800-556-9393

800-324-6370

Home » Articles Library » 2 Ways to Transfer Ownership of a Life Insurance Policy

2 Ways to Transfer Ownership of a Life Insurance Policy

As property, policyowners can transfer their life insurance contracts to other persons or entities. A policyowner can transfer either all or only some of the “bundle of rights” that comprises a life insurance policy to almost any person or entity.

The two basic ways of making a lifetime transfer of a policy are: (1) the absolute assignment; and (2) the collateral assignment. An absolute assignment, as its name implies, transfers all the policyowner’s rights irrevocably. A collateral assignment, again as its name implies, assigns so much of the death benefit as necessary for as long as necessary to secure a lender’s rights. But no more of the proceeds will go to the lender than the amount of debt owed.

Requirements

The assignment does not have to be of any particular form (absent specific provisions in state law or the contract to the contrary). Because life insurance is treated as personal property, policyowner may transfer ownership rights, not only by many different types of documents, but also by many different actions. For example, if a person sells a business and the business owns a life insurance policy, the sale of all the assets of the business carries with it the personal property the business owned – including the life insurance.

Likewise, a property settlement in connection with a divorce may have the effect of transferring the ownership of life insurance on the life of one or the other (or both) spouse(s) even though no one ever uses the word “assignment” with regard to these transfers. But this type of transfer (where a clause in the divorce decree disposes of life insurance) is both very dangerous and very awkward. If a policyowner names his new spouse as beneficiary of the insurance proceeds and the insurer has no notice or knowledge of the divorce decree’s change, both spouses are likely to claim the proceeds. Furthermore, if the decree requires the policyowner spouse to maintain the policy for the benefit of his or her ex-spouse, the policyowner cannot obtain a policy loan-even to keep the policy in force through a premium loan.

Before either the absolute or collateral type of assignment or any other instance of a policy ownership transfer is valid, the policyowner must notify the insurer (and, where required by the terms of the contract, the insurer must consent to the assignment). Once notified in writing at the insurer’s home office, the insurer must honor the policyowner’s transfer—unless the terms of the contract itself forbid assignments. So if the insurer then disregards (by intention or neglect) the assignee’s rights and makes payment to someone else, the courts may force the insurer to make a second payment to the assignee. If the policyowner gives no notice to the insurer, it will be protected in a transaction initiated by a former owner. For instance, if the former owner applies for a policy loan and he has not given the insurer proper notice that he had assigned the policy, the insurer is protected in making that loan.

The insurer does not, however, have to verify the bona fides of the transaction between the policyowner and the transferee nor the validity of the transaction. In other words, the insurer is not accountable for the mental or legal capacity of the policyowner to make the assignment (unless it had knowledge that the policyowner was not legally competent to make it or there were irregularities in the assignment form).

Absolute Assignments

Policyowners use an absolute assignment in life insurance planning when the policyowner wants to sell or give away all of his or her rights under the contract. The goal might be to obtain valuable consideration, to save estate taxes, avoid creditors, or purely for love and affection and to assure the transferee of financial security. There are many common examples of sales and gifts:

- A client might sell a policy on his life to his business.

- A business might sell a policy on an employee’s life to the employee or to the employee’s spouse or child or trust (or to a pension plan).

- A shareholder might sell a policy on his life to a new business associate.

- A client might give a policy on her life to her spouse.

- A client might give a policy on his life to his children or to a family trust.

Tax Implications

Both sales and gift transactions have important and sometimes unexpectedly expensive tax implications. Planners should thoroughly research before allowing any sale of a life insurance policy. Also, understand what should be considered before allowing a client to make a gift of a policy. A valid gift requires that the donor have contractual capacity and intent to make a voluntary gratuitous transfer and the gift must be delivered to and accepted by the donee (assignee).

Nontax Implications

Planners must be aware of the nontax implications of an absolute assignment in order to avoid them and/or alert the client to their potential effect. Some of these are:

Although an absolute assignment itself may not per se change the interest of a revocable beneficiary, as a practical matter the new owner can immediately change the beneficiary and often makes that change almost simultaneously with the assignment. Some absolute assignment forms state that the new owner is automatically the primary policy beneficiary until the new owner makes a change to the beneficiary designation.

If the policyowner made an irrevocable beneficiary designation before making an absolute assignment of the policy, in most states the assignment will not defeat that designation (without the written consent of the beneficiary) and the transferee should be apprised of this fact.

Absolute assignments may put the policy and its proceeds beyond the claims of the policyowner’s creditors, but planners should inform policyowner that—like diamonds—an absolute assignment is forever. There is a loss of both control and flexibility from the transferor’s viewpoint.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Copyright ©1984-2024 Life Quotes, Inc., and/or Life Quotes Partners, LLC, 850 North Cass Avenue, Suite 102, Westmont, Illinois, 60559. Life Quotes, Inc. and certain of its personnel are licensed as insurance agents, brokers or producers in all states. CA agent #0A13858, LA agent #200696 , MA agent #1746830 . CA under agency #0827712 dba Quotes for Life Insurance Agency, LA agency #205078 dba Life Quotes Inc, UT agency #90093 . All rights reserved. Telephone (630) 515-0170. Founded 1984.

Life insurance policies described, quoted, shown and illustrated throughout this website are not available in all states and may include those issued by: Life insurance policies described, quoted, shown and illustrated throughout this website are not available in all states and may include those issued by: American Family Life Insurance Company, Madison, WI; American General Life Insurance Company, Houston, TX and The United States Life Insurance Company in the City of New York, NY, both AIG companies; American National Insurance Company, Galveston, TX; American National Insurance Company of New York, Glenmont, NY; Assurity Life Insurance Company, Omaha, NE and Assurity Life Insurance Company of New York, Albany, NY; Banner Life Insurance Company, Frederick, MD, and William Penn Life Insurance Company, Garden City, NY, both Legal & General America companies; Boston Mutual Life Insurance Company of Boston, MA; Columbian Life Insurance Company, Chicago, IL and Columbian Mutual Life Insurance Company, Binghamton, NY, both members of Columbian Financial Group of Binghamton, NY; Fidelity Life Association, A Legal Reserve Life Insurance Company, Oak Brook, IL; Globe Life Insurance Company of New York, Syracuse, NY; Gerber Life Insurance Company, White Plains, NY; Globe Life and Accidental Insurance Company, Omaha, NE, a holding company of Torchmark Corporation, McKinney, TX; Foresters Financial, Buffalo, NY; John Hancock Life Insurance Company (USA), Boston, MA; Lafayette Life Insurance Company, Cincinnati, OH; Lincoln Life & Annuity Insurance Company of New York, Syracuse, NY and The Lincoln National Life Insurance Company, Fort Wayne, IN, both insurance company affiliates of Lincoln National Corporation, whose marketing name is Lincoln Financial Group; Minnesota Life Insurance Company of St. Paul, MN and Securian Life Insurance Company of St. Paul MN, both part of the Securian Life Insurance Company of St. Paul MN; Mutual of Omaha Insurance Company, Omaha, NE, United of Omaha Life Insurance Company, Omaha, NE, and Companion Life Insurance Company, Hauppauge, NY all Mutual of Omaha affiliate companies; North American Company for Life & Health Insurance, West Des Moines, IA; Pacific Life Insurance Company, Omaha, NE; Penn Mutual Life Insurance Company, Horsham, PA; Principal Life Insurance Company, Des Moines, IA; Protective Life Insurance Company and Protective Life and Annuity Insurance Company, Birmingham, AL; Pruco Life Insurance Company, Newark, NJ and Pruco Life Insurance Company of New Jersey, Newark, NJ, member companies of Prudential Financial, Inc., Newark, NJ; Sagicor Life Insurance Company off Austin, TX a member of the Sagicor Financial Corporation of Austin, TX; The Savings Bank Mutual Life Insurance Company of Massachusetts, Woburn, MA and Centrian Life Insurance, Woburn, MA (SBLI and The No Nonsense Life Insurance Company are registered trademarks of The Savings Bank Mutual Life Insurance Company of Massachusetts, which is in no way affiliated with SBLI USA Mutual Life Insurance Company, Inc.); Transamerica Financial Life Insurance Company, Harrison, NY, and Transamerica Life Insurance Company, Cedar Rapids, IA, both AEGON companies; United American Insurance Company, McKinney, TX.

