your child uses a fortune teller (free printable) to determine which one of 4 Avatars they are. The avatars have both a female and a male name, but the information is the same — so it doesn't matter if a boy or a girl gets that avatar.

They read up on their salary information, budgeting information, and general financial information. Each avatar is at a different stage in their career, and in a different stage of life (so lots of possibilities to play several rounds of this).

They fill in a budgeting sheet based on the information they've been given.

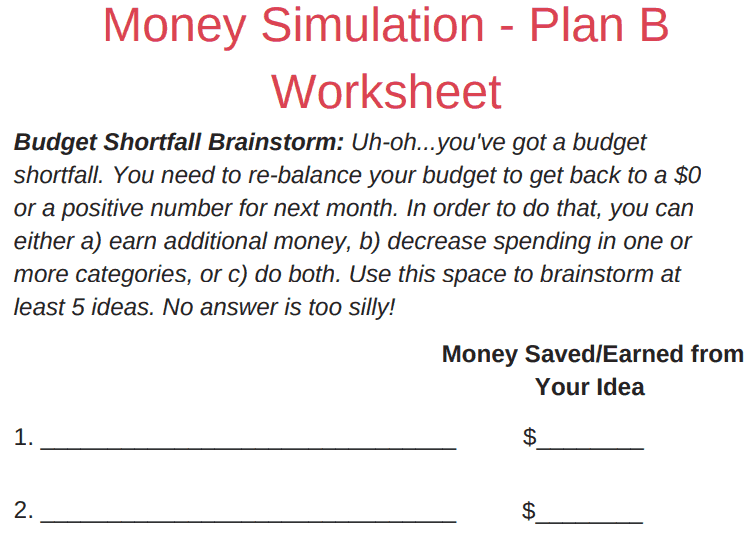

Then, the simulation really begins. They take a turn with the fortune teller again, who spits out a a real-life scenario. Once they figure out what their new situation is, they need to deal with it within their current budget constraints.

Your students then fill in follow-up questions and information about how things went for them.

Other resources for you:

- How to Teach Budgeting (from Beginner to Advanced Levels)

- 6 Budgeting Projects for Middle School Students

- 4 Budget Projects for High School Students

- 11 Teenage Budgeting Tips

- How a Teenager Can Improve their Budget

- Prom Budget Planner

Alright…let's move on to many more fun budgeting activities with PDFs and financial scenarios for students.

Fun Budgeting Activities (with PDFs)

Fun budgeting activities (PDFs you can print) will not only begin teaching your students and kids how to budget for specific events OR for life, in general, but it will make the process entertaining.

Heck, your kids might beg for more money activities after you introduce a few of these fun budgeting activities below.

Psst: you might want to check out my comprehensive article on budgeting for kids , and the best teen budget worksheets .

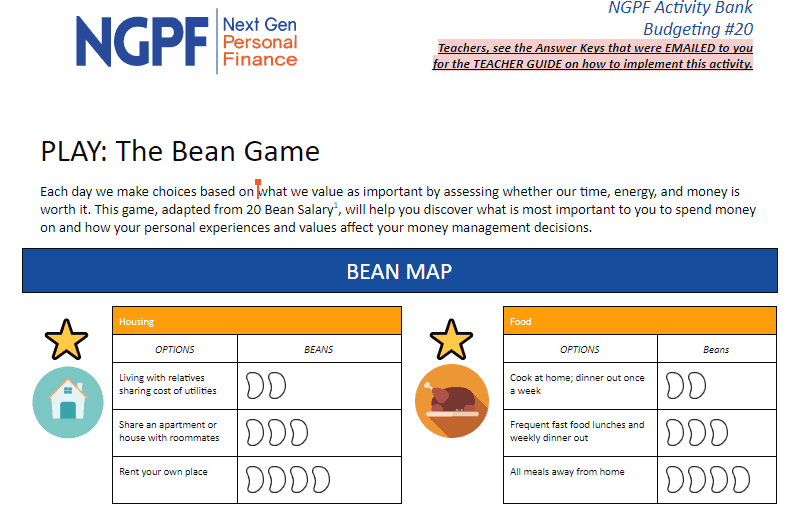

1. Next Gen Personal Finance’s Bean Game

Suggested Age Range: Not given.

I just love this – every student receives 20 beans, as well as a game board that shows a cost (in beans) for different spending and saving categories. Students must decide how to spend their 20 beans across all categories.

What might trip your students up? There are starred categories that are “musts”, so your student has to spend some beans on those.

Midway through, if you want to really shake things up, the creators of this game suggest telling your students that they’ve been demoted or downsized at work and now only have 13 beans – they must remove 7 beans from their boards.

This is an individual activity, but can easily be used in groups of 2 as well.

2. ConsumerFinance.gov’s Bouncing Ball Budgets

Suggested Age Range: 13-19 years

What I like about this spending activity is it has a physical component. Meaning, that kids get into a group and throw a ball at one another. The number that is closest to their right index finger (the ball has numbers on it) corresponds to a question about spending habits.

The student then has 30 seconds to answer the question, which will help them analyze their own spending habits.

Example questions include:

- Give an example of a big expense you’ve had to save money for.

- Give an example of why you might call yourself a saver or a spender.

- What do you find hard to resist spending money on?

3. Design Mom's Teen Budgeting Game

Suggested Age Range: For teenagers.

In just an hour of play, your students and teens can go through 12 months on a budget. New challenges are thrown their way for each month, such as being fined for a traffic ticket or earning an extra $5 in interest on savings.

Teens are given $300 each (remember, this is a game, not the real world!), and must satisfy 9 different budgeting categories ranging from rent to movies.

Free printables include:

- Budget Worksheet

- Banker’s Instructions

- Explanation of “Budget Options”

The goal of the game, or how to win? Is to end the game with $450 in savings PLUS a “Well Being” Factor of 96 or higher.

Psst: Here's more budget games for kids and teens to check out. Also, here's 19 free financial literacy games for high school students .

