- CFO Services Overview

- CFO Services Packages

- Accounting & Audit Support

- Business Analysis & Cost Structuring

- Business Valuations

- Cash Flow Budgeting & Management

- Entrepreneurship Programmes

- Financial Decision-Making

- Financial Forecasts and Projections

- Financial Gap Analysis

- Financial Technology & Automation

- Fundraising Services

- Implementing Management Accounts

- Post-Investment Financial Management

- Profit Maximization & Dividends

- Risk Mitigation & Internal Controls

- Working Capital Cycle Improvements

- Cloud Accounting Overview

- Cloud Accounting Packages

- Annual Financial Statements

- Business Tax Services

- Independent Reviews of Financial Statements

- Monthly Bookkeeping & Reporting

- Payroll Services

- VAT Registration, Recon & Submissions

- Xero Cloud Accounting

- Automation Overview

- Business Systems Integration

- Custom Workflow Creation

- Systems Gap Analysis

- Tech Stack for Tourism

- Zoho CRM Development

- About Outsourced CFO

- Company Snapshot

The Importance of Financial Planning for your Businesses

When you’re starting out and putting in the hours to turn that business dream into a functioning reality, it can be difficult to think of next week – never mind next year. However, it always pays to plan ahead, especially when it comes to the financial future of your business.

Business Financial Planning:

Financial planning for your business helps you to forecast future financial results and decide how best to use your company’s current financial resources in order to realise both your short-term and long-term plans. Because planning involves looking well into the future, it is a highly creative thinking process as well as an analytical one, and you might need to call in the experts to help you juggle both these aspects of your financial roadmap.

How can financial planning help me achieve my company goals?

Having a strong financial plan for your business is probably the most important single thing that you can do to help yourself succeed. It’s your roadmap, your guideline, a reminder of what your goals are–what you are trying to achieve in the short term and the long term. It is so important that possible investors, bankers, and creditors won’t even set up a meeting with you if you don’t have a financial plan in place. We cannot state this clearly enough – get your business’s financial function set up effectively from the start, and the rest will follow.

Here are 5 benefits of financial planning for your business:

Financial planning can help you:

- Manage your cash flow properly: Good financial planning allows you to set clear expectations regarding your cash flow so that you know where you can spend and where you need to cut back. This is especially important after the initial startup expenditures.

- Allocate your budget: Financial planning for businesses makes for clever budget allocation and allows all players within your company to understand where and how money will be spent, ensuring less friction.

- Set realistic goals: If you don’t know how much you have to work with, you can’t set realistic financial goals that work within your budget. Your vision might be lofty, but it pays to be realistic.

- Mitigate your risk: A good financial plan should prepare for unexpected expenses, as well as times of lower income. That way you can ride out the bad times, but keep your doors open.

- Plan a roadmap for the future: Financial planning helps you clarify your company goals and communicate them to your employees and other stakeholders. This makes it easier for the business owners and top management to make more good decisions when planning to scale.

Most people have some idea of what they would like to achieve financially, but they don’t always know how to go about setting realistic goals. Companies that put in the time and effort to work out an effective and strategic financial plan , will be able to allocate their time and resources effectively, allowing them to expand while ensuring good cash flow and healthy accounts.

Does my business need a financial plan?

In short – yes. If money is the lifeblood of your business, then you cannot afford NOT to have a sound financial plan in place. A good financial plan that you refer back to, will allow you to spot anomalies and positive or negative trends in your finances so that you can take the necessary corrective action. This means that you can make your money work for you – spending when and where it’s needed for growth, and cutting back on those outgoings that are becoming a financial black hole.

We have found that business owners and entrepreneurs are often so involved in the day-to-day running of their businesses, that they don’t have the time and energy to think of long-term financial planning and strategy. This is where we recommend a financial consultant or CFO with the expertise to see what you might miss. Many entrepreneurs are making use of the services of a virtual CFO instead of hiring full-time, as this allows them access to expertise without the cost of a permanent hire.

What should be included in a business financial plan?

All business financial plans , whether you’re just starting a business or building an expansion plan, should include at least the following:

- Revenue or income – what money is actually coming into your business.

- Your basic fixed operating costs such as rent and utilities.

- General monthly expenses such as marketing etc.

- Costing of your goods or services – take the time to note every cent and every minute that you put into producing your product or service.

- Total profit or loss – the formula for this is income minus cost of goods or services.

- Actual operating income (total profit minus expenses).

After you have these basics down and feel that you have at least an overview of the financial health of your business, it is important to remember that ‘big-picture’ higher-order financial planning and strategizing are also necessary for the long-term viability of your business. Finance is complex and the finance function is often one of the last frontiers to get fortified by the leadership team. It is also one that becomes increasingly more important as you head towards further expansion, possible fundraises and potential acquisitions. Getting the numbers right is critical. So is developing the right strategy based on analysis, forecasts , and smart financial management . This is where you need the advice of an expert CFO or the assistance of a virtual ‘CFO-as service’ company like Outsourced CFO.

At Outsourced CFO we can assist with getting your financial planning off to a solid start, in order to help you with building long-term profitability for your business. Reach out to us and let’s get your business ready for growth.

Share This Post

Have any questions let's chat..

We love meeting founders and executives! Jump on a call with our team to answer any questions you may have.

GET IN TOUCH

5th floor Vunani Chambers

33 Church Street

Cape Town City Centre

+27 (0) 21 201 2260 (SA)

+1 646 814 0918 (USA)

CFO SERVICES

Cloud accounting.

- Monthly Bookkeeping

- Zoho ERP Development

Start typing and press enter to search

Privacy overview.

