- Search Search Please fill out this field.

- What's in a Prospectus?

Investigating New Offerings

How to get a company's prospectus.

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

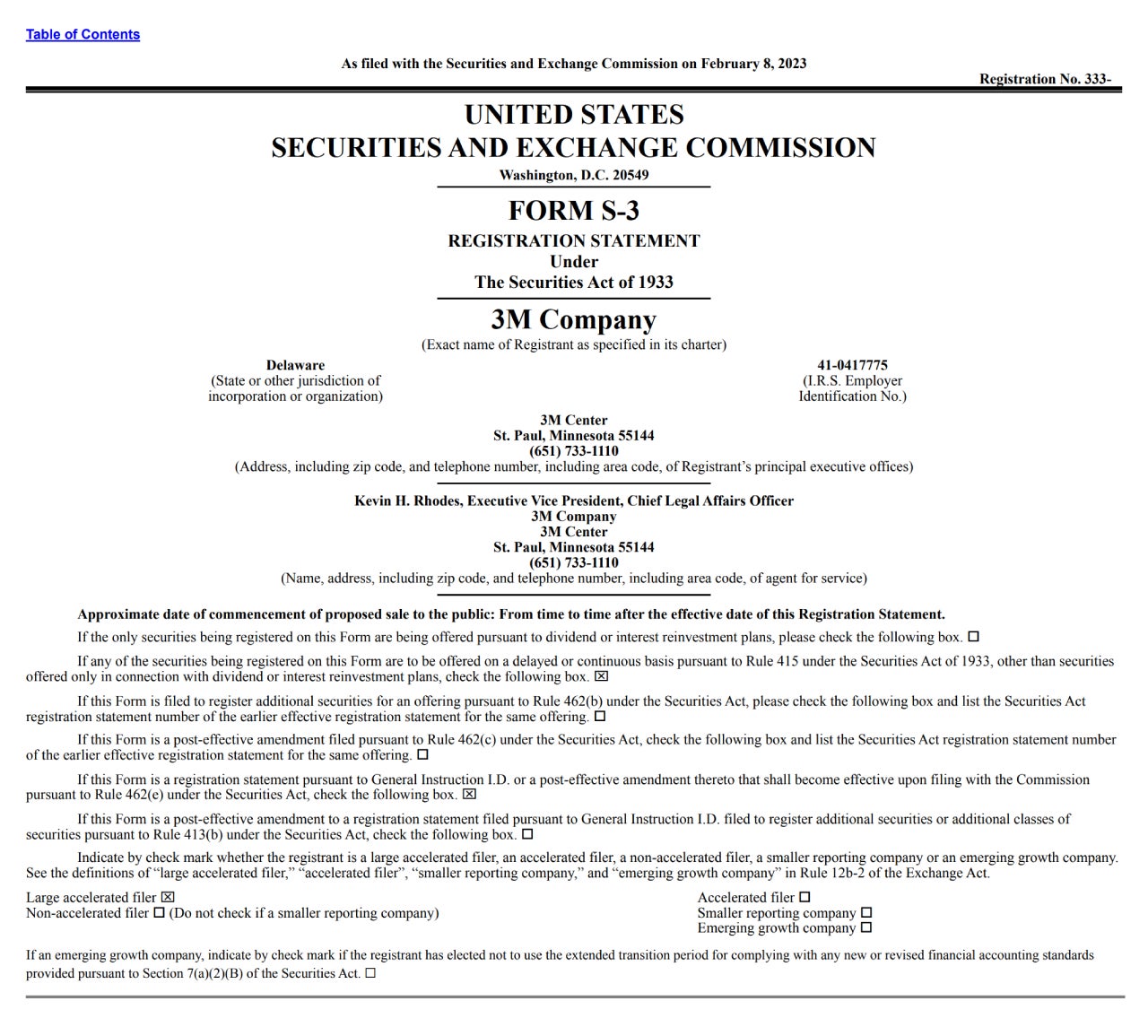

A company's prospectus is a formal legal document designed to provide information and full details about an investment offering for sale to the public. Companies are required to file the documents with the Securities and Exchange Commission (SEC) . The prospectus documents must be made available to a prospective public investor prior to purchase. Investors are encouraged to read and understand the terms of the offering before making a purchase decision.

Key Takeaways

- A prospectus is a formal document that is required by and filed with the SEC that provides details about an investment offering for sale to the public.

- This document is used to help potential investors make a more informed decision on whether or not to invest.

- EDGAR is a public online tool that allows individuals and analysts to search for and retrieve corporate prospectus filings.

- Investors may also seek to obtain a prospectus through their broker or by contacting a company's investor relations department.

Mutual funds and hedge funds must also offer potential investors a prospectus; however, here we focus on firms' prospectus prior to a corporate IPO or secondary offering.

What's in a Prospectus?

Company prospectus documents have become increasingly accessible with the advent of the internet. Most companies have a corporate website with a section labeled Investor Relations that should have available a wide range of company documentation, including quarterly and annual reports . Many investment websites may also offer links directly to a company's or fund's prospectus documents.

The prospectus document is issued to inform investors of the potential risks involved with investing in a particular stock or mutual fund. The information provided in the prospectus also serves as a form of protection for the issuing company against any claims that information was not fully disclosed or detailed prior to the investor putting money into an investment.

Companies that wish to offer stock or bond for sale to the public must file a prospectus as part of the registration process with the SEC. Companies must file a preliminary and final prospectus. However, the SEC has specific guidelines as to what's listed in a prospectus for various securities.

The preliminary prospectus (sometimes known as a red herring ) is the first offering document provided by a security issuer and includes most of the details of the business and transaction. However, the preliminary prospectus doesn't contain the number of shares to be issued or price information. Typically, the preliminary prospectus is used to gauge interest in the market for the security being proposed.

The final prospectus contains the complete details of the investment offering to the public. The final prospectus contains any finalized background information as well as the number of shares or certificates to be issued and the offering price .

A prospectus will include the following information at a minimum:

- A brief summary of the company’s background and financial information

- The name of the company issuing the stock

- The number of shares

- Type of securities being offered

- Whether an offering is public or private

- Names of the company’s principals

- Names of the banks or financial companies performing the underwriting

Some companies are allowed to file an abridged prospectus, which is a prospectus but contains some of the same information as the final prospectus.