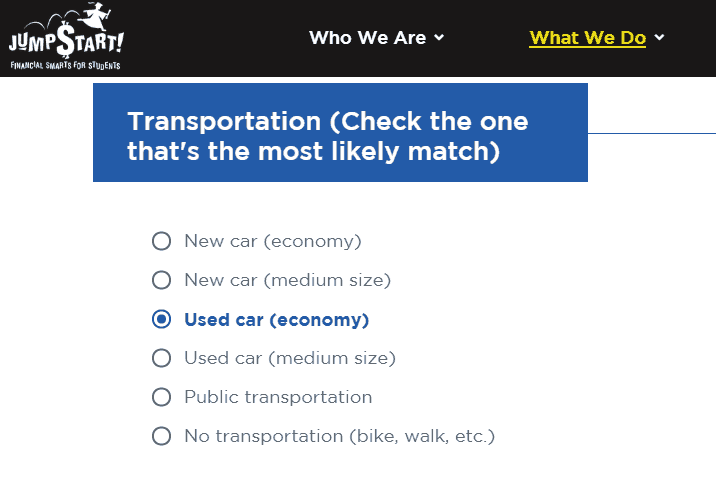

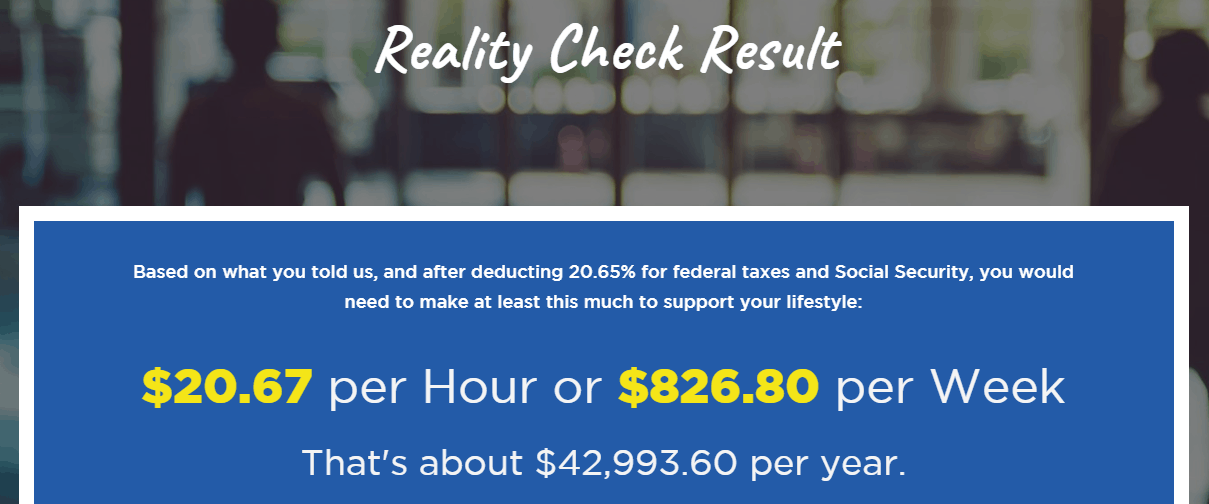

4. Jump$tart’s Reality Check Activity

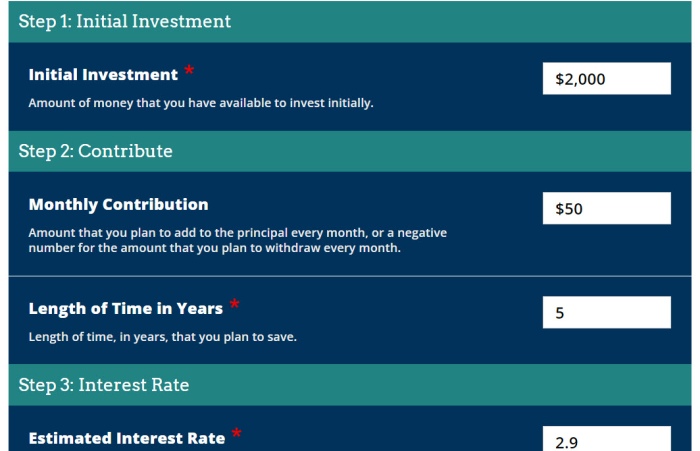

A fun activity to kick off money lessons or a money unit would be to have your students go through this Reality Check calculator.

They get to answer various questions (there are only 10) about the type of lifestyle they want to live, and then fill out estimated amounts they think they’ll spend each month for specific budget categories.

Then the “reality” kicks in when they see what kind of income they’ll have to maintain in order to live that lifestyle.

Suggestion: perhaps you can set this reality check game up on computers as a transition activity for students, OR, as one of your various money centers for the day.

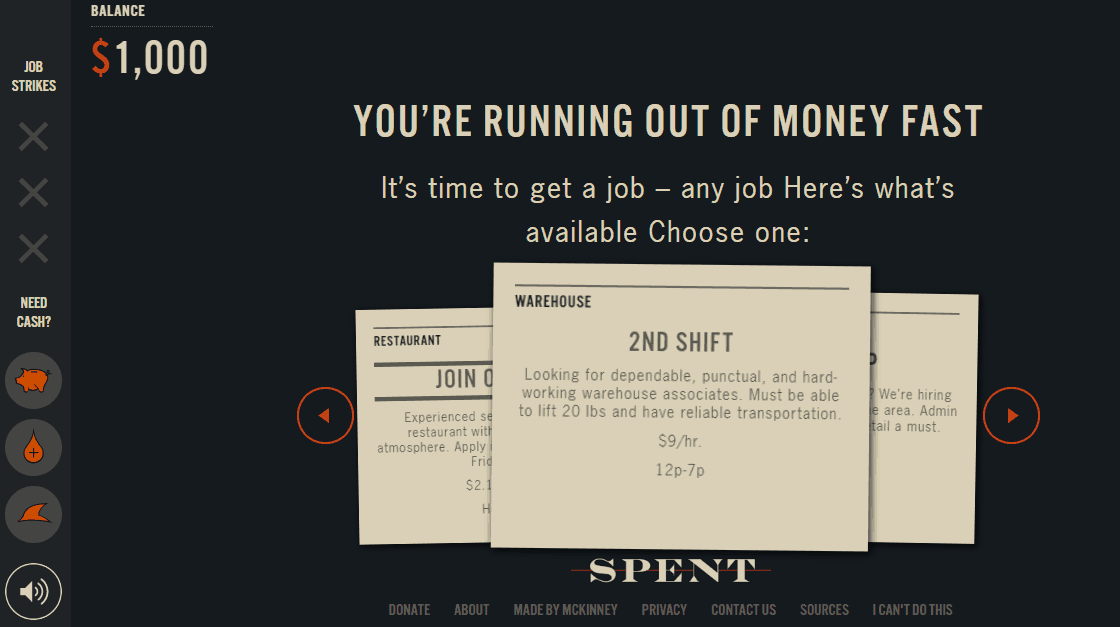

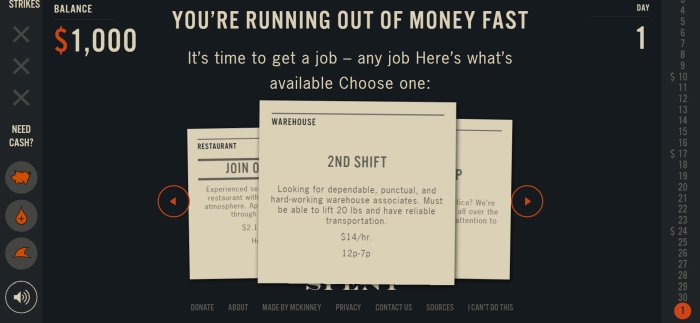

5. McKinney’s PlaySpent.org

Here’s an interesting budgeting game for students to play, that will also increase their awareness of how hard it can be to survive without a job.

They are given the scenario that they are down to their last $1,000 since losing their job. The object of this game is to use that $1,000 as wisely as possible so that they can live with it for over one month.

6. FinanceintheClassroom.org’s Investigation of Regional Housing Costs

Suggested Age Range: Grades 10-12

What I love about this budgeting scenario is that they actually created it – I’ve been talking about how important it is to research the cost of living before moving or accepting a job offer somewhere for years.

Mostly because I’ve had personal experience from it! In my mid-20s, I took a job in Palm Beach Gardens, Florida. While I learned a lot at the job (I was eventually laid off from it), the fact is, I didn’t save any money (outside of retirement) during those almost two years because the cost of living was just too high.

With this budgeting scenario, students are asked to look at the finances and situation of Trish and Scott who want to move from Annapolis, MD to somewhere else for a job offer.

Students then must analyze the housing costs for one of their new job offers and see if they can or cannot afford to accept the job and move there.

Such a valuable financial lesson to learn young (especially since because young adults are least able to afford high-cost-of-living areas).

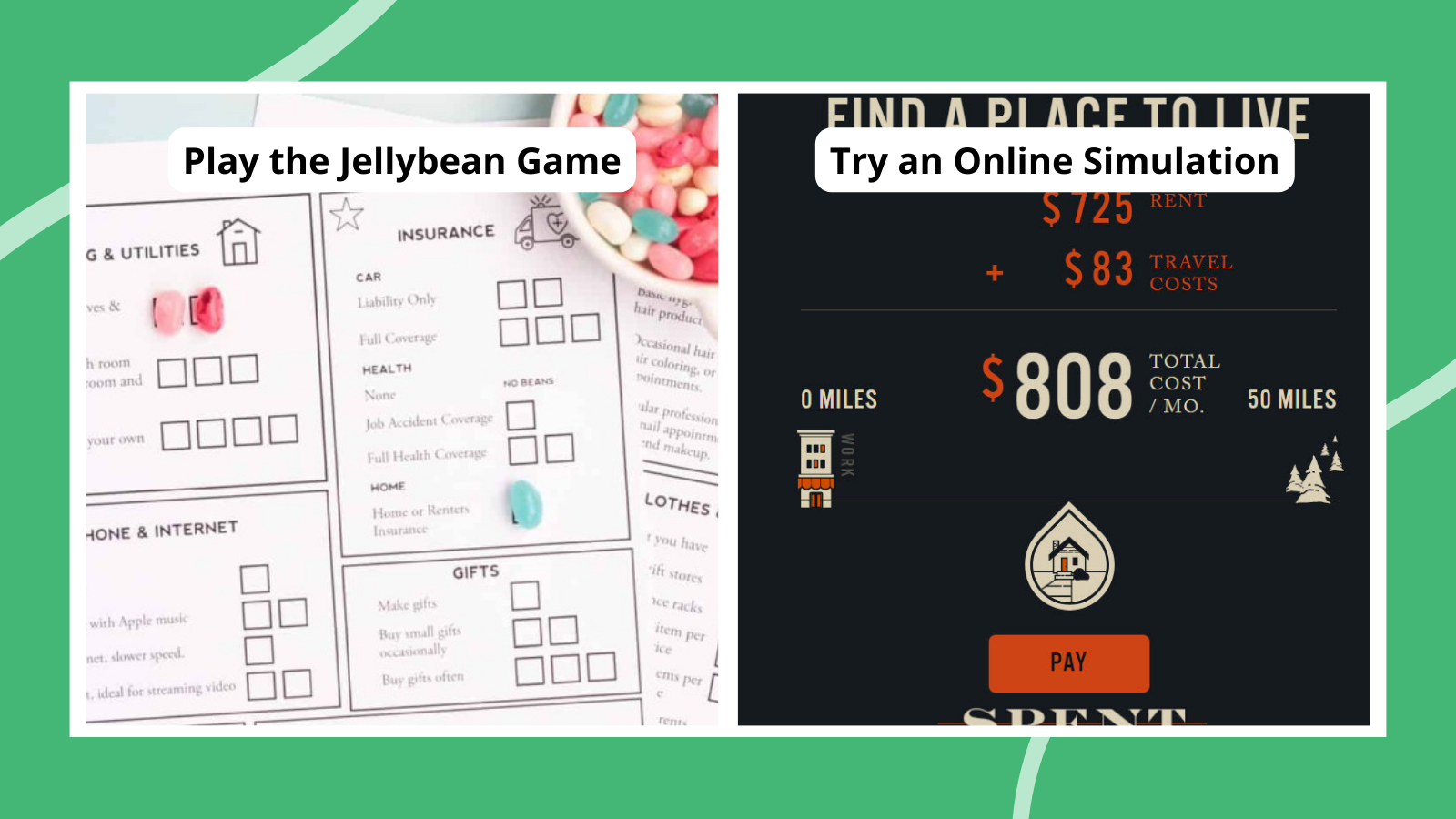

7. Sarah and Jessica's Jelly Bean Game

Group students together in sizes of 2-4, and hand them 20 jelly beans in total (tell them not to eat them!). The group then collectively decides how they'd like to spend those 20 jelly beans, based on money values, spending needs vs. wants , etc.

