- Search Search Please fill out this field.

- Business Leaders

How to Create a Business Succession Plan

:max_bytes(150000):strip_icc():format(webp)/professional_profile_pic__mark_p._cussen_cfp_cmfc_afc-5bfc262e46e0fb0026006c58.jpg)

For many small business owners, maintaining positive cash flow and a stable balance sheet can be an ongoing battle that consumes virtually all of their time. Even retirement often seems like a distant speck on the horizon, let alone plans to hand over the business. However, establishing a sound business succession plan is beneficial for most business owners and can be absolutely necessary for some.

For business owners that are at or near retirement, the issue of succession cannot be ignored. In this article, we will take you through the steps you'll want to take to create a successful succession plan.

Picking a Successor Isn't Easy

Many factors determine whether a succession plan is necessary, and sometimes the logical and easy choice will be to sell the business lock, stock, and barrel simply. However, many owners prefer the thought of their businesses continuing on even after they're gone.

Choosing a successor can be as easy as appointing a family member or assistant to take the owner's place. However, there may be several partners or family members from which the owner will have to choose — each with a number of strengths and weaknesses to be considered. In this case, a lasting resentment by those who were not chosen may happen, regardless of what choice is ultimately made. Partners who do not need or want a successor may simply sell their portion of the business to the other partners of the business in a buy-sell agreement .

How Much Is the Business Worth?

When business owners decide to cash-out (or if death makes the decision for them), a set dollar value for the business needs to be determined, or at least the exiting share of it. This can be done either through an appraisal by a certified public accountant (CPA) or by an arbitrary agreement between all partners involved. If the portion of the company consists solely of shares of publicly-traded stock, then the valuation of the owner's interest will be determined by the stock's current market value.

Life Insurance: The Standard Transfer Vehicle

Once a set dollar value has been determined, life insurance is purchased on all partners in the business. In the event that a partner passes on before ending his relationship with their partners, the death benefit proceeds will then be used to buy out the deceased partner's share of the business and distribute it equally among the remaining partners.

There are two basic arrangements used for this. They are known as "cross-purchase agreements" and "entity-purchase agreements." While both ultimately serve the same purpose, they are used in different situations.

Cross-Purchase Agreements

These agreements are structured so that each partner buys and owns a policy on each of the other partners in the business. Each partner functions as both owner and beneficiary on the same policy, with each other partner being the insured. Therefore, when one partner dies, the face value of each policy on the deceased partner is paid out to the remaining partners, who will then use the policy proceeds to buy the deceased partner's share of the business at a previously agreed-upon price.

As an example, imagine that there are three partners who each own equal shares of a business worth $3 million, so each partner's share is valued at $1 million. The partners want to ensure that the business is passed on smoothly if one of them dies, so they enter into a cross-purchase agreement. The agreement requires that each partner take out a $500,000 policy on each of the other two partners. This way, when one of the partners dies, the other two partners will each be paid $500,000, which they must use to buy out the deceased partner's share of the business.

Entity-Purchase Agreements

The obvious limitation here is that, for a business with a large number of partners (five to ten partners or more), it becomes impractical for each partner to maintain separate policies on each of the others. There can also be substantial inequity between partners in terms of underwriting and, as a result, the cost of each policy.

There can even be problems when there are only two partners. Let's say one partner is 35 years old, and the other is 60 years old — there will be a huge disparity between the respective costs of the policies. In this instance, an entity-purchase agreement is often used instead.

The entity-purchase arrangement is much less complicated. In this type of agreement, the business itself purchases a single policy on each partner and becomes both the policy owner and beneficiary. Upon the death of any partner or owner, the business will use the policy proceeds to purchase the deceased person's share of the business accordingly. The cost of each policy is generally deductible for the business, and the business also "eats" all costs and underwrites the equity between partners.

3 Reasons to Have a Business Succession Plan

Creating and implementing a sound succession plan will provide several benefits to owners and partners:

- It ensures an agreeable price for a partner's share of the business and eliminates the need for valuation upon death because the insured agreed to the price beforehand.

- The policy benefits will be immediately available to pay for the deceased's share of the business, with no liquidity or time constraints. This effectively prevents the possibility of an external takeover due to cash flow problems or the need to sell the business or other assets to cover the cost of the deceased's interest.

- A succession plan can greatly help in establishing a timely settlement of the deceased's estate .

The Bottom Line

Proper business succession planning requires careful preparation. Business owners seeking a smooth and equitable transition of their interests should seek a competent, experienced advisor to assist them in this business decision.

American Bar Association. " Forms of Stock Purchase Agreements ," Page 1.

:max_bytes(150000):strip_icc():format(webp)/dv740090-5bfc2b8b46e0fb00265bea71.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

-min.jpg)

leadership development

A Guide to Building the Best Succession Plans (+ Examples)

Dive into a detailed succession plan example & learn how to cultivate future leaders. Get tips & tools for smooth transitions & sustained growth.

Matthew Reeves

CEO of Together

Published on

February 6, 2024

Updated on

Time to Read

mins read time

Picture this: your CEO announces their retirement. The board scrambles to find a suitable replacement. Morale dips. Uncertainty hangs heavy in the air. Sound familiar?

It's an all-too-common scenario of unplanned leadership transitions, a recipe for disruption and lost momentum. In fact, 49% of companies worldwide lack a formal succession plan, leaving them vulnerable to talent gaps and costly instability.

But it doesn't have to be this way.

Succession planning isn't a luxury, it's a strategic lifeline. It's identifying and nurturing your future leaders, not before the storm, but while the sun shines. It's ensuring a smooth handover of the baton, preserving institutional knowledge, and guaranteeing your organization's continued growth—even when the inevitable winds of change blow.

Ready to break free from the reactive dance of unplanned transitions? Let's explore the power of succession planning and uncover the tools to build a future-proof leadership pipeline .

Understanding what succession planning is

Ever heard of a company built like a house of cards? One key departure, and the whole thing crumbles. That's the scenario succession planning aims to prevent.

Simply put, succession planning is building the bridge between your present leadership and a vibrant future. It's identifying and nurturing talent – your high-potential stars – to seamlessly step into critical roles when the time comes. Think of it as inoculating your organization against talent shock.

Why is this so crucial? Consider this:

- Deloitte reports 86% of leaders believe succession planning is an "urgent" and "important" priority, yet only 13% believe they do it well.

- Firing a CEO, without a succession plan in place, costs companies an average of $1.8 billion in shareholder value, whether the new CEO is from inside or outside the company.

- McKinsey research reveals that unsuccessful leadership transitions lead to 20% lower employee engagement and 15% lower team performance.

Think of a well-executed succession plan as your secret weapon:

- It fosters organizational stability and smooth transitions, safeguarding against knowledge gaps and disruption.

- It attracts and retains top talent, who see clear pathways for growth and development within the company.

- It cultivates a culture of learning and continuous improvement, empowering your future leaders to excel.

- It boosts employee engagement and morale, knowing the organization invests in their long-term potential.

In a nutshell, succession planning isn't just about filling empty chairs; it's about building a thriving legacy. It's the insurance that your organization not only survives, but thrives, even as the leadership baton passes to the next generation.

Ready to learn how to craft your own winning succession plan? Buckle up, the next section explores the essential ingredients for success!

🛤️ Also read our Guide on The 4 Stages of Succession Planning

9 key elements of an effective succession plan.

A common misconception around succession planning is that it's simply a wish list – a hopeful glance toward the future with little substance or strategy. But in reality, it's far more than that. It's a meticulously crafted roadmap that guides an organization through the inevitable twists and turns in its leadership journey.

