- Innovative Prompts

- Strategies Packs

- Skills Packs

- SOPs Toolkits

- Business Ideas

- Super Guides

- Innovation Report

- Canvas Examples

- Presentations

- Spreadsheets

- Discounted Bundles

- Search for:

No products in the cart.

Return to shop

Nike Business Model

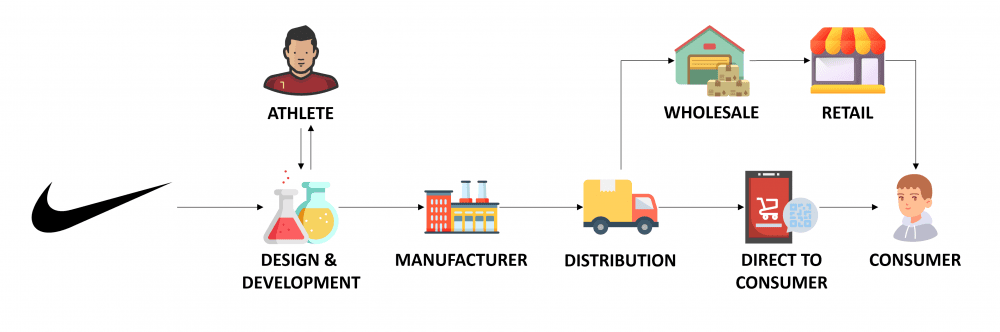

The Nike Business Model is based on producing and selling athletic and sports products, including footwear, clothing, equipment — and also some services. Everything is under one of the most famous brands in the world. Let’s take a closer look at how and why Nike company has become so relevant in the business world.

A brief history of Nike

Nike was first founded as “Blue Ribbon Sports” in January 1964 by Phil Knight, a student at the University of Oregon and track athlete, along with his coach Bill Bowerman. The company was officially rebranded as Nike in May 1971, which is the Goddess of Victory in Greek mythology.

Headquartered in Beaverton, Oregon, Nike is one of the most well-succeeded sports brands globally, manufacturing shoes and sportswear, but the story behind its foundation is that, before that, Adidas and Puma — both of them German brands — completely dominated the sneakers market, in every single sport.

So, Knight decided to introduce cheap, but high-quality running shoes, and he achieved it through a partnership with Onitsuka Tiger (now known as Asics), a Japanese running shoes company, as its U.S. distributor.

In the ’70s, the partnership between Blue Ribbon Sports and Onitsuka collapsed, so Knight decided it was time for its own line of footwear. The company was relabeled as Nike, and the worldwide-famous swoosh design was first used in 1971.

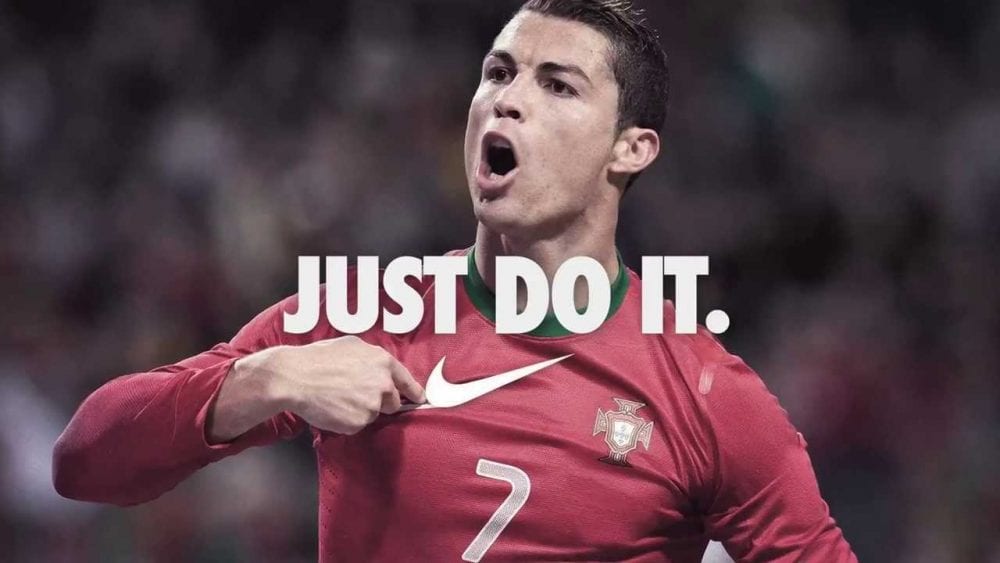

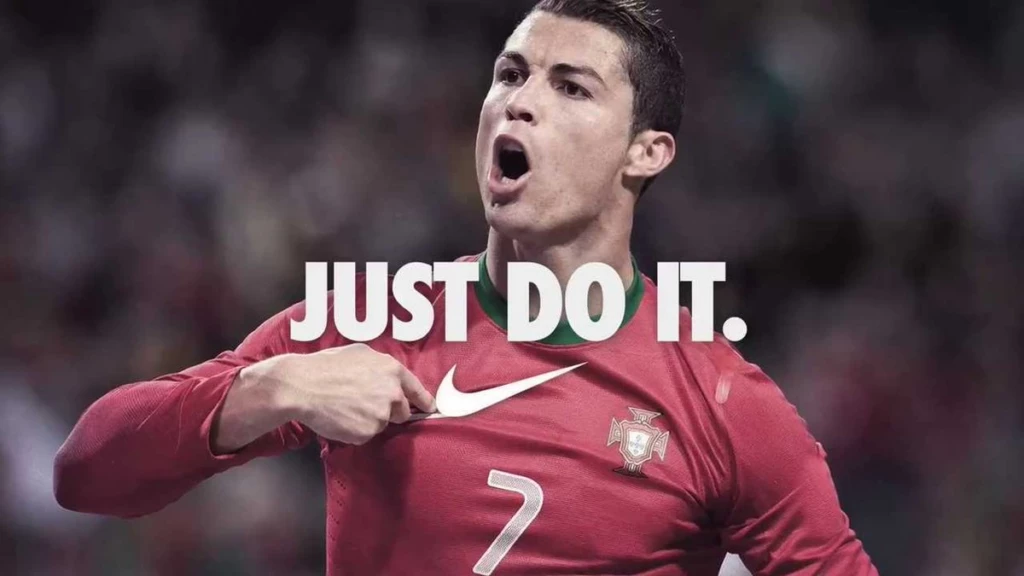

After that, Nike thoroughly conquered the sneakers market of sports footwear. Some of its main achievements include Michael Jordan’s signature footwear, the Air Jordan (1984), as well as renowned marketing campaign slogans, such as “There is no finish line” (1977) and “Just do it” (1988). The Nike marketing strategy has been pivotal in establishing the brand’s dominance, and nowadays, it controls an impressive 38% of the global sports market.

Who Owns Nike

Nike is owned by one of its co-founders, Phil Knight, the Chairman Emeritus. The company also has Mark Parker as the Executive Chairman and John Donahoe as the President and CEO.

Nike’s Mission Statement

“ Our mission is what drives us to do everything possible to expand human potential. We do that by creating groundbreaking sports innovations, by making our products more sustainably, by building a creative and diverse global team, and by making a positive impact in communities where we live and work”.

How Nike makes money

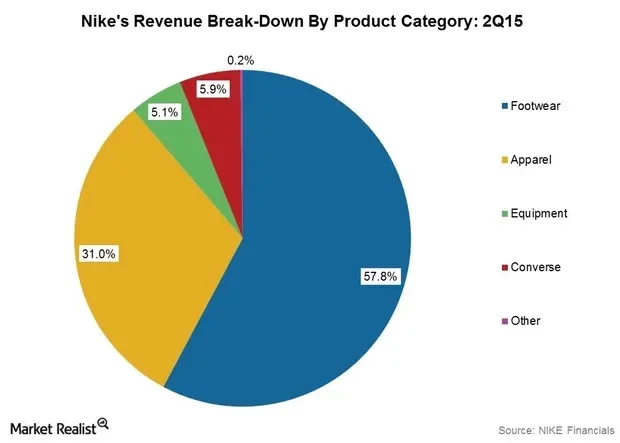

Nike is the largest footwear and apparel seller in the world, and its revenue is generated mainly from these sales. Although its footwear items are designed especially for athletic purposes, with massive investment in innovation and high-quality products, most of them are usually worn on a daily basis, for leisure times.

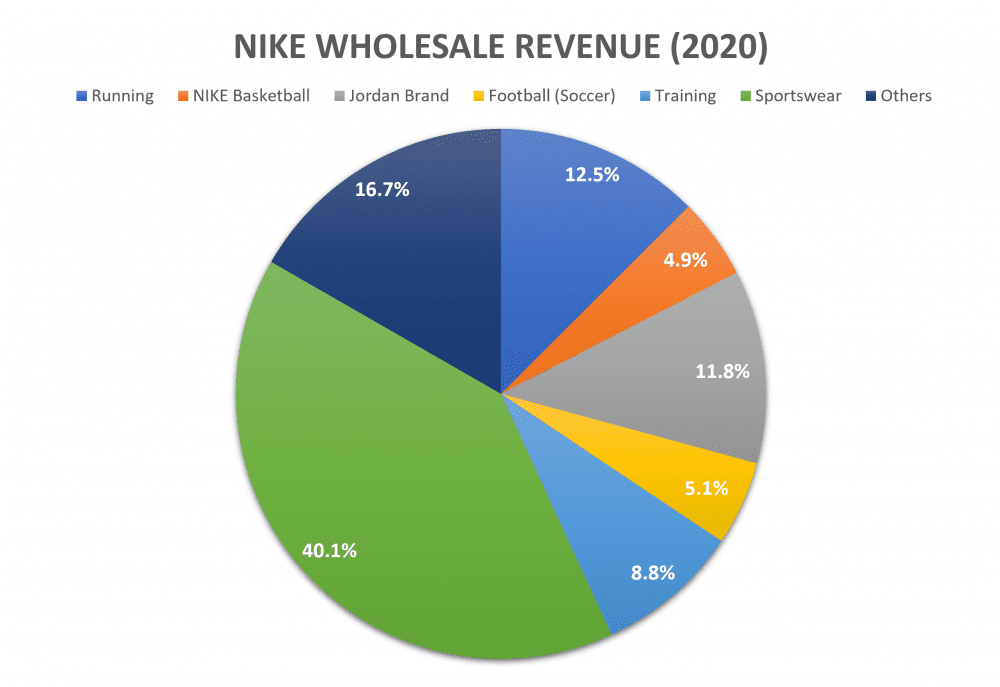

Nike also sells sports equipment and accessories, such as balls, eyewear, bags, gloves, digital devices, and more, as well as recreational articles for many physical and outdoor activities. The company targets men, women, young athletes, and kids — in order of revenue. And Nike’s product subdivides into six categories: Running, Basketball, Jordan Brand, Soccer, Training, and Sportswear (lifestyle products), being Running, Jordan, and Sportswear are the strongest ones in revenue.

Nike’s Outsourcing

Nike doesn’t actually produce the items it sells. Its manufacturing is all outsourced, mostly outside the United States. They are more than 300 external independent suppliers, in over 35 countries, such as Vietnam, China, Indonesia, and Thailand.

Manufacturers in India, Argentina, Italy, Mexico, and Brazil are also contracted to produce for local markets. In spite of its large supply chain and manufacturing network, Nike still focuses on maintaining the quality and innovative character of its products, investing heavily in research and development.

Nike’s Business Model challenges

- Competition: Sports articles and apparel market is marked by massive competition, not only in the USA but all over the globe, both in marketing and supply chain — because the amount of suppliers for high-quality raw materials is limited. This competition leads to a great investment in research and development and in marketing and sales, in order to stand out;

- Trends: Nike’s success relies on anticipating customers’ demands. But these changing preferences are not always easy to predict. So, there is no certainty that every new product will gain the expected acceptance in the market. Therefore, it requires a great expenditure in adjusting the mix to keep profitable. Moreover, Nike relies on experts in several areas in order to produce innovative articles, such as engineers, physiologists, designers, biochemists, chemists, orthopedists, coaches, etc.;

- Global risks: Some global conditions and changes can have either positive or negative impacts on sales, such as economic crises or recessions (especially in emerging nations), environmental policies, trade regulations, data security and privacy, and more.