How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

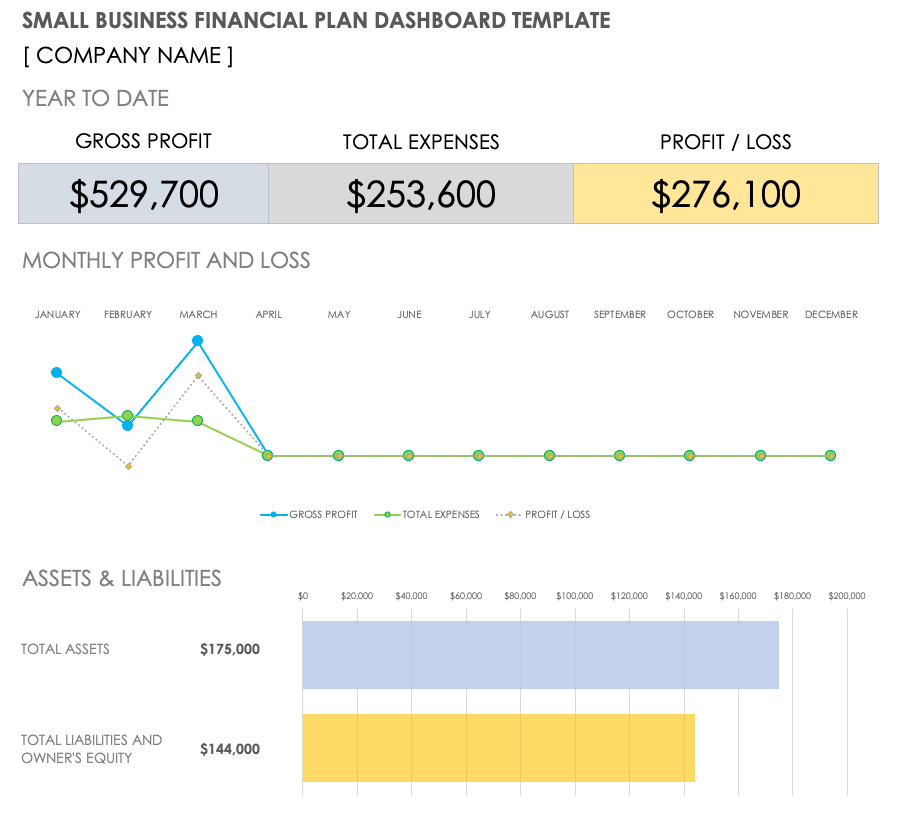

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

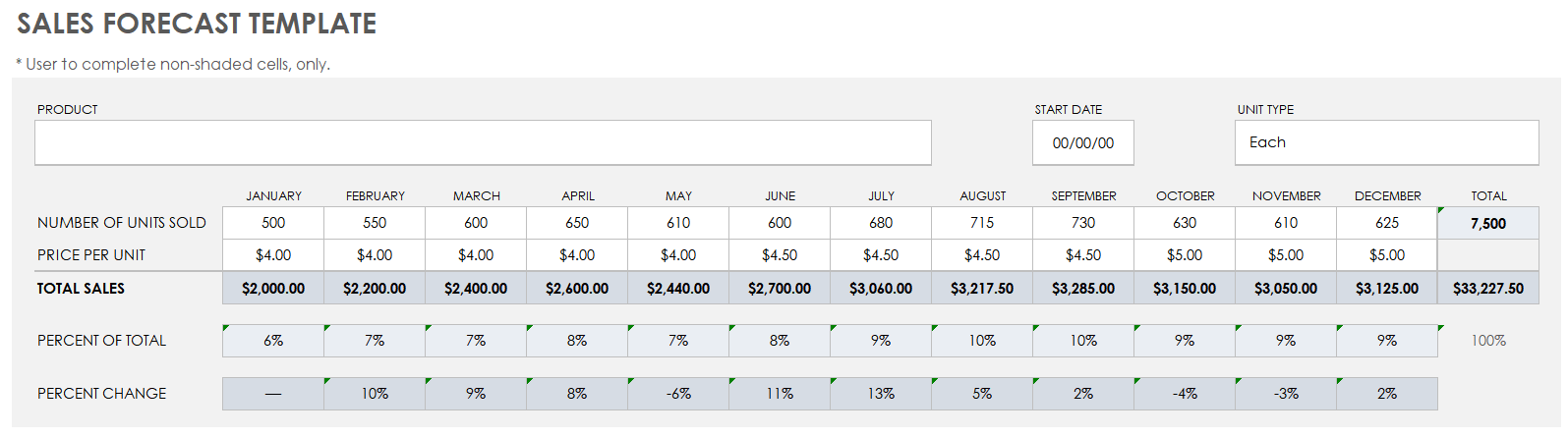

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

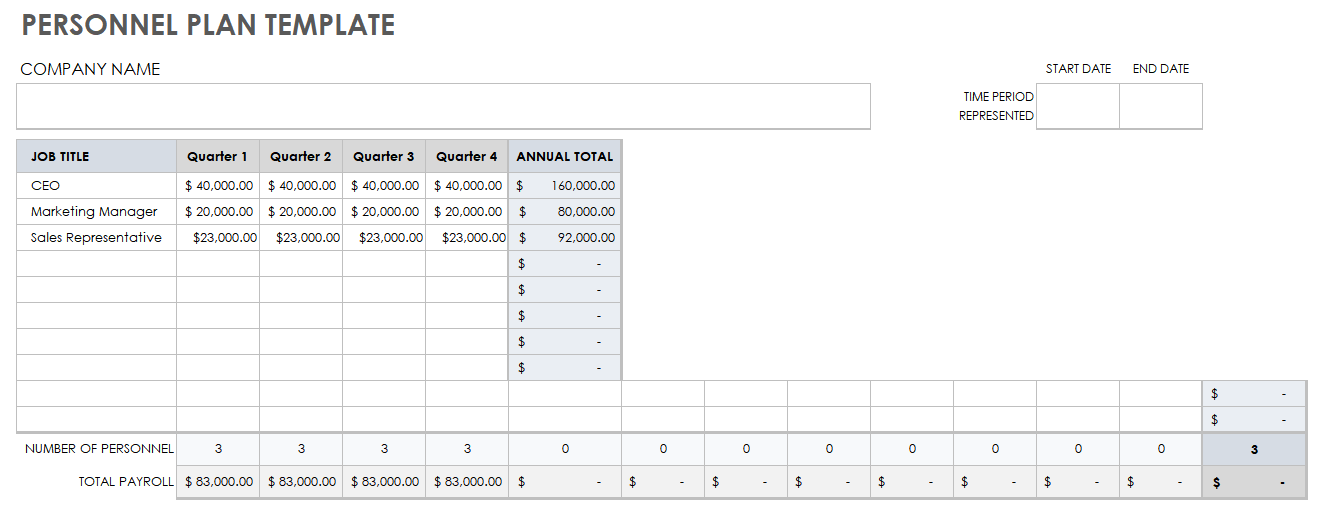

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

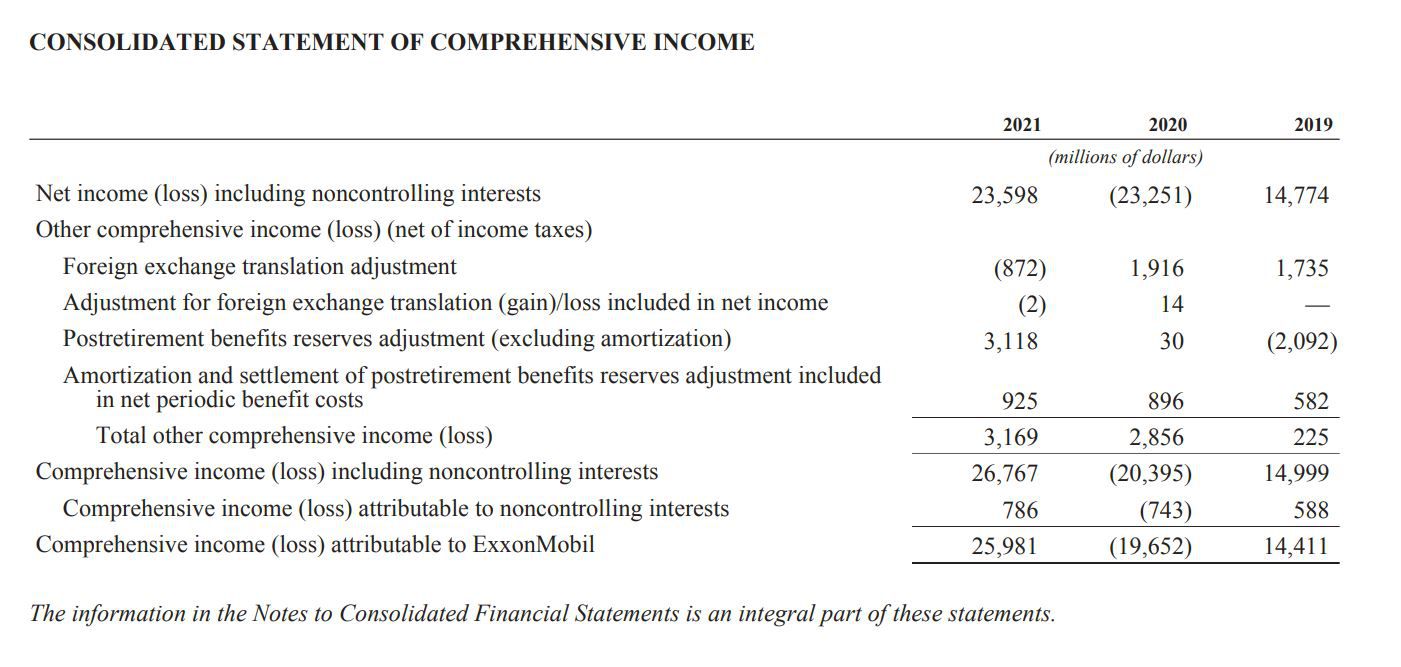

Profit and loss forecast

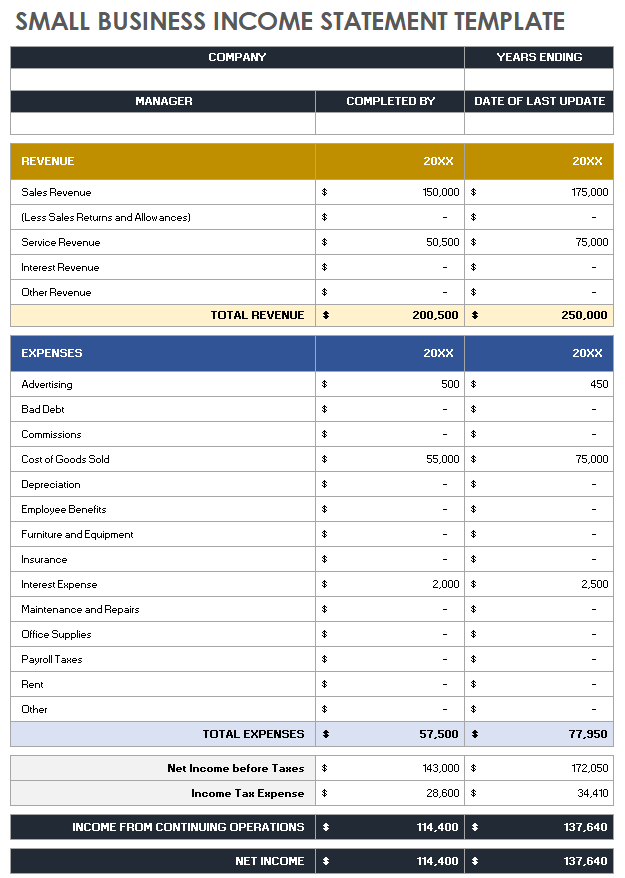

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

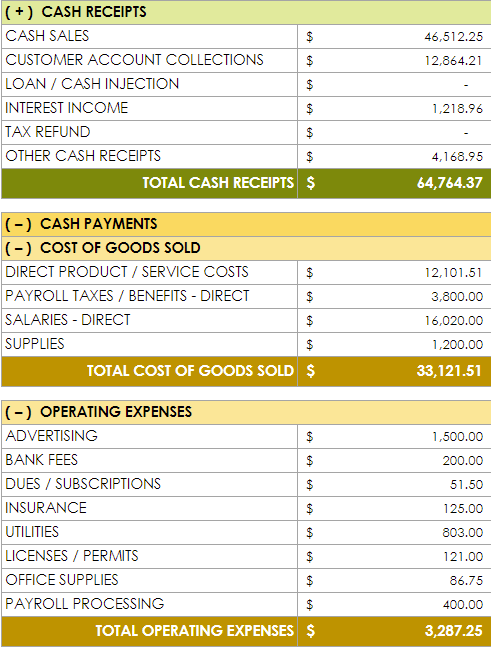

Cash flow forecast

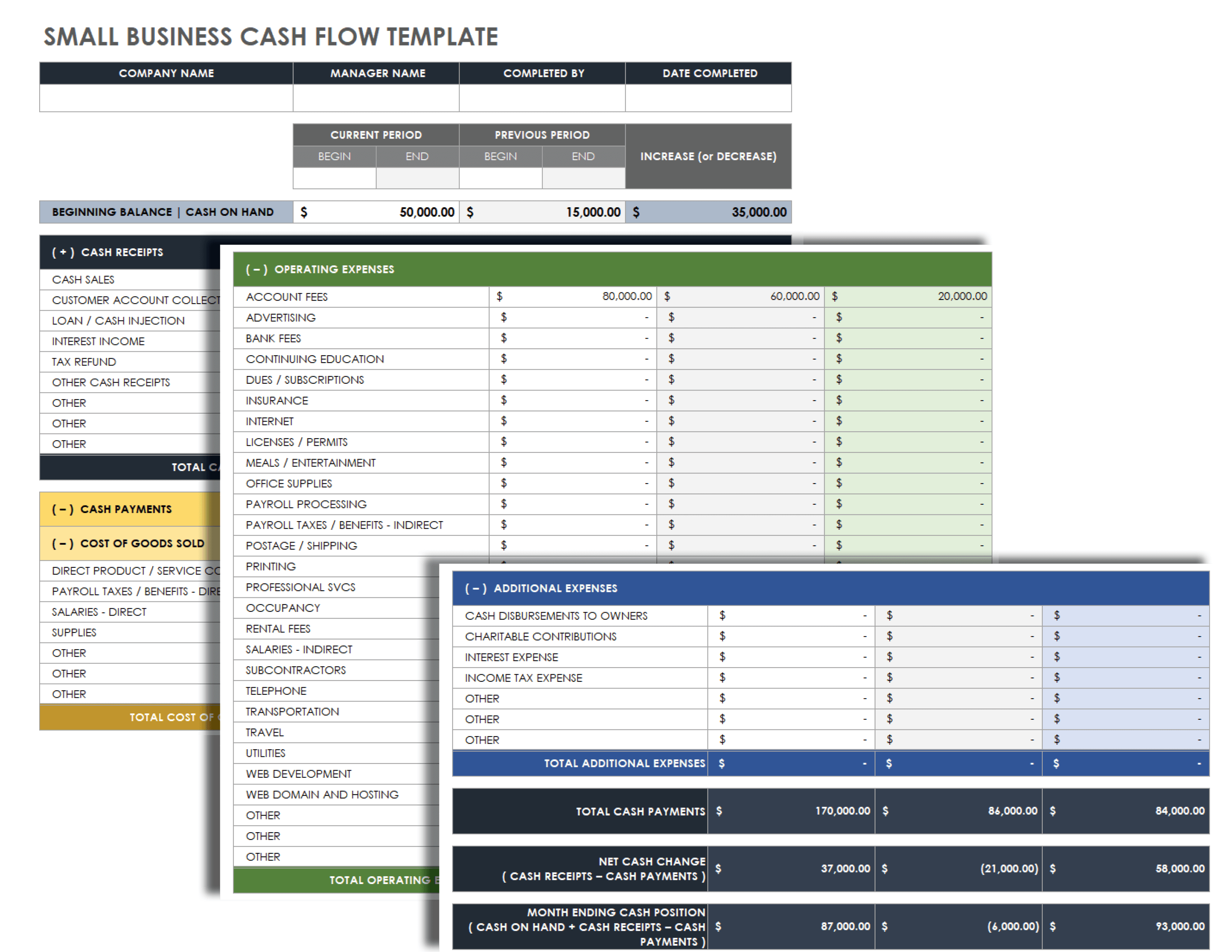

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

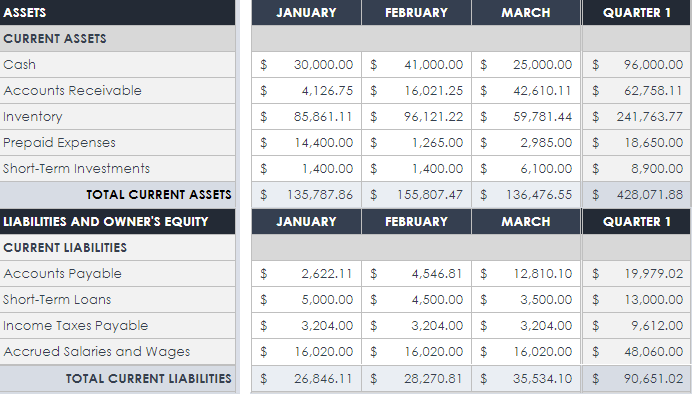

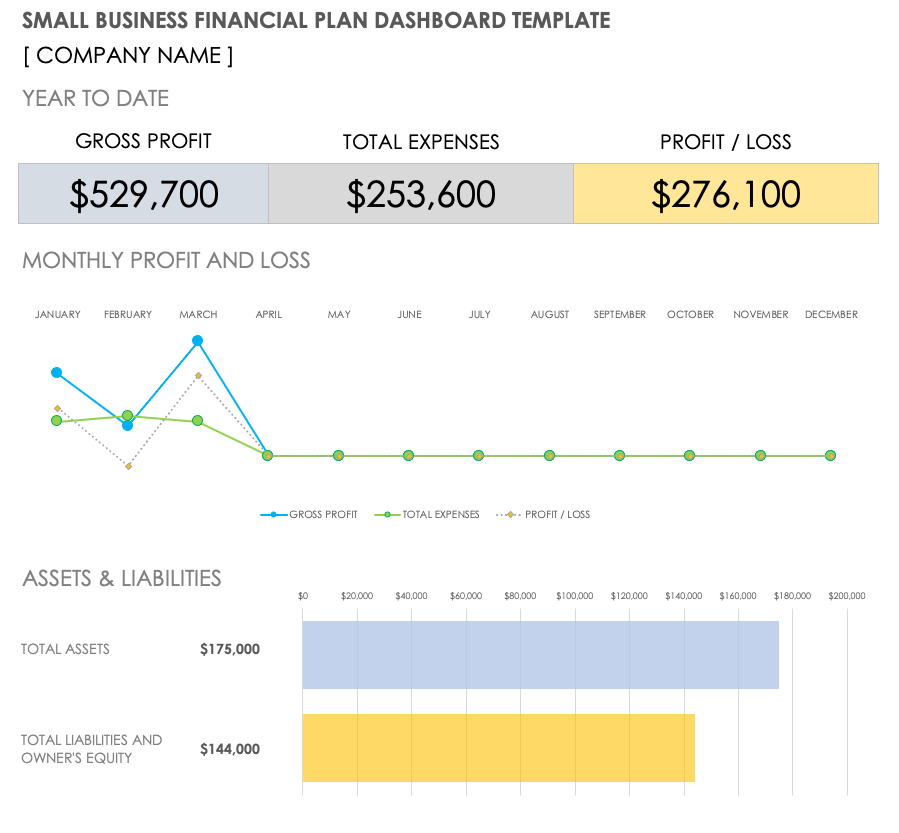

Balance sheet

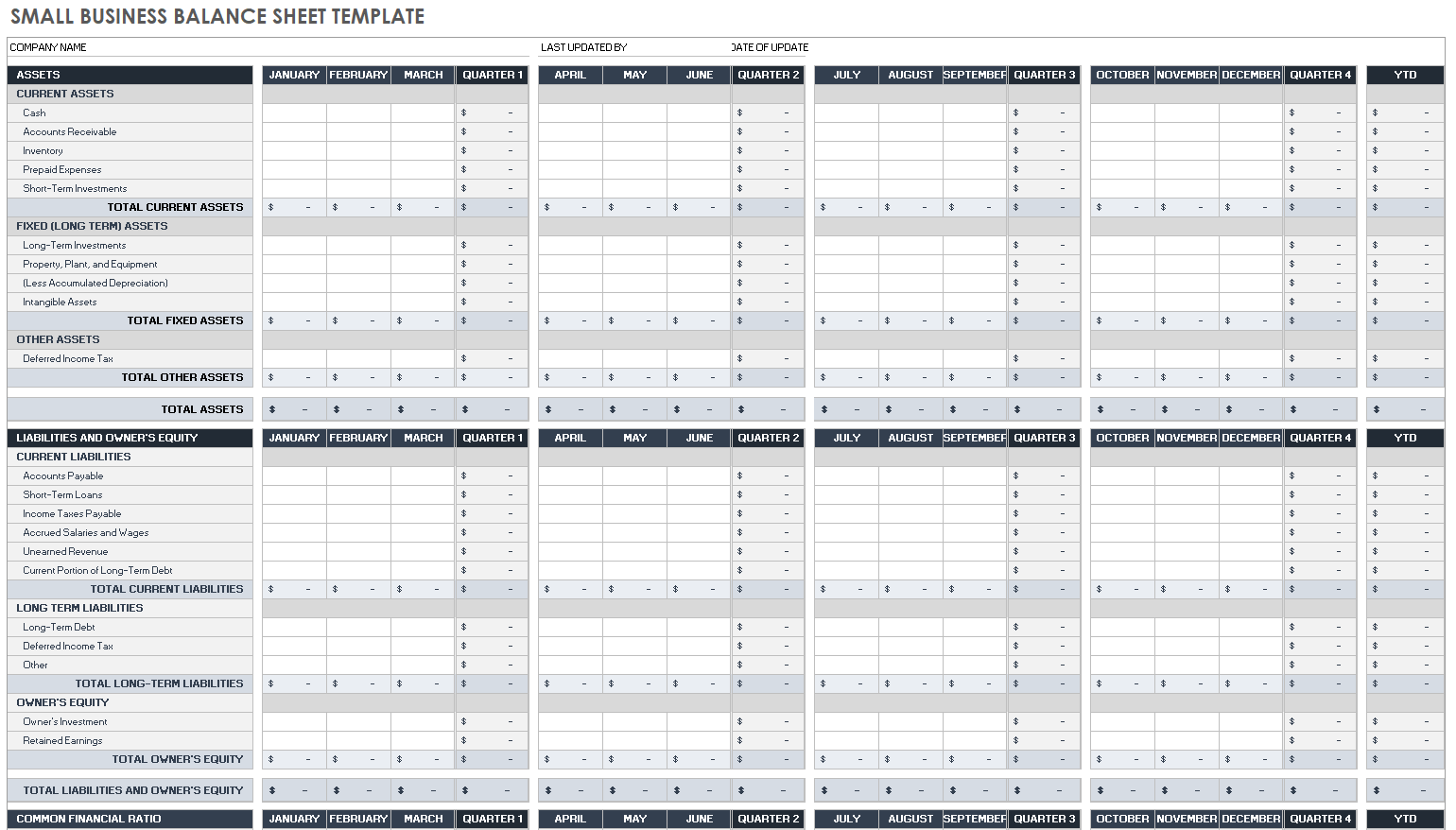

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

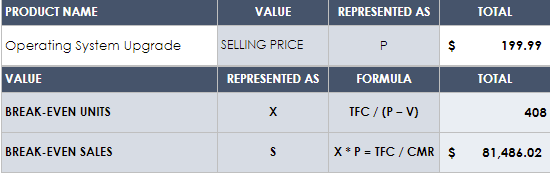

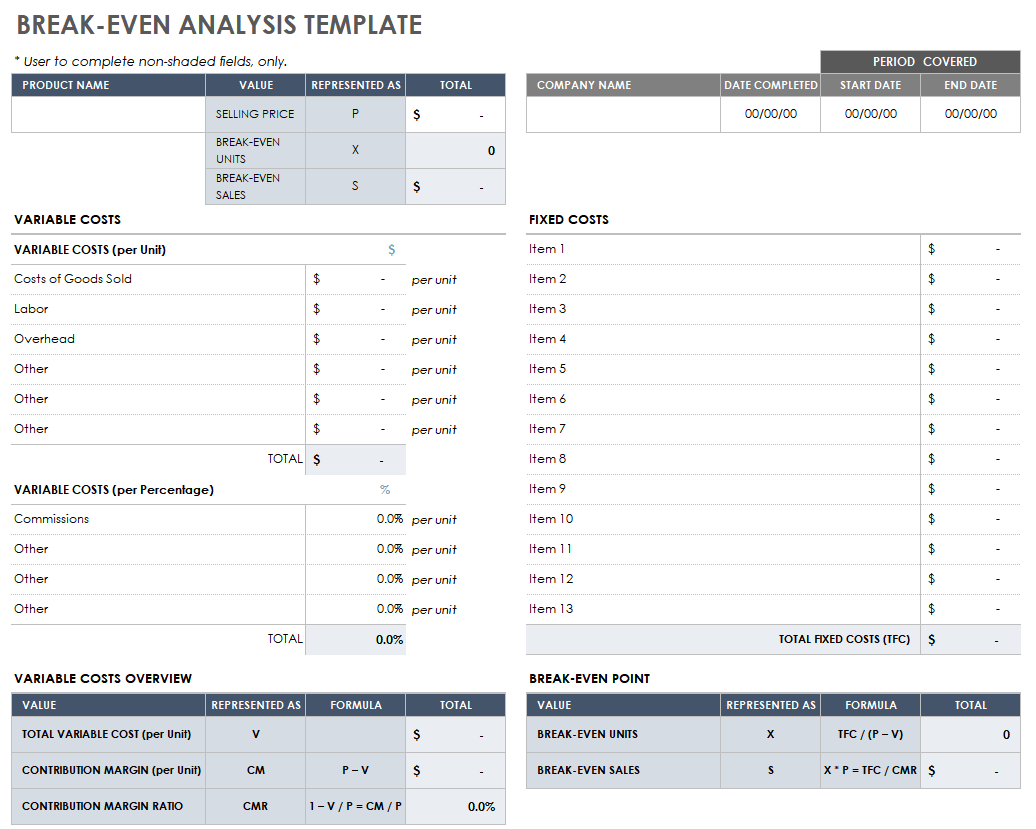

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

3 Min. Read

What to Include in Your Business Plan Appendix

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Discover the world’s #1 plan building software

Do you have the world's best boss? Enter them to win two tickets to Sandals!

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

6 Elements of a Successful Financial Plan for a Small Business

Table of Contents

Many small businesses lack a full financial plan, even though evidence shows that it is essential to the long-term success and growth of any business.

For example, a study in the New England Journal of Entrepreneurship found that entrepreneurs with a business plan are more successful than those without one. If you’re not sure how to get started, read on to learn the six key elements of a successful small business financial plan.

What is a business financial plan, and why is it important?

