Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Oil and Gas Business Plan

Mar.28, 2024

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Table of Content

The oil and gas sector is a highly regulated industry. A well-structured oil and gas business plan can help navigate these complexities.

According to a survey by EY, inadequate business planning is one of the top reasons oil and gas projects fail to achieve target profitability. “Firms that take a comprehensive approach through integrated business planning are better positioned to withstand market volatility and capitalize on opportunities,” notes Herb Listen, EY’s U.S. Oil & Gas Leader.

In this article, we’ll outline the key elements of an oil and gas business plan along with an oil and gas business plan template. By the end of this article, you’ll understand what it takes to develop a robust oil and gas drilling business plan.

What Is the Business Plan for an Oil and Gas Company?

A business plan for the oil and gas industry is a professional document that:

- Outlines the company’s goals

- Specifies strategies

- Producing oil and gas resources

The oil and gas station business plan serves as:

- A roadmap for the company’s operations

- A tool for securing financing from investors or lenders

Here are some key components typically included in an oil and gas business plan:

- Executive Summary: A concise overview of the business, its objectives, and the key elements of the oil and gas development business plan.

- Company Description: Details about the company, its history, ownership structure, and legal form.

- Industry Analysis: An assessment of the current state of the oil and gas industry, including market trends, competition, and regulatory environment.

- Operations Plan: A description of the company’s operational processes, including techniques, methods, processes, and logistics.

- Marketing Plan: An outline of the company’s plans for marketing and selling its oil and gas products, including target markets, pricing strategies, and distribution channels.

- Management and Organization Team: Details about the company’s management team, organizational structure, and key personnel.

- Financial Projections: Detailed financial forecasts, including projected financial statements, supported by assumptions and analyses.

The oil and gas company should tailor the oil and gas startup business plan to their specific goals and circumstances, and they should regularly update it to reflect changes in the industry, market conditions, and operations.

Why Do You Need a Business Plan Sample for an Oil and Gas Exploration Company?

There are a few key reasons why you would need a solid business plan, like the biodiesel business plan when starting your own oil and gas business:

- Attract Investment: The oil and gas industry requires significant upfront capital for exploration, drilling, equipment, and operations. A detailed oil and gas upstream business model and plan demonstrates to potential investors a viable strategy for generating returns.

- Guide Operations: An oil and gas field business plan serves as a roadmap for executing exploration and production activities. It lays out key milestones, timelines, capital expenditures needed, regulatory requirements, and operational plans.

- Analyze Economics: Thorough market analysis, cost projections, pricing forecasts, and breakeven modeling allow testing the economic viability of prospects before committing major resources. The oil and gas exploration business plan quantifies potential returns and profits based on various scenarios.

To illustrate the importance of a sample business plan, let’s walk through the key sections of an oil and gas business plan template for a fictional oil and gas exploration firm called TX Energy:

[related_post id=”112376″]

Clear and detailed

Alex provided us a detailed report on a business we were thinking of buying. The report was very clear and detailed, and he was available to answer any questions. We highly recommend his service

Executive Summary

Business overview.

TX Energy is a newly formed independent oil and gas exploration and production company headquartered in Houston, Texas. Our mission is to become a leading operator in the Gulf of Mexico region through the acquisition and development of high-quality offshore prospects.

Management Team

With a seasoned management team that has over 100 combined years of experience in the offshore Gulf, we plan to leverage our deep industry knowledge and technical expertise to build a portfolio of attractive assets.

Business Strategy

Our initial focus will be on identifying and acquiring undervalued offshore leases with proven undeveloped reserves and executing low-risk, high-return drilling programs.

We are seeking $75 million in equity financing to fund lease acquisitions, drilling operations, and general working capital needs during our start-up phase.

Financial Projections

Financial projections show the potential for strong growth and returns, with estimated revenues of $50 million by Year 5.

Company Overview

TX Energy is an independent exploration and production company in the Gulf of Mexico. We were founded in 2024 by a team of seasoned industry professionals with a successful track record in this region.

Corporate headquarters: Houston, TX

Operating region: U.S. Gulf of Mexico

Business Concept

Leverage management’s expertise to:

- Identify and acquire undervalued offshore leases

- Optimize development plans for discovered resources

- Execute low-risk, high-return drilling programs

- Rapidly build a diversified portfolio of producing properties

Industry Analysis

The U.S. Energy Information Administration expects the demand for oil and natural gas will grow in the coming years. Some key industry statistics and forecasts:

- The oil and gas market size is projected to increase from $7,625.82 billion in 2024 to $9,347.9 billion in 2028, with a CAGR of 5.2%. (Source – The Business Research Company )

- The global oil demand is forecasted to rise by 1.7 million barrels per day (mb/d) in the first quarter of 2024. The expansion pace might slow down from 2.3 mb/d in 2023 to 1.3 mb/d in 2024. (Source – IEA )

Key Industry Drivers and Trends:

Business plan for investors.

- Rapid adoption of subsea tiebacks and multi-well platforms to reduce costs

- Increased interest in re-developing legacy fields using advanced recovery techniques

- Growing regulatory oversight and focus on safety/environmental practices

- Persistent workforce shortages requiring investment in training pipelines

Customer Analysis

Our primary customers will be midstream companies, refiners, and utilities purchasing our crude oil and natural gas production. We have identified the following key players as potential off-takers in the Gulf region:

- Mid-Continent Oil Pipelines (Crude oil transport)

- Kinder Morgan/BP (Natural gas processors)

- Marathon Petroleum (Refiner)

- Southern Company (Utility)

As a non-integrated independent producer, we will aim to establish long-term sales agreements and strategic relationships with creditworthy counterparties. Our go-to-market strategy will focus on:

- Leveraging management’s industry network to engage top prospective customers early

- Ensuring adequate takeaway capacity ahead of new wells coming online

- Negotiating favorable pricing terms based on our high-quality offshore crude

- Bundling gas production with crude offtakes where possible

Competitive Analysis

Large integrated operators such as Chevron, Shell, and BP, as well as several large independent companies, dominate the upstream market of the Gulf of Mexico. Fewer mid-sized players focus solely on exploiting stranded/bypassed reserves on the shelf. Our primary competitors include:

Our primary competitors include:

Relative to these competitors, our key advantages are:

- Unrivaled management experience and technical capabilities specific to shelf opportunities

- Exclusive focus on low-risk, quicker cycle time development projects

- Simple value investment proposition vs. diversified multi-regional operators

Other competitive strengths include a projected low operating cost structure and established relationships with service companies active in the region.

Marketing Plan

TX Energy will position itself as the premier low-risk, low-cost developer of shelf oil and gas resources in the Gulf of Mexico. We will pursue a commodity-focused strategy, marketing our high-quality crude and gas production to maximize netbacks.