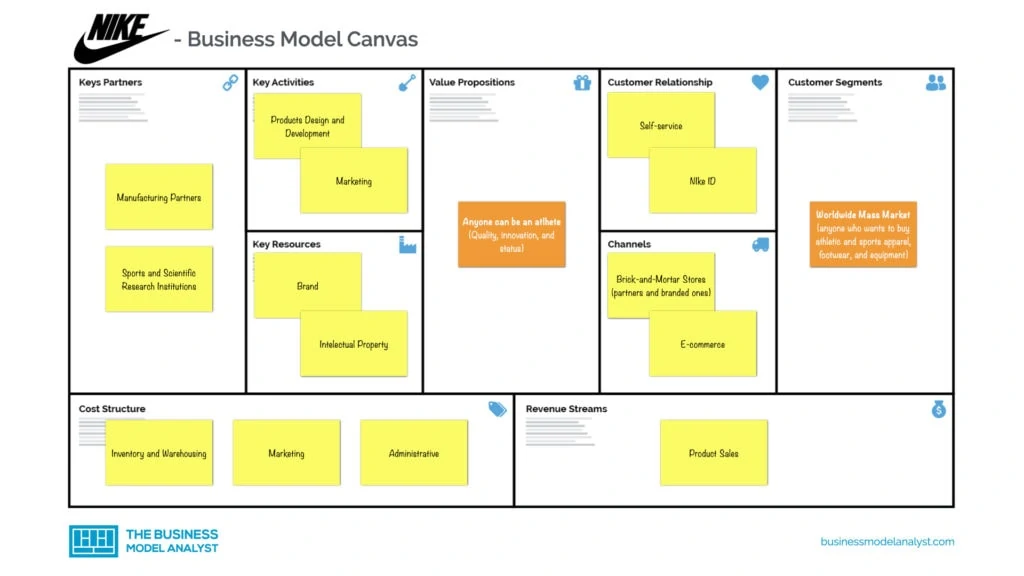

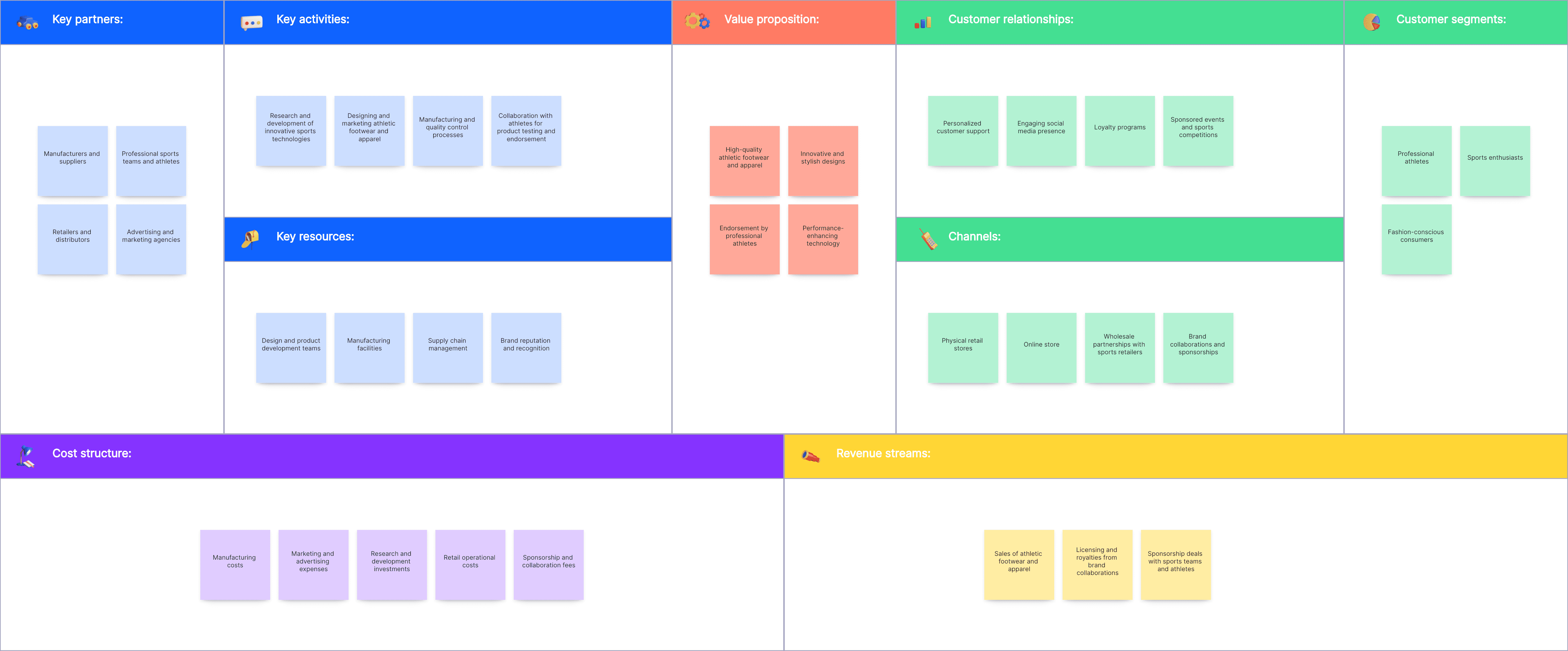

Nike’s Business Model Canvas

Let’s take a look at the Nike Business Model Canvas .

Download FREE!

To download Nike Business Model Canvas today just enter your email address!

Nike’s Customer Segments

Nike markets to anyone who wants to buy athletic and sports apparel, footwear, and equipment. Geographically speaking, Nike’s market is divided into four main divisions, also in order of revenue:

- North America

- EMEA (Europe, Middle East, and Africa)

- Greater China

- APLA (the Asia Pacific and Latin America)

Nike’s Value Propositions

Nike offers products to inspire anyone to become an athlete. Their products heavily rely on the quality, innovation, and status of the brand. This is the foundation of the brand, and it is exactly what the customers seek when they buy a Nike. The company offers a great variety of items, for many different sports and activities.

But, indeed, what matters for the audience is acquiring a product that has been heavily studied and developed from the best raw materials and technology available. Also, they want to carry the successful reputation the brand states, since athletes such as Michael Jordan, Tiger Woods, and Cristiano Ronaldo speak for the company.

Nike’s Channels

Nike uses many different channels for marketing . Its main channel is the brick-and-mortar stores, especially the Nike-branded ones. The company has an extensive sales network, with 1,152 physical stores throughout the world (numbers of 2019). Nike also has an e-commerce platform, which serves more than 45 countries.

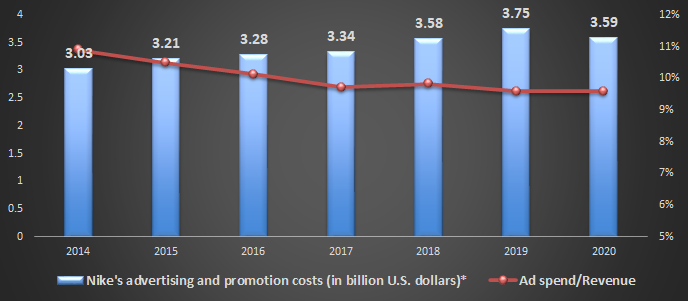

Besides that, Nike employs other channels, such as social media, digital, print, and TV advertising, brand events, and heavy sponsorship of athletes and teams. Therefore, its marketing expenses usually reach over $3.5 billion a year ($3,753 million in 2019).

Nike’s Customer Relationships

The relationship with the customers is practically restricted to self-service. The customer will check the product in a store (online or offline), and buy and use it. There will be some interaction with a salesperson when needed. Moreover, there is a FAQ session on the website and customer support via phone, e-mail, or live chat. Nike also has Nike ID, which is a personalization service that brings Nike products closer to customers’ desires.

Nike’s Revenue Streams

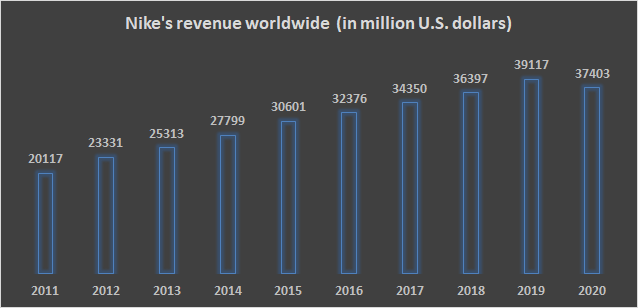

The revenue streams of the company are the sales of its products: footwear, apparel, equipment, and accessories. The total revenue reached $39,117 million, in 2019.

Nike’s Key Resources

Nike’s key resources consist of:

- Physical structures : Five distribution centers in Memphis and others in California;

- Human resources: Nike Explore Tea Sports Research Lab, with more than 40 researchers that work on innovations;

- Intellectual property : Third-largest design patent portfolio in the United States.

Nike’s Key Activities

The main key activity of the company is designing and developing the products. In order to achieve that, other activities are involved, such as research (about materials, technologies, and trends/behavior) and negotiation with the suppliers. Additionally, marketing, sales, and advertising are essential for this business model .

Nike’s Key Partners

As Nike relies on outsourced contractors to manufacture its articles, these manufacturers are surely its most important key partners . They are more than 145 footwear factories and over 400 apparel factories, mostly outside the United States. Besides that, other partners include some universities and institutions in North America, Europe, and Asia for sports and scientific research.

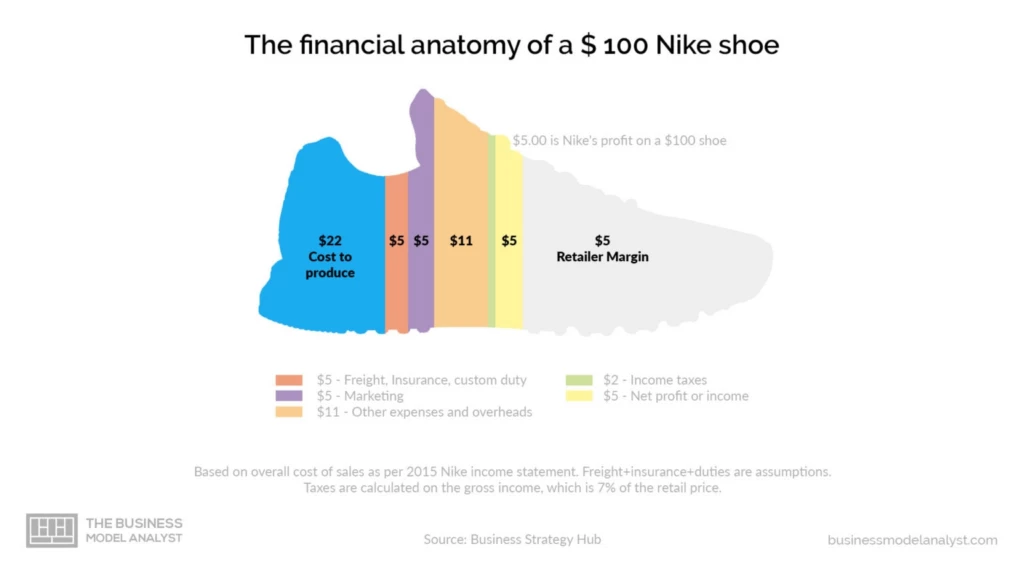

Nike’s Cost Structure

The largest expenses for Nike are the costs of sales (mostly inventory and warehousing), that account for more than $21 billion per year. Additionally, around $3 billion is for marketing, including advertising and promotion costs, sponsorship, media, brand events, and retail brand presentation. Other general and administrative expenses cost over $500 million a year.

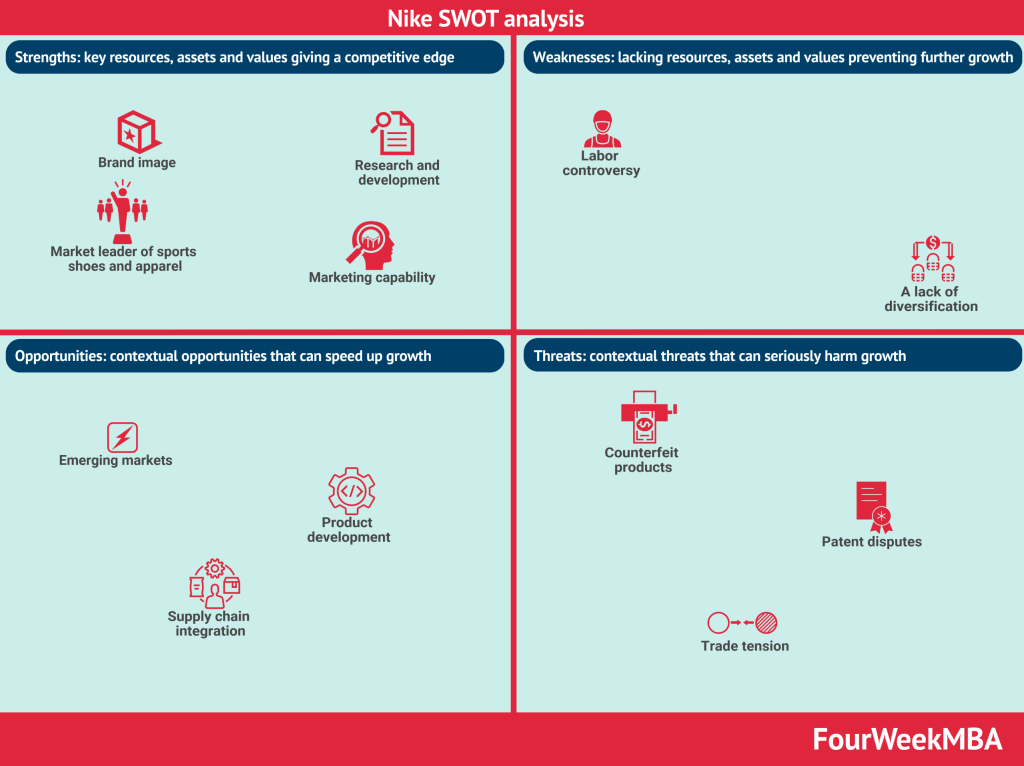

Nike’s SWOT Analysis

Below, there is a detailed swot analysis of Nike:

- Production costs: Since Nike’s business model outsources almost all its production, the company has reduced its operational costs, significantly, and focused its efforts and capital on marketing and sales. However, that doesn’t mean Nike has lost control over production quality. It only relies on suppliers that can support the brand’s standards;

- Minor sales variations: The demand for Nike’s products doesn’t fluctuate a lot during the year. The sales of fashion products and apparel usually remain equivalent all throughout the months. Due to some major campaigns, the company sometimes experiences a sudden rise. But, in these cases, there have been many studies, and it is ready to meet the demand;

- Quality: As Nike produces higher quality products, compared to most of its competitors , the company is also able to raise prices. This works out precisely because the quality has made the brand achieve a strong and reliable reputation, resulting in market-leading;

- Speed: For sales to succeed, the companies must transform ideas into products on the shelves as fast as possible. Nike, through its processes, has accomplished this efficiency, keeping its audience engaged and avoiding losses.

-> Read more about Nike’s SWOT Analysis .

Nike’s business model success rests on the sum of innovation and marketing. The company faces some strong players in the market — such as Adidas or Under Armour. That’s why the brand maintains its focus on research and development. Its future plans, for instance, are to increase the use of sustainable material, a strategy to grow popularity and engage the audience.

Daniel Pereira

Related posts.

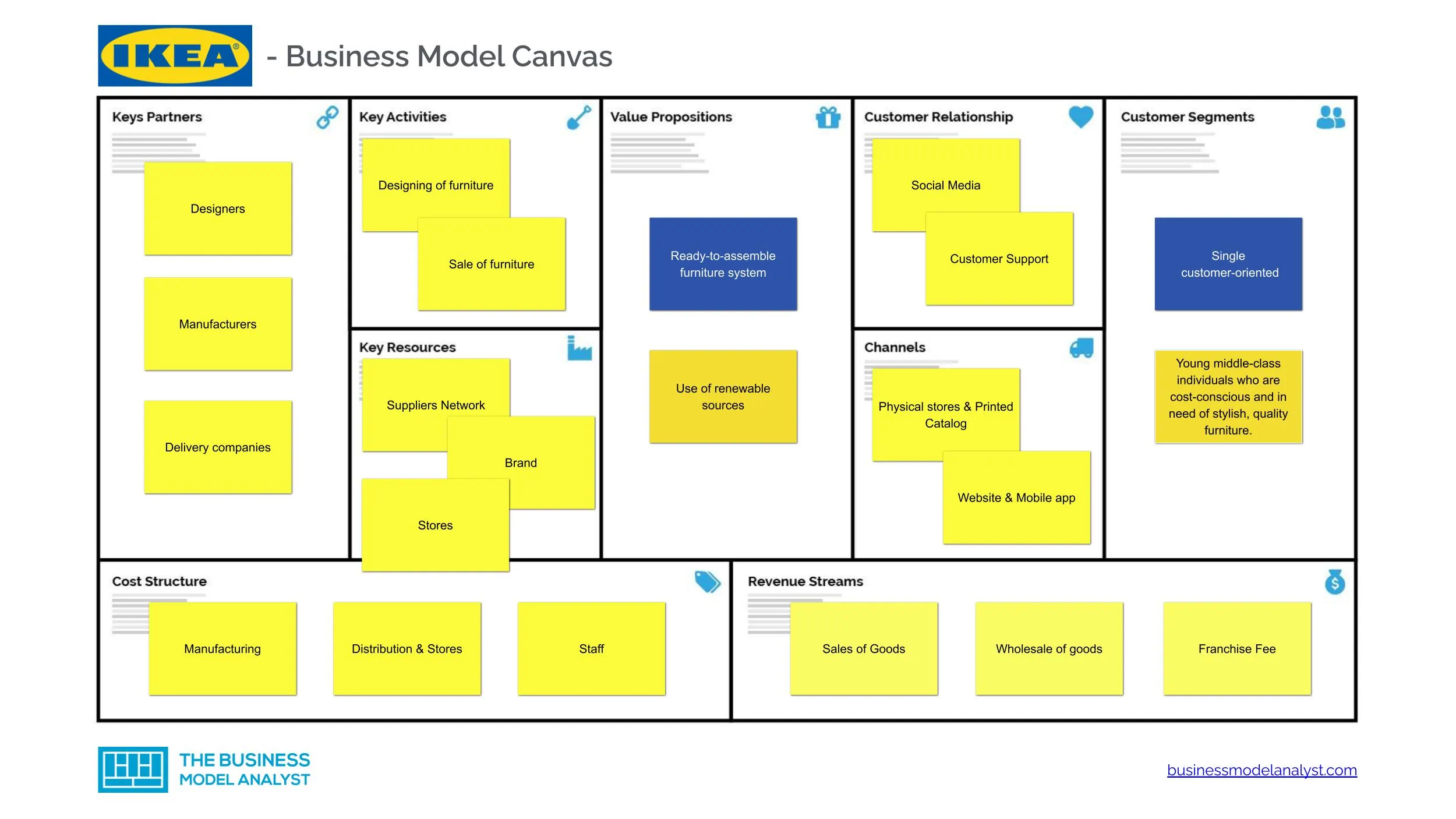

Ikea Business Model

IKEA is a furniture design company that specializes in the sale of flat-packed furniture, kitchen [...]

