- Search Search Please fill out this field.

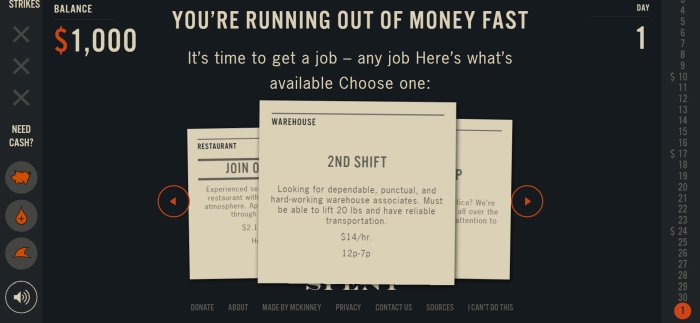

- Corporate Finance

What Is Activity-Based Budgeting (ABB)? How It Works and Example

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Investopedia / NoNo Flores

What is Activity-Based Budgeting (ABB)?

Activity-based budgeting (ABB) is a system that records, researches, and analyzes activities that lead to costs for a company. Every activity in an organization that incurs a cost is scrutinized for potential ways to create efficiencies . Budgets are then developed based on these results.

Activity-based budgeting (ABB) is more rigorous than traditional budgeting processes, which tend to merely adjust previous budgets to account for inflation or business development.

Key Takeaways

- Activity-based budgeting (ABB) is a method of budgeting where activities that incur costs are recorded, analyzed and researched.

- It is more rigorous than traditional budgeting processes, which tend to merely adjust previous budgets to account for inflation or business development.

- Using activity-based budgeting (ABB) can help companies to reduce costs and, as a result, squeeze more profits from sales.

- This method is particularly useful for newer companies and firms undergoing material changes.

How Activity-Based Budgeting (ABB) Works

Keeping costs to a minimum is a crucial part of business management. When done effectively and not too excessively, companies should be able to maintain and keep growing their revenues , while squeezing out higher profits from them.

Using activity-based budgeting (ABB) can help companies to reduce the activity levels required to generate sales. Eliminating unnecessary costs should boost profitability.

The activity-based budgeting (ABB) process is broken down into three steps.

- Identify relevant activities. These cost drivers are the items responsible for incurring revenue or expenses for the company.

- Determine the number of units related to each activity. This number is the baseline for calculations.

- Delineate the cost per unit of activity and multiply that result by the activity level.

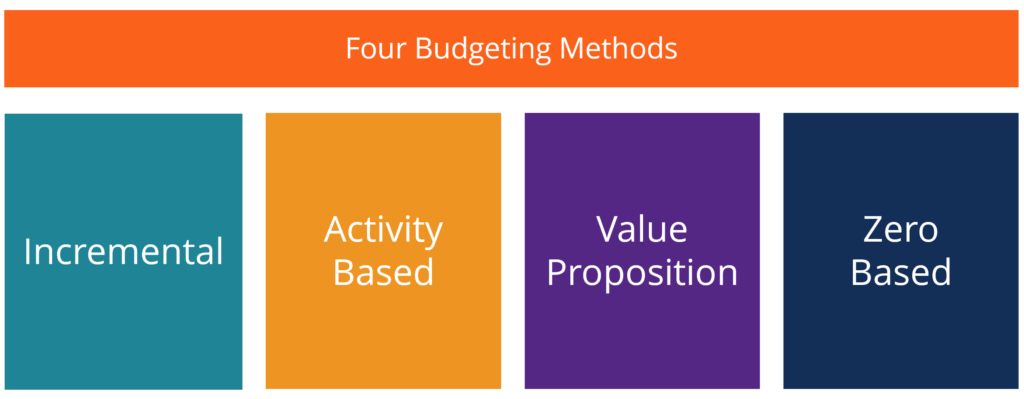

Activity-Based Budgeting (ABB) Vs. Traditional Budgeting Processes

Activity-based budgeting (ABB) is an alternative budgeting practice. Traditional methods are more simplistic, adjusting prior period budgets to account for inflation or revenue growth. Rather than using past budgets to calculate how much a firm will spend in the current year, activity-based budgeting (ABB) digs deeper.

Activity-based budgeting (ABB) is not necessary for all companies. For example, established firms that experience minimal change typically find that applying a flat rate to data from the previous year to reflect business growth and inflation is sufficient.

In contrast, newer companies without access to historical budgeting information cannot consider this an option. Activity-based budgeting (ABB) is also likely to be implemented by firms undergoing material changes, such as those with new subsidiaries , significant customers, business locations, or products. In these types of cases, historical information may no longer be a useful basis for future budgeting.

Example of Activity-Based Budgeting

Company A anticipates receiving 50,000 sales orders in the upcoming year, with each single order costing $2 to process. Therefore, the activity-based budget (ABB) for the expenses relating to processing sales orders for the upcoming year is $100,000 ($50,000 * $2).

This figure may be compared to a traditional approach to budgeting. If last year’s budget called for $80,000 of sales order processing expenses and sales were expected to grow 10%, only $88,000 ($80,000 + ($80,000 * 10%)) is budgeted.

Advantages and Disadvantages of Activity-Based Budgeting

Activity-based budgeting (ABB) systems allow for more control over the budgeting process. Revenue and expense planning occurs at a precise level that provides useful details regarding projections. ABB allows for management to have increased control over the budgeting process and to align the budget with overall company goals.

Unfortunately, these benefits come at a cost. Activity-based budgeting (ABB) is more expensive to implement and maintain than traditional budgeting techniques and more time consuming as well. Moreover, ABB systems need additional assumptions and insight from management, which can, on occasion, result in potential budgeting inaccuracies.

:max_bytes(150000):strip_icc():format(webp)/aa014176-5bfc2b8bc9e77c002630643b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Activity Based Budget (ABB)

It is the management accounting tool that does not consider the history data in prior years. The budget needs to build from scratch, the cost will be changed base on the activities.

Example of Activity Based Budget

The company plan to produce 500,000 units of products next year, please use the activity base budget to prepare the budget.

First, we need to calculate the overhead cost which requires to produce a unit of product X.

| Description | Cost per unit | Production units | Total cost |

|---|---|---|---|

| Direct Material | $ 5 | 500,000 units | 2,500,000 |

| Direct Labor | $ 10 | 5,000,000 | |

| Setup Cost | $ 0.4 | 2,000,000 | |

| Assembling | $ 3 | 1,500,000 |

| Principle of Activity Based Budget | |

|---|---|

| Control cost driver, not cost | ABB tries to control the cost driver rather than the cost itself. A cost driver is a factor that limits the cost, so if we can manage it mean we can manage the total cost. It helps the company to understand deeply in each cost category and be able to reduce. The manager also aware of the impact when each cost driver change. |

| Reduce non-value-added activities | Not all activities have the same value to the company and customer. We need to rank them based on their value, non-value-added activities should be decreased. |

| Beyond control of each department | The activities will be driven by the need of a whole company, so it is not under the control of each department. |

| Flexible | Each activity and cost driver will analyze every year in order to respond to any change which aims to reduce cost without impact on quality. |

What are the advantages of Activity Based Budget?

| Advantages of Activity Based Budget | |

|---|---|

| Focus on company objective | The budget will start from , and lead to required activities, and the resource need to implement. The budget will focus on the company goals rather than the department goals. It will prevent the conflicts of interest between company and each department. |

| Strengthen the critical success factor | We already know the level of activities requires to archive a certain output. Each activity’s cost will depend on the cost driver. All of them provide different value to the company, and some components differentiate us from competitors. These are the factors which we must perform the best and maintain the value. |

| Straight to the result | As the budget starts from the target, the whole process has ensured that the result is achieved. It differences from the traditional budget where all departments follow the top management. And we are not sure if all activities can archive a certain level of outcome. |

What are the Disadvantages of Activity Based Budget?

| Disadvantages of Activity Based Budget | |

|---|---|

| Complexity | The nature of this method is very complicated. Analyzing require activities for a certain level is not as easy as it sounds. Some activities are not directly linked to the outcome. It requires the expert with enough experience to make a proper estimate. Moreover, all activities will need to define the cost driver which impacts to total cost. |

| Resource consumption | This process requires top management involvement along with all heads department. They need to do a lot of research and data analysis to come up with the best solution. They need to spend time with operation in order to prepare the budget for next year. |

| Require a full understanding of company operation | Top management needs to have a complete understanding of the company operation and the relationship between departments. It will be hard to find someone who fully understands the whole process. |

| Require Activity Base Costing | This budgeting will not work if the company does not use Activity Based Costing. |

Related posts:

.webp)

Activity-based budgeting: how to implement + pros & cons

To truly understand what your company is spending, it’s not enough to only know the financials, but you need to know what the key cost drivers are behind those expenses. To help understand these drivers, activity-based budgeting can help. Typically used when transparency is required to reveal inefficiencies that may be compressing the company’s profit margin, ABB can create clarity around spending pain points.

In this article, we’ll explain what activity-based budgeting is and why it’s important for better understanding your financial picture. We’ll also review some of the pros and cons and explain how to implement ABB if it’s the right fit for your business. Like most budgeting or accounting practices, using activity-based budgeting requires a team effort, so it’s important to create alignment among your teams before getting started.

What is activity-based budgeting (ABB)?

Unlike creating a traditional operating budget , activity-based budgeting involves the recording, research, and analysis of the activities that generate costs for the company. It’s a more rigorous process than traditional budgeting, which adjusts according to inflation or business development. Companies generally implement ABB to find the cost drivers that are causing a company to overspend.

Examples of cost drivers are direct labor hours, customer contacts, engineering change orders, machine orders, and number of product returns. Each of these activities comes with a cost, and every company will be structured differently. With activity-based budgeting, a company can track each of those costs independently, providing greater budget transparency.

