- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

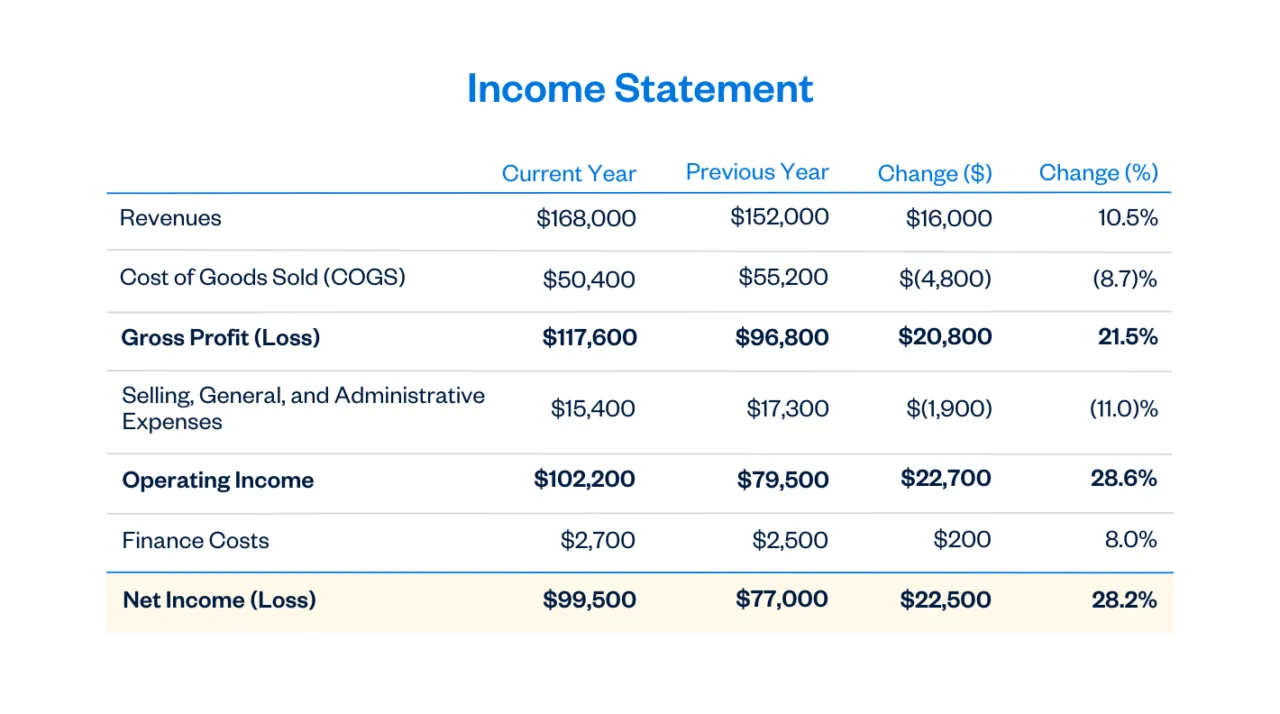

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

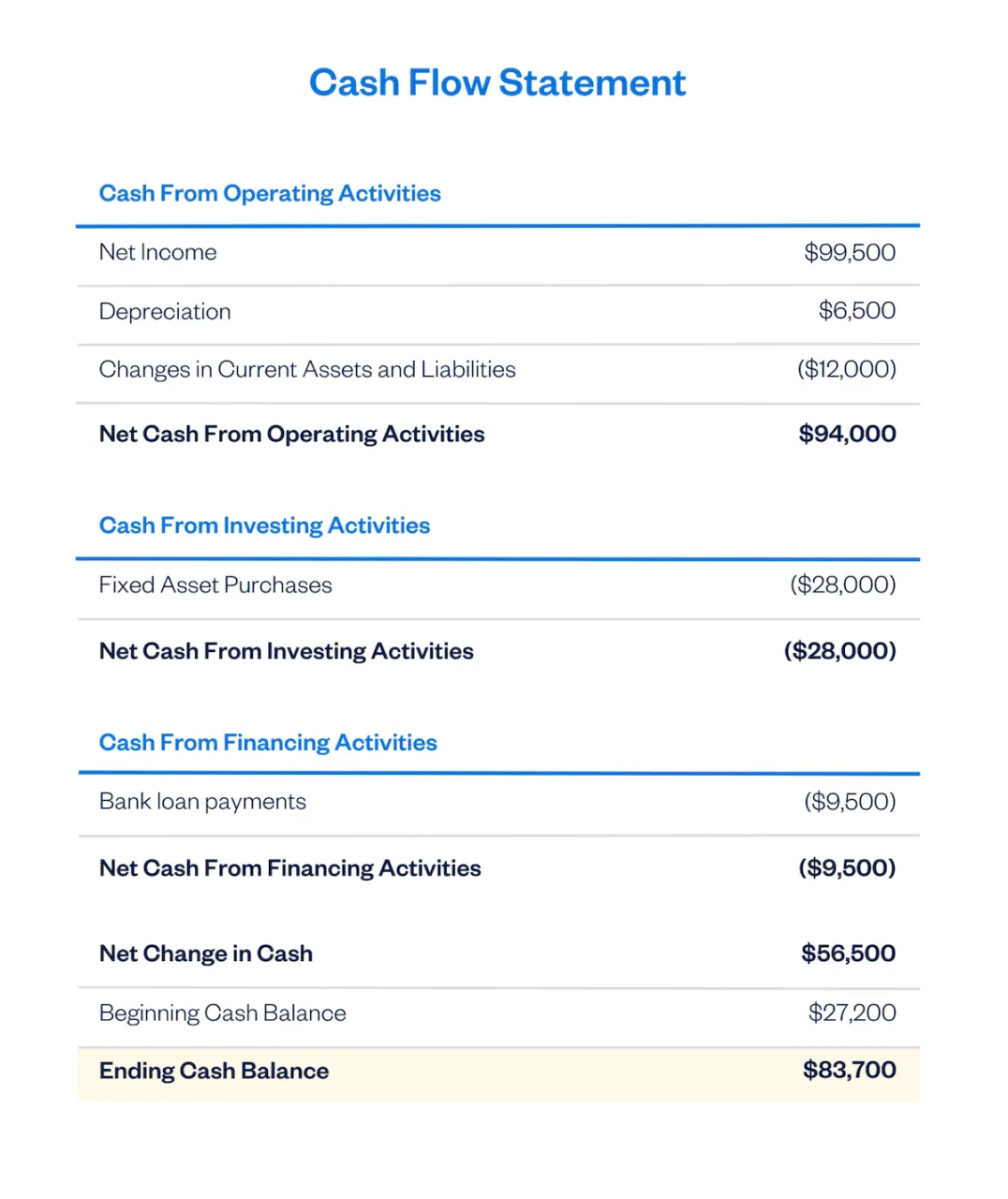

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

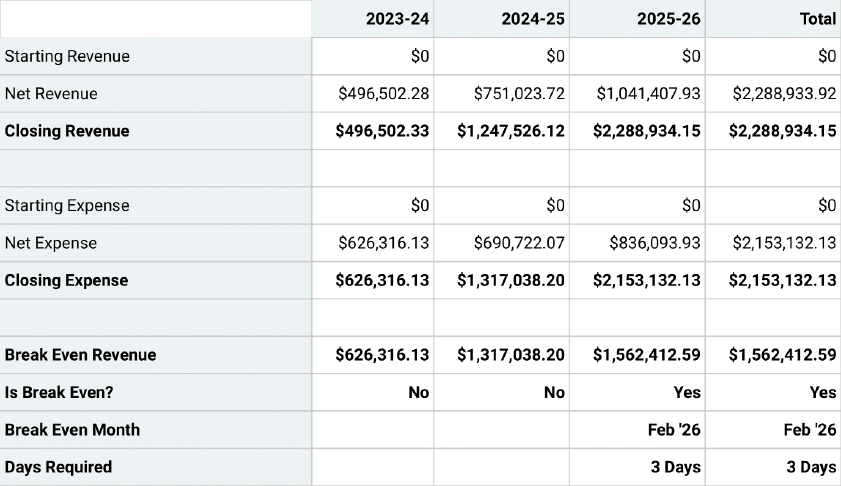