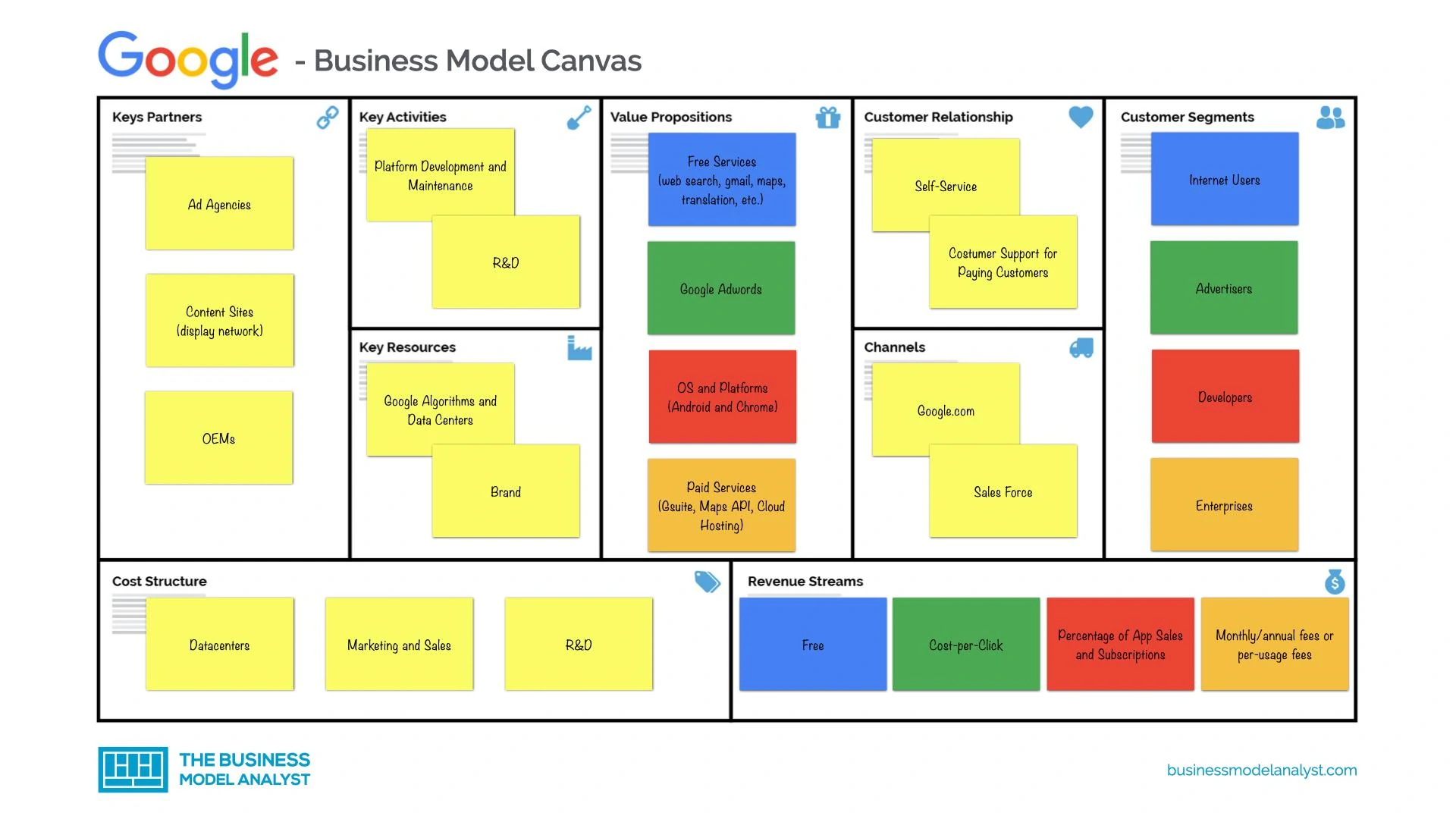

Google Business Model

The Google business model is a multisided platform. What started as a search company is [...]

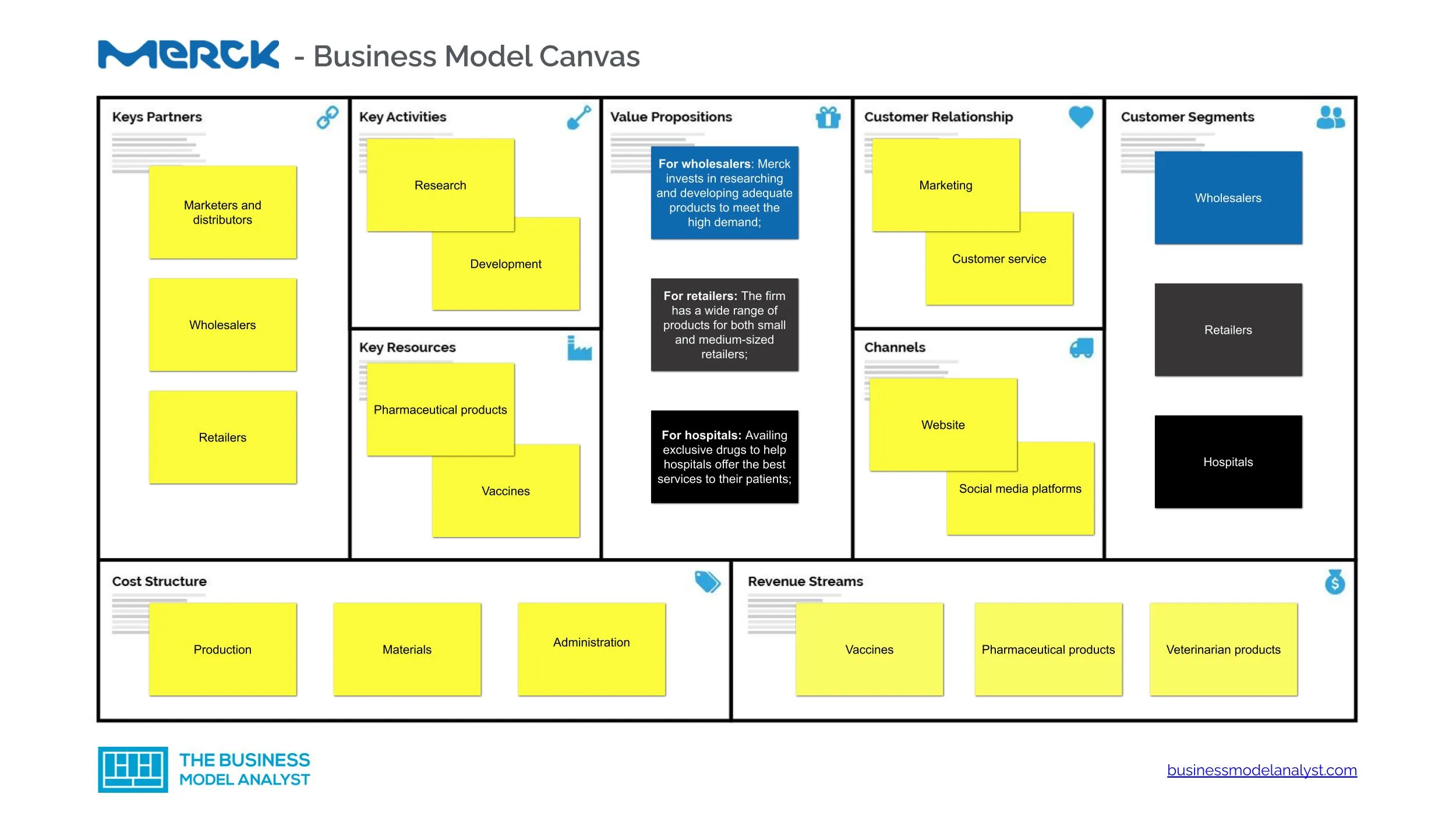

Merck Business Model

The Merck business model focuses on developing and selling pharmaceutical products to meet global market [...]

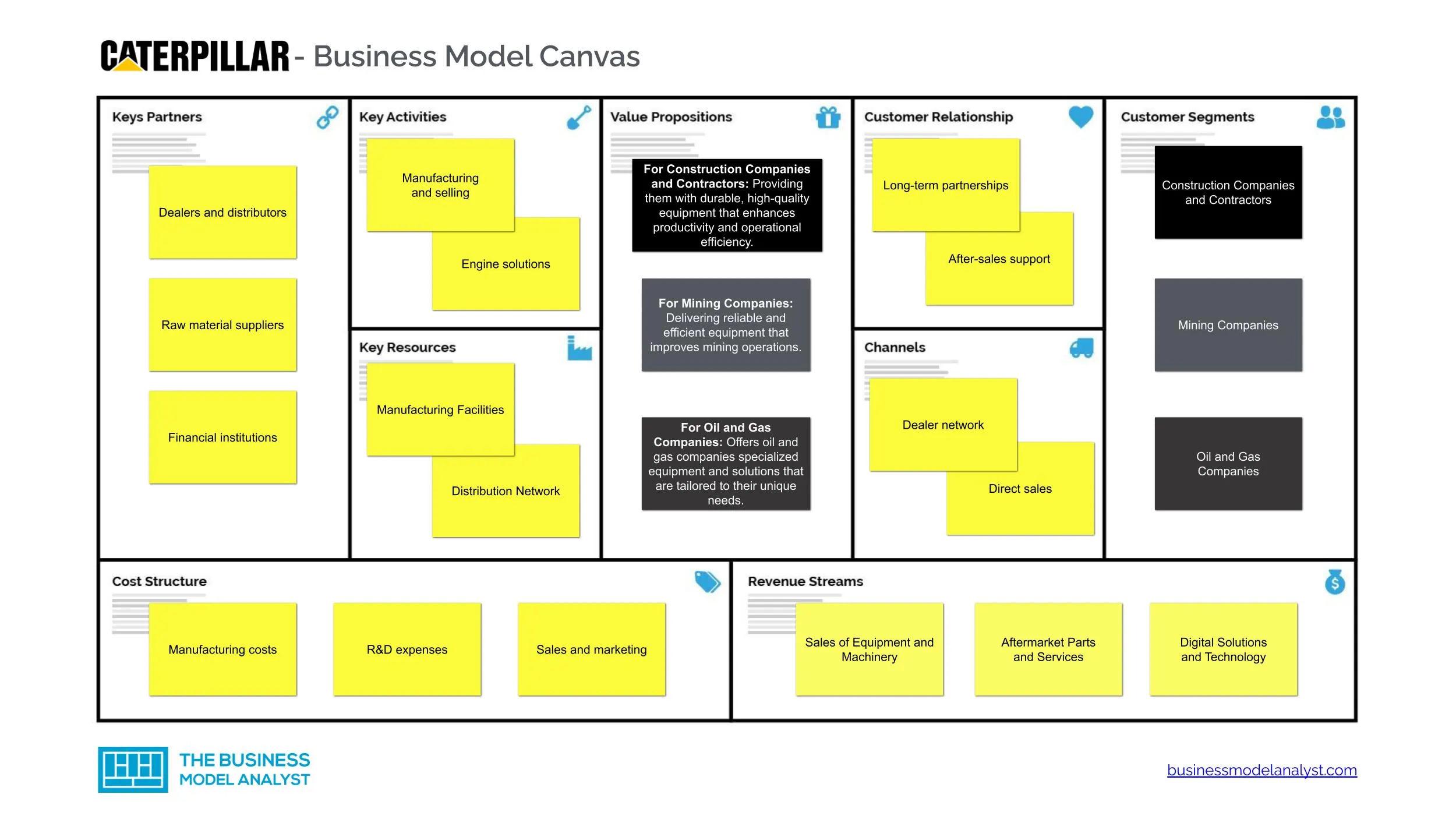

Caterpillar Business Model

The Caterpillar business model is built on innovation, quality, and a deep understanding of customer [...]