The first offering is detailed by the preliminary prospectus provided by the security issuer, which outlines information about the company, its business plan and structure, and the transaction in question. The preliminary document also discloses names of the company's principals, details about the amount the underwriters are earning per sale and specifies whether the offering is public or private.

The final prospectus contains details and information about the finalized offering, including the precise number of shares or certificates being issued and the offering price of shares.

In the case of mutual funds , a fund prospectus contains information on and details about its objectives, proposed investment strategies , perceived potential risks, projected performance, distribution policy, fees and expenses and fund management.

In the U.S., all companies filing with the SEC must supply their documentation to a service known as EDGAR , or the Electronic Data Gathering, Analysis and Retrieval System. The EDGAR website allows you to get all the filings of a company , including its prospectus and annual reports, which include financial statements. The EDGAR database can be searched using the company ticker symbol. EDGAR’s Companies & Other Filers Search will list a company's filings with the most recent filings shown first. Most of the filings made through EDGAR are available for download or can be viewed for free.

Canada has a similar website known as SEDAR+ , which includes SEDAR (System for Electronic Document Analysis and Retrieval), which provides company filings on the web. Like EDGAR, the SEDAR+ website provides easy access to public company documentation.

As an example, the figure below, produced from EDGAR, shows a sample prospectus for the company PNC Financial Group's offering of corporate bonds maturing in the year 2024.

We can see the following information listed:

- Securities offered, which are senior notes that pay 3.50%

- The maturity date of the notes, which is January 23, 2024

- The issue date, which has yet to be determined

- How interest will be paid and denominations to be issued

- Use of proceeds or how the money raised will be spent, which might include financing operations, paying down debt, or buying back stock

U.S. Securities and Exchange Commission. " Updated Investor Bulletin: Investing in an IPO ."

Cornell Law School. “ Preliminary Prospectus .”

Investor.gov. " Registration Under the Securities Act of 1933 ."

Investor.gov. " Mutual Fund Prospectus ."

:max_bytes(150000):strip_icc():format(webp)/adobestock_215111252-5bfc2e7e46e0fb0083c1000c.jpeg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What is a prospectus?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Financial planning

- Connect with Nina Semczuk on LinkedIn Linkedin

- • Investing

- Connect with Brian Beers on Twitter Twitter

- Connect with Brian Beers on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money.

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

A prospectus is a legal document required by the U.S. Securities and Exchange Commission (SEC) for companies that offer securities for sale to the public. Its purpose is to provide potential investors with information including the company’s financial health, the risks associated with investing in its securities, and associated fees and expenses. Mutual funds, exchange-traded funds (ETFs), public offerings and other common investments have prospectuses that you can look over before investing.

Here’s more about the purpose of a prospectus, how to find one and what key information to look for when reading this type of document.

What is the purpose of a prospectus?

The primary purpose of a prospectus is to provide potential investors with the information they need to make informed investment decisions, including the potential risks involved with the investment.

By law, companies that offer securities for sale must provide potential investors with a prospectus. The document must be filed with the SEC and is subject to strict regulatory requirements. Current shareholders must also be provided with a copy of the prospectus including summary prospectuses that are issued after any updates or changes to the fund’s managers or other key business areas.

What does a prospectus include?

The SEC has guidelines for what must be included in a prospectus in order to help investors compare different investments more easily. A prospectus for shares in a fund company (think mutual funds or ETFs, for instance) will generally have at least the following information:

- Investment objectives/goals

- Fee table and expenses

- Investment strategies

- Investments, risks and performance

- Management information, including investment advisors and portfolio managers

- How to buy and sell fund shares

- Tax information

- Financial intermediary compensation

Prospectuses may differ depending on the nature of the investment offering. For example, an initial public offering for a company’s stock will be different from an established mutual fund prospectus. The IPO prospectus typically won’t have a reporting history since it’s a new offering, and will also include a “use of proceeds” section that covers how the company will use the money raised in the offering.

For stock in a company, a prospectus and/or prospectus supplement will typically contain some or all of the following:

- Summary of consolidated financial data

- Ratio of earnings to fixed charges

- Risk factors

- Use of proceeds

- Description and price range of common stock or securities

- Plan of distribution, dividend policy, capitalization and dilution

- Underwriting information

- Legal information

Summary prospectus vs statutory prospectus

A summary prospectus is a disclosure document that includes key information from the beginning of a complete prospectus and recent updates but doesn’t include all the sections and details of a statutory prospectus. As the name suggests, summary prospectuses are typically abbreviated versions of statutory prospectuses.

Example of a prospectus

How to find a prospectus

For many investments, you can find prospectuses on the issuing company’s website. Vanguard, for example, lists its ETF prospectuses on one page. You can also find them under “fund literature,” which also typically includes shareholder reports and statements of additional information. Fidelity and other large companies also have dedicated pages that host all relevant fund literature.

In addition to company websites, the government has EDGAR , a database where you can access the filings all public companies make with the SEC, including prospectuses. This is where you’ll find information for regular companies that offer common stock. The database can be a little tricky to use, but this EDGAR guide can help you navigate the search function. It also has a glossary of the different form types you’ll find in the database.

And if you’re already a shareholder of a fund, you should receive a prospectus from the investment company and other financial documents on a periodic basis, as required by the SEC.

Where to find important information on a prospectus

When reviewing a prospectus, you’ll want to read through the risks associated with the investment, the company’s financials and management team, along with fees and expenses. The investment objectives and strategies are also important to review to see if they align with what you want and your risk tolerance .

Most prospectuses have a table of contents and are in PDF form, which means you can easily search for keywords using the (control + F) search function.

Bottom line

A prospectus is an important legal document that provides potential investors with information about a company’s investment offering. Investors should review prospectuses carefully to understand the risks associated with an investment and verify whether the company’s objectives align with their own. If you still have questions or concerns about a particular investment opportunity after reading a prospectus, consult a financial advisor for further guidance.

Related Articles

What is a broad-based index fund?

What are mutual funds?

What is a money market fund?

How to pick the best 529 plan

How to Write an Effective Business Sale Prospectus

When it comes to selling your business, a well-crafted business sale prospectus is essential for attracting potential buyers and getting the best price possible. A prospectus is a comprehensive document that showcases your business , its operations, financials, and future potential. With a perfect blend of storytelling and data, an effective prospectus can be the key to unlocking your business’s true value. In this detailed guide, we will discuss how to write an effective business sale prospectus, incorporating engaging headings, valuable insights, and best SEO practices to make your document stand out.