For each round they go through, they'll deal with different scenarios, such as someone's leg breaking (did they choose to spend on insurance?), or getting a raise at work.

Now, let's move on to money management worksheets.

8. Budgeting a Trip in a Rural Setting Vs. City Setting

ConsumerFinance.gov has these two lesson plans that are exactly the same…except where the students plan a trip to: rural or a city location.

I say, why not take this a step further and show your students one aspect of cost-of-living by having them budget out BOTH a trip to a rural setting AND a trip to a city setting ?

Then, they can compare the costs of each and discuss why one is (most likely) costlier than the other.

Money Management Worksheets for Students (with PDFs)

I love that you're looking for money management worksheets for your students – it means you care about their money future!

After hours of research, I've curated a list of free printable money management worksheets (available in PDF format, so you can easily print them out), that, in my opinion, are the best available.

1. Practical Money Skill’s The Art of Budgeting

Suggested Age Range: 14-18 years

What I specifically like about this lesson is the “Rework a Budget” section, found on Page 11.

Students are given the chance to budget for a girl named Gabrielle. And then, they’re asked to rework the budget once her month actually played out – which is such a great lesson because, let’s face it, planned budgets and planned spending is often not what happens in real life.

Yet, you want to teach students to learn early on that just because your planned spending and your actual spending aren’t the same, doesn’t mean you should give up on budgeting.

Instead, rework it! They’ll get better and better with doing that, the more they budget.

2. Second Harvest Food Bank’s Shopping on a Budget Activity

I don’t know that I would call this budgeting activity fun , but eye-opening For sure.

This budgeting activity for students attempts to bring awareness to how difficult it can be to feed your family nutritious food on a low budget.

3. ConsumerFinance.gov’s Create a Savings First Aid Kit

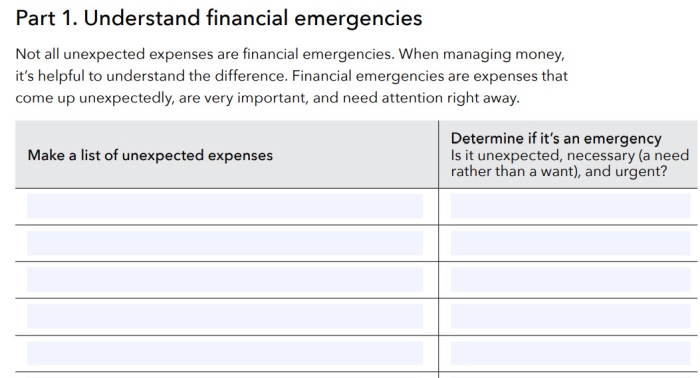

One of the most valuable parts of this activity is having students complete the simple acts of:

- Brainstorming possible unexpected expenses that pop up in life

- Determine if those expenses are an emergency, or not

Simple, but effective.

I hope you've found some awesome fun budgeting activities, budgeting worksheets for students, and budget scenario activities you're going to give a try with your own students and kids. Let me know how it goes in the comments below!

- Latest Posts

Amanda L. Grossman

Latest posts by amanda l. grossman ( see all ).

- 19 Unique Kid Piggy Banks (Plus How to Use Them for Money Lessons) - April 3, 2024

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- Try for free

7th Grade Money Worksheets

- Most Popular

- Most Recent

- OPD Program

- Debt Consolidation

- Credit Counselling

- Financial Education

- Extension Activities

- Conquer Cashalot

- Calculators

- Success Stories

- Board of Directors

- Annual Report

- Medicine Hat

Free worksheets to teach money concepts by grade

Find free school worksheets, fun money games and financial literacy activities to teach kids about money. Check out all of our Alberta teaching resources by grade below.

- School Programs

Whether you’re looking for teaching resources, homeschooling activities, or just want to keep your kids busy, Money Mentors is here to support you with the tools to teach financial literacy at home, in the community and in schools with resources for Grades K-12.

What our clients have to say

Alberta Financial Literacy Activities by Grade

Financial literacy lesson plans, activities and resources are free for teachers, parents and students to use in the classroom and at home to teach grade-appropriate money concepts.

If you’re a teacher in Alberta looking for more support, book a FREE financial literacy presentation in your classroom. Explore all school programs by grade to see how Money Mentors’ free sessions can complement your teaching and help students achieve curriculum outcomes.

Kindergarten Worksheets & Games

In these learning activities, students explore the different Canadian coins and bills (i.e., loonies, toonies, $5, and $10) and learn how to identify them with a sorting activity and puzzles.

- Coin & Bill Puzzle

- Coin & Bill Sorting Activity

FREE SESSION INFO

Grade 1 Worksheets & Games

Through these learning activities, students learn more about all Canadian coins and bills in an interactive way. They have the opportunity to play games, read poems, and engage in rich discussion.

- Money Bingo

- Coin Sorting by Letter

- Money Go Fish

- Money Guess Game

- Getting to Know Coins

- I’ve Got Money

- Pickle’s Nickel Poem

- Value & Quantity

Grade 2 Worksheets & Games

These engaging learning activities will help solidify students’ knowledge of coins and bills, while introducing them to the ways in which you can spend your money.

- Money Memory

- Canadian Coins – Poem

- Coin Riddles – Activity

- Wants vs. Needs – Worksheets

Grade 3 Worksheets & Games

These learning activities will help students learn the difference between goods and services and about where people spend their money. They will help students apply their reasoning and math skills.

- At the Store – Worksheets for Addition & Subtraction

- Canadian Money – Word Search

- Difference Between Goods & Services – Worksheet

- Where Do You Go Shopping? – Vocabulary Worksheet

Grade 4 Worksheets

These learning activities will foster discussion to help students explore Canadian currency, quality and quantity, and needs and wants through a sorting activity, puzzles, discussions, and a Kahoot!

- Crossword Puzzle

- Identifying Quantity & Quality

- Your Needs & Wants

- Comparing Costs Kahoot!

Grade 5 Worksheets

In these learning activities, students will have the opportunity to explore the methods through which we purchase items, including cheques, debit and credit cards. Students will also be able to learn about the advantages and disadvantages of paying using each method.

- All About Cheques – Worksheet

- Debit & Credit Cards – Worksheet

Grade 6 Worksheets

These learning activities give students the opportunity to explore advertisements and comparison shopping, helping them understand how to shop smart and get the most for the money they spend.

- Ask About Ads – Activity

- Comparison Shopping – Worksheet

- Understanding Slang Terms

Grade 7 Money Concepts

In these learning activities, students will be introduced to the basics of budgeting and to the types of expenses they can expect as they get older.

- Fixed vs. Variable Expenses – Worksheet

- Spending Plan Vocabulary – Worksheet

Grade 8 Money Concepts

In these learning activities, students will be able to explore banking vocabulary and opportunity costs through a situation-based activity, a matching game, and Blooket.

- Opportunity Cost – Worksheet

- Understanding Banking Vocabulary – Worksheet

Grade 9 Money Concepts

These learning activities introduce students to the basics of debt and credit. They’ll learn the difference between secured and unsecured debt and gain a better understanding of credit terminology.

- Secured vs. Unsecured Debt – Worksheet

- Understanding Credit Lingo – Activity

Grades 10 -12 Budgeting 101

These learning activities will help students to navigate increasingly complex financial decisions through an exploration of needs and wants, assets and liabilities, and SMART goals. They’ll create their own spending plan and determine their net worth.

- Calculating Gross & Net Income

- Fixed vs. Variable Income

- Your Spending Plan

- Assets & Liabilities Sorting Activity

- Your Net Worth

- Your SMART Goals

- Budgeting 101 Kahoot!

