Free Small Business Budget Templates

By Andy Marker | August 12, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled the most useful free small business budget templates in Microsoft Excel and Google Sheets formats, and also provided helpful details for filling out these templates.

Included on this page, you’ll find many useful small business budget templates, including a simple small business budget template and a business budget template . Plus, discover why you need a small business budget template , and how to create a small business budget template .

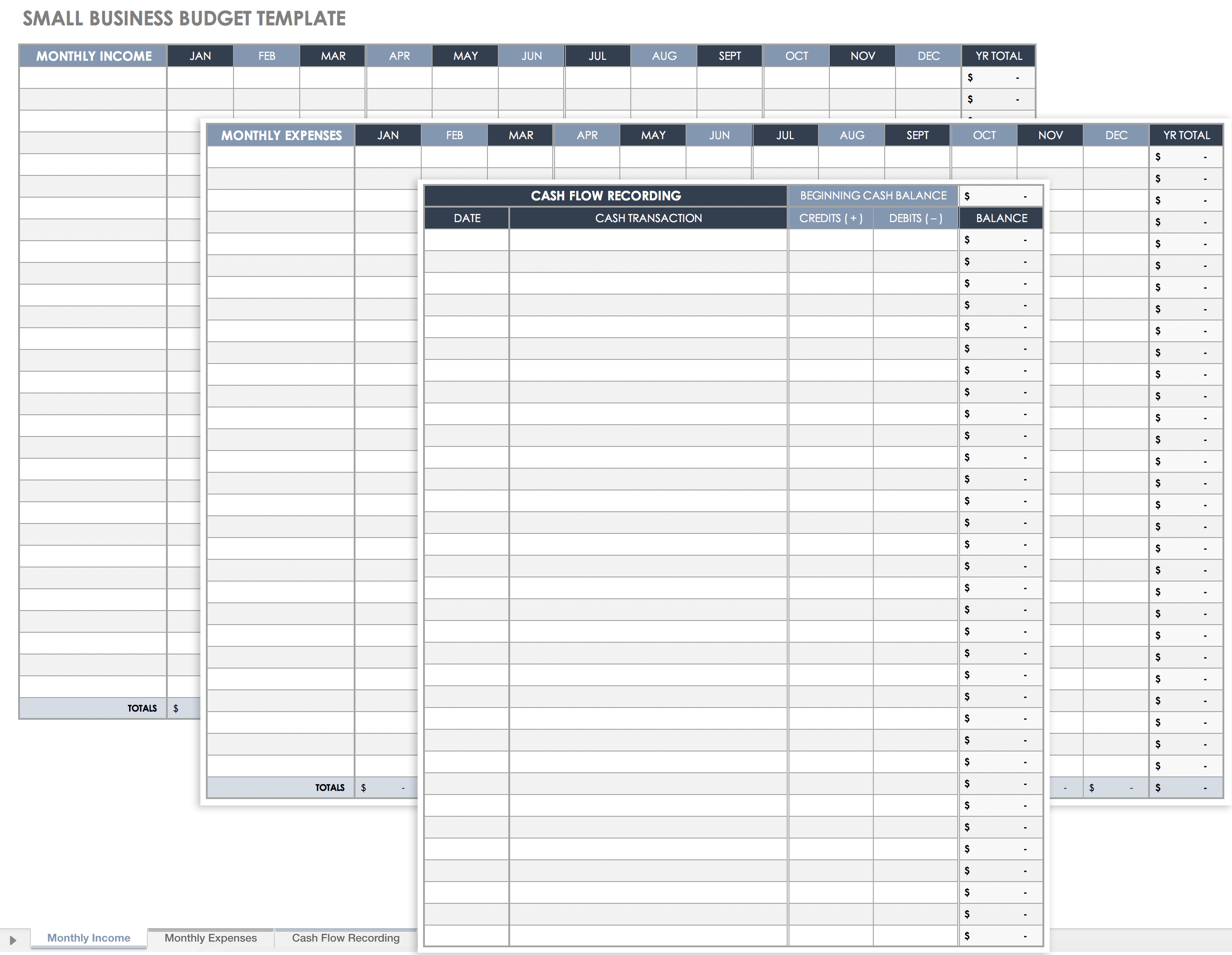

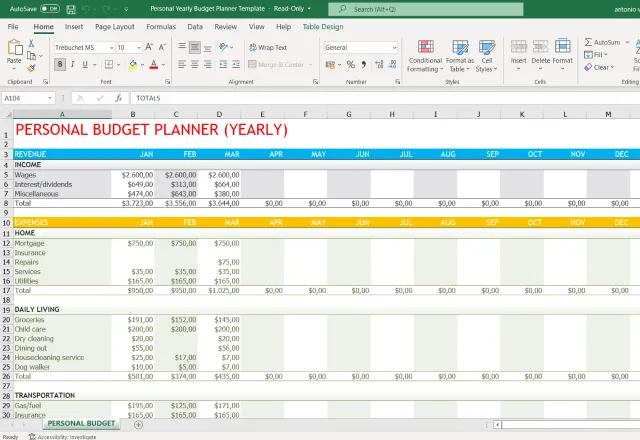

Small Business Budget Template

Use this small business budget template to track and manage your business’s finances. This easy-to-fill template includes a sheet for month-by-month income, another sheet for tallying monthly expenses, and a third sheet for recording cash flow balances that factors in credit and debit cashflow balances. Easily track and view monthly income and expenses to calculate total profits. The completed budget will help you gauge how close you are to reaching your financial goals.

For more on small business templates, see “ Free Business Templates for Organizations of All Sizes .”

Download Free Small Business Budget Template - Excel

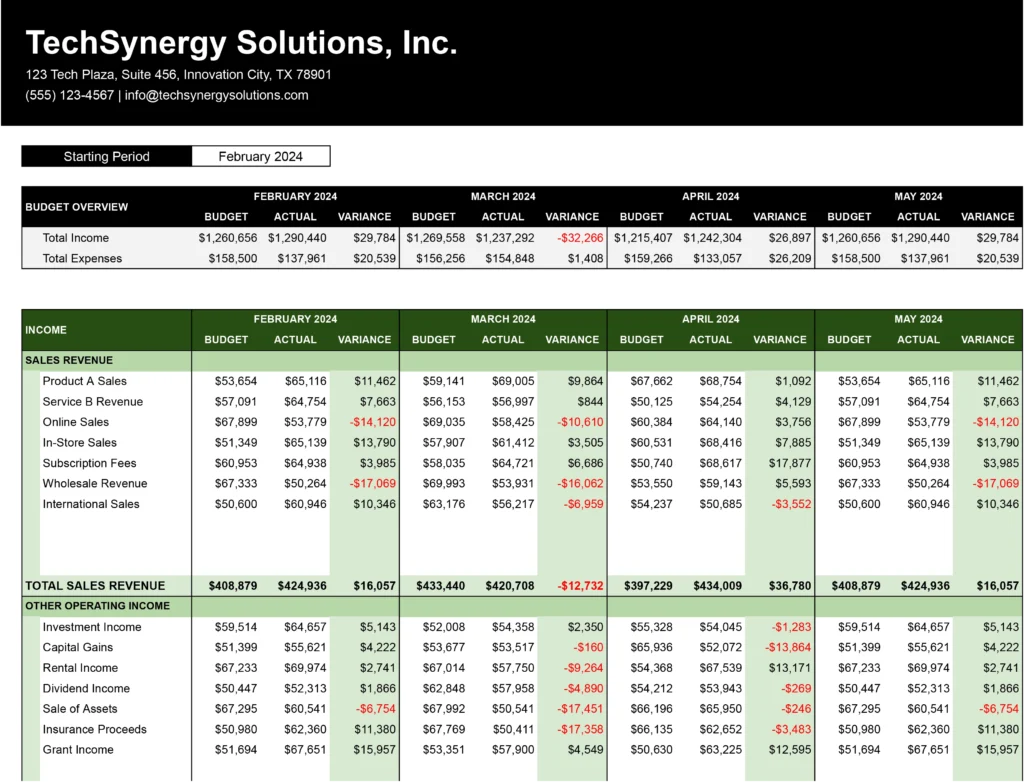

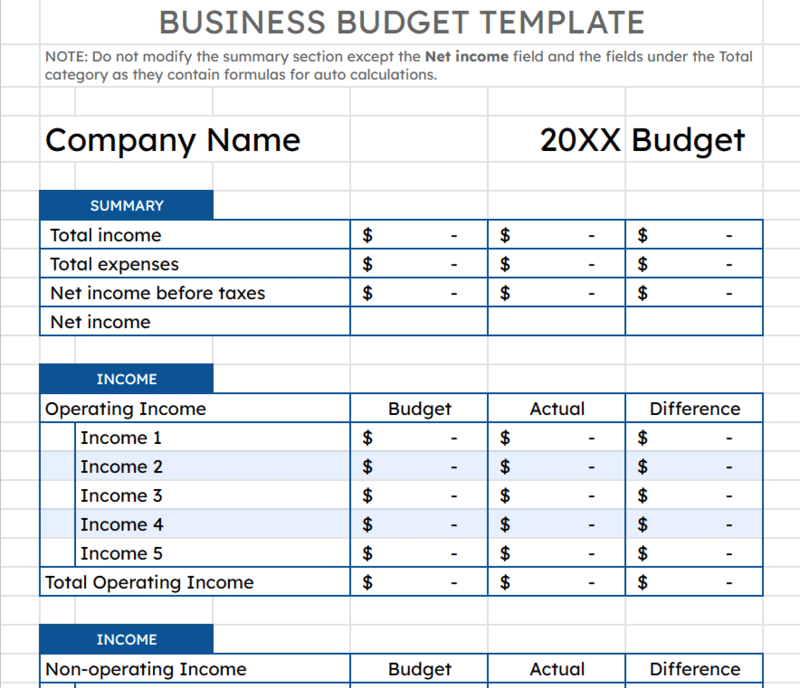

Business Budget Template

This detailed, all-in-one budgeting template is a perfect fit for small business owners who want to keep tabs on the financial health of their company. The template includes columns for labor hours, rate, materials, unit costs, and budgeted and actual figures for tallied over/under figures. Use the template to easily compare budgeted amounts to actual expenses for greater insight into how well you’re meeting your budget.

For more on business budget templates, see “ Free Business Budget Templates for Any Company .”

Download Business Budget Template - Excel

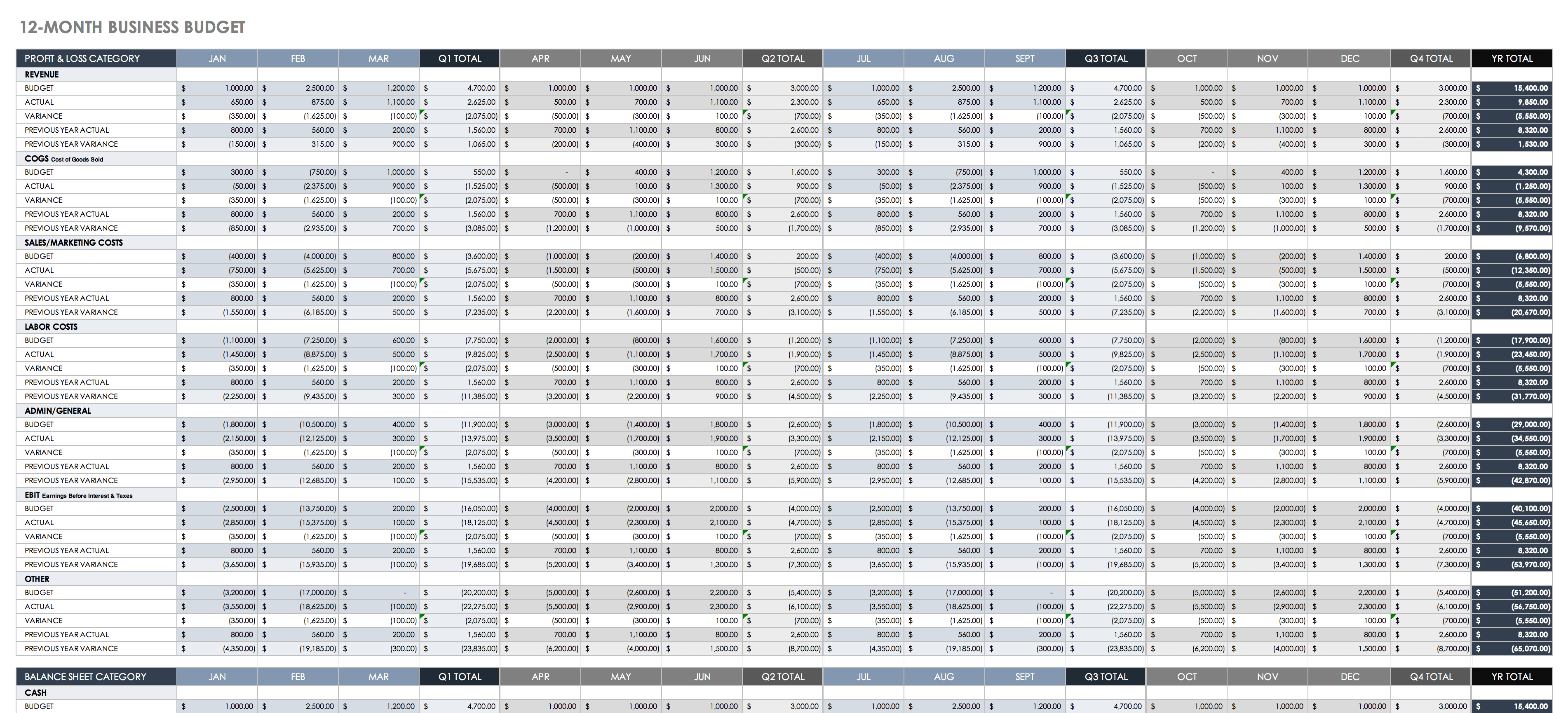

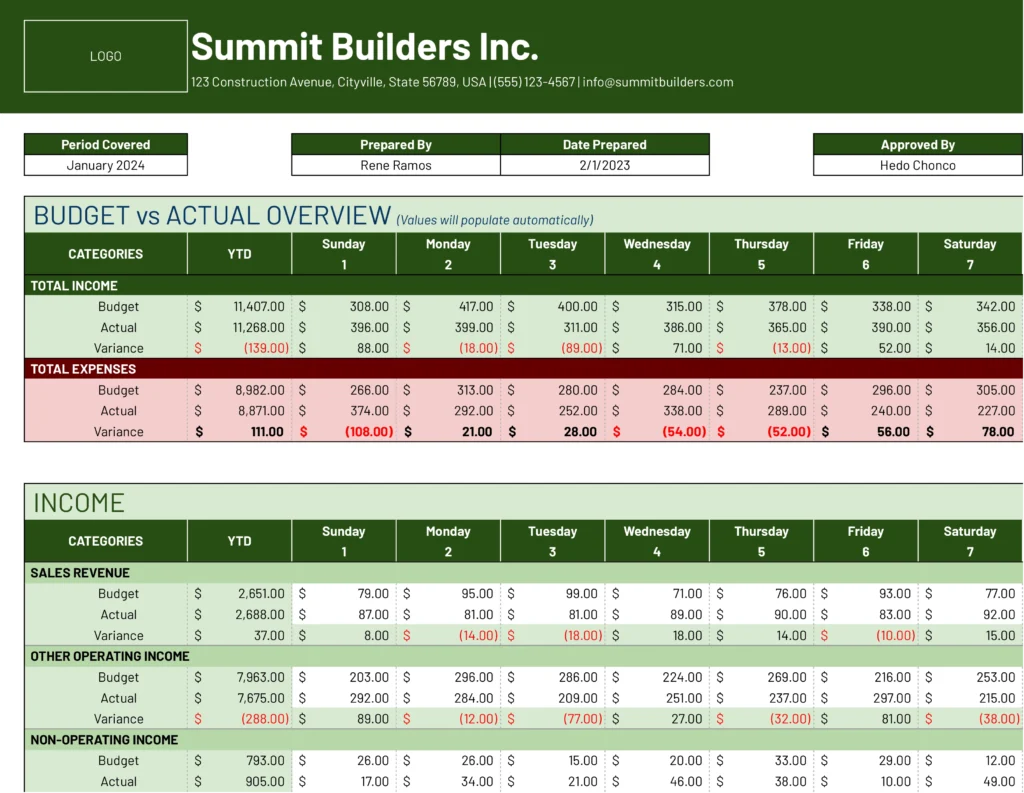

12-Month Business Budget Template

Track your small business’s month-by-month financials with this easily fillable 12-month business budget template. The template includes profit and loss category rows for cost of goods sold (GOGS), sales and marketing costs, labor costs, and earnings before interest and taxes (EBIT). You can also factor in cash, inventory, accounts receivable, net fixed assets, and long-term debt to gain month-by-month, quarterly, and annual insight into your business’s time-sensitive budget.