Understanding the Purpose of a Business Sale Prospectus

Before diving into the details, it’s crucial to understand the purpose of a business sale prospectus. A prospectus serves as a sales tool that provides potential buyers with an in-depth look into your business, its performance, and its growth prospects. By presenting a clear, concise, and compelling narrative, your prospectus can pique the interest of buyers and help you secure a successful sale.

Gathering the Right Information

To craft an impactful prospectus, you need to gather relevant information that highlights the strengths and potential of your business. This includes:

- Company history and background

- Business model and value proposition

- Market analysis and competitive landscape

- Financials and key performance indicators (KPIs)

- The management team and organizational structure

- Growth opportunities and future plans

Writing a Captivating Executive Summary

The executive summary is the first section of your prospectus and should grab the reader’s attention right away. It should provide an overview of your business and its key selling points, including:

- A brief introduction to your company and its mission

- A snapshot of your financial performance and growth trajectory

- Highlights of your competitive advantages and unique value proposition

- A summary of your business’s potential for future growth

Showcasing Your Business Model and Value Proposition

In this section, delve into the details of your business model and explain how your company generates revenue. Highlight the unique aspects of your value proposition and discuss how it differentiates your business from competitors. Use engaging headings and clear explanations to make this section easy to understand and navigate.

Analyzing Your Market and Competitive Landscape

Provide an overview of the market your business operates in, including market size, growth trends, and key customer segments. Identify your main competitors and discuss your business’s competitive advantages, such as superior products, services, or intellectual property. Use data-driven insights to showcase your market position and growth potential.

Presenting Financials and KPIs

A crucial aspect of your prospectus is the presentation of your financial information and KPIs. This section should include the following:

- Historical financial statements (income statement, balance sheet, cash flow statement)

- Financial projections and assumptions

- Key performance indicators relevant to your industry (e.g., customer acquisition cost, lifetime value, churn rate)

- Explanation of any irregularities or unique aspects of your financials

Highlighting Your Management Team and Organizational Structure

Introduce your management team and highlight their relevant experience and qualifications. Showcase their contributions to the company’s success and explain how they will continue to drive growth in the future. Also, provide an overview of your organizational structure, including key departments and roles.

Discussing Growth Opportunities and Future Plans

In this section, outline your plans for future growth and how potential buyers can capitalize on these opportunities. This might include expanding into new markets, developing new products or services, or leveraging strategic partnerships.

Crafting a Compelling Conclusion

Wrap up your business sale prospectus with a strong conclusion that reinforces your main selling points and entices potential buyers to take the next step. Summarize the key aspects of your business, its competitive advantages, and growth opportunities. Remind readers why your business is a valuable investment and encourage them to explore further by contacting you or your representatives.

Ensuring SEO Optimization and Readability

To ensure your prospectus ranks well in search engines and reaches a wider audience, implement SEO best practices:

- Incorporate relevant long-tail keywords throughout the document without overstuffing

- Use descriptive and engaging headings to break up sections and improve readability

- Optimize your document’s metadata, including title tags and meta descriptions, to enhance search engine visibility

- Keep paragraphs concise and use clear, straightforward language

Bonus Tip:Take the time to proofread and edit it thoroughly. Use tools like Grammarly.com to identify and fix grammar errors, and consider enlisting a professional editor or copywriter to ensure your document is polished and compelling.

Writing an effective business sale prospectus is a critical step in marketing your business and attracting the right buyers. By providing a comprehensive overview of your company’s history, value proposition, financial performance, and growth potential, you can showcase the unique aspects that make your business a valuable investment opportunity. Following the tips and best practices outlined in this guide, you can create a compelling prospectus that stands out from the competition and helps you secure the best possible price for your business.

Related Articles

How to Create a Business Plan That Investors Will Love

A compelling business plan is crucial for attracting investors and securing funding for your startup or existing business. With the right approach, you can create…

The Ultimate Guide to Writing a Successful Business Plan

In the highly competitive world of business, a well-crafted and comprehensive business plan is the cornerstone of success. It serves as a blueprint for your…

Finding Your Unique Selling Proposition: How to Stand Out Among Competitors

In a world where competition is fierce, businesses are left with a daunting task: to stand out among their competitors. This is where your Unique…

How to Sell a Business with Intellectual Property

There’s an unspoken mantra echoing through the entrepreneurial world: the value of a business often lies more in its intangible assets than the tangible. In…

How to create a financial plan for your small business

Running a small business requires dedication, hard work, and a solid financial plan. A comprehensive financial plan is crucial to the success of any small…

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Cancel reply

There was a problem reporting this post.

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

- Invite this member to groups

- Message this member

- Add this member as a connection

Please note: This action will also remove this member from your connections and send a report to the site admin. Please allow a few minutes for this process to complete.

Write an Investment Prospectus

Try our AI Legal Assistant - it's free while in beta 🚀

Genie's AI Legal Assistant can draft, risk-review and negotiate 1000s of legal documents

Note: Want to skip the guide and go straight to the free templates? No problem - scroll to the bottom. Also note: This is not legal advice.

Introduction

Creating a prospectus can be daunting and it is essential for investors and companies to ensure that it is accurate and compliant with applicable laws. A prospectus is a document provided by a company which outlines the offering of a security to potential investors; containing information about the firm’s past performance, current financial standing and future plans. It provides all the necessary details for investors to make an informed decision about whether or not to invest in said company, as well as safeguarding their investment by ensuring that the business is abiding by relevant regulations.

The prospectus also serves another purpose - to attract investors. By providing thorough information, it builds trust between them and the business while creating confidence in its legitimacy. This can be particularly beneficial for start-up organisations who may not have an established track record yet. For companies, having this document demonstrates their commitment to transparency and accountability which both increases credibility with stakeholders as well as establishing trust amongst them.

At Genie AI, we are here to help you make this process easier - providing detailed step-by-step guidance on how to create a secure legal template library without paying a lawyer fee along with access our free template library today! Our millions of datapoints teach AI what constitutes market-standard language for such documents; so whether you’re an experienced attorney or just starting out in writing your first draft – we’ve got you covered! With us, you can avoid any legal pitfalls whilst ensuring that you protect both yourself and your investors from potential risks down the line; no matter what stage your company is at. Read on below for more advice from Genie AI on how best to create an effective prospectus today!

