- HR & Payroll

How to Calculate Labor Costs: The Small Business Owner’s Guide

Did you know many small businesses were shut down in 2021 because they were unable to keep the labor cost low?

Depending on the industry, business owners must deal with a variety of significant operational costs such as rent, inventory, labor cost calculations, and a few others.

Labor cost calculations must be appropriately accounted for by business owners who want to stay on budget and optimize earnings.

Otherwise, it's all too simple to overspend or undercharge, which isn't a good way to operate a company part of labor cost calculations.

Let us look more into details in this article:

•What is labor cost, and why is it important for business owners to figure it out?

•Why Calculate Labor Cost?

•How to calculate labour cost?

•The importance of total labor costs

•Employee Labor Percentage: How to Work It Out?

•Labor Percentages for Groups of Workers

•Different Types of Compensation

•As a small business, how do you pay an employee?

What is labor cost, and why is it important for business owners to figure it out?

- The total amount spent on employees by your company includes salary for hourly and salaried workers, as well as employee perks and taxes.

If you run a manufacturing or production-oriented company, the amount you spend on labor costs has an impact on your company's prime cost, which includes the total cost of products sold plus other expenses.

Many business owners use this statistic to evaluate their company's efficiency and profitability of labor cost calculations. As a result, it's critical to keep in mind that labor cost calculations are far higher than hourly or salaried pay.

Payroll taxes, overtime, employer national insurance contributions, bonuses, sick days, maternity and paternity pay, training costs, and more are all included in labor cost calculations.

Anything that has anything to do with employee compensation can be considered a labor cost calculations. In small-business operations, labor cost calculations are a crucial component.

It's normal for a business owner to hire staff to execute specific tasks that are critical to the company's success - especially as the company grows.

For labor cost calculations, there are several types of business labor, and each business labor expense can be ascribed to one of them. Accounting software is used by most managers to compute labor cost calculations.

Variable labor, fixed labor, direct labor, and indirect labor are the four categories of labor cost calculations.

•Variable Labor

Variable labor expenses fluctuate according to the entire amount of production output, as the name implies.Hourly employees are the most popular sort of variable labor for small firms of labor cost calculations.

The variable labor cost calculations move in lockstep with the increase or fall in demand for these businesses.While most organizations hire these personnel directly, some use a temporary employment agency to recruit and hire new variable labor staff of labor cost calculations.

Small organizations frequently utilize variable labor staff to keep labor cost calculations down and ensure that pay does not exceed projected income.

It's uncommon for business owners to guarantee working hours to these personnel since they desire to preserve the right to reduce hours if sales and production output fall short of labor cost calculations.

•Fixed Labor

According to the Small Business Administration, fixed labor cost calculations stay constant regardless of a company's production output.Fixed labor cost calculations are apparent examples of owners and employees that earn a fixed compensation regardless of total hours worked.

One advantage of constant labor cost calculations is that owners don't have to pay overtime to managers and supervisors.

Lowering fixed labor cost calculations without sacrificing the efficiency or efficacy of business operations, on the other hand, is usually difficult.

•Direct Labo r

Direct expenses are costs associated with a specific cost object, such as raw materials needed in the development of a specific product or software used to ensure the quality of a consumer good or service. Labor and direct materials account for the majority of direct expenditures of labor cost calculations.

Variable and constant labor cost calculations can be classified as direct or indirect labor costs, according to the Financial Accounting Standards Board, which is the authority on the generally accepted accounting principles.

All employees who are responsible for generating a company's products or services are considered direct labor part of labor cost calculations. Quality control engineers, assembly line employees, production supervisors, and delivery truck drivers are all examples of direct labor.

Direct labor, as opposed to indirect labor, refers to the costs associated with each consumer goods or service produced by a corporation part of labor cost calculations.

To determine a portion of the cost of products sold, direct labor is often managed through the use of precise time clock codes that can be linked to various manufacturing departments.

•Indirect Labor

Indirect labor refers to labor cost calculations that cannot be linked back to a specific product or service, or that are otherwise labor expenses that are shared across the firm, such as administrative function expenses.

Office managers, accountants, sales team members, maintenance personnel, and administrative assistants are some such examples part of labor cost calculations.

While indirect labor contributes to a firm's indirect manufacturing overhead, it is a sort of labor cost calculations that is not allocated to the company's products or services because it affects the entire company.

Because employees provide auxiliary services to the company's overall manufacturing process, this labor cost, unlike direct labor expenses, cannot be ascribed to a single product or service.

It's crucial to remember that indirect labor must be paid for using gross income from product sales part of labor cost calculations. Within your overall business running costs, labor cost and labor cost percentage are two of the most important variables to monitor of labor cost calculations.

Why? Because labour is one of the most expensive aspects of running a restaurant.

According to Chron, restaurant labor cost calculations account for 30-35 percent of overall income on average in the foodservice industry. Furthermore, the labor cost calculations is rising all the time.

In a 2019 research, over half of restaurant operators cited rising labour costs. As a result, several businesses have had to raise menu pricing or cut personnel.

So, what is the difference between labour cost and labour cost percentage? And how can restaurateurs accurately calculate them? The amount you spend on labour has an impact on your prime cost, which is the metric that many restaurateurs use to assess their restaurant's efficiency.

Labour expenditures must be weighed in with your other continuous expenses, such as rent and food. Because labour is by far the largest expense most firms encounter, knowing how to calculate labor cost calculations is critical if you want to run a profitable organization.

Labor cost calculations vary per industry, although they typically account for roughly 60% of overall expenses in most industries.

Employers paid an average of $37.73 per hour worked by non-government workers in March 2020. That figure rises to $52.45 per hour for federal employees.

There is no way to tell how much each extra employee costs your company unless you have a solid labour cost formula.It's impossible to accurately forecast your existing and future hiring capabilities without this information. If you don't know how much labour costs to produce your goods or services, you won't be able to price them correctly.

While it may appear that calculating labour costs is simple, many organisations take a very narrow approach, only accounting for the cost of employee compensation.

This is included in the labour cost formula, but your total labour cost includes all of the costs associated with hiring, onboarding, training, and retaining personnel. This comprises payroll taxes, benefit packages, and other employee-related costs like space and equipment.

Why Calculate Labor Cost?

You wouldn't sign a lease for new office space without first performing the arithmetic to check if the monthly rent was affordable, right? Similarly, you should not hire a new employee unless you have completed a thorough analysis of whether the benefits of hiring them outweigh the financial cost.

Many businesses run into problems as they grow because they overestimate their personnel demands and underestimate the true labor cost calculations.

In the best-case scenario, this reduces profits, and in the worst-case scenario, it necessitates layoffs.Using a labour cost formula, you can get a specific dollar figure for how much each hour of labour cost calculations.

It's far easier to figure out how many full-time and part-time staff you can afford to hire with this amount in mind than it is to estimate. Knowing your labour expenses allows you to determine the best prices for your products, maximizing your revenues. If you undervalue your labour costs, you'll establish prices that are too low and end up with margins that are insufficient to keep your business afloat.

If you overestimate labour costs, you'll end up with excessively expensive prices and won't be able to compete effectively, you should have marketing skills.

When determining how much to charge, consider labour expenditures as well as the cost of goods supplied.Finally, assessing your labor cost calculations might assist you in identifying revenue leaks that are eroding company profits. Employee mobile phone usage, company vehicle mileage, and hiring costs are just a few examples.

Monitoring expenditure patterns in these areas can also aid in the detection of possible fraud.

How to calculate Labour Cost?

It's a little more complicated to calculate the overall cost of labour than just adding up the entire cost of all the payments. The following is a step-by-step guide to calculate an employee's total labour cost with the formula for direct labor cost.

● Calculate the gross paymen t

The gross remuneration for an hourly employee is just the number of hours worked multiplied by the hourly rate with the the formula for direct labor cost. It is essentially the salary that an employee receives during a certain period for a salaried employee.

When an employee works full-time, for example, they may work 2,080 hours in a year (40 hours x 52 weeks). As a result, you'll begin with the following equation, the formula for direct labor cost.

Gross Pay = Pay Rate x Gross hours

Gross Pay = £15/hour x 2,080 hours

Gross Pay = £31,200

● Calculate the additional labour costs

Add the costs of each payment or benefit with the the formula for direct labor cost, such as non-salaried employees' overtime pay, employer-paid payroll taxes, bonuses, sick pay, vacation days, paid training, employer contributions to retirement plans, and employer-paid health and life insurance of the formula for direct labor cost.

● Calculate the total cost of labour

To calculate the total labour cost for each employee use the formula for direct labor cost, add the gross payment and any additional labour cost calculations.

Gross pay with additional labour costs equals total labour cost calculations. You can compute the overall labour cost calculations for a year, a week, or the projected time frame of a given project, depending on what you're doing.

• Recruitment

Before you even recruit your first employee, you start incurring labour cost calculations. After all, maintaining a website, promoting job postings, attending job fairs, and other recruitment efforts all cost money.

Some specialist roles may be more expensive to fill than others, such as entry-level employment. The cost-per-hire is the average cost of attracting a new employee for any position with the formula for direct labor cost.

The total of your internal and external recruiting expenses is used to calculate your recruiting costs with the formula for direct labor cost.

Job board fees, background checks, drug tests, career fairs, the setup and maintenance of your career's website, and fees paid to recruiters are all regular recruitment expenses to include in your calculations with the formula for direct labor cost.

This is the most obvious personnel cost, and it's also the simplest. This is the total cost of all of your employees' salaries or hourly wages with

Make sure you use the same period for all of the other categories described below, regardless of the unit of time you use to assess pay costs.

•Benefits and Health Insurance

Another significant labor-related cost is employee benefits. Benefits accounted for $11.82 of the $37.73 hourly employee cost that we mentioned before. This equates to around 30% with the formula for direct labor cost.

In general, the more employees you have, the lower your per-employee benefits will be with the formula for direct labor cost.

Benefits calculations should include health insurance premiums, employer retirement contributions, retirement program administration costs, paid time off, and extra income such as overtime with the formula for direct labor cost.

•Employment Taxes

Your business pays taxes on every employee it hires. This includes federal income taxes, Social Security and Medicare taxes, as well as unemployment compensation. We don't include federal income taxes because they are deducted from the employee's pay.

Employee wages are also withheld for Social Security and Medicare taxes, but the employer is responsible for paying a matching sum on top of that with the formula for direct labor cost. Use the IRS guidance described here to calculate your percentage of the expense for each of these taxes.

In most cases, new employees are not productive straight away. Rather, you'll have to invest time and money in educating them, which should be considered into your labour expenditures with the the formula for direct labor cost.

According to a survey published by Training magazine, the average cost of training per employee in the United States is $1,075 per employee.

Consider travel, training materials, equipment, software, and other digital programs, and payment for outside aid when calculating your training costs with the the formula for direct labor cost.

You can also include loss of productivity, which is the amount of money you are not making since the employee is not completely productive yet if you want to be more exact.

These numbers may be more readily available in some professions, such as sales, but not in others, such as service-based industries with the formula for direct labor cost.

You're probably aware of overhead expenditures like rent and utilities, and you're probably under the impression that they're separate from labour cost calculations. In reality, the number of staff you have has a direct impact on your overhead.

Because the more employees you hire, the more desks you'll need, and the more square footage of space you'll need, it's best to include overhead in your labour cost calculations.

The cost of your physical workspace, property taxes, electricity, office supplies, equipment, and upkeep are all elements to consider when calculating your overhead costs with the formula for direct labor cost.

If you supply business vehicles, cell phones, laptops, or other equipment to employees, be sure they're included with the formula for direct labor cost.

•Additional Costs to Consider

In addition to the above-mentioned recurrent expenditures, don't forget to account for variable costs such as seasonal or temporary labour, as well as one-time costs such as Christmas bonuses with the with the formula for direct labor cost.

Consider the cost of contractors, such as freelance graphic designers or consultants, and keep in mind that these costs may decrease as you hire more people.

What Is Job Costing?

The practice of recording expenses and revenue for each particular project is known as job costing, sometimes known as project-based accounting.

Job costing examines each project in-depth, separating labor, material, and overhead expenses. Compared to other costing methodologies, it makes fewer assumptions.

In the construction sector, where costs vary greatly from work to job, job costing is a frequent practice. Manufacturers, creative agencies, law firms, and others use it as well.

Job costing can be a useful tool for small business owners to examine specific jobs and determine if any spending can be lowered on similar projects in the future because it monitors costs in detail for each job.

The Importance of Total Labor Costs

- For small enterprises and small business owners, total labor costs have numerous advantages.

•Calculating overall labor expenses correctly might help you budget for prospective projects and price your products or services effectively.

•It can also assist you in determining how many staff you can afford to hire, how many projects you should do, and which ones are worthwhile.

•When preparing estimates for customers who pay your small business on a per-project basis, it's vital to use entire labor costs.

•You will be under budget for labor if you solely consider gross labour costs in your estimate.

•When the project is finished, you'll either have to raise the labour cost, which will disappoint your customer, or deduct the higher labour costs from your profits, which will frustrate you.

Employee Labor Percentage: How to Work It Out?

Employee labor percentage, also known as cost of labor percentage, represents a company's overall payroll expenditure as a percentage of gross sales.

Payroll is a significant expenditure for any company, and in some industries, it is the most significant cost.

Employee labor percentage tracking is especially crucial for small business owners since it is a critical measure they must understand to spot problems and chances to save money on payroll.

Employee Labor Percentage Overview

The employee labor or labor cost percentage relates the amount of money a company spends on payroll to the amount of money it makes.

Payroll covers all labor costs, not just salaries and wages. Payroll taxes, such as the Social Security tax, and benefit allocations should also be included.

The gross sales of a company are referred to as revenue. Use gross sales from your company's income statement to calculate the employee labour % for a year. You can use information from interim sales reports when measuring over a shorter period, such as a month or week.

Labor Percentage Calculation

A company's labour cost percentage is calculated by dividing its total payroll by its gross sales. Payroll is a substantial expenditure for most firms; in certain cases, it may be the most significant cost.

Use gross sales from a yearly income statement to calculate the annual employee labour percentage. You can run sales reports if you're measuring a shorter time, such as a week or month.

Gather Sales Information

The top of a company's yearly income statement contains this information. You can locate gross sales on intermediate reports or compute it by aggregating sales figures from daily or weekly reports to figure out employee labor proportion for different periods.

Find Labor Cost

Add up all of your wage and salary expenses. Bonuses, commissions, and other forms of payment should be included. Remember to factor in payroll taxes and employee perks of labor cost calculations.

Determine the percentage

Multiply the labor cost by the gross sales and multiply by 100. Assume total sales are $500,000 and labor costs are $140,000. Multiply $140,000 by $500,000 to get a total of $140,000. The percentage of labour provided by your employees is 28%.

Labor Percentages for Groups of Workers

Calculating employee labor percentages for specific groups of workers is sometimes useful. Manufacturers, for example, must calculate the cost of production, and analyzing this measure can aid in the analysis and control of labor cost calculations.

The employee labor percentage is calculated in the same way, with the exception that you only add the labor cost calculations for the specific group of employees you're interested in.

The Significance of Labor Cost

The ability to successfully regulate the cost of labor is crucial for a small organization. Labor costs typically range from 20 to 35 percent of gross sales of labor cost calculations.

Employee percentages vary by industry; a service business may have a percentage of 50 percent or higher, whereas a factory must maintain a ratio below 30 percent.

Cutting labor costs, on the other hand, is a delicate balancing act. Payroll cuts that are too drastic can make it difficult to recruit and retain effective staff of labor cost calculations.

Effective labor cost control entails discovering cost-cutting opportunities without jeopardizing employee motivation or productivity.

Tips to Reduce Your Labor Costs

Keeping your labor expenditures under control is an important aspect of your company's expense management. This should not imply lowering staff compensation or cutting shortcuts on additional labor expenditures.

It does, however, necessitate being vigilant and establishing clear guidelines for attendance, overtime, and time reporting.

Get Time Tracking Right

Accurately tracking staff hours is one of the most significant techniques for lowering labor costs. Time tracking errors can have major and costly ramifications for your company.

Keep an Eye on Overtime Hours

Most of the additional labor expenditures, such as payroll taxes and benefits, are beyond your control.

You do, however, have control over your team's schedule. This implies you can control how many overtime hours your workers work.

Of course, there are times when overtime is unavoidable, but if you want to cut labor expenditures, keep it to a minimum.

How to pay the staff?

Learning how to pay your staff may seem difficult if you're a new business owner. You can't just hand them a wad of cash from your bank account, after all. You must keep legal records of every dollar that travels from your hands to theirs.

Different Types of Compensation

There are three main ways in which companies pay their workers:

•Hourly Compensatio n

Hourly pay is calculated on a per-hour basis. The amount of time an employee works during a pay period determines their salary. You may, for example, pay an associate $20 per hour for their services. They are owed $1,600 if they work 80 hours in a pay period.

A part-time employee or someone who does not have a steady schedule, such as a restaurant server, would benefit from an hourly wage.

Hourly workers are typically considered non-exempt, which means they are eligible for overtime compensation.

If you're still getting your firm up and running and figuring out how many employees you'll need and how often you'll need them, you can decide to pay a new hire an hourly wage.

•Salaried Compensation

Salaried personnel are paid a set amount each payday, which is calculated by dividing their annual wage by the number of pay periods.

With a $60,000 yearly salary and a bi-weekly pay period, for example, an employee will receive $2,307 in pre-tax wages per payday.

Salaries are most appropriate for corporate jobs where the employee's time contribution is predictable. Overtime pay is usually not available to salaried staff.

•Commission-Based Compensation

Employees can also be paid on a commission basis. They may be paid a low base rate, which could be hourly or salaried, with bonus compensation if they met predetermined sales targets .

A full-time salesperson at your organization, for example, might earn a base yearly pay of $35,000. They also get paid a commission depending on a proportion of the agreements they close.

Employees in sales roles benefit from commission-based income since it motivates them to achieve specific objectives.

To verify that you are properly rewarding your employees while complying with minimum wage and overtime requirements, see the FLSA.

How Much to Pay an Employee?

The amount you should pay your employees is determined by how much your competitors pay for similar jobs and the type of business you own.

Conduct market research to find out how much other companies in your area and location pay for the position you're hiring for or the type of labor you require.

As a small business, how do you pay an employee?

Set up payroll to begin paying personnel, and be sure to select a payroll system that makes sense to you.

Decide if you'll pay your staff weekly, biweekly, semimonthly, monthly, or on a different schedule entirely. After that, calculate your employees' gross salary for the pay period as follows:

Multiply the hourly rate by the number of hours worked during the pay period for hourly employees. Remember to remove any unscheduled time from your estimates if they took any unexpected time off.

Employees who are paid on a salary: Multiply their annual salary by the number of pay periods in your annual payroll plan.

Commission employees: Determine whether they are paid on an hourly or salaried basis. Then, based on your company's compensation structure, add their commission earnings for that pay period.

How to Pay an Employee?

•Calculate Net Pay

You've calculated your employees' gross salary and the amount of tax withheld from their paycheck. Subtract the amount deducted from their gross salary to arrive at their net pay.

For example, if an employee's gross compensation for the pay period is $2,500 and $680 in taxes must be withheld, the employee will receive $1,820 on payday.

•Paychecks should be distributed to your employees

It's now time to pay your employees their owed net compensation. The most common methods of paying an employee are checks and direct deposits.

If you use direct deposit, consult the bank details provided by your employees. Alternatively, you can have checks cut for employees by your bank or payroll provider.

•File Taxe s

Paying taxes on behalf of your W-2 employees is your responsibility. Take the part of the employee's paycheck that has been withheld and distribute it to the appropriate places for tax filings.

File taxes with the IRS, your state's tax collection agency, and the tax collection agency for your municipality. It's worth noting that some taxes are solely paid by the employer.

•Pay Into Benefits

The government will not receive all of the withheld salaries. A portion of your salary may go toward employee benefits, depending on your firm. Deposit into the appropriate accounts on behalf of your employees if you offer any employee benefits programs.

•Update Payroll Records

In the event of an audit, you'll need to retain your payroll records for several years. Maintain an up-to-date, well-organized, and easily accessible payroll register.Include details on who was paid, how long they worked, how much they were paid, and what taxes were deducted.

Best Payroll Solution for Small Businesses

Payroll appears to be a difficult task, doesn't it? How do small business owners deal with the situation?

Businesses at the enterprise level have in-house teams dedicated to paying personnel. Small firms may not be able to afford a payroll specialist or may not have enough employees to justify the labor cost calculations.

In the majority of cases, however, even one-person enterprises are responsible for labor law compliance and tax withholding.

In a small firm, payroll software is the most efficient way to pay staff. It saves both money and time. Payroll software automates every stage of the detailed payroll process we just went through, including payment distribution.

Paying a 1099 employee is as simple as paying them their gross wages. To put it another way, keep your standard payroll procedures in place but don't withhold their taxes.

1099 workers aren't officially employees. They are referred to as independent contractors.

It is the responsibility of independent contractors to pay their payroll taxes. They'll be responsible for filing all of their state and federal taxes part of labor cost calculations.

If the person paying for the work has control over the ultimate product or outcome but not over how the work is done, the person is classed as an independent contractor.

The contractor, not your company, would handle quarterly tax payments to the IRS and state and local governments. While you can pay independent contractors a set fee, you can't offer them a salary; otherwise, they'd be deemed non-exempt workers, and you'd have to provide them with a W-2.

If you're unsure whether someone is an employee or an independent contractor, you should seek legal advice from a lawyer who can explain how federal labor regulations relate to your business. You must ensure that you are paying your employees by the FLSA to avoid any potential litigation or legal difficulties.

How Deskera Can Assist You?

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave , attendance , payroll , and other expenses . Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Labor expenditures must be appropriately accounted for by business owners who want to stay on budget and optimize earnings.

- Variable labor expenses fluctuate according to the entire amount of production output, as the name implies.

- If you don't know how much labour costs to produce your goods or services, you won't be able to price them correctly.

- Finally, assessing your labour costs might assist you in identifying revenue leaks that are eroding company profits.

- It's a little more complicated to calculate the overall cost of labour than just adding up the entire cost of all the payments.

- Keeping your labor expenditures under control is an important aspect of your company's expense management.

- It is the responsibility of independent contractors to pay their payroll taxes. They'll be responsible for filing all of their state and federal taxes

Related Articles

What are Fringe Benefits?

Haryana Code on Wages Rules 2021

Your Field Guide for Managing Quirky Work Personalities

Hey! Try Deskera Now!

Everything to Run Your Business

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One .

Labor Costing

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Get Any Financial Question Answered

Table of contents, what is labor costing.

Labor costing is the process of calculating the cost of labor for a product or service.

It is a crucial part of business operations and can significantly impact profitability. Labor costs are typically broken down into direct and indirect costs .

Different methods, techniques, and formulas are used to calculate labor costs.

Measurement of Labor Turnover

A high labor turnover rate can indicate several issues within a company, such as poor working conditions, low wages, or a lack of opportunities for advancement.

It can also be caused by factors outside of the company’s control, such as the overall economy or changes in the industry. Regardless of the cause, a high labor turnover rate can be costly for a company.

Three principal methods can be used to measure labor turnover:

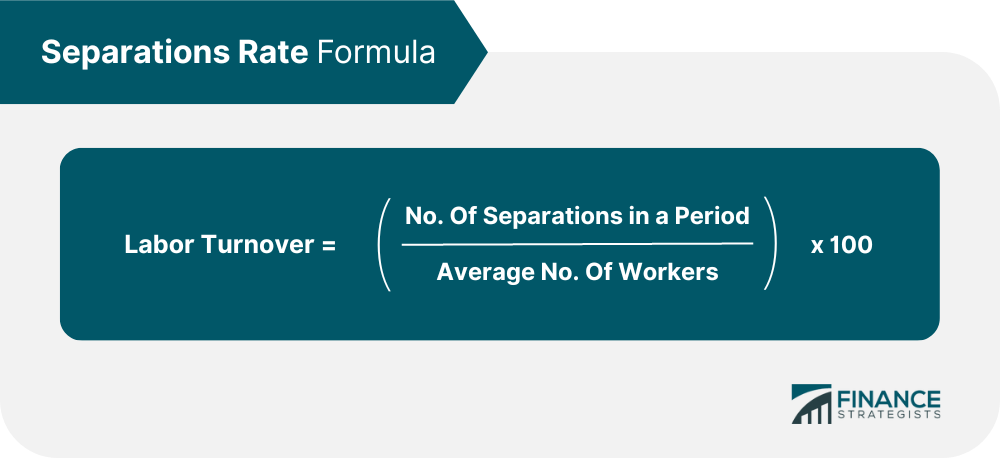

Separation Method

This method considers the number of employees who leave the company divided by the average number of employees during the period.

The formula for separations rate is:

Labor turnover = (No. of separations in a period / Average no. of workers) x 100

LT = (NS / ANW) x 100

So if a company currently has 100 employees and ten leave during the year, the separation rate would be 10%.

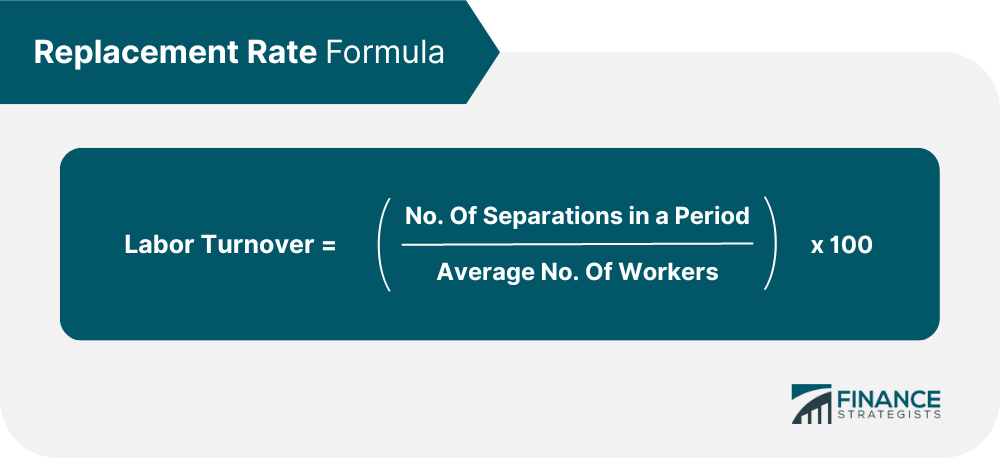

Replacement Method

This method looks at the number of workers replaced during the month/year divided by the average number of employees during the period.

The formula for replacement rate is:

Labor turnover = (No. of replacements in a period / Average no. of workers) x 100

LT = (NR / ANW) x 100

For example, if a firm has 200 employees and ten are replaced during the year, the replacement rate would be 20%.

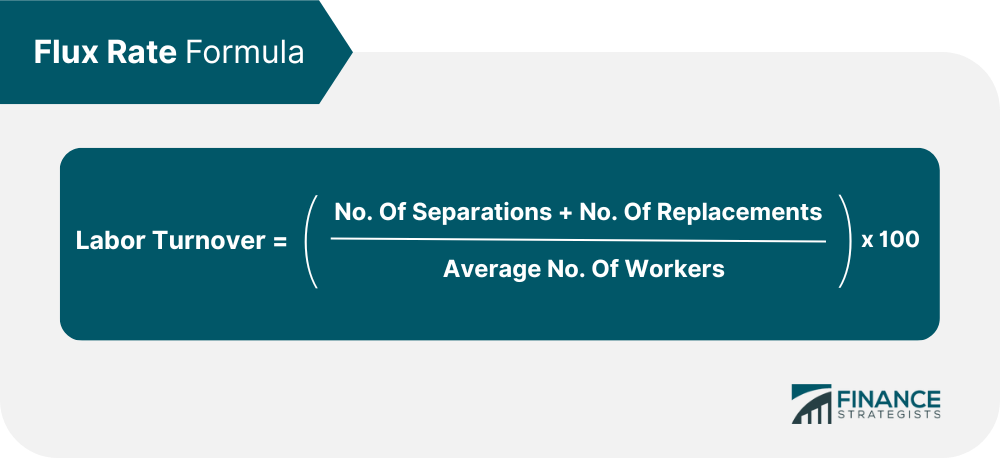

Flux Method

This method accounts for the number of employees who left and the number of new employees divided by the average number of employees during the period.

The formula for flux rate is:

Labor turnover = ((No. of separations + No. of replacements) / Average no. of workers) x 100

LT = ((NS + NR) / ANW) x 100

For instance, if a business has 1000 employees and a hundred of them leave and a hundred are replaced during the year, the flux rate would be 20%.

Labor Productivity

Labor productivity measures how much output (in terms of goods or services) is produced by one unit of labor input.

It is typically calculated as output per hour of work. Labor productivity can be measured at the level of an individual worker, a team, a department, a company, an industry, or even an economy.

Labor productivity = Output / Actual hours worked

Labor Costing per Unit

This method of labor costing assigns a specific cost to each unit produced. The total labor cost is then divided by the number of units produced to calculate the labor cost per unit.

Labor cost per unit = Direct wages / No. of units

Time Allowed

It is a period given to complete a task or work.

Standard time + Incentive allowance

Labor Efficiency

It measures how a given workforce efficiently accomplishes a task compared to the standard set in finishing certain tasks.

It is measured by dividing the actual output by the standard output multiplied by 100 to get the percentage. A higher percentage means higher efficiency.

Labor efficiency = (Actual output / Standard output) x 100

Time Rate Method

This is the most commonly used method in businesses to calculate the cost of labor. In this method, the labor cost is calculated by multiplying the time taken to complete a task by the hourly pay rate.

Earnings = Hours worked x Rate per hour

For example, if an employee takes 5 hours to complete a task and their hourly rate of pay is $10, then the cost of labor for that task would be $50.

Straight Rate Method

A type of wage system is known as payment by result. In this method, employees’ output (worker’s efficiency) will be multiplied by the rate per piece finished rather than the time involved in doing the work.

Earnings = Output x Rate per unit

For example, if an employee produces ten widgets in an hour and their rate per widget is $1, then the cost of labor for that task would be $10.

Differential Piece Rate System

It is a wage payment in which a worker gets a high piece rate for completing the job within the allotted time and a lower piece rate for completing the job beyond the allotted time.

F.W. Taylor's System

Fredrick Winslow Taylor developed this system. It follows the principle that the efficient worker is rewarded while the worker who performs below the standard gets penalized.

Here is how this method is calculated:

Earnings = 80% of price rate when below standard

Earnings = 120% of price rate when at or above standard

Merrick Differential Price Rate System

W.H. Merrick developed this system. It is similar to Taylor’s system with a slight variation. Instead of penalizing the worker, a lower differential price rate is paid for work done below the standard time.

Gantt Task Bonus Plan

Henry L. Gantt developed it. In this system, workers are given a bonus for completing the task before the deadline. The amount of bonus is generally a percentage of the wages earned.

Halsey Premium Plan

Halsey, Doolittle, and Emerson developed it. In this system, workers are given a bonus for completing the task before the deadline. The amount of bonus is generally a percentage of the wages earned.

In this system, he is paid a bonus of 50% for the time saved plus the salary for the actual time spent on the job.

The formula for this method is:

Earnings = (Hours worked x Rate per hour) + (Time saved x Rate per hour x 50%)

E = (HW x RH) + (TS x RH x 50%)

Halsey-Weir Plan

It is a modification of the Halsey premium plan. In this system, a standard time is determined, and if a worker saves time by finishing a job earlier, he is paid a bonus of 30%, plus wages for the actual time spent on the job.

Earnings = (Hours worked x Rate per hour) + (Time saved x Rate per hour x 30%)

E = (HW x RH) + (TS x RH x 30%)

Rowan System

In the Rowan system, if the time taken by the worker to finish the task is more than the set period, he is paid according to the time rate, but when the worker finishes the work earlier than the standard time; then he is entitled to a bonus along with the time wages.

Earnings = Hours worked x Rate per hour + (Time saved / time allowed x Hours worked x Per hour rate)

E = HW x RH + (TS / TA x HW x RH)

Barth Variable Sharing Plan

It was developed by Barth and Co. In this system, the time rate is not guaranteed, which means workers are not paid for the hours worked more than the standard hours.

Earnings = rate per hour x √(Standard hours x Hours worked)

E = RH x √(SH x HW)

Labor Costing FAQs

What is labor costing.

Labor Costing is the process of tracking and accounting for the wages and benefits associated with employing workers in a given organization or business. It involves understanding how wages, hours worked, overtime pay, bonuses, and other compensation affect profitability.

How do I calculate labor costs?

To calculate labor costs, you must determine an employee's hourly wage rate (including any overtime or bonus payments) and add relevant taxes, contributions to pension plans, health insurance premiums, and other employee-related expenses. Once these have been identified and calculated, total labor costs can be determined by multiplying the number of hours worked by each employee during a given period with their total wage rate.

What are the key components of Labor Costing?

The key components of Labor Costing include wages and salaries, overtime pay, bonuses and incentives, holiday pay, taxes, and contributions to pension plans or health insurance premiums. All of these factors must be taken into account when calculating labor costs.

What is the purpose of Labor Costing?

The purpose of Labor Costing is to accurately track and manage expenses associated with hiring employees to maximize profitability. By understanding how much each employee costs an organization over time, businesses can better allocate resources and optimize their workforce according to budget constraints while maintaining quality output.

How can I reduce labor costs?

There are several ways to reduce labor costs, including hiring temporary staff for specific projects instead of full-time employees, automating certain processes to reduce the amount of human labor needed, and using performance-based incentives to reward high-performing workers. Additionally, businesses can improve efficiency by restructuring their workforce and eliminating redundant or unnecessary roles.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Control-Factor Unit

- Cost Accumulation

- Difference Between Direct and Indirect Labor Cost

- Incentive Plans

- Labor Costing: Practical Questions With Answers

- Methods of Time-Keeping

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

- HR + Payroll Software

Talent Acquisition

- Talent Management

Workforce Management

- Benefits Administration

Payroll Software

Hr software, expense management software, recruiting software, automated talent sourcing, onboarding software, talent development, career management software, paycor paths, learning management system, pulse surveys, compensation planning, time + attendance software, scheduling software, benefits advisor, aca reporting software, workers’ compensation, compliance overview, payroll / business tax credits, workforce benefits, regulatory compliance, data & security.

HCM for Leaders and Frontline Managers

Leaders: Find and Hire Top Talent

Employee Talent Management for Leaders

Workforce Management for Leaders

Streamlined Benefits Admin for Leaders

Simplify Compliance Management With Paycor

- By Industry

Professional Services

Manufacturing, restaurants, 1-49 employees, 50-1000 employees, 1000+ employees.

TRANSFORM FRONTLINE MANAGERS INTO EFFECTIVE LEADERS

Apps & tech partners, retirement services, franchisor opportunities, private equity, guides + white papers, case studies, hr glossary.

Perspectives+

News + press, sponsorships, ai guiding principles.

DE&I AT PAYCOR

Plans + pricing, take a guided tour, watch a demo, solution finder, call us today:, the biggest cost of doing business: a closer look at labor costs.

Last Updated: December 8, 2022 | Read Time: 14 min

Many organizations are feeling the pressure to do even more with less—fewer employees, fewer resources and smaller budgets. So, as an HR leader you might be wondering what you can do to confront the labor cost issue head-on and find solutions.

Labor costs can account for as much as 70% of total business costs; this includes employee wages, benefits, payroll and other related taxes. Yet, according to a Paycor survey, HR professionals only spend 15% of their time managing the cost of labor.

However, keeping an eye on the annual operational costs (especially now) could help you prepare for the financial future. To be an asset as an HR leader, you need to think like a financial executive, but also be creative with ways of reducing costs.

How to Reduce Labor Costs During a Recession

As a recession sweeps the nation, many companies are left wondering how to reduce annual costs of labor without gutting their workforce. slashing employee hours, or making other unpopular decisions.

While there is no one-size-fits-all answer to this question, there are a few strategies that can help you get started. Here are four tips for reducing labor expenses during a recession.

- Cut back on overtime If your employees are working more than 40 hours a week, consider cutting their hours back to 40. This will save your organization money on labor while still allowing your employees to earn a decent wage.

- Offer incentives for employees to work their allotted hours You could offer a bonus for employees who stay within their allotted hours. This will help to motivate your employees to work fewer hours, which will in turn cut costs.

- Carefully hire the right candidates from the beginning The average cost of turnover can cost up to 30% of an employee’s first-year wages, so this is an important strategy for reducing annual costs of labor in the long run.

- Use temp labor during busy times If you have peaks and valleys in your business, consider using temp labor during your busy times to help with the workload.

Having access to labor information allows you to plan for the future and help your organization make more informed decisions. Armed with the right data and advanced technologies, like Paycor’s Time & Attendance software, you can create a strategy to correct the problem and more easily predict when you might need additional staff in the future, which will enable better budget forecasting.

Which Industries Have The Highest Labor Costs?

A June 2022 report from the Bureau of Labor Statistics , showed the average cost of labor of 30 different industries in 2021 compared to 2020.

What’s interesting about this report is that we were at the height of COVID-19, and you’ll see some big changes. Travel Arrangement and reservation services went from 73.7% to -7.3%. And the air transportation industry had the highest increase in 2019 at 106.9%, and fell to 7.6% in 2021.

2023 Labor Costs

Salary budgets are the highest they’ve been in over 20 years. Why? Attracting high-quality talent is extremely competitive right now; and, inflation is at an all-time high, making the bump necessary. That’s why it’s important to know how to strategically establish salary ranges .

The Consumer Price Index increased 8.5 percent for the 12 months ending in July . This means that companies are having to revise their pay budgets.

According to Consultancy WTW’s July Salary Budget Planning Report :

- On average, companies are planning to increase pay by 4.1% in 2023.

- In 2022, the average pay increase was 4%.

- Inflation is at 8.5% at the time of this report.

- Around 96% of companies globally increased salaries (compared to 63% in 2020).

Employer labor expenses also include benefits. According to AON, average costs for employers in the U.S. will increase 6.5 percent to more than $13,800 per employee in 2023 . This is a huge jump from 2022 when the costs rose 3.7% from 2021.

How can HR & Finance Departments Work Better Together?

HR and finance teams can work better together if they take a walk in each others’ shoes. To start thinking like a CFO when approaching business expenses, you might want to start with these questions:

Are We Overspending on Labor?

Check overtime. There may be hidden costs that you need to watch out for.

According to a survey from Qualtrics , 57% of employees said they “want the opportunity to work overtime or extra shifts” to bring in more money as inflation continues to rise and we go into a recession.

Are We Underutilizing Our Workforce?

If HR isn’t tapping into the full spectrum of talent in your company, you’re leaving money on the table. By not taking full advantage of your employee’s potential, disengagement and lack of motivation soon follow.

This can lead to a dramatic decrease in productivity and high turnover rates, which in turn can negatively impact your company’s bottom line.

Are We Accurately Capturing and Recording Time Worked?

HR can lead the way by championing a time management solution that accurately tracks and manages hourly workers, eliminates duplication errors, and reduces payroll losses.

Are We Looking At Labor Costs in Silos?

If you’re not adding non-employee (freelancers, contract workers, consultants) and contingent labor into the labor cost equation, your numbers will be way off.

You run the risk of potentially misclassifying employees and non-employees, which can result in harsh fines if the company is audited.

Now that you are thinking like a CFO and working alongside them, it is important to understand labor expenses, what is normal, and how to optimize your company’s budget.

What is An Acceptable Labor Cost Percentage?

An acceptable average cost percentage is 25-35% of gross sales. This can vary greatly depending on the business, industry, and location.

For example, a retail store in a small town may have labor percentages less than 25%, while the manufacturing sector may have labor percentages higher than 35%.

There are many factors that contribute to the total labor cost percentage for a business, including the type of business, the industry, the unit labor cost, location, and the number of employees.

The type of work, and the wage rates can also affect the total labor cost percentage for employees.

What Percent of A Business’ Costs Are Labor?

The percentage varies, but labor costs include employee’s salaries, cost of benefits, and taxes. They are often broken up into direct costs and indirect costs.

The sales price of a product or service takes into account the labor costs, and any other overhead expenses, including materials. When these prime costs are taken into consideration, then they are able to see if the cost of labor is too high or too low.

If the company has to lower its prices, then they are going to have to cut labor costs as well so that they are not running in the negative.

The restaurant labor costs are lower as many of the staff receives tips, and the lower wages reduce the cost.

Direct Costs vs. Indirect Labor Costs

Direct costs are tied to the production of a product or service such as a production line worker in the manufacturing sector, or a salesperson.

Indirect labor costs are not tied to production and could be classified as someone in security.

Fixed vs. Variable Costs

Salaries paid to your workforce are fixed annual costs, as they don’t change based on production.

Over time, temporary staffing, commissions, and bonuses are all considered variable labor costs since they will change depending on many different factors.

Variable cost is often hard to predict, but it’s an important component of determining your company’s annual labor cost. In the manufacturing sector, the costs are variable as the output of machines can change.

Labor Cost Percentage Formula

Calculating labor costs is pretty straightforward. To find your labor cost percentage, divide your labor cost by gross sales and multiply by 100.

Labor Cost Percentage = (Total Labor Cost / Total Gross Sales) x 100

Be sure to include the cost of all bonuses, commissions, benefits, and all taxes you pay.

For example: If your labor costs total $250,000 and gross sales equal $500,000, the labor cost formula would look like this: 250,000 ÷ 500,000 x 100 = 50%.

How Paycor Helps

Having a good understanding of your current labor costs and trends is essential for keeping spending in check. Companies that integrate disruptive, HR advanced technologies will increase revenue and productivity by up to 9% while lowering HR costs by 7% (HBR). Whether you are in the manufacturing sector or the airline industry, your CFO will really like the sound of those statistics. Paycor Analytics can help. Discover how our simple reporting provides insight into hours and costs to optimize your spending.

Related Resources

Read Time: 34 min

The Complete Guide to Payroll Services

Paycor's comprehensive payroll services are designed to streamline your business operations. From accurate calculations to compliance management, we've got you covered.

Read Time: 10 min

5 Benefits of AI Talent Sourcing Technology for Recruiters

Discover the advantages of AI recruiting technology for recruiters in the digital age. From automated candidate screening to enhanced efficiency, this guide uncovers the top benefits.

Read Time: 9 min

New DOL Overtime Rule: FAQs

The DOL made changes to the overtime threshold in April 2024. See the details of what employers should be aware of, here.

For Agencies

Let's Talk: (844) 800 - 2211

Remembering Shay Litvak Our Co-Founder and CTO

November 1979 - September 2023

How Is Labor Cost Calculated: A Simple Guide

Ralitsa Golemanova

Whether you’re running a restaurant, a construction company, or another small business with employees, labor costs are some of the biggest expenses you'll need to cover.

That’s why it’s essential to understand what labor costs are and how they are determined. Labor cost does not only mean the hourly rate that you pay a member of your staff . It spans a number of other expenses that you need to account for. Only after factoring them in you can get the actual labor expenses for your company.

How is labor cost calculated, then? Read on to get a clear overview and make the right calculations for your business.

What Is Labor Cost?

The expenses that you pay for each employee equal your labor cost for that particular staff member.

Labor cost includes gross wages for an employee , as well as additional payments on their behalf, like Social Security and Medicare taxes, as well as benefits.

You have to keep tabs on your labor expenses and to constantly compare them to your revenue, so that employee costs don’t harm your bottom-line . This is called labor cost percentage and is the key to solid business management and growth.

How Is Labor Cost Calculated?

In order to calculate the labor cost of an employee per hour, you need to go through a simple process of factoring in all expenses related to their employment.

The simple labor cost per hour formula looks like this:

Labor cost per hour = (gross pay + all annual costs) / actual worked hours per year

Let’s break down each of these calculations into steps.

We’ll use a hypothetical employee, Maria, as an example. She is an hourly, non-exempt employee, who works full-time in a company in California with more than 26 employees. She gets the minimum wage of $13.

So, how do you calculate the labor cost for Maria?

#1. Calculate the Gross Pay

The first thing you want figure out is the gross pay of an employee.

Here is the formula:

Gross pay = gross hourly rate x number of hours worked for a pay period

In this case, let’s calculate Maria’s gross pay per year. The total hours that Maria is supposed to work for the period of one year is:

Total number of hours per year = 40 hours per week x 52 weeks = 2080 hours

This means that her gross pay per year is:

$27,040 = $13 x 2080 hours

#2. Figure Out the Actual Worked Hours

The total work hours per year are 2080. However, every employee needs to take days off.

Let’s say that Maria did not work 12 days in that year. Here is how to calculate hours not worked:

Hours not worked = 12 days x 8 hours = 96 hours

Then you can easily get the net hours worked:

Actual worked hours = total number of hours per year - hours not worked

This would mean, in this case:

1984 hours = 2080 hours - 96 hours

The actual hours that Maria has worked for a year are 1984 hours.

#3. Determine All Annual Costs Per Employee

Next, you have to take into account all related expenses that you owe for Maria, such as taxes and healthcare. They come on top of her gross pay. Only after you calculate them can you get the actual labor cost per hour for a particular staff member, or the true cost per hour.

Some typical labor costs besides the actual pay to the employee are:

Payroll Taxes:

- FICA taxes (7.65%), of which Social Security is 6.2% and Medicare is 1.45%

- FUTA taxes (standard rate of 6%, but exceptions apply)

- State unemployment taxes

- Local unemployment taxes

Employee Benefits:

- Health insurance

- Additional insurance such as dental, life or disability

- Retirement plans

- Paid time off (sick and vacation days)

- Meals at work

- Education and training

Other Possible Expenses:

- Overtime pay

- Workers’ compensation insurance

- Work supplies

In Maria’s case, here is the breakdown of additional labor costs:

- $2,348.56 annual taxes: 6.2% Social Security is $1676.48, 1.45% Medicare is $392.08, 0.6% FUTA on the first $7,000 is $42, and California state unemployment insurance is 3.4% on the first $7,000, which equals $238

- $3,120 health insurance

- $1,200 benefits

- $500 overtime

Thus, the extra annual costs that you have to pay for having Maria in your team are $7,668.56. Of course, this is just an example and these costs can vary greatly.

#4. Calculate the Total Annual Payroll Cost

You are now ready to determine the actual annual payroll cost for Maria, or the total labor cost for her. Here is how to do that:

Annual payroll cost = gross pay + other annual costs

In this example, the amount is:

$34,708.56 = $27,040 + $7,668.56

This is the total cost of Maria’s work for your business per year.

#5. Calculate the Hourly Labor Cost

At last, you can figure out Maria’s cost of labor per hour.

Her hourly labor rate (wage) is $13. However, you want to get the total cost per hour. Here is how you can do that:

Hourly labor cost = annual payroll cost / actual hours worked

For Maria, our hourly labor cost calculator comes up with the following:

$17.50 per hour = $34,708.56 / 1984 hours

Now you know the actual labor cost per hour for hiring Maria.

Determine Your Labor Cost Percentage

Knowing your labor cost expenses per employee is necessary for determining your labor cost percentage , which shows you the relationship between your total revenue for a given period and your labor costs during that time.

The formula is:

Labor cost percentage = labor costs for all employees / total revenue

When you determine your labor cost percentage, you can make a deeper analysis of your employee expenses. That’s how you can figure out if you need to reduce them to increase your overall profit margins .

The average labor cost percentage should typically be in the range of 20% to 35% of a company’s gross sales. However, there are variations, depending on your field. It’s not uncommon for restaurants and other service businesses to have a labor cost percentage of up to 50%. In other areas, such as heavy industry, the percentage should not be more than 30% to ensure profitability.

Tips to Reduce Your Labor Costs

Keeping your labor costs under control is a large part of the expense management for your business. This does not mean reducing employee wages and cutting corners when it comes to the extra labor costs. However, it does entail being observant and setting clear rules regarding attendance, overtime and logging of worked hours .

Get Time Tracking Right

One of the most important tips for decreasing your labor expenses is to accurately track employee hours . Mistakes in time tracking can have serious and costly consequences for your business.

With solutions like Hourly, you can be sure that clocking in and out for your employees is seamless , and that you get the most accurate information about their actual worked hours. The platform offers geofencing, which is great for teams on the go, as you can set the physical area in which employees can track time.

Keep an Eye on Overtime Hours

You cannot do much about reducing most of the additional labor costs, such as payroll taxes and benefits.

However, you have control over the scheduling of your team. This means you can regulate the overtime hours that your employees are working. There are situations when you can’t avoid overtime, of course, but try to keep it at a minimum if you want to reduce labor costs.

Keep Track of Labor Costs for Your Business

Staying on top of labor cost calculations and monitoring labor expenses are essential for running a successful company, whatever industry you’re in.

If you’re ready to take your internal operations to the next level, Hourly can help. Our platform combines the top features that you need in your day-to-day business management. From time tracking and payroll to workers’ comp and meeting payroll records requirements , we’ve got your back.

Want to get started? Just download the Hourly app on your mobile device.

Ready to transform your business into a profit-pumping machine? Learn how with our monthly newsletter.

Subscription implies consent to our privacy policy.

A Simple Guide To Comp Time And How To Use It

What Are Florida's Overtime Laws?

How to Process Payroll - DIY Payroll: A Step-by-Step Guide

- History Of Establishment

- Winning Awards

- Testimonials

- Appellate Practice

- Bankruptcy & Restructuring

- Commercial Arbitration

- Construction Disputes

- Employment Litigation

- Government & Regulatory Litigation

- Insurance & Reinsurance Litigation

- Insurance Recovery

- Intellectual Property Litigation

- Judicial Review Proceedings

- Media & Entertainment Litigation

- Mergers & Acquisitions Litigation

- Product Liability Litigation

- Real Estate Litigation

- Sexual Harassment & Employment Discrimination

- Shareholders Dispute

- Tax Litigation

- Technology Disputes

- Trade Disputes

- Other Commercial & Civil Disputes

- Competition Crime

- Corruption & Bribery

- Criminal Defense Attorney

- Employee Rights Violation

- Environmental Crimes

- False Advertising & Deception

- Intellectual Property Infringement

- Merchandising Banned Commodities

- Merchandising Counterfeit Goods

- Money Laundering

- Property Damage

- Property Fraud

- Securities Fraud

- Smuggling Offense

- Tax Evasion & Avoidance

- Bankruptcy Decisions

- Civil Decisions in Criminal Judgements

- Civil & Commercial Judgements

- Family & Matrimonial Judgements

- Foreign Judgements & Arbitral Awards in Vietnam

- Inheritance Rights Judgements

- Judicial Review Judgements

- Labor Judgements

- Pledged Assets or Mortgage Judgements

- Civil & Commercial Contracts Attorney

- Corporate Governance

- Cross-border Transactions

- In-house/Retainer Counsel Service

- Private Client Services

- Coffee Break with Stephen Le

- Legal update

- Legal Insights

- Frequently Asked Questions

- All Podcast

Or follow us

Litigation & Arbitration Criminal Investigation & White Collar Crimes Judgements Enforcement Others

Understanding Labor Cost and Its Implications for Businesses

In today’s dynamic economic landscape, where businesses are constantly seeking ways to enhance competitiveness and profitability, one of the most critical aspects of financial management is the understanding and management of labor costs. Labor costs play a pivotal role in determining a company’s financial health, pricing strategies, profitability, and overall competitive advantage. In this comprehensive article, we will delve into the definition and calculation of labor costs, explore the various factors that influence them, and discuss their profound implications for businesses. Additionally, we will examine effective strategies for managing and reducing labor costs while maintaining a balance between cost efficiency, quality, and legal compliance.