How to set up activity-based budgeting

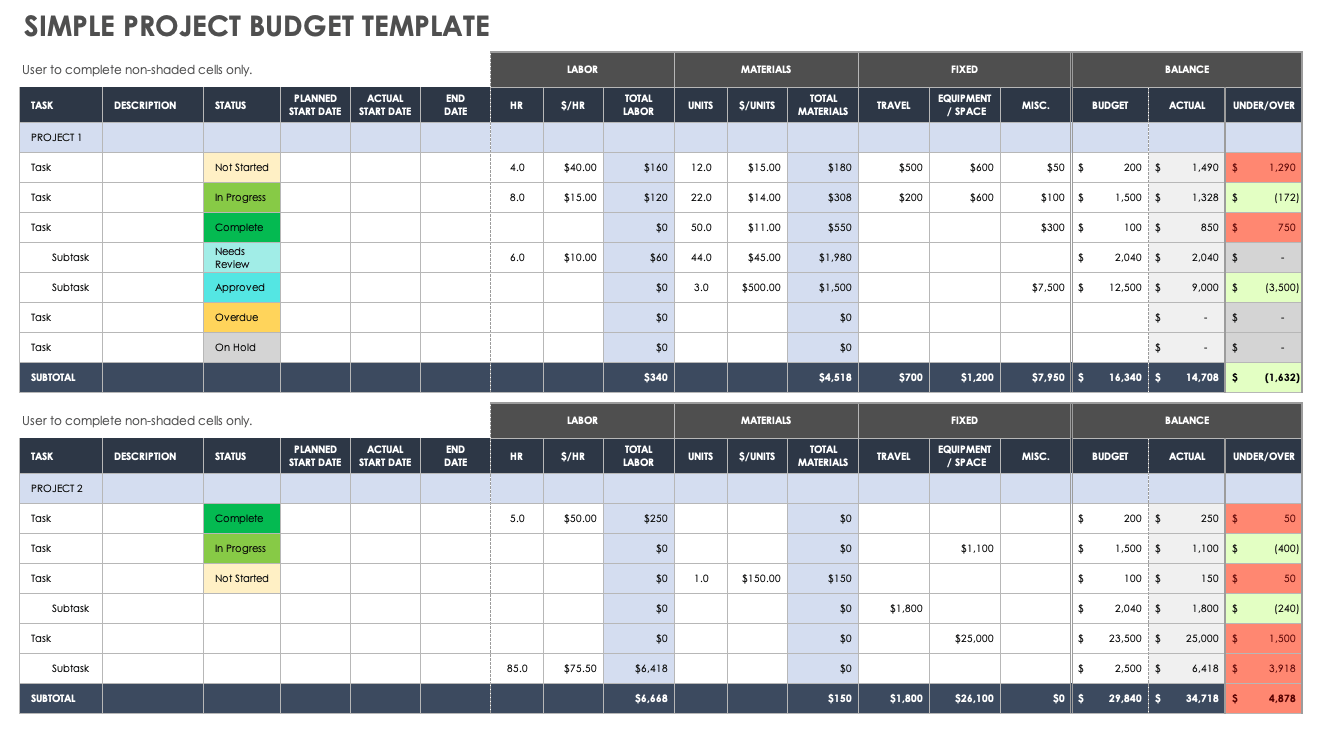

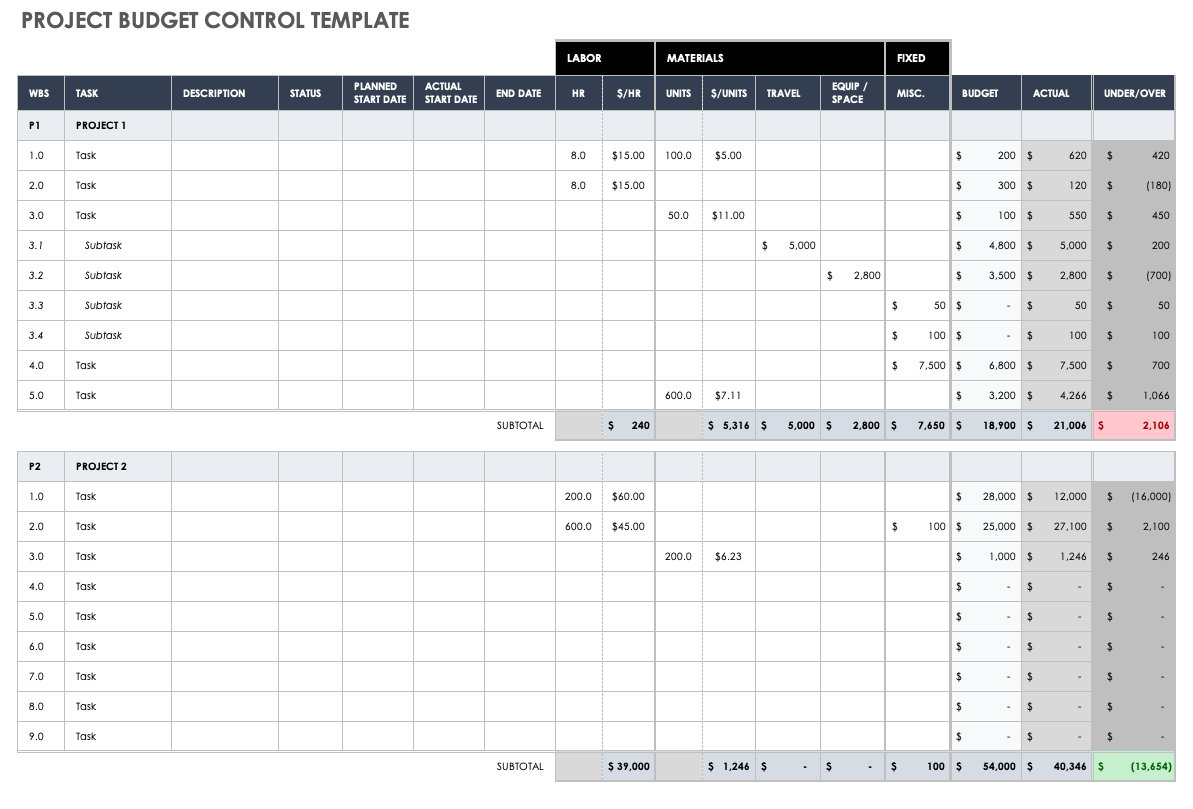

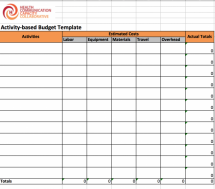

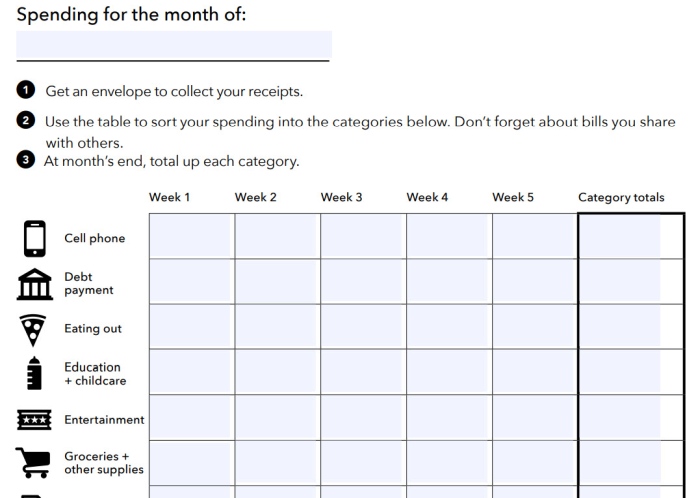

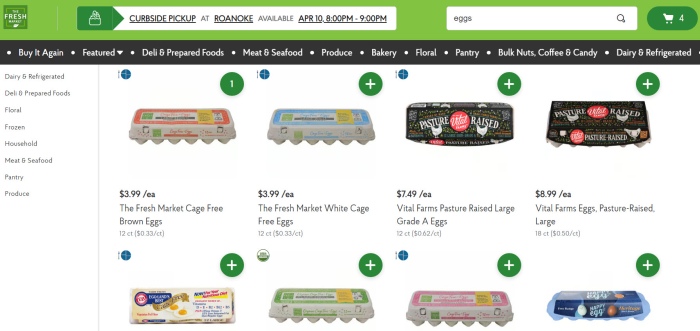

The first step in setting up ABB is to identify the activities where money is being spent, then determine the number of units that activity requires. Best practices for this is to start with labor and materials costs, then do administrative costs. All these costs should be set up in a spreadsheet format and grouped based on commonalities.

For example, if a department requires three full-time employees, the number of units required would be 120 (hours worked) per week. If the cost per hour is $20, that equates to a cost of $2400 per week. That’s a person-hour cost, so it should be grouped with other activities where the unit of measurement is the labor cost.

By breaking costs down in this manner, companies can determine where cuts can be made to increase profitability. In the scenario above, rather than simply cutting the department budget and expecting the department head to adjust, the numbers gleaned from ABB can facilitate research on how the number of person-hours can be reduced.

Examples of activity-based budgeting

Activity-based budgeting provides more accurate numbers for business expenses and calculating cost of goods sold (COGS). In traditional budgeting, a company with $4,000 in COGS from last month and an average sales increase of 10%, the COGS for the new month is estimated at $4,400. If sales exceed the monthly projection, that number will be off.

With activity-based budgeting, the cost per unit sold is used to calculate the budget. Let’s say in the example above that the $4,000 in monthly sales represents 800 units with a production cost of $5 per unit. Rather than estimating new month sales cost as a percentage, the company can calculate a per-unit cost increase. That 10% increase is now 80 units sold.

The difference may seem trivial, but in this case, ABB fills in additional business expense categories that can be used to cut costs and/or improve profitability. Can production costs be cut down? Can the number of units sold be increased? Having access to the more granular data provided by ABB can help facilitate better decisions in these areas.

Another example of ABB providing cost savings is maintenance and upkeep. In traditional budgets, these are entered as an estimated expense, leaving margin for inaccuracies and even abuse of funds. With activity-based budgeting, each maintenance call or upgrade is itemized based on its unit cost. This makes it easier to see where costs can be trimmed back.

Pros and cons of activity-based budgeting

Activity-based budgeting offers some clear advantages over traditional budgeting and zero-based budgeting . It provides more accurate cost data and gives a company insights for making business decisions that are simply not available with traditional budgeting. It’s also difficult to implement and maintain, so it requires a commitment from your entire team. Here are some pros and cons to consider:

Pros of activity-based budgeting

Competitive edge

Using activity-based budgeting can cut unnecessary costs and allow a company to compete more effectively, particularly in price-sensitive markets. Reducing overhead gives a company more flexibility for expansion and product development.

