- Browse All Articles

- Newsletter Sign-Up

- 22 Apr 2024

- Research & Ideas

When Does Impact Investing Make the Biggest Impact?

More investors want to back businesses that contribute to social change, but are impact funds the only approach? Research by Shawn Cole, Leslie Jeng, Josh Lerner, Natalia Rigol, and Benjamin Roth challenges long-held assumptions about impact investing and reveals where such funds make the biggest difference.

- 23 Jan 2024

More Than Memes: NFTs Could Be the Next Gen Deed for a Digital World

Non-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.

- 12 Sep 2023

How Can Financial Advisors Thrive in Shifting Markets? Diversify, Diversify, Diversify

Financial planners must find new ways to market to tech-savvy millennials and gen Z investors or risk irrelevancy. Research by Marco Di Maggio probes the generational challenges that advisory firms face as baby boomers retire. What will it take to compete in a fintech and crypto world?

- 17 Aug 2023

‘Not a Bunch of Weirdos’: Why Mainstream Investors Buy Crypto

Bitcoin might seem like the preferred tender of conspiracy theorists and criminals, but everyday investors are increasingly embracing crypto. A study of 59 million consumers by Marco Di Maggio and colleagues paints a shockingly ordinary picture of today's cryptocurrency buyer. What do they stand to gain?

- 17 Jul 2023

Money Isn’t Everything: The Dos and Don’ts of Motivating Employees

Dangling bonuses to checked-out employees might only be a Band-Aid solution. Brian Hall shares four research-based incentive strategies—and three perils to avoid—for leaders trying to engage the post-pandemic workforce.

- 20 Jun 2023

- Cold Call Podcast

Elon Musk’s Twitter Takeover: Lessons in Strategic Change

In late October 2022, Elon Musk officially took Twitter private and became the company’s majority shareholder, finally ending a months-long acquisition saga. He appointed himself CEO and brought in his own team to clean house. Musk needed to take decisive steps to succeed against the major opposition to his leadership from both inside and outside the company. Twitter employees circulated an open letter protesting expected layoffs, advertising agencies advised their clients to pause spending on Twitter, and EU officials considered a broader Twitter ban. What short-term actions should Musk take to stabilize the situation, and how should he approach long-term strategy to turn around Twitter? Harvard Business School assistant professor Andy Wu and co-author Goran Calic, associate professor at McMaster University’s DeGroote School of Business, discuss Twitter as a microcosm for the future of media and information in their case, “Twitter Turnaround and Elon Musk.”

- 06 Jun 2023

The Opioid Crisis, CEO Pay, and Shareholder Activism

In 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”

- 16 May 2023

- In Practice

After Silicon Valley Bank's Flameout, What's Next for Entrepreneurs?

Silicon Valley Bank's failure in the face of rising interest rates shook founders and funders across the country. Julia Austin, Jeffrey Bussgang, and Rembrand Koning share key insights for rattled entrepreneurs trying to make sense of the financing landscape.

- 27 Apr 2023

Equity Bank CEO James Mwangi: Transforming Lives with Access to Credit

James Mwangi, CEO of Equity Bank, has transformed lives and livelihoods throughout East and Central Africa by giving impoverished people access to banking accounts and micro loans. He’s been so successful that in 2020 Forbes coined the term “the Mwangi Model.” But can we really have both purpose and profit in a firm? Harvard Business School professor Caroline Elkins, who has spent decades studying Africa, explores how this model has become one that business leaders are seeking to replicate throughout the world in her case, “A Marshall Plan for Africa': James Mwangi and Equity Group Holdings.” As part of a new first-year MBA course at Harvard Business School, this case examines the central question: what is the social purpose of the firm?

- 25 Apr 2023

Using Design Thinking to Invent a Low-Cost Prosthesis for Land Mine Victims

Bhagwan Mahaveer Viklang Sahayata Samiti (BMVSS) is an Indian nonprofit famous for creating low-cost prosthetics, like the Jaipur Foot and the Stanford-Jaipur Knee. Known for its patient-centric culture and its focus on innovation, BMVSS has assisted more than one million people, including many land mine survivors. How can founder D.R. Mehta devise a strategy that will ensure the financial sustainability of BMVSS while sustaining its human impact well into the future? Harvard Business School Dean Srikant Datar discusses the importance of design thinking in ensuring a culture of innovation in his case, “BMVSS: Changing Lives, One Jaipur Limb at a Time.”

- 18 Apr 2023

What Happens When Banks Ditch Coal: The Impact Is 'More Than Anyone Thought'

Bank divestment policies that target coal reduced carbon dioxide emissions, says research by Boris Vallée and Daniel Green. Could the finance industry do even more to confront climate change?

The Best Person to Lead Your Company Doesn't Work There—Yet

Recruiting new executive talent to revive portfolio companies has helped private equity funds outperform major stock indexes, says research by Paul Gompers. Why don't more public companies go beyond their senior executives when looking for top leaders?

- 11 Apr 2023

A Rose by Any Other Name: Supply Chains and Carbon Emissions in the Flower Industry

Headquartered in Kitengela, Kenya, Sian Flowers exports roses to Europe. Because cut flowers have a limited shelf life and consumers want them to retain their appearance for as long as possible, Sian and its distributors used international air cargo to transport them to Amsterdam, where they were sold at auction and trucked to markets across Europe. But when the Covid-19 pandemic caused huge increases in shipping costs, Sian launched experiments to ship roses by ocean using refrigerated containers. The company reduced its costs and cut its carbon emissions, but is a flower that travels halfway around the world truly a “low-carbon rose”? Harvard Business School professors Willy Shih and Mike Toffel debate these questions and more in their case, “Sian Flowers: Fresher by Sea?”

Is Amazon a Retailer, a Tech Firm, or a Media Company? How AI Can Help Investors Decide

More companies are bringing seemingly unrelated businesses together in new ways, challenging traditional stock categories. MarcAntonio Awada and Suraj Srinivasan discuss how applying machine learning to regulatory data could reveal new opportunities for investors.

- 07 Apr 2023

When Celebrity ‘Crypto-Influencers’ Rake in Cash, Investors Lose Big

Kim Kardashian, Lindsay Lohan, and other entertainers have been accused of promoting crypto products on social media without disclosing conflicts. Research by Joseph Pacelli shows what can happen to eager investors who follow them.

- 31 Mar 2023

Can a ‘Basic Bundle’ of Health Insurance Cure Coverage Gaps and Spur Innovation?

One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency.

- 23 Mar 2023

As Climate Fears Mount, More Investors Turn to 'ESG' Funds Despite Few Rules

Regulations and ratings remain murky, but that's not deterring climate-conscious investors from paying more for funds with an ESG label. Research by Mark Egan and Malcolm Baker sizes up the premium these funds command. Is it time for more standards in impact investing?

- 14 Mar 2023

What Does the Failure of Silicon Valley Bank Say About the State of Finance?

Silicon Valley Bank wasn't ready for the Fed's interest rate hikes, but that's only part of the story. Victoria Ivashina and Erik Stafford probe the complex factors that led to the second-biggest bank failure ever.

- 13 Mar 2023

What Would It Take to Unlock Microfinance's Full Potential?

Microfinance has been seen as a vehicle for economic mobility in developing countries, but the results have been mixed. Research by Natalia Rigol and Ben Roth probes how different lending approaches might serve entrepreneurs better.

- 16 Feb 2023

ESG Activists Met the Moment at ExxonMobil, But Did They Succeed?

Engine No. 1, a small hedge fund on a mission to confront climate change, managed to do the impossible: Get dissident members on ExxonMobil's board. But lasting social impact has proved more elusive. Case studies by Mark Kramer, Shawn Cole, and Vikram Gandhi look at the complexities of shareholder activism.

