Small Business Startup Costs Explained

3 min. read

Updated March 4, 2024

What will it cost to start your business ?

While every business is unique, there’s a common approach to helping you figure out what it’s going to take to get your business off the ground and sustain it as sales ramp up.

And, knowing the startup costs for your new business is critical before you launch. Underestimating the funds required could leave you without enough cash in the bank and heading towards failure before you even get started.

Read this guide and learn to calculate, manage, and minimize your startup costs.

- What are startup costs?

Startup costs are what a business spends to get up and running before generating revenue.

Starting costs vary based on business type but often include expenses like lease payments, permits, and market research. They can also include asset purchases such as vehicles, real estate, and equipment. Crucially, starting costs also include the money that you need to have in the bank to cover expenses as your business launches until your sales have grown enough to cover those expenses.

- Startup cost examples

Starting costs typically include expenses that occur before you start selling and major purchases, otherwise know as assets.

Startup expenses

- Permits and licenses

- Incorporation fees

- Logo design

- Website design

- Brochure and business card printing

- Down payment on rental property

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Cash to cover operations until sales can cover expenses

- Improvements to your chosen location

- Vehicles used for business operations

- Intangible assets like trademarks, copyrights, and patents.

- Why calculate startup costs?

Knowing your initial costs and expenses improves your chances of launching successfully . It helps you:

Avoid unnecessary risks:

You can avoid unexpected financial pitfalls and make informed decisions by understanding potential expenses.

Start your financial plan :

It helps you budget and determine if you have adequate funds to launch and operate until you’re profitable.

Convince investors :

A detailed breakdown of startup costs can make your business more appealing to investors, as you’ll demonstrate thorough planning and financial acumen.

Improve decisions:

With a clear view of costs, you can make decisions about pricing , scaling, and other critical areas more confidently.

- What are your startup costs?

Starting costs vary from business to business. So, how do you know your costs and, more importantly, how much money you need to cover them?

Check out the following resources to answer those questions.

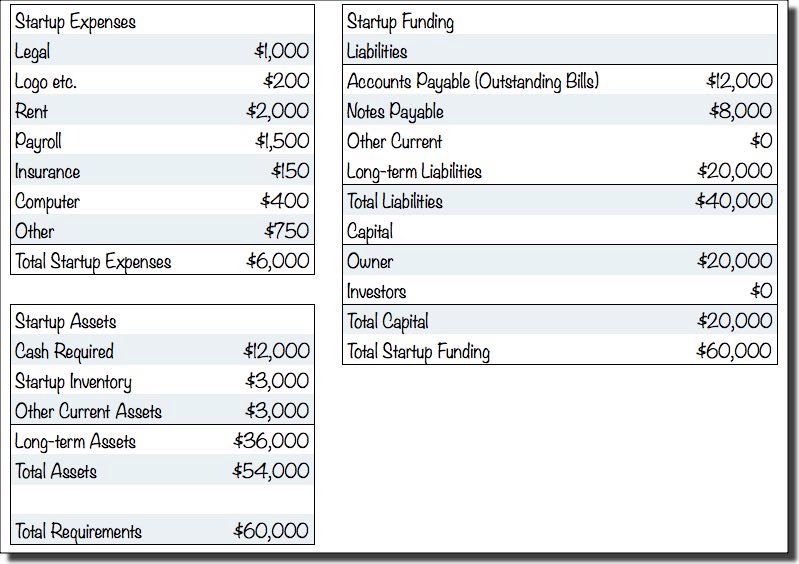

How to calculate your startup costs

Accurately estimate startup costs by accounting for expenses, assets, and cash.

3 Steps to Figure Out How Much Money You Need to Start a Business

How much cash will it take to start your business? Your total cash must go beyond startup costs and ensure you’re prepared to cover emergencies and initial growth.

How Much Should You Personally Cover for Startup Costs?

Before covering any business expenses, consider the impact on your personal finances. What’s the right amount? How will you pay yourself back? And are the rewards worth the risk?

- Tips for managing startup costs

Follow these steps to minimize unnecessary expenses and prioritize the right things.

How to reduce your startup costs

Keep your startup expenses in check and save money through proper planning, tracking, and exploring possible tax deductions.

Hidden startup costs you may overlook

It’s challenging to account for everything. Don’t let overlooked fees and expenses immediately throw off your budget.