Viewing the business as a unit

ABB provides a single-unit view where costs are measured in units. Administration and sales might be different departments, but they can both be measured in hours. Manufacturing incorporates materials and production costs, but these are recorded on the company bottom line, not the department's.

ABB eliminates bottlenecks

Activity-based budgeting reveals activities that are not necessary or redundant, providing justification to eliminate them. This makes the company more efficient and frees up employees to work on new projects or expand on existing ones.

Improves customer relationships

When the company eliminates unnecessary activities and streamlines production costs, customer service improves. Business owners are able to see which activities directly affect profitability, so they tend to spend more time addressing customer concerns.

Better tail spend management

Tail spend management is a term used to describe the analysis of high-volume, low-value expenses that clog up the transaction list and represent usually 20% or less of total spending. A common example of tail spend is print and packaging expenses. They fall outside the main purchasing processes and are often not effectively managed by the procurement team.

Cons of activity-based budgeting

Complexity and understanding

The most significant drawback to activity-based budgeting is the complexity of the system and learning to understand it. Business owners, the executive team (if applicable), and all managers and accounting personnel need to fully understand it before it can be implemented.

Resource intensive

Everyone needs to be on board and each person involved will need to take on additional tasks. Time consuming analyses are required, so employees may have to work extra hours to get them done. Owners will need to be more hands on while this is happening.

Implementation costs

The main implementation cost for ABB is the training for the employees involved, including upper-level management. This may require the addition of new people who have previous experience with activity-based budgeting.

How to implement activity-based budgeting

Before attempting the implementation of activity-based budgeting, it’s important to sit down with your team and get everyone on board. Evaluate your current budgeting process and determine whether the more detailed analysis of ABB is required. Companies with simple cost structures and fewer departments may not need it.

Each member of your team needs to understand that there will be extensive training involved to learn how to do activity-based budgeting. You’ll also need tools for spend management with features like auto-categorization and expense tracking. This is all part of the “getting organized” portion of this exercise.

Once the decision has been made and training is complete, the next step is to identify activities that incur costs and assign units to measure those costs. Calculate the cost per unit and multiple that by the activity level. Schedule regular meetings to evaluate those costs and uncover areas where they can be modified or reduced.

In most cases, ABB is implemented as a temporary measure to streamline company costs. Once that’s done, most companies go back to more traditional budgeting practices. To learn more about this and to acquire the expense tracking and spend management tools you’ll need to be effective with activity-based budgeting, visit Ramp.com .

The term activity-based budgeting is defined in our Ramp Finance Glossary .

Don't miss these

How Gill’s Onions increased compliance, drove efficiency, and reduced tears with Ramp

How Dragonfly Pond Works leveled up expense management with Ramp

.png)

How Girl Scouts of the Green & White Mountains saved 20+ hours per month with Ramp

How 8VC resolved accounting coding challenges, increased spend visibility, and cut time to close with Ramp

How Studs consolidated expense management, travel, and bill pay into Ramp’s single efficient platform

How Mindbody & Classpass saved time, enhanced visibility, and improved usability with Ramp

How Rarebreed Veterinary Partners prepared for scale with Ramp

.webp)

- Higher credit limit than traditional business credit cards

- Spend management tools

- Give an unlimited number of physical and virtual cards to employees

- Spending controls and limits for employees

- Average savings of 5% from rewards and expense-reducing features

- More than $350,000 in offers from Ramp’s partners

- No annual fees, foreign transaction fees, or card replacement fees

- No credit check or personal guarantee is required

- No interest accumulation on your balance

- Seamless integration with numerous accounting software

- You must pay back the balance in full at the end of each month

- No elevated cashback rewards for specific categories

- You need $50,000 in your business bank account to qualify

- Cashback rewards

- Issue an unlimited number of employee cards

- Access to over $350,000 in offers from multiple partners

- Automated expense management software

- Track vendors and receive pricing insights from one dashboard

- Automated accounts payable

- Zero fees or interest

- No interest or fees

- No personal guarantee

- Balances do not carry over, so you must pay them by the end of each month

- Your business must be incorporated to qualify for a card

- You need at least $50,000 in a business bank account to qualify

- Average net savings of 5% due to cost-reducing features

- Unlimited physical and virtual employee cards

- Access to $350,000 in deals from various partners

- View vendor information and pricing on a single dashboard

- Automate accounts payable

- No fees or interest

- Cashback rewards with flexible redemption options

- Built-in expense management software

- No credit check or personal guarantee required

- Must be a registered business to qualify

- Must have most of your business spend in the US

- Get cashback on purchases

- Provide unlimited physical and virtual employee card

- Access more than $350,000 in deals from various partner

- Use automated software for expense management

- Cashback rewards on purchases

- No personal guarantee or credit check required

- The Ramp Card is ideal for incorporated businesses

- Comes with automated expense management tools

- Provides 5% net savings on average

- Features AI-powered tools for detailed spending insights and cost-cutting recommendations

- Integrates seamlessly with accounting software to aid financial tracking and reporting

- Best for businesses aiming to streamline financial operations and enhance savings

- Offers 5% net savings on average through expense-cutting features

- No personal guarantee or credit check required for eligibility

- Automated expense management features like spending limits and receipt-matching

- Integration with accounting platforms including NetSuite, Quickbooks, and Xero

- Offers AI-powered cost-saving insights

- Not available to sole proprietors or unregistered small businesses

- Requires $50,000 in a business bank account to qualify

Card Details

The Ramp Card is an innovative corporate card, particularly suited for LLCs, that combines automated expense management features with cashback rewards. It offers detailed spending insights with AI-powered recommendations for cutting costs, and integrates seamlessly with accounting software to simplify financial tracking and reporting. Cards come with no annual fees, foreign transaction fees, or card replacement fees. Ramp is an excellent choice for businesses that want to streamline their financial operations while saving money.

- Primarily focused on cost-cutting, which might not suit all business needs

- Geared mainly towards U.S. businesses, which may limit its appeal for international transactions

Ramp’s charge card program comes with the additional perk of tools designed to help your business track and reduce its spending.

- No annual fee

- Valuable cash back

- Additional tools to track spending

- Unlimited physical and virtual employee cards with custom limits

- Not available to sole proprietors

- Must have $50,000 in liquid assets

- Unlimited free virtual and physical employee cards

- Customizable spending limits for employees

- Real-time transaction visibility

- Connects with accounting systems like QuickBooks and NetSuite

- Automates bill payments and invoice processing

- Provides a comprehensive audit trail and expert support for negotiations

- Unlimited virtual cards

- Real-time expense tracking

- Integration with accounting software

- Automated bill payments and invoice processing

- Requires full balance payments monthly

- Limited to businesses with most of their operations in the U.S.

- Corporate card and spend management platform

- Free employee cards with custom spending limits

- Cashback rewards on all purchases with no fees

- Built-in fraud protection ensures that your organization's finances are always secure

- Offers an average savings of 5% by identifying cost-saving opportunities

- No annual fees or interest

- Custom spend and vendor controls

- High credit limits

- Automatic receipt matching and expense categorization

- As a corporate charge card, balance can't be carried monthly

- Must have $50,000 in a business bank account to qualify

- Unlimited employee cards with custom spending limits

- Assists with software price negiotations

- Accounts payable software

- Uses business revenue to determine eligibility and credit limit

- Only available to corporations, LLCs, and LPs

- As a charge card, balance can't be carried monthly

- Automated receipt matching

- Balance must be paid in full each month

- Integrates with accounting platforms like NetSuite, Quickbooks, and Xero

- No annual fee or foreign transaction fees

- Must be a corporation, LLC, or LP to qualify

- Must have most of your operations and business spending in the US to qualify

- Corporate card with built-in spend management

- Automated expense reports on fuel spending

- Advanced financial management features

- Unlimited free employee cards

- Requires a registered business and $50,000 in a U.S. business bank account to qualify

- Balance must be paid in full monthly

- Corporate card with customizable spending controls

- Unlimited free physical and virtual employee cards

- No personal guarantee or credit check required to qualify

- Advanced expense management automations and accounting integrations

- Must be a corporation, limited liability company, or LP to qualify

- Must have most of your operations and corporate spend in the US (though international purchases are supported with no foreign transaction fees)

- Credit limits up to 30 times higher than traditional credit cards

- Sales-based underwriting makes for an easier qualification process

- No credit check or personal guarantee required for eligibility

The Ramp Corporate Card is ideal for startups without a credit history. You just need an EIN number and $50,000 in a business bank account to qualify, and there's no credit check or personal guarantee required. Ramp's corporate card offers cashback on purchases and built-in expense management software to streamline your business finances.

Some of its features include receipt matching, subscription management, and AI-powered spending insights. Ramp is an excellent choice for startups that are aiming to earn rewards on business purchases while managing expenses.

- Ramp Corporate Card includes built-in spend management and travel-specific features

- Ability to set and enforce your company's travel spending policy on employee cards

- Features a travel dashboard displaying complete trip itineraries and flight information for each employee

- Offers cashback on purchases, including those made through travel booking platforms

- Provides AI-powered finance automation and insights

- Real-time expense reporting, customizable spending controls, and card templates for efficient financial management

- Seamless integration with over 100 applications, including travel management platforms

- No annual, application, or late payment fees

- Universal cashback reward applicable to all types of travel expenses

- Advanced financial management features suitable for tracking travel spending

- Compatibility with 100+ applications for streamlined travel expense management

The Ramp Card is an innovative corporate card, particularly suited for LLCs, that combines automated expense management features with cashback rewards on purchases. It offers detailed spending insights with AI-powered recommendations for cutting costs, and integrates seamlessly with accounting software to simplify financial tracking and reporting. Cards come with no annual fees, foreign transaction fees, or card replacement fees. Ramp is an excellent choice for businesses that want to streamline their financial operations while saving money.

