What is Cost Assignment?

Share This...

Cost assignment.

Cost assignment is the process of associating costs with cost objects, such as products, services, departments, or projects. It encompasses the identification, measurement, and allocation of both direct and indirect costs to ensure a comprehensive understanding of the resources consumed by various cost objects within an organization. Cost assignment is a crucial aspect of cost accounting and management accounting, as it helps organizations make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

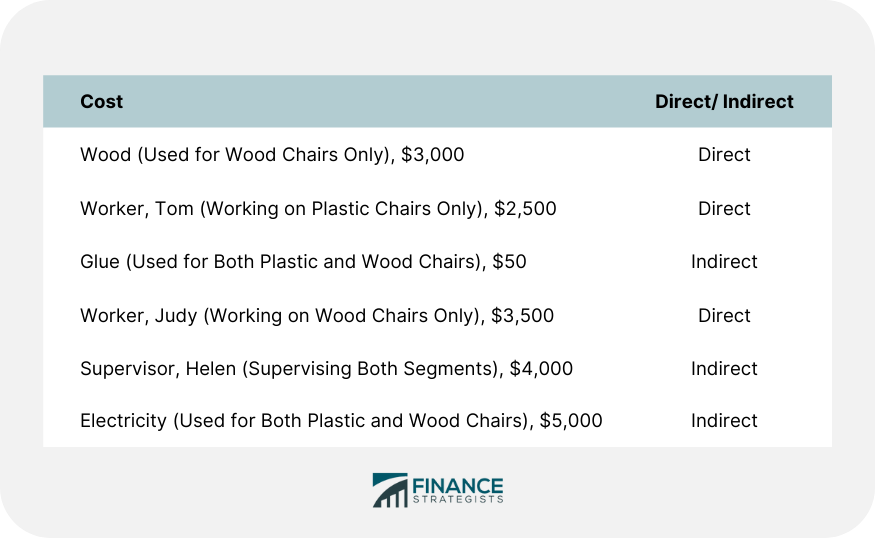

There are two main components of cost assignment:

- Direct cost assignment: Direct costs are those costs that can be specifically traced or identified with a particular cost object. Examples of direct costs include direct materials, such as raw materials used in manufacturing a product, and direct labor, such as the wages paid to workers directly involved in producing a product or providing a service. Direct cost assignment involves linking these costs directly to the relevant cost objects, typically through invoices, timesheets, or other documentation.

- Indirect cost assignment (Cost allocation): Indirect costs, also known as overhead or shared costs, are those costs that cannot be directly traced to a specific cost object or are not economically feasible to trace directly. Examples of indirect costs include rent, utilities, depreciation, insurance, and administrative expenses. Since indirect costs cannot be assigned directly to cost objects, organizations use various cost allocation methods to distribute these costs in a systematic and rational manner. Some common cost allocation methods include direct allocation, step-down allocation, reciprocal allocation, and activity-based costing (ABC).

In summary, cost assignment is the process of associating both direct and indirect costs with cost objects, such as products, services, departments, or projects. It plays a critical role in cost accounting and management accounting by providing organizations with the necessary information to make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

Example of Cost Assignment

Let’s consider an example of cost assignment at a bakery called “BreadHeaven” that produces two types of bread: white bread and whole wheat bread.

BreadHeaven incurs various direct and indirect costs to produce the bread. Here’s how the company would assign these costs to the two types of bread:

- Direct cost assignment:

Direct costs can be specifically traced to each type of bread. In this case, the direct costs include:

- Direct materials: BreadHeaven purchases flour, yeast, salt, and other ingredients required to make the bread. The cost of these ingredients can be directly traced to each type of bread.

- Direct labor: BreadHeaven employs bakers who are directly involved in making the bread. The wages paid to these bakers can be directly traced to each type of bread based on the time spent working on each bread type.

For example, if BreadHeaven spent $2,000 on direct materials and $1,500 on direct labor for white bread, and $3,000 on direct materials and $2,500 on direct labor for whole wheat bread, these costs would be directly assigned to each bread type.

- Indirect cost assignment (Cost allocation):

Indirect costs, such as rent, utilities, equipment maintenance, and administrative expenses, cannot be directly traced to each type of bread. BreadHeaven uses a cost allocation method to assign these costs to the two types of bread.

Suppose the total indirect costs for the month are $6,000. BreadHeaven decides to use the number of loaves produced as the allocation base , as it believes that indirect costs are driven by the production volume. During the month, the bakery produces 3,000 loaves of white bread and 2,000 loaves of whole wheat bread, totaling 5,000 loaves.

The allocation rate per loaf is:

Allocation Rate = Total Indirect Costs / Total Loaves Allocation Rate = $6,000 / 5,000 loaves = $1.20 per loaf

BreadHeaven allocates the indirect costs to each type of bread using the allocation rate and the number of loaves produced:

- White bread: 3,000 loaves × $1.20 per loaf = $3,600

- Whole wheat bread: 2,000 loaves × $1.20 per loaf = $2,400

After completing the cost assignment, BreadHeaven can determine the total costs for each type of bread:

- White bread: $2,000 (direct materials) + $1,500 (direct labor) + $3,600 (indirect costs) = $7,100

- Whole wheat bread: $3,000 (direct materials) + $2,500 (direct labor) + $2,400 (indirect costs) = $7,900

By assigning both direct and indirect costs to each type of bread, BreadHeaven gains a better understanding of the full cost of producing each bread type, which can inform pricing decisions, resource allocation, and performance evaluation.

Other Posts You'll Like...

Statement of Other Comprehensive Income vs Regular Income Statement

REG CPA Practice Questions Explained: Deducting Medical Expenses as Itemized Deductions

What is Other Comprehensive Income or OCI?

How to Detect Discrepancies in the Income Statement

The Most Common Causes of Discrepancies in the Income Statement

How to Correct Discrepancies in the Income Statement and the Implications

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

Helicopter Pilot to CPA: How Chase Passed His CPA Exams

How Josh Passed His CPA Exams Using Shorter Study Sessions

The Changes That Helped Marc Pass His CPA Exams After Failing 6 Times

The CPA Study Tweaks Gabi Used to Pass Her CPA Exams

How Skylar Went From a Psychology Major to Becoming a CPA

How Dalton Is Passing Exams by Making His CPA Study a Lifestyle

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

Module 5: Job Order Costing

Introduction to accumulating and assigning costs, what you will learn to do: assign costs to jobs.

Financial and managerial accountants record costs of production in an account called Work in Process. The total of these direct materials, direct labor, and factory overhead costs equal the cost of producing the item.

In order to understand the accounting process, here is a quick review of how financial accountants record transactions:

Let’s take as simple an example as possible. Jackie Ma has decided to make high-end custom skateboards. She starts her business on July 1 by filing the proper forms with the state and then opening a checking account in the name of her new business, MaBoards. She transfers $150,000 from her retirement account into the business account and records it in a journal as follows:

For purposes of this ongoing example, we’ll ignore pennies and dollar signs, and we’ll also ignore selling, general, and administrative costs.

After Jackie writes the journal entry, she posts it to a ledger that currently has only two accounts: Checking Account, and Owner’s Capital.

