Presentations made painless

- Get Premium

Shopify: Business Model, SWOT Analysis, and Competitors 2023

Inside This Article

Shopify, an e-commerce platform, has revolutionized the way businesses sell their products online. With its easy-to-use tools and exceptional customer service, Shopify has become a leading player in the e-commerce industry. In this blog article, we will discuss Shopify's business model, conduct a SWOT analysis, and examine its competitors. We will also provide insights into the future of Shopify and how it plans to maintain its position as a top e-commerce platform in 2023.

What you will learn:

- You will gain an understanding of the ownership structure of Shopify and who holds the majority of shares in the company

- You will learn about Shopify's mission statement and how it guides the company's decisions and actions

- You will discover the various revenue streams that Shopify uses to generate income, including transaction fees, subscription fees, and add-on services.

Who owns Shopify?

Shopify is a publicly traded company, meaning that it is owned by its shareholders. The company went public in May 2015, with an initial public offering (IPO) on the New York Stock Exchange (NYSE), which valued the company at $1.27 billion. Since then, Shopify has experienced steady growth, with its market capitalization exceeding $100 billion in 2021.

Shopify's largest shareholders include its co-founders Tobias Lutke, Daniel Weinand, and Scott Lake, who collectively own around 10% of the company's shares. Other major shareholders include institutional investors such as Fidelity, Vanguard, and BlackRock.

Despite being a publicly traded company, Shopify's co-founders retain significant control over the company through their ownership of Class B shares, which have 10 votes per share compared to the one vote per share for Class A shares. This dual-class share structure allows the co-founders to maintain control over key decisions and protect the company's long-term vision.

In summary, Shopify is a publicly traded company owned by its shareholders, with its co-founders retaining significant control through their ownership of Class B shares.

What is the mission statement of Shopify?

Shopify, one of the leading e-commerce platforms, has a clear and concise mission statement that guides its actions and decisions. The company's mission statement is:

"To make commerce better for everyone."

This statement encapsulates Shopify's commitment to empowering entrepreneurs and businesses of all sizes to succeed in the digital marketplace. By providing a user-friendly platform, robust tools and resources, and exceptional customer support, Shopify aims to level the playing field and create opportunities for anyone with a great product or idea.

At its core, the mission statement reflects Shopify's belief that commerce should be accessible, inclusive, and empowering. Whether you're a small business owner just starting out or a multinational corporation looking to expand your reach, Shopify seeks to provide the tools and support you need to succeed.

To achieve its mission, Shopify focuses on several key values, including:

Customer-first mentality: Shopify puts its customers at the center of everything it does, striving to provide the best possible experience for merchants and shoppers alike.

Entrepreneurial spirit: Shopify was founded by entrepreneurs, and the company continues to prioritize innovation, creativity, and risk-taking.

Community-oriented: Shopify recognizes the importance of community and seeks to foster a supportive and collaborative environment for its merchants, partners, and employees.

Overall, Shopify's mission statement reflects its commitment to making commerce better for everyone, and its values guide its actions and decisions as a company. By staying true to this mission and continuing to innovate and improve its platform, Shopify is poised to remain a leader in the e-commerce space for years to come.

How does Shopify make money?

Shopify is an ecommerce platform that allows businesses to create their own online stores and sell products to customers. But how does Shopify make money? There are a few different ways that the company generates revenue.

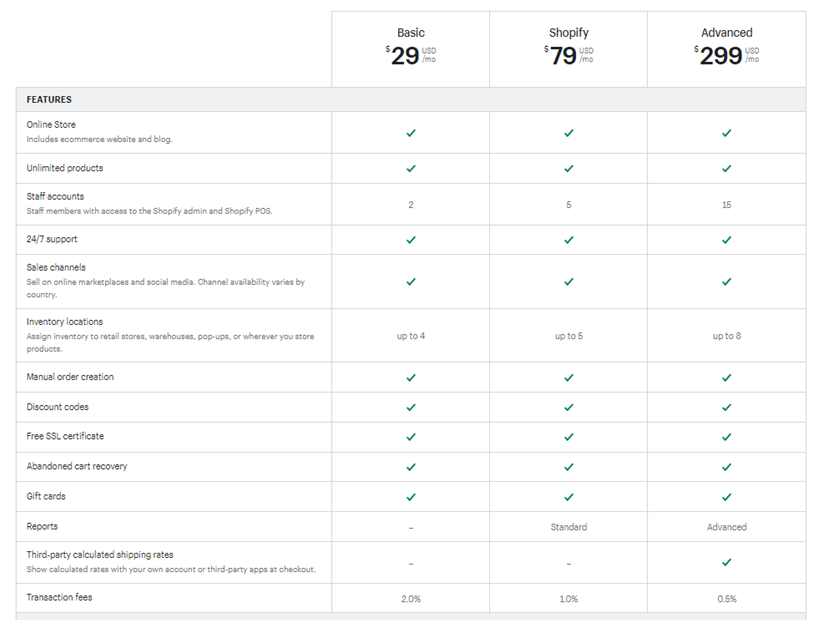

First, Shopify charges a monthly subscription fee to use its platform. The pricing plans range from $29 to $299 per month, depending on the features and level of support that a business needs. This subscription fee is a recurring source of revenue for Shopify, and it helps to cover the cost of maintaining the platform and providing customer service to users.

In addition to the subscription fee, Shopify also charges transaction fees on each sale that a business makes through its platform. These fees range from 2.4% to 2.9% of the transaction amount, plus a fixed fee of 30 cents per transaction. This fee helps to cover the cost of payment processing and fraud prevention, and it is a percentage of the revenue generated by businesses on the platform.

Shopify also offers a range of add-on services and apps that businesses can use to enhance their online stores. For example, businesses can purchase themes, marketing tools, and shipping and fulfillment services through Shopify's app store. Shopify charges a commission on these add-on services, which helps to generate additional revenue for the company.

Finally, Shopify generates revenue through its Shopify Capital program, which provides loans to businesses that use the platform. Shopify takes a percentage of the loan amount as a fee, and businesses pay back the loan plus interest over time. This program helps to provide financing options for small businesses, while also generating revenue for Shopify.

Overall, Shopify generates revenue through a combination of subscription fees, transaction fees, add-on services, and financing programs. These revenue streams help to support the platform and enable Shopify to continue to innovate and improve its offerings for businesses.

Shopify Business Model Canvas Explained

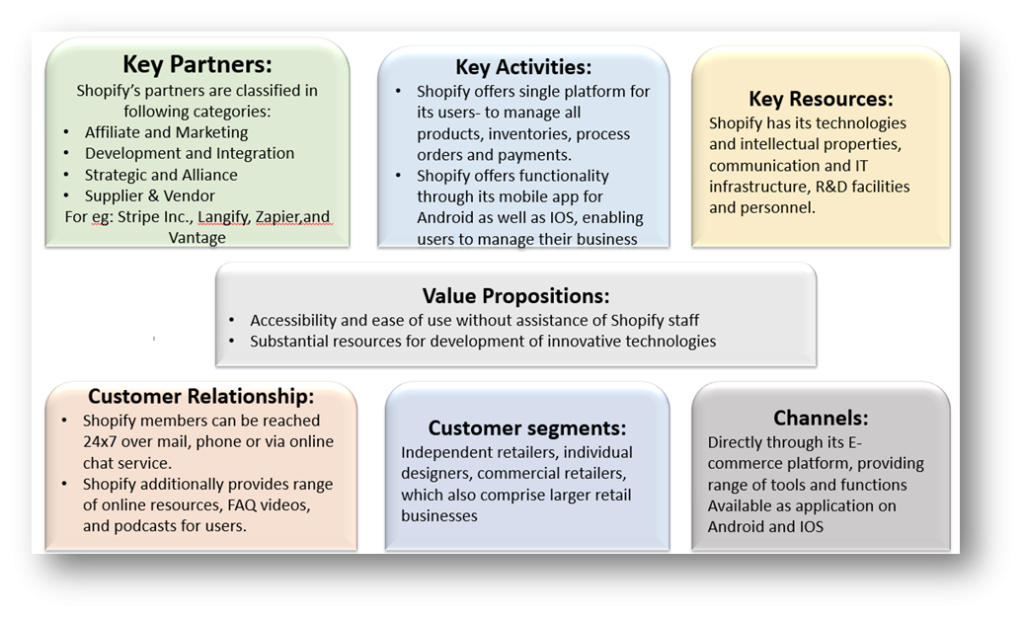

A business model canvas is a visual representation of how a business creates, delivers, and captures value. It helps entrepreneurs and business owners to understand and analyze their business model. Let's take a look at how Shopify's business model canvas can be explained using the nine building blocks of the canvas:

Customer segments: Shopify's customer segments include small and medium-sized businesses, entrepreneurs, and individuals who want to sell products online.

