Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

How to Write a Business Plan to Start a Bank

Published Feb.29, 2024

Updated Apr.23, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Table of Content

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

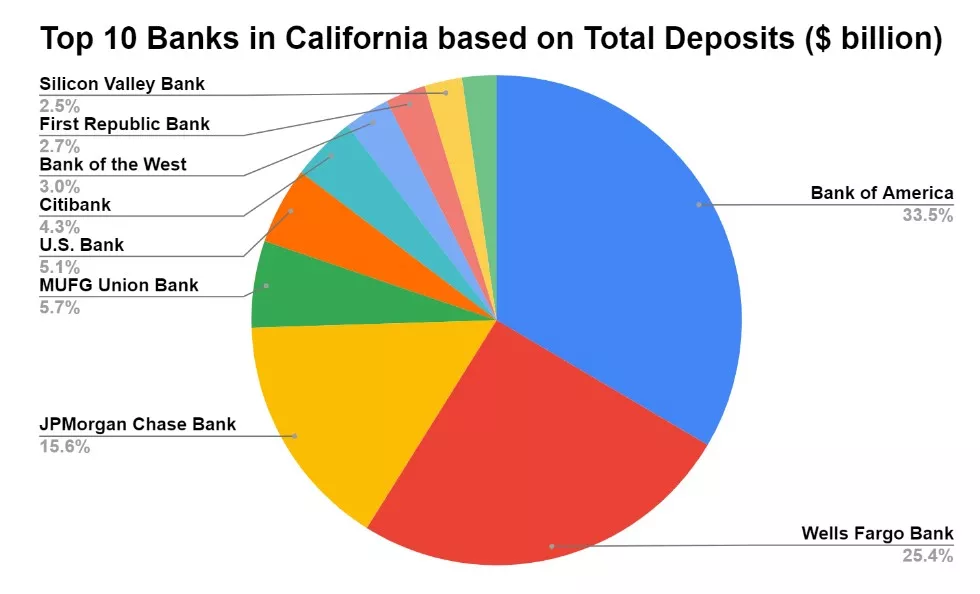

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have computers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; inventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Case: OGScapital Provides Quality of Earnings (QoE) Support

Ice Vending Machine Business Plan

OGScapital at the National Citizenship and Immigration Conference

How to Start a Plumbing Business in 2024: A Detailed Guide

Vegetable Farming Business Plan

Trading Business Plan

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Bank Business Plan Template FAQs

What is the easiest way to complete my bank business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your bank business plan.

How Do You Start a Bank Business?

Starting a bank business is easy with these 14 steps:

- Choose the Name for Your Bank Business

- Create Your Bank Business Plan

- Choose the Legal Structure for Your Bank Business

- Secure Startup Funding for Your Bank Business (If Needed)

- Secure a Location for Your Business

- Register Your Bank Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Bank Business

- Buy or Lease the Right Bank Business Equipment

- Develop Your Bank Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Bank Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

How To Write a Business Plan for Banking in 9 Steps: Checklist

By alex ryzhkov, resources on banking.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

- Bundle Business Plan & Fin Model

The traditional retail banking approach is a thriving business model in the banking industry, providing a wide range of financial services to individual customers. With the demand for these services continuously growing, it is crucial for aspiring entrepreneurs to understand how to write a comprehensive business plan for banking success.

According to recent statistical data, the retail banking industry has experienced significant growth over the past few years. In fact, it is projected to reach a market value of $22.4 trillion by 2026 . The increasing number of individuals seeking convenient banking solutions and personalized financial services has contributed to this remarkable expansion.

To enter this competitive industry and establish a successful retail banking business, it is important to follow a structured approach. Here is a checklist of nine essential steps to guide you through the process:

- Conduct market research

- Define your target market and identify your target customers

- Analyze the competition

- Determine your unique value proposition

- Assess the financial feasibility and profitability of the business

- Identify potential banking partners and suppliers

- Develop a pricing and revenue model

- Define your marketing and sales strategy

- Establish a cohesive team and management structure

By following these steps, you can create a solid foundation for your retail banking business. Each step is crucial in ensuring that you thoroughly analyze the market, understand your customers' needs, differentiate yourself from competitors, and build a profitable venture.

Stay tuned for our upcoming blog posts, where we will delve deeper into each of these steps, providing valuable insights and practical tips to help you craft a compelling business plan for your banking venture.