Debits are entries on the left side of the account, and credits are entries on the right side.

Here is a quick review of debits and credits:

You can view the transcript for “Colin Dodds – Debit Credit Theory (Accounting Rap Song)” here (opens in new window) .

Also, this system of debits and credits is based on the following accounting equation:

Assets = Liabilities + Equity.

- Assets are resources that the company owns

- Liabilities are debts

- Equity is the amount of assets left over after all debts are paid

Let’s look at one more initial transaction before we dive into recording and accumulating direct costs such as materials and labor.

Jackie finds the perfect building for her new business; an old woodworking shop that has most of the equipment she will need. She writes a check from her new business account in the amount of $2,500 for July rent. Because she took managerial accounting in college, she determines this to be an indirect product expense, so she records it as Factory Overhead following a three-step process:

- Analyze transaction

Because her entire facility is devoted to production, she determines that the rent expense is factory overhead.

2. Journalize transaction using debits and credits

If she is using QuickBooks ® or other accounting software, when she enters the transaction into the system, the software will create the journal entry. In any case, whether she does it by hand or computer, the entry will look much like this:

3. Post to the ledger

Again, her computer software will post the journal entry to the ledger, but we will follow this example using a visual system accountants call T-accounts. The T-account is an abbreviated ledger. Click here to view a more detailed example of a ledger .

Jackie posts her journal entry to the ledger (T-accounts here).

She now has three accounts: Checking Account, Owner’s Capital, and Factory Overhead, and the company ledger looks like this:

In a retail business, rent, salaries, insurance, and other operating costs are categorized into accounts classified as expenses. In a manufacturing business, some costs are classified as product costs while others are classified as period costs (selling, general, and administrative).

We’ll treat factory overhead as an expense for now, which is ultimately a sub-category of Owner’s Equity, so our accounting equation now looks like this:

Assets = Liabilities + Owner’s Equity

147,500 = 150,000 – 2,500

Notice that debits offset credits and vice versa. The balance in the checking account is the original deposit of $150,000, less the check written for $2,500. Once the check clears, if Jackie checks her account online, she’ll see that her ledger balance and the balance the bank reports will be the same.

Here is a summary of the rules of debits and credits:

Assets = increased by a debit, decreased by a credit

Liabilities = increased by a credit, decreased by a debit

Owner’s Equity = increased by a credit, decreased by a debit

Revenues increase owner’s equity, therefore an individual revenue account is increased by a credit, decreased by a debit

Expenses decrease owner’s equity, therefore an individual expense account is increased by a debit, decreased by a credit

Here’s Colin Dodds’s Accounting Rap Song again to help you remember the rules of debits and credits:

Let’s continue to explore job costing now by using this accounting system to assign and accumulate direct and indirect costs for each project.

When you are done with this section, you will be able to:

- Record direct materials and direct labor for a job

- Record allocated manufacturing overhead

- Prepare a job cost record

Learning Activities

The learning activities for this section include the following:

- Reading: Direct Costs

- Self Check: Direct Costs

- Reading: Allocated Overhead

- Self Check: Allocated Overhead

- Reading: Subsidiary Ledgers and Records

- Self Check: Subsidiary Ledgers and Records

- Introduction to Accumulating and Assigning Costs. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Colin Dodds - Debit Credit Theory (Accounting Rap Song). Authored by : Mr. Colin Dodds. Located at : https://youtu.be/j71Kmxv7smk . License : All Rights Reserved . License Terms : Standard YouTube License

- What the General Ledger Can Tell You About Your Business. Authored by : Mary Girsch-Bock. Located at : https://www.fool.com/the-blueprint/general-ledger/ . License : All Rights Reserved . License Terms : Standard YouTube License

Privacy Policy

COST ASSIGNMENT Definition

COST ASSIGNMENT involves assigning costs of an account to the accounts that are responsible or accountable for incurring the cost. For example, the cost of issuing purchase orders is allocated to the various objects procured. The cost assignment is done through assignment paths and cost drivers. The assignment path identifies the source account (the account whose cost is being assigned "Issue Purchase Orders" in the above example) and destination accounts (the accounts to which the costs are being allocated the various cost objects procured by issuing purchase orders in the above example). The cost driver identifies the measure or rationale on the basis of which the assignment needs to be done, that is, whether the costs of issuing purchase orders need to be assigned to various cost objects evenly, based on some defined percentage values, or based on some criterion, like the number of purchase orders of each cost object issued. Defining the cost drivers and assignment paths (i.e., source and destination accounts) enable proper assignment and accounting of the various costs incurred in the organization.

Learn new Accounting Terms

LIQUIDATOR is a person appointed by a court of law or unsecured creditors who liquidates assets or preserves them for the benefit of affected parties.

CONTRACTUAL ALLOWANCE, in healthcare, is the difference between what hospitals bill and what they receive in payment from third party payers, most commonly government programs; also known as contractual adjustment.

Suggest a Term

* = required field

Enter a term, then click the entry you would like to view.

404 Not found

- Subscriber Services

- For Authors

- Publications

- Archaeology

- Art & Architecture

- Bilingual dictionaries

- Classical studies

- Encyclopedias

- English Dictionaries and Thesauri

- Language reference

- Linguistics

- Media studies

- Medicine and health

- Names studies

- Performing arts

- Science and technology

- Social sciences

- Society and culture

- Overview Pages

- Subject Reference

- English Dictionaries

- Bilingual Dictionaries

Recently viewed (0)

- Save Search

- Share This Facebook LinkedIn Twitter

Related Content

Related overviews.

cost centre

absorption costing

cost allocation

cost tracing

See all related overviews in Oxford Reference »

More Like This

Show all results sharing these subjects:

- Business and Management

cost assignment

Quick reference.

The procedures by which direct or indirect costs are charged to or made the responsibility of particular cost centres, and ultimately charged to the products manufactured or services provided by the organization. Procedures used to achieve cost attribution include absorption costing, activity-based costing, marginal costing, and process costing. See also cost allocation; cost tracing.

From: cost assignment in A Dictionary of Accounting »

Subjects: Social sciences — Business and Management

Related content in Oxford Reference

Reference entries.

View all related items in Oxford Reference »

Search for: 'cost assignment' in Oxford Reference »

- Oxford University Press

PRINTED FROM OXFORD REFERENCE (www.oxfordreference.com). (c) Copyright Oxford University Press, 2023. All Rights Reserved. Under the terms of the licence agreement, an individual user may print out a PDF of a single entry from a reference work in OR for personal use (for details see Privacy Policy and Legal Notice ).

date: 09 April 2024

- Cookie Policy

- Privacy Policy

- Legal Notice

- Accessibility

- [66.249.64.20|195.158.225.230]

- 195.158.225.230

Character limit 500 /500

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Online only.

What Is Cost Allocation?

Table of Contents

For your business to make money, you must charge prices that not only cover your expenses, but also provide a profit. Cost allocation is the process of identifying and assigning costs to the cost objects in your business, such as products, a project, or even an entire department or individual company branch.

While a detailed cost allocation report may not be vital for extremely small businesses, such as a teen’s lawn service, more complex businesses require the process of cost allocation to ensure profitability and productivity.

In short, if you can assign a cost to any part of your business, it’s considered a cost object.