- Corporate card particularly suited for LLCs

- Combines automated expense management features with cashback rewards on purchases

- Offers detailed spending insights with AI-powered recommendations for cutting costs

- Integrates seamlessly with accounting software to simplify financial tracking and reporting

- Excellent choice for businesses that want to streamline their financial operations while saving money

- Earn a $250 statement credit after spending $5,000 within the first three months of card membership

- Introductory rate of 0% APR for the first 12 months

- 2% cashback for the first $50,000 in purchases each year. Then, unlimited 1% cashback

- Expanding Buying Power lets you exceed your credit limit while still receiving rewards

- 3% balance transfer fee

- No overlimit fees

- 0% intro APR for the first 12 months

- Access to more capital

- No annual fees

- You only get 2% cashback for the first $50,000 before going down to unlimited 1% cashback

- $39 penalty fee for late payments and returned payments

Activity-based budgeting: Overview, steps, benefits

Over the years, businesses have found measures to reduce costs and boost the overall efficiency of business processes. Traditional budgeting methods proved quite useful, but activity-based budgeting proved even more valuable. This is because it offers a more accurate way to budget and track product cost driver rates.

Now, business activity-based budgeting has become a widely adopted method that allows businesses to reduce costs without using historical data (such as the previous year's budget). This guide will discuss this golden method, how it works, why you can count on it, and an example of its usage.

What is activity-based budgeting?

Activity-based budgeting is a process for analyzing business activities and costs to create budgets without taking historical data into account. It was born out of the sheer will to maximize efficiency while reducing costs.

The system comprises a series of steps involving recording, researching, and analyzing everything contributing to a company's cost driver. It doesn't require historical data like a traditional budgeting system.

The result is that each of the activities analyzed will allow the organization to find ways to cut costs without reducing performance. The company then creates its budget based on the insights from these results.

What are the features of activity-based budgeting?

Every business wants to improve its critical activities without incurring unnecessary costs. This can help increase profits when done right. Hence, activity-based budgeting ABB is an important tool for avoiding unnecessary costs while focusing on high-value activities that help generate more sales.

For easier comprehension, the process can be split into three stages.

Step 1: Identify your business activities

The first and most important step to maximizing output is a deep understanding of the inputs. So, this step is where you evaluate all the activities that call the shots for your operational costs.

Each of these activities you consider doesn't have to impact revenue or profits directly. So, ensure you pay attention to every business activity regardless of how minute it might seem.

Once you've identified them, proceed to figure out the cost drivers, i.e., what factors determine the cost of each of these activities.

The final process is to begin making material operational changes to the activities. Remember, the sole aim is to reduce costs and unnecessary activities, so make sure your changes contribute to the company's goal.

Step 2: Calculate the unit of each activity

After figuring out the cost drivers, find the unit of each activity as well. Finding the unit will help you progress to the next activity-based budgeting step. The unit can be any figure that denotes the amount of workforce behind an activity.

For example, a unit could be the number of raw materials, the number of factory workers, and the number of transport vehicles or equipment in a production line that contributes to the normal function of the business activities.

Step 3: Compute the cost per unit

The final task is to multiply the units calculated in step 2 by the costs you identified in step 1. This value is the cost per unit of production.

You can then use the cost per unit value to create your monthly or annual budget by identifying all the tasks and multiplying them by the corresponding task. While doing this, ensure you keep track of the figures and find ways to cut the cost per unit of activity completed.

When optimizing any cost drivers, you can check how much reduction you achieve by recalculating the cost per unit. Compare the value to the initial value to see how much cost you could reduce without reducing the overall efficiency of the process.

What is an activity-based budgeting example?

To further understand the concept, we'll illustrate an imaginary company's activity-based budgeting process.

So, if Company A hopes to reach a net sale of 7,000 units of its products within a month, the company spends $3 to produce one unit. Since you can calculate the activity-based budgeting ABB with the cost and the total number of units, then:

Activity-based budget = 7,000 units × $3 = $21,000

This means the business will have an activity-based budgeting estimate of $21,000 for that month.

Suppose Company A optimizes costs and manages to reduce them to $2 for the same number of units.

Activity-based budget = 7,000 × $2 = $14,000

Hence, the new business line can boost efficiency, reduce costs, and gain an additional $6,000 profit. This figure is more reliable for budgeting than that of a traditional budgeting method.

What is the benefit of activity-based budgeting?

As discussed earlier, activity-based budgeting can be quite helpful for businesses and operational managers at any stage. Below are some of the several advantages you should consider adopting this method.

Proper budget management

When you create an activity-based budget, you'll get the liberty of proper business operations management. There'll be a better evaluation of certain costs, more clarification of each process, and reasons for inefficiencies. With this knowledge, the accounting unit can draw up a straightforward calculation and plan to create a budget with minimum incurred costs and accurate results.

Offers competitive edge

Reducing your operational costs can give you an edge over competitors. The activity-based budgeting method can help you sell products at a lower price and keep operations at an optimal level. The extra profit can also help build your organization and improve overall performance.

Efficiency boost

Regardless of your type of business, there are limitations to the resources available. Hence, it's smart to incorporate a process that can help maximize your required resources.

Using activity-based budgeting, you can allocate resources effectively when necessary. So, you can focus more on relevant activities that create more cash inflow and meet the company goals.

More cost control insights

Activity-based budgeting helps reduce costs by using data and analytics of operational activities with costs. This insight allows any business or organization to easily track its operational costs and sales order processing expenses. This budgeting method gives you more idea into the factors that affect your production costs and steps to take if you want to reduce them.

Boost profitability

There is a chance to boost the overall profitability of company production processes with activity-based budgeting. Considering how well it deals with the production and associated costs, it's a simple process to optimize either of them, increase the earning capacity and reflect business growth.

What are the disadvantages of activity-based budgeting?

Costly process.

To effectively carry out activity-based costing, one must work at micro levels. Data collation and careful evaluation of various company activities and processes could be costly, especially compared to other budgeting methods like zero-based budgeting and traditional budgeting methods.

Time consumption

The activity-based budgeting methods are quite time-consuming. Of course, it's a simple process if you're dealing with a small business. But you might be surprised how time-consuming it can be if the company or organization has many sections and departments.

Can be complex

This method can be difficult if the budgeting team doesn't understand the technical details and factors that can help determine a cost driver. It might also be complex if it's your first time dealing with cost and unit calculations.

Latest Posts

A term sheet is a non-binding legal document that outlines the basic terms and conditions of an investment transaction between two parties - typically between an investor and a startup seeking funding.

Capitalization Table (Cap Table)

A capitalization table, commonly referred to as a cap table, is a detailed spreadsheet or ledger that tracks the equity ownership of a company.

A SAFE (Simple Agreement for Future Equity) note is an agreement between an investor and a startup to exchange capital for equity at a future date. It is becoming a more favored financing method for startups in their early stages.

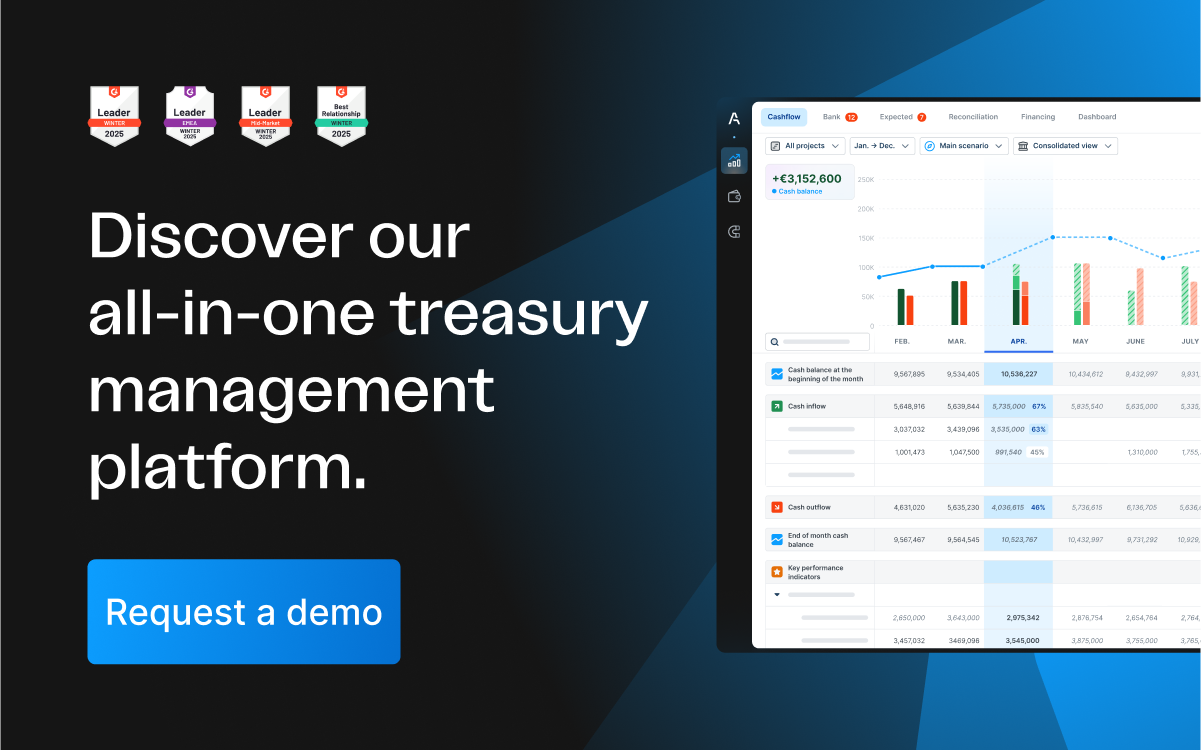

Request a Free Vena Demo Today

Learn how Vena reduces budgeting, reporting, and analysis times by 50%.

Activity-Based Budgeting

Activity-based budgeting (abb).

Activity-based budgeting is a budgeting method that closely examines every cost associated with an activity. In contrast to typical budgeting methods, activity-based budgeting is more granular in nature and does not rely on data from prior years.

What Is Activity Based Budgeting?

Activity-based budgeting is one of many budgeting techniques. While not as common as methods, such as traditional budgeting or zero-based budgeting , it can nonetheless be a very useful exercise for many organizations. Activity-based budgeting is more thorough and rigorous than most other budgeting methods because it involves breaking out the costs associated with every single activity carried out by an organization. This more detailed method of budgeting allows companies to understand which activities are driving the most profits and how to better manage resources and reduce costs. It is also useful for companies who are undergoing significant changes in their business and need to re-evaluate the impact of every activity.

