Trending News

Related Practices & Jurisdictions

- Family Law / Divorce / Custody

- Corporate & Business Organizations

- Litigation / Trial Practice

There has been considerable speculation that one consequence of the Coronavirus will be an increase in the divorce rate resulting from togetherness imposed by the quarantine that pushes marriages already on shaky ground over the brink. Whether divorces will increase in the future due to Covid-19 remains an open question, but what is certain is that a sizable number of future divorces will involve the transfer of a business ownership interest between spouses as part of the divorce. To address this situation, this post focuses on key business issues that arise when one spouse (the “Divesting Spouse”) transfers an ownership interest in a business to the other spouse (the “Recipient Spouse”) as part of a divorce settlement. Addressing these issues will help the Recipient Spouse continue to run the business successfully and also avoid future conflicts with the Divesting Spouse, as well as with future investors and potential buyers of the business.

1. Don’t Rely on Divorce Decree or Settlement Agreement to Document the Transfer of a Business Ownership Interest Between Spouses

A divorce decree and settlement agreement will document the terms of the divorce and the division of property between spouses, but it is not a good idea to rely on the decree or the divorce settlement to memorialize the transfer of a business interest between spouses. There are a number of reasons for the Recipient Spouse to insist on securing a stock transfer agreement (or its equivalent), including the fact that the Recipient Spouse will likely be required to show the transfer document to third parties in the future, including banks or other lenders, new investors, company officers or managers, and potential future buyers. The Recipient Spouse will not want to show the decree or settlement agreement to these third parties, however, because they include private matters unrelated to the business. This will therefore require the Recipient Spouse to prepare a heavily redacted document for review by third parties. It is more efficient to simply require a transfer document to be signed that is limited solely to issues related to the business.

Another reason for the use of a transfer document is that it will include many provisions that are not normally part of a settlement agreement. The decree or settlement agreement will become a very lengthy document if it includes all of the provision that are traditionally set forth in a separate document that covers the transfer of a business interest.

2. Secure a Separate Release of the Divesting Spouse’s Claims Against the Business

After the business is transferred and the divorce becomes final, the Recipient Spouse will not want to defend claims that are brought by the Divesting Spouse against the business. This requires the Recipient Spouse to secure a broad release of claims against the business from the Divesting Spouse. This release of the business is separate from and in addition to the release that the Divesting Spouse provides to the Recipient Spouse, individually.

For example, if the Divesting Spouse was an officer, employee, director or manager of the company, the Divesting Spouse’s release needs to include a release of all employment claims, such as claims for unpaid wages/back pay, vacation time, unpaid expenses, and commissions. The release will also include the Divesting Spouse’s release all claims for wrongful termination, claims related to the distribution of any profits generated by the company and all other business related claims. The release will also confirm that the Divesting Spouse has resigned from all positions with the company and has no further right or authority to take any action for or make any statements on behalf of the company.

3. Confirm Broad Transfer of All Rights by Divesting Spouse

The provisions that confirm the transfer of ownership in the business by the Divesting Spouse need to be broadly described in the transfer agreement to include all rights, title and interest of every kind related in any way to the business. This includes all rights of the Divesting Spouse in any and all intellectual property of the company, such as company names, trademarks, trade secrets and patent rights. This is particularly important if the Divesting Spouse worked in the business, because the Recipient Spouse does not want to be faced with a situation in the future where the Divesting Spouse later claims that he or she developed some software, designs or other intellectual property rights that are not owned by the business, and which are now being used by the Divesting Spouse in direct competition with the company.

4. Consider Requesting Divesting Spouse to Accept Restrictive Covenants

In a normal M&A transaction, a company buyer secures a set of restrictive covenants from the seller as part of the purchase agreement to prevent the seller from competing in any way with the company after the sale takes place. The buyer will require the seller to provide all of the following restrictive covenants that will last for two to five years: (i) a covenant not to compete, restricting any involvement by the Divesting Spouse — whether as an owner, employee, consultant, etc., — in a business that is competitive with the subject business for a reasonable period of time within a reasonable geographic area, (ii) an agreement not to interfere with the business’s relationship with its customers and vendors or to solicit customers, or attempt to persuade the business’s customers and vendors to cease doing business with the company, and (iii) an agreement not to hire or solicit the hiring of any of the employees of the business, or otherwise attempt to persuade any of the employees of the business to cease their employment relationship with the company.

If the Recipient Spouse is concerned that the Divesting Spouse may compete in business against the company after the divorce, the Recipient Spouse may want to request the Divesting Spouse to agree to accept some or all of these restrictions. The Divesting Spouse will not agree to accept these post-divorce restrictions, however, without a corresponding commitment from the Recipient Spouse to provide some amount of additional consideration in the divorce settlement.

5. Request Confidentiality Agreement from Divesting Spouse

Confidentiality agreements are similar to restrictive covenants in that they prevent the person who is subject to the agreement from taking actions that are harmful to the business. The confidentiality agreement is specific, however, in prohibiting the individual officer or employee from using or transferring any of the company’s confidential information or trade secrets. All of the company’s officers and employees are subject to a common law duty not to use or misuse any of the company’s confidential information, but a written confidentiality agreement makes this prohibition clearer on the use of confidential information and trade secrets.

If the Divesting Spouse has not already entered into a confidentiality agreement with the company, the Recipient Spouse will want to request the Divesting Spouse to accept and sign a confidentiality agreement to protect the company’s valuable confidential information and trade secrets. The Recipient Spouse wants to make sure that the company’s confidential information, technology and trade secrets are maintained in strict confidence.

6. Secure “Tail Coverage” of Divesting Spouse From D&O Carrier

If the company has a directors and officers liability insurance policy (a “D&O Policy”) that provides protection for officers and directors from third party claims, these polices will generally remain for one or two years after the company’s officers and directors are no longer affiliated with the company. The Recipient Spouse will therefore want to secure “tail coverage” to provide continuing insurance coverage for claims made against the Divesting Spouse. In this regard, the Recipient Spouse may want to secure a tail policy will extend the D&O coverage over former officers and directors for a total period of five years.

The Recipient Spouse may feel like securing a tail policy that extends coverage for third party claims against the Divesting Spouse is unnecessary because it provides a benefit solely for the Divesting Spouse. In fact, a tail policy provides insurance protection that protects both the Recipient Spouse and the Divesting Spouse, and it is also a benefit to the company. If third party claim is made against the Divesting Spouse after the divorce related to the business, the Divesting Spouse will likely demand that the company indemnify him or her. If the D&O policy is still in place, however, the tail policy will enable the company tender a defense of the claim against the Divesting Spouse, because the D&O carrier will cover all of these legal defense costs. Fortunately, a tail policy that extends D&O coverage is often not too expensive to secure.

7. Specify Treatment of Future Tax Filings

Dealing with all of the tax issues involved in the transfer of the business is an extensive subject that goes beyond the scope of this post, and spouses engaging in the transfer of a business interest are strongly advised to consult with a tax advisor during their divorce. But there is one tax issue that the Recipient Spouse should consider addressing up front. Many businesses held in marriages are structured as pass through entities (i.e., LLC’s partnerships, Sub S corporations), which means that the owners pay the taxes on all profits that are generated by the company. As a result, in the year following the divorce, Recipient Spouse may be required to issue a K-1 to the Divesting Spouse based on the ownership interest held in the business by the Divesting Spouse during the year in which the divorce took place.

If the K-1 issued in the year after the divorce reflects any income that is apportioned to the Divesting Spouse, he or she may expect to receive a cash distribution from the company that is sufficient to cover the Divesting Spouse’s federal tax liability based on this income. If the company does not issue any distribution to the Divesting Spouse, that would create what is known as “phantom income” because the Divesting Spouse has to pay taxes on this income even though no distribution was issued by the Company. The issuance of phantom income to the Divesting Spouse is likely to provoke a heated dispute at that point.