What is cost allocation?

Cost allocation is the method business owners use to calculate profitability for the purpose of financial reporting . To ensure the business’s finances are on track, costs are separated, or allocated, into different categories based on the area of the business they impact.

For instance, cost allocation for a small clothing boutique would include the costs of materials, shipping and marketing. Calculating these costs consistently would help the store owner ensure that profits from sales are higher than the costs of owning and running the store. If not, the owner could easily pinpoint where to raise prices or cut expenses .

For a larger company, this process would be applied to each department or individual location. Many companies use cost allocation to determine which areas receive bonuses annually.

Regardless of your business size, you’ll want to review and choose the best accounting software to help this process run as smoothly as possible.

Types of costs

In the boutique example above, the process of cost allocation is pretty simple. For larger businesses, however, many more costs are involved. These costs break down into seven categories.

- Direct costs: These expenses are directly related to a product or service. In your business’s financial statements, these costs can be linked to items sold. For a small clothing store, this might include the cost of inventory.

- Direct labor: This cost category includes expenses directly related to the employee production of items or services your business sells. Direct labor costs include payroll for employees involved in making the items your business sells.

- Direct materials: As the name suggests, this category includes costs related to the resources used to manufacture a finished product. Direct materials include fabric to make clothing, or the glass used in building tables.

- Indirect costs: These expenses are not directly related to a product or service, but necessary to create the product or service. Indirect costs include payroll for those who work in operations. It also lists costs for materials you use in such small quantities that their costs are easy to overlook.

- Manufacturing overhead: This category includes warehouse costs, and any other expenses directly related to manufacturing the products sold. Manufacturing overhead costs include payroll for warehouse managers, as well as warehouse expenses such as rent and utilities.

- Overhead costs: These include expenses that support the company as a whole but are not directly related to production. Some examples of overhead costs are marketing, operations and utilities for a storefront.

- Product costs: Also called “manufacturing costs” or “total costs,” this category includes expenses for making or acquiring the product you sell. All manufacturing overhead costs are also listed in this category.

Example of cost allocation

To better explain the process of cost allocation and why it’s necessary for businesses, let’s look at an example.

Dave owns a business that manufactures eyeglasses. In January, Dave’s overhead costs totaled $5,000. In the same month, he produced 3,000 eyeglasses with $2 in direct labor per product. Direct materials for each pair of eyeglasses totaled $5.

Here’s what cost allocation would look like for Dave:

Overhead: $5,000 ÷ $3,000 = $1.66 per pair

Direct costs:

- Direct materials: $5 per pair

- Direct labor: $2 per pair

- Overhead: $1.66 per pair

- Total cost: $8.66 per pair

As you can see, without cost allocation, Dave would not have made a profit from his sales. Larger companies would apply this same process to each department and product to ensure sufficient sales goals. [Read related article: How to Set Achievable Business Goals ]

How to allocate costs

Cost objects vary by business type. The cost allocation process, however, consists of the same steps regardless of what your company produces.

1. Identify cost objects.

To begin allocating costs, you’ll need to list the cost objects of your business. Remember that anything within your business that generates an expense is a cost object. Review each product line, project and department to ensure you’ve gathered all cost objects.

2. Create a cost pool.

Next, gather a detailed list of all business costs. It’s a good idea to categorize the costs based on the reason for each amount. Categories should cover utilities, insurance , square footage and any other expenses your business incurs.

3. Allocate costs.

Now that you’ve listed cost objects and created a cost pool, you’re ready to allocate costs. As demonstrated in the example above, add up the costs of each cost object. At a glance, your report should justify all expenses related to your business. If costs don’t add up correctly, use the list to determine where you can make adjustments to get back on track.

What is cost allocation used for?

Cost allocation is used for many reasons, both externally and internally. Reports created by this process are great resources for making business decisions , monitoring productivity and justifying expenses.

External reports are usually calculated based on generally accepted accounting principles (GAAP) . Under GAAP, expenses can only be reported in financial statements during the time period the associated revenue is earned. For this reason, overhead costs are divided and allocated to individual inventory items. When the inventory is sold, the overhead is expensed as a portion of the cost of goods sold (COGS) .

Internal financial data, on the other hand, is usually reported using activity-based costing (ABC). This method assigns all products to the overhead expenses they caused. This process may not include all overhead costs related to operations and manufacturing.

Cost allocation reports show which cost objects incur the most expenses for your business and which products or departments are most profitable. These findings can be a great resource to pair with employee monitoring software when evaluating productivity. If you determine that a cost object is not as profitable as it should be, you should do further evaluations on productivity. If another cost object is found to exceed expectations, you can use the report to find staff members who deserve recognition for their contributions to the company.

Recognition is one of the best ways to keep employees motivated .

What is a cost driver?

A cost driver is a variable that can change the costs related to a business activity. The number of invoices issued, the number of employee hours worked, and the total of purchase orders are all examples of cost drivers in cost accounting .

While cost objects are related to the specific process or product incurring the costs, a cost driver sheds light on the reason for the incurred cost amounts. These items can take different forms – including fixed costs, such as the initial fees during the startup phase . Cost drivers give a bird’s-eye view of the entire company and how each department operates.

It’s common for only one cost driver to be used with very small businesses , since they are focused on using minimal reporting to estimate overhead costs.

Benefits of cost allocation

- It simplifies decision-making. Cost allocation gives you a detailed overview of how your business expenses are used. From this perspective, you can determine which products and services are profitable, and which departments are most productive.

- It assists in staff evaluation. You can also use cost allocation to assess the performance of different departments. If a department is not profitable, the staff productivity may need improvement. Cost allocation can also be an indicator of departments that exceed expectations and deserve recognition. Awards and recognition are a great way to motivate staff and, in turn, increase productivity. [Read related article: Best Business Productivity Apps ]

Even if you operate a very small business, it’s a great idea to learn the process of cost allocation, especially if you anticipate expansion in the future. Since the method can be complex, it’s ideal to use accounting software as an aid. Whether you choose to start allocating costs on your own with software or hire a professional accountant , it’s a process no business owner can afford to overlook.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

Understanding Cost Objects – What They Are and Why They Matter

Businesses must clearly understand their costs as they strive to make informed financial decisions. One tool that companies use to track and manage their costs is cost objects.

But what exactly is a cost object, and how is it used in accounting and finance? In this blog post, we will explore the definition of cost objects, common types used in business and finance, and their role in cost accounting.

We will also answer frequently asked questions, including who assigns costs to cost objects and why we assign them. We will also discuss the challenges businesses may face when assigning costs and provide examples of cost objects used in the manufacturing industry.

Finally, we will explore techniques for allocating costs to cost objects and discuss how the size of a business can impact its use. By the end of this post, you will have a comprehensive understanding of cost objects and their importance in managing business finances.

What Is a Cost Object and How Is It Defined in Accounting and Finance? – Understanding Cost Objects

In accounting and finance, a cost object consumes resources or generates costs within a business or organization. It can be a product, service, project, department, customer, or any other entity that requires resources and generates costs.

A cost object can help identify the costs associated with producing a particular product or service, performing a specific activity, or serving a typical customer. This information can then be used to make more informed decisions about pricing, resource allocation, and process improvements .