Financial Management Research Paper Topics

Financial management research paper topics have emerged as an essential part of contemporary education in business and economics. As financial management continues to evolve with global economic changes, the need for research and analysis in this area grows. This article provides a comprehensive guide for students who study management and are assigned to write research papers on various aspects of financial management. From understanding the diverse topics to learning how to write an impactful research paper, this page offers valuable insights. Additionally, it introduces iResearchNet’s writing services, specifically tailored to assist students in achieving academic excellence. The content is structured to guide students through topic selection, writing, and leveraging professional services to meet their academic goals. Whether a novice or an advanced student of financial management, this resource offers a multifaceted perspective on the vast and dynamic field of financial management research.

100 Financial Management Research Paper Topics

The field of financial management offers a vast array of research paper topics. This complex discipline touches every aspect of business operations, influencing strategic planning, decision-making, and organizational growth. Below, you will find a comprehensive list of financial management research paper topics, divided into 10 categories. Each category offers 10 unique topics that cater to various interests within financial management. These topics have been carefully selected to reflect the richness and diversity of the subject.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% off with 24start discount code, financial planning and control.

- The Role of Budgeting in Financial Planning

- Strategic Financial Management in SMEs

- The Impact of Working Capital Management on Profitability

- Ethical Considerations in Financial Planning

- Risk Management in Financial Planning

- Cost Control Techniques in Manufacturing

- Financial Decision-making Processes in Non-profit Organizations

- The Impact of Inflation on Financial Planning

- International Financial Planning Strategies

- The Relationship between Corporate Governance and Financial Planning

Investment Analysis and Portfolio Management

- The Efficient Market Hypothesis: A Critical Analysis

- The Role of Behavioral Finance in Investment Decisions

- Modern Portfolio Theory and Its Limitations

- Risk and Return Analysis in Emerging Markets

- Socially Responsible Investment Strategies

- The Impact of Political Instability on Investment Decisions

- Real Estate Investment Trusts (REITs): An In-depth Study

- Impact of Technology on Portfolio Management

- Mutual Funds vs. ETFs: A Comparative Study

- The Role of Artificial Intelligence in Investment Management

Corporate Finance

- Capital Structure Decisions in Startups

- The Role of Dividends in Corporate Financial Management

- Mergers and Acquisitions: Strategic Financial Analysis

- Corporate Financing in Developing Economies

- An Analysis of Venture Capital Financing

- The Impact of Corporate Social Responsibility on Financial Performance

- The Role of Financial Management in Business Turnaround Strategies

- Debt Financing vs. Equity Financing: A Comparative Analysis

- Corporate Financial Risk Management Strategies

- Financing Innovation: Challenges and Opportunities

International Financial Management

- Exchange Rate Dynamics and International Financial Decisions

- The Role of International Financial Institutions in Economic Development

- Cross-border Mergers and Acquisitions

- Globalization and Its Impact on Financial Management

- International Tax Planning Strategies

- Challenges in Managing International Financial Risk

- Currency Risk Management in Multinational Corporations

- International Capital Budgeting Decisions

- The Impact of Cultural Differences on International Financial Management

- Foreign Direct Investment Strategies and Financial Management

Financial Markets and Institutions

- The Role of Central Banks in Financial Stability

- The Evolution of Microfinance Institutions

- The Impact of Regulation on Banking Operations

- An Analysis of Stock Market Efficiency

- Financial Derivatives and Risk Management

- The Role of Technology in Financial Services

- A Study of Financial Crises and Regulatory Responses

- Peer-to-Peer Lending Platforms: A New Paradigm

- The Role of Credit Rating Agencies in Financial Markets

- The Future of Cryptocurrency in the Financial Landscape

Personal Finance Management

- Financial Literacy and Personal Investment Decisions

- The Role of Technology in Personal Finance Management

- Retirement Planning Strategies

- Impact of Consumer Behavior on Personal Financial Decisions

- Personal Finance Management in the Gig Economy

- A Study of Personal Bankruptcy Trends

- Credit Card Management Strategies for Individuals

- The Effect of Education on Personal Financial Management

- The Role of Financial Counseling in Personal Finance

- Estate Planning: A Comprehensive Analysis

Risk Management

- Enterprise Risk Management: A Strategic Approach

- The Role of Insurance in Financial Risk Management

- Financial Innovations in Risk Management

- A Study of Credit Risk Management in Banks

- Risk Management Strategies in Supply Chain Finance

- Cyber Risk Management in Financial Institutions

- The Impact of Climate Change on Financial Risks

- A Study of Operational Risk Management in the Healthcare Sector

- Behavioral Aspects of Risk Management

- Crisis Management and Financial Stability

Financial Technology (FinTech)

- The Rise of Blockchain Technology in Finance

- The Impact of FinTech on Traditional Banking

- Regulatory Challenges in the Age of FinTech

- Financial Inclusion through FinTech Innovation

- Artificial Intelligence in Financial Services

- The Future of Cryptocurrencies: Opportunities and Risks

- A Study of Peer-to-Peer Lending Platforms

- FinTech and Consumer Privacy: Ethical Considerations

- Mobile Banking: An Evolutionary Study

- The Role of Big Data Analytics in Financial Decision Making

Ethics and Sustainability in Finance

- Ethical Investing: Trends and Challenges

- Corporate Social Responsibility Reporting in Finance

- Sustainable Finance in Emerging Economies

- Environmental, Social, and Governance (ESG) Criteria in Investment

- The Impact of Business Ethics on Financial Performance

- The Role of Sustainability in Corporate Financial Strategy

- Green Bonds and Financing Sustainable Development

- Social Impact Investing: Opportunities and Challenges

- A Study of Gender Equality in Financial Institutions

- Financial Strategies for Achieving Sustainable Development Goals

Accounting and Finance

- Forensic Accounting: Techniques and Case Studies

- The Role of Management Accounting in Financial Decision-making

- International Financial Reporting Standards (IFRS) Adoption

- The Impact of Taxation on Financial Management

- Accounting Information Systems: An In-depth Analysis

- The Role of Auditing in Corporate Governance

- Accounting Ethics: A Study of Professional Conduct

- Environmental Accounting and Sustainable Development

- The Effect of Automation on Accounting Practices

- A Comparative Study of GAAP and IFRS

The extensive list above offers a broad spectrum of financial management research paper topics. They cater to different academic levels and areas of interest, providing a wealth of opportunities for students to explore the multi-dimensional world of financial management. The selection of these topics can lead to exciting discoveries and insights, pushing the boundaries of existing knowledge in the field. Whether it’s understanding the intricate dynamics of global finance or delving into the ethical considerations in investment decisions, these topics serve as starting points for thought-provoking research that can shape future practices in financial management. By choosing a topic from this comprehensive list, students embark on a journey of intellectual exploration that can contribute to both academic success and the broader understanding of financial management in the modern world.

Financial Management and the Range of Research Paper Topics

Financial management is a multifaceted discipline that stands at the intersection of economics, business administration, and finance. It governs the planning, organizing, directing, and controlling of financial activities within an organization or individual framework. In an ever-changing global economy, the importance of financial management cannot be overstated. It empowers organizations and individuals to make informed decisions, manage risks, and achieve financial stability and growth. This article delves into the vast domain of financial management and explores the wide array of research paper topics it offers.

A. Definition and Core Concepts of Financial Management

Financial management refers to the efficient and effective management of money to achieve specific objectives. It involves processes and tasks such as budgeting, forecasting, investment analysis, risk management, and financial reporting. The primary goals are to maximize shareholder value, ensure liquidity, and maintain solvency.

- Budgeting and Forecasting : These processes involve planning and estimating future financial needs and outcomes. They guide decision-making and help in aligning resources with organizational goals.

- Investment Analysis : This includes evaluating investment opportunities and determining the most profitable and sustainable investments.

- Risk Management : This aspect focuses on identifying, evaluating, and mitigating financial risks, including market risk, credit risk, and operational risk.

- Financial Reporting : This entails the preparation and presentation of financial statements that accurately reflect the financial position of an organization.