The Recipient Spouse will therefore want to address in the divorce settlement how the future K-1 that will be issued to the Divesting Spouse will address any income generated by the business in the year of the divorce. If the Recipient Spouse is prepared to issue a distribution to the Divesting Spouse, that will take care of the issue. If the Recipient Spouse has no intention of authorizing the company to issue any distributions in the future to the Divesting Spouse, however, this issue will need to be dealt with by the Recipient Spouse in a manner that will not lead to a future legal dispute with the Divesting Spouse.

The transfer of ownership interests in business is common in divorce settlements. But if business issues related to the transfer of this type of interest are not considered at the time of the divorce, the parties may find themselves engaging in continuing disputes they did not anticipate. The Recipient Spouse, in particular, needs to take steps to ensure that the transfer takes place in a manner that allows the business to continue to run successfully, and to head off potential future conflicts with the Divesting Spouse and others after the divorce.

Current Legal Analysis

More from winstead, upcoming legal education events.

Sign Up for e-NewsBulletins

Tax Free Transfers of Stock Options in Divorce: A Look at Section 1041

1. introduction to tax-free transfers of stock options in divorce, 2. understanding section 1041 of the internal revenue code, 3. eligibility criteria for tax-free transfers of stock options, 4. calculating the basis of transferred stock options, 5. reporting requirements for tax-free transfers in divorce, 6. potential tax implications for the receiving spouse, 7. strategies for maximizing tax benefits in stock option transfers, 8. real-life examples of tax-free transfers in divorce, 9. navigating section 1041 for tax-free stock option transfers.

1. tax-Free transfers of Stock Options in Divorce: An Introduction

When it comes to dividing assets in a divorce, stock options can be a complex and often overlooked aspect. However, understanding the tax implications and potential benefits of tax-free transfers of stock options can have a significant impact on the overall financial outcome of a divorce settlement. In this section, we will delve into the introduction of tax-free transfers of stock options in divorce, exploring the various perspectives and providing in-depth information to help you make informed decisions.

2. Taxable vs. Tax-Free Transfers: A Comparison

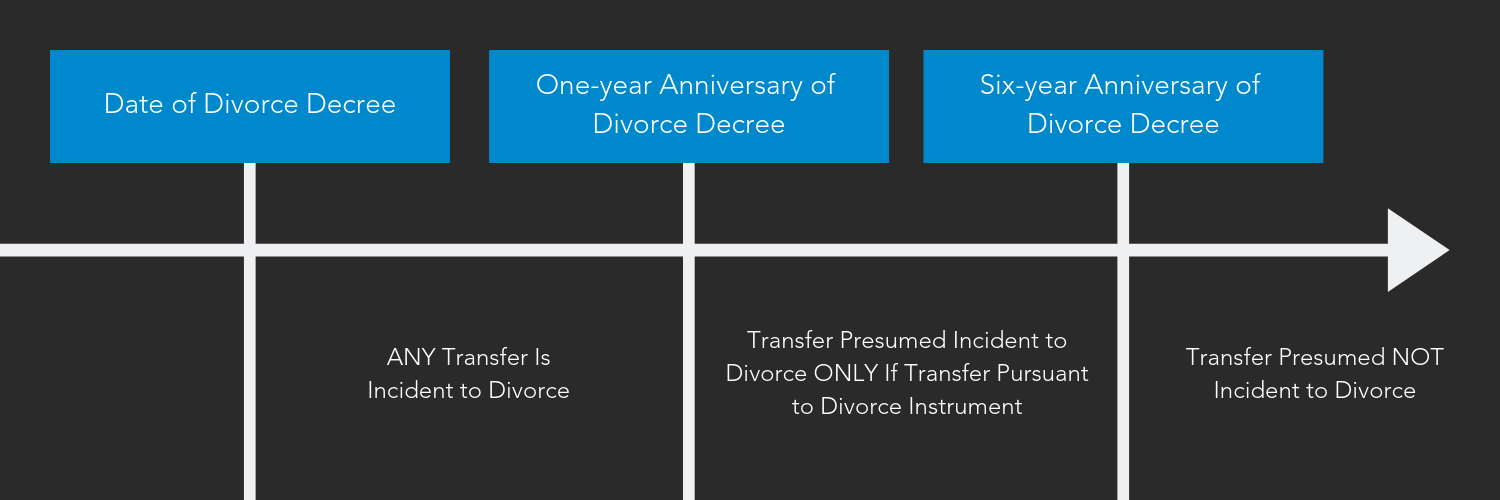

One of the first considerations when dealing with stock options in a divorce is whether the transfer will be taxable or tax-free. In general, transfers of stock options between spouses incident to a divorce are eligible for tax-free treatment under Section 1041 of the internal Revenue code . This means that the recipient spouse will not incur any immediate tax liability upon receiving the stock options.

However, it is important to note that if the stock options are transferred outside of the divorce process, such as in a post-divorce settlement or as part of a property division agreement, they may be subject to taxation. Therefore, it is crucial to carefully navigate the divorce process to ensure tax-free treatment for stock option transfers.

3. qualified Domestic Relations order (QDRO): An Option Worth Considering

In some cases, utilizing a Qualified domestic Relations order (QDRO) can be an advantageous strategy when transferring stock options in a divorce. A QDRO is a court-issued order that allows for the division of certain retirement plans and benefits without incurring immediate tax consequences. While stock options are not technically considered retirement plans, they can often be included within the scope of a QDRO.

By utilizing a QDRO, the transferring spouse can effectively transfer stock options to the recipient spouse without triggering immediate tax liability. This can be particularly beneficial if the stock options have a substantial value or if their exercise could result in a significant tax burden.

4. Timing Considerations: Pre- or Post-Vesting Transfers

Another important aspect to consider when transferring stock options in a divorce is the timing of the transfer. Stock options can be either vested or unvested, and the timing of the transfer can have implications for both parties involved.

If the stock options are unvested at the time of the divorce, it may be advantageous to delay the transfer until they become vested. By doing so, the recipient spouse can potentially benefit from any future appreciation in the value of the stock options. However, if the transferring spouse is concerned about potential tax liability upon exercise, it may be more prudent to transfer the unvested options immediately.

On the other hand, if the stock options are already vested at the time of the divorce, it may be more straightforward to transfer them directly to the recipient spouse. This eliminates the need to consider future vesting schedules and allows for a cleaner division of assets.

5. seeking Professional guidance : The key to Making informed Decisions

Navigating the complexities of tax-free transfers of stock options in divorce requires careful analysis and consideration. It is highly recommended to seek the guidance of a qualified tax professional or divorce attorney who specializes in complex financial matters. Their expertise can help you understand the specific tax implications, evaluate the best options for your unique circumstances, and ensure compliance with all applicable laws and regulations.

Understanding the intricacies of tax-free transfers of stock options in divorce is essential for maximizing the financial outcomes of a divorce settlement. By comparing taxable and tax-free transfers, exploring options such as QDROs, considering timing considerations, and seeking professional guidance, you can make informed decisions that protect your financial interests and minimize potential tax liabilities.

Introduction to Tax Free Transfers of Stock Options in Divorce - Tax Free Transfers of Stock Options in Divorce: A Look at Section 1041

Section 1041 of the Internal Revenue Code plays a crucial role in tax-free transfers of stock options in divorce cases. It provides a unique opportunity for divorcing couples to transfer their stock options without triggering any tax consequences. Understanding the intricacies of this section is essential for both parties involved in a divorce settlement, as it can significantly impact their financial situation. Let's delve into Section 1041 and explore its implications from different perspectives.

From the perspective of the spouse receiving the stock options, Section 1041 offers a substantial advantage. It allows them to acquire the stock options without any immediate tax liability. This means that they can defer the tax payment until they exercise the options or sell the underlying stock . By deferring the tax liability, the receiving spouse can potentially minimize their overall tax burden and have more control over their financial planning.