For example, each bike would be a cost object in a manufacturing company that produces bicycles. The costs associated with producing each bicycle, such as materials, labor, and overhead expenses, would be tracked and assigned to that cost object.

This information can then be used to determine the true cost of each bicycle and make more informed decisions about pricing, production processes, and resource allocation.

In service-based businesses, cost objects can be more challenging to identify. For example, each project or client could be a cost object in a consulting firm. The costs associated with each project or client, such as labor and travel expenses, would be tracked and assigned to that cost object.

There are two types of cost objects: direct and indirect. Direct cost objects can be traced to a particular product, service, or activity. Indirect cost objects are not easily traced back to a particular product, service, or activity but consume resources and generate costs.

It is essential to accurately assign costs to cost objects to make more informed decisions about pricing, resource allocation, and process improvements. Failure to accurately assign costs to cost objects can lead to inaccurate pricing decisions, inefficient use of resources, and ultimately lower profits.

What Are Some Common Types of Cost Objects Used in Business and Finance? – Understanding Cost Objects

In business and finance, everyday cost objects are used to identify and track costs associated with producing goods or services, providing customer support, and managing operations. These cost objects help businesses understand the true costs of their activities and make informed decisions about pricing, resource allocation, and process improvements.

Output Cost – Types of Cost Objects Used in Business and Finance

One common type of cost object is the output cost. This refers to the cost of producing a good or providing a service that will be sold for a profit. It includes materials, labor, and overhead expenses directly associated with the production process. By accurately identifying and tracking output costs, businesses can determine the true cost of their products or services and make informed pricing decisions that maximize profits.

Operational Cost – Types of Cost Objects Used in Business and Finance

Another common type of cost object is operational cost. This includes departmental, functional, event, and customer-specific costs associated with managing and operating a business.

For example, the operational cost of an event management company would include all expenses related to planning and executing events, such as venue rentals, catering, and marketing expenses. By tracking operational costs, businesses can identify areas where they can improve efficiency and reduce costs while maintaining a high service level.

Business Relationship Cost – Types of Cost Objects Used in Business and Finance

Business relationship costs are another type of cost object. These costs refer to the money spent promoting or maintaining relationships with customers, suppliers, and other business partners.

For example, licensing fees, trade association dues, and customer freebies are all examples of business-related costs. These costs are significant because they help businesses establish and maintain strong relationships with their partners, which can lead to increased revenue and long-term success.

In addition to these types of cost objects, businesses may use many other objects to track costs and make informed decisions.

For example, customer acquisition costs, which refer to acquiring new customers, can be useful for businesses looking to expand their customer base. Similarly, employee-related costs, such as salaries , benefits, and training expenses, can be tracked as a cost object to help businesses understand the true cost of their workforce.

What Is an Example of a Cost Object in Business? – Understanding Cost Objects

An example of a cost object in business could be a product line or a specific service. Let’s consider the scenario of a company that manufactures and sells three different types of smartphones – basic, mid-range, and premium. In this case, each product line is a cost object, and the company can track the costs associated with each line separately.

The company can identify and track the costs associated with each cost object to determine the cost of producing each smartphone model. For example, the cost of materials, labor, and overhead for producing each smartphone can be tracked separately for each product line .

This information can be used to make informed pricing decisions, as the company can determine the actual cost of each product and adjust the price accordingly to maximize profitability.

In addition to pricing decisions, cost objects can help identify areas where costs can be reduced or efficiency can be improved. For example, suppose the company identifies that the cost of producing the mid-range smartphone is higher than expected.

In that case, they can analyze the costs associated with that product line to identify areas where costs can be reduced. This may include identifying cheaper materials or streamlining the production process.

Another scenario where cost objects can be helpful is in customer profitability analysis. By tracking the costs associated with each customer, businesses can identify which customers are the most profitable and which are not. This information can be used to make informed decisions about customer acquisition and retention strategies.

Who Typically Assigns Costs to Cost Objects Within an Organization? – Understanding Cost Objects

In an organization, the process of assigning costs to cost objects is typically performed by various individuals or departments, depending on the size and complexity of the organization. The following list outlines some of the key stakeholders involved in the cost assignment process:

1. Management Accountants – Who Typically Assigns Costs to Cost Objects Within an Organization?

Management accountants are responsible for analyzing and reporting on the organization’s financial performance. They often play a key role in assigning costs to cost objects, as they deeply understand the organization’s financial systems and processes.

2. Production Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

Production managers are responsible for overseeing the production process and ensuring that it runs smoothly and efficiently. They may assign costs to cost objects related to the production process, such as the cost of raw materials, labor, and equipment.

3. Sales and Marketing Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

Sales and marketing managers promote the organization’s products or services and generate revenue. They may assign costs to cost objects related to sales and marketing activities, such as advertising and promotions.

4. Purchasing Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

Purchasing managers are responsible for sourcing and procuring the materials and supplies needed for the organization’s operations. They may assign costs to cost objects related to the procurement process, such as raw materials and shipping costs.

5. IT Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

IT managers are responsible for overseeing the organization’s technology systems and infrastructure. They may assign costs to cost objects related to IT expenses, such as software licenses and hardware maintenance.

6. Human Resources Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

Human resources managers are responsible for managing the organization’s workforce. They may assign costs to cost objects related to employee compensation, benefits, and training.

7. Financial Controllers – Who Typically Assigns Costs to Cost Objects Within an Organization?

Financial controllers are responsible for managing the organization’s financial systems and processes. They may assign costs to cost objects related to overhead expenses, such as rent, utilities, and insurance.

8. Operations Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

Operations managers are responsible for overseeing the day-to-day operations of the organization. They may assign costs to cost objects related to operational expenses, such as supplies and equipment maintenance.

In addition to these stakeholders, other individuals or departments may be involved in the cost assignment process, depending on the specific needs and requirements of the organization. For example, a large manufacturing company may have a dedicated cost accounting team responsible for assigning costs to cost objects and analyzing the organization’s financial performance.

How Are Cost Objects Used in Cost Accounting to Help Businesses Manage Their Costs? – Understanding Cost Objects

Cost accounting is a branch of accounting that focuses on measuring, analyzing, and reporting the costs associated with producing goods or providing services.

One of the key concepts in cost accounting is the use of cost objects, which are specific items, products, or activities to which costs can be attributed.

Cost objects are used to help businesses manage their costs in several ways, as outlined below:

1. Cost Control – How Are Cost Objects Used in Cost Accounting

Cost objects help businesses control costs by identifying the specific items or activities driving their expenses. By assigning costs to specific cost objects, businesses can track their expenses more accurately and identify areas where they may be overspending.

For example, a manufacturing company may use cost objects to track the costs of producing each product in its line. This can help them identify the most profitable products needing reevaluation or discontinued.

2. Cost Analysis – How Are Cost Objects Used in Cost Accounting

Cost objects also help businesses analyze costs and make informed decisions about managing them. By analyzing the costs associated with specific cost objects, companies can identify trends, patterns, and areas for improvement.

For example, a service-based company may use cost objects to track the costs associated with each client or project. This can help them identify which clients or projects are the most profitable and which may cost them money.