Definitions (feel free to skip)

Executive Summary - A summary of the main points of a document that is typically located at the beginning of the document. Prospectus - A document that provides detailed information about an investment opportunity, including an overview of the investment, the management team, and the financial plan. Target Audience - The specific group of people that a document or message is intended for.

Understanding the Basics of Investment Prospectus Writing

Researching common prospectus formats, gaining an understanding of the basics of prospectus writing, defining your audience and goals, identifying who will be reading the prospectus, outlining the primary goal of the document, developing an outline and writing plan, brainstorming key points to include, organizing the points into a logical outline, establishing a timeline for writing the prospectus, crafting an effective executive summary, summarizing the main points of the document, highlighting the investment opportunity and its benefits, outlining the management team and operating structure, presenting the investment opportunity and its benefits, describing the investment opportunity in detail, explaining the potential benefits of the investment, presenting potential returns and roi, analyzing the market and the competition, researching the relevant market, identifying the competition, explaining the potential advantages of the investment, describing the management team, outlining the qualifications of key team members, describing the skills and experience of the management team, explaining the operating structure and financial plan, presenting the operating structure of the investment, outlining the financial plan for the investment, explaining the sources of funding, outlining the risk factors, identifying potential risks associated with the investment, explaining the strategies for mitigating those risks, finalizing and distributing the prospectus, proofreading and editing the document, formatting the document for printing or digital distribution, distributing the prospectus to the intended audience, get started.

- Learn about the purpose of an investment prospectus

- Review the SEC requirements for writing a prospectus

- Familiarize yourself with the key components of a prospectus, such as risks, fees, and performance

- Understand who the intended audience is for the prospectus

- Research different types of prospectus writing

Once you have a good understanding of the basics of investment prospectus writing, you can move on to the next step in the guide.

- Gather samples of investment prospectuses from various sources such as the SEC, investment banks, and other institutions

- Read through the samples to get an idea of the common format and structure

- Note the language and tone used in the prospectuses

- Identify the common topics and sections included in the prospectus

- Once you have a thorough understanding of the common prospectus formats, you can move on to the next step in the guide.

- Read up on the basics of investment prospectus writing, such as what should be included, how to structure it and what the various sections are

- Understand the purpose of a prospectus, which is to provide potential investors with information about a company’s financial situation and future plans

- Familiarize yourself with the Securities and Exchange Commission’s rules and regulations for creating a prospectus

- Research and analyze the competition to determine what other companies in the same industry are doing and how to make your prospectus stand out

- Know the different types of prospectuses (e.g. private placement memorandum, offering circular, private-placement letter)

You’ll know you’ve completed this step when you have a good understanding of the basics of prospectus writing, the purpose of a prospectus, SEC regulations, the competition, and the different types of prospectuses.

- Identify who is likely to read the prospectus (e.g. potential investors, investment analysts, etc.)

- Consider what the primary goals of the prospectus are (e.g. to inform, to persuade, etc.)

- Make sure the language used in the prospectus is suitable for the audience

- Tailor the content of the prospectus to the target audience

- Define the key message that you want to communicate to the reader

- When you are satisfied that the prospectus is written for the intended audience, with the goals in mind, you can move on to the next step.

- Identify the specific individuals or organizations who will be reading the prospectus.

- Research the background and interests of the readers to ensure that the correct tone and level of detail is used.

- Decide whether the prospectus should be tailored for each reader or sent out in a single version.

- When you have identified the readers and their needs, you can move on to the next step of outlining the primary goal of the document.

- Determine the primary goal of the document and state it clearly

- Outline the supporting information that will be included in the document

- Ensure the primary goal is clearly communicated and that the information is relevant and useful to the reader

- Review the outline and verify that it accurately reflects the goal of the document

- When the outline is finalized, the next step can begin

- Create a timeline for when each section needs to be completed

- Develop an outline for the document, including a list of topics to be covered in each section

- Consider the target audience when outlining the document

- Make a list of the information and research materials you will need to complete each section of the document

- Outline the structure of the document - what information will go at the beginning, in the middle, and at the end

- When you have an outline and writing plan in place, you will have a solid foundation for creating your investment prospectus

- Identify the purpose of the investment prospectus

- Look at the investor’s goals and needs

- Research the target market

- Identify key points of the investment

- Determine what financial data needs to be included

- Determine other information that should be included in the prospectus

- Research comparable investments in the same sector

- When you have a list of key points to include in the prospectus, check it off your list and move on to the next step.

- Create an outline that includes all the key points you brainstormed

- Decide on a flow that works best for the prospectus

- Group related points together in the outline

- Prioritize the points and determine which should be included in the introduction, body, and conclusion

- Check that the outline is organized in a logical and clear way

- When the outline is complete, you can move on to the next step of writing the prospectus.

- Gather the necessary information from the team and potential investors

- Decide on a timeline for the project and document it

- Set a schedule for each step of the process

- Assign tasks to project members and allocate sufficient time for each task

- Determine when the prospectus will be completed and when it will be shared with potential investors

- Track project progress to ensure completion on time

How you’ll know when you can check this off your list and move on to the next step:

- When all tasks associated with the prospectus are complete and the timeline is properly documented.

- Define the target audience of the executive summary

- Consider what information should be included in the summary

- Keep the summary concise and direct

- Highlight the most important points of the prospectus

- Focus on the benefits of investing

- Describe the company and its products or services

- Explain the unique value proposition of the company

- Include any competitive advantages

- Summarize the key financial and operational objectives

- Provide a conclusion that ties all the elements together

When you can check this off your list and move on to the next step:

- When you have incorporated all the key elements of an executive summary into your prospectus.

- Understand the purpose of the document and outline the main points you want to include

- Create a summary of the main points that is clear and concise

- Keep the summary short and straightforward

- Check for any information that is essential to understanding the document and make sure to include it in the summary

- Check for accuracy, clarity, and relevance

- Once you are satisfied with the summary, you can consider this step complete and move on to the next step.

- Describe the project in detail and explain why it’s a good investment opportunity

- Highlight the main points of the project, such as expected returns, potential risks, timeline, and any other relevant information

- Explain how the project will benefit investors, such as tax incentives, potential for growth, etc

- Include any other relevant details that make this project a viable option for investors

- You can check this off your list when you have all the necessary information included in the document and it is written in a clear and concise way.