Pricing Strategy

As a non-integrated producer, we will pursue a commodity marketing strategy focused on achieving maximum netback pricing for our offshore production. Specific tactics include:

- Crude oil – Secure term marketing agreements with refiners or marketers, pricing based on regional benchmarks like LLS or WTI

- Natural gas – Pursue portfolio-based sales to LDCs, utilities, and marketers at Henry Hub+/- basis pricing

Sales & Distribution Channels

We will employ two primary sales and distribution channels:

- Crude oil production – Pipeline connections from offshore platforms to main corridor pipelines like LOCAP and NGPL

- Natural gas production – Subsea tiebacks into regional gathering systems and interstate/intrastate pipelines

Strategic Partnerships

Establishing strategic relationships across our supply chain will be a critical success factor. Key partnership areas include:

- Offshore drilling contractors

- Subsea construction and installation contractors

- Pipeline companies and midstream providers

- Supply boat and support vessel operators

Marketing Programs

Our key marketing initiatives will focus on building brand awareness and establishing TX Energy as a trusted and preferred supplier to Gulf Coast off-takers:

- Investor marketing/participation at industry conferences and events

- Working interest/royalty owner marketing of upcoming development projects

- Direct outreach to commercial teams at potential customers

- Development of professional digital marketing materials

Operations Plan

Oil & gas leases.

Our lease acquisition strategy will initially target offshore shelf properties with the following characteristics:

- Water depths < 600 feet

- Located near existing infrastructure to minimize upfront capital costs

- Proven undeveloped reserves between 10-50 million BOE

- Technically reasonable development plan via subsea tiebacks or platform drilling

We have already identified a pipeline of potential acquisition targets fitting this criteria. Once leases are acquired, we will conduct geologic and reservoir studies to high-grade the most attractive drilling opportunities.

Drilling & Completion Activities

We will utilize jack-up and submersible rig types commonly used on the shelf For relatively shallow drilling targets. We will use the best available techniques and technologies to drill all wells and to ensure maximum production rates and recoverable reserves.

Production, Facilities & Maintenance

Depending on the size and scope of each project, we will utilize either:

- Subsea tiebacks to existing third-party infrastructure

- New-build production platforms designed for unmanned operations

Environmental & Regulatory

We are committed to operating at the highest level of environmental, safety, and regulatory standards in offshore space. This includes comprehensive SEMS programs, oil spill prevention and response plans, and other mandatory policies/procedures.

Key regulatory bodies overseeing our operations include:

- Bureau of Safety and Environmental Enforcement (BSEE)

- Bureau of Ocean Energy Management (BOEM)

- U.S. Coast Guard

- Environmental Protection Agency

Organization & Management Team

TX Energy has assembled a world-class team with unmatched technical and regional expertise in the offshore Gulf of Mexico:

- John Watson, Chief Executive Officer – John has 30+ years of offshore engineering and operations experience. He is a former VP of offshore at a major energy company with expertise in subsea tieback developments and shelf production.

- Jane Litt, VP of Exploration – Jane has 25 years of experience in offshore Gulf exploration. She was previously a senior exploration advisor at a large independent oil company. She holds a Ph.D. in Petroleum Geology from Rice University.

Additional key hires planned for Year 1 include:

- Drilling Manager

- Production Engineer

- HSE/Regulatory Specialist

- Land/Legal Counsel

- Accounting/Finance support

As we grow, certain additional functions like HR, IT, and engineering teams may be built out internally rather than fully outsourced.

Financial Plan

Based on our phased development plan and production ramp-up schedule, we are seeking $75 million in equity financing to fund TX Energy’s start-up and growth over the initial 5 years period:

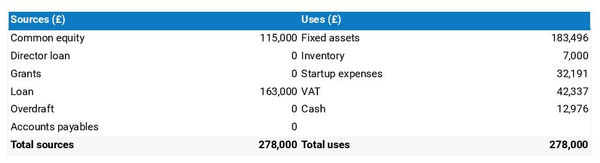

Use of Funds

- Offshore lease acquisitions: $25M

- Capital expenditures (drilling/facilities): $30M

- Operating expenditures: $15M

- General working capital: $5M

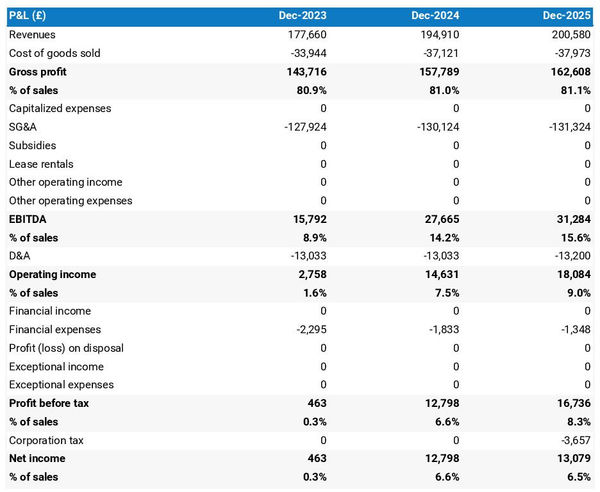

Projected Profit & Loss Statement

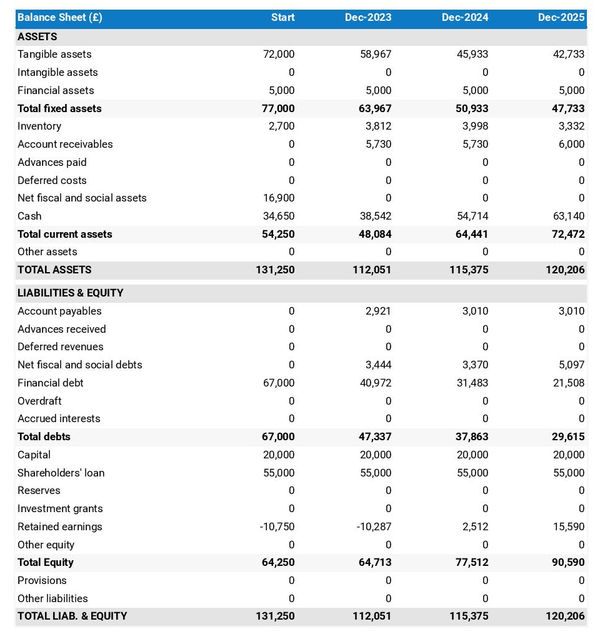

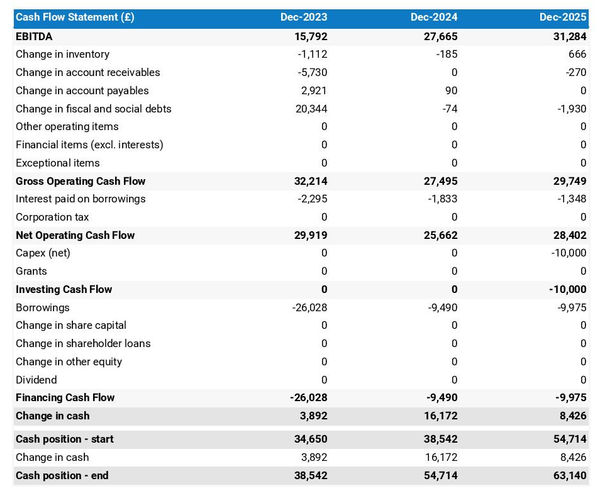

Projected balance sheet, projected cash flow statement.