Download 12-Month Business Budget Template - Excel

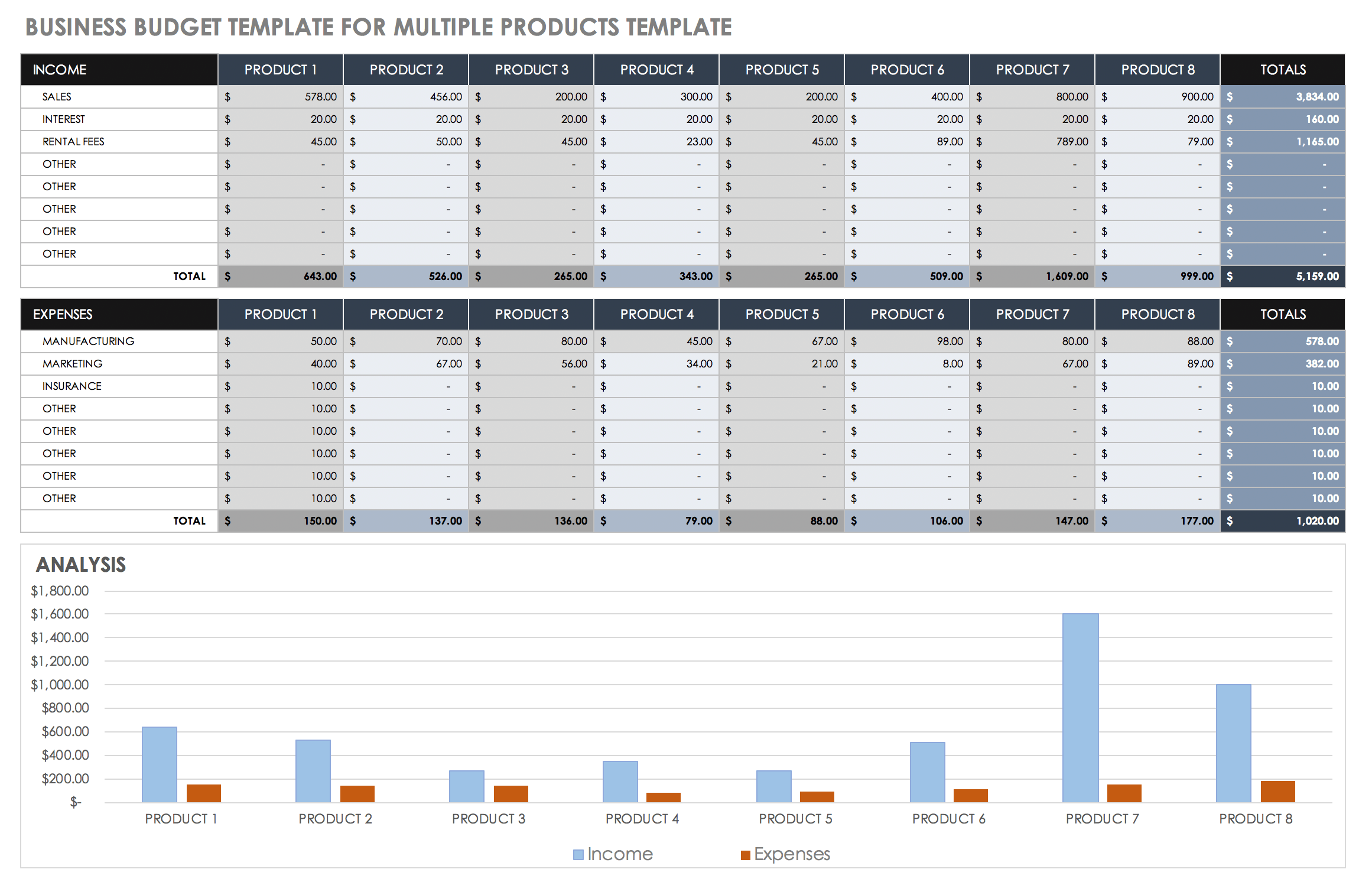

Business Budget Template for Multiple Products

Use this customizable template to track single or multiple-project budgets to get a comprehensive picture of your company’s financials. This business budget template for multiple projects allows you to factor in business income (actual vs. budgeted), product-by-product COGS figures, and gross profit (non-operating income) so you can quickly tally your total adjusted income. Enter operating expenses to see your company’s financial position and how close you are to reaching your goals.

Download Business Budget Template for Multiple Products - Excel

For more operating budget templates, refer to our collection in this article .

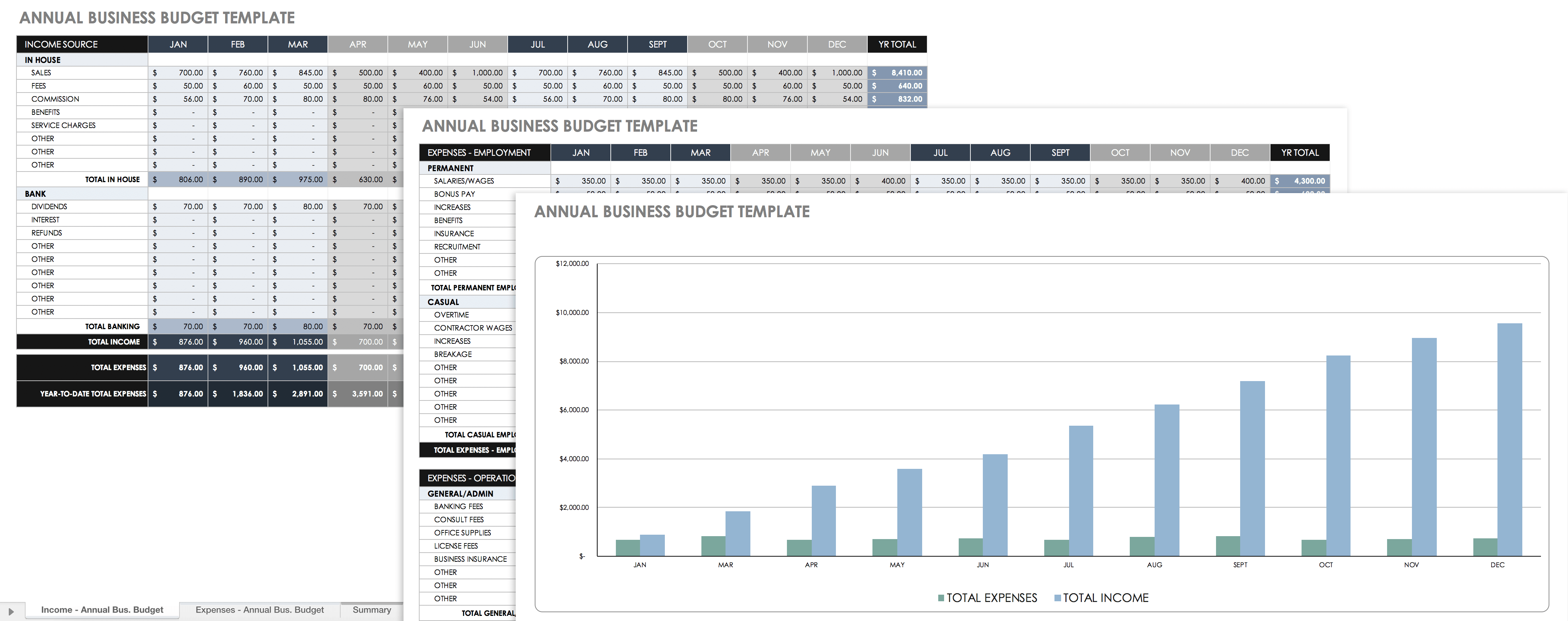

Annual Business Budget Template

Get a yearly checkup on your company’s financial health with this annual business budget template. Use the income sheet to enter your sales figures (fees billed, commission income, service income, etc.), and compare those numbers to individual entries on an expenses sheet (COGS, travel, insurance, etc.). Plus, use the summary sheet to see an overview of your spending, based on income vs. expenses. The completed template will show you how close you are adhering to your budget and can help you determine any clarifications or adjustments.

Download Annual Business Budget Template - Excel For more annual business budget templates, see our article “ Free Annual Business Budget Templates ”.

Business Expense Budget Template

For an expense-by-expense, detailed drilldown of your small business’s expenditures — and how they affect your company’s budget — this template features a planned expenses sheet that totals your projected employee, office, marketing, training, and travel costs, and compares these against a sheet of your actual expenses. Use the third expense variance sheet to inspect the variance between the two (planned vs. actual), and the expense analysis sheet to gain a dashboard view, so you can analyze your organization’s overall financial health.

Download Business Expense Budget Template - Excel

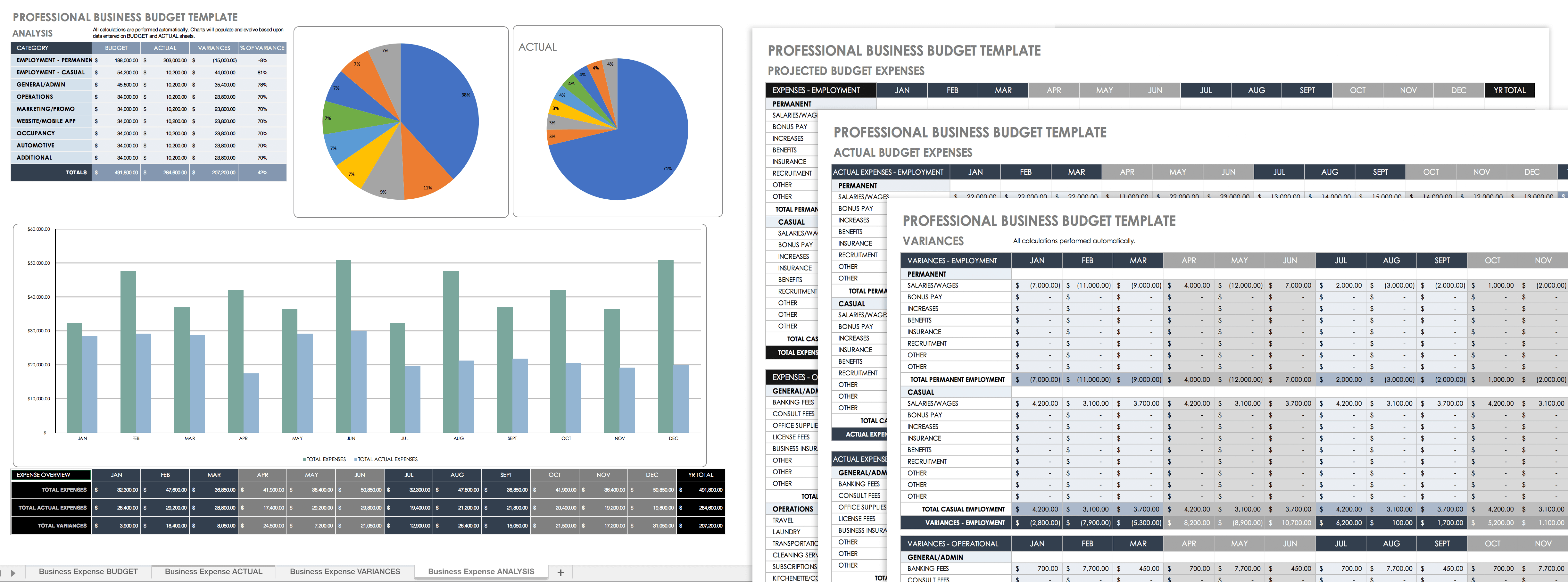

Professional Business Budget Template

Use this professional business budget template to make informed decisions about how projected and actual expenses affect your company’s bottom line. Enter employee and operations expenses on one sheet, compare them to actual expenses on a business expense actual sheet, and then inspect the variances and any discrepancies. A professional business analysis sheet provides a comprehensive analytical overview so you can see where you need to make adjustments to help your company meet its financial goals.

Download Professional Business Budget Template - Excel

If you are looking for budget templates for nonprofits, check out this article for a vast variety of budget templates suitable for any nonprofit organization.

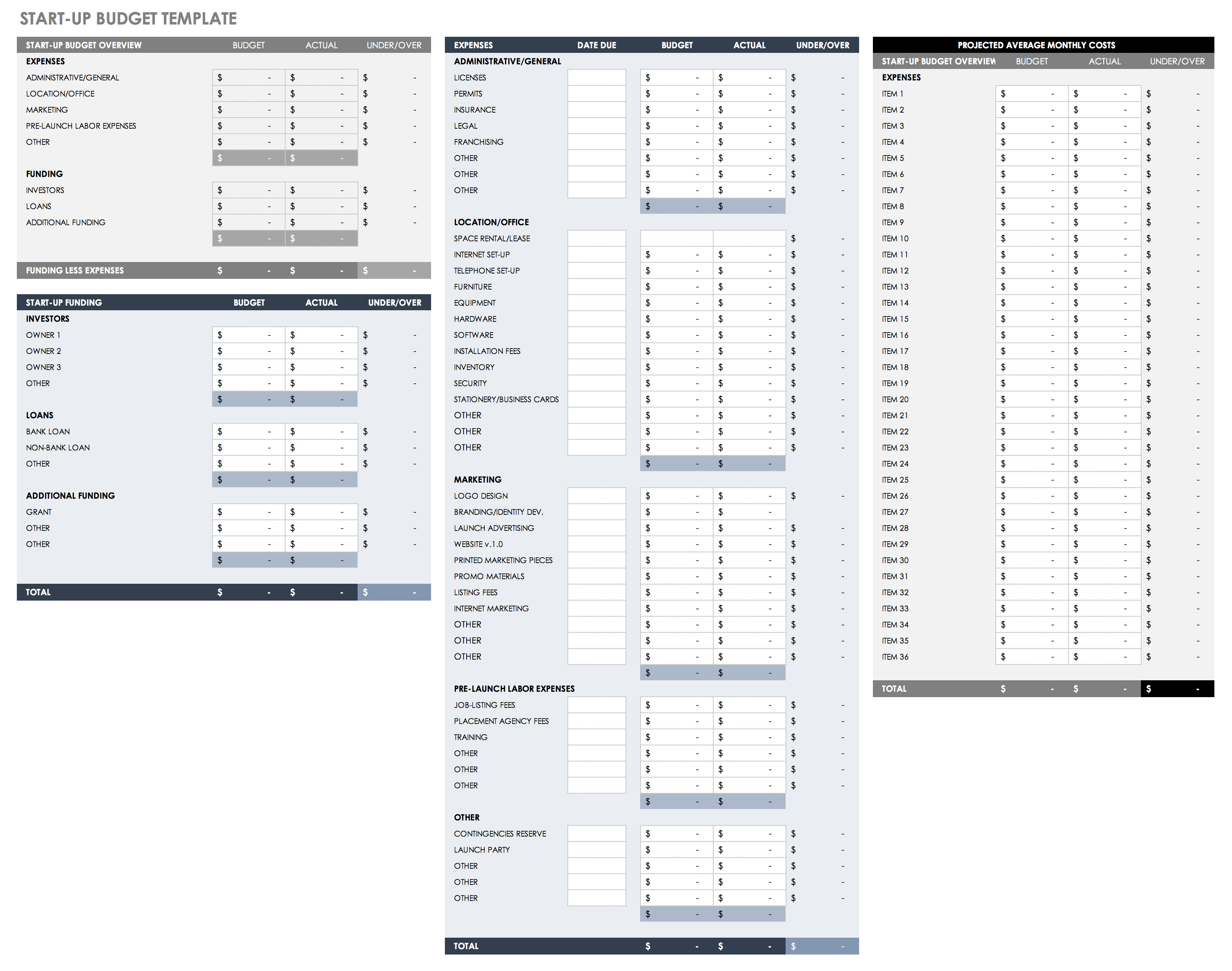

Startup Budget Template

Designed with simplicity in mind, this single-sheet, startup budget calculator features a single dashboard view on your business expenses. Use the template to easily compare projected and actual expenses, and use the first-year budget calculations section to gain immediate insight into projected average monthly costs, based on budgeted and actual income and expenses. Factor in small business expenses, such as office space, loans, and marketing costs, to ensure your company is financially successful from the get-go.