- Search Search Please fill out this field.

- Life Insurance

- Definitions

What Is a Collateral Assignment of Life Insurance?

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

The advantage to using a collateral assignee over naming the lender as a beneficiary is that you can specify that the lender is only entitled to a certain amount, namely the amount of the outstanding loan. That would allow your beneficiaries still be entitled to any remaining death benefit.

Lenders commonly require that life insurance serve as collateral for a business loan to guarantee repayment if the borrower dies or defaults. They may even require you to get a life insurance policy to be approved for a business loan.

Key Takeaways

- The borrower of a business loan using life insurance as collateral must be the policy owner, who may or may not be the insured.

- The collateral assignment helps you avoid naming a lender as a beneficiary.

- The collateral assignment may be against all or part of the policy's value.

- If any amount of the death benefit remains after the lender is paid, it is distributed to beneficiaries.

- Once the loan is fully repaid, the life insurance policy is no longer used as collateral.

How a Collateral Assignment of Life Insurance Works

Collateral assignments make sure the lender gets paid only what they are due. The borrower must be the owner of the policy, but they do not have to be the insured person. And the policy must remain current for the life of the loan, with the policy owner continuing to pay all premiums . You can use either term or whole life insurance policy as collateral, but the death benefit must meet the lender's terms.

A permanent life insurance policy with a cash value allows the lender access to the cash value to use as loan payment if the borrower defaults. Many lenders don't accept term life insurance policies as collateral because they do not accumulate cash value.

Alternately, the policy owner's access to the cash value is restricted to protect the collateral. If the loan is repaid before the borrower's death, the assignment is removed, and the lender is no longer the beneficiary of the death benefit.

Insurance companies must be notified of the collateral assignment of a policy. However, other than their obligation to meet the terms of the contract, they are not involved in the agreement.

Example of Collateral Assignment of Life Insurance

For example, say you have a business plan for a floral shop and need a $50,000 loan to get started. When you apply for the loan, the bank says you must have collateral in the form of a life insurance policy to back it up. You have a whole life insurance policy with a cash value of $65,000 and a death benefit of $300,000, which the bank accepts as collateral.

So, you then designate the bank as the policy's assignee until you repay the $50,000 loan. That way, the bank can ensure it will be repaid the funds it lent you, even if you died. In this case, because the cash value and death benefit is more than what you owe the lender, your beneficiaries would still inherit money.

Alternatives to Collateral Assignment of Life Insurance

Using a collateral assignment to secure a business loan can help you access the funds you need to start or grow your business. However, you would be at risk of losing your life insurance policy if you defaulted on the loan, meaning your beneficiaries may not receive the money you'd planned for them to inherit.

Consult with a financial advisor to discuss whether a collateral assignment or one of these alternatives may be most appropriate for your financial situation.

Life insurance loan (policy loan) : If you already have a life insurance policy with a cash value, you can likely borrow against it. Policy loans are not taxed and have less stringent requirements such as no credit or income checks. However, this option would not work if you do not already have a permanent life insurance policy because the cash value component takes time to build.

Surrendering your policy : You can also surrender your policy to access any cash value you've built up. However, your beneficiaries would no longer receive a death benefit.

Other loan types : Finally, you can apply for other loans, such as a personal loan, that do not require life insurance as collateral. You could use loans that rely on other types of collateral, such as a home equity loan that uses your home equity.

What Are the Benefits of Collateral Assignment of Life Insurance?

A collateral assignment of a life insurance policy may be required if you need a business loan. Lenders typically require life insurance as collateral for business loans because they guarantee repayment if the borrower dies. A policy with cash value can guarantee repayment if the borrower defaults.

What Kind of Life Insurance Can Be Used for Collateral?

You can typically use any type of life insurance policy as collateral for a business loan, depending on the lender's requirements. A permanent life insurance policy with a cash value allows the lender a source of funds to use if the borrower defaults. Some lenders may not accept term life insurance policies, which have no cash value. The lender will typically require the death benefit be a certain amount, depending on your loan size.

Is Collateral Assignment of Life Insurance Irrevocable?

A collateral assignment of life insurance is irrevocable. So, the policyholder may not use the cash value of a life insurance policy dedicated toward collateral for a loan until that loan has been repaid.

What is the Difference Between an Assignment and a Collateral Assignment?

With an absolute assignment , the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.

The Bottom Line

If you are applying for life insurance to secure your own business loan, remember you do not need to make the lender the beneficiary. Instead you can use a collateral assignment. Consult a financial advisor or insurance broker who can walk you through the process and explain its pros and cons as they apply to your situation.

Progressive. " Collateral Assignment of Life Insurance ."

Fidelity Life. " What Is a Collateral Assignment of a Life Insurance Policy? "

Kansas Legislative Research Department. " Collateral Assignment of Life Insurance Proceeds ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1465621717-5f131bf876c043898c13e6c471acf50f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Why Buy From Us:

- No questions asked 100% money back guarantee - You buy with confidence

- Professionally drafted and regularly updated documents

- Our documents are written in plain English and are easy to use and edit

- Instant access to your document - Buy once and use as many times as you like

- Our templates are designed to help you save time, money and effort

- If we currently don't have your document you can send us a request

Copyright © 2024 The Legal Stop Limited. All Rights Reserved.

The Legal Stop Limited – Company Number: 7394508

Free Documents | Confidentiality Agreement | Partnership Agreement | Employment Contract | HR Policies

Web Cookies: By using our website you agree to our use of web cookies in accordance with our privacy statement .

The Economic Times daily newspaper is available online now.

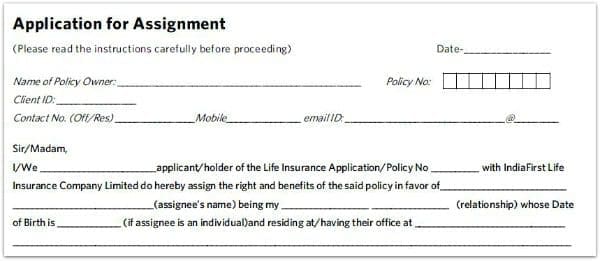

All you need to know about assigning life insurance policy.

The insured needs to either endorse the policy document or make a deed of assignment and register the same with the insurer.

- Conditional assignment: This is done when the insured wishes to pass benefits of the policy to a relative in case of early death or certain conditions. The rights of the policyholder are restored once the conditions are fulfilled.

- Absolute assignment: This is done as a part of consideration for a loan in favour of the lender/bank/lending institution. In such an assignment, the insured loses his rights in the policy and the absolute assignee can deal with it independently.

- Proof of income.

- Self attested copy of photo ID and address proof .

- Self attested copy of PAN card.

Read More News on

(Your legal guide on estate planning, inheritance, will and more.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

India is abandoning this healthy habit in droves

Ola Cabs is winding down its struggling international business

Here is what it takes to get a job at an Apple supplier

Where is Flipkart’s long-in-the-making IPO?