Activity-Based Budgeting vs. Traditional Budgeting

How does activity-based budgeting differ from traditional budgeting? When developing a traditional budget, companies will often look at values (such as revenue and expenses) from prior years and then use those values as a baseline when projecting future values. For example, a company might have revenues of $100 million in the prior year and project a 10% growth for a forecasted total of $110 million in revenue for the upcoming year. In contrast, activity-based budgeting igneous historical values. Instead, activity-based budgets look at all the activities expected to be carried out by a business in the upcoming year and then outlines the cost associated with each activity in detail.

Activity-based budgeting looks at all costs and resources associated with an activity such as:

- Raw materials

- Number of expected labor hours

Traditional Budgeting

Traditional budgeting involves:

- Reviewing historical costs

- Projecting future costs by increasing or decreasing historical costs

Examples of Activity-Based Budgeting

Company Y expects to receive 10,000 orders for one of their products in their next fiscal. To process each order, it costs Company Y a total of $5. In an activity-based budget, the costs for processing these 10,000 sales orders would be $50,000. Now, let’s look at this example from a traditional budgeting perspective, which we know looks at historical costs while activity-based budgeting does not. So let’s say that in the prior year budget, Company Y spent $40,000 on processing sales orders. And in the budget for the upcoming year, Company Y is expecting a 10% growth in sales. In this case, only $44,000 would be budgeted for.

Advantages of ABB

Here are a few advantages of activity-based budgeting (ABB):

- Helps cut costs

- Improves resource allocation

- Increase cross-departmental budget collaboration

- More control over the budget

Disadvantages of ABB

Here are a few disadvantages of activity-based budgeting (ABB):

- More expensive to implement

- More time-consuming to perform

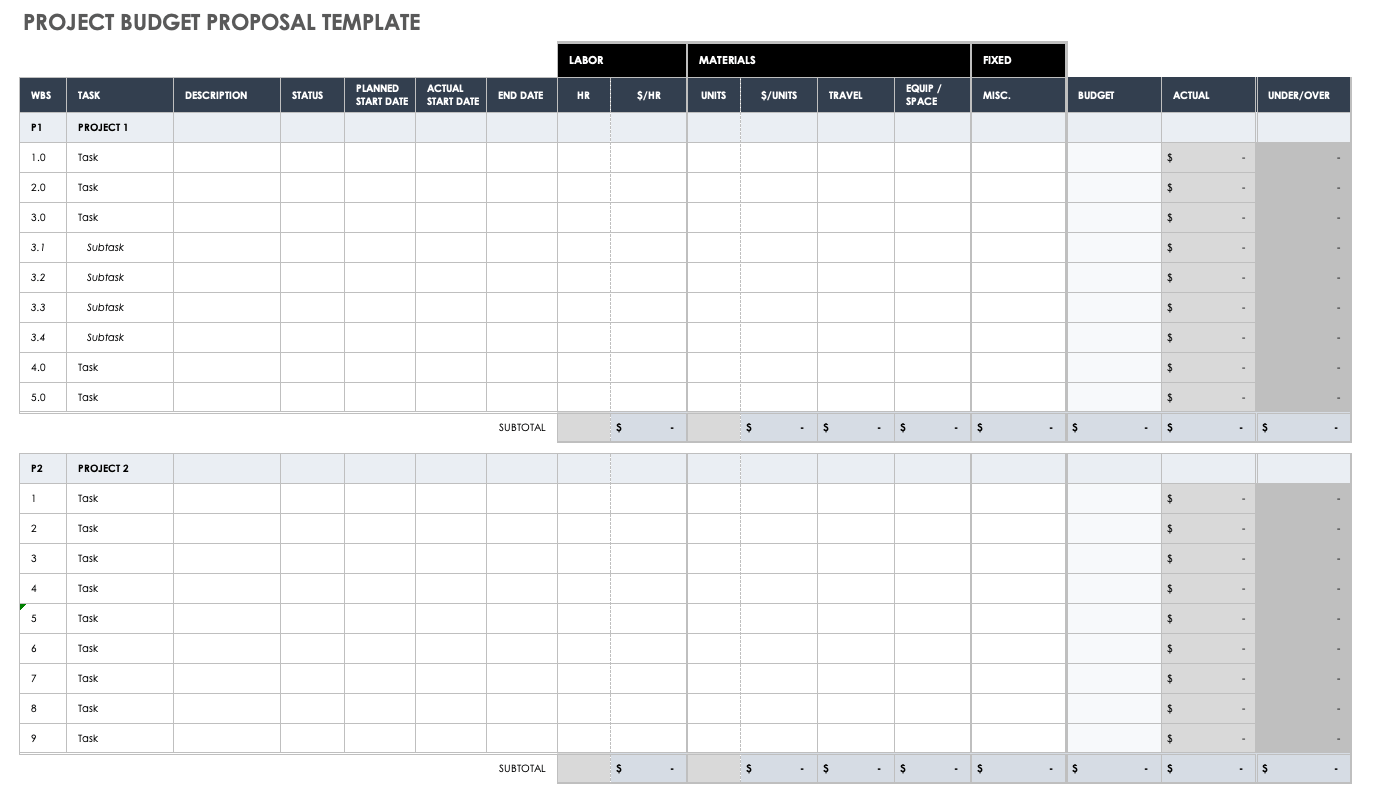

How To Make an Activity-Based Budget

So how do you create your own activity-based budget? There are three main steps involved: 1. Identify Your Activities and Their Associated Costs. Any activity that supports the business or generates revenue counts as an activity. And any expense required to carry out that activity counts as a cost. 2. Compute Baseline Units for Each Activity. What do we mean by units? Examples include the number of staff and numbers of wage hours required to perform the activity. 3. Compute the Total Cost of Each Activity. First, calculate the cost per unit for each activity. Then multiply that number by the activity level. If you’re looking for templates for your budgeting needs, head on over to our library of free Excel templates .

See How Vena Can Be Used for All Your Budgeting Needs

Learn how Vena’s Excel-based FP&A Platform helps finance teams, like yours, automate and consolidate your data, gain a single source of truth and reduce budget cycle times by up to 77%.

Recommended Resources

Plan, budget and forecast excel templates.

The Benefits (and Drawbacks) of Zero-Based Budgeting

The Most Complete Excel-Based Budgeting and Forecasting Software

How Cube works

Sync data, gain insights, and analyze business performance right in Excel, Google Sheets, or the Cube platform.

Built with world-class security and controls from day one.

Cube meets you where you work—your spreadsheets. Get started quickly with a fast implementation and short time to value.

Developer Center

Cube's API empowers teams to connect and transform their data seamlessly.

Integrations

Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more.

Break free from clunky financial analysis tools. Say hello to a flexible, scalable FP&A solution.

See Cube in action

Data Integrity

Automatically structure your data so it aligns with how you do business and ensure it fits with your existing models.

Reporting & Analytics

Easily collaborate with stakeholders, build reports and dashboards with greater flexibility, and keep everyone on the same page.

Planning & Modeling

Accelerate your planning cycle time and budgeting process to be prepared for what's next.

.png)

Creating a high-impact finance function

Get secrets from 7 leading finance experts.

Download the ebook

Business Services

Real Estate

Financial Services

Manufacturing

Learn how Veryable unwound a complex spreadsheet stack

Essential reading for forward-thinking FP&A leaders.

Customer Stories

Discover how finance teams across all industries streamline their FP&A with Cube.

Featured Customers

BlueWind Medical reduced company spend by over $100k with Cube

Edge Fitness Clubs cuts reporting time by 50% & saves $300,000 annually

Join our exclusive, free Slack community for strategic finance professionals like you.

Join the community

Content Library

Discover books, articles, webinars, and more to grow your finance career and skills.

Need your finance and FP&A fix? Sign up for our bi-weekly newsletter from former serial CFO turned CEO of Cube, Christina Ross.

Strategic Finance Assessment

Gain invaluable insights into how strategic your finance team is with our free assessment tool.

Become a strategic finance pro! Join our free and exclusive Slack community for professionals just like you.

Help Center

Make the most of Cube or dig into the weeds on platform best practices in our dedicated support center.

We're on a mission to help every company hit their numbers. Learn more about our values, culture, and the Cube team.

Grow your career at Cube. Check out open roles and be part of the team driving the future of FP&A.

Got questions or feedback for Cube? Reach out and let's chat.

In the news

Curious what we're up to? Check out the latest announcements, news, and stories here.

A newsletter for finance—by finance

Sign up for our bi-weekly newsletter from 3x serial CFO turned CEO of Cube, Christina Ross.

Subscribe now

Activity-based budgeting: is this budgeting method right for you?

Budgeting & forecasting.

Updated: February 26, 2024 |

Jake Ballinger

FP&A Writer, Cube Software

Jake Ballinger is an experienced SEO and content manager with deep expertise in FP&A and finance topics. He speaks 9 languages and lives in NYC.

Running a business becomes more expensive every year.

After all, materials and wages aren’t getting cheaper. Nothing to be done about that.

...What's something you can control?

The budgeting process.

And there's a budgeting method that helps reflect business growth while also giving you fine control over spending.

It's called the activity-based budgeting method.

And in this post, we'll show you exactly how to do it.

Get out of the data entry weeds and into the strategy.

Sign up for The Finance Fix

Sign up for our bi-weekly newsletter from serial CFO and CEO of Cube, Christina Ross.

What is activity-based budgeting?

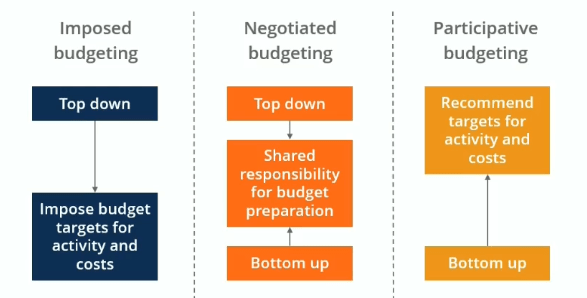

Activity-based budgeting (ABB) is a top-down financial budgeting method focusing on resources allocated to individual budgeting activities instead of departments or products.

