Guide to Investment Advisory Business Models

AICPA MEMBER

The content in the CPA's Guide to Investment Advisory Business Models and accompanying resources is not intended as legal advice. CPAs with a PFP practice should consult legal or other appropriate professional counsel. As the range of financial topics clients wish to discuss expands, two questions have become common and important.

When does the financial advice I provide in my CPA practice require registration?

Should I become an investment adviser?

This guide will help you answer these questions along with

Download the Guide to Investment Advisory Business Models

File name: cpa-guide-investment.pdf

Reserved for AICPA® & CIMA® Members

Already a member of the aicpa or cima, log in with your account, not a member of the aicpa or cima, mentioned in this article, related content.

This site is brought to you by the Association of International Certified Professional Accountants, the global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants.

CA Do Not Sell or Share My Personal Information

- Business Ideas

- Registered Agents

How to Start an Investment Advisory Business in 14 Steps (In-Depth Guide)

Updated: April 12, 2024

BusinessGuru.co is reader-supported. When you buy through links on my site, we may earn an affiliate commission. Learn more

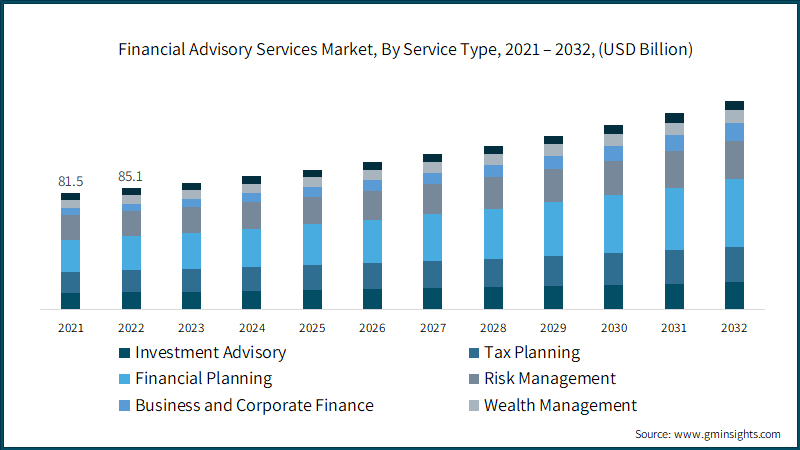

The investment advisory services industry is on the rise. It’s expected to grow at a compound annual growth rate (CAGR) of over 5.5% between 2023 and 2032. With more individuals and businesses seeking professional guidance for their investments, the demand for financial advisors continues to rise.

Whether you dream of running a boutique financial planning firm or building a national wealth management company, now is a good time to start.

This guide will walk you through how to start an investment advisory business. Topics include market research, competitive analysis, marketing, registering an EIN, obtaining business insurance, and more. Here’s everything to know to start your own financial planning firm.

1. Conduct Investment Advisory Market Research

Thorough market research is imperative when starting an investment advisory firm. It provides insights into industry trends, competitive landscapes, target demographics, startup costs, profitability benchmarks, and growth opportunities.

Some details you’ll learn through market research as a financial advisor include:

- Top specializations are retirement planning, wealth management, and portfolio management. Other popular niches include financial planning, estate planning , tax advisory, and insurance services.

- When choosing a niche, also consider target demographics. For example, women now control over 50% of personal wealth in the U.S. representing a major customer segment.

- The financial barriers to launching an RIA firm have also lowered considerably. Startup costs can range from as little as $2,000 for a solo practice to $75,000 or more for larger firms.

- Ongoing overhead expenses are estimated between $40,000 to $280,000 based on company size and services offered.

- Higher revenue potential exists in wealth management and portfolio management niches.

With robust market growth and ideal customer targeting, the financial advisor business industry presents a compelling opportunity for aspiring entrepreneurs. Conducting in-depth market analysis can further help secure a foothold.

2. Analyze the Competition

Understanding the competitive landscape is vital for positioning your advisory firm. Competitive analysis will help develop a thorough financial advisor business plan. Conduct competitor analysis across these key areas:

- Research which investment services local competitors provide. Identify service gaps you could fill.

- Evaluate the target demographics and assets under management (AUM) of competitors using free online tools like BrightScope .

- Establish the average and median AUM figures in your market. Identify any underserved niche demographics you can target.

- Consider private lending services that clients may require analysis with.

- Most registered investment advisors (RIAs) generate revenue through asset-based fees, fixed fees, hourly fees, or retainer fees.

- Benchmark what fee ranges and models competitors follow for the services you will provide using the Kitces financial planning fee survey. This will help you develop competitive pricing.

- A key differentiator will be your ability to provide solid risk-adjusted returns.

- Use sites like Advisory World to compare investment returns of active advisors across 1, 3, and 5-year periods. Make your performance benchmarks accordingly.

- Scan online listings, website pages, content assets, reviews, and social media handles of top firms.

- Gauge what it will take to match or exceed their digital footprint and marketing content through clear unique value propositions and positioning.

The competitor analysis drill equips advisors with intelligence for strategic decision-making around offerings, niches, pricing models, and marketing tactics when starting their RIA firm. It forms the blueprint for long-term positioning and growth.

3. Costs to Start an Investment Advisory Business

When starting an RIA firm, advisors must budget for both initial and recurring expenses. Here is a comprehensive breakdown:

Startup Costs

- Business Formation: Forming a legal business entity like an LLC will cost $500 – $2,000 including state registration fees and licensing.

- Regulatory Registration: Registering as an investment advisor with the SEC costs about $3,000 – $5,000 while state registrations average $700.

- Office Space & Supplies: Leasing basic office space will range from $1,000 – $5,000 per month based on location and size.

- Legal & Compliance Setup: Engaging lawyers to review operating agreements, ensure SEC compliance protocols, and develop client contracts can cost between $3,000 – $10,000 initially.

- Salaries: Hiring even one full-time support staff like an office administrator, broker , or para-planner may cost $45,000 – $60,000 per year.

- Insurance Plans: E&O insurance is essential, costing on average $2,000 – $7,000 annually depending on coverage.

- Marketing: An initial year of inbound marketing via a company website, online directory listings, content, and SEO can range from $15,000 – $30,000 or more. Ongoing marketing is factored into recurring costs.

In total, starting an RIA firm may cost between $40,000 – $280,000+ depending on staff, office space, desired scale, and other elections.

Ongoing Costs

- Marketing Activities: Blogging, SEO services, PPC ads, retargeting campaigns, social media – $2,400 – $4,800 monthly

- Office Rent & Utilities: Depending on commercial lease terms – $5,000+ per month

- Staff Payroll Including Taxes & Benefits: Employee salaries + 20% – 30% for payroll taxes, health plans, other benefits

- Technology, Tools & Software: CRMs, financial planning tools, portfolio analytics, data aggregation – $300 – $1,500 monthly

- Admin, Operations, Finance: Phone systems, tax prep services, bookkeeping, product samples or client gifts/retainers – $2,500+ per month

- Regulatory Fees: Annual SEC fees, state notice filings, licensing renewals – $1,500+ yearly

Ongoing costs for a small RIA firm generally start around $40,000 per annum while larger firms may incur over $250,000+ in annual overhead expenses. The payoff is building an independent, scalable, and highly profitable advisory business.

4. Form a Legal Business Entity

When establishing an investment advisory firm, the legal structure carries major implications for liability, taxation, and business continuity. The four primary options—sole proprietorship, partnership, S-corp, and LLC—have unique pros and cons for RIAs.

Sole Proprietorship

The simplest and most affordable business model in the financial services industry is sole proprietorship. However, the owner assumes unlimited personal liability for company debts, losses, and legal issues of your own firm. Tax reporting is also meshed with personal returns. Only suited for single-employee operations with no growth ambitions.