B. Importance of Financial Management

- Ensuring Financial Stability : Effective financial management helps in maintaining the financial health of an organization or individual by ensuring a balance between income and expenditure.

- Optimizing Resources : It enables the optimal utilization of resources by aligning them with short-term and long-term goals.

- Strategic Planning : Financial management plays a key role in strategic planning by providing insights into financial capabilities and constraints.

- Enhancing Profitability : By making informed investment and operational decisions, financial management enhances the profitability of an organization.

C. Modern Trends and Challenges in Financial Management

The evolution of technology, globalization, regulatory changes, and societal expectations have shaped modern financial management. Some noteworthy trends and challenges include:

- Financial Technology (FinTech) : The integration of technology into financial services has revolutionized banking, investing, and risk management.

- Globalization : The interconnectedness of global markets presents both opportunities and challenges in managing international financial operations.

- Sustainability and Ethics : The growing focus on environmental, social, and governance (ESG) criteria has led to ethical investing and sustainable finance.

- Regulatory Compliance : Navigating the complex regulatory landscape is a challenge that requires constant adaptation and vigilance.

D. Range of Research Paper Topics in Financial Management

The vastness of financial management offers a rich source of research paper topics. From exploring the intricacies of investment analysis to understanding the ethical dimensions of finance, the possibilities are endless. The following are some broad categories:

- Corporate Finance : Topics related to capital structure, mergers and acquisitions, dividend policies, and more.

- Investment and Portfolio Management : Including research on investment strategies, portfolio optimization, risk and return analysis, etc.

- International Financial Management : This encompasses studies on exchange rate dynamics, global financial strategies, cross-border investments, etc.

- Risk Management : Topics include various risk management techniques, insurance, financial innovations in risk management, etc.

- Personal Finance Management : This field covers financial planning for individuals, retirement strategies, credit management, etc.

- Financial Technology : Blockchain, cryptocurrencies, mobile banking, and more fall under this innovative domain.

- Ethics and Sustainability in Finance : Research in this area may focus on ethical investing, corporate social responsibility, green financing, etc.

Financial management is an expansive and dynamic field that intertwines various elements of finance, economics, and business administration. Its importance in today’s world is immense, given the complexities of the global financial system. The array of research paper topics that this subject offers is indicative of its diversity and depth.

From traditional concepts like budgeting and investment analysis to modern phenomena like FinTech and sustainability, the world of financial management continues to evolve. It invites scholars, practitioners, and students to explore, question, and contribute to its understanding.

The range of research paper topics in financial management offers avenues for academic inquiry and practical application. Whether it’s investigating the effects of globalization on financial strategies or exploring personal finance management in the gig economy, there’s a topic to spark curiosity and inspire research. These research endeavors not only enrich academic literature but also play a crucial role in shaping the future of financial management. In a rapidly changing world, continuous exploration and learning in this field are essential to remain relevant, innovative, and responsible.

How to Choose Financial Management Research Paper Topics

Choosing the right research paper topic in the field of financial management is a critical step in the research process. The chosen topic can shape the direction, depth, and impact of the research. Given the wide array of subfields within financial management, selecting a suitable topic can be both exciting and challenging. Here’s a comprehensive guide to assist you in choosing the ideal financial management research paper topic.

1. Understand Your Interest and Strengths

- Assess Your Interests : Consider what aspects of financial management intrigue you the most. Your enthusiasm for a subject can greatly enhance the research process.

- Identify Your Strengths : Understanding where your skills and knowledge lie can guide you towards a topic that you can explore competently.

- Connect with Real-world Issues : Relating your interests to current industry challenges or trends can make your research more relevant and engaging.

2. Consider the Scope and Depth

- Define the Scope : A clear understanding of the scope helps in keeping the research focused. Too broad a topic can make the research vague, while too narrow may limit your exploration.

- Determine the Depth : Decide how deep you want to delve into the topic. Some subjects may require extensive quantitative analysis, while others may be more theoretical.

3. Examine Academic and Industry Relevance

- Align with Academic Requirements : Ensure that the topic aligns with your course objectives and academic requirements.

- Analyze Industry Needs : Consider how your research could contribute to the industry or address specific financial management challenges.

4. Evaluate Available Resources and Data

- Assess Data Accessibility : Ensure that you can access the necessary data and information to conduct your research.

- Consider Resource Limitations : Be mindful of the time, financial, and technological resources that you’ll need to complete your research.

5. Review Existing Literature

- Analyze Previous Research : Review related literature to identify gaps, controversies, or emerging trends that you can explore.

- Avoid Duplication : Ensure that your chosen topic is unique and not merely a repetition of existing studies.

6. Consult with Experts and Peers

- Seek Guidance from Faculty : Consulting with faculty or mentors can provide valuable insights and direction.

- Collaborate with Peers : Discussions with classmates or colleagues can help in refining ideas and getting diverse perspectives.

7. Consider Ethical Implications

- Evaluate Ethical Considerations : Ensure that your research complies with ethical guidelines, especially if it involves human subjects or sensitive data.

- Reflect on Social Impact : Consider how your research might influence society, policy, or industry standards.

8. Test the Feasibility

- Conduct a Preliminary Study : A small-scale preliminary study or analysis can help in gauging the feasibility of the research.

- Set Realistic Goals : Ensure that your research objectives are achievable within the constraints of time, resources, and expertise.

9. Align with Career Goals

- Consider Future Applications : Think about how this research might align with your career goals or professional development.

- Build on Past Experience : Leveraging your past experiences or projects can lend depth and continuity to your research.

10. Stay Flexible and Adaptable

- Be Open to Change : Research is often an iterative process; being flexible allows for adaptation as new insights or challenges emerge.

- Maintain a Balanced Perspective : While focusing on your chosen topic, keep an open mind to interrelated areas that might enrich your research.

Choosing the right financial management research paper topic is a nuanced process that requires careful consideration of various factors. From understanding personal interests and academic needs to evaluating resources, ethics, and feasibility, each aspect plays a significant role in shaping the research journey.

By following this comprehensive guide, students can navigate the complexities of selecting a suitable research paper topic in financial management. The ultimate goal is to find a topic that resonates with one’s interests, aligns with academic and professional objectives, and contributes meaningfully to the field of financial management. Whether delving into the dynamics of risk management or exploring the impact of FinTech innovations, the chosen topic should be a catalyst for inquiry, creativity, and growth.

How to Write a Financial Management Research Paper

Writing a research paper on financial management is a rigorous process that demands a thorough understanding of financial concepts, analytical skills, and adherence to academic standards. From selecting the right topic to presenting the final piece, each step must be methodically planned and executed. This section provides a comprehensive guide to help students craft an impactful financial management research paper.

1. Understand the Assignment

- Read the Guidelines : Begin by understanding the specific requirements of the assignment, including formatting, length, deadlines, and the expected structure.

- Clarify Doubts : If any aspect of the assignment is unclear, seek clarification from your instructor or mentor to avoid mistakes.

2. Choose a Strong Topic

- Identify Your Interest : Select a topic that interests you, aligns with your strengths, and meets academic and industry relevance. Refer to the previous section for detailed guidelines on choosing a topic.

3. Conduct Extensive Research

- Explore Varied Sources : Use academic journals, textbooks, online databases, and industry reports to gather diverse perspectives and evidence.

- Evaluate the Credibility : Ensure that the sources are credible, relevant, and up-to-date.

- Organize Your Findings : Maintain well-organized notes, including source citations, to facilitate smooth writing later.

4. Develop a Thesis Statement

- Define Your Focus : Craft a clear and concise thesis statement that outlines the central argument or purpose of your research.

- Align with the Evidence : Ensure that your thesis is well-supported by the evidence you have gathered.

5. Create an Outline

- Structure Your Paper : Plan the structure of your paper, including the introduction, body, and conclusion.

- Organize Ideas : Arrange your ideas, arguments, and evidence logically within the outline.

6. Write a Compelling Introduction

- Introduce the Topic : Provide background information and context to the reader.