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

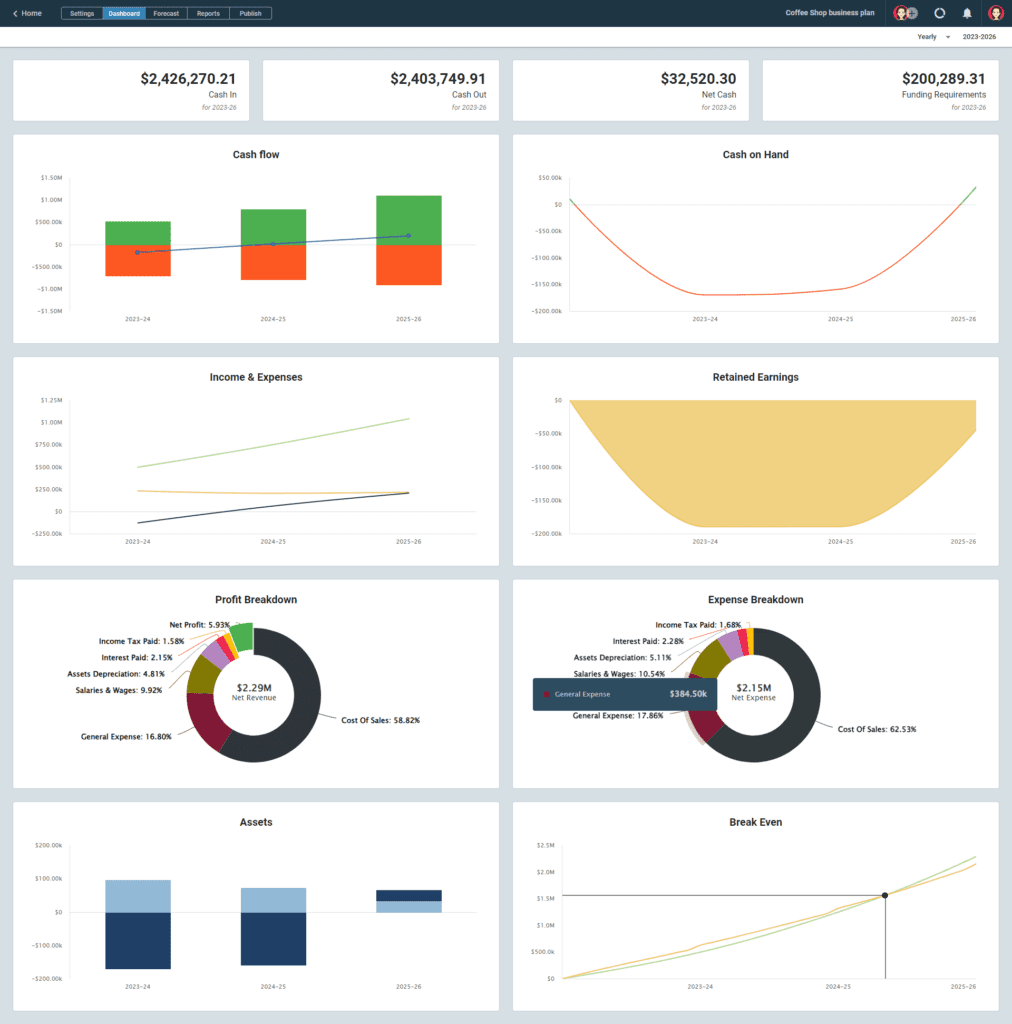

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

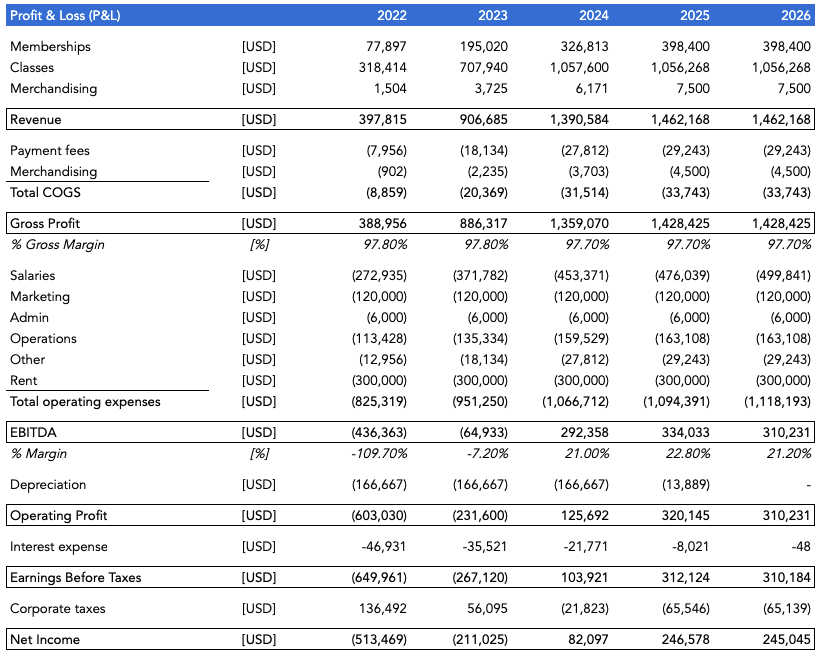

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

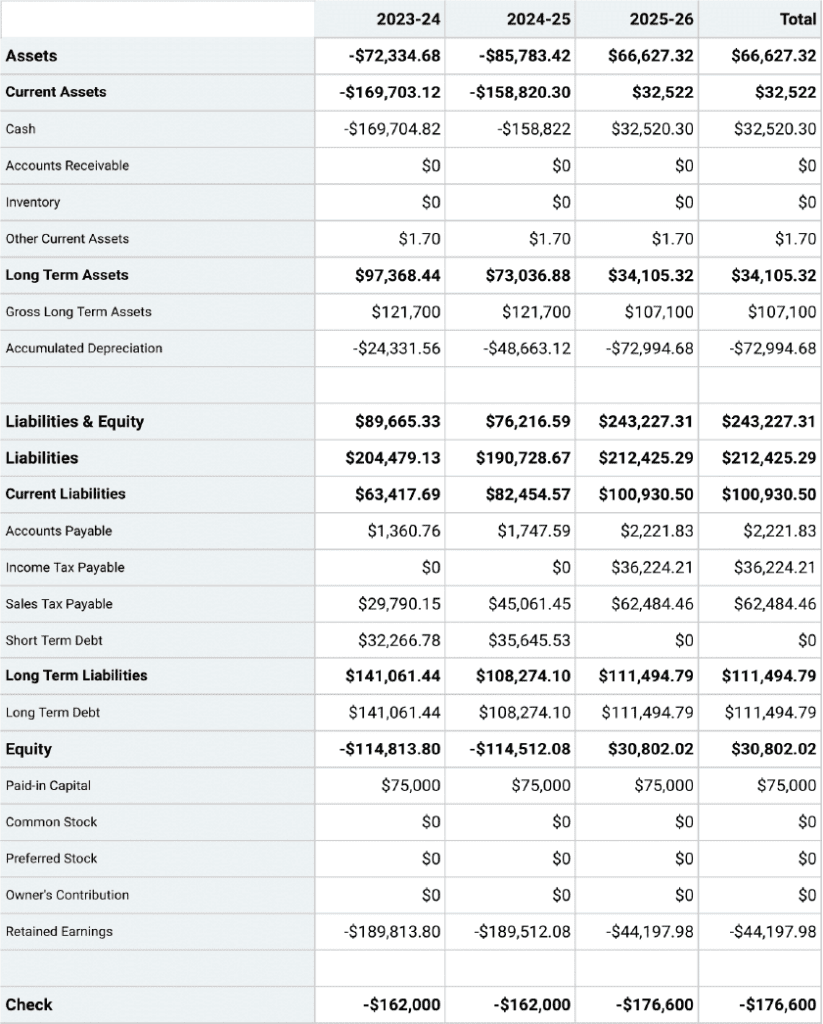

Projected Balance Sheet

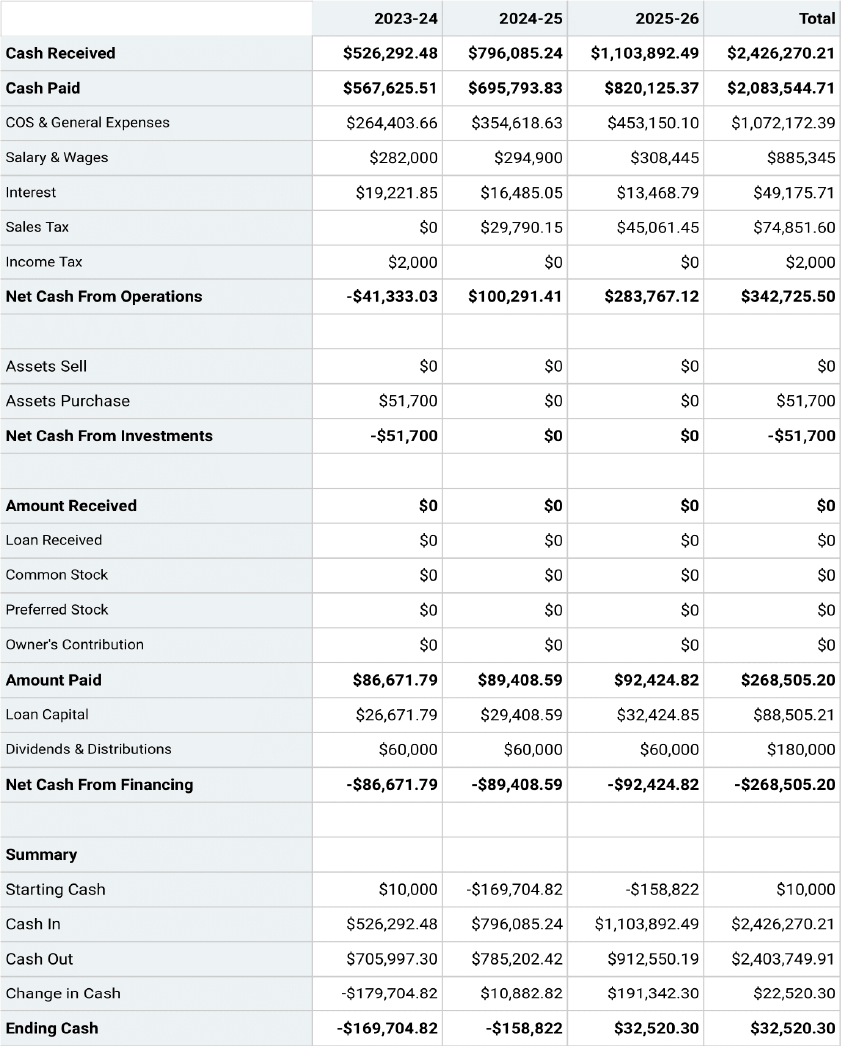

Projected Cash-Flow Statement

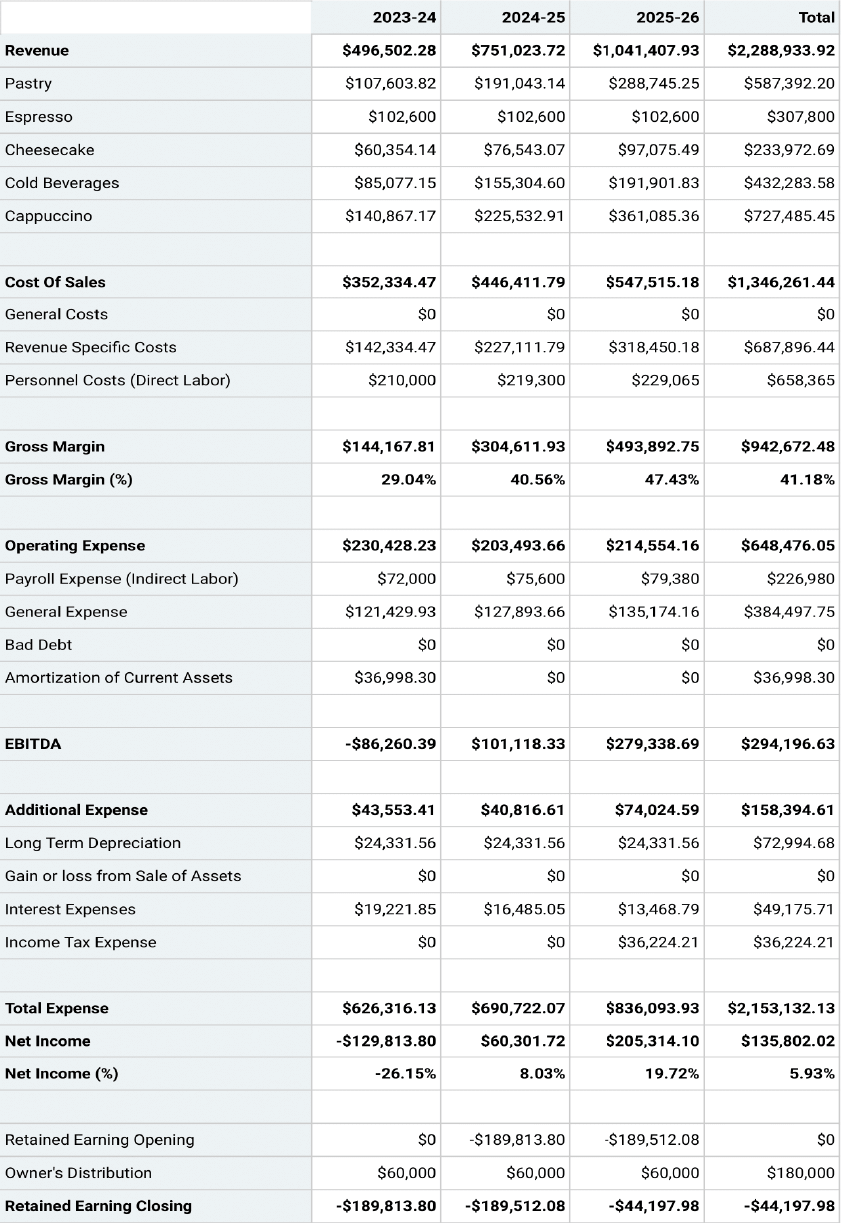

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, business plan financials: 3 statements to include.

The finance section of your business plan is essential to securing investors and determining whether your idea is even viable. Here's what to include.

If your business plan is the blueprint of how to run your company, the financials section is the key to making it happen. The finance section of your business plan is essential to determining whether your idea is even viable in the long term. It’s also necessary to convince investors of this viability and subsequently secure the type and amount of funding you need. Here’s what to include in your business plan financials.

[Read: How to Write a One-Page Business Plan ]

What are business plan financials?

Business plan financials is the section of your business plan that outlines your past, current and projected financial state. This section includes all the numbers and hard data you’ll need to plan for your business’s future, and to make your case to potential investors. You will need to include supporting financial documents and any funding requests in this part of your business plan.

Business plan financials are vital because they allow you to budget for existing or future expenses, as well as forecast your business’s future finances. A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Sections to include in your business plan financials

Here are the three statements to include in the finance section of your business plan:

Profit and loss statement

A profit and loss statement , also known as an income statement, identifies your business’s revenue (profit) and expenses (loss). This document describes your company’s overall financial health in a given time period. While profit and loss statements are typically prepared quarterly, you will need to do so at least annually before filing your business tax return with the IRS.

Common items to include on a profit and loss statement :

- Revenue: total sales and refunds, including any money gained from selling property or equipment.

- Expenditures: total expenses.

- Cost of goods sold (COGS): the cost of making products, including materials and time.

- Gross margin: revenue minus COGS.

- Operational expenditures (OPEX): the cost of running your business, including paying employees, rent, equipment and travel expenses.

- Depreciation: any loss of value over time, such as with equipment.

- Earnings before tax (EBT): revenue minus COGS, OPEX, interest, loan payments and depreciation.

- Profit: revenue minus all of your expenses.

Businesses that have not yet started should provide projected income statements in their financials section. Currently operational businesses should include past and present income statements, in addition to any future projections.

[Read: Top Small Business Planning Strategies ]

A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Balance sheet

A balance sheet provides a snapshot of your company’s finances, allowing you to keep track of earnings and expenses. It includes what your business owns (assets) versus what it owes (liabilities), as well as how much your business is currently worth (equity).

On the assets side of your balance sheet, you will have three subsections: current assets, fixed assets and other assets. Current assets include cash or its equivalent value, while fixed assets refer to long-term investments like equipment or buildings. Any assets that do not fall within these categories, such as patents and copyrights, can be classified as other assets.

On the liabilities side of your balance sheet, include a total of what your business owes. These can be broken down into two parts: current liabilities (amounts to be paid within a year) and long-term liabilities (amounts due for longer than a year, including mortgages and employee benefits).

Once you’ve calculated your assets and liabilities, you can determine your business’s net worth, also known as equity. This can be calculated by subtracting what you owe from what you own, or assets minus liabilities.

Cash flow statement

A cash flow statement shows the exact amount of money coming into your business (inflow) and going out of it (outflow). Each cost incurred or amount earned should be documented on its own line, and categorized into one of the following three categories: operating activities, investment activities and financing activities. These three categories can all have inflow and outflow activities.

Operating activities involve any ongoing expenses necessary for day-to-day operations; these are likely to make up the majority of your cash flow statement. Investment activities, on the other hand, cover any long-term payments that are needed to start and run your business. Finally, financing activities include the money you’ve used to fund your business venture, including transactions with creditors or funders.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

Applications are open for the CO—100! Now is your chance to join an exclusive group of outstanding small businesses. Share your story with us — apply today.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

More tips for your startup

How to change your ein, or how to fix an incorrect ein, micro-business vs. startup: what’s the difference, micro businesses: what are they and how do you start one.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Craft the Financial Section of Business Plan (Hint: It’s All About the Numbers)

Writing a small business plan takes time and effort … especially when you have to dive into the numbers for the financial section. But, working on the financial section of business plan could lead to a big payoff for your business.

Read on to learn what is the financial section of a business plan, why it matters, and how to write one for your company.

What is the financial section of business plan?

Generally, the financial section is one of the last sections in a business plan. It describes a business’s historical financial state (if applicable) and future financial projections. Businesses include supporting documents such as budgets and financial statements, as well as funding requests in this section of the plan.

The financial part of the business plan introduces numbers. It comes after the executive summary, company description , market analysis, organization structure, product information, and marketing and sales strategies.

Businesses that are trying to get financing from lenders or investors use the financial section to make their case. This section also acts as a financial roadmap so you can budget for your business’s future income and expenses.

Why it matters

The financial section of the business plan is critical for moving beyond wordy aspirations and into hard data and the wonderful world of numbers.

Through the financial section, you can:

- Forecast your business’s future finances

- Budget for expenses (e.g., startup costs)

- Get financing from lenders or investors

- Grow your business

- Growth : 64% of businesses with a business plan were able to grow their business, compared to 43% of businesses without a business plan.

- Financing : 36% of businesses with a business plan secured a loan, compared to 18% of businesses without a plan.

So, if you want to possibly double your chances of securing a business loan, consider putting in a little time and effort into your business plan’s financial section.

Writing your financial section

To write the financial section, you first need to gather some information. Keep in mind that the information you gather depends on whether you have historical financial information or if you’re a brand-new startup.

Your financial section should detail:

- Business expenses

Financial projections

Financial statements, break-even point, funding requests, exit strategy, business expenses.

Whether you’ve been in business for one day or 10 years, you have expenses. These expenses might simply be startup costs for new businesses or fixed and variable costs for veteran businesses.

Take a look at some common business expenses you may need to include in the financial section of business plan:

- Licenses and permits

- Cost of goods sold

- Rent or mortgage payments

- Payroll costs (e.g., salaries and taxes)

- Utilities

- Equipment

- Supplies

- Advertising

Write down each type of expense and amount you currently have as well as expenses you predict you’ll have. Use a consistent time period (e.g., monthly costs).

Indicate which expenses are fixed (unchanging month-to-month) and which are variable (subject to changes).

How much do you anticipate earning from sales each month?

If you operate an existing business, you can look at previous monthly revenue to make an educated estimate. Take factors into consideration, like seasonality and economic ups and downs, when basing projections on previous cash flow.

Coming up with your financial projections may be a bit trickier if you are a startup. After all, you have nothing to go off of. Come up with a reasonable monthly goal based on things like your industry, competitors, and the market. Hint : Look at your market analysis section of the business plan for guidance.

A financial statement details your business’s finances. The three main types of financial statements are income statements, cash flow statements, and balance sheets.

Income statements summarize your business’s income and expenses during a period of time (e.g., a month). This document shows whether your business had a net profit or loss during that time period.

Cash flow statements break down your business’s incoming and outgoing money. This document details whether your company has enough cash on hand to cover expenses.

The balance sheet summarizes your business’s assets, liabilities, and equity. Balance sheets help with debt management and business growth decisions.

If you run a startup, you can create “pro forma financial statements,” which are statements based on projections.

If you’ve been in business for a bit, you should have financial statements in your records. You can include these in your business plan. And, include forecasted financial statements.

You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business , to learn more about the different types of financial statements for your business.

Potential investors want to know when your business will reach its break-even point. The break-even point is when your business’s sales equal its expenses.

Estimate when your company will reach its break-even point and detail it in the financial section of business plan.

If you’re looking for financing, detail your funding request here. Include how much you are looking for, list ideal terms (e.g., 10-year loan or 15% equity), and how long your request will cover.

Remember to discuss why you are requesting money and what you plan on using the money for (e.g., equipment).

Back up your funding request by emphasizing your financial projections.

Last but not least, your financial section should also discuss your business’s exit strategy. An exit strategy is a plan that outlines what you’ll do if you need to sell or close your business, retire, etc.

Investors and lenders want to know how their investment or loan is protected if your business doesn’t make it. The exit strategy does just that. It explains how your business will make ends meet even if it doesn’t make it.

When you’re working on the financial section of business plan, take advantage of your accounting records to make things easier on yourself. For organized books, try Patriot’s online accounting software . Get your free trial now!

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

500+ business plans and financial models

4 Key Financial Statements For Your Startup Business Plan

- September 12, 2022

- Fundraising

If you’re preparing a business plan for your startup, chances are that investors (or a bank) have also asked you to produce financial projections for your business. That’s absolutely normal: any startup business plan should at least include forecasts of the 3 financial statements.

The financial projections need to be presented clearly with charts and tables so potential investors understand where you are going, and how much money you need to get there .

In this article we explain you what are the 4 financial statements you should include in the business plan for your startup. Let’s dive in!

Financial Statement #1: Profit & Loss

The profit and loss (P&L) , also referred to as “income statement”, is a summary of all your revenues and expenses over a given time period .

By subtracting expenses from revenues, it gives a clear picture of whether your business is profitable, or loss-making. With the balance sheet and the cash flow statement, it is one of the 3 consolidated financial statements every startup must produce every fiscal year .

Most small businesses produce a P&L on a yearly basis with the help of their accountant. Yet it is good practice to keep track of all revenues and expenses on a monthly or quarterly basis as part of your budget instead.

When projecting your financials as part of your business plan, you must do so on a monthly basis. Usually, most startups project 3 years hence 36 months. If you have some historical performance (for instance you started your business 2 years ago), project 5 years instead.

Expert-built financial model templates for tech startups

Financial Statement #2: Cash Flow

Whilst your P&L includes all your business’ revenues and expenses in a given period, the cash flow statement records all cash inflows and outflows over that same period.

Some expenses are not necessarily recorded in your P&L but should be included in your cash flow statement instead. Why is that? There are 2 main reasons:

- Your P&L shows a picture of all the revenues you generated over a given period as well as the expenses you incurred to generate these revenues . If you sell $100 worth of products in July 2021 and incurred $50 cost to source them from your supplier, your P&L shows $100 revenues minus $50 expenses for that month. But what about if you bought a $15,000 car to deliver these products to your customers? The $15,000 should not be recorded as an expense in your P&L, but a cash outflow instead. Indeed, the car will help you generate revenues, say over the next 5 years, not just in July 2021

- Some expenses in your P&L are not necessarily cash outflows. Think depreciation and amortization expenses for instance: they are pure artificial expenses and aren’t really “spent”. As such, whilst your P&L might include a $100 depreciation expense, your cash flow remains the same.

Financial Statement #3: Balance Sheet

Whilst the P&L and cash flow statement are a summary of your financial performance over a given time period, the balance sheet is a picture of your financials at a given time.

The balance sheet lists all your business’ assets and liabilities at a given time (at end of year for instance). As such, it includes things such as:

- Assets: patents, buildings, equipments, customer receivables, tax credits etc. Assets can be either tangible (e.g. buildings) or intangible (e.g. customer receivables ).

- Liabilities: debt, suppliers payables, etc.

- Equity : the paid-in capital invested to date in the company (from you and any other potential investors). Equity also includes the cumulative result of your P&L: the sum of your profits and losses to date

Whilst P&L and cash flow statement are fairly simple to build when preparing your business plan, you might need help for your balance sheet.

Financial Statement #4: Use of Funds

The use of funds is not a mandatory financial statement your accountant will need to prepare every year. Instead, you shall include it in your startup business plan, along with the 3 key financial statements.

Indeed, the use of funds tells investors where you will spend your money over a given time frame. For instance, if you are raising $500k to open a retail shop, you might need $250k for the first year lease and another $250k for the inventory.

Use of funds should not be an invention from you: instead it is the direct result of your cash flow statement . If you are raising for your first year of business, and your projected cash flow statement result in a $500k loss (including all revenues and expenses), you will need to raise $500k.

For instance, using the example above, if you need $500k over the next 12 months, raise $600k or so instead. Indeed, better be on the safe side in case things do not go as expected!

Privacy Overview

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

The Beginner’s Guide to Reading & Understanding Financial Statements

- 10 Jun 2020

An ability to understand the financial health of a company is one of the most vital skills for aspiring investors, entrepreneurs, and managers to develop. Armed with this knowledge, investors can better identify promising opportunities while avoiding undue risk, and professionals of all levels can make more strategic business decisions.

Financial statements offer a window into the health of a company, which can be difficult to gauge using other means. While accountants and finance specialists are trained to read and understand these documents, many business professionals are not. The effect is an obfuscation of critical information.

If you’re new to the world of financial statements, this guide can help you read and understand the information contained in them.

Access your free e-book today.

Understanding Financial Statements

To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: balance sheets, income statements, cash flow statements, and annual reports. The value of these documents lies in the story they tell when reviewed together.

1. How to Read a Balance Sheet

A balance sheet conveys the “book value” of a company. It allows you to see what resources it has available and how they were financed as of a specific date. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders).

The balance sheet also provides information that can be leveraged to compute rates of return and evaluate capital structure, using the accounting equation: Assets = Liabilities + Owners’ Equity.

Assets are anything a company owns with quantifiable value.

Liabilities refer to money a company owes to a debtor, such as outstanding payroll expenses, debt payments, rent and utility, bonds payable, and taxes.

Owners’ equity refers to the net worth of a company. It’s the amount of money that would be left if all assets were sold and all liabilities paid. This money belongs to the shareholders, who may be private owners or public investors.

Alone, the balance sheet doesn’t provide information on trends, which is why you need to examine other financial statements, including income and cash flow statements, to fully comprehend a company’s financial position.

This article will teach you more about how to read a balance sheet .

2. How to Read an Income Statement

An income statement , also known as a profit and loss (P&L) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period. The document is often shared as part of quarterly and annual reports, and shows financial trends, business activities (revenue and expenses), and comparisons over set periods.

Income statements typically include the following information:

- Revenue: The amount of money a business takes in

- Expenses: The amount of money a business spends

- Costs of goods sold (COGS): The cost of component parts of what it takes to make whatever a business sells

- Gross profit: Total revenue less COGS

- Operating income: Gross profit less operating expenses

- Income before taxes: Operating income less non-operating expenses

- Net income: Income before taxes less taxes

- Earnings per share (EPS): Division of net income by the total number of outstanding shares

- Depreciation: The extent to which assets (for example, aging equipment) have lost value over time

- EBITDA: Earnings before interest, taxes, depreciation, and amortization

Accountants, investors, and other business professionals regularly review income statements:

- To understand how well their company is doing: Is it profitable? How much money is spent to produce a product? Is there cash to invest back into the business?

- To determine financial trends: When are costs highest? When are they lowest?

This article will teach you more about how to read an income statement .

Related: Financial Terminology: 20 Financial Terms to Know

3. How to Read a Cash Flow Statement

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified duration of time, known as the accounting period. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of it.

Cash flow statements are broken into three sections: Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. Investing activity is cash flow from purchasing or selling assets—usually in the form of physical property, such as real estate or vehicles, and non-physical property, like patents—using free cash, not debt. Financing activities detail cash flow from both debt and equity financing.

It’s important to note there’s a difference between cash flow and profit . While cash flow refers to the cash that's flowing into and out of a company, profit refers to what remains after all of a company’s expenses have been deducted from its revenues. Both are important numbers to know.

With a cash flow statement, you can see the types of activities that generate cash and use that information to make financial decisions .

Ideally, cash from operating income should routinely exceed net income, because a positive cash flow speaks to a company’s financial stability and ability to grow its operations. However, having positive cash flow doesn’t necessarily mean a company is profitable, which is why you also need to analyze balance sheets and income statements.

This article will teach you more about how to read a cash flow statement .

4. How to Read an Annual Report

An annual report is a publication that public corporations are required to publish annually to shareholders to describe their operational and financial conditions.

Annual reports often incorporate editorial and storytelling in the form of images, infographics, and a letter from the CEO to describe corporate activities, benchmarks, and achievements. They provide investors, shareholders, and employees with greater insight into a company’s mission and goals, compared to individual financial statements.

Beyond the editorial, an annual report summarizes financial data and includes a company's income statement, balance sheet, and cash flow statement. It also provides industry insights, management’s discussion and analysis (MD&A), accounting policies, and additional investor information.

In addition to an annual report, the US Securities and Exchange Commission (SEC) requires public companies to produce a longer, more detailed 10-K report, which informs investors of a business’s financial status before they buy or sell shares.

10-K reports are organized per SEC guidelines and include full descriptions of a company’s fiscal activity, corporate agreements, risks, opportunities, current operations, executive compensation, and market activity. You can also find detailed discussions of operations for the year, and a full analysis of the industry and marketplace.

Both an annual and 10-K report can help you understand the financial health, status, and goals of a company. While the annual report offers something of a narrative element, including management’s vision for the company, the 10-K report reinforces and expands upon that narrative with more detail.

This article will teach you more about how to read an annual report .

A Critical Skill

Reviewing and understanding these financial documents can provide you with valuable insights about a company, including:

- Its debts and ability to repay them

- Profits and/or losses for a given quarter or year

- Whether profit has increased or decreased compared to similar past accounting periods

- The level of investment required to maintain or grow the business

- Operational expenses, especially compared to the revenue generated from those expenses

Accountants, investors, shareholders, and company leadership need to be keenly aware of the financial health of an organization, but employees can also benefit from understanding balance sheets, income statements, cash flow statements, and annual reports.

If you don’t have a financial background, the good news is that there are steps you can take to learn about finance and jumpstart your career . Building your financial literacy and skills doesn’t need to be difficult.

Are you interested in gaining a toolkit for making smarter financial decisions and communicating decisions to key stakeholders? Explore our online finance and accounting courses , and download our free course flowchart to determine which best aligns with your goals.

About the Author

ZenBusinessPlans

Home » Business Plans

How to Write a Business Plan Financial Projection [Sample Template]

How do you prepare a business plan financial statement? Do you need help developing business plan financial projections? Do you need a business plan projections template? Then i advice you read on because this article is for you.

What is a Business Plan Financial Statement?

The financial statement is a distinct section of your business plan because it outlines your financial projections. A business lives and dies based on its financial feasibility and most importantly its profitability. Regardless of how hard you work or how much you have invested of your time and money, people, at the end of the day, only want to support something that can return their investments with profits.

Your executive summary may be brilliantly crafted, and your market or industry analysis may be the bomb. But your business plan isn’t just complete without a financial statement to justify it with good figures on the bottom line.

Your financial statement is what makes or mars your chances of obtaining a bank loan or attracting investors to your business. Even if you don’t need financing from a third party, compiling a financial statement will help you steer your business to success. So, before we dig further into how to prepare a financial statement, you need to understand what a financial statement is not.

What’s the Difference Between a Financial Projection Statement and Accounting Statement?

However, you need to keep in mind that the financial statement is not the same as an accounting statement. Granted, a financial statement includes financial projections such as profit and loss, balance sheets, and cash flow, all of which makes it look similar to an accounting statement.

But the major difference between them is that an accounting statement deals with the past, while the financial projections statement of your business plan outlines your future spending and earnings. Having made this point clear, let’s now look at the steps involved on preparing a financial statement for your business plan.

So what exactly do you have to include in this section? You will need to include three statements:

- Income Statement

- Balance Sheet

- Cash-Flow Statement

Now, let’s briefly discuss each.

Components of a Business Plan Financial Statement

Income statement.

This beautiful composition of numbers tells the reader what exactly your sources of revenue are and which expenses you spent your money on to arrive at the bottom line. Essentially, for a given time period, the income statement states the profit or loss ( revenue-expenses ) that you made.

Balance sheet

The key word here is “ balance, ” but you are probably wondering what exactly needs to be weighed, right? On one side you should list all your assets ( what you own ) and on the other side, all your liabilities ( what you owe ), thereby giving a snapshot of your net worth ( assets – liabilities = equity ).

Cash flow statement

This statement is similar to your income statement with one important difference; it takes into account just when revenues are actually collected and when expenses are paid. When the cash you have coming in ( collected revenue ) is greater than the cash you have going out ( disbursements ), your cash flow is said to be positive.

And when the opposite scenario is true, your cash flow is negative. Ideally, your cash flow statement will allow you to recognize where cash is low, when you might have a surplus, and how to be on top of your game when operating in an uncertain environment.

How to Prepare a Business Plan Financial Projections Statement

1. Start by preparing a revenue forecast and a forecast profit and loss statement

Also, prepare supporting schedules with detailed information about your projected personnel and marketing costs. If your business has few fixed assets or it’s just a cash business without significant receivables, you don’t need a forecast balance sheet.

2. Using your planned revenue model, prepare a spreadsheet

Set the key variables in such a way that they can be easily changed as your calculations chain through. To ensure that your projected revenues are realistic and attainable, run your draft through a number of iterations. For each year covered in your business plan, prepare a monthly forecast of revenues and spending.

3. If you plan to sell any goods, then include a forecast of goods sold

This applies the most to manufacturing businesses. Give a reasonable estimate for this cost. And be of the assumption that the efficiency of your products would increase with time and the cost of goods sold as a percentage of sales will decline.

4. Quantify your marketing plan

Look at each marketing strategy you outlined in the business plan and attach specific costs to each of them. That is, if you are looking at billboard advertising, TV advertising, and online marketing methods such as pay-per-click advertising and so on; then you should estimate the cost of each medium and have it documented.

5. Forecast the cost of running the business, including general and administrative costs

Also, forecast the cost of utilities, rents, and other recurring costs. Don’t leave out any category of expenses that is required to run your business. And don’t forget the cost of professional services such as accounting and legal services.

6. In the form of a spreadsheet, forecast the payroll

This outlines each individual that you plan to hire, the month they will start work, and their salary. Also include the percentage salary increases (due to increased cost of living and as reward for exemplary performance) that will come in the second and subsequent years of the forecast.

Additional tips for Writing a Business Plan Financial Statement

- Don’t stuff your pages with lots of information, and avoid large chunks of text. Also, use a font size that is large enough. Even if these would spread out your statement into more pages, don’t hesitate to spread it out. Legibility matters!

- After completing the spreadsheets in the financial statement, you should summarize the figures in the narrative section of your business plan.

- Put a table near the front of your financial statement that shows projected figures, pre-tax profit, and expenses. These are the figures you want the reader to remember. You can help the reader retain these figures in memory by including a bar chart of these figures, too.

As a final note, you should keep in mind that a financial statement is just an informed guess of what will likely happen in the future. In reality, the actual results you will achieve will vary. In fact, this difference may be very far from what you have forecast.

So, if your business is a start-up, prepare more capital than your projections show that you will need. Entrepreneurs have a natural tendency to project a faster revenue growth than what is realistic. So, don’t let this instinct fool you.

More on Business Plans

SMALL BUSINESS MONTH. 50% Off for 6 Months. BUY NOW & SAVE

50% Off for 6 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to make financial statements for small businesses.

Information is power. As long as you can make sense of that information. As a business owner, you’ll want to track your financial progress to make informed business decisions about your future. And that involves understanding cash flows, operating expenses, and net profit, all found in your financial statements.

Even if you delegate the bookkeeping to a professional, and don’t prepare financial statements yourself, you’ll need to know what your CPA is talking about when they walk you through your balance sheet.

In this article, you’ll learn about the 3 principal financial statements—income statements, balance sheets, and cash flow statements—and how to interpret them.

Here’s what we’ll cover: Income Statement (Profit and Loss Statement) Balance Sheet Difference Between an Income Statement and a Balance Sheet Cash Flow Statement Financial Statements Are Fundamental

NOTE: FreshBooks Support team members are not certified tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need tax advice, please contact an accountant in your area .

Income Statement (Profit and Loss Statement)

An income statement shows a company’s financial performance by revealing whether it’s made a profit or a loss.

Without an income statement, you’d be in the dark about the profitability of your business. An income statement is also known as a profit and loss statement, profit and loss account, or P&L.

The reporting period for an income statement is typically one fiscal year.

What Goes on an Income Statement?

Let’s now jump to the format of an income statement.

In most cases, it will look something like this:

Now, let’s dig into what an income statement covers.

Revenues (or Sales)

This is the top line on your income statement. It’s the total amount for the year of all the things or services you sold. But if you’ve given any discounts, you’ll reduce your sales by the discount amount.

For example, if you sold $100 in t-shirts but offered a 10% discount as a Black Friday incentive, you would record $90 as your net sales amount.

Cost of Goods Sold (or Cost of Sales)

These are the expenses directly related to the sales you’ve made. Suppose you’re selling electronics. The cost of goods sold is the cost of the electronics you sell within a financial year. And this is important. It’s not the cost of the electronics you bought in the year.

In a service-related business, a consultancy, for example, the cost of sales is often termed direct costs. Hence, you’ll include costs directly related to your service.

Gross Profit

Gross profit is the profit that results directly and specifically from the trading activity of buying and selling. You calculate the gross profit by subtracting the cost of goods sold from revenues.

Selling, General, and Administrative Expenses

All other expenses like salaries, rent, or travel merely facilitate the main trading activity of your business and are often categorized under selling, general, or administrative (SG&A) expenses.

You can have as many categories of SG&A expense as is necessary and helpful for running your business. Some of the common ones are:

- Office supplies

- Salaries and wages

- Marketing and advertising

Operating Income

Next is operating income. As the name implies, it’s the profit your business has earned from its operations when considering all the revenue and expenses necessary to run your business.

Finance Costs

Finance costs represent the costs of financing arrangements, such as interest on bank loans. You’ll want to strip financing costs away from SG&A expenses because they don’t represent the costs necessary for producing the goods or services you sell.

Net Income

After factoring in finance costs, you’re left with net income (or net loss). This is the much-talked-about bottom line. Your net income is how much your company has earned throughout the year.

What About Income Taxes?

You may ask yourself, why didn’t we include taxes? A small business isn’t burdened with income tax unless it’s structured as a C-corporation (which few small businesses are due to their complexity and maintenance costs). Instead, the business profits pass through to the owner and get taxed on the individual Form 1040.

Balance Sheet

Also known as the statement of financial position, the balance is an organization’s most important financial report because it shows the company’s financial health.

A balance sheet reports data for a specific point in time, often the last day of a fiscal year.

What Goes on a Balance Sheet?

Balance sheets contain 3 sections: assets, liabilities, and equity.

These are the resources your company owns that have a current or future economic value. These include cash, equipment (such as computers), and vehicles.

Assets can be broken down into:

- Current assets: This is anything you own that can be converted to cash within one year (e.g., accounts receivable and inventory). Also called short-term assets.

- Non-current assets: These are assets that can’t be quickly converted into cash, like computers, equipment, and vehicles, or intangible assets, like trademarks and copyrights. Also called fixed assets or long-term assets.

2. Business Liabilities

These are amounts your business owes other entities such as banks, employees, and suppliers.

- Current liabilities: Amounts you owe that are due within one year (e.g., accounts payable and payroll liabilities)

- Non-current (long-term) liabilities: Debts that will be repaid in more than one year

3. Owner Equity or Shareholder Equity

This is the value of the owner’s or shareholders’ investment in the business after liabilities are subtracted from assets. It may also be called owner’s or shareholders’ capital.

Purpose of a Balance Sheet

The balance sheet shows anyone what your business is worth. Lenders, investors, partners, and potential buyers will want to review your balance sheet.

The overall worth of your business can be measured or estimated by the total value of its assets, which are recorded and presented on the balance sheet.

But even more important, your balance sheet shows your business’s net worth , which is the owner’s equity (or shareholder’s equity). This is a business’s residual value after removing its liabilities . It’s what ultimately belongs to the business owner.

Format of a Balance Sheet

Balance sheets are prepared based on the accounting equation, which is:

Traditionally, before accounting software was developed and bookkeeping was done with pencil and paper, assets were put on the left side of the balance sheet, while equity and liabilities went to the right side.

Today, however, a balance sheet will almost always look like this:

Now here’s something to remember.

The net income (your income statement bottom line) is annually transferred to your balance sheet, where it will appear as retained earnings. So retained earnings are a running total of your company’s profitability from day 1.

Difference Between an Income Statement and a Balance Sheet

If you want to know how your business has performed over a span of time (a year, month, or quarter), you’ll want to refer to your income statement.

On the flip side, if you want to know your business’s financial health, to know its value or worth at a particular point since it was established, the balance sheet is the report you’ll want to refer to.

Cash Flow Statement

A cash flow statement shows the movement of cash, the cash inflows and outflows within the business, based on 3 cash sources and cash expenditure categories: operations, investing, and financing.

This is an extremely important financial statement because, ultimately, cash is the best indicator of the financial health of an enterprise.

The reporting period for a cash flow statement is often one fiscal year but could be a quarter, month, or any reporting period that makes sense for your business.

Why Do You Need a Cash Flow Statement?

You already have an income statement that shows you the profits you’ve made. Why do you still need a cash flow statement?

An income statement is prepared based on the accrual method of accounting . This means your sales are recorded when you earn them, not when your business receives the actual cash.

This creates a timing difference. A sales amount of $10,000 on your income statement, for example, doesn’t always mean this amount is in your bank account. It may be an invoice you sent to your customer, and you’re still awaiting payment.

The same goes for expenses. In accrual-basis accounting, expenses are recorded when your business incurs them and not when you pay out the cash.

But what about the cash figure on the balance sheet? While the balance sheet captures the cash balance, which can be meaningful, this balance sheet figure doesn’t tell us the source of the cash.

The cash could be from a windfall, like an insurance claim, which is a one-time event and unsustainable. Or it could be from normal day-to-day business operations, which are more sustainable.