Download Start-up Budget Template - Excel

For more startup budget templates, see “ Free Startup Budget Templates ”.

Why You Need a Small Business Budget Template

A small business budget template is a reliable tool that enables you to calculate expenses, revenue, and profits to see how close you are to reaching your organization’s financial goals. You can also use a template to factor in unexpected costs and revenue to determine which expenditures to trim in order to keep the company’s profitability on track. In short, a small business budget reveals additional opportunities and possible revenue streams.

A small business budget template provides a clear, autotallied, factor-by-factor picture of a company’s estimated capital vs. the reality of expenditures. Simply enter the following details:

- Planned Expenses: These include employee costs (wages and benefits), office costs (lease, utilities, etc.), and other known payments.

- Additional Costs: These costs might include marketing, legal fees, training, and travel.

- Actual Costs: This refers to how much items actually cost (compared to planned expenses).

- Planned Income: This includes anticipated income from sales, services, investors, etc.

- Actual Income: This refers to the actual income (compared to planned income).

Once you enter the above budget details, use the template to inspect the variances between the projected budget and the actual numbers to track your business’s finances and make any necessary adjustments.

How to Create a Small Business Budget Plan

A small business budget allows you to plan for expenses and analyze anticipated income against actual income. When creating a small business budget, consider the following factors:

- Specify Fixed and Variable Costs: Determine all fixed and variable costs involved in running your small business, such as office space, equipment, employee wages, insurance, and training.

- Factor in Cost of Goods: Enter the cost of goods (COGS), which includes beginning inventory, shipping charges, and related labor.

- Estimate Your Income: Calculate the income you expect to earn, whether it is from existing capital, investors, or projected profits.

- Analyze Your Profit Margin: Compare the variance between projected costs and actual costs — as well as projected income compared to actual income — to determine how close you are to meeting financial goals.

- Adjust Your Budget: Update your budget as needed, once you see how estimates compare with actual income and expenses.

We’ve also compiled the most useful free budget proposal templates for organizations, project managers, grant writers, researchers, team members, and other stakeholders.

Discover a Better Way to Manage a Small Business Budget and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Free Small-Business Budget Templates

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A business budget template is one of the most important tools you can use to run your small business. However, many small-business owners skip this vital business management step.

The misconceptions surrounding budgeting are plenty. It seems complicated and time-consuming. But with a good business budget template, the process can be much less daunting.

An effective small-business budget template is a living document. Creating a budget and then forgetting about it is wasted effort. You must compare your actual numbers against your budgeted numbers regularly.

Therefore, your budget should be easy to access and adjust on an ongoing basis. But you don’t have to spend a lot of money on business budgeting software , if you don't want to. There are several free small-business budget templates available online.

QuickBooks Online

Why you need a business budget template

A business budget template is an essential tool for business owners who want to take care of their bottom line. Why should you invest in a smart template from the start?

Here's how a business budget template can set you up for success:

Track cash flow, expenses and revenue.

Prepare for regular business slowdowns.

Allocate your budget to the portions of your business that need capital most.

Plan for business investments and purchases.

Project all costs to starting and running your business.

Generally speaking, your business budget template can act as a business health scorecard if you invest in setting one up properly. Here's our list of the best budget templates available so you can do just that.

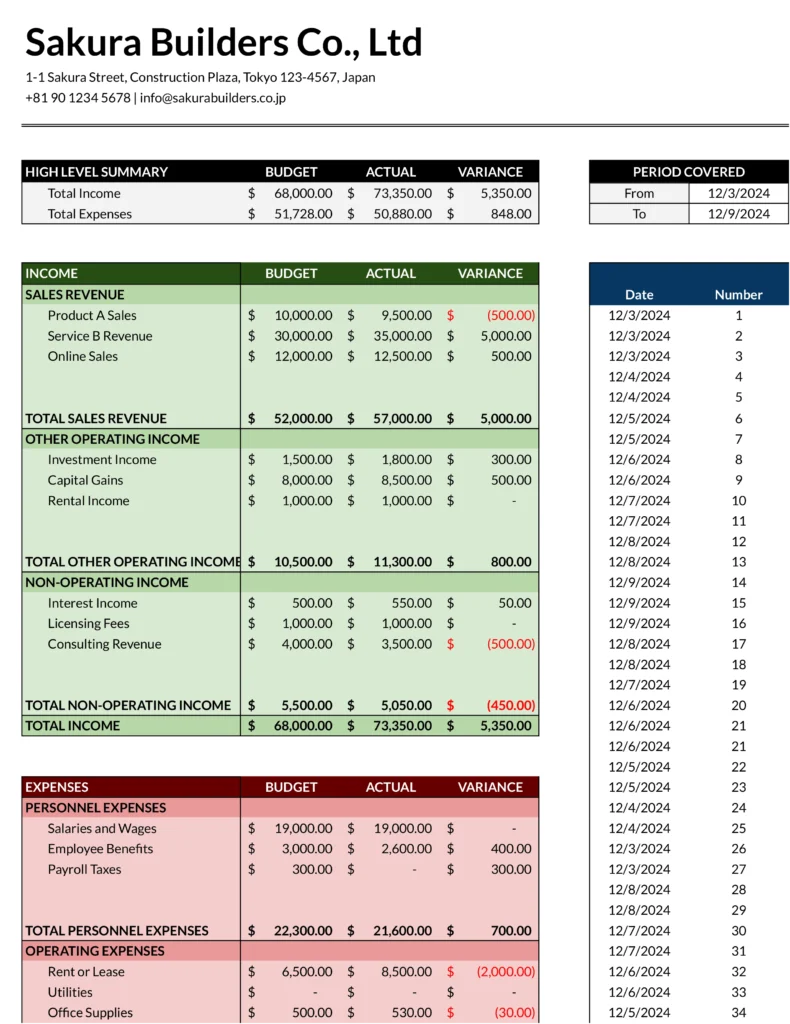

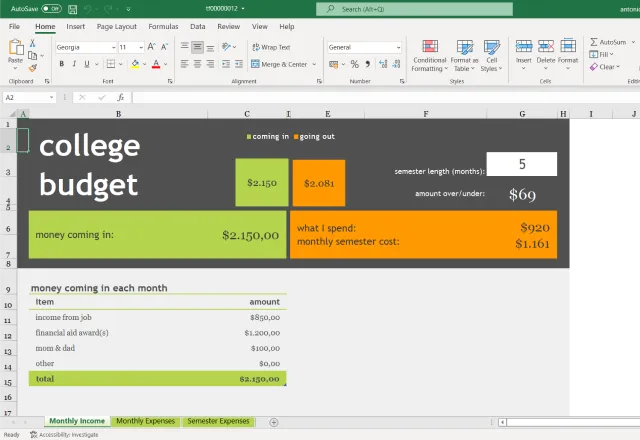

Capterra’s Free Small-Business Budget Template

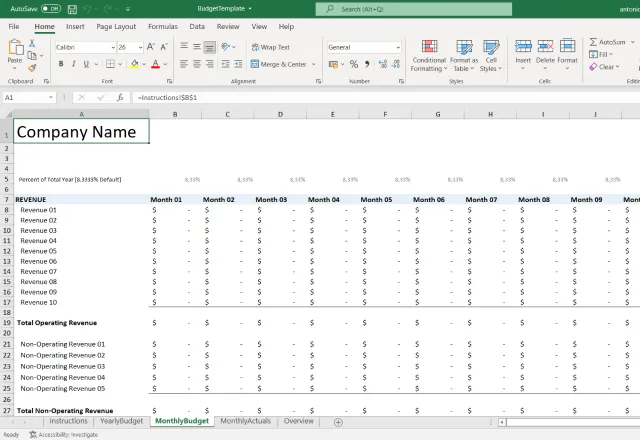

The Capterra small-business budget template has been a fan favorite since it was published in 2015. In this one simple Excel workbook, you can create your monthly budget, your annual budget and then compare your actual numbers to your budgeted numbers. It also has a convenient overview sheet, which gives users access to their performance at a glance.

To help you through the process, Capterra has included a detailed Instructions tab, which walks you through how to use the template step by step. Start here to save yourself hours of time and frustration. As a bonus, there are several resources linked on the Instructions tab to help you create the perfect budget for your small business.

PDFConverter.com 15 Best Budgets

Rather than one bloated Excel workbook that tries to do everything, PDFConverter.com has compiled a library of 15 small-business budget templates.

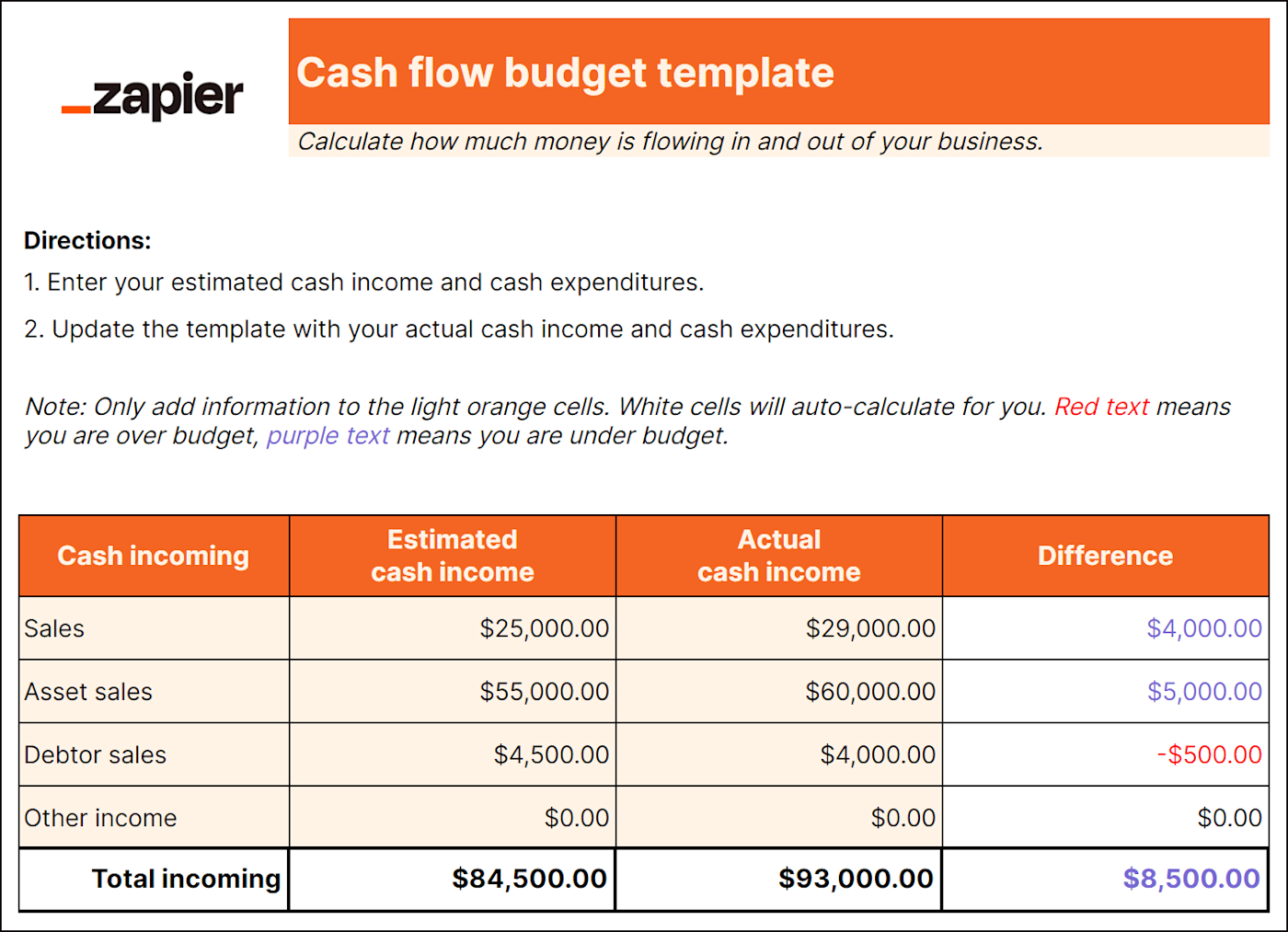

These templates cover a wide range of budgeting needs, from a basic overview of your business income and expenses to marketing budget templates. The startup budget template is ideal for newbie entrepreneurs still in the planning stage of their businesses. And the cash flow template is perfect for identifying and plugging cash flow leaks.

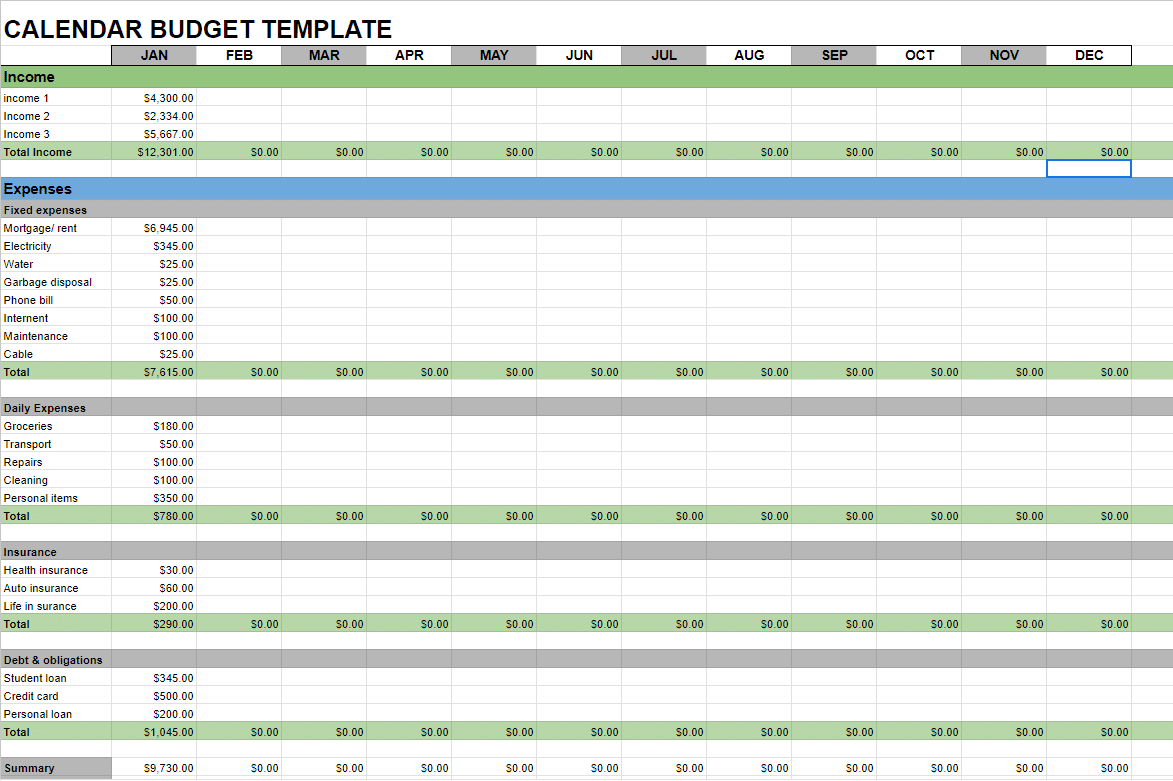

Annual Business Budget in Google Sheets

Do you love all things Google? You can create a comprehensive budget for your small business right from Google Sheets. Simply navigate to your Sheets and then click on Template Gallery . Our friends at Intuit QuickBooks have created an annual business budget you can use for free.

To fully appreciate the power of the template, review the Summary tab after you have entered your budget figures. The tables and graphs on this tab offer a visual representation of your income and expenses, making it easy to see where you stand at a glance.