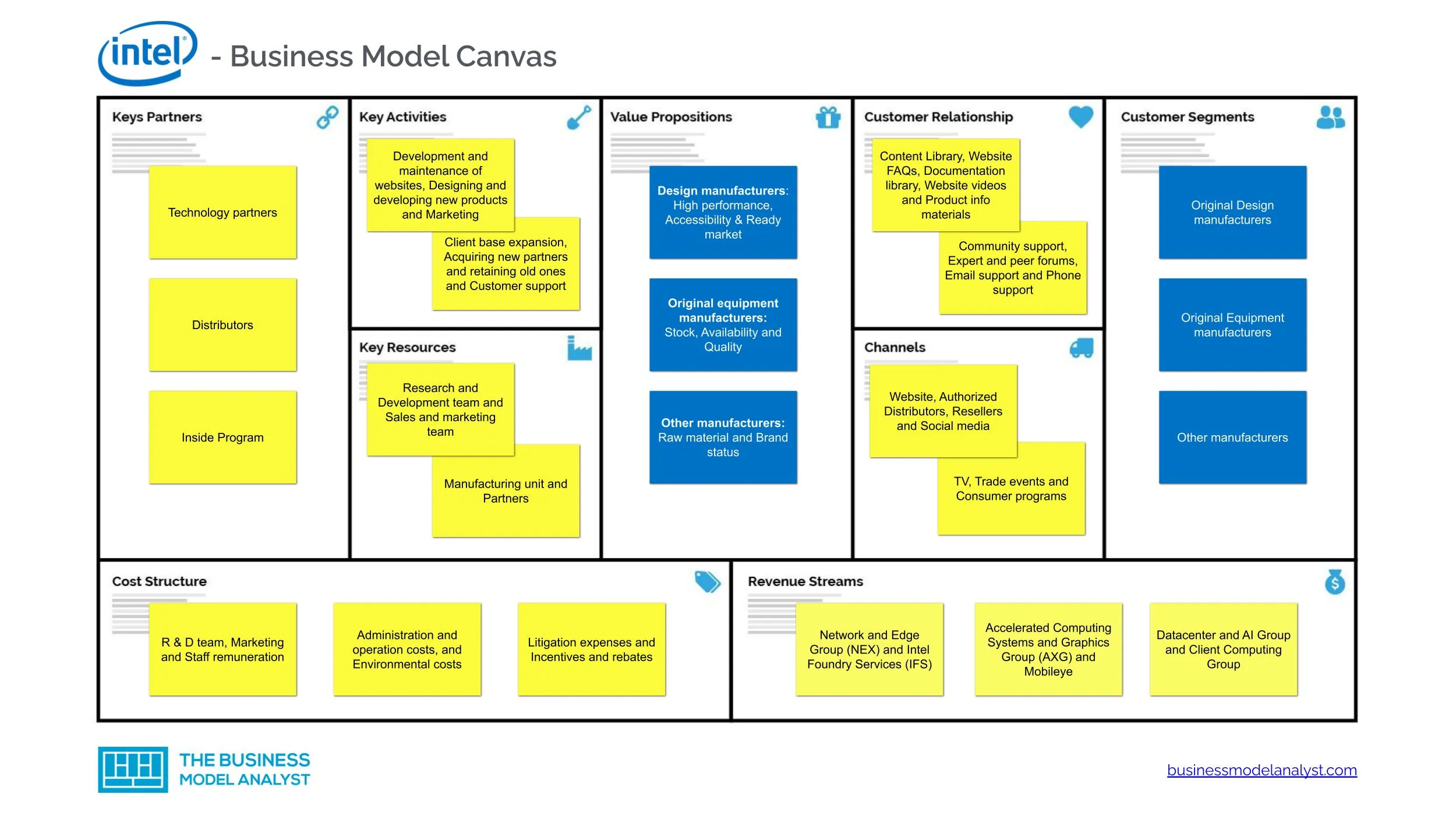

Intel Business Model

The Intel business model is based on supplying microprocessors, motherboard chipsets, graphics chips, integrated circuits, [...]

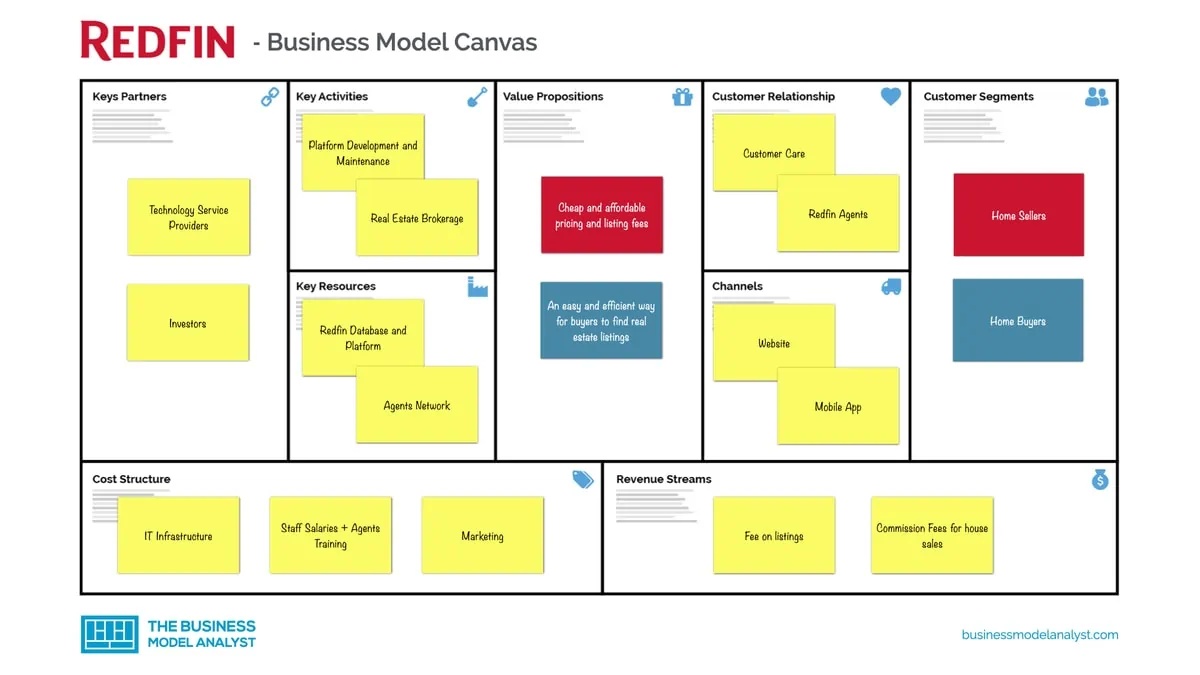

Redfin Business Model

The Redfin business model is centered around real estate brokerage services. Redfin is currently one [...]

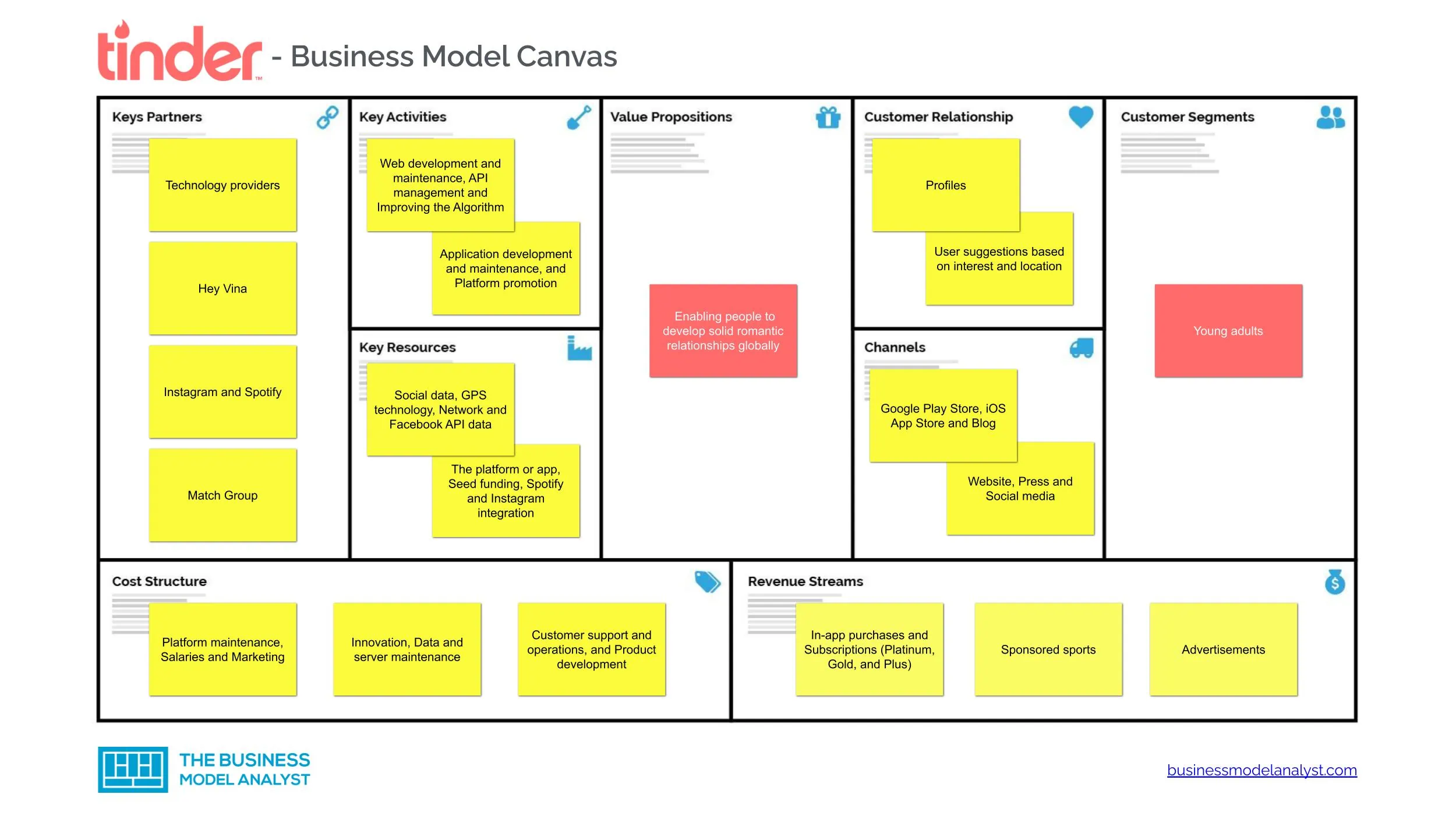

Tinder Business Model

While the Tinder business model is based on freemium services, subscribers can pay to access [...]

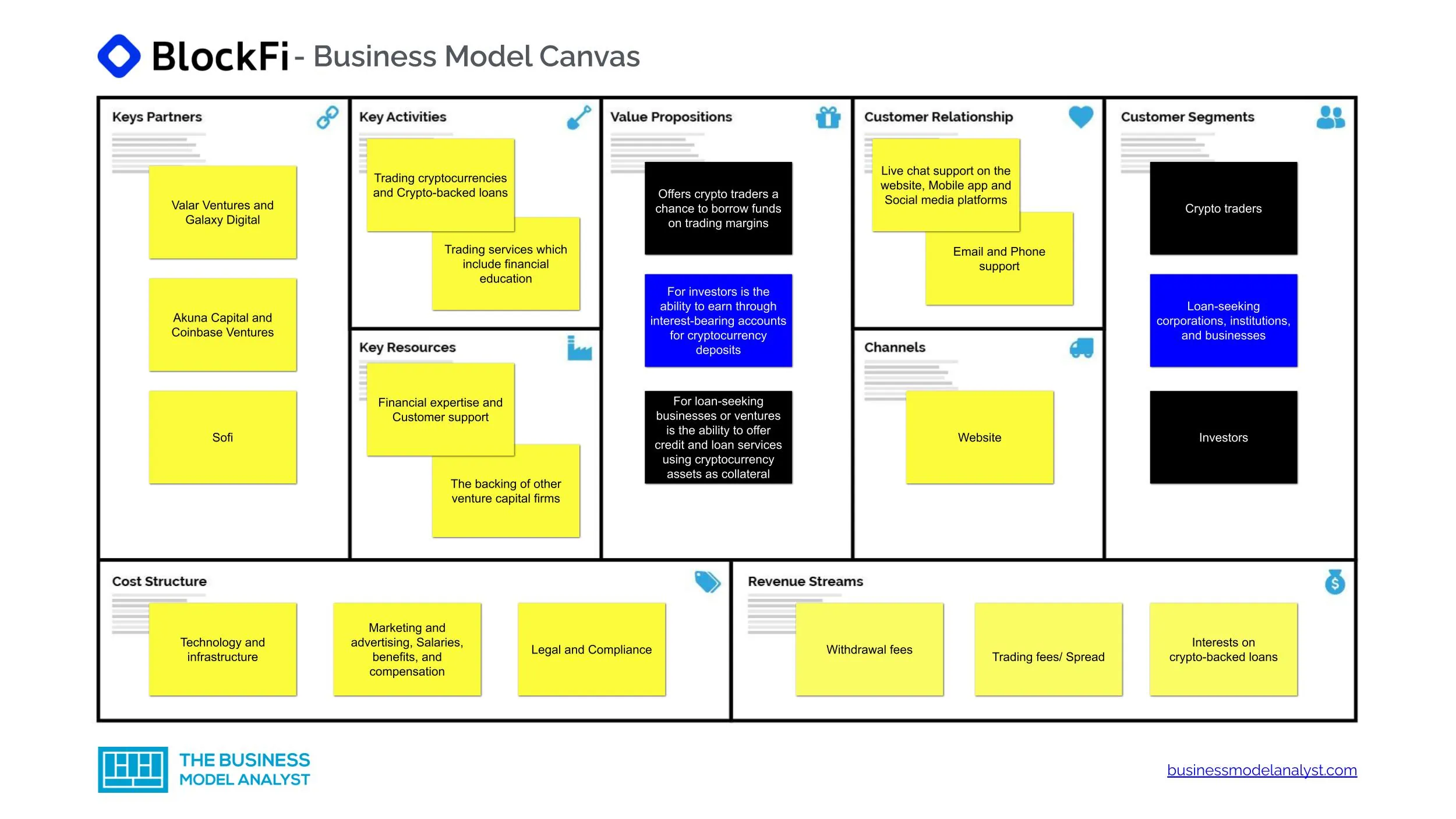

BlockFi Business Model

The BlockFi business model involves lending, borrowing, or providing financial services for cryptocurrency assets, as [...]

Leave a Reply

Your email address will not be published. Required fields are marked *

RECEIVE OUR UPDATES

Username or email address *

Password *

Remember me Log in

Lost your password?

Nike Business Model: Not a business but an inspiration

Born in a family of runners, Nike has always been a household name. I would spend a considerable amount of time trying new models and visiting the Nike Website for any possible discounts.

Quite recently, I finished Phil Knight’s Memoir- Shoe Dog. The story behind the brand speaks of resilience. Nike entered an already dominated market, faced supply-chain issues, financial problems, and lawsuits.

Each hurdle had the potential to put them out of business, but they fought against all odds and emerged to be the most dominant player in the sportswear market. Today, let us analyze the industry and the business model & strategies that made Nike a success story.