So, where do you begin in crafting this vital roadmap?

The answer lies in breaking down the essential components that make it truly effective. Imagine these components as individual building blocks, each carefully chosen and strategically placed to form a sturdy and reliable path toward a thriving future.

Let's delve into these critical elements, dissecting their roles and exploring the tools and strategies you can employ to ensure your succession plan isn't just a pipe dream, but a tangible bridge to a prosperous tomorrow.

1. Identification of key roles

In a successful succession plan , identifying key roles is crucial. This isn't about randomly selecting positions to fill; it's about discerning the very engines that drive your organizational ship, the positions that hold the greatest influence and impact. It requires critical thinking and strategic foresight, looking beyond the immediate present and anticipating future needs and growth areas.

For instance, if you're a tech company, your lead software developer or project manager may be key roles. Identify these roles early on to ensure a smooth transition when changes occur.

2. Talent assessment

Once you have identified the key roles, the next step is talent assessment , the delicate yet crucial task of discovering the hidden gems within your talent pool.

Think beyond resumes and experience – look for hidden gems with the right blend of skill, potential, and leadership qualities. Think diverse perspectives and fresh ideas that can fuel innovation and growth.

3. Communication strategy

Next, we build the superstructure of communication and development . Transparency is key – keep your crew informed about the plan and their potential role within it. Hold regular meetings, create informative materials, and foster an open dialogue to build trust and engagement , while celebrating milestones along the way to motivate and inspire.

4. Leadership development

Imagine a seasoned leader stepping down, leaving behind a vacuum that cripples your organization. Leadership development equips potential successors with the skills, confidence, and experience to step into those shoes with minimal disruption.

So, how can you invest in leadership development ? The options are varied and adaptable:

- Tailored training programs - Design programs that cater to individual strengths, weaknesses, and leadership styles.

- Stretch assignments - Challenge individuals with projects outside their comfort zone to push their boundaries and unlock hidden potential.

- Conferences and workshops - Provide access to external knowledge and networking opportunities to broaden perspectives and learn from industry experts.

- Leadership rotations - Give individuals exposure to different departments and functions to develop a holistic understanding of the organization.

5. Mentorship programs

Mentorship programs are a vital ingredient in any robust succession plan. They bridge the gap between experienced leaders and emerging stars, weaving threads of knowledge, wisdom, and practical experience to prepare the next generation for success.

The power of mentorship isn't just anecdotal. It's more than just learning the ropes; it's a knowledge-sharing ecosystem where seasoned veterans impart their hard-won insights, helping rising stars navigate the complexities of leadership, build confidence, and refine their skills.

6. Emergency succession plan

No matter how meticulous your planning is, the future can hold surprises. Sudden leadership departures or unforeseen circumstances can disrupt even the most stable organizations. That's why every robust succession plan needs a safety net: a comprehensive Emergency Succession Plan ready to be activated at a moment's notice.

Think of it like a fire drill for your organization. Just as you regularly practice for an emergency evacuation, the Emergency Succession Plan outlines the immediate steps and responsible individuals in case of critical leadership disruptions. This ensures a swift and decisive response, minimizing chaos and keeping the organization on track even amidst turbulence.

Regularly review and update your emergency plan to reflect personnel changes, organizational shifts, and evolving risks. Conduct simulations to identify potential gaps and refine your response mechanisms.

7. Succession planning committee

A comprehensive succession plan isn't just about identifying future leaders and offering training; it requires careful execution and oversight. That's where the Succession Planning Committee steps in, acting as the driving force behind the plan's implementation and success.

Here's how this committee fuels your succession plan's success:

- Gathering diverse perspectives - The committee isn't a one-man show; it's a melting pot of knowledge and experience. Including representatives from HR, senior leadership, and even key stakeholders ensures you're not missing any crucial angles.

- Avoiding bias and blind spots - We're all human, which means we have our own biases and blind spots. A well-structured committee helps mitigate these risks, ensuring a fair and objective approach to talent selection and development.

- Building trust and transparency - The committee acts as a bridge between leadership, HR, and the wider organization, fostering transparency throughout the process. This helps build trust among employees, who feel their voices are heard and that the selection process is fair and well-considered.

8. Integration with performance management

Think of performance management and succession planning as two sides of the same coin. By integrating them, you create a powerful engine for talent development, ensuring a smooth transition of leadership and building a future-proof organization that thrives on its people's potential.

Here’s how you can do this:

- Align development with goals - Use performance reviews to identify strengths and weaknesses of potential successors, aligning their development plans with the specific skills and knowledge needed for future leadership roles. This way, you're not just giving them generic training; you're providing targeted development that directly contributes to your succession plan's success.

- Go beyond annual check-ins - Foster a culture of ongoing feedback and development where managers and mentors regularly provide constructive criticism and guidance. This continuous feedback loop helps individuals stay on track, identify areas for improvement, and build the confidence needed to step into leadership roles.

- Track progress and make adjustments - Use performance management data to track the development of potential successors, assess the effectiveness of your training programs, and identify any gaps that need to be addressed. This ongoing monitoring allows you to adjust your plan as needed, ensuring it remains relevant and effective in the ever-changing business landscape.

9. Regular review and update

Just like your organization adapts and grows over time, your succession plan needs to be a living document, constantly evolving to stay relevant. Regular review and updates are crucial to ensure you have the right leaders ready to step in whenever needed.

Here's how you can embrace continuous improvement in your succession planning:

- Regular reviews - Schedule frequent reviews, ideally annually or even bi-annually, to assess your plan’s effectiveness and identify areas for improvement.

- Data-driven decisions - Gather feedback from employees, stakeholders, and leadership teams to understand their perspectives and concerns. Use performance data and industry trends to inform your decisions about changes and updates.

- Talent pool refreshment - Regularly assess your pool of potential successors and identify new individuals who possess the skills and qualities needed for future leadership roles. Don't rely on the same shortlist year after year.

Remember, a dynamic and adaptable succession plan is an investment in your organization's long-term success. By prioritizing continuous improvement, you ensure you have a pipeline of talented individuals ready to lead when the time comes, navigated by a plan that reflects your evolving needs and keeps you ahead of the curve.

Succession plan example

Now that we've explored the key components and principles of effective succession planning, let's put theory into practice. We'll walk you through a succession plan example for a fictional company, highlighting how these elements come together in real-world situations.

Remember, this is just a jumping-off point, adapt and customize it to fit the specific needs and structure of your organization.

1. Succession plan overview

- Ensure continuity of leadership and knowledge transfer in key roles to maintain business growth and sustainability.

- Protect the organization from disruptions caused by unexpected departures.

- Develops a pipeline of talented leaders for future growth.

- Motivates employees by providing career development opportunities .

2. Key Positions

- CEO (responsible for overall strategy and vision)

- Head of Operations (looks after production and supply chain)

- Head of Sales and Marketing (drives customer acquisition and revenue growth)

- Chief Technology Officer (leads innovation and technology development)

3. Talent Assessment

GreenGrow Gardens employs a three-pronged approach to assess the potential for each key position:

Performance reviews

GreenGrow's performance reviews delve deeper, assessing qualities like communication, problem-solving, and collaboration. Employees at all levels, including peers, direct reports, and even clients, provide anonymous feedback on potential successors. This multi-dimensional, 360-degree feedback helps uncover hidden strengths and weaknesses often missed in traditional reviews.

Leadership potential assessments

Beyond resumes - GreenGrow utilizes validated leadership assessments to measure cognitive abilities, emotional intelligence, strategic thinking, and adaptability.