Grades 10 – 12 Borrowing Basics

This series of learning activities helps students choose the right credit card for them (as over half of young adults obtain their first credit card between ages 18-20). They’ll also learn more about simple interest and how to calculate it, analyze a credit card statement, and play a Kahoot!

- Forms of Credit

- Calculating Simple Interest

- Analyzing Credit Reports

- Picking Your Credit Card

- Reading a Credit Card Statement

- Borrowing Basics Kahoot!

Grades 10 – 12 Debt Decisions

In these learning activities, students are introduced to debt ratios and the roll down your debt method of debt repayment. Additionally, Quizlet will help them to become familiar with debt terminology.

- Calculating Debt Ratios

- Roll Down Your Debt Practice

- Debt Quizlet

- Debt Decisions Kahoot!

Grades 10 – 12 Tax Tips

These practical learning activities will familiarise students with paystubs and filing taxes. As a result, they’ll be more prepared to dive into the world of work!

- Tax Tips Kahoot!

- Paystub Identification

- Paystub Sorting Activity

- Taxes Sorting Activity

- Taxes Quizlet

Grades 10 – 12 Banking on Your Future

In these engaging and relevant learning activities, students will be introduced to services provided by financial institutions and how to make complaints to financial institutions. They’ll also have the opportunity to choose a bank account that’s right for them!

- Banking on Your Future Kahoot!

- Financial Institutions Quizlet

- Choosing a Bank Account

- Opening a Bank Account and Making a Complaint

- Reading a Bank Statement

Additional Financial Resources

Can’t find what you’re looking for? We have lots of other great resources to help you on your financial education journey—from free online courses and youth spending plans to money tips and our online Conquer Cashalot game .

Feeling overwhelmed these days? Let us help.

1-888-294-0076

© Money Mentors 1997 - 2024

Charity ID: 891652463RR0001

140, 109 Quarry Park Blvd SE Calgary, AB, T2C 5E7

Quick Links

Privacy & terms.

- Privacy Policy

- Usage Agreement

Sign up for our newsletter

- Kindergarten

- Greater Than Less Than

- Measurement

- Multiplication

- Place Value

- Subtraction

- Punctuation

- 1st Grade Reading

- 2nd Grade Reading

- 3rd Grade Reading

- Cursive Writing

- Alphabet Coloring

- Animals Coloring

- Birthday Coloring

- Boys Coloring

- Buildings Coloring

- Cartoons Coloring

- Christmas Coloring

- Country Flag Coloring

- Country Map Coloring

- Disney Coloring

- Fantasy Coloring

- Food Coloring

- Girls Coloring

- Holidays Coloring

- Music Coloring

- Nature Coloring

- New Year Coloring

- People Coloring

- Religious Coloring

- Sports Coloring

- Toys Coloring

- Transportation Coloring

- US Sports Team Coloring

- Valentine Day Coloring

Grade 7 Planning Budget

Displaying top 8 worksheets found for - Grade 7 Planning Budget .

Some of the worksheets for this concept are Economic management sciences ems learners workbook, 7 grade math real world project monthly budgeting, Economic and management sciences grade 7, Make a budget, Lesson plan a plan for the future making a budget, Real life budget i, Shopping on a budget group activity, Grade five saving and creating a personal budget.

Found worksheet you are looking for? To download/print, click on pop-out icon or print icon to worksheet to print or download. Worksheet will open in a new window. You can & download or print using the browser document reader options.

1. ECONOMIC MANAGEMENT SCIENCES EMS LEARNERS WORKBOOK

2. 7 grade math real world project: monthly budgeting, 3. economic and management sciences grade 7, 4. make a budget -, 5. lesson plan a plan for the future: making a budget, 6. real-life budget i -, 7. shopping on a budget group activity, 8. grade five saving and creating a personal budget.

For Teachers

Home » Teachers

Money Education for 7th Graders

Here are the financial principles and money lesson plans for 7th grade students that you should be teaching!

Your 7th-grade students are in the thick of middle school: growing, learning, and developing more refined money management skills. Hopefully, they have a broad and diverse financial literacy background by now, with a good understanding of basic economic principles and theories. You can take them to another level in this grade, focusing on more specific aspects of money and looking in-depth into several topics. According to the World Book Learning Resources, 7th-graders should learn economic concepts through the lens of World Trade and Resources. You can approach this overarching theme in several ways: foundations of economics, microeconomics, macroeconomics, global economics, and personal finance. Teachers can get their 7th-grade students ready for the next grade and beyond by covering these ideas. Use this guide to see what you should go over this year, how to teach these concepts, and you’ll even find a ready-to-teach lesson plan for each topic!

National Standards for Personal Finance Education

Download our free teachers' cheat sheet.

Our free cheat sheet covers every learning objective in the National Standards for Personal Finance Education and the corresponding Kids' Money Lesson Plans - we cover each and every standard!

Foundations of Economics

Your students will benefit greatly by learning and reviewing the basics of economics. Understanding the building blocks of money education will help them grasp more challenging topics, meaning they will be more financially savvy than ever as they grow older. Going deeper into the subject, you can show how governments and businesses constantly make decisions based on available resources. You can demonstrate how scarcity, limited resources, human desires, opportunity cost, and trade-offs all impact decisions at many levels. You can also teach students about the qualities of a market economy, including property rights, freedom of enterprise, competition, consumer choice, and the limited role of government.

Teachers will see unlimited opportunities to teach this concept through hands-on activities and online resources. You can use modern economies and current events to display how these theories work in reality, including:

- Have students research competition among companies in an industry. You can guide them to corporations they have heard of, showing how they use various forms of advertisement to attract customers, comparing revenue and market share, and more. Explain that healthy competition benefits consumers, pricing, and product evolution. They can create poster boards or use online presentation tools to show their comparisons and present them to the class.

- Get into the idea of limited resources more fully. Since the focus of the 7th grade is world trade and resources, you could have them research a designated country, looking at its resources in detail. You could have students dive into its top exports, how many specific resources it has, what kinds of products it makes, and other items.

7th Grade Lesson Plan #1

Want to get all 7th grade lesson plans, microeconomics.

You can describe how microeconomics studies the costs and benefits of financial decisions relating to people, businesses, and governments. Teachers can show how different financial entities are interrelated, with banks, companies, and labor unions working within the same systems. Students learn that private investment leads to economic growth through health initiatives, higher education, and training workers to improve their skills. You can go over how the government also promotes economic expansion through policy, regulation, and subsidies. Teachers can touch on the idea of physical capital, such as factories, equipment, and workers, and how putting time and money into these items can boost economies. Students may learn about historical and modern-day entrepreneurs, showing them that profit has been a significant driver of economies for a long time.

As you delve into microeconomics with your 7th-grade class, you will find many engaging ways to teach students about this complex topic. You can go deeply into sub-topics, having your class or homeschooler:

- Research a prominent entrepreneur in U.S. history. Have kids give a brief biography of the person, list their accomplishments, and pinpoint the problems that their person was trying to solve. They can create a report on these individuals and show how they influenced the business world, focusing on their impact beyond our borders (e.g., Henry Ford’s mass production of the automobile spread across the globe, oil pioneers unlocked its potential in other countries).

- Compare private and public companies. Explain that in many industries, these firms may work together, while in others, different rules and regulations apply that may affect how they cooperate. Profit is often the central driver in private companies, and students can create projects that show the many contributions of private goods and services and their role in production and job creation.

7th Grade Lesson Plan #2

Macroeconomics.

Teachers of 7th-graders can approach macroeconomics, which is the study of the results of choices made at a societal level on economies in many different ways. One of the main topics to teach to this grade level is inflation and its impact on prices, interest rates, and business activity. You can connect past periods of inflation to current events, comparing the rates and prices of goods and services then versus now. The good part of teaching money ideas in this grade is you can also link them to history and other subjects. For example, you can get into the Great Depression, continuously revisiting the idea of economics and its role in our country’s past. You can go over unemployment rates over time, showing kids that the numbers constantly change due to multiple factors.

Your 7th-graders will enjoy learning about these topics, particularly if you connect them to their lives. Some ways you can do that include:

- Get into detail with the idea of scarcity. This basic economic concept will keep popping up throughout money education, so it is a good idea to hammer it home. You can talk about human, natural, and capital resources, showing them that prices, supply, and demand all change due to scarcity. Students can fill out current event worksheets about modern-day products, goods, and services, connecting the idea of scarcity. For example, they may talk about digital art, NFTs, and cryptocurrency, highlighting the prices of these items and how rarity affects the value.

7th Grade Lesson Plan #3

Global economics.

This topic is ideal for 7th-graders, as it directly correlates with the theme of their year. You can explain that the world is more interconnected than ever before in history and that trade and financial connections between nations are vital. Different countries have various economic systems, which you can highlight for your students, and you can describe the types of countries that are similar and unique from each other. You can dive into developing and developed countries and how their means of production differ. Trade agreements, currencies, and national debts are other areas to target as you go over this concept. In this unit, teachers can show the importance of imports and exports and how countries have GDPs that directly tie into their trade with other countries.