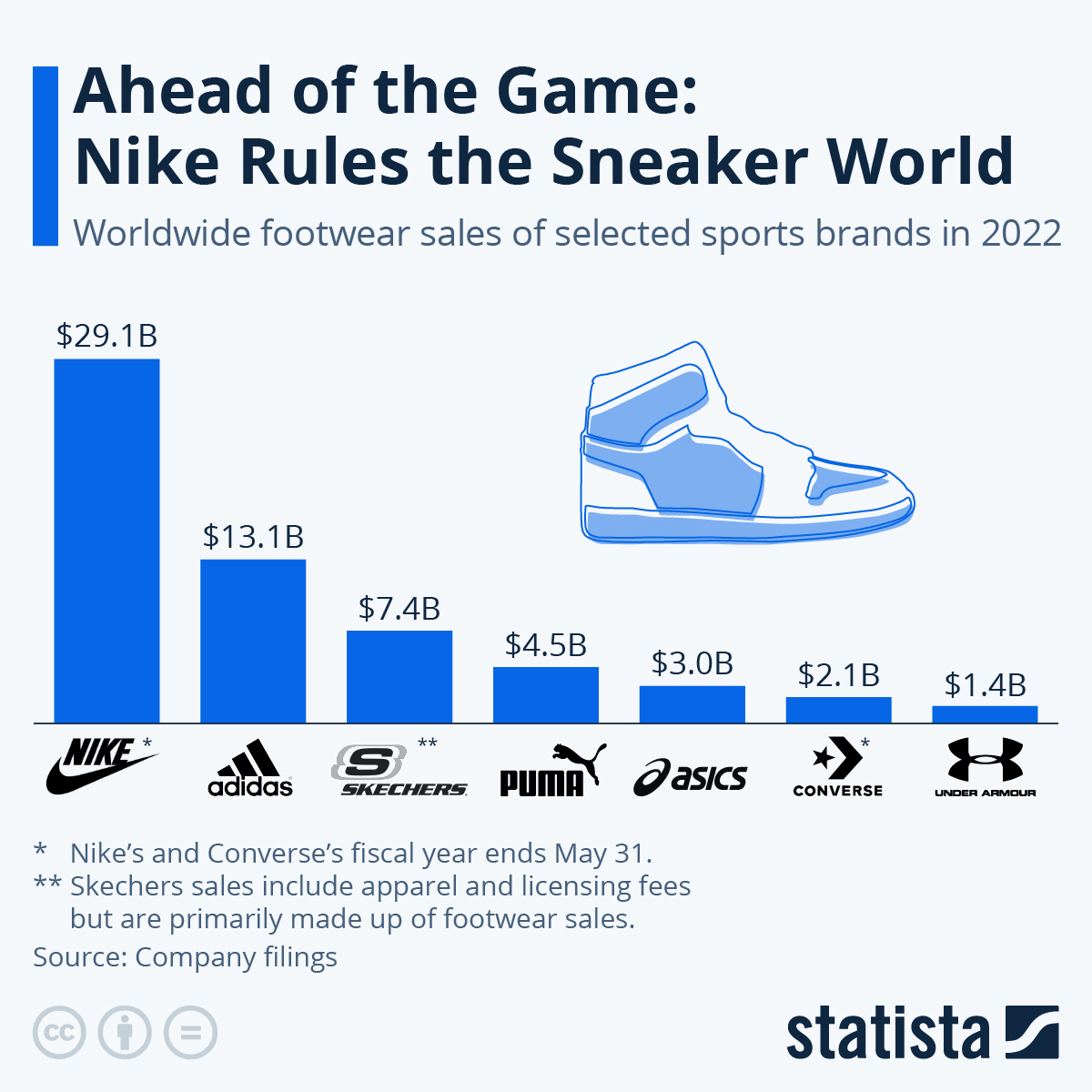

The Sportswear Industry

The sportswear industry in the world is dominated by Nike, Adidas, Asics, and UnderArmour. The global sportswear market size is projected to reach US$ 113190 million by 2026, from US$ 93160 million in 2020, at a CAGR of 3.3% during 2021-2026.

The sportswear industry saw a hit during the COVID 19 pandemic; however, it fared far better than the rest of the apparel industry. There was a shift in the sales pattern; people started to buy sportswear for indoor sports rather than outdoor sports.

The industry saw a change in their customer base- there was an increase in women buyers, and currently, more than 50% of buyers are women. Moreover, the pandemic shifted the public’s focus towards physical health and the importance of an active life, which boosted sales for the sportswear industry.

The industry is highly competitive as there is a shortage of raw materials and incredible demand. This problem causes an imbalance in the supply chain. New companies often do not have the funds to handle such an imbalance. Nike faced the same issue for a very long time and was floating due to supply-chain delays but eventually dealt with it after it introduced the idea of “futures” to its stockholders.

The problem was then resolved after the cash inflow when the company became public. However, even a small market share in this segment can yield good profits. Nike was not the first to enter this market, but with its innovative designs and marketing strategies, it managed to make its way to the top. Nike doesn’t sell shoes. It sells an idea with its marketing strategy!!

Nike’s Outsourcing Business Model

Nike has a mass-market business model which caters to sports enthusiasts. The product categories are broadly shoes, sports apparel, and accessories. Their first products were running shoes, given that Phil Knight was a runner himself.

Before they went public, they opened their Apparel line, which has been equally successful. They ventured out to Basketball sneakers and slowly created a demand for shoes as footwear used for daily use.

Nike Inc. (originally known as Blue Ribbon Sports) first started as a reseller for Onitsuka Tiger shoes from Japan. Post their fallout, they outsourced their manufacturing from 300 independent suppliers in 35 countries such as China, Vietnam, Thailand, etc. Today, there are 1096 Nike retail stores worldwide, apart from E-commerce and online platforms. They sell their products in 170 countries across the world. Nike currently has a brand value of 34.8Bn USD.

They have the highest market share in the shoes and sports apparel department. They were the first American shoe-selling company to open their warehouse and sell their products in the Chinese market. Countries such as India, Italy, Mexico, and Argentina have manufacturing units catering to local markets. This move significantly lowers the supply chain woes and makes Nike accessible all over the world.

Value Proposition

Nike’s business model focuses on Innovation and Customization. Despite the sportswear being outsourced, Nike maintains strict quality checks. It spends a lot of resources and time for designing, research, and development.

Bill Bowerman (Nike’s early partner) would often use waffle irons to experiment with shoes! Their designs are admirable- anyone who has a pair of Nike’s Air Zooms can vouch for this. They introduced the world to Air-Cushioning technology in shoes.

There is a special team- Nike Explore Team Sport Research Lab, which is responsible for innovations. It employs researchers with doctorates in biomedical engineering, biomechanics, kinesiology, mechanical engineering, physics, physiology, and systems science. The company maintains advisory boards and research committees consisting of athletes, trainers, coaches, orthopedists, podiatrists, equipment managers, and experts who can guide the product design and development process.

Customization is another feature that Nike provides. NikeID is a service that allows buyers to customize their shoes. They can choose colors, sports style, and traction. One can visit Nike by You, Custom shoes and have a shoe tailored to their needs and likes.

Brand positioning and Advertising

When Knight first started Nike, he did not believe in the power of advertising. Funny how things change, Nike spent 3.59 billion U.S. dollars only on advertising and promotional events in 2020. Nike roughly spends 10% of its revenue on advertising. However, their marketing strategy often reminds me of a verse from the book and their spirit throughout the book.

I’d tell men and women in their mid-twenties not to settle for a job or a profession or even a career. Seek a calling. Even if you don’t know what that means, seek it. Phil Knight

The first employees of the firm were Shoe dogs. Bill Bowerman was Phil Knight’s track coach. Jeff Johnson and Phil Knight went for 13-mile runs when they met to discuss strategies. All of them loved running and shoes. Their love for running pushed them to sell shoes and build amazing designs for runners around the world.

They were passionate about the cause and reflected the same in their marketing strategies. More than advertising their shoes, they advertise running and sports. They are master storytellers; they create demand for themselves by inspiring people to take up sports.

Another amazing strategy that makes the brand alluring is that it is inclusive and takes a firm stand on social issues. Nike was one of the first brands to release Pro Hijab, a product for Muslim women in sports. They’ve encouraged women empowerment and involvement of women in sports- their social media channel NikeWomen inspires women to take up sport and a healthy lifestyle.

Nike’s worldwide fan following is certainly anchored to its essence of standing for social justice over and over again. The recent decision of Nike to split with soccer player Neymar based on an allegation raised by a female employee of sexual harassment by the soccer player affirms the brand’s willingness and effort to stick to social norms.

Check out this story on how Nikes stand for social justice has created a powerful node in its brand association .

The company supported and debuted an ad campaign centered on Colin Kaepernick. He was a former NFL player who refused to stand for the national anthem before his games in protest of racism and discrimination in America. The sport boycotted him due to political pressure, but Nike debuted an ad campaign supporting the cause right after the event.

When Nike first started, celebrity endorsements were considered one-way tickets to putting a brand’s shoes on the map. Nike has indeed continued to follow this particular strategy and has the world’s leading athletes to promote its products, including Tiger Woods, Michael Jordan, Cristiano Ronaldo, Rafael Nadal, and many more. In the 2016 Olympics, In the category of shoe brands- Nike had the highest number of players who won medals.

Wrapping up

Shoes are one of the world’s oldest creations. One thing that can be observed is how Nike has always been a pioneer in innovating shoes and sports apparel. Nike has built a business model that observes trends and always stayed relevant to the market.

Entrepreneurs can surely take a leaf out of Nike’s books. Stay resilient, relevant, do not be intimidated by competition, and sell a vision rather than a product.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

BlackRock, the story of the world’s largest shadow bank

BlackRock has $7.9 trillion worth of Asset Under Management which is equal to 91 sovereign wealth funds managed. What made it unknown but a massive banker?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

The Nokia Saga – Rise, Fall and Return

Nokia is a perfect case study of a business that once invincible but failed to maintain leadership as it did not innovate as fast as its competitors did!

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-

Manasvi is an aspiring entrepreneur - always on hunt for problems she can solve. She’s an education, business and public policy enthusiast. She loves spending her weekends teaching underprivileged children or on her couch reading books.

Related Posts

How does Instacart work and make money: Business Model

What does Zscaler do | How does Zscaler work | Business Model

What does Chegg do | How does Chegg work | Business Model

What does Bill.com do | How does Bill.com work | Business Model

What does Cricut do | How does Cricut work | Business Model

What does DexCom do? How does DexCom business work?

What does CarMax do? How does CarMax business work?

What does Paycom do? How does Paycom work?

What does FedEx do | How does FedEx work | Business Model

How does Rumble work and make money: Business Model

Dollar General Business Model & Supply Chain Explained

What does C3 AI do | Business Model Explained

What does Aflac do| How does Aflac work| Business Model

How does Booking.com work and make money: Business Model

What does Okta do | How does Okta work | Business Model

What does Alteryx do | How does Alteryx work | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Presentations made painless

- Get Premium

Nike: Business Model, SWOT Analysis, and Competitors 2023

Inside This Article

Nike is a global sports apparel giant, renowned for its iconic swoosh logo and innovative products. This blog article delves into Nike's business model, providing insights into how the company operates and generates revenue. Additionally, a SWOT analysis will be conducted to evaluate Nike's strengths, weaknesses, opportunities, and threats in the ever-evolving market. Furthermore, the article will explore Nike's competitors and examine how the company maintains its competitive edge in the industry. Stay tuned to gain a comprehensive understanding of Nike's current position in the market and its future prospects for 2023.

What You Will Learn:

- Who owns Nike: Discover the ownership structure of Nike and the key stakeholders involved in the company.

- Nike's mission statement: Gain insights into Nike's mission and values, and how they shape the company's overall direction and decision-making.

- How Nike makes money: Explore the various revenue streams and business strategies that contribute to Nike's financial success.

- Nike Business Model Canvas Explained: Understand the different components of Nike's business model canvas and how they interrelate to support the company's operations and growth.

- Nike's competitors: Learn about the main competitors in the sports apparel and footwear industry and how Nike positions itself against them.

- Nike SWOT Analysis: Explore the strengths, weaknesses, opportunities, and threats facing Nike, providing a comprehensive understanding of the company's current position in the market.

Who owns Nike?

Ownership structure of nike.

Nike, the globally recognized sportswear brand, operates under a complex ownership structure. As a publicly traded company, Nike is owned by a diverse group of shareholders who hold its stock. However, a few significant stakeholders have a notable influence on the company's direction and decision-making processes.

Founders and Executive Team

Nike's origins trace back to its founders, Bill Bowerman and Phil Knight. Although they no longer have direct ownership, their legacy is deeply ingrained in the company's core values and vision. Today, Nike's executive team, led by CEO John Donahoe, plays a crucial role in shaping Nike's future strategies and operations.

Institutional Investors

A significant portion of Nike's ownership lies with institutional investors. These investors are typically large financial institutions such as mutual funds, pension funds, and asset management companies. They hold substantial amounts of Nike stock on behalf of their clients, including individual investors and organizations.

Individual and Retail Investors

Individual investors, including retail investors, also play a critical role in Nike's ownership. These are everyday people who buy Nike stock through brokerage accounts, retirement plans, or other investment vehicles. Their collective ownership, though dispersed, can have a meaningful impact on the company's overall ownership structure.

Exchange-Traded Funds (ETFs)

Another important category of Nike's ownership is through exchange-traded funds (ETFs). These investment funds pool money from multiple investors to buy a diversified portfolio of stocks, including Nike. By investing in ETFs, individuals can indirectly own Nike shares without purchasing them directly.

Employee Stock Ownership Plans (ESOPs)

Nike offers Employee Stock Ownership Plans (ESOPs) as a way to incentivize and reward its employees. Through these plans, employees can become partial owners of the company by receiving shares or stock options. This ownership structure further aligns the interests of employees with the success and performance of Nike.

Other Stakeholders

Apart from the aforementioned ownership categories, Nike's ownership extends to other stakeholders as well. These include suppliers, business partners, and strategic investors who may hold specific ownership stakes or have influence over the company's operations due to close business relationships.

In summary, Nike's ownership is distributed among a wide range of shareholders, including founders, institutional investors, individual investors, ETFs, and employees. This diverse ownership structure reflects the company's commitment to maintaining a broad base of ownership and fostering a sense of collective responsibility towards its success.

What is the mission statement of Nike?

Nike's mission statement.

Nike's mission statement is to bring inspiration and innovation to every athlete in the world. The company believes that if you have a body, you are an athlete, and it strives to create products and experiences that empower and motivate individuals to reach their full potential.

Inspiring and innovating

Nike's mission statement reflects its commitment to inspire and innovate. By constantly pushing boundaries and challenging the status quo, Nike aims to create products that not only meet the needs of athletes but also exceed their expectations. This drive for innovation can be seen in the advanced technologies and materials used in Nike's footwear, apparel, and equipment.

Inclusive athleticism

Nike's mission statement emphasizes inclusivity by stating that everyone is an athlete. This means that Nike's products and experiences are designed to cater to individuals of all ages, genders, sizes, and abilities. By embracing diversity, Nike aims to celebrate and empower athletes from all walks of life, encouraging them to pursue their passions and achieve their goals.

Empowering individuals

Nike's mission statement also highlights its objective to empower individuals. Through its products, campaigns, and initiatives, Nike aims to inspire people to believe in themselves, overcome obstacles, and unleash their full potential. By providing athletes with the tools they need to succeed, Nike seeks to empower individuals to push their limits and achieve greatness in their respective fields.

Global reach

Lastly, Nike's mission statement emphasizes its global reach. The company's commitment to bringing inspiration and innovation to every athlete in the world demonstrates its ambition to connect with individuals worldwide. By expanding its presence in various countries and cultures, Nike aims to make a positive impact on the lives of athletes globally, fostering a sense of community and unity through the power of sport.

In summary, Nike's mission statement encapsulates its dedication to inspiring and innovating, promoting inclusive athleticism, empowering individuals, and reaching a global audience. These core principles guide Nike in its pursuit of excellence and its mission to bring inspiration and innovation to every athlete in the world.