What you won’t regret spending money on as a business owner

There is such a thing as being too frugal. But where should you invest more money? While it depends on your business, you can start with these recommendations from a seasoned entrepreneur.

Get the rest of your business finances in order

Knowing what it costs to start your business will make it far easier to get your finances in order.

Check out the rest of our startup financial resources to better understand your path to profitability.

- Create your financial plan

- Set up accounting and payroll

- Prepare for funding

One-page business plan template

A quick and easy way to list out your expenses and explore how they fit into your overall business.

Download Template

AI-powered revenue and expenses

Instantly generate possible revenue streams and expenses with the AI-powered LivePlan Assistant.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

Table of Contents

- Get your business finances in order

Related Articles

3 Min. Read

How to Separate Your Small Business and Personal Finances

6 Min. Read

Buying Your Way Into Entrepreneurship: What You Need to Know

4 Min. Read

When Is the Right Time to Pay Yourself a Salary?

<1 Min. Read

How to Write a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

- Search Search Please fill out this field.

- Small Business

- How to Start a Business

Business Startup Costs: It’s in the Details

:max_bytes(150000):strip_icc():format(webp)/TimothyLi-picture1-4fb5c746f503451bacfee414a08f5c1f.jpg)

There's more to a business than furnishings and office space. Especially in the early stages, startup costs require careful planning and meticulous accounting. Many new businesses neglect this process , relying instead on a flood of customers to keep the operation afloat, usually with abysmal results.

Key Takeaways

- Startup costs are the expenses incurred during the process of creating a new business.

- Pre-opening startup costs include a business plan, research expenses, borrowing costs, and expenses for technology.

- Post-opening startup costs include advertising, promotion, and employee expenses.

- Different types of business structures—like sole proprietorships, partnerships, and corporations—have different startup costs, so be aware of the different costs associated with your new business.

Startup costs are the expenses incurred during the process of creating a new business. All businesses are different, so they require different types of startup costs. Online businesses have different needs than brick-and-mortars ; coffee shops have different requirements than bookstores. However, a few expenses are common to most business types.

Understanding Common Business Startup Costs

The business plan.

Essential to the startup effort is creating a business plan —a detailed map of the new business. A business plan forces consideration of the different startup costs. Underestimating expenses falsely increases expected net profit, a situation that does not bode well for any small business owner.

Research Expenses

Careful research of the industry and consumer makeup must be conducted before starting a business. Some business owners choose to hire market research firms to aid them in the assessment process.

For business owners who choose to follow this route, the expense of hiring these experts must be included in the business plan.

Borrowing Costs

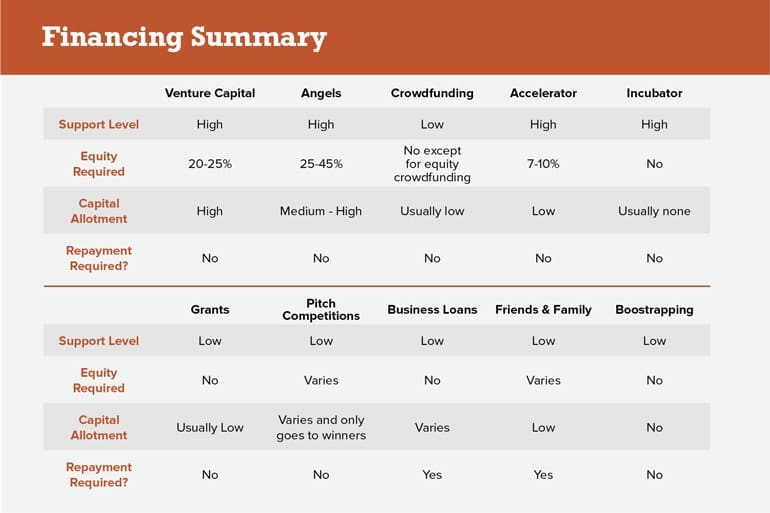

Starting up any kind of business requires an infusion of capital. There are two ways to acquire capital for a business: equity financing and debt financing. Usually, equity financing entails the issuance of stock, but this does not apply to most small businesses, which are proprietorships.

For small business owners, the most likely source of financing is debt in the form of a small business loan . Business owners can often get loans from banks, savings institutions, and the U.S. Small Business Administration (SBA). Like any other loan, SBA business loans are accompanied by interest payments. These payments must be planned for when starting a business, as the cost of default is very high.