Sections of a Cash Flow Statement

A cash flow statement has 3 sections:

- Cash from operations (or from operating activities)

- Cash from investing activities

- Cash from financing activities

And this is what a typical cash flow statement looks like:

Cash From Operating Activities

Cash from operations is the first section of a cash flow statement, revealing its relative importance in the cash flow statement hierarchy. Cash from operating activities is the most meaningful because this is cash from your day-to-day trading activities.

These include cash received from sales, set off against cash expenses like the cost of goods sold, utility expenses, and rent.

It also takes into account non-cash items, like depreciation , that are included in net income but don’t involve any actual cash movement. And it considers any changes in your assets and liabilities during the time period, like an increase in accounts receivable .

Since operating activities are the mainstay of a business, a company with positive cash flow from operating activities will be more sustainable.

Cash From Investing Activities

The main source and use of cash from investing activities are purchasing and selling fixed assets. Common examples of fixed asset items are things like buildings, vehicles, computer equipment, or machinery.

But other investment items can appear in the investing activity section, such as buying stocks and bonds for investment purposes.

Cash From Financing Activities

All cash inflows and outflows from financing activities will be captured in this last section of cash flow statements.

If you’ve taken out a bank loan to purchase equipment, the cash the bank provided you will show up in this section. And when you begin making loan payments, these will be included here.

Financial Statements Are Fundamental

In Sam Walton’s autobiography Made In America , here’s what Al Johnson, the CEO of Walmart at one time, revealed about Walmart’s owner and founder:

“Every Friday morning for six years, I would take my columnar pad with all the numbers on it into Sam’s office for him to review. Sam would jot them down on his own pad and work through the calculations himself. I always knew I could not just go in there and lay a sheet of numbers in front of him and expect him to just accept it.”

As a small business owner, you should be able to make sense of your financial statements. It will ensure you ask the right questions and follow important clues and cues.

You can make financial statements manually in a spreadsheet, but accounting software automates everything, so it’s faster and easier and leaves less room for error. With all your financial information in one place, you can immediately access your financial data whenever you or your accountant needs it.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

Pro Forma Business Plan Template & Financial Statements

Written by Dave Lavinsky

What are Pro Forma Financial statements?

A pro forma business plan is simply another name for a business plan. The term “pro forma” specifically means “based on financial assumptions or projections” which all business plans are. That is, all business plans present a vision of the company’s future using assumptions and projections. “Pro forma” most specifically refers to the financial projections included in your plan, as these are entirely based on future assumptions.

Pro forma financial statements are a type of statement that provides estimates or financial projections for a company. They are often used by businesses to plan for upcoming periods or quarters, assess new opportunities, or track progress against goals.

Why include a Pro Forma Statement in your Business Plan

A pro forma statement is important for your business plan because it gives investors and lenders an idea of your company’s potential financial health. They use your pro forma statements in determining whether to invest in your company or not. Among other things, they consider the likelihood your company will achieve the financial results you forecast, and their expected return on investment (ROI). Your pro forma financial statements also help you to identify and track key financial indicators and metrics over time.

Writing a Pro Forma Business Plan

When writing a pro forma business plan, you will need to include information such as your company’s sales forecasts, expenses, capital expenditure plans, and funding requirements. You should also include a pro forma income statement, balance sheet, and cash flow statement.

Importance of a Pro Forma Income Statement in Business Plans

The pro forma income statement is a crucial financial tool that can be used to assess the viability of your business. It shows a company’s expected revenue and expenses over a period of time and can help you to identify potential problems early on.

Finish Your Business Plan Today!

Types of pro forma statements in business plans.

There are several types of pro forma statements, including the income statement, balance sheet, and cash flow statement.

Pro Forma Income Statement

A pro forma income statement is an estimate of your company’s financial performance over a period of time. It shows your expected revenue and expenses and can be used to assess the viability of your business.

Example 5 Year Annual Income Statement

Pro Forma Balance Sheet

A pro forma balance sheet is an estimate of your company’s financial position at a specific point in time. It shows your assets, liabilities, and equity, and can be used to assess your company’s financial health.

Example 5 Year Annual Balance Sheet

Pro Forma Cash Flow Statement

A pro forma cash flow statement is an estimate of how your company’s cash flows over a period of time. It shows your expected cash inflows and outflows and can be used to assess your company’s financial health and ensure you never run out of money.

Example 5 Year Annual Cash Flow Statement

Pro Forma Income Statements for a Business Plan

Pro forma statements for a business plan can take many different forms, but they all typically include information on sales forecasts, expenses, capital expenditure plans, and funding requirements. A pro forma statement that is included in a business plan template should also include financial projections and break-even analysis.

Cash Flow Statements and Pro Forma Income Statements

The main difference between a cash flow statement and a pro forma income statement is that a cash flow statement shows your actual cash inflows and outflows, while a pro forma income statement shows your estimated future financial performance. For example, if you make a sale today, it will be considered revenue in your income statement. But, if you don’t receive payment for that sale for 90 days, that would be reflected in your cash flow statement. A cash flow statement can help you to manage your finances effectively, while a pro forma income statement can help you to assess the viability of your business.

Pro Forma Statements and Budgets

Pro forma statements and budgets are both financial tools that can be used to track the progress of a business. However, there are key differences between them.

A budget is a plan for how you will use your resources to achieve specific goals. It shows your expected income and expenses and can help you to stay on track financially.

A pro forma statement estimates your company’s future financial performance. It shows your expected revenue and expenses and can be used to assess the viability of your business.

Both pro forma statements and budgets can be useful tools for businesses. However, budgets are more focused on short-term planning , while pro forma statements are more concerned with long-term financial planning.

Business Plan Pro Forma Template and Example

The following is an example of a pro forma business plan:

Executive Summary

In this pro forma business plan, we forecasted our company’s sales, expenses, and capital expenditures over the next three years. We also estimated our funding requirements and outlined our plans for growth. Our pro forma income statement shows that we are expected to have positive net income each year of the forecast period. Our pro forma balance sheet shows that we will have a strong financial position, with increasing equity and minimal debt. Lastly, our pro forma statement predicts healthy cash flow throughout the three-year period. We believe that these results demonstrate the viability of our business and its potential for long-term success.

Our company is XYZ, a leading provider of ABC products and services. We have been in business for 10 years, and our products are sold in over 10 countries. We have a strong track record of financial success, and we are now looking to expand our operations into new markets. In order to do this, we need to raise $5 million in funding.

Business Plan Pro Forma

In this section of the business plan, we will provide pro forma statements for our company’s sales, expenses, capital expenditures, funding requirements, and cash flow. These statements will demonstrate the viability of our business and its potential for long-term success.

Sales Forecast

We forecast that our sales will increase by 20% in each year of the forecast period. This growth will be driven by our expansion into new markets, as well as our continued focus on innovation and customer service.

Expense Forecast

We expect our expenses to increase at a slower rate than our sales, due to our economies of scale. We anticipate that our expenses will increase by 15% in Year 1, 10% in Year 2, and 5% in Year 3.

Capital Expenditure Forecast

We forecast that our capital expenditures will increase in line with our sales, at a rate of 20% per year. We plan to invest heavily in research and development, as well as new product launches.

Funding Requirements

We estimate that we will need to raise $5 million in funding in order to expand our operations into new markets. We plan to use this funding to invest in research and development, as well as to cover the costs of marketing and new product launches.

Cash Flow Forecast

Our pro forma cash flow statement predicts healthy cash flow throughout the three-year period. We expect to have positive cash flow in each year of the forecast period.