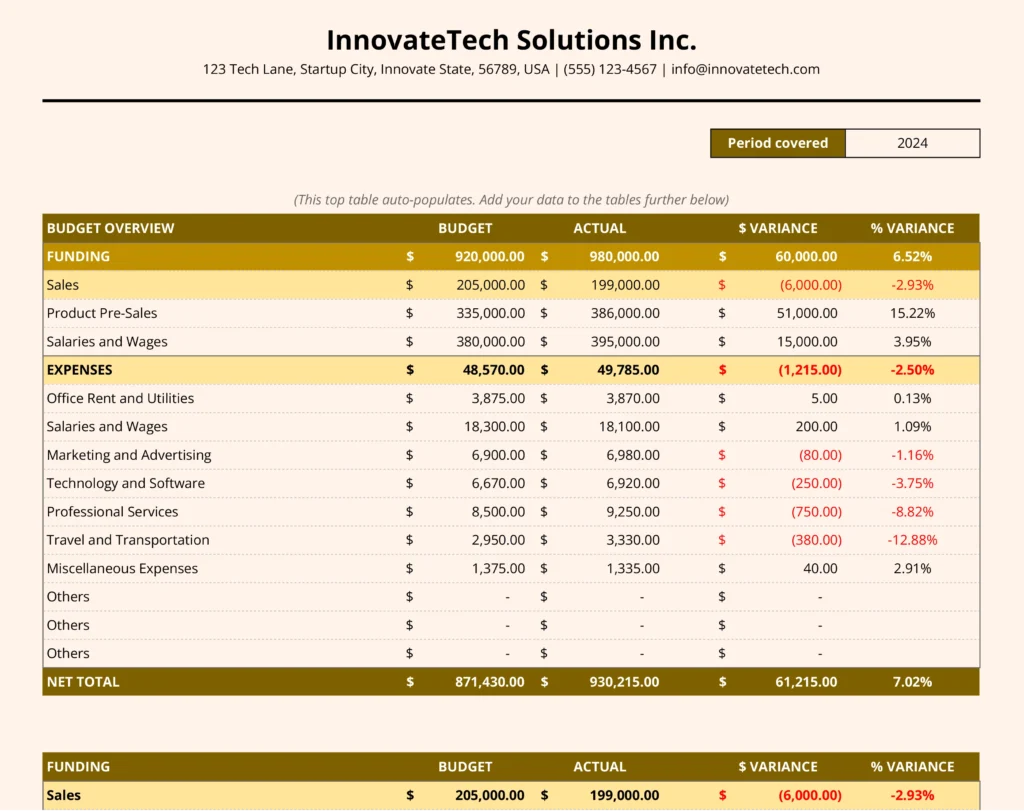

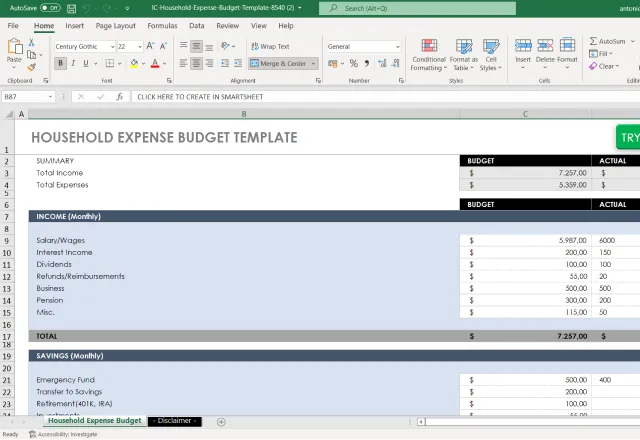

Microsoft Office Template

This beautiful template from Microsoft Office focuses exclusively on expenses, but it does that job exceptionally well. There are tabs for planned and actual expenses, a tab for automatically calculated variances between the two and an expense analysis tab complete with pie charts.

Your accounting software

While not a free template per se, you likely have a powerful budgeting tool available right inside your business accounting software . Though not as flexible as a separate template, there are many advantages to using the budgeting feature of your accounting software.

The budgeting feature in your accounting software will coincide with your chart of accounts. Depending on the software you use, you can create a budget to actual comparison reports with the click of a button, making analysis a cinch.

Some software programs even let you set multiple budget scenarios and have “cloning” features, which simplify the budgeting process after the first year.

Designing your budget

Now that you’ve chosen your business budget template, it’s time to start designing your budget. This is where many small-business owners procrastinate because people typically see budgeting as restrictive or punishing.

It's time to shift your perspective on budgeting. Most people start with income and tinker with their expense amounts until they arrive at a balanced or surplus budget. This method usually leads to unrealistic projections and ends in frustration.

Instead of a top-down approach, consider “reverse engineering” your budget by following these four simple steps:

Form your income projections and write those down outside of your budget template. Put this paper or spreadsheet away until after you have completed the next step.

Enter your expenses into your budget template. Be very honest in your entries and include everything. Going through several months’ or even a year’s worth of accounting data or bank and credit card statements will ensure you capture all your spending. This is not the step where you want to try to eliminate expenses. Record everything, only excluding expenses you have already eliminated from your monthly or annual spending.

Enter your income from the projections you formed in step 1.

Review your budget. If your budget shows a projected loss, analyze your expenses and identify areas where you can reduce spending.

This approach makes sure you avoid the temptation of forcing your budget to balance. While you do want your budget to balance — or better, to show a cash surplus — having unrealistic income or expense numbers will lead to frustration and resistance during the budgeting process.

Monthly or quarterly, compare your actual income and expense numbers to your budgeted numbers. Regular tracking helps identify financial pitfalls before they become unmanageable.

Frequently asked questions

How do i make a budget template.

You can create a small-business budget template from scratch by using free software like Microsoft Excel or Google Sheets. However, it’s often more efficient to download a template (see our list above). A template with built-in tables and formulas makes plugging in your revenue and expenses and calculating your profit or loss quick and straightforward.

What is included in a small-business budget?

Your small-business budget will include your revenue, expenses and your profit or loss. Each section will be broken into subcategories. For example, under revenue, you might have sales and income from sponsorships. Expenses might be broken down into rent, employee salaries and marketing. After you tally your revenue and expenses, you can then calculate your profit and loss statement.

How much should a small-business budget be?

A budget will vary by your business and industry. For example, you can potentially start a social media consulting business for less than $5,000. But a food truck business may necessitate a budget of at least $50,000. You must tailor your small-business budget to your unique needs.

On a similar note...

Business Budget Template

Having a business budget is essential for any size business. A business budget helps you decide whether you can grow your business, give yourself a raise, purchase additional inventory and assets, and whether you may be able to avoid bankruptcy.

It's possible to modify a personal budget spreadsheet to apply to a business, but if you are using our Income Statement Template , you'll want to use the business budget spreadsheet so that you can create a budget that is parallel to your income statement.

For those who are just starting a business, or thinking of starting a business, you might be interested in the free Business Start Up Costs template. A startup cost analysis is an important part of a good business plan and can help you get things off the ground before you begin using a more detailed business budget.

License : Private Use (not for distribution or resale)

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Description

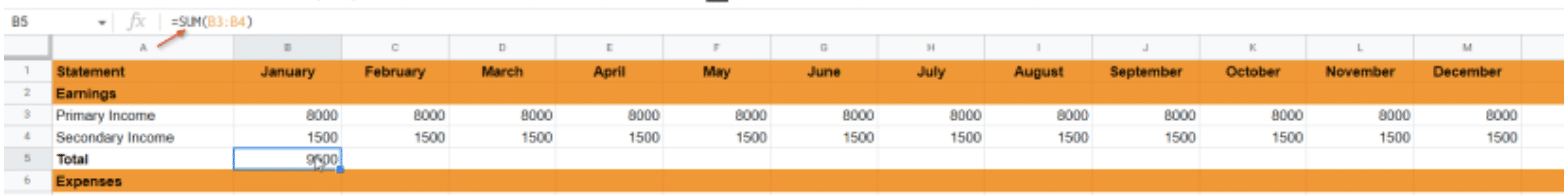

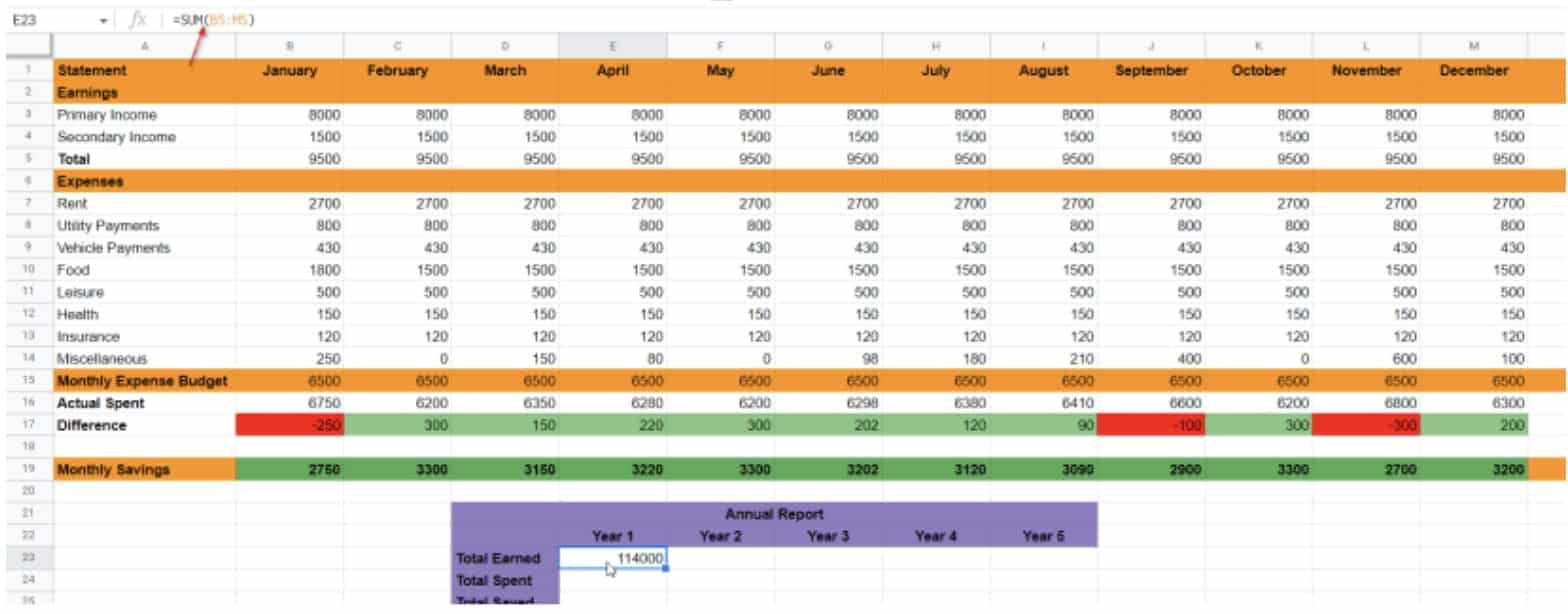

This spreadsheet contains two sample business budgets designed for companies providing services or selling products.

Service Providers : The Services worksheet is a simple business budget that separates income and business expenses into categories that closely match those used in an income statement. The categories are fairly comprehensive, but it is also easy to add, remove, and modify the categories.

Retailers, Manufacturers, Publishers : The Goods worksheet includes the categories in the Services worksheet, but also has a Cost of Goods Sold section for recording inventory and purchases and calculating Gross Profit.

12-Month Business Budget

This worksheet is a variant of the above business budget, with sales and business expenses broken down by month . This is helpful for budgeting quarterly expenses and other business expenses that occur at specific times of the year.

The Goods worksheet lets you record sales and cost of goods sold for multiple products .

Business Budget for Multiple Products

This version allows you to perform a detailed analysis of your business expenses and cost of goods sold (COGS) if you are selling multiple products. Columns are also included for calculating the Percentage of Total Sales for each product and the various expenses.

Using the Business Budget Spreadsheet

These business budget templates are pretty simple to modify and customize. However, here are some things you should know and keep in mind as you use these templates:

Double-Check the Formulas

If you add or move categories around, make sure to double-check the calculations, especially the SUM() formulas that calculate the totals and subtotals, to make sure that the right cells are summed.

Conditional Formatting for red Values

The Difference is calculated as Actual - Budget. Conditional formatting is used to highlight the Difference red if income is less than the budget amount or if business expenses are more than the budget. In other words, a red value means you ought to take a closer look at it.

Analyzing Cost of Goods Sold

The costs associated with producing and purchasing goods are variable costs that increase or decrease with the volume of production and sales, such as wages for direct labor required to produce the goods, packaging, inventory purchases, shipping, and commissions. These costs are usually compared to the total sales. A careful study of these costs can help you determine pricing for your products, which products are more profitable, etc.

Multiple Products

The Goods spreadsheet is set up initially to record total net sales for each quarter. If you want to perform a more detailed analysis for multiple products, you can insert additional rows and separate the sales and costs according to product, or you can use the bonus spreadsheet that is designed for performing a detailed analysis for multiple products.

Income Taxes

A separate section under business expenses calculates the Net Income Before Taxes by subtracting the Total Expenses from Total Income. This helps you make a simple estimate of the income taxes, assuming all the Expenses are tax deductible. If you have any taxable expenses make sure to subtract those values from the Net Income Before Taxes before estimating your income tax budget.

Budgeting Large Non-Recurring Expenses

One of the reasons for budgeting is of course to help you determine whether you will be able to afford upgrades, new construction, asset purchases, etc. However, this budget spreadsheet is mainly for comparing your operating income and expenses to make sure that in your normal business activities you are earning more than you are spending. You would typically look at your Net Income to determine whether you will be able to expand your business, make large asset purchases, etc.

More Business Budgeting Resources

- Small Business Budgeting Tips and Techniques at investopedia.com

- Drafting Your Budget at entrepreneur.com

Follow Us On ...

Financial Statements

Business growth

Business tips

7 free small business budget templates for future-proofing your finances

As a small business owner, you're likely balling with a lot more than your personal checking account. If you don't properly manage your business finances, there's more on the line than an overdraft fee—you now have an entire organization to account for.

Small business budgets are necessary to balance revenue, estimate how much you'll spend, and project financial forecasts, so you can stay out of the red and keep your business afloat.

But creating a small business budget template isn't a small task. Since I don't have a business to run, I did the heavy lifting for you—check out these free, downloadable templates for your small business budgeting.

Table of contents:

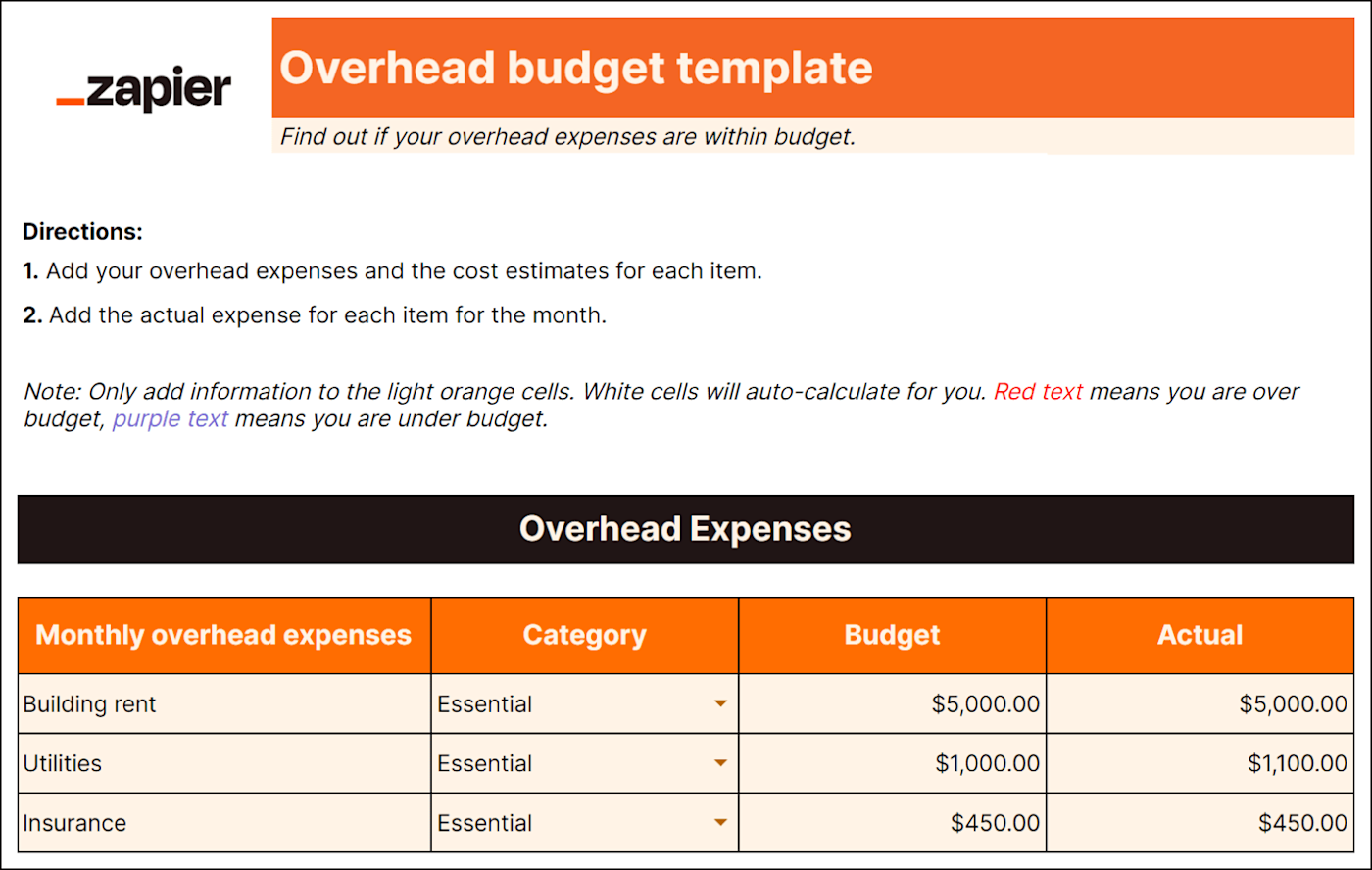

2. Overhead budget template

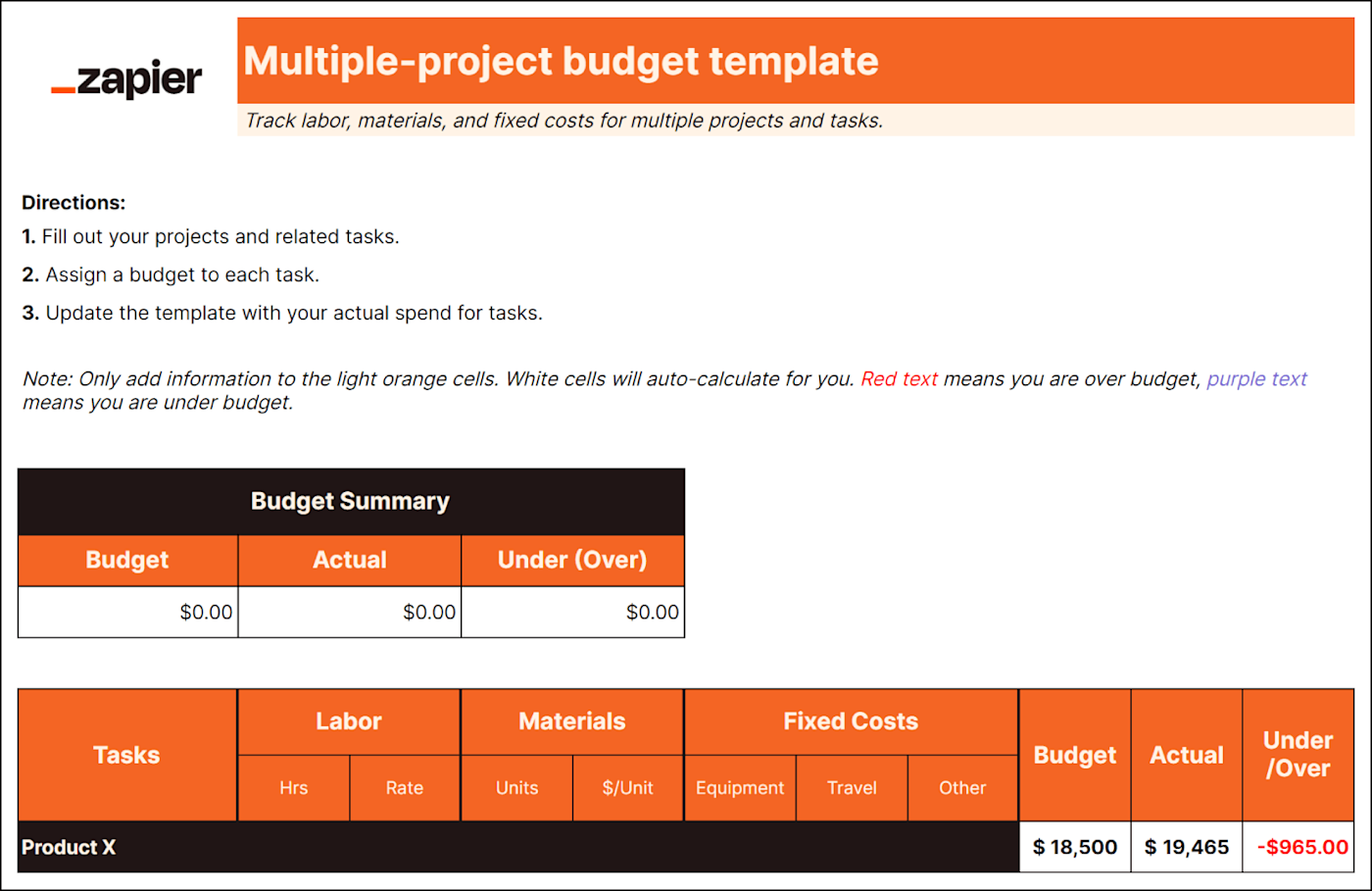

3. multiple-project budget template.

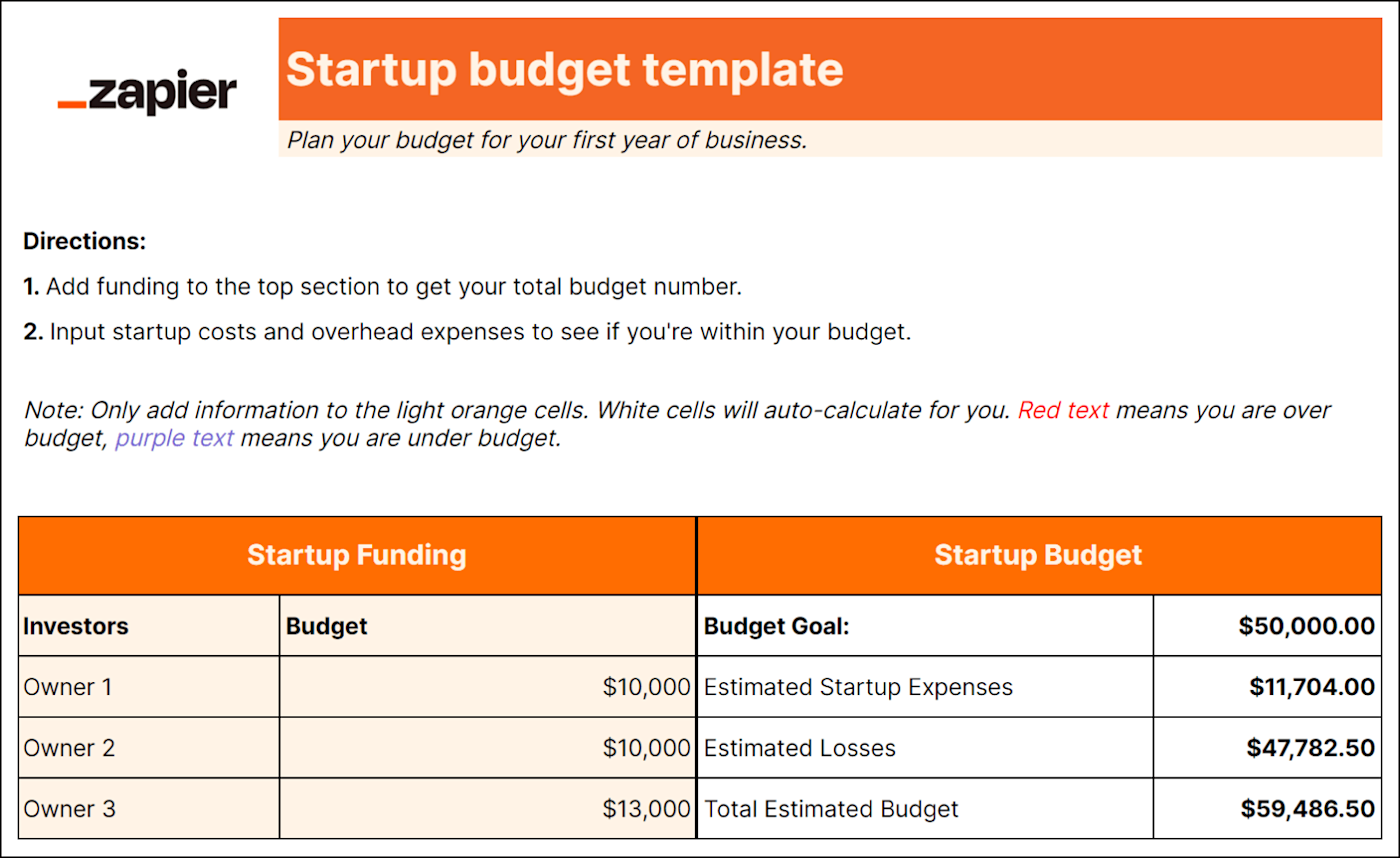

4. Startup budget template

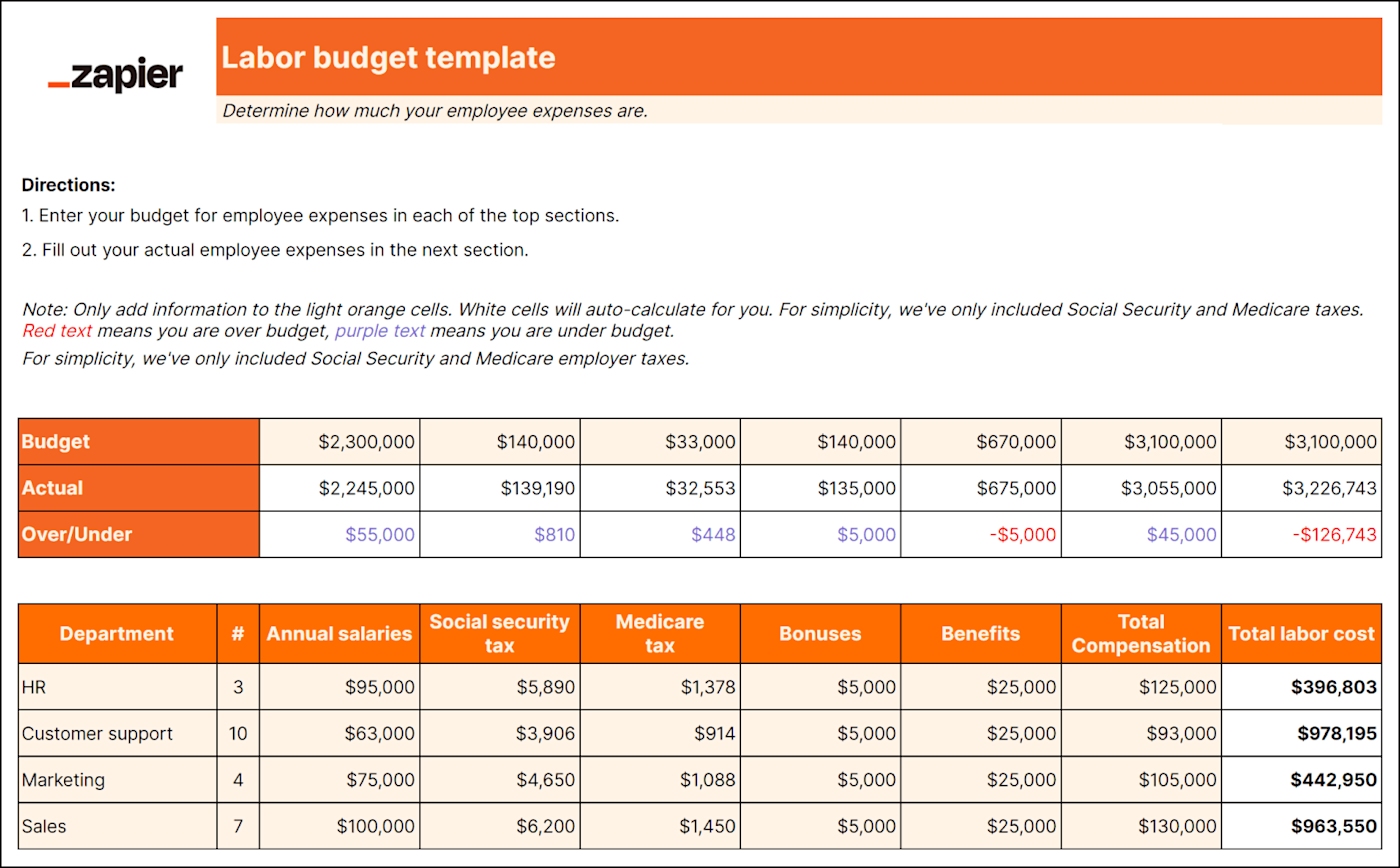

5. Labor budget template

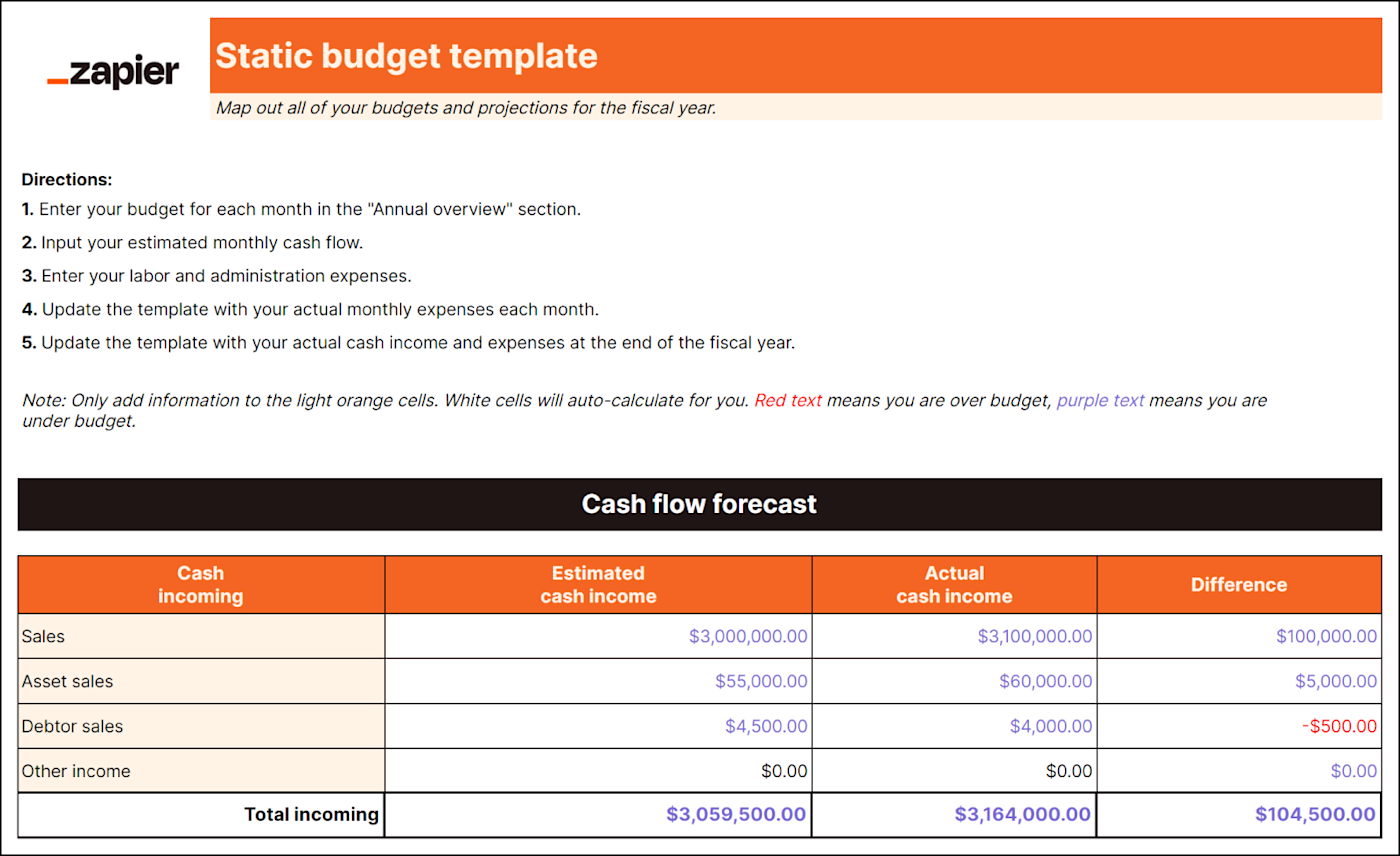

6. cash flow budget template, 7. administrative budget template, periodic budget reviews, how to design your small business budget plan, small business budget faq, 1. static budget template.