General & Limited Partnerships

Involve two or more co-owners in a jointly operated advisory firm. A general partnership has equal participation in management while a limited partnership designates general partners overseeing operations. Unlimited personal liability still applies to general partners. Intricate profit/loss sharing arrangements also get complex fast with multiple partners.

S-Corporation

S-corp status offers RIAs liability protection and allows income/losses to pass to shareholders’ tax returns. Save for payroll taxes. Stringent IRS rules around ownership structure and shareholder compensation make scalability a challenge. Extensive record-keeping requirement is a downside for entrepreneurs.

Limited Liability Company (LLC)

The LLC structure uniquely combines the pass-through taxation benefits of a partnership with the liability protections of a corporation. Advisors’ assets remain shielded from any business lawsuits or claims, encouraging entrepreneurial risk-taking. Operationally, LLCs also impose lesser regulations compared to S-corps.

5. Register Your Business For Taxes

An Employer Identification Number (EIN) serves as a business’s tax ID number with the IRS for tax reporting and payment obligations. All investment advisory firms must acquire an EIN within the first few months of founding their LLC or corporation entity.

Obtaining an EIN is free and can be instantly processed online via the IRS website . Simply navigate to the EIN Assistant page and respond to a short Q&A about your entity structure and business activities. Upon submission of the form, your EIN is immediately displayed and emailed to you.

Additionally, investment advisors with plans to sell information products, workshops, or other taxable items must register with relevant state agencies to collect and remit sales tax. The process entails submitting details about your business products/services along with EIN.

Obtain an EIN to get a seller’s permit, sales tax ID number, and certificate of authority to collect statewide sales tax rates.

Most states do not charge registration fees. However, you must file regular sales tax returns to avoid penalties. Consulting a tax professional can help streamline multi-state sales tax compliance requirements as your RIA firm’s offerings and client base expand.

6. Setup Your Accounting

Comprehensive financial planning requires a little financial planning of your own. Robust accounting practices are non-negotiable for investment advisory firms. As RIAs directly handle client assets and investments, meticulous record-keeping, reporting, and auditing protections must be implemented from inception.

Open a Business Bank Account

Begin by establishing separate business banking and credit card accounts to avoid commingling personal and company funds which can trigger IRS red flags. Apply for credit cards designed specifically for small businesses that offer higher limits based on your EIN and entity history rather than personal credit scores.

Accounting Software

Next, integrate cloud accounting software like QuickBooks to automate income/expense tracking, generate financial statements, send client invoices, facilitate payments, and sync data across bank/credit card accounts. Their user-friendly UI helps advisors with no accounting background easily manage finances.

Hire an Accountant

Bookkeeping services are also vital for reconciling transactions, ensuring balances match actual bank statements, providing editable ledgers for taxes, and producing quarterly profit/loss statements. Expect to invest at least 4-6 hours monthly for robust bookkeeping at approximately $50 – $150 per hour.

7. Obtain Licenses and Permits

Before accepting any clients or managing assets, aspiring RIAs must register as investment advisors and obtain all necessary regulatory approvals. Find federal license information through the U.S. Small Business Administration . The SBA also offers a local search tool for state and city requirements.

For RIAs managing $100 million in assets or working with mutual funds, Securities and Exchange Commission registration in the financial planning profession is mandatory. This involves submitting Form ADV paperwork, appointing a chief compliance officer, putting investor protection protocols in place, and usually hiring an independent auditing firm.

Smaller RIAs with $100 million assets under management (AUM) must register through the state they are headquartered in. Form ADV must still be filed but directly with state securities regulators.

For both SEC and state-registered advisors, obtaining an RIA compliance certificate is vital to demonstrate an understanding of ethical guidelines and fiduciary duties in advising clients on investments. Requirements range from passing the Series 65 exam to accredited coursework completion.

Certain niches like insurance, retirement planning, or portfolio management call for additional licenses like Series 6, 7, 63, 65, or 66. Study material and exam fees for these range from $60 – $170 per license. Some states also mandate Investment Banking Representative licenses.

The licensing process provides rigorous training in ethical ground rules and advisor responsibilities around investor interests. Once armed with SEC/state registrations and key specialty permits, RIAs can commence legally serving clients.

8. Get Business Insurance

Starting a new financial advisor business requires insurance to mitigate risks that can derail hard-built success. Being financial stewards of client investments also requires advisors to implement adequate protections for their firms.

Lacking coverage would prove catastrophic for many reasons:

- Should hackers infiltrate client databases and steal personally identifiable information?

- Facing lawsuits, you must pay steep legal fees and settlement costs without insurance.

- If an advisor commits fraud, trades on insider tips, or mishandles client funds, financial and reputational damages ensue with no coverage fallback.

- When natural disasters like floods, storms, or wildfires damage premises and equipment firms face possibly permanent closure.

Ideal insurance coverage includes:

- Errors & omissions (E&O)

- Commercial property

- Workers Compensation

- Umbrella liability plans

E&O shields against negligence claims while cyber protects data assets. Obtain quotes by having an insurer evaluate the firm’s regulatory compliance rigor, security protocols, disaster recovery readiness, and liability exposures. Expect total annual premiums between $5,000 – $20,000 for adequate coverage.

Obtaining business insurance is akin to building organizational resilience. It prepares firms to smoothly handle major liability events, data breaches, and property disasters with financial compensation and legal protections firmly in place.

9. Create an Office Space

Establishing a professional office is pivotal for RIAs to conduct client meetings, securely manage sensitive financial documents, and grow teams as assets under management expand. Some options for an office space for a registered investment advisor include:

Coworking Spaces

Shared offices through providers like WeWork allow solo advisors to start with flexible, low-commitment arrangements. Opting for coworking spaces ranging from $300 – $800 monthly also builds networking opportunities with other entrepreneurs that could lead to referrals. However, being unable to host privacy-dependent client meetings on-site can be a key constraint.

Commercial Office

Dedicated office suites within Class A buildings provide the most professional environment for RIAs to meet and service high-net-worth individuals or institutions. While rents average $3,000+ monthly, the turns key infrastructure, reception staff, conference rooms, onsite parking and credibility with elite clients justify costs as AUMs scale to millions.

10. Source Your Equipment

Outfitting an RIA office with robust technology separates thriving firms from mediocre players. The specialized hardware and software needed fall into four categories, computing devices, cybersecurity programs, portfolio analytics tools, and client relationship management (CRM) systems.

New Equipment

Opting for the latest models with full warranties reassures clients about the firm’s financial stability. Shop business-grade devices with enhanced encryption, firewalls, malware detection, and data recovery features. Expect approximately $3,000 per high-spec laptop/desktop. Check out Best Buy and Office Depot .

Used Equipment

Gently used equipment through auction platforms like eBay cuts acquisition costs by 40% to 60%. Search for off-lease items from reputable manufacturers thoroughly inspected and data-wiped by sellers. Confirm compatibility specs align with software needs before purchase. Try Craigslist and Facebook Marketplace to start.

Rented Equipment

Renting hardware monthly allows advisors to deploy robust systems without major upfront capital. Certain specialty programs are exclusively available via rental from developers. Expect pricing between 5% to 10% of retail costs. While convenient initially, perpetual rents can add up over time.

Leased Equipment

Leasing gives access to cutting-edge equipment via affordable monthly payments over 3 to 5 years backing out the residual value. The lessor assumes the risk and maintenance responsibilities. Ideal for complex IT systems and continually upgrading tech. Adds 20% to 30% premium over outright purchases.