Educators can quickly locate many practical resources for teaching global economics to 7th-graders. There are multiple ways to approach this concept, such as:

- Research the recent history of global interaction. Have kids look at trade agreements: which countries joined them, how alliances can shift, and what today’s trading patterns look like. They can make PowerPoints or posters showing world maps, highlighting which countries trade with each other and which ones are left out of the process.

- Put students into teams. Assign each group a nation to learn about, having them create a detailed report on its economy, resources, and level of financial independence. After they have researched and prepared their reports, have the class participate in a round table activity. Students can present their country’s strengths and needs, appealing to specific nations for trade.

7th Grade Lesson Plan #4

Personal finance.

Teachers can tie everything together as they get into the topic of personal finance. In this unit, your 7th-graders will get to start planning out their financial futures, including budgets, income, and resources. You can cover crucial ideas like saving and investing, introducing your learners to the different vehicles they can use to grow their money. Kids at this age know what saving is and why it is so important, but they may not know about the many ways they can keep their money safe or make it increase over time. You can teach them about income, how different careers lead to variation in the salaries you receive, and how they can boost that income over their career.

There are many activities for teaching personal finance to 7th-graders. You can focus on your students’ interests, creating or finding exercises that get them thinking about their short-term and long-term money goals. One of these activities may:

- Have kids think about how they can get an income. They have financial wants and needs but may not know where to get the cash to buy things they desire. You can have partners brainstorm ideas for creating income. When they are done, share out and make a class poster with all of their money-making plans. Often, the first step is to plan and organize your thoughts when it comes to money, so it’s critical that your students get into this habit.

7th Grade Lesson Plan #5

More resources for 7th grade teachers.

- 7th grade money games and activities

- Grades 6-12

- School Leaders

Free printable Mother's Day questionnaire 💐!

25 Meaningful Saving and Budgeting Activities for High School Students

Teach teens financial fitness now so they have a prosperous future.

If we let students graduate high school without learning key skills like saving and budgeting, we’re doing them a real disservice. These budgeting activities are terrific for a life-skills class, morning meeting discussion, or advisory group unit. Give teens the knowledge they need to make smart financial choices now and in the future!

Classroom Saving and Budgeting Activities

Try the Jellybean Game

Before you get into the nitty-gritty of numbers, start with this clever activity that gives kids practice allocating assets in a low-stakes way. They’ll use jellybeans to decide what they need, want, and can truly afford.

Learn more: The Jellybean Game

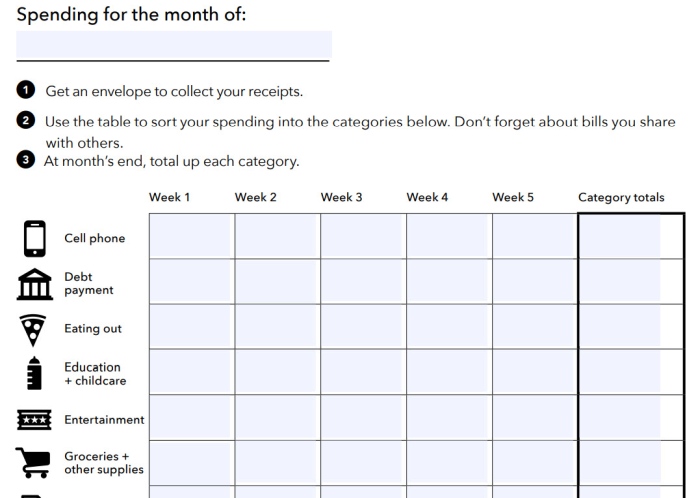

Use budget-planning worksheets

The Consumer Financial Protection Bureau has developed lots of tools to help teens and adults learn to manage money. Show kids how to use their Income Tracker, Spending Tracker, Bill Calendar, and Budget Worksheet (all at the link below). Start by having kids consider their current financial situation. Then, give them hypothetical “adult” situations to plan for, with income and expenses drawn from typical people in your area.

Learn more: Budgeting Worksheet Tools

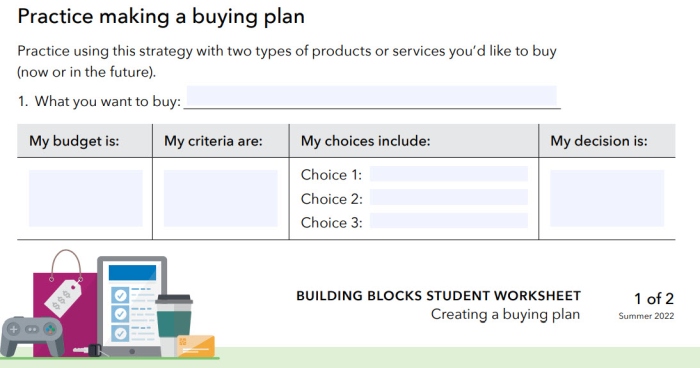

Create a buying plan

This activity encourages kids to think about purchases, especially major ones. Saving money is just one part of the process—they also need to consider what makes a good purchase and whether they should pay up front or borrow the money instead.

Learn more: Creating a Buying Plan

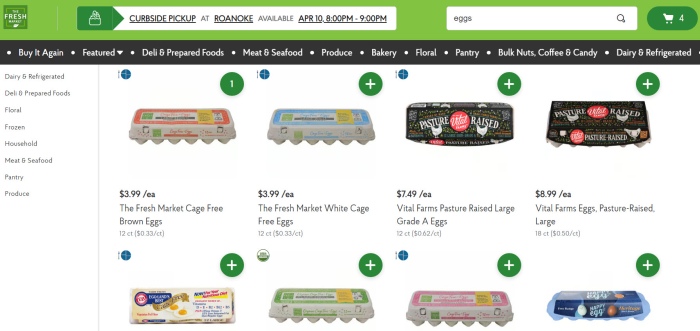

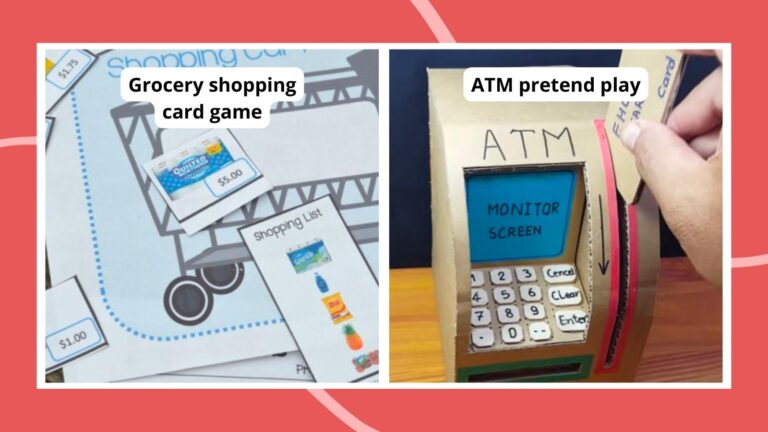

Practice grocery shopping

Most kids probably have no idea how much groceries cost. Use grocery store websites to your advantage, and have kids take a virtual shopping trip. They can plan meals and determine what they’ll need to buy. Or have them start with a weekly food budget and work backwards from there. Either way, remind them to make sure their menus include healthy options.

Learn more: Make a Great Grocery List at WebMD

Build a savings “first-aid kit”

It’s no secret that things can and do go wrong. Budgeting activities like this one help students learn what to do when unexpected expenses crop up. Students learn about real-world costs and come up with ways to save in advance and adjust on the fly.

Learn more: Savings First Aid Kit

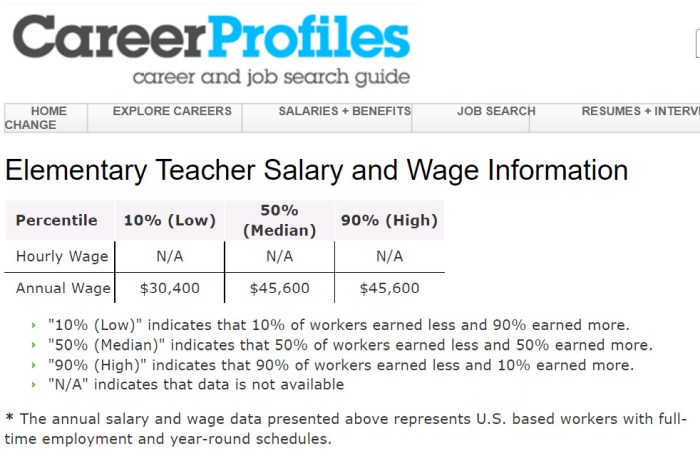

Discover what jobs actually pay

Ask students to list some jobs they think they’d like to do someday. Then, have them research average salaries for those jobs. Encourage them to factor in where they plan to live (salary ranges can be dramatically different across the country). Plus, ask them to think about the education they’ll need to land those jobs, and how long it will take them to earn the money to pay back any loans they’ll have to take.