- Present the Thesis : Clearly state your thesis to guide the reader through your research.

- Engage the Reader : Use compelling language to create interest in your study.

7. Develop the Body of the Paper

- Present Your Arguments : Use clear and concise paragraphs to present each main idea or argument.

- Support with Evidence : Include relevant data, charts, graphs, or quotations to support your claims.

- Use Subheadings : Subheadings can help in organizing the content and making it more reader-friendly.

8. Include Financial Analysis

- Apply Financial Models : Use relevant financial models, theories, or frameworks that pertain to your topic.

- Perform Quantitative Analysis : Utilize statistical tools, if necessary, to analyze financial data.

- Interpret the Results : Ensure that you not only present the numbers but also interpret what they mean in the context of your research.

9. Write a Thoughtful Conclusion

- Summarize Key Points : Recap the main arguments and findings of your paper.

- Restate the Thesis : Reiterate your thesis in light of the evidence presented.

- Provide Insights : Offer insights, implications, or recommendations based on your research.

10. Revise and Edit

- Review for Clarity : Read through the paper to ensure that the ideas flow logically and the arguments are well-articulated.

- Check for Errors : Look for grammatical, spelling, and formatting errors.

- Seek Feedback : Consider getting feedback from peers, tutors, or mentors to enhance the quality of your paper.

11. Follow Formatting Guidelines

- Adhere to Citation Style : Follow the required citation style (APA, MLA, etc.) consistently throughout the paper.

- Include a Bibliography : List all the references used in the research in a properly formatted bibliography.

- Add Appendices if Needed : Include any supplementary material like data sets or additional calculations in the appendices.

Writing a financial management research paper is a complex task that demands meticulous planning, diligent research, critical analysis, and clear communication. By adhering to these detailed guidelines, students can craft a research paper that not only meets academic standards but also contributes to the understanding of intricate financial management concepts.

Whether exploring investment strategies, corporate finance, or financial risk management, a well-crafted research paper showcases one’s analytical capabilities, comprehension of financial principles, and the ability to apply theoretical knowledge to real-world scenarios. It is an invaluable exercise in intellectual exploration and professional development within the realm of financial management.

iResearchNet Writing Services

For custom financial management research paper.

For students who are striving to excel in their academic journey, but are grappling with the challenges of creating a robust financial management research paper, iResearchNet comes to the rescue. With an array of quality writing services tailored to suit your unique needs, we are here to help you achieve your academic goals. Here’s an overview of our unique offerings, aimed at providing you the best in custom financial management research paper writing.

- Expert Degree-Holding Writers : Our team comprises handpicked writers, each holding degrees in finance or related fields. They come with a wealth of experience in academic writing, industry exposure, and a deep understanding of financial management concepts. They have the expertise to delve into complex topics and transform them into comprehensive, high-quality research papers.

- Custom Written Works : At iResearchNet, we believe every assignment is unique. We offer bespoke services, writing each paper from scratch, ensuring it matches your specific requirements and academic level. Our writers create well-structured, argumentative, and analytically sound papers that reflect original thinking.

- In-Depth Research : We recognize the importance of thorough research in crafting a superior financial management paper. Our writers dive deep into a variety of resources, extracting relevant information, data, and insights to ensure that your paper is rich in content, evidential support, and critical analysis.

- Custom Formatting : We adhere to the formatting style of your choice – APA, MLA, Chicago/Turabian, or Harvard. Our writers are adept at applying these styles to your paper, ensuring that every citation, reference, and the general layout complies with the required academic standards.

- Top Quality : Our commitment to quality is uncompromising. Each paper goes through a rigorous quality check, ensuring clarity of thought, precision of language, validity of arguments, and the overall coherence of the paper.

- Customized Solutions : We recognize that each student has unique needs. Our writers engage in a collaborative process with you to understand your academic objectives, style preferences, and specific requirements to provide a custom solution that best fits your needs.

- Flexible Pricing : We offer our premium services at competitive prices. We believe that every student deserves access to quality writing services, and our flexible pricing system ensures our services are affordable.

- Short Deadlines : Faced with a tight deadline? No worries. We can handle urgent orders, with turnaround times as short as three hours for certain assignments, without compromising on quality.

- Timely Delivery : We respect your timelines and are committed to delivering your paper well within your specified deadline, giving you ample time for review and revisions, if needed.

- 24/7 Support : Our dedicated customer service team is available around the clock to answer your queries, resolve any issues, and provide updates on your order status.

- Absolute Privacy : We have stringent privacy policies in place to ensure the confidentiality of your personal information and order details. We guarantee that your data will never be shared with third parties.

- Easy Order Tracking : Our user-friendly online platform enables you to easily track your order’s progress, communicate with the writer, and manage all aspects of your order conveniently.

- Money Back Guarantee : Your satisfaction is our ultimate goal. If, for any reason, you are not satisfied with our services, we offer a money-back guarantee, assuring you that your investment is safe with us.

With iResearchNet, you can rest assured that your financial management research paper is in capable hands. We understand the challenges that come with academic writing and strive to offer a comprehensive, stress-free solution that caters to your specific needs. Our core values of quality, integrity, and customer satisfaction drive us to deliver top-tier services that elevate your academic journey.

Leave the daunting task of research and writing to us, and focus on what truly matters – learning, understanding, and applying financial management concepts. So, reach out today, and let us help you turn your academic challenges into opportunities for growth and success!

Unlock Your Potential with iResearchNet – Your Partner in Academic Success!

Are you ready to take your financial management research paper to the next level? The journey to academic excellence is filled with challenges, but you don’t have to face them alone. With iResearchNet’s team of highly qualified writers and industry experts, we’ve got your back!

1. Embrace Quality and Excellence: We are not just offering a service; we are offering a partnership in your academic success. Our carefully crafted research papers are more than mere assignments; they are learning tools, meticulously designed to help you understand and excel in financial management.

2. Save Time, Learn More: By trusting us with your research paper, you free yourself to focus on understanding core financial management concepts, preparing for exams, or engaging in other valuable educational pursuits. Let us handle the intricate details of research and writing.

3. Invest in Your Future: This is more than just another paper; it’s a step towards your future career in finance. Our expertly crafted custom papers can be your gateway to deeper insights and better grades.

Why Wait? Let’s Get Started!

The clock is ticking, and your deadline is fast approaching. Our expert writers are standing by, ready to transform your requirements into a masterpiece of academic writing. With iResearchNet, you are not just buying a paper; you are investing in knowledge, quality, and your future success.

Take action today. Click the link below, fill in the details, and start your journey towards academic excellence with iResearchNet. Experience the difference that professionalism, quality, and personalized service can make in your academic life.

Order Now – Let iResearchNet Guide You to Success!

Order high quality custom paper.

A conceptual framework proposed through literature review to determine the dimensions of social transparency in global supply chains

- Published: 16 May 2024

Cite this article

- Preethi Raja 1 &

- Usha Mohan ORCID: orcid.org/0000-0003-2161-7600 1

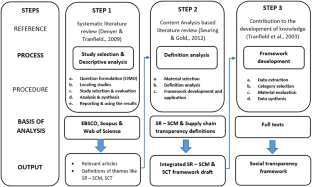

The current focus in supply chain management (SCM) research revolves around the relationship between sustainability and supply chain transparency (SCT). Despite the three pillars of sustainability – environmental, social, and economic- the limited and scattered analysis is on the social part, and the least is on socially responsible supply chain management (SR-SCM). SCT plays a significant role in elevating the sustainability of the supply chain. This review paper emphasizes the integration of SCT and sustainable supply chain, especially the social aspect as SR-SCM, and coining the new term social transparency (ST). ST is openness to communicating details about the impact of business on people, their well-being, and compliance with social sustainability standards and policies. This paper establishes a conceptual framework using three research methods. systematic literature review, content analysis-based literature review, and framework development. By locating studies in databases like EBSCO, Scopus, and Web of Science, 273 peer-reviewed articles were identified in the intersection of social sustainability, supply chains, and transparency. Finally, the framework proposes five dimensions: tracking and tracing suppliers till provenance, product and process specifications, financial transaction information, social sustainability policies and compliance, and performance assessment to determine ST in global supply chains.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price excludes VAT (USA) Tax calculation will be finalised during checkout.