11. Establish Your Brand Assets

Crafting a distinctive brand identity helps investment advisory firms stand out amidst competition while nurturing instant recall value and trust with target clientele.

Getting a Business Phone Number

Acquiring a unique business phone and fax number lends legitimacy over using personal cell contacts for client communications. Cloud-based systems like RingCentral offer toll-free numbers with call routing, voicemail transcriptions, conference calling, and fax/SMS capabilities ideal for advisory operations. Plans start from $20 monthly per user.

Creating a Logo and Brand Assets

A custom logo symbolizing core values, strengths, or specialty areas paired with cohesive visual assets reinforces consistent brand recognition. When designing through affordable services like Looka , advisors can choose from an array of icons, colors, and typography styles matched to their positioning.

Business Cards and Signage

Vistaprint offers cost-effective business cards showcasing advisor credentials, services, and contact information for in-person client meetings and referrals. Plus customized interior/exterior office signage with logos establishes professional visibility. Content is also displayed on their website and mobile apps.

Purchasing a Domain Name

Domains like www.firmnameInvestmentAdvisors.com available through registrars like Namecheap lend authority and amplify SEO efforts. Opt for .com over alternate extensions. Keep names short and easy to remember. Renew for 5-10 years to retain ownership rights. Expect around $15 yearly for domain registration.

Building a Website

Well-designed websites quickly convey advisor value propositions while capturing contact details from prospects. Every RIA needs one. Options include intuitive drag-and-drop site builders like Wix for DIY sites or outsourcing creation to expert freelancers found on marketplaces like Fiverr for complete customization.

12. Join Associations and Groups

Expanding professional networks through industry associations, local meetups, and online forums fuels growth for investment advisors by enabling best practice sharing, referrals, and potentially lucrative partnerships.

Local Associations

Area chapters of leading wealth management bodies like the National Association of Personal Financial Advisors (NAPFA) and the Financial Planning Association (FPA) regularly host workshops, conferences, and networking events attended by top regional RIAs. Expect membership fees of $400 – $850 annually.

Local Meetups

Platforms like Meetup make discovering relevant seminars, mixer events, and skill-building workshops effortless via location/interest-based searches. Attending free meetups keeps advisors abreast of solution innovations.

Facebook Groups

Popular Facebook communities enable advisors to crowdsource guidance from thousands of networks. Learn about niche markets like fee-only planning, exit planning, socially responsible investing, behavioral finance, and other specializations. Check out Funding & Investment Secrets and Value Investments .

13. How to Market an Investment Advisory Business

Implementing multifaceted marketing strategies is non-negotiable for RIAs to consistently attract and convert high-net-worth individuals and institutional clients.

Referral Marketing

While an advisor’s professional and personal networks generate initial clientele, referral programs incentivize existing customers to endorse their services. Offering free credits, gift cards, or donations to their charity of choice for every new client sent establishes goodwill and amplifies word-of-mouth promotion.

Digital Marketing

- Google Ads campaigns targeted by keywords like “retirement planning”, “portfolio management”, and “wealth advisor” help RIAs appear at the top of search results for relevant buyer queries in their geographic area. Expect costs per click between $5 to $15.

- Facebook/Instagram ads showcase niche expertise to hyper-specific demographics filtered by age, income, education levels, and interests. Plan around $100 per month for testing.

- Publishing YouTube explainers establishing thought leadership around market developments, retirement strategies for different generations, and college savings helps content travel virally.

- SEO-optimized blogging discussing industry trends, advisor perspectives, and wealth planning advice improves organic visibility and search rankings when ranking for advisor terms.

Traditional Marketing

- Direct mailers with promotional offers mailed to high-income zip codes still garner respectable conversion rates in certain niches. Budget $2 per mailer.

- Sponsoring community events like golf tournaments and galas frequented by high-net-worth individuals creates networking opportunities. Plan $5,000+ per event.

- Local radio spots build mass reach for name recognition. Expect around $200 for 30 times weekly spot plays.

- Print ads in financial industry trade journals tap directly into large RIA networks open to mergers and acquisition deals.

As trust and credibility anchor business growth in advisory services, marketing should aim to nurture community relationships and convey functional expertise first and foremost.

14. Focus on the Customer

As you learn how to start a investment advisory business, remember your customer comes first. Delivering white-glove service and prioritizing client interests is pivotal for a new financial advisory business.

This involves proactively updating customers on portfolio performance rather than relying on them to inquire. Conducting periodic reviews to realign investment strategies with evolving financial goals also reinforces commitment.

During moments of market volatility assuaging concerns through educational sessions, risk analysis, and adjustment recommendations provides reassurance. Help navigate complex decisions around inheritance planning, stock options, and home purchases.

The exemplary experience at every interaction breeds loyalty even amidst fee changes. Satisfied individuals gladly refer family and friends once the advisor earns goodwill through genuine care for their financial well-being. Over time, the majority of new business stems from word-of-mouth on the back of stellar service.

Ultimately an advisor’s success hinges on the success achieved for customers. The relationships nurtured, knowledge imparted and outcomes secured determine growth. Service with integrity at the core sparks a virtuous cycle benefitting both clients and the firm.

You Might Also Like

March 8, 2024

0 comments

How to Start a Budgeting Coach Business in 14 Steps (In-Depth Guide)

The personal finance coaching industry has exploded in recent years. Between the overall task ...

How to Start a Credit Score Counseling Business in 14 Steps (In-Depth Guide)

The credit score counseling industry has seen steady growth in recent years. According to ...

March 1, 2024

The investment advisory services industry is on the rise. It’s expected to grow at ...

How to Start a Bookkeeping Business in 14 Steps (In-Depth Guide)

The bookkeeping industry is booming, with an expected compound annual growth rate (CAGR) of ...

Check Out Our Latest Articles

How to start a dog clothing business in 14 steps (in-depth guide), how to start a vintage clothing business in 14 steps (in-depth guide), how to start a bamboo clothing business in 14 steps (in-depth guide), how to start a garage cleaning business in 14 steps (in-depth guide).

US wealth management: A growth agenda for the coming decade

Wealth management is a growth industry, but it is experiencing a set of accelerating disruptions. While the pandemic challenged the performance of the US wealth management industry for much of 2020, the last 12 months have given rise to optimism that the conditions for a significant wave of innovation and experimentation across the wealth management ecosystem are in place. The conditions include rapid technological advancements, fast-evolving consumer needs and behaviors (accelerated by the pandemic), and an environment of economic stimulus.

About the authors

This article is a collaborative effort by Pooneh Baghai , Alex D’Amico , Vlad Golyk, Agostina Salvo, and Jill Zucker .

To thrive in this dynamic environment, firms must prioritize growth, adopt an innovation mindset, and be prepared to reallocate resources rapidly in response to the changing context. Finally, to free resources for strategic investment and prepare for any potential market downturn, firms can rethink their cost structures and improve the industry’s spotty record on cost management.

To guide these efforts, this paper offers a brief overview of the US wealth management industry’s present conditions and then presents four themes that define the new growth narrative we foresee. We recommend agenda items for wealth managers to address as they plan how to flourish in the changing ecosystem. Finally, we offer questions for organizational self-assessment.

Coming out of the crisis: Resilient but not unscathed

At face value, the US wealth management industry entered 2021 from a position of strength—record-high client assets, record growth in the number of self-directed and advised clients, and healthy pretax margins (Exhibit 1). However, beneath these strong headline numbers, the story was mixed, with the worst two-year revenue growth since 2010, as well as negative operating leverage. The depressed margins and profit pools that resulted were caused primarily by rock-bottom interest rates and uneven cost discipline (Exhibit 2).