On the other hand, from the perspective of the spouse transferring the stock options, Section 1041 may seem less favorable. The transferor spouse is generally unable to claim any tax deductions or losses on the transfer of stock options. Additionally, they may face potential tax consequences if the receiving spouse exercises the options and sells the stock at a higher value. Therefore, it is crucial for the transferring spouse to carefully evaluate the potential tax implications before deciding to transfer the stock options.

To provide a comprehensive understanding of Section 1041, let's explore some key points through a numbered list:

1. Tax-free transfers: Section 1041 allows stock options to be transferred between spouses without triggering immediate tax consequences. This means that the transfer does not result in any taxable income for either party at the time of the transfer.

2. Carryover basis: The receiving spouse assumes the same basis in the stock options as the transferring spouse. This means that the receiving spouse's basis will be the same as the transferring spouse's basis, which is typically the fair market value of the options at the time of the transfer.

3. Holding period: The receiving spouse's holding period for the stock options includes the transferring spouse's holding period. This is important for determining whether the stock options qualify for long-term capital gains treatment upon exercise and sale.

4. Exercise and sale: When the receiving spouse exercises the stock options and sells the underlying stock, they will be responsible for any resulting tax liability. The tax liability will depend on the difference between the exercise price and the fair market value of the stock at the time of exercise.

5. Alternative options: While section 1041 provides tax-free transfers , it's important to consider alternative options. For example, the transferring spouse could sell the stock options before the divorce is finalized, potentially resulting in a lower tax liability . Alternatively, the couple could agree to divide other assets in a way that offsets the value of the stock options, eliminating the need for a transfer.

6. seeking professional advice : Given the complexities involved in tax-free transfers of stock options, it is highly recommended for both parties to seek professional tax advice. A tax professional can help evaluate the tax implications of various options and determine the most advantageous approach based on the couple's specific circumstances.

Understanding Section 1041 is crucial for divorcing couples navigating the division of stock options. By considering the implications from different perspectives and exploring alternative options , both parties can make informed decisions that minimize their tax liabilities and optimize their financial outcomes.

Understanding Section 1041 of the Internal Revenue Code - Tax Free Transfers of Stock Options in Divorce: A Look at Section 1041

Section 2: Eligibility Criteria for Tax-Free Transfers of Stock Options

When it comes to dividing assets in a divorce, stock options can often present a complex challenge. However, Section 1041 of the Internal Revenue Code offers a potential solution by allowing tax-free transfers of stock options between spouses in a divorce. This provision can be highly beneficial for both parties involved, as it enables them to divide the assets without incurring immediate tax consequences. However, it is important to understand the eligibility criteria for tax-free transfers of stock options to ensure compliance with the IRS regulations .

1. Marital Settlement Agreement: In order to qualify for tax-free transfers of stock options, the transfer must be made pursuant to a divorce or separation instrument, such as a marital settlement agreement or court order. This agreement should clearly outline the terms of the transfer and specify that it is incident to the divorce.

2. Transfer during Divorce or within One Year: The transfer of stock options must occur either during the divorce or within one year after the marriage ends. It is crucial to complete the transfer within this timeframe to meet the eligibility criteria for tax-free treatment. Any transfers made outside of this window may result in taxable events for both parties.

3. No Additional Consideration: To qualify as a tax-free transfer, the stock options must be transferred without the receipt of any additional consideration. This means that no money or property should be exchanged for the stock options. If any additional consideration is involved, it may trigger taxable consequences.

4. Continuation of Same Terms and Conditions: The transferred stock options must retain the same terms and conditions as originally granted. This includes factors such as exercise price, vesting schedule, and expiration date. Any alteration to these terms could jeopardize the tax-free treatment of the transfer.

5. Reporting Requirements: Although the transfer itself may be tax-free, it is important to note that there are reporting requirements associated with the transfer of stock options in divorce. Both parties must report the transfer on their individual tax returns and provide the necessary documentation to the IRS. Failure to comply with reporting requirements can lead to potential penalties or audits.

To illustrate the eligibility criteria for tax-free transfers of stock options, let's consider an example. Sarah and John are going through a divorce, and as part of their marital settlement agreement, they decide to divide their stock options. Sarah transfers her stock options to John within a year of their divorce, without receiving any additional consideration. The transferred stock options retain the same terms and conditions as originally granted. Both Sarah and John report the transfer on their tax returns and provide the required documentation to the IRS.

In comparing different options for dividing stock options in a divorce, the tax-free transfer option provided by Section 1041 is often the most advantageous. It allows for a seamless division of assets without triggering immediate tax consequences. Other options, such as cash buyouts or dividing the options themselves, may result in taxable events for one or both parties. However, it is essential to consult with a tax professional or financial advisor to determine the best approach based on individual circumstances.

understanding the eligibility criteria for tax-free transfers of stock options is essential when navigating the division of assets in a divorce. By adhering to the requirements outlined in Section 1041, individuals can ensure a smooth transfer process while avoiding unnecessary tax liabilities . It is crucial to carefully consider the options available and seek professional guidance to make informed decisions that align with one's financial goals .

Eligibility Criteria for Tax Free Transfers of Stock Options - Tax Free Transfers of Stock Options in Divorce: A Look at Section 1041

Calculating the Basis of Transferred Stock Options

When it comes to tax-free transfers of stock options in divorce, understanding how to calculate the basis of transferred stock options is essential. This calculation determines the tax consequences for both parties involved and can greatly impact the overall financial outcome of the divorce settlement. In this section, we will delve into the intricacies of calculating the basis of transferred stock options, exploring different perspectives and providing in-depth information to help navigate this complex process.

1. Understand the concept of basis:

The basis of an asset represents its value for tax purposes. In the context of stock options, the basis refers to the cost or value of the options at the time of transfer. It is crucial to determine the correct basis to accurately calculate any potential capital gains or losses upon subsequent exercise or sale of the options.

2. Consider the different methods for calculating basis:

There are several methods available for calculating the basis of transferred stock options. These methods include:

A. Carryover basis: Under this method, the recipient spouse assumes the same basis as the transferor spouse. The transferred stock options retain their original basis, ensuring no immediate tax consequences upon transfer. However, this method may result in a higher tax liability when the options are eventually exercised or sold.

B. Fair market value (FMV) basis: With this method, the recipient spouse establishes a new basis for the transferred stock options based on their fair market value at the time of transfer. This approach allows for a potential step-up in basis, potentially reducing tax liabilities in the future. However, accurately determining the FMV of stock options can be challenging, and disagreements between the parties may arise.

3. Seek professional valuation assistance:

Given the complexities involved in determining the FMV of transferred stock options, it is advisable to seek professional valuation assistance. Engaging a qualified appraiser or financial expert can help ensure an accurate assessment of the options' value, minimizing the risk of disputes and potential tax complications down the line.

4. Evaluate the tax implications:

It's important to consider the tax implications of each basis calculation method. While carryover basis may provide immediate tax relief, it could result in higher taxes upon exercise or sale of the options. On the other hand, establishing a new basis through FMV may lead to potential tax savings in the future but requires careful valuation and assessment. Evaluating the overall tax consequences, including potential capital gains or losses , can help determine the best approach for calculating the basis of transferred stock options.

5. Consider the specific circumstances:

The best option for calculating the basis of transferred stock options may vary depending on the specific circumstances of the divorce. Factors such as the financial situation of both parties, the nature of the stock options, and the potential future exercise or sale of the options should be taken into account. Consulting with a tax professional or financial advisor who specializes in divorce matters can provide valuable insights tailored to individual circumstances.

Calculating the basis of transferred stock options is a critical aspect of tax-free transfers in divorce . Understanding the different methods available, seeking professional assistance, evaluating the tax implications, and considering the specific circumstances are all crucial steps to ensure an accurate and favorable outcome. By navigating this complex process effectively, divorcing parties can minimize potential tax liabilities and maximize their financial well-being.

