- Search Search Please fill out this field.

What Is Risk Analysis?

Understanding risk analysis, how to perform a risk analysis.

- Qualitative vs. Quantitative

- Advantages and Disadvantages

- Risk Analysis FAQs

The Bottom Line

- Trading Skills

- Risk Management

Risk Analysis: Definition, Types, Limitations, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Erika Rasure is globally-recognized as a leading consumer economics subject matter expert, researcher, and educator. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest.

:max_bytes(150000):strip_icc():format(webp)/CSP_ER9-ErikaR.-dce5c7e19ef04426804e6b611fb1b1b4.jpg)

Investopedia / Zoe Hansen

The term risk analysis refers to the assessment process that identifies the potential for any adverse events that may negatively affect organizations and the environment. Risk analysis is commonly performed by corporations (banks, construction groups, health care, etc.), governments, and nonprofits. Conducting a risk analysis can help organizations determine whether they should undertake a project or approve a financial application, and what actions they may need to take to protect their interests. This type of analysis facilitates a balance between risks and risk reduction. Risk analysts often work in with forecasting professionals to minimize future negative unforeseen effects.

Key Takeaways

- Risk analysis seeks to identify, measure, and mitigate various risk exposures or hazards facing a business, investment, or project.

- Quantitative risk analysis uses mathematical models and simulations to assign numerical values to risk.

- Qualitative risk analysis relies on a person's subjective judgment to build a theoretical model of risk for a given scenario.

- Risk analysis can include risk benefit, needs assessment, or root cause analysis.

- Risk analysis entails identifying risk, defining uncertainty, completing analysis models, and implementing solutions.

Risk assessment enables corporations, governments, and investors to assess the probability that an adverse event might negatively impact a business, economy, project, or investment . Assessing risk is essential for determining how worthwhile a specific project or investment is and the best process(es) to mitigate those risks. Risk analysis provides different approaches that can be used to assess the risk and reward tradeoff of a potential investment opportunity.

A risk analyst starts by identifying what could potentially go wrong. These negatives must be weighed against a probability metric that measures the likelihood of the event occurring.

Finally, risk analysis attempts to estimate the extent of the impact that will be made if the event happens. Many risks that are identified, such as market risk , credit risk, currency risk, and so on, can be reduced through hedging or by purchasing insurance.

Almost all sorts of large businesses require a minimum sort of risk analysis. For example, commercial banks need to properly hedge foreign exchange exposure of overseas loans, while large department stores must factor in the possibility of reduced revenues due to a global recession . It is important to know that risk analysis allows professionals to identify and mitigate risks, but not avoid them completely.

Types of Risk Analysis

Risk-benefits.

Many people are aware of a cost-benefit analysis. In this type of analysis, an analyst compares the benefits a company receives to the financial and non-financial expenses related to the benefits. The potential benefits may cause other, new types of potential expenses to occur. In a similar manner, a risk-benefit analysis compares potential benefits with associated potential risks. Benefits may be ranked and evaluated based on their likelihood of success or the projected impact the benefits may have.

Needs Assessment

A needs risk analysis is an analysis of the current state of a company. Often, a company will undergo a needs assessment to better understand a need or gap that is already known. Alternatively, a needs assessment may be done if management is not aware of gaps or deficiencies. This analysis lets the company know where they need to spending more resources in.

Business Impact Analysis

In many cases, a business may see a potential risk looming and wants to know how the situation may impact the business. For example, consider the probability of a concrete worker strike to a real estate developer . The real estate developer may perform a business impact analysis to understand how each additional day of the delay may impact their operations.

Root Cause Analysis

Opposite of a needs analysis, a root cause analysis is performed because something is happening that shouldn't be. This type of risk analysis strives to identify and eliminate processes that cause issues. Whereas other types of risk analysis often forecast what needs to be done or what could be getting done, a root cause analysis aims to identify the impact of things that have already happened or continue to happen.

Though there are different types of risk analysis, many have overlapping steps and objectives. Each company may also choose to add or change the steps below, but these six steps outline the most common process of performing a risk analysis.

Step #1: Identify Risks

The first step in many types of risk analysis to is to make a list of potential risks you may encounter. These may be internal threats that arise from within a company, though most risks will be external that occur from outside forces. It is important to incorporate many different members of a company for this brainstorming session as different departments may have different perspectives and inputs.

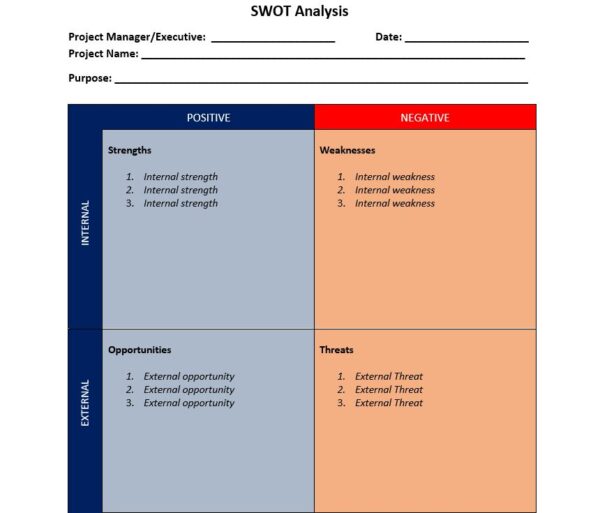

A company may have already addressed the major risks of the company through a SWOT analysis. Although a SWOT analysis may prove to be a launching point for further discussion, risk analysis often addresses a specific question while SWOT analysis are often broader. Some risks may be listed on both, but a risk analysis should be more specific when trying to address a specific problem.

Step #2: Identify Uncertainty

The primary concern of risk analysis is to identify troublesome areas for a company. Most often, the riskiest aspects may be the areas that are undefined. Therefore, a critical aspect of risk analysis is to understand how each potential risk has uncertainty and to quantify the range of risk that uncertainty may hold.

Consider the example of a product recall of defective products after they have been shipped. A company may not know how many units were defective, so it may project different scenarios where either a partial or full product recall is performed. The company may also run various scenarios on how to resolve the issue with customers (i.e. a low, medium, or high engagement solution.

Step #3: Estimate Impact

Most often, the goal of a risk analysis is to better understand how risk will financially impact a company. This is usually calculated as the risk value, which is the probability of an event happening multiplied by the cost of the event.

For example, in the example above, the company may assess that there is a 1% chance a product defection occurs. If the event were to occur, it would cost the company $100 million. In this example, the risk value of the defective product would be assigned $1 million.

The important piece to remember here is management's ability to prioritize avoiding potentially devastating results. For example, if the company above only yielded $40 million of sales each year, a single defect product that could ruin brand image and customer trust may put the company out of business. Even though this example led to a risk value of only $1 million, the company may choose to prioritize addressing this due to the higher stakes nature of the risk.

Step #4: Build Analysis Model(s)

The inputs from above are often fed into an analysis model. The analysis model will take all available pieces of data and information, and the model will attempt to yield different outcomes, probabilities, and financial projections of what may occur. In more advanced situations, scenario analysis or simulations can determine an average outcome value that can be used to quantify the average instance of an event occurring.

Step #5: Analyze Results

With the model run and the data available to be reviewed, it's time to analyze the results. Management often takes the information and determines the best course of action by comparing the likelihood of risk, projected financial impact, and model simulations. Management may also request to see different scenarios run for different risks based on different variables or inputs.

Step #6: Implement Solutions

After management has digested the information, it is time to put a plan in action. Sometimes, the plan is to do nothing; in risk acceptance strategies, a company has decided it will not change course as it makes most financial sense to simply live with the risk of something happening and dealing with it after it occurs. In other cases, management may want to reduce or eliminate the risk.

Implementing solutions does not necessarily mean risk avoidance. A company can decide to simply live with the current risks it faces. Other potential solutions may include buying insurance, divesting from a product, restricting trade in certain geographical regions, or sharing operational risk with a partner company.

Qualitative vs. Quantitative Risk Analysis

Quantitative risk analysis.

Under quantitative risk analysis, a risk model is built using simulation or deterministic statistics to assign numerical values to risk. Inputs that are mostly assumptions and random variables are fed into a risk model.

For any given range of input, the model generates a range of output or outcome. The model's output is analyzed using graphs, scenario analysis , and/or sensitivity analysis by risk managers to make decisions to mitigate and deal with the risks.

A Monte Carlo simulation can be used to generate a range of possible outcomes of a decision made or action taken. The simulation is a quantitative technique that calculates results for the random input variables repeatedly, using a different set of input values each time. The resulting outcome from each input is recorded, and the final result of the model is a probability distribution of all possible outcomes.

The outcomes can be summarized on a distribution graph showing some measures of central tendency such as the mean and median, and assessing the variability of the data through standard deviation and variance. The outcomes can also be assessed using risk management tools such as scenario analysis and sensitivity tables. A scenario analysis shows the best, middle, and worst outcome of any event. Separating the different outcomes from best to worst provides a reasonable spread of insight for a risk manager.

For example, an American company that operates on a global scale might want to know how its bottom line would fare if the exchange rate of select countries strengthens. A sensitivity table shows how outcomes vary when one or more random variables or assumptions are changed.