Consequently, while the industry is now benefiting from vigorous market performance, it faces significant crosscurrents: equity-market and interest-rate uncertainty and industry-specific challenges including lack of cost discipline, increased competition from new entrants, and an aging and shrinking advisor force.

Despite this near-term uncertainty, US wealth management remains a growth industry, albeit with moderating revenue growth projections. McKinsey modeling suggests industry revenue pools will grow by about 5 percent per year over the next five years, 1 Long-term asset class forecast, Q2 2021 , State Street Global Advisors, April 22, 2021, ssga.com. driven by moderating market performance, moderate net flows, and the continued shift from brokerage to advisory (where revenue yields are typically higher). However, the growth will not be equally split among industry segments. We expect digital advice models, including robo- and hybrid advisory, to continue growing fastest, potentially even outperforming their historical revenue growth of more than 20 percent per year. Next in terms of growth will be registered investment advisors (roughly 10 percent projected annual growth rate), followed by national/regional broker–dealers (6 percent), direct brokerages (5 percent), wirehouses (2 percent), and other broker–dealers (independent, retail, and insurance owned) plus private banks (1 percent). If interest rates return to prepandemic levels, wirehouses and direct brokerages will disproportionately benefit, given their reliance on interest income from cash for profitability, with the overall growth rate for the industry reaching about 7 percent a year—similar to the growth that occurred between 2015 and 2018.

A growth agenda for the coming decade

Over the last 18 months, the industry has spurred a significant wave of innovation and experimentation. It is also facing long-standing demographic shifts that will redistribute wealth among subsegments. This combination of forces will shape growth trends for years to come. We see four key themes: fast-growth segments, new client needs, new products, and new business models (Exhibit 3).

Fast-growth segments offer new potential

Three investor segments are showing signs of significant and lasting growth: women, engaged first-time investors, and a segment we call hybrid affluent investors.

Women are taking center stage as investors over the next decade. Today, women control a third of total US household investable assets—approximately $12 trillion. Over the next decade, this share will grow. The biggest cause of this shift will be demographics: as baby boomer men die, many will cede control of assets to their female spouses, who tend to be both younger and longer lived. By 2030, American women are expected to control much of the $30 trillion in investable assets that baby boomers will possess—a potential wealth transfer that approaches the annual GDP of the United States. At the same time, younger affluent women are becoming more financially savvy; for example, 30 percent more married women are making financial and investment decisions than five years ago. 2 For more on these trends, see Pooneh Baghai, Olivia Howard, Lakshmi Prakash, and Jill Zucker, “ Women as the next wave of growth in US wealth management ,” July 29, 2020, McKinsey.com.

$3O trillion in investable assets will be possessed by baby boomers by 2030, much of it controlled by women

A new wave of engaged investors are opening accounts. The resurgence of the engaged-investor, or active-trader, segment has been one of the most headline-catching disruptions in the industry. Since the start of 2020, more than 25 million new direct brokerage accounts have been opened, a significant percentage by first-time investors. This growth resulted from a confluence of prepandemic market developments (for example, the elimination of online brokerage commissions, access to fractional share capabilities) and pandemic-related trends such as high savings rates (enabled by lower consumption).

While this segment’s exponential growth is likely not sustainable (for example, there was a sharp decline in trading app downloads and active daily users in the third quarter of 2021), it remains poised for accelerated growth over the next decade, given engaged investors’ relatively low median age of 35. 3 Schwab Generation Investor Study 2021, aboutschwab.com. The opportunity for wealth managers is to serve this segment by meeting their demand for direct brokerage-based investing and to build deeper relationships with them over time—for example, by recognizing that these new investors tend to express their personal values in their investment decisions.

40% increase in total direct brokerage accounts since the start of 2020—more than 25 million new accounts

Hybrid affluent investors are an opportunity to differentiate. While headlines have focused on the rise of first-time young investors with typically low assets, growth in the hybrid investor segment—those with at least one self-directed account and a traditional advisor—has been overlooked. In 2021, a third of affluent investors—households with more than $250,000 and less than $2 million in investable assets—were hybrid (Exhibit 4), a sharp increase of nine percentage points in just three years. The biggest beneficiaries of this trend have been incumbent and new direct brokerages, as well as some traditional wealth managers with sizable direct brokerage platforms.

The rapid growth of hybrid affluent investors is a result of two trends that are expected to persist: investors’ desire for human advice and the ease and affordability of direct investing. Therefore, to foster deep relationships with affluent clients and prevent them from investing with competitors, wealth managers of all types need to have both direct brokerage and advisor-led offerings with a seamlessly integrated experience across the two. Achieving this will not be easy; it will require careful management of channel conflicts and potential revenue cannibalization.

New customer needs provide an opening to differentiate

Investors are increasingly looking for institutions that can provide them with omnichannel access, integration of banking and wealth management services, and personalized offerings. As similar kinds of benefits become available from providers of other services, investors see them more as needs than as luxuries. In fact, fully 50 percent of high-net-worth (HNW) and affluent clients say their primary wealth manager should improve digital capabilities across the board.

Omnichannel access is no longer just ‘nice to have.’ One of the clearest disruptions triggered by the pandemic has been the sharp acceleration of digital adoption across consumer segments—including wealthier and older clients who were previously less digitally inclined with respect to financial advice. As a result, according to McKinsey’s latest Affluent and High-Net-Worth Consumer Insights Survey, digital is now the most preferred channel for clients, closely followed by remote (Exhibit 5).

This trend is even more pronounced for the HNW segment, which we define as households with more than $2 million in investable assets: roughly 40 percent of HNW clients say phone or video conferences are their preferred wealth management channels, and only 15 percent look forward to going back into branches or resuming in-person visits. Interestingly, the preference for digital and remote engagement among HNW clients is higher than for their affluent counterparts.

50% of clients think their primary wealth manager should improve their digital capabilities

Convergence of banking and investing has gone mainstream. Over the last three years, there has been a striking increase in clients’ preference to consolidate their banking and wealth relationships to achieve convenience and better relationship deals: the share with this preference has risen from 13 percent in 2018 to 22 percent in 2021. The trend applies to both wealthy and young households (Exhibit 6). In particular, 53 percent of those aged under 45 and about 30 percent of those with $5 million to $10 million in investable assets prefer to consolidate relationships.

Banks and wealth managers alike can benefit from this trend, but their starting position differs by client segment: HNW, ultra-HNW, 4 In this article we define HNW customers as those with between $2 million and $25 million in investable assets; ultra-HNW have more than $25 million in investablele assets. and older clients tend to consolidate banking with their primary wealth manager, whereas young investors are more likely to consolidate wealth management with their primary bank.

Clients’ reasons for consolidating with their primary bank or investment firm vary. High-yield deposits, lower management fees, and seamless transactions across accounts are the top three reasons for consolidation—and are basically table stakes. Beyond that, our research has found that banks generally win on convenience (for example, an existing relationship with the client, customer service tailored to younger clients), while investment firms win on products and reputation (for example, more expansive accounts or products such as securities-based lending, concierge-like customer service tailored to older clients, and recommendations).

The increased preference for consolidating banking and investing has been driven by a flurry of innovation. National banks are building wealth management capabilities and closely integrating experiences with traditional banking services, often in partnership with fintechs. Full-service wealth managers are upgrading their digital banking capabilities. And consumer-facing fintechs—with millions of users—are blurring the lines between investing and cash management.

Rise of personalized investing. Personalization matters. It is a key driver of client satisfaction and the number-three factor for clients selecting financial advisors. Wealth managers have responded to the demand to personalize investment management with customized, tax-efficient managed accounts. Because of their operational complexity, these products have typically been accessible only to the HNW and ultra-HNW segments. However, direct indexing, fractional share trading, and $0 online commissions are shifting the paradigm by enabling customized portfolios of securities at lower minimums.