Customized profiles - GreenGrow uses customized profiles to tailor development programs and mentorship opportunities to maximize each potential leader's growth potential.

Example in action

Assessing Jessica Davis for Head of Sales and Marketing

Performance review - Jessica consistently surpassed sales targets while fostering a positive and collaborative team environment. Her innovative marketing campaigns have gained national recognition, showcasing her strategic thinking and creativity.

360-degree feedback - Jessica received high praise for her communication skills, ability to motivate others, and willingness to mentor junior team members. Clients commended her customer focus and understanding of their needs.

Leadership potential assessment - Jessica's assessment revealed strong analytical skills, strategic thinking, and a high score in adaptability. However, it also highlighted a potential tendency to micromanage.

Based on this multifaceted assessment, GreenGrow identifies Jessica as a strong candidate for Head of Sales and Marketing. Her development plan will focus on empowering her team, delegating tasks effectively, and further honing her strategic leadership skills.

GreenGrow offers a range of tailored development programs to ensure that its future leaders have the skills, knowledge, and experience they need to thrive in their roles. Some examples include:

- Mentorship pairings with senior leaders

- Executive coaching

- Leadership training courses

- Stretch assignments to test readiness for higher-level roles

Example in action

Development plan for Jessica

- Executive coaching to enhance strategic thinking and decision-making.

- Leadership training program focused on effective team management and conflict resolution.

- Participation in industry conferences and networking events.

- Lead a cross-functional project to launch a new product line, demonstrating the ability to drive innovation and collaboration.

5. Communication strategy

GreenGrow Gardens believes that transparency and trust are essential for a successful succession plan. Here's how they communicate openly with employees and stakeholders:

1. Unveiling the roadmap

- Town hall meetings - Mr. Thompson, the CEO, holds regular town hall meetings where he openly discusses the succession plan, its purpose, and the benefits for both employees and the company.

- Internal newsletter - A dedicated section in the company newsletter features updates on the progress of the plan, highlighting individuals like Jessica Davis and their development journey.

2. Tailoring the message

- Management training - Senior managers are trained on effectively communicating the plan to their teams, addressing potential concerns and anxieties with clarity and empathy.

- Stakeholder briefings - Mr. Thompson personally meets with key stakeholders, including investors and board members, to explain the plan's details and rationale, addressing their specific interests and concerns.

3. Fostering engagement

- Interactive Q&A sessions - Following announcements, GreenGrow offers dedicated Q&A sessions where employees and stakeholders can raise questions and receive clear answers.

- Internal social media platform - A dedicated forum on the company's internal social media platform allows employees to discuss the plan, share feedback, and offer suggestions.

4. Celebrating milestones

- Internal recognition - As individuals like Jessica Davis progress through their development programs and achieve milestones, GreenGrow celebrates their successes through company-wide announcements and internal awards.

- Success stories - The company newsletter and internal communications channels regularly feature success stories of individuals who have benefited from the succession plan, showcasing how it empowers employees to grow and reach their full potential.

6. Succession timeline

GreenGrow Gardens understands that a clear and realistic timeline is key to a successful succession plan. Here's how they define their roadmap for Jessica Davis' potential transition to Head of Sales and Marketing:

Year 1: Building the Foundation

.JPG)

Year 2: Refining and Preparing

.JPG)

This timeline is a dynamic roadmap, subject to adjustments based on Jessica's development, business needs, and unexpected circumstances.

7. Contingency planning

GreenGrow Gardens recognizes that surprises can strike. To ensure seamless operations even in the face of unexpected departures or disruptions, they have a robust contingency plan in place. This plan includes:

- Temporary assignments - Key responsibilities can be temporarily redistributed among senior team members while a more permanent solution is found.

- External recruitment - If internal talent isn't readily available, GreenGrow explores external recruitment options to fill essential roles quickly.

- Internal promotions - When possible, qualified internal candidates are considered for promotions, offering career advancement opportunities and minimizing disruption.

8. Monitoring and evaluation

GreenGrow Gardens understands that continuous monitoring and evaluation are crucial for a future-proof succession plan. Here’s how the company keeps a watchful eye on its succession plan.

- Progress checks - Development programs and talent readiness are regularly assessed, ensuring individuals stay on track and the plan remains relevant.

- Adaptive approach - The plan isn't set in stone. Adjustments are made based on progress, feedback, and evolving business needs.

9. Documentation and knowledge transfer

GreenGrow Gardens knows that effective knowledge transfer is a continuous process, not a one-time event. The company cultivates a culture of learning , collaboration, and wisdom sharing by following these diverse strategies:

- Detailed job profiles - Beyond responsibilities, each key position has a comprehensive profile outlining crucial skills, decision-making frameworks, and industry best practices.

- Process playbooks - Every critical operational and marketing process is meticulously documented, step-by-step, with flowcharts and visuals for clarity.

- Wisdom vault - GreenGrow Gardens has established a centralized repository of essential documents, historical reports, and even video recordings of seasoned leaders sharing their insights. This "wisdom vault" is accessible to all, fostering a culture of learning and preserving valuable knowledge for future generations.

- Shadowing - High-potential individuals like Jessica Davis shadow mentors like Mr. Thompson, observing their daily routines, decision-making processes, and client interactions. This firsthand experience provides invaluable insights and builds confidence for future leadership roles.

- Cross-pollination through teams - Cross-training programs break down departmental barriers, allowing individuals to gain firsthand experience from colleagues in other functions.

- Mentorship circles - Experienced leaders like Mr. Thompson act as mentors, guiding and supporting potential successors through personalized advice, problem-solving sessions, and regular feedback.

- Internal knowledge portal - GreenGrow has developed a user-friendly online platform where employees can access documented knowledge, share best practices, and learn from each other.

This is a hypothetical succession plan example, and a real succession plan would include more specific details and timelines for each element.

HR's role in succession planning

Succession planning isn't just about filling chairs when leaders move on; it's about strategically cultivating future talent and ensuring seamless transitions for ongoing success. In this crucial endeavor, HR emerges as the architect, playing a multi-faceted role in designing and implementing robust succession plans.

HR wears many hats in this process:

- Talent scout - They identify high-potential individuals across the organization, assessing skills, leadership qualities, and potential through performance reviews, assessments, and even 360-degree feedback.

- Development facilitator - HR collaborates with leadership teams to tailor development programs for potential successors, including mentorship pairings , executive coaching, and leadership training courses.

- Process architect - They work with leaders to define key roles, document responsibilities, and establish clear talent pipelines for various positions, ensuring a smooth flow of talent as needs evolve.

- Communication champion - HR ensures open communication throughout the process, informing employees and stakeholders about the purpose, benefits, and timeline of the succession plan, fostering trust and engagement.

- Change navigator - When unexpected challenges arise, HR helps navigate disruptions and adapt the plan accordingly, ensuring continuity and minimizing uncertainty.

For a truly successful succession plan, collaboration between HR and leadership teams is paramount. Here's how they can work together:

- Leadership buy-in - HR educates leaders on the importance of succession planning, securing their commitment and active participation. This ensures the plan receives the resources and support it needs to thrive.

- Strategic alignment - HR collaborates with leadership to define the organization's future direction and identify the skills and qualities needed for future leaders. This alignment ensures the plan develops leaders who are equipped to navigate the company's future challenges and opportunities.

- Leadership development - HR partners with leaders in designing and delivering leadership development programs. Leaders can share their own experiences and insights, while HR provides expertise in training methodologies and program evaluation.