- Create an executive summary of the investment opportunity and its benefits

- Identify the management team and what roles they will play

- Explain the structure of the business and how it will operate

- Detail the experience and qualifications of the management team

- Outline the organizational structure and how it will be managed

- Describe any relevant industry experience of the management team

- Provide a timeline of the activities needed to launch the business

Once you have outlined the management team and operating structure, you can move on to the next step in the guide.

- Provide a brief overview of the investment opportunity and the benefits it offers

- Explain why this investment opportunity is attractive and why investors should pursue it

- Identify the potential returns of the investment, including any potential risks

- Describe the competitive advantage the investment has over other opportunities

- Summarize the key points of the investment opportunity to create a compelling case

When you have provided an overview of the investment opportunity and its benefits, you will know you can check this step off your list and move on to the next step.

- Research the company, including its history, finances, management, competitive landscape, and other relevant factors

- Outline the potential for returns and risks associated with the investment

- Describe the investment opportunity in detail, including an overview of the company, its potential markets, products or services, and its competitive advantage

- Provide an analysis of the potential for return on investment

- Explain the potential risks associated with the investment

When this step is complete, you should have a clear and comprehensive description of the investment opportunity and its potential risks and rewards.

- Outline the long-term benefits of the investment, including how it is likely to increase in value over time

- Discuss the different types of returns that investors can expect to receive

- Explain the tax benefits associated with the investment, if any

- Describe the potential social, environmental, or economic benefits of the investment

- Highlight any other potential benefits that the investment could bring

You will know you are finished with this step when you have included all potential benefits of the investment in your prospectus.

- Gather all of the necessary information about the investment including past performance, current market trends, and future projections

- Determine the expected return on investment (ROI) for the investment and present it in the prospectus

- Calculate the potential risk associated with the investment

- Present a realistic timeline for when the investor can expect to see returns

- Explain the potential tax implications and the investor’s responsibility to pay taxes

When you have completed this step, you will have presented realistic potential returns and ROI, as well as the associated risks and timeline.

- Research the current market trends for the investment category, as well as competitors in the space

- Evaluate the strengths and weaknesses of the competition in relation to the investment you are offering

- Research the overall environment of the target market you have identified, including any external factors that may influence the success of the investment

- Use surveys, focus groups, interviews, etc. to gather insights on how the market perceives the investment you are offering

- Analyze the data you have collected to identify any potential opportunities or threats to the success of the investment

- When you have completed your analysis, you should have a good understanding of the current market situation and how your investment will fit into it.

- Gather data on the industry, such as market size, growth rate, potential customers, and potential competitors

- Research the current competitive landscape and identify possible opportunities or threats

- Analyze the industry and market to determine any potential trends

- Identify any external factors that could influence the market

- When you have a thorough understanding of the industry and its dynamics, you will be ready to move on to the next step.

- Research the competition in the target market to identify their strengths, weaknesses, and potential threats

- Make note of any potential obstacles or challenges posed by the competition

- Analyze the strategies of the competition to identify any potential opportunities

- Note any industry trends, pricing strategies, and customer service approaches of the competition

- When you’ve identified the competition, their strengths, weaknesses, opportunities, and threats, as well as industry trends, pricing strategies, and customer service approaches, you can check this step off your list and move on to the next step.

- List the potential advantages of the investment in bullet point format

- Outline the potential returns of the investment

- Explain why investors should consider this investment

- Provide a summary of the potential benefits of the investment

- Once you have listed and explained the potential advantages, you can check this step off your list and move on to the next step: Describing the Management Team.

- List the qualifications of the executive team members

- Identify any key personnel that are not part of the executive team, but who are integral to the success of the project

- Describe the experience of the executive team members related to the business being pursued

- Demonstrate the ability of the executive team to successfully manage the business being pursued

- Outline any other relevant qualifications that the executive team members possess

- Once you have outlined the qualifications of the executive team, you can move on to the next step of outlining the qualifications of key team members.

- Gather the resumes of each key team member.

- Outline the qualifications of each key team member, such as their education, licenses, and experience in the investment industry.

- Include any other qualifications that the team members have that may be pertinent to the investment prospectus.

- Use an easily readable format and include relevant information such as titles, years of experience, and specialties.

When you can check this off your list:

- When all of the qualifications of each key team member have been outlined in the investment prospectus.

- Research the qualifications and experience of the management team

- Describe each team member’s role in the company and their experience in the industry

- Outline how each team member’s skills and experience will help the company achieve its goals

- Describe the qualifications and experience of any consultants used by the company

- When you are finished, you can proceed to the next step of explaining the operating structure and financial plan

- Outline the operating structure of the investment, including roles and responsibilities

- Explain the financial plan, including revenue streams and budgeting

- Include any financial projections and forecasts

- Describe any risks associated with the investment

- Explain how you plan to measure and monitor performance

- Include any information about capital requirements or investors

Once you have outlined the operating structure, explained the financial plan and included any financial projections and forecasts, you can move on to the next step.

- Outline the strategy for the investment

- Describe the operational structure of the investment

- Explain the roles and responsibilities of the different parties involved

- Include any relevant documents and information to support the operating structure

- Assess any risks associated with this structure

- Include any relevant legal documents associated with the structure

Once all the information is gathered, reviewed and organized, you can mark this step as complete and move on to the next step - outlining the financial plan for the investment.

- Research historical financial data of current investments

- Identify any potential risks associated with an investment

- Estimate expected return on investment

- Estimate liquidity and cash flow of the investment

- Estimate the investment’s future performance

- Calculate the return on equity

- Prepare a financial plan

When you have completed the above steps, you can check it off your list and move on to the next step.

- List the sources of funding, such as debt, equity, grants, and lines of credit.

- Identify the terms of the different sources of funding, such as the interest rate, payment schedule, and any collateral required.

- Summarize the sources of funding and the terms associated with them in the investment prospectus.

- Check whether you have provided a complete overview of the sources of funding for the investment when you finish summarizing them.

- Identify all of the potential risks associated with the investment, such as market volatility, liquidity, or other external factors

- List the risks and potential consequences for the investor

- Provide any details or information about the risks that could be helpful in understanding them

- Outline any strategies that can be used to mitigate or lessen the risks

- When all risks have been identified and outlined, you can move on to the next step in writing the investment prospectus – identifying potential risks associated with the investment.