Conduct Market Research

Before starting a business plan for a banking venture, it is crucial to conduct thorough market research. This step will provide you with valuable insights into the industry, current trends, and the needs and demands of potential customers.

When conducting market research, you should start by identifying the target market for your banking services. This involves determining the demographic characteristics, financial needs, and preferences of your potential customers. Understanding your target market will help you tailor your banking products and services to meet their specific requirements.

Analyze the current competition in the banking industry to identify key players and understand the services they offer. This will help you assess the market saturation and identify any gaps or opportunities for your business.

To ensure the success of your banking venture, it is essential to determine your unique value proposition. This is what sets your bank apart from the competitors and highlights the advantages you can offer to potential customers. Understanding your strengths and weaknesses will enable you to develop strategies to capitalize on your unique selling points.

- Utilize online resources, industry reports, and market studies to gather relevant data and insights.

- Conduct surveys or interviews with potential customers to gain a deeper understanding of their preferences and expectations.

- Stay updated on the latest banking trends and innovations to identify potential new opportunities in the market.

By conducting comprehensive market research, you will gain the necessary knowledge and understanding to develop a business plan that aligns with the needs and demands of your target market. This research will serve as a solid foundation for the subsequent steps in creating a successful banking venture.

| Banking Financial Model Get Template |

Define Your Target Market And Identify Your Target Customers

Defining your target market and identifying your target customers is a crucial step in creating a successful business plan for banking. By understanding who your customers are, you can tailor your products and services to meet their specific needs and preferences. This will not only help you attract and retain customers but also differentiate your business from competitors in the market.

To define your target market, consider factors such as demographics, psychographics, and behavior. Demographics include characteristics such as age, gender, income level, and education. Psychographics, on the other hand, focus on attitudes, values, lifestyle choices, and interests. By understanding these factors, you can create a customer profile that reflects the characteristics and preferences of your target market.

Once you have defined your target market, you can then identify your target customers within that market segment. This involves conducting further research and analysis to determine the specific individuals or groups within your target market who are most likely to use your banking services. This could be based on factors such as income level, life stage, occupation, or geographic location.

Tips for Defining Your Target Market and Identifying Your Target Customers:

- Conduct surveys or interviews with potential customers to gain insights into their banking needs and preferences.

- Utilize market research data and industry reports to understand the current trends and demands in the banking industry.

- Segment your target market into smaller, more specific groups based on shared characteristics or needs.

- Consider the competition and how your banking services can offer unique value to your target customers.

- Regularly review and update your target market and customer profiles as market conditions and customer preferences may change over time.

By defining your target market and identifying your target customers, you can develop effective marketing strategies and tailor your products and services to meet the specific needs and preferences of your customers. This will not only help you attract and retain loyal customers but also drive the profitability and growth of your banking business.

Analyze The Competition

When writing a business plan for banking, it is crucial to thoroughly analyze the competition in the industry. Understanding your competitors will help you identify their strengths and weaknesses, allowing you to position your business to stand out in the market. Here are some key steps to analyze the competition:

- Identify direct and indirect competitors: Begin by researching and listing all the banks and financial institutions that offer similar services to your target market. This includes both local and national competitors.

- Study their products and services: Analyze the range of financial products and services offered by your competitors. Look at their interest rates, fees, and additional benefits they provide to customers.

- Examine their target market: Determine the specific demographics and needs of your competitors' target customers. This will help you identify potential gaps in the market and tailor your offerings to meet those needs.

- Assess their marketing strategies: Analyze how your competitors are promoting their services and attracting customers. Look at their advertising campaigns, online presence, and customer engagement strategies. Identify what sets them apart in terms of branding and messaging.

- Evaluate customer feedback and reviews: Explore online platforms, such as social media, business review websites, and forums to discover what customers are saying about your competitors. This will provide valuable insights into their strengths and weaknesses from a customer's perspective.

- Stay up-to-date: Continuously monitor your competitors' activities and adapt your strategies accordingly. Stay informed about any new products, services, or marketing tactics they may introduce.

- Be objective: Avoid underestimating your competitors or solely focusing on their weaknesses. Recognize their strengths and learn from them to enhance your own business.

- Identify opportunities: Analyzing the competition can help you identify gaps in the market that your business can fill. Look for areas where your competitors may be lacking or failing to meet customer demands.