A business financial plan is an overview of a business’s financial situation and a forward-looking projection for growth. A business financial plan typically has six parts: sales forecasting, expense outlay, a statement of financial position, a cash flow projection, a break-even analysis and an operations plan.

A good financial plan helps you manage cash flow and accounts for months when revenue might be lower than expected. It also helps you budget for daily and monthly expenses and plan for taxes each year.

Importantly, a financial plan helps you focus on the long-term growth of your business. That way, you don’t get so caught up in the day-to-day activities that you lose sight of your goals. Focusing on the long-term vision helps you prioritize your financial resources.

Financial plans should be created annually at the beginning of the fiscal year as a collaboration of finance, HR, sales and operations leaders.

The 6 components of a successful financial plan for business

1. sales forecasting.

You should have an estimate of your sales revenue for every month, quarter and year. Identifying any patterns in your sales cycles helps you better understand your business, and this knowledge is invaluable as you plan marketing initiatives and growth strategies .

For instance, a seasonal business can aim to improve sales in the off-season to eventually become a year-round venture. Another business might become better prepared by understanding how upticks and downturns in business relate to factors such as the weather or the economy.

Sales forecasting is also the foundation for setting company growth goals. For instance, you could aim to improve your sales by 10 percent over each previous period.

2. Expense outlay

A full expense plan includes regular expenses, expected future expenses and associated expenses. Regular expenses are the current ongoing costs of your business, including operational costs such as rent, utilities and payroll.

Regular expenses relate to standard business activities that occur each year, such as conference attendance, advertising and marketing, and the office holiday party. It’s a good idea to distinguish essential expenses from expenses that can be reduced or eliminated if needed.

Expected future expenses are known future costs, such as tax rate increases, minimum wage increases or maintenance needs. Generally, a part of the budget should also be allocated to unexpected future expenses, such as damage to your business caused by fire, flood or other unexpected disasters. Planning for future expenses ensures your business is financially prepared via budget reduction, increases in sales or financial assistance.

Associated expenses are the estimated costs of various initiatives, such as acquiring and training new hires, opening a new store or expanding delivery to a new territory. An accurate estimate of associated expenses helps you properly manage growth and prevents your business from exceeding your cost capabilities.

As with expected future expenses, understanding how much capital is required to accomplish various growth goals helps you make the right decision about financing options.

3. Statement of financial position (assets and liabilities)

Assets and liabilities are the foundation of your business’s balance sheet and the primary determinants of your business’s net worth. Tracking both allows you to maximize your business’s potential value.

Small businesses frequently undervalue their assets (such as machinery, property or inventory) and fail to properly account for outstanding bills. Your balance sheet offers a more complete view of your business’s health than a profit-and-loss statement or a cash flow report.

A profit-and-loss statement shows how the business performed over a specific time period, while a balance sheet shows the financial position of the business on any given day.

4. Cash flow projection

You should be able to predict your cash flow on a monthly, quarterly and annual basis. Projecting cash flow for the full year allows you to get ahead of any financial struggles or challenges.

It can also help you identify a cash flow problem before it hurts your business. You can set the most appropriate payment terms, such as how much you charge upfront or how many days after invoicing you expect payment .

A cash flow projection gives you a clear look at how much money is expected to be left at the end of each month so you can plan a possible expansion or other investments. It also helps you budget, such as by spending less one month for the anticipated cash needs of another month.

5. Break-even analysis

A break-even analysis evaluates fixed costs relative to the profit earned by each additional unit you produce and sell. This analysis is essential to understanding your business’s revenue and potential costs versus profits of expansion or growth of your output.

Having your expenses fully fleshed out, as described above, makes your break-even analysis more accurate and useful. A break-even analysis is also the best way to determine your pricing.

In addition, a break-even analysis can tell you how many units you need to sell at various prices to cover your costs. You should aim to set a price that gives you a comfortable margin over your expenses while allowing your business to remain competitive.

6. Operations plan

To run your business as efficiently as possible, craft a detailed overview of your operational needs. Understanding what roles are required for you to operate your business at various volumes of output, how much output or work each employee can handle, and the costs of each stage of your supply chain will aid you in making informed decisions for your business’s growth and efficiency.

It’s important to tightly control expenses, such as payroll or supply chain costs, relative to growth. An operations plan can also make it easier to determine if there is room to optimize your operations or supply chain via automation, new technology or superior supply chain vendors.

For this reason, it is imperative for a business owner to conduct due diligence and become knowledgeable about merchant services before acquiring an account. Once the owner signs a contract, it cannot be changed, unless the business owner breaks the contract and acquires a new account with a new merchant services provider.

Tips on writing a business financial plan

Business owners should create a financial plan annually to ensure they have a clear and accurate picture of their business’s finances and a realistic view for future growth or expansion. A financial plan helps the business’s leaders make informed decisions about purchases, debt, hiring, expense control and overall operations for the year ahead.

A business financial plan is essential if a business owner is looking to sell their business, attract investors or enter a partnership with another business. Here are some tips for writing a business financial plan.

Review the previous year’s plan.

It’s a good idea to compare the previous year’s plan against actual performance and finances to see how accurate the previous plan and forecast were. That way, you can address any discrepancies or overlooked elements in next year’s plan.

Collaborate with other departments.

A business owner or other individual charged with creating the business financial plan should collaborate with the finance department, human resources department, sales team , operations leader, and those in charge of machinery, vehicles or other significant business tools.

Each division should provide the necessary data about projections, value and expenses. All of these elements come together to create a comprehensive financial picture of the business.

Use available resources.

The Small Business Administration (SBA) and SCORE, the SBA’s nonprofit partner, are two excellent resources for learning about financial plans. Both can teach you the elements of a comprehensive plan and how best to work with the different departments in your business to collect the necessary information. Many websites, including business.com , and service providers, such as Intuit, offer advice on this matter.

If you have questions or encounter challenges while creating your business financial plan, seek advice from your accountant or other small business owners in your network. Your city or state has a small business office that you can contact for help.

Several small business organizations offer free financial plan templates for small business owners. You can find templates for the financial plan components listed here via SCORE .

Business financial plan templates

Many business organizations offer free information that small business owners can use to create their financial plan. For example, the SBA’s Learning Platform offers a course on how to create a business plan. It also offers worksheets and templates to help you get started. You can seek additional help and more personalized service from your local office.

SCORE is the largest volunteer network of business mentors. It began as a group of retired executives (SCORE stands for “Service Corps of Retired Executives”) but has expanded to include business owners and executives from many industries. Advice is free and available online, and there are SBA district offices in every U.S. state. In addition to participating in group or at-home learning, you can be paired with a mentor for individualized help.

SCORE offers templates and tips for creating a small business financial plan. SCORE is an excellent resource because it addresses different levels of experience and offers individualized help.

Other templates can be found in Microsoft Office’s template library, QuickBooks’ online resources, Shopify’s blog and other places. You can also ask your accountant for guidance, since many accountants provide financial planning services in addition to their usual tax services.

Diana Wertz contributed to the writing and research in this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

The Importance of a Financial Plan for a Small Business

- Small Business

- Business Planning & Strategy

- Small Business Plans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Graph Linear Equations in Excel 2007

Importance of ratio analysis in financial planning, fundamental principles of strategic & business planning models.

- The Importance of Planning in an Organization

- Key Tools for Planning Finances

Going through the process of constructing a financial plan is a valuable exercise for any business owner. The financial plan helps guide the day-to-day decision making of the business. Comparing forecast numbers to actual results yields important information about the overall financial health and efficiency of the business. Even a one-person company needs to have a financial plan in place.

Cash Management and Budgets

Having a financial plan for your business helps you break down what is needed in your shorter-term budgets, says Brilliant Tax & Accounting Services . Many businesses have monthly or seasonal variations in revenues, which translate into periods when cash is plentiful and times when cash shortages occur.

In building the financial plan, the owner takes these cycles into account to keep a tight rein on expenditures during the forecast low revenue periods. Poor cash management can result in negative consequences such as not being able to make payroll. Having a financial plan that is structured so there is always a cash cushion helps the business owner sleep better at night. The cash cushion allows the business to take advantage of opportunities that arise, such as the chance to purchase inventory from a supplier at temporarily reduced prices.

Long-Range View

In business it is easy to become focused on the crises or issues that must be dealt with on a daily basis. The price for being too short-term oriented is that the owner may not spend enough time planning what needs to be done to grow the business long-term. The financial plan, with its forward looking focus, allows the business owner to better see what expenditures need to be made to keep the company on a growth track and to stay ahead of competitors, according to Spend Journal . The financial plan is a blueprint for continual improvement in the company's performance.

Spotting Trends

A business owner makes so many decisions over the course of a month that it can be difficult to tell which decisions resulted in success and which ideas or strategies did not work. Preparing the financial plan involves setting quantifiable targets that can be compared to actual results during the year. The owner can see, for example, whether an increase in advertising expenditures led to the hoped-for jump in sales. Trends in the sales of individual products help the owner make decisions about how to allocate marketing dollars.

Prioritizing Expenditures

Conserving financial resources and allocating capital effectively in a small business is a critical element of success. The benefits of financial planning for business include a business owner identifying the most important expenditures – those that bring about immediate improvements in productivity, efficiency, or market penetration, versus those that can be postponed until cash is more plentiful. Even the largest, most well-capitalized corporations go through this prioritization process, comparing the cost to the benefits of each proposed expenditure.

Measuring Progress

Especially in the early stages of their ventures, small business owners work long hours and deal with numerous challenges. It can be difficult to tell whether progress is being made or whether the business is mired in mediocrity. Seeing that actual results are better than forecast provides the small business owner needed encouragement. A chart showing steady growth in revenues month by month, or a rising cash balance is a great motivating factor. The importance of financial plan in business is similar to the importance of financial planning for students: It helps the owner see, with the clarity of hard data, that the business is on its way to being a success.

- Brilliant Tax & Accounting Services: The Importance of Financial Planning for Small Businesses

- Spend Journal: 9 Key Benefits of Business Financial Planning

Related Articles

How to put a business plan in motion, what is a quarterly budget, about business financial planning, how to write a department business plan, key concepts of financial management, the similarities between a cash budget and long-term financial planning, cash budgeting, forecasting cash flow and account analysis, the role of finance in formulating business strategies, the effects of seasonality on working capital, most popular.

- 1 How to Put a Business Plan in Motion

- 2 What Is a Quarterly Budget?

- 3 About Business Financial Planning

- 4 How to Write a Department Business Plan

Business Financial Plan Example: Strategies and Best Practices

Any successful endeavor begins with a robust plan – and running a prosperous business is no exception. Careful strategic planning acts as the bedrock on which companies build their future. One of the most critical aspects of this strategic planning is the creation of a detailed business financial plan. This plan serves as a guide, helping businesses navigate their way through the complex world of finance, including revenue projection, cost estimation, and capital expenditure, to name just a few elements. However, understanding what a business financial plan entails and how to implement it effectively can often be challenging. With multiple components to consider and various economic factors at play, the financial planning process may appear daunting to both new and established business owners.

This is where we come in. In this comprehensive article, we delve into the specifics of a business financial plan. We discuss its importance, the essential elements that make it up, and the steps to craft one successfully. Furthermore, we provide a practical example of a business financial plan in action, drawing upon real-world-like scenarios and strategies. By presenting the best practices and demonstrating how to employ them, we aim to equip business owners and entrepreneurs with the tools they need to create a robust, realistic, and efficient business financial plan. This in-depth guide will help you understand not only how to plan your business finances but also how to use this plan as a roadmap, leading your business towards growth, profitability, and overall financial success. Whether you're a seasoned business owner aiming to refine your financial strategies or an aspiring entrepreneur at the beginning of your journey, this article is designed to guide you through the intricacies of business financial planning and shed light on the strategies that can help your business thrive.

Understanding a Business Financial Plan

At its core, a business financial plan is a strategic blueprint that sets forth how a company will manage and navigate its financial operations, guiding the organization towards its defined fiscal objectives. It encompasses several critical aspects of a business's financial management, such as revenue projection, cost estimation, capital expenditure, cash flow management, and investment strategies.

Revenue projection is an estimate of the revenue a business expects to generate within a specific period. It's often based on market research, historical data, and educated assumptions about future market trends. Cost estimation, on the other hand, involves outlining the expenses a business anticipates incurring in its operations. Together, revenue projection and cost estimation can give a clear picture of a company's expected profitability. Capital expenditure refers to the funds a company allocates towards the purchase or maintenance of long-term assets like machinery, buildings, and equipment. Understanding capital expenditure is vital as it can significantly impact a business's operational capacity and future profitability. The cash flow management aspect of a business financial plan involves monitoring, analyzing, and optimizing the company's cash inflows and outflows. A healthy cash flow ensures that a business can meet its short-term obligations, invest in its growth, and provide a buffer for future uncertainties. Lastly, a company's investment strategies are crucial for its growth and sustainability. They might include strategies for raising capital, such as issuing shares or securing loans, or strategies for investing surplus cash, like purchasing assets or investing in market securities.

A well-developed business financial plan, therefore, doesn't just portray the company's current financial status; it also serves as a roadmap for the business's fiscal operations, enabling it to navigate towards its financial goals. The plan acts as a guide, providing insights that help business owners make informed decisions, whether they're about day-to-day operations or long-term strategic choices. In a nutshell, a business financial plan is a key tool in managing a company's financial resources effectively and strategically. It allows businesses to plan for growth, prepare for uncertainties, and strive for financial sustainability and success.

Essential Elements of a Business Financial Plan

A comprehensive financial plan contains several crucial elements, including:

- Sales Forecast : The sales forecast represents the business's projected sales revenues. It is often broken down into segments such as products, services, or regions.

- Expenses Budget : This portion of the plan outlines the anticipated costs of running the business. It includes fixed costs (rent, salaries) and variable costs (marketing, production).

- Cash Flow Statement : This statement records the cash that comes in and goes out of a business, effectively portraying its liquidity.

- Income Statements : Also known as profit and loss statements, income statements provide an overview of the business's profitability over a given period.

- Balance Sheet : This snapshot of a company's financial health shows its assets, liabilities, and equity.

Crafting a Business Financial Plan: The Steps

Developing a business financial plan requires careful analysis and planning. Here are the steps involved:

Step 1: Set Clear Financial Goals

The initial stage in crafting a robust business financial plan involves the establishment of clear, measurable financial goals. These objectives serve as your business's financial targets and compass, guiding your company's financial strategy. These goals can be short-term, such as improving quarterly sales or reducing monthly overhead costs, or they can be long-term, such as expanding the business to a new location within five years or doubling the annual revenue within three years. The goals might include specific targets such as increasing revenue by a particular percentage, reducing costs by a specific amount, or achieving a certain profit margin. Setting clear goals provides a target to aim for and allows you to measure your progress over time.

Step 2: Create a Sales Forecast

The cornerstone of any business financial plan is a robust sales forecast. This element of the plan involves predicting the sales your business will make over a given period. This estimate should be based on comprehensive market research, historical sales data, an understanding of industry trends, and the impact of any marketing or promotional activities. Consider the business's growth rate, the overall market size, and seasonal fluctuations in demand. Remember, your sales forecast directly influences the rest of your financial plan, particularly your budgets for expenses and cash flow, so it's critical to make it as accurate and realistic as possible.

Step 3: Prepare an Expense Budget

The next step involves preparing a comprehensive expense budget that covers all the costs your business is likely to incur. This includes fixed costs, such as rent or mortgage payments, salaries, insurance, and other overheads that remain relatively constant regardless of your business's level of output. It also includes variable costs, such as raw materials, inventory, marketing and advertising expenses, and other costs that fluctuate in direct proportion to the level of goods or services you produce. By understanding your expense budget, you can determine how much revenue your business needs to generate to cover costs and become profitable.

Step 4: Develop a Cash Flow Statement

One of the most crucial elements of your financial plan is the cash flow statement. This document records all the cash that enters and leaves your business, presenting a clear picture of your company's liquidity. Regularly updating your cash flow statement allows you to monitor the cash in hand and foresee any potential shortfalls. It helps you understand when cash comes into your business from sales and when cash goes out of your business due to expenses, giving you insights into your financial peaks and troughs and enabling you to manage your cash resources more effectively.

Step 5: Prepare Income Statements and Balance Sheets

Another vital part of your business financial plan includes the preparation of income statements and balance sheets. An income statement, also known as a Profit & Loss (P&L) statement, provides an overview of your business's profitability over a certain period. It subtracts the total expenses from total revenue to calculate net income, providing valuable insights into the profitability of your operations.

On the other hand, the balance sheet provides a snapshot of your company's financial health at a specific point in time. It lists your company's assets (what the company owns), liabilities (what the company owes), and equity (the owner's or shareholders' investment in the business). These documents help you understand where your business stands financially, whether it's making a profit, and how your assets, liabilities, and equity balance out.

Step 6: Revise Your Plan Regularly

It's important to remember that a financial plan is not a static document, but rather a living, evolving roadmap that should adapt to your business's changing circumstances and market conditions. As such, regular reviews and updates are crucial. By continually revisiting and revising your plan, you can ensure it remains accurate, relevant, and effective. You can adjust your forecasts as needed, respond to changes in the business environment, and stay on track towards achieving your financial goals. By doing so, you're not only keeping your business financially healthy but also setting the stage for sustained growth and success.

Business Financial Plan Example: Joe’s Coffee Shop

Now, let's look at a practical example of a financial plan for a hypothetical business, Joe’s Coffee Shop.

Sales Forecast

When constructing his sales forecast, Joe takes into account several significant factors. He reviews his historical sales data, identifies and understands current market trends, and evaluates the impact of any upcoming promotional events. With his coffee shop located in a bustling area, Joe expects to sell approximately 200 cups of coffee daily. Each cup is priced at $5, which gives him a daily sales prediction of $1000. Multiplying this figure by 365 (days in a year), his forecast for Year 1 is an annual revenue of $365,000. This projection provides Joe with a financial target to aim for and serves as a foundation for his further financial planning. It is worth noting that Joe's sales forecast may need adjustments throughout the year based on actual performance and changes in the market or business environment.

Expenses Budget

To run his coffee shop smoothly, Joe has identified several fixed and variable costs he'll need to budget for. His fixed costs, which are costs that will not change regardless of his coffee shop's sales volume, include rent, which is $2000 per month, salaries for his employees, which total $8000 per month, and utilities like electricity and water, which add up to about $500 per month.

In addition to these fixed costs, Joe also has variable costs to consider. These are costs that fluctuate depending on his sales volume and include the price of coffee beans, milk, sugar, and pastries, which he sells alongside his coffee. After a careful review of all these expenses, Joe estimates that his total annual expenses will be around $145,000. This comprehensive expense budget provides a clearer picture of how much Joe needs to earn in sales to cover his costs and achieve profitability.

Cash Flow Statement

With a clear understanding of his expected sales revenue and expenses, Joe can now proceed to develop a cash flow statement. This statement provides a comprehensive overview of all the cash inflows and outflows within his business. When Joe opened his coffee shop, he invested an initial capital of $50,000. He expects that the monthly cash inflows from sales will be about $30,417 (which is his annual revenue of $365,000 divided by 12), and his monthly cash outflows for expenses will amount to approximately $12,083 (his total annual expenses of $145,000 divided by 12). The cash flow statement gives Joe insights into his business's liquidity. It helps him track when and where his cash is coming from and where it is going. This understanding can assist him in managing his cash resources effectively and ensure he has sufficient cash to meet his business's operational needs and financial obligations.

Income Statement and Balance Sheet

With the figures from his sales forecast, expense budget, and cash flow statement, Joe can prepare his income statement and balance sheet. The income statement, or Profit & Loss (P&L) statement, reveals the profitability of Joe's coffee shop. It calculates the net profit by subtracting the total expenses from total sales revenue. In Joe's case, this means his net profit for Year 1 is expected to be $220,000 ($365,000 in revenue minus $145,000 in expenses).

The balance sheet, on the other hand, provides a snapshot of the coffee shop's financial position at a specific point in time. It includes Joe's initial capital investment of $50,000, his assets like coffee machines, furniture, and inventory, and his liabilities, which might include any loans he took to start the business and accounts payable.

The income statement and balance sheet not only reflect the financial health of Joe's coffee shop but also serve as essential tools for making informed business decisions and strategies. By continually monitoring and updating these statements, Joe can keep his finger on the pulse of his business's financial performance and make necessary adjustments to ensure sustained profitability and growth.

Best Practices in Business Financial Planning

While crafting a business financial plan, consider the following best practices:

- Realistic Projections : Ensure your forecasts are realistic, based on solid data and reasonable assumptions.

- Scenario Planning : Plan for best-case, worst-case, and most likely scenarios. This will help you prepare for different eventualities.

- Regular Reviews : Regularly review and update your plan to reflect changes in business conditions.

- Seek Professional Help : If you are unfamiliar with financial planning, consider seeking assistance from a financial consultant.

The importance of a meticulously prepared business financial plan cannot be overstated. It forms the backbone of any successful business, steering it towards a secure financial future. Creating a solid financial plan requires a blend of careful analysis, precise forecasting, clear and measurable goal setting, prudent budgeting, and efficient cash flow management. The process may seem overwhelming at first, especially for budding entrepreneurs. However, it's crucial to understand that financial planning is not an event, but rather an ongoing process. This process involves constant monitoring, evaluation, and continuous updating of the financial plan as the business grows and market conditions change.

The strategies and best practices outlined in this article offer an invaluable framework for any entrepreneur or business owner embarking on the journey of creating a financial plan. It provides insights into essential elements such as setting clear financial goals, creating a sales forecast, preparing an expense budget, developing a cash flow statement, and preparing income statements and balance sheets. Moreover, the example of Joe and his coffee shop gives a practical, real-world illustration of how these elements come together to form a coherent and effective financial plan. This example demonstrates how a robust financial plan can help manage resources more efficiently, make better-informed decisions, and ultimately lead to financial success.

Remember, every grand journey begins with a single step. In the realm of business, this step is creating a well-crafted, comprehensive, and realistic business financial plan. By following the guidelines and practices suggested in this article, you are laying the foundation for financial stability, profitability, and long-term success for your business. Start your journey today, and let the road to financial success unfold.

Related blogs

Stay up to date on the latest investment opportunities

.png)

- Creating a Small Business Financial Plan

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 02, 2023

Get Any Financial Question Answered

Table of contents, financial plan overview.

A financial plan is a comprehensive document that charts a business's monetary objectives and the strategies to achieve them. It encapsulates everything from budgeting and forecasting to investments and resource allocation.

For small businesses, a solid financial plan provides direction, helping them navigate economic challenges, capitalize on opportunities, and ensure sustainable growth.

The strength of a financial plan lies in its ability to offer a clear roadmap for businesses.

Especially for small businesses that may not have a vast reserve of resources, prioritizing financial goals and understanding where every dollar goes can be the difference between growth and stagnation.

It lends clarity, ensures informed decision-making, and sets the stage for profitability and success.

Understanding the Basics of Financial Planning for Small Businesses

Role of financial planning in business success.

Financial planning is the backbone of any successful business endeavor. It serves as a compass, guiding businesses toward profitability, stability, and growth.

With proper financial planning, businesses can anticipate potential cash shortfalls, make informed investment decisions, and ensure they have the capital needed to seize new opportunities.

For small businesses, in particular, tight financial planning can mean the difference between thriving and shuttering. Given the limited resources, it's vital to maximize every dollar and anticipate financial challenges.

Through diligent planning, small businesses can position themselves competitively, adapt to market changes, and drive consistent growth.

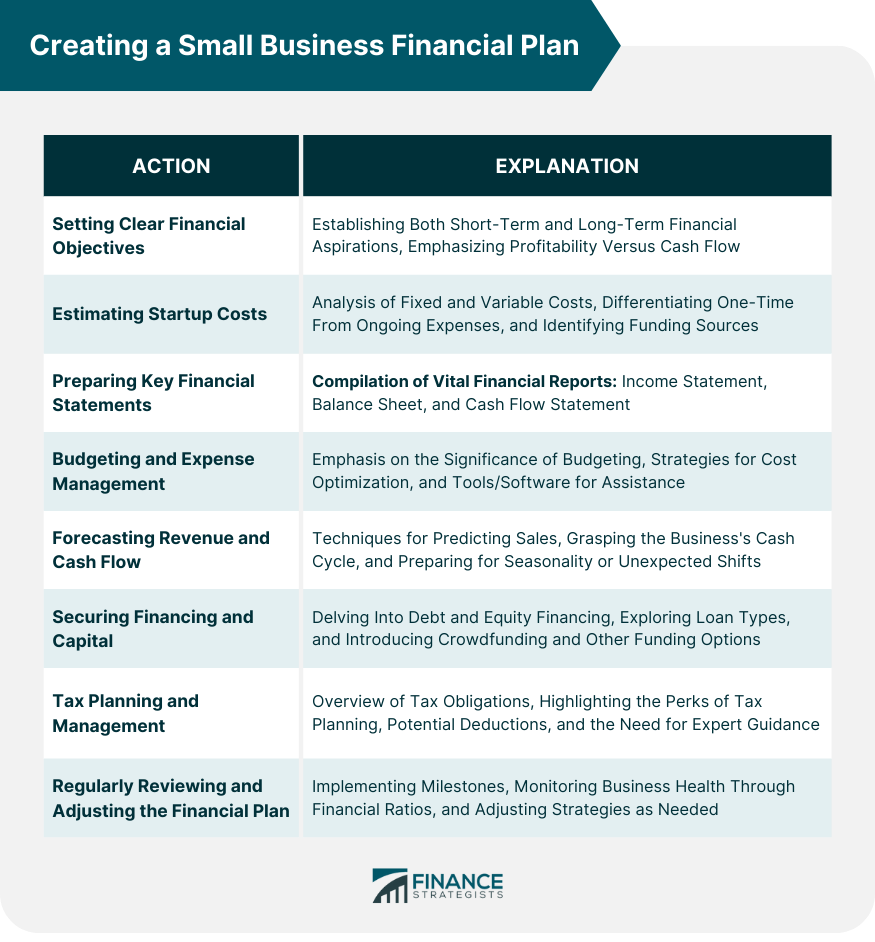

Core Components of a Financial Plan for Small Businesses

Every financial plan comprises several core components that, together, provide a holistic view of a business's financial health and direction. These include setting clear objectives, estimating costs , preparing financial statements , and considering sources of financing.

Each component plays a pivotal role in ensuring a thorough and actionable financial strategy .

For small businesses, these components often need a more granular approach. Given the scale of operations, even minor financial missteps can have significant repercussions.

As such, it's essential to tailor each component, ensuring they address specific challenges and opportunities that small businesses face, from initial startup costs to revenue forecasting and budgetary constraints.

Setting Clear Small Business Financial Objectives

Identifying business's short-term and long-term financial goals.

Every business venture starts with a vision. Translating this vision into actionable financial goals is the essence of effective planning.

Short-term goals could range from securing initial funding and achieving a set monthly revenue to covering startup costs. These targets, usually spanning a year or less, set the immediate direction for the business.

On the other hand, long-term financial goals delve into the broader horizon. They might encompass aspirations like expanding to new locations, diversifying product lines, or achieving a specific market share within a decade.

By segmenting goals into short-term and long-term, businesses can craft a step-by-step strategy, making the larger vision more attainable and manageable.

Understanding the Difference Between Profitability and Cash Flow

Profitability and cash flow, while closely linked, are distinct concepts in the financial realm. Profitability pertains to the ability of a business to generate a surplus after deducting all expenses.

It's a metric of success and indicates the viability of a business model . Simply put, it answers whether a business is making more than it spends.

In contrast, cash flow represents the inflow and outflow of cash within a business. A company might be profitable on paper yet struggle with cash flow if, for instance, clients delay payments or unexpected expenses arise.

For small businesses, maintaining positive cash flow is paramount. It ensures that they can cover operational costs, pay employees, and reinvest in growth, even if they're awaiting payments or navigating financial hiccups.

Estimating Small Business Startup Costs (for New Businesses)

Fixed vs variable costs.

When embarking on a new business venture, understanding costs is paramount. Fixed costs remain consistent regardless of production levels. They include expenses like rent, salaries, and insurance . These are predictable outlays that don't fluctuate with business performance.

Variable costs , conversely, change in direct proportion to production or business activity. Think of costs associated with materials for manufacturing or commission for sales .

For a startup, delineating between fixed and variable costs aids in crafting a more dynamic budget, allowing for adaptability as the business scales and evolves.

One-Time Expenditures vs Ongoing Expenses

Startups often grapple with numerous upfront costs. From purchasing equipment and setting up a workspace to initial marketing campaigns, these one-time expenditures lay the foundation for business operations.

They differ from ongoing expenses like utility bills, raw materials, or employee wages that recur monthly or annually.

For a small business owner, distinguishing between these costs is critical. One-time expenditures often demand a larger chunk of initial capital, while ongoing expenses shape the monthly and annual budget.

By categorizing them separately, businesses can strategize funding needs more effectively, ensuring they're equipped to meet both immediate and recurrent financial obligations.

Funding Sources for Small Businesses

Personal savings.

This is often the most straightforward way to fund a startup. Entrepreneurs tap into their personal savings accounts to jumpstart their business.

While this method has the benefit of not incurring debt or diluting company ownership, it intertwines the individual's personal financial security with the business's fate.

The entrepreneur must be prepared for potential losses, and there's the evident psychological strain of putting one's hard-earned money on the line.

Loans can be sourced from various institutions, from traditional banks to credit unions . They offer a substantial sum of money that can be paid back over time, usually with interest .

The main advantage of taking a loan is that the entrepreneur retains full ownership and control of the business.

However, there's the obligation of monthly repayments, which can strain a business's cash flow, especially in its early days. Additionally, securing a loan often requires collateral and a sound credit history.

Investors, including angel investors and venture capitalists , offer capital in exchange for equity or a stake in the company.

Angel investors are typically high-net-worth individuals who provide funding in the initial stages, while venture capitalists come in when there's proven business potential, often injecting larger sums. The advantage is substantial funding without the immediate pressure of repayments.

However, in exchange for their investment, they often seek a say in business decisions, which might mean compromising on some aspects of the original business vision.

Grants are essentially 'free money' often provided by government programs, non-profit organizations, or corporations to promote innovation and support businesses in specific sectors.

The primary advantage of grants is that they don't need to be repaid, nor do they dilute company ownership. However, they can be highly competitive and might come with stipulations on how the funds should be used.

Moreover, the application process can be lengthy and requires showcasing the business's potential or alignment with the specific goals or missions of the granting institution.

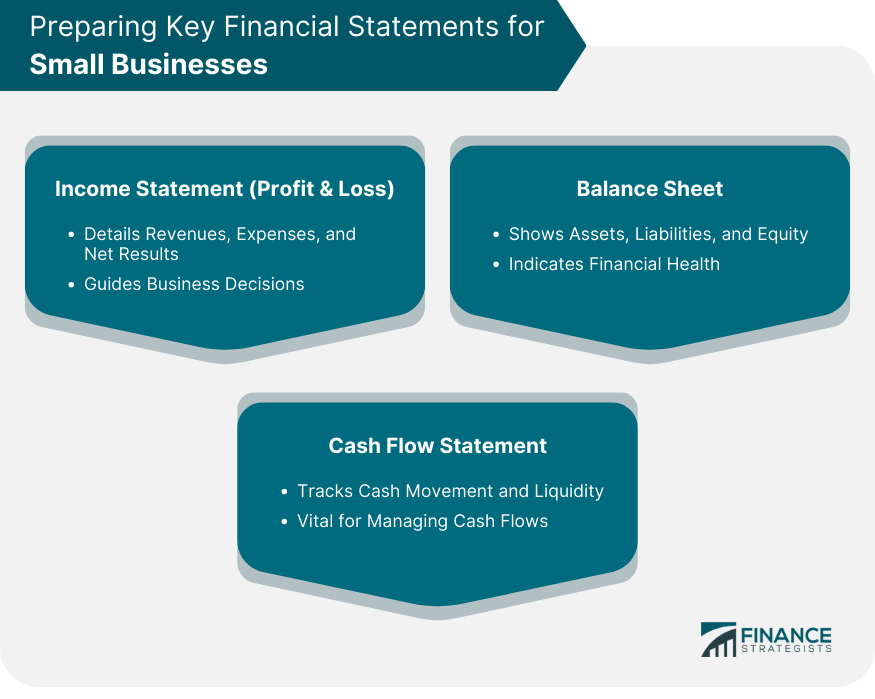

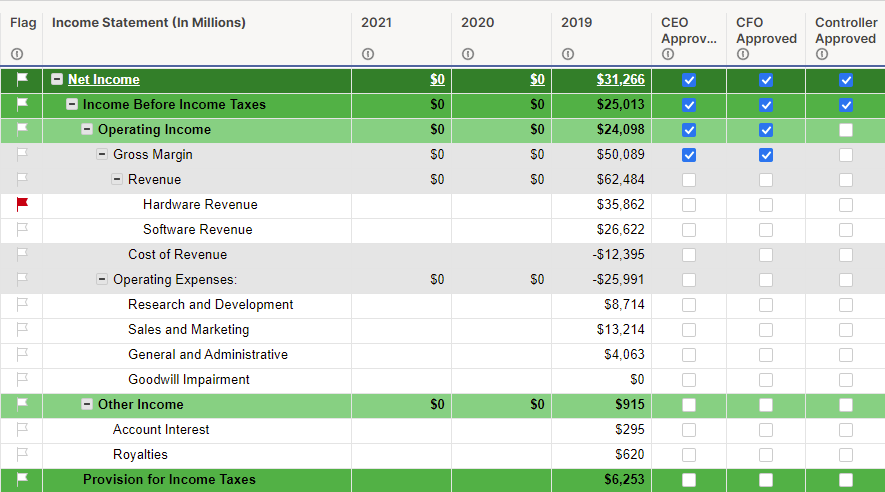

Preparing Key Financial Statements for Small Businesses

Income statement (profit & loss).