Overall, these projections in the coal mining business plan illustrate TX Energy’s ability to rapidly grow production, revenue, and cash flow in a capital-efficient manner and achieve strong economic returns for investors.

Partner With OGSCapital for a Professional Oil and Gas Business Plan

Over at OGSCapital, we understand just how crucial it is for independent oil and gas outfits to have a really solid, well-polished business plan. Whether you need to win over investors or secure financing from lenders, our team has got your back.

With more than 15 years of expertise in aiding both startups and established businesses in crafting thorough and persuasive business plans such as the renewable energy business plan and logistics business plan , we’re well-equipped to assist.

Contact us today to learn more about our business plan consulting services and how we can help you.

Download Oil and Gas Business Plan Sample in pdf

Frequently Asked Questions

Is oil and gas a good business?

Yes, because the oil and gas industry is one of the largest sectors in the world, generating over trillion in global revenue as of 2022. In 2024, the industry is expected to have solid growth.

How to start your own oil and gas company?

Starting an oil and gas company involves several steps:

Step 1: Do market research.

Step 2: Decide your geographical location.

Step 3: Build a team.

Step 4: Create an oil and petroleum business plan.

Step 5: Set up a legal entity (LLC, Corporation, etc.)

Step 6: Seek funding.

Step 7: Get the equipment.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Vegetable Farming Business Plan

Trading Business Plan

How To Write A Textile Manufacturing Business Plan

Start a Vending Machine Business in 2024: A Detailed Guide

What Is Strategic Planning: Definition and Process

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Oil & Gas Business Plan Template

A successful oil and gas business is based on a solid business plan. To help you out, we've designed a business plan template PDF specifically for your oil & gas business.

Get your copy today!

Download The Template

For help completing your oil & gas business plan, read our guide .

How can an oil & gas business plan template help you?

- A solid oil & gas business plan acts as your strategy guide for building a successful business.

- Whether you're an existing oil & gas business or just starting out, a business plan helps you get organised.

- Use a oil & gas business plan to help secure funding for your business.

Get your free oil & gas business plan PDF!

Created by tradify - the easiest way to manage your plumbing, oil & gas business..

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

Oil and Gas Business Plan with Wise Business Plans

Corporate oil & gas business plan development.

The Oil and Gas Business Planning industry continues to make new strides in the United States in the oil and gas companies, and many small business owners are finding ways to leverage the booming industry to create their own success stories. However, it takes more than a smart idea to start your engine and race toward success in this competitive field of petroleum.

Post-Pandemic Recovery

During May 2020, the amount of gasoline supplied to the market increased to nearly 5.9 million barrels a day, up from 5.1 million in the first week of April but well below the typically more than 9 million before the pandemic. On the other hand, gasoline saw a normalizing demand at around 55%, which improved by 64% during mid-2020. Industry experts expect a slow but steady recovery during 2021, giving hope to the industry operators.

Key Components of Petroleum Business:

- The clarity in Products and Services- The COVID-19 crisis accelerates what was already shaping up to be one of the industry’s most transformative moments. The Wise Business Plans professionals take time to find out which pain point the product or service will be addressing and develop a business plan that accurately communicates it.

- Costing Strategy- The costs associated with embarking upon a business in the Oil and Gas business industry can be challenging, especially in the post-pandemic era. On its current course and speed, the industry could now be entering an era defined by intense competition, technology-led rapid supply response, flat to declining demand, investor skepticism, and increasing public and government pressure regarding the impact on climate and the environment. However, under most scenarios, oil and gas will remain a multi-trillion-dollar market for decades. Given its role in supplying affordable energy, it is too important to fail. The question of how to create value in the next normal is therefore fundamental.

- Trends- Trends are major in all segments of the economy but especially in those that directly impact the atmosphere. “Clients operating in this industry have to be aware of regulations, laws, and standards that are enacted by governing bodies. Without this type of information their business models could suffer significant losses”, says Mr. Ferriolo. “We do exhaustive, real-time research that protects the client and places them in the best possible position to succeed”, says Mr. Ferriolo.

- Innovation- The industry will need to dig deep and tap its proud history of bold structural moves, innovation, and safe and profitable operations in the toughest conditions to change the current paradigm. The winners will be those that use this crisis to boldly reposition their portfolios and transform their operating models. Companies that don’t will restructure or inevitably atrophy.

How To Get Into The Oil Business

In the oil and gas sector, starting your own company requires a lot of capital, time, and expertise. Even so, as this industry produces multi-millionaires and yields a higher ROI than in any other industry, all your troubles and efforts will be worthwhile.

You should focus on these things if you have previous experience in this area and want to know how to start an oil company.

1. Decide Where to Invest

You can have a filling station or you can drill your wells in the oil and gas industry. One can choose from a variety of options: a service company, a product company, or a company that cleans up oil spills.

It is important to determine your motivations and strengths before making any detrimental moves in this field. Getting a sense of the amount of capital needed can help you make the right choice.

2. Make an Oil and Gas Business Plan

You need to make a detailed oil & gas business plan and list all your resources and liabilities after deciding what you want to focus on. It is imperative to include all the projected operating expenses in your petroleum business plans, such as insurance, permits, licenses, salaries, and ongoing expenses.

A business plan for an oil and gas company will serve as a blueprint for your business. Your business plan will be a valuable tool if you are considering applying for a loan or wish to attract investors. In case you have no prior experience creating business plans , In case you have no prior experience creating business plans, you can hire us to assist you.

Do You Need Help in Creating a Business Plan?

If you need a business plan writer , you no longer have to worry about the complexities of writing a professional business plan. Our MBA-qualified business plan writers have written over 15000+ business plans for over 400 industries in over a decade.

Let our professional business plan writers help you get funding

3. Identify Your Investors

Once you’ve decided what type of oil business is right for you and calculated the loans and funding you’ll need, the next step is to make sure you can get a fair loan.

To run any company in this field, you will need a fair amount of capital from the very beginning, so you may have to consider finding investors. Don’t worry about the capital Here are 7 ways to raise capital for getting into the oil business:

- Self-Funding: If you look around, you may find the capital you need right in your own home. It may come from your already existing assets or savings. You retain full control of the business by providing the initial capital yourself. Angel investors and even single investors can influence the direction of a company.

- Crowdfunding: A method of raising money from a large number of people. Several people pool their small investments to raise the capital needed to launch a company or project. It’s a win-win situation for you. Currently, U.S. oil is the most popular commodity in the world.

- Angel Investor: Private or seed investors (also called angel investors) are high-net-worth individuals who provide financial support to small businesses in exchange for ownership equity. Furthermore, investors can also offer business advice. Particularly if they have oil and gas industry experience, this may be beneficial.

- Friends and Family: Friends and families are the second-largest sources of business capital in the U.S. A family member will be aware of your work history or management experience. It’s likely that they already know about the potential of your gas or oil share, and may even have helped to acquire it.

- Bank Loan: Getting a bank loan is probably the most traditional way to obtain start-up capital. As the bank wants to ensure that you can pay back the loan, you will likely be required to submit a lot of information during your initial application. Our experienced team has helped our clients raise millions in funding through banks (debt financing) and investors (debt/equity financing).