By thoroughly analyzing the competition, you can gain a comprehensive understanding of the banking industry landscape and position your business for success.

Determine Your Unique Value Proposition

Once you have conducted market research and analyzed the competition, it is essential to determine your unique value proposition. This is the factor that sets you apart from your competitors and provides value to your target customers.

- Identify your strengths: Assess your strengths, skills, and resources that you can leverage to differentiate yourself in the market. Determine what unique qualities or services you can offer that others may not have.

- Understand customer needs: Gain a deep understanding of your target customers' pain points and what they value most in retail banking services. This will help you tailor your value proposition to meet their specific needs.

- Highlight benefits: Clearly communicate the benefits that your customers will receive by choosing your retail banking services. Whether it's competitive interest rates, personalized customer service, or innovative digital banking solutions, emphasize these advantages in your value proposition.

- Emphasize convenience: In today's fast-paced world, convenience plays a crucial role in attracting and retaining customers. If your retail banking approach offers online and mobile banking services, express how these features simplify and enhance the banking experience for your customers.

- Offer specialized services: Consider if there are any specialized financial services or niche markets you can cater to. By becoming an expert in a specific area, you can establish yourself as the go-to retail bank for those customers.

- Research what unique innovations or strategies other successful retail banks have implemented. This can inspire you and help you think outside the box when determining your unique value proposition.

- Regularly seek feedback from your customers to understand if your value proposition aligns with their expectations and if any adjustments need to be made.

Assess The Financial Feasibility And Profitability Of The Business

Assessing the financial feasibility and profitability of your banking business is crucial in determining whether your venture will be sustainable and successful. It involves conducting a thorough analysis of your projected income and expenses to determine if your business model is financially viable.

To assess the financial feasibility of your business, start by determining your startup costs. This includes expenses such as office space rental, equipment purchase, employee salaries, and marketing expenses. Consider obtaining quotes from suppliers and researching industry benchmarks to accurately estimate these costs.

Next, project your revenue streams. Calculate the potential income from your various financial services, taking into account factors such as interest rates, fees, and customer acquisition rates. It is important to be realistic in your projections, using market research and industry trends to guide your estimations.

Once you have projected your income and expenses, you can calculate your profitability. Compare your projected revenue with your anticipated expenses to determine if your business will generate a profit. This analysis will help you identify any potential financial gaps or areas that may need adjustment.

To ensure the accuracy of your financial projections, it is recommended to seek the assistance of a financial expert or accountant. They can review your calculations, provide valuable insights, and help you identify any potential risks or areas for improvement.

- Consider creating multiple financial scenarios to account for different market conditions and potential risks.

- Regularly update your financial projections as your business evolves and market conditions change.

- Take into account regulatory requirements and compliance costs when assessing profitability.

- Keep track of industry benchmarks and trends to ensure your profitability remains competitive.

- Explore potential cost-saving measures or revenue-generating opportunities to optimize your financial feasibility.

Identify Potential Banking Partners and Suppliers

When starting a retail banking business, it is crucial to identify potential banking partners and suppliers who can support your operations and provide the necessary financial services and products. These partnerships can greatly impact the success and growth of your business. Here are some key steps to consider when identifying potential banking partners and suppliers:

- 1. Research and analyze different banks: Begin by researching and analyzing various banks to find the ones that align with your business goals and values. Consider factors such as their reputation, financial stability, range of services, and compatibility with your target market.

- 2. Evaluate their service offerings: Assess the specific financial services and products offered by potential banking partners. Ensure that they can meet the needs and demands of your target customers. Look for partners who offer competitive interest rates, flexible loan terms, and convenient banking channels.

- 3. Consider their technological capabilities: In today's digital age, it is essential to partner with banks that have robust online and mobile banking platforms. These technologies can enhance the customer experience and improve operational efficiency.

- 4. Examine their customer support: Customer support is crucial in the banking industry. Evaluate the responsiveness and quality of service offered by potential banking partners. Look for partners who prioritize customer satisfaction and provide efficient dispute resolution processes.

- 5. Assess their fees and charges: Compare the fees and charges imposed by different potential banking partners. Consider the impact these fees may have on your customers and your business's profitability. Look for partners who offer transparent fee structures and reasonable charges.

- 6. Seek recommendations and references: Reach out to other business owners or industry professionals for recommendations and references. Their experiences and insights can provide valuable information and help you make an informed decision.