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

RETRACTED ARTICLE: Converging concepts of sustainability and supply chain networks: a systematic literature review approach

Stakeholder roles in sustainable supply chain management: a literature review

Making transparency transparent: a systematic literature review to define and frame supply chain transparency in the context of sustainability

Data availability.

The data that supports the findings of this systematic literature review and content analysis are either included in this manuscript or are publicly available in the referenced sources. All included studies and their respective citations are provided in the reference section. Any additional data or materials used for this review can be obtained upon request from the corresponding author.

Abbreviations

Supply chain management

Socially responsible supply chain management

Supply Chain Transparency

Social Transparency

Multinational Corporations

Code of Conduct

Corporate Social Responsibility

Preferred Reporting Items for Systematic Reviews and Meta-analyses

Radio frequency Identification

Internet of Things

Sustainable Supply Chain Management

Supply Chain

Textile Standard Certification

Worldwide Responsible Accredited Production

Global Organic Textile Standard

Global Recycled Standard

Registration, Evaluation, Authorization and Restriction on the use of Chemicals

Social Accountability International Certification

Indian Standards Institution Mark

Bureau of Indian Standards

Abdul S, Khan R, Zkik K, Belhadi A, Kamble SS (2021) Evaluating barriers and solutions for social sustainability adoption in multi-tier supply chains. Int J Prod Res 0(0):1–20. https://doi.org/10.1080/00207543.2021.1876271

Article Google Scholar

Al-Khatib AW (2023) Internet of things, big data analytics and operational performance: the mediating effect of supply chain visibility. J Manuf Technol Manage 34(1):1–24. https://doi.org/10.1108/JMTM-08-2022-0310

Awaysheh A, Klassen RD (2010) The impact of supply chain structure on the use of supplier socially responsible practices. Int J Oper Prod Manage, 30 (12)

Bangladesh garment workers (2023) ‘frustrated’ by Gov’t wage hike after protests. The minimum wage increase comes after weeks of the worst protests in a decade hit Bangladesh’s major industrial areas. November 08, [Cited 30.01.2024]. https://www.aljazeera.com/news/2023/11/8/bangladesh-garment-workers-frustrated-by-govts-wage-hike-after-protests#:~:text=Bangladesh&20is&20the&20second&20largest,according&20to&20the&20manufacturers'&20association .

Bangladesh workers’ protest (2023) 150 factories shut, cases against 11k workers. Bangladesh’s garment workers earn $95 a month as minimum wage and are demanding a minimum wage of $208 a month. BS Web Team November 13, [Cited 30.01.2024]. https://www.business-standard.com/world-news/bangladesh-workers-protest-150-factories-shut-cases-against-11k-workers-123111300291_1.html

Bozic D (2015) From Haute Couture to Fast-Fashion: Evaluating Social Transparency in Global Apparel Supply Chains. MIT Thesis

Brun A, Karaosman H, Barresi T (2020) Supply chain collaboration for transparency. Sustain (Switzerland), 12 (11)

Carter CR, Rogers DS (2008) A framework of sustainable supply chain management: moving toward new theory. Int J Phys Distribution Logistics Manage

Delaney A, Connor T (2016) Forced Labour in the Textile and Garment Sector in Tamil Nadu, South India Strategies for Redress . October , 1–67. http://corporateaccountabilityresearch.net/njm-report-xiii-sumangali

Denyer D, Tranfield D (2009) Producing a systematic review. In: Buchanan DA, Bryman A (eds) The sage handbook of organizational research methods. Sage Publications Ltd., pp 671–689

Doorey DJ, Doorey DJ (2018) The transparent supply chain: from resistance to implementation at Nike. J Bus Ethics 103(4):587–603

Egels-Zandén N, Hansson N (2016) Supply Chain transparency as a consumer or corporate Tool: the case of Nudie Jeans Co. J Consum Policy 39(4):377–395. https://doi.org/10.1007/s10603-015-9283-7

Egels-Zandén N, Hulthén K, Wulff G (2015) Trade-offs in supply chain transparency: the case of Nudie Jeans Co. J Clean Prod 107:95–104

Elkington J (1998) Accounting for the triple bottom line. Measuring Business Excellence

Fair Labor Association (2012) Understanding the Characteristics of the Sumangali Scheme in Tamil Nadu Textile & Garment Industry and Supply Chain Linkages . May . www.fairlabor.orgwww.solidaridadnetwork.org

Faisal M, Sabir N, Bin L (2023) Operationalizing transparency operationalizing in supply chains using a systematic literature review and graph theoretic approach. https://doi.org/10.1108/BIJ-05-2022-0291

Francisco K, Swanson D (2018) The Supply Chain Has No Clothes: Technology Adoption of Blockchain for Supply Chain Transparency. Logistics

Fraser IJ, Müller M, Schwarzkopf J (2020) Transparency for multi-tier sustainable supply chain management: a case study of a multi-tier transparency approach for SSCM in the automotive industry. Sustain (Switzerland) 12(5):1–24

Google Scholar

Hohn MM, Durach CF (2023) Taking a different view: theorizing on firms ’ development toward an integrative view on socially sustainable supply chain management . 53 (1), 13–34. https://doi.org/10.1007/s10551-012-1245-2

https://cleanclothes.org/news/2015/03/18/rana-plaza-survivor-and-others-arrested-at-childrens-place-headquarters

https://cleanclothes.org/campaigns/the-accord

Huq FA, Stevenson M, Zorzini M (2014) Social sustainability in developing country suppliers an exploratory study in the ready made garments industry of Bangladesh. Int J Oper Prod Manage

Jamalnia A, Gong Y, Govindan K (2023) Sub-supplier’s sustainability management in multi-tier supply chains: a systematic literature review on the contingency variables, and a conceptual framework. Int J Prod Econ 255(January 2022):108671. https://doi.org/10.1016/j.ijpe.2022.108671

Klassen RD, Vereecke A (2012) Social issues in supply chains: capabilities link responsibility, risk (opportunity), and performance. Intern J Prod Econ

Kraft T, Valdés L, Zheng Y (2018) Supply Chain visibility and social responsibility: investigating consumers ’ behaviors and motives. Manufacturing & Service Operations Management

Lamming RC, Caldwell ND, Harrison DA, Phillips W (2001) Transparency in Supply Relationships: Concept and Practice . November , 4–10

Limited KEDSP (2019) Evaluation of Sumangali_Eradication of extremely exploitative working conditions in Southern India’s textile industry . June

Mayer DM, Ong M, Sonenshein S, Ashford S (2019) To Get Companies to Take Action on Social Issues, Emphasize Morals, Not the Business Case. [Website]. [Cited 11.11.2023]. Available: https://hbr.org/2019/02/to-get-companies-to-take-action-on-social-issues-emphasize-morals-not-the-business-case

McGrath P, McCarthy L, Marshall D, Rehme J (2021) Tools and technologies of transparency in sustainable global supply chains. Calif Manag Rev 64(1):67–89

Moher D, Liberati A, Tetzlaff J, Altman DG, Antes G, Atkins D, Barbour V, Barrowman N, Berlin JA, Clark J, Clarke M, Cook D, D’Amico R, Deeks JJ, Devereaux PJ, Dickersin K, Egger M, Ernst E, Gøtzsche PC, Tugwell P (2009) Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. PLoS Med 6(7). https://doi.org/10.1371/journal.pmed.1000097

Montecchi M, Plangger K, C. West D (2021) Supply chain transparency: a bibliometric review and research agenda. Int J Prod Econ 238(August 2020):108152. https://doi.org/10.1016/j.ijpe.2021.108152