- Small Business Administration (SBA): Despite its long history, the SBA is still a useful source of funding . They offer federally guaranteed loans of up to $5 million to “small” businesses. Furthermore, you will receive the funding you require without compromising your oil and gas business plan. The loan will also likely have light terms and interest rates. SBA’s goal is to boost the economy. A small business loan is one of the easiest ways to get cash. With decades of experience in business credit and lending, Wise Business Plans is uniquely suited to help you. You are just 4 steps away from getting a small business loan .

Pro Tip: Here is a step by step guide on 5 best places to find a venture capitalist

Wise Business Plans has decades of experience in early-stage investments, so we will help you get your first venture capital investment .

Do You Need Investment?

4. check the regulations.

You should check all the relevant regulations, licenses, and permits , as well as your tax identification number, before starting an oil business. You may be aware of some of them from previous experience, but you should always consult a business or tax attorney when addressing legal issues.

Do You Need a License to operate an Oil and Gas Business?

Wise business plans have eased the process to obtain a business license, which is generally necessary to operate an oil and gas business.

Let Wise help you Get your License to operate an Oil and Gas Business

5. Form a Legal Entity

Those in the group will want to shield themselves from personal liability. You can form a limited liability company (LLC) or an S corporation. An LLC is a flexible entity with elements of both a partnership and a corporation. To simplify federal income tax matters, S corporations elect to pass income and losses on to shareholders.

Need to Register an Oil and Gas Business?

We at Wise Business Plans provide you with a wide range of business formation services for incorporating a company in a way that makes the process easy and allows you to stay focused on other important tasks. Our business formation services include

- Tax ID Number

- LLC Formation

- NonProfit Business Formation

- S Corporation Registration

You can form your business entity in just 4 Simple Steps with Wise Business Plans

Open a Business Bank and Get Credit Cards

Personal asset protection is enhanced when you open specialized business banking and credit accounts.

When your personal and professional accounts are mixed, your personal assets (your home, automobile, and other valuables) are vulnerable if your company is sued.

Furthermore, learning how to establish business credit may assist you in receiving credit cards and other financial resources in your company’s name (rather than yours), improved interest rates, greater lines of credit, and more.

6. Set up a Business Bank Account.

Apart from being a requirement when applying for business loans, establishing a business bank account has several benefits.

- Separates your personal belongings from your company’s assets, which is critical for personal asset protection.

- Makes tax preparation and accounting simple.

- It makes tracking expenses easier and more organized.

Recommended: To discover the greatest bank or credit union, read our Best Banks for Small Business review.

7. Open Net 30 Account

To establish and grow business credit, as well as improve company cash flow, net 30 payment terms are utilized. Businesses purchase products and pay off the whole amount within a 30-day period using a net 30 account.

Net 30 credit vendors are reported to the major business credit bureaus (Dun & Bradstreet, Experian Business, and Equifax Business Credit). This is the way businesses build business credit to qualify for credit cards and other lines of credit.

Recommended: Read our list of the top net 30 vendors guide to start getting business credit or simply open your net 30 account with wise business plans in seconds.

8. Get a Business Credit Card

It’s exciting to open a business credit card for your firm. A business credit card can assist you to establish credit, safeguard your company financially, access rewards (such as cashback), and simplify cash flow. It can also assist you to manage your expenditures.

Recommended: Learn more about the best business cards in our business credit card review.

9. Build a Great Team

When taking on such a venture, human capital plays a crucial role. You must determine how many employees you need to hire and whether they have enough experience and training to do their jobs well.

Here are some useful team-building tips which might help you in building your team.

10. Use Top-Notch Equipment

Make sure you use top-notch equipment to ensure and protect your business and investments. For those who work directly in the oil production sector, it is extremely important to ensure your piping, control, and measuring systems are all up-to-date.

If you plan to start a procurement and supply company, you should include quality general equipment, such as valves, pumps, and generators, along with personal safety equipment. By providing high-quality tubular to your customers, along with other drilling and wellhead equipment, you will stand out as a reliable and conscientious provider.

11. Choose an Exploration Site

Obtain county and/or state permits for drilling and land use. Execute a lease with the property owner and/or the owner of mineral rights once you determine which party owns the property and if there are no prior claims that might affect your exploration.

In case your seismic data indicates there could be a subsurface trap containing significant oil, drill multiple exploratory wells on the site. Provide all necessary supplies and equipment for well capping and storing oil in storage tanks prior to hiring a drilling company for this purpose.

Ensure that you have a plan for containing and transporting any natural gas and oil that may be present in your site’s reservoirs. Roads may need to be built to access the site. Trailers or other structures are necessary for offices and living accommodations. Communication capabilities should also be available at the site.

Business Planning for the Oil & Gas Sector

Vigilance is more than ever needed in crafting a solid oil and gas business plan. Smart planning showing commitment and consistency in intentions will always win financiers’ confidence. As part of that strategy, we’ve identified several key components that every oil and gas startup business plan must address, including:

Luckily, a properly written oil and gas business plan is a key element to the process that can help your business raise the necessary capital to purchase equipment, hire staff, and cover operating expenses as you plan to enter the Oil and Gas industry .

Oil And Gas Business Plan Writing Services

Wise Business Plans has had the privilege and the opportunity to create oil and gas Companies that support business owners in this foundational industry, and we have worked hard to build up a knowledge base and the research skills needed to be the premier online provider of oil and gas business plans.

When you’re ready to jump into the action, we’d love to help you start strong and make a mark in the world of energy production, so contact us today to get started on planning your future success.

Download a sample oil and gas business plans template for FREE to get an idea of the basic elements of oil and gas startup business plan writing. Also, you can quickly check our FAQ page for some basic questions and answers.

Wise business plans also offer a net 30 account application . Net-30 accounts allow you 30 days to pay the bill in full after you have purchased products. Net 30 accounts can also make managing your business finances easier. Apply for your net 30 business accounts now

Need Nearest Business Plan Writing Services

Looking for a professional business plan writing services near me ? Contact us to achieve your company’s goals and get funded.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

Sample Oil and Gas Business Plan

This article will be providing you with an oil and gas business plan guide or template.

The energy sector of every economy is huge and offers enormous investment opportunities. Whatever your niche area or interests are, starting a business can be very challenging.

However, having a plan makes the process a lot less difficult and helps with better coordination.

Here, we aim to help entrepreneurs who, though being experienced in the oil and gas sector have no idea how to launch their business operations.

OIL AND GAS BUSINESS PLAN SAMPLE

To better organize your plan, there are basic sections that cannot be left out. They touch on the different aspects of running a successful oil and gas business.

They include the executive summary, the company description, and the products & services sections.

Other crucial sections include the market analysis section, strategy & implementation, organization & management team as well as the financial plan & projections sections.

So, how do you develop each of these sections? You’ll want to read on to find out.

i. Executive Summary

As the introductory section of your plan, the executive summary gives a concise overview of your oil and gas business plan. What you should seek to do with this section is make and keep your audience interested by learning about your business.

The basics about your company should be known here.