3. Cost Planning – How Are Cost Objects Used in Cost Accounting

Cost objects help businesses plan for their costs and make informed pricing, budgeting, and resource allocation decisions.

By understanding the costs associated with specific cost objects, businesses can make more accurate projections about their future expenses and revenues. For example, a construction company may use cost objects to track the costs associated with each phase of a building project. This can help them create more accurate project estimates and avoid cost overruns.

4. Cost Reduction – How Are Cost Objects Used in Cost Accounting

Cost objects help businesses reduce their costs by identifying areas where they may be able to streamline their operations or reduce waste.

By analyzing the costs associated with specific cost objects, businesses can identify opportunities for cost reduction and implement strategies to improve their efficiency. For example, a retail store may use cost objects to track the costs associated with each product line. This can help them identify the most profitable products that may tie up valuable resources.

5. Cost Allocation – How Are Cost Objects Used in Cost Accounting

Cost objects help businesses allocate their costs to the appropriate departments, products, or services. By assigning costs to specific cost objects, businesses can ensure that their expenses are accurately allocated and reported.

This can help them make more informed decisions about resource allocation and pricing. For example, a hospital may use cost objects to track the costs associated with each patient. This can help them allocate costs to the appropriate departments and ensure their expenses are accurately reported to insurance providers and regulatory agencies.

When Would It Be Appropriate to Use a Project as a Cost Object? – Understanding Cost Objects

Using a project as a cost object can be appropriate in several situations, as outlined below:

1. Project Cost Control – When Would It Be Appropriate to Use a Project as a Cost Object?

By using a project as a cost object, businesses can control their costs more effectively by tracking the expenses associated with a specific project.

This can help them identify areas where they may be overspending and take corrective action before it is too late. For example, a construction company may use a project as a cost object to track the costs associated with building a new office building. This can help them monitor their expenses and ensure they stay within budget.

2. Project Cost Analysis – When Would It Be Appropriate to Use a Project as a Cost Object?

Using a project as a cost object can also help businesses analyze their costs and make informed decisions about future projects.

By analyzing the costs associated with a specific project, businesses can identify areas to reduce costs or improve their efficiency. For example, a software development company may use a project as a cost object to track the costs of developing a new app. This can help them identify areas where they may be able to streamline their development process and reduce costs.

3. Project Cost Planning – When Would It Be Appropriate to Use a Project as a Cost Object?

Using a project as a cost object can help businesses plan for their costs more effectively by providing a detailed breakdown of the expenses associated with a specific project.

This can help businesses make more accurate projections about their expenses and revenues. For example, a marketing agency may use a project as a cost object to track the costs associated with developing a new advertising campaign. This can help them create more accurate project estimates and avoid cost overruns.

4. Project Cost Reduction – When Would It Be Appropriate to Use a Project as a Cost Object?

By using a project as a cost object, businesses can identify areas where they may be able to reduce costs and improve their efficiency. This can help them achieve their goals more effectively and with fewer resources.

For example, a manufacturing company may use a project as a cost object to track the costs associated with developing a new product line. This can help them identify areas where they may be able to reduce costs and improve their manufacturing processes.

5. Project Cost Allocation – When Would It Be Appropriate to Use a Project as a Cost Object?

Using a project as a cost object can help businesses allocate their costs more accurately to the appropriate departments or products. By tracking the expenses associated with a specific project, businesses can ensure that their costs are allocated correctly and reported accurately.

For example, a consulting firm may use a project as a cost object to tracking the costs associated with a specific client engagement. This can help them allocate costs to the appropriate departments and ensure that their expenses are accurately reported.

Who Benefits the Most From Using Cost Objects to Track Expenses in a Business?

Below are some of the stakeholders that can benefit the most from using cost objects to track expenses in a business:

1. Management – Who Benefits the Most From Using Cost Objects?

One of the primary beneficiaries of using cost objects to track expenses is management. By better understanding where money is spent within a company, management can make more informed decisions about where to allocate resources, which projects to pursue, and which expenses to cut. Cost objects can also help management identify areas where efficiency and costs can be improved.

2. Accountants – Who Benefits the Most From Using Cost Objects?

Accountants also benefit from using cost objects to track expenses in a business. Cost objects provide a more accurate picture of where money is being spent, which helps accountants create more accurate financial statements. This can help them comply with financial reporting requirements, such as GAAP or IFRS, and provide stakeholders with a clear view of the company’s financial health.

3. Sales and Marketing – Who Benefits the Most From Using Cost Objects?

Sales and marketing teams can benefit from using cost objects to track expenses by understanding the cost of acquiring new customers or generating new leads. Using cost objects, they can see how much money is spent on specific campaigns or initiatives and make informed decisions about where to invest their resources.

4. Operations – Who Benefits the Most From Using Cost Objects?

Operations teams can benefit from using cost objects to track expenses by identifying areas where efficiency can be improved. By understanding the cost of specific processes or activities, operations teams can find ways to streamline operations and reduce costs.

5. Investors – Who Benefits the Most From Using Cost Objects?

Investors can benefit from using cost objects to track expenses in a business by having a better understanding of how the company is using its resources. This can help them make informed decisions about whether or not to invest in a company and can provide insight into the company’s long-term financial health.

6. Customers – Who Benefits the Most From Using Cost Objects?

While not traditional stakeholders, customers can indirectly benefit from using cost objects to track expenses in a business. By better understanding where money is being spent, companies can potentially reduce their costs and offer products or services at a lower price point. This can ultimately benefit customers by providing them with more affordable options.

What Are Some Challenges Businesses May Face When Assigning Costs to Cost Objects? – Understanding Cost Objects

Assigning costs to cost objects can be challenging for businesses, mainly when numerous cost objects are involved or when the costs are not easily attributable to a specific object. Below are some of the common challenges businesses may face when assigning costs to cost objects:

1. Identifying Cost Objects – Challenges Businesses May Face

One of the biggest challenges businesses face when assigning costs to cost objects is identifying the appropriate cost objects. It can be challenging to determine which costs should be assigned to which cost objects, mainly if many cost objects are involved or if the costs are not easily attributable to a specific object.

2. Allocating Indirect Costs – Challenges Businesses May Face

Another challenge businesses face when assigning costs to cost objects is allocating indirect costs. Indirect costs, such as overhead or administrative expenses, can be difficult to allocate to specific cost objects. Businesses may need to use allocation methods, such as activity-based costing, to allocate indirect costs to cost objects.

3. Choosing the Right Allocation Method – Challenges Businesses May Face

Businesses may face challenges in choosing the right allocation method when assigning costs to cost objects. Several different allocation methods are available, each with advantages and disadvantages. Choosing the correct method can be challenging and may require careful consideration of the specific circumstances and goals of the business.

4. Ensuring Accuracy – Challenges Businesses May Face

Assigning costs to cost objects requires accuracy to ensure the resulting data is reliable and valuable. However, achieving accuracy can be difficult, mainly if the data is incomplete or inaccurate. Businesses may need to implement procedures to ensure data accuracy in cost allocation.

5. Updating Cost Object Data – Challenges Businesses May Face

Cost objects may change over time, challenging businesses when assigning costs. For example, if a product line is discontinued, the costs associated with that product line may need to be allocated to a different cost object. Businesses must ensure that they regularly update cost object data to reflect changes in the industry.