An Income Statement , often termed as the Profit & Loss statement , showcases a business's financial performance over a specific time frame. It details revenues , expenses, and ultimately, profits or losses.

By analyzing this statement, business owners can pinpoint revenue drivers, identify exorbitant costs, and understand the net result of their operations.

For small businesses, this document is instrumental in making informed decisions. For instance, if a certain product line is consistently unprofitable, it might be prudent to discontinue it. Conversely, if another segment is thriving, it might warrant further investment.

The Income Statement, thus, serves as a financial mirror, reflecting the outcomes of business strategies and decisions.

Balance Sheet

The Balance Sheet offers a snapshot of a company's assets , liabilities , and equity at a specific point in time.

Assets include everything the business owns, from physical items like equipment to intangible assets like patents .

Liabilities, on the other hand, encompass what the company owes, be it bank loans or unpaid bills.

Equity represents the owner's stake in the business, calculated as assets minus liabilities.

This statement is crucial for small businesses as it offers insights into their financial health. A robust asset base, minimal liabilities, and growing equity signify a thriving enterprise.

In contrast, mounting liabilities or dwindling assets could be red flags, signaling the need for intervention and strategy recalibration.

Cash Flow Statement

While the Income Statement reveals profitability, the Cash Flow Statement tracks the actual movement of money.

It categorizes cash flows into operating (day-to-day business), investing (buying/selling assets), and financing (loans or equity transactions) activities. This statement unveils the liquidity of a business, indicating whether it has sufficient cash to meet immediate obligations.

For small businesses, maintaining positive cash flow is often more vital than showcasing profitability.

After all, a business might be profitable on paper yet struggle if clients delay payments or unforeseen expenses emerge.

By regularly reviewing the Cash Flow Statement, small business owners can anticipate cash crunches and strategize accordingly, ensuring seamless operations irrespective of revenue cycles.

Small Business Budgeting and Expense Management

Importance of budgeting for a small business.

Budgeting is the financial blueprint for any business, detailing anticipated revenues and expenses for a forthcoming period. It's a proactive approach, enabling businesses to allocate resources efficiently, plan for investments, and prepare for potential financial challenges.

For small businesses, a meticulous budget is often the linchpin of stability, ensuring they operate within their means and avoid financial pitfalls.

Having a well-defined budget also fosters discipline. It curtails frivolous spending, emphasizes cost-efficiency, and sets clear financial boundaries.

For small businesses, where every dollar counts, a stringent budget is the gateway to financial prudence, ensuring that funds are utilized judiciously, fostering growth, and minimizing wastage.

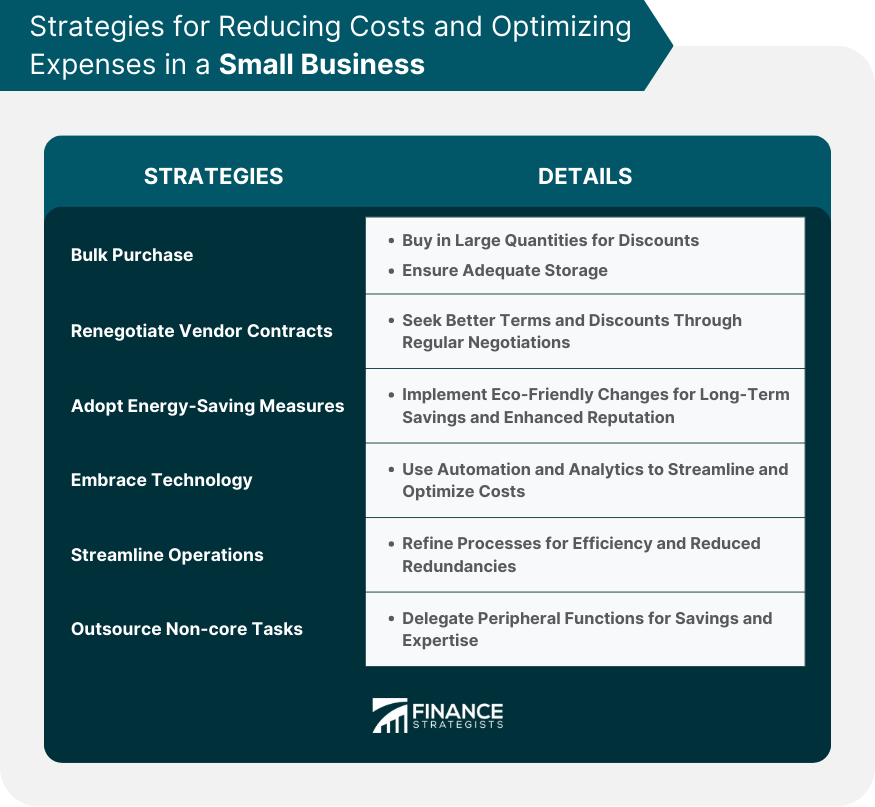

Strategies for Reducing Costs and Optimizing Expenses

Bulk purchasing.

When businesses buy supplies in large quantities, they often benefit from discounts due to economies of scale . This can significantly reduce per-unit costs.

However, while bulk purchasing leads to immediate savings, businesses must ensure they have adequate storage and that the products won't expire or become obsolete before they're used.

Renegotiating Vendor Contracts

Regularly reviewing and renegotiating contracts with suppliers or service providers can lead to better terms and lower costs. This might involve exploring volume discounts, longer payment terms, or even bartering services.

Building strong relationships with vendors often paves the way for such negotiations.

Adopting Energy-Saving Measures

Simple changes, like switching to LED lighting or investing in energy-efficient appliances, can lead to long-term savings in utility bills. Moreover, energy conservation not only reduces costs but also minimizes the environmental footprint, which can enhance the business's reputation.

Embracing Technology

Modern software and technology can streamline business processes. Automation tools can handle repetitive tasks, reducing labor costs.

Meanwhile, data analytics tools can provide insights into customer preferences and behavior, ensuring that marketing budgets are used effectively and target the right audience.

Streamlining Operations

Regularly reviewing and refining business processes can eliminate redundancies and improve efficiency. This might mean merging roles, cutting down on unnecessary meetings, or simplifying supply chains. A leaner operation often translates to reduced expenses.

Outsourcing Non-core Tasks

Instead of maintaining an in-house team for every function, businesses can outsource tasks that aren't central to their operations.

For instance, functions like accounting , IT support, or digital marketing can be outsourced to specialized agencies, often leading to cost savings and access to expert skills.

Cultivating a Culture of Frugality

Encouraging employees to adopt a cost-conscious mindset can lead to collective savings. This can be fostered through incentives, regular training, or even simple practices like recycling and reusing office supplies.

When everyone in the organization is attuned to the importance of cost savings, the cumulative effect can be substantial.

Forecasting Small Business Revenue and Cash Flow

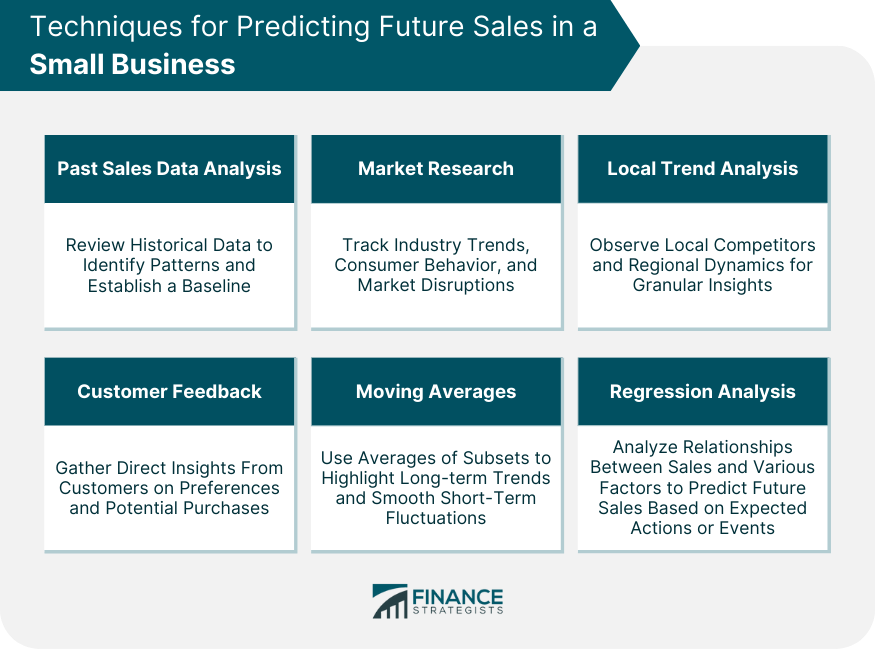

Techniques for predicting future sales in a small business, past sales data analysis.

Historical sales data is a foundational element in any forecasting effort. By reviewing previous sales figures, businesses can identify patterns, understand seasonal fluctuations, and recognize the effects of past initiatives.

This information offers a baseline upon which to build future projections, accounting for known recurring variables in the business cycle .

Market Research

Understanding the larger market dynamics is crucial for accurate forecasting. This involves tracking industry trends, monitoring shifts in consumer behavior, and being aware of potential market disruptions.

For instance, a sudden technological advancement can change consumer preferences or regulatory changes might impact an industry.

Local Trend Analysis

For small businesses, localized insights can be especially impactful. Observing local competitors, understanding regional consumer preferences, or noting shifts in the local economy can offer precise data points.

These granular details, when integrated into a larger forecasting model, can enhance prediction accuracy.

Customer Feedback

Direct feedback from customers is an invaluable source of insights. Surveys, focus groups, or even informal chats can reveal customer sentiments, preferences, and potential future purchasing behavior.