Elsewhere, a portfolio manager might use a sensitivity table to assess how changes to the different values of each security in a portfolio will impact the variance of the portfolio. Other types of risk management tools include decision trees and break-even analysis.

Qualitative Risk Analysis

Qualitative risk analysis is an analytical method that does not identify and evaluate risks with numerical and quantitative ratings. Qualitative analysis involves a written definition of the uncertainties, an evaluation of the extent of the impact (if the risk ensues), and countermeasure plans in the case of a negative event occurring.

Examples of qualitative risk tools include SWOT analysis , cause and effect diagrams, decision matrix, game theory , etc. A firm that wants to measure the impact of a security breach on its servers may use a qualitative risk technique to help prepare it for any lost income that may occur from a data breach.

While most investors are concerned about downside risk, mathematically, the risk is the variance both to the downside and the upside.

Example of Risk Analysis: Value at Risk (VaR)

Value at risk (VaR) is a statistic that measures and quantifies the level of financial risk within a firm, portfolio , or position over a specific time frame. This metric is most commonly used by investment and commercial banks to determine the extent and occurrence ratio of potential losses in their institutional portfolios. Risk managers use VaR to measure and control the level of risk exposure. One can apply VaR calculations to specific positions or whole portfolios or to measure firm-wide risk exposure.

VaR is calculated by shifting historical returns from worst to best with the assumption that returns will be repeated, especially where it concerns risk. As a historical example, let's look at the Nasdaq 100 ETF , which trades under the symbol QQQ (sometimes called the "cubes") and which started trading in March of 1999.

In January 2000, the ETF returned 12.4%. But there are points at which the ETF resulted in losses as well. At its worst, the ETF ran daily losses of 4% to 8%. This period is referred to as the ETF's worst 5%. Based on these historic returns, we can assume with 95% certainty that the ETF's largest losses won't go beyond 4%. So if we invest $100, we can say with 95% certainty that our losses won't go beyond $4.

One important thing to keep in mind is that VaR doesn't provide analysts with absolute certainty. Instead, it's an estimate based on probabilities. The probability gets higher if you consider the higher returns, and only consider the worst 1% of the returns. The Nasdaq 100 ETF's losses of 7% to 8% represent the worst 1% of its performance. We can thus assume with 99% certainty that our worst return won't lose us $7 on our investment. We can also say with 99% certainty that a $100 investment will only lose us a maximum of $7.

Advantages and Disadvantages of Risk Analysis

Pros of risk analysis.

Risk analysis allows companies to make informed decisions and plan for contingencies before bad things happen. Not all risks may materialize, but it is important for a company to understand what may occur so it can at least choose to make plans ahead of time to avoid potential losses.

Risk analysis also helps quantify risk, as management may not know the financial impact of something happening. In some cases, the information may help companies avoid unprofitable projects. In other cases, the information may help put plans in motion that reduce the likelihood of something happen that would have caused financial stress on a company.

Risk analysis may detect early warning signs of potentially catastrophic events. For example, risk analysis may identify that customer information is not being adequately secured. In this example, risk analysis can lead to better processes, stronger documentation, more robust internal controls , and risk mitigation.

Cons of Risk Analysis

Risk is a probabilistic measure and so can never tell you for sure what your precise risk exposure is at a given time, only what the distribution of possible losses is likely to be if and when they occur. There are also no standard methods for calculating and analyzing risk, and even VaR can have several different ways of approaching the task. Risk is often assumed to occur using normal distribution probabilities, which in reality rarely occur and cannot account for extreme or " black swan " events.

The financial crisis of 2008 , for example, exposed these problems as relatively benign VaR calculations that greatly understated the potential occurrence of risk events posed by portfolios of subprime mortgages .

Risk magnitude was also underestimated, which resulted in extreme leverage ratios within subprime portfolios. As a result, the underestimations of occurrence and risk magnitude left institutions unable to cover billions of dollars in losses as subprime mortgage values collapsed.

Risk Analysis

May aid in minimizing losses due to management preemptively forming a risk plan

May allow management to quantify risks and assign dollars to future events

May protect company resources, produce better processes, and mitigate overall risk

Relies heavily on estimates, so it may be difficult to perform for certain risks

Can not predict unpredictable, black swan events

May underestimate risk magnitude or occurence, leading to overconfident operations

What Is Meant by Risk Analysis?

Risk analysis is the process of identifying and analyzing potential future events that may adversely impact a company. A company performs risk analysis to better understand what may occur, the financial implications of that event occurring, and what steps it can take to mitigate or eliminate that risk.

What Are the Main Components of a Risk Analysis?

Risk analysis is sometimes broken into three components. First, risk assessment is the process of identifying what risks are present. Second, risk management is the procedures in place to minimize the damage done by risk. Third, risk communication is the company-wide approach to acknowledging and addressing risk. These three main components work in tandem to identify, mitigate, and communicate risk.

Why Is Risk Analysis Important?

Sometimes, risk analysis is important because it guides company decision-making. Consider the example of a company considering whether to move forward with a project. The decision may be as simple as identifying, quantifying, and analyzing the risk of the project.

Risk analysis is also important because it can help safeguard company assets. Whether it be proprietary data, physical goods, or the well-being of employees, risk is present everywhere. Companies must be mindful of where it most likely to occur as well as where it is most likely to have strong, negative implications.

Risk analysis is the process of identifying risk, understanding uncertainty, quantifying the uncertainty, running models, analyzing results, and devising a plan. Risk analysis may be qualitative or quantitative, and there are different types of risk analysis for various situations.

:max_bytes(150000):strip_icc():format(webp)/investing1-5bfc2b9046e0fb005119b292.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Business Plan Risk Analysis - What You Need to Know

The business plan risk analysis is a crucial and often overlooked part of a robust business plan. In the ever-changing world of business knowing potential pitfalls and how to mitigate them could be the difference between success and failure. A well-crafted business plan acts as a guiding star for every venture, be it a startup finding its footing or a multinational corporation planning an expansion. However, amidst financial forecasts, marketing strategies, and operational logistics, the element of risk analysis frequently gets relegated to the back burner. In this blog, we will dissect the anatomy of the risk analysis section, show you exactly why it is important and provide you with guidelines and tips. We will also delve into real-life case studies to bring to life your learning your learning.

Table of Contents

- Risk Analysis - What is it?

- Types of Risks

- Components of Risk Analysis

- Real-Life Case Studies

- Tips & Best Practices

- Final Thoughts

Business Plan Risk Analysis - What Exactly Is It?

Risk analysis is like the radar system of a ship, scanning the unseen waters ahead for potential obstacles. It can forecast possible challenges that may occur in the business landscape and plan for their eventuality. Ignoring this can be equivalent to sailing blind into a storm. The business plan risk analysis section is a strategic tool used in business planning to identify and assess potential threats that could negatively impact the organisation's operations or assets. Taking the time to properly think about the risks your business faces or may face in the future will enable you to identify strategies to mitigate these issues.

Types of Business Risks

There are various types of risks that a business may face, which can be categorised into some broader groups:

- Operational Risks: These risks involve loss due to inadequate or failed internal processes, people, or systems. Examples could include equipment failure, theft, or employee misconduct.

- Financial Risks: These risks are associated with the financial structure of the company, transactions the company makes, and the company's ability to meet its financial obligations. For instance, currency fluctuations, increase in costs, or a decline in cash flow.

- Market Risks: These risks are external to the company and involve changes in the market. For example, new competitors entering the market changes in customer preferences, or regulatory changes.

- Strategic Risks: These risks relate to the strategic decisions made by the management team. Examples include the entry into a new market, the launch of a new product, or mergers and acquisitions.

- Compliance Risks: These risks occur when a company must comply with laws and regulations to stay in operation. They could involve changes in laws and regulations or non-compliance with existing ones.

The business risk analysis section is not a crystal ball predicting the future with absolute certainty, but it provides a foresighted approach that enables businesses to navigate a world full of uncertainties with informed confidence. In the next section, we will dissect the integral components of risk analysis in a business plan.

Components of a Risk Analysis Section

Risk analysis, while a critical component of a business plan, is not a one-size-fits-all approach. Each business has unique risks tied to its operations, industry, market, and even geographical location. A thorough risk analysis process, however, typically involves four main steps:

- Identification of Potential Risks: The first step in risk analysis is to identify potential risks that your business may face. This process should be exhaustive, including risks from various categories mentioned in the section above. You might use brainstorming sessions, expert consultations, industry research, or tools like a SWOT analysis to help identify these risks.