Best for: Multiple departments or revenue streams; Industries with complex operations

A static budget combines all the function-specific budgets a business uses into one. Typically, a static budget includes the following items (plus any other budgets your business might use):

Cash flow projections: Estimations of how much money will flow into and out of your business. They also help you decide when, how, and what you should spend money on.

Total expected spending: All estimated expenses, including labor and administrative costs.

By integrating all of your budgets and projections, the static budget provides a full picture of your business's estimated expenses and financial strategy for the upcoming fiscal year.

Best for: Service-based businesses

It's easy to forget about expenses that aren't directly tied to production, like delivery charges or utilities. But these costs exist (and can add up quickly), so you need an overhead budget. A detailed overhead budget template will include:

Administration expenses

It compares your budgeted amount to actual figures (warning: it may be a rude awakening) and can help improve accuracy for future financial planning.

Predicting overhead spending helps you plan how to use other funds more practically too—if you know how much you'll spend on overhead, you can make better business decisions. For example, you'd know whether you can afford to invest money into other initiatives like adding a delivery service or upgrading equipment.

Best for: Project-based industries

If you're managing multiple projects like website development or event planning, each with its own budget and expenses, you need a multiple-project budget to help keep your head on straight. This type of budget will help you track the following items per project:

Product-by-product COGS (cost of goods sold)

Labor costs

Equipment and resource costs

Indirect project expenses like travel

A multiple-projects budget establishes estimates for everything you need to get projects across the finish line. It also lets you track costs to ensure you're not spending more than you accounted for in the budget.

4. Startup budget template

Best for: New small businesses and startups

Startups need to ensure financial success from the get-go, so they can reinvest profit into the business and potentially attract more investors.

But unlike established small businesses, you don't have past financial data to base expenses on. That's why you need a startup budget to focus on expenses for your first year of business, including items like:

Funding from investors and loans

Licensing and permits

Logo and website design

Website domain

Business software

Security installation

Overhead expenses

Capital expenses

Best for: Larger businesses with lots of employees

Unless you're a one-person show, you'll need a labor budget. And even if you are a one-person show, it's good to know if you can afford to pay yourself. A labor budget breaks down all employee-related costs like:

Payroll taxes

Contract labor

Break down employee costs into direct, indirect, fixed, and variable categories to clarify how your company allocates its resources. You can also consider different scenarios more easily when you understand the breakdown of labor costs.

For example, you can simulate the impact of adding or reducing staff in specific departments or assess the effects of different compensation structures on different teams.

An accurate forecast of labor costs ensures you can sustainably meet your staffing needs and can help you make informed hiring decisions. Down the road, it can also help you determine if you can afford to give your staff raises, bonuses, or additional benefits.

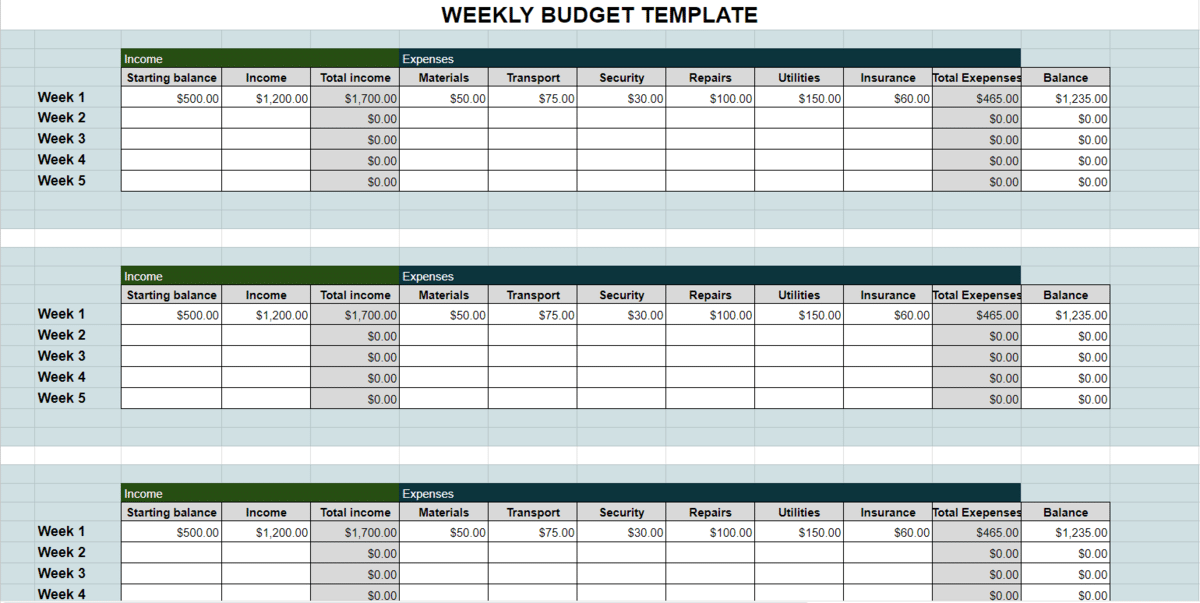

Best for: Businesses with fluctuating income and expenses; Seasonal businesses; Retail

As important as it is to be mindful of how much money you're spending, you should also track how much money you're making . A cash flow budget helps estimate how money is flowing in and out of your business. It includes:

Starting balance (set at the beginning of the month, quarter, or year)

Projected cash inflow from all revenue streams

Estimated cash expenditures

Ending balance (calculated at the end of the month, quarter, or year)

This type of budget lets you proactively manage your resources, anticipate potential cash shortages, and strategize for growth. For instance, if you know you're only going to break even this year, you may wait on expanding or making a large investment.

Best for: Businesses focused on streamlining operations

An administrative budget includes all those general expenses that the company as a whole needs to function. This type of budget accounts for:

Depreciation expenses

Training and development

Communication expenses

Accounting fees

While you could technically include administrative expenses in an overhead budget and call it a day, a separate administrative budget gives more of an eagle-eye view of how well your business is operating.

Without an eye on administrative costs, you may be spending unnecessarily or lose focus on areas where it'd be wiser to invest your money. In other words, you could be spending way too much on fancy pens when you should be saving up to upgrade your cash register.

A budget isn't a "set it and forget it" deal. Regular budget reviews can help you stay on track with your financial goals and respond proactively to changing market conditions.

You should compare your estimated budget to actual spending. Then you can see where you went over and where you can splurge more. Try to review your budget monthly, quarterly, and yearly.

Monthly: Compare actual performance against your budgeted figures for the month. Identify any deviations and look for insights into cash flow, sales trends, and expense management.

Quarterly: Dive deeper into performance over the last three months. Use trends to project revenue and expenses for the upcoming quarter and identify areas for improvement.

Yearly: Reflect on your long-term financial objectives for the fiscal year. Assess the effectiveness of your budgeting strategies, and set new budget targets for the upcoming year.

It's cliched but true: you gotta spend money to make money. But that's no excuse to start throwing cash at your business willy-nilly.

Budgeting forces you to prioritize your objectives, so you spend money on the things that matter most. Here's how to create a small business budget in four steps:

Identify your working capital for the budgeting period. Add up your current assets like cash, accounts receivable, and inventory. Then subtract current liabilities like accounts payable and short-term debt. The remaining amount is what you have left to cover your operational expenses during the budgeting period.

Separate business and personal expenses. If you haven't already, open a dedicated business bank account. This makes it easier to track, categorize, and analyze your finances.

Determine your fixed and variable costs. Make a list of costs that stay the same every month (fixed costs) and what changes (variable costs). These will change based on the purpose of the budget. For instance, a labor budget will only consider employee-related costs.

Calculate your total expenses. Add up all the costs for your business, including fixed costs, variable costs, labor, and any other applicable expenses. This total is how much your business needs to run. Any leftover money from your working capital can be allocated toward other business investments.

Budgeting methods

If you've budgeted before and hated it, you may just have been using an ineffective budgeting method for your preferences. Here are a few budgeting methods to try instead:

Traditional: This budget is set for a determined amount of time and uses last year's numbers as a benchmark. Once you set your budget, you don't change it unless you get approval for an adjustment.

Rolling: This dynamic approach spans a continuous time frame instead of a fixed time period. As each month or quarter passes, you add a new budget period and drop the oldest period. This lets businesses adjust projections based on real-time performance and market conditions.

Flexible: This budget changes along with your sales forecast. As real-time sales activity deviates from budgeted amounts, you recalculate the budget to reflect the new data.

Still don't know where to start with your small business budget? Check out the answers to these common questions before you open a new Google Sheet.

What should a business budget include?

A business budget should include all income sources and expenses. Income sources could include projected revenue from sales, loans, or potential investor funding. Expenses may include items like office space rent, employee salaries, insurance, and marketing. Add anything that helps paint a full picture of your finances.

How much does the average small business startup cost?

The average small business startup costs $40,000 in its first year of business. But this will absolutely vary depending on your type of business, unique expenses, and cash income. For instance, there are multiple types of businesses you can start with $10,000 or less.

What is the best free business budgeting software?

The best free budgeting business software will depend on what your business needs, but you can try apps like Mint or Wave. Or you can use a spreadsheet—scroll up for some free small business budget templates.

Automate your small business

Knowing when or where to invest money into your business is just one of the many tasks you have on your plate as a small business owner. Learn how automation for small businesses can help take some of those recurring tasks off your hands, so you can focus on growing your business.

Related reading:

The best free small business software

The best CRMs for small businesses

How to create effective document templates

21 free Google Sheets templates to boost productivity

Get productivity tips delivered straight to your inbox

We’ll email you 1-3 times per week—and never share your information.

Cecilia Gillen

Cecilia is a content marketer with a degree in Media and Journalism from the University of South Dakota. After graduating, Cecilia moved to Omaha, Nebraska where she enjoys reading (almost as much as book buying), decor hunting at garage sales, and spending time with her two cats.

- Small business

- Finance & accounting

Related articles

How to create a sales plan (and 3 templates that do it for you)

How to create a sales plan (and 3 templates...

How to build a B2B prospecting list for cold email campaigns

How to build a B2B prospecting list for cold...

The only Gantt chart template you'll ever need for Excel (and how to automate it)

The only Gantt chart template you'll ever...

6 ways to break down organizational silos

Improve your productivity automatically. Use Zapier to get your apps working together.

- 18 min read

Top 10 Free Excel Business Budget Templates for 2023

What Is Budgeting?

Why is budgeting important, how to create a budget template, how to make a monthly budget template, why use a template for budgeting, how to use an excel budget template, top free excel business budget templates, 1. business case excel template, benefits of using a business case excel template, 2. p&l statement excel template, benefits of using a p&l statement excel template, 3. revenue forecasting excel template, benefits of using a revenue forecasting excel template, 4. balance sheet excel template, benefits of using a balance sheet excel template, 5. income statement excel template, 6. startup business budget excel template, 7. expense-tracking excel template, 8. cash runway excel template, 9. unit economics excel template, 10. operating budget excel template.

A business budget is an essential tool for any business, no matter how big or small. It helps you stay on track with your finances and ensure that all areas of your organization run efficiently. With a budget in place, you can quickly identify areas where costs are getting out of control and make adjustments before they become problematic.

Creating a budget can be daunting, especially if you are unfamiliar with Excel. Thankfully, many free Excel business budget templates are available that make it easy to set up your own budget. These templates provide an easy-to-follow format that allows you to quickly input your income and expenses so you can get started right away.

Budgeting is a process of predicting and managing your income and expenses. It helps you plan out how much money you will need to cover your business costs for the month or year ahead. With budgeting, you can track spending, identify areas where you may be overspending, and make adjustments as needed to stay within your budget.

Budgeting is essential for any business, as it allows you to plan ahead and ensure your organization is on the right track financially. Without a budget, setting goals and tracking progress can be challenging. A budget also helps you identify areas where costs are getting out of control so you can take corrective action before they become too costly.

When creating a budget template, it's essential to include all the categories and items relevant to your business. This includes revenue sources, fixed costs such as rent or utilities, variable expenses like advertising or travel, and any other relevant items. Once you have identified these categories, you can enter them into an Excel spreadsheet. It's important to remember that budgeting can be complex, and you should always consult a professional if you need help.

Once all the information has been entered into your template, it's time to begin tracking income and expenses. This will give you an accurate picture of how much money is coming in and going out each month. As the months progress, you can easily adjust your budget if it becomes necessary. This way, you'll always have an accurate picture of your financial situation and be able to adjust accordingly.

Using a free Excel business budget template, you can quickly and easily create a comprehensive budget that will help keep your finances in check. Once you're comfortable with the budget, you can modify it as needed to accommodate any changes in your business. With a bit of time and effort, you can have an adequate budget in place that will keep your business running smoothly.

Creating a monthly budget template is similar to creating a one-time budget. Start by identifying all the relevant categories and items to your business. Once you have all the information gathered, enter it into an Excel spreadsheet. You can then use this template to track your monthly expenses and income. As the months pass, adjust your budget based on new developments or changes in your business.

Using a template for budgeting provides several benefits. It allows you to quickly create accurate and up-to-date budgets, allowing you to make informed decisions about your finances. Additionally, templates make it easy to track expenses and income so you can adjust as needed. Finally, free Excel business budget templates can save time and money as you won't need to hire a professional to help with budgeting.

Using an Excel budget template is a great way to get started creating your business budget. All of the free templates provided here include a simple format that's easy to use and understand. Here are some tips for getting the most out of your Excel budget template:

- Start by entering all your income sources, such as sales revenue, interest income, and other sources of revenue.

- Next, enter your expenses, such as payroll, rent, supplies, and other operating costs.

- Make sure to include taxes and other overhead costs in your budget.

- Set up a timeline for budgeting so you can stick to it throughout the year.

- Run reports and analyze the data in your budget. This will help you identify areas where costs are getting out of control or where there may be opportunities to save money.

By taking the time to create an accurate and up-to-date business budget, you can ensure that your organization runs as smoothly and efficiently as possible. With the help of free Excel business budget templates, you can quickly and easily create a budget that works for your organization.

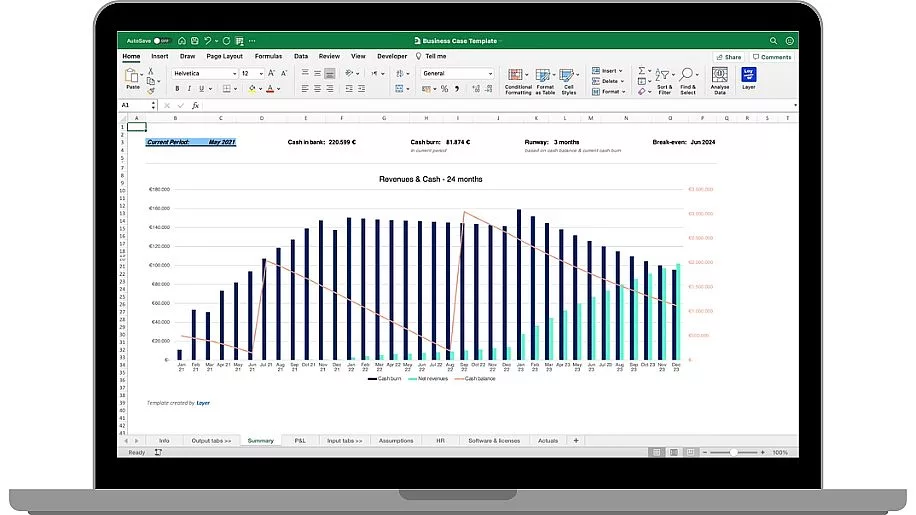

A business case excel template helps businesses easily analyze and evaluate different scenarios to inform decision-making. This type of template includes pivoting tables, graphs, financial projections, and other valuable data that can help you make the best possible decisions for your organization. Business cases are often used to compare various investment or product opportunities to determine which one is the most profitable.

There are many benefits to using a business case excel template, such as:

- Streamlining the decision-making process by providing relevant data and insights that help inform decisions.

- Creating an organized structure for analyzing different scenarios and options.

- Consolidating data into one place to make it easier to analyze and compare.

- Generating various reports that can be used to track performance and make informed decisions.

- The ability to customize the template for specific needs or goals.