Tips: Identifying Your Ideal Banking Partner

- 1. Clearly define your banking needs and priorities before approaching potential partners.

- 2. Consider partnering with a bank that has experience in serving the retail banking sector.

- 3. Look for banks that offer tailored banking solutions to meet the unique requirements of your target market.

- 4. Prioritize banks with strong financial stability and a solid reputation to ensure the security of your customers' funds.

- 5. Don't overlook the importance of effective communication and a positive working relationship with your banking partner.

Identifying potential banking partners and suppliers requires thorough research, evaluation, and consideration of various factors. By selecting the right partners, you can establish a strong foundation for your retail banking business and deliver exceptional financial services to your customers.

Develop A Pricing And Revenue Model

Developing a pricing and revenue model is crucial for the success of your banking business. It involves determining how you will generate revenue and setting prices for your products and services. Here are the key steps to follow:

- Understand your costs: Before setting prices, it is important to have a clear understanding of your costs. Calculate the costs associated with providing each financial service, including overhead costs, employee salaries, technology expenses, and marketing costs.

- Consider market demand: Analyze the market demand for your services and consider the pricing strategies of your competitors. Determine how much customers are willing to pay for the value you offer and factor this into your pricing decisions.

- Create pricing tiers: Consider offering multiple pricing tiers for different levels of service or different customer segments. This allows you to cater to a wider range of customers and capture more revenue.

- Incorporate value-added services: Identify additional services or features that you can offer at an additional cost. For example, you could provide premium customer support, personalized financial advice, or access to exclusive rewards programs.

- Set profitable prices: Set prices that not only cover your costs but also generate a profit. Consider the long-term sustainability of your pricing strategy and ensure that it aligns with your overall business goals.

- Test and refine: Monitor customer response to your pricing and revenue model and collect feedback. Continuously analyze and refine your approach to ensure that it remains competitive and profitable.

- Research pricing strategies used by successful banks to gain insights and inspiration.

- Consider offering introductory offers or promotions to attract new customers and generate initial interest.

- Regularly review and adjust your pricing and revenue model to adapt to changing market conditions.

Define Your Marketing and Sales Strategy

Once you have identified your target market and competition, it is crucial to define a clear marketing and sales strategy. This will guide your efforts in reaching and convincing potential customers to choose your banking services over those of your competitors.

Firstly, you need to determine your positioning in the market. Identify what sets your bank apart from others and emphasize these unique selling points. Whether it is superior customer service, innovative mobile banking features, or competitive interest rates, highlighting your unique value proposition will attract customers who prioritize these factors.

Next, establish your marketing channels to reach your target audience effectively. This could include a combination of online and offline channels, such as social media, search engine optimization, traditional advertising, and partnerships with local businesses or community organizations. Understand your target customers' preferences and habits to ensure your messages are delivered through the most appropriate channels.

An important aspect of your marketing strategy is to clearly communicate the benefits and features of your banking services. Develop compelling messaging that focuses on how your services can address the specific financial needs and goals of your target market. Highlight any additional benefits, such as cashback rewards or fraud protection, to differentiate your offerings from competitors.

Tips for a Successful Marketing and Sales Strategy:

- Invest in creating a visually appealing and user-friendly website and mobile app to enhance your online presence.

- Utilize data analytics to track and optimize your marketing campaigns, enabling you to refine your messaging and target your audience more effectively.

- Consider implementing referral programs to incentivize satisfied customers to spread the word about your bank and attract new customers.

- Regularly monitor and respond to customer feedback to maintain and improve customer satisfaction levels.

- Stay updated on industry trends and continuously adapt your marketing strategy to remain competitive in the evolving banking landscape.

Lastly, your sales strategy should focus on efficiently converting leads into customers. Train your sales team to effectively communicate the unique benefits of your banking services and handle objections. Provide them with the necessary tools and resources, such as sales scripts and collateral, to guide their interactions with potential customers.

To maximize sales opportunities, consider hosting informational events or workshops to educate potential customers about your services. Additionally, establish partnerships with local businesses or organizations to offer special promotions or discounts to their members, further incentivizing them to choose your bank.

With a well-defined marketing and sales strategy in place, you will be equipped to drive customer acquisition and grow your business in the competitive retail banking industry.

Establish A Cohesive Team And Management Structure

Building a cohesive team and establishing a strong management structure is crucial for the success of your banking business. A well-organized and harmonious team can help drive growth, foster innovation, and ensure efficient operations.