Assets under management (AUM) in direct indexing tripled between 2018 to 2020, reaching $215 billion, or 17 percent of the retail separately managed account (SMA) market. We anticipate direct indexing volumes to triple through 2025, given how this new investing technology meets client needs, most notably the growing demand for tax-efficient investing and the desire of some retail investors, particularly younger clients, to ensure that their portfolio holdings reflect their personal values (Exhibit 7). The recent flurry of acquisitions of direct indexing providers by leading US wealth and asset managers will create further supply-side momentum in expanding the growth of the category.

Broader adoption among clients will require further innovation. For both self-directed and advisor-led models, offering direct indexing requires a careful consideration of the trade-offs associated with taxes and environmental, social, and governance (ESG) constraints. All this creates a need for intuitive interfaces and analytical tools, which need to be integrated into the advisor desktop and workflow.

New products expand ways to serve customers

Across industries, transformation arises from the introduction of new products. In wealth management, we see notable potential in two main categories of new products: investments in private markets and investments in digital assets.

Democratization of private markets. In the current lower-for-even-longer interest-rate environment, investors’ appetite for alternative investments is as high as ever, with the young leading the way: about 35 percent of 25-to-44-year-old investors indicate an increased demand for alternatives. Within alternatives, private markets (private equity, private debt, real estate, infrastructure, and natural resources), an asset class that was once the preserve of institutional investors, is making inroads to individual portfolios. Large private-markets firms are building out retail distribution capabilities and vehicles, and home offices make it easier for clients to access private-markets products, often with the help of fintech infrastructure providers. Increased client demand and innovations have potential to increase the share of assets allocated to private markets from about 2 percent in 2020 to 3 to 5 percent by 2025, representing asset growth of between $500 billion and $1.3 trillion. It is imperative for wealth managers to facilitate this growth by making it easier for their clients to access private markets.

Digital assets going mainstream. The arrival of an army of new retail investors has proven to be a boon to the growth of new asset classes that were incubated in the margins of the market. Nowhere is this phenomenon clearer than in the realm of digital assets, which have ballooned from a combined valuation of $100 billion in 2019 to a market capitalization of more than $2.5 trillion today. They span multiple digital asset classes, or “tokens,” beyond cryptocurrencies, including tokenized equities, bonds debt, stablecoins (typically pegged to conventional currencies), art, and collectibles. The motivations for investors in digital assets are diverse—experimentation, speculation, the search for inflation protection, or getting exposure to the building blocks of new technology that is increasingly cast as the next iteration of the internet (that is, Web3). Whatever the motivation, investors’ enthusiastic embrace of digital assets is very clear. For example, digital trading platform Coinbase has gathered a staggering 68 million verified users.

For wealth managers, digital assets present both an opportunity and a challenge. On the one hand, the cryptocurrency market has grown too large to ignore amid robust client demand; 11 percent of affluent clients and 8 percent of HNW clients invest in digital assets. On the other hand, three broad challenges are associated with offering cryptocurrencies. First, regulatory ambiguity—on asset classification and tax reporting, among other issues—has lingered, often creating uncomfortable levels of risk exposure for wealth managers. While it is still early days, the advent of crypto exchange-traded funds (ETFs) could help address some of these challenges. Second, the infrastructure required for offering digital assets, including custody services, differs from what is required for traditional investment products. Lastly, digital asset classes are not well understood by many advisors, so advising on the products is challenging for them.

Wealth managers face a choice: they can take a wait-and-see approach and accept the business risks associated with staying out of a rapidly growing market, or they can pursue the opportunity aggressively by leveraging partnerships with fintechs while addressing heightened regulatory risks. What remains for certain is that over the longer term, there is meaningful potential for a far broader class of digital assets to enter the investing mainstream and for the underlying technologies of blockchain-based decentralized finance (DeFi) to revolutionize the distribution of investment products, including the T+0 settlement cycle.

New business models position firms for growth

The last of our four contours of the new growth narrative is the introduction of new business models. Two such models are of importance: offering services to registered investment advisors (RIAs) and digitizing the delivery of advice.

Advisors’ desire for independence presents an opportunity to serve RIAs. The last decade has seen a migration of advisors to registered independent advisors, with 24 percent of all financial advisors being part of an RIA in 2020, compared with 16 percent in 2010. This shift is expected to continue apace, with the share of advisors affiliated with RIAs growing to 26 percent by 2025. Motivations for advisors’ migration to RIAs include the expectation of higher payouts plus two other factors: First, advisors are looking at the RIA channel as the best way to monetize their business, with RIA acquisition multiples for top advisors (those with books over $1 billion) two to three times higher than retire-in-place incentives at traditional wealth managers. Second, technology and services firms, working in conjunction with the major custodians, have lowered barriers for advisors to launch their own firms. Moreover, advisors believe they can procure technology and services that are similar to or better than what traditional wealth managers provide.

While this trend presents a challenge for wirehouses and broker–dealers, whose advisor force is expected to shrink by 3 percent over the next five years, there is a silver lining: RIAs’ reliance on third-party products and solutions creates an opportunity for participants in the wealth management ecosystem to seek a share of this fast-growing revenue and profit pool. Some ecosystem participants are viewing this segment in terms of a single product or service—lead generation, tech point solutions, custodial offerings, banking-as-a-service for advisors, asset management. Others, including turn key asset management providers (TAMPs), established custodians, and traditional wealth managers with attacker mindsets, are attempting to build a next-generation, wirehouse-quality platform for advisors.

Therefore, wealth managers, especially those who rely on advisor recruiting for growth, need to look beyond the competitive threat posed by the fast-growing RIA channel and explore new business models that would allow them to participate in this growing revenue and profit pool. Wealth managers seeking to serve the RIA segment will need to manage technology as a core competency, and those with large advisor forces will need to manage the advisor attrition risks associated with opening up the platform (even partially) to RIAs.

2X faster annual revenue growth projected over the next five years for RIA channel versus industry overall

The opportunity for digital advice models. Digital advice models, including robo-advisor and hybrid advisor models, have been around for more than a decade and have been the fastest-growing wealth management delivery model, with more than 20 percent annual revenue growth between 2015 and 2020. They still account for only about 1 percent of the market, but the growth prospects are high: the last three years—and last 18 months in particular—have marked a step increase in investor comfort levels with these offerings (Exhibit 8). In fact, the share of investors saying they are comfortable with remote advice grew from about 38 percent in 2018 to roughly 46 percent in 2021. Among clients younger than 45, the comfortable share grew from 43 percent to 59 percent. Similarly, while comfort with digital-only advice remains modest overall at about 15 percent, it has more than doubled since 2018 among investors under 45, to roughly half in 2021.

Unsurprisingly, the growing interest has motivated wealth managers to expand into and innovate in this channel. However, wealth managers should be aware that achieving a step change in adoption of digital advice offerings will require going beyond the lower-cost value proposition, privileged acquisition strategies, and brand equity. Among investors who do not express comfort with robo-advisor models, the main reasons they give are perceived lack of personalization, privacy concerns, and lack of motivation to explore the offering. Bringing more investors on board will require matching the advisor-like experience with personalized content and solutions.

60% increase in share of investors comfortable with digital-only models since 2018 and 21% increase in those comfortable with remote models

Embracing the new growth narrative: A four-part agenda

Clearly, wealth management remains an attractive industry with strong growth fundamentals and long-term margins. If anything, the disruptions we have discussed in this report expand the industry’s options and will shape the growth narrative for the next decade.