- Mentorship matching - HR facilitates the matching of potential successors with experienced mentors within the organization, leveraging the wisdom and guidance of current leaders to nurture the next generation.

By proactively embracing their role and fostering strong collaboration, HR can ensure that succession planning is not just a box-ticking exercise, but a strategic investment in the future of the organization. By nurturing a pipeline of well-prepared leaders, HR empowers companies to navigate change, overcome challenges, and secure their ongoing success.

Securing your organization’s future with Together

While the daily grind of operations might keep succession planning on the back burner, its importance cannot be overstated. It's not just about filling empty chairs, it's about cultivating future-proof leaders who drive sustainable growth and navigate the ever-evolving business landscape.

Consider the tangible benefits: smoother transitions, minimized disruption, talent retention , and even a competitive edge when attracting top talent. The example we explored, GreenGrow Gardens, showcased how a well-designed plan fosters employee engagement, nurtures future leaders, and ultimately secures the company's continued growth.

But building an effective plan takes more than good intentions. It requires dedicated resources, expertise, and efficient tools to manage and optimize the process. This is where Together, a powerful mentoring platform, enters the picture.

Together streamlines every step of your succession planning journey:

- Talent identification - Utilize data-driven insights and assessments to identify and track high-potential individuals across your organization.

- Development roadmap - Design personalized development plans, match mentors with successors, and track progress through intuitive dashboards.

- Knowledge transfer - Facilitate seamless knowledge sharing through structured mentorship programs and collaborative tools.

- Communication and visibility - Keep everyone informed with built-in communication features and transparent progress reports.

Embrace the future, invest in your talent, and unlock the full potential of your organization. Take the first step by exploring Together : a platform designed to empower your HR team, engage your employees, and cultivate the future leaders who will take your organization to new heights.

Book a demo today and learn how Together can transform your succession planning into a powerful engine for sustained growth and a vibrant future.

About the Author

Table of Contents

Social sharing.

Hear how they started with Together

Related articles.

Elevate your mentorship program today

Schedule 20 minutes to see Together’s platform in action, or jump right in for free.

Together Platform

- Pricing Why Choose Together

- Customer Help Center

- Platform Status

- Why Mentorship

- Colleague Connect

- Matching Together for MS Teams Integrations Reporting & Surveys Security & Compliance

- Human Resources

- Learning & Development

- Department Leads

- Community Managers

- Attracting & Retaining Talent

- Diversity & ERG

- Employee Engagement

- High Potentials

- New Manager

- Remote Work

Terms of Service

- Customer Terms

- Cookie Policy

- Acceptable Use

- Uptime Agreement

- Data Processing Addendum

- Mentorship program planning hub

- White Paper & Ebooks Webinars & Interviews Customer Success Stories

- HR & L&D Playbook

- ROI Calculator

- [email protected]

- +1 (833) 755-5502

- Help Center

- Partnership Programs

Every business needs a succession plan: Here's how to get started

A business succession plan helps ensure that your wishes are followed once you can no longer take care of your enterprise. Follow these steps to make sure you have the best plan possible in place.

Find out more about getting legal help

by Michelle Kaminsky, Esq.

Writer and editor Michelle earned a Juris Doctor (J.D.) degree from Temple University's Beasley School of Law in...

Read more...

Updated on: November 1, 2023 · 4 min read

1. Decide on your goals

2. choose your successor, 3. work together on future goals, 4. ask for help.

If you want to be sure that your business continues to thrive after your retirement, illness, or death, now is the perfect time to begin drawing up a succession plan. Think of this document as being similar to doing estate planning for yourself, with the difference being that a succession plan ensures that your enterprise will experience as seamless a transition as possible once you are no longer able to manage it.

With a proper business succession plan in place, you can handpick the person or company who will take over your business and make sure they are well equipped to handle matters right out of the gate. Moreover, if your business changes hands because of your death, having your share of the business already appraised means your estate can be settled more quickly—a benefit for both your business and your loved ones.

There is no one correct way to write a business succession plan. In fact, you have several options regarding what will happen to your enterprise when you're no longer running it. You may choose to sell it outright in return for cash or assets, transfer your interest to a trust or annuity before your death, or establish a partnership with family members, to which you can then transfer the business. All of these options are complicated legal maneuvers for which professional advice is recommended.

If you have decided to pass the business on to someone else, however, there are some general steps you can follow as you develop the succession plan.

When starting to plan for the future of your business without you, it is important to zero in on your view for what it should look like. Do you want your business to stay predominantly like it is or do you want whomever takes over to have the freedom to expand it as they see fit?

Another important question to address is whether you plan on handing over the business at retirement or whether your plan is largely geared toward a change of hands because of your incapacitation or death. If you are planning on retiring, it is also important to incorporate some retirement planning into your goals, particularly regarding the time frame.

Once you have a general idea of what you want for your business, your choice of successor will probably become clearer. Perhaps because of your specific goals or because you don't have someone in mind to take over, you may decide to have a different company take over your business. In this case, you should research the best company to fit your needs and desires for the future of your enterprise, knowing that you may not have too much control after you cede the reins.

On the other hand, searching for an individual to take over requires considering many more personal qualities. Of course you want a reliable and responsible individual with strong leadership skills, but it can be difficult to separate emotions from more practical considerations, especially when close family members are involved. If this could be an issue, you should strongly consider reviewing outside consultants to help decide what's best for you.

Once you have chosen a successor, together you can devise future strategies for your business. You should identify your successor's primary duties and then conduct a training period so they can be exposed to those areas.

Keep in mind that because this person is going to be in charge someday, giving them increased responsibilities now can not only help you see how they would handle certain situations but also help instill confidence that they will be ready to do it all on their own in the future. To better ensure you've made the right choice, you may wish this training period to last for an extended period of time before you give up control entirely.

There's no question that establishing a business succession plan is a serious undertaking, so seeking professional advice—especially regarding drawing up legal agreements, such as a buy/sell contract —is highly recommended. A proper business succession plan has all of the necessary legal documents prepared and ready for execution whenever it needs to be put into effect, whether it's by choice or by circumstance.

Remember, too, that, just as you should with estate planning documents, you must make sure your business succession plan is always up to date. If life events such as births, deaths, marriages, or divorces would impact your plan, it's time to revisit it and make sure it's still what you want.

Overall, developing a succession plan for your business now, while your enterprise is in a good, solid place, means you can take your time and make informed decisions. Once you have decided on your successor and have a clear path to having them take over, you can rest easier knowing that all of your hard work building your business won't simply fall by the wayside once you're gone—and that kind of peace of mind is priceless.

You may also like

What does 'inc.' mean in a company name?

'Inc.' in a company name means the business is incorporated, but what does that entail, exactly? Here's everything you need to know about incorporating your business.

October 9, 2023 · 10min read

What is a power of attorney (POA)? A comprehensive guide

Setting up a power of attorney to make your decisions when you can't is a smart thing to do because you never know when you'll need help from someone you trust.

May 7, 2024 · 15min read

Thank you! We will contact you in the near future.

Thanks for your interest, we will get back to you shortly

- Change Management Tools

- Organizational Development

- Organizational Change

Home » Human Resources » Business succession planning: The complete guide

Business succession planning: The complete guide

Business succession planning (BSP) is the best way for HR to ensure they retain the institutional knowledge and experience they have worked hard to accumulate in a business.

It also helps ensure your enterprise’s survival in an age where HR focusing on employee retention and quality talent is vital to business resilience .

BSP involves handing authority to lower levels of staff to avoid role gaps and ensure a successful transition for staff to leadership roles when companies lose employees through passing away, departing the company, or experiencing termination.