Creating a business case template in Excel can help you analyze data and make informed decisions that will benefit your organization.

Download the Business Case Excel Template for Free.

A Profit and Loss (P&L) statement Excel template is a spreadsheet that helps businesses analyze their financial performance and make informed decisions. This type of template includes tables and graphs that can be used to track income, expenses, and profits over a period of time. It also provides insight into cash flow and profitability.

Using a P&L statement Excel template provides several benefits, such as:

- Giving an overview of the business's financial performance over some time.

- Breaking down income and expenses into categories to make it easier to analyze.

- Being able to track profit margins, cash flow, and other vital metrics.

- Generating reports that can be used to inform decision-making.

- Analyzing different scenarios to identify areas for improvement.

By using a P&L statement Excel template, businesses can quickly and easily analyze their financial performance and make informed decisions that will benefit the organization.

Download the P&L Statement Excel Template for Free.

A revenue forecasting Excel template helps businesses predict future financial performance by analyzing historical trends and data. This type of template includes a variety of graphs, charts, and tables that can be used to analyze past performance and make projections for the future. Revenue forecasting is often used to set business goals and inform strategic plans.

Using a revenue forecasting Excel template has many benefits, such as:

- Allowing businesses to develop reliable projections and estimates based on past performance.

- Identifying trends and insights that can inform decision-making.

- Generating various reports and dashboards that can be used to track performance.

- Establishing goals and benchmarks that can be used to measure success.

Download the Revenue Forecasting Excel Template for Free.

The best picks for business budgeting software tools to monitor your financial performance and ensure your business is using its resources efficiently.

A balance sheet Excel template is a spreadsheet that helps businesses track financial transactions and analyze the organization's overall health. This template includes several sections, such as assets, liabilities, and equity. A balance sheet provides an overview of a company's finances, showing how much money it has in cash, investments, or debts.

Using a balance sheet excel template has many benefits, such as:

- Allowing businesses to analyze and compare financial data easily.

- Creating an organized structure for tracking assets and liabilities.

- Generating various reports that can be used to measure performance.

By creating a balance sheet excel template, businesses can quickly and efficiently track their financial data and make informed decisions about their organization's finances.

Download the Balance Sheet Excel Template for Free.

An income statement Excel template helps businesses analyze and track their financial performance. This template includes several sections, such as revenue, expenses, and net income. An income statement provides an overview of a company's profitability, showing how much money it has earned or lost over a given period.

Download the Income Statement Excel Template for Free.

A startup business budget Excel template helps businesses manage their finances and plan for the future. This template includes several sections: revenue projection, expenses, and cash flow. Companies can use a startup business budget template to analyze their financial performance accurately and determine the best course of action for their organization.

Download the Startup Business Budget Excel Template for Free.

Top Free Google Sheets Templates and Financial Statements to help you manage your business financials, monitor performance, and make informed decisions.

An expense-tracking Excel template or an expense-tracker Excel template helps businesses track and analyze their spending. This template includes several sections, including expenses by category, total costs, and monthly averages. By using an expense tracking template, businesses can quickly and easily identify areas of overspending or unnecessary expenses so they can make better decisions about their finances.

Download the Expense-Tracking Excel Template for Free.

A cash runway Excel template is a type of spreadsheet that helps businesses track their cash flow and analyze the short-term financial health of the organization. This template includes several sections, such as cash inflows, outflows, and balances. A cash runway provides an overview of a company's ability to pay its expenses and manage liquidity, showing how much cash is available to the organization at any given time.

Download the Cash Runway Excel Template for Free.

A unit economics Excel template is a spreadsheet that helps businesses analyze the profitability of individual products, services, or customer segments. This template includes several sections, such as revenue per unit, cost per unit, and operating profit per unit. Using a unit economics Excel template, businesses can accurately analyze the profitability of different product lines and identify potential areas for improvement.

Download the Unit Economics Excel Template for Free.

An operating budget Excel template helps businesses track and manage their expenses. This type of template includes several sections, such as fixed costs, variable costs, and capital investments. An operating budget provides an overview of a company's expected expenses over a given period of time, helping the organization make smart decisions about its finances.

Download the Operating Budget Excel Template for Free.

Using the top free Excel business budget templates is an effective way for businesses to create and maintain financial plans. From business cases to revenue forecasting and balance sheets, these templates help businesses stay organized and make informed decisions that benefit their organization.

Hady has a passion for tech, marketing, and spreadsheets. Besides his Computer Science degree, he has vast experience in developing, launching, and scaling content marketing processes at SaaS startups.

Layer is now Sheetgo

Automate your procesess on top of spreadsheets.

Home > Finance > Accounting

The Best Business Budget Templates for Small Businesses

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Every small-business owner should have a business budget that helps track finances and helps ensure the growth and success of their business. A simple business budget template can streamline the process of budgeting, increase efficiency, and give you greater control over your money.

In this post, we’ll explain how to create a business budget template, what to include in your template, and where to find the best budget templates online.

Table of contents

- How to create a business budget

- What to include in a business budget

- Best business budget templates

The takeaway

- Business budget template FAQ

How to create a business budget template

Let’s start off by saying that downloading a pre-made budget template online is probably your best bet. However, you can also use a basic budget tool to create your own customized template.

Creating a business budget starts with setting up a spreadsheet with rows and columns that houses data relating to business expenses and supply costs. Then you follow these steps:

1. Choose a budgeting tool.

There are many ways small-business owners can track a business budget, such as by using Excel, Google Sheets, a budgeting app , or financial software, like QuickBooks . Once you’ve chosen a tool, you can download a free blank template online and start customizing.

2. Add your business information.

Before you start filling in budget amounts, make sure you add business information to the top of the template, including your company name, the month, and the budgeting period. This will help you track changes in your budget over time.

3. Create budget categories across the columns.

Now it’s time to list your budget categories. These categories should include fixed costs, related operating expenses, employee pay , inventory costs , etc. Don’t forget to add a category for total expenses at the bottom of the spreadsheet.

4. Enter budget values.

With your categories set up, it’s time to enter the values in each cell. Enter the budget goal amount in one column, and then create a section for actual totals in the next column. From there, you’ll be able to compare the differences between those values and track your net profits.

5. Track and monitor.

Now you can use your template to track and monitor your business expenses over time. You can use the budget to identify expenses that are cutting into your profits and take steps to minimize overspending.

By signing up I agree to the Terms of Use and Privacy Policy .

What should your business budget template include?

Your business budget should be customized to meet the needs of your particular business. However, there are a few main categories that every small business budget should include.

Here are some basic budget components to get you started:

- Estimated revenue

- Fixed costs

- Variable expenses

- One-time expenses

- Total cash flow

- Budget summary

Free business budget templates

1. capterra small-business budget template.

This free budgeting template is compatible with Excel and will help you see how your budget is going over the course of a year. Fill in projected revenue and expenses to see monthly budget comparisons.

2. Gusto startup budget template

Gusto’s budget template is designed for new business owners looking to get a better handle on their operating costs. You can download the template to Google Drive. After that, follow its listed instructions to customize the template to your needs.

3. Microsoft Office expense budget template

This expense budget template will help you evaluate your actual expenses and compare them against your planned budget. Charts and graphs help highlight trends and changes across each month. It’s an ideal template for small and medium businesses.

4. PDFconverter.com templates

Head to PDFconverter.com to choose from a host of budgeting templates for any type of business. You’ll find basic, simple templates for first-time budgeters as well as more detailed templates for financial professionals.

Compare our top picks for business accounting software

Data as of 3/9/23. Offers and availability may vary by location and are subject to change. *Only available for businesses with an annual revenue beneath $50K USD **Current offer: 90% off for 3 mos. or 30-day free trial †Current offer: 50% off for three months or 30-day free trial ‡Current offer: 75% off for 3 mos. Available for new customers only

A business budget template streamlines the process of creating a budget spreadsheet. You can find many free templates online that can be customized in Excel, Google Sheets, or small business financial software. Alternatively, you can opt to create your own budget template from scratch. No matter which option you choose, your budget template is the first step to gaining greater control over your business finances.

Would you like to learn more about business budgeting? Check out Business.org for the Best Billing and Invoicing Software for Small Businesses 2022 .

Related reading

- The 6 Best Budget Apps of 2023

- What Is the Average Business Loan Interest Rate?

- How Do I Get a Business Line of Credit?

Business budget templates FAQ

Many online resources offer free business budget templates that are compatible with Excel, including Capterra , PDFConverter.com , and Microsoft Office . Once you download the template, you’ll be able to open it in Excel and start filling in the fields.

A business budget template is a great way to kickstart your business budget. With it, you’ll want to take a look at your revenue, fixed costs, and variable expenses to determine budget categories and amounts. Don’t forget to set aside funds for unexpected expenses, too.

You can create a budget spreadsheet from scratch in Excel or Google Sheets, or you can download a compatible template to get you started. Once you’ve chosen or designed your template, enter your budget amounts and fill in expenses as they come up throughout the month. At the end of the month, check your results and adjust your budget as needed.

Every business budget should include categories for estimated revenue, fixed costs, variable costs, one-time expenses, unexpected expenses, and profits.

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

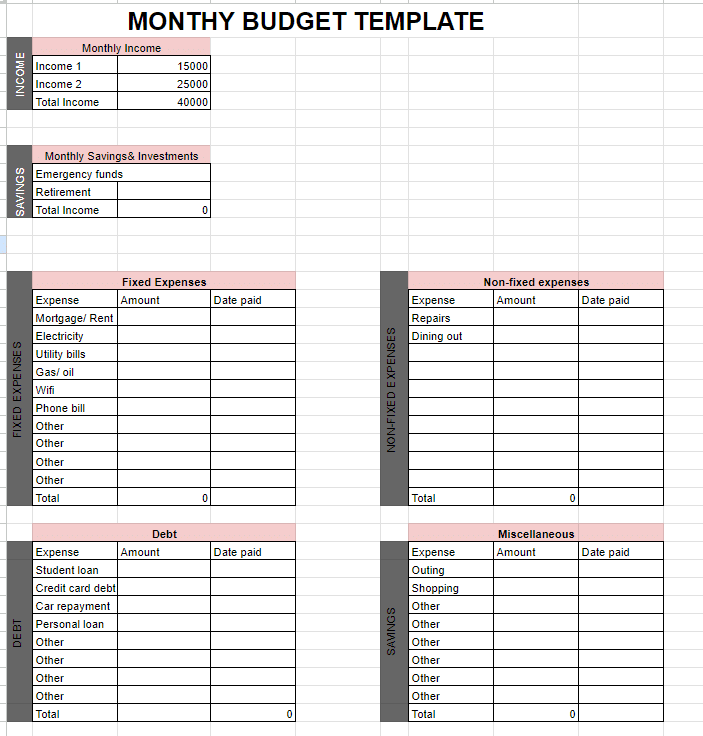

7 Free Excel Spreadsheet Templates for Budgeting

Bookkeeping is crucial. Whether you are a housemaker or a business owner, keeping a budget is essential to meet your financial goals.

Some people create budgets in their minds, while others get them down on paper. Why not try another way?

Excel budget templates offer a quick way of budgeting. They provide the outline and you only need to fill in the cells.

You can choose any Excel template and use it to track expenses.

To help you make the right choice, we have listed the seven best free Excel budget templates for you. Let’s review them in detail below 😃

Table of Contents

Project Budget

Personal monthly budget, balance sheet, family budget planner, portfolio tracker, customizable 401k calculator, cash flow tracker.

A project manager is responsible for utilizing the funds of a project efficiently. In any business, funds make the backbone of the project.

If the manager is unable to manage the expenses properly, he may put the hard work of the entire team at stake 😕

To this effect, we suggest getting the Excel Project Budget template . It has helped hundreds of people execute their dream projects successfully and can help you too.

This free budget template will get you through all small and mid-level projects. You can use it for contract work, home renovation, office remodeling, etc.

It shows the actual costs and planned budget. You can use it to see if your expenses are within the budget and, if not, how you can improve them.

All in all, this is great for small tasks that are not as detail-oriented. But if you have bigger projects, it is better you get the paid version of this spreadsheet template.

Having a personal budget that keeps you on track with your savings goals is essential. You need to know where all your money is going and if these expenses are necessary.

You can use the Excel Personal budget template for this purpose. It will help you manage your monthly expenses. And you can add multiple sources of income apart from monthly income if any.

It also allows you to set monthly goals and helps you save money accordingly. You can separate fixed costs and see your actual spending. It includes budget categories like housing costs, travel expenses, entertainment, taxes, and others.

All you need to do is add your income and expenses, and this free budget template will do all the calculations for you 😉

Its primary purpose is to compare your budget with your actual costs on a monthly basis. For that, it records your projected and actual expenses.

It will instantly show you the difference and if you were able to meet your set goal. You can always start again and do better.

Being a business owner, you need to be well aware of all your assets and liabilities. An active reminder of how much money you have and how much you need to pay off is important.

It helps keep your mind straight and know the financial health of your company in a better manner. Only then can you make informed decisions and investments.

It will also tell you where to cut down money so you can perform adequate money management and add more to your equity.

You can use the Excel Balance Sheet template for this purpose. It is very easy to use and contains simple terms that even a layman can understand. Moreover, the template is easily customizable, and you can change it in whichever way you want 🎨

You can use this template to summarize your finances. And identify areas that are causing a deficit in your budget.

This balance sheet can also help you determine your net worth at a point in time. It is automatically calculated for you under the owner’s equity portion.

At the bottom of the sheet, you can find the common financial ratios. These include debt ratio, working capital, and 0ther information.

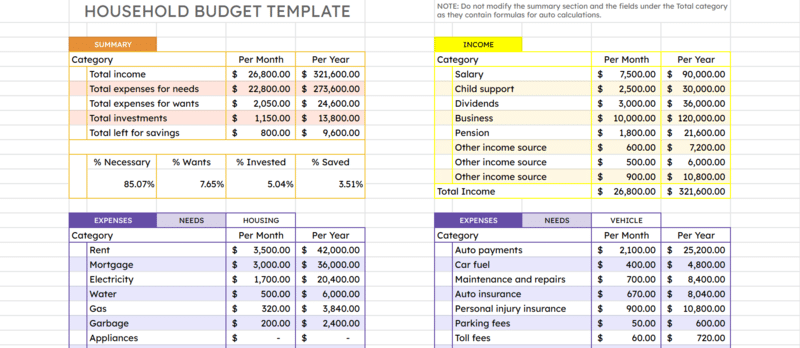

Having a household budget template is very important when you have a family. Household expenses keep on increasing, especially with kids.

To maintain them, you need to have a Family Budget Planner. It will tell you exactly where all the money is going and what you can do to save it.

You can use the Vertex42 Family Budget template . It will help you keep track of your money based on income and expenses for each month 🗓️

It can also work as a yearly planner and allow you to see the bigger picture. The family budget template can be really helpful in planning major life events beforehand.

For example, if you want to buy a house after two years, you need to start saving for it today. You will have to set a goal, for instance, $10,000. Per your income and monthly expenses, you will know where to cut down and add more money to meet your goal.

The best part of this template is its easy-to-use interface. The design is clear, and you can easily understand where to make changes. The template will automatically calculate and update the remaining expenses.

It contains different expense categories like Home Expenses, Daily Living, Children, and others.

If you are a shareholder, you need to have this budget template. It will help you actively keep track of your investments and shares. You can use it to see your transaction history, and your dividends or simply evaluate your equity 💲

The Portfolio Tracker can be of great help in this instance. Whether you are an active trader or prefer being a passive investor, bookkeeping is important to know your financial status.

You can use the Simple Investment Tracker for this purpose. It will readily give you an estimate of your total cost of accounts. It also shows the gain or loss per the market value and you can compare it with previous performance.

You can also check your Average Entry Price compared to the Current Costs and see if you are making enough profit. Moreover, it offers an easy way to compare investment value with market value and visualize the difference.

This budget template will offer comprehensive insights into your investment accounts. It is designed for people who want to quickly view their investments and their profit.

It only shows your investment, its details, and its current value. A disadvantage is that it doesn’t go into the details of everything. This can be difficult to understand as some sections require a description.

Other than that, it’s great for keeping track of your investments.

Having a strong financial status at the time of retirement is a dream of many. But only so many people are able to achieve it.

The key difference is planning and proper budgeting. You need to set a goal or a fixed amount of money that you need to save up before your retirement approaches.

Most people mindlessly put money in their 401k. To get your retirement plan on track, you need to invest money actively. It helps you make wise and informed decisions, and you can use your investments in a better way.