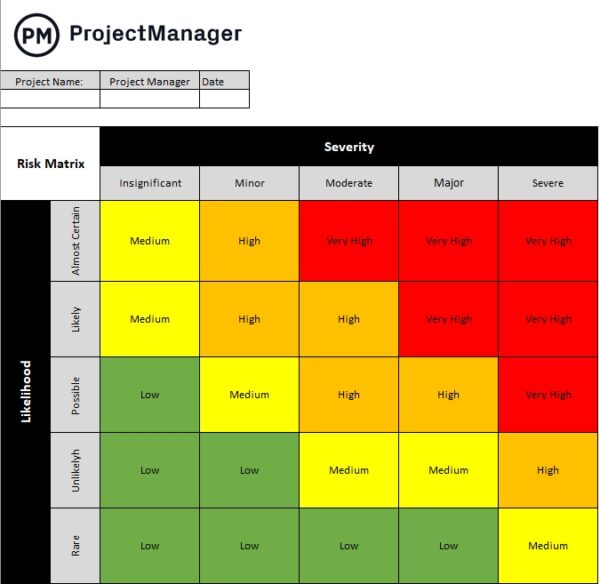

- Risk Assessment: Once you've identified potential risks, the next step is to assess them. This involves evaluating the likelihood of each risk occurring and the potential impact it could have on your business. Some risks might be unlikely but would have a significant impact if they did occur, while others might be likely but with a minor impact. Tools like a risk matrix can be helpful here to visualise and prioritise your risks.

- Risk Mitigation Strategies: After assessing the risks, you need to develop strategies to manage them. This could involve preventing the risk, reducing the impact or likelihood of the risk, transferring the risk, or accepting the risk and developing a contingency plan. Your strategies will be highly dependent on the nature of the risk and your business's ability to absorb or mitigate it.

- Monitoring and Review: Risk analysis is not a one-time task, but an ongoing process. The business landscape is dynamic, and new risks can emerge while old ones can change or even disappear. Regular monitoring and review of your risks and the effectiveness of your mitigation strategies is crucial. This should be an integral part of your business planning process.

Through these four steps, you can create a risk analysis section in your business plan that not only identifies and assesses potential threats but also outlines clear strategies to manage and mitigate these risks. This will demonstrate to stakeholders that your business is prepared and resilient, able to handle whatever challenges come its way.

Business Plan Risk Analysis - Real-Life Examples

To fully grasp the importance of risk analysis, it can be beneficial to examine some real-life scenarios. The following are two contrasting case studies - one demonstrating a successful risk analysis and another highlighting the repercussions when risk analysis fails.

Case Study 1: Google's Strategic Risk Mitigation

Consider Google's entry into the mobile operating system market with Android. Google identified a strategic risk : the growth of mobile internet use might outpace traditional desktop use, and if they didn't have a presence in the mobile market, they risked losing out on search traffic. They also recognised the risk of being too dependent on another company's (Apple's) platform for mobile traffic. Google mitigated this risk by developing and distributing its mobile operating system, Android. They offered it as an open-source platform, which encouraged adoption by various smartphone manufacturers and quickly expanded their mobile presence. This risk mitigation strategy helped Google maintain its dominance in the search market as internet usage shifted towards mobile.

Case Study 2: The Fallout of Lehman Brothers

On the flip side, Lehman Brothers, a global financial services firm, failed to adequately analyse and manage its risks, leading to its downfall during the 2008 financial crisis. The company had significant exposure to subprime mortgages and had failed to recognise the potential risk these risky loans posed. When the housing market collapsed, the value of these subprime mortgages plummeted, leading to significant financial losses. The company's failure to conduct a robust risk analysis and develop appropriate risk mitigation strategies eventually led to its bankruptcy. The takeaway from these case studies is clear - effective risk analysis can serve as an essential tool to navigate through uncertainty and secure a competitive advantage, while failure to analyse and mitigate potential risks can have dire consequences. As we move forward, we'll share some valuable tips and best practices to ensure your risk analysis is comprehensive and effective.

Business Plan Risk Analysis Tips and Best Practices

While the concept of risk analysis can seem overwhelming, following these tips and best practices can streamline the process and ensure that your risk management plan is both comprehensive and effective.

- Be Thorough: When identifying potential risks, aim to be as thorough as possible. It’s crucial not to ignore risk because it seems minor or unlikely; even small risks can have significant impacts if not managed properly.

- Involve the Right People: Diverse perspectives can help identify potential risks that might otherwise be overlooked. Include people from different departments or areas of expertise in your risk identification and assessment process. They will bring different perspectives and insights, leading to a more comprehensive risk analysis.

- Keep it Dynamic: The business environment is continually changing, and so are the risks. Hence, risk analysis should be an ongoing process, not a one-time event. Regularly review and update your risk analysis to account for new risks and changes in previously identified risks.

- Be Proactive, Not Reactive: Use your risk analysis to develop mitigation strategies in advance, rather than reacting to crises as they occur. Proactive risk management can help prevent crises, reduce their impact, and ensure that you're prepared when they do occur.

- Quantify When Possible: Wherever possible, use statistical analysis and financial projections to evaluate the potential impact of a risk. While not all risks can be quantified, putting numbers to the potential costs can provide a clearer picture of the risk and help prioritise your mitigation efforts.

Implementing these tips and best practices will strengthen your risk analysis, providing a more accurate picture of the potential risks and more effective strategies to manage them. Remember, the goal of risk analysis isn't to eliminate all risks—that's impossible—but to understand them better so you can manage them effectively and build a more resilient business.

In the ever-changing landscape of business, where uncertainty is a constant companion, the risk analysis section of a business plan serves as a guiding compass, illuminating potential threats and charting a course toward success. Throughout this blog, we have explored the critical role of risk analysis and the key components involved in its implementation. We learned that risk analysis is not just about identifying risks but also about assessing their potential impact and likelihood. It involves developing proactive strategies to manage and mitigate those risks, thereby safeguarding the business against potential pitfalls. In conclusion, a well-crafted business plan risk analysis section is not just a formality but a strategic asset that empowers your business to thrive in an unpredictable world. As you finalise your business plan, keep in mind that risk analysis is not a one-time task but an ongoing practice. Revisit and update your risk analysis regularly to stay ahead of changing business conditions. By embracing risk with a thoughtful and proactive approach, you will position your business for growth, resilience, and success in an increasingly dynamic and competitive landscape. Want more help with your business plan? Check out our Learning Zone for more in-depth guides on each specific section of your plan.

How it works

For Business

Join Mind Tools

Article • 12 min read

Risk Management and Risk Analysis

Assessing and managing risks.

By the Mind Tools Content Team

Risk is made up of two parts: the probability of something going wrong, and the negative consequences if it does.

Risk can be hard to spot, however, let alone to prepare for and manage. And, if you're hit by a consequence that you hadn't planned for, costs, time, and reputations could be on the line. Similarly, overestimating or overreacting to risks can create panic, and do more harm than good.

This makes Risk Analysis an essential tool. It can help you to identify and understand the risks that you could face in your role. In turn, this helps you to manage these risks, and minimize their impact on your plans.

By approaching risk in a logical manner you can identify what you can and cannot control , and tackle potential problems with measured and appropriate action. This can then help to alleviate feelings of stress and anxiety, both in and outside of work.

In this article and video, we look at how you can identify and estimate risks. You will then learn how a strategy of avoiding, sharing, accepting, and controlling can help you to manage risk effectively.

What Is Risk Analysis?

Risk Analysis is a process that helps you to identify and manage potential problems that could undermine key business initiatives or projects. However, it can also be applied to other projects outside of business, such as organizing events or even buying a home!

To carry out a Risk Analysis, you must first identify the possible threats that you face, then estimate their likely impacts if they were to happen, and finally estimate the likelihood that these threats will materialize.

Risk Analysis can be complex, as you'll need to draw on detailed information such as project plans, financial data, security protocols, marketing forecasts, and other relevant information. However, it's an essential planning tool, and one that could save time, money, and reputations.

What is Risk Management?

Definition : Risk management is a strategy of avoiding risk, sharing it, accepting it, and controlling it as effectively as you can. Once you've identified the value of the risks you face, you can then start to look at ways of managing them.

When to Use Risk Analysis

Risk analysis is useful in many situations:

- When you're planning projects, to help you to anticipate and neutralize possible problems.

- When you're deciding whether or not to move forward with a project.

- When you're improving safety and managing potential risks in the workplace.

- When you're preparing for events such as equipment or technology failure, theft, staff sickness, or natural disasters.

- When you're planning for changes in your environment, such as new competitors coming into the market, or changes to government policy.

How to Use Risk Analysis

To carry out a risk analysis, follow these steps:

1. Identify Threats

The first step in Risk Analysis is to identify the existing and possible threats that you might face. These can come from many different sources. For instance, they could be:

- Human – Illness, death, injury, or other loss of a key individual.

- Operational – Disruption to supplies and operations, loss of access to essential assets, or failures in distribution.

- Reputational – Loss of customer or employee confidence, or damage to market reputation.

- Procedural – Failures of accountability, internal systems, or controls, or from fraud.

- Project – Going over budget, taking too long on key tasks, or experiencing issues with product or service quality.

- Financial – Business failure, stock market fluctuations, interest rate changes, or non-availability of funding.

- Technical – Advances in technology, or from technical failure.

- Natural – Weather, natural disasters, or disease.

- Political – Changes in tax, public opinion, government policy, or foreign influence.

- Structural – Dangerous chemicals, poor lighting, falling boxes, or any situation where staff, products, or technology can be harmed.