With an activity-based budgeting approach, you break down each business activity into tasks and assign costs for each task. This helps you determine the funding needed to support each task performed.

Examples of business activities include:

- Purchasing materials and supplies for production, such as raw materials, components, and parts.

- Manufacturing processes for producing goods or services, like quality control checks and assembly workflows.

- Marketing activities like advertising campaigns, sales promotion efforts, and hiring .

- Research and development efforts such as product testing.

Breaking these processes down and identifying cost drivers allows for greater control over financial decisions and better visibility into how funds are used.

Activity-based budgeting can also help organizations identify cost drivers and redundant processes to streamline business operations and maximize resource efficiency.

What’s a cost driver?

A cost driver is a factor that influences the cost of doing business, from production and manufacturing to marketing and hiring. Examples of cost drivers include:

- The number of units produced in a period

- The number of direct labor hours involved in a project

- The machine hours used in a week

- The square footage of factory space occupied

- The cost of hiring an employee or contractor in the current market

The more of each cost driver you use for producing an item or a service, the higher the total associated costs with that item.

Breaking down these costs is the first step in reducing the cost of producing goods or providing services.

Resource allocation based on activities

Resource allocation based on activities, a core principle of Activity-Based Budgeting (ABB), ensures that financial resources are aligned with operational demands within an organization. Unlike traditional methods, ABB prioritizes resource allocation according to specific activities' requirements, optimizing resource utilization and directing investments towards activities that contribute most to organizational goals. This approach enhances transparency and accountability in budgeting, facilitating informed decisions and driving efficiency in financial planning and analysis processes.

Why do companies use activity-based budgets?

Controlling costs is imperative to preserving revenue , so companies always look for creative ways to avoid overspending. This is why activity-based budgeting is such an effective budgeting approach.

Understand expenses incurred : Traditional methods of budgeting rely on the previous year’s data to establish the basis for changes. To perform activity-based budgeting, finance analyzes every cost from the ground up. Activity-based analysis occurs without consideration of the previous year's budgeting activities to justify every cost on its merit.

Improve business efficiency : Inefficiency creates a stealthy burden on cash . Using budget analysis to reduce inefficiencies in your process is an excellent way to ensure your business only spends money where it needs to.

Activity-based budgeting is an in-depth approach to planning future spending . It scrutinizes every expenditure at every step of the process to identify places to trim the fat and improve your business processes.

Companies use activity-based budgeting to get a deep understanding of and control costs. By breaking down costs into separate activities, companies can allocate resources more effectively, improve financial performance, and identify redundant or unnecessary activities.

Activity-based budgeting also helps ensure that the most important activities allocate the right budget . It can help uncover opportunities for cost savings It helps managers to track actual spending versus budgeted amounts and compare spending across different departments or locations.

You might consider using activity-based budgeting if:

- Your organization is in cost-cutting mode

- There are visibility challenges in your spending

- You’re restructuring the entire organization

- Traditional method of budgeting hasn't been working well for you

What are the benefits of activity-based budgeting?

Companies turn to activity-based budgeting when they need a better handle on spending . This type of budgeting exercise helps young companies manage their costs from the start and established companies bring expenses under control when needed.

Full spend visibility : Activity-based budgeting creates a granular view of every process that crates cost or revenue for the company. This level of detail takes time, but the effort pays considerable dividends in cost savings.

Budgetary control : Making decisions for the budget based on cost drivers enables better control over your spending. It allows companies to understand exactly what drives spend (and budget inflation) for better cash performance.

Competitive advantage : Reducing costs and optimizing processes allows you to produce goods more efficiently and retain more profit. Activity-based budgeting shows you where to improve and what’s essential to your process.

What are the challenges of activity-based budgeting?

The biggest challenge of activity-based budgeting is when you have many new activities or variables—like new business locations—that you can't account for or that skew your numbers.

Time-consuming: The granular detail of an activity-based budget process requires significant research and analysis and can become time consuming. This budgeting system takes more time and labor investment than other planning methods .

Expensive: The level of research required to complete an activity-based budget means that many stakeholders will invest time in preparing data. This has associated costs not experienced with traditional budgeting . However, the cost benefits of this exercise may well justify the investment.

How do you create an activity-based budget [with example]?

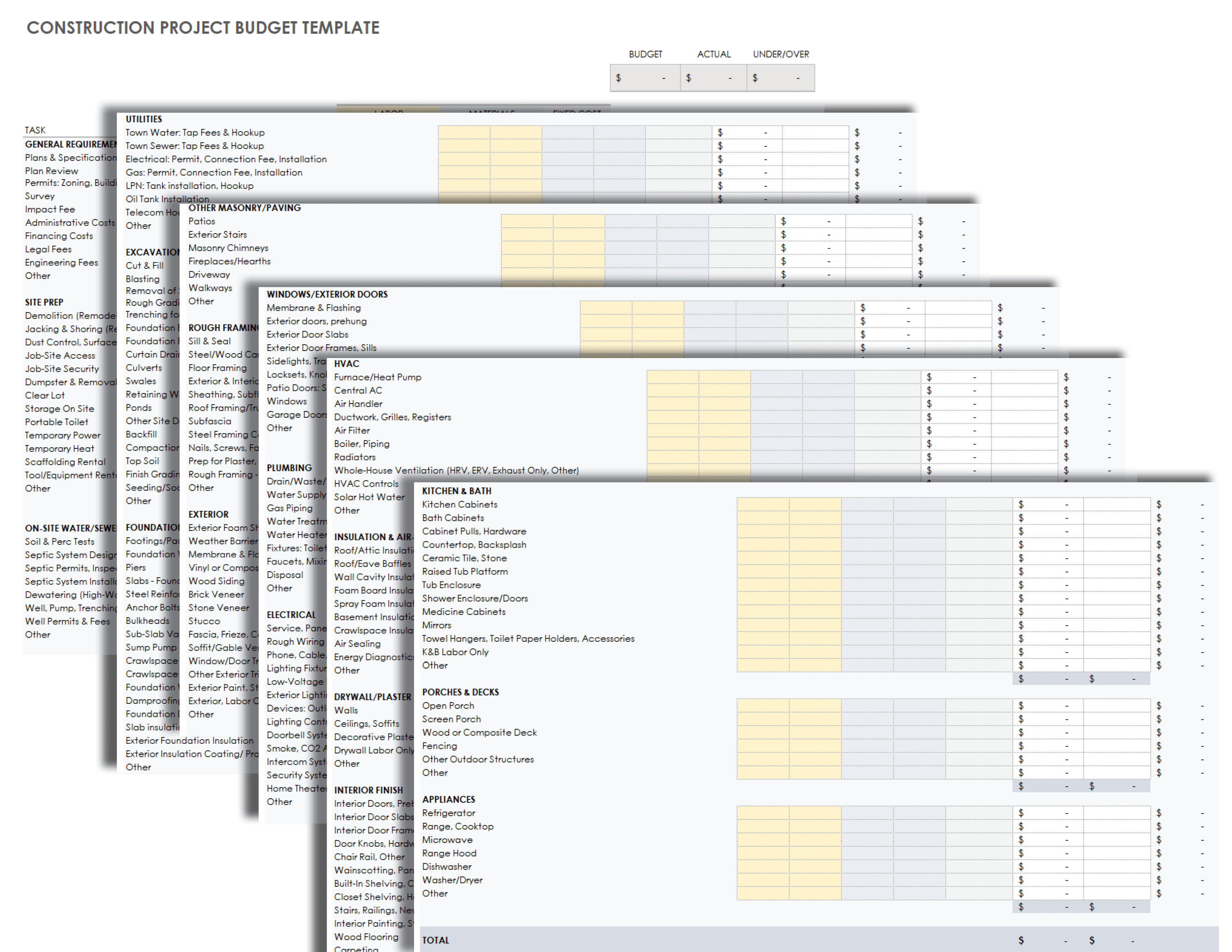

An activity-based budget breaks down each element of an organization’s spending into its component activities.

This includes:

- Analyzing direct expenses, such as materials purchasing and machine hours

- Calculating overhead costs and indirect spend associated with each activity.

By breaking down spending in this granular manner, organizations more accurately determine their total budgets for each activity and adjust accordingly.

To build an activity-based budget, use these steps.

1. Identify expense and revenue activities

Break down each process into its steps. For each step in the process, identify the expense it generates.

For example, manufacturing a product isn’t just “buy materials, make products.” The process is more complicated.

- Create an RFP to source materials.

- Purchase the raw materials and supplies needed for the product.

- Create components from materials and parts.

- Use those components to build the product.

- Test the product to ensure it meets quality standards.

- Package the product in appropriate sleeving and materials.

- Ship out the finished product.

- Track and record sales on delivered products.

If a company estimates it needs to build 50,000 units of a product (based on its previous year of sales), it must complete each of the above steps for every item. Each repetition of the above steps has an associated cost.

2. Estimate the cost drivers necessary for activities

An activity-based analysis looks at each step in this example to identify every cost driver associated with production, including materials, equipment, labor hours, and utilities.

In our manufacturing example, the product requires:

- Several machinists at market wage rates to keep up with expected production.

- A dedicated production line with a specialty machine.

- Specialized packaging for shipment.

All these factors affect the price of production for each unit you produce.

So, we break down the product example above into its costs:

- Machining operation: 500 machine hours at $5/hour = $2,500

- Labor costs: 500 hours at $15/hour = $7,500

- Materials costs: $2 per unit = $100,000

- Shipping costs : $.5 per unit = $25,000

From here, you can calculate the total and per-unit cost of producing your item.

3. Calculate the total cost

Once you have the figures for every piece of activity, you can calculate the total cost and per-unit cost of production:

Total cost: $135,000 for 50,000 units

Per-unit total: $2.70 per unit cost

4. Identify improvements and unnecessary costs

With the above information, the organization can evaluate activity performance to become deeply familiar with its granular costs and use the information to cut individual cost drivers, such as:

- Sourcing less-expensive materials for production

- Improving shipping expenses through volume negotiation

- Optimizing machine outputs to produce items faster

This step-by-step analysis is intensive but effective to drive costs down and under control. This process helps organizations reduce costs for any business activity: Manufacturing, sales, marketing, recruiting, etc.