Calculating the Basis of Transferred Stock Options - Tax Free Transfers of Stock Options in Divorce: A Look at Section 1041

Reporting Requirements for Tax-Free Transfers in Divorce

When it comes to dividing assets in a divorce, tax implications are an important consideration. In the context of stock options, Section 1041 of the Internal Revenue Code allows for tax-free transfers between spouses as part of a divorce settlement. However, it is crucial to understand the reporting requirements associated with such transfers to ensure compliance with the tax laws . In this section, we will delve into the reporting requirements for tax-free transfers in divorce, providing insights from different perspectives and offering in-depth information on the topic.

1. Form 1099-B: One of the key reporting requirements for tax-free transfers of stock options in divorce is the issuance of Form 1099-B. This form is used to report the sale or exchange of securities, including stock options. When a spouse transfers stock options to the other spouse as part of a divorce settlement, the transferring spouse is generally responsible for reporting the transaction on Form 1099-B. This form must be furnished to both the internal Revenue service (IRS) and the recipient spouse.

2. Valuation of Stock Options: Another crucial aspect of reporting tax-free transfers in divorce is determining the fair market value (FMV) of the stock options being transferred. The FMV is necessary for accurate reporting on Form 1099-B. There are different methods for valuing stock options, such as the black-Scholes model or professional appraisals. It is essential to consult with a financial expert or tax professional to determine the most appropriate valuation method for your specific situation.

3. Reporting Basis: The basis of the transferred stock options also plays a significant role in reporting requirements. The basis is the original cost of the options, which is used to calculate the gain or loss upon their subsequent sale. In the case of tax-free transfers in divorce, the recipient spouse assumes the basis of the transferring spouse. This means that when the recipient spouse eventually sells the stock options, they will use the transferring spouse's basis to determine their taxable gain or loss.

4. reporting Capital gains : If the recipient spouse sells the stock options received in the divorce settlement, they may have a taxable capital gain or loss . It is crucial to report such transactions accurately on Schedule D of Form 1040, which is used to report capital gains and losses . The recipient spouse should consult with a tax professional to ensure proper reporting and to explore any available deductions or strategies to minimize the tax impact .

5. Alternative Reporting Options: While Form 1099-B is the standard reporting method for tax-free transfers of stock options in divorce, there are alternative options available. For instance, some divorcing couples may choose to report the transfer on Form 8275, Disclosure Statement, to disclose any positions that may be contrary to the tax rules. This approach provides an extra layer of transparency to the IRS, potentially reducing the risk of an audit or further scrutiny.

understanding the reporting requirements for tax-free transfers in divorce is essential to ensure compliance with the tax laws and avoid potential penalties or audits. By following the guidelines outlined above and consulting with professionals, divorcing couples can navigate the complexities of reporting stock option transfers accurately. Ultimately, the best reporting option will depend on individual circumstances, and seeking expert advice is crucial to make informed decisions and optimize tax outcomes.

Reporting Requirements for Tax Free Transfers in Divorce - Tax Free Transfers of Stock Options in Divorce: A Look at Section 1041

Potential Tax Implications for the Receiving Spouse

When it comes to the division of assets in a divorce, stock options can become a complex matter. In our previous blog post, we explored the tax-free transfers of stock options under section 1041 of the Internal Revenue Code. While this provision allows for tax-free transfers between spouses during divorce, it is important to consider the potential tax implications for the receiving spouse. In this section, we will delve into the various tax considerations that the receiving spouse should keep in mind.

1. Basis Adjustment: One significant tax implication for the receiving spouse is the basis adjustment of the transferred stock options. In a tax-free transfer, the receiving spouse assumes the same basis as the transferring spouse. This means that if the transferring spouse had a low basis in the stock options, the receiving spouse will also have a low basis. Consequently, if the receiving spouse later sells the stock options, they may face a higher capital gains tax liability .

2. Alternative Minimum Tax (AMT): Another crucial consideration is the potential impact of the Alternative Minimum tax (AMT) on the receiving spouse. The AMT is a separate tax system that limits certain deductions and exemptions, potentially resulting in a higher tax liability. In the case of stock options, exercising them may trigger an AMT liability for the receiving spouse. It is essential for the receiving spouse to understand the potential AMT consequences and plan accordingly.

3. Timing of Exercise: The timing of exercising stock options can also affect the tax implications for the receiving spouse. If the receiving spouse chooses to exercise the stock options immediately after the transfer, they may face a higher tax liability due to ordinary income tax rates. On the other hand, if the receiving spouse waits to exercise the stock options and sells them as long-term capital assets, they may benefit from lower capital gains tax rates . The decision of when to exercise the options should be carefully evaluated based on the current tax laws and the receiving spouse's financial situation.

4. Holding Period: The duration for which the receiving spouse holds the stock options before selling them can have a significant impact on the tax consequences. If the receiving spouse holds the options for at least one year after exercise and two years after the grant date, any resulting gain will be considered long-term capital gain . This can result in a lower tax rate compared to short-term capital gains , which are taxed at ordinary income rates. The receiving spouse should consider the potential tax savings associated with holding the stock options for a longer period before selling.

5. Consideration of Other Assets: When evaluating the tax implications of receiving stock options in a divorce, it is crucial to consider the overall division of assets. The receiving spouse should assess the tax consequences of the stock options in conjunction with other assets received in the divorce settlement. For example, if the receiving spouse also receives significant retirement assets, the tax implications of the stock options may be offset by the potential tax advantages of the retirement accounts. A comprehensive analysis of all assets is essential to make an informed decision.

While tax-free transfers of stock options under Section 1041 can provide a valuable option for divorcing couples, it is vital for the receiving spouse to carefully consider the potential tax implications. Understanding the basis adjustment, AMT implications, timing of exercise, holding period, and overall asset division can help the receiving spouse make informed decisions to minimize their tax liability . Seeking the guidance of a qualified tax professional or financial advisor is highly recommended to navigate the complexities of tax considerations in divorce.

Potential Tax Implications for the Receiving Spouse - Tax Free Transfers of Stock Options in Divorce: A Look at Section 1041

1. Understanding the Different Types of Stock Options:

When it comes to maximizing tax benefits in stock option transfers, it is crucial to have a solid understanding of the different types of stock options. Broadly speaking, there are two main types: non-qualified stock options (NSOs) and incentive stock options (ISOs). NSOs are typically granted to employees and can be exercised at any time, whereas ISOs are granted to key employees and have specific tax advantages. It is essential to differentiate between these options as the tax implications can vary significantly.

2. Timing is Key: Exercising Options at the Right Time:

Timing plays a crucial role in maximizing tax benefits in stock option transfers. It is important to consider the tax implications of exercising options at different times. For NSOs, exercising them at the earliest opportunity may be beneficial, as it starts the clock for long-term capital gains treatment. On the other hand, ISOs have specific holding period requirements to qualify for favorable tax treatment. Understanding these timing considerations can help individuals strategize when to exercise their options for maximum tax benefits.

3. Utilizing the 1041 Election:

Section 1041 of the Internal Revenue Code provides an opportunity for tax-free transfers of stock options in divorce. By making a 1041 election, divorcing spouses can transfer stock options between themselves without triggering any immediate tax consequences. This can be an advantageous strategy, as it allows for the division of assets without incurring unnecessary taxes. However, it is important to note that the transferor's basis in the stock options carries over to the transferee, potentially affecting future tax implications.

4. Evaluating the Option to Exercise Prior to Transfer:

Another strategy to consider is exercising stock options prior to the transfer in a divorce. By doing so, the transferor can potentially reduce the future tax burden for both parties. This approach allows the transferor to take advantage of any built-in gains and reset the cost basis for the transferee. However, it is crucial to carefully evaluate the financial implications of exercising options, considering factors such as exercise price, market conditions, and potential alternative investment opportunities .