The executive section always appears first in a plan. While this is true, it should be written last. The reason is this; it should capture all the key aspects of the business plan.

Consider adding certain sections like your business name & location, your services & products as well as your mission & vision statements. Also, the specific purpose of your plan should be added.

Business Name & Location

One of the first things you’ll need to include in your business name as well as its location. Introducing your business is paramount and gives your reader or a starting point on what the business is about.

How does your location positively impact your operations?

Services & Products

Here, you’ll need to give a breakdown of your oil and gas products and services . What specific niche area you involved with and how are your products and services beneficial to your clients.

People only pay for value and you should briefly discuss what value your services offer to your clients.

Mission & Vision Statements

The mission and vision statements of your oil and gas business should shed light on your company’s purposes, goals and values. Your mission statement should tell about why the business exists as well as the purpose it serves.

Also include information on what your business offers.

You should focus on what you seek to ultimately achieve with your oil and gas business for the mission statement. In a nutshell, the vision statement gives purpose to the existence of your business.

It’s important when writing this statement to never leave anything open to interpretation.

Specific Purpose

Every serious business has a purpose. What’s yours about? By clarifying your purpose or aims, your chances of achieving your goals are increased.

ii. Company Description

The company description section seeks to further reveal details about your oil and gas business. Basically, you want to explain who you are, your mode of operation as well as the goals you wish to achieve.

Details to be included are the legal structure of the company, as well as its brief history.

Being an oil & gas business, you’ll have to provide details on the needs or demands you intend to fill or meet.

The company description should give an overview of your services & products while also identifying your target market and your suppliers.

Also, include a summary of company growth backed by financial or market highlights.

Of course, this won’t be complete without a summary of your long and short-term goals including how you intend to make a profit.

iii. Products & Services

While this was covered in the executive summary section, only a summary of it was given.

This section takes a more detailed look at the products and services being offered by your oil & gas business with a focus on the benefits being derived by customers.

Here, you’ll also need to explain the market role of such products & services.

What edge or competitive advantages do your products & services have over those from competitors. Are there new products in the works? Provide information on such.

Here is a sample plan on crude oil refining .

iv. Market Analysis

A lot of work in the form of research is required to demonstrate your understanding of the oil and gas industry.

Your research should provide a detailed sketch of your target market with a focus on key aspects such as its size and demographics.

Have an industry description and outlook with statistics serving as proof. What more? There should be historical, current, and projected marketing data for your oil and gas business.

Also, include an evaluation of your competitors with a special focus on their weaknesses and strengths.

v. Strategy & Implementation

Strategy and implementation have a lot to do with sales and marketing. This is basically an operating plan on how you wish to sell and distribute your oil & gas products and services.

It focuses on market entry, pricing, costs, promotion, and distribution details.

What are your operational plans in regards to the operational cycle of the business? You also want to include information on labor sources as well as the number of employees you’ll need.

vi. Organization & Management Team

The organization & management team section discusses the organizational structure of the oil and gas business.

You want to provide a description of key departments as well as employees by providing an organizational chart.

There should be information about the owners, their level of involvement as well as percentage ownership. Also, profiles of your management team will be necessary.

vii. Financial Plan & Projections

Under the financial plan & projections section, you’ll need some expert help. The services of a professional accountant will suffice.

The key areas analyzed under this section include the historical financial data, realistic prospective financial information, and brief analysis of financial data.

With these points covered, your oil and gas business plan should be ready for implementation. You also stand the chance of getting the much-deserved financing required.

One Comment

Hi dear , Iam from Papua New Guinea,Alotau Milne Bay Province. Papua New Guinea. Iam a Tradesmen, Heavy Diesel Fitter and Maintenance Fitter Machinist. Former Mechanical Maintenance Engineer for BHP STEEL and Ok Tedi Mining LTD Mill Maintenance Rebuildshop. Iam urgently seeking for any mechanical Fitter jobs in Australian Oil Rig Drilling companies and Mining. Any other farming jobs suits my qualifications. Thank you very much for your time and kind assistance. I wait patiently to hear from you soon.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

How To Write a Business Plan for Oil And Gas in 9 Steps: Checklist

By henry sheykin, resources on oil and gas.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

The oil and gas industry is a cornerstone of the global economy, providing the fuel and energy resources that power our everyday lives. In the US, the most common business model for oil and gas companies is exploration and production, where lucrative fields are located, developed, and extracted for processing and sale.

The demand for oil and gas continues to grow, with the global consumption projected to reach 100 million barrels per day by 2020. As the industry evolves and competition intensifies, it is crucial for companies to have a well-defined business plan that outlines their strategies for success.

Conduct Market Research

Market research is a crucial step in developing a business plan for oil and gas companies. It provides valuable insights into the industry, helps identify opportunities and challenges, and allows for informed decision-making. Here are some important considerations when conducting market research:

- Understand the oil and gas industry landscape: Gain a comprehensive understanding of the current state of the oil and gas industry, including market trends, demand-supply dynamics, and regulatory changes. Stay updated on emerging technologies and innovations that may impact the industry.

- Identify target market segments: Determine the specific market segments within the oil and gas industry that align with your business goals. This could include exploration, drilling, production, refining, or distribution. Assess the size, growth potential, and profitability of each segment.

- Analyze competitors: Identify and analyze key competitors in your target market segments. Evaluate their strengths, weaknesses, market positioning, and business strategies. Understand how your business can differentiate itself from competitors and offer unique value to customers.

- Evaluate customer needs and preferences: Gain insights into the needs, preferences, and challenges of potential customers within your target market segments. Determine the factors that influence their purchasing decisions and explore ways to meet their specific requirements effectively.

- Assess market demand and pricing: Understand the current and future market demand for oil and gas products. Evaluate pricing trends and competitive pricing strategies. This analysis will help you determine the feasibility and profitability of your business venture.

Tips for conducting effective market research:

- Utilize industry reports, market studies, and government data to gather reliable information.

- Interview industry experts, potential customers, and suppliers to gain valuable insights.

- Stay updated on industry news and publications to identify market opportunities.

- Consider partnering with market research firms or consultants to conduct comprehensive studies.

- Regularly review and update your market research to adapt to changing industry dynamics.

By conducting thorough market research, you can gain a deep understanding of the oil and gas industry, identify target market segments, and make informed decisions that will drive the success of your business plan.

Identify Target Market And Competition

In order to develop a successful business plan for your oil and gas company, it is crucial to identify your target market and understand the competition in the industry. This step will help you tailor your business strategies and make informed decisions to differentiate yourself from competitors.

Identifying Your Target Market:

Begin by conducting thorough market research to ascertain the demand for oil and gas products in your desired region. Identify the specific industries or sectors that heavily rely on these resources, such as transportation, manufacturing, or energy production. Determine their current and future needs, as well as any potential barriers to entry.

Consider the geographical factors that may impact your target market, such as proximity to oil fields or major distribution hubs. Additionally, analyze the demographics and purchasing power of potential customers to better understand their consumption patterns and preferences.

- Segment your target market based on various criteria, such as size, location, or industry.

- Conduct surveys or interviews with industry experts and potential customers to gather valuable insights.