Here are some important steps to consider when establishing a cohesive team and management structure:

- Clearly define roles and responsibilities: Clearly defining roles and responsibilities for each team member is essential to avoid confusion and ensure everyone understands their specific tasks and goals. This clarity will help streamline operations and promote accountability within the team.

- Build a diverse team: A diverse team brings different perspectives, experiences, and skill sets to the table. Consider hiring individuals with a mix of backgrounds and expertise to foster creativity and drive innovation within your organization. Encourage collaboration and an inclusive work environment.

- Encourage effective communication: Open and effective communication is key to maintaining a cohesive team. Encourage regular team meetings, provide opportunities for feedback, and establish channels for transparent communication among team members. This will foster a culture of trust and collaboration.

- Invest in professional development: Continuously investing in your team's professional development will not only enhance individual skill sets, but also contribute to the overall growth and success of your banking business. Offer training programs, workshops, and opportunities for mentorship to help your team members stay up-to-date with industry trends and developments.

- Promote a positive work culture: A positive work culture is essential for attracting and retaining talented individuals. Foster a supportive and inclusive environment where teamwork, respect, and recognition are valued. Encourage a healthy work-life balance and provide opportunities for team building activities.

- Implement effective performance management: Establish a performance management system that includes regular performance reviews and feedback sessions. Reward and recognize high-performing team members, while also addressing any performance issues in a timely and constructive manner. This will help motivate your team and drive continuous improvement.

Tips for establishing a cohesive team and management structure:

- Clearly communicate your vision and goals to the team, outlining how each individual contributes to the overall objectives.

- Delegate responsibilities based on individual strengths and expertise, allowing team members to take ownership of their work.

- Encourage collaboration and cross-functional teamwork to foster a sense of unity within the organization.

- Provide regular training and development opportunities to enhance skills and keep up with industry advancements.

- Lead by example, demonstrating professionalism, integrity, and a strong work ethic.

Establishing a cohesive team and management structure requires careful planning and ongoing effort. By investing in your team, fostering effective communication, and promoting a positive work culture, you can create a strong foundation for your banking business to thrive.

In conclusion, writing a business plan for a banking venture requires careful consideration and attention to detail. By following the 9-step checklist outlined in this blog post, you can ensure that your business plan covers all the necessary elements for success. Conducting market research, defining your target market, analyzing the competition, and determining your unique value proposition are essential steps to understand the market landscape and position your business effectively. Additionally, assessing the financial feasibility, identifying potential banking partners and suppliers, and developing a pricing and revenue model will help ensure the profitability of your business. Defining a robust marketing and sales strategy and establishing a cohesive team and management structure are crucial for effective operations and growth. By adhering to these steps, you can build a strong foundation for your banking business and increase the likelihood of success in the highly competitive banking industry.

Banking Financial Model

$169.00 $99.00 Get Template

| Expert-built startup financial model templates |

Related Blogs

- Starting a Business

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Writing a business plan in 9 steps

Discover all the doors a solid business plan can help open for you, including business banking accounts, loans and other forms of funding. Presented by Chase for Business .

Whether you're starting your first business or your company is seeking funding , a business plan is essential for charting your path to success.

A well-written and researched business plan can act as a roadmap that outlines your plan for selling and marketing your products and services, making profits and growing over a period of three to five years. Your plan can also help position your company within the industry and set your business apart from competitors.

With the right tools and a little excitement, you can write a business plan. In this article, you'll learn how to write a business plan in a step-by-step process.

1. Ask these questions

To get in the right frame of mind and gather necessary details for writing an effective business plan, ask yourself the following questions:

- Why do I want to start this business? What’s my reasoning or inspiration?

- How does my business stand out from the competition?

- What is my unique value proposition?

- Who are my target customers? How can I reach them?

- Who is already on my management team? What gaps do I need to fill?

- How can my business make a profit? How soon will it break even?

Knowing the answers to these questions will help guide the structure and cadence of your business plan.

2. Research before you write

Your business plan should be a well-researched, actionable document that you can return to again and again. To get the information you need, use the following tactics when writing a business plan:

- Do a SWOT analysis. Consider your company’s strengths, weaknesses, opportunities and threats. This type of analysis allows you to identify what sets your business apart and plan for potential risks.