Note: It is vital that you consider any and all risks to your team members. Managers and leaders have a duty of care , and so will have legal and moral obligations to keep their employees safe.

You can use a number of different approaches to carry out a thorough analysis:

- Run through a list such as the one above to see if any of these threats are relevant.

- Think about the systems, processes, or structures that you use, and analyze risks to any part of these. What vulnerabilities can you spot within them?

- Ask others who might have different perspectives. If you're leading a team, ask for input from your people, and consult others in your organization, or those who have run similar projects.

Tools such as SWOT Analysis , Failure Mode and Effects Analysis , PMESII-PT , and PEST Analysis can also help you uncover threats, while Scenario Analysis helps you to explore possible future threats.

Tip: Be mindful not to confuse Risk Analysis with Risk Assessment. The latter is the process of formally analyzing and mitigating the risks and hazards of an activity by an employee for their health and safety.

2. Estimate Risk

Once you've identified the threats you're facing, you need to calculate both the likelihood of these threats being realized, and their possible impact.

One way of doing this is to make your best estimate of the probability of the event occurring, and then to multiply this by the amount it will cost you to set things right if it happens. This gives you a value for the risk:

Risk Value = Probability of Event x Cost of Event

As a simple example, imagine that you've identified a risk that your rent may increase substantially.

You think that there's an 80 percent chance of this happening within the next year, because your landlord has recently increased rents for other businesses. If this happens, it will cost your business an extra $500,000 over the next year.

So the risk value of the rent increase is:

0.80 (Probability of Event) x $500,000 (Cost of Event) = $400,000 (Risk Value)

You can also use a Risk Impact/Probability Chart to assess risk. This will help you to identify which risks you need to focus on.

Tip: Don't rush this step. Gather as much information as you can so that you can accurately estimate the probability of an event occurring, and the associated costs. Use past data as a guide if you don't have an accurate means of forecasting.

Tip: Look for cost-effective approaches – it's rarely sensible to spend more on eliminating a risk than the cost of the event if it occurs. It may be better to accept the risk than it is to use excessive resources to eliminate it.

Be sensible in how you apply this, though, especially if ethics or personal safety are in question.

Avoid the Risk

In some cases, you may want to avoid the risk altogether. This could mean not getting involved in a business venture, passing on a project, or skipping a high-risk activity. This is a good option when taking the risk involves no advantage to your organization, or when the cost of addressing the effects is not worthwhile.

Remember that when you avoid a potential risk entirely, you might miss out on an opportunity. Conduct a "What If?" Analysis to explore your options when making your decision.

Risk Management Framework

A Risk Management Framework serves as the bedrock on which a company's risk culture is built, offering a structured approach to protect its assets. Adopting an effective Risk Management Framework is crucial to protecting an organization's financial future.

The Five Elements of a Risk Management Framework

1. risk identification.

An exhaustive catalog of potential risks is produced, encompassing IT, operational, regulatory, legal, political, strategic, and credit risks.

2. Risk Measurement

The magnitude and likelihood of specific and aggregate risk exposures is measured. This assessment aids in determining the impact of risks on the organization's overall risk profile, allowing for informed prioritization.

3. Risk Mitigation

Once risks are identified and measured, strategies for risk reduction or elimination can be devised. Options include asset or liability sales, insurance, derivatives hedging, and diversification.

4. Risk Reporting and Monitoring

Regular and automated reporting on both specific and aggregate risk measures is essential for maintaining optimal risk levels. Real-time accessibility through dashboards enhances proactive risk management.

5. Risk Governance

Establishing a structured process to help employees adhere to the Risk Management Framework is vital. This involves defining roles, segregating duties, assigning authority, and overseeing risk-related matters at all levels within the organization.

A robust Risk Management Framework provides the framework for risk management but relies on active participation and adherence from all stakeholders to be truly effective.

Share the Risk

You could also opt to share the risk – and the potential gain – with other people, teams, organizations, or third parties.

For instance, you share risk when you insure your office building and your inventory with a third-party insurance company, or when you partner with another organization in a joint product development initiative.

Accept the Risk

Your last option is to accept the risk. This option is usually best when there's nothing you can do to prevent or mitigate a risk, when the potential loss is less than the cost of insuring against the risk, or when the potential gain is worth accepting the risk.

For example, you might accept the risk of a project launching late if the potential sales will still cover your costs.

Before you decide to accept a risk, conduct an Impact Analysis to see the full consequences of the risk. You may not be able to do anything about the risk itself, but you can likely come up with a contingency plan to cope with its consequences.

However, it's important to bear in mind that everyone's definition of "acceptable risk" is different, so be sure to communicate with others before you make a decision, and use tools like the Prospect Theory to predict people's different reactions to risk.

Control the Risk

If you choose to accept the risk, there are a number of ways in which you can reduce its impact.

Business Experiments are an effective way to reduce risk. They involve rolling out the high-risk activity but on a small scale, and in a controlled way. You can use experiments to observe where problems occur, and to find ways to introduce preventative and detective actions before you introduce the activity on a larger scale.

- Preventative action involves aiming to prevent a high-risk situation from happening. It includes health and safety training, firewall protection on corporate servers, and cross-training your team.

- Detective action involves identifying the points in a process where something could go wrong, and then putting steps in place to fix the problems promptly if they occur. Detective actions include double-checking finance reports, conducting safety testing before a product is released, or installing sensors to detect product defects.

Plan-Do-Check-Act is a similar method of controlling the impact of a risky situation. Like a business experiment, it involves testing possible ways to reduce a risk. The tool's four phases guide you through an analysis of the situation, creating and testing a solution, checking how well this worked, and implementing the solution.

Alternatively, James Reason's Swiss Cheese Model of System Accidents explores how there is no single solution to minimizing risk, but rather uses a combination of methods to get the best results.

Risk Analysis is a proven way of identifying and assessing factors that could negatively affect the success of a business or project. It allows you to examine the risks that you or your organization face, and helps you decide whether or not to move forward with a decision.

You perform a Risk Analysis by identifying threats, and estimating the likelihood of those threats being realized.

Once you've worked out the value of the risks you face, you can start looking at ways to manage them effectively. This may include choosing to avoid the risk, sharing it, or accepting it while reducing its impact. Not only can this help you to make sensible decisions but it can also alleviate feelings of stress and anxiety.

It's essential that you're thorough when you're working through your Risk Analysis, and that you're aware of all of the possible impacts of the risks revealed. This includes being mindful of costs, ethics, and people's safety.

You've accessed 1 of your 2 free resources.

Get unlimited access

Discover more content

10 common presentation mistakes.

Avoiding Common Pitfalls in Your Presentations

Book Insights

Fool Me Once: Scams, Stories, Secrets from the Trillion-Dollar Fraud Industry

By Kelly Richmond Pope

Add comment

Comments (1)

firstname lastname

Hi, there is no option to download the tools 'print this free worksheet, and then follow these steps'. Can you please advise me how to download this free risk assessment template?

Get 20% off your first year of Mind Tools

Our on-demand e-learning resources let you learn at your own pace, fitting seamlessly into your busy workday. Join today and save with our limited time offer!

Sign-up to our newsletter

Subscribing to the Mind Tools newsletter will keep you up-to-date with our latest updates and newest resources.

Subscribe now

Business Skills

Personal Development

Leadership and Management

Member Extras

Most Popular

Newest Releases

Pain Points Podcast - Balancing Work And Kids

Pain Points Podcast - Improving Culture

Mind Tools Store

About Mind Tools Content

Discover something new today

Pain points podcast - what is ai.

Exploring Artificial Intelligence

Pain Points Podcast - How Do I Get Organized?

It's Time to Get Yourself Sorted!

How Emotionally Intelligent Are You?

Boosting Your People Skills

Self-Assessment

What's Your Leadership Style?

Learn About the Strengths and Weaknesses of the Way You Like to Lead

Recommended for you

Leading by example.

How to Lead a Team Honestly and Authentically

Business Operations and Process Management

Strategy Tools

Customer Service

Business Ethics and Values

Handling Information and Data

Project Management

Knowledge Management

Self-Development and Goal Setting

Time Management

Presentation Skills

Learning Skills

Career Skills

Communication Skills

Negotiation, Persuasion and Influence

Working With Others

Difficult Conversations

Creativity Tools

Self-Management

Work-Life Balance

Stress Management and Wellbeing

Coaching and Mentoring

Change Management

Team Management

Managing Conflict

Delegation and Empowerment

Performance Management

Leadership Skills

Developing Your Team

Talent Management

Problem Solving

Decision Making

Member Podcast

Visure Solutions

- Requirements ALM Platform

- Contributor - Reviewer

- Report Manager

- Quality Analyzer

- Automated Checklist

- Tool Qualification Package

- Microsoft Word & Excel

- Sparx Systems Enterprise Architect

- Micro Focus ALM/QC

- Azure DevOps

- Rapita Systems

- MATLAB Simulink

- Ansys Scade

- Aerospace & Defense

- Medical Devices

- Banking & Finance

- Pharmaceutics

- Software Factories

- Energy and Utilities

- Requirements Management

- Risk Management

- Test Management

- Traceability

- Reusability

- Requirements Gathering

- Requirements Reporting

- Impact Analysis

- Change Management

- Source Code

- Requirements Review

- Requirements Collaboration

- Visure Implementation & Deployment

- Process Improvement

- IREB CPRE Certified Training

- Requirements Engineering Methodology Workshop

- Visure Tool Workshop

- Requirements Specification

- Model Based Systems Engineering (MBSE) Online Training Course

- Requirements AI- Course Online Training

- Master Requirements Writing

- Streamlining Tender Management Process

- Leveraging AI to Accelerate Requirements Management Process

- Smooth Migration from IBM DOORS

- Unveiling V8- A New AI-powered Version

- Optimizing for DO-178C & DO-254 Certification

- How to Meet DO-178B/C Certifications: Complete Guide

- Requirements Management: Complete Guide

- Guide to Leveraging AI for Requirements Management Processes

- Guide to ASPICE Certification Compliance

- Jama Connect

- Visure Requirements ALM Platform

- Requirements Management & Traceability

- Requirements Management & Traceability with Microsoft Office Word and Excel

- RTCA DO-178C

- RTCA DO-254

- Tender & Procurement Management Guide

- FMEA Risk Management

- Our Customers

What is Risk Analysis: Definition & Tools | Complete Guide

Table of contents, what is risk analysis: definition & tools | complete guide, introduction:.