Given the pace of change, stasis is not a viable option. We recommend that wealth managers follow a four-part agenda for action: reposition, redesign, reimagine, and reallocate.

Reposition the firm for what’s next

Every wealth manager needs to take a hard look at the secular growth themes shaping the industry—fast-growth segments, banking, personalization, new product propositions, and new business models—and decide, based on the firm’s unique sources of competitive advantage, which of these updrafts it should ride. Where a firm lacks natural advantages in capitalizing on particular growth themes, M&A is a critical lever for accelerating the repositioning of individual wealth management franchises. The last 24 months have seen numerous high-profile transactions as firms seek scale and/or the acquisition of new capabilities to accelerate their strategy. We expect M&A to be a particularly important theme over the next 24 months as wealth managers reposition themselves for the postpandemic “next normal,” whenever it arrives.

Redesign offerings for new needs

Firms also should monitor and try to anticipate evolving client needs, using this information to redesign their offerings. Examples could include new value propositions (for instance, around tax efficiency, integration of wealth and banking, or specific high-growth segments), privileged access to new products (such as digital assets or private markets), or completely new business models (for example, light-guidance digital offerings).

Reimagine client engagement and experience

The third agenda item is to radically reimagine client engagement and experience. The pandemic has reset clients’ assumptions about how they want to be served, and the accelerated uptake of technology has created unprecedented degrees of freedom for wealth managers. Every wealth manager needs to ask, “What is the blueprint for a client experience model in a digital-first world?” and “How can such a model simultaneously deepen our relationships and broaden our reach?”

Reallocate resources to support the strategy

Finally, successful wealth management firms make a bold commitment to putting the money where the strategy is, and they make multiyear resource-reallocation decisions, including where firm’s top talent spends time, in favor of growth. Regular reallocation of resources is a critical but often neglected step that can close the loop between visionary strategic intent and successful implementation.

Our research across industries suggests that fortune favors the bold: the top third of companies, which have been the most dynamic resource reallocators, achieved 1.6 times higher total returns to shareholders than the bottom third (about 10 percent versus 6 percent annualized over 20 years). In the wealth management context, we estimate that top performers are making strategic resource reallocation decisions to the tune of 15 percent or more of operating expenses over five years, whereas those simply dabbling with subscale experiments in strategic growth areas will not see results. Simply put, firms should not aim to be all things to all clients.

Five questions for wealth management executives

Given the significance of the opportunity at hand, wealth management executives must consider their firm’s readiness to capitalize on it. To provoke a self-assessment, we offer five questions for executives to ponder and discuss with their teams:

- What are the three or four priority growth themes you are betting on for the next five years? While several growth avenues and disruptions are reshaping the wealth management landscape, the optimal recipe will differ depending on an individual firm’s starting position and its sources of competitive advantage. Clarifying priority growth themes and aligning with your executive team help lay a foundation for developing a winning growth strategy.

- Do you have the right team and operating model? To paraphrase Peter Drucker’s famous phrase, “Execution eats strategy for breakfast.” A prerequisite for successful execution is an effective leadership team that is brought together around critical behaviors. In the context of wealth management and the shifts the industry is going through, these behaviors for executive teams must include operating in an agile manner and developing connections across business units and functions. In addition, the team needs leaders who are not afraid to experiment and innovate and whose mandates are aligned with major growth themes that typically cut across business unit lines (for example, banking and wealth, segments, sustainability). 5 For more, see Natasha Bergeron, Aaron De Smet, and Liesje Meijknecht, “ Improve your leadership team’s effectiveness through key behaviors ,” January 2020, McKinsey.com.

- Does your ability to attract sought-after client-facing and technology talent match your ambition? Over the last 12 to 18 months, wealth managers of different sizes and business models have publicly announced ambitious hiring targets with an emphasis on client-facing and technology talent. However, these plans have been challenged by severe labor shortages across industries, as a result of what has been dubbed the Great Attrition: 40 percent of employees say they are at least somewhat likely to leave their current job in the next three to six months, and 54 percent of employees say they leave because they do not feel valued by their organizations. 6 Aaron De Smet, Bonnie Dowling, Marino Mugayar-Baldocchi, and Bill Schaninger, “ ‘Great Attrition’ or ‘Great Attraction’? The choice is yours ,” McKinsey Quarterly , September 8, 2021, McKinsey.com. Wealth management is no exception to this trend. While many of the levers for attracting and retaining talent remain effective, other factors have gained importance during COVID-19, with more than 80 percent of workers saying that a hybrid-office working model is the optimal route forward. In addition to rethinking their operating models to attract and retain talent, wealth managers need to take bolder and more creative approaches to attracting new-to-industry talent. These may include flexible working arrangements, alternative career paths (including new payout structures for client-facing roles and programs aimed at creating the next generation of advisor talent), and partnerships with various types of educational institutions.

- Are you reallocating a significant portion of your resources—spending and capital—toward priority growth areas, including M&A? Systematic and dynamic resource allocation is an essential part of a winning business strategy. Achieving industry-leading levels in this area involves several steps: conducting a critical review of the firm’s existing cost structure, introducing a culture that continuously reallocates resources from low- to high-value tasks, increasing transparency around returns of individual projects, and implementing governance processes to enable more dynamic resource allocation. Capital reallocation can be a powerful tool for acceleration of growth in high-priority areas, which requires a clear M&A blueprint consistent with the broader enterprise strategy. We expect three major M&A themes to shape wealth management deal making in the next 18 to 24 months: (a) transactions focused on platform synergies, mostly in the vibrant RIA market but also among the largest wealth managers; (b) transactions focused on entering adjacent revenue pools, such as asset management, banking, retirement, or payments; and (c) transactions to acquire capabilities that will be key for growth—for example, direct indexing, tax solutions, or wealth tech. While not all deals are accretive in value, the top 25 percent of deals achieve 8.5 percent excess TRS. Top acquirers are distinguished from the rest by two characteristics: the ability to embed M&A in their strategic planning process and a clear post-acquisition playbook, inclusive of an integration capability. Thinking through programmatic M&A in the context of business strategy is essential for making accretive deals that contribute to both top-line growth and business value.

- Do you have a partnership strategy rooted in your business strategy? When it comes to digital, data, and technology, it is impossible for any organization to stay ahead of the pack on every dimension, so a clear partnership strategy is crucial. In fact, many wealth management incumbents already rely on fintechs to gain access to better technology across the value chain—client acquisition, client front-end, portfolio management, point solutions on advisor desktops, cybersecurity, and cloud infrastructure, among others. Looking ahead, it is important for executives and their teams to be clear-eyed about which capabilities will be a source of sustainable competitive advantage and then to decide how to acquire those capabilities: build in-house, build in-house in partnerships with fintechs, or outsource.

Despite a modest dip in profits, the US wealth management industry has thus far come through the pandemic not only unscathed but with tailwinds from sustained demand for advice, potential upside of higher interest rates, the rise of new client segments, and the embrace of unprecedented levels and speed of innovation. As the industry moves toward the hoped-for postpandemic new normal, it faces near-term macroeconomic uncertainty but also meaningful opportunity.

Tomorrow’s successful managers will need to adapt their models to preempt the disruptions that lie ahead and adopt a new sense of purpose and innovation as they head into a period of growth.

Pooneh Baghai is a senior partner in McKinsey’s Toronto office; Alex D’Amico and Jill Zucker are senior partners in the New York office, where Agostina Salvo is an associate partner; and Vlad Golyk is a partner in the Southern California office.

Explore a career with us

Related articles.

Crossing the horizon: North American asset management in the 2020s

North American wealth management: Money in motion, but not always to the bottom line

The value of personal advice: Wealth management through the pandemic

Why USA Financial?