- Perform due diligence. If you’re planning to buy an existing business, make sure you research the company’s finances, sales, inventory and other aspects to ensure it’s a sound investment.

- Use Porter’s Five Forces . This analytical approach is a framework for analyzing your company’s competitive environment.

3. Think about your audience

Ask yourself, who will read my business plan, and what kind of information do they need? For example, if you’re looking for funding, you should include plenty of financial data and forecasting. If you’re seeking to bring on new business partners, you should include a detailed section where you outline how the business intends to support growth over the next three to five years.

If you want to share your business plan with different types of stakeholders, think about writing more than one version. This will allow you to make sure every reader has the right, targeted details about your business.

4. Include market analysis

Writing and researching a business plan gives you the opportunity to learn more about your industry, market, competitors, audience, local government, suppliers, sales channels and more. It also allows you to assess risk related to your market or supply chain.

To do this research, you can start by looking for online data related to your industry and target audience. It’s a good idea to include data that's recent enough to still be relevant and from a credible source.

With a bit of patience, the information you need can be found online for free. Services also exist that provide customized data for a fee — which can be a good option for business owners without the luxury of time.

5. Make realistic projections

When writing a business plan, you’re naturally going to be excited, and it may feel easy to think positively and overestimate how well your business will perform. Optimism may cause you future distress when investors or business partners expect more than your business is able to provide.

It’s always better to aim low and blow your projections out of the water than to do the opposite. Make your business plan as realistic as possible. When you include accounting data, carefully consider the market, your competitors and the demand for your products.

6. Share your vision

Although financial projections, product descriptions and management charts serve as the focus for most business plans, including a vision statement can help you personalize your goals and refer back to your initial mission.

In this section, briefly discuss your reason for starting the business, share any underlying motivations and hypothesize on how your company can contribute to a larger cause.

7. Keep it concise

As you write your business plan, it's tempting to include every detail about your company. Before you know it, your market analysis alone might be 10 pages long. If your business plan becomes too big, it may become less actionable, or your readers may not devote the time to reading and comprehending it.

Take care to feature only the essential data when you write your business plan. Be sure to include the standard sections mentioned above.

A good suggestion is to feature a page or two for each section plus any financial statements or resumes. If you have additional research or notes that don't fit neatly into your plan, keep them on file for your own internal use.

8. Include a visual element

Most business plans tend to be text-heavy — but that doesn’t mean you can’t make yours visually appealing for the reader. Include relevant graphics, pictures, charts and diagrams.

9. Keep the style simple

Focus on presenting your information and storytelling in a clear way that doesn’t require additional context to be understood. Keep the formatting as simple as possible. Use a classic serif font like Times New Roman to maintain readability. The last thing you want is for investors to focus more on your font choice than your financial projections.

A business plan can help you review your idea and put actionable goals in place. Once you’ve worked out the details, a business banker can walk you through important next steps like setting up a business checking account .

What to read next

Manage your business how to help protect your business from check fraud.

Think writing checks is a safe way to pay vendors? Think again. Learn about five common scams and how to help prevent them.

START YOUR BUSINESS 10 tips before starting your new businesses

Thinking about starting a business? Check these 10 items off your list.

MANAGE YOUR BUSINESS Inventory management can help maintain cash flow

Inventory can eat up a lot of cash. Here are a few ways to manage inventory with cash flow in mind.

MANAGE YOUR BUSINESS Banking tips for cash businesses

Learn how to keep your cash business safe, secure and compliant.

Writing a Bank Business Plan

When it comes to seeking funding from a bank or other financial institution, one of the most important things you can do is have a well-written business plan . This document will not only give potential lenders and investors an idea of your company’s current position and future goals but will also provide them with a clear understanding of the risks involved in lending you money or investing in your business.

What is a Business Plan?

A business plan is a document that provides a detailed description of a business, its products or services, its market, and its financial projections. It is used to secure funding from lenders or investors and to provide guidance for the business’s future operations.

Why Write a Business Plan

There are several reasons why you might want to write a plan for your business, even if you’re not looking for funding, they are:

- To clarify your company’s purpose and direction

- To better understand your industry and customers

- To develop a realistic financial plan and accurate projections

- To identify potential risks and opportunities

- To track your company’s progress over time

An effective and well-written plan is helpful for potential investors and clarifies the plans you have for any future business partners.