No matter how well you plan, surprises are always a possibility when you’re working on a project. Risk Analysis is the process of identifying and assessing these risks so that you can come up with a plan to deal with them. This guide will teach you everything you need to know about Risk Analysis, including the definition of risk and how to use different tools to assess it. Let’s get started!

What is Risk Management?

Risk management can be concisely defined as the effect of uncertainty on objectives. It involves the identification, evaluation, and prioritization of risks followed by the application of resources to minimize or control their negative impact. In other words, Risk Management is the process of applying Risk Analysis techniques in order to make better decisions about project investments, schedule, quality, and other aspects of project management.

Each organization faces slightly different risks, which could stem from many different sources and include everything from strategic management errors to IT security threats to natural disasters. For this reason, organizations must conduct periodic risk assessments and implement a plan to mitigate the possible disruptions.

What Are the 3 Types of Risks?

While there are many types of risks, the following three types are always relevant:

- Personal Risks : Include the loss of life, injury, and other consequences of unmanaged workplace hazards.

- Property Risks : From natural disasters to theft to cyberattacks, there are many property risks threatening organizations these days.

- Liability Risks : Organizations in certain industries, such as finance, medical, aerospace, and defense, face many liability risks due to various regulations and strict compliance requirements.

Five Steps to Risk Assessment

All risk assessments follow the same basic five steps, even though the steps are sometimes described using different jargon or slightly altered to better meet the needs of various organizations.

- Step 1: Risk Identification . The first risk assessment step aims to identify all risks that might cause harm to the organization and negatively affect its objectives. There are a number of risk identification techniques that can be used to accomplish this step.

- Step 2: Risk Analysis . With risks identified, it’s time to analyze them and determine their likelihood and consequences. At the end of this step, the organization should have a much better understanding of the risks it’s facing and be aware of their potential effect on project goals and objectives.

- Step 3: Risk Ranking . The next step is to rank the discovered risks according to the magnitude of their potential impact. Some risks may have such a huge potential negative impact that they are not worth taking, while the impact of other risks may be negligible.

- Step 4: Risk Response Planning . Starting from the highest-ranking risks, the goal is to come up with a plan that would make it possible to minimize their probability and impact.

- Step 5: Risk Assessment Review . Because organizations are always evolving, it’s necessary to regularly review and update the risk assessment to maintain its relevancy and usefulness

What is Risk Analysis?

Risk Analysis is the practice of assessing and managing uncertainties in order to reduce their potential impact on a project. Risk Analysis can be used in a variety of different contexts, but it is most commonly applied to business and investment decisions. Risk Analysis techniques help organizations make more informed decisions by taking into account the potential impact of uncertainties.

There are two main types of Risk Analysis: quantitative and qualitative. Quantitative Risk Analysis uses mathematical and statistical methods to calculate the likelihood and potential impact of risks. Qualitative Risk Analysis uses expert judgment to assess the likelihood and potential impact of risks.

What are some benefits of Risk Analysis?

The main benefit of Risk Analysis is that it can help organizations make more informed decisions. Risk Analysis takes into account the potential impact of uncertainties, which allows organizations to be better prepared for them. Additionally, Risk Analysis can help reduce the consequences of risks.

Which Risk Analysis Technique is Right for You?

The best Risk Analysis technique to use depends on the specific needs of your organization. If you need a quick and easy way to assess the likelihood and impact of risks, Qualitative Risk Analysis may be the best option. If you need a more precise and detailed assessment, Quantitative Risk Analysis may be a better fit.

No matter which Risk Analysis technique you choose, the goal is always the same: to make more informed decisions by taking into account the potential impact of uncertainties.

4 Methods of Risk Analysis:

There are four main methods of Risk Analysis:

- Bow-Tie Analysis – The quantitative risk analysis approach is utilized to discover the origins and consequences of all conceivable project risks. The project management team must first identify risks that may affect the project and then consider causes, ramifications, and, most importantly, a risk mitigation strategy for them. It’s a versatile tool that can be utilized in any sector.

- Risk Analysis Matrix – The risk analysis matrix ranks risks according to their significance, with the most serious risks at the top of the list. Its main goal is to assist decision-makers in ranking risks and developing a risk management strategy that includes the proper resources and methods for coping with threats. The relative level of a risk’s likelihood is determined using a qualitative rather than a statistical risk.

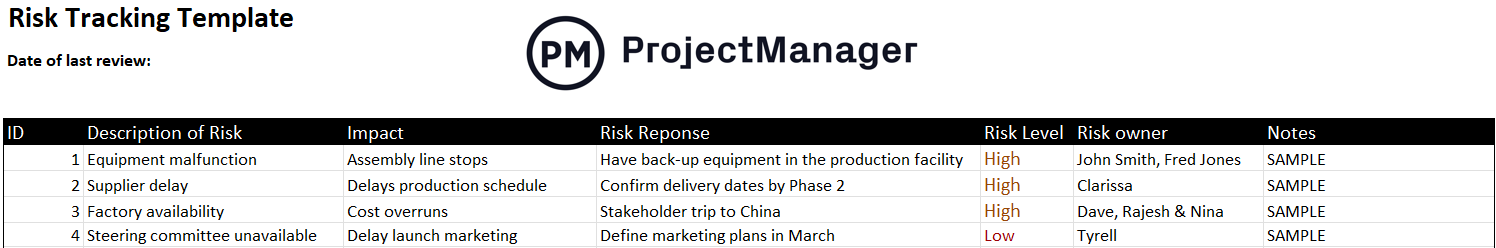

- Risk Register -A risk register is an important project management tool for recording project risks. It’s a document that lists all of the possible risks that might occur throughout the project’s execution phase, as well as critical information on them. It’s intended to be used as an input into the risk management plan, which discusses who is responsible for these dangers, how they will be monitored, and what the reaction plan is in case they do happen.

- SWIFT Analysis – The purpose of the SWIFT method is to identify and assess possible risks resulting from modifications to a project plan. Team members must come up with any “what if” concerns they can in order to discover all potential risks that may occur.

Conclusion:

Risk analysis is a critical step in the decision-making process. By understanding and evaluating the risks associated with a particular choice, we can make more informed decisions that are likely to have a positive outcome. The techniques and methods we’ve looked at in this post provide a roadmap for conducting an effective risk analysis. Whether you’re making important business decisions or simply trying to figure out which option is best for your family, employing risk analysis will help you feel more confident in your choices.

Don’t forget to share this post!

Privacy Overview

Get FREE Access to Our Online Training

"master requirements writing course", enter your information below:.

- Your Full Name *

- Work Email *

- Phone This field is for validation purposes and should be left unchanged.

- Contact sales

Start free trial

Project Risk Analysis: Tools, Templates & Techniques

There are many project risks that can affect your project and, as a project manager, you’re responsible for the risk analysis process. Risk analysis, or risk assessment is essential because it allows project managers to classify project risks and determine which of them should be tracked closely.

What Is Project Risk Analysis?

Risk analysis consists of using tools and techniques to determine the likelihood and impact of project risks that have been previously identified. Therefore, risk analysis helps project managers decipher the uncertainty of potential risks and how they would impact the project in terms of schedule, quality and costs if, in fact, they were to show up. Risk analysis isn’t exclusive to project management and it’s used in other disciplines such as business administration, construction or manufacturing.