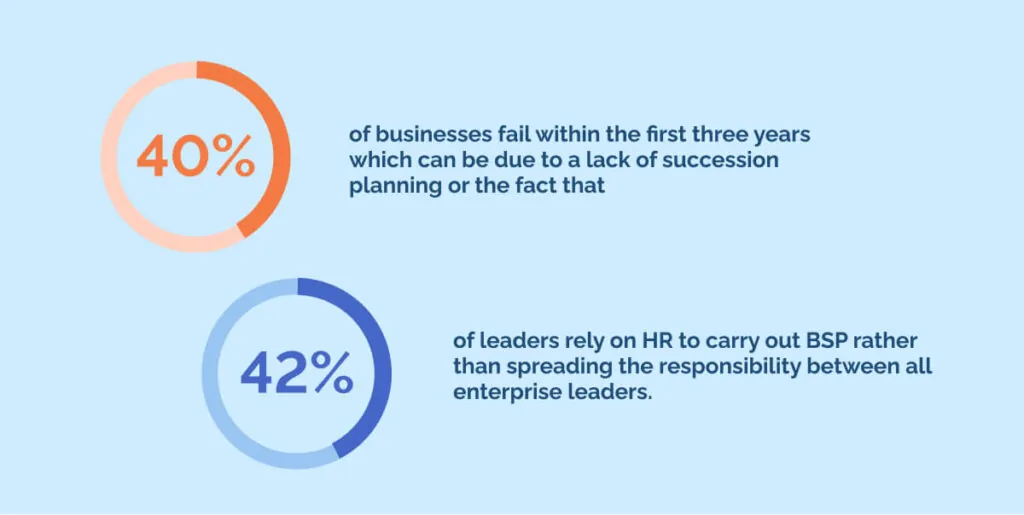

40% of businesses fail within the first three years which can be due to a lack of succession planning or the fact that 42% of leaders rely on HR to carry out BSP rather than spreading the responsibility between all enterprise leaders.

However, effective business succession planning can benefit the culture, operations and finances of any enterprise.

In this guide, we’ll explore:

What is business succession planning?

Why is business succession planning important, the 7 types of business succession planning, benefits of succession planning, barriers to business succession planning, how leaders and hr can achieve succession planning.

Succession planning in business involves strategically transferring leadership roles from one employee or a team to another and is often a care aspect of businesses owned by multiple owners.

This business strategy aims to maintain the seamless operation of a business, ensuring continuity even when key individuals transition to new opportunities, retire, or pass away.

Additionally, it can facilitate a liquidity event, allowing the smooth transfer of ownership to emerging staff without impacting employee productivity while preserving the business’s ongoing viability.

Business succession planning is crucial for continuity and yet 43% of businesses do not have a BSP plan . These businesses are missing out on an approach which can ensure a smooth transition of leadership, preserve wealth, maintain employee morale, and safeguard the company’s legacy.

Let’s go into more detail about why business succession is important to help you understand why it may benefit your organization.

Business resilience strengthening

Ensuring business resilience is paramount for sustained success, whether maintaining the current structure or navigating transitions like sales or restructuring, safeguarding assets for continual growth and prosperity.

Ensuring harmony between owners

In business partnerships, fostering harmony is essential. Balancing owner or CEO relationships within the business dynamic ensures effective operations and long-term success, nurturing a supportive and cohesive work environment.

Minimizing taxes

Minimizing estate and income taxes is a strategic goal in business succession planning. By implementing tax-efficient strategies, businesses can preserve wealth, allowing for seamless transitions and securing financial legacies.

Streamlining the retirement process

Streamlining the retirement process for the current leadership generation is a key aspect of business succession planning. Efficiencies in transitioning leadership responsibilities enable a smooth and effective handover, promoting continuity.

Control over decisions

Retaining control over decision-making processes is critical in business succession planning. By avoiding the delegation of crucial choices, businesses can ensure a strategic direction that aligns with their vision, values, and goals.

Benefits even in failure

Business succession planning remains valuable even in failure. It supports a successful transition to a new owner, offering opportunities for recovery and revitalization, ensuring that the business legacy endures despite setbacks.

Consider why BSP is important if you need to implement it in your enterprise as you consider all the reasons above.

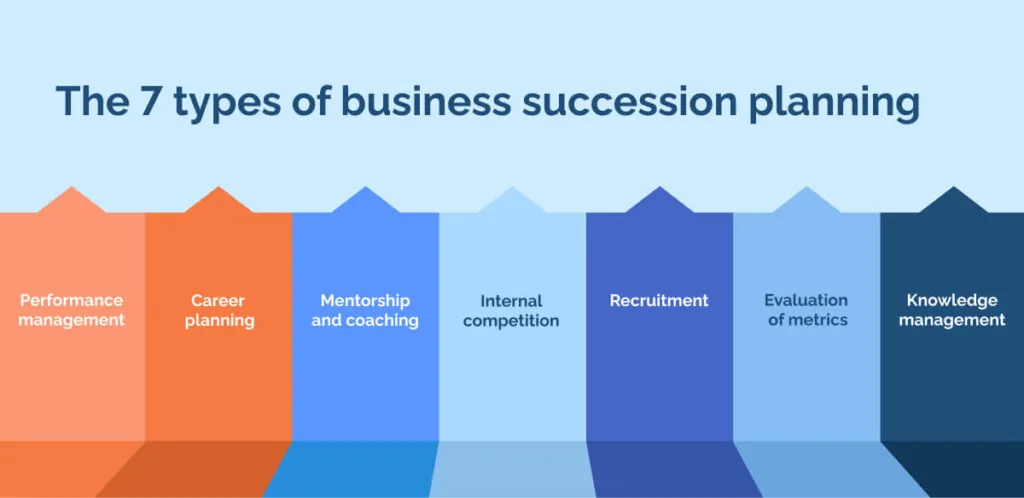

It’s challenging to understand a concept like BSP without examples, so here are some ways you might use succession planning strategies in practice.

1. Performance management

Performance management involves setting performance objectives and assessing employee performance against them.

Its primary goal is to ensure high-quality work, optimal performance, and efficient work processes.

Identifying high achievers and areas for improvement is a key outcome of performance management.

2. Career planning

Collaborative efforts between management and employees define career objectives and align them with prospects as you strategically move employees into key positions.

This process identifies employee strengths and interests, matching them with business needs. Career planning contributes to employee retention and enhances job satisfaction.

3. Mentorship and coaching

Active coaching and mentoring by managers and senior staff for employees with leadership potential assist them in gaining the necessary skills for promotion.

These programs aid personal and professional development, unlocking individuals’ full potential and preparing them for leadership roles.

4. Internal competition

Fostering internal competition among potential leaders through assigning comparable responsibilities at the same executive level.

This approach, for instance, is seen in hedge funds, where potential fund managers control portfolios of similar sizes, aiding in identifying suitable candidates for senior positions.

5. Recruitment

The success of succession plans relies on recruiting individuals capable of filling essential roles.

Developing broad sector relationships allows recruiters to swiftly fill crucial positions with external applicants, ensuring the continuous smooth operation of the organization.

6. Evaluation of metrics

Organizations assess succession planning programs through metrics such as bench strength, talent retention, leadership development, knowledge management, and competency management.

This step involves evaluating leaders’ training readiness based on competency assessments, providing insights into the reliability of succession plans.

7. Knowledge management

The capture, identification, transfer, and utilization of organizational knowledge are integral to succession planning.

Knowledge audits ensure the recording of sufficient information in specific divisions and functions, enabling future leaders to assume responsibilities in these areas seamlessly.