Insurance, License, and Permit Fees

Many businesses are expected to submit to health inspections and authorizations to obtain certain business licenses and permits. Some businesses might require basic licenses while others need industry-specific permits.

Carrying insurance to cover your employees, customers, business assets, and yourself can help protect your personal assets from any liabilities that may arise.

Technological Expenses

Technological expenses include the cost of a website, information systems, and software, including accounting and point of sale (POS) software , for a business. Some small business owners choose to outsource these functions to other companies to save on payroll and benefits.

Equipment and Supplies

Every business requires some form of equipment and basic supplies. Before adding equipment expenses to the list of startup costs, a decision has to be made to lease or buy.

The state of your finances will play a major part in this decision. Even if you have enough money to buy equipment, unavoidable expenses may make leasing, with the intention to buy at a later date, a viable option. However, it is important to remember that, regardless of the cash position , a lease may not always be best, depending upon the type of equipment and terms of the lease.

Advertising and Promotion

A new company or startup business is unlikely to succeed without promoting itself. However, promoting a business entails much more than placing ads in a local newspaper.

It also includes marketing —everything a company does to attract clients to the business. Marketing has become such a science that any advantage is beneficial, so external dedicated marketing companies are most often hired.

Employee Expenses

Businesses planning to hire employees must plan for wages, salaries, and benefits, also known as the cost of labor .

Failure to compensate employees adequately can end in low morale, mutiny, and bad publicity, all of which can be disastrous to a company.

Additional Startup Cost Considerations

Have some extra money set aside for any overlooked or unexpected expenses. Most companies fail because they lack the cash to deal with unexpected problems during the business season.

It is important to note that the startup costs for a sole proprietorship differ from the startup costs for a partnership or corporation. Some additional costs a partnership might incur include the legal cost of drafting a partnership agreement and state registration fees.

Other costs that may apply more to a corporation include fees for filing articles of incorporation, bylaws, and terms of original stock certificates.

Launching a new business can be invigorating. However, getting caught up in the excitement and neglecting the details can lead to failure. Above anything else, observe and consult with others who have traveled this road before—you never know where you might learn the business advice that helps your particular business succeed.

U.S. Small Business Administration. " Fund Your Business ."

U.S. Small Business Administration. " Loans ."

U.S. Small Business Administration. " Apply For Licenses and Permits ."

U.S. Small Business Administration. " Choose a Business Structure ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for April 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/soleproprietorship-Final-578020d8a89e486180a235fe9e76c9e9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

The Complete Guide to Business Startup Costs

The top challenge for small business owners is cash flow and the cost of running the business is the second biggest challenge. To put it bluntly, startups need money. No amount of passion, persistence, or patience will make up for a lack of capital.

Most aspiring business owners are short on time, so it’s tempting to run through the least interesting parts of planning at a sprint. Even the word “budget” can trigger boredom and frustration for some. But startup costs are the biggest financial risk to account for when launching a new business.

Planning for business startup costs is about taking control. It’s how any organization can ensure that they remain in control as the business takes on a life of its own.

Why business startup costs are so important

Startup costs are what a business spends before the business starts running. These costs are more than an initial investment in a new business. They’re a way to attract investors, secure loans, and estimate the future health of any organization.

38% of startups fail because they run out of capital . Some businesses start fast and hope that their popularity will cover a lack of planning. Without a clear plan for funding, most are likely to fail.

Financial planning is the first step to a successful long-running business. The first step to creating a financial plan is to outline the set-up costs.

Start With the Basics

Most businesses are either brick-and-mortar or online businesses, and most small businesses sell services. The type of business can determine the typical business startup costs. Some common costs include:

- Office Space

- Equipment and supplies

- Licenses and permits

- Website build

- Staffing or contract help

Once you have a clear list of anticipated expenses, do some research and estimate the cost of each item. Start with the most expensive items on the list.

As you research the average cost for these items, put some time into researching potential savings. Then, think about what these savings could cost in terms of time and effort.

Separate out recurring expenses from one-time expenses, and weigh the value of each decision by its long-term value to the business. Ideally, your initial budget will cover the first five years of the business. Get into the details at this stage and come up with best and worst-case scenarios for your business startup costs.

Embarking on a new business venture is kind of like moving or planning a wedding. There are always major surprise costs that you can’t plan for.