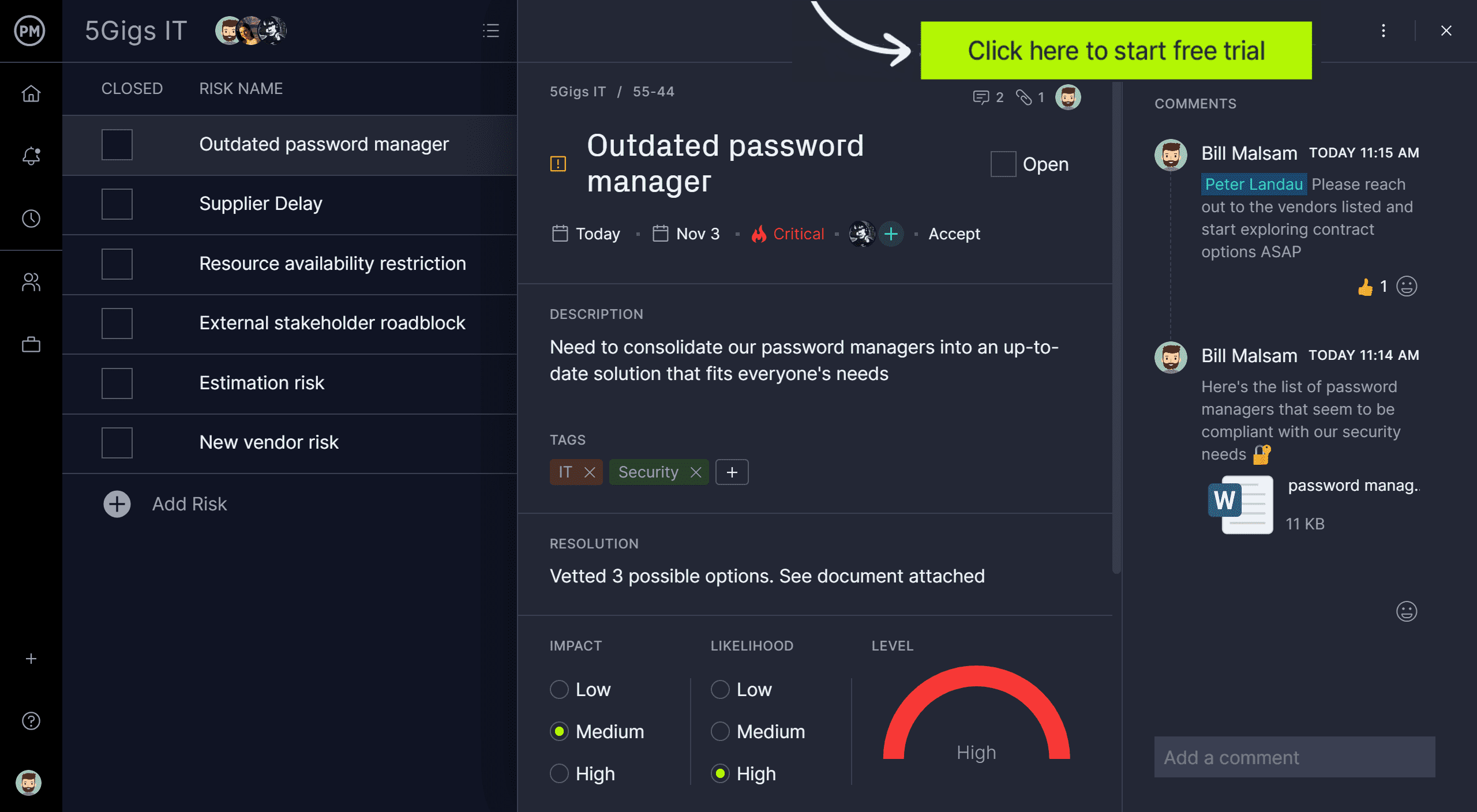

No matter what industry you’re in, you’ll always have projects and so, you should use project management software for risk analysis. ProjectManager , for instance, has risk management tools that let you track risks in real time. Keep track of individual risk events and mark their impact, likelihood and overall risk level with a risk matrix. Then assign that risk to a team member and use project dashboards to monitor. Get started with ProjectManager today for free.

How to Analyze Project Risks

At a basic level, there are three things you should consider when assessing project risks : risk probability, risk impact and risk exposure. These three things can be estimated through qualitative and quantitative risk analysis.

Risk Probability

All risks have a certain probability of occurrence, which means they might or might not happen. Estimating risk probability isn’t an exact science, but there are several techniques you can use, such as examining data from past projects. By analyzing similar projects from the past, you can better determine whether there’s a high or low chance of project risk.

Risk Impact

Consider the type of risk and its potential impact on the project. Some risks will bring financial stress, while others might involve resource management issues or delays to the project schedule. To make things simple, you can simply assign levels of impact for your project risks, such as low, medium or high depending on how critical they are.

Risk Exposure

Risk exposure combines risk probability and risk impact in one formula that’s used by businesses to determine whether they’re ready to assume a potential risk or not. This technique can only be used when you can measure the potential losses associated with risk. The risk exposure formula is:

Risk Exposure = Risk impact * Risk probability

So, if a given risk had an impact of $1 million and the probability of that risk was 50%, your risk exposure would equal $500,000.

What Is Qualitative Risk Analysis?

Qualitative risk analysis refers to the risk analysis tools and techniques that rely on expert subject matter opinions, subjective and non-statistical means to assess the likelihood and impact of project risks. A risk matrix is a typical example of a qualitative risk analysis tool.

What Is Quantitative Risk Analysis?

By contrast, quantitative risk analysis is a statistical analysis of project risks. While it takes longer than qualitative analysis, quantitative risk analysis tends to be more accurate as it relies on data. Some examples of quantitative risk analysis tools are linear regression models or the Monte Carlo simulation, both statistical techniques that simulate scenarios and their different outcomes so that managers can better understand how risk can affect their business or project. Let’s take a closer look at some risk analysis tools and techniques you can use.

8 Project Risk Analysis Tools & Techniques

There are several risk analysis methods and tools that help managers through the analysis and decision-making process. Some of these involve the use of risk analysis tools such as project management charts and documents. Let’s dive into these risk analysis methods and how they can help you.

1. Team Brainstorming Sessions

Estimating risk probability and impact is a huge part of risk analysis. As stated, this can be done subjectively, which might lead to error, especially if you do it by yourself as the project manager. To avoid this, you can involve all the team members you consider relevant to get their input on risk likelihood and potential negative consequences.

2. Delphi Technique

The Delphi technique involves a panel of experts on topics that are critical to your project risk. It could be financial experts, lawyers, project management consultants or any other type of professional. This risk analysis method consists of promoting a debate among these experts who ultimately need to reach a consensus on a particular topic, such as estimating the business impact of a risk.

3. SWOT Analysis

SWOT analysis allows managers to understand the current situation of their business or project by looking at its strengths, weaknesses, opportunities and threats. As a risk analysis tool, it lets you note which of your weaknesses might be exploited by others and which external threats might affect your projects, such as economic conditions or the threat of new competitors.