Value proposition: Shopify's value proposition is to provide an all-in-one e-commerce platform that makes it easy for businesses to set up and manage their online stores.

Channels: Shopify's channels include its website, social media, and referral programs.

Customer relationships: Shopify's customer relationships are primarily self-service, but it also provides customer support via live chat, email, and phone.

Revenue streams: Shopify's revenue streams include monthly subscription fees, transaction fees, and additional fees for premium features.

Key resources: Shopify's key resources include its technology platform, software, and customer support team.

Key activities: Shopify's key activities include software development, customer support, and marketing.

Key partnerships: Shopify's key partnerships include payment processors, shipping companies, and app developers.

Cost structure: Shopify's cost structure includes expenses related to software development, customer support, and marketing.

Overall, the Shopify business model canvas is focused on providing an easy-to-use e-commerce platform for small and medium-sized businesses. Its revenue streams are based on monthly subscription fees and transaction fees, and it leverages partnerships with payment processors and shipping companies to streamline the e-commerce experience for its customers.

Which companies are the competitors of Shopify?

Shopify is one of the leading e-commerce platforms that has revolutionized the way businesses sell their products online. However, just like any other industry, the e-commerce sector is highly competitive, and Shopify has several competitors that offer similar features and services. In this section, we will take a closer look at some of the companies that are the main competitors of Shopify.

WooCommerce: WooCommerce is an open-source e-commerce platform that is built on WordPress. It is one of the most popular e-commerce platforms, and it offers a wide range of features and extensions that can be used to build an online store. WooCommerce is free to use, but users need to pay for hosting, domain name, and other add-ons.

Magento: Magento is an open-source e-commerce platform that is designed for medium to large businesses. It offers a wide range of features and customization options, and it can be integrated with various third-party applications. Magento is known for its scalability, but it requires technical expertise to set up and maintain.

BigCommerce: BigCommerce is a cloud-based e-commerce platform that is designed for businesses of all sizes. It offers a wide range of features, including customizable templates, multi-channel selling, and payment integrations. BigCommerce is easy to use and offers excellent customer support.

Wix: Wix is a website builder that also offers e-commerce functionality. It is a popular platform for small businesses and offers a wide range of templates and customization options. Wix is easy to use and offers affordable pricing plans.

Squarespace: Squarespace is a website builder that also offers e-commerce functionality. It is known for its beautiful templates and easy-to-use interface. Squarespace is a popular choice for small businesses that want to build a professional-looking website.

In conclusion, Shopify has several competitors that offer similar features and services. Each of these platforms has its strengths and weaknesses, and businesses need to choose the platform that best suits their needs.

Shopify SWOT Analysis

Shopify is one of the most popular e-commerce platforms in the world, serving over 1 million businesses in more than 175 countries. The company has been growing at a rapid pace in recent years, with its revenue increasing by 110% in 2020. However, like any other business, Shopify has its strengths, weaknesses, opportunities, and threats. A SWOT analysis of Shopify can help us understand the company's current position and its future prospects.

User-Friendly Platform: Shopify is known for its user-friendly platform, which requires no coding skills. This makes it easy for anyone to set up an online store and start selling products.

Wide Range of Features: Shopify offers a wide range of features, including customizable themes, payment gateways, and shipping options. This allows businesses to create a unique online store that meets their specific needs.

Large User Base: With over 1 million businesses using Shopify, the platform has a large user base. This means there is a lot of support available in terms of forums, tutorials, and apps.

Limited Customization: While Shopify offers a lot of features, there are limitations to how much customization can be done. This can be frustrating for businesses that want to create a unique online store.

Cost: Shopify's pricing plans can be expensive, especially for businesses that are just starting out. This can be a barrier for some businesses that want to use the platform.

Dependence on Third-Party Apps: Shopify relies heavily on third-party apps to provide certain features. This can be a problem if the app is no longer supported or if it stops working correctly.

Opportunities

Expansion into New Markets: Shopify has the opportunity to expand into new markets, such as international markets or niche industries.

Partnership with Big Brands: Shopify has already partnered with big brands like Facebook and Google. There is an opportunity for the company to form more partnerships that can help it grow.

Diversification of Services: Shopify has the opportunity to diversify its services beyond e-commerce. For example, it could offer marketing or analytics services to businesses.

Competition: Shopify faces competition from other e-commerce platforms like WooCommerce and Magento. This competition could lead to a loss of market share.

Economic Downturn: An economic downturn could lead to a decrease in consumer spending, which would negatively impact businesses using the Shopify platform.

Security Breaches: Shopify is a prime target for hackers due to the large amount of sensitive data it holds. A security breach could damage the company's reputation and lead to a loss of customers.

In conclusion, Shopify is a strong e-commerce platform with a large user base and a wide range of features. However, there are weaknesses and threats that the company needs to address to maintain its position in the market. By diversifying its services and forming partnerships, Shopify can continue to grow and remain competitive.

Key Takeaways

- Shopify is a publicly traded company, with the majority of its shares owned by institutional investors.

- The mission statement of Shopify is to make commerce better for everyone, by providing tools and resources for entrepreneurs to start and grow successful businesses.

- Shopify makes money primarily through subscription fees and transaction fees from its platform users, as well as through additional services such as payment processing and shipping solutions.

- The Shopify Business Model Canvas highlights key aspects of the company's operations, including its customer segments, value propositions, revenue streams, and more.

- Some of Shopify's main competitors include WooCommerce, BigCommerce, and Magento, as well as larger e-commerce platforms like Amazon and eBay. A SWOT analysis of Shopify reveals its strengths in areas such as user experience and brand recognition, but also highlights potential weaknesses and threats such as increasing competition and changing consumer preferences.

In conclusion, Shopify is a leading e-commerce platform that has revolutionized the way businesses sell online. The company was founded by Tobias Lutke, Scott Lake, and Daniel Weinand in 2004. Today, Shopify's mission is to make commerce better for everyone, and it does so by providing a range of tools and services to help businesses grow and succeed. Shopify's business model is based on a subscription-based model that allows businesses to create their online store, manage their inventory, and process payments. Shopify generates revenue through subscription fees, transaction fees, and other services such as shipping and marketing. Shopify's main competitors include WooCommerce, Magento, and BigCommerce. Finally, a SWOT analysis of Shopify reveals that the company has a strong brand, a comprehensive set of features, and a large user base, but it also faces challenges such as increasing competition and the need to innovate continuously. Overall, Shopify is a powerful platform that empowers businesses to sell online and grow their reach.

What are the strengths of Shopify?

Easy to Use: Shopify is easy to use and requires no coding skills or technical knowledge. It provides a straightforward setup and intuitive tools to help you create a professional online store.

Security and Reliability: Shopify is a secure and reliable eCommerce platform. It has been in business since 2004 and utilizes the latest security protocols and technology to ensure your store remains secure.

Affordable Pricing: Shopify offers pricing plans that cater to businesses of all sizes and budgets. It also offers a free 14-day trial, so you can test out the platform before committing to a plan.

Customization Options: Shopify allows you to customize your store with a variety of features and design options. This includes themes, plugins, widgets, and more.

Payment Options: Shopify supports multiple payment options, including credit cards, PayPal, Apple Pay, and more. This makes it easy for customers to purchase from your store.

Excellent Support: Shopify provides excellent customer support, with a dedicated team of agents to help you with any questions or issues.

What are the threats to Shopify?

Cyber Security: Shopify stores are vulnerable to malicious attacks, such as hacking, malware, and data theft.

Increase in Competition: With the rise of other e-commerce platforms, such as Amazon, eBay, and Etsy, competition in the market has grown significantly, forcing Shopify to innovate in order to stay ahead.

Payment Processing: Shopify relies on third-party payment processors to process customer payments, which can be a source of potential problems.

Pricing: Shopify's pricing model is complex, and customers may be put off by its high monthly subscription fees.

System Failure: Shopify is a complex system, and any system failure could cause significant disruption to the user experience.

What is a SWOT analysis in ecommerce?

A SWOT analysis in ecommerce is a tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of an online business. The analysis helps to identify areas where the business can improve, capitalize on market opportunities, and mitigate potential risks. It is often used to benchmark a business’s performance against its competitors and gain a better understanding of the competitive landscape.

How to do a SWOT analysis on a shop?

Start by identifying the shop and what it offers: Before you begin your SWOT analysis, it is important to identify the shop and what services or products it provides.