Unexpected costs will always happen and your initial research can help determine how much to set aside for common surprises in your niche or industry.

Make the Math Work

The math and principles involved in calculating costs and budgeting can seem intimidating after a day of too much research online, but the goal is simple. What comes in needs to meet or exceed what goes out.

This kind of math is difficult to do in your head, but it’s easy to organize in a simple spreadsheet.

As you make estimates, it may be a good idea to double or triple variable line items like paid advertising or legal services. If you plan to take out a small business loan, be sure to include the cost of these loan payments in your startup costs.

If your outline of business cost exceeds your income projections, review your projected costs in the order of priority. Next, you’ll want to consider how each cost impacts the bottom line and future opportunities. Make decisions early about how to reduce costs or save certain costs for a later date.

Quick Tips To Improve Startup Costs Today

Business startup costs are more than what the business has to spend, they’re a way of shaping the future of the business. For example, selling an ecology-minded product is more than the product and how it’s produced. It’s a philosophy that impacts the whole of business operations. These ideas trickle down to the decisions the team makes about spending.

These are some quick tips to ensure that your organization’s budget will cover everything your team needs.

Plan for Professional Help

Research, organization, and planning skills are essential to running a successful business. If these aren’t your strongest skill sets, consider taking some courses online and invest effort in improving those skills. It’s also essential to recognize that there are areas where it may be better to outsource.

Many startups plan to figure things out on their own or to grab legal or financial advice for free to save money. But it’s essential to plan ahead and to prepare for the initial costs that can help your team solve the most challenging problems you will face.

What if you make a mistake on your taxes and have to accomodate an audit at the last minute? What if a customer slips in the parking lot on your property on opening day?

Small businesses are full of surprises. Setting a budget aside for legal, accounting, and leadership can help build a stronger foundation for your startup.

Invest in the Right People

Because salaries vary by job and location, you might plan to budget for employee costs after addressing fixed costs like rent and insurance. But, if an employee position is fundamental to the business’s future success, it’s better to budget the ideal salary first.

Spend time researching other ways to save on business startup costs that will have less business impact.

Some ventures are DIY visions that can fly solo, but many great business ideas require a team. People power is the most valuable and expensive item on the list of business startup costs, whether the plan is to bring together a unique group of freelancers for a set period of time or to build an in-house team.

If you’re starting lean, it’s a good idea to outsource talent, then hire permanently when you have the budget to build. Don’t forget to include the investment it will take to bring on the right people.

These resources right here on Crazy Egg can help you get started:

- Best Applicant Tracking Software

- Best Recruiting Software

- Best HR Software

Figure Out Your CAC

Marketing can seem like an extra when viewed alongside hardware and other fixed startup costs. But within the first few months, your team will start obsessing about another kind of cost—customer acquisition cost (CAC).

CAC is how much the business spends for each new lead.If you develop a comprehensive marketing plan before launch, it is much easier to estimate your CAC and the related business costs.

For example, your team might be planning to send a weekly newsletter. The cost for that marketing channel will include a marketing automation platform that averages $150 per month.

There are also other line items that will increase this budget including:

- Stock photography

- A freelance illustrator

- Freelance writers

You’ll also want to budget for the employee time it may take to connect the email marketing platform to other platforms for website analytics and other business necessities. These extra costs can seem like an insignificant future investment, but always include them in the initial planning.

Don’t Forget About Taxes

Business taxes can be confusing. Start by planning to set aside the current corporate tax rate if you operate your business in the United States.

You’ll also want to budget for a certified public accountant. This can help your team learn early on about what you can and cannot deduct to save money.

Long-Term Strategies for Your Startup Budget

Plan your business startup costs from the perspective of a business that’s been in operation for a year. Working backwards in this way will make your first few months as a new business more successful.

If you’re not able to find answers to questions about business operations in your specific niche or industry, head to an online forum or join a mentoring program. This perspective of preparedness will pay off in the long run.

The ideas below are a few other ways that your team can prepare and succeed.

It’s All About the Business Plan

Any solid business plan includes financial details, and it’s a good idea to dig into startup cost research as you create your business plan. Information discovered during the earliest stages of planning can help create a solid and realistic early budget.

It can also help your team make crucial business decisions that will impact revenue down the line. For example, if the average rent in your area is more than 20% of your anticipated monthly profit, it’s worth considering a remote business.