Having a formalized succession plan offers numerous advantages for both employers and employees.

Employee advantages

Employees know the potential for advancement and even ownership, fostering empowerment and increasing job satisfaction.

A plan for future opportunities reinforces employees’ commitment to career development because every staff member is a key employee in their role in the larger scale of the company.

Management and tracking advantages

Management’s dedication to succession planning results in supervisors mentoring employees to transfer knowledge and expertise.

Improved tracking of employee value enables leaders or HR to fill internal positions promptly when opportunities arise.

Improved communication

Enhanced communication between leadership and employees facilitates each business partner’s shared understanding of company values and vision.

A new generation of leaders is essential during mass workforce retirements.

Proper succession planning is particularly beneficial for public company shareholders.

Having the next CEO actively involved in business operations and well-respected long before the current CEO’s retirement ensures stability.

A well-communicated succession plan prevents investors from selling the company’s stock when the CEO retires.

Additionally, succession planning can cultivate a new generation of leaders, serving as an exit strategy for business owners looking to sell their stakes.

Recent academic sources suggest there are three major barriers to business succession planning: Tax, finances and legal issues.

Tax poses a significant barrier to business succession planning due to complex regulations and financial implications.

Transfer of ownership can trigger substantial tax liabilities, discouraging smooth transitions and hindering the effective implementation of succession plans.

Financial challenges hinder business succession planning, creating hurdles in funding the transition process.

Lack of resources may hinder adequate preparation, limiting the ability to address critical aspects and ensure a seamless transfer of ownership.

Legal

Legal issues pose a barrier to business succession planning by introducing complexities and uncertainties.

Ambiguous regulations, contractual disputes between owners, and compliance challenges can impede the smooth ownership transition, creating obstacles in executing succession plans.

Consider these barriers and try to integrate them within your business succession plans by liaising with finance and legal teams and explaining the barriers and urge them to consider the best way to overcome them.

More than 74% of leaders report they are unprepared and lack the training for the challenges they face in their roles . Knowing how to work with HR to achieve a business succession plan before attempting it ensures leaders’ approach is systematic and successful.

Here are seven tips to initiate the succession planning process within your company.

1. Proactively develop a plan

Leaders must work with HR to anticipate potential departures via a workforce management plan to fill gaps during planned retirements or unexpected resignations.

Leaders must assess the impact of critical roles on daily operations and consider the possible consequences of personnel changes. HR can then consider how to negate the impact of these changes in future.

To develop your plan, follow these three steps:

- Outline roles

Outline the roles, skills, and experience essential for successors (succession profiles). Seek extensive team feedback to comprehensively understand the requirements for your succession plan.

- Anticipate future needs

Anticipate your company’s future needs through a 5-year forecast. Assess organizational structure changes, turnover patterns, compensation strategies, potential retirements, and future training plans.

- Regularly revise job descriptions

Revise job descriptions based on gathered insights. Clearly communicate expectations to define suitable candidate profiles for the succession plan.

2. Identify succession candidates

HR can recognize team members capable of stepping into crucial roles. They must look beyond immediate organizational chart hierarchies and consider employees with skills conducive to higher positions.

Discovering suitable successors is pivotal in crafting an effective business succession plan. Methodically assess current talent, evaluating their skills, experience, and potential.

Consider leadership qualities, adaptability, and alignment with organizational goals. Engage in open communication with potential candidates to gauge interest and aspirations.

A meticulous identification process ensures a smooth transition, maintaining continuity and fostering the long-term success of your business.

3. Communicate the plan

Effectively communicating a business succession plan is essential for a seamless transition. Start by informing key stakeholders, such as employees, clients, and investors, about the plan’s purpose and benefits.

Use clear and transparent messaging to address concerns and ensure understanding. Implement a phased communication approach, providing updates at appropriate intervals.

Foster open dialogue to address questions and concerns, promoting a sense of stability and confidence in the transition process.

In private HR discussions, inform selected individuals that they are under consideration for roles of increasing significance.

Emphasize the absence of guarantees and acknowledge that circumstances may alter the plan.

4. Enhance professional development

Elevating professional development within your business succession plan is crucial for future leadership.

Intensify investment in the career development of chosen successors as part of workforce engagement management efforts.

Implement job rotations to broaden their knowledge and connect them with mentors to enhance soft skills like communication, empathy, and diplomacy.

Identify key skills and competencies required for successors. Implement tailored training programs, mentorship initiatives, and continuous learning opportunities.

Encourage collaboration and cross-functional experiences to broaden expertise. Regularly assess and adjust development plans to align with evolving business needs.

Prioritizing professional growth ensures a robust pipeline of capable leaders for a seamless succession.

5. Trial the plan

Test potential successors by having them assume some of the responsibilities of a manager during a vacation.

Pilot your business succession plan through a phased trial. Select a small-scale scenario, monitor its execution, gather feedback, and make adjustments accordingly. This trial ensures a smooth full-scale implementation.

Doing so provides valuable experience for the staff and allows you to identify areas requiring additional employee training .

6. Integrate with the hiring strategy

Align your hiring strategy with the business succession plan by identifying potential successors during recruitment.

Foster a culture of mentorship and skill development, ensuring a seamless leadership transition.

Identify talent gaps left by potential successors and use this information to shape future recruiting efforts.

7. Consider your succession

When crafting a succession plan, consider your eventual replacement. Identify an employee who could step into your role and initiate measures to aid their preparation for the transition.

Your workforce is dynamic, and change is the only constant when it comes to employee behaviors.

While predicting departures may be challenging, effective succession planning ensures business continuity, securing a stable future for your company using an agile approach to financial sustainability.

Implement business succession planning to ensure your survival

Implementing business succession planning is crucial for ensuring the survival and continuity of your enterprise as you keep ownership and avoid a buy-sell agreement scenario.

By identifying and nurturing future leaders, clarifying legal obligations, and addressing financial and tax considerations, senior leaders fortify their enterprise against unforeseen challenges.

This strategic approach secures your company’s legacy and fosters resilience and adaptability for sustained success for any enterprise.

If you liked this article, you may also like:

How to use Bloom’s Taxonomy for business

6 Key HR Challenges for 2023

Tristan Ovington

Tristan Ovington is a professional senior writer and journalist, specializing in providing expert insights on various topics such as digital adoption, digital transformation, change management, and Cloud apps. He delivers his knowledge through accessible online content that is data-driven and presented in a friendly tone, making it easy for readers to understand and implement.

Join the industry leaders in digital adoption

By clicking the button, you agree to the Terms and Conditions. Click Here to Read WalkMe's Privacy Policy

Buying and Selling a Business | Ultimate Guide

Business Succession Planning: 5 Ways to Transfer Ownership Of Your Business

Published October 11, 2019

Published Oct 11, 2019

WRITTEN BY: Robert Newcomer-Dyer

Business succession planning is a series of logistical and financial decisions about who will take over your business upon retirement, death, or disability. To write a succession plan, the first step is to identify the ideal successor to take over the business, then determine the best selling arrangement. This usually involves a buy-sell agreement, secured with a life insurance policy or loan.

There are five common ways to transfer ownership of your business:

- Co-owner: Selling your shares or ownership interests to a co-owner.

- Heir: Passing ownership interests to a family member.

- Key employee: Selling your business to a key employee.

- Outside party: Selling your business to an entrepreneur outside your organization.

- Company: For a business with multiple owners, you can sell your ownership interests back to the company, then distribute them to the remaining owners.