This waste recycler vs. contraceptive maker legal tussle has a Mahadev scam accused Tibrewala twist

INR10,000 crore HDFC Credila deal: Why PE funds are upbeat on the education-loan market

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

- Manulife US REIT

- Manulife Investment Management

- Individual Manulife US REIT Manulife Investment Management

Are you looking for:

Assign your policy

Deed of Assignment

Assign your policy to an Individual

DOWNLOAD DEED OF ASSIGNMENT FORM

Assign your policy to a Corporate

DOWNLOAD CORPORATE OWNER CERTIFICATION FORM

DOWNLOAD CORPORATE POLICY OWNER AUTHORISED SIGNATORY FORM

Instructions

When making a transfer of ownership from the Policyowner (Assignor) to another person or company (Assignee), the Assignee will have full control of the policy as if he or she is the Policyowner. Both the Assignor and Assignee should be 18 years old or older. If the Assignor or Assignee is below 18 years old, please contact our Client Services team at (65) 6833-8188 for assistance. To perform an Assignment, please complete the Deed of Assignment Form and submit it to us with the necessary document(s) requested.

What you need to provide

Please refer to the “Assignment of Policy Checklist” found in the Deed of Assignment Form .

Can a Deed of Assignment be performed for all policies? Not all policies are eligible for a Deed of Assignment. Please refer to the “Assignment of Policy Checklist” found in the Deed of Assignment Form for the submission requirements.

SHOW MORE OF "ASSIGN YOUR POLICY"

Show less of "assign your policy", assign your policy to a financial institution.

Assign your policy to a Financial Institution as additional security for a loan.

Other services that we offer

We are always here to help in whatever way we can.

QUICK LINKS

- Goal Selector

MANULIFE INVESTMENT MANAGEMENT

- Individual investors

- Institutional investors

- FAQ | Self-serve & Support | Manulife Singapore

- Complaint Resolution Process

- How to Start with Retirement Planning

- How to Grow My Wealth Through Investment Plans

- How Can I Protect Myself And My Loved Ones Financially Through Life Insurance

- How Health Insurance Can Protect You From High Medical Expenses

- How to Start Building Your Savings Plan

Terms of use

Fair dealing policy

Insurance guides & useful links

Statement of personal data protection

Cybersecurity Advisory

©2020 - 2024 Manulife (Singapore) Pte Ltd

Collateral Assignment of Life Insurance: Everything You Need to Know

- August 8, 2023

Life insurance isn’t just about peace of mind for the future; it can also serve as a lifesaver when you’re looking for ways to secure a loan. This clever maneuver is known as a collateral assignment of life insurance. It’s a deal between you and your lender where your life insurance policy, specifically the cash value component, is used as collateral for a loan.

When assigning your life insurance policy as collateral for a loan, the lender will become a temporary beneficiary of your policy. If the assigner dies before repaying the loan, the lender can claim the death benefit up to the outstanding loan balance. If the policyholder defaults, the cash value of the policy will be collected.

Who can benefit from the collateral assignment of life insurance?

If you need to secure a loan but don’t have typical assets like a house or significant savings, collateral assignment of life insurance could be your ticket. It’s great for small business owners, entrepreneurs, and folks with sizable insurance policies but limited liquid assets.

To use a life insurance policy as collateral, the policy term should be at least as long as the loan duration and should possess a cash value component equal to the loan amount.

What types of life insurance can be used as collateral?

To make this work, you’ll need a permanent life insurance policy that has a cash value component. This includes options like whole life, universal life, and variable life insurance. Unfortunately, term life insurance doesn’t quite make the cut, as it lacks a cash value.

How to use life insurance as collateral for a loan?

1. Ensure the lender accepts life insurance as collateral.

2. Apply for the collateral assignment through the bank or directly with the insurer.

3. Fill out an “assignment of Life Insurance Policy as Collateral form” provided by your insurer.

4. Submit the form to the insurer, and wait for approval.

5. Once the collateral assignment is approved, notify your bank or lender.

6. Bank or lender will set the loan terms such as the interest rate, payment terms, and other obligations.

Is life insurance as collateral widely accepted? Do all banks accept it?

Typically, permanent life insurance policies such as whole life and universal life, which have a cash value component, can be used as collateral. Lenders such as banks want security, and the cash value component of a whole life insurance policy provides this. This cash value grows over time and can be used if the borrower defaults on the loan, which decreases the risk for the lender.

How is the loan amount determined when using life insurance as collateral?

The borrowing capacity is determined as a proportion of the cash value, varying across different insurance companies. Typically, the permissible borrowing range hovers around 90% to 95%. Applying these percentages to a cash value of $50,000, one could potentially secure a loan amounting to $45,000 to $47,500.

What happens when you are unable to pay back the life insurance loan?

The cash value of your policy will be collected by the lender. If this is insufficient, the amount you owe is deducted from the death benefit when you pass away. In some instances, you might also incur a substantial tax bill.

Is the collateral assignment of the life insurance agreement permanent?

No, the collateral assignment of the life insurance agreement is not permanent. It’s tied to the lifespan of the loan. Once the loan is fully repaid, the assignment can be released, and the life insurance policy returns to its original beneficiary arrangement.

What are the tax implications of using life insurance as collateral for a loan?

If the amount you borrow directly from the insurance company is equal to or less than the total insurance premiums you have paid, it is not subject to taxation. However, If you surrender your policy, or allow it to lapse, and the total amount of outstanding loans and interest surpasses what you have paid in premiums, there is a possibility of incurring a tax liability. In essence, you would be required to pay income tax on any investment earnings in that scenario.

Best Online Life Insurance Calculator

At Everyday Life Insurance , we specialize in finding the perfect policy to match your unique circumstances. Whether you’re a small business owner looking to back your loan or a stay-at-home mom working to provide for her family, we’re here to help. Use our online life insurance calculator to find the best plan for your finances, in just 15 minutes.

Disclaimer : The comments, opinions, and analyses expressed at Everyday Life are for informational purposes only and should not be considered individual investment, legal or tax advice.

- How it works

- Get started

- Smart life insurance guide

- Affiliate program

- Privacy policy

- Legal information

Everyday Life

12 Forbes Ln, Andover MA 01810

(888) 681-3811

[email protected]

695 Atlantic Avenue, 9th Floor, Boston MA 02111

© 2024 Everyday Life Inc. All Rights Reserved.

Here is your personal referral link..

Share it with your friends!

- Contact Support

- Returning Customer?

- Sign in to your account

- Contact support

- New Zealand

- South Africa

Deed of assignment

Document Only

- Detailed guidance notes

Lawyer Assist

- Unlimited support by email

- Review of your edited document by a lawyer

- A document drawn just for you to your exact requirements

- Free discussion before we provide an estimate

Document overview

- Length: 5 pages (1100 words)

If the document isn’t right for your circumstances for any reason, just tell us and we’ll refund you in full immediately.

We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted.

You don’t need legal knowledge to use our documents. We explain what to edit and how in the guidance notes included at the end of the document.

Email us with questions about editing your document. Use our Lawyer Assist service if you’d like our legal team to check your document will do as you intend.

Our documents comply with the latest relevant law. Our lawyers regularly review how new law affects each document in our library.

About this document

Use this deed to assign (transfer) a policy for life insurance or an endowment to another person. The reason could be any, but it should be a sale in which money changes hands.

We include reasonable warranties by the seller and undertakings by the buyer. It is clear and simple, but thorough and complete for an arm’s length transaction.

The transfer will be complete and valid only when the insurer has been formally notified.