Sources of Business Funding for Banks

There are many sources of business funding available to banks, including:

- Equity financing: This is when you sell a portion of your business to investors in exchange for capital. This can be a good option if you need a large amount of money quickly, as it doesn’t require you to pay back the funds over time.

- Debt financing: This is when you borrow money from a lender, such as a bank, in exchange for repayment plus interest. This type of financing can be helpful if you need to keep your cash flow low in the early stages of your business.

- Grants: There are several different government and private grants available to businesses, which can often be used for start-up costs or expansion.

- Venture capital: This is when you receive funding from a venture capitalist in exchange for a portion of your company’s equity. Venture capitalists typically invest their own personal savings in high-growth businesses with a lot of potential.

Resources to Write a Bank Business Plan

To write a bank business plan, you’ll need access to a variety of resources, including:

Sample Plans for Your Business

A good place to start is by looking at some sample plans for businesses in your industry. This will give you a good idea of the types of information to include in your own plan.

Business planning software

There are a number of software programs that can help you create professional-looking plans for your business.

Market Research

When writing a business plan for a bank, it’s important to include a section on your company’s market research. This will include detailed information about your industry, your market, and your competition.

Industry Analysis

In order to accurately describe your industry and the market for your products or services, you’ll need to conduct an industry analysis. This should include information about the size and growth of the industry, the key players in the industry, and any major trends or changes that are taking place.

Target Market Analysis

To effectively market your products or services, you need to understand who your target market is. This should include information about the demographics of your target customers (age, gender, income, etc.), psychographics (lifestyle preferences, interests, etc.), and geographic (location, region).

Competition Analysis

In order to differentiate your business from the competition, you’ll need to know what they’re offering and how they’re positioning themselves in the market. This should include a SWOT analysis (strengths, weaknesses, opportunities, threats) of your competitors.

Customer Segments

A customer segment is a group of customers who share common characteristics, such as age, income, location, or lifestyle preferences. When creating business plans for a bank, it’s important to identify and target your key customer segments. This will help you focus your marketing efforts and create products and services that appeal to your target market.

There are a variety of ways to segment customers, including:

- Demographics: Age, gender, income, location, etc.

- Psychographics: Lifestyle preferences, interests, etc.

- Behavior: How they interact with your brand, what channels they use to purchase products or services, etc.

- Usage: How often they purchase your product or service, how much they spend, etc.

- Value: How much they’re willing to pay for your product or service, how much they value customer service, etc.

Once you’ve identified your customers, you can create buyer personas. These are fictional characters that represent your ideal customer within each segment. Creating buyer personas will help you better understand your target market and create more effective marketing campaigns.

Financial templates

If you’re not familiar with financial terminology or calculations, use a financial template to help you develop your business’s financial projections as well as including an income statement and balance sheets.

Accounting and Legal Advice

It’s important to seek out accounting and legal advice from professionals who can help ensure that your business plan is accurate and complete.

Bank Business Plan Template

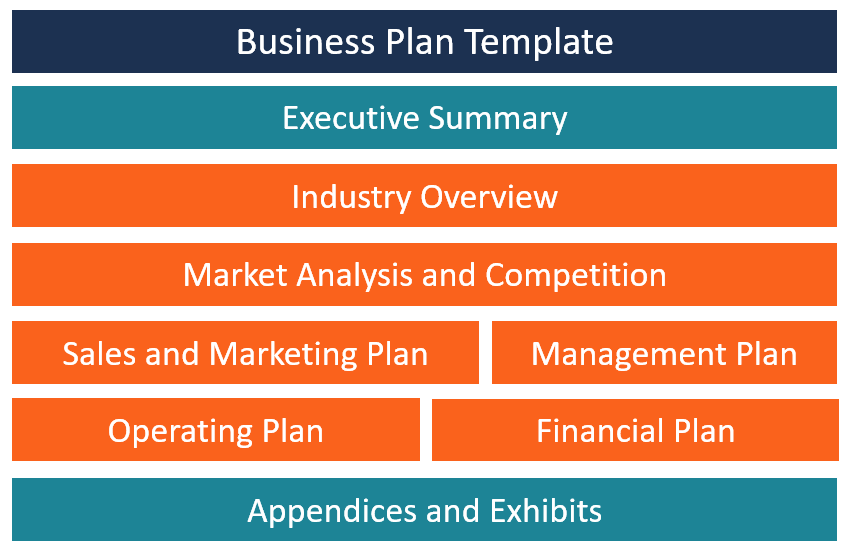

While there is no one-size-fits-all template for writing a business plan, there are some key elements that should be included. Here is a brief overview of what should be included:

Executive Summary

This is a high-level overview of your company, its products or services, and its financial situation. Be sure to include information on your target market, your competitive advantage, and your plans for growth.