How a Business Succession Plan Works

A business succession plan is a document that is intended to guide through a change in ownership by providing step-by-step instructions. If a purchase is involved, the sale price and purchase terms are clearly outlined, relieving stress for the departing owner’s family. A well-crafted succession plan aims to benefit everybody—the departing owner, the business, employees, and the successor.

A small business succession plan should include the following:

- A succession timeline: Details regarding the circumstances when a succession would take place and specific dates as applicable.

- Your potential successors: A list of potential successors, including strengths and order of consideration.

- Formalized standard operating procedures (SOPS): A collection of documents, procedures, employee handbooks, and training documentation.

- Your business’s valuation: The valuation of your business should include the method by which is valued and be updated frequently.

- How your succession will be funded: Details including whether the succession is funded through life insurance, a seller’s note, or other funding options.

Who Should Create a Business Succession Plan

Succession plans are commonly associated with retirement; however, they serve an important function earlier in the business lifespan: If anything unexpected happens to you or a co-owner, a succession plan can help reduce headaches, drama, and monetary loss. As the complexity of the business and the number of people impacted by the exit grows, so does the need for a well-written succession plan.

You should consider creating a succession plan if you:

- Have complex processes: How will your employees and successor know how to operate the business once you exit? How will you duplicate your subject matter expertise?

- Employ more than just yourself: Who will step in to lead employees, administer human resources (HR) and payroll, and choose a successor and leadership structure?

- Have repeat clients and ongoing contracts: Where will clients go after your exit, and who will maintain relationships and deliver on long-term contracts?

- Have a successor in mind: How did you arrive at this decision, and are they aware and willing to take ownership?

Many business owners ignore succession planning because they don’t believe it’s necessary or put it off until they’re ready to retire. For small, simple businesses, a succession plan may not be necessary. However, consider what would happen to your business if you were no longer able to run the day-to-day operations. Who would take over? Would the business be viable?

When to Create a Small Business Succession Plan

Every business needs a succession plan to ensure that operations continue, and clients don’t experience a disruption in service. If you don’t already have a succession plan in place for your small business, this is something you should put together as soon as possible.

While you may not plan to leave your business, unplanned exits do happen. In general, the closer a business owner gets to retirement age, the more urgent the need for a plan. Business owners should write a succession plan when a transfer of ownership is in sight, including when they intend to list their business for sale, retire, or transfer ownership of the business. This will ensure the business operates smoothly throughout the transition.

The 5 Common Types of Succession Plans

There are several scenarios in which a business can change ownership. The type of succession plan you create may depend on a specific scenario. You may also wish to create a succession plan that addresses the unexpected, such as illness, accident, or death, in which case you should consider whether to include more than one potential successor.

Here are the five most common types of small business succession plans in detail.

1. Selling Your Business to a Co-owner

If you founded your business with a partner or partners, you may be considering your co-owners as potential successors. Many partnerships draft a mutual agreement that, in the event of one owner’s untimely death or disability, the remaining owners will agree to purchase their business interests from their next of kin.

This type of agreement can help ease the burden of an unexpected transition—for the business and family members alike. A spouse might be interested in keeping their shares but may not have the time investment or experience to help it blossom. A buy-sell agreement ensures they’re given fair compensation, and allows the remaining co-owners to maintain control of the business.

Potential Drawbacks

A buy-sell agreement with a co-owner requires a lot of cash kept on-hand. Your co-owner should be prepared to buy-out your shares, theoretically, at any moment. Many businesses will fund this plan with life insurance. Term life insurance is relatively inexpensive and can offset a lot of costs in the event of an owner’s death. Permanent life insurance is a bit more expensive with the added benefit of a payout in the event of retirement or disability.

If you choose to draft a buy-sell agreement with your co-owner, you’ll want to make sure a life insurance policy is stipulated in the agreement. The company can also purchase key person insurance that pays out in the event a key member of the business dies or becomes disabled. We recommend speaking with an expert for specific help on the type of policy you’ll need.

2. Passing Your Business Onto an Heir

Choosing an heir as your successor is a popular option for business owners, especially those with children or family members working in their organization. It is regarded as an attractive option for providing for your family by handing them the reins to a successful, fully operational enterprise. Passing your business on to an heir is not without its complications.

Some steps you can take to pass your business onto an heir smoothly are:

- Determine who will take over: This is an easy decision if you already have a single-family member involved in the business but gets more complicated when multiple family members are interested in taking over.

- Provide clear instructions: Include instructions on who will take over and how other heirs will be compensated.

- Consider a buy-sell agreement: Many succession plans include a buy-sell agreement that allows heirs that are not active in the business to sell their shares to those who are.

- Determine future leadership structure: In businesses where many heirs are involved, and only one will take over, you can simplify future discussions by providing clear instructions on how the structure should look moving forward.

Failing to address these steps may lead to a chaotic transition. For example, if a future leadership structure is not implemented, and the business passes on to more than one heir, the resulting power struggle may negatively impact the business. Alternatively, each heir may incorrectly assume the other will take over day-to-day responsibilities.

Before instructions can be given on who will take over leadership of the business, a future leader should be chosen. This is likely to be complicated when more than one heir is interested in taking over. Business owners can reference current business contributions and responsibilities from potential heirs to assist in choosing a successor.

Making business decisions within a family can get messy. Emotions can run high, especially after an untimely death or disability. Further, second-generation businesses rarely survive the transition, as they’re often sold by the inheriting family member, or fail outright. Only about 30% keep the same name and ownership following an inheritance.

Altogether, this should beg the question; is inheritance even the best idea? If your successor is skilled and business savvy, then perhaps the answer is “yes.” If not, you may consider selling your business to a co-owner, key employee, or outside buyer instead.

3. Selling Your Business to a Key Employee

When you don’t have a co-owner or family member to entrust with your business, a key employee might be the right successor. Consider employees who are experienced, business-savvy, and respected by your staff, which can ease the transition. Your org chart can help with this. If you’re concerned about maintaining quality after your departure, a key employee is generally more reliable than an outside buyer.

Just like selling to a co-owner, a key employee succession plan requires a buy-sell agreement. Your employee will agree to purchase your business at a predetermined retirement date, or in the event of death, disability, or other circumstance that renders you unable to manage the business.

A common drawback to key employee succession is money. Most employees aren’t in the financial position to buy the business they work for. Even if they are, having enough liquid cash on hand is another challenge.

One solution is seller financing, in which your employee pays you (or your family) back over time. There’s typically a down payment of 10% or higher, then monthly or quarterly payments with interest until the purchase is paid for in full. The exact terms of the loan will need to be negotiated and then laid out clearly in your succession plan.

4. Selling Your Business to an Outside Party

When there isn’t an obvious successor to take over, business owners may look to the community: Is there another entrepreneur, or even a competitor, that would purchase your business? To ensure that the business is sold for the proper amount, you will want to calculate the business value properly, and that the valuation is updated frequently.

This is easier for some types of businesses than others. If you own a more turnkey operation, like a restaurant with a good general manager, your task is simply to demonstrate that it’s a good investment. They won’t have to get their hands dirty unless they want to and will ideally still have time to focus on their other business interests.

Meanwhile, if you own a real estate company that’s branded under your own name, selling could potentially be more challenging. Buyers will recognize the need to rebrand and remarket and, as a result, may not be willing to pay full price.

Instead, you should prepare your business for sale well in advance; hire and train a great general manager, formalize your operating procedures, and get all your finances in check. Make your business as stable and turnkey as possible, so it’s more attractive and valuable to outside buyers.