Identify the Strengths and Weaknesses of the shop: To identify the shop’s strengths and weaknesses, consider the shop’s offerings such as its product selection, customer service, location, advertising, pricing, and customer loyalty. What advantages does the shop have over its competitors? What can it do better?

Identify Opportunities and Threats: To identify opportunities and threats, consider the shop’s environment both inside and outside its industry. Are there any new products or services that the shop can offer? Are there any developing markets or competitors that could pose a threat?

Analyze the Results: Once you have identified the shop’s strengths, weaknesses, opportunities, and threats, analyze the results and determine how the shop can use them to its advantage. What strategies can the shop use to capitalize on its strengths and address its weaknesses? How can the shop leverage the opportunities and mitigate the threats?

Want to create a presentation now?

Instantly Create A Deck

Let PitchGrade do this for me

Hassle Free

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2023 Pitchgrade

Detailed Understanding of Shopify Business and Revenue Model

Shopify is a shining example of innovation and success in the rapidly changing e-commerce industry. It enables millions of entrepreneurs to transform their ideas into profitable online ventures.

Shopify has established itself as a top eCommerce platform, with over 1.7 million active merchants globally and an astounding $41.1 billion in Gross Merchandise Volume (GMV) in Q4 2021 alone. This thorough examination delves deeply into the complex inner workings of Shopify’s revenue model to reveal the strategies behind its outstanding development and success.

Shopify stays at the forefront of the e-commerce revolution, propelling innovation and enabling companies to prosper in the digital era. Come along as we analyze Shopify’s business model and discover the tactics that have allowed it to grow into a global eCommerce powerhouse.

But what is Shopify? How does it work? What business model does it follow? In this comprehensive blog, we’ll decode everything.

What is Shopify ?

Shopify is an all-in-one eCommerce platform that makes it simple for business owners to design, develop, and manage their online businesses. Since its founding in 2006, Shopify has evolved into a comprehensive solution that provides various tools and features to simplify eCommerce for companies of all sizes.

Shopify offers a user-friendly interface and robust backend infrastructure to support every facet of online retail, from setting up a shop and managing inventory to processing payments and tracking sales.

Shopify has over 1.75 million active merchants and is still growing, making it a household name in eCommerce. Shopify provides a scalable and adaptable solution to fit your demands, regardless of whether you’re an aspiring business owner trying to open your first online store or an established brand looking to expand your online operations.

With a large selection of easily customizable themes, integrated payment methods, and potent marketing tools, Shopify enables companies to design distinctive and engaging online experiences for their clients, spurring expansion and prosperity in the cutthroat digital market.

Shopify Market Size

Source: Oberlo

Shopify has become a significant force in the worldwide eCommerce industry and is still growing in power.

- According to recent figures, Shopify is now the second-largest platform in the US, with a staggering 23% of the market in the US alone in 2021.

- Additionally, Shopify’s Gross Merchandise Volume (GMV) exceeded $200 billion in 2021, demonstrating the platform’s substantial influence on global e-commerce.

- Shopify’s market share is constantly increasing in other countries.

- With a market share of 18% in the UK in 2021, Shopify cemented its status as the top eCommerce platform in the area.

- Furthermore, Shopify has a 20% global market share among eCommerce platforms in 2021, evidence of its broad acceptance and appeal to companies of all kinds.

In the future, Shopify’s market size is anticipated to rise steadily due to several variables, including growing customer preference for online shopping, the growth of digital entrepreneurship, and Shopify’s ongoing innovation in advanced technology. Shopify’s user-friendly design, robust features, and scalable solutions put it in a solid position to take advantage of the increasing demand for eCommerce platforms and hold onto its market-leading position globally.

How Does Shopify Work?

Shopify unifies your online business operations into a single platform, giving you access to orders, analytics, and sales channels through a single admin.

Business owners may use Shopify to create and personalize an online store and sell products online, on mobile devices, and in-person in pop-up and brick-and-mortar stores. With robust connectivity, orders and customer data can be synchronized and handled centrally across various channels, including social media and online marketplaces.

Since Shopify is hosted on the cloud and is entirely secure, you may use it from any internet-connected device without risk. This allows you the freedom to manage your company from any location.

eCommerce enterprises require various tools to handle shipping, payment processing, and inventory management. Business owners may have to invest money and time in connecting these systems.

Because of this, Shopify combines various technologies into one location—your Shopify admin—to provide a comprehensive picture of all your business activity. Additionally, Shopify connects with other apps and tools necessary for conducting business.

Shopify Business Model – What Can You Learn From It?

Understanding Shopify’s business model can help entrepreneurs create profitable e-commerce businesses.

Fundamentally, Shopify is a subscription-based platform that gives retailers the resources and tools they need to set up and run online stores. Let’s examine the main elements of Shopify’s business model and the takeaways for business owners from each one:

Value Proposition

Shopify’s value proposition is rooted in its capacity to provide an all-inclusive and intuitive e-commerce platform, enabling entrepreneurs to establish and expand their virtual enterprises effortlessly.

Shopify adds value by making e-commerce easier for businesses of all sizes by offering features like integrated marketing tools, safe payment processing, and customizable storefronts.

Which are the Main Resources for Shopify?

Shopify’s primary assets consist of:

- Intellectual properties include a vast global database of clients and companies.

- The Shopify business platform is supported and bolstered by technology and IT infrastructure.

- Facilities for research and development.

- More than 10,000 committed employees at Shopify work hard to develop the company and promote sustainable growth.

What are Shopify Channels?

Shopify’s website provides access to its services. Here, you can find all relevant information about the platform’s features, costs, resources, tools, community, online courses, and blogs.

It’s also available as an application on Play Store and App Store.

Customer Segments

Presently, this platform accommodates more than 4.1 million online stores worldwide . Because it enables retailers to sell both physical and digital goods online on social networking platforms, seller marketplaces, and other websites, Shopify is a well-liked platform. Shopify POS (Point of Sale) also allows you to sell products online.

Shopify primarily serves two categories of clients:

- Individual retailers include independent merchants, resellers, and small retail establishments.

- Commercial merchants are sizable businesses that operate in various industries. For instance, well-known companies like Red Bull , Fitbit, Sephora, and Kraft Heinz Co. use Shopify.

Its primary distribution method is Shopify’s web platform, which allows merchants to manage their businesses, access resources, and sign up for subscriptions. Shopify also uses partnerships with agencies and affiliates, content production, and digital marketing platforms to connect and interact with potential consumers.

Who are Shopify’s Key Partners?

Shopify is a massive e-commerce company that has formed strategic partnerships to guarantee its survival. Critical partners for Shopify are:

- Vendors and suppliers: This group comprises trustworthy companies that provide services, technology, and tools to support Shopify’s ongoing expansion.

- Developers: They assist in creating new Shopify features and smoothly integrating third-party apps.

- Marketers: By utilizing initiatives like affiliate marketing, they support Shopify’s marketing initiatives.

- Alliance Partners : Shopify works on joint marketing and branding initiatives with top businesses across various industries.

Essentially, business owners may take a cue from Shopify’s business model by emphasizing customer service, utilizing partnerships and technology to improve their products, and adopting a customer-centric e-commerce strategy. Through comprehending and implementing these concepts, entrepreneurs can construct and expand prosperous e-commerce enterprises that flourish in the cutthroat digital environment.

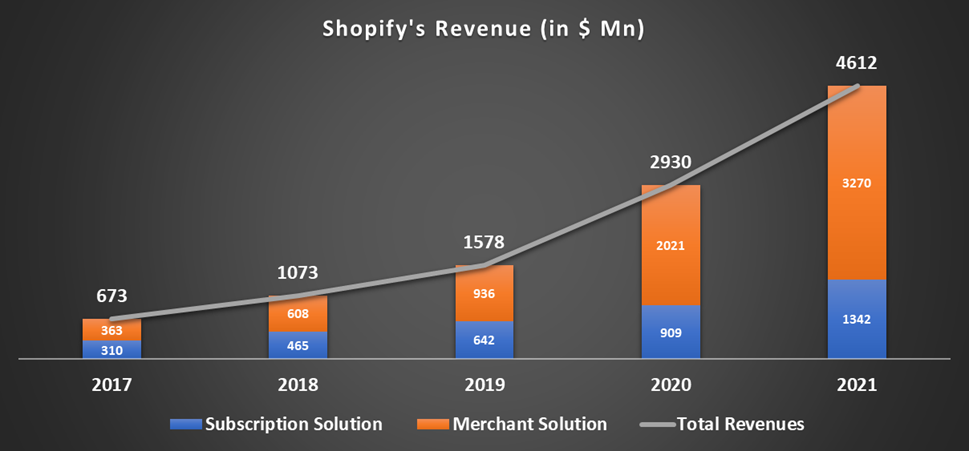

Shopify Revenue Model: How Does Platform Make Money?