As well as the deed document, we have included a template notice that the assignment has taken place. This may or may not be useful to you: your insurer may prefer you to use their own form, but sometimes other parties, like your bank, also need to know or appreciate being told.

We offer a simpler version if you are a trustee assigning the policy to a beneficiary.

If you are making or receiving a transfer as part of a divorce or separation, use this alternative document .

Completing this deed

For technical legal reasons , all assignments of life policies must be by deed and not by contract.

The main practical difference is that a deed requires a witness to the signatures. Unless it is more convenient to do otherwise, the same witness can verify the signatures of both parties.

Taxation of life assurance policies is complex and we recommend that you consult with a tax accountant. The effect of tax is also an important consideration in assessing the value to the assignee of the policy.

When to use this document

The deed can be used to assign a policy:

- from one individual to another, for payment or as a gift

- in a sale by the life assured to anyone or any company

Features and contents

The deed includes the following paragraphs:

- Warranties by the assignor

- The assignment

- Dispute resolution

- Severance and invalidity

- Notice of assignment to deliver to the insurer or bank

Talk to us about this document

We are happy to answer any questions you have. Arrange for us to call you.

Recent reviews

Choose the level of support you need.

- reporting on whether your changes comply with the law

- answering your questions about how to word a new clause or achieve an outcome

- checking that your use of defined terms is correct and consistent

- correcting spelling mistakes

- reformatting the document ready to sign

What other customers thought

Select Language

Find the right insurance for you

Switch to the Simpler Insurance

Hi There, We are working on our product and launching this soon.

Enter your Details

Submit your details and we will notify you once we launch our Product.

Hello, our Product is launching soon. Please share your details, and we will notify you once we are live.

- {{itemType}}

Thank you for showing interest.

Once we launch our product, we'll let you know.

What Is Assignment in Life Insurance Policy?

While purchasing a life insurance plan, you might encounter several unfamiliar terms, which can make this process even harder to follow. However, understanding these terms and their functions is essential to make an error-free decision while handling your policy.

Assignment is one such necessary process associated with life insurance, dealing with the transfer of ownership of your policy. It is often confused with a nomination, which refers to naming beneficiaries of your contract. Therefore, you must understand the aspects of assignment in a life insurance policy.

What Is Assignment and Assignee in Life Insurance Policy?

Assignment refers to the process of transferring your privileges as a policyholder to another person or entity such as the bank. Once the ownership is transferred, the former policyholder will have no further authority over it. You can assign your policy for various reasons, for instance to someone you love or to your bank in case you owe debt repayment.

Two other terms related to the assignment process are – assignor and assignee.

Assignor: An assignor is the one who is transferring their policy rights to someone else.

Assignee: An assignee is a person or an institution that receives the policy rights and now has complete control over it.

In many cases where people assign their policies to the bank, they remain the life insured, whereas the bank receives the claim benefit after their demise.

What Are the Types of Assignment in Life Insurance Policy?

Absolute assignment.

In an absolute assignment, you can transfer your life insurance policy ownership to another being without any terms and conditions. Here, the assignor can sign over the entire policy as a gift to their loved ones or if they owe an outstanding debt.

After the transfer procedure is complete, the assignee will be responsible for all policy-related decisions, including paying the outstanding premiums and designating nominees.

For Example,

Suppose you have purchased a ULIP plan to secure your family after you pass away. Now, within a few years, you are in need of urgent financing to support your child’s education.

So, instead of surrendering your policy, you can use it as collateral to seek help from someone. Now you have assigned your insurance plan to a friend (assignee) through an absolute assignment by which your friend can take over all the rights of your policy including paying future premiums.

Conditional Assignment

Condition assignment is a policy where you transfer the life insurance policy rights to an assignee under specific terms and conditions. Therefore, the transfer will only be valid if those conditions are met.

Furthermore, it can also be a temporary transfer, where the policy is transferred back to the assignor once they fulfil the predetermined conditions.

The transfer takes place through a form that mentions the reason and condition of the assignment along with an assigned percentage of the sum assured and who will pay the future premiums.

For Example:

Suppose you have assigned your life insurance policy under conditional assignment to a bank for which you secured a loan. If you repay the loan within the set time, the bank will transfer the policy rights back to you. However, if you fail to repay the EMIs, the bank can surrender your policy and get their money back.

An assignment is a legal process through which policy ownership transfers from an assignor to an assignee. It can be beneficial under multiple circumstances, especially in a financial emergency. Therefore, before you buy a life insurance plan, understand these features since they can help you in the future.

In addition, the assignment of a life insurance policy can also be used as a present to your loved ones. While nomination is where you directly assign beneficiaries to ensure that your loved ones are protected in your absence.

FAQs about Assignment in Life Insurance Policy:

Does the policy risk get transferred in the assignment process, what is an endorsement in an assignment, what are the liabilities and rights of the assignee, other important features of life insurance.

- This is an informative article provided on 'as is' basis for awareness purpose only and not intended as a professional advice. The content of the article is derived from various open sources across the Internet. Digit Life Insurance is not promoting or recommending any aspect in the article or its correctness. Please verify the information and your requirement before taking any decisions.

- All the figures reflected in the article are for illustrative purposes. The premium for Coverage that one buys depends on various factors including customer requirements, eligibility, age, demography, insurance provider, product, coverage amount, term and other factors

- Tax Benefits, if applicable depend on the Tax Regime opted by the individual and the applicable tax provision. Please consult your Tax consultant before making any decision.

- Digit Insurance

- ']" itemprop="itemListElement" itemscope itemtype="http://schema.org/ListItem"> Life Insurance

- ']" itemprop="itemListElement" itemscope itemtype="http://schema.org/ListItem"> Features

- ']" itemprop="itemListElement" itemscope itemtype="http://schema.org/ListItem"> Assignment in Life Insurance Policy

Last updated: 2024-03-28

How to Assign a Mortgage Life Insurance Policy

Home » Blog » How to Assign a Mortgage Life Insurance Policy

Table of Contents

If you’re on this here blog, I can assume a couple of things:

- you’ve either bought or are buying a house and

- you’ve either bought or are buying Mortgage Protection or Life Insurance because you have to.

I can also probably assume you’re a responsible adult – or at the very least, you’re very good at pretending, which as we all know: all the best people are.

Now, there is one thing you need to know.

This one thing is either coming to you too late, or just in the nick of time, depending on whether or not you now own a house.

The banks are great for mortgages, but they’re a rip off when it comes to Mortgage Protection Insurance in Ireland.

They’ll try to force you to buy their Mortgage Protection (a type of Life Insurance that will pay off the rest of your mortgage if you die) because:

- It makes it harder for you to switch your mortgage (if the bank even mentions the words “block policy”, you should dive out the nearest window)

- It’s more money for them, especially if they hoodwink you into adding Serious Illness Cover, which will go directly into their pockets even if you need it for medical bills!

You’re basically paying them so they can pay themselves if you die or get sick before you’re done paying off your mortgage.

Yes, it sucks.

No, there’s not a massive amount you can do about it except arm yourself with all the information you can.

Which is why I’m going to talk you through Mortgage Protection, buying it, and assigning it to your bank/lender.

How do you assign a mortgage life insurance policy?

- Arrange your policy (through a broker preferably – scroll down to find out why)

- Complete a Deed of Assignment (it forms part of your legal pack that the bank sends to your solicitor)

- Send the completed Notice of Assignment and your policy schedule to the bank

- The bank sends the Notice of Assignment and the policy schedule to the insurer

- The nsurer assigns your policy to the bank and sends a confirmation letter to the bank

And that’s it, fairly straightforward, ignore the bank if they try to spook you by saying it causes delays if you don’t buy from them. It doesn’t.