That’s not to say that a healthy startup budget isn’t necessary for starting an online business. Ecommerce seems like a wildly inexpensive option, but the many small costs of starting a website, enabling an online shopping cart, and installing useful business apps can quickly add up.

Get Into the Details Early

It can also be tempting to make quick uninformed guesses about the software and services a business will spend on during set-up. Skimping on research can lead to massive costs later when the initial investment projections don’t line up with that early guesswork.

We’ll show you what this could mean with a few quick examples.

First, there are many different options for ecommerce website builders . Each offers unique themes and features for different types of business, and these details can make a dramatic difference in the monthly cost for these services.

Or, maybe the plan is to build a website. Choosing the least expensive WordPress hosting could mean a lack of security that impacts business operations later on.

It’s also important to keep an eye out for introductory rates or trial offers. Complete this detailed research with an understanding of how recurring costs can vary over time.

Give Yourself Time

You may want to knock out your business startup cost estimates in a few hours, but think about this piece of your financial plan as a long-term investment. Take the time to research each line item as though it is the only thing on your list.

For each expenditure, follow a simple step-by-step process.

First, write out questions about each line item. These are some sample questions to consider for business rentals:

- How much will the rent increase each year?

- What’s included in the lease?

- Is the location safe?

- Does the space meet any technology needs?

- Who handles repairs?

- Do you need to pay for parking?

List the pros and cons of different options and compare multiple sites and features. This will help ensure that each estimate is a comprehensive guess that will build on the foundation of your business.

Then, rinse and repeat for each item on your list.

Prepare to Grow the Business

Some business owners are just hoping to get their venture off the ground, but most successful owners begin their process with dreams of growth.

Whether you’re putting a quick Slideshare together for an internal team or a polished presentation to woo new lenders or investors, a formal financial plan is a smart way to organize your early costs.

This document can also help to draw clear connections between anticipated costs and projected revenue.

Your financial prospectus should outline:

- Detailed startup costs

- Your business model

- Sources of revenue

- Growth forecasts

These details will show any lender or investor that your team has done everything they can to develop a viable business with powerful potential. This will inspire the investment the business will need to expand.

If you’re not ready to project five years into the future with your financial plan, prepare to project a minimum of six months. It will usually take 18-24 months for your company to turn a profit.

Most home-based startups begin with less than $5,000 in capital. This guide, How to Start a Business for Less Than $100 is full of great tips for founders with big ideas and small budgets.

Another option is to learn about the best small business loans and start applying.

Make your website better. Instantly.

Keep reading about operations.

How to Set Up a Virtual Phone System in 15 Minutes or Less

Setting up a virtual phone system is easy—it takes just three steps and less than 15 minutes. You don’t need to waste time comparing providers…

NimbleWork Review

Finding a management system that integrates smoothly with your company’s workflow can be a daunting task. With so many options available, how do you know…

ONLYOFFICE Review

Working on the cloud has many advantages, but you may prefer having all your software housed under your own servers. That way, you have total…

Oyster Review

Hiring top talent is hard enough on its own. Doing it across borders can seem downright impossible. Navigating complex legal requirements, tax regulations, and labor…

Best Virtual Mailboxes Compared

Among the six virtual mailbox brands we reviewed, iPostal1 and Anytime Mailbox are our favorite virtual mailbox companies. Although we like iPostal1 or AnyTimeMailbox for…

Best PEO Companies

PEO services take a lot of the burden of HR, employee and benefits administration, and more off of your organization’s plate. We looked into many…

Funding Circle Review

Funding Circle is a lending platform that aims to help small businesses secure the finances they need. The service offers several perks that attract entrepreneurs,…

Replicon Review

Whether you’re a new business with a small workforce or a large enterprise with thousands of employees, there’s one common, underlying necessity for teams of…

Best Business Checking Accounts

Over the years, we’ve started dozens of businesses spanning numerous industries and business models. While each is unique, there’s one common thread among them all—they…

Looka Review

Making a good first impression on customers is crucial, so your company’s branding needs to be spot-on. Looka helps you do this by harnessing the…

Best Online Business Banking Compared

It’s no secret that people have no time to visit the bank. With online banking, you get the same services and convenience as a traditional…

Best Email Hosting Providers Compared

Just like a website, emails need hosting too. Most hosting plans come with email hosting baked in, but that’s not always the case. Furthermore, where…

Xoxoday Review

Happy employees equal happy customers, and happy customers equal business success. To help you cultivate happy employees, Xoxoday offers a trio of innovative employee engagement…

KnowledgeOwl Review

What if you had a digital library of helpful content that was easily accessible from anywhere, at any time? KnowledgeOwl offers this, functioning like a…

Traqq Review

Tracking your team’s work hours and monitoring their activities takes a lot of time. Filling out spreadsheets and calculating payroll manually is even more difficult…

Over 300,000 websites use Crazy Egg to improve what's working, fix what isn't and test new ideas.