One of the main drawbacks to an outside sale succession plan is the unexpected: It’s nearly impossible to predict exactly what the sales process will have in store. The process of selling a business to an outside party is complex and could encounter roadblocks like: your business not being as valuable as you anticipated, lack of credible buyers, your business not being able to sell at all, and more. Business brokers, like VNB Business Brokers , are experienced and well-versed in all aspects of selling and purchasing businesses on their clients’ behalf.

Consider outsourcing to a business broker so that you can focus on running your business and maintaining its value while professionals handle the sale. In addition to taking care of potential problems, VNB will ensure all steps of the process including finding and vetting buyers, structuring your deal, preparing documents, and negotiating terms. After one quick call, VNB Business Brokers will be able to tell you things like: what your business is worth, if the valuation price can be increased and how long it will take to sell your business.

Schedule a free consultation today and find out what the next step is.

5. Selling Your Shares Back to the Company

The fifth option is available to businesses with multiple owners. An “entity purchase plan” or a “stock redemption plan” is an arrangement where the business purchases life insurance on each of the co-owners. When one owner dies, the business uses the life insurance proceeds to purchase the business interest from the deceased owner’s estate, thus giving each surviving owners a larger share of the business.

An entity purchase is similar to a cross-purchase, in which you sell your shares to a co-owner or co-owners. In most circumstances, a cross-purchase is more financially viable. When co-owners purchase shares directly, they get a “step-up in basis,” which means the stock’s basis is revalued at its current price. With an entity purchase, the original basis remains, and your co-owners will be liable for potentially higher capital gains.

Despite this drawback, entity purchases can still be beneficial when you have a large number of co-owners. Drafting cross-purchase agreements with each owner can be cumbersome. An entity purchase agreement, in comparison, is much simpler to implement. It can typically be funded with a single life insurance policy for each co-owner.

How to Create a Succession Plan

There are several key steps necessary to create a comprehensive small business succession plan, and several ways to go about creating your plan. Some business owners may choose to create their own succession plan, while others may wish to engage the help of a professional, depending on the complexity of the plan and the business.

Whether you create your plan yourself or engage a professional, the five steps to writing a succession plan are:

- Determining timeline: Define when the succession should take place, either on a predetermined date or in the event of death or disability.

- Choosing your successor: If this is not a purchase by a specific party, consider choosing three or more potential candidates, filling out a profile for each.

- Formalizing your standard operating procedures: Document your standard operating procedures (SOPs), including an organizational chart, employee handbook, operations manual, and any other recurring meetings or processes.

- Valuing your business: Several methods exist to value your business. Once you have calculated your business’s value, it should be updated frequently.

- Funding your succession plan: Define a specific path that lays out how the successor will purchase the business. Options include life insurance, loan, and seller financing.

Small Business Succession Planning Providers

Creating a small business succession plan can be complicated, and many business owners choose to engage a professional third party to help them determine the value of the business, the type of succession plan, and create any supporting documentation. The choice of provider may be based on the complexity of the business as well as the event being planned for.

For small businesses with multiple employees and simple to complex finances, a local CPA may be a viable option, or you might consider hiring a business attorney to help you draft the paperwork. For more complex scenarios, a business attorney and CPA should likely be involved, to ensure that everything goes smoothly when the succession plan kicks in.

Finally, for larger, more complex businesses, business owners may wish to consider working with an accounting firm with extensive experience in creating business succession plans. There are hundreds, if not thousands, of such firms. Business owners can start by researching local firms or may choose to work with one of the so-called “Big Four,” such as PriceWaterhouseCoopers—operating as PwC—which specializes in privately held businesses.

Succession Planning Pro Tips

1. Avoid common mistakes

Asghar kazim, cfp, chfc, clu, principal & co-founder, united wealth group llc ..

“One of the most common mistakes business owners make in succession planning is failing to review their plan regularly. Time changes many things and, for your succession plan to be effective, it needs to be reviewed regularly and updated to reflect any changes. These could be company changes, tax law updates, changes in valuation, or new industry developments, among other things.

“For family-owned businesses, you’ll also need to consider aspects such as changing family dynamics—do all members have the same desire regarding what to do in the future, or are all key players still with the business? Business owners must update and adjust their business plan to reflect changes such as these.”

2. Create your succession plan at the right time

Whitney l. sorrell, jd, cpa, mba, principal attorney, sorrell law firm, plc.

“Business owners should start the succession preferably 5 years or more before they want to retire. Many business owners want to transfer their business to their family members in a way that minimizes the tax cost, holds the business assets in asset protected structures, continues the cash flow to the business owner post succession, and ensures a successful transition of management to the succeeding family members.

“The techniques bringing these benefits have better results over time. Other business owners are selling their business to a third-party buyer. Again, allowing time to prepare the business for sale will reach the highest possible price, and allowing time to properly structure that sale will allow the transaction to incur the smallest legal tax liability and the greatest level of wealth protection upon receipt of the sale price.

3. Consider the benefits of succession planning

Ed alexander, esq., founder, alexander abramson, pllc.

“The benefits of succession planning are that you don’t spend 30 years running and building a business only to leave empty-handed. Liquidating and closing up shop—not selling out—will be very unprofitable. The majority of the value of most businesses is in their goodwill and intangibles, not their hard assets.

“As I tell my clients, failing to plan is planning to fail. There have been many times when I’ve spoken to clients after their business sales, and they say to me, “I wish I’d started planning earlier.” They’re happy with the outcome, but they only realize after the fact how much even six months of additional planning could have improved the sale price.”

Bottom Line

While many experts recommend beginning succession planning three to five years ahead of retirement, it is never too early to begin. Knowing how your business will transition, who will take over, and how heirs and partners will be compensated are all keys to reducing future stress in the event of an owner’s sudden departure.

About the Author

Find Robert On LinkedIn

Robert Newcomer-Dyer

Robert has over 15 years of experience in sales leadership, finance, and business development. He recently spent six years leading a team of small business financing professionals, facilitating the deployment of critical capital to over 9,000 small businesses across the US.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

Business Succession Planning: A Step-by-Step Guide

Business succession planning is a valuable tool for both small businesses and growing enterprises. In small businesses, succession planning means effectively managing changes in ownership or leadership. In larger organizations, it that can help to avoid potential talent gaps that have a detrimental effect on the company. The right strategy can help you plan ahead so that you can transfer knowledge and retain employees in key roles. And this is a top priority in these uncertain, post-pandemic times.

With that in mind, we have created a step-by-step guide to help you design and implement a plan that sets your business up for long-term success . We will take a look at the benefits of succession planning in HR and break down the succession planning process to help you understand everything that’s involved.

What Is a Succession Plan?

Why is business succession planning important, what is succession planning in hr, the business succession planning process in 5 steps, business succession planning best practices, succession planning template, succession planning tools.

- Create a succession plan with performance management software 🚀

So, what is the definition of succession planning? How can you apply it to your business?

Business succession planning is a process that helps you prepare your company for the future. Essentially, it’s about creating a strategy and process for identifying potential future leaders and developing their skills so that they are ready to take on a new role when one of your key employees leaves the company.

Through careful planning, communication, training, and feedback, you can create a successful change management strategy that prepares you for potential transitions in your business. This helps you avoid key player talent gaps. It also helps you proactively develop your inclusive leaders of the future.

Despite its valuable role in business planning, according to a survey conducted by SHRM last year, only 44% of HR professionals claim that their organization has a succession plan in place. What’s more, only 21% of those that do have a plan in place have created a formal succession management plan.

Do you have a detailed succession plan in place? If not, then you’ve come to the right place.