How does Nike make money?

Selling athletic footwear and apparel.

One of the primary ways Nike generates revenue is through the sale of athletic footwear and apparel. Known for its iconic swoosh logo, Nike offers a wide range of products for various sports and activities. From running shoes to basketball sneakers, and from soccer jerseys to yoga pants, Nike caters to the needs of athletes and fitness enthusiasts worldwide.

Nike's footwear line is particularly popular, with innovative designs and technologies that aim to enhance performance and provide comfort. Whether it's the latest Air Max series or the timeless Jordan sneakers, Nike constantly introduces new styles to attract customers. The company also collaborates with athletes, celebrities, and designers to create limited edition and exclusive collections, further driving demand.

Licensing and endorsements

Nike's brand recognition and global reach have allowed the company to secure licensing agreements and endorsements with various professional sports leagues, teams, and individual athletes. Through these partnerships, Nike can use team logos, player names, and other intellectual property on its products, including jerseys, shoes, and accessories.

Endorsements play a significant role in Nike's marketing strategy. The company sponsors numerous world-renowned athletes, such as Cristiano Ronaldo, LeBron James, and Serena Williams. By associating its brand with these high-profile figures, Nike aims to create a positive image and inspire consumers to purchase its products.

Direct-to-consumer sales

In recent years, Nike has placed a strong emphasis on its direct-to-consumer (DTC) sales channel. This includes selling products through its own physical stores, as well as its e-commerce platform. By bypassing third-party retailers and selling directly to customers, Nike can maintain better control over pricing, inventory, and the overall shopping experience.

Nike's online store has become increasingly important, offering a wide selection of products and personalized shopping experiences. Through its website and mobile app, customers can customize shoes, join exclusive member programs, and receive personalized recommendations based on their preferences and previous purchases. This direct relationship with consumers not only allows Nike to gather valuable data but also enables the company to build brand loyalty and increase customer lifetime value.

Other revenue streams

Apart from its core business of selling athletic footwear and apparel, Nike also generates revenue through other avenues. These include:

- Equipment sales: Nike produces a range of sporting equipment, such as soccer balls, basketballs, and golf clubs. These products are sold through various channels, including sports stores and online platforms.

- Brand licensing: Nike licenses its brand to third-party companies to produce and sell products such as bags, accessories, and even technology like fitness trackers and smartwatches.

- Converse subsidiary: Nike owns Converse, a popular sneaker brand with a distinct style. Converse operates as a subsidiary and contributes to Nike's overall revenue through its own product sales.

In summary, Nike's revenue primarily comes from selling athletic footwear and apparel, leveraging licensing and endorsements, focusing on direct-to-consumer sales, and exploring additional revenue streams outside its core business. Through these various avenues, Nike continues to strengthen its position as a leading global sports brand.

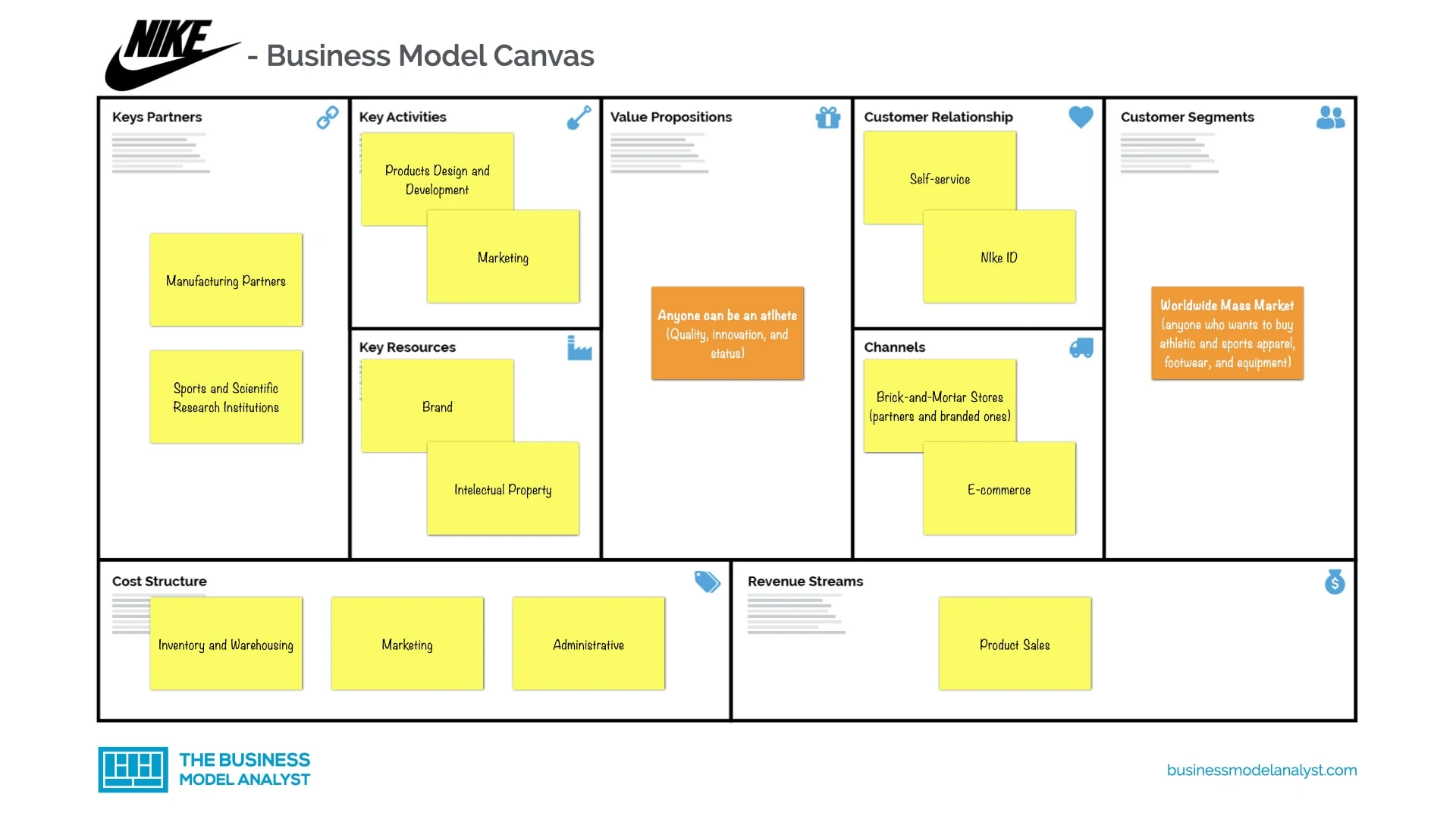

Nike Business Model Canvas Explained

What is a business model canvas.

A Business Model Canvas is a strategic management tool that allows businesses to describe, design, challenge, and pivot their business models. It provides a visual representation of the key components and relationships of a business model, helping organizations understand and communicate how they create, deliver, and capture value.

The Key Components of Nike's Business Model Canvas

Nike's Business Model Canvas consists of nine key components that work together to drive the company's success. Let's explore each component in detail:

Customer Segments: Nike targets a diverse range of customer segments, including athletes, sports enthusiasts, and fashion-conscious consumers. By segmenting their customer base, Nike can better tailor their products and marketing efforts to meet specific needs and preferences.

Value Proposition: Nike's value proposition centers around providing high-quality athletic footwear, apparel, and equipment that enhance the performance and style of athletes. Their focus on innovation, sustainability, and brand image sets them apart from competitors.

Channels: Nike utilizes various distribution channels to reach its customers, including their own retail stores, e-commerce platforms, and partnerships with retail chains. This multi-channel approach ensures broad market coverage and convenient access for consumers.

Customer Relationships: Nike cultivates strong customer relationships through various means, such as personalized marketing campaigns, loyalty programs, and social media engagement. They strive to create an emotional connection with their customers and foster brand loyalty.

Revenue Streams: Nike generates revenue through the sale of its products and services. This includes revenue from direct sales, wholesale partnerships, licensing agreements, and endorsements by professional athletes. They also offer additional services like customization and digital fitness apps.

Key Activities: Nike's key activities revolve around product design, development, and marketing. They invest heavily in research and development to create innovative products that cater to the evolving needs of athletes. Marketing efforts focus on brand building, sponsorships, and collaborations.

Key Resources: Nike's key resources include their manufacturing facilities, design teams, supply chain network, and brand reputation. Their extensive global supply chain ensures efficient production and distribution of products worldwide.

Key Partnerships: Nike collaborates with various partners, including athletes, sports teams, suppliers, and retail partners. These partnerships help them leverage expertise, expand market reach, and enhance brand credibility.

Cost Structure: Nike incurs costs related to manufacturing, marketing, research and development, logistics, and retail operations. They also invest in sustainability initiatives, corporate social responsibility, and brand promotion. Cost management is crucial to maintaining profitability.

Nike's Business Model Canvas provides a comprehensive overview of how the company operates and creates value. By understanding the key components and their interdependencies, Nike can continuously adapt and innovate to stay ahead in a highly competitive industry. This strategic tool serves as a roadmap for success and guides decision-making processes within the organization.

Which companies are the competitors of Nike?

One of the main competitors of Nike is Adidas. Adidas is a German multinational corporation that designs and manufactures sports shoes, clothing, and accessories. It is known for its iconic three stripes logo and its wide range of athletic footwear and apparel. Like Nike, Adidas has a strong presence in the global market and sponsors numerous professional athletes and sports teams. The rivalry between Nike and Adidas is intense, with both companies competing for market share and constantly innovating to stay ahead of each other.

Under Armour

Under Armour is another major competitor of Nike. Founded in 1996, Under Armour is an American sports clothing and accessories company that specializes in performance apparel, footwear, and accessories. It gained popularity for its moisture-wicking fabric technology, which quickly became a staple in the athletic apparel industry. Under Armour has built a strong brand image and has a significant customer base, particularly among athletes and fitness enthusiasts. The company's focus on innovation and high-performance products puts it in direct competition with Nike.

Puma is a well-known sportswear brand and a direct competitor of Nike. Founded in 1948, Puma is a German multinational corporation that designs and manufactures athletic and casual footwear, apparel, and accessories. The company has a diverse product portfolio that caters to various sports and lifestyle segments. Puma is known for its bold and distinctive designs, collaborating with renowned celebrities and designers to create unique collections. With a strong global presence and a focus on performance and style, Puma competes directly with Nike in the sports apparel market.

New Balance

New Balance is a Boston-based company that has been competing with Nike in the athletic footwear and apparel space for decades. Established in 1906, New Balance initially focused on arch supports and orthopedic shoes but later expanded into athletic footwear. The brand is recognized for its emphasis on fit, comfort, and quality. New Balance has a loyal customer base, particularly among runners, and is known for its wide range of sizes and widths, accommodating various foot shapes. While Nike dominates the market in terms of revenue and brand recognition, New Balance remains a strong competitor, especially in the running shoe segment.

Reebok, a subsidiary of Adidas since 2005, is another prominent competitor of Nike. Founded in 1958, Reebok is an American athletic footwear and apparel company that specializes in sports and fitness products. It has a rich heritage in the fitness industry and has collaborated with various athletes and fitness influencers to create innovative products. Reebok's focus on cross-training and functional fitness gives it a unique positioning in the market. Although Reebok may not be as large as Nike, it competes fiercely with the brand in certain segments, such as fitness and training shoes.

Nike SWOT Analysis

- Strong brand image and reputation: Nike is one of the most recognizable and valuable brands in the world. The company has established a strong brand image through its innovative products, marketing campaigns, and endorsements by top athletes.

- Extensive product portfolio: Nike offers a wide range of athletic footwear, apparel, equipment, and accessories for various sports and activities. This diverse product portfolio allows the company to cater to the needs and preferences of different consumer segments.

- Robust distribution network: Nike has an extensive global distribution network that includes owned retail stores, e-commerce platforms, and partnerships with third-party retailers. This widespread presence enables the company to reach customers in different regions and effectively distribute its products.

- Strong research and development capabilities: Nike invests heavily in research and development to continuously innovate and improve its products. The company's focus on technological advancements and performance-enhancing features gives it a competitive edge in the market.

- Effective marketing and advertising strategies: Nike's marketing campaigns are known for their creativity, emotional appeal, and ability to connect with consumers. The company's partnerships with top athletes and teams, as well as its use of social media platforms, help to create a strong brand presence and drive consumer engagement.

- High dependence on third-party manufacturers: Nike outsources the manufacturing of its products to third-party suppliers, primarily located in Asia. This dependence on external manufacturers exposes the company to risks such as supply chain disruptions, quality control issues, and labor-related controversies.

- Vulnerability to changing fashion trends: The sports apparel and footwear industry is highly influenced by changing fashion trends. Nike needs to continually adapt its product offerings to stay relevant and meet evolving consumer preferences. Failure to do so could result in a decline in sales and market share.

- Potential negative impact of counterfeit products: Nike's popularity and strong brand image make it a target for counterfeiters. The presence of counterfeit Nike products in the market not only affects the company's revenue but also damages its brand reputation.

- Limited presence in certain geographic markets: While Nike has a strong global presence, its market share in certain regions, such as parts of Asia and Latin America, is relatively low compared to its dominance in North America and Europe. Expanding its footprint in these regions could be a growth opportunity for the company.

Opportunities

- Growing athleisure trend: The increasing popularity of athleisure, which combines athletic and casual wear, presents an opportunity for Nike to expand its product offerings. By introducing more fashionable and versatile products, the company can tap into this growing consumer segment.

- Emerging markets: Developing countries, especially in Asia and Latin America, offer significant growth opportunities for Nike. As disposable incomes rise and consumer spending on sports and fitness increases, the demand for Nike's products is expected to grow in these markets.

- E-commerce growth: The rapid expansion of e-commerce presents an opportunity for Nike to reach a wider customer base and increase sales. By investing in its e-commerce platforms and digital marketing strategies, the company can enhance the online shopping experience and drive online sales.

- Sustainability and ethical sourcing: With increasing consumer awareness and demand for sustainable and ethically sourced products, Nike has the opportunity to strengthen its commitment to environmental and social responsibility. By adopting sustainable practices throughout its supply chain and promoting transparency, the company can attract environmentally conscious consumers.

- Expansion into new product categories: Nike can explore opportunities to expand into new product categories, such as wearable technology, fitness apps, and health-related services. By leveraging its brand equity and expertise in athletic performance, the company can diversify its revenue streams and stay ahead of competitors.

- Intense competition: Nike faces intense competition from both established and emerging players in the sports apparel and footwear industry. Competitors such as Adidas, Under Armour, and Puma pose a threat to Nike's market share and profitability.

- Economic uncertainties: Nike's financial performance is influenced by macroeconomic factors such as economic downturns, currency fluctuations, and trade policies. Economic uncertainties can impact consumer spending and result in reduced demand for Nike's products.