- Analyze the investment from both an internal and external viewpoint to identify potential risks

- Research and analyze the industry, market, and regional environment where the investment is located

- Review existing and future competition to identify potential risk areas

- Evaluate potential legal and regulatory risks

- Consider the potential operational and financial risks

- Make sure to take a holistic view of the investment, considering all potential risks

- When you have identified and analyzed all potential risks, you can move on to the next step of outlining the risk factors.

- Research the investment and analyze the potential risks associated with it

- Develop strategies to minimize the risks, such as diversification or hedging

- Outline the strategies in the prospectus

- Provide a brief summary of each strategy

- Include any supporting documents if necessary

- Once you have outlined the strategies and their respective summaries, you can move on to the next step.

- Gather all materials needed for the prospectus, such as the executive summary, financial information, and other information that was gathered from previous steps.

- Create a cover page for the prospectus that includes the name of the company and key individuals involved.

- Gather the contact information for all recipients of the prospectus.

- Distribute the prospectus electronically or via physical mail.

- Follow up with the recipients to ensure they received the prospectus and to answer any questions they have.

When you have completed the above steps, you will have finalized and distributed the prospectus. You can then check this off your list and move on to the next step.

- Read through the prospectus a few times to check for any typos, grammar errors, or formatting issues.

- Have someone else read the prospectus to give a fresh set of eyes, and to catch any errors you may have missed.

- Make any necessary edits or changes to the prospectus.

- When the prospectus is free of any errors and has been approved, you can check this step off your list and move on to formatting the document for printing or digital distribution.

- Select a paper size and format that best suits your document

- Choose a font type and font size that is appropriate for the document

- Adjust the margins, page layout, and page numbering

- Ensure that all images, charts, and tables are properly inserted and sized

- Insert headers and footers if desired

- Preview the document to ensure that it looks as intended

Once you have proofread and formatted the document, you can be confident that it is ready for printing or digital distribution.

- Gather contact information for potential investors

- Determine the best method for distributing the prospectus (email, mail, etc.)

- Compose the email and/or letter to accompany the prospectus

- Send the prospectus to the intended audience

- Track responses and follow up as needed

- When all of the intended recipients have received the prospectus and any accompanying materials.

Example dispute

Lawsuits referencing prospectus.

- A plaintiff may raise a lawsuit against a company referencing a prospectus if the prospectus contains inaccurate or misleading information that results in the plaintiff suffering financial losses.

- The plaintiff must be able to prove that the company was aware of the false or misleading information in the prospectus and that it was material to the decision of the plaintiff to purchase the security.

- Civil liability may arise if the company did not properly update the prospectus with any material changes after the problems were identified by the company.

- If the lawsuit is successful, the plaintiff may be able to recover their losses in full, plus interest, and any punitive damages awarded by the court.

- In order to win the case, the plaintiff must show that the false or misleading information in the prospectus was the direct cause of their financial losses.

Templates available (free to use)

Aim Listing Verification Notes Admission Documents Or Prospectus Consent Letter From Mentioned Parties Prospectus Regulation Rules Forward Looking Statements Ipo Prospectus Legend Free Writing Prospectus For Registered Equity Offerings Free Writing Prospectus For When You Upsize Or Downsize Your Ipo Memo On Directors Responsibilities Regarding A Prospectus Secondary Offer Prospectus Content Outline

Helpful? Not as helpful as you were hoping? Message me on Linkedin

Links to get you started

Our AI Legal Assistant (free while in beta) Contract Template Library Legal Clause Library

Try the world's most advanced AI Legal Assistant, today

- Can this simulation giant stay relevant long into the future?

- Can Open Text continue to carve a niche for itself in the realm of enterprise information management?

- The Rise Of Barrick Gold And How The Company Plans On Successfully Plotting Its Course Forward

- Can NioCorp Develop Critical Minerals Sustainably While Providing Shareholders With Returns In The Long Run?

- Patriot Battery Metals: Leading the Charge in Lithium Exploration?

Understanding a prospectus

- by StockWire

- April 7, 2023

A prospectus – what exactly is it?

In short, a prospectus is a legal document that informs the public and potential investors about the planned release of a new security which could be anything from stocks and ETFs (exchange traded funds) to mutual funds and bonds. The prospectus will reveal information about the company that investors will want to take into account before they potentially invest in the security.

The prospectus will contain information about facets like the management team of the company, financial performance, potential growth and more that will help investors to make better decisions with regards to their risk tolerance. The SEC (Securities and Exchange Commission) requires companies to submit this document before going public with their security.

How a prospectus works

We know what a prospectus contains but how does the process actually work? Well, a company will first need to submit a preliminary prospectus which is filed before the company plans to take their security public.

This preliminary prospectus is basically used to gauge the temperature of interest from potential investors. The preliminary prospectus is the one that will contain all of the information about the company for potential investors to take into account. However, it will not contain information like how many outstanding shares will become available or what the starting share prices will be.

When the company feels they have enough information, they will then file their final prospectus when their security is actually ready to officially go public. The final prospectus will contain all of the relevant information about pricing and share volume that the preliminary prospectus left out.

It’s worth noting that companies will file a prospectus to also share information about some of the risks involved with purchasing their security. It’s important that they do this to some degree as the prospectus is actually there to also protect companies from any claims that they did not fully disclose pertinent information about their financial status or potential growth. (1) U.S. Securities and Exchange Commission. "What Is a Registration Statement?"

Types of prospectuses

We have touched on the fact that companies need to issue a preliminary and final prospectus before they can take their security public. However, there are actually a number of different types of prospectuses. Let’s take a brief look at some of the different types of a prospectus that one can find.

An abridged prospectus: in short, one could call this a “summary prospectus.” It is basically just a reader-friendly document that contains the information of the company and its security in simpler terms.

A deemed prospectus: there are times where a company may opt against selling their securities directly to the public. If this is the case, they will use an issuing house to handle the task of issuing their prospectus. This would be known as a deemed prospectus.

A mutual fund prospectus: as the name suggests this is based on mutual funds or ETFs. The mutual fund prospectus will issue information on the fund’s overall objectives, investment strategies, past financial performance, the distribution policy of the funds, potential risks and information on the management team. `

A shelf prospectus: a shelf prospectus is when a company issues a prospectus that contains information on several different securities, all at once. This is also known as “shelf registration.” The “shelf” in the name refers to the shelf life of the prospectus, as it generally only lasts for a year.

A statutory prospectus: one could consider a statutory prospectus to be a mixture of the abridged prospectus and the mutual fund prospectus. This is because it provides a summary of ETF or mutual funds securities but in much greater detail.