5. Weighing the Benefits of Stock Option Buyouts:

In some cases, a buyout of stock options may be the most favorable option for both parties. A buyout involves one spouse compensating the other for their share of the stock options, effectively transferring ownership. This strategy allows for a clean break and avoids potential future complications. However, it is important to carefully assess the financial implications of a buyout, including any immediate tax consequences and the potential for future growth in the value of the options.

6. Seeking Professional Advice:

Navigating the complexities of tax benefits in stock option transfers can be challenging, especially during a divorce. Seeking professional advice from a tax expert or financial planner is highly recommended. They can provide personalized guidance based on your specific situation, helping you make informed decisions that maximize tax benefits while considering your long-term financial goals .

Maximizing tax benefits in stock option transfers requires careful consideration of the different types of stock options, timing considerations, the utilization of Section 1041, evaluating the option to exercise prior to transfer, weighing the benefits of stock option buyouts, and seeking professional advice. By strategizing effectively, individuals can minimize tax liabilities and ensure a smooth transition of stock options during a divorce.

Strategies for Maximizing Tax Benefits in Stock Option Transfers - Tax Free Transfers of Stock Options in Divorce: A Look at Section 1041

1. Tax-Free Transfer of Stock Options: A real-Life Case study

In this section, we will explore a real-life case study that exemplifies the tax-free transfer of stock options in a divorce. By delving into the intricacies of this scenario, we can gain valuable insights and understand the various perspectives involved.

Imagine a couple, Sarah and John, who are undergoing a divorce. Sarah holds stock options in a company where she works, and they have appreciated significantly over the years. As they navigate the division of assets, Sarah and John are faced with the challenge of determining how to handle these stock options in a tax-efficient manner.

1.1 Sarah's Perspective

From Sarah's point of view, she wants to ensure that she can transfer her stock options to John without triggering any tax consequences. She is aware that under Section 1041 of the Internal Revenue Code, transfers of property between spouses incident to divorce are generally tax-free. However, she also knows that stock options have unique characteristics that require careful consideration.

1.2 John's Perspective

John, on the other hand, is concerned about the potential tax implications of receiving Sarah's stock options. He wants to explore the most advantageous options available to him, both in terms of immediate tax consequences and future financial gains. John is particularly interested in understanding the tax basis of the stock options and the potential impact on capital gains taxes upon exercise or sale.

1.3 Evaluating the Options

To address their concerns, Sarah and John consult with their respective tax advisors and family law attorneys. After careful analysis, they consider the following options:

1.3.1 Option 1: Direct Transfer of Stock Options

One option is for Sarah to transfer her stock options directly to John. This transfer would be made incident to the divorce, thereby qualifying for tax-free treatment under Section 1041. However, it is important to note that the tax basis of the stock options would carry over to John. This means that any future gains upon exercise or sale of the options would be subject to capital gains taxes .

1.3.2 Option 2: Cash Equalization

Another possibility is for Sarah to retain the stock options and compensate John with other assets of equal value, such as cash or property. By doing so, Sarah can maintain control over the stock options and potentially benefit from any future appreciation without triggering immediate tax consequences for either party.

1.3.3 Option 3: Deferred Distribution

Alternatively, Sarah and John could agree to defer the division of the stock options until a later date, such as when they are exercised or sold. This approach allows them to delay the tax consequences and potentially take advantage of more favorable tax rates in the future. However, it is essential to establish clear guidelines and mechanisms for the eventual division of the proceeds.

1.4 The Best Option

Ultimately, the best option for Sarah and John depends on their unique circumstances, financial goals, and risk tolerance. It is crucial for them to carefully evaluate the tax implications, future potential gains, and their individual preferences before making a decision.

By examining this real-life case study, we gain valuable insights into the complexities and considerations involved in tax-free transfers of stock options in divorce. Each option presents its advantages and potential drawbacks, emphasizing the importance of seeking professional advice and taking a comprehensive approach to asset division.

Navigating Section 1041 for Tax-Free Stock Option Transfers

When it comes to the division of assets in a divorce, stock options can present a unique challenge. These financial instruments, often granted by employers as a form of compensation, can hold significant value. However, the tax implications of transferring stock options can complicate matters even further. In this section, we will explore Section 1041 of the Internal Revenue Code, which provides guidelines for tax-free transfers of stock options in divorce cases.

1. Understanding Section 1041: Section 1041 allows for the tax-free transfer of property between spouses or former spouses incident to a divorce. This means that the transfer of stock options from one spouse to another in a divorce settlement may be exempt from capital gains tax. However, it is important to note that this tax advantage only applies to transfers that occur as part of the divorce settlement and within one year of the divorce. Any subsequent transfers may be subject to capital gains tax.

2. Requirements for Tax-Free Transfers: To qualify for tax-free treatment under Section 1041, certain requirements must be met. Firstly, the transfer must be made between spouses or former spouses as a result of a divorce or separation agreement. Secondly, the transfer must be incident to the divorce, meaning it is related to the ending of the marriage. Lastly, the transfer must occur within one year of the divorce. It is crucial to meet these requirements to ensure the tax-free status of the stock option transfer.

3. Valuing Stock Options: Determining the value of stock options is a crucial step in the division of assets during a divorce. The value of stock options can fluctuate greatly, depending on various factors such as the current market price, the strike price, and the expiration date. It is advisable to consult with a financial expert or a valuation specialist to accurately assess the value of stock options. This will help ensure a fair and equitable distribution of assets between spouses.

4. Different Approaches to Stock Option Transfers: There are several approaches to consider when transferring stock options in a divorce settlement. One option is for the recipient spouse to assume the stock options entirely. This means that they will take over the rights and obligations associated with the options. Another approach is to divide the options between both spouses, allowing each party to retain a portion of the options. Alternatively, the options can be sold, and the proceeds divided between the spouses. The best approach will depend on the specific circumstances of the divorce and the financial goals of each party involved.

5. Tax Considerations: While Section 1041 allows for tax-free transfers of stock options, it is essential to consider other tax implications that may arise. For example, if the stock options are exercised after the transfer, any resulting capital gains or losses will be attributed to the recipient spouse. Additionally, if the transferred options are subject to restrictions or vesting requirements, the recipient spouse may be subject to ordinary income tax upon their eventual exercise. It is crucial to consult with a tax professional to fully understand the potential tax consequences of stock option transfers.

Navigating Section 1041 for tax-free stock option transfers in divorce cases requires careful consideration of the requirements, valuation, and various approaches available. By understanding the implications and seeking professional guidance, couples can effectively divide stock options while minimizing tax consequences . Each case is unique, and the best option will depend on the specific circumstances and goals of the parties involved.

Navigating Section 1041 for Tax Free Stock Option Transfers - Tax Free Transfers of Stock Options in Divorce: A Look at Section 1041

Read Other Blogs

Here is a possible segment that meets your requirements: The hospitality and tourism industry is...

Algorithmic Trading: The Rise of Algorithmic Trading with Dealer Options In the fast-paced world of...

1. Understanding the Composite Adoption Rate In the ever-evolving landscape of technology, keeping...

In the realm of digital marketing, the pathway that potential customers traverse from awareness to...

In the pursuit of maximizing return on investment, businesses must navigate the complex landscape...

Software work is a crucial aspect of modern technology and plays a significant role in various...

One of the most effective ways to grow your startup is by leveraging the power of referrals....

In the healthcare industry, patient follow-up is a crucial process that ensures the continuity of...

Skincare products are more than just cosmetics. They are the result of scientific research,...

Dividing Stocks in a Divorce Protect Your Investments

Last updated: may 11, 2023 • 10 min read.

Disclosure: This page may contain affiliate links and we may receive a commission through them, but this is at no additional cost to you. For more information, please read our privacy policy.