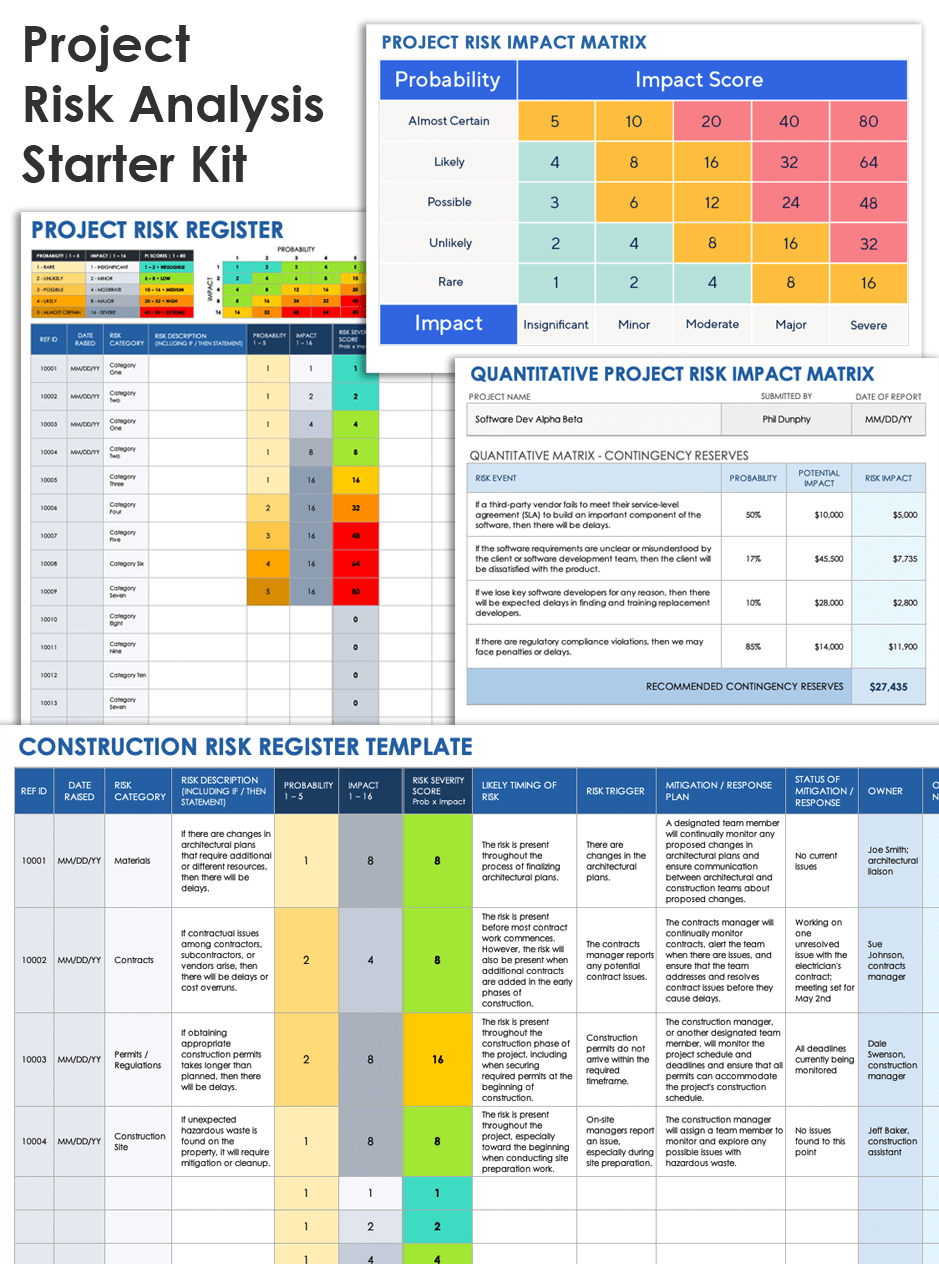

4. Risk Analysis Matrix

The risk analysis matrix assesses the likelihood and the severity of risks, classifying them by order of importance. It’s main purpose is to help managers prioritize risks and create a risk management plan that has the right resources and strategies to properly mitigate risks. Risk likelihood is measured on a relative scale, not a statistical one, which makes it a qualitative risk analysis tool. This tool is also called the probability/consequence matrix by some project managers.

5. Risk Register

A risk register is a crucial project management tool to document project risks. It’s a document that lists all the potential risks that could occur during the project execution phase, as well as critical information about them. It’s meant to be used as input for the risk management plan, which describes who’s responsible for those risks, the risk mitigation strategies and the resources needed. Creating a risk register usually involves several reliable information sources such as the project team, subject matter experts and historical data.

6. Decision Tree Analysis

A decision tree analysis consists of mapping out the potential outcomes that might occur after a decision is made. This is a great method to analyze risks in new projects. Create decision trees as you go through your project planning process so you can identify potential risks and their probability and impact along the way.

7. Bow Tie Analysis

This qualitative risk analysis method is used to identify causes and consequences for all potential project risks. The project management team must first identify risks that might affect the project and then think about causes, consequences and more importantly, a risk mitigation strategy for them. It’s a versatile method that can be used in any industry.

8. SWIFT Analysis

SWIFT stands for Structured What If Technique. It’s a risk analysis method that focuses on identifying potential risks associated with changes made to a project plan. As its name suggests, team members have to come up with any “what if” questions they can to find out all the potential risks that could arise.

What Is Risk Analysis?

Risk analysis is the process that determines how likely it is that risk will arise in a project. It studies the uncertainty of potential risks and how they would impact the project in terms of schedule, quality and costs if, in fact, they were to show up. Two ways to analyze risk are quantitative and qualitative. But it’s important to know that risk analysis is not an exact science, so it’s important to track risks throughout the project life cycle.

Get your free

Risk Management Plan Template

Use this free Risk Management Plan Template for Word to manage your projects better.

Types of Risk Analysis

There are two main types of risk analysis: qualitative and quantitative risk analysis. Let’s learn about these two approaches.

Qualitative Risk Analysis

The qualitative risk analysis is a risk assessment done by experts on the project teams who use data from past projects and their expertise to estimate the impact and probability value for each risk on a scale or a risk matrix.

The scale used is commonly ranked from zero to one. That is, if the likelihood of the risk happening in your project is .5, then there is a 50 percent chance it’ll occur. There is also an impact scale, which is measured from one to fine, with five being the most impact on the project. The risk will then be categorized as either source- or effect-based.

Once risks are identified and analyzed, a project team member is designated as a risk owner for each risk. They’re responsible for planning a risk response and implementing it.

Qualitative risk analysis is the base for quantitative risk analysis and reduces project uncertainty while focusing on high-impact risks. This allows you to assign a risk owner and plan out an appropriate risk response. Get started with qualitative risk analysis with our free risk assessment template.

Quantitative Risk Analysis

By contrast, quantitative risk analysis is a statistical analysis of the effect of those identified risks on the overall project. This helps project managers and team leaders to make decisions with reduced uncertainty and supports the process of controlling risks.

Quantitative risk analysis counts the possible outcomes for the project and figures out the probability of still meeting project objectives . This helps with decision-making, especially when there is uncertainty during the project planning phase. It helps project managers create cost, schedule or scope targets that are realistic.

The Monte Carlo simulation is an example of a quantitative risk analysis tool. It’s a probability technique that uses a computerized method to estimate the likelihood of a risk. It’s used as input for project management decision-making.

Risk Analysis Methods

There are several risk analysis methods that are meant to help managers through the analysis and decision-making process. Some of these involve the use of risk analysis tools such as charts and documents. Let’s dive into these risk analysis methods and how they can help you.

Bow Tie Analysis

This qualitative risk analysis method is used to identify causes and consequences for all potential project risks. The project management team must first identify risks that might affect the project and then think about causes, consequences and more importantly, a risk mitigation strategy for them. It’s a very versatile method that can be used in any industry.

Risk Analysis Matrix

The risk analysis matrix assesses the likelihood and the severity of risks, classifying them by order of importance. It’s main purpose is to help managers prioritize risks and create a risk management plan that has the right resources and strategies to properly mitigate risks. Risk likelihood is measured on a relative scale, not a statistical one, which makes it a qualitative risk analysis tool.

Related: Free Risk Analysis Matrix Template

Risk Register

A risk register is a crucial project management tool to document project risks. It’s a document that lists all the potential risks that could occur during the project execution phase, as well as critical information about them.

It’s meant to be used as input for the risk management plan, which describes who’s responsible for those risks, the risk mitigation strategies and the resources needed. Creating a risk register usually involves several, reliable information sources such as the project team, subject matter experts and historical data.

SWIFT Analysis

SWIFT stands for Structured What If Technique. It’s a risk analysis method that focuses on identifying potential risks associated with changes made to a project plan. As its name suggests, team members have to come up with any “what if” questions they can to find out all the potential risks that could arise.

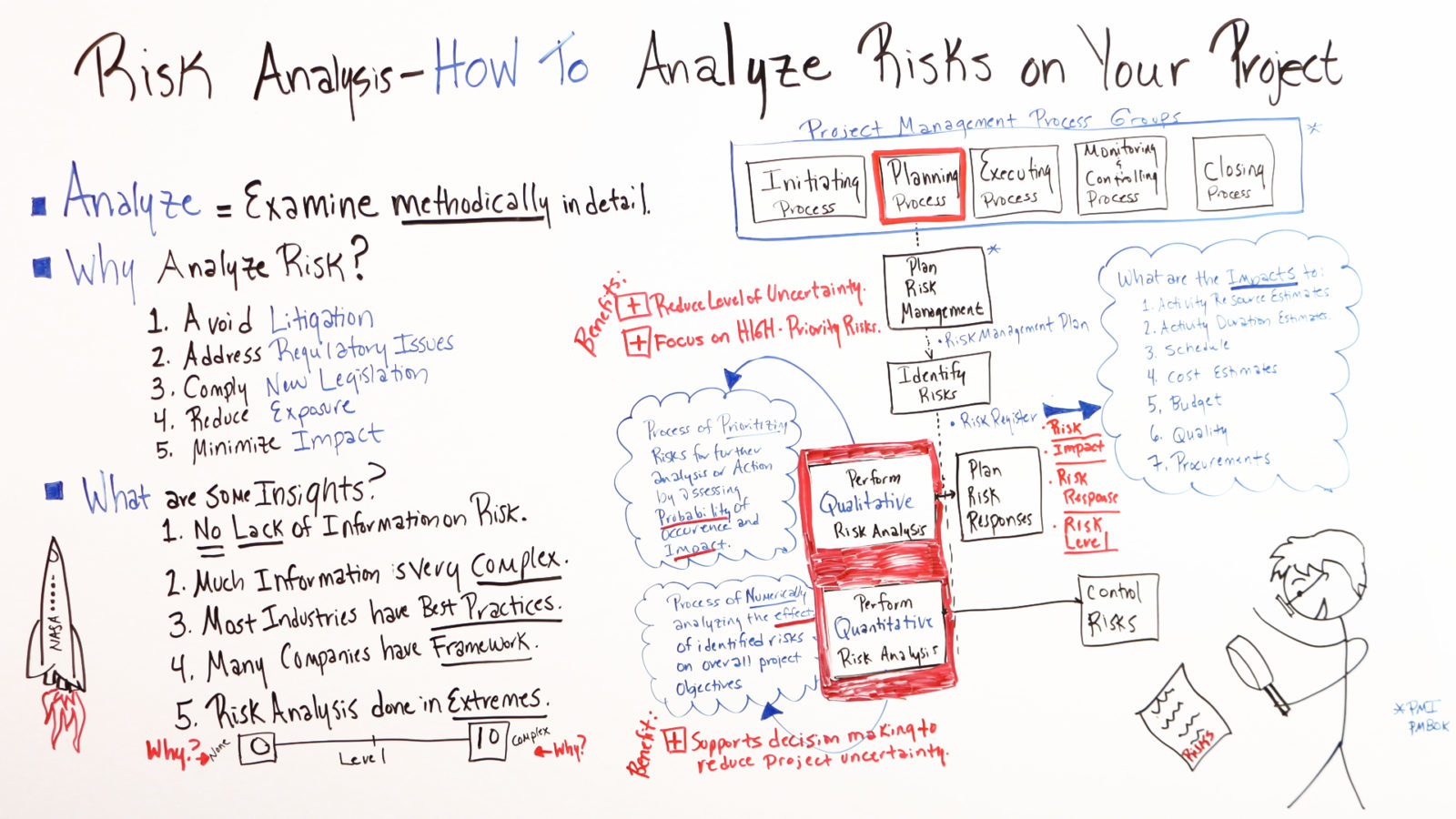

Benefits of Risk Analysis

There are many benefits to using risk analysis in your projects. Here are some of the most common ones.