Learn more: Job Salaries by Field

Find out how credit cards work

These days, most people pay with plastic instead of cash. Sometimes they use debit cards, but often they’re credit cards. If you’re going to use them, you need to know how they work. Divide your class into groups, and ask each to research a different question about credit cards, like how they work, what interest they charge, and how to use them safely.

Learn more: Best Credit Cards at Money Under 30

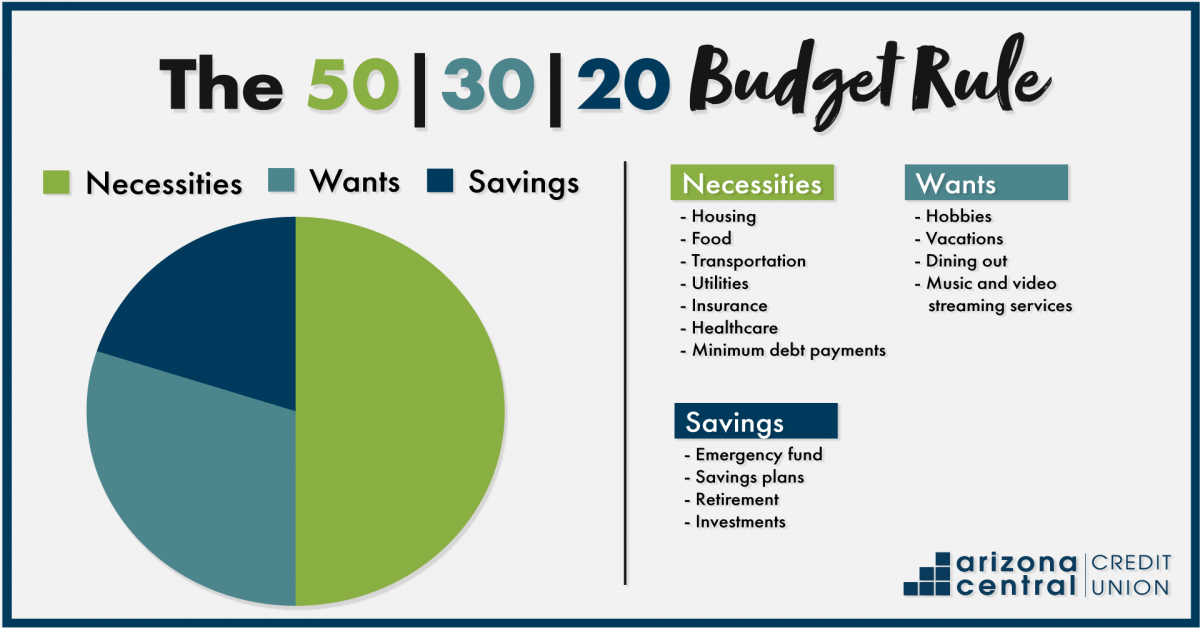

Experiment with different budget models

There’s no one right way to set up a budget. Expose students to a variety of models, like proportional budgets, the “pay yourself first” model, the envelope budget, and more. Ask them to think about which kind of person each model works best for and which one they’d choose.

Learn more: 6 Different Ways To Budget Your Money at Young Adult Money

Explore Budgeting Apps

Teens are usually pretty attached to their phones, so show them one way to make really good use of screen time: budgeting apps. Learn how to choose a good one in this video.

Calculate compound interest

When you invest your money in an interest-bearing account, it earns money just by sitting there! That money can really grow over time too. Have students complete budgeting activities like looking up current interest rates and then calculating the potential interest from using those accounts for short and long periods of time. Explore local bank offerings, and take into account things like fees too.

Learn more: Compound Interest Calculator

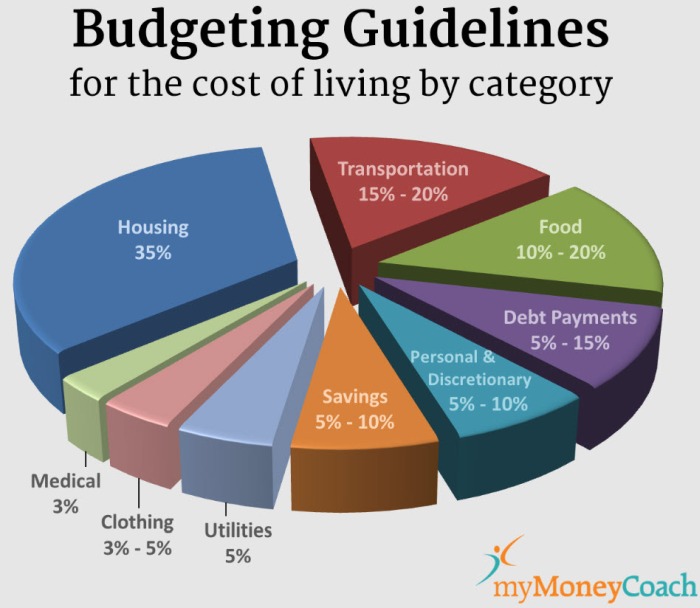

Learn what “living expenses” means

Kids generally don’t think about all the costs of daily living. Start by brainstorming a big list as a class of all the things people need to spend money on each month: rent or mortgage, car payments, credit card payments, food, entertainment, utilities, Internet access, and more. Break kids into groups and have each group research the average costs of those items in your area. Come back together as a class and add up their findings to see what “living expenses” can really be.

Learn more: Monthly Expenses at Inspired Budget

Get a reality check

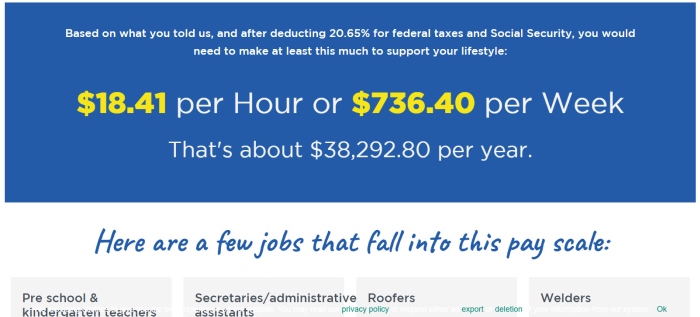

Everybody’s got dreams, but how realistic are they? That’s where the Jump$tart Reality Check program comes in. By making choices about the future they want, teens will learn what they’ll need to earn to make it happen. The answers might really surprise them.

Learn more: Reality Check—Online Tool for Students

Reflect on needs vs. wants

Ask students to reflect on what they truly need to survive vs. things that just make life easier or more fun. Budgeting activities like this can help them identify items they can eliminate when funds get really tight.

Learn more: Needs vs. Wants

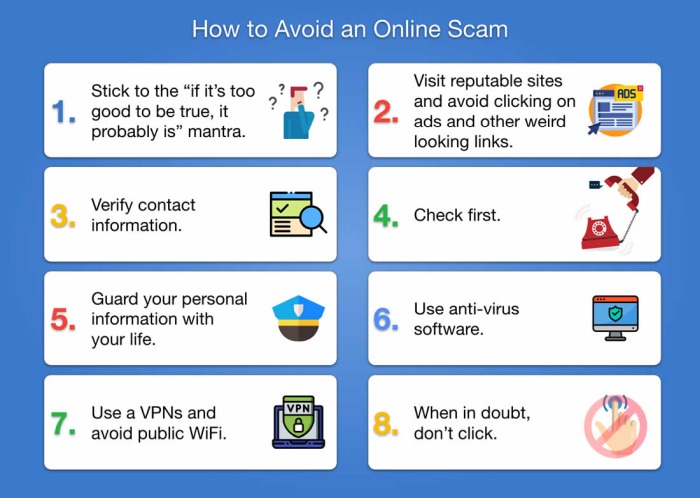

Learn to protect your money

If teens don’t learn smart skills like avoiding phishing scams, how to choose good passwords, or identifying fraudulent sites, they can lose everything they save. Take time to learn about the most common fraud issues, and teach them how to be responsible online.

Learn more: 8 Ways To Protect Your Money That All Students Should Know at We Are Teachers

Savings and Budgeting Online Games

How Not To Suck at Money

The title pretty much says at it all: By playing this game, students learn how to manage their money and use it responsibly.

Learn more: How Not To Suck at Money

The Uber Game

Let students imagine life as an Uber driver. This game is based on actual Uber driver experiences and can be a real eye-opener.

Learn more: The Uber Game

Hit the Road

Think of this like Oregon Trail for the modern age. A group of friends is setting off on a cross-country trip, but they’ve got to manage their funds to get where they want to go. Try this one as a group activity so kids have to work together to make smart choices.