- Keep an eye on emerging trends and technologies that may influence the demand for oil and gas resources.

Evaluating the Competition:

Analyze the existing players in the oil and gas industry to understand their business models, market share, and competitive advantages. Identify their strengths and weaknesses, as well as the unique value propositions they offer to customers.

Assess the barriers to entry in the industry, such as proprietary technology, established relationships with distributors, or access to key resources. Evaluate the potential threats posed by new entrants or substitute products, and determine their impact on your market position.

By studying your competition, you can identify gaps in the market and develop strategies to differentiate your business. Focus on delivering value to your target market that sets you apart from competitors, whether it be through innovative technology, superior customer service, or sustainable practices.

- Monitor industry publications, reports, and news to stay updated on the latest developments in the oil and gas sector.

- Attend industry conferences and trade shows to network with industry professionals and gain insights into market trends.

- Perform a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to evaluate your own business and its position in the market.

Define The Business's Value Proposition

The value proposition of an oil and gas company is the unique combination of products, services, and benefits that it offers to its customers. It is what sets the company apart from its competitors and communicates how it can meet the specific needs and desires of its target market.

When defining your business's value proposition, it is important to consider the following:

- Identify your target market's pain points: Understanding the challenges and problems faced by your target market will allow you to tailor your value proposition to address their specific needs. Consider conducting market research and customer surveys to gain insights into their pain points.

- Highlight your unique selling points: Determine what makes your oil and gas company different from others in the industry. It could be your advanced technology, expertise in a specific area, or commitment to sustainable practices. Emphasize these unique selling points to capture the attention of potential customers.

- Showcase the benefits: Clearly communicate the benefits that customers can expect from using your products or services. This could include cost savings, increased efficiency, environmental sustainability, or improved reliability. The goal is to demonstrate how your offerings can solve their pain points and provide value.

Tips for defining your business's value proposition:

- Keep it concise and easy to understand.

- Focus on the most compelling aspects of your offerings.

- Use customer testimonials or case studies to support your claims.

- Regularly review and refine your value proposition to stay competitive in the market.

Determine The Legal And Regulatory Requirements

When starting an oil and gas business, it is crucial to understand and comply with the legal and regulatory requirements of the industry. Failure to do so can lead to severe consequences, including fines, penalties, and even legal action. Here are some important steps to help you navigate through the legal landscape:

- Research and understand the federal, state, and local laws related to oil and gas exploration and production. These laws can vary depending on the location, so it is essential to consult with legal experts who specialize in the industry.

- Determine the permits and licenses required to operate your business. This may include environmental permits, drilling permits, and operating licenses. It is crucial to obtain all necessary permits before commencing any operations.

- Develop a comprehensive plan to comply with health, safety, and environmental regulations. This may involve implementing safety protocols, conducting regular inspections, and maintaining proper waste disposal procedures.

- Ensure compliance with labor and employment laws. This includes understanding regulations related to employee rights, wages, benefits, and working conditions. It is important to develop clear policies and procedures to adhere to these laws.

- Consider the impact of international regulations if you plan to expand your business globally. Different countries may have varying requirements and restrictions on oil and gas exploration and production.

- Consult with legal experts who specialize in the oil and gas industry to ensure you have a thorough understanding of the legal and regulatory landscape.

- Maintain proper documentation and records to demonstrate compliance with regulations. This will help you in case of an audit or legal dispute.

- Regularly review and stay updated on any changes or updates to the laws and regulations that may affect your business. This will ensure that you remain compliant at all times.

Determining the legal and regulatory requirements is a critical step in writing a business plan for an oil and gas company. By thoroughly understanding and complying with the applicable laws and regulations, you can ensure the smooth operation of your business and avoid potential legal issues.

Assess The Financial Feasibility

When starting a business in the oil and gas industry, it is crucial to thoroughly assess the financial feasibility of your venture. This step will help determine if your business idea is viable and if it has the potential to generate profitable returns. Here are some important factors to consider:

- Costs and Expenses: Calculate the upfront costs of acquiring exploration and drilling equipment, as well as the ongoing expenses for personnel, maintenance, and regulatory compliance. This will give you a clear understanding of the financial resources required to operate your business.

- Revenue Potential: Evaluate the potential revenue you can generate by estimating the quantity and quality of oil and gas resources that can be extracted from your targeted fields. Consider market prices, demand, and production costs to determine if your revenue projections are realistic.

- Profitability Analysis: Conduct a thorough analysis of your projected costs and revenues to assess the profitability of your business. Take into account factors such as production volumes, profit margins, and market fluctuations. This analysis will help you understand if your business can generate sustainable profits.

- Financial Projections: Develop comprehensive financial projections that include income statements, cash flow statements, and balance sheets. These projections will provide a clear picture of your business's financial performance over time and help you identify potential risks and opportunities.

- Consider consulting with a financial advisor or accountant who specializes in the oil and gas industry. They can provide valuable insights and help you navigate complex financial considerations.

- Include contingency plans in your financial feasibility assessment to account for potential risks and uncertainties, such as changes in oil and gas prices or regulatory policies.

- Regularly review and update your financial projections to ensure they align with market conditions and any changes in your business operations.

By thoroughly assessing the financial feasibility of your oil and gas business, you will have a solid foundation for making informed decisions and securing the necessary funding to propel your venture forward. Remember, accurate financial projections and a realistic understanding of costs and revenue potential are essential for long-term success in this competitive industry.

Develop A Marketing And Sales Strategy

Developing an effective marketing and sales strategy is crucial for the success of an oil and gas business. It involves identifying your target market, understanding their needs, and creating a plan to reach and engage with them. Here are the key steps to develop a comprehensive marketing and sales strategy:

- Identify your target market: Begin by defining your ideal customers. Consider factors such as location, industry, size, and specific needs. This will help you tailor your marketing efforts towards those who are most likely to become your customers.

- Research your competition: Analyze your competitors' marketing and sales strategies to identify areas where you can differentiate yourself. This will help you understand what sets your business apart and how to position yourself in the market.

- Create a compelling value proposition: Clearly communicate the unique value your business offers to your target market. Highlight the benefits and advantages of choosing your oil and gas products or services.

- Select appropriate marketing channels: Determine the most effective channels to reach your target market. This could include online platforms, industry publications, trade shows, direct mail, or partnership collaborations. Invest in targeted advertising and a strong online presence to increase brand awareness.

- Develop a content marketing plan: Use content marketing to provide valuable information and establish your expertise in the industry. This can include blog posts, whitepapers, case studies, and informative videos. Regularly update your content to maintain engagement with your audience.

- Build relationships with industry influencers: Identify key influencers or thought leaders in the oil and gas industry and establish connections with them. Collaborate on content, participate in industry events, and seek endorsements to expand your reach and credibility.

- Train and equip your sales team: Ensure your sales team is knowledgeable about your products and services, capable of effectively communicating your value proposition, and skilled in closing deals. Provide ongoing training and equip them with the necessary sales tools.

Tips for developing a successful marketing and sales strategy:

- Stay updated with industry trends and changes to adapt your marketing and sales approach accordingly.