Company Description

This section provides more detail on your company, including its history, structure, and management team. Be sure to include information on your company’s mission and vision, as well as its values and goals.

Products and Services

Here you will describe your company’s products or services in detail, including information on your target market and your competitive advantage.

Market Analysis

In this section, you will provide an overview of your market, including demographic information and information on current and future trends. This is also a good section to add the marketing plan you have developed to appeal to potential customers.

Sales and Marketing

This section will detail your sales and marketing strategy, including information on your pricing, your distribution channels, and your promotion plans.

Financial projections

This is perhaps the most important section of your business plan, as it will provide lenders and investors with an idea of your company’s financial health. Be sure to include detailed information on your past financial performance, as well as your projections for future revenue and expenses. This is also a good section to include your cash flow statements, income statements, and information about any bank accounts opened for your business.

This is where you will include any supporting documents, such as your financial statements, marketing materials, or product data sheets.

While this is not an exhaustive list of everything that should be included in your bank business plan, it covers the most important elements. By taking the time to write a well-thought-out and detailed business plan, you will increase your chances of securing the funding you need to grow your business.

Opening a bank is a detailed and complex process, but it can be enormously rewarding both professionally and financially. The best way to increase your chances of success is to write a business plan that outlines all aspects of opening and running a bank. This document should include market analysis, organizational structure, financial projections, and more. Our team has extensive experience helping entrepreneurs open banks. We have created a comprehensive business plan template that covers all the key points you need to consider when writing your own business plan. By following our template, you can be sure that you haven’t missed any essential elements in your planning process. Investing in professional help when writing your business plan gives you the best chance for success when opening a new bank.

Bank Business Plan Template FAQs

Do i need to use a business plan template.

There is no one-size-fits-all answer to this question. If you are seeking funding from a lender or investor, they may have specific requirements for the format and content of your business plan. In other cases, using a template can be helpful in ensuring that you include all of the important information in your plan.

Where can I find a business plan template?

There are a number of resources that offer business plan templates, including the Small Business Administration (SBA) and the U.S. Chamber of Commerce. Additionally, many software programs that offer business planning tools also include templates.

How long should my business plan be?

Again, there is no one-size-fits-all answer to this question. The length of your business plan will depend on the complexity of your business and the amount of detail you need to include. In general, however, most business plans range from 20 to 50 pages.

Do I need to hire a professional to help me write my business plan?

While you are not required to hire a professional to write your business plan, it may be helpful to do so. A professional can help you ensure that your plan is well-written and free of errors. Additionally, they can offer advice on how to best structure your plan and make it more likely to succeed.

- Business Planning

- Venture Funding

Small Business Resources is now the Center for Business Empowerment.

Suggested Keywords

Center for Business Empowerment

How to write an effective business plan in 11 steps (with workbook)

February 02, 2023 | 14 minute read

Writing a business plan is a powerful way to position your small business for success as you set out to meet your goals. Landmark studies suggest that business founders who write one are 16% more likely to build viable businesses than those who don’t and that entrepreneurs focused on high growth are 7% more likely to have written a business plan. 1 Even better, other research shows that owners who complete business plans are twice as likely to grow their business successfully or obtain capital compared with those who don’t. 2

The best time to write a business plan is typically after you have vetted and researched your business idea. (See How to start a business in 15 steps. ) If conditions change later, you can rewrite the plan, much like how your GPS reroutes you if there is traffic ahead. When you update your plan regularly, everyone on your team, including outside stakeholders such as investors, will know where you are headed.

What is a business plan?

Typically 15-20 pages long, a business plan is a document that explains what your business does, what you want to achieve in the business and the strategy you plan to use to get there. It details the opportunities you are going after, what resources you will need to achieve your goals and how you will define success.

Why are business plans important?

Business plans help you think through barriers and discover opportunities you may have recognized subconsciously but have not yet articulated. A business plan can also help you to attract potential lenders, investors and partners by providing them with evidence that your business has all of the ingredients necessary for success.