- Changing consumer preferences: Consumer preferences and trends are constantly evolving, making it crucial for Nike to stay ahead of changing demands. Failure to anticipate and respond to shifts in consumer preferences could lead to a decline in sales and market share.

- Counterfeit products: The presence of counterfeit Nike products in the market not only affects the company's revenue but also erodes consumer trust in the brand. Nike needs to continue investing in anti-counterfeiting measures to protect its intellectual property and maintain brand integrity.

- Regulatory challenges: Nike operates in multiple countries, each with its own regulations related to labor practices, environmental standards, and product safety. Compliance with these regulations can be complex and costly, and non-compliance could result in reputational damage and legal penalties.

Key Takeaways

- Nike is a publicly traded company, meaning it is owned by shareholders who hold its stocks.

- Nike's mission statement is to bring inspiration and innovation to every athlete in the world, emphasizing its commitment to innovation and inclusivity.

- Nike generates revenue primarily through the sale of athletic footwear, apparel, and equipment, both through its own retail stores and online platforms.

- The Nike Business Model Canvas showcases the key elements of Nike's business model, including its value proposition, customer segments, key activities, and revenue streams.

- Nike faces competition from companies such as Adidas, Under Armour, Puma, and New Balance, among others. A SWOT analysis of Nike reveals its strengths, weaknesses, opportunities, and threats in the market.

In conclusion, Nike is a globally recognized brand that has become a household name in the sports industry. As for the ownership, Nike is a publicly traded company, with the majority of its shares held by institutional investors and individual shareholders.

Nike's mission statement is to bring inspiration and innovation to every athlete in the world. They define an athlete as anyone with a body, emphasizing their commitment to inclusivity and promoting a healthy and active lifestyle.

Nike generates its revenue through various channels, including the sale of footwear, apparel, and equipment. They have a strong presence in both the retail and e-commerce sectors, with a significant portion of their sales coming from direct-to-consumer channels.

The Nike Business Model Canvas provides a comprehensive overview of the key elements that drive Nike's success. It highlights their value proposition, customer segments, distribution channels, and key activities that enable them to deliver their products to consumers worldwide.

In terms of competition, Nike faces stiff competition from other major sportswear brands such as Adidas, Under Armour, Puma, and Reebok. These companies constantly strive to capture market share and innovate in order to attract and retain customers.

A SWOT analysis of Nike reveals its strengths, weaknesses, opportunities, and threats. Nike's strengths lie in its strong brand image, extensive product portfolio, and effective marketing strategies. However, weaknesses such as labor controversies and dependency on third-party manufacturers pose challenges. Opportunities for Nike include expanding into emerging markets and leveraging digital technologies, while threats include intense competition and economic fluctuations.

Overall, Nike's success can be attributed to its strong brand positioning, commitment to innovation, and ability to adapt to changing consumer preferences. As they continue to evolve and navigate the competitive landscape, Nike remains a dominant force in the sports industry.

Want to create a presentation now?

Instantly Create A Deck

Let PitchGrade do this for me

Hassle Free

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2023 Pitchgrade

- Search Search Please fill out this field.

- NIKE's Industry

NIKE’s Financials

History and leadership, recent developments, the bottom line.

- Company Profiles

- Consumer Discretionary

How NIKE Makes Money

NIKE North America is the company's largest geographic segment

- How Companies Make Money

- Lockheed Martin

- Nike CURRENT ARTICLE

- Bank of America

- Credit Karma

NIKE Inc. ( NKE ) is a global footwear and apparel company that designs, develops, markets, and sells athletic footwear, apparel, equipment, accessories, and services. Although primarily designed for athletic use, many of its products are worn for casual or leisure activities.

Key Takeaways

- NIKE designs, develops, markets, and sells athletic footwear, apparel, equipment, and accessories.

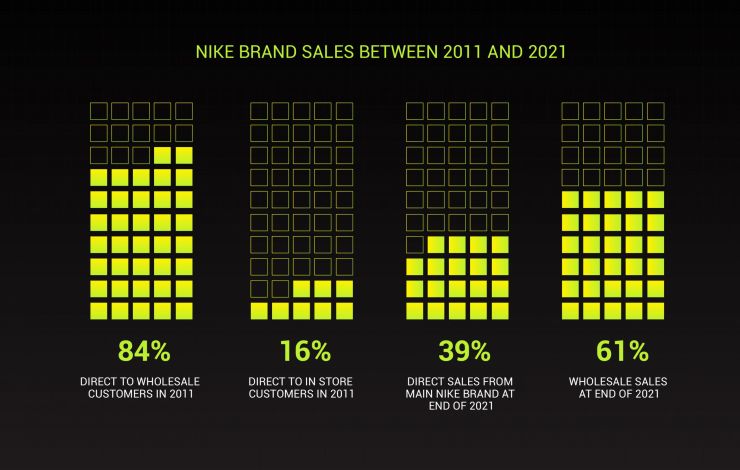

- Most of NIKE's sales are generated by selling footwear to wholesale customers in North America.

- NIKE faces competition from Adidas, Puma, and ASICS.

NIKE's Industry

The majority of NIKE's products are manufactured by independent contractors and sold either directly to consumers through NIKE retail outlets and digital platforms, or by independent distributors, licensees, and sales representatives. NIKE is based in Oregon with many global rivals, including Adidas AG ( ADDYY ), ASICS Corp. ( 7936 ), Lululemon Athletica Inc. ( LULU ), Puma SE ( PUMSY ), and Under Armour Inc. ( UAA ). NIKE operates through three segments: NIKE Brand; Converse; and Corporate.

- NIKE Brand: Includes six geographical segments: North America; Europe, Middle East & Africa; Greater China; Asia Pacific & Latin America; and Global Brand Divisions.

- Converse: NIKE's Converse segment is engaged in the design, distribution, licensing, and sale of casual sneakers, apparel, and accessories under the following trademarks: Converse, Chuck Taylor, All-Star, One Star, Star Chevron, and Jack Purcell.

- Corporate: NIKE's Corporate segment revenue primarily consists of foreign currency hedge gains and losses related to revenues generated by NIKE's other operating segments.

NIKE announced in March financial results for Q3 of its 2024 fiscal year (FY) , the three months ended Feb. 29, 2024. The company posted a net income of $1.2 billion, down 5% from the year-ago quarter. Revenue stayed flat year over year (YOY) with $12.4 billion. Earnings before interest and taxes (EBIT) , a profitability metric NIKE uses for its business segments, dropped 5% YOY to $1.4 billion. The NIKE Brand segment comprises over 95% of the company's total revenue.

NIKE breaks out revenue, but not profits, for its major product lines and distribution channels. The share of revenue generated by product lines in Q3 FY 2024 was: Footwear (68%); Apparel (28%); Equipment (4%); and Other. A negligible amount is attributable to Other, which includes revenue from licensing businesses of the Global Brand Divisions and Converse segments, and to foreign currency hedge gains and losses accounted for in the Corporate segment. NIKE reports revenue and EBIT for its business segments.

NIKE’s identity was inspired by the Greek goddess of victory and the company was first founded in 1964 as Blue Ribbon Sports by Phil Knight and Bill Bowerman. During the 1970s, NIKE moved from importing Japanese shoes to creating its own footwear. By 1971, the company's Swoosh was created by Carolyn Davidson. In 2024, the company has headquarters in the U.S., China, and the Netherlands with John Donahoe serving as NIKE's President and CEO.

In 2023, Football Australia and Nike executed a 10-year contract extension for a third decade, the longest of Nike’s federation and club partnerships in Australia. In Feb. 2024, NIKE partnered with NFL clubs to increase opportunities for Native American and Indigenous youth.

Does NIKE Pay Shareholders Dividends?

Yes, owners of NIKE stock receive dividends. In May 2024, NIKE declared a quarterly cash dividend of $0.370 per share on the Company’s outstanding Class A and Class B Common Stock payable on July 1, 2024.

How Many Employees Does NIKE Have?

In 2023, NIKE employed over 83,700 workers.

What Is NIKE's Commitment to Sustainability?

The company is committed to a 100% renewable electricity policy by 2025 in NIKE corporate offices, distribution centers, Air MI, and retail locations. Additionally, the company strives to divert 100% of its waste from landfills.

NIKE enjoyed an estimated sales of more than $22 billion in 2023. The company holds the largest market share for sneakers globally. NIKE was founded in 1969 and has headquarters in the U.S., China, and the Netherlands.

U.S. Securities and Exchange Commission. " Nike Inc., Form 10-K for the Fiscal Year Ended May 31, 2023 ." Page 1.

U.S. Securities and Exchange Commission. " Nike Inc., Form 10-K for the Fiscal Year Ended May 31, 2023 ." Page 5.

U.S. Securities and Exchange Commission. " Nike Inc., Form 10-K for the Fiscal Year Ended May 31, 2023 ." Page 42.

U.S. Securities and Exchange Commission. " Nike Inc., Form 10-Q for the Quarterly Period Ended February 29, 2024 ." Pages 21-22.

Nike Inc. " Nike, Inc. Reports Fiscal 2024 Third Quarter Results ." Pages 4 and 7.

U.S. Securities and Exchange Commission. " Nike Inc., Form 10-Q for the Quarterly Period Ended February 29, 2024 ." Pages 19-20.

U.S. Securities and Exchange Commission. " Nike Inc., Form 10-Q for the Quarterly Period Ended February 29, 2024 ." Page 19.

NIKE Inc. " About ."

NIKE Inc. " Football Australia and Nike Announce 10-Year Partnership Extension ."

NIKE Inc. " Nike Commits $3.2 Million to Fund Football Programs for Indigenous Youth, Partners With NFL Clubs ."

NIKE Inc. " Investor Relations ."

Statista. " NIKE Employees Worldwide ."

NIKE Inc. " Protecting the Planet ."

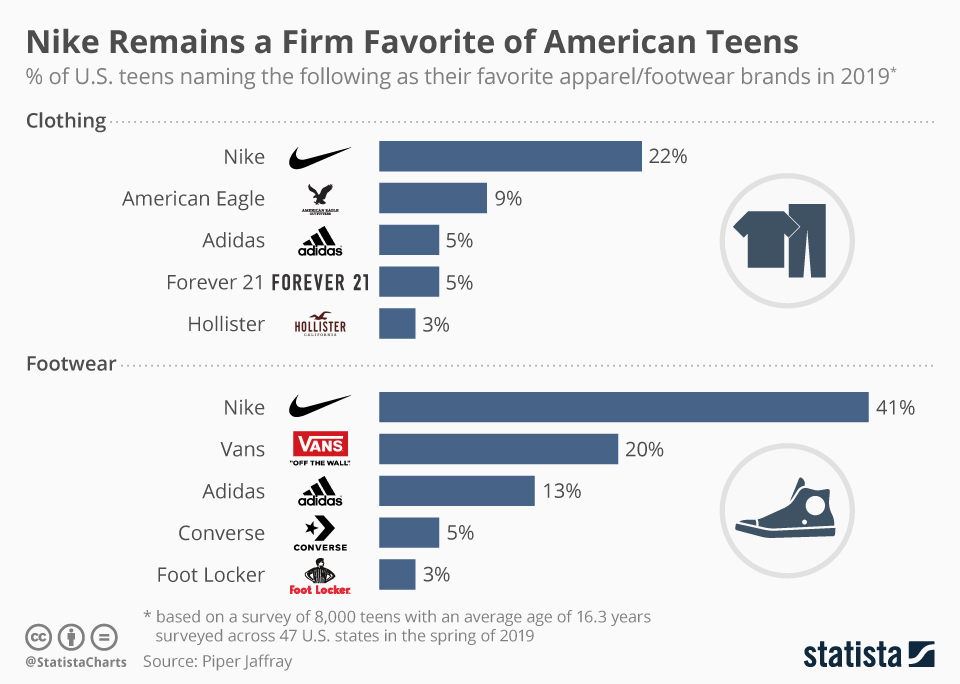

Statista. " America's Favorite Sneaker Brands ."

:max_bytes(150000):strip_icc():format(webp)/alibaba3-5bfc2e5c46e0fb0051455a16.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Nike - Ruling The Sneaker Industry

Sarika Anand

Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations. The content in this post has been approved by Nike .

Sports is indeed a global medium of communication. It penetrates through cultures, nations, and divisions. It's a long-standing consumer desire as well as a stimulus of human aspirations and development.

Individual effort, collaboration, respect, how to win, how to lose, and how to compete strongly and fairly are all valuable lessons learned via sports. In both good and terrible times, sports inspire, fascinate, and reward us. Sports is a fantastic industry to work in, and an even better one to run.

Nike has risen from a quiet small town, in Oregon to become the world's leading sports footwear and clothing corporation. It all began with a shoe and a t-shirt. It is now a diverse and sophisticated multinational corporation. Nike is well recognised for its footwear, clothes, and accessories. It offers products under the Nike and Jordan brands, and also via its Jordan Brand and Converse divisions.

Nike - Company Highlights

| Startup Name | Nike |

|---|---|

| Formerly Called | Blue Ribbon Sports, Inc.(1964–1971) |

| Industry | Apparel, Accessories, Sports equipment |

| Headquarter | Beaverton, Oregon, U.S. |

| Founders | Bill Bowerman and Phil Knight |

| Founded | January 25, 1964 |

| Key People | Phil Knight (Chairman Emeritus), Mark Parker (Executive Chairman), and John Donahoe (President and CEO) |

| Areas Served | Worldwide |

| Website | www.nike.com |

About Nike, and How it Works? Nike - Industry Nike - Name, Logo, and Tagline Nike - Founders Nike - Startup Story Nike - Vision, and Mission Nike - Business Model, and Revenue Model Nike - Investments Nike - Acquisitions Nike - Competitors Nike - Controversies Nike - Future Plans

About Nike, and How it Works?

Nike is an American multinational athletic brand that designs, manufactures, promotes, and distributes footwear, clothing, training accessories, and service. Many of its merchandise are used for leisure or casual activities while being built for sports purposes.

The bulk of Nike's products are made by independent contractors and sold directly to customers through Nike retail shops and online mediums, as well as through independent retailers, franchisees, and sales agents.

The company's global headquarters are in the Portland metropolitan region, in Beaverton, Oregon, the United States. It employs about 44,000 people globally, and the company's brand was valued at $19 billion in 2014, making it the leading name in the sporting world.

Nike sells its products under Nike Pro, Nike Golf, Nike+, Air Jordan, Nike Blazers, Air Max, and other brands, as well as subsidiaries including Hurley, Jordan, and Converse. Nike supports many popular professional athletes and sports clubs and teams throughout the globe, and its trademarks "Just Do It" and the Swoosh emblem is very well known.

Nike - Industry

The sports sector is becoming the world's largest as more individuals participate in sports and leisure activities to improve and balance their stress, health and work regulation. It has become popular as an active and passive piece of recreation.

Customers are actively investing more in sportswear, with sportswear and accessories accounting for a substantial portion of the cost. Sport in the twenty-first century is an industry characterised by extremism. Market research is currently at the forefront of marketing sports products and accessories, as marketplaces throughout the world become highly competitive.

The worldwide sports equipment and accessories industry is booming, with the rapid acceptance of innovative technology and a willingness to adapt to demographic shifts. The sector is booming because of e-commerce, which is a prominent retail medium these days that allows users to experience all of the available sports equipment manufacturers. It is a one-stop store for all athletics equipment and products, increasing the marketability of worldwide athletic apparel.

Numerous established market participants in retail, e-commerce, sports shops, and wholesale, as well as many new startups, make the sports equipment and accessories industry extremely competitive. Growing consumer health consciousness is predicted to propel the growth of sports equipment throughout the forthcoming years. In addition, the emerging trend of following famous athletes will fuel the accessories industry.

The market for sports equipment and apparel was estimated to be $480 billion in 2021, with a CAGR of 7.2 per cent expected to reach $817 billion by 2026.

Nike - Name, Logo, and Tagline

The word "Nike" was extracted from Greek mythology where Nike is the Winged Goddess of Victory. The 'swoosh' logo is derived from the goddess's wing, and it represents the sound of movement, speed, drive and, strength.

Nike's very popular slogan says, "Just Do It."

Nike - Founders

Bill Bowerman and Phil Knight founded Nike on January 25, 1964, which was then named "Blue Ribbon Sports", and then it became "Nike", Inc. on May 30, 1971.

Phil Knight

Philip Hampson Knight is a multimillionaire American entrepreneur. He, along with being the co-founder, is the former chairman and Chief executive officer of Nike. Forbes ranked Knight as the world's 24th richest person on July 23, 2020, with his net worth being $54.5 billion.

In addition, he is the co-founder and CEO of Laika, a time-lapse film production company. Knight completed his education at the Stanford Graduate School of Business and the University of Oregon. He competed in track at the University of Oregon under Bill Bowerman , his coach and with him, he eventually co-founded Nike.

Bill Bowerman

William Jay Bowerman was a field and track coach in the United States and a co-founder of Nike, Inc. He coached 51 All-Americans, 31 Olympic competitors, 12 American record-holders, 22 NCAA winners, and 16 sub-4 minute milers in his time.

He despised the title of coach, yet during his 24 years at the University of Oregon, the Duck's track and field team won every season except one, won four NCAA championships, and placed in the top ten in the country 16 times.

He helped Nike transition from being a supplier of other shoe brands to designing their shoes as a co-founder. He designed several of the company's popular products, including the Cortez and Waffle Racer.

Nike - Startup Story

Nike's roots may be traced all the way back to the year 1964 when Blue Ribbon Sports (Nike's former name) was created. Phil Knight had recently finished his bachelor's education at the University of Oregon, followed by a Master's degree at Stanford University, giving him two life-changing encounters.

He ran for the University of Oregon track team, where he met Bill Bowerman, his team's coach. Aside from his extreme rivalry, Bowerman was preoccupied with upgrading his running shoes and exploring various models on a constant schedule after learning from a local shoemaker.

Knight became the first runner to put Bowerman's footwear to the check. Bowerman offered to bring one of his shoes and customise it with his own design, perceiving Phil as a comfortable and modest runner with someone to explore.

Knight accepted the invitation, and the shoes reputedly functioned so well that his colleague Davis grabbed them and won gold in the 400-meters track race in the year 1960 Olympics. According to him, Bowerman made the shoes for Otis Davis. Knight attended Stanford's MBA school after graduating from the University of Oregon, where he wrote a thesis recommending that the manufacturing of running shoes be shifted from Germany to Japan, where labour costs were lower .

Knight put this theory to the test when he went on a trip to Japan shortly after graduation in 1962. He agreed to market the country's famous Tiger shoes in the United States with a group of Japanese entrepreneurs.

Coach Bowerman endorsed Knight's initiative, agreeing to an equal partnership with him for the ownership of their new firm, Blue Ribbon Sports, which was formed on January 25, 1964, in Eugene, Oregon.

After starting Blue Ribbon Sports, Knight evaluated the market for his foreign shoes by distributing them out of his car when he returned to America. Early on, it was clear that there was a demand for these less priced but still high-quality alternatives to Adidas and Puma, the industry's heavyweights.

Nike - Vision, and Mission

Nike's vision statement says, “ To bring inspiration and innovation to every athlete in the world .”

Nike's mission statement says, "Our mission is what drives us to do everything possible to expand human potential. We do that by creating groundbreaking sports innovations, by making our products more sustainably, by building a creative and diverse global team and by making a positive impact in communities where we live and work."

Nike - Business Model, and Revenue Model

Nike's business model revolves around creating and distributing athletic and sporting goods, such as footwear, apparel, and equipment – as well as certain services. Everything is under one of the world's most well-known brands.

Customer Segment

Nike sells sports or athletic wear, footwear, and types of equipment. Nike's market is divided into four primary sections, also in order of revenue, geographically:

- North America

- the Asia Pacific and Latin America

- Europe, Middle East, and Africa

Customer-Seller Relationship of Nike

Customers' interactions are almost entirely limited to self-service. The consumer will examine the brand or product online or offline at the store, purchase it, and put it to use. When necessary, there will be some engagement with a salesman. A FAQs section is also available on the official website, as well as customer service through phone, email, or live chat. Nike also offers Nike ID, a customisation service that tailors Nike items to the preferences of clients.

Value Proposition

Nike makes merchandise that encourages people to participate in sports. Their goods are significantly reliant on the brand's quality, inventiveness, and prominence. This is the brand's core, and it's exactly what buyers want when they buy a pair of Nikes.

Nike has a wide range of products for several sports and hobbies. What counts to the audience, though, is getting a product that has been thoroughly researched and developed using the greatest raw materials and technology available. They also want to maintain the brand's excellent reputation, which includes superstars like Michael Jordan , Tiger Woods, and Cristiano Ronaldo .

Cost Structure

Sales costs (mainly inventories and warehouses) account for more than $21 billion in annual expenditures for Nike. A further $3 billion is allocated to marketing, which includes spending for promotion and marketing, sponsor, marketing, brand events, and brand personality display. Over $500 million is spent each year on other general and administrative expenditures.

Nike is the world's largest footwear and clothing retailer, with these sales accounting for the majority of their income. Although its sports footwear is developed with a large investment in technology and high products, the majority of its products are utilized regularly for recreation purposes.

Nike also provides balls, sunglasses, backpacks, gloves, digital gadgets, and other sports equipment and accessories, as well as recreational items for a variety of physical and outdoor activities.

In order of sales, the corporation targets women, men, young athletes, and children. Nike's goods are divided into six groups: running, basketball, Jordan Brand, soccer, training, and sportswear (lifestyle products). Running, Jordan Brand and Sportswear are Nike's most profitable segments.

Nike - Investments

| Date | Organization Name | Round | Amount |

|---|---|---|---|

| Dec 2, 2021 | AllStar Code | Grant | $500K |

| Oct 14, 2021 | SpringHill Entertainment | Venture Round | - |

| Oct 14, 2021 | The SpringHill Company | Private Equity Round | - |

| Nov 20, 2019 | HandsFree Labs | Corporate Round | - |

| Mar 4, 2014 | Reflektion | Series A | $8M |

| Oct 7, 2013 | Grabit Inc. | Series A | $6M |

| Jan 4, 2011 | Rock Health | Grant | $500K |

Nike - Acquisitions

| Acquiree Name | About Acquiree | Date | Amount |

|---|---|---|---|

| RTFKT | RTFKT is a developer of custom sneakers designed for video game enthusiasts. | Dec 13, 2021 | - |

| Datalogue | Datalogue uses artificial intelligence to automate data preparation. | Feb 8, 2021 | - |

| TraceMe | TraceMe is a technology company connecting athletes, influencers, celebrities through new social media platforms. | Oct 11, 2019 | - |

| Celect | Celect is a cloud-based, predictive analytics SaaS platform that helps retailers optimize their overall inventory portfolios. | Aug 6, 2019 | - |

| Invertex | Invertex leverages 3D scanning to allow a customer specific e-commerce experience and create mass customization product lines. | Apr 9, 2018 | - |

| Zodiac | Zodiac is a predictive customer analytics platform that helps marketers predict consumer behavior. | Mar 22, 2018 | - |

| Virgin Mega USA | Virgin Mega USA is a virtual community that enables users to purchase and experience music products. | Aug 2, 2016 | - |

| Umbro | Umbro is an English sportswear and football equipment supplier. | Oct 23, 2007 | - |

| Converse | We make rad sneakers and apparel. | Jul 9, 2003 | $309M |

| Hurley | Hurley is a big brand providing a large chain of Apparel | Feb 22, 2002 | - |

Nike - Competitors

Adidas, Skechers USA, Puma, New Balance, Steve Madden, and ASICS America are Nike's competitors.

Nike - Controversies

Child Labour Allegations - Nike was chastised in the 1990s for using child labour in factories it hired to make footballs in Pakistan and Cambodia. Despite taking steps to stop or at least limit the practice, Nike continues to outsource production to firms that operate in locations where child labour is difficult to avoid due to a lack of regulation and oversight. An investigation from 2001 revealed instances of child labour and bad working conditions in a Nike facility in Cambodia. The documentary followed six young women who worked 7 days a week, frequently for 16 hours.

Paradise Papers - Nike was one of the firms that utilised offshore entities to evade taxes, according to the Paradise Papers, a series of private electronic papers linked to offshore investment, released on November 5, 2017.

Strikes in China Factory - One of the largest strikes in mainland China occurred in April 2014 at the Yue Yuen Industrial Holdings Dongguan shoe factory, which produces shoes for Nike and other brands. Yue Yuen underpaid a monthly employee by 250 yuan. Yue Yuen's average monthly wage is 3000 yuan. 70,000 people work at the plant. This practice had been in place for almost two decades.

Nike - Future Plans

Nike has not been spared from the covid outbreak. Revenue decreased by 1% in 2020 after falling by 38% the previous quarter. The company's ability to enhance profit and generate substantial growth in its digital platform, however, has delighted the market.

Nike's success has persuaded investors that the company is gaining market share throughout the pandemic and would come back stronger than its rivals. Those aspects, particularly the company's digital capabilities, reflect well for the firm's competition in the next 5 years.

Nike originally set a goal of $50 billion in annual revenue by the year 2020 in 2015. Due to previous setbacks when it lost momentum to Adidas, it was obligated to postpone that until 2022, but despite the pandemic's setbacks, the business is on the path to meeting that goal. To do so, it would have to increase sales at a compound annual rate of approximately 9% from $39.1 billion in fiscal 2019.

When the pandemic was already over, the company, like the rest of the apparel industry, seemed to be well-positioned to capitalise on demand. Stores were reopened, and there was undoubtedly a surge in spending on streetwear such as Nike's classic sneakers. Nike could be able to reach more than $60 billion in revenue by 2025, three years after surpassing its $50 billion objectives in 2022, thanks to its digital momentum and recovery from the pandemic.

However, the firm's profit ought to increase as more of its sales shift to online and direct, where it has complete leverage over the selling process and isn't required to share income with its partner companies. Nike's Consumer Direct Offense has helped the company gain ground on competitors like Under Armour and Adidas, and this growth is projected to continue in the future years.

Nike seems to have a bright future ahead of them. The stock should continue to be a winner over the next five years, with profit margins improving, a headwind from the end of the covid-19 virus outbreak, and a strong leader in its sector.

Nike - FAQs

What does nike do.

Nike is an American multinational athletic brand that designs, manufactures, promotes, and distributes footwear, clothing, training accessories, and service.

Who founded Nike?

Bill Bowerman and Phil Knight founded Nike in the year 1964.

What was the former name of Nike?

The company was founded with the name, "Blue Ribbon Sports".

How does Nike make money?

Nike's business model is totally based on manufacturing and selling athletic and sporting goods, such as footwear, apparel, and equipment – as well as certain services.

Which companies do Nike compete with?

Adidas, Skechers USA, New Balance, Steve Madden, and ASICS America are among Nike's competitors.

Must have tools for startups - Recommended by StartupTalky

- Manage your business smoothly- Google Workspace

Nike Marketing Strategy: Winning Formula to Boost Sales and Loyalty

Nike, Inc. is an American multinational business that designs, develops, manufactures, markets, and sells footwear, apparel, equipment, accessories, and services on a global scale. Nike is a major player in the athletic world. The company pulled in revenue of over US$51.6 billion in its 2023 fiscal year and

The Success Story of NoBroker: Creating a Dalal-Free Real Estate Ecosystem in India!

Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations. Anything that has to do with real estate, specifically as a purchaser has always been convoluted and annoying. The constant push from the sellers, nagging from the middlemen, lack of fluid communication, and running

NoBroker Business Model | How NoBroker Makes Money?

A digital revolution is taking place in India's real estate business. To stay up with the trends and meet the wants of their customers, real estate companies are investing in new technologies like cloud services, mapping platforms, and artificial intelligence. By eliminating the middleman and connecting owners, purchasers, and tenants

Adidas Vs Nike: Who is Leading the Market?

If you are an adventurer, a good pair of sneakers is a must for you in your life. The best part is, that it can be worn with any kind of clothes that you decide to deck up with. You can never go wrong with sneakers as they are comfortable

Profitable Business Models > Business models of large companies

Nike: Business Model Canvas and History

- by Joanne Moyo

- July 31, 2021

From selling shoes from the back of a car to a Sportswear Giant

The Nike swoosh has become a symbol of excellence and success around the world. Standing tall among competitors in the industry, this uncontested giant has built itself up through larger-than-life marketing campaigns, high-profile endorsements, and stylish designs.

With famous brand ambassadors such as Lebron James, Tiger Woods, and Michael Jordan, the Nike brand was valued at approximately 34.8 billion U.S. dollars in 2020. Named after the Greek goddess of victory, Nike has been the number one sports footwear for decades.

But this high level of success didn’t come from anywhere. In fact, Nike had pretty humble beginnings but what was clear from the start was the drive to offer athletes a better shoe. This core principle has been the basis of all Nike designs from 1962 till today.

So how exactly did Nike become successful? What challenges did it face, and what made it different from other sport footwear manufacturers? Let’s roll it back to the time of bell-bottoms, tie-dye t-shirts, and go-go boots.

1962-1970: The birth of Nike as Blue Ribbon Sports

1962-1962: how the idea of nike was born.

It’s 1960, and Phil Knight, an average track runner at the University of Oregon, has graduated and is looking for his next opportunity. As part of the track team, he had been coached by Bill Bowerman, who was famous for producing star athletes.

Bill had one particular skill that would prove to be crucial to the birth of Nike. He was fascinated by the idea of tweaking and customizing his runner’s shoes for optimum performance. He had learned the skill from a local cobbler. Bowerman was obsessed with the connection between design and speed in all his improvements. His students preferred his custom designs, and Knight was one of them.

Knight enrolled at Stanford University for an MBA Program and wrote a paper analyzing the production costs of running shoes in Germany. His proposal was based on the theory that production should be moved to Japan, where labor was cheaper.