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway

Writing a business plan is an essential process for any forward-thinking entrepreneur or business owner. A business plan requires a lot of up-front research, planning, and attention to detail, but it’s worthwhile. Creating a comprehensive business plan can help you achieve your business goals and secure the funding you need.

Related content

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

- How to Get a Business License: What You Need to Know

- What Is a Cash Flow Statement?

Best Small Business Loans

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

Business Startup Costs in 2022: What Small Business Owners Can Expect

Starting a new business is exciting, but it also may come with intimidating startup costs. Before you become a business owner, you’ll want to sit down and estimate the total price tag of the venture. In this article, we walk you through the process of calculating each business startup cost so you can launch your business on the right foot.

What Are Business Startup Costs?

Every new business owner will run into costs associated with launching a business — but the amount you’ll pay depends on your business type and your needs. You’ll want to know ahead of time estimates of the business expenses you can expect so you aren’t hit with surprising costs you can’t afford during the launch process.

Business startup costs depend largely on the type of business you open, which can be:

- Brick-and-mortar

- Service provider

When you start a new business, you may pay for things like business formation fees, marketing costs, business insurance, a website, and more. We cover each possible expense in detail below.

Compare Business Formation Services

Form an LLC, corporation, or nonprofit, and get an EIN, business license, or registered agent service. Use Nav to find the right business formation service for your business.

How Much Does It Typically Cost to Start a Business?

The amount you’ll pay to start a small business will depend on the business itself. According to a 2021 Shopif y survey , small business entrepreneurs spent $40,000 on average in the first year of launching a new business. But this is an average.

A small business with a physical location will come with a heavier price tag than a business that is run completely out of a home. You’ll have to pay for things like rent or a commercial mortgage, furniture, and physical marketing materials. But you’ll also need more insurance coverage since you’ll have a business location where customers or employees could hurt themselves.

You can use this startup costs worksheet from the U.S. Small Business Administration (SBA) to help guide you through your estimate process.

10 Most Common Startup Expenses

In the first year of running a small business, you’ll likely encounter two types of costs:

- Capital expenditure : One-time purchase or debt that invests in the future of your business. This can include purchasing new property, facility upgrades, updated equipment, or patents.

- Operating cost : Ongoing expense that allows your business to run in an efficient and productive way. Marketing, payroll, insurance, and research falls into this category.

The amount you pay for each operating cost depends on how much of the work you do yourself and how much you offload onto a professional that you’ll have to pay.

Here are the 10 startup expenses you’re most likely to encounter.

1. Research costs

Conducting market research before you launch a business can bring clarity to how effective your products or services will be. You can subscribe to a marketing research platform for a more affordable but more do-it-yourself option. Or you can hire a market research firm. According to the Vernon Research Group , hiring a market research firm can cost anywhere from $4,000 to $50,000, depending on the type of research you conduct.

2. Getting a business plan written

A business plan is an essential document that establishes your business structure and goals. You can write your own informal business plan or subscribe to software like LivePlan to guide you through the process, which charges a monthly fee.

Otherwise, you can turn to a business plan company to complete it for you. If you hire a professional service to write your business plan, you can expect costs to start around $1,500 and increase with complexity.

3. Business formation fees

How much you’ll pay for business formation depends on the business entity type you choose. A sole proprietor won’t have costs directly associated with founding a business, but an LLC will need to pay to file articles of organization (or if you’re incorporating, articles of incorporation). Filing fees depend on the state you live in but typically cost between $50 and $100, and may cost as much as $300.

You may also have to pay for a state or federal business license , depending on your industry. Associated costs depend on the license.

4. Insurance and permits

Business insurance can provide protection if you need to pay for claims against your business. Without insurance, you’ll have to pay upfront for the damages and potential legal fees. You’ll likely need different business insurance if you run a fully online business than if you operate an office space, for example.