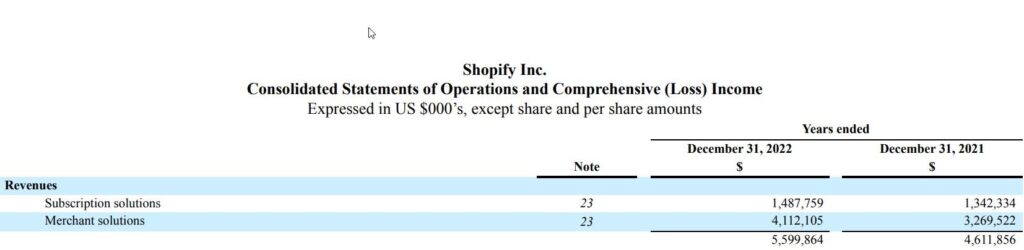

Shopify generates income from two sources: merchant solutions, which is a component based on merchant performance, and subscription solutions, which is a recurring subscription service. Let’s examine each revenue source in more detail to see how Shopify generates such a big profit:

Subscription-Based Solutions

Shopify makes money by offering subscription options for varying business sizes.

While larger businesses choose Shopify Plus , website owners can incorporate a Shopify store with the ‘Basic’ plan.

The platform also changed how developers split revenue, creating a relationship where developers and merchants benefit from each other’s success.

Merchant Solutions

Shopify provides merchant solutions to supplement the ones offered through a subscription and handle the wide range of features merchants often need, such as working capital financing, shipping and fulfilment, and payment acceptance.

Approximately 70% of Shopify’s revenue came from merchant solutions in 2021.

Let’s examine in-depth how Shopify generates revenue with different merchant solutions:

- Shopify Payments: Shopify’s payment gateway, Shopify Payments, is primarily responsible for revenue generated by merchant solutions, including currency conversion and payment processing fees. Shopify charges merchants 2.4% to 2.9% of each transaction’s gross merchandise value (GMV), depending on the subscription level.

- Advertising: When retailers click on the apps the Shopify App Store’s partners promote.

- Shopify Capital: To expand their enterprises, merchants can use Shopify Capital to apply for loans and obtain cash advances. A store owner can only borrow a maximum of $2 million. However, the cash advance or loan must be paid back within a year. Shopify Capital assesses the loan’s set borrowing cost.

- The amount a user or merchant must pay to get a loan is known as the fixed borrowing cost. Shopify Capital receives a percentage of the merchant’s daily sales revenue until the loan repayment is made.

- Shopify Shipping: This feature enables retailers to oversee their shipments by utilizing Shopify’s shipping partners.

- Shopify Point of Sale (POS): Shopify’s sales channel enables retailers to sell their goods in person and take payments from customers using a mobile device.

- Shopify Email: An email marketing platform that helps retailers handle their advertising efforts. Shopify provides the service for free up to a point, after which merchants must pay.

Shopify Pricing Plans

Shopify provides many options to meet companies’ requirements in different development phases. Each plan includes various features and functionalities, so merchants may select the one that best fits their needs and budget.

An outline of Shopify’s pricing tiers is shown below:

Final Thoughts

Because of its unique business strategy, Shopify can flourish in an ecosystem that is important and relevant to the needs of modern merchants. Put more simply, consumers need to be sold for them to want to buy.

Shopify has always been a model of creativity and a never-ending hunt for goods and services that address present-day and emerging needs.

It’s almost impossible to find an eCommerce platform that matches Shopify’s level of simplicity and smooth integration with sales channels. Shopify’s many selling potential and essential business management capabilities outweigh its few shortcomings, which include essential SEO tools, restricted store design options, and simplistic blogging features. There is just no platform that compares to Shopify in terms of ease of use, sales volume, room for expansion, and cost for both new businesses and seasoned retailers.

Let’s hope Shopify keeps introducing new features and making the lives of eCommerce business owners more manageable, as it was hard to imagine earlier.

Good luck to you!

- Search 71887

- Search 95514

- Search 22420

Deconstructing Shopify’s Business Model

Global retail e-commerce sales stand at $6.3 trillion in 2023 and is estimated to grow by over 29% and reach $8.1 trillion by 2026.

E-commerce has transformed the way retail businesses operate and generate revenue. With faster buying options, reduction in operational costs, access to a broader customer base, enhanced customer data insights, and increased profit margins, e-commerce stores are becoming ubiquitous.

They’re not just an excellent option for a business to expand its reach or an individual to enter the market but are also increasingly preferred by consumers. However, how can companies and individuals build an online store and manage and grow it seamlessly to generate revenue?

The answer to this question comes through user-friendly e-commerce platforms like Shopify.

Table of Contents

What is Shopify?

Founded in 2006, Shopify is a subscription-based e-commerce platform that helps sellers build and personalize their online stores. It’s a fully-hosted cloud-based platform that can be accessed with an internet connection on any compatible device.

Shopify is a popular e-commerce brand helping millions of merchants achieve their dreams; therefore, it is critical to understand Shopify’s customer segmentation.

Shopify Customer Segmentation

Currently, this platform hosts over 4.1 million stores online globally. Shopify is a popular platform since it empowers merchants to sell their physical and digital products online on social media sites, seller marketplaces, or other websites. You can also sell online using Shopify POS (Point of Sale).

Primarily, Shopify caters to two types of customers:

- Individual retailers: Small retail businesses, independent artisans, sellers, and resellers.

- Commercial retailers : Large retail businesses spanning across industries. For example, leading brands such as Kraft Heinz Co., Fitbit , Sephora , and Red Bull use Shopify. Shopify is a popular venue among famous personalities with celebrities such as David Beckham, Adele, and Kylie Jenner using Shopify to kick-start their online stores.

Shopify is a leading e-commerce platform , but why do businesses trust Shopify to build and grow their online store? Let’s find out.

Shopify’s Unique Set of Solutions

A few features that make Shopify unique are:

1. Point of Sales

Shopify’s POS feature enables brands to sell their products in the physical world, through brick-and-mortar outlets, trade shows, and pop-up stores. This feature helps track sales and inventory through a centralized dashboard to let store owners view orders and transaction history.

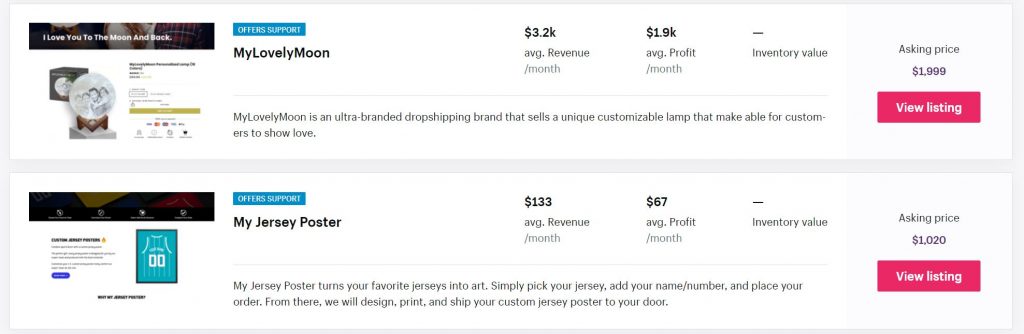

2. Dropshipping

Shopify empowers dropshipping, which enables store owners to sell products without maintaining an inventory of those items. Dropshipping on Shopify works by connecting wholesalers across the globe.

3. SEO Tools

Search Engine Optimization (SEO) helps improve the ranking of a store’s website and reach a broader customer base. Shopify offers various SEO application integrations to help store owners improve their website’s ranking.

4. Dashboard Analytics

Shopify aids store owners in assessing their store’s performance through its detailed analytics. Data on consumer insights, sales, marketing, inventory, acquisition, and more can be viewed.

5. Abandoned Cart Reminders

Shopify keeps track of customers who have added products to their carts but abandoned them afterward. It’ll send you email reminders so that you can remind your customers (through automated emails) to complete their purchases.

This unique and valuable feature helps increase sales and boost profitability .

6. Customer Support

Shopify is known for its top-notch customer support consisting of engineers, advisers, and experts to help you navigate the world of e-commerce effectively.

What is Shopify’s Operational Model?