Divorce can be an emotionally challenging and financially complex process. One of the critical aspects is dividing assets, such as stocks. Understanding how to split stocks in a divorce can be a daunting task, but with the right guidance, you can make informed decisions. In this article, we'll explore the steps you need to take to ensure a fair and equitable distribution of your stock holdings during a divorce.

Determining Marital Assets

Before diving into the process of dividing stocks, it is essential to have a clear understanding of the assets that will be subject to division in a divorce. Identifying and classifying marital assets can be a complex task, as it involves determining which assets were acquired during the marriage and which ones are considered separate property. This step is crucial, as it sets the foundation for an equitable division of stocks and other assets, ensuring both parties receive their fair share.

Separate property includes assets acquired before marriage or as gifts or inheritance during the marriage. Marital property, on the other hand, refers to assets acquired during the marriage. In most cases, only marital property is subject to division in a divorce.

Community Property State vs. Equitable Division States

The division of assets is determined by the state laws where you reside. In a community property state such as California, spouses have equal ownership of marital assets, requiring a 50-50 split. In equitable division states, assets are divided based on what is fair and equitable, which may not always be equal.

Dividing Stock Holdings

When it comes to dividing stock holdings, the goal should be to achieve a fair and equitable distribution that reflects each spouse's contribution to the marriage and considers their future financial needs. This process may require careful negotiation, compromise, and an in-depth understanding of the intricacies of the stock market. By approaching the division of stock holdings with a clear objective and a willingness to work together, both parties can pave the way for a smooth asset division and a more amicable divorce process.

1. Determine the Value of the Stocks

To divide your stocks, first establish the current value and monetary value of your stock holdings. Consider the stock market fluctuations and past performance of the shares. Consulting a financial advisor or forensic accountant with years of experience can help you determine an accurate valuation.

2. Assess Tax Implications

Dividing stocks can have tax consequences. Consider the capital gains taxes that may arise when selling or transferring stocks. A financial professional can guide you through the potential tax implications and help you make the best decision.

3. Evaluate Vesting Schedules and Unvested Stocks

Unvested stocks or stock options are those that have not yet met the vesting schedule set by the employer. These may be divided differently from vested stocks. Check with a legal professional to determine the best way to address these in your divorce agreement.

Retirement Accounts and Stock Units

Dividing retirement accounts like 401(k)s, IRAs, or pension plans can be complicated. You may need a Qualified Domestic Relations Order (QDRO), a court order that grants a non-employee spouse the right to a portion of the employee's retirement benefits.

Stock Units in Retirement Plans

Employee stock units or employee stock options within retirement plans should be considered when dividing assets. The division of these types of assets should also be addressed in the divorce settlement.

Working with Professionals

It's essential to seek legal advice when dividing stocks in a divorce. A family law attorney with extensive experience in handling high-asset divorces can help you navigate the complicated process and ensure your best interests are represented. They can offer invaluable insights into state-specific laws, regulations, and precedents that may affect the division of your stocks. Furthermore, they can assist in negotiating settlements, drafting agreements, and representing your interests in court, if necessary.

Financial Expertise

In addition to legal counsel, enlisting the help of a financial expert or financial institution is crucial in successfully managing the division of stocks in a divorce. These professionals can provide guidance on valuing and dividing stocks, considering factors such as market conditions, company performance, and future growth potential. Their expertise can help ensure a fair and accurate valuation of your stock assets.

Moreover, financial experts can assist you in understanding and managing the tax implications of dividing stocks. They can help you devise strategies to minimize potential tax liabilities and ensure compliance with relevant tax laws and regulations.

Considerations and Strategies

One spouse may choose to buy out the other's share of the stocks by providing cash value or other assets of equal value. This can be a suitable option if both parties agree and there is enough liquidity to facilitate the buyout.

Another strategy is to offset the value of the stocks with other marital assets like real estate, investment accounts, or bank accounts. This allows each spouse to retain assets of similar value without the need to sell or transfer shares.

Co-Ownership

In some cases, spouses may choose to maintain co-ownership of the stocks, particularly if they believe in the future performance of the company. This approach may require continued cooperation between the former spouses, but it can potentially lead to greater financial gain.

Selling Stocks and Dividing Proceeds

If both parties agree, selling the stocks and dividing the proceeds can be an option. This approach simplifies the division process but may trigger capital gains taxes and depends on the stock's fair market value at the time of sale.

Special Considerations

Dividing unvested RSUs (restricted stock units) and stock options can be complex, as they are typically tied to future work or performance. The Hug formula or time rule is often used to determine the division of these assets, factoring in the grant date, vesting schedule, and date of separation. Consult a family law attorney or financial professional to address these unique assets.

Child Support and Spousal Support

The division of stocks may impact child support and spousal support obligations. It's essential to consider these factors when determining the best way to divide assets, ensuring a fair outcome for all parties involved.

Tips for Navigating Stock Division in a Divorce

- Keeping emotions in check. Divorce is an emotionally taxing experience, and it's essential to separate emotions from financial decisions. Focus on making rational choices that protect your financial future and prioritize your best interests.

- Updating beneficiary designations. After dividing stocks in a divorce, don't forget to update beneficiary designations on your investment and retirement accounts. This ensures that your assets will be distributed according to your wishes in the event of your death.

- Rebuilding your financial future. Once your divorce is finalized and your stocks have been divided, it's essential to focus on rebuilding your financial future. Create a new budget, adjust your financial goals, and seek professional advice to help you get back on track.

- Record-keeping and documentation. Maintaining thorough records and documentation throughout the divorce process is crucial. Keep track of all stock transactions, account statements, and valuations to ensure a transparent and fair division of assets. Proper record-keeping can also help you avoid potential disputes or complications in the future.

- Seeking a free consultation. Many family law attorneys and financial professionals offer free consultations to discuss your unique situation. Take advantage of these opportunities to gain valuable insight and understand your options when it comes to dividing stocks in a divorce.

When dividing stock options, it's important to consider the past work and future work associated with the options. Stock options granted as a reward for past services during the marriage might be considered marital property, while those granted for future performance may be treated differently. A legal professional can help you determine how these factors impact the division of stock options.

Impact of Divorce on Stock Portfolio

The division of stocks in a divorce can significantly impact your investment strategy and risk tolerance. As your financial situation changes following the separation, it becomes essential to reevaluate your stock portfolio and align it with your new financial goals and circumstances.

Post-divorce, you may need to shift your investment focus and adjust your strategies to ensure they align with your updated financial objectives. This might involve diversifying your portfolio to minimize risks, adjusting your stock holdings to optimize returns, or considering new investment opportunities that were previously overlooked.

As your financial stability and future income potential may be affected by the divorce, it's important to reevaluate your risk tolerance. Consider how much risk you are willing to take with your investments and adjust your stock portfolio accordingly. For example, you might choose to invest more conservatively or take on additional risk, depending on your new financial situation and goals.

Following the division of stocks, it's crucial to rebalance your portfolio to ensure it maintains a well-diversified and risk-appropriate composition. Rebalancing involves selling or buying stocks to achieve your desired asset allocation, which can help minimize risk and maximize returns.

Prenuptial and Postnuptial Agreements

A prenuptial agreement established before the marriage or a postnuptial agreement created during the marriage can be a valuable tool in addressing the division of stocks in a divorce. These legally binding agreements can outline how stocks and other assets will be divided, simplifying the process and reducing potential conflicts. If you have a prenuptial or postnuptial agreement in place, consult with a family law attorney to understand its implications for your stock division.

Divorce Mediation

Divorce mediation can be a cost-effective and less adversarial approach to dividing stocks and other assets. In mediation, a neutral third-party mediator facilitates negotiations between spouses, helping them reach a mutually agreeable settlement. This process can lead to a more amicable resolution, allowing both parties to maintain control over the division of their assets, including stocks.