The most common types of business insurance are:

- General liability insurance : Protects against “general” claims for property damage, bodily injury, or personal injury. The cost is determined by how risky your industry is, like retail vs. construction.

- Errors and omissions insurance : Covers mistakes you or your employees make against customers or clients. The price depends on factors like the size of your business, the industry, revenue, and its employee training process.

- Commercial property insurance : Protects offices or brick-and-mortar locations against damages from instances like flooding, fire, theft, or vandalism. The cost depends on factors like the property value and its assets, as well as its location.

- Workers compensation insurance : Pays for medical and benefit costs for employees that get hurt or ill while working. The cost of your workers’ compensation policy depends on the state, business size, payroll, and your industry’s risk.

Having a business website that looks good and is functional is essential — it acts as the face of your business. Hiring a web design company to create a website for you can cost into the tens of thousands of dollars, but it can be worthwhile to pay this cost upfront to ensure that your site is everything you need it to be. You’ll also need to consider hosting options, which can determine how quickly your website loads when customers visit, and how much traffic your site can handle.

There are several affordable do-it-yourself website builders and hosting services out there, including:

- Squarespace : You can use this website builder to create a business website for between $16 and $49 per month.

- Weebly : Create a business website for between $0 and $26 per month.

- Wix : Its website plans cost between $16 and $45 per month.

- Shopify : You can set up an online shop for between $29 and $299 per month.

6. Setting up accounting systems

You don’t want to skip figuring out your accounting process before you start a business — or you may find yourself under a mountain of paperwork come tax time. Some accounting solutions cost money. To start with, opening a business bank account is a great way to separate your personal and business expenses from the beginning. (And you may pay a monthly fee, depending on the account).

In terms of tracking your transactions, you can do it for free manually using a spreadsheet or pay for software that automates much of the process:

- QuickBooks : $30 to $100 per month

- FreshBooks : $15 to $50 per month

- Xero : $12 to $65 per month

- Wave : Accounting software is free

Connecting your business checking account to accounting software can simplify your bookkeeping and accounting. You can import your transaction information to easily see your business’s cash flow and expenditures. When it comes time to pay your business taxes, you can send this information directly to your bookkeeper or CPA.

7. Marketing expenses

You may not need to pay for marketing, but if you do, it’s good to keep costs below 10% of your total budget. Your business may benefit from physical marketing materials, like signs or mailers, or from online marketing. Social media marketing can be free or paid.

Come up with a small business marketing plan to make sure you are clear on your goals and not spending money without getting results.

8. Technology and equipment fees

An office or physical location can eat up a large portion of your budget. Whether or not you have an office that staff comes into, you’ll need to equip it. You’ll need reliable technology like a computer and internet access to run any modern business. If you have a physical location or staff office, you’ll need things like office supplies and office furniture. Costs depend on how large the location is and the types of equipment you need.

9. Inventory fees

If you’re opening a business that requires you to keep inventory, like retail or wholesale, you’ll need to estimate how much your initial inventory supply will cost. You’ll want to consider stocking up more inventory in the beginning than you might later. The cost depends on how much inventory you need and what you’re ordering.

10. Hiring employees

According to Glassdoor, it costs around $4,000 on average to hire someone new. These costs include background checks and drug testing, marketing, posting on job boards, and any internal expenses. These expenses will vary based on your business, but if you’re planning to hire employees for your new business, you’ll need to budget accordingly.

In Total, How Much Startup Cash Will You Need?

As mentioned, the average business startup costs fall around $40,000, but you can do it for much less or much more. The amount you pay for organizational costs depends on factors like your business size, the industry, the state it’s located in, and whether or not you have employees.

If you complete your startup cost estimate and realize you don’t have enough cash on hand to launch — even though you’re ready in every other way — consider turning to lenders. Small business lenders can give you a leg up to start a new business and help you avoid waiting around for years before launching.

Nav shows you your best options for small business loans if you need cash for things like capital expenses or business credit cards for help with cash flow. Create a free account at Nav.com to see the financing options you’re most likely to qualify for instantly.

Can You Write Off Startup Costs?

Yes, you can deduct certain startup costs on your tax return, but not all of them. The IRS provides a useful breakdown of what is allowed for a tax deduction for a new business. However, it’s a smart idea to hire a professional accountant to complete your tax return for you because of the complexity involved.