What is mortgage protection/life insurance for a mortgage?

As I said above: it’s a type of insurance that pays off the rest of your mortgage if you die. You have to get it if you’re buying a house. You can buy it from the insurer directly, your bank/lender, or a broker who will usually work with all the insurers.

You also have the option of using existing Life Insurance cover (for example, if you already have a policy) as your cover.

To make that crystal clear, your options are:

Mortgage lender/your bank:

- Tied to the bank so they can only sell you their overpriced Mortgage Protection policy.

- Your premium forms part of your mortgage repayments so it’s hard to see how much you’re paying for your policy.

- It’s potentially a problem because: you should always shop around at all of the insurers to make sure you get a good deal.

- You know how bankers get slated all the time for being more concerned with lining their own pockets? Yes. That. Think about it.

- If you have a health issue and they can’t offer you cover, then you’re on your own.

Insurance brokers:

- Will advise on policies from all the providers to recommend the best deal for you.

- You get all the information, so you actually know what you’re dealing with.

- Heavily discounted premiums compared to the banks

- If you have a health issue and one insurer can’t offer you cover, your broker can try elsewhere.

- A sound bunch of lads

- Can only sell their own policies, so you’re definitely not getting the best deal for you.

- Probably shouldn’t do. Known for being occasionally nefarious, but you do you, boo.

An existing policy:

- It’s a bit confusing but you can use an existing Life Insurance policy as your Mortgage Protection, presuming it’s equal to the value of your mortgage and runs for the same term – so if your mortgage is for 30 years and €200,000, your Life Insurance policy would need to match or exceed that (e.g. a 31 year, €201,000 policy works ; a 29 year, €199,000 policy doesn’t)

- You have to assign the policy to your lender, if this is the case. Essentially, it’s you saying, “yes, I want to use my Life Insurance policy to pay off my mortgage.”

- If there’s any moolah left over afterwards, it’ll go to your dependents.

- You’re better off having both Mortgage Protection and Life Insurance because it’s two pay-outs, but if you’re strapped for the cash, or have had some health issues since you took it out, assigning an existing policy can be a solid shout.

If you’ve already bought your policy and are wondering about how to actually assign it, I get round to that in a second.

By the way, you can’t use life insurance that you have through work (death in service benefit) for a mortgage.

Is Mortgage Protection/Life Insurance different?

Yes. Mortgage Protection is a type of Life Insurance that only covers your mortgage to your lender. Life Insurance leaves a tax-free lump sum to your dependents. They could use it to pay for literally anything they want.

A $2,500 human-sized replica mask of your cat, for example .

Is it confusing? 100 percent.

Is it confusing on purpose? 100 per cent.

My two cents? Get Life Insurance and Mortgage Protection. It’s two pay-outs. It won’t break the bank monthly, but it could mean an awful lot to your family down the line.

Think of it like this: A Mortgage Protection payout gives your family a mortgage-free home. A Life Insurance payout gives your family a replacement income. They need both, so you need both.

Can you change your Mortgage Protection policy?

Yes. Any time you want. It could totally be worth it for a better price or benefits, so seriously: look into it. A few euro in the difference might not seem like much, but take that €5 a month and multiply it out by 12 and then by the length of your actual mortgage (which could be up to 35 years) and you’d be surprised how much it’ll add up to.

Just look at that fiver go. €5 x 12 x 35 = €2,100.

And that’s before we go anywhere near the difference you could save if you wanted to switch your actual mortgage down the line.

And don’t mind your bank if they say that getting Mortgage Protection or assigning an existing Life Insurance policy will delay your mortgage or that they’ll look more favourably on your application if you do what they want.

Remember: It’s all a

They’re trying to scare you into buying their overpriced policy.

Tell them where to go.

Because you already know where you can get the best mortgage protection quotes .

Why do you need to assign a policy to a bank?

To make it legal.

Otherwise, it’s a bit like two young fellas swearing loyalty by spitting into a handshake. You telling your bank about your existing policy is grand and all, but if anything happens, they want the legal papers to say they get any payout.

Otherwise, all they’ve got is a spitty handshake and no cover.

How do you assign a Life Insurance policy to a bank/your lender?

It’s a bit like giving your bank a gift. You take out the policy and pay the premiums. When you die (no ‘ifs’ here, pal), your bank gets any pay-out.

To assign the policy (or policies if you have taken two single life policies) you need to complete a deed of assignment for each policy,

The deed is a legal document that forms part of your legal pack. It’s written in legalese, which means it’s completely impenetrable to normal people.

You can try reading it, but honestly, you’ll have as much luck taking another crack at Finnegans Wake. At least then you can sound cultured if you pretend you read Joyce’s gibberish.

You have to sign the deed of assignment.

Listen, it’s a bit like Apple’s terms and conditions; everyone ticks the box and nobody has a clue what they agreed to. Have you just sold your soul to a factory wherever iPhones are manufactured? Possibly.

But you’re still gonna have to do it.

The bit you sign is called the Notice of Assignment. You sign it and send it back to your bank along with your mortgage protection certificate.

The bank then sends it to the insurer and the insurer notes the bank as the legal owner of your policy.

Now, because the assignment is in effect a legal transaction, the banks don’t let us get involved so it’s up to them to send the necessary documents in a timely fashion to the insurer.

Once it’s with the insurer, we can chase it and give the insurer a bit of a prod if you’re in a rush but until then, our hands are tied.

*That’s how it usually works but each bank may do things differently.

What happens when the insurer receives the notice of assignment?

The insurer will assign your policy to the bank, so the bank becomes the owner of your policy and gets any pay-out.

Who notifies your bank that the policy has been assigned?

The insurer will send a confirmation of the assignment letter to the bank stating:

“Thank you for your recent Notice of Assignment in respect of the above-numbered policy. We have noted your interest and confirm that we hold no prior charge on this policy.”

Once the bank has confirmation of the assignment, they’re happy to issue your mortgage cheque.

How do I assign two life of another mortgage protection policies?

If you’re buying as a couple we recommend two single life policies to reduce any potential inheritance tax.

Assigning two policies works in the same way as assigning a single policy only you will have to complete a Deed of Assignment for each policy.

Is there a fee payable to assign a policy?

And just like that, you’ve assigned your policy.

Your TL;DR of tips, once more:

- Don’t buy Mortgage Protection from your lender. You likely won’t be getting the best deal and it makes it a little trickier if you want to switch your mortgage down the line.

- You can use an existing Life Insurance policy as your Mortgage Protection. However, you’re probably better off keeping them separate, as two policies = two pay-outs and an easier life for your family.

- Mortgage Protection = covers your mortgage. Life Insurance = covers you.

- If you’re bringing your own policy to the table, you’ll need to legally assign it to your bank by following the steps in this article. It’s basically you, your solicitor, your bank and insurer formally saying that the policy will pay-out your mortgage if you die.

- Before you buy any policy, make sure you go with a reputable broker so that you know you’re actually getting the best deal.

That’s all, folks!

Over to you…

I hope that clears up how to assign a mortgage life insurance policy to a bank. It’s simple, no matter how difficult your bank may try to make it seem.

But if you have any questions, please complete the short form below and I’ll be right back or even better: call me

- Your Email *

- I’ve read & agree with the Terms of Business and Privacy Statement .

- Name This field is for validation purposes and should be left unchanged.

How Does Tax Relief on Income Protection Work?

Don’t know where to start?

Have a nose through our free life insurance guides

Life Insurance Quotes - Free and Easy!

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

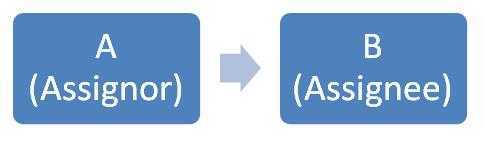

Assignment of Life Insurance Policy

The person who assigns the policy, i.e. transfers the rights, is called the Assignor and the one to whom the policy has been assigned, i.e. the person to whom the policy rights have been transferred is called the Assignee.

Assignment of a Life Insurance Policy simply means transfer of rights from one person to another. The policyholder can transfer the rights of his insurance policy to another for various reasons and this process is called Assignment.

The person who assigns the policy, i.e. transfers the rights, is called the Assignor and the one to whom the policy has been assigned, i.e. the person to whom the policy rights have been transferred is called the Assignee. Once the rights have been transferred to the Assignee, the rights of the Assignor stands cancelled and the Assignee becomes the owner of the policy.

here are 2 types of Assignment:

- Absolute Assignment – This means complete Transfer of Rights from the Assignor to the Assignee, without any further conditions applicable.

- Conditional Assignment – This means that the Transfer of Rights will happen from the Assignor to the Assignee subject to certain conditions. If the conditions are fulfilled then only the Policy will get transferred from the Assignor to the Assignee.

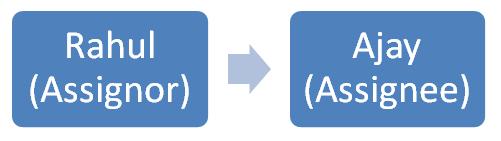

Let’s take an example:

Rahul owns 2 Life Insurance policies of value Rs 2 lakhs and Rs 5 lakhs respectively. He would like to gift one policy of Rs 2 lakhs to his best friend Ajay. In that case, he would like to absolutely assign the policy in his name such that the death or maturity proceeds are directly paid to him. Thus, after the assignment, Ajay becomes the absolute owner of the policy. If he wishes, he may again transfer it to someone else for any other reason. This type of Assignment is called Absolute Assignment.

Now, Rahul needed to take a loan for Rs 5 lakhs. So, he thought of doing so against the other policy that he owned for Rs 5 lakhs. To take a loan from ABC bank, he needed to conditionally assign the policy to that Bank and then the bank would be able to pay out the loan money to him. If Rahul failed to repay the loan, then the bank would surrender the policy and get their money back.

Once Rahul’s loan is completely repaid, then the policy would again come back to him. In case, Rahul died before completely repaying the loan, then also the bank can surrender the policy to get their money back. This type of Assignment is called Conditional Assignment.

Sachin Telawane is a Content Manager and writes on various aspects of the Insurance industry. His enlightening insights on the insurance industry has guided the readers to make informed decisions in the course of purchasing insurance plans.

- Tax Planning

What is ‘Assignment’ of Life Insurance Policy?

Insurance is a contract between the insurance company (insurer) and you (policyholder) . It is a contract with full of jargon. As much as possible, we must try to understand all the insurance terms mentioned in the policy bond (certificate) . One such insurance jargon which is mostly used is Assignment .

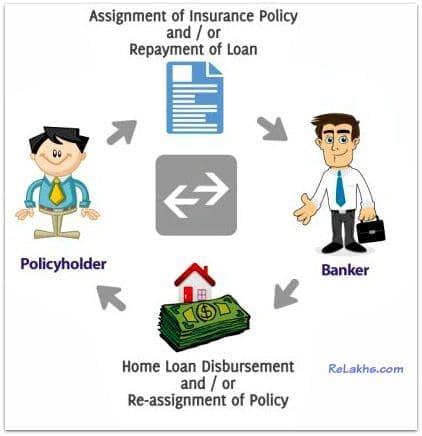

If you are planning to apply for a home loan, your home loan provider may surely use this term. So, what is Assignment? Why assignment of a life insurance policy is required? What are different types of assignment? What are the differences between Assignment & Nomination?

What is Assignment?

Assignment of a life insurance policy means transfer of rights from one person to another. You can transfer the rights on your insurance policy to another person / entity for various reasons. This process is referred to as ‘ Assignment ’.

The person who assigns the insurance policy is called the Assignor (policyholder) and the one to whom the policy has been assigned, i.e. the person to whom the policy rights have been transferred is called the Assignee .

Once the rights have been transferred from the Assignor to the Assignee, the rights of the policyholder stands cancelled and the assignee becomes the owner of the insurance policy.

Assigning one’s life insurance policy to a bank is fairly common. In this case, the bank becomes the policy owner whereas the original policyholder continues to be the life assured on whose death the bank or the policy owner is entitled to receive the insurance money.

Types of Assignment

The assignment of an insurance policy can be made in two ways;

- Example : Mr. PK Khan owns a life insurance policy of Rs 1 Crore. He would like to gift this policy to his wife. He wants to make ‘absolute assignment’ of this policy in his wife’s name, so that the death benefit (or) maturity proceeds can be directly paid to her. Once the absolute assignment is made, Mrs. Khan will be the owner of the policy and she may again transfer this policy to someone else.

- Example : Mr. Mallya owns a term insurance policy of Rs 50 Lakh. He wants to apply for a home loan of Rs 50 Lakh. His banker has asked him to assign the term policy in their name to get the loan. Mallya can conditionally assign the policy to the home loan provider to acquire a home loan. If Mallya meets an untimely death ( during the loan tenure) , the banker can receive the death benefit under this policy and get their money back from the insurance company.

- In case if the death benefit received by the banker is more than the outstanding loan amount, the insurer will pay the bank the outstanding dues and pay the balance to the nominee directly. The balance amount (if any) will be paid to Mallya’s beneficiaries ( legal heirs / nominee) .

How to assign a life insurance policy?

The Assignment must be in writing and a notice to that effect must be given to the insurer. Assignment of a life insurance policy may be made by making an endorsement to that effect in the policy document (or) by executing a separate ‘ Assignment Deed ’. In case of assignment deed, stamp duty has to be paid. An Assignment should be signed by the assignor and attested by at least one witness.

Download absolute assignment deed sample format / conditional assignment deed format.

Nomination Vs Assignment

Nomination is a right given to the policyholder to appoint a person(s) to receive the death benefit (death claim) . The person in whose favor the nomination is effected is termed as ‘nominee’. The nominee comes into picture only after the death of the life assured (policy holder) . The nominee will not have the absolute right over the money (claim proceeds) . The other legal heirs of the policy holder can also recover money from the nominee.

(However, as per Insurance Laws (Amendment) Act, 2015 – If an immediate family member such as spouse / parent / child is made as the nominee, then the death benefit will be paid to that person and other legal heirs will not have a claim on the money)

Under nomination, the rights of the policyholder are not transferred. But, assignment is transfer of rights, interest and title of the policy to some other person (or) entity. To make assignment, consent of the insurer is also required.

Important Points

- Assignment of policies can be done even when a loan is not required or for some special purposes.

- If you assign the policy for other purpose other than taking a loan, the nomination stands cancelled.

- If the policy is assigned, then the assignee will receive the policy benefit. Death benefit will be paid to the Nominee, in case the policy is not assigned.

- The policy would be reassigned to you on the repayment of the loan (under conditional assignment) .

- Types of insurance policies used for assignment purpose to get business loans, generally include an endowment plan, money back policy or a ULIP. Home loan providers generally ask for the assignment of Term insurance plans on their names. (The term plan tenure should be more than the home loan tenure)

- An assignment of a life insurance policy once validly executed, cannot be cancelled or rendered in effectual by the assignor. The only way to cancel such assignment would be to get it re-assigned by the assignee in favor of the assignor.

- You can also raise a loan against your policy from your insurance company itself. In this case, your policy would have to be assigned to insurance company.