Morgan TR, Gabler CB, Manhart PS (2023) Supply chain transparency: theoretical perspectives for future research. The International Journal of Logistics Management , 2008 . https://doi.org/10.1108/ijlm-02-2021-0115

Parmar BL, Freeman RE, Harrison JS, Wicks AC, Purnell L, Bidhan L, Edward R, Jeffrey S, Andrew C (2011) The Academy of Management annals Stakeholder Theory: the state of the art Stakeholder Theory : the state of the art. Management 936836193:403–445

Report of the World Commission on Environment and Development (1987) United Nations. Our Common Future

Robledo P, Triebich M (2020) Position Paper on Transparency. Clean Clothes Campaign , April . www.fashionchecker.org

Rodr JA, Enez CGIM, Ramon E, Pagell M (2016) NGO’s initiatives to enhance social sustainability in the supply chain: poverty alleviation through supplier development programs. J Supply Chain Manage, 1–26

Sancha C, Gimenez C, Sierra V (2016) Achieving a socially responsible supply chain through assessment and collaboration. J Clean Prod, 112

Schäfer N (2022) Making transparency transparent: a systematic literature review to define and frame supply chain transparency in the context of sustainability. Manage Rev Q

Senyo PK, Osabutey ELC (2023) Transdisciplinary perspective on sustainable multi-tier supply chains: a triple bottom line inspired framework and future research directions. Int J Prod Res 61(14):4918–4933. https://doi.org/10.1080/00207543.2021.1946194

Seuring S, Gold S (2012) Conducting content-analysis based literature reviews in supply chain management. Supply Chain Manage 17(5):544–555

Shrivastava P, Hart SL (1995) Creating sustainable corporations. Bus Strategy Environ 4:154–165

Sikdar SK (2003) Sustainability development and sustainability metrics. Am Inst Chem Eng, 49 (8)

Sodhi MS, Tang CS (2019) Research Opportunities in Supply Chain Transparency . 0 (0), 1–14. https://doi.org/10.1111/poms.13115

Spence L, Bourlakis M (2009) The evolution from corporate social responsibility to supply chain responsibility: the case of Waitrose. Supply Chain Management: Int J

Tranfield D, Denyer D, Smart P (2003) Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br J Manag 14:207–222

Venkatesh VG, Kang K, Wang B, Zhong RY, Zhang A (2020a) System architecture for blockchain based transparency of supply chain social sustainability. Robotics and Computer-Integrated Manufacturing

Venkatesh VG, Zhang A, Deakins E, Venkatesh M (2020b) Drivers of sub-supplier social sustainability compliance: an emerging economy perspective. Supply Chain Management: Int J

Wognum PMN, Bremmers H, Trienekens JH, Vorst JGA, Van Der J, Bloemhof JM (2011) Systems for sustainability and transparency of food supply chains – Current status and challenges. Advanced Engineering Informatics

Yawar SA, Seuring S (2015) Management of Social issues in Supply chains: a Literature Review Exploring Social Issues, actions and performance outcomes. J Bus Ethics

Download references

There is no funding for this project.

Author information

Authors and affiliations.

Department of Management Studies, IIT Madras, Chennai, 600036, Tamil Nadu, India

Preethi Raja & Usha Mohan

You can also search for this author in PubMed Google Scholar

Ethics declarations

Conflict of interest.

There is no conflict of interest in this paper.

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Supplementary Material 1

Supplementary material 2, supplementary material 3, rights and permissions.

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Raja, P., Mohan, U. A conceptual framework proposed through literature review to determine the dimensions of social transparency in global supply chains. Manag Rev Q (2024). https://doi.org/10.1007/s11301-024-00440-1

Download citation

Received : 21 July 2023

Accepted : 26 April 2024

Published : 16 May 2024

DOI : https://doi.org/10.1007/s11301-024-00440-1

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Social sustainability

- Socially responsible supply chain

- Supply chain transparency

- Social transparency evaluation framework

- Corporate social responsibility

- Conceptual framework development

- Find a journal

- Publish with us

- Track your research

What do Financial Markets say about the Exchange Rate?

Financial markets play two roles with implications for the exchange rate: they accommodate risk sharing and act as a source of shocks. In prevailing theories, these roles are seen as mutually exclusive and individually face challenges in explaining exchange rate dynamics. However, we demonstrate that this is not necessarily the case. We develop an analytical framework that characterizes the link between exchange rates and finance across all conceivable market structures. Our findings indicate that full market segmentation is not necessary for financial shocks to explain exchange rates. Moreover, financial markets can accommodate a significant extent of international risk sharing without leading to the classic exchange rate puzzles. We identify plausible market structures where both roles coexist, addressing challenges faced when examined separately.

The authors have no relevant or material financial interests that relate to the research described in this paper. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.

MARC RIS BibTeΧ

Download Citation Data

Conferences

More from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

Smart. Open. Grounded. Inventive. Read our Ideas Made to Matter.

Which program is right for you?

Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world.

A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers.

A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems.

Earn your MBA and SM in engineering with this transformative two-year program.

Combine an international MBA with a deep dive into management science. A special opportunity for partner and affiliate schools only.

A doctoral program that produces outstanding scholars who are leading in their fields of research.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance.

A joint program for mid-career professionals that integrates engineering and systems thinking. Earn your master’s degree in engineering and management.

An interdisciplinary program that combines engineering, management, and design, leading to a master’s degree in engineering and management.

Executive Programs

A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact.

This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world.

Non-degree programs for senior executives and high-potential managers.

A non-degree, customizable program for mid-career professionals.

Use imagination to make the most of generative AI

US voters exhibit ‘flexible morals’ when confronting misinformation

Sam Altman thinks AI will change the world. All of it.

Credit: stavklem / Shutterstock

Ideas Made to Matter

Financial Markets

Lending standards can be too tight for too long, research finds

Betsy Vereckey

May 14, 2024

The economy plays a huge role in lending trends, which is why it’s harder to get a loan in a recession than it is during a boom time.

Lending standards were loose during the lending boom of the mid-2000s, for example, when credit spreads and default rates were low. And standards were relatively tight during the credit crunch in 2008 – 2009, when default rates were high, and they continued to be tight even during the recovery that followed, so credit spreads also remained high.

What was notable was that lending standards were notably slow to loosen up — even after the turmoil began to ease in 2009 and into 2010, said finance professor Jonathan A. Parker, a co-director of the MIT Golub Center for Finance and Policy and the MIT Consumer Finance Initiative .

New research from Parker and his co-authors suggests that some of the persistence of tightness after a shock is self-inflicted. When banks try to protect themselves by increasing their due diligence in evaluating potential borrowers, they set off a chain reaction whereby other banks do the same and worsen the credit crunch.

Parker, Michael J. Fishman of Northwestern University, and Ludwig Straub of Harvard unpack this ripple effect in “ A Dynamic Theory of Lending Standards ,” examining the effort banks take to screen out bad borrowers. The researchers created a model that examines the effects of tight lending standards versus loose lending standards and shows what can happen when banks go the extra mile to acquire a plethora of information on borrowers and condition their lending on that information. Here’s what they found:

- By not funding people who are less creditworthy, tighter standards worsen the pool of potential borrowers who are looking for loans, which in turn creates an even bigger incentive for banks to employ tight standards in the future.

- Tighter standards in a good market are inefficient. They amplify and prolong downturns, decrease overall lending, and increase credit spreads.

The following insights led the researchers to those conclusions.

Lending standards are inefficient when they’re too tight

When the economy is good, banks rely less on consumers’ private information to make loans, Parker said. They rely more on publicly available information, which is an efficient and low-cost way to acquire data to assess loan applicants.

But when there’s a financial shock to credit markets, or when banks have to be selective about the loans they make because of balance sheet constraints or management concerns about leverage, banks put in more work to evaluate potential borrowers.