Find out if you’re a right-fit advisor.

Coaching & Consulting

Unlock quality referrals, scale your business, free up time.

Incorporated Compliance

The support you need to grow and protect what you’ve built.

Transition Assistance

Hands-on partners to make the process go smoothly.

Marketing Support

Tools and resources for attracting your ideal clients.

Attentive Operations

Simplified paperwork to reduce needless back and forth.

Investments & Asset Management

Diversified investment solutions in an all-in-one portfolio management platform.

Financial Planning

Frictionless planning tools to optimize client experience.

Insurance & Annuities

Manage risk efficiently to complement your portfolios.

Integrated Technology

Get more options with solutions that work.

Stay informed with the latest from industry experts, including these featured series:

- All Insights

- Trending Report Series

- Marketing Insights

- The RARE Advisor Series

Advisor Events

Learn from speakers and industry experts, including these featured events:

- Prospective Advisors

- Affiliated Advisors

Our History

Our success story is your success story.

Corporate Structure

Support your practice with our family of specialized companies.

- USA Financial Exchange

- USA Financial Formulas

- USA Financial Securities

- USA Financial Insurance Services

- USA Financial Advisor Advancement

Opportunities to join our team.

Leadership & Team

Meet our team committed to helping you grow.

Media/Press

Stay up to date on what’s new and noteworthy.

- How We Work

- Investor Insights

- Forms & Disclosures

- Investor Logins

- Advisor Login

Guide to Building and Growing Your Advisory Business

The decade’s-long trend toward fee-based advisory business was validated as financial professionals faced the global pandemic in 2020. While professionals relying on new clients for revenue via transactional business found themselves in a predicament as the country went on lockdown and people stayed home, those with recurring revenue streams from assets under management (AUM) were able to navigate the choppy waters with far less revenue fluctuation in their businesses.

While the trend toward AUM has been growing for the past decade, there appears to be a perfect storm triggering demand. The current market conditions have investors clamoring for active participation in the stock market. Meanwhile, regulatory changes seemingly favor the business model where conflicts of interest can be reduced or eliminated.

This puts financial professionals in a position to introduce investment advisory services or grow their current AUM. This guide will share 30-years of insights, tools, and best practices for growing and managing AUM whether you’re just getting started or have been doing it for many years.

- Setting yourself up for success.

- Understanding TAMPs.

- Legal stuff.

- A different kind of growth.

- Your questions answered.

Want to keep reading?

Related posts.

What’s Trending: Rates Too High, Yet Somehow Too Low

The Federal Reserve is in quite a conundrum - rates are both too high and too low. What people don’t realize is that there is a little-known calculation that actually helps identify this. We’ll reveal this calculation in this episode of the Trending Report, as well as cover market data as of 3/22/2024.

What is a TAMP and Why Do Advisors Use Them?

The financial services industry is a whirlwind of change: New rules, products, and evolving technologies that can quickly overwhelm even the most seasoned advisor. Add to that the juggling act of managing daily demands and operational tasks while building your ideal practice. No wonder so many advisors feel like they’re just winging it year after year.

What’s Trending: Active vs. Passive Portfolio Errors

As humans, we tend to make very predictable errors. We’ve been on a strong bull run for quite some time now, and we’re seeing investors making the same mistakes they have in the past. In this episode of the Trending Report, we’ll take a deeper look at these active vs. passive portfolio errors, as well as cover market data ending on 3/8/2024.

- Create Account

Signed in as:

- Business Models

- Team Building

- Transitioning/Retirement

- Articles & Interviews

- Template Tutorials

BUSINESS MODELS FOR FINANCIAL ADVISORS

HANDBOOK AND TEMPLATES

Introduction

Listen to the introduction to Business Models for Financial Advisors read by Christine Timms.

Read the introduction to Business Models for Financial Advisors .

Table Of Contents

Peek at the table of contents to see all of the topics the book covers.

SUMMARY OF HANDBOOK

A well articulated, written business model is a valuable tool for advisors at all stages of their career. Advisors having a deeper understanding of their own practice and who it serves best, will lead to sustainable relationships based on a win-win business model. I define an advisor’s business model as the articulation of who the advisor’s most compatible clients are, the services and products that the advisor offers those clients, how those products/services are provided, how clients are charged and how the advisor is paid. I show how advisors in all stages of their careers can benefit from a well-defined business model, even those about to retire. The handbook provides a checklist process to quickly articulate, develop or analyze an existing or desired unique business model. I provide an example of the process by showing completed checklists based on the final years of my practice and the resulting printed business model. I include discussions regarding many of the required decisions as we progress through the checklists for the various business model components. I also discuss household capacity of practices and provide an analytical tool and checklists to facilitate the segmentation of clientele. This handbook includes appendices “Why Advisors are Not Interchangeable”, “Why Many Revenue Sharing Advisors Have and Deserve Above Average Incomes” and “The Average Advisor of Various Financial Advice Channels.”

TESTIMONIALS

“The ideas and templates Chris developed in Business Models for Financial Advisors are useful and practical. Advisors like myself can benefit immensely by using these tools to help structure our practice and therefore provide a more consistent and positive client experience.”

—Maili Wong, CFA, CFP®, FEA

Executive Vice-President, Senior Investment Advisor & Senior Portfolio Manager,

Director, Wellington-Altus Holdings Inc.

Author of Smart Risk: Invest Like The Wealthy To Achieve A Work-Optional Life

2022 Canadian Advisor Of The Year (Wealth Professional)

One of Report On Business 2021 SHOOK Canada's Top Wealth Advisors

One of Canada’s Most Powerful Women: Top 100TM by WXN

“I really like your approach and, in particular, all the useful templates and checklists you provide. It is far more practical than many practice management books I have read over the 32 years I have been in the industry.”

—Gary Mayzes

Senior Vice-President & Regional Manager, Wellington-Altus Private Wealth

Over 30 years experience in the investment advice industry

“Business Models for Financial Advisors has been a valuable source of ideas and tools for my practice. The service model (communications, investing, tax, resource management, pricing/client cost) checklists provided us with documented questions on areas we may have thought of previously but have never written down as a defined process. It created awareness that we may not be going as deep into personalizing meetings for each client. My associate specifically found the financial planning service model helpful. Along with our current model, he appreciates the detail put into the checklists. I think they would be a major asset for advisors that lack process and a huge asset for advisors early in a career.”

—Kevin Punshon

Financial Advisor for over 30 years

Chairman’s Club member

Branch Manager Big Five Canadian Bank owned brokerage firm

“The ideas and checklists presented in Business Models for Financial Advisors are very timely and helpful for us to use as a business planning tool as we develop and settle our business plan forward and develop the appropriate business model(s) to help us accomplish our objective.… It is, in aggregate, a superb tool for us to use to help all of the people in my practice determine, define and settle the forward direction we need to take our business to the next higher level.”

—Rollie Guenette

Financial Advisor for over 25 years

Big Five Canadian Bank owned brokerage firm

“Your business models book was excellent. I’ve shared it with my team to read so that we can implement some of your best practices. It’s always valuable to take a deeper dive into your business and be continually improving on the efficiency and what you have to offer. Your book pushed us to do that.”

—Adam Slumskie

Portfolio Manager

Financial Advisor for 13 years

Named one of 2021 Top Wealth Advisors in Canada by Shook Research and the Globe & Mail

available templates

Business model checklists, service model client segmentation checklists.