For instance, if a majority of loyal customers express interest in a new product or service, it can be indicative of future sales potential.

Moving Averages

This technique involves analyzing a series of data points (like monthly sales) by creating averages from different subsets of the full data set.

For yearly forecasting, a 12-month moving average can be used to smooth out short-term fluctuations and highlight longer-term trends or cycles.

Regression Analysis

Regression analysis is a statistical tool used to identify relationships between variables. In sales forecasting, it can help understand how different factors (like marketing spend, seasonal variations, or competitor actions) relate to sales figures.

Once these relationships are understood, businesses can predict future sales based on planned actions or expected external events.

Understanding the Cash Cycle of Business

The cash cycle encompasses the time it takes for a business to convert resource investments, often in the form of inventory, back into cash.

This involves the processes of purchasing inventory, selling it, and subsequently collecting payment. A shorter cycle implies quicker cash turnarounds, which are vital for liquidity.

For small businesses, a firm grasp of the cash cycle can aid in managing cash flow more effectively.

By identifying bottlenecks or delays, businesses can strategize to expedite processes. This might involve renegotiating payment terms with suppliers, offering discounts for prompt customer payments, or optimizing inventory levels to prevent overstocking.

Ultimately, understanding and optimizing the cash cycle ensures that a business remains liquid and agile.

Preparing for Seasonality and Unexpected Changes

Seasonality affects many businesses, from the ice cream vendor witnessing summer surges to the retailer bracing for holiday shopping frenzies.

By analyzing historical data and market trends, businesses can prepare for these cyclical shifts, ensuring they stock up, staff appropriately, and market effectively.

Small businesses, often operating on tighter margins , need to be especially vigilant. Beyond seasonality, they must also brace for unexpected changes – a local construction project obstructing store access, a sudden competitor emergence, or unforeseen regulatory changes.

Building a financial buffer, diversifying product or service lines, and maintaining flexible operational strategies can equip small businesses to weather these unforeseen challenges with resilience.

Securing Small Business Financing and Capital

Role of debt and equity financing.

When businesses seek external funding, they often grapple with the debt vs. equity conundrum. Debt financing involves borrowing money, typically via loans. While it doesn't dilute ownership, it necessitates regular interest payments, potentially impacting cash flow.

Equity financing, on the other hand, entails selling a stake in the business to investors. It might not demand regular repayments, but it dilutes ownership and might influence business decisions.

Small businesses must weigh these options carefully. While loans offer a structured repayment plan and retained control, they might strain finances if the business hits a rough patch.

Equity financing, although relinquishing some control, might bring aboard strategic partners, offering expertise and networks in addition to funds.

The optimal choice hinges on the business's financial health, growth aspirations, and the founder's comfort with sharing control.

Choosing Between Different Types of Loans

A staple in the lending arena, term loans offer businesses a fixed amount of capital that is paid back over a specified period with interest. They're often used for significant one-time expenses, such as purchasing machinery, real estate , or even business expansion.

With predictable monthly payments, businesses can plan their budgets accordingly. However, they might require collateral and a robust credit history for approval.

Lines of Credit

Unlike term loans that provide funds in a lump sum, a line of credit grants businesses access to a pool of funds up to a certain limit.

Businesses can draw from this line as needed, only paying interest on the amount they use. This makes it a versatile tool, especially for managing cash flow fluctuations or unexpected expenses. It serves as a financial safety net, ready for use whenever required.

As the name suggests, microloans are smaller loans designed to cater to businesses that might not need substantial amounts of capital. They're particularly beneficial for startups, businesses with limited credit histories, or those in need of a quick, small financial boost.

Since they are of a smaller denomination, the approval process might be more lenient than traditional loans.

Peer-To-Peer Lending

A contemporary twist to the traditional lending model, peer-to-peer (P2P) platforms connect borrowers directly with individual lenders or investor groups.

This direct model often translates to quicker approvals and competitive interest rates as the overheads of traditional banking structures are removed. With technology at its core, P2P lending can offer a more user-friendly, streamlined process.

However, creditworthiness still plays a pivotal role in determining interest rates and loan amounts.

Crowdfunding and Alternative Financing Options

In an increasingly digital age, crowdfunding platforms like Kickstarter or Indiegogo have emerged as viable financing avenues.

These platforms enable businesses to raise small amounts from a large number of people, often in exchange for product discounts, early access, or other perks. This not only secures funds but also validates the business idea and fosters a community of supporters.

Other alternatives include invoice financing, where businesses get an advance on pending invoices, or merchant cash advances tailored for businesses with significant credit card sales.

Each financing mode offers unique advantages and constraints. Small businesses must meticulously evaluate their financial landscape, growth trajectories, and risk appetite to harness the most suitable option.

Small Business Tax Planning and Management

Basic tax obligations for small businesses.

Navigating the maze of taxation can be daunting, especially for small businesses. Yet, understanding and fulfilling tax obligations is crucial.

Depending on the business structure—whether sole proprietorship , partnership , LLC , or corporation—different tax rules apply. For instance, while corporations are taxed on their earnings, sole proprietors report business income and expenses on their personal tax returns.

In addition to income taxes, small businesses may also be responsible for employment taxes if they have employees. This covers Social Security , Medicare , federal unemployment, and sometimes state-specific taxes.

There might also be sales taxes, property taxes, or special state-specific levies to consider.

Consistently maintaining accurate financial records, being aware of filing deadlines, and setting aside funds for tax obligations are essential practices to avoid penalties and ensure compliance.

Advantages of Tax Planning and Potential Deductions

Tax planning is the strategic approach to minimizing tax liability through the best use of available allowances, deductions, exclusions, and breaks.

For small businesses, effective tax planning can lead to significant savings.

This might involve strategies like deferring income to a later tax year, choosing the optimal time to purchase equipment, or taking advantage of specific credits available to businesses in certain sectors or regions.

Several potential deductions can reduce taxable income for small businesses. These include expenses like rent, utilities, business travel, employee wages, and even certain meals.

By keeping abreast of tax law changes and actively seeking out eligible deductions, small businesses can optimize their financial landscape, ensuring they're not paying more in taxes than necessary.

Importance of Hiring a Tax Professional or Accountant

While it's feasible for small business owners to manage their taxes, the intricate nuances of tax laws make it beneficial to consult professionals.

An experienced accountant or tax consultant can not only ensure compliance but can proactively recommend strategies to reduce tax liability.

They can guide businesses on issues like whether to classify someone as an employee or a contractor, how to structure the business for optimal taxation, or when to make certain capital investments.

Beyond just annual tax filing, these professionals offer year-round counsel, helping businesses maintain clean financial records, stay updated on tax law changes, and plan for future financial moves.

The investment in professional advice often pays dividends , saving businesses from costly mistakes, penalties, or missed financial opportunities.

Regularly Reviewing and Adjusting the Small Business Financial Plan

Setting checkpoints and milestones.

Like any strategic blueprint, a financial plan isn't static. It serves as a guiding framework but should be flexible enough to adapt to evolving business realities.

Setting regular checkpoints— quarterly , half-yearly, or annually—can help businesses assess whether they're on track to meet their financial objectives.

Milestones, such as reaching a specific sales target, launching a new product, or expanding into a new market, offer tangible markers of progress. Celebrating these victories can bolster morale, while any shortfalls can serve as lessons, prompting strategy tweaks. F

or small businesses, where agility is an asset, regularly revisiting the financial plan ensures that the business remains aligned with its overarching financial goals while being responsive to the dynamic marketplace.

Using Financial Ratios to Monitor Business Health

Financial ratios offer a distilled snapshot of a business's health. Ratios like the current ratio ( current assets divided by current liabilities ) can shed light on liquidity, indicating whether a business can meet short-term obligations.

The debt-to-equity ratio , contrasting borrowed funds with owner's equity, offers insights into the business's leverage and potential financial risk.

Profit margin , depicting profitability relative to sales, can highlight operational efficiency. By consistently monitoring these and other pertinent ratios, small businesses can glean actionable insights, understanding their financial strengths and areas needing attention.

In a realm where early intervention can stave off major financial setbacks, these ratios serve as vital diagnostic tools, guiding informed decision-making.

Pivoting Strategies Based on Financial Performance

In the ever-evolving world of business, flexibility is paramount. If financial reviews indicate that certain strategies aren't yielding anticipated results, it might be time to pivot.

This could involve tweaking product offerings, revising pricing strategies, targeting a different customer segment, or even overhauling the business model.

For small businesses, the ability to pivot can be a lifeline. It allows them to respond swiftly to market changes, customer feedback, or internal challenges.

A robust financial plan, while offering direction, should also be pliable, accommodating shifts in strategy based on real-world performance. After all, in the business arena, adaptability often spells the difference between stagnation and growth.

Bottom Line

Financial foresight is integral for the stability and growth of small businesses. Effective revenue and cash flow forecasting, anchored by historical sales data and enhanced by market research, local trends, and customer feedback, ensures businesses are prepared for future demands.

With the unpredictability of the business environment, understanding the cash cycle and preparing for unforeseen challenges is essential.

As businesses contemplate external financing, the decision between debt and equity and the myriad of loan types, should be made judiciously, keeping in mind the business's health, growth aspirations, and risk appetite.

Furthermore, diligent tax planning, with professional guidance, can lead to significant financial benefits. Regular reviews using financial ratios allow businesses to gauge their performance, adapt strategies, and pivot when necessary.

Ultimately, the agility to adapt, guided by a well-structured financial plan, is pivotal for businesses to thrive in a dynamic marketplace.

Creating a Small Business Financial Plan FAQs

What is the importance of a financial plan for small businesses.

A financial plan offers a structured roadmap, guiding businesses in making informed decisions, ensuring growth, and navigating financial challenges.

How do forecasting revenue and understanding cash cycles aid in financial planning?

Forecasting provides insights into expected income, aiding in budget allocation, while understanding cash cycles ensures effective liquidity management.

What are the core components of a financial plan for small businesses?

Core components include setting objectives, estimating startup costs, preparing financial statements, budgeting, forecasting, securing financing, and tax management.

Why is tax planning vital for small businesses?

Tax planning ensures compliance, optimizes tax liabilities through available deductions, and helps businesses save money and avoid penalties.

How often should a small business review its financial plan?

Regular reviews, ideally quarterly or half-yearly, ensure alignment with business goals and allow for strategy adjustments based on real-world performance.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Advanced Diploma in Financial Planning

- Average Cost of a Certified Financial Planner

- Benefits of Having a Financial Planner

- Cash Flow-Based Financial Planning

- Charitable Financial Planning

- Components of a Good Financial Plan

- Fee-Only Financial Planning

- Financial Contingency Planning

- Financial Planner for Retirement

- Financial Planning Career Pathway

- Financial Planning Pyramid

- Financial Planning Tips

- Financial Planning Trends

- Financial Planning and Analysis

- Financial Planning for Married Couples

- Financial Planning for Military Families

- Financial Planning for Startups

- Financial Planning vs Budgeting

- Financial Tips for Young Adults

- High-Net-Worth Financial Planning

- How to Become a Chartered Financial Planner