Best practices for successful activity-based budgeting

In this section, we'll explore key strategies for achieving success with ABB, from engaging stakeholders to leveraging technology and fostering a culture of collaboration.

Piloting : Start with pilot projects or smaller-scale implementations to test the effectiveness of ABB before scaling up. Monitoring : Continuously monitor and evaluate ABB processes to identify areas for improvement and make necessary adjustments. Training : Invest in training and skill development for employees involved in ABB implementation to ensure they have the necessary expertise. Culture : Foster a culture of collaboration and communication to facilitate the successful implementation and ongoing management of ABB. Technology : Utilize technology and software solutions to streamline ABB processes and improve data accuracy and analysis capabilities. Review : Regularly review and update ABB methodologies and assumptions to ensure they remain aligned with organizational goals and objectives.

Using Cube for activity-based budgeting

As you can see, activity-based budgeting can be a powerful strategy.

What about you? Are you going to try activity-based budgeting at your company this year?

If you're wondering about the logistics, like getting all your actuals together, then you should consider Cube.

Cube connects to your source systems (like your ERP) and matches, validates, and de-dupes you data so you fetch it into your Excel spreadsheet in a single click and start budgeting.

Interested in hearing more? Request a free demo below:

Related Articles

Incremental budgeting: is it the right budgeting method for you?

Comparing different capital budgeting techniques

How does flexible budgeting enhance financial planning?

NorthOne is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A., Member FDIC.

What is Activity-Based Budgeting? Definition and Guide

Table of Contents

Get your business banking done 90% faster with North One

Get started for free. 1

1 Minimum $50 deposit required. See your Deposit Account Agreement for more details.

North One is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A., Member FDIC.

If you’re looking for a budgeting system to implement in your small business, activity-based budgeting is worthy of consideration—especially if you’re looking to cut costs in your operation. Not only does having a clear budget help you keep your operation running, it also allows you to identify supply chain problems in need of resolution. Perhaps most important of all, a budget helps you determine whether or not you’re on target to meet your goals—and if not, where you’re coming up short.

In this article, we’ll explain exactly what activity-based budgeting is, how the method works, and why you may want to consider using it for your business.

What is activity-based budgeting

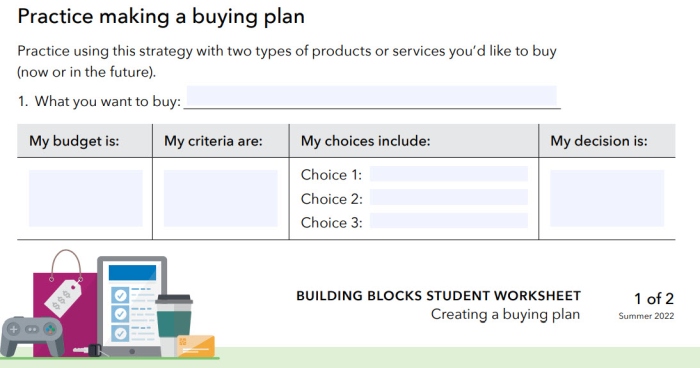

Much like traditional budgeting, activity-based budgeting is a process by which you identify, analyze, and research your business’s key expenses and activities, then use that information to produce the budget. Where it differs from more traditional budgeting, however, is that instead of relying on prior-year values to set a forward-looking budget, an activity-based approach identifies cost drivers and accounts for them accordingly.

For example, instead of simply increasing your marketing department’s budget by 3% next year, activity-based budgeting breaks down the expenses associated with marketing for the year ahead and accounts for their anticipated costs in the upcoming year.

If you’re a business owner who feels overwhelmed by your expenses, or struggles each month to understand where your money went, this approach could be useful. Since you’re essentially trimming all the fat until only the most essential line items in your budget remain, you’re sure to save money with activity-based budgeting.

This approach to budgeting is rigorous and intense—if you’ve been working with a more lenient, traditional budget, you may find this approach difficult to adjust to at first. But if you need a whole new method to budgeting to start growing your accounts, the initial struggle could be worth it.

How activity-based budgeting works

Here’s how you would go about establishing and maintaining an activity-based budget for your own business:

- Identify your cost drivers: Identify each and every cause of costs relevant to your business. These could include things like labor costs, the price of renting your facilities, manufacturing costs, materials, and products returned by customers. Be sure to include not only the revenue-generating activities but also those necessary to fulfill orders and keep your business running.

- Determine the number of units necessary for each cost driver: This could include the number of staff working on administrative tasks, vehicles needed to make deliveries, and staff members working on producing physical materials.

- Calculate the cost per unit for each cost driver: For each cost driver, determine the cost per unit. The formula used to determine this involves taking the total number of units for a given cost driver and dividing that number by the total cost for that cost driver.

- Push activity costs to the appropriate budget: Once you quantify cost drivers, attribute them to the business’s core cost centers. This will begin to paint a picture of the business’s overall budget. This will give you your general framework for your activity-based budget.

Once you have your activity-based budget, compare it with your expenses from the last six months. Are there other areas where you’ve spent significant money? How will removing them from your budget shift your operation or the quality of the product?

Looking at your expenses from the standpoint of what is truly essential will allow you to determine where you’ve been unnecessarily spending. Over time, you may also realize that things you left off your list originally were actually essential to your operation. Feel free to adjust and reevaluate what is included in your budget as you move through the year to ensure it’s aligning well with your business needs.

Activity-based budgeting in practice

To give you a sense of what this approach to budgeting actually looks like in day-to-day situations, let’s take a look at a real-life example of the system in action.

Let’s say that your business wants to create a forward-looking budget for its widget department. At the beginning of the year, you’ll ask your vice president of widget development to put together a budget of the anticipated costs to run this business line. Then, as expenses are incurred for the widget department, they’re pushed to that cost center and reviewed against projected costs.

Over time, the budget becomes clearer based on where projected costs are realized, exceeded, or not incurred at all. As a result, the business gets a better understanding of how much it’s actually spending on the widget department.

In this method, because the cost of each activity is consistently updated, you don’t need to consider things like inflation when projecting your upcoming year’s budget—the cost per unit has already been corrected to reflect that.

Advantages and disadvantages of activity-based budgeting

The advantage of approaching budgeting in this way is that you as a small business owner have more control over the process of budgeting overall. Since planning for your expenses and projecting your revenue each period is broken down into individual units and activities, you’re more clearly seeing your business’s bottom line. Consider which costs are necessary in order to reach your goals, and which ones need to be eliminated or substituted for a more cost-effective alternative.

One of the major downsides is that this budgeting method requires careful analysis of both your business model and your finances to establish and maintain it. While this is often seen as a negative, for business owners who are struggling to overcome their financial challenges, adopting a budgeting system that forces you to look closely at your operation on a regular basis can be just what you need to turn things around.

Final thoughts

There is no perfect budgeting model for every business. In order to find yours, consider carefully what your objectives are and what is realistic for your business to take on and maintain. While the activity-based budgeting system can be more intensive than other models, it’s a great way to tap into your business, determine what’s working and what isn’t, and trim the fat until you get your operation on the path toward growth.

Although it’s not always a model most small business owners are interested in maintaining over the long term, the rigorous analysis baked into activity-based budgeting can help you quickly achieve your short-term financial goals.

Try North One Connected Banking for free 1

Carter Grieve

Related posts, what is incremental budgeting and how to use it, envelope budget system: guide for home and business, invoice processing: definition and key steps, w-4 vs. w-2 tax forms: everything you need to know, revenue vs. profit: the 4 key differences, what is a pay stub what do i need to show my employees.

Username or Email Address

Remember Me

Registration is closed.

- Open an Account

How To Do Activity Based Budgeting

It was during my early days as a financial analyst. The company I worked for was struggling with managing its resources effectively. That’s when I stumbled upon Activity-Based Budgeting.

It was like finding a compass in the middle of a dense financial forest. Implementing ABB not only helped the company regain control over its finances, but it also gave me a fresh perspective on budget management.

Understanding Activity-Based Budgeting is crucial for managing your business finances effectively. It’s more than just crunching numbers; it’s about understanding the pulse of your business operations. By aligning your budget with your activities, you can make informed decisions, optimize your resources, and steer your business towards growth and profitability.

Key Takeaways

Imagine you’re planning a party. You wouldn’t just say, “I’m going to spend $200,” without knowing what you need, right? You’d probably make a list: $50 for food, $30 for decorations, $20 for drinks, and so on. That’s essentially what an Activity-Based Budget is.

It’s a budget that breaks down your expenses based on different activities in your business. Instead of just saying, “We’ll spend $10,000 next month,” you’d say, “We’ll spend $3,000 on manufacturing, $2,000 on marketing, $1,000 on delivery, and so on.” This way, you have a clear idea of where your money is going and can make more informed financial decisions.

Understanding the Basics of Activity-Based Budgeting

Have you ever tried to bake a cake without knowing how much flour, sugar, or eggs you need? You might end up with a culinary disaster on your hands. Similarly, running a business without understanding where and how your resources are being used is like trying to bake that cake blindfolded. And that’s where Activity-Based Budgeting (ABB) comes into play.

In simple terms, ABB is your recipe for financial success. It tells you exactly how much of each resource you need (and where you need it) based on the activities or tasks being performed in your business. It’s like having a financial blueprint that guides you in allocating resources more accurately and efficiently.

Now, I know what you’re thinking: “Finance and fun don’t usually go together.” But who says we can’t have a little chuckle while we’re navigating the labyrinth of budgeting? Here’s a joke to lighten the mood: Why don’t accountants trust calculators? Because they can always count on their fingers!

Now, let’s talk about a traditional budgeting versus ABB. Imagine you’re planning a road trip. With traditional budgeting, you would set aside a lump sum of money for the whole journey without considering the specifics. It’s like saying, “I have $500 for this trip,” without thinking about the cost of gas, food, accommodation, and those irresistible roadside souvenirs.

On the other hand, ABB is like meticulously planning your budget for each segment of your trip. You allocate funds for gas based on the distance you’ll cover, for food based on the number of meals you’ll have, and so on. That way, you know exactly where your money is going, and you can make adjustments as needed.