Liquidation vs. Transfer of Stocks

When dividing stocks, you may have the option to either liquidate or transfer the stocks to your former spouse. Liquidation involves selling the stocks and dividing the proceeds, while a transfer maintains the stock ownership but changes the name on the account. Each option has its pros and cons, and you should consult with a financial professional to determine the best choice for your situation.

Post-Divorce Financial Planning

After your divorce is finalized, it's important to revisit your financial plan and make adjustments based on your new circumstances. This may include revising your budget, updating your estate plan, and reevaluating your investment strategy. Working with a financial advisor can help you develop a comprehensive plan to achieve your financial goals post-divorce.

By considering these additional points, you can further ensure a smooth and fair division of stocks during your divorce, while also preparing yourself for a strong financial future.

The process of dividing stocks in a divorce is multifaceted and requires careful consideration of various factors. By exploring different approaches, seeking professional guidance, and staying informed about the potential implications of your decisions, you can work towards a fair and equitable division of stocks that sets you up for financial success in your post-divorce life.

Join the Newsletter

Subscribe to get our latest content by email.

Restricted Stock Units (RSUs) and Divorce: What You Need to Know

Jason Crowley, CFA, CFP, CDFA

In this guide, I’m going to walk you through how to handle Restricted Stock Units (RSUs) in a divorce.

So if you or your spouse has RSUs, you’ll find the answers to your questions here.

Let’s get started.

- How RSUs work

- RSUs and taxes

An example of how RSUs work

Understanding the basics of rsus in a divorce.

- How to calculate the marital (community) portion of RSUs

- Looking at a few different RSU divorce scenarios

- How to value or divide RSUs in divorce

- How RSUs impact alimony and child support

How Restricted Stock Units (RSUs) work

Before we get too far into the details of how to divide RSUs in a divorce, let’s cover the basics.

Restricted Stock Units (RSUs) are a type of stock-based compensation used to attract and retain employees. Like stock options and phantom stock, RSUs are one of many ways that your employer can provide you with an opportunity to share in the success of the company.

They became more popular as an alternative to stock options after accounting scandals involving companies like Enron and WorldCom.

Until that time, stock options were the vehicle of choice. But after a Financial Accounting Standards Board ruling in 2004 which changed the corporate accounting rules for stock options, companies began shifting away from stock options in favor of RSUs.

Like stock options, RSUs provide an incentive to remain with the company (until the shares vest) and help it perform well so that the stock price increases in value.

So, what are RSUs exactly?

RSUs are a promise to issue shares of employer stock once certain conditions have been met.

The shares are “restricted” because they are subject to a vesting schedule based on length of employment or performance goals. The shares may also be subject to further restrictions such as limitations on the ability to sell or transfer shares. These other restrictions are more common in private companies.

RSUs are similar to stock options in that you can receive shares of company stock, but there are some important differences to note as well. For example, if the stock price declines significantly, a stock option can lose all practical value as the options become “underwater” and the exercise price is higher than the stock price. This effectively eliminates any incentive to remain with the company since your stock options are now worthless.

That is not the case with RSUs. Even if the share price falls after you are granted shares, the RSUs always have some value (unless the stock price falls to $0).

The catch is that you must remain employed at your company until vesting for the RSUs to have any value to you. If you leave the company, any unvested RSUs are usually forfeited.

Exceptions may take place in certain situations. For instance, vesting may be allowed to continue or is accelerated due to specific agreements or life changes built into the RSU agreement (e.g., death, disability, or retirement, depending on the plan and grant agreement).

RSUs and Taxes

With RSUs, you are taxed when the shares vest (not when they’re granted). Your taxable income is based on the value of the shares at vesting.

Example: 100 shares vest at $10/share. Your taxable income is $1,000.

This compensation income is subject to federal taxes, state taxes, and payroll taxes ( Social Security , Medicare). Like other W-2 income, the company is required to withhold taxes.

An employer may offer several ways to pay taxes at vesting, or it may use a single mandatory method. The most common practice is withholding some of the vested shares to cover the withholding taxes.

The stock price at vest becomes your cost basis and the vest date is the start of your holding period (if you don’t sell the shares immediately). If you hold the shares for more than one year after vest, any increase in stock price from the value at vest to the sale price is taxable as long-term capital gains. If you hold for less than one year, it’s taxable as short-term capital gains.

Let’s look at an example of how all this works.

You are granted 10,000 RSUs (shares of company stock) that vest at a rate of 25% a year. The market price at the time the shares are granted is $20.

- At Grant: The total pre-tax value of the RSUs is $200,000. However, you have no taxable income to report when the shares are granted.

- The stock price is $25 at the time of vesting. You have $62,500 of taxable income to report. (2,500 shares x $25/share)

- Share prices rise to $30 at the time of vesting. Your taxable income is $75,000 (2,500 shares x $30/share)

- Share prices fall to $10/share. Your taxable income is $25,000 (2,500 shares x $10/share)

- The stock price at vest is $40/share. Your taxable income is $100,000 (2,500 shares x $40/share)

The overall total value of the vested shares at vest is $262,500.

The above example is a “graded” vesting schedule because the shares are vested in portions over time.

By contrast, companies can also use “cliff” vesting. That takes place when 100% of the shares are vested all at once after completing a stated period of service or specific performance goals.

Graded vesting can take place at regular intervals, or there can be varying intervals between vesting dates.

It’s not uncommon to have a combination of cliff and graded vesting. For instance, you might have 25% of the shares vest after 1 year, then have the remaining shares vest monthly for the next 36 months.

Regardless of the vesting schedule, each block of shares is taxable upon vesting.

As part of the divorce process, you and your spouse will be required to complete financial disclosures. The idea is to ensure that you both have an understanding of the entire financial picture.

The financial disclosures include providing details on all assets and compensation. That includes any RSU grants.

RSUs and other forms of stock-based compensation can be valuable assets that need to be addressed in a divorce.

Seeking stock options and RSUs as compensation during a divorce can be challenging, mainly because the value will change over time.

Stock prices change all the time. As a result, the value of the stocks will not become fixed until a spouse decides to exercise his or her options and cash out or until the RSUs vest.

There are two main ways to divide RSUs.

- Option 1: The employee spouse can keep the RSUs and buy out the other spouse’s interest based on the current value.

- Option 2: Deferred division. With this approach, the employee spouse continues to hold the unvested RSUs in his/her name until the RSUs are released. At that time, the non-employee spouse would receive their share of the vested RSUs.

Both methods carry their advantages and disadvantages.

If your spouse cuts you a check for the value of the RSUs now, you could miss out on future gains, especially if the company is still in the start-up phase.

But by getting the value of the options up front, you are also eliminating the risk of future drops in value.

If a spouse received RSUs while you were married, they will likely be considered as marital property (at least in part). This means you are entitled to a portion as part of your divorce settlement, depending on the divorce laws of your state.

Before a proper division can take place, there will need to be a determination of what part of the RSUs is marital property vs. separate property.

How to determine the marital (community) portion of RSUs in divorce

Laws will vary from state to state, but no matter where you live, determining the marital portion of RSUs can be complicated.

Part of this depends on the property division laws in your state. Some states, such as California, are community property states, and all marital assets are divided equally. In equitable distribution states, which encompass the vast majority of states, assets are divided fairly but not always equally.

Determining what part of RSUs are community property is influenced by several factors:

- When was the RSU award granted?

- What is the vesting schedule?

- What is the vesting criteria? In other words, do the RSUs vest over time or is vesting contingent on meeting certain performance metrics?

- Why was the RSU awarded? Employees can be granted RSUs as rewards for past performance or as an incentive for future performance. If the RSU was granted for past performance, it means a spouse may receive RSUs after separation as a bonus for work that took place during the marriage.

- Most RSUs do not allow an employee to transfer ownership of restricted shares to their spouse.