- Regularly measure and analyze the effectiveness of your marketing campaigns to optimize your strategy.

- Leverage technology and automation tools to streamline your marketing and sales processes.

- Establish strong relationships with prospective clients through networking events and industry conferences.

- Cultivate a positive brand image and reputation through excellent customer service and delivering on promises.

By carefully developing and implementing a marketing and sales strategy, your oil and gas business can effectively reach your target market, differentiate yourself from competitors, and ultimately drive growth.

Outline The Company's Organizational Structure

In order to effectively run an oil and gas company, it is essential to establish a clear and efficient organizational structure. The structure should outline the hierarchy of roles and responsibilities within the company, and provide a framework for communication and decision-making.

A well-defined organizational structure helps to streamline operations and ensure that tasks and responsibilities are properly allocated. This is particularly important in the oil and gas industry, where efficient management of resources and coordination of activities are crucial for success.

When outlining the company's organizational structure, there are a few key elements to consider:

- Leadership roles: Identify key leadership positions within the company, such as the CEO, COO, and department heads. Clearly define the responsibilities and authority of each role, and establish a chain of command.

- Departments and functions: Determine the different departments or functions within the company, such as exploration, drilling, production, finance, and marketing. Assign specific roles and responsibilities to each department, and ensure seamless coordination between them.

- Reporting structure: Establish reporting lines within the organization, ensuring that there is clear communication and accountability. Determine who reports to whom, and implement regular check-ins and performance evaluations.

- Communication channels: Define the channels and methods of communication within the company. This could include regular team meetings, emails, or virtual collaboration tools. Encourage open and transparent communication to foster a positive working environment.

- Decision-making process: Clarify how decisions will be made within the organization. This could involve a hierarchical decision-making structure or a more collaborative approach. Ensure that decision-making processes are efficient, transparent, and aligned with the company's goals and values.

- Consider the scalability of your organizational structure, as your company may grow and evolve over time.

- Regularly review and update the organizational structure to adapt to changes in the business environment.

- Encourage cross-departmental collaboration and communication to foster innovation and efficiency.

- Ensure that roles and responsibilities are clearly defined to avoid confusion and overlap.

- Promote a culture of accountability and empowerment, where employees have the necessary authority to fulfill their roles.

By carefully outlining the company's organizational structure, you can lay the foundation for efficient operations and effective management in the oil and gas industry.

Create A Product/Service Pricing Strategy

When it comes to the oil and gas industry, determining the right pricing strategy for your products or services is crucial for achieving profitability and staying competitive in the market. Here are some key factors to consider when creating your pricing strategy:

- Cost Analysis: Begin by assessing the costs involved in exploring, drilling, extracting, and processing oil and gas resources. Calculate both the variable costs, such as raw materials and labor, and fixed costs, such as equipment maintenance and regulatory compliance. This analysis will help you determine the baseline price at which you need to sell your products or services in order to cover expenses and achieve desired profits.

- Market Analysis: Analyze the current market trends and demand for oil and gas products. Consider factors such as global oil prices, geopolitical events, and environmental regulations that may impact the supply and demand dynamics. Understanding the market conditions will help you determine if you can set premium prices for your products or if you need to adjust your pricing to remain competitive.

- Competitor Analysis: Evaluate the pricing strategies of your competitors to gauge the market's price range. Identify what differentiates your offerings from your competitors and whether you can position yourself as a premium provider or cost-effective solution. This analysis will help you set your pricing strategy within a competitive range while highlighting your unique value proposition.

- Value-Based Pricing: Consider adopting a value-based pricing strategy, wherein you price your products or services based on the perceived value they offer to the customers. Identify the benefits and advantages your offerings bring to the market, such as improved efficiency, higher production yields, or environmental sustainability. This allows you to justify a higher price and capture the value you provide.

Tips for Creating an Effective Pricing Strategy:

- Regularly monitor the costs associated with your operations and adjust your pricing accordingly to maintain profitability.

- Stay updated on the latest market trends, technological advancements, and regulatory changes that may influence your pricing decisions.

- Consider offering different pricing tiers or packages to cater to various customer segments and increase your market reach.

- Regularly review and update your pricing strategy based on customer feedback, industry developments, and changes in market dynamics.

By carefully considering the cost analysis, market analysis, competitor analysis, and value-based pricing, you can create a product/service pricing strategy that ensures profitability while meeting the needs of your target market. Remember to regularly review and fine-tune your pricing strategy to remain competitive and adapt to changing market conditions.

Establish A Risk Management Plan

Creating a risk management plan is essential for the success and sustainability of any oil and gas business. The industry is inherently risky, with factors like fluctuating oil prices, geopolitical tensions, and environmental concerns constantly impacting operations. By proactively identifying and mitigating risks, companies can protect their assets, reputation, and bottom line.

1. Assess potential risks: Begin the risk management process by thoroughly assessing all potential risks that could impact your business. This includes both external factors such as market volatility, regulatory changes, and geopolitical instability, as well as internal factors like equipment failure, supply chain disruptions, and safety hazards.

2. Prioritize risks: Once you have identified the potential risks, prioritize them based on their likelihood of occurrence and potential impact on your business. This will help you allocate resources and attention to the most critical risks.

3. Develop risk mitigation strategies: For each identified risk, develop mitigation strategies to minimize their impact. This may involve implementing preventive measures, contingency plans, or even transferring certain risks through insurance coverage.

4. Establish monitoring and reporting processes: Regularly monitor and assess the effectiveness of your risk mitigation strategies. Establish a reporting system to ensure that any emerging risks or issues are promptly identified and addressed.

5. Train and educate employees: Ensure that your employees, from top management to field operators, are knowledgeable about the risks facing the business and their roles in risk management. Conduct regular training sessions and provide ongoing education to keep your team informed and prepared.

Tips for establishing a strong risk management plan:

- Engage experts: Consider seeking guidance from industry experts or hiring a consultant who specializes in risk management for oil and gas companies.

- Stay updated with regulations: Keep abreast of changing regulations and ensure compliance to mitigate legal risks.

- Regularly review and update your plan: Risks evolve over time, so regularly review and update your risk management plan to address emerging threats.

- Cultivate a safety culture: Foster a culture of safety throughout your organization to minimize accidents and incidents.

By establishing a comprehensive risk management plan , your oil and gas business can better navigate uncertainties and position itself for success in a dynamic industry.

In conclusion, writing a comprehensive business plan is crucial for success in the oil and gas industry. By following the nine steps outlined in this checklist, entrepreneurs can strategically plan and prepare for the challenges and opportunities that come with starting and running an oil and gas business. Conducting thorough market research, understanding the target market and competition, defining the business's value proposition, and complying with legal and regulatory requirements are foundational elements. Assessing financial feasibility, developing effective marketing and sales strategies, outlining the organizational structure, creating a pricing strategy, and establishing a risk management plan further enhance the chances of success in this competitive industry. With careful planning and execution, oil and gas businesses can thrive and contribute to the energy sector.

$169.00 $99.00 Get Template

Related Blogs

- Starting a Business

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

How to write a business plan for an oil refinery?