- An insurer may accept the assignment or decline. (The insurer shall, before refusing to act upon the endorsement, record in writing the reasons for such refusal and communicate the same to the policy-holder not later than thirty days from the date of the policy-holder giving notice of such transfer or assignment)

- In case of death of the absolute Assignee (to whom the policy rights have been transferred under absolute assignment) , the rights under the policy will be transferred to the legal heirs of the assignee.

- You can also assign a life insurance policy under Married Women’s Property Act . (At the time of making the application (buying a policy), a separate MWPA form has to be filled by the proposer for it to be covered under MWP Act. Do note that the existing life insurance policies cannot be assigned under MWP Act)

- Partial assignment or transfer of a policy can also be made. But banks will accept any of your life insurance policies as long as the sum assured is equal to or greater than the loan amount.

Hope you find this post informative and do share your comments.

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net)

About The Author

Sreekanth Reddy

Can a LIC policy be assigned to someone not related by blood??

Dear Chowdhury, Yes, it is possible. However, Assignment is not permitted on all life insurance policies issued under How to buy Term Life Insurance under Married Women’s Property Act?

Very useful and gathered more knowledge

Hi, I got a question in CFP EXAM 5( case study paper) with regard to assignment of money back policy to a minor. I would like to know can a conditional assignment be made to a minor and if yes what about the premium that is yet to be paid? and would a guardian need to be appointed till the minor attains majority? and is it possible that an absolute assignment can be made?

Dear Dhaarini,

Where an assignment is made in favour of minor, the policy can not be dealt with during the minority of the assignee, even with consent of natural guardian or appointed guardian. This means minor assignee cannot raise loan, surrender or further assign the policy during his/her minority.

If the assignment is in favour of a minor, in the event of claim, policy money cannot be paid to him, as he cannot give valid discharge. It is therefore desirable that where the assignee is minor, testamentary guardian should be appointed in respect of all the properties of such minor including the policy moneys. The father i.e. natural guardian of the minor can only appoint the testamentary guardian. The appointment can be done by a separate instrument or on the back of the policy.

What if a wife has taken a policy in the name of his husband and put the nominee herself and also pays all the premiums herself, and now they are taking divorce. So, now can husband assign the policy to her and what benefits she can receive after assignment. Can she withdraw tha amount of the policy??

Dear Monika, Yes, he can make an Absolute assignment in the name of Wife..

Under Life Assurance one can assign a policy only if that policy is a policy of his/her own life. Here wife has taken a policy on her husband life and hence assignment does not arise. In the event of death of her husband she receives the death benefit irrespective of her relationship at the time of death. This is because under Life Assurance the Insurable Interest is required at the proposal stage and needs not be present at the claim stage.

I wanna give my policy to new owner

A assigned his policy to his brother B and B is paying premiums. A’s nominee is his father. What will happen if B dies?

Dear Mr Naidu, May I know what type of Assignment is this??

A assigned his policy to his brother B, out of love and affection as absolute assignment. Whose life is covered?. What happens if B dies?

Dear Mr Naidu, If the assignee (Mr B) dies, then his/her legal heirs will be entitled to the policy money. Kindly note that an assignee cannot make a nomination on the policy which is assigned to him.

“Absolute assignment is generally made for valuable consideration e.g. raising of loan from an individual / institution. This assignment has the effect of passing the title in the policy absolutely to the assignee and the policyholder in no way retains any interest in the policy. The absolute assignee can deal with the policy in any manner he likes and may even transfer his interest to another person or surrender the policy. Under absolute assignment when the assignee (Mr B) dies the benefits go to the legal heirs of the assignee and not to the heirs of the life assured.”

What is the procedure to get the policy assigned? How much time does it take?

Thanks for this. I always like to use study materials by Indians in preparing for my professional exams. The contents here are superb and easy to understand.

Once assignment is done, on whose name Renewal receipts and PPC will be generated.

Dear Gayu ..in the name of Policyholder only.

My colleagues were looking for USPS PS 1000 this month and were informed of an online platform that hosts a ton of fillable forms . If people are wanting USPS PS 1000 too , here’s https://goo.gl/Qqo6in .

Dear Sreekanth, I am having an LIC policy for the past 10 year. now i would like to assign the same to my mother. Now after the assignment, whose life is covered and who gets all the benefit? Do i have to appoint a new nominee after the assignment?

Dear Bhavik ..Life cover will be in your name only. Your mother can get the benefits. You can make her as the nominee.

If policy assigned to absolute assignment from A to B. B is the assignee of the policy and he have all rights of the policy. After assignment who will have a life cover A or B. Who will get the death benefits

Dear Senthil, Life cover – A. Beneficiary – B.

Thanks for this information, Let me know who will pay the remaining premium after assignment.and what are the other reasons for assignment except loan and gift. Manish

Dear Manish ..The policy holder only has to pay the premium.

I have a ULIP assigned to my home loan. I have paid two annual premiums till now. If I dont pay the next premium, will it have any impact on my home loan ? I know that my ulip will get discontinued in this case but can the bank force me to pay the premium legally ?

Dear Kalis, If sum assured falls below the outstanding loan amount then you banker may ask you to assign another policy or pay the premiums on this one.

Thanks. Sum assured is already below the loan amount. In this case, can bank take any legal action against me if I don’t pay the premium?

Dear Kalis..Why do you want to take this risk?

Who will have to pay tax if single premium ULIP where premium is >20% of sum assured is assgned to spouse & she then sureender it.

Dear Vishal ..The insured (policyholder)..

my father aged 72 has taken a ULIP policy on my Child with coverage 10 lakhs .But now he would like to Assign the policy to my mother’s Name aged 67.

Please Clarify weather the life coverage and policy benefits will be transferred to my Mother or will it continue with my son.

Dear Nisha, May I know who is the ‘insured’ in this policy? Is the child just a nominee to the policy? “If he assigns the policy for other purpose other than taking a loan, the nomination stands cancelled. If the policy is assigned, then the assignee will receive the policy benefit. “

Hi.. Really nice blog.very informative and useful. I liked the way You explained very briefly about Assignment’ of Life Insurance Policy.

Hi Srikanth,

Nice article on Assignment!

I Just wanted to know If i nominate my spouse for the life insurance or nominate my child and appoint my spouse how these to things are different in terms claim settlement of life insurance.

Ideally I may want my spouse to look-after my child education until they turn major and they do not misuse the claim amount.

Please let me know if possible your contact number so that we discuss further..

Please suggest.

Thanks, Shravan

Dear Shravan, If you are planning to buy a new Term plan, you can assign the policy under MWP Act by mentioning the Percentages (share in death benefits) among your legal heirs (spouse & kids). You also have the option to write a WILL and give detailed instructions about how the claim amount (if any, on such policy) should be used or allocated.

Dear Sreekant, Thanks for such valuable information. Please do correction on your post that the existing life insurance policies cannot be assigned under MWP Act. Pl correct me if I am wrong. Please let me know that even if I assign the policy unconditionally to the bank for home loan purpose, after repaying the home loan successfully, the bank should re-assign the policy to me. If it does not do this, what options do I have? Thanks again.

Dear Vivek, Yes, only new insurance policies can be assigned (while purchasing new ones) under MWP. I should have written the sentence as ‘You can also assign a new life insurance policy under….’ Thank you for pointing this out. (I have provided all the details about MWP act in another article).

If a policy is assigned with absolute assignment, it cannot be cancelled. It can be done only by another valid re-assignment. So, the banker has to re-assign it after the repayment of loan. When you do not wish to give away your complete control over policy, do not go in for absolute assignment.

thanks for prompt response.