To get started on Shopify, you must create a seller account by following the steps below:

- Describe your business needs

- Pick the products or services you’d like to sell

- Select a name for your Shopify store

- Identify how you’ll market your store (examples include social media, website or blog, or online marketplaces)

- Create a Shopify account

After you’re done creating your online store, you can customize the store’s themes, add products to it, edit shop settings, select your Shopify pricing plan, and test the website to ensure that it’s compatible with both PC and mobile views.

Now that your online store is ready, it’s time to promote and improve its SEO ranking to start selling your products. When customers buy your products, Shopify will process your payment, and your store will begin generating revenue.

Note : You can avoid being charged extra transaction fees using Shopify payments as your preferred payment gateway.

If you want to wait to commit to Shopify, you can try Shopify’s 3-day free trial to get a sense and feel of the platform.

Who are the Key Partners of Shopify?

Shopify is an e-commerce behemoth and has partnered with strategic partners to ensure its continued success. Shopify’s key partners include:

- Suppliers and vendors: Comprising a network of dependable suppliers of tools, technologies, and services to aid Shopify’s continuous development and growth .

- Developers: They help develop new functionalities for Shopify and integrate third-party solutions seamlessly.

- Marketers: They help further Shopify’s marketing efforts with programs such as affiliate marketing.

- Alliance partners: Shopify collaborates with leading companies in various sectors on projects, such as branding and joint marketing.

What are Shopify’s Key Resources?

Shopify’s key resources include:

- Intellectual properties comprising a massive database of customers and businesses worldwide.

- Technology and IT infrastructure that supports and props the Shopify business platform.

- Research and development facilities.

- Shopify has over 10,000 dedicated employees who strive to advance the business and help it grow sustainably.

What are Shopify Channels?

Shopify is accessible through its website. Here, you can find all pertinent information related to the platform’s solutions, products, pricing, resources, tools, support, community, online courses, and blog.

It’s also available as an application on Android and iOS.

How does Shopify Service its Customers?

As a platform, Shopify promotes self-servicing. Retailers can easily set up their online stores with Shopify’s host of tools.

Regarding customer support, Shopify has a dedicated 24/7 help and support team available over chat, phone, and email. The help and support team can provide tailored solutions to buyers and merchants. To further assist its customers, Shopify offers its customers online resources , including FAQs, user guides, podcasts, and videos.

Shopify also has active online community forums to facilitate collaboration and communication among buyers and sellers. Its social media handles help brands interact and communicate with their customers directly.

What is Shopify’s Cost Structure?

Shopify incurred an expenditure of $6.4 billion for the fiscal year 2022 . Its cost of revenue consists of research and development, sales and marketing, transaction and loan losses, operating expenditure, and general and administrative expenses.

How Does Shopify Generate Revenue?

Shopify is more than just an e-commerce website builder. It provides end-to-end solutions to businesses and gives them the tools necessary to scale and succeed. Its revenue for 2022 was $5.59 billion, of which it earned $1.49 billion from subscription solutions and the remaining $4.11 billion from merchant solutions.

But does Shopify earn revenue from subscription and merchant solutions only? Not quite . Shopify’s revenue streams can be categorized into five sections:

Subscriptions

Shopify earns the majority of its revenue from its various subscription plans , including:

- Basic: The Shopify basic plan costs $29 per month. With this plan, you can quickly launch your online store, sell and add unlimited products, create two staff accounts, and connect four inventory locations.

- Shopify: Shopify’s ‘Shopify’ is a standard plan that costs $79 monthly. This plan includes all the features of the Basic plan and additional features, such as professional reporting, lower transaction fees, more staff accounts and inventory locations (five), and allows users to automate their workflows.

- Advanced: Shopify’s Advanced plan costs $299 monthly. It includes all the features of the Shopify plan and boasts of a custom report builder, the lowest transaction fees, and lets you add more staff accounts (15) and inventory locations (eight).

- Starter: The Shopify Starter plan costs $9 per month and is suitable for merchants looking to sell their products on social media or messaging blogs.

- Plus: Starting at $2,000 monthly, Shopify Plus offers enterprise-level solutions for businesses dealing in many goods.

Payment Processing Fees

Shopify charges transaction fees on each transaction successfully carried out on Shopify for payment processing. The fees for the three plans are as follows:

- Basic: Shopify charges a transaction fee of 2.9% + $0.30 per transaction.

- Shopify: Shopify charges a transaction fee of 2.6% + $0.30 per transaction.

- Advanced: Shopify charges a transaction fee of 2.4% + $0.30 per transaction.

Transaction Fees When Using Third-Party Payment Gateways

When using Shopify, you’ll be charged a transaction fee for using payment providers that aren’t Shopify Payments.

The transaction fees are as follows:

- Basic: 2% of the transaction value

- Shopify: 1% of the transaction value

- Advanced: 5% of the transaction value

Note: You’ll only be charged an extra fee on top of your transaction fee if you disable Shopify Payments entirely.

Shipping and PoS solutions

Shopify earns a small fee through its additional merchant solutions, such as shipping and PoS solutions:

- Shipping: If merchants use Shopify’s shipping partners, Shopify charges a small fee from the partners.

- PoS : Shopify’s PoS feature lets merchants easily sell their products in physical stores. This feature costs 2% or higher (based on the seller’s plan) per transaction.

Additional costs

Shopify earns additional money from services such as:

- Building a website: If a seller needs the help of a Shopify Expert to design and develop their store’s website, they’ll need to spend between $2,000-$5,000.

- Shopify themes: If a seller wants a custom look and feel for their online store, they’ll have to buy one of Shopify’s premium themes, ranging from $150 to $350.

- Shopify App Store : While Shopify offers several apps for free, you might need custom third-party apps to help with your store’s accounting, marketing, inventory, or shipping. Paid apps can range anywhere between $9 to $299 per month in the Shopify App Store.

- Emails: Shopify offers its merchants several free marketing channels , including social media and emails. But a seller can only send up to 2500 free emails monthly. Shopify charges $0.001 for each mail above the threshold.

Other avenues Shopify generates revenue from are Shopify Capital, investing in other startups, domain sales, Shopify Pay Installments, and Shopify Exchange.

The Bottom Line: Shopify is a Specialized E-commerce Platform

With a market cap of $55.79 billion, Shopify is an easy-to-use, omnichannel commerce platform for all sales channels. It’s suitable for businesses of all sizes to build, grow, and scale an online store.

References & more information

- https://www.shopify.com/pricing

- https://www.shopify.com/blog/what-is-shopify

- https://trends.builtwith.com/shop/Shopify

- https://www.statista.com/statistics/379046/worldwide-retail-e-commerce-sales/

- https://www.feedough.com/how-does-shopify-work-shopify-business-model/

- https://businessmodelanalyst.com/shopify-business-model/

- https://thestrategystory.com/2022/03/18/how-does-shopify-make-money-business-model/

- https://startuptalky.com/shopify-business-model/

- https://productmint.com/shopify-business-model-how-does-shopify-make-money/

- https://investors.shopify.com/financial-reports/default.aspx#reports

- https://www.oberlo.com/blog/shopify-partners

- Featured Image by Roberto Cortese

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Kevin Johnson

Cancel reply.

A useful post for our customers.

You may also like

Facebook Business Model | How does Facebook make money?

Company: Facebook, Inc CEO: Mark Zuckerberg Year founded: 2004 Headquarter: Menlo Park, California, USA Number of Employees (June 2020): 52,534 Public or Private: Public Ticker Symbol: FB Market Cap (Nov...

How Does Tinder Make Money?

Company: Tinder CEO: Sean Rad Year founded: 2012 Headquarter: Dallas, US Number of Employees (Dec 2018): 200 Parent Company: Interactive Corp (IAC) Type: Private Valuation (March 2019): $10 billion Annual Revenue (Dec...

Swiggy Business Model (2022)| How does Swiggy make money

Last updated: Sept 07, 2020 Company: Swiggy CEO: Sriharsha Majety, Nandan Reddy, and Rahul Jaimini Year founded: 2014 Headquarter: Bangalore, India For all the foodies, what more could you ask for...

Amazon Business Model | How does Amazon make money

Last updated: Feb 13, 2021 Company : Amazon CEO : Andrew Jassy Year founded : 1994 Headquarter : Seattle, Washington United States Business world has never been the same since the inception of...

Uber Business Model | How does Uber make money

Company: Uber CEO : Dara Khosrowshahi Year founded : 2009 Headquarter : San Francisco, California, USA Number of Employees (Nov 2020): 26,900 Public or Private: Public Annual Revenue (2020): $14.1 Billion...