Eight checklist templates to help you articulate, develop or analyze your business model:

- Compatible Sustainable Clientele Checklist (sample and template)

- Service Model: Communication Checklist (sample and template)

- Service Model: Investing Checklist (sample and template)

- Service Model: Financial Planning Checklist (sample and template)

- Service Model: Tax Services Checklist (sample and template)

- Resource Management Checklist (sample and template)

- Pricing and Client Costs Checklist (sample and checklist)

- Choosing Compensation Structure (sample and checklist)

- Four checklist templates to help you articulate your customized service offerings for A/B/C/D segments of your clientele.

- Segmenting Clientele: Identify Your Segmentation Criteria

- Segmenting Clientele: Checklists for each of the components of the service model (samples and templates)

Free Flow Chart

Investment allocation decision flow chart.

A template to prepare a concise and simplified summary of your approach to investing and a practical worksheet for meetings and conversations with clients regarding the allocations in their investment portfolio.

Note that some templates may not be exactly as pictured above or in the handbooks.

Copyright © 2023 CT Financial - All Rights Reserved.

Page Unavailable

Unfortunately, the page you requested is temporarily unavailable.

Please try again later or call 1-800-522-7297 between the hours of 8:30AM – 7:00PM EST

Akamai Reference Number: 18.24fc733e.1714239772.157079e2

- Search Search Please fill out this field.

- What Is an RIA?

- Understanding RIAs

Registering as an RIA

- Responsibilities

- Requirements

RIAs vs. Broker-Dealers

How rias make money, how to choose an ria, what else to check, the bottom line.

- Finding a Financial Advisor

Registered Investment Advisor (RIA) Definition

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Investopedia / Julie Bang

What Is a Registered Investment Advisor (RIA)?

A registered investment advisor (RIA) is a financial firm that advises clients on securities investments and may manage their investment portfolios . RIAs are registered with either the U.S. Securities and Exchange Commission (SEC) or state securities administrators.

RIAs and the people who work from them have fiduciary obligations to their clients, meaning that they have a fundamental duty to always and only provide investment advice that is in their client’s best interests.

Key Takeaways

- Registered investment advisors (RIAs) are financial firms which manage the assets of individual and institutional investors.

- RIAs must register with the U.S. Securities and Exchange Commission (SEC) or a state regulatory agency, depending on the value of assets under the RIA’s management.

- RIAs typically earn their income through management fees, calculated as a percentage of a client’s assets under management (AUM) by the RIA.

- Unlike broker-dealers, RIAs have a fiduciary duty to put the best interests of the client first.

- Investment advisor representatives (IARs) are the financial professionals who work for RIAs.

Understanding Registered Investment Advisors (RIAs)

The rules on investment advisors were formulated by the Investment Advisers Act of 1940 . This law requires individuals or businesses that dispense professional investment advice to register with the SEC, although there are exemptions for smaller firms. Advisors might also be considered qualified professional asset managers (QPAMs) .

Investment advisors are permitted, although not required, to register with the SEC if they manage a minimum of $25 million in assets . However, it becomes mandatory for those firms that manage $100 million or more, as RIAs managing at least that amount are required quarterly to disclose their holdings to the SEC. Investment advisors who manage smaller sums of investment money are typically required to register with state securities authorities.

RIA vs. IAR

Note that there is a difference between a registered investment advisor (RIA) and an investment advisor representative (IAR) . An RIA is a company that offers financial guidance to clients. The IAR is the person who gives the financial advice. The RIA can have many employees, including several IARs, or it can be just one person who is both the RIA and the IAR. The IAR thus works for the RIA and provides the actual financial services to the clients.

Registering as an RIA does not imply any recommendation or endorsement by the SEC or any other regulator. It means only that the investment advisor has fulfilled all of that agency’s requirements for registration. Registering with the SEC requires disclosing information that includes:

- Investment style of the advisor

- Assets under management (AUM)

- Their fee structure

- Any disciplinary actions that were taken against the advisor

- Any current or potential conflicts of interest

- Key officers, if the RIA is a company

RIAs must annually update their information on file with the SEC, and the information must be made available to the public.

Services of an RIA

RIAs provide more services than just investment advice. Their services and advice may cover the following subjects:

- Financial planning

- Retirement planning

- Estate planning

- Wealth management

- Investment management

- Debt repayment

Requirements of RIAs

RIAs must follow certain practices and procedures when furnishing advice to their clients. These include:

- SEC registration : RIAs with more than a certain level of AUM are required to register with the SEC, as well as a state governing body depending on the location and the number of clients .

- Disclosure : RIAs are required to disclose any risks or possible conflicts of interest pertaining to the specific transactions that they recommend to their clients. RIAs must also ensure that the client understands any risks.

- Assumption of burden of proof : RIAs, if confronted by a client about the suitability of an investment, bear the burden of proof—meaning that the RIA must prove that the risk was disclosed and that the investment could be considered suitable.

- Fiduciary duty : RIAs are required to act as fiduciaries , meaning that they must act in the best interests of clients and avoid any conflict of interest concerning products and services offered to them.

- FINRA compliance : RIAs are required to meet certain compliance requirements with the Financial Industry Regulatory Authority (FINRA) . Besides providing online applications for registering RIAs, the FINRA requires Form ADV to be filed.

- Documentation : RIAs are required to keep extensive documentation in compliance with SEC record-keeping regulations.

RIAs differ from broker-dealers in important ways. RIAs provide advice on all matters related to finance, including investments, taxation, and estate planning. Broker-dealers tend to focus more narrowly on facilitating purchases and sales of assets like stocks.

Most importantly, in interactions with clients, RIAs are expected to act in a fiduciary capacity, while broker-dealers are only required to satisfy the standard of suitability . Clients of RIAs can be assured that their advisors always and unconditionally put their best interests first. Clients of broker-dealers need to be aware that the broker-dealer is permitted to dispense advice that is merely “suitable” for their client’s investment portfolios.

Unlike RIAs, broker-dealers are not required to disclose potential conflicts of interest or make their clients aware of less expensive or more tax-efficient investment alternatives.

The following are some common fee structures for investment advisory firms:

- Management fees : An RIA can collect a management fee annually as a percentage of the RIA’s AUM. Management fees can align incentives, as an RIA who can raise the value of a client’s portfolio can collect a higher management fee .

- Performance-based fees : An RIA can assess a fee based strictly on the performance of a portfolio. Not all clients are eligible for this type of fee structure, though—in general, only those with at least $1.1 million in assets managed by the RIA or $2.2 million in net worth can qualify.

- Asset-class-based fees : Some RIAs who charge management fees vary the percentage rates based on asset class . An RIA might charge a management fee of 1.5% for equities like stocks and a 0.75% management fee for fixed-income investments such as bonds.

- Hourly or flat fees : RIAs are increasingly providing fee-based services that are not contingent upon how much money the client has to invest. Investors can work with RIAs who charge fees on an hourly basis or at a flat rate, with some RIAs offering subscription-based services.

Many RIAs collect fees based on how much investment money they manage. But other fee structures are emerging that may be better suited for smaller investors.

Always do some careful research before selecting an investment advisor. You need a firm that is aligned with your interests and needs. An excellent source and starting point is the SEC’s Investment Adviser Public Disclosure website , which allows you to search for every RIA in the country.

Note that when you are choosing an RIA, you are choosing the financial firm that you will be working with, and not necessarily an individual advisor. Investment advisor representatives (or IARs) are the individuals who work for the RIA and directly provide advice to clients. It's quite possible that an RIA have just a single advisor, or else have several IARs, each with their own unique areas of expertise and approach to investing.

Therefore, when you're selecting an RIA, you're not just choosing a firm but also potentially choosing among the individual IARs within that firm. Make sure to understand both the philosophy and standards of the RIA and the specific skills and qualifications of the IAR who may be handling your portfolio.

Once you select those firms that fit your location requirements, you can review each firm’s website and social media. Also: