What Is a Joint Business Plan (JBP)? Benefits & Best Practices

By 8th & Walton | on October 2, 2022

From small businesses to large corporations, the most successful companies begin and stick with a clear business plan. When a company defines its goals, lays out a path to meet objectives, and agrees on financial spending and expectations, it creates a shared vision and accountability to succeed.

Many businesses experience greater growth when partnering with another business. In the supplier and retailer relationship, both parties working independently would be detrimental. To create a mutually beneficial partnership, they must begin by defining each company’s responsibilities, expectations, and needs in a joint business plan.

What Is a Joint Business Plan?

A joint business plan (JBP) is the collaborative process of planning between a retailer and a supplier in which both companies agree on short-term and long-term objectives, financial goals, growth, and shared business initiatives for profitability.

Joint business planning focuses on agreeing on common objectives and aligning on a single goal or set of goals. The companies in the joint business plan must work together to accomplish a shared vision.

What Is the Purpose of a Joint Business Plan?

For retailers and suppliers, having a joint business plan can create a win-win strategy in growing consumer sales. An effective JBP allows suppliers to build stronger relationships with their retailers so both parties can mutually support and benefit from each other.

When a retailer and supplier recognize each others’ needs and agree on common goals, they can share insights to support each other and improve sales, customer growth, and processes.

How Does a Joint Business Plan Work?

Two companies can come together with a joint business plan because they have one thing in common: a shared shopper . Whether it is a supplier partnering with a retailer or a children’s clothing company partnering with a toy manufacturer, having the same target audience is the first element that brings the companies together.

The companies considering a joint business venture should then share their individual business plans and discuss their mutual growth opportunities. This is where the general goals and areas of support can be defined. Specific tactics and category strategies can also be fleshed out in early discussions before moving to the formal process.

Once both companies are in agreement that the partnership will be mutually beneficial, the joint business plan can be created. Formal contracts are drawn up, approved, signed, and the plan is ready to be executed. Periodic reviews and necessary adjustments to the JBP are recommended as needed.

Benefits of Joint Business Planning

Why enter into a joint business plan with another company? The benefits can be not only financial but educational as well:

- Aligning goals. For a retailer/supplier joint business plan, being aligned on goals creates clarity on all other areas of the business. Defining expectations on all areas from marketing to supply chain to sales goals leaves minimal area for questions. Agreeing on goals, no matter how and when they are measured, keeps both parties accountable and benefits both to meet expectations.

- Shared resources and exposure. Partnering with another company can bring a new audience and a new platform. In a simple retailer/supplier joint business plan, the retailer can introduce the supplier’s product to its core shoppers. At the same time, shoppers loyal to the supplier’s product or brand can be introduced to the retailer’s store and website for the first time.

- Greater return on investment. By partnering with another company with a shared vision, the benefits above will provide a better ROI when the plan is executed correctly.

Joint Business Planning Best Practices

How can companies ensure their joint business plan is a good fit for both parties? These are some best practices to include in preparation for entering into the partnership:

1. Align Internally First

Before entering into a joint business plan with another company, all members of the business must agree on the benefits of the partnership. Recognizing the advantages and seeing the bigger picture is key. When employees are in alignment within the company, it will be easier to align with the partnering company on the shared vision of the joint business plan.

2. Create the Plan Together

When two businesses enter into a partnership, the joint business plan should not be built by only one. A company sending another a complete plan or just a form to fill out is not collaborative. Both companies need to build the plan from the ground up. Collaborating in the development of the joint business plan is just as important as executing the plan itself.

3. Set Specific Goals

Expectations for success in the partnership need to be specific. “We need to grow sales” or “production costs will decrease” are good goals, but too general. Keep specifics in your plan that are as specific as they are realistic. If one company wants to grow sales by 40% in the next quarter, this should be spelled out in the joint business plan so get early support or push back from the other company.

4. Assign a Metric to Each Goal

Putting a metric with a goal keeps the company accountable to the mission of the joint business plan. For example, if the goal is to grow sales by 40% in the next quarter, it would be wise to assign a weekly growth metric. If the metric is too low over a few weeks, the plan shows that action needs to be taken immediately in order to meet the 40% sales growth goal for the quarter.

5. Communicate Responsibility and Accountability

The joint business plan is the place to eliminate all guesswork. If Company A is responsible for providing labels to Company B, be very specific about the responsible parties. Clarify that the packaging coordinator of Company A will mail the labels to the warehouse manager of Company B on the first of the month.

6. Include Risks and Solutions

Planning for setbacks is key to planning for success. The joint business plan should include any possible risks or obstacles foreseen by either company. Having solutions in place for multiple scenarios makes the plan easier to execute.

7. Constantly Evaluate the Relationship

Joint business plans work better with trust, mutual respect, and a great working relationship. Keeping the relationship healthy between the companies and individuals relying on each other brings more success to the overall plan. Monitor the relationship periodically and work to resolve conflicts as they arise.

Joint Business Plans at Walmart

Walmart works with its suppliers to create plans for sales and category growth. The company relies on suppliers to bring insights to the table to spot trends and get in front of potential gaps in the business.

Back in 2011, Walmart created a joint business plan with Proctor and Gamble to pick up lost sales in air fresheners. This category was down over 2% across the chain, but P&G brought insights to Walmart on how consumers were purchasing throughout the industry.

Consumers had no problem going to Walmart for aerosol sprays for under a dollar, but would then go to specialty stores to purchase expensive candles in the same scent. Through communicating through the joint business plan, Walmart was able to create excitement around higher price-point items and show the shared shopper they could purchase the extra items in one store.

Positive business collaborations can be extremely beneficial in growing retail sales. Two companies sharing a common vision can build on each other’s best practices and support each other to mutually win at the register.

Suppliers looking for support in their Walmart business have found great collaboration with 8th & Walton. Our team of experts supports suppliers to improve reporting, analytics, supply chain, accounting, and more. To begin a great collaboration with us, request a free 15-minute consultation this week.

About the Author

8th & Walton consists of retail industry experts with a combined 200+ years of Walmart and Walmart supplier experience. Having helped hundreds of CPG companies in their efforts to be better supplier partners to the world's most influential retailer, the 8th & Walton editorial team prides itself on being a go-to resource for Walmart supplier news and insights.

Related Content

Walmart’s Supplier One: What We Know So Far

Walmart OTIF: A Supplier’s Guide to On-Time In-Full

First 5 Steps to Using Walmart Luminate™ Basic

Joint Business Plan (JBP): Benefits, Best Practices & Objectives

- Recent Posts

- The Art of Engaging Polls and Surveys: Interactive Content for Connection - March 15, 2024

- How to Start a Mobile Hookah Business? (Step-by-Step Guide) - March 13, 2024

- How to Start a Laboratory Testing Business? (Practical Guide) - March 12, 2024

Last Updated on November 28, 2023 by Arif Chowdhury

Imagine two retail brands, each with their own unique strengths and market presence. Now picture the joint business venture, with two partnering business partners, joining forces to conquer a new market together through joint ventures. This is the power of partnering with other teams in a company – a joint business plan , where executive summaries are created to outline shared goals and maximize potential.

Collaboration is vital in today’s competitive industry landscape. By forming joint ventures, companies can pool their resources, expertise, and networks to unlock new opportunities, expand their reach, and drive growth like never before.

Joint ventures allow companies to collaborate and create stronger teams , leading to increased success. A joint business plan serves as the blueprint for this collaborative venture, outlining key objectives, strategies, and tactics that both parties will execute together.

A well-crafted joint business plan typically includes an executive summary that outlines the purpose and scope of the collaboration. It also details specific marketing initiatives such as promotions or product launches aimed at capturing the target market’s attention. It covers aspects like distribution channels, branding efforts, and sales projections to ensure alignment between both parties.

In this blog post series on joint business plans, we will explore the importance of collaboration in driving success for retailers and companies in today’s fast-paced retail industry. Collaboration is crucial for the success of ventures in the retail industry.

We will delve into the key components of an effective joint business plan and provide real-life examples to illustrate its impact. So buckle up as we embark on this exciting journey towards collaborative success!

Benefits of implementing a joint business plan

Implementing a joint business plan can bring numerous benefits to retailers and companies involved in the venture. Let’s explore some of these advantages in detail:

1. Increased Alignment and Synergy between Partners

One of the key benefits of implementing a joint business plan is the increased alignment and synergy between partners. When all parties in a joint venture are working towards a shared goal, it becomes easier to align joint venture strategies , joint venture objectives, and joint venture activities.

This alignment fosters collaboration and teamwork in the venture, allowing partners to leverage each other’s strengths and expertise.

- Better coordination between teams.

- Shared vision leads to improved decision-making.

- Enhanced trust and mutual understanding.

Example: Imagine two companies collaborating on a marketing campaign. With a joint venture business plan in place, both companies can align their messaging, target audience, and promotional activities for maximum impact.

2. Enhanced Communication and Coordination

Another significant benefit of a joint business plan is the improvement in communication and coordination among partners.

Clear channels of communication are established, ensuring that information flows seamlessly between all parties involved. This enhanced communication enables faster problem-solving, timely decision-making, and efficient resource allocation.

- Regular meetings facilitate open dialogue.

- Improved sharing of information and knowledge.

- Quick resolution of conflicts or issues.

Example: In a joint business plan between a manufacturer and distributor, regular communication helps them stay updated on market trends, customer feedback, and inventory levels. This enables them to make informed decisions regarding production volumes, delivery schedules, and product promotions.

3. Improved Resource Allocation and Cost Optimization

Implementing a joint business plan allows partners to optimize resource allocation effectively. By pooling resources together strategically, partners can reduce duplication of efforts while maximizing efficiency.

This collaborative approach also helps in identifying cost-saving opportunities by streamlining processes or leveraging economies of scale.

- Shared resources lead to reduced costs.

- Elimination of redundant activities.

- Efficient use of available assets.

Example: Two companies in the logistics industry can collaborate on a joint business plan to optimize their transportation routes, thereby reducing fuel costs, minimizing delivery times, and maximizing the utilization of their fleets.

Recommended Reading: Esthetician Business Plan [Free Downloadable Template]

Best practices for successful joint business planning

1. establishing clear goals and objectives.

To ensure a successful joint business plan, it is crucial to establish clear goals and objectives . This means clearly defining what you want to achieve together with your partner or stakeholders. By setting specific targets, you can align your efforts towards a common purpose.

One way to do this is by using category management principles. This involves analyzing market trends, consumer behavior, and competitive landscape to identify opportunities for growth. By understanding the category dynamics, you can develop strategies that capitalize on market trends and consumer preferences.

2. Regular Communication and Feedback Among Stakeholders

Effective communication is key in any collaborative effort, including joint business planning. Regularly communicating with your partners and stakeholders helps maintain alignment and fosters a sense of shared responsibility.

By providing feedback throughout the planning process, you can address any issues or concerns promptly. This allows for adjustments to be made in real-time, ensuring that everyone remains on track towards achieving their goals.

3. Creating a Structured Timeline with Defined Milestones

A structured timeline with defined milestones is essential for keeping joint business planning on track. Breaking down the plan into smaller, manageable tasks helps ensure progress is made consistently.

Consider creating a Gantt chart or project timeline that outlines key activities, deadlines, and responsible parties. This visual representation provides clarity on the sequence of tasks and allows for better coordination among team members.

Establishing milestones helps measure progress along the way. Celebrating these achievements boosts morale and keeps everyone motivated throughout the planning process.

4. Developing a Win Strategy

A win strategy focuses on identifying how both parties involved can benefit from the joint business plan. It aims to create mutually beneficial outcomes that drive growth for all stakeholders.

When developing a win strategy, consider factors such as market share gains, revenue growth opportunities, cost savings through economies of scale, or access to new markets or distribution channels.

Recommended Reading: Dump Truck Business Plan [Free Downloadable Template]

Evaluating the progress of a joint business plan

To ensure the success of a joint business plan, it is crucial to regularly evaluate its progress. This evaluation allows you to monitor key performance indicators (KPIs), conduct reviews and assessments, and make necessary adjustments to stay on track.

Monitoring Key Performance Indicators (KPIs)

Monitoring KPIs is an essential step in evaluating the progress of a joint business plan. These performance metrics provide valuable insights into the effectiveness of your plan and help you gauge its success. By tracking KPIs, such as sales growth, revenue generated, or customer satisfaction levels, you can assess whether your joint business plan is delivering the desired results.

Some key performance indicators that are commonly monitored include:

- Sales performance: Keep an eye on how well your products or services are selling. Track factors like sales volume, average transaction value, and conversion rates.

- Promotional effectiveness: Evaluate the impact of marketing campaigns and promotions on driving sales. Measure metrics like click-through rates, website traffic generated from promotions, or coupon redemption rates.

- Product performance: Assess how well specific products are performing in terms of sales numbers, customer feedback, or market share gained.

- Customer satisfaction: Monitor customer feedback and ratings to determine if your joint business plan is meeting their expectations.

Conducting Regular Reviews and Assessments

Regular reviews and assessments are vital for evaluating the progress of a joint business plan. Schedule periodic meetings with all stakeholders involved in the partnership to discuss achievements, challenges faced, and areas that require improvement.

These reviews provide an opportunity to analyze data collected from KPI monitoring and gather insights from each party’s perspective.

During these sessions:

- Share research findings: Present any relevant market research or consumer insights that can inform decision-making processes.

- Discuss results achieved: Review the outcomes achieved so far based on set goals and objectives outlined in the joint business plan.

- Identify bottlenecks and risks: Identify any obstacles or risks that may be hindering progress and brainstorm potential solutions.

- Collaborate on adjustments: Work together to determine necessary adjustments or modifications to the joint business plan, ensuring it remains aligned with changing market dynamics.

Recommended Reading: Missouri Small Business Loans: Rates, Requirements & Funds

Making Necessary Adjustments to Stay on Track

Flexibility is key when evaluating the progress of a joint business plan. As you monitor KPIs and conduct reviews, you may identify areas where adjustments are required to maximize success. Making these necessary adjustments allows you to adapt your strategies, overcome challenges, and capitalize on emerging opportunities.

Consider the following steps for making adjustments:

- Analyze data: Examine the data collected from KPI monitoring and reviews to identify trends or patterns that require attention.

- Identify areas for improvement: Pinpoint specific areas within the joint business plan that need adjustment based on performance gaps or changing market conditions.

- Collaborate with partners: Engage in open discussions with your partners to gather their input and insights regarding potential adjustments.

- Develop action plans: Create detailed action plans outlining the necessary steps to implement changes effectively.

- Monitor results: Continuously monitor the impact of these adjustments on performance metrics and assess their effectiveness.

By regularly evaluating the progress of your joint business plan, monitoring KPIs, conducting reviews, and making necessary adjustments, you can enhance its chances of success. This iterative process ensures that your joint business plan remains aligned with evolving market dynamics and increases your likelihood of achieving mutually beneficial outcomes.

Recommended Reading: Copywriter for Small Business: Get The Maximum Result

Finding the right partner for joint business planning

Identifying the ideal partner for joint business planning is crucial to the success of any collaborative endeavor .

It requires careful consideration of various factors, including complementary strengths and expertise, compatibility in terms of values and culture, as well as conducting due diligence before entering into an agreement.

Identifying Complementary Strengths and Expertise

When seeking a business partner for joint business planning, it’s essential to identify individuals or organizations with complementary strengths and expertise. This means looking for partners who possess skills and resources that complement your own.

For example, if you’re a manufacturer looking to expand your distribution channels, partnering with a retailer or distributor who has established relationships with consumers can be highly advantageous.

Consider the following when assessing complementary strengths:

- Look for partners who excel in areas where you may have limitations or gaps.

- Seek out individuals or organizations that bring unique perspectives and capabilities to the table.

- Evaluate potential partners based on their track record of success in relevant areas.

Assessing Compatibility in Terms of Values and Culture

In addition to complementary strengths, compatibility in terms of values and culture is vital for a successful partnership. When embarking on joint business planning, you’ll be working closely together towards shared goals.

Therefore, aligning values and having a similar organizational culture can foster effective collaboration.

Here are some considerations when assessing compatibility:

- Evaluate whether your partner shares similar core values such as integrity, transparency, and customer-centricity.

- Assess whether there is alignment in terms of long-term objectives and vision.

- Consider how well your respective cultures will blend together to create a harmonious working relationship.

Conducting Due Diligence Before Entering into an Agreement

Before finalizing any partnership agreement, it’s crucial to conduct thorough due diligence. This involves gathering information about potential partners to ensure they are reliable, trustworthy, financially stable, and have a good reputation within their industry.

Here are some steps to consider during the due diligence process:

- Research: Conduct extensive research on potential partners, including their history, financials, and reputation.

- References: Reach out to their existing or past business partners to gather insights into their reliability and performance.

- Legal Assistance: Engage legal professionals to review contracts and agreements to ensure they protect your interests.

- Pilot Projects: Consider starting with small-scale pilot projects to test compatibility before committing to a long-term partnership.

Recommended Reading: LinkedIn Search Appearances: Boost Your Profile

Maintaining a common vision and strategic objectives

To ensure the success of a joint business plan, it is crucial to maintain a common vision and strategic objectives with your partner. This involves aligning long-term goals and ensuring a shared understanding of strategic priorities. By continuously reinforcing the importance of collaboration, you can foster a strong partnership that drives mutual growth.

Aligning Long-Term Goals with the Partner’s Vision

When embarking on a joint business plan, it is essential to align your objectives with your partner’s vision.

This alignment ensures that both parties are working towards a common goal and have a clear understanding of each other’s expectations. By taking the time to understand your partner’s vision, you can identify areas where your goals intersect and collaborate effectively.

Ensuring Shared Understanding of Strategic Priorities

In order to execute a successful joint business plan, it is vital to establish shared understanding of strategic priorities.

This involves open communication and regular discussions about the strategies and tactics that will be employed to achieve desired outcomes. By aligning your strategies with those of your partner, you can create synergy and maximize the impact of your joint efforts.

Continuously Reinforcing the Importance of Collaboration

Collaboration is key in any joint business plan, as it allows for the pooling of resources, expertise, and networks. To maintain effective collaboration throughout the partnership, it is important to continuously reinforce its importance.

This can be done through regular check-ins, open communication channels, and providing support where needed. By fostering an environment that encourages collaboration, you can build trust and strengthen the relationship with your partner.

Maintaining a common vision and strategic objectives in a joint business plan requires strong leadership and effective strategy execution. It involves aligning long-term goals with your partner’s vision, ensuring shared understanding of strategic priorities, and continuously reinforcing the importance of collaboration.

You raise the chance of reaching win-win results if you keep this alignment throughout the collaboration. Recall that effective collaborative company planning needs constant communication and a dedication to collaborating to achieve shared objectives.

Recommended Reading: Pink Friday Small Business: Boost Sales with Events

Resources to help you get started with joint business planning

Creating a joint business plan can seem like a daunting task, but fear not! There are plenty of resources available to assist you in this process.

Let’s explore some of these resources that can help you get started with joint business planning.

Online Templates for Creating Joint Business Plans

One helpful resource is the availability of online templates specifically designed for creating joint business plans. These templates provide a structured framework that allows you to outline your goals, strategies, and actions in a clear and organized manner.

With pre-defined sections and prompts, these templates make it easier for you to navigate through the planning process.

- Saves time and effort by providing a ready-made structure.

- Ensures consistency and completeness in your joint business plan.

- Provides guidance on what information to include in each section.

- May lack customization options for unique business needs.

- Requires careful adaptation to fit your specific partnership dynamics.

Industry-Specific Case Studies Showcasing Successful Collaborations

Another valuable resource is industry-specific case studies that showcase successful collaborations between businesses. These case studies offer real-life examples of how joint business planning has been implemented effectively across various industries.

By examining these success stories, you can gain insights into best practices, challenges faced, and strategies employed by others in similar partnerships.

- Offers practical examples that demonstrate the benefits of joint business planning.

- Provides inspiration and ideas for implementing collaborative strategies.

- Helps identify potential pitfalls and ways to overcome them.

- May not directly align with your unique partnership situation.

- Limited availability of industry-specific case studies may restrict options for certain sectors.

Expert Guides on Effective Partnership Management

To further support your joint business planning efforts, expert guides on effective partnership management are available as well. These guides provide comprehensive advice on building strong partnerships, fostering collaboration, managing conflicts, and maximizing mutual benefits.

They offer valuable insights from experienced professionals who have navigated the complexities of joint business planning.

- Offers expert advice and proven strategies for successful partnership management.

- Provides step-by-step guidance on various aspects of joint business planning.

- Helps you avoid common pitfalls and challenges associated with partnerships.

- Requires careful adaptation to your specific partnership dynamics.

- May not address industry-specific nuances or challenges.

Recommended Reading: How to Start a Photography Business with No Experience (A Step-by-Step Guide)

Frequently Asked Questions (FAQs)

Can any type of business benefit from joint business planning.

Absolutely! Joint business planning is applicable across industries and sectors. Whether you’re a small startup or an established corporation, collaborating with another company through joint business planning can bring numerous benefits such as increased market share, cost savings through shared resources, access to new customer segments, enhanced product offerings, and improved overall competitiveness.

How do I find the right partner for joint business planning?

Finding the right partner for joint business planning starts with identifying companies that complement your strengths and fill gaps in your capabilities. Look for organizations with similar values and strategic objectives but different areas of expertise that can add value to your offerings.

Networking events, industry conferences, trade associations, online platforms are great places to connect with potential partners. Take the time to build relationships, assess compatibility, and ensure alignment before diving into joint business planning.

What are some common challenges in joint business planning?

While joint business planning offers numerous benefits, it can also come with its fair share of challenges. Common obstacles include differences in organizational culture and decision-making processes, conflicting priorities and objectives, resource allocation issues, and communication breakdowns.

The key to overcoming these challenges is open and transparent communication, mutual respect, and a willingness to compromise when necessary.

How do you evaluate the progress of a joint business plan?

Evaluating the progress of a joint business plan requires establishing clear metrics and milestones at the outset. Regularly review these indicators to gauge performance against targets.

Maintain open lines of communication with your partner to address any concerns or roadblocks that may arise along the way. By regularly assessing progress and making necessary adjustments, you can ensure that your joint business plan remains on track towards achieving its objectives.

Are there any resources available to help me get started with joint business planning?

Yes! There are several resources available to assist you in getting started with joint business planning. Industry publications, online forums, webinars, and workshops often provide valuable insights and best practices for successful collaboration.

Consulting firms specializing in strategic partnerships can offer guidance tailored to your specific needs. Don’t hesitate to tap into these resources as you embark on your joint business planning journey.

In today’s competitive business landscape, collaboration is key to success. That’s where joint business planning comes in. By partnering with another company and aligning your goals and strategies, you can unlock a whole new level of growth and profitability. Joint business planning allows you to pool resources, share expertise, and leverage each other’s networks to achieve mutually beneficial outcomes.

But it’s not just about the immediate gains. Joint business planning sets the foundation for long-term partnerships built on trust and shared vision. It enables you to navigate challenges together, adapt to market changes swiftly, and seize opportunities that may have been out of reach individually. By working hand in hand with a like-minded partner, you can amplify your impact and create a powerful synergy that propels both businesses forward.

Ready to tap into the power of joint business planning? Start by evaluating potential partners who align with your values and objectives. Establish open lines of communication, set clear expectations, and define measurable goals together. Remember, successful joint business planning requires ongoing collaboration and commitment from both parties. With the right partner by your side, there’s no limit to what you can achieve together.

What Is Joint Business Planning?

Joint Business Planning (JBP) helps Consumer Goods suppliers and retailers build winning relationships that benefit both parties and improve the commerce experience through clear insights into the other's needs and recognition of mutual interests.

Charles Redfield

Executive vice president and chief merchandising officer – sam’s club (walmart).

The symbiotic relationship between retailer and Consumer Packaged Goods (CPG) companies has, till now, been able to support steady growth based on demand alone. Now, as the Consumer Goods (CG) industry continues to shift away from organic expansion, the need to reach more customers and engage new audiences is more important than ever.

Let's dive in to some of the key shifts our customers are seeing in the retail environment:

Authentic challenger brands are continually entering the market. According to a recent survey carried out by McKinsey, 30-40% of consumers have been trying new brands and products during the pandemic. Of these consumers, 12% expect to continue to purchase the new brands after the pandemic. More competition = more difficulty obtaining or retaining market share.

Global supply chain stress has created a multitude of issues for companies seeking to keep costs down. Disruptions in labour markets have seen 15% of companies with insufficient labour for their facilities to keep up with increases in demand, leading to inflation re-emerging as a significant problem for the first time since the 1970s.

Changing consumer needs are not only encouraging the rise of new, healthier alternative brands but also instigating real legislative change. For example, in October 2022, HFSS (High in Fat, Salt & Sugar) regulations will see a crackdown on promotions for unhealthy food and drinks, which will have serious repercussions for both suppliers and retailers.

Evan Sheehan

Retail, wholesale & distribution leader - deloitte global.

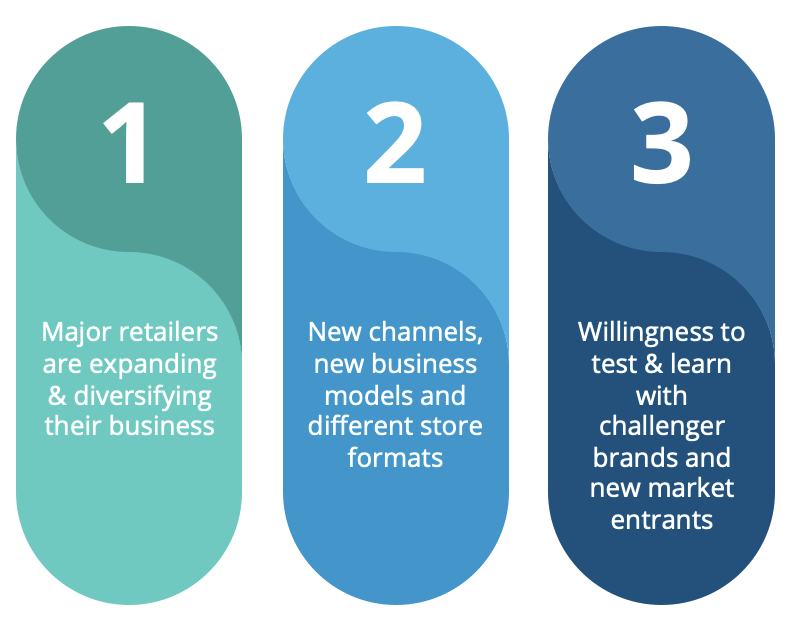

These shifts have caused retailers to change the way they do business; the traditional playbook needs to be thrown out and rewritten. The diversification we have seen in channels, models and store formats means that retailers’ expectations for suppliers have changed. And, as increasing numbers of authentic challenger brands come to market, competition has never been higher.

For both retailers and suppliers, Key Account Management (KAM) needs to be revisited. A culture of test & learn in real time needs to be applied to contend with these new market entrants and, with “key accounts contribut[ing] between 40% to 80% of revenue for a branded supplier” in developed markets as indicated by this article by Bain & Company , the time to reinvent is now.

Major incentives for change can be distilled into these three points:

In the past, the CPG industry power dynamic has often favoured the supplier, but this is no longer the case. Only 3% of retailers are in an exclusive relationship with just one supplier in a given category, indicating the clout they hold to sway access to consumers is higher than ever before. With a number of Consumer Goods companies falling prey to a one-size-fits-all to their global business models, they have been losing valuable ground to more specialised, relevant competitors.

For CPG companies, visibility at point-of-sale for their products is vital. For retailers, getting the product in-store to sell is their business. Having retailers being ‘on-side’ and aligned is game-changing for suppliers.

But, as indicated in the name, Joint Business Plans need to be exactly that: Joint. If the manufacturers arrive at the table with a railroad agenda, offering little to no agency to the retailer, it will be too one-sided and off balanced. If retailers have unrealistic expectations, e.g broad assortments or 24-hour delivery, from certain suppliers, the equilibrium of the plan will be thrown off from the outset. This is where the value of insight-sharing cannot be understated; IGD asserts that both sides must 'be prepared to share information with each other' to achieve success.

Both CPG companies and retailers need to be able to influence the plan and offer respective insights to avoid creating a zero-sum atmosphere.

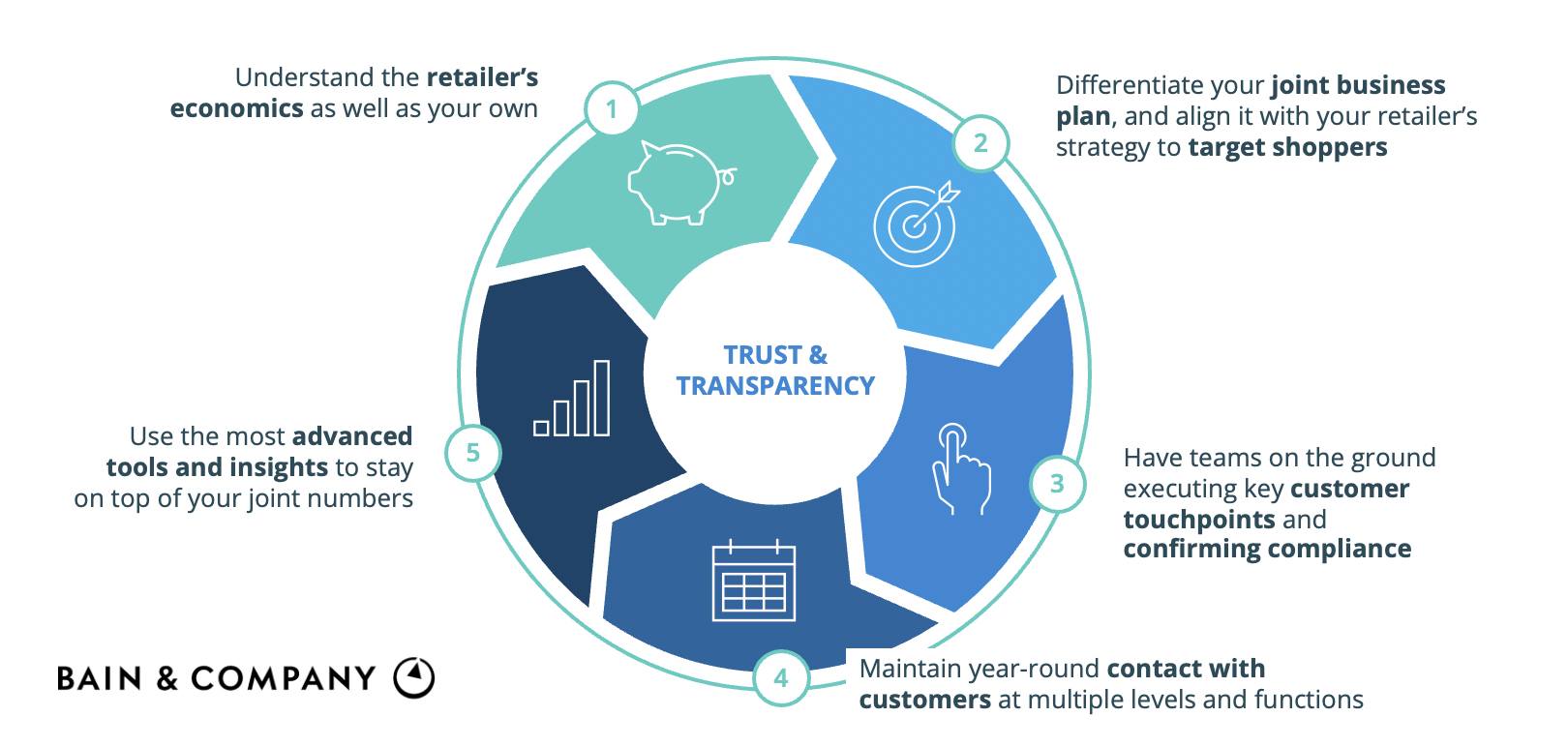

For companies collaborating on Joint Business Plans, certain proactive steps need to be taken to fit the plan to benefit both parties. Bain & Company have set out five key steps that they have seen Consumer Goods companies take to achieve 'more trustful and productive' relationships and provide significant value.

Entering into a business relationship, such as a JBP, with a full understanding of where a potential partner is in the market is pivotal to a successful collaboration. Being aware of any weaknesses provides the opportunity to address them before they become an issue and impact your business.

In turn, a complete understanding of your own business’ strengths and weaknesses before embarking on any external partnership is equally important. A Joint Business Plan can only be successful if it truly brings benefit to both the retailers and CPG companies; without this, joint commitment can’t be assured.

This demands the creation of an environment where retailers and CPG companies can offer total visibility into their data, thereby enabling creation of target audiences and consumer journeys. As indicated by an IGD Industry Survey , ‘Too often trust is the biggest barrier to putting any proposal into action’. Data transparency reduces the possibility of down-the-line surprises and potential derailing of the plan.

While keeping costs down may be advantageous, it is vital not to lose sight of the top priority; understanding the target customer segments.

Customer data extracted through the collaborative JBP can help maintain product stock levels, illustrate demand and identify trends in product distribution. Without this information, even a theoretically perfect Joint Business Plan will fail. Understanding who the customers are and what they are buying better enables CPG companies and retailers to produce and distribute - keeping the customer’s needs at the crux of their strategy.

It’s important to note that Joint Business plans are not one-size-fits-all; it may take more time to differentiate a plan to make it more tailored to a specific relationship, but the benefits can outweigh the expense.

Research by POI illustrates that 58% of CPG companies are struggling with retailer aligned compliance for store-level promotion execution. Clearly, there is a concerted need to ensure in-real time that assured promotions are being carried out, but 27% of CPG companies do not get any real-time insights into retailer compliance, forcing them to wait until the end of a cycle to make any significant changes.

While promotion compliance isn’t a new issue in the Consumer Goods industry, it can be a major roadblock to a JBP. With teams in the field, far more regular compliance checks can be performed and the information shared much wider, much faster.

The dialogue between each party needs to continue beyond initial negotiations and agreements. Regular meetings provide opportunities to correct mid-cycle issues, where the retailer and CPG company can align on real-time results and solutions.

Without clearly defined and tracked performance metrics, the success of the JBP is uncertain. Both parties need to agree on what data sources are going to be reviewed. Expectations must be laid out internally and externally, to establish what each side hopes to get out of the arrangement. This will prevent potential disappointment if or when unaired expectations aren’t met.

It is also important to have discussed and agreed upon the terms and investment in the JBP. Going into a project aware of the value that each business is adding to the other and being able to quantify the ROI is fundamental to a successful Joint Business Plan.

As shown in the recent Promotion Optimization Institute (POI) State of the Industry Report , 64% of manufacturers have challenges when looking for data from retailers. When data is such a foundational element to gainful retailer partnerships, it needs to be shared. The ideal is to involve teams from across the company including distribution, sales, finance and marketing. Siloed internal communication can negatively impact information sharing and lead to failure of a JBP.

CPG companies need to leverage real-time insights pulled from a range of commercial data sources that allow them to optimize strategies based on their business goals and current supply and promotion constraints. This maximises the value of every dollar invested in trade spend.

Closely aligned with the tenets of Bain's Key Account Management Commercial Excellence framework, Aforza drives Joint Business Planning with an end-to-end platform of core functionalities:

Account 360° View : Gain a complete view of an account's hierarchies and key relationships, as well as visibility into all engagement activity across channels.

Real-time Data & Insights on Account Performance: Get real-time insights, from a range of commercial data sources, across all aspects of your key account performance.

Integrated Trade Promotions: Optimize trade spend and target key customers by displaying a real-time view into promotion performance, inventory levels, sales order insights, budgets & funds, plans & objectives.

Retail Execution Checks from Field Sales Teams: Leverage your teams in the field to check key account compliance and take promotion-based order capture with penny-perfect pricing on mobile; online or offline .

Digital Asset Management : Ensuring all important business documents are centralised and accessible against the account, such as contracts and Joint Business Plans.

Check out this demo from Aforza's Chief Product Officer, Nick Eales, as he showcases how leading Consumer Goods companies are leveraging Aforza to create productive account collaborations that unlock revenue potential like never before:

With industry-leading innovations and capabilities, the Aforza cloud & mobile solution continues to help consumer goods companies sell more and grow faster. Take the first steps now and create productive account collaborations that unlock revenue potential like never before.

Joint Business Planning at WOW Tech

WOW Tech Group was founded in 2018 with the coming together of two industry leaders, Womanizer Group Management GmbH from Germany and Standard Innovation Corporation from Canada.

Their stated mission is to be the premier provider of pleasure products that enable people all over the world to increase the satisfaction of their personal and sexual well-being.

With Aforza, WOW Tech enabled Joint Business Planning by allowing Key Account Managers (KAMs) to easily set up and manage account plans and set sales targets across various KPIs.

Take a Tour

Joint Business Plans: Top Tips for Successful Retail Collaboration

Our top tips on how to develop a joint business plan with your retail partner..

Aug 21, 2023

Joint Business Plans (JBPs) are strategic collaborations between suppliers and retailers to drive mutual growth and achieve shared business objectives. These plans outline the joint activities, goals, and strategies that both parties will undertake to grow retail sales, enhance profitability, and improve the overall performance of the partnership.

JBPs are usually negotiated once a year, at the start of the retailer's financial year. Most things that happen in that year such as distribution changes and promotional space offered are usually dictated by the JBPs; that doesn’t mean that changes not specified in the JBP won’t happen but in general, they influence the year’s decisions.

Here's a few of our top tips to developing Joint Business Plans:

1. understand the retailer's business objectives:.

Gain a deep understanding of the retailer's overall business strategy, goals, and priorities.

2. Align with retailer's strategy:

Ensure your business objectives align with the retailer's strategy. Identify areas where your brand or product can contribute to the retailer's goals.

3. Gather data and insights:

Collect relevant data and insights to support your JBP. This includes market research, consumer trends, sales data, and shopper behaviour analysis.

4. Develop strategies and action plans:

Work together with the retailer to develop strategies and action plans that will help achieve your defined goals.

5. Communicate and review:

Maintain open and regular communication channels with your buyer throughout the JBP implementation. Schedule periodic meetings to review progress, share insights, discuss challenges, and make any necessary adjustments.

6. Accountability & Conditionality:

Within the JBP it’s likely you’ll have invested in the retailer to gain additional space or get new products listed etc. Ensure you only pay investment that was linked to changes once that change has been completed by the retailer; this is referred to as conditionality.

Conclusion:

Remember, a successful Joint Business Plan requires strong collaboration and a focus on mutual growth. By aligning goals, strategies, and resources, suppliers and retailers can create a powerful partnership that drives sustainable business success.

You might also like:

Understanding Retail Investment

Navigating the world of investments in retail is a critical task, especially for startups, so let's delve into key strategies for crafting a compelling proposal that benefits both you and the retailer.

The Pros and Cons of Promoting During Retailer Events

Retailers’ promotion calendars are full of seasonal and event driven promotion timings, so with extra space and Pos up for grabs, should you be investing during these times or not? We delve into the pros’ and cons so you can consider these in your decision making.

Sign up to our community

Get retail insights delivered to your inbox

Valuable insights

Retail-focused

Perfect for challenger brands

Joint Business Partnership: Everything You Need to Know

A joint business partnership is a business venture taken on by two people or companies with the same goal. 3 min read updated on February 01, 2023

A joint business partnership is a business venture taken on by two people or companies with the same goal. The two entities forming a joint venture will create a business relationship through the exchange of value of some sort.

What Is a Joint Venture?

A joint venture is a type of business partnership but is different from a basic partnership. When two entities come together to complete a project or other type of short-term business goal, they can form a joint venture using a joint venture agreement. The agreement makes sure both sides are on the same page.

Joint Venture Versus Partnership

Unlike a joint venture, a partnership is meant for a long-term business goal. If the purpose of the joining of two parties is to start and run a business for the foreseeable future, they will likely form a partnership and not a joint venture. The main difference between partnerships and a joint venture is the relationship's duration. Joint ventures take on projects, partnerships are businesses.

When two entities form a joint venture, they enter into a contract and agree to work toward the same specific task. In such an agreement, the two parties involved will likely share the costs of the project whether financially or with manpower. Once the goal is reached or the task is complete, the joint venture will be dissolved.

When two entities form a partnership, they become owners of a business together. This means that they will share in the profits and losses of the business as well as the liability, depending on the type of partnership they choose. Partnerships are meant to continue indefinitely as other businesses do.

Members of a partnership and a joint venture include individuals, groups, or other business structure types. Two corporations can form a partnership or joint venture, or one corporation could form with an individual. Capital cost allowance in a partnership is determined by the provisions laid out in the partnership agreement. Joint ventures typically allow for unlimited capital cost as long as both parties are in agreement.

Basically, a joint venture is a partnership meant for one transaction. Because it is a type of partnership, the same liabilities and rights apply to joint ventures as they do to partnerships.

Why Use a Partnership Agreement?

A partnership agreement is a written or oral agreement, or sometimes it's simply implied, between entities or individuals involved in a partnership. According to the Uniform Partnership Act, used as the law of partnerships in many states, partnership agreements are legally binding and are amendable. They act as a sort of partnership operating agreement like an LLC's operating agreement.

Partnership agreements are very important as they govern the business relationship between those involved in a joint venture or partnership. They lay out the following aspects of the relationship:

- Who the partners are.

- Partner duties and responsibilities.

- Partner investments or contributions.

- Distribution of shares.

- Provision for partnership dissolution or termination.

However, by law, a partnership agreement cannot relieve partners of certain basic responsibilities such as liability (unless forming a liability partnership). It's important to use caution with the wording of a partnership agreement because it can affect how the partners involved can make decisions and changes regarding the business. Without a carefully drafted partnership agreement , you could end up in a situation where your partner is making drastic changes without consulting you.

What Is a Joint Venture Agreement?

A joint venture agreement is essentially a partnership agreement with a few differing aspects. The main difference is that the joint venture agreement must clearly outline the goal of the venture. It should state why the joint venture is being formed and for how long. There are fewer requirements in a joint venture agreement. It need not specify the rights or duties of those involved.

Joint ventures can be formed orally or implied, so a written document is not necessarily required. If two parties are acting as if they have formed a joint venture, but never wrote an agreement, their business relationship is still valid and legal. The lack of a written joint venture agreement can lead to legal issues or miscommunication between the parties, so it is better to form one even though it's not required.

If you need help with a joint business partnership, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- What Is A Joint Venture Agreement

- Joint Venture Contracts

- Joint Partnership

- Difference Between a Joint Venture and a Partnership

- MOU for Joint Venture Agreement

- Joint Venture Cost

- How Does a Partnership Work

- California Joint Venture Law

- Partnership Agreement Between Two Limited Companies

- Joint Contract: Everything You Need To Know

- Instructor-Led Virtual Training

- Instructor-Led Classroom Training

- eLearning Training Solutions for Individuals

- Assessments

- Team Training for Retailers

- Team Training for Suppliers

- Sales Training

- Space Management Training

- Annual Learning Subscription

- Complimentary Assessments

- Complimentary Learning Tools

- Thought-Leadership Blog

- Train Ahead — Our Difference

- Individual Learner Login to eLearning

- Schedule Consult

Improve Collaboration and Joint Business Planning Results in 3 Steps

Collaboration is on many organization’s strategic plans, with effective Joint Business Planning (JBP) being the outcome. Retailers’ and Vendors’ have the opportunity to determine mutual areas of interest and build their businesses in a collaborative way — namely by taking steps to improve Shopper satisfaction with a better experience.

However, effective Collaboration and JBP require more than a desire or written strategic plan. Both require that your organization undertake 3 consecutive steps:

- Prepare your organization internally for collaboration;

- Align your internal approach across your multifunctional teams through common training; and

- Implement external Collaboration and Joint Business Planning.

Collaboration and Joint Business Planning can help both Retailers and Vendors manage the change that continues to dominate, including:

- Changing partner needs and expectations between Retailers and Vendors

- Changing market and Shopper,

- Less resources available internally due to downsizing / consolidation, and

- Increased requirements due to more and bigger data and a more complex Shopper.

Here are some resources to help you get started:

- Complimentary Download: Collaborative Relationship Continuum Model

- Course Video Preview: Collaborative Business Planning

- Course Overview: Collaborative Business Planning

3 Steps: Improved Collaboration and Joint Business Planning

Step 1: be prepared internally.

It’s important for teams and organizations to first understand what collaboration is:

Collaboration is highly diversified multifunctional teams working together inside and outside a Retailer / Vendor with the purpose to create value by improving innovation, Shopper relationships and efficiency while leveraging technology for effective interactions in the virtual and physical space. (Carlos Dominguez, Cisco) (modified by Sue Nicholls, CMKG)

Are you ready to collaborate? Start by defining your assets, prioritizing your opportunities and seeking out the right business partners. The questions below can help determine if your organization is ready to collaborate ( taken from the Category Management Association’s whitepaper on “Strategic Collaboration for Shopper Satisfaction” ):

- What do you want to gain by collaborating?

- Is your company set up to foster and support collaboration?

- What multifunctional resources / data / technology / intellectual property can be shared with your collaborative business partners?

Step 2: Create Internal Alignment

Moving to a collaborative approach requires your multifunctional teams to be able to see the “bigger picture”, turn data into insights, think beyond brand into total category, and better understand the consumer AND Shopper. These responsibilities must be expanded to marketing, sales, private label and retail teams in an aligned approach.

Alignment of all functions in your organization occurs through engagement and training in category management . In fact, training approaches need to change for most organizations, as traditional “point and click” linear approaches based on a new data source or tactic no longer suffice. In a collaborative approach, teams need to start thinking more strategically about how the decisions and recommendations they make align to the overall strategies for the organization and for their external collaborative business partners. This can be accomplished by equipping multifunctional teams with a common set of knowledge and skills acquired through training courses.

Role-based training in combination with strategic training will help individuals and teams feel more confident they are making choices and recommendations that match with your overall collaborative efforts and Shopper.

Step 3: Move to External Collaboration and Joint Business Planning

Now that you’ve established where you are currently at with your Retailer or Vendor partners, you can undertake Joint Business Planning (JBP) — the “next level” in a collaborative relationship. JBP should build from foundations established in collaborative relationships.

In theory, Joint Business Planning is a collaborative effort between the Vendor and Retailer which involves open sharing of information. Shared information allows for the creation of a common, mutually-agreed-to business plan. But let me insert a bit of reality into this idyllic definition. From a basic level, it is a business plan that is developed between Vendors and Retailers, through sharing of select information. The plan should include expected trends, initiatives and the forecasted market environment, so that there is a greater chance for the goals and objectives within the plan to be attained.

The higher the level of collaboration between the organizations, the closer you will move toward the theoretical definition of Joint Business Planning.

A successful Joint Business Plan requires each party to clearly understand the others’ goals, business and customer requirements. This shared understanding becomes the foundation of the JBP, with both businesses pooling their resources and expertise to achieve specific goals. The risks and rewards of the plan are also shared.

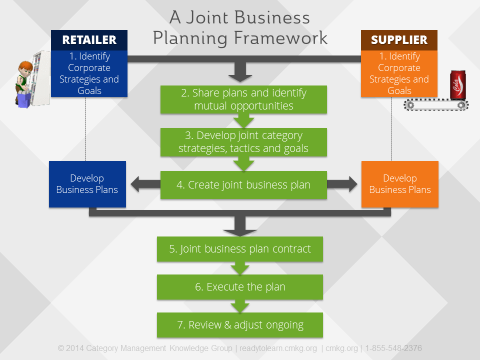

While specific approaches vary by Retailer, the following framework from CMKG category management training provides the key steps associated with most joint business planning processes:

Let’s look at the first step for the Retailer – identifying corporate strategies and goals . The Retailer, usually led by the senior management team, creates the sales, cost of goods and operating targets for the upcoming year. When you look at a Retailer’s income statement , there are 3 ways that a Retailer can influence net income:

- increased sales;

- decreased cost of goods sold; and

- decreased operating expenses.

Retailers’ targets will most likely include initiatives behind all three of these components of the income statement to increase their net margin and income. Examples of initiatives may include new store openings, the current market, and private label opportunities for the Retailer. Other initiatives may be based on supply chain upgrades, information technology upgrades, or any other types of business process improvements that will impact the bottom line for the Retailer.

In summary, if you have properly defined collaboration internally and strategically selected your business partners upfront, you are less likely to run into problems. Problems are likely to arise in a Joint Business Plan if:

- There are unclear objectives, one of the parties was not transparent in their sharing of information, or the plan was not properly communicated to everyone involved.

- The partners have different objectives or hidden agendas in the joint venture.

- One party is investing much more in terms of expertise, financial, and/or assets than the other party, creating an imbalance.

- Different cultures and management styles with partners may result in poor integration and cooperation.

- The partners don’t provide sufficient leadership and support in the early stages of the program.

The Opportunity? For Retailers and Vendors to define mutual areas of interest, build business in a collaborative way, and improve the Shopper experience.

Want to learn more about Collaborative and Joint Business Planning? Category Management Knowledge Group can help you, your team or your organization through a single online, live or webinar course or a customized program. We have some great category management training options available to meet your needs. You can preview our brand new, accredited Collaborative Business Planning course below:

Topics: Category Management , Strategic Collaboration / Joint Business Planning

Written by Sue Nicholls, Founder & President CMKG

Posts by audience.

- Analytics Work (15)

- Business Acumen Development (2)

- Business Reviews / Category Reviews (1)

- Career Advancement (1)

- Category Analytics (7)

- Category Definition Work (5)

Latest Posts

Empowering success: trusted online & instructor-led training solutions for retailers, suppliers and solution providers, about cmkg.org.

We're a global training company in Canada, dedicated to retailers, suppliers and solution providers. Whether you're a category manager or part of a sales or marketing team, our personalized programs, for organizations, teams and individuals, are tailored to elevate your skills.

shoptraining.cmkg.org

readytolearn.cmkg.org

QUICK LINKS

- Sue’s Thought Leadership Blog

- Category Management Quarterly Newsletter

Subscribe to Sue Nicholls’ Thought Leadership Blog.

ZenBusinessPlans

Home » Business Plan Tips

How to Write a Joint Venture Business Plan

A joint venture business plan is a document that defines a business arrangement between two or more companies. Just as with a normal business plan, this plan also includes numerous sections and extensively describes the aim, companies, and responsibilities of each company in the joint venture. This plan also outlines temporary activities that help to attain specific goals.

Coming together to form a joint venture is nothing new in the business world. However, the real deal is to have an arrangement that equally protects the interests of each party so that everyone in the joint venture can put their best creative foot forward. Have it in mind that the best way to guarantee all parties understand their obligations and are fully participating is to put together a detailed joint venture business plan .

Although each company in the venture can put together the business plan, a legal review is often recommended to validate if the plan is legitimate. These plans are also known to be above and beyond a standard business plan. Most often, the plans will vary based on the specifics and interests of each party in the arrangement.

Steps to Write a Joint Venture Business Plan

Forming a joint venture involves several critical steps that begin with identifying and analyzing a viable joint venture partner to agree with. This sort of agreement requires well-detailed documentation and other allied/ancillary agreements. To write a solid joint venture business plan, here are steps to take;

Step 1: Write a Detailed Company Profile

Although this wouldn’t be the first page of your joint venture business plan, it is often recommended you start the writing process by first providing a brief description of each company involved in the joint venture. You have to include the management teams of each company, the resources, or goods available, and every other detail vital to the joint venture.

Consider creating a profile to briefly describe the partners in the agreement. You should also outline the expertise of each company and the reason for inclusion in the joint venture. You may also have to write a statement on the purpose of the joint venture as well.

Step 2: Spell Out your Marketing Strategies

The next step will be to discuss the market strategies you intend to leverage to achieve success for the joint venture. Just as with a normal business plan, it needs to define the market the goods and services are meant for. This section will also need to contain a thoroughly done analysis, graphs, and all other vital information that describes the market and why the joint venture will attain success.

Most often, companies in the agreement are advised to cooperate on this section to put together an analysis from each partner. Have in mind that the length and detail of this section will depend on the purpose of the joint venture; a competitive analysis may also be necessary.

Step 3: Input your Financial Projections

Note that every joint venture business plan is expected to include financial projections. While this may be the final section of the business plan, it will include information specific to product prices and cost of goods or services sold, and possible expenses from the activities.

You may need to include Pro forma financial statements in this section. Note that these statements provide a formal look at potential profits and let banks or lenders properly evaluate the venture’s possibility for success. Other statements or documents may also be included in this section.

Step 4: Your Executive Summary

Although the Executive Summary will be the first page of the joint venture business plan, it is always recommended you write it last. This page of your joint venture business plan provides a concise view of the business agreement. Depending on the joint venture activities, the section of the business plan will span anywhere from a few paragraphs to a few pages.

Important Clauses to Include in a Joint Venture Business Plan

A joint venture business plan is the bedrock of any joint venture. It outlines the objective and purpose of the joint venture. Have in mind there are ideal clauses a joint venture agreement is expected to contain. Here are very important clauses that should be inserted in the joint venture business plan:

Definitions

It is critical for every business plan to have a clause that defines all the necessary terms in the plan. This is primarily to avoid any form of misunderstanding and misinterpretation in the plan. Have it in mind that certain words or terms are given confining definitions for the purpose of interpretation of the plan. This clause will help guarantee a mutual understanding between the parties as to what a certain term means.

Parties to the Joint Venture

A joint venture business plan is meant to identify all the parties involved in a joint venture. Have in mind that there is a possibility that the original party won’t be the investing party, and the investing party may be the parent company of the original party. In such circumstances, this clause is very necessary to ensure that the joint venture agreement is binding to the investing parties as well as the original parties.

Nature of the Relationship

This is one of the most vital functions of the joint venture business plan. This clause in a business plan is meant is to outline the nature of the relationship between the joint partners, whether the parties owe any contractual obligations to one another, or whether the arrangement is just a contractual relationship where each party remains at arm’s length.

Business Objectives and Purpose of the Joint Venture

Note that this clause outlines the purpose why the joint venture was established. There are numerous reasons why businesses enter into a joint venture, from expanding their markets to completing a specific project. The purpose of the joint venture will need to be extensively considered before proceeding with finding a joint venture partner.

The Structure of the Joint Venture

This clause will have to include details about what structure the joint venture will be, such as an LLC, LLP, or incorporated. This clause shall also contain the details of the formation of the joint venture thereof. It shall also mention the registered office and the location where the joint venture will be carrying out its business.

Parties’ Contributions

This clause will note if the work will be split 50/50, who’s bringing what to the table, and what you can expect from the other person or company. Outlining this in your joint venture business plan in detail will ensure that all partner’s expectations are aligned. This is to ensure that each party understands what they will be committing to the venture, and also to ensure that they are bound by that commitment.

Distribution of Shares

The shareholding of all the partners will have to be outlined under this clause. Note that the distribution of shares is a very important aspect as the shareholdings will more or less dictate the proportion of ownership among shareholders.

Note that distributions of shares must not be 50:50; they can vary depending on the agreement between all parties. The shares can be distributed by a mutually agreed ratio or based on the capital contribution of the parties.

Rights and Obligations of the Parties

Indeed every party in a joint venture has certain rights that they can exercise and certain obligations. In the joint venture business plan, this clause will have to explain in detail everything that is expected from the parties. This is to limit or avoid future disputes and misunderstandings.

Joint venture business plans will need to explain who will manage the venture and take care of its day-to-day operations. It will also specify different levels of approval for different types of decisions.

Some joint ventures agree to establish a management committee instead of appointing the board of directors where the joint venture has been entered into for a particular short-term project. The mode of management needs to be explicitly outlined in the joint venture business plan.

Representation and Warranties

Note that these are statements of fact made by the parties entering into the joint venture. Representations and warranties are more or less made before entering into an agreement and such representations and warranties will also have to be mentioned in the joint venture business plan.

Representations and warranties are necessary so that the parties have adequate and vital information about each other such as financial standings of the parties or the loans taken by the parties, pending litigation, etc.

Indemnity Clause

Indemnity is a legal obligation on the parties to compensate the other party in case of breach of any contractual obligation. Most often, the party that suffers due to a breach of representations and warranties is entitled to be indemnified for the losses. Have it in mind that the indemnity clause will have to be fair, mutually agreed upon, and well balanced. The language and scope of this clause will also need to be clear and precise.

Dispute Resolution

In all business arrangements, there are bound to have disagreements and issues. While these issues will not always lead to litigation, it is recommended that all parties agree on a mechanism to deal with such situations.

Each party in a joint venture can be from different jurisdictions and governed by varying laws. Therefore the mechanism to resort to in case a dispute arises will need to be mutually agreed upon by the parties and explicitly noted in the plan.

Non-compete clause

This is a very important clause to include in a joint venture business plan. Depending on the nature of the agreement, it might be necessary to note that the two businesses are restricted from directly competing with one another, at least for a stipulated time. However, the non-compete clause will need to be reasonable otherwise it might be treated as a violation of a person’s fundamental right to trade.

Confidentiality

Within a joint venture agreement, parties are expected to disclose certain vital information concerning the company. Note that this information can be related to technology, trade secrets, or intellectual property. The information in the wrong hands might cause the party to incur massive losses.

This is why this clause is very important in a joint venture business plan. The clause may also need to provide that the information disclosed for the joint venture should never be used for personal gains.

Force Majeure

This clause is used to provide relief and protection to a party in a situation where the party is unable to meet some of its obligations. Note that this inability to fulfill obligations may be due to events that are totally beyond the control of the parties. The event could be a flood or an earthquake or a fire so on and so forth.

Termination

You need to understand that not every joint venture survives long and is often terminated. Owing to that, this clause will have to be included in the joint venture business plan. The termination clause centers on instances, breaches, or the occurrence of which the joint venture will be terminated.

Exit Mechanism

Even while still under an agreement, there can be many reasons why the parties would want to exit the joint venture. This could include short of funds or the joint venture going into a loss for some time. It is very common for a party to want out of the joint venture, maybe due to certain unresolved issues. Owing to that, the exit mechanism will need to be noted in the joint venture plan.

Deadlock Resolution

Deadlocks tend to arise when the parties in the joint venture have equal powers and are finding it hard to agree on a common conclusion.

Note that things like this can lead to disagreement especially when neither party is ready or willing to surrender their powers or accept the other party’s decision. While this cannot be entirely avoided in a joint venture, you should establish a mechanism that will help the parties to come to a common agreement or to resolve the deadlock.

Financial and Administrative Record Keeping

All parties in the joint venture must collaborate on maintaining their financial records. They also need to decide the process of administrative record keeping. While this may not be necessary, it is good practice for joint ventures to work with one accounting firm that is agreed upon by all members. This will help to limit the risk of any conflict of interest or complications in the future.

Intellectual Property

For joint ventures that will produce intellectual property that is of potential value to each of the parties, this clause is very necessary to avoid the risk of one party attempting to take advantage of the other’s intellectual property. This clause in the joint venture business plan should note who will own any new intellectual property created by the venture, and the extent to which the parties are permitted to use that property outside the venture.

More on Business Plan Tips

Taking supplier collaboration to the next level

Companies with advanced procurement functions know that there are limits to the value they can generate by focusing purely on the price of the products and services they buy. These organizations understand that when buyers and suppliers are willing and able to cooperate, they can often find ways to unlock significant new sources of value that benefit them both.

Buyers and suppliers can work together to develop innovative new products, for example, boosting revenues and profits for both parties. They can take an integrated approach to supply-chain optimization, redesigning their processes together to reduce waste and redundant effort, or jointly purchasing raw materials. Or they can collaborate in forecasting, planning, and capacity management—thereby improving service levels, mitigating risks, and strengthening the combined supply chain.

Earlier work has shown that supplier collaboration really does move the needle for companies that do it well. In one McKinsey survey of more than 100 large organizations in multiple sectors, companies that regularly collaborated with suppliers demonstrated higher growth, lower operating costs, and greater profitability than their industry peers (Exhibit 1).

Despite the value at stake, however, the benefits of supplier collaboration have proved difficult to access. While many companies can point to individual examples of successful collaborations with suppliers, executives often tell us that they have struggled to integrate the approach into their overall procurement and supply-chain strategies.

Barriers to collaboration

Several factors make supplier collaboration challenging. Projects may require significant time and management effort before they generate value, leading companies to prioritize simpler, faster initiatives, even if they are worth less. Collaboration requires a change in mind-sets among buyers and suppliers, who may be used to more transactional or even adversarial relationships. And most collaborative efforts need intensive, cross-functional involvement from both sides, a marked change to the normal working methods at many companies. This change from a cost-based to a value-based way of thinking requires a paradigm shift that is often difficult to come by.

The actual value generated by collaborating can also be difficult to quantify, especially when companies are also pursuing more conventional procurement and supply-chain improvement strategies with the same suppliers, or when they are simultaneously updating product designs and production processes. And even when companies have the will to pursue greater levels of supplier collaboration, leaders often admit that they don’t have the skill, lacking the structures they need to design great supplier-collaboration programs, and being short of staff with the capabilities to run them. After all, what great supplier collaboration necessitates is much more than the mere application of a process or framework—it requires the buy-in and long-term commitment of leaders and decision makers.

A shared perspective

To understand more about the factors that hamper or enable supplier-collaboration programs, we partnered with Michigan State University (MSU) to develop a new way of looking at companies’ use of supplier collaboration. The Supplier Collaboration Index (SCI) is a survey- and interview-based benchmarking tool that assesses supplier-collaboration programs over five major dimensions (Exhibit 2).