- Avoid potential litigation

- Address regulatory issues

- Comply with new legislation

- Reduce exposure

- Minimize impact

Risk analysis is an important input for decision-making during all the stages of the project life cycle . Project managers who have some experience with risk management are a great resource. We culled some advice from them, such as:

- There’s no lack of information on risk

- Much of that information is complex

- Most industries have best practices

- Many companies have risk management framework

Project Risk Analysis Templates

There are several quantitative and qualitative risk analysis methods. There are several tools that can be used for different purposes. To help, we’ve prepared some free risk analysis templates to help you through the risk analysis process.

Risk Register Template

This risk register template has everything you need to keep track of the potential risks that might affect your project as well as their probability, impact, status and more.

Risk Analysis Matrix Template

This risk matrix template lets you visualize your project risks in one color-coded graph to classify them by likelihood and severity. This allows you to better understand the most critical risks for your project.

Risk Analysis In Project Management

Risk analysis is a fundamental step in the project risk management process, which consists of four main stages.

- Risk identification: First, identify your potential project risks and list them using a risk register.

- Risk analysis: Now, estimate the impact, likelihood and exposure for each risk and assign a priority level based on this information. The higher the priority level, the more resources are allocated to mitigate the risk.

- Create a risk management plan: Create risk mitigation strategies, or contingency plans to alleviate the impact of each project risk you’ve previously analyzed. These details are usually included in a risk management plan.

- Track risks until project completion: Implementing your risk management plan is as important as creating one. Set up project controls to keep track of risk at all times.

Risk Analysis Video

If we’ve caught your attention when it comes to discussing risk analysis on a project, don’t worry. Watch project management guru Jennifer Bridges, PMP, as she helps visualize how to analyze risks on your project.

Thanks for watching!

How ProjectManager Helps Your Risk Analysis

ProjectManager is online work and project management software that allows you to manage risks alongside your project. Activate the Risk View to create a running list of all of your project risks. Then add descriptions, mark likelihood, impact and level with an embedded risk matrix. Work towards resolutions with your team and add comments along the way.

Project Tracking You Can Trust

It’s hard to recognize risk without a proper project tracking system in place. Across all of ProjectManager’s views, you can monitor progress and communicate with your team as you work together. But, to take it even further, leverage our built-in dashboards and project reports to stay on top of all aspects of your projects, so you’re ready to identify risks as soon as they appear.

Analyzing and resolving risk is a team effort and our software is collaborative to the core. Teams can comment, share files and get updates from email notifications and in-app alerts. There’s one source of truth and you’re always getting real-time data so everyone is on the same page. Get started with ProjectManager today for free.

Deliver your projects on time and under budget

Start planning your projects.

- Guide: Risk Analysis

Daniel Croft

Daniel Croft is an experienced continuous improvement manager with a Lean Six Sigma Black Belt and a Bachelor's degree in Business Management. With more than ten years of experience applying his skills across various industries, Daniel specializes in optimizing processes and improving efficiency. His approach combines practical experience with a deep understanding of business fundamentals to drive meaningful change.

- Last Updated: July 5, 2023

- Learn Lean Sigma

Risk Analysis is an essential proactive measure in Lean Six Sigma, aiming to identify, assess, and control potential risks to business processes. As a preliminary step in new projects, it safeguards against introducing new problems while managing existing ones.

This structured approach is important in a data-driven environment, where unaddressed risks could undermine efforts to eliminate waste and reduce variation. By anticipating problems before they arise, Risk Analysis acts as a strategic tool for informed decision-making, resource allocation, and maintaining continuous improvement within an organization.

Table of Contents

What is risk analysis.

Risk Analysis is a structured approach for identifying, assessing, and controlling potential risks that can affect the efficiency and effectiveness of business processes. Risk analysis can also be used a the start of a new Lean Six Sigma project as a way of identifying potential risks to project success. Risk analysis is an integral part of process improvement and management, ensuring that any changes made to enhance a process do not add new issues and that existing risks are identified and managed.

In the context of Lean Six Sigma, Risk analysis is key because the methodology is data-driven and focused on elimating waste and reducing variation. Any unaddressed risks could add variability, cause defects, or create waste within the process, which will directly counteract the Lean Six Sigma project objectives.

The Importance of Risk Analysis

Risk Analysis in Continuos Improvement and Lean Six Sigma has multiple purposes:

Preventative Measure: Risk Analysis can serve as a first line of defence against potential problems. By identifying potential risks early on, teams can put preventative measures in place to prevent them from occurring. This is likely going to be more cost-effective than addressing the issues after they arise.

Decision Making: Using risk analysis supports informed decision-making. When leaders understand the risks, they can make informed choices that balance the risk with the reward, which should in turn lead to more sustainable business strategies.

Resource Optimization: Conducting a risk analysis can allow for better strategic allocation of resources. Resources can be directed to areas of the business at the greatest risk rather than spreading employees’ focus across areas of low to no risk.

How Risk Analysis is Applied in Continuous Improvement

Using the DMAIC method, you will see how Risk analysis is important in each stage of the process:

- Define : Identify the project goals and potential risks to success.

- Measure : Quantitatively assess the risks to understand their potential impact on the project.

- Analyze : Examine the root causes of risks and how they might affect process variability and waste.

- Improve : Develop and implement strategies to mitigate identified risks.

- Control : Put controls in place to monitor risks over time and ensure that mitigation strategies are effective.

How to Conduct a Risk Analysis

Step 1: risk identification.

The first step of any risk management process should be the identification of risks. The goal of this step is to develop a comprehensive list of all of the risks that could prevent the process or project of a business from achieving its goals. Here are the methods we recommend using to identify the risks:

Conduct a Brainstorming session with a cross-functional team: This process involves gathering a cross-functional team which is a team with a range of backgrounds who are also stakeholders that are familiar with the process and facilitate a session risk identification, which encourages a flow of ideas to uncover as many potential risks as possible. This can be done with team members noting down potential risks on sticky notes and discussing the risk with the team. The sticky note helps form the documentation of the process.

Other methods include analyzing historical data . This could include reviewing past performance data, incident logs, and previous risk assessments of the process. This can often help identify trends and recurring issues that could pose risks.

Another useful structured method that you can bring into the brainstorming process is using an FMEA analysis . The FMEA which stands for Failure Modes and Effects Analysis, is a systematic approach to identifying all possible failures in a design, manufacturing process, product, or service.

If you are interested in learning more and applying the FMEA to your risk analysis, we recommend taking a look at our FMEA guide .

Step 2: Risk Assessment

Once you have identified a list of potential risks, it is likely going to be a long list where addressing all of them might be difficult. This is where an assessment is needed to understand the extent of the risk’s potential impact on objectives. Common tools for the assessment include:

Risk Matrix: This is a grid that helps you to plot the likelihood of a risk occurring against the severity of its impact. It provides a visual representation of the priority of the risks.

Probability and Impact Grid: Similar to a Risk Matrix, this grid assesses risks by their likelihood and potential impact, but often in more detail and with more dimensions.

Risk Register : A Risk Register is a document that contains all the information about identified risks, including their nature, likelihood, impact, and the measures taken to mitigate them.

You can download our Risk assessment template from our Templates section

Step 3: Risk Prioritization

Risk prioritization is about deciding which risks need immediate attention and which can be monitored over time. It involves sorting the risks based on the assessment carried out in the previous step. High-likelihood, high-impact risks are given the highest priority, while low-likelihood, low-impact ones are lower in priority.

Step 4: Risk Mitigation

This step involves creating action plans for the high-priority risks. The strategies are typically categorized as follows:

- Avoidance : Changing plans to circumvent the risk.

- Reduction : Taking steps to minimize the likelihood of the risk occurring or its impact if it does.

- Transfer : Shifting the risk to a third party, like through insurance or outsourcing.

- Acceptance : Deciding to accept the risk, often because the cost of mitigation is greater than the cost of the risk itself, but preparing contingency plans for dealing with it if it occurs.