How Does Craigslist Make Money? (2022)

Last updated: May 23, 2020 Company: Craigslist, Inc. Industry: Classified advertisements forum Founder: Craig Newmark CEO: Jim Buckmaster Year founded: 1995 Headquarter: San Francisco, California, United States Number...

OYO Business Model | How Does Oyo Make Money?

Last updated: September 30, 2021 Company: Oyo Rooms CEO: Ritesh Agarwal Year founded: 2013 Headquarter: Gurgaon, Haryana, India. Number of Employees (2019): 25,000+ Type: Private Valuation (Aug 2020): $8...

How Does PayPal Make Money? (2022)

Last updated: May 23, 2020 Company: PayPal Holdings, Inc. Founders: Ken Howery | Luke Nosek | Max Levchin | Peter Thiel | Elon Musk CEO: Daniel Schulman Year founded: 1998 Headquarter: San Jose, California, USA Number...

Airbnb Business Model | How does Airbnb make money?

Company: Airbnb Founder(s): Brian Chesky, Nathan Blecharczyk, Joe Gebbia Year founded: 2008 CEO(s): Brian Chesky Headquarter: San Francisco, California Number of Employees (2020): 6,000 Type: Public Market Cap...

How Does HQ Trivia Make Money?

Last updated: Feb 18, 2020 Company: HQ Trivia Founders: Rus Yusupov and Colin Kroll Year founded: 2017 CEO: Rus Yusupov Headquarter: New York, NY Number of Employees (2019): 25 Annual Revenue (2019): $10 million...

Recent Posts

- Who Owns Westin Hotels & Resorts?

- Who Owns Truist Bank?

- Who Owns Alfa Romeo?

- Who Owns Burt’s Bees?

- Top 15 Ruggable Competitors and Alternatives

- Top 15 Ticketmaster Competitors and Alternatives

- Who owns Kidz Bop?

- Top 20 Zapier Competitors and Alternatives

- Top 15 Boxabl Competitors and Alternatives

- Who Owns High Noon?

Business Strategy Hub

- A – Z Companies

- Privacy Policy

Subscribe to receive updates from the hub!

- Red Queen Effect

- Blue Ocean Strategy

- Only the paranoid survives

- Co-opetition Strategy

- Mintzberg’s 5 Ps

- Ansoff Matrix

- Target Right Customers

- Product Life Cycle

- Diffusion of Innovation Theory

- Bowman’s Strategic Clock

- Pricing Strategies

- 7S Framework

- Porter’s Five Forces

- Strategy Diamond

- Value Innovation

- PESTLE Analysis

- Gap Analysis

- SWOT Analysis

- Strategy Canvas

- Business Model

- Mission & Vision

- Competitors

Shopify Business Model: A Comprehensive Review

Shopify is a leading ecommerce platform that has revolutionized the way businesses operate online. In this comprehensive review, we will delve into Shopify’s business model and explore how it empowers entrepreneurs to create and manage their online stores with ease.

Table of Contents

As an ecommerce platform, Shopify provides businesses with the necessary tools and features to establish a successful online presence. Whether you’re a small startup or a large enterprise, Shopify offers a user-friendly interface, powerful marketing tools, and a variety of sales channels to help you reach your target audience.

One of the key aspects of Shopify’s business model is its Software as a Service (SaaS) approach. Through a monthly subscription fee, businesses gain access to the platform’s robust set of features and services, without the need for expensive infrastructure and technical expertise.

Shopify’s monetization strategy extends beyond its subscription fees. The company also generates revenue through its Merchant Solutions, offering payment processing services, shipping solutions, working capital, and more. This comprehensive approach ensures that businesses have all the tools they need to succeed in the online marketplace.

Key Takeaways:

- Shopify is a leading ecommerce platform that offers a comprehensive set of features and services for businesses to establish and manage their online stores.

- The company operates on a Software as a Service (SaaS) model, where businesses pay a monthly subscription fee to access the platform’s tools and services.

- Shopify generates revenue through its subscription fees and additional services, such as payment processing and shipping solutions.

- Businesses of all sizes can benefit from Shopify’s user-friendly interface, powerful marketing tools, and variety of sales channels.

- By leveraging Shopify’s platform, entrepreneurs can focus on building their online business while enjoying the support and resources provided by the company.

What is Shopify and How Does it Work?

Shopify is a comprehensive commerce platform that enables businesses of all sizes to start, grow, manage, and scale their online stores. With its user-friendly interface and wide range of features and tools, Shopify provides businesses with everything they need to establish a successful online presence.

One of the key features of Shopify is its ability to allow businesses to create and customize their online stores. Whether you’re a small boutique or a large enterprise, Shopify offers a variety of customizable templates and themes to help you create a unique and visually appealing online store.

In addition to creating an online store, Shopify also allows businesses to sell their products across multiple sales channels. This means that you can sell your products not only on your own website but also on popular platforms like Facebook, Instagram, and Amazon. By expanding your reach through various sales channels, you can increase your chances of reaching more customers and boosting your sales.

Furthermore, Shopify provides businesses with the tools they need to accept payments seamlessly. The platform supports numerous payment gateways, allowing you to offer your customers a variety of options to pay for their purchases. From credit cards to digital wallets, Shopify ensures a secure and smooth checkout process for both you and your customers.

Marketing plays a critical role in the success of any online business, and Shopify understands this. That’s why they offer a wide range of marketing tools to help you promote your products and reach your target audience. Whether it’s email marketing, SEO optimization, or social media integration, Shopify provides you with the necessary tools to elevate your marketing efforts.

Scalability is another key aspect of Shopify’s platform. As your business grows, Shopify is designed to handle increasing volumes of traffic, orders, and inventory. The platform is cloud-based, which means that you don’t have to worry about the technical aspects of hosting and infrastructure. Shopify takes care of it all, allowing you to focus on what matters most – growing your business.

Key Features and Benefits of Shopify

Shopify offers several key features and benefits for businesses. Let’s explore them in detail:

User-Friendly Interface

One of the standout features of Shopify is its user-friendly interface. The platform is designed to be intuitive and easy to navigate, making it a great choice for both experienced merchants and beginners. With a simple setup process, businesses can quickly create their online stores and start selling.

Layout Options and Themes

Shopify provides businesses with a wide range of layout options and themes. From modern and sleek designs to more traditional and classic styles, there are plenty of choices to create a unique and visually appealing online store. The responsive layouts ensure a seamless user experience across different devices, optimizing engagement and conversion rates .

Brand Reputation

As a leader in the e-commerce industry, Shopify has built a strong brand reputation. Choosing Shopify as an e-commerce solution adds credibility to a business, instilling trust and confidence in customers. The platform’s reliability and commitment to security contribute to maintaining its positive reputation.

Innovation and Continuous Improvement

Shopify is known for its focus on innovation and continuous improvement . The company invests in technology and regularly updates its platform to offer new features and functionalities. By staying at the forefront of industry trends, Shopify ensures that businesses have access to the latest tools and capabilities to drive growth and stay competitive.

Cost Considerations

While Shopify offers a range of features and benefits, businesses should consider the costs associated with the platform. While the subscription fees are affordable, businesses should carefully evaluate their budget and needs before purchasing add-ons or premium themes, as these can incur additional costs. It’s essential to strike a balance between the investment and the expected return on investment.

Shopify Subscription Plans and Pricing

When it comes to choosing the right subscription plan for your business, Shopify offers a range of options to suit different needs and budgets. Let’s take a closer look at the available plans:

1. Basic Shopify

Starting at $29/month, Basic Shopify is perfect for small businesses looking to establish their online presence. This plan includes all the essential features to get you started, such as unlimited product listings, 24/7 support, and the ability to sell across multiple channels.

Priced at $79/month, the Shopify plan is designed for growing businesses that need additional features and scalability. In addition to the features offered in the Basic Shopify plan, Shopify offers advanced analytics, gift cards, and professional reports to help you make data-driven decisions and optimize your sales.

3. Advanced Shopify

If you’re looking for more advanced features and comprehensive tools, the Advanced Shopify plan is the right choice. With a price tag of $299/month, this plan offers all the features from the previous plans plus advanced report builder, third-party calculated shipping rates, and access to the advanced Shopify API.

4. Shopify Plus

For large enterprises and high-volume businesses, Shopify offers Shopify Plus. This customizable enterprise solution is tailored to your specific needs and comes with advanced features, dedicated support, and priority access to new features. Pricing for Shopify Plus starts at $2,000/month.

Each Shopify plan comes with a 14-day free trial, allowing you to explore and test the platform before making a commitment. It’s important to carefully consider your business requirements and growth potential when selecting a plan.