The researchers found that this can lead to a domino effect that causes banks to keep up their tough due diligence persistently, even after economic conditions improve. This makes loans more costly to make and means that credit markets get stuck with high interest rates that borrowers end up having to pay.

If the market is in good shape, less due diligence makes more sense. Over-diligence slows down the process, costs the banks more money — an expense they pass on to borrowers — and reduces their ability to lend to worthy borrowers.

Counterintuitively, in credit markets where most potential borrowers are creditworthy, “less checking would make the loans actually cheaper for those good borrowers who would’ve gotten through the tight lending standards, who would have gotten loans either way,” Parker said.

This is especially relevant right now because there are a lot of commercial real estate losses on bank balance sheets and there is lingering concern about the fiscal health of banks following the year-ago collapse of Silicon Valley Bank and two other large regional lenders.

“There’s a bunch of regulatory concern about the loans that banks are making right now,” Parker said. And that concern is causing banks to put in more effort than necessary when checking a borrower’s history.

The real estate market is another sore spot. Lending standards are currently tight , especially in commercial real estate.

“When you have people with reasonably good credit scores who are putting a down payment down on a house that’s a good piece of collateral, it doesn’t make sense for banks to be doing a lot of evaluation of whether that loan is going to pay off or not,” Parker said.

“The chances that [a loan] will fail are very small. Some of them will default and lose a little bit of money, but that will be a rare event,” he said.

The government should intervene when lending standards are too tight

Parker said that it can be beneficial to have the government relax lending standards when they’re too tight for too long. Lending standards, for example, were too tight for too long following the 2008 – 2009 financial crisis, Parker said.

In a high interest rate environment, the government could temporarily support the lending market with a temporary loan guarantee program funded by a tax on loan payments. In 2009, the government purchased mortgage-backed securities, which pool borrowers, and took over Fannie Mae and Freddie Mac so they could continue to insure mortgages.

Fintechs are adding additional pressure

Financial technology startups are now lending like banks, approving loans with just a few taps on a cellphone — but without the same degree of regulation. For example, short-term point-of-sale lending, known as “ buy now, pay later ,” is carving some safe loans out of the credit card space and stealing market share. These companies make loans with a soft credit check based on “what is being purchased, where it’s being bought, and maybe even when,” Parker said.

Related Articles

Buy now, pay later loans — which allow consumers to break up payment into four installments — began to soar in popularity during the online spending boom spurred by the pandemic. Amid high credit card interest rates , these loans remain popular with people who want to keep a low credit card balance.

Parker said that might push credit card interest rates higher: As some of the better credit risks are carved out of banks’ lending pool, credit card companies might tighten lending standards and reduce credit to marginal borrowers.

“This is a very active place in the economy today, where there are lots of fintech lenders that are working on developing new lending models,” Parker said. For example, SoFi, an online finance company that specializes in student loan refinancing, connects borrowers with investors who want to lend them money.

Parker said that traditional banks should be aware that their borrower pool is being influenced by the arrival of these companies, perhaps more than they realize.

The arrival of buy now, pay later “changes how competitive credit cards are,” Parker said, because the “loans that they’re making are effectively different and separate” from the ones the banks are making.

If buy now, pay later works, “some safe loans would presumably be carved out of the credit card space and satisfied by buy now, pay later,” Parker said. “There are still a bunch of questions about exactly how this is going. But credit card interest rates might end up a little bit higher because some of the better credit risks are being removed from their lending pool.”

Read next: How target date funds impact investment behavior

- Knowledge Insight

- Solutions & Services

- Sustainability

- Investor Relations

- Publications

- Management Consulting

- Systems Consulting

- Financial IT Solutions

- Industrial IT Solutions

- IT Infrastructure Services

- Sustainability Management Policy

- Materiality Topics

- News Release

- What's new

- Message from the President

- Corporate Philosophy

- Management Vision

- Corporate Governance

- Corporate Overview

- NRI Group Companies and offices

- Management Policy

- Financial Data

- Stocks&Ratings

Free Word Search

Search by topic.

- Keyword Industry Purpose Expert Area #AI #IoT #Cloud #Innovation #Digital marketing #Work style reforms #Global #Fintech #Big data #sharing economy #Cyber security #Data analytics #UX/UI design #Regional revitalization #Market Analysis #My number #Management #DX #Sustainability #CX #Circular Economy #Carbon neutral #Zero Trust #Smart City #Fishery, Agriculture & Forestry #Housing, Construction, Real estate #Foods #Chemicals, raw materials #Healthcare, Medical #Social security #Machinery, Precision Instruments #Energy, environment #Transportation, Logistics #IT, Communication #Media, publication #Consumer goods, Retail #Service #Broker Dealers #Asset Managers #Insurance Companies #Banks #Other finance #Public #Electric, High technology #automotive #Real-time management #Global operation #Business model innovation #Corporate governance #Mission vision and value building #Business resturctuting #HRM strategy #Cost restructuring #M&A・PMI #PMO, Project management #Business process restructuring #Sales, Chanel reform #Marketing strategy #Customer relation #Supply chain optimization #Business platform #Regulatory compliance #Policy Design #IT investment optimization #BCP, Risk management #Information security #Work style reforms #Data analytics #IT governance #IT sector structure #Information strategy #Management information visualization and utilization #Operation and system integration #IT optimization #IT resource reinforcement #Digital Workplace #RPA #Policy recommendations #Kotaro Kuwazu #Minoru Aoshima #Takahide Kiuchi #Sadakazu Osaki #Tetsuya Inoue #Makoto Shirota #Tatsuo Tanaka #Naoaki Fujino #Shun-ichi Kita #Ryoji Kashiwagi #Haruhiko Kanda #Hirofumi Tatematsu #Noriyuki Kobayashi #Katsutoshi Takehana #Eiji Fujiyoshi #Global #Asia Pacific #North America #Europe #Africa #Middle East #South America #Japan #China #Hong Kong #Taiwan #India #Australia #Thai #The Philippines #Indonesia #Singapore #The US #The UK #Vietnam #Germany

List of overseas bases of NRI

- Capital Markets & IT - lakyara May 2024

- Asset Management

Financial business trends elucidated with data

May. 15, 2024

The new, improved version of NISAs (Nippon Individual Savings Accounts) may have an indelible impact on Japan’s investment trust market. The new NISAs have accentuated the distinction between funds that are suitable as stable investment vehicles and funds that are not. In the first three months following the new NISAs’ advent, investment trusts eligible to be held in NISAs captured an outsized share of asset inflows while most NISA-ineligible investment trusts experienced asset outflows. Amid ongoing changes in the Japanese public’s image of investing, NISA-eligibility may be influencing investment trust investors’ fund selection decisions, even when the fund being purchased will not be held in a NISA. If so, investment trust sponsors will have to seriously weigh whether to make compliance with NISA eligibility requirements a feature of their new products.

Download (595KB)

About the Author

Hisashi Kaneko

Chief Researcher

Financial Market & Digital Business Research Department

E-mail: [email protected]

You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

- IMF at a Glance

- Surveillance

- Capacity Development

- IMF Factsheets List

- IMF Members

- IMF Timeline

- Senior Officials

- Job Opportunities

- Archives of the IMF

- Climate Change

- Fiscal Policies

- Income Inequality

Flagship Publications

Other publications.

- World Economic Outlook

- Global Financial Stability Report

- Fiscal Monitor

- External Sector Report

- Staff Discussion Notes

- Working Papers

- IMF Research Perspectives

- Economic Review

- Global Housing Watch

- Commodity Prices

- Commodities Data Portal

- IMF Researchers

- Annual Research Conference

- Other IMF Events

IMF reports and publications by country

Regional offices.