The varying components of a prospectus

We have briefly touched on some of the information you can find in a prospectus but there are several other factors to consider. In addition to some of the points we have touched on, let’s take a look at some of the other key components that you can find within a company’s prospectus. By knowing what the components of a prospectus are, you will be better equipped to read and understand them.

General overview and history: as we noted earlier, a company will include information on their history and some of their past accomplishments as a company as well. This will include what strategies have helped them achieve success in the past, what their financial history looks like and what the unique selling point of the company is that helps them stand out from the competition.

Financial information: a company may then include a closer look at financial performance over a specified period of time. This could include things like stock performance and the gross and net profit of the company in that time.

Deal structure: you will typically find that companies who have issued securities in the past will make sure to add this in their future prospectuses. The prospectus will include information about the capital structure of the company with details on the company’s debt, equity and how investor participation will impact the deal structure. It will also make it clear what the company would ideally like their future capital structure to look like as well.

Information on management: on a more basic level, the company will include information about their higher level executives in the company, where they received their education and qualifications from and how the executives seek to protect the company’s investments.

Securities offering: the prospectus will detail the two types of securities that a company can offer investors, namely debt securities and equity securities. This additional round of potential investment will be detailed in the prospectus and will show what the potential rates on the securities will be.

Risk potential: a company’s prospectus will also include any risk potential of investing in the security. This will show the investor what issues they may face with regard to government regulations or capital restrictions.

Products and services: this part is fairly basic, it’s simply where the company will highlight what they may include to sell to the public.

Plan for capital intake : this will be a detailed look at what the company plans to do with the investments it receives for its security once it goes public. This could include what new products it intends to finance or what it plans to expand the company.

Prospectus FAQs

How does a prospectus serve the public.

A prospectus is vital for potential investors in the public as it gives you crucial information about the company that is about to issue a security. Not only do you receive information on the previous financial standing of the company but you also receive information on potential risks of purchasing the security they are about to go public with.

Is there more than one kind of prospectus?

Yes, for the most part you will typically be dealing with a preliminary and a final prospectus. However, as we mentioned earlier on, there are varying degrees of a prospectus when used for things like ETFs. mutual funds or for limited periods of time.

Who regulates these prospectuses and can they be trusted?

All company prospectuses in the US are regulated and filed by the SEC. No company in the US can issue a public security without going through the SEC first with their preliminary and final prospectuses. You can trust that the SEC has rigorously combed through these prospectuses to ensure the information is accurate.

Stockwire Inc. does not hold a position in the securities and/or financial instrument(s) mentioned herein, has not received any compensation, whether in securities or monetary form, for the content of this publication by any company mentioned herein and does not stand to benefit from any volume generated by this publication. Stockwire Inc. and its authors do not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. Any information, opinions or views provided in this document, including hyperlinks to the Stockwire website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Stockwire Inc. or its affiliates. You should conduct your own research and consult with your qualified advisor before taking any action based upon the information contained in this document. Stockwire Inc. and its affiliates do not accept any liability for any for any investment decisions made based on the information provided in this document. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the Stockwire Inc. website. For more information on our terms and conditions of use, please see stockwire.com/terms/ and stockwire.com/privacy/ and stockwire.com/disclaimer/

Many investors express regret for not paying attention to the companies when they were first reviewed by the StockWire.

These companies have certainly had a successful run, but there are other companies that are worth considering as well. Our team believes that some companies are currently undervalued and represent a good opportunity.

You can get a free copy of our Research report called InsightWire for a limited time by filling out your e-mail address below.

I have read and agree to the Terms and Conditions and Privacy Policy

Whatsapp Newsletter Alert

Alternatively, you may consider subscribing to our WhatsApp Newsletter for direct updates straight to your WhatsApp. By simply clicking on this link and sending us a brief message , you can stay up-to-date with our latest insights. This way, as soon as our newsletter is published, you'll receive an immediate notification, ensuring you never miss out on our valuable content.

We will contact you soon.

You might also like

Everything you need to know about investing in index

Different types of stocks

Meme Stocks – what are they?

Listing requirements and what they mean

What are Small Cap and Big Cap Stocks?

Earnings Reports

Privacy overview.

- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Finance and Business

- Business Skills

- Business Writing

How to Write a Prospectus

Last Updated: February 5, 2024 Fact Checked

This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD . Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006. There are 10 references cited in this article, which can be found at the bottom of the page. This article has been fact-checked, ensuring the accuracy of any cited facts and confirming the authority of its sources. This article has been viewed 136,734 times. Learn more...

A prospectus is, in effect, a research proposal. The purpose of this document – be it a single page or dozens of pages long – is to sell your idea to the appropriate professor or research committee. You may be writing a prospectus for an undergraduate research project, a grad school study, or a doctoral dissertation. A prospectus also is used to apply for grants or other funding from universities or nonprofit organizations. [1] X Trustworthy Source Investor.gov Website maintained by the Securities and Exchange Commision’s Office of Investor Education and Advocacy providing free resources about investing. Go to source

Things You Should Know

- State your topic of study and the questions you intend to answer; then, explain how and why your study will answer those questions.

- Outline the chapters of your prospectus and each stage of research, and include an estimate of the project's costs and timeline.

- Use standard formatting unless otherwise instructed, with a table of contents and bibliography.

- Carefully proofread your prospectus before submitting it for evaluation.

Describing the Goals of the Study

- Your topic isn't as broad as an entire subject such as history or sociology. Rather, you're going to list a specific aspect of that subject, such as "The Causes of World War II" or "The Impact of Globalization in Latin America."

- This topic generally would be far too broad to write a single paper (or even a single book) about and even begin to cover it in a more than superficial manner.

- In a shorter prospectus, such as for an undergraduate research paper, you typically won't need to devote more than a sentence to your topic before moving on to your research questions.

- Before you start formulating your questions, you may want to look at other research projects in your discipline to get a good idea of the types of questions typically asked.

- For example, a history question may involve extensive research and synthesis of that research to discover any patterns that may emerge.

- In contrast, questions in the social sciences such as political science may be based more on data gathering and statistical analysis.

- In a short prospectus, this may simply be a bullet-point list of specific questions you expect to address through your research.

- A longer prospectus, such as a grant proposal or dissertation prospectus, typically devotes several pages to discussing the specific questions that your research will address.

- The more advanced you are in your discipline, the more crucial this portion of your prospectus is going to be.