So, in essence, while traditional budgeting gives you a bird’s eye view of your finances, ABB lets you zoom in and manage each activity’s budget effectively. It provides a clearer picture of where your resources are going, helping you make more informed decisions and ensuring smooth business operations.

Activity-Based Budgeting Versus Zero Based Budgeting

Activity-Based Budgeting is a method of budgeting that focuses on activities or tasks rather than departments or units. It identifies the key activities in business processes and allocates costs to these activities based on the resources required to perform them. This approach allows for a more accurate and detailed budgeting process, as it takes into account the specific needs of each activity.

On the other hand, Zero Based Budgeting is a budgeting method that requires you to start from scratch every year. It involves justifying and building your budget from zero based on the current needs and priorities of your business. This approach helps to eliminate unnecessary costs and encourages thorough analysis of each expense. However, it can be a time-consuming and resource-intensive process.

So, which one is better for your business? It ultimately depends on your priorities and the level of detail you need in your budgeting process. If you want a more accurate and detailed budget that considers the specific needs of each activity, ABB may be a better fit for your business. However, if you want to thoroughly evaluate and justify each expense in your budget, ZBB may be a more suitable method.

Activity-Based Budgeting Versus Activity-Based Costing

Activity-Based Costing and Activity-Based Budgeting are like two sides of the same financial coin. ABC is a method for determining the cost of each activity involved in producing a product or service. It’s about looking back and understanding where your money went.

On the other hand, the Activity-Based Budgeting method is for planning future costs based on those activities. It’s about looking forward and deciding where your money should go. So while ABC helps you understand your past and present financial situation, ABB helps you plan for your financial future.

Step-by-Step Guide to Implementing Activity-Based Budgeting

Alright, now that we’ve set the stage, let’s dive into the nitty-gritty of implementing the Activity-Based Budgeting method in your business. It might seem like a daunting task, but remember, every expert was once a beginner. So let’s break it down together, shall we?

Make sure to download our free Excel template to follow along:

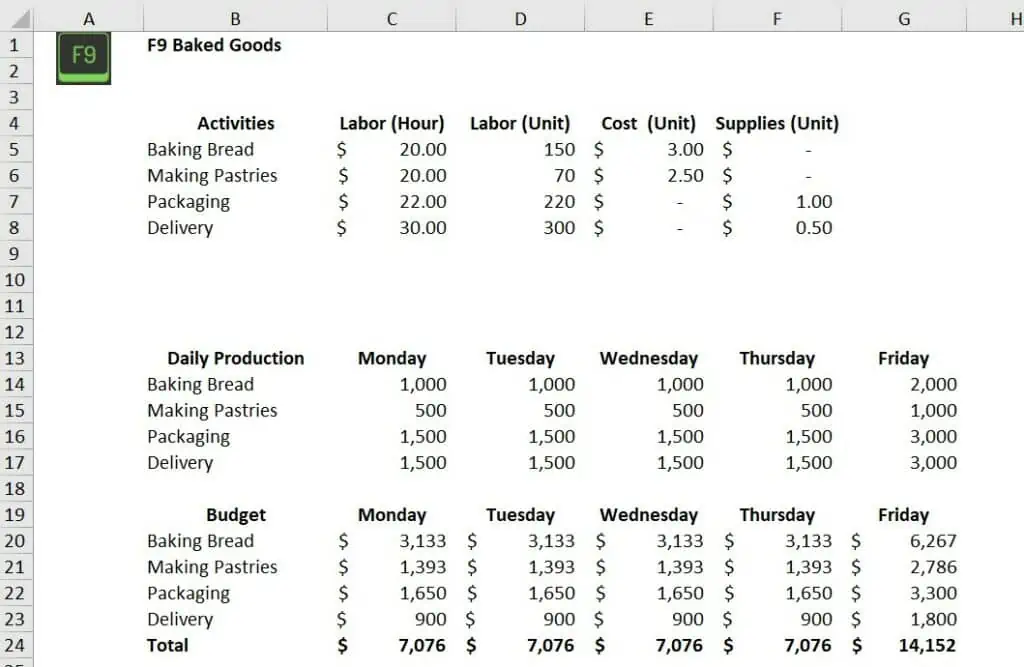

Step 1: Identify Your Activities

The first step is to identify all the activities or tasks that your business performs. Think of it as taking inventory of everything you do. For instance, if you run a bakery, your activities might include baking bread, making pastries, packaging, and delivery.

Step 2: Assign Costs to Each Activity

Once you have your list of activities, it’s time to assign costs to each one. This is where ABB really shines. Instead of just looking at your total expenses, you’re breaking them down based on each activity. Remember our road trip analogy? It’s like calculating the cost of gas for each leg of the journey.

Step 3: Identifying Cost Drivers

Next, you need to determine the cost drivers, i.e., what causes the costs for each activity. In our bakery example, the drivers could be the number of loaves baked, the hours spent on baking, or the number of deliveries made. Identifying these drivers will help you understand what influences your costs and where you can make adjustments.

Step 4: Create Your Budget

Now comes the fun part – creating your budget! Based on the costs and drivers you’ve identified, you can allocate resources for each activity. It’s like planning your road trip budget based on the distance, meals, and accommodations.

Step 5: Monitor and Adjust

Finally, keep an eye on your budget and adjust as needed. Just like you might need to reroute during your road trip due to unexpected detours, you’ll need to fine-tune your budget as your business evolves.

Now, I won’t sugarcoat it – the activity-based budget process can come with its challenges compared to a traditional budget. It requires a detailed understanding of your operations and when you incur costs. It can also be time-consuming. But remember, Rome wasn’t built in a day. Start small, perhaps with one department or project. As you get the hang of it, you can gradually implement ABB across your entire business.

Activity-Based Budgeting Advantages

Alright folks, it’s time for the grand reveal: the benefits of mastering Activity-Based Budgeting! If you’ve been following along, you’re already getting a sense of what this powerful tool can do. But let’s really dig into the gains that ABB can bring to your business.

Improved Accuracy

With ABB, you’re not just making educated guesses about where your resources are going. It’s like having a GPS for your finances; you know exactly where you’re headed and how to get there. This leads to more accurate budgeting, which in turn helps you avoid nasty financial surprises down the line.

Greater Efficiency

Activity-Based Budgeting is all about ensuring that every dollar works as hard as it can for your business. By aligning your budget with your activities, you can identify areas where you might be overspending and find cost savings. It’s like realizing you’ve been using premium gas for a car that runs perfectly fine on regular. Who doesn’t love finding ways to save?

Informed Decision-Making

One of the biggest advantages of ABB is the clarity it provides. When you understand the cost driver of each activity, you can make more informed decisions about where to invest your resources. It’s like knowing exactly how much bang you’re getting for your buck.

Now, let’s talk about some real-life success stories. Take the case of ABC Bakery (name changed for privacy). They were struggling with high production costs and low profitability. After implementing an Activity-Based Budget, they discovered that their packaging costs were through the roof due to custom boxes for each product. By switching to standardized packaging, they were able to drastically reduce costs and boost profitability.

Then there’s XYZ Manufacturing (name changed for privacy). They used ABB to identify that their assembly process was consuming a large portion of their budget. By streamlining the process and training their employees to work more efficiently, they were able to cut costs significantly.

Potential Pitfalls and How to Avoid Them

Let’s talk about some common pitfalls businesses encounter when implementing ABB and, more importantly, how to steer clear of them.

Overcomplicating the Process

Remember when you first learned to ride a bike? You didn’t start by tackling the Tour de France route. Similarly, when implementing ABB, it’s easy to get overwhelmed if you try to do too much too soon. Start small, perhaps with one department or project, and as you gain confidence, gradually expand your ABB implementation.

Neglecting to Involve the Team

ABB is not a one-person show. It’s like a choir performance; everyone needs to be in sync for it to work. Make sure to involve all relevant team members in the process. Their insights can be invaluable in identifying activities and cost drivers, and their buy-in will be crucial for successful implementation.

Ignoring the Need for Regular Updates

Implementing ABB isn’t a “set it and forget it” kind of deal. It’s more like tending a garden; it needs regular attention and care. As your business evolves, so will your activities and costs. Regularly review and update your ABB to ensure it remains accurate and relevant.

Have any questions? Are there other topics you would like us to cover? Leave a comment below and let us know! Make sure to subscribe to our Newsletter to receive exclusive financial news right to your inbox.

Related Posts

- How To Get A Heavy Equipment Loan

- The Ultimate Guide to 50+ Financial Modeling Resources

- Your Flux Analysis Step-By-Step Survival Guide

- How To Do Account Reconciliation Without Pulling Your Hair Out

- Taking Vertical Analysis To The Next Level

- Your Unconventional Guide To Managing Working Capital

FP&A Leader | Digital Finance Advocate | Small Business Founder

Mike Dion brings a wealth of knowledge in business finance to his writing, drawing on his background as a Senior FP&A Leader. Over more than a decade of finance experience, Mike has added tens of millions of dollars to businesses from the Fortune 100 to startups and from Entertainment to Telecom. Mike received his Bachelor of Science in Finance and a Master of International Business from the University of Florida, laying a solid foundation for his career in finance and accounting. His work, featured in leading finance publications such as Seeking Alpha, serves as a resource for industry professionals seeking to navigate the complexities of corporate finance, small business finance, and finance software with ease.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

ACTIVITY-BASED BUDGETING: MEANING, ADVANTAGES, AND DISADVANTAGES

A budget is a quantitative plan or forecast for a future period of a business. An activity-based budget is one of the types of the budget which is made based on an activity or different activities in a business.

In an activity-based budget, the business closely considers every cost incurred to determine if it can reduce these costs and create efficiencies.

How to make an Activity-Based Budget?

A business that wants to operate an activity-based budget must use a three-step process to make these budgets. These are as below.

1) Identify cost drivers

2) estimate the number of units for each cost driver.

The number of units for each cost driver will depend on the level of planned activity of the business.

3) Calculate the cost per unit of activity according to the cost driver

When should businesses use an activity-based budget.

Before using an activity-based budget, businesses must first determine whether this budget can help the business. Therefore, businesses must first know when to use this type of budget before applying it.

Advantages of Activity-Based Budgeting