Definition of Labor Cost

What is labor cost.

In a business context, labor cost encompasses the total financial outlay associated with employee compensation. It goes beyond the direct salaries and wages paid to employees and includes a range of supplementary costs. These supplementary costs comprise health benefits, social security contributions, pension funds, and any other related payroll taxes. Labor costs represent a significant portion of a company’s operating expenses, making them a focal point in financial management and strategic planning.

Why it matters?

The significance of labor costs extends beyond mere financial considerations. It has far-reaching implications for compliance with labor laws and financial reporting standards. Mismanagement or inaccuracies in labor cost calculation can lead to legal disputes, financial penalties, and damage to the company’s reputation. Furthermore, labor costs directly impact a company’s pricing strategies, profitability, and competitive positioning in the market. Effective labor cost management is not only crucial for the company’s bottom line but also for ensuring sustainable business growth and compliance with regulatory requirements.

Breaking Down Labor Cost

Direct labor costs.

Direct labor costs are explicitly tied to the creation or production of goods and services. These costs are directly attributable to specific operational activities, making them an integral part of product costing and pricing strategies.

In production, direct labor costs are closely monitored as they significantly affect the cost of goods sold and, consequently, the pricing structure of products. They also influence decisions regarding production methods, automation, and labor allocation

For instance, in the automotive industry, the wages of assembly line workers who assemble cars are direct labor costs. These costs are meticulously calculated to ensure competitive pricing and profitability.

The proper allocation of direct labor costs is crucial for accurate product costing, pricing decisions, and financial reporting. Failure to accurately account for these costs can lead to skewed financial statements and potential legal ramifications.

Indirect Labor Costs

Indirect labor costs encompass the expenses related to personnel who support the production process but do not directly contribute to the manufacture of specific products or services. These costs are less visible but equally important for business operations. This includes the salaries of administrative staff, facility maintenance personnel, and the human resources department, among others.

Indirect labor costs affect a company’s overall budgeting and financial planning. Efficient management of these costs is vital for maintaining profitability and ensuring operational efficiency.

How to Calculate Labor Costs

Calculating labor costs is a fundamental aspect of financial management in businesses. The basic formula for this calculation is:

Total Labor Cost = Direct Costs + Indirect Costs

Introduction to the Basic Labor Cost Formula

Direct Costs . These are the wages paid directly for manufacturing a product or providing a service. It includes hourly wages, salaries, bonuses, and commissions.

Indirect Costs . These are costs not directly tied to a specific product or service but necessary for the business’s overall functioning. This includes salaries for administrative staff, training costs, and employee benefits.

Simple Examples

Example 1: A factory employs workers for manufacturing, paying them a total of $50,000 (direct costs). The administrative and supporting staff salaries sum up to $20,000 (indirect costs). The total labor cost is $50,000 (direct) + $20,000 (indirect) = $70,000.

Example 2: A retail store pays its sales staff $30,000 and spends $10,000 on other employee-related expenses. The total labor cost would be $30,000 + $10,000 = $40,000.

In addition to the basic formula, it is important to consider the impact of external factors on labor costs. For instance, economic conditions like inflation can increase the cost of living, subsequently pushing up wage demands. Industry-specific demands also play a crucial role; for example, in tech industries, the high demand for specialized skills can significantly raise direct labor costs

The Importance of Understanding Labor Costs

Impact on pricing.

- The Direct Link. The cost of labor directly influences the pricing of products and services. Higher labor costs can lead to higher product prices to maintain profit margins.

- Customer Response. Pricing strategies affect customer behavior. If labor costs drive prices too high, it may reduce demand, affecting sales and profitability.

Proportion in Total Expenses

- Expense Breakdown. Labor costs typically constitute a significant portion of total business expenses. Understanding this breakdown is crucial for budgeting and financial planning.

- Variability Factor. Labor costs can vary based on seasonality, market demand, and changes in production levels, affecting overall business expenses.

Competitive Edge in the Market

Cost Efficiency. Efficient management of labor costs can provide a competitive edge by enabling lower product prices or higher investment in quality and innovation.

Quality vs. Cost. Balancing labor costs and quality is critical. Cutting labor costs too much may affect product quality, while high labor costs can lead to pricing challenges in competitive markets.

Labor costs not only affect a company’s balance sheet but also influence strategic decisions. For example, a business may decide to relocate operations to a region with lower labor costs. However, this must be balanced against potential impacts on product quality and employee morale. A detailed examination of how labor costs affected the profitability and strategic decisions in different businesses, such as manufacturing and retail, can offer deeper insights into their importance.

Unpacking the Factors Influencing Labor Cost

Understanding the various factors that influence labor costs is crucial for effective business management. These factors include:

Worker Availability . The supply of skilled labor in the market directly impacts labor costs. A scarcity of skilled workers can drive up wages, while a surplus may lead to lower costs.

Location . Geographic location affects labor costs due to varying living costs, availability of talent, and economic conditions. Urban areas generally have higher labor costs compared to rural locations.

Task Difficulty. Jobs requiring specialized skills or high-risk tasks often command higher wages, influencing the overall labor costs.

Efficiency. The efficiency of the workforce impacts labor costs. Higher productivity can lead to cost savings, while inefficiency can increase costs due to overtime and lowered output.

Legislation. Legal requirements like minimum wage laws, overtime pay, and benefits mandates significantly impact labor costs. Compliance with labor laws is essential to avoid legal ramifications.

Each factor impacting labor costs can have a substantial effect. For example, in urban areas where the cost of living is high, businesses may face higher wage demands. Conversely, in rural areas, the availability of labor might be less, but the cost could be lower. The complexity of tasks also dictates labor costs – specialized tasks require higher compensation. Furthermore, the efficiency of the workforce is crucial; more efficient workers reduce the need for a larger workforce, thereby reducing costs.

Strategies to Manage and Reduce Labor Costs

To optimize labor costs, businesses can employ various strategies:

- Automate to Increase Efficiency. Implementing automation in repetitive and routine tasks can reduce the need for manual labor, thereby lowering labor costs.

- Optimize Employee Scheduling. Effective scheduling can reduce overtime costs and ensure that staffing levels are aligned with business needs.

- Enhance Workforce Productivity . Training and development initiatives can improve employee productivity, reducing the need for additional staffing.

- Outsource Non-Core Functions. Outsourcing non-essential functions to third-party vendors can result in cost savings, as it often comes with lower associated labor costs.