Merchant Solutions by Shopify

Shopify understands the importance of providing additional services to enhance the merchant experience. To meet the varying needs of online businesses, Shopify offers a range of Merchant Solutions designed to streamline operations, increase sales, and improve customer satisfaction.

1. Shopify Payments

Shopify Payments is a fully integrated payment processing service that simplifies transactions for merchants. By eliminating the need for third-party payment gateways, Shopify Payments allows businesses to accept credit card payments directly through their online stores. This seamless integration ensures a smooth checkout experience and provides merchants with access to robust transaction data and analytics .

2. Shopify Shipping

Efficient order fulfillment is crucial for any online store’s success, and this is where Shopify Shipping comes into play. With Shopify Shipping, merchants gain access to discounted shipping rates from trusted partners, making it easier and more cost-effective to ship products to customers. Additionally, Shopify provides tools and features to simplify the fulfillment process, such as label printing and order tracking.

3. Shopify Capital

Shopify Capital aims to fuel the growth of businesses by providing working capital. Merchants can apply for funding directly through their Shopify account, and upon approval, receive a lump sum payment. This capital injection can be used for various purposes, such as purchasing inventory, expanding marketing efforts, or investing in product development . Shopify Capital offers flexible repayment terms and deducts repayments from future sales, ensuring a seamless and manageable repayment process.

4. Shopify POS

Shopify recognizes that not all sales occur online, which is why they developed Shopify POS, a smartphone application that enables in-person sales. With Shopify POS, merchants can convert their devices into secure point-of-sale systems, allowing them to accept payments and manage inventory both online and offline. This omnichannel approach ensures a consistent and seamless buying experience for customers, regardless of the sales channel they choose.

These Merchant Solutions not only generate additional revenue for Shopify but also enhance the overall merchant experience. By offering integrated payment processing, efficient order fulfillment, working capital, and in-person sales capabilities, Shopify equips businesses with the tools they need to succeed in the highly competitive e-commerce landscape.

Shopify’s Customer Segments and Value Propositions

Shopify caters to two major customer segments: small and medium-sized businesses (SMEs) and larger enterprises. The platform’s value propositions center around its subscription-based eCommerce platform, which offers businesses an intuitive and user-friendly solution to create and manage their online stores seamlessly.

For SMEs, Shopify provides a cost-effective and efficient way to establish a professional online presence. The platform’s user-friendly interface and a wide range of customizable templates make it easy for SMEs to set up and customize their online stores without requiring extensive technical expertise or coding knowledge.

On the other hand, larger enterprises benefit from Shopify’s enterprise solution, Shopify Plus. This version of the platform offers advanced features, scalability, and dedicated support to meet the unique needs of larger businesses. Shopify Plus empowers enterprises to scale their operations and handle high volumes of traffic, transactions, and inventory efficiently.

With the aim of empowering businesses of all sizes, Shopify provides the necessary tools and resources for success in the e-commerce space. By leveraging Shopify’s subscription-based eCommerce platform, SMEs and larger enterprises can focus on their core competencies, streamline their online operations, and maximize their online sales potential.

Shopify’s Revenue Streams and Key Resources

Shopify, as a leading ecommerce platform, generates revenue through various streams, primarily from its subscription fees and merchant services fees.

First, Shopify charges merchants a subscription fee for using its platform and gaining access to its range of features. This subscription-based model allows businesses to create and manage their online stores effectively. By offering different subscription plans, such as Basic Shopify, Shopify, Advanced Shopify, and Shopify Plus, Shopify caters to the needs of businesses of all sizes. Each plan comes with a 14-day free trial, enabling merchants to try out the platform before committing to a paid subscription.

Second, Shopify earns revenue through merchant services fees, such as payment processing fees through Shopify Payments. By integrating a payment processing service within its platform, Shopify provides a seamless and secure payment experience for merchants and their customers. This not only adds convenience but also generates additional revenue for Shopify.

As for key resources, Shopify’s platform and ecosystem are the cornerstone of its business. The Shopify platform provides the technology and tools necessary for merchants to create and manage their online stores efficiently. It offers a user-friendly interface, customizable themes, and a wide range of features, including sales channels, marketing tools, inventory management, and customer support.

Furthermore, the Shopify ecosystem comprises a vast network of app developers, third-party integrations, and service providers. This ecosystem enhances the functionality and versatility of the Shopify platform, allowing businesses to extend their capabilities and integrate with various tools and services to meet their specific needs.

Revenue Streams and Key Resources

Together, these revenue streams and key resources enable Shopify to provide a comprehensive and lucrative platform for merchants in the ever-growing ecommerce industry.

Key Activities and Partnerships of Shopify

As a leading e-commerce platform, Shopify engages in key activities and partnerships to enhance its services and expand its reach. The company focuses on platform development, marketing and sales efforts, collaboration with app developers, and strategic partnerships with industry giants like Facebook.

Platform Development and Maintenance

Shopify prioritizes the continuous development and maintenance of its platform to ensure it remains reliable, secure, and up-to-date. The company invests in cutting-edge technologies and follows industry best practices to deliver a seamless user experience for merchants and their customers. This includes regular updates, bug fixes, and the introduction of new features and functionalities.

Marketing and Sales

To attract new merchants and drive business growth, Shopify invests in robust marketing and sales initiatives. The company employs various strategies, such as digital advertising, content marketing, search engine optimization (SEO), and social media campaigns, to raise awareness about its platform and its benefits for businesses. By targeting specific audiences and highlighting key selling points, Shopify effectively showcases its value proposition to potential customers.

Collaboration with App Developers

Shopify recognizes the importance of offering a diverse range of applications and integrations to enhance its platform’s capabilities. To achieve this, the company collaborates with talented app developers who create innovative tools and solutions tailored to the needs of merchants. By fostering these partnerships, Shopify ensures that its platform remains highly adaptable and customizable, enabling businesses to meet their unique requirements and scale effectively.

Strategic Partnerships with Facebook

Shopify has established a strategic partnership with Facebook, one of the world’s largest social media platforms. This partnership allows Shopify merchants to leverage Facebook’s extensive user base and advertising capabilities to reach a wider audience and drive sales. By seamlessly integrating with Facebook’s marketing tools, Shopify enables businesses to create targeted ad campaigns, showcase products, and streamline the purchasing process, ultimately boosting their online presence and revenue.

Example Table

By engaging in these key activities and partnerships, Shopify strengthens its position as a leading e-commerce platform and empowers businesses to succeed in the competitive online market.

Shopify’s Cost Structure and Competitors

When it comes to Shopify’s cost structure, the company incurs expenses in various areas to ensure the smooth functioning of its platform and to stay ahead in the competitive ecommerce market. These expenses primarily include:

- Platform Development and Maintenance: Shopify invests in continuous development and maintenance of its platform to provide merchants with a reliable and user-friendly experience.

- User Acquisition: To attract new merchants, Shopify allocates resources for marketing and advertising campaigns, as well as customer acquisition strategies.

- Human Resources: Shopify’s team comprises skilled professionals who work diligently to provide exceptional support, maintain the platform’s technological infrastructure, and drive innovation.

In addition to understanding Shopify’s cost structure, it is vital to analyze its competitors. Two prominent competitors in the ecommerce platform industry are BigCommerce and Salesforce. Let’s take a closer look at each:

1. BigCommerce

BigCommerce is another popular ecommerce platform that offers a range of features and services similar to Shopify. Known for its scalability and flexibility, BigCommerce caters to both small and large businesses. Here is a brief comparison between Shopify and BigCommerce:

2. Salesforce

Salesforce, a cloud-based software company, offers a wide range of solutions for customer relationship management (CRM), sales, and marketing. While not primarily an ecommerce platform, Salesforce provides tools and services that can overlap with certain aspects of Shopify’s offerings. Here are a few points of comparison between Shopify and Salesforce:

While each platform has its own strengths and weaknesses, Shopify remains a popular choice among businesses due to its user-friendly interface, extensive range of features, and strong reputation in the industry. Competitors like BigCommerce and Salesforce offer their own unique value propositions, which businesses should carefully evaluate based on their specific needs and priorities in order to make an informed decision.

SWOT Analysis of Shopify

Shopify, the popular e-commerce platform, boasts several strengths that contribute to its success. Firstly, it offers a user-friendly interface that simplifies the process of setting up and managing an online store. This intuitive interface appeals to businesses of all sizes and levels of technical expertise.

Secondly, Shopify is known for its reliable customer service. The platform provides timely and efficient support to its users, ensuring that any technical issues or inquiries are addressed promptly.