Putting together a business plan for an oil refinery can be daunting - especially if you're creating a business for the first time - but with this comprehensive guide, you'll have the necessary tools to do it confidently.

We will explore why writing one is so important in both starting up and growing an existing oil refinery, as well as what should go into making an effective plan - from its structure to content - and what tools can be used to streamline the process and avoid errors.

Without further ado, let us begin!

In this guide:

Why write a business plan for an oil refinery?

What information is needed to create a business plan for an oil refinery.

- How do I build a financial forecast for an oil refinery?

The written part of an oil refinery business plan

- What tool should I use to write my oil refinery business plan?

Understanding the document's scope and goals will help you easily grasp its structure and content. Before diving into the specifics of the plan, let's take a moment to explore the key reasons why having an oil refinery business plan is so crucial.

To have a clear roadmap to grow the business

Small businesses rarely experience a constant and predictable environment. Economic cycles go up and down, while the business landscape is mutating constantly with new regulations, technologies, competitors, and consumer behaviours emerging when we least expect it.

In this dynamic context, it's essential to have a clear roadmap for your oil refinery. Otherwise, you are navigating in the dark which is dangerous given that - as a business owner - your capital is at risk.

That's why crafting a well-thought-out business plan is crucial to ensure the long-term success and sustainability of your venture.

To create an effective business plan, you'll need to take a step-by-step approach. First, you'll have to assess your current position (if you're already in business), and then identify where you'd like your oil refinery to be in the next three to five years.

Once you have a clear destination for your oil refinery, you'll focus on three key areas:

- Resources: you'll determine the human, equipment, and capital resources needed to reach your goals successfully.

- Speed: you'll establish the optimal pace at which your business needs to grow if it is to meet its objectives within the desired timeframe.

- Risks: you'll identify and address potential risks you might encounter along the way.

By going through this process regularly, you'll be able to make informed decisions about resource allocation, paving the way for the long-term success of your business.

To get visibility on future cash flows

If your small oil refinery runs out of cash: it's game over. That's why we often say "cash is king", and it's crucial to have a clear view of your oil refinery's future cash flows.

So, how can you achieve this? It's simple - you need to have an up-to-date financial forecast.

The good news is that your oil refinery business plan already includes a financial forecast (which we'll discuss further in this guide). Your task is to ensure it stays current.

To accomplish this, it's essential to regularly compare your actual financial performance with what was planned in your financial forecast. Based on your business's current trajectory, you can make adjustments to the forecast.

By diligently monitoring your oil refinery's financial health, you'll be able to spot potential financial issues, like unexpected cash shortfalls, early on and take corrective actions. Moreover, this practice will enable you to recognize and capitalize on growth opportunities, such as excess cash flow enabling you to expand to new locations.

To secure financing

A detailed business plan becomes a crucial tool when seeking financing from banks or investors for your oil refinery.

Investing and lending to small businesses are very risky activities given how fragile they are. Therefore, financiers have to take extra precautions before putting their capital at risk.

At a minimum, financiers will want to ensure that you have a clear roadmap and a solid understanding of your future cash flows (like we just explained above). But they will also want to ensure that your business plan fits the risk/reward profile they seek.

This will off-course vary from bank to bank and investor to investor, but as a rule of thumb. Banks will want to see a conservative financial management style (low risk), and they will use the information in your business plan to assess your borrowing capacity — the level of debt they think your business can comfortably handle — and your ability to repay the loan. This evaluation will determine whether they'll provide credit to your oil refinery and the terms of the agreement.

Whereas investors will carefully analyze your business plan to gauge the potential return on their investment. Their focus lies on evidence indicating your oil refinery's potential for high growth, profitability, and consistent cash flow generation over time.

Now that you recognize the importance of creating a business plan for your oil refinery, let's explore what information is required to create a compelling plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Writing an oil refinery business plan requires research so that you can project sales, investments and cost accurately in your financial forecast.

In this section, we cover three key pieces of information you should gather before drafting your business plan!

Carrying out market research for an oil refinery

Before you begin writing your business plan for an oil refinery, conducting market research is a critical step in ensuring precise and realistic financial projections.

Market research grants you valuable insights into your target customer base, competitors, pricing strategies, and other crucial factors that can impact the success of your business.

In the course of this research, you may stumble upon trends that could impact your oil refinery.

1. Your oil refinery may see increased demand for products that are more eco-friendly, such as biodiesel fuel or renewable diesel fuel. 2. The market research might reveal that customers could be interested in purchasing products from your refinery that are more cost-effective than traditional oil-based fuels.

Such market trends play a pivotal role in revenue forecasting, as they provide essential data regarding potential customers' spending habits and preferences.

By integrating these findings into your financial projections, you can provide investors with more accurate information, enabling them to make well-informed decisions about investing in your oil refinery.

Developing the marketing plan for an oil refinery

Before delving into your oil refinery business plan, it's imperative to budget for sales and marketing expenses.

To achieve this, a comprehensive sales and marketing plan is essential. This plan should provide an accurate projection of the necessary actions to acquire and retain customers.

Additionally, it will outline the required workforce to carry out these initiatives and the corresponding budget for promotions, advertising, and other marketing endeavours.

By budgeting accordingly, you can ensure that the right resources are allocated to these vital activities, aligning them with the sales and growth objectives outlined in your business plan.

The staffing and equipment needs of an oil refinery

Whether you are at the beginning stages of your oil refinery or expanding its horizons, having a clear plan for recruitment and capital expenditures (investment in equipment and real estate) is vital to ensure your business's success.

To achieve this, both the recruitment and investment plans must align coherently with the projected timing and level of growth in your forecast. It is essential to secure appropriate funding for these plans.

A oil refinery might incur staffing costs for engineers, mechanics, and other skilled labor to maintain the refinery and keep it operational. Equipment costs might include the purchase of specialized machinery, tanks, and other equipment necessary to refine oil. Additionally, they might incur costs for necessary safety equipment and supplies, such as fire extinguishers and protective clothing.

To create a financial forecast that accurately represents your business's outlook, remember to factor in other day-to-day operating expenses.

Now that you have all the necessary information, it's time to dive in and start creating your business plan and developing the financial forecast for your oil refinery.

What goes into your oil refinery's financial forecast?

The objective of the financial forecast of your oil refinery's business plan is to show the growth, profitability, funding requirements, and cash generation potential of your business over the next 3 to 5 years.

The four key outputs of a financial forecast for an oil refinery are:

- The profit and loss (P&L) statement ,

- The projected balance sheet ,

- The cash flow forecast ,

- And the sources and uses table .

Let's look at each of these in a bit more detail.

The projected P&L statement

The projected P&L statement for an oil refinery shows how much revenue and profits your business is expected to generate in the future.

Ideally, your oil refinery's P&L statement should show:

- Healthy growth - above inflation level

- Improving or stable profit margins

- Positive net profit

Expectations will vary based on the stage of your business. A startup will be expected to grow faster than an established oil refinery. And similarly, an established company should showcase a higher level of profitability than a new venture.

The projected balance sheet of your oil refinery

Your oil refinery's forecasted balance sheet enables the reader of your plan to assess your financial structure, working capital, and investment policy.