If RSUs are granted and vest during a marriage, then determining the characterization (marital vs. separate) is relatively simple. If the employee wants to keep the RSUs, then they can negotiate an equitable trade-off based on the current value of the RSUs. The other option is the split the present value of the stock, and sell half, which is given to the non-employee spouse.

Time Rule Formulas

Dividing RSUs after a divorce is especially relevant in California. Many Silicon Valley tech companies, particularly start-ups, offer employees RSUs as a form of deferred compensation.

When RSUs are granted during a marriage but not yet vested, a division becomes more complicated. Often in California divorces, The Hug Formula or the Nelson Formula are used to sort things out.

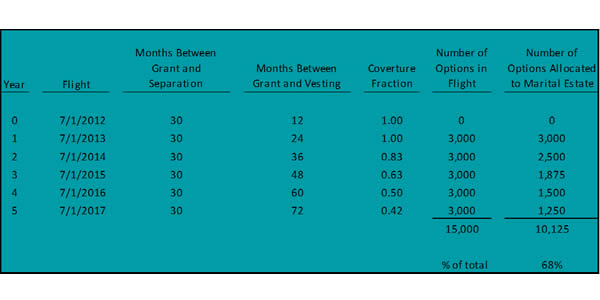

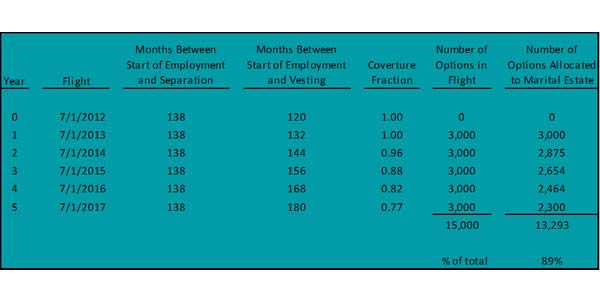

Hug and Nelson refer to California Appellate cases that further defined the division of stock options and RSUs in a divorce. Both of these are variations of the time rule.

The time rule essentially looks at the total earning period and what portion of the total earning period occurred during marriage. That ratio is the marital percentage.

Keep in mind, vesting is contingent on the employee spouse staying with the company for several years. If the employee leaves or terminates, those RSU grants have no value.

The Hug Formula for Calculating the Marital Portion of RSUs

Using the Hug Formula , the shares owed to the non-employee spouse are calculated by thinking of an RSU as deferred compensation for past performance. The formula calculates the percentage of community interest as follows:

(Period of Time Between Start Date at Company and End of Marriage) /

(Period of Time Between Start Date at Company and Vesting)

The community interest is multiplied by the total shares harvested. That number is divided in half. That total is the non-employee’s portion of the vested shares.

The Nelson Formula for Calculating the Community Portion of RSUs

The Nelson Formula considers the stock as primarily future incentives for performance. The community interest under the Nelson Formula is:

(Time worked between the date of the grant and the date of separation) /

(The date of the grant and the date the option is first exercisable)

Community interest is multiplied by the number of shares that have vested and divided in half. That amount is the non-employee’s portion of the vested shares.

Both formulas are applicable but do have some differences to note . After weighing these differences, the choice of which one to use is typically determined by both spouses.

In some cases, RSUs are considered marital property on the date the RSU was granted. If the RSU is not vested by is deemed marital property, the parties will need to negotiate the value of the RSUs and compensate the non-employee with a payment.

Another option is for both parties to agree to wait until the RSUs vest in the future when they can be sold, creating a more accurate valuation. Most divorcing couples do not go this route, instead preferring a clean financial break from their partners.

Looking at a few different scenarios for RSUs and divorce

Depending on your situation, dividing RSUs in a divorce can be relatively easy to determine, or it can be just the opposite.

Let’s take a closer look at a few scenarios:

- RSUs granted during marriage that vest during marriage: These are generally considered as marital or community property and would be divided according to the division of asset laws for your state.

- RSUs granted after a separation or a divorce are generally considered separate property.

- RSUs granted during a marriage that vest after separation: There is usually a marital portion and a separate portion. This is calculated using one of the time rule formulas discussed above.

- RSUs granted before marriage that vest during marriage: This falls in the same category as RSUs granted during marriage that vest after separation. There’s a marital portion and a separate portion.

How to Value or Divide RSUs in Divorce

Ok, so now you’ve figured out the marital portion of the RSUs.

What’s next?

Decision time…

Do you want to divide the RSUs or do a buyout?

Let’s look at how both of these options work.

Dividing RSUs in Divorce

With this option, you and your spouse will split the marital (or community) property RSUs.

Unvested RSUs can’t be transferred on the books. Luckily, there’s a workaround.

The employee spouse can hold the other spouse’s RSUs in constructive trust. Don’t worry, you don’t actually have to create a trust. All this means is that the employee spouse essentially becomes the broker for the other spouse’s RSUs. The employee spouse will transfer the other spouse’s shares to them once the RSUs vest.

The shares can be transferred (not the unvested RSUs).

Dealing with the taxes is where things can get a little complicated.

In a nutshell, the income and withholdings are all reported in the employee’s name. You can allocate the spouse’s portion of the income and withholdings to the spouse on your tax returns. If you’re going this route, be sure to work with a CPA.

The alternative to allocating income and withholdings is to simply have the employee pay the taxes and only deal with the net shares released.

The drawback here is that the shares withheld are often not enough to cover the taxes owed. Sometimes, the employee spouse gets the short end of the stick with this approach.

How to Value RSUs for Offset in a Divorce

The other option for dealing with RSUs is to value them for offset. This means you’re going to place a value on the RSUs that you’re keeping and your spouse will get other assets or cash in exchange.

If the company is publicly traded, this approach is actually pretty simple.

Step 1: Calculate the marital (community) property portion.

Step 2: Multiply the number of unvested community property RSUs by the current stock price. This gives you the pre-tax community value.

Step 3: Apply a tax discount. This can be a little tricky, but the idea is to estimate the taxes that you would pay on the RSUs.

Step 4: Divide by 2 to calculate each spouse’s portion.

Let’s look at how this works with an example.

Let’s say there are 200 total unvested RSUs and 100 of them are community property . The stock price is $10 per share.

100 community shares x $10/sh = $1,000 pre-tax community value

Let’s assume the tax rate is 25%.

Tax discount = $1,000 x 25% = $250

After-tax marital (community) value = $1,000 – $250 – $750

After-tax value for each spouse = $750 / 2 = $375

In this example, you would owe $375 to buy out your spouse’s interest in the community RSUs.

Keep in mind there’s a risk that the unvested RSUs are forfeited if the employee leaves the company prior to vesting.

That’s why it’s unusual for the non-employee spouse to consider doing a buyout.

It’s not all or nothing

So far, we’ve talked about either doing a buyout or splitting the RSUs.

It’s not all or nothing. You could consider doing a partial buyout, where one spouse buys out a portion of the other’s RSUs and you split the rest of the RSUs.

This can be a good solution in situations where you have a lot of RSUs and one spouse wants to trade for other assets like the marital home or a pension.

How RSUs Impact Alimony and Child Support

In most states, a big part of calculating child support and alimony payments is based on the income of both parties. Generally speaking, guidelines are in place to consider all sources of income.

Compensation, in general, has gotten more complex than ever before. RSUs are one form of this more complicated compensation issue. Bonuses, commissions, deferred compensation, stock options, and other sources of income can all impact the amount of income parents make and must report for child support purposes.

The tricky part is that these forms of compensation are not always paid out regularly. That is true for RSUs awarded on a cliff schedule (all at once), and sometimes on a graded schedule if the intervals are not spaced consistently.

The IRS does not treat the initial grant of the restricted stock as income for income tax purposes.

However, for purposes of calculating child or spousal support, a court might treat the vesting of the right to exercise the option as income. The current value minus the purchase price will determine the amount of income.