Learn more: Hit the Road

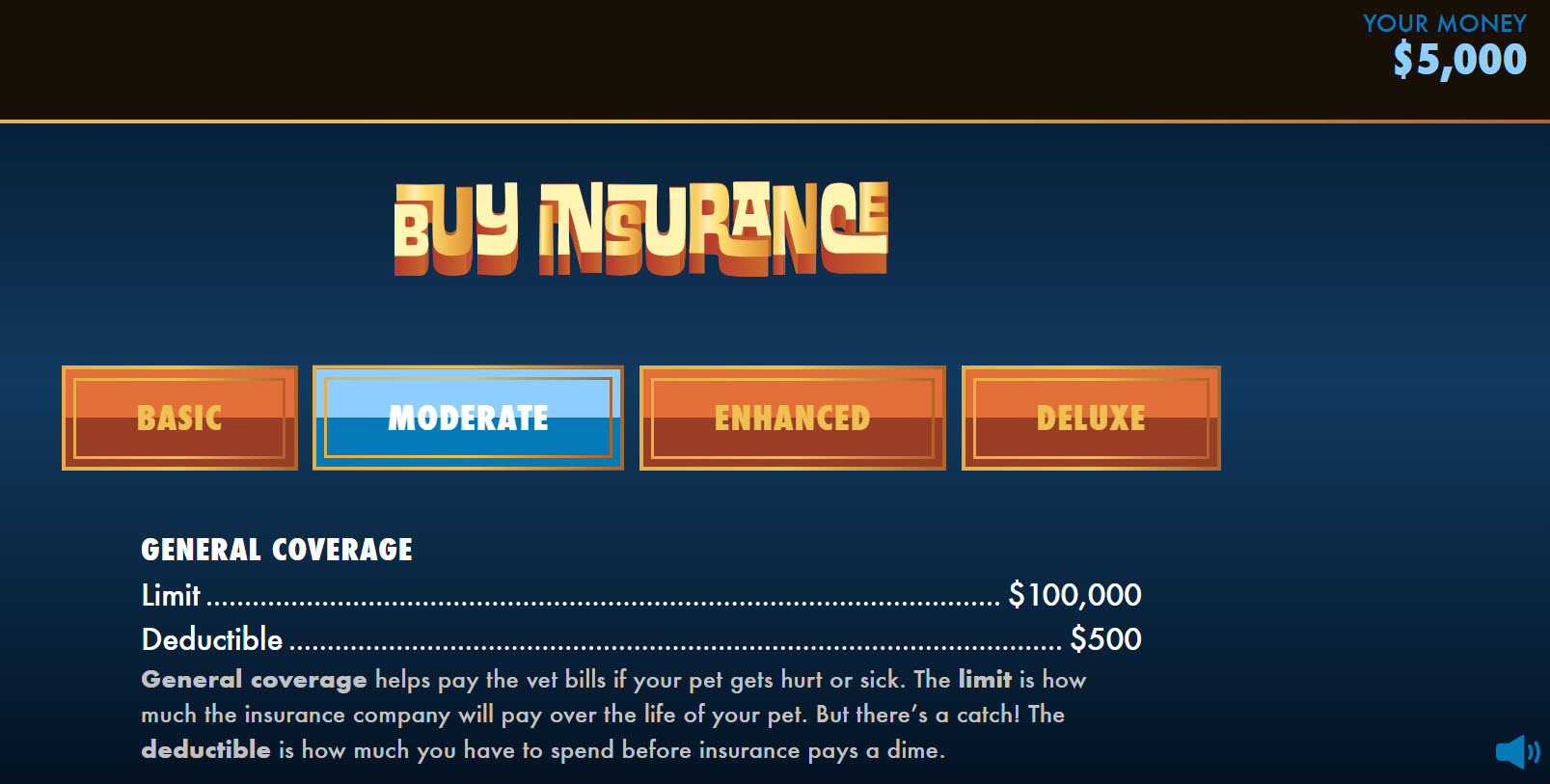

Budgeting and saving is important, but students should also learn about the importance of having the right kind of insurance. Because sometimes life really is just a bummer!

Learn more: Bummer

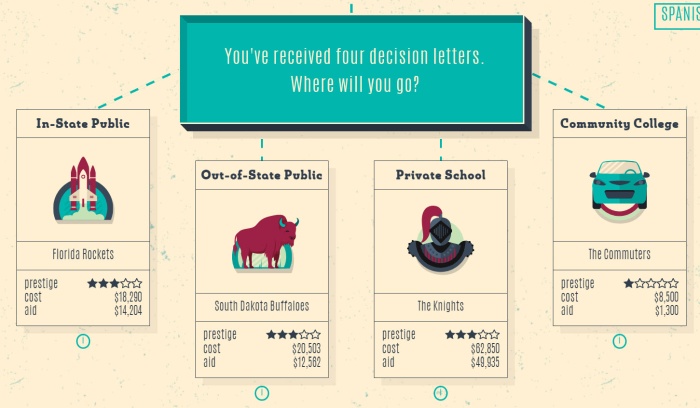

College-bound kids might figure they’ll take loans now and figure out how to pay them back later, but do they really have a handle on the true costs? These interesting online simulations let you pick your school, then walk through four years of potential expenses and income opportunities to find out how you fare in the end.

Learn more: Payback

Misadventures in Money Management

This online game feels a bit like a graphic novel, and it helps kids learn the basics of budgeting and money management. Explore multiple topics and complete missions to learn valuable skills.

Learn more: Misadventures in Money Management

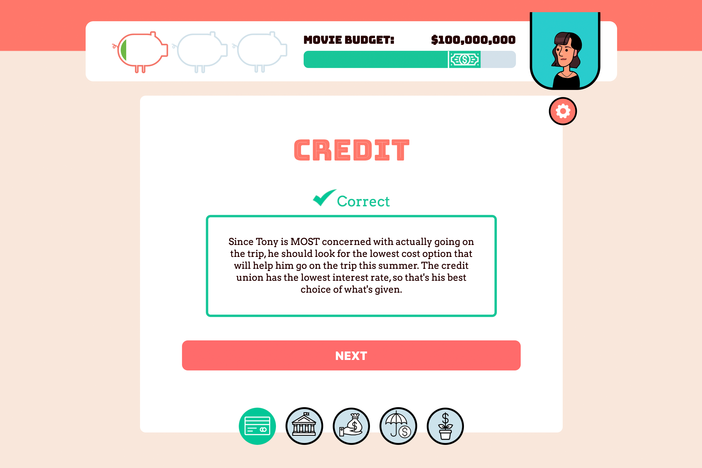

Lights, Camera, Budget!

Managing your own money can feel a little dull, so why not try your hand at managing a multimillion-dollar movie budget instead? This one has levels for both middle and high school students too.

Learn more: Lights, Camera, Budget!

Living on the financial edge is a sad reality for so many people. Show kids what that can feel like with this online simulation. When the game starts, you have no housing and no job and just $1,000 in the bank. Can you get a job and make it to the end of the month?

Learn more: Spent

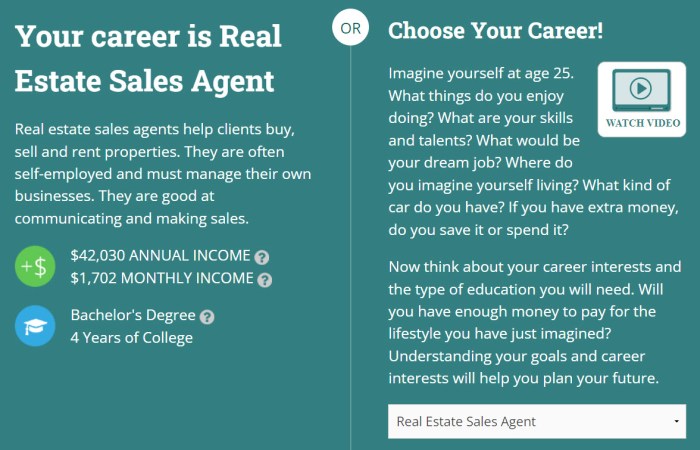

Claim Your Future

This cool online game assigns you a career (or lets you choose one) and tailors your experience to your location. You get to make choices about housing and other expenses, and the game calculates how those things fit into a responsible budget.

Learn more: Claim Your Future

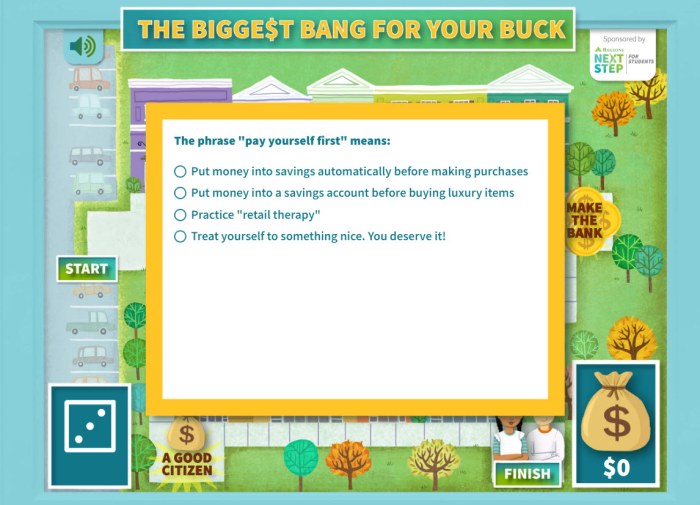

The Biggest Bang for Your Buck

This online game guides kids through a shopping trip with financial literacy questions along the way. It’s simple but a terrific way to introduce a discussion on spending, saving, and budgeting.