To help with that, you can use the free Customizable 401k Calculator Template . It is all you need to get your retirement plan on track. The interface of this template is simple, and it gives instant results on your entered values 🤓

Add your current annual income, your employer’s contribution, and your expected salary increment. Also, add your withheld salary, current age and the age you plan to retire at, interest rate, and other similar things.

The template budget excel will automatically calculate all other factors. It also displays all your data on a chart for better understanding.

As the name tells, a Cash Flow Tracker helps you track your cash flows. Cashflow simply means the money that comes in (inflow) and the money that goes out (outflow).

Having a cash flow tracker is crucial regardless of whether you are an individual or a business. It can help recognize expenses, operating cash, receivables of the business, and more.

It can also hugely impact your business decisions and planning. If your outflow is greater than your inflow, you need to cut down your expenses and improvise.

This will help you decide if your pace is well-suited for upcoming projects. And make timely decisions to improve it 🤗

The spreadsheet is easy to understand, and you can customize it however you like. All this contributes to making your money-tracking experience smoother. The goal is to help perform all operations smoothly and bring maximum inflows.

Frequently asked questions

Does excel have a budget template.

Yes, Excel has a variety of budget templates. From Personal Budgets to Project Budgets to Family Budget Planners, Excel has it all.

15 Excel Templates for Small Business Budget Management

Excel offers a variety of great templates that conveniently help you organize the data you need to store, present or calculate, and many of them can come in very handy to small business owners who don’t have time to waste or workers to spare.

Here are 15 excellent Excel templates that will help any small business owner keep track of expenditures, income and all other budget-related data. Each live link below will allow you to download the templates you need.

1) Business Budget Template is one of the more basic, but still very effective ones for organizing your company’s budget. Enter all expenses and income by category to know at all times how you are doing financially and whether you need to make any adjustments.

2) Rolling Business Budget and Forecast Template is a more developed template for financial professionals. You can use it to get real results for income statements and balance sheets and then compare them to things like budget targets, expense restrictions and financial results from recent years or months.

3) Startup Budget Template – if you are not yet a small business owner, but are considering it, this template will help you evaluate how much money you will need to get your business off the ground.

4) Expense Budget Template is a template that focuses on giving you a detailed breakdown of your company’s spending habits. The template is programmed to calculate total budget differences once you have inputted your expenses.

5) Budget Summary Report Template will enable small finance teams to keep very good books no matter how complex their budget. It helps to provide a very clear and accurate picture of how your business is doing at the end of every month.

6) Cash Flow Budget Report Template – If you are looking for a simple template that will clearly show you where your money is coming from and where it is going to, this is an excellent one. It covers cash flow trends for both operations and financing.

7) Annual Operating Budget Services enables service companies to create a budget plan for the full fiscal year in a very detailed manner.

8) Annual Operating Budget Manufacturing is another template for helping business to create an annual operating budget, but this one is tailor-made for manufacturing companies instead.

9) Targeted Budgeting Tool is a template for the marketing department. It helps you construct return-on-marketing-investment (ROMI) indices for each type of marketing and advertising that you are working on so that you can see how much income is being produced by the money that you are investing into promotion yourself.

10) Capital Budgeting Template can help companies to analyze and justify significant business investments. If you want to be better informed before making big decision about how to spend your money and what to invest in, this is a good tool for you.

11) Business Trip Budget Template is a template that will help you plan out and record all of the costs of your business trips including travel fares, hotels, dining, transportation and anything else that goes into making a business trip successful.

12) Event Budget Template – if you are planning some type of promotion or party for your company, this template will help you see whether it was worth it by helping you compare the costs of the event with the money that was made from it.

13) Training Budget Template enables you to keep track of quarterly training costs so that you can see how much money you will need to set aside each year for training purposes.

14) Marketing Budget Template will help you to forecast the size of your marketing budget and keep a tab on all other financial aspects related to promotions and marketing.

15) Channel Marketing Budget Template can help you to decide how much you want to spend on marketing. It looks at pricing and discounting scenarios, revenue, and sales forecasts to help you make a plan for how much money you need to set aside for marketing purposes.

These great budget management Microsoft Excel templates can make your budgeting easier and less time consuming, so that you can focus more attention on other important aspects of the business.

About author

About Author

Denise grier.

Denise Grier is a freelance writer, pro blogger, SEO and WordPress expert.

Related posts

The Benefits of Attending Conferences and Other Networking Events in Your Business Niche

Bridging the Gap Between Online and Offline Sales

If You Own an E-commerce Site, SEO is Even More Crucial So That Customers Can Easily Find You

The Importance of Online Reputation Management for Small Businesses

Branding Your Small Business In a Way That Shines Above the Competition

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked

Save my name, email, and website in this browser for the next time I comment.

Check Out Our Most Recent Products

Check Out Our Lender Products

Check Out Our Accounting Products

Check Out the Latest Blogs

Cause-Related Marketing Creates Brand Awareness and is ...

Tax Filing Tips For When You Experience ...

The Processes Private Lenders Go Through to ...

Social Media Strategies That Boost SEO

Savvy Lenders Keep Up With The Most ...

Accounting: Tips for Making Your Busy Tax ...

The Difference Between a Business Plan and ...

QuickBooks Chosen as 2017 Best Accounting Software

The History of Accounting is Fascinating!

The 7 Best Mobile Apps to Help ...

Privacy overview.

Do you have more than one person in your office who needs a license?

MoneyThumb converters are licensed to individual users. Multiple users will need a multi-user license.

Take advantage of our volume pricing for multiple users. Select your quantity and the discount will automatically be applied at checkout.

2qfx Convert Pro+ license options:

- Pro+ – Lifetime license with 1 year of PDF+ (Currently Windows only)

- Pro – Lifetime license, without PDF+

- Express – 50-day Express License, including PDF+ (Currently Windows only)

See Compare PDF Convert Editions for details

Budget template designs you can bank on

Budgets don't have to be boring find a customizable design template for your budget and bring some eye—splashing aesthetics to your next budget—based project. from household and personal budgets to banking for business, there's a budget template for you..

Simplify your budget with a template

Reaching your financial goals takes careful planning and saving—using the right tools is the first step to budgeting effectively. Simplify your monthly or weekly budgeting by using a free, customizable budget template. Monitor all of your home or business expenses accurately and decide what areas of your budget can be better managed. Whether you're managing the office budget of a small business or need to track your personal expenses, using a template makes it easier to stay organized. By visualizing your expenses and financial goals, you'll be able to see exactly where your money goes. Browse budget templates made for a range of uses, from regular monthly budgets to budgets focused on weddings, college, or saving for a home. You won't need to worry about your calculating skills when you use a budget template—focus your energy on saving and let a template do the rest.With easy-to-use templates, you'll save time and money year-round by creating beautiful custom cards. Focus on celebrating with your loved ones and let the template do the rest!

Download Now for Free

Get an immediate download of this template, then access any other templates you'd like in one click.

Yearly Business Budget Template

Download the free yearly budget template for businesses.

More Budget Templates Templates

Monthly Business Budget Template

Download template in

Weekly Business Budget Template

Startup Budget Template

Browse Other Templates

When it comes to managing your business’s finances, having a robust yearly business budget template is indispensable. This guide will walk you through the essentials of creating and utilizing a yearly business budget template, ensuring you’re well-equipped to handle your financial planning efficiently.

Creating an Annual Business Budget

How do you create an annual business budget.

Begin by understanding your business’s financial situation. Collect data on all sources of income and expenditures. A yearly business budget template helps categorize and visualize these financial components, making it easier to forecast and plan for the year ahead.

Excel and Business Budget Templates

- Does Excel have a business budget template?

Yes, Excel offers various budget templates, including those specifically tailored for business use. These templates are customizable, allowing you to adjust them according to your business needs. Comparing Excel’s offerings with other platforms can help you choose the most suitable template for your business.

Budgeting for Small Businesses

- How do I create a budget for a small business template?

Small businesses must focus on creating a budget that’s both realistic and flexible. Consider your business’s unique financial cycles and tailor your budget template to account for these nuances. This ensures that your budget is a practical tool for day-to-day financial management.

Yearly Budget Sheets

- How do I create a yearly budget sheet?

A yearly budget sheet should provide a comprehensive view of your financial year. Start by projecting your income and expenses, then break these down by month. This approach helps in identifying financial trends and making informed decisions.

Diving Deeper: Various Business Budget Templates

- Annual Business Budget Templates: Ideal for tracking overall financial health. Customize these templates to reflect your specific revenue streams and expense categories.

- Professional Business Budget Templates: Designed for established companies, these templates offer advanced features like department-wise budgeting and long-term financial planning.

- Startup Budget Templates: Startups benefit from these templates as they focus on scalability and initial investment tracking.

The Importance of Financial Planning

A well-structured yearly business budget template is more than just a financial tool. It’s a roadmap for your business’s success. By monitoring your financial performance and adapting your strategies accordingly, you can ensure the financial health and growth of your business.

Embrace the power of an effective yearly business budget template to streamline your financial planning. Whether you’re a startup or an established enterprise, the right template can make a significant difference in your financial management.

Free budget template in Excel: the top 8 for 2024

Budgeting is an essential aspect of money management, whether it’s for personal or business-related purposes. And when it comes to planning, aggregating, and analyzing budgets, Excel is still the go-to tool for many people from different lifestyles and professions.

Having a budget template in Excel is a more accessible, affordable, and familiar option for many users. What’s more, you can easily customize your templates to suit your exact budgeting needs. Whether you need to budget for your new startup business, control annual department spending, or save up for your first car, there is a template out there for everyone.

So, if you’re an Excel fan, here are some of our favorite free Excel budget templates that you can customize to fit your own needs:

Free Excel budget templates for 2024

- Expense tracker by Sheetgo

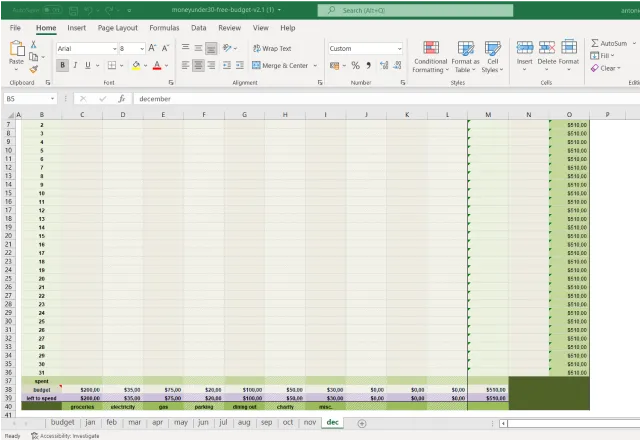

- Monthly Budget Planner by Money Under 30

- Annual Budget Planner by Budget Templates

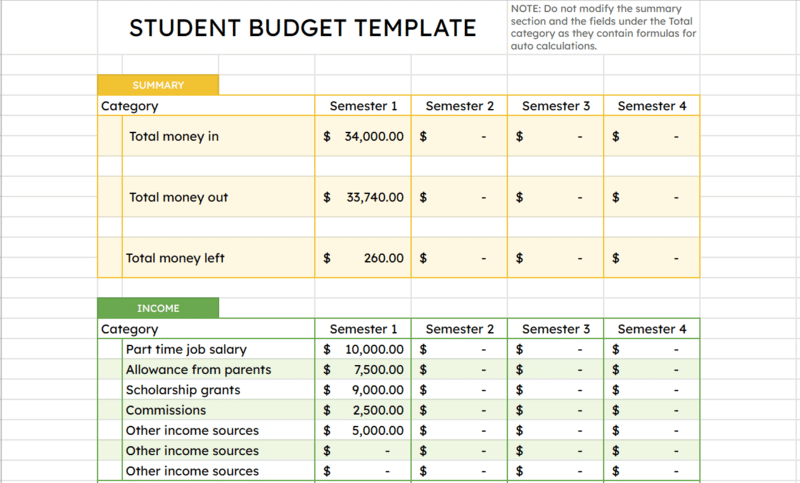

- Student Budget template by Microsoft

- Household Expense Budget template by Smartsheet

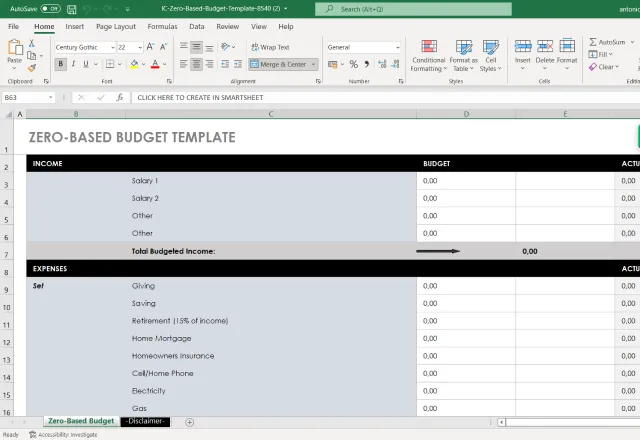

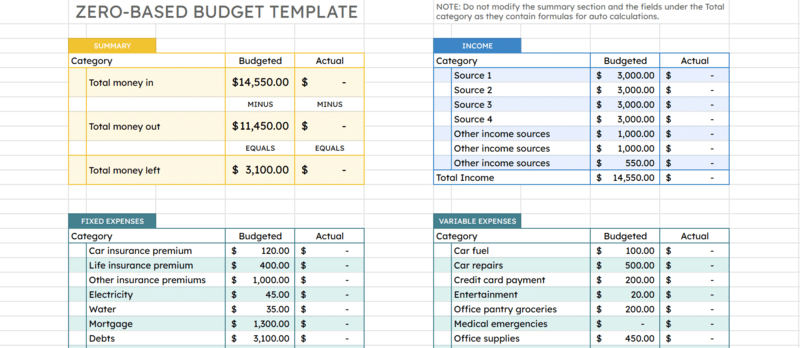

- Zero-based Budget Spreadsheet by Smartsheet

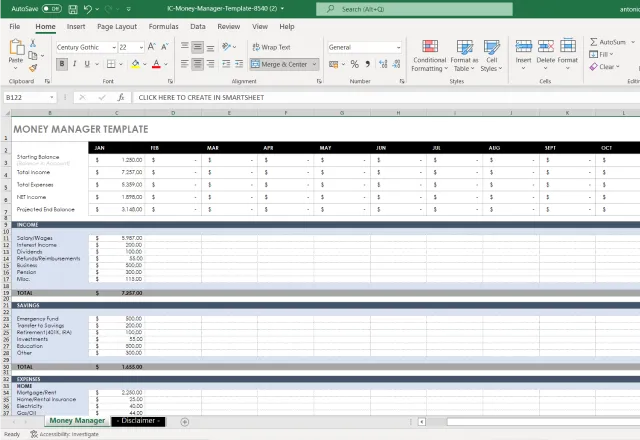

- Money Manager template by Smartsheet

- Small business budget template by Capterra

What are budget templates?

- Why use budget templates in Excel?

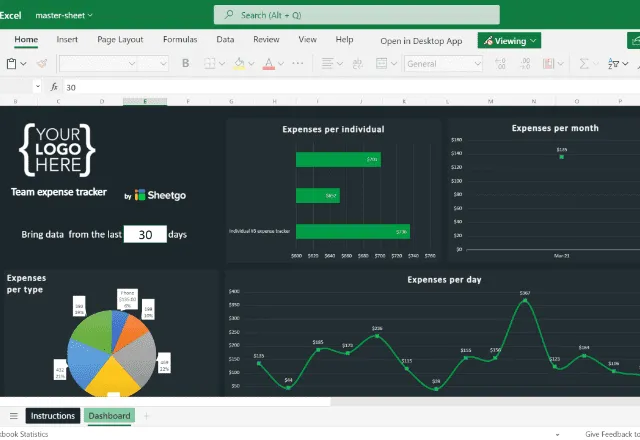

1. Expense tracker by Sheetgo

This Sheetgo Expense tracker template is ideal for small businesses and project teams — or anyone looking for a simple way to monitor expenses and automate financial management in their company. You could even use it at home with your family, to track how much each person is spending!

The Expense tracker workflow is not only easy to use, but it also gives you a better understanding of where your expenses come from. Share the individual expense tracker spreadsheets with each user so that they can track their spending. These individual sheets are then connected to the expenses master sheet, where all budgeting data is combined for an entire overview of group spending.