6. Ensuring Consistency – Challenges Businesses May Face

Consistency in cost allocation is important to ensure the resulting data is comparable over time. However, achieving consistency can be challenging, mainly if the business uses different allocation methods or cost objects over time. Companies may need to implement procedures to ensure that cost allocation is consistent over time.

7. Dealing with Complexity – Challenges Businesses May Face

Some businesses may have complex operations, making assigning costs to cost objects challenging. For example, assigning costs to cost objects can become complex if a business operates in multiple locations or has multiple product lines. Businesses may need sophisticated cost allocation methods or software to handle this complexity.

When Should a Business Consider Creating a New Cost Object? – Understanding Cost Objects

There may be situations where a business needs to create a new cost object to manage costs better.

Below are some scenarios where a business should consider creating a new cost object:

1. Introducing a New Product or Service – When Should a Business Consider Creating a New Cost Object?

When a business introduces a new product or service, creating a new cost object may be appropriate to track the costs associated with that product or service. This can help the business to determine the profitability of the new offering and to identify opportunities to reduce costs.

2. Expanding into a New Market or Region – When Should a Business Consider Creating a New Cost Object?

If a business expands into a new market or region, it may need to create a new cost object to track the costs associated with that market or region. This can help the business determine whether the expansion is profitable and identify opportunities to reduce costs in the new market or region.

3. Undertaking a Large Project – When Should a Business Consider Creating a New Cost Object?

When a business undertakes a large project, such as building a new factory or launching a new marketing campaign, it may be appropriate to create a new cost object to track the costs associated with the project. This can help the business determine the project’s total cost and identify opportunities to reduce costs.

4. Tracking Costs for a Specific Customer – When Should a Business Consider Creating a New Cost Object?

Sometimes, a business may want to track costs associated with a specific customer, particularly if that customer represents a significant portion of the business’s revenue. Creating a new cost object for the customer can help the business determine the customer’s profitability and identify opportunities to reduce costs associated with serving that customer.

5. Managing Costs for a Specific Department – When Should a Business Consider Creating a New Cost Object?

Suppose a business wants to track costs associated with a specific department, such as human resources or IT. In that case, creating a new cost object for that department may be appropriate. This can help the business determine the department’s total cost and identify opportunities to reduce costs.

6. Reorganizing the Business – When Should a Business Consider Creating a New Cost Object?

Suppose a business undergoes a significant reorganization, such as merging with another company or restructuring its operations. In that case, it may be appropriate to create new cost objects to reflect the new organizational structure. This can help the business to track costs associated with the new structure and to identify opportunities to reduce costs.

What Are Some Examples of Cost Objects Used in the Manufacturing Industry? – Understanding Cost Objects

In the manufacturing industry, cost objects are crucial in determining the cost of producing goods. Cost objects track and allocate costs to specific products, departments, or activities. This helps manufacturers understand the true cost of production and make informed decisions to improve profitability. Some common examples of cost objects used in the manufacturing industry include:

1. Products – Examples of Cost Objects Used in the Manufacturing Industry

Producing a specific product is an everyday cost object in manufacturing. By tracking the cost of materials, labor, and overhead associated with producing a product, manufacturers can determine the profitability of each product and make informed decisions about pricing, production volumes, and product mix.

2. Production Processes – Examples of Cost Objects Used in the Manufacturing Industry

Cost objects can also be used to track the cost of specific production processes, such as assembly, machining, or testing. By understanding the cost of each process, manufacturers can identify inefficiencies, reduce waste, and optimize production to improve profitability.

3. Departments – Examples of Cost Objects Used in the Manufacturing Industry

Cost objects can be used to track the cost of individual departments within a manufacturing facility, such as production, engineering, or quality control. By understanding the cost of each department, manufacturers can identify opportunities to reduce costs and improve efficiency.

4. Suppliers – Examples of Cost Objects Used in the Manufacturing Industry

Manufacturers can also use cost objects to track the cost of materials and services specific suppliers provide. By understanding the cost of each supplier, manufacturers can negotiate better pricing, improve supplier relationships, and reduce supply chain risks.

5. Equipment – Examples of Cost Objects Used in the Manufacturing Industry

Operating and maintaining specific equipment costs can be tracked using cost objects. By understanding the cost of each piece of equipment, manufacturers can identify opportunities to improve equipment efficiency, reduce downtime, and optimize maintenance schedules.

6. Customers – Examples of Cost Objects Used in the Manufacturing Industry

Cost objects can be used to track the cost of serving specific customers. By understanding the cost of each customer, manufacturers can identify which customers are profitable and which are not and make informed decisions about pricing, sales, and marketing.

7. Projects – Examples of Cost Objects Used in the Manufacturing Industry

Cost objects can be used to track the cost of specific projects, such as new product development, process improvement, or facility upgrades. By understanding the cost of each project, manufacturers can make informed decisions about project prioritization, resource allocation, and project management.

What Are Some Techniques Used to Allocate Costs to Cost Objects? – Understanding Cost Objects

There are several techniques used to allocate costs to cost objects, including:

1. Direct Allocation – Techniques Used to Allocate Costs to Cost Objects

Direct allocation is the simplest method, assigning costs directly to a specific cost object. For example, the cost of raw materials used in a product can be assigned directly to that product.

2. Activity-Based Costing (ABC) – Techniques Used to Allocate Costs to Cost Objects

ABC is a more sophisticated method of cost allocation that assigns costs to cost objects based on the activities that drive those costs.

ABC involves identifying all the activities involved in producing a product or service and assigning the costs associated with each activity to the cost object. This method is proper when products or services require different activity levels and when traditional allocation methods may not accurately reflect the cost drivers.

3. Job Order Costing – Techniques Used to Allocate Costs to Cost Objects

Job order costing is a cost allocation method used in manufacturing companies that produce custom or unique products. With job order costing, costs are assigned to a specific job or order rather than a product or service. For example, a custom furniture manufacturer might use job order costing to track the costs of producing a specific piece of furniture.

4. Process Costing – Techniques Used to Allocate Costs to Cost Objects

Process costing is a cost allocation method used in manufacturing companies that produce large quantities of identical products. It assigns costs to a specific production process rather than a product or service. For example, a cereal manufacturer might use process costing to track the costs associated with producing a certain type of cereal.

5. Standard Costing – Techniques Used to Allocate Costs to Cost Objects

Standard costing is a method of allocation that assigns costs to cost objects based on predetermined standards or estimates. This method is often used in manufacturing companies that produce large quantities of identical products. Standard costing assigns costs based on the estimated cost of producing a single product unit .

6. Variable Costing – Techniques Used to Allocate Costs to Cost Objects

Variable costing is a method of allocation that assigns only variable costs to a specific cost object, such as direct materials, direct labor, and variable overhead.

Fixed costs are not assigned to a specific cost object but are treated as period expenses. This method is proper when analyzing the profitability of particular products or services, as it provides a more accurate picture of the variable costs associated with production.

How Does the Size of a Business Impact the Use of Cost Objects? – Understanding Cost Objects

The size of a business can impact the use of cost objects in several ways.

Firstly, smaller businesses may have fewer cost objects than larger firms, as they may have a simpler organizational structure and product/service offerings. This can make it easier for them to assign and track costs, as there are fewer cost objects to manage.

On the other hand, larger businesses may have a more complex organizational structure, with multiple departments and product/service offerings. This can result in more cost objects, making assigning and tracking costs more challenging. However, larger businesses may also have more resources and specialized personnel to manage and allocate costs to cost objects.

Secondly, the size of a business can impact the level of detail in cost tracking. Smaller companies may not require as detailed cost tracking as larger businesses, as they may have fewer transactions and expenses to manage. For example, a small retail business may only need to track costs at a high level for each product category, while a large retail chain may need to track costs for each product SKU.

Thirdly, the size of a business can impact the choice of cost allocation methods. Smaller companies may have more flexibility in choosing a cost allocation method, as they may have a more straightforward cost structure . Larger businesses, on the other hand, may need to use more complex cost allocation methods to assign costs to each cost object accurately.

How Can Businesses Stay Up-to-Date With Best Practices for Using Cost Objects in Accounting and Finance? – Understanding Cost Objects

To stay up-to-date with best practices for using cost objects in accounting and finance, businesses can take several steps:

1. Attend Industry Conferences And Seminars – Staying Up-to-Date With Best Practices

Attending conferences and seminars related to accounting and finance can provide businesses with the latest updates and best practices in cost object management. These events are also an excellent opportunity to network with other professionals in the field.

2. Read Industry Publications – Staying Up-to-Date With Best Practices

Keeping up-to-date with industry publications, such as accounting and finance journals, can provide businesses with valuable insights and best practices for using cost objects. Subscribing to newsletters and following industry influencers on social media can also provide helpful information.

3. Engage With Professional Associations – Staying Up-to-Date With Best Practices

Professional associations, such as the American Institute of Certified Public Accountants (AICPA), offer accounting and finance professionals training and resources. Engaging with these organizations can provide businesses access to the latest updates and best practices in cost object management.

4. Utilize Technology – Staying Up-to-Date With Best Practices

Advances in technology have made it easier for businesses to manage their costs and allocate them to cost objects. Cost accounting software can give businesses real-time data and analytics to make informed business decisions.

5. Work With A Professional Accountant – Staying Up-to-Date With Best Practices

Working with a professional accountant can guide businesses on best practices for using cost objects. An experienced accountant can also help businesses identify areas for improvement and implement effective cost-management strategies.

Conclusion – Understanding Cost Objects

In conclusion, understanding cost objects is a crucial aspect of cost accounting and finance for any business. It allows for effective cost management and decision-making, enabling companies to accurately track expenses and allocate costs to the appropriate sources.

By identifying and assigning costs to cost objects, businesses can gain insights into their operations, identify areas for improvement, and optimize their financial performance. However, it is essential to consider the challenges that may arise when assigning costs to cost objects and to review and update the allocation methods used regularly.

With the right techniques and best practices, businesses of all sizes can benefit from using cost objects in their accounting and finance practices. By staying up-to-date with the latest trends and practices in cost accounting, companies can ensure that they make informed decisions and maximize their profitability.

Recommended Readings – Conclusion

- Understanding Absorption Costing and Improving Absorption Rate

- Cost of Goods Sold COGS- Defined & Explained (With Examples)

- Opportunity Cost- Defined & Explained (With Examples)

Frequently Asked Questions – Understanding Cost Objects

1. what is the main purpose of the cost object – faqs.

The primary purpose of a cost object is to enable a business to identify and track the costs associated with a specific item, product, service, or activity.

By assigning costs to cost objects, businesses can analyze and manage their expenses more effectively, make informed decisions, and improve profitability. Cost objects provide businesses with a way to allocate costs accurately and fairly and help them understand the financial impact of each cost element on their overall operations.

For example, a manufacturing company might assign costs to each unit of a particular product to determine its profitability, or a service-based business might give costs to specific clients to better understand the profitability of each customer relationship.

2. Why Do We Assign Cost to Cost Objects? – FAQs

We assign costs to cost objects for several reasons. The primary reason is to track the costs associated with producing a product, providing a service, or engaging in an activity. By assigning costs to specific cost objects, we can accurately measure the expenses that go into producing each unit or providing each service. This allows us to calculate profitability, set prices, and make informed decisions about our business operations.

Another reason we assign costs to cost objects is to allocate expenses fairly and accurately across different departments, products, or services. This helps us understand which areas of our business are the most profitable and where we need to make adjustments to improve performance. By allocating costs to cost objects, we can ensure that each business area is responsible for its expenses and that costs are shared fairly across the organization.

Finally, assigning costs to cost objects allows us to comply with accounting and financial reporting standards. For example, businesses must report their expenses in financial statements, and assigning costs to cost objects helps ensure that these reports accurately reflect the expenses associated with each product or service. This is important for regulatory compliance and providing investors and other stakeholders with accurate financial information.

Updated:5/18/202

Meet The Author

Danica De Vera

Related posts.

Accounting Career in a City vs Small Town: Pros and Cons

When considering an accounting career, the choice between a city and a small town is crucial. In a city, accountants can benefit from diverse job opportunities, higher salaries, and networking events. On the other hand, small towns offer a tight-knit community, lower living costs, and a better work-life balance.

17 Best US Cities for Accountants (With Salaries)

When choosing a city for your accounting career, consider factors like cost of living, job market, industry focus, networking potential, and lifestyle preferences. Top US cities for accountants include Washington D.C., New York City, Denver, Los Angeles, Boston, Chicago, and Dallas-Fort Worth, offering diverse opportunities and vibrant lifestyles.

What Is Technical Accounting? Definition, Roles, Skills, and Career Paths

Technical accounting delves deep into the intricate details of accounting standards and principles. It ensures compliance with regulations and frameworks like GAAP or IFRS. Technical accountants handle tasks such as financial reporting compliance, interpretation of accounting standards, and complex transactions analysis, providing invaluable insights and safeguarding financial well-being.

Subscribe to discover my secrets to success. Get 3 valuable downloads, free exclusive tips, offers, and discounts that we only share with my email subscribers.

Social media.

Quick links

- Terms of Service

Other Pages

Contact indo.

- 302-981-1733

- [email protected]

© Accounting Professor 2023. All rights reserved

Discover more from accounting professor.org.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Workflow Solutions

FloQast Close

FloQast Reconciliation Management

FloQast Variance Analysis

FloQast Analyze

FloQast Compliance Management

FloQast Ops

FloQast ReMind

Finance and Accounting Operations Platform

Platform Overview

AI and Machine Learning

Scalability

Trust & Security

Integrations

FloVerse Community

FloQast Studios

FloQast Blog

Controller Manifesto

FloQademy - Join / Sign In

Charting the Future of Accounting eBook

Your next step: navigating the future amidst changes and challenges

Chief Accounting Officer

Accounting Manager

Compliance Manager

Internal Audit Manager

By Workflow

Financial Close

Account Reconciliations

Audit Findings

Controls and Risk Management

SOX Compliance

Audit Readiness

Oracle NetSuite

Sage Intacct

FloQast Connect API

By Platform

The IPO Playbook for Finance & Accounting Teams

An at-a-glance guide to going public

Success Stories

Video Testimonials

PulteGroup Constructs Faster Close and Team Productivity with FloQast

Learn how FloQast helped PulteGroup reduce paper consumption, speed up its monthly Close, and streamline compliance reporting.