Learn more: The Biggest Bang for Your Buck

For kids who are sure they can make enough money to live on with their social media accounts, this game might be a bit of a reality check.

Learn more: Influenc’d

Budgeting activities are just the start! Check out these life skills every teen should learn .

Plus, get all the best teaching tips and ideas straight to your inbox when you sign up for our free newsletters .

You Might Also Like

Our Favorite Activities for Teaching Money Skills

Saving, budgeting, shopping, and more! Continue Reading

Copyright © 2024. All rights reserved. 5335 Gate Parkway, Jacksonville, FL 32256

- Kindergarten

- Greater Than Less Than

- Measurement

- Multiplication

- Place Value

- Subtraction

- Punctuation

- 1st Grade Reading

- 2nd Grade Reading

- 3rd Grade Reading

- Cursive Writing

Grade 7 Planning Budget

Grade 7 Planning Budget - Displaying top 8 worksheets found for this concept.

Some of the worksheets for this concept are Economic management sciences ems learners workbook, 7 grade math real world project monthly budgeting, Economic and management sciences grade 7, Make a budget, Lesson plan a plan for the future making a budget, Real life budget i, Shopping on a budget group activity, Grade five saving and creating a personal budget.

Found worksheet you are looking for? To download/print, click on pop-out icon or print icon to worksheet to print or download. Worksheet will open in a new window. You can & download or print using the browser document reader options.

1. ECONOMIC MANAGEMENT SCIENCES EMS LEARNERS WORKBOOK

2. 7 grade math real world project: monthly budgeting, 3. economic and management sciences grade 7, 4. make a budget -, 5. lesson plan a plan for the future: making a budget, 6. real-life budget i -, 7. shopping on a budget group activity, 8. grade five saving and creating a personal budget.

IMAGES

COMMENTS

(7 th - 8 th Grade) Monthly Budget Worksheet: This worksheet lets students plan their budgets or plug in numbers to a sample budget to see how the process works ... and develop a plan for the future. (9 th-12 th Grade) Budgeting Activity: This worksheet requires students to determine the expenses of living independently, seeing how much it ...

This budgeting activity for students attempts to bring awareness to how difficult it can be to feed your family nutritious food on a low budget. 3. ConsumerFinance.gov's Create a Savings First Aid Kit. Suggested Age Range: 13-19 years.

Grade 7 EMS Worksheet Edupstairs Grade R - 9 Learning www.edupstairs.org Assessment Task: Personal Budgets How budgeting helps us to save (Individual activity) Read the information below and do the exercise that follows. Martha's income and expenses for one month Martha has the following sources of income: Pocket money: R200

Financial Literacy Worksheets for 6 th -8 th Grade. Middle school students are preparing for high school and beyond; the more money education, the better. These worksheets will strengthen their financial literacy and boost their confidence. Kid's Money Budget Worksheet: This worksheet provides students with an engaging.

Activity 1 1. Explain what the term 'Capital' means. 2. There are 5 different types of capital. In your own words, explain each of the ... Lesson 7 . Budgets . A budget is a written plan on how to spend future income. It is a written document showing . Tom Newby School. Grade 7 EMS 2016 - Term 2 Topic 5 ...

These money skills activities teach budgeting, saving, and more. Saving, budgeting, shopping, and more! Saving, budgeting, shopping, and more! Skip to main content. ... Search for: Grades Grades. All Grades K-5 All Grades 6-12 PreK 6th Grade Kindergarten 7th Grade 1st Grade 8th Grade 2nd Grade 9th Grade 3rd Grade 10th Grade 4th Grade 11th Grade ...

Line Chart Comparison in Excel. In this computer lesson plan, students use a line chart to compare profits from two different school years. Following…. Browse our printable 7th Grade Money Worksheets resources for your classroom. Download free today!

For learners just beginning to learn about budgets, you could take a look at this budgeting for kids worksheet pack. Twinkl South Africa/Suid-Afrika Senior Phase Economic and Management Sciences. This activity / activities sheet is great for grade 7 learners who are learning to work with budgets in grade 7 EMS.

1. Grade 7 Mathematics Financial Literacy - Budget Adjustment Activity. Budget Adjustment Activity. Help make a new budget plan for the employee. To create a budget plan you can use a digital spreadsheet, paper, a document, or an organizational tool of your creation. TVO Media Education Group.

We also have this differentiated budgeting worksheet . Twinkl South Africa/Suid-Afrika Senior Phase Economic and Management Sciences Grade 7 The Economy. This activity / activities sheet is great for grade 7 learners who are learning to work with budgets in grade 7 EMS.

This activity on working with budgets is great for grade 7 EMS lessons. For more budgeting activities, see our Braai Day mathematical literacy budgeting activity, or our EMS Grade 8 class camp budgeting activity. Working on financial maths? Thy this Financial maths formulas assets worksheet. Twinkl South Africa/Suid-Afrika Senior Phase Economic ...

Alberta Financial Literacy Activities by Grade. Financial literacy lesson plans, activities and resources are free for teachers, parents and students to use in the classroom and at home to teach grade-appropriate money concepts. ... Grade 7 Money Concepts. ... Grades 10 -12 Budgeting 101. These learning activities will help students to navigate ...

Find interactive games, flash cards, lessons by grade level, family resources, and at-home activities for students in grades K-8. Repeat after us: It's never too early to learn how to budget. Set your grade 3-5 students up for future financial success with this "Plans and Goals" lesson and activity sheet .

Grade 7 Planning Budget. Displaying top 8 worksheets found for - Grade 7 Planning Budget. Some of the worksheets for this concept are Economic management sciences ems learners workbook, 7 grade math real world project monthly budgeting, Economic and management sciences grade 7, Make a budget, Lesson plan a plan for the future making a budget ...

Money Education for 7th Graders. Here are the financial principles and money lesson plans for 7th grade students that you should be teaching! Your 7th-grade students are in the thick of middle school: growing, learning, and developing more refined money management skills. Hopefully, they have a broad and diverse financial literacy background by ...

Learning Activities 12 Learning Sessions 13 Personal Budget Planners 31 Money Management Worksheets 33 ... Introduction Grade 7 Financial Literacy Resource Guide. ... and budgeting as they pursue their careers and post-secondary education. 1. The financial literacy strand in Ontario's Mathematics curriculum was introduced in year 2020 for ...

All Grades K-5 All Grades 6-12 PreK 6th Grade Kindergarten 7th Grade 1st Grade 8th Grade 2nd Grade 9th Grade 3rd Grade 10th Grade 4th Grade 11th Grade 5th Grade 12th Grade. ... we're doing them a real disservice. These budgeting activities are terrific for a life-skills class, morning meeting discussion, or advisory group unit. Give teens the ...

INTRODUCTION: Dear learner This revision pack is to help and support you to master the content of term 2 to be ready for the high school. It contains Financial Literacy, namely Accounting concepts, income and expenses, and budgets. If you worked through all the lesson plans and activities of term 2, you are ready to do these activities.

Grade 7 Planning Budget - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Economic management sciences ems learners workbook, 7 grade math real world project monthly budgeting, Economic and management sciences grade 7, Make a budget, Lesson plan a plan for the future making a budget, Real life budget i, Shopping on a budget group activity, Grade ...

Activity 1 Week 1 1. Explain what the term 'Capital' means. 2. In your excise books Paste 5 different pictures of capital and explain how can each used to start a business Activity 2 Week 1 1. Explain what the term Asset means. 2. Mention two types of asset and explain them

5.0 (1 review) What is a budget? - Never spend more than what your income is. - Spending must be planned so that you do not end up with a lot of debt. - This plan is called a budget. - A plan of how to spend future income. - A written document to show planned income and estimated expenses for a specified period of time (short, medium or long term).

Supports budget formulation and tracks budget execution for HRA/OSP, conducts risk management and internal controls activities and coordinates legislative proposals. Develops and updates organizational performance criteria; provides routine internal and external performance reporting; responds to data calls and specific inquiries from ...

Council is accepting community feedback on its Draft Delivery Program 2022-2026 and Operational Plan for the 2024-25 financial year until 7 June. "The Delivery Program describes Council's activities over a four-year period, while the Operational Plan 2024-2025 details our proposed activities for next financial year," said Mayor Claire Pontin.