ReLakhs.com is a blog on personal finances. The main aim of this blog is to help you make INFORMED financial decisions by presenting the content on money matters in a simple, unbiased and easy to understand manner.

Popular Posts

Latest court judgements on women’s property rights, who gets the joint bank account monies if one account holder dies, income tax deductions list fy 2023-24 | under old & new tax regimes, top 5 best aggressive hybrid equity mutual funds | equity-oriented balanced funds, useful links.

- Community (Forum) - SignUp

- Forum (Old)

- Privacy Policy

Viewsletter

Cared by T-Square Cloud

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

- Share on WhatsApp

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share on Email

Annual General Meeting (AGM) 2024

For more information on our AGM, please click here .

Popular searches

Your search history

No search history

- Customer Services

- Policy Assignment

- Assign Policy to New Owner

Assign policy to new owner

An absolute Assignment is a transfer of ownership from the Assured (Assignor) to another person or institution (Assignee). The Assignee becomes the new owner of the policy and assumes full legal rights over the policy. All proceeds, including surrender, maturity and claims, will be payable to the Assignee.

You can assign the policy if

1. the policy

- is not using CPF/SRS monies for premium payments

- is not effected under trust

- is not used to be exempted from CPF Board's Home Protection Scheme (HPS)

- is allowed to be assigned under the plan

2. both Assignor and Assignee are

- of sound mind

- not bankrupt

- not under duress

3. The Assignor must be at least 18 years old. For policies issued on or after 1 March 2009, the Assignee must be at least 18 years old. For policies issued before 1 March 2009, the Assignee must be at least 21 years old.

Both the Assignor and Assignee must come to our Customer Service Centre at 1 Pickering Street, #01-01 Great Eastern Centre, with their NRIC.

If the assignment is done between spouses, or parent and child, or siblings, and relationship can be established by producing the marriage certificate or birth certificate, they need not be present at our Customer Service Centre.

Please complete the Absolute/Collateral Assignment form. Additional documents required are stated on the overleaf of the form.

Yes, you can assign to a company or institution.

Both the Assignor and Assignee must come to our Customer Service Centre at 1 Pickering Street, #01-01 Great Eastern Centre, with their NRIC (if the relationship between them is buyer and seller).

For an assignment to a company or institution, a company stamp is required on the assignment form.

No. Once absolutely assigned, the policy ownership will belong to the Assignee. However, the policy ownership can be transferred back to you provided the Assignee agrees to it. A new assignment will need to be done.

You can still assign the policy if the nomination made is a revocable nomination. The revocable nomination will be automatically revoked once the policy is assigned. If the policy has a trust nomination, the trust nomination will have to be revoked before you make an assignment.

- Contact Support

- Returning Customer?

- Sign in to your account

- Contact support

- United Kingdom

- New Zealand

- South Africa

Deed of assignment

Document Only

- Detailed guidance notes

Lawyer Assist

- Unlimited support by email

- Review of your edited document by a lawyer

Document overview

- Length: 5 pages (1140 words)

If the document isn’t right for your circumstances for any reason, just tell us and we’ll refund you in full immediately.

We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted.

You don’t need legal knowledge to use our documents. We explain what to edit and how in the guidance notes included at the end of the document.

Email us with questions about editing your document. Use our Lawyer Assist service if you’d like our legal team to check your document will do as you intend.

Our documents comply with the latest relevant law. Our lawyers regularly review how new law affects each document in our library.

About this deed of assignment for a life insurance policy

Use this deed of assignment to transfer a life insurance policy to another person. The reason for transfer might be as a gift, as settlement of a divorce or on separation, or in return for a payment.

The transfer will be complete and valid only when the insurer has been formally notified. As well as the deed document, we have included a template notice that the assignment has taken place. This may or may not be useful to you: your insurer may prefer you to use their own form, but sometimes other parties, like your bank, also need to know or appreciate being told.

Additionally, if the reason for transfer is divorce or separation, this document includes undertakings and promises so that either party cannot fail to cooperate.

The document is straightforward to complete and written in plain English.

Completing this deed of assignment

For technical legal reasons, all assignments of life policies must be by deed and not by contract. The main practical difference is that a deed requires a witness to the signatures.

Unless it is more convenient to do otherwise, the same witness can verify the signatures of both parties.

When to use this deed of assignment

The deed can be used to assign a policy:.

- From one individual to another, for payment or as a gift

- In a sale by the life assured to anyone or any company

- To or by the trustees of a trust for any reason

- For a transfer to a former spouse or life partner

- Use in all provinces of Canada

Document features and contents

The deed of assignment includes the following paragraphs:.

- Warranties by the assignor

- The assignment

- Limitation of liability

- Publicity: allows you to decide whether any part of the deal can be made public

- Dispute resolution

- Severance and invalidity

- All other legal paragraphs

- Form: Notice of Assignment to deliver to the insurer and bank

Recent reviews

Choose the level of support you need.

- reporting on whether your changes comply with the law

- answering your questions about how to word a new clause or achieve an outcome

- checking that your use of defined terms is correct and consistent

- correcting spelling mistakes

- reformatting the document ready to sign

What other customers thought

Assignment under Insurance Policies

By J Mandakini, NUALS

Editor’s Note: This paper attempts to explore the concept of assignment under Indian law especially Contract Act, Insurance Act and Transfer of Property Act. It seeks to appreciate why the assignment is made use of for securities of a facility sanctioned by ICICI Bank. Also, it explains how ICICI Bank faces certain problems in executing the same.

INTRODUCTION

For any facility sanctioned by a lender, collateral is always deposited to secure the same. Such mere deposition will not suffice, the borrower has to explicitly permit the lender to recover from the borrower, such securities in case of his default.

This is done by the concept of assignment, dealt with adequately in Indian law. Assignment of obligations is always a tricky matter and needs to be dealt with carefully. The Bank should not fall short of any legally permitted lengths to ensure the same. This is why ambiguity in its security documents have to be rectified.

This paper attempts to explore the concept of assignment in contract law. It seeks to appreciate why the assignment is made use of for securities of a facility sanctioned by ICICI Bank. The next section will deal with how ICICI Bank faces certain problems in executing the same. The following sections will talk about possible risks involved, as well as defenses and solutions to the same.

WHAT IS ASSIGNMENT?

Assignment refers to the transfer of certain or all (depending on the agreement) rights to another party. The party which transfers its rights is called an assignor, and the party to whom such rights are transferred is called an assignee. Assignment only takes place after the original contract has been made. As a general rule, assignment of rights and benefits under a contract may be done freely, but the assignment of liabilities and obligations may not be done without the consent of the original contracting party.

The liability on a contract cannot be transferred so as to discharge the person or estate of the original contractor unless the creditor agrees to accept the liability of another person instead of the first. [i]

Illustration

P agrees to sell his car to Q for Rs. 100. P assigns the right to receive the Rs. 100 to S. This may be done without the consent of Q. This is because Q is receiving his car, and it does not particularly matter to him, to whom the Rs. 100 is being handed as long as he is being absolved of his liability under the contract. However, notice may still be required to be given. Without such notice, Q would pay P, in spite of the fact that such right has been assigned to S. S would be a sufferer in such case.

In this case, that condition is being fulfilled since P has assigned his right to S. However, P may not assign S to be the seller. P cannot just transfer his duties under the contract to another. This is because Q has no guarantee as to the condition of S’s car. P entered into the contract with Q on the basis of the merits of P’s car, or any other personal qualifications of P. Such assignment may be done with the consent of all three parties – P, Q, S, and by doing this, P is absolved of his liabilities under the contract.

1.1. Effect of Assignment