- IMF Resident Representative Offices

- IMF Regional Reports

- IMF and Europe

- IMF Members' Quotas and Voting Power, and Board of Governors

- IMF Regional Office for Asia and the Pacific

- IMF Capacity Development Office in Thailand (CDOT)

- IMF Regional Office in Central America, Panama, and the Dominican Republic

- Eastern Caribbean Currency Union (ECCU)

- IMF Europe Office in Paris and Brussels

- IMF Office in the Pacific Islands

- How We Work

- IMF Training

- Digital Training Catalog

- Online Learning

- Our Partners

- Country Stories

- Technical Assistance Reports

- High-Level Summary Technical Assistance Reports

- Strategy and Policies

For Journalists

- Country Focus

- Chart of the Week

- Communiqués

- Mission Concluding Statements

- Press Releases

- Statements at Donor Meetings

- Transcripts

- Views & Commentaries

- Article IV Consultations

- Financial Sector Assessment Program (FSAP)

- Seminars, Conferences, & Other Events

- E-mail Notification

Press Center

The IMF Press Center is a password-protected site for working journalists.

- Login or Register

- Information of interest

- About the IMF

- Conferences

- Press briefings

- Special Features

- Middle East and Central Asia

- Economic Outlook

- Annual and spring meetings

- Most Recent

- Most Popular

- IMF Finances

- Additional Data Sources

- World Economic Outlook Databases

- Climate Change Indicators Dashboard

- IMF eLibrary-Data

- International Financial Statistics

- G20 Data Gaps Initiative

- Public Sector Debt Statistics Online Centralized Database

- Currency Composition of Official Foreign Exchange Reserves

- Financial Access Survey

- Government Finance Statistics

- Publications Advanced Search

- IMF eLibrary

- IMF Bookstore

- Publications Newsletter

- Essential Reading Guides

- Regional Economic Reports

- Country Reports

- Departmental Papers

- Policy Papers

Selected Issues Papers

- All Staff Notes Series

- Analytical Notes

- Fintech Notes

- How-To Notes

- Staff Climate Notes

Recent Challenges to the Conduct of Monetary Policy in the WAEMU

Author/Editor:

Alain Feler ; Lawrence Norton

Publication Date:

May 17, 2024

Electronic Access:

Free Download . Use the free Adobe Acrobat Reader to view this PDF file

This paper discusses recent challenges in BCEAO monetary policy, from a recent spike in inflation, the persistent erosion of external reserves, and strains in the regional financial market. In response to these shocks, the BCEAO operated via both policy rates and liquidity management, including by shifting from fixed to variable rate auctions. The paper finds that the conduct of monetary policy became progressively more constrained by financial stability and external viability challenges, arguing for enhanced monetary-fiscal policy coordination to help the BCEAO meet its reserves objectives.

Selected Issues Paper No. 2024/013

International organization Monetary policy

9798400274121/2958-7875

SIPEA2024013

Please address any questions about this title to [email protected]

Welcome to the MIT CISR website!

This site uses cookies. Review our Privacy Statement.

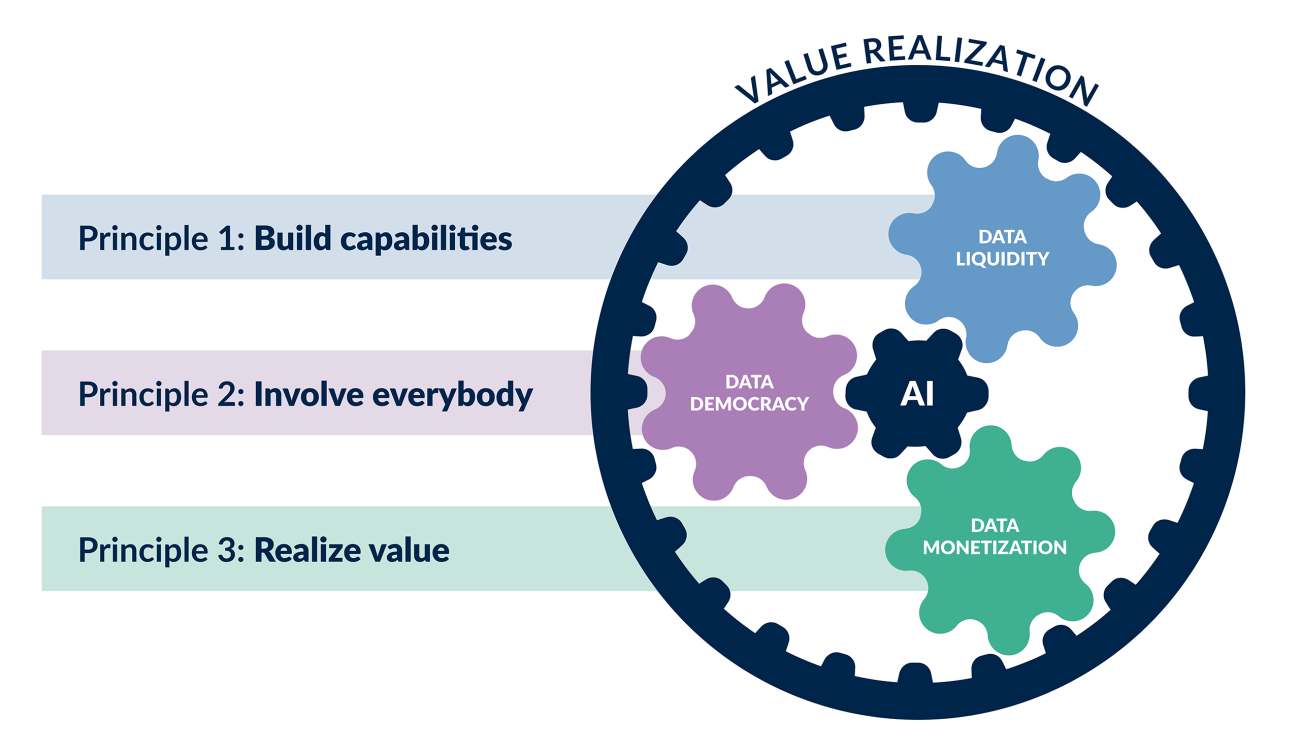

AI Is Everybody’s Business

This briefing presents three principles to guide business leaders when making AI investments: invest in practices that build capabilities required for AI, involve all your people in your AI journey, and focus on realizing value from your AI projects. The principles are supported by the MIT CISR data monetization research, and the briefing illustrates them using examples from the Australia Taxation Office and CarMax. The three principles apply to any kind of AI, defined as technology that performs human-like cognitive tasks; subsequent briefings will present management advice distinct to machine learning and generative tools, respectively.

Access More Research!

Any visitor to the website can read many MIT CISR Research Briefings in the webpage. But site users who have signed up on the site and are logged in can download all available briefings, plus get access to additional content. Even more content is available to members of MIT CISR member organizations .

Author Barb Wixom reads this research briefing as part of our audio edition of the series. Follow the series on SoundCloud.

DOWNLOAD THE TRANSCRIPT

Today, everybody across the organization is hungry to know more about AI. What is it good for? Should I trust it? Will it take my job? Business leaders are investing in massive training programs, partnering with promising vendors and consultants, and collaborating with peers to identify ways to benefit from AI and avoid the risk of AI missteps. They are trying to understand how to manage AI responsibly and at scale.

Our book Data Is Everybody’s Business: The Fundamentals of Data Monetization describes how organizations make money using their data.[foot]Barbara H. Wixom, Cynthia M. Beath, and Leslie Owens, Data Is Everybody's Business: The Fundamentals of Data Monetization , (Cambridge: The MIT Press, 2023), https://mitpress.mit.edu/9780262048217/data-is-everybodys-business/ .[/foot] We wrote the book to clarify what data monetization is (the conversion of data into financial returns) and how to do it (by using data to improve work, wrap products and experiences, and sell informational solutions). AI technology’s role in this is to help data monetization project teams use data in ways that humans cannot, usually because of big complexity or scope or required speed. In our data monetization research, we have regularly seen leaders use AI effectively to realize extraordinary business goals. In this briefing, we explain how such leaders achieve big AI wins and maximize financial returns.

Using AI in Data Monetization