Lastly, Shopify is renowned for its secure platform. The company prioritizes the safety and privacy of its users’ data, implementing robust security measures to protect against cyberthreats. This commitment to security instills confidence in businesses and customers alike.

While Shopify may have numerous strengths, it also faces a few weaknesses. One notable weakness is the need for advertising to attract customers. With increasing competition in the e-commerce space, businesses using the platform must invest in marketing efforts to effectively reach their target audience.

Additionally, Shopify can present challenges in setting up products. The process may require technical knowledge or assistance, making it slightly more complex for less tech-savvy users. However, Shopify provides resources and support to help businesses overcome these challenges.

Shopify also identifies various opportunities for growth. One key opportunity lies in integrating with trending apps. By partnering with popular applications, Shopify can enhance its platform’s functionality and attract a wider range of users.

Expanding its customer base is another potential opportunity for Shopify. As the e-commerce market continues to grow, there is ample opportunity for the platform to appeal to new customers and increase its market share.

Despite its strengths and opportunities, Shopify also faces threats in the market. One significant threat is competition from other large-scale platforms. Shopify must stay vigilant and innovative to differentiate itself and retain its user base in the face of fierce competition.

Overall, Shopify’s strengths lie in its user-friendly interface, reliable customer service, and secure platform. The company acknowledges its weaknesses and actively pursues opportunities for growth while remaining vigilant against market threats.

Shopify has revolutionized the ecommerce industry with its disruptive business model, offering businesses of all sizes the necessary tools and support to thrive in the online business landscape . As an ecommerce platform, Shopify provides a subscription-based model that enables businesses to create and manage their online stores effectively. The platform’s user-friendly interface, extensive range of features, and strong reputation have made it a top choice for businesses looking to establish and grow their online presence.

One of Shopify’s key strengths lies in its ability to generate multiple revenue streams through its subscription-based model and Merchant Solutions. This comprehensive ecosystem ensures that businesses can easily monetize their online ventures. By leveraging the Shopify platform, businesses can focus on product development and sales, confident that the backend operations are taken care of.

Key takeaways from Shopify’s success include its user-friendly platform, which allows businesses to set up and customize their online stores without technical expertise. The platform’s extensive feature set, including marketing tools and integration with various sales channels, enables businesses to effectively reach and engage their target audience. Lastly, Shopify’s reliable customer service and secure platform provide peace of mind to businesses, knowing that they are supported and their customers’ data is protected.

In conclusion, Shopify’s business model as an ecommerce platform is a game-changer for businesses of all sizes. With its subscription-based approach, comprehensive ecosystem, and focus on user experience, Shopify empowers businesses to monetize their online ventures successfully. Whether you are a small startup or an established enterprise, Shopify offers the necessary tools and support to thrive in the competitive online business landscape.

What is Shopify and how does it work?

What are the key features and benefits of shopify, what are the subscription plans and pricing options for shopify, what are the merchant solutions offered by shopify, who are the customer segments for shopify and what are its value propositions, how does shopify generate revenue and what are its key resources, what are the key activities and partnerships of shopify, what is shopify’s cost structure and who are its competitors, what is the swot analysis of shopify, what is the conclusion of shopify’s business model.

Editorial Team

Rolex business model: a comprehensive review, ross stores business model: a comprehensive review.

The Leading Source of Insights On Business Model Strategy & Tech Business Models

How Does Shopify Make Money? Shopify Business Model In A Nutshell

Shopify is an e-commerce platform that enabled over 2 million merchants by 2021 to commercialize their products. While Shopify works with a subscription -based business model , it makes most of its money via merchant services, which are additional services provided to merchants. In 2023, the company generated over $7 billion in revenue, of which over $1.8 billion (26% of total revenue) was from subscriptions and $5.2 billion (74% of total revenue) from merchant solutions.

Table of Contents

Shopify Mission

Our mission is to make commerce better for everyone, and we believe we can help merchants of nearly all sizes, from aspirational entrepreneurs to large enterprises, and all retail verticals realize their potential at all stages of their business life cycle.

That is how Shopify emphasizes the core mission within its financial statements.

Shopify focuses primarily on small and medium-sized businesses by offering several levels of subscription plans. The most popular is the plan which costs less than $50 per month.

However, as we’ll see, the enterprise accounts are those driving the gross merchandise sales on the platform.

Inside Shopify Subscription Business

Three primary plans are at the core of Shopify subscription -based offering running with a 14-day free trial.

Most merchants subscribe to the Basic and Shopify plans.

At the same time, the majority of Spotify’s gross merchandise volume (the $ amount of products sold within the platform) comes from merchants paying for the Advanced Shopify and Plus Shopify plans.

And as reported by Shopify also the retention of the highest-priced tier (Shopify Plus) is higher, compared to the lowest tiers.

Shopify Plus is a service thought for enterprise customers, with larger volumes, which is several times more expensive than the advanced plan.

Shopify Plus is for merchants with higher-volume sales and it offers additional functionality, scalability, and support requirements, including a dedicated Merchant Success Manager.

That comprises brands like Unilever, Kylie Cosmetics, Allbirds, and MVMT. Shopify has around 5,300 enterprise accounts as of 2018, which are a key driver of both the company’s subscription and merchant revenues.

Enterprise contracts are also way more stable as the enterprise clients usually sign an annual or multiyear contract. And those plans automatically renew, unless notice of cancellation by the enterprise account.

Merchant Solutions

Those consist of additional services offered on top of the platform.

Shopify merchant solutions primarily make money from payment processing fees from Shopify Payments, transaction fees, Shopify Shipping, Shopify Capital, referral fees from partners, and sales of point-of-sale (“POS”) hardware.

As pointed out on its financial statements Shopify Payments is a fully integrated payment processing service that allows merchants to accept and process payment cards online and offline and is also designed to drive higher retention among merchant subscribers.

According to the company two-thirds of its merchants have enabled Shopify Payments.

Other services comprise:

- Shopify Shipping which allows merchants to select from a variety of shipping partners to buy and print outbound and return shipping labels and track orders directly within the Shopify platform.

- Shopify Capital where eligible merchants secure financing and accelerate the growth of their business by providing access to simple, fast, and convenient working capital. In short, Shopify purchases a designated amount of future receivables at a discount or make a loan The merchant in remits a fixed percentage of their daily sales until the outstanding balance has been remitted.

- Shopify POS a mobile application that lets merchants sell their products in a physical or retail setting.

In short, Shopify uses the merchant solutions revenues (which are higher than the subscription revenues in 2018) to have a higher retention rate for its subscription basis, which renews on a recurring basis.

Some of those key solutions (like Shopify Payments and Capital) sustain merchants’ activities, thus strengthening its core business .

A Technology Platform

Shopify defines its platform as a multi-tenant cloud-based system engineered for high scalability, reliability, and performance .

Shopify is hosted primarily on cloud-based servers. According to the company the key attributes and values of the Shopify platform can be summarized in:

- Scalability (to sustain spikes of traffic especially on large merchants e-commerces).

- Reliability.

- Performance.

- Deployment (the software automatically updates, thus not creating maintenance costs for merchants).

Why The Ecosystem Matters

Open source has played a critical role in Shopify’s growth . Indeed, one of the key elements that make Shopify a compelling platform is given by its rich ecosystem of app developers, theme designers and other partners (digital and service professionals, marketers, photographers, and affiliates).

Shopify KPIs

Key performance indicators are a few metrics that matter to the business and depending on the kind of business those might vary.

For instance, usually for a SaaS or subscription-based business , the key metric is the MRR or monthly recurring revenues. That’s because the core business is based on creating a recurring customer base.

For a platform hosting third-parties products and services, a key metric is called gross merchandise volume (GMV), or the $ volume of products sold through the platform by third-party sellers, or merchants.

Since Shopify is a hybrid between a subscription -based platform offering additional services, the company uses MRR and GMV as two key performance indicators (KPIs).

It is important to highlight that among the two, the GMV needs to be evaluated in accordance with the growth of the subscription base.

In short, Shopify core business is subscription -based, and its merchant solutions are a key ingredient to sustain the growth of the customer base, thus making the subscription service more valuable, by reducing the churn.

Let’s now break down the key elements of Shopify.

Key takeaways

- Shopify is a platform business model as it enables third-parties merchants to commercialize their products on its cloud-based e-commerce.

- The company’s core business is a subscription -based service.

- The company’s most popular plans are those below $50, at the same time subscription revenues are also driven by enterprise accounts, which pay substantially higher fees compared to the standard tiers available on Shopify.