Tiffany Verbeck

Tiffany Verbeck is a Digital Marketing Copywriter for Nav. She uses the skills she learned from her master’s degree in writing to provide guidance to small businesses trying to navigate the ins-and-outs of financing. Previously, she ran a writing business for three years, and her work has appeared on sites like Business Insider, VaroWorth, and Mission Lane.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

How to make a business plan

Table of Contents

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Join thousands of teams using Miro to do their best work yet.

EXCLUSIVE SUMMIT OFFER Join foundr+ and get Ecommerce Kickstarter program free!

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, business startup costs checklist: how much and where to spend.

Written by Kevin Conner | July 18, 2022

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Many aspiring business owners don’t know where to get started. They have a vision, but thinking about marketing, hiring, product development, and more can become overwhelming. In most cases, the best place to start is crunching the numbers—determining your business startup costs.

Without a budget, you can’t make good decisions, and you can’t make a budget without understanding your expenses.

So to help you keep your business from being one of the many that go under each year, we wanted to outline some examples of typical startup costs so you can better budget your business and know what to expect. After consulting this cost checklist, you should be able to determine a forward plan of action for your new enterprise.

Note that we wanted to focus mostly on online businesses, but other businesses can still greatly benefit and do some quick adjustments and research to make sure they’re on the right track as well.

Business Startup Costs

Supplies, furniture, and office space, marketing and web presence, inventory and production, fees, taxes, and licenses, having a backup fund, setting up your budget, paying yourself adequately.

You need to be able to support yourself without hurting yourself. If you cut corners in your own personal life (by deeply cutting your salary), it can affect your physical and mental health, which can be a contributing factor to business failure. The Global Benefits Attitudes survey shows a clear link between reduced workplace productivity and increased stress levels. Don’t sell yourself short, and don’t try to cut your own salary first.

Review the real cost of living in your area and be honest with yourself about what you would be comfortable with. Be sure to add health insurance and other benefits (for yourself and your household, if applicable) into that equation.

This is your business. Your personal well-being is a core need to consider. When calculating your salary needs, include:

• Rent or mortgage payments • Utility costs • Child care costs • Property, luxury, excise, and other taxes • Insurance (car, home, and/or other) • Vehicle payments or maintenance costs • Debt or credit card payments. • Groceries • Entertainment costs • Gifts • Clothing

Your payroll for your business, especially an online business, can be a complicated item on your startup costs list. As a general rule, payroll is the greatest startup cost for a business. Fundera considers it to be 25-50% of a total budget.

At the same time, your employees, if you have any, will make or break your business.

An online business has many options and few constraints. It might be in your best long-term financial interest to have someone on your permanent payroll. But you almost never need onsite employees, and you can look to the growing pool of remote workers .

There’s a strong possibility that you’ll want to use freelance help as you start your business, as there are a series of specialized tasks (web development, perhaps some initial marketing, graphic design, and more) that you’ll want help with.

Freelancers vary in cost greatly depending on the level of experience you are looking for. This is also the department where “you get what you pay for” matters most. Don’t let working for your business become a race to the bottom for subpar freelancers desperate for any gig.

You can find freelancers either through job boards, contacts you might have in the industry, Facebook groups, and sites such as UpWork and Fiverr . Each platform has its advantages and disadvantages, so look for what would be best for your needs. If you need help, consult this resource on how to hire remote workers or hire for small businesses .

As for the business startup costs relating to freelancers, try to tally up the estimated hours and multiply that by the rates you are willing to pay.

Here are a few common examples of freelancers you might hire and what they might cost:

• Freelance writers (for initial copy) – They are generally paid per word. For quality work you can expect to pay 15 to 25 cents per word. Some writers also charge per project. • Freelance designers – $25-$300 per hour • Web Development or Programming – $30-$150 per hour • Virtual Assistants – $5 to $25 per hour

The rates vary due to location, service, and what the freelancer charges. Typically, US-based freelancers charge the highest rates. Here’s a more detailed breakdown of average freelancer hourly rates .

Just because your business doesn’t have a physical storefront doesn’t mean that you don’t need a space and tools to work with. Many owners don’t consider this until too late when compiling their business startup costs list. We’re here to help you flesh out the ideas likely already floating around your head.

Computer Equipment, Programs, Apps, etc.