Closing Collaboration in a Multinational Accounting Team: How Emma Improved Team Collaboration and Internal Controls Together with FloQast

Emma's 70-person geographically distributed accounting team improved internal controls and streamlined the audit thanks to FloQast.

Qualys Modernizes SOX Compliance and Improves the Annual Audit with FloQast

Read how in just a matter of weeks, Qualys leveraged FloQast to standardize the close process and organize controls and documentation for a more simplified SOX compliance.

Partner Program

Become a Partner

Take Your Business to the Next Level

FloQast’s suite of easy-to-use and quick-to-deploy solutions enhance the way accounting teams already work. Learn how a FloQast partnership will further enhance the value you provide to your clients.

All Resources

Checklists & Templates

Customer Video Testimonials

Whitepapers

Customer Success Stories

Month-End Close Checklist

SOX RCM Template

Leverage best practices to build a SOX RCM that focuses on what’s most important for SOX compliance.

Customer Success Management

Customer Success

Global Community

Request Support

Earn Free CPE with FloQademy

FloQademy, FloQast’s learning portal, provides over 100+ hours of free CPE, on-demand, 24/7, and is open to everyone.

The FloQast Advantage

Initiatives

Diversity, Inclusion, & Community

Contact FloQast

Get In Touch

Accounting automation and collaboration platform FloQast raises $110M

Read about FloQast's business model and successful round of series D funding

What is Cost Allocation? Definition & Process

Jul 16, 2020 Michael Whitmire

Working with the former accountants now working at FloQast, we decided to take a look at some of the pillars of the accounting professions.

The key to running a profitable enterprise of any kind is making sure that your prices are high enough to cover all your costs — and leave at least a bit for profit. For a really simple business — like the proverbial lemonade stand that almost every kid ran — that’s pretty simple. Your costs are what you (or your parents) paid for lemons and sugar. But what if it’s a more complex business? Then you might need to brush up on cost accounting, and learn about allocation accounting . Let’s walk through this using the hypothetical company, Lisa’s Luscious Lemonade.

What is cost allocation ?

The cost allocation definition is best described as the process of assigning costs to the things that benefit from those costs or to cost centers . For Lisa’s Luscious Lemonade, a cost center can be as granular as each jug of lemonade that’s produced, or as broad as the manufacturing plant in Houston.

Let’s assume that the owner, Lisa, needs to know the cost of a jug of lemonade. The total cost to create that jug of lemonade isn’t just the costs of the water, lemons, sugar and the jug itself, but also includes all the allocated costs to make it.

Let’s start by defining some terms…

Direct costs are costs that can be traced directly to the product or service itself. For manufacturers, these consist of direct materials and direct labor. They appear in the financial statements as part of the cost of goods sold .

Direct materials are those that become an integral part of the finished product. This will be the costs of the water, sugar, lemons, the plastic jug, and the label.

Direct labor includes the labor costs that can be easily traced to the production of those finished products. Direct labor for that jug will be the payroll for the workers on the production line.

Indirect costs are the costs that can’t be easily traced to a product or service but are clearly required for making whatever an enterprise sells. This includes materials that are used in such insignificant quantities that it’s not worth tracing them to finished products, and labor for employees who work in the factory, but not on the production line.

Overhead costs encompass all the costs that support the enterprise that can’t be directly linked to making the items that are sold. This includes indirect costs , as well as selling, marketing, administration, and facility costs.

Manufacturing overhead includes the overhead costs that are directly related to making the products for sale. This includes the electricity, rent, and utilities for the factory and salaries of supervisors on the factory floor.

Product costs are all the costs in making or acquiring the product for sale. These are also known as manufacturing costs or total costs . This includes direct labor, direct materials, and allocated manufacturing overhead.

What is the process?

The first step in any cost allocation system is to identify the cost objects to which costs need to be allocated. Here, our cost objec t is a jug of lemonade. For a more complex organization, the cost object could be a product line, a department, or a branch.

Direct costs are the simplest to allocate. Last month, Lisa’s Luscious Lemonades produced 50,000 gallons of lemonade and had the following direct costs:

Total costs Cost per gallon Direct materials $142,500 $2.85 Direct labor $37,500 $.75

How are costs allocated?

Allocating overhead costs is a bit more complex. First, the overhead costs are split between manufacturing costs and non-manufacturing costs. Some of this is pretty straightforward: the factory floor supervisor’s salary is clearly a manufacturing cost, and the sales manager’s salary is a non-manufacturing cost. But what about the cost of human resources or other service departments that serve all parts of the organization? Or facilities costs, which might include the rent for the building, insurance, utilities, janitorial services, and general building maintenance?

Human resources and other services costs might be logically split based on the headcount of the manufacturing versus non-manufacturing parts of the business. Facilities costs might be split based on the square footage of the manufacturing space versus the administrative offices. Electricity usage might be allocated on the basis of square footage or machine hours , depending on the situation.

Let’s say that for Lisa’s Luscious Lemonades, after we split the overhead between manufacturing and non-manufacturing costs, we have the following annual manufacturing overhead costs :

Supervisor salary $84,000 Indirect costs $95,000 Facility costs $150,000 Human resources $54,000 Depreciation $65,000 Electricity $74,000 Total manufacturing overhead $522,000

In a perfect world, it would be possible to keep an accurate running total of all overhead costs so that management would have detailed and accurate cost information. However, in practice, a predetermined overhead rate is used to allocate overhead using an allocation base .

This overhead rate is determined by dividing the total estimated manufacturing overhead by the estimated total units in the allocation base . At the end of the year or quarter, the allocated costs are reconciled to actual costs.

Ideally, the allocation base should be a cost driver that causes those overhead costs . For manufacturers, direct labor hours or machine-hours are commonly used. Since Lisa only makes one product — gallon jugs of lemonade — the simplest cost driver is the number of jugs produced in a year.

If we estimate that 600,000 gallons of lemonade are produced in a year, then the overhead rate will be $522,000 / 600,000 = $.87 per gallon.

Our final cost to produce a gallon of Lisa’s Luscious Lemonade is as follows:

Direct materials $2.85 Direct labor $0.75 Manufacturing overhead $0.87 Total cost $4.47

What is cost allocation used for?

Cost allocation is used for both external reporting and internally for decision making. Under generally accepted accounting principles (GAAP), the matching principle requires that expenses be reported in the financial statements in the same period that the related revenue is earned.

This means that manufacturing overhead costs cannot be expensed in the period incurred, but must be allocated to inventory items, where those costs remain until the inventory is sold, when overhead is finally expensed as part of the cost of goods sold. For Lisa’s Luscious Lemonade, that means that every time a jug of lemonade is produced, another $4.47 goes into inventory. When a jug is sold, $4.47 goes to the cost of goods sold.

However, for internal decision-making, the cost allocation systems used for GAAP financials aren’t always helpful. Cost accountants often use activity-based costing , or ABC, in parallel with the cost allocation system used for external financial reporting .