- If you're writing a prospectus for a research project in an undergraduate course, your professor likely won't expect you to contribute something new or profound to the field. However, graduate research and dissertations typically attempt to make a unique contribution to the area.

- You may need to do some preliminary research before you can write this portion of your prospectus, particularly if you believe you are the only person ever to do research seeking specifically to answer the questions you've listed.

- Any statement you make regarding the importance of your research should be supported by research, and you should be able to defend those assertions to the people reviewing your prospectus.

- You want your thesis statement to be as clear as possible. If you find it difficult to craft a clear answer to the questions you've presented, it may be that your questions aren't as clear as they could be.

- Keep in mind that if your question is vague or muddled, you're going to have a hard time coming up with a clear, definitive thesis statement.

- At this level, you're not just selling your idea, you're also selling your own knowledge, passion, commitment, and skills as a researcher to find the answers you seek.

- For grant applications, information about yourself as a person and your personal interest in the topic you plan to research also can be important. When deciding which projects to fund, having a personal commitment or dedication to a particular issue may give you an edge.

- Depending on the type of research you plan to do, you also may have to outline your position and your access or ability to gather various types of information, such as archives or classified documents.

Explaining the Organization of the Study

- Keep in mind that this is just a plan – nothing's set in stone. At this early stage, your paper likely will change as you get into your research or start gathering the data and crunching numbers to work on your project.

- You can create specific paragraphs or an outline, or you can write this section in a single seamless narrative. For shorter papers, that's probably all this section will be – essentially a couple of paragraphs that tell the readers how you anticipate you'll organize the final report on the project.

- For example, if you're doing a statistical analysis, you must first gather the data, then compile statistics from that data, then analyze the statistics you create.

- For scientific experiments, this is the place where you'll describe the steps in the experiment.

- If you're doing a project in the humanities, the stages of your research may not be as clear-cut as they would be if you were doing a research project for a more scientific discipline.

- For graduate research projects or dissertations, the timeframe may be more open-ended. In these situations, you should provide an estimate in your prospectus of when you believe your project will be completed.

- Coming up with a timeline and ultimate deadline of when the research will be completed is particularly important if you're applying for a grant.

- How long you think it will take to complete your research affects the feasibility of the project, which is ultimately how your prospectus will be evaluated. Be realistic in what you can do within the time constraints you have.

- Keep in mind that while you may be able to get an extension if your research ends up taking longer than you anticipated in your prospectus, you also may be expected to justify the reasons you need more time or explain why the initial estimate in your prospectus was incorrect.

- This is especially important if you're applying for a grant, as the people who review your prospectus will want a detailed breakdown of what you intend to do with the money if you're awarded the grant.

- Typically you'll need to include expenses such as fees for access to archives or for copying, any costs for data collecting, and rentals of lab or other equipment.

- You also should include a list of any resources you plan to use for which you anticipate there being no cost, such as use of the university library or computers and employment of student volunteers.

Formatting Your Prospectus

- The guidelines also typically will include details on which citation method you should use, and may include details on using a particular style guide that will govern word usage, grammar, and punctuation rules.

- Your assignment information also may specifically state how long each section is supposed to be, and which sections must be included.

- Type your prospectus in a standard, legible font such as Times New Roman or Helvetica.

- Typically you'll have one-inch margins on all sides of the paper, and your text will be double-spaced. Include page numbers if your prospectus is more than one page.

- Follow the guidelines from your professor or department in regard to creating a cover sheet or using special formatting or headers on the first page.

- If footnotes or end notes are required, set these up in your word processing app before you start working on your prospectus.

- The table of contents essentially is a list of chapters for your final report, and gives the readers of your prospectus an idea of what the final report will look like and how long it will be.

- Some professors or departments require an annotated bibliography, in which you not only cite the sources you plan to use but provide a detailed description of what the source is and how it fits into your research.

- Check the guidelines from your professor or department to make sure you're using the correct citation method for your bibliography.

- Reading your prospectus backwards is a good way to proofread and catch errors you might have missed otherwise.

- In addition to editing for grammar and punctuation, you also should check your language carefully. Make sure everything is written in a formal, professional tone.

- Keep your audience in mind as you edit. While you may be writing your prospectus for professors or a department committee that has full understanding of your project's topic, you shouldn't assume any particular level of understanding. Rather, your prospectus should be written so that it can be understood by a generally intelligent person without any special knowledge in your field.

Expert Q&A

- Be realistic about what you can accomplish through your research. Writing a prospectus that seems narrow in scope, but feasible, is better than writing a prospectus that seems overly ambitious and impractical. Thanks Helpful 0 Not Helpful 0

- Don't worry if your final paper or study ends up deviating from your prospectus. This often happens when you get further into your research, and is to be expected. Thanks Helpful 0 Not Helpful 0

You Might Also Like

- ↑ https://www.investor.gov/introduction-investing/investing-basics/glossary/prospectus

- ↑ https://www.wichita.edu/academics/fairmount_college_of_liberal_arts_and_sciences/english/deptenglish/WritingaResearchProspectus.php

- ↑ https://english.washington.edu/sites/english/files/documents/ewp/academicresearchpapersequence_grollmus.pdf

- ↑ https://www.slu.edu/arts-and-sciences/theological-studies/student-resources/pdfs/prospectus-template.pdf

- ↑ https://writing.wisc.edu/handbook/assignments/planresearchpaper/

- ↑ https://poorvucenter.yale.edu/writing/graduate/writing-through-graduate-school/prospectus-writing

- ↑ https://www.investor.gov/introduction-investing/investing-basics/glossary/mutual-fund-fees-and-expenses

- ↑ https://examples.yourdictionary.com/reference/examples/table-of-content-examples.html

- ↑ https://www.sciencebuddies.org/science-fair-projects/science-fair/writing-a-bibliography-examples-of-apa-mla-styles

- ↑ https://academicguides.waldenu.edu/writingcenter/writingprocess/proofreading

About This Article

- Send fan mail to authors

Reader Success Stories

Laura Matamoros

Aug 10, 2019

Did this article help you?

May 11, 2016

Jul 31, 2017

Sep 25, 2017

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

Don’t miss out! Sign up for

wikiHow’s newsletter

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Business How to Write Business Proposal (Examples + Free Templates)

How to Write Business Proposal (Examples + Free Templates)

Written by